Attached files

| file | filename |

|---|---|

| 8-K - RAMCO-GERSHENSON PROPERTIES TRUST 8-K - RPT Realty | a50247549.htm |

| EX-99.1 - EXHIBIT 99.1 - RPT Realty | a50247549ex99-1.htm |

Exhibit 99.2

|

Ramco-Gershenson Properties Trust

|

||

|

Quarterly Financial and Operating Supplement

|

||

|

March 31, 2012

|

||

|

TABLE OF CONTENTS

|

||

|

Page

|

||

|

Overview

|

||

|

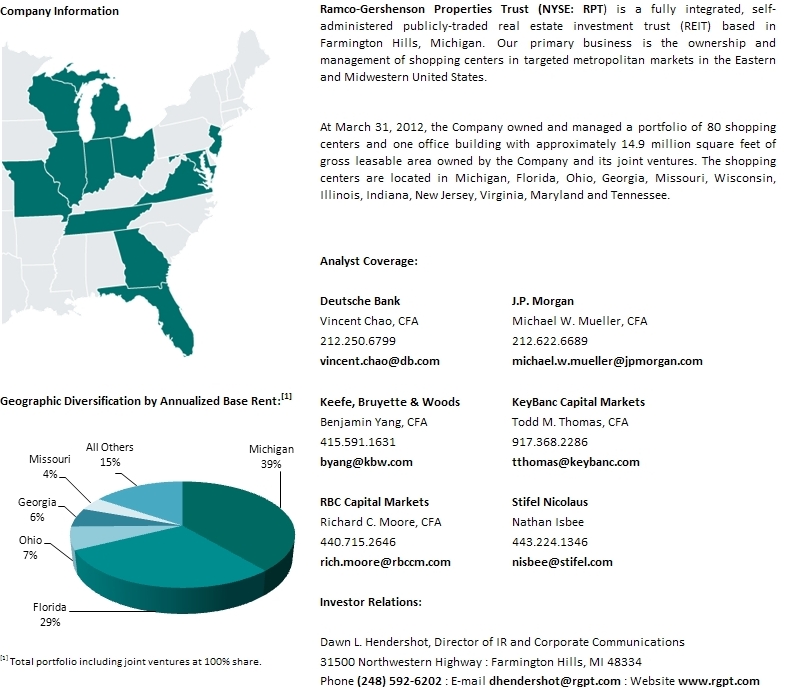

Company Information

|

3

|

|

|

Disclosures

|

4

|

|

|

Financial Results and Debt Information

|

||

|

Consolidated Balance Sheets

|

5

|

|

|

Consolidated Balance Sheets Detail

|

6

|

|

|

Consolidated Market Data

|

7

|

|

|

Summary of Debt Expiration - Consolidated Properties

|

8

|

|

|

Summary of Outstanding Debt - Consolidated Properties

|

9

|

|

|

Consolidated Statements of Operations

|

10

|

|

|

Consolidated Statements of Operations Detail

|

11

|

|

|

Funds from Operations and Additional Disclosures

|

12

|

|

|

EBITDA

|

13

|

|

|

Operating and Portfolio Information

|

||

|

Consolidated Same Properties Analysis

|

14

|

|

|

Summary of Expiring GLA - Consolidated and Unconsolidated Properties

|

15

|

|

|

Top Twenty-Five Tenants - Consolidated and Unconsolidated Properties

|

16

|

|

|

Leasing Activity - Consolidated and Unconsolidated Portfolios

|

17

|

|

|

Portfolio Summary Report

|

18 - 21

|

|

|

Redevelopment and Development Projects

|

22

|

|

|

Acquisitions / Dispositions

|

23

|

|

|

Joint Venture Information

|

||

|

Joint Venture Combined Balance Sheets

|

24

|

|

|

Summary of Joint Venture Debt

|

25

|

|

|

Joint Venture Contribution to Funds from Operations

|

26

|

|

|

Joint Venture Summary of Expiring GLA

|

27

|

|

|

Joint Venture Leasing Activity

|

28

|

|

Page 2 of 28

Page 3 of 28

|

Ramco-Gershenson Properties Trust

|

|

Quarterly Financial and Operating Supplement

|

|

March 31, 2012

|

|

Disclosures

|

|

Forward-Looking Statements

|

|

Certain information contained in this Quarterly Financial and Operating Supplemental Information Package may contain forward-looking statements that represent the company and management's hopes, intentions, beliefs, expectations or projections of the future. Management of Ramco-Gershenson believes the expectations reflected in the forward-looking statements are based on reasonable assumptions. It is important to note that certain factors could occur that might cause actual results to vary from current expectations and include, but are not limited to, (i) the ongoing slow recovery of the U.S. economy; (ii) the existing global credit and financial crisis; (iii) other changes in general economic and real estate conditions; (iv) changes in the interest rate and/or other changes in interest rate environment; (v) the availability of financing; (vi) adverse changes in the retail industry; and (vii) our ability to qualify as a REIT. Additional information concerning factors that could cause actual results to differ from those forward-looking statements is contained in the company's SEC filings, including but not limited to the company's report on Form 10-K for the year ended December 31, 2011. Copies of each filing may be obtained from the company or the Securities & Exchange Commission.

|

|

Funds From Operations

|

|

Management considers funds from operations, also known as "FFO", an appropriate supplemental measure of the financial performance of an equity REIT. Under the NAREIT definition, FFO represents net income attributable to common shareholders, excluding extraordinary items, as defined under accounting principles generally accepted in the United States of America ("GAAP"), gains (losses) on sales of depreciable property, plus real estate related depreciation and amortization (excluding amortization of financing costs), and after adjustments for unconsolidated partnerships and joint ventures. In addition, NAREIT has recently clarified its computation of FFO to exclude impairment charges on depreciable property and equity investments in depreciable property. Management has restated FFO for prior periods accordingly. FFO should not be considered an alternative to GAAP net income attributable to common shareholders as an indication of our performance. We consider FFO as a useful measure for reviewing our comparative operating and financial performance between periods or to compare our performance to different REITs. However, our computation of FFO may differ from the methodology for calculating FFO utilized by other real estate companies, and therefore, may not be comparable to these other real estate companies.

|

Page 4 of 28

|

Ramco-Gershenson Properties Trust

|

|

Consolidated Balance Sheets

|

|

March 31, 2012

|

|

(in thousands)

|

|

March 31,

|

December 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

ASSETS

|

||||||||

|

Income producing properties, at cost:

|

||||||||

|

Land

|

$ | 130,585 | $ | 133,145 | ||||

|

Buildings and improvements

|

846,584 | 863,763 | ||||||

|

Less accumulated depreciation and amortization

|

(218,623 | ) | (222,722 | ) | ||||

|

Income producing properties, net

|

758,546 | 774,186 | ||||||

|

Construction in progress and land held for development or sale

|

89,926 | 87,549 | ||||||

|

Real estate assets held for sale

|

5,222 | - | ||||||

|

Net real estate

|

$ | 853,694 | $ | 861,735 | ||||

|

Equity investments in unconsolidated joint ventures

|

96,502 | 97,020 | ||||||

|

Cash and cash equivalents

|

6,305 | 12,155 | ||||||

|

Restricted cash

|

5,853 | 6,063 | ||||||

|

Accounts & notes receivable, net

|

12,689 | 12,614 | ||||||

|

Other assets, net

|

57,597 | 59,236 | ||||||

|

TOTAL ASSETS

|

$ | 1,032,640 | $ | 1,048,823 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Mortgages and notes payable:

|

||||||||

|

Mortgages payable

|

$ | 324,617 | $ | 325,887 | ||||

|

Unsecured revolving credit facility

|

19,000 | 29,500 | ||||||

|

Unsecured term loan facilities

|

135,000 | 135,000 | ||||||

|

Junior subordinated notes

|

28,125 | 28,125 | ||||||

|

Total mortgages and notes payable

|

$ | 506,742 | $ | 518,512 | ||||

|

Capital lease obligation

|

6,263 | 6,341 | ||||||

|

Accounts payable and accrued expenses

|

27,646 | 31,546 | ||||||

|

Other liabilities & distributions payable

|

11,094 | 11,250 | ||||||

|

TOTAL LIABILITIES

|

$ | 551,745 | $ | 567,649 | ||||

|

Ramco-Gershenson Properties Trust ("RPT") Shareholders' Equity:

|

||||||||

|

Preferred shares, $0.01 par, 2,000 shares authorized: 7.25% Series D Cumulative Convertible Perpetual Preferred Shares, (stated at liquidation preference $50 per share), 2,000 issued and outstanding as of March 31, 2012 and December 31, 2011.

|

$ | 100,000 | $ | 100,000 | ||||

|

Common shares of beneficial interest, $0.01 par, 60,000 shares authorized, 39,454 and 38,735 shares issued and outstanding as of March 31, 2012 and December 31, 2011, respectively

|

395 | 387 | ||||||

|

Additional paid-in capital

|

578,438 | 570,225 | ||||||

|

Accumulated distributions in excess of net income

|

(226,672 | ) | (218,888 | ) | ||||

|

Accumulated other comprehensive loss

|

(2,415 | ) | (2,649 | ) | ||||

|

TOTAL SHAREHOLDERS' EQUITY ATTRIBUTABLE TO RPT

|

449,746 | 449,075 | ||||||

|

Noncontrolling interest

|

31,149 | 32,099 | ||||||

|

TOTAL SHAREHOLDERS' EQUITY

|

480,895 | 481,174 | ||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ | 1,032,640 | $ | 1,048,823 | ||||

Page 5 of 28

|

Ramco-Gershenson Properties Trust

|

|

Consolidated Balance Sheets Detail

|

|

March 31, 2012

|

|

(in thousands)

|

|

March 31,

|

December 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

Investment in real estate

|

||||||||

|

Construction in progress

|

$ | 13,774 | $ | 10,822 | ||||

|

Land held for development or sale

|

76,152 | 76,727 | ||||||

|

Construction in progress and land held for development or sale

|

$ | 89,926 | $ | 87,549 | ||||

|

Other assets, net

|

||||||||

|

Deferred leasing costs, net

|

$ | 14,478 | $ | 14,895 | ||||

|

Deferred financing costs, net

|

5,185 | 5,565 | ||||||

|

Lease intangible assets, net

|

12,894 | 13,702 | ||||||

|

Straight-line rent receivable, net

|

16,039 | 16,030 | ||||||

|

Prepaid and other deferred expenses, net

|

6,838 | 6,702 | ||||||

|

Other, net

|

2,163 | 2,342 | ||||||

|

Other assets, net

|

$ | 57,597 | $ | 59,236 | ||||

Page 6 of 28

|

Ramco-Gershenson Properties Trust

|

|

Consolidated Market Data

|

|

March 31, 2012

|

|

March 31,

|

March 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

Market price per common share

|

$ | 12.22 | $ | 12.53 | ||||

|

Common shares outstanding

|

39,453,765 | 38,428,589 | ||||||

|

Operating Partnership Units

|

2,618,533 | 2,899,079 | ||||||

|

Dilutive securities

|

266,372 | 357,030 | ||||||

|

Total common shares and equivalents

|

42,338,670 | 41,684,698 | ||||||

|

Equity market capitalization

|

$ | 517,378,547 | $ | 522,309,266 | ||||

|

Fixed rate debt (excluding unamortized premium)

|

$ | 487,703,266 | $ | 392,723,471 | ||||

|

Variable rate debt

|

19,000,000 | 184,857,285 | ||||||

|

Total fixed and variable rate debt

|

$ | 506,703,266 | $ | 577,580,756 | ||||

|

Capital lease obligation

|

6,262,934 | 6,567,368 | ||||||

|

Cash and cash equivalents

|

(6,304,973 | ) | (12,696,925 | ) | ||||

|

Net debt

|

$ | 506,661,227 | $ | 571,451,199 | ||||

|

Equity market capitalization

|

$ | 517,378,547 | $ | 522,309,266 | ||||

|

Convertible perpetual preferred shares

|

98,300,000 |

(1)

|

- | |||||

|

Total market capitalization

|

$ | 1,122,339,774 | $ | 1,093,760,465 | ||||

|

Net debt to total market capitalization

|

45.1 | % | 52.2 | % | ||||

|

(1)

|

Convertible preferred shares based on a market price of $49.15 per share at March 31, 2012 as compared to liquidation value of $50.00 per share.

|

Page 7 of 28

|

Ramco-Gershenson Properties Trust

|

||

|

Summary of Debt Expiration - Consolidated Properties

|

||

|

March 31, 2012

|

||

|

Cumulative

|

|||||||||||||||||||||||

|

Scheduled

|

Total

|

Percentage

|

Percentage

|

||||||||||||||||||||

|

Amortization

|

Scheduled

|

Scheduled

|

of Debt

|

of Debt

|

|||||||||||||||||||

|

Year

|

Payments

|

Maturities

|

Maturities

|

Maturing

|

Maturing

|

||||||||||||||||||

|

2012

|

3,746,891 | 10,602,053 | 14,348,944 | 2.8 | % | 2.8 | % | ||||||||||||||||

|

2013

|

4,693,996 | 21,127,323 | 25,821,319 | 5.1 | % | 7.9 | % | ||||||||||||||||

|

2014

|

3,971,137 | 48,676,361 | (1) | 52,647,498 | 10.4 | % | 18.3 | % | |||||||||||||||

|

2015

|

3,753,247 | 73,189,467 | 76,942,714 | 15.2 | % | 33.5 | % | ||||||||||||||||

|

2016

|

1,894,009 | 75,000,000 | (2) | 76,894,009 | 15.2 | % | 48.7 | % | |||||||||||||||

|

2017

|

1,835,834 | 110,000,000 | 111,835,834 | 22.1 | % | 70.8 | % | ||||||||||||||||

|

2018

|

1,599,341 | 82,046,854 | (3) | 83,646,195 | 16.5 | % | 87.3 | % | |||||||||||||||

|

2019

|

1,265,942 | 3,148,142 | 4,414,084 | 0.9 | % | 88.2 | % | ||||||||||||||||

|

2020

|

549,024 | 24,717,029 | 25,266,053 | 5.0 | % | 93.2 | % | ||||||||||||||||

|

2021

|

348,004 | - | 348,004 | 0.1 | % | 93.3 | % | ||||||||||||||||

| 2022 | + | - | 34,538,612 | 34,538,612 | 6.7 | % | 100.0 | % | |||||||||||||||

|

Subtotal Mortgage Debt

|

$ | 23,657,425 | $ | 483,045,841 | $ | 506,703,266 | |||||||||||||||||

|

Unamortized premium

|

- | 38,817 | 38,817 | ||||||||||||||||||||

|

Total mortgage debt (including unamortized premium)

|

$ | 23,657,425 | $ | 483,084,658 | $ | 506,742,083 | |||||||||||||||||

|

(1)

|

Scheduled maturities in 2014 include $19.0 million which represents the balance of the Unsecured Revolving Credit Facility drawn as of 03/31/12 due at maturity in April 2014.

|

|

(2)

|

Scheduled maturities in 2016 include $75 million of Unsecured Term Loan assuming Company exercises a one-year extension option in April 2015.

|

|

(3)

|

Scheduled maturities in 2018 include $60 million of Unsecured Term Loan due Sept 2018.

|

Page 8 of 28

|

Ramco-Gershenson Properties Trust

|

|

Summary of Outstanding Debt - Consolidated Properties

|

|

March 31, 2012

|

| Balance | Stated | % of | ||||||||||||||

|

at

|

Interest

|

Loan

|

Maturity | Total | ||||||||||||

|

Property Name

|

Location

|

Lender or Servicer

|

03/31/12

|

Rate

|

Type

|

Date

|

Indebtedness

|

|||||||||

|

Mortgage Debt

|

||||||||||||||||

|

The Crossroads

|

Royal Palm Beach, FL

|

L.J. Melody & Co./Salomon

|

10,678,423 | 6.5000 | % |

Fixed

|

Aug-12

|

2.1 | % | |||||||

|

East Town Plaza

|

Madison, WI

|

Citigroup Global Markets

|

10,430,194 | 5.4500 | % |

Fixed

|

Jul-13

|

2.1 | % | |||||||

|

Centre at Woodstock

|

Woodstock, GA

|

Wachovia

|

3,443,810 | 6.9100 | % |

Fixed

|

Jul-13

|

0.7 | % | |||||||

|

Kentwood Towne Centre (1)

|

Kentwood, MI

|

Nationwide Life

|

8,501,477 | 5.7400 | % |

Fixed

|

Jul-13

|

1.7 | % | |||||||

|

The Auburn Mile

|

Auburn Hills, MI

|

Citigroup Global Markets

|

6,931,863 | 5.3800 | % |

Fixed

|

May-14

|

1.4 | % | |||||||

|

Crossroads Centre

|

Rossford, OH

|

Citigroup Global Markets

|

24,145,094 | 5.3800 | % |

Fixed

|

May-14

|

4.8 | % | |||||||

|

Ramco Aquia Office LLC

|

Stafford, VA

|

JPMorgan Chase Bank, N.A.

|

14,386,942 | 5.7980 | % |

Fixed

|

Jun-15

|

2.8 | % | |||||||

|

Jackson West

|

Jackson, MI

|

Key Bank

|

16,866,418 | 5.2000 | % |

Fixed

|

Nov-15

|

3.3 | % | |||||||

|

West Oaks I

|

Novi, MI

|

Key Bank

|

26,801,701 | 5.2000 | % |

Fixed

|

Nov-15

|

5.3 | % | |||||||

|

New Towne Plaza

|

Canton Twp., MI

|

Deutsche Bank

|

19,455,672 | 5.0910 | % |

Fixed

|

Dec-15

|

3.8 | % | |||||||

|

Hoover Eleven

|

Warren, MI

|

Canada Life/GMAC

|

3,789,686 | 7.6250 | % |

Fixed

|

Feb-16

|

0.7 | % | |||||||

|

River City Marketplace

|

Jacksonville, FL

|

JPMorgan Chase Bank, N.A.

|

110,000,000 | 5.4355 | % |

Fixed

|

Apr-17

|

21.7 | % | |||||||

|

Jackson Crossing

|

Jackson, MI

|

Wells Fargo Bank, N.A.

|

24,380,752 | 5.7600 | % |

Fixed

|

Apr-18

|

4.8 | % | |||||||

|

Hoover Eleven

|

Warren, MI

|

Canada Life/GMAC

|

1,642,790 | 7.2000 | % |

Fixed

|

May-18

|

0.3 | % | |||||||

|

Crossroads Centre Home Depot

|

Rossford, OH

|

Farm Bureau

|

3,815,620 | 7.3800 | % |

Fixed

|

Dec-19

|

0.8 | % | |||||||

|

West Oaks II and Spring Meadows Place

|

Novi, MI / Holland, OH

|

JPMorgan Chase Bank, N.A.

|

30,337,773 | 6.4950 | % |

Fixed

|

Apr-20

|

6.0 | % | |||||||

|

Coral Creek (2)

|

Coconut Creek, FL

|

Key Bank

|

8,970,051 | 6.7800 | % |

Fixed

|

Jul-32

|

1.8 | % | |||||||

|

Subtotal Mortgage Debt

|

$ | 324,578,266 | 5.6709 | % | 64.1 | % | ||||||||||

|

Unamortized premium

|

38,817 | 0.0000 | % | 0.0 | % | |||||||||||

|

Total mortgage debt (including unamortized premium)

|

$ | 324,617,083 | 5.6709 | % | 64.1 | % | ||||||||||

|

Corporate Debt

|

||||||||||||||||

|

Unsecured Revolving Credit Facility

|

Key Bank, as agent

|

$ | 19,000,000 | 2.5000 | % |

Variable

|

Apr-14

|

3.7 | % | |||||||

|

Unsecured Term Loan (3)

|

Key Bank, as agent

|

75,000,000 | 3.4675 | % |

Fixed

|

Apr-16

|

14.8 | % | ||||||||

|

Unsecured Term Loan (4)

|

Key Bank, as agent

|

60,000,000 | 4.1982 | % |

Fixed

|

Sep-18

|

11.8 | % | ||||||||

|

Junior Subordinated Note (5)

|

The Bank of New York Trust Co.

|

28,125,000 | 7.8700 | % |

Fixed

|

Jan-38

|

5.6 | % | ||||||||

|

Subtotal Corporate Debt

|

$ | 182,125,000 | 4.2872 | % | 35.9 | % | ||||||||||

|

Total debt

|

$ | 506,742,083 | 5.1732 | % | 100.0 | % | ||||||||||

|

Capital Lease Obligation (6)

|

Gaines Twp., MI

|

Crown Development Corp

|

$ | 6,262,934 | 5.8000 | % |

Ground Lease

|

Oct-14

|

N/A | |||||||

|

(1)

|

The Company owns a 77.9% interest in this property.

|

|

(2)

|

The mortgage loan was paid in full on April 2, 2012.

|

|

(3)

|

Effectively converted to fixed rate through swap agreement that expires at final maturity in April 2016. Assumes Company exercises a one-year extension option in April 2015.

|

|

(4)

|

Effectively converted to fixed rate through swap agreements that expire at loan maturity in September 2018.

|

|

(5)

|

Fixed rate until January 2013, and then at LIBOR plus 3.30%.

|

|

(6)

|

99 year Ground Lease expires Sept 2103. Purchase option date is Oct 2014.

|

Page 9 of 28

|

Ramco-Gershenson Properties Trust

|

|

Consolidated Statements of Operations

|

|

For the Three Months Ended March 31, 2012 and 2011

|

|

(in thousands, except per share data)

|

|

Three Months Ended March 31,

|

||||||||||||

|

Increase

|

||||||||||||

|

2012

|

2011

|

(Decrease)

|

||||||||||

|

REVENUE

|

||||||||||||

|

Minimum rent

|

$ | 21,481 | $ | 19,373 | $ | 2,108 | ||||||

|

Percentage rent

|

195 | 64 | 131 | |||||||||

|

Recovery income from tenants

|

7,937 | 7,386 | 551 | |||||||||

|

Other property income

|

746 | 1,509 | (763 | ) | ||||||||

|

Management and other fee income

|

967 | 992 | (25 | ) | ||||||||

|

TOTAL REVENUE

|

31,326 | 29,324 | 2,002 | |||||||||

|

EXPENSES

|

||||||||||||

|

Real estate taxes

|

4,306 | 4,165 | 141 | |||||||||

|

Recoverable operating expense

|

3,934 | 3,808 | 126 | |||||||||

|

Other non-recoverable operating expense

|

834 | 672 | 162 | |||||||||

|

Depreciation and amortization

|

8,710 | 8,370 | 340 | |||||||||

|

General and administrative

|

4,879 | 5,057 | (178 | ) | ||||||||

|

TOTAL EXPENSES

|

22,663 | 22,072 | 591 | |||||||||

|

INCOME BEFORE OTHER INCOME AND EXPENSE, TAX AND DISCONTINUED OPERATIONS

|

8,663 | 7,252 | 1,411 | |||||||||

|

OTHER INCOME AND EXPENSES

|

||||||||||||

|

Other expense

|

(112 | ) | (210 | ) | 98 | |||||||

|

Gain on sale of real estate

|

69 | 155 | (86 | ) | ||||||||

|

Earnings from unconsolidated joint ventures

|

496 | 962 | (466 | ) | ||||||||

|

Interest expense

|

(6,749 | ) | (7,959 | ) | 1,210 | |||||||

|

Amortization of deferred financing fees

|

(380 | ) | (624 | ) | 244 | |||||||

|

Provision for impairment

|

(2,536 | ) | - | (2,536 | ) | |||||||

|

LOSS FROM CONTINUING OPERATIONS BEFORE TAX

|

(549 | ) | (424 | ) | (125 | ) | ||||||

|

Income tax provision

|

(25 | ) | (59 | ) | 34 | |||||||

|

LOSS FROM CONTINUING OPERATIONS

|

(574 | ) | (483 | ) | (91 | ) | ||||||

|

DISCONTINUED OPERATIONS

|

||||||||||||

|

Gain on sale of real estate

|

264 | - | 264 | |||||||||

|

Income from discontinued operations

|

258 | 230 | 28 | |||||||||

|

INCOME FROM DISCONTINUED OPERATIONS

|

522 | 230 | 292 | |||||||||

|

NET LOSS

|

(52 | ) | (253 | ) | 201 | |||||||

|

Net loss attributable to noncontrolling partner interest

|

534 | 21 | 513 | |||||||||

|

NET INCOME (LOSS) ATTRIBUTABLE TO RPT

|

482 | (232 | ) | 714 | ||||||||

|

Preferred share dividends

|

(1,812 | ) | - | (1,812 | ) | |||||||

|

NET LOSS AVAILABLE TO COMMON SHAREHOLDERS

|

$ | (1,330 | ) | $ | (232 | ) | $ | (1,098 | ) | |||

|

LOSS PER COMMON SHARE, BASIC

|

||||||||||||

|

Continuing operations

|

$ | (0.04 | ) | $ | (0.01 | ) | $ | (0.03 | ) | |||

|

Discontinued operations

|

0.01 | - | 0.01 | |||||||||

|

|

$ | (0.03 | ) | $ | (0.01 | ) | $ | (0.02 | ) | |||

|

LOSS PER COMMON SHARE, DILUTED

|

||||||||||||

|

Continuing operations

|

$ | (0.04 | ) | $ | (0.01 | ) | $ | (0.03 | ) | |||

|

Discontinued operations

|

0.01 | - | 0.01 | |||||||||

| $ | (0.03 | ) | $ | (0.01 | ) | $ | (0.02 | ) | ||||

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

|

||||||||||||

|

Basic

|

38,884 | 37,927 | 957 | |||||||||

|

Diluted

|

38,884 | 37,927 | 957 | |||||||||

Page 10 of 28

|

Ramco-Gershenson Properties Trust

|

|

Consolidated Statements of Operations Detail

|

|

For the Three Months Ended March 31, 2012 and 2011

|

|

(in thousands)

|

|

Three Months Ended March 31,

|

||||||||||||

|

Increase

|

||||||||||||

|

2012

|

2011

|

(Decrease)

|

||||||||||

|

Other property income

|

||||||||||||

|

Lease termination income

|

$ | 456 | $ | 1,174 | $ | (718 | ) | |||||

|

Temporary income

|

136 | 147 | (11 | ) | ||||||||

|

TIF revenue

|

75 | 69 | 6 | |||||||||

|

Other

|

79 | 119 | (40 | ) | ||||||||

|

Other property income

|

$ | 746 | $ | 1,509 | $ | (763 | ) | |||||

|

Management and other fee income

|

||||||||||||

|

Management fees

|

$ | 714 | $ | 772 | $ | (58 | ) | |||||

|

Leasing fees

|

222 | 145 | 77 | |||||||||

|

Construction fees

|

31 | 75 | (44 | ) | ||||||||

|

Management and other fee income

|

$ | 967 | $ | 992 | $ | (25 | ) | |||||

|

Other expense

|

||||||||||||

|

Real estate taxes and insurance expense on land held for development or sale

|

$ | (257 | ) | $ | (276 | ) | $ | 19 | ||||

|

Interest income

|

49 | 66 | (17 | ) | ||||||||

|

Other

|

96 | - | 96 | |||||||||

|

Other expense

|

$ | (112 | ) | $ | (210 | ) | $ | 98 | ||||

Page 11 of 28

|

Ramco-Gershenson Properties Trust

|

|

Funds from Operations and Additional Disclosures

|

|

For the Three Months Ended March 31, 2012 and 2011

|

|

(in thousands, except per share data)

|

|

Three Months Ended March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Net loss available to common shareholders

|

$ | (1,330 | ) | $ | (232 | ) | ||

|

Adjustments:

|

||||||||

|

Rental property depreciation and amortization expense

|

8,720 | 8,733 | ||||||

|

Pro-rata share of real estate depreciation from unconsolidated joint ventures

|

1,687 | 1,623 | ||||||

|

Gain on sale of depreciable real estate

|

(264 | ) | - | |||||

|

Provision for impairment on income-producing properties (1)

|

1,976 | - | ||||||

|

Noncontrolling interest in Operating Partnership

|

(1 | ) | (17 | ) | ||||

|

FUNDS FROM OPERATIONS

|

$ | 10,788 | $ | 10,107 | ||||

|

Weighted average common shares

|

38,884 | 37,927 | ||||||

|

Shares issuable upon conversion of Operating Partnership Units

|

2,619 | 2,899 | ||||||

|

Dilutive effect of securities

|

266 | 299 | ||||||

|

WEIGHTED AVERAGE EQUIVALENT SHARES OUTSTANDING, DILUTED

|

41,769 | 41,125 | ||||||

|

FUNDS FROM OPERATIONS, PER DILUTED SHARE

|

$ | 0.26 | $ | 0.25 | ||||

|

Dividend per common share

|

$ | 0.16325 | $ | 0.16325 | ||||

|

Payout ratio - FFO

|

63.2 | % | 66.4 | % | ||||

|

Additional Supplemental Disclosures:

|

||||||||

|

Consolidated (includes discontinued operations):

|

||||||||

|

Straight-line rental income

|

$ | 51 | $ | (81 | ) | |||

|

Above/below market rent amortization

|

(1 | ) | (18 | ) | ||||

|

Fair market value of interest adjustment - acquired property

|

8 | 9 | ||||||

|

Stock-based compensation expense

|

576 | 484 | ||||||

|

Pro-rata share from Unconsolidated Joint Ventures (includes discontinued operations):

|

||||||||

|

Straight-line rental income

|

43 | 104 | ||||||

|

Above/below market rent amortization

|

7 | 24 | ||||||

|

Fair market value of interest adjustment - acquired property

|

43 | 62 | ||||||

|

(1)

|

Amount represents our proportionate ownership share of the total $2.5m impairment provision for one property held in a consolidated partnership.

|

Page 12 of 28

|

Ramco-Gershenson Properties Trust

|

|

Earnings Before Interest, Taxes, Depreciation and Amortization

|

|

For the Trailing Twelve Months Ended March 31, 2012 and 2011

|

|

(in thousands, except per share data)

|

|

Twelve Months Ended March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

EBITDA Calculation

|

||||||||

|

Net loss

|

$ | (28,299 | ) | $ | (22,624 | ) | ||

|

Add back:

|

||||||||

|

(Gain) loss on sale of depreciable real estate from continuing operations

|

(7,461 | ) | 2,037 | |||||

|

Gain on sale of joint venture depreciable real estate

|

(2,718 | ) | - | |||||

|

Provision for impairment on income-producing properties

|

18,868 | - | ||||||

|

Provision for impairment on unconsolidated joint ventures

|

9,611 | - | ||||||

|

Provision for impairment on joint venture income-producing properties

|

1,644 | 1,820 | ||||||

|

Provision for impairment for land available for sale

|

11,468 | 28,787 | ||||||

|

Bargain purchase gain on acquisition of real estate

|

- | (9,836 | ) | |||||

|

Deferred gain recognized upon acquisition of real estate

|

- | (1,796 | ) | |||||

|

Loss on early extinguishment of debt

|

750 | 242 | ||||||

|

Income tax provision (benefit)

|

761 | (440 | ) | |||||

|

Interest expense

|

27,608 | 32,734 | ||||||

|

Amortization of deferred financing fees

|

1,628 | 2,772 | ||||||

|

Depreciation and amortization

|

36,971 | 33,166 | ||||||

|

Non-recurring depreciation expense for joint venture redevelopment projects

|

2,656 | - | ||||||

|

Consolidated EBITDA

|

$ | 73,487 | $ | 66,862 | ||||

|

Scheduled mortgage principal payments

|

$ | 5,123 | $ | 5,080 | ||||

|

Debt and Coverage Ratios

|

||||||||

|

Consolidated net debt to EBITDA - trailing twelve months

|

6.9 | 8.5 | ||||||

|

Interest coverage ratio (EBITDA / interest expense) - trailing twelve months

|

2.7 | 2.0 | ||||||

|

Fixed charge coverage ratio (EBITDA / interest expense + preferred dividends + scheduled principal amortization - trailing twelve months.)

|

1.8 | 1.8 | ||||||

|

Operating Ratios

|

||||||||

|

GAAP NOI

|

$ | 83,879 | $ | 80,342 | ||||

|

Operating margin (GAAP NOI / total rental revenue)

|

69.1 | % | 69.4 | % | ||||

|

General & Administrative Expense as a Percentage of Total Rental Revenues Under Management (1)

|

||||||||

|

Revenue from REIT owned properties

|

$ | 121,453 | $ | 115,803 | ||||

|

Revenue from joint venture properties

|

84,874 | 88,780 | ||||||

|

Revenue from non-REIT properties under management contract

|

3,376 | 3,337 | ||||||

|

Total rental revenues under management

|

$ | 209,703 | $ | 207,920 | ||||

|

General and administrative expense

|

$ | 19,473 | $ | 18,053 | ||||

|

General and administrative expense / total rental revenues under management

|

9.3 | % | 8.7 | % | ||||

|

(1)

|

General & administrative expense shown as a percentage of rental revenues under management which includes base rent, recoveries and other income from wholly owned properties, joint venture and managed properties that are not owned.

|

Page 13 of 28

|

Ramco-Gershenson Properties Trust

|

|||

|

Consolidated Same Properties Analysis

|

|||

|

For the Three Months Ended March 31, 2012 and 2011

|

|||

|

(in thousands)

|

|||

|

Three Months Ended March 31,

|

||||||||||||

|

2012

|

2011

|

% Change

|

||||||||||

|

Number of Properties

|

41 | 41 | 0.0 | % | ||||||||

|

Occupancy

|

92.6 | % | 91.6 | % | 1.0 | % | ||||||

|

REVENUE (1)

|

||||||||||||

|

Minimum rent

|

$ | 17,793 | $ | 17,585 | 1.2 | % | ||||||

|

Percentage rent

|

195 | 64 | 204.7 | % | ||||||||

|

Recovery income from tenants

|

6,819 | 6,854 | -0.5 | % | ||||||||

|

Other property income

|

183 | 191 | -4.2 | % | ||||||||

| $ | 24,990 | $ | 24,694 | 1.2 | % | |||||||

|

EXPENSES

|

||||||||||||

|

Real estate taxes

|

$ | 3,657 | $ | 3,719 | -1.7 | % | ||||||

|

Recoverable operating expense

|

3,236 | 3,347 | -3.3 | % | ||||||||

|

Other non-recoverable operating expense

|

493 | 582 | -15.3 | % | ||||||||

| $ | 7,386 | $ | 7,648 | -3.4 | % | |||||||

|

NET OPERATING INCOME

|

$ | 17,604 | $ | 17,046 | 3.3 | % | ||||||

|

Operating Expense Recovery Ratio

|

98.9 | % | 97.0 | % | 1.9 | % | ||||||

|

(1)

|

Excludes straight-line rent, above/below market rent, lease termination fees, prior year adjustments and centers held for redevelopment or available for sale.

|

Page 14 of 28

|

Ramco-Gershenson Properties Trust

|

||||||||||||||||||||||||||||||

|

Summary of Expiring GLA - Consolidated and Unconsolidated Properties

|

||||||||||||||||||||||||||||||

|

March 31, 2012

|

||||||||||||||||||||||||||||||

|

Anchor Tenants [1]

|

Non-Anchor Tenants

|

All Leases

|

||||||||||||||||||||||||||||

|

Expiration

Year |

Number of

Leases |

GLA

|

%

of GLA

|

%

of ABR

|

ABR

psf

|

Number of

Leases |

GLA

|

%

of GLA

|

%

of ABR

|

ABR

psf

|

Number of

Leases |

GLA

|

%

of GLA

|

%

of ABR

|

ABR

psf

|

|||||||||||||||

|

(2)

|

1

|

24,000

|

0.3%

|

0.3%

|

$ 8.50

|

20

|

49,292

|

0.9%

|

0.7%

|

$ 10.71

|

21

|

73,292

|

0.5%

|

0.5%

|

$ 9.99

|

|||||||||||||||

|

2012

|

5

|

270,388

|

2.9%

|

1.7%

|

4.76

|

159

|

497,309

|

8.8%

|

10.2%

|

15.87

|

164

|

767,697

|

5.2%

|

6.0%

|

11.96

|

|||||||||||||||

|

2013

|

19

|

715,832

|

7.8%

|

6.8%

|

7.22

|

255

|

773,172

|

13.6%

|

15.8%

|

15.85

|

274

|

1,489,004

|

10.0%

|

11.3%

|

11.70

|

|||||||||||||||

|

2014

|

19

|

879,906

|

9.6%

|

7.4%

|

6.40

|

254

|

805,742

|

14.2%

|

16.1%

|

15.47

|

273

|

1,685,648

|

11.3%

|

11.8%

|

10.74

|

|||||||||||||||

|

2015

|

27

|

1,055,498

|

11.5%

|

11.9%

|

8.63

|

209

|

689,086

|

12.1%

|

14.5%

|

16.23

|

236

|

1,744,584

|

11.7%

|

13.2%

|

11.63

|

|||||||||||||||

|

2016

|

30

|

1,206,761

|

13.1%

|

13.8%

|

8.78

|

182

|

698,042

|

12.3%

|

15.6%

|

17.34

|

212

|

1,904,803

|

12.8%

|

14.8%

|

11.91

|

|||||||||||||||

|

2017

|

24

|

849,341

|

9.2%

|

11.8%

|

10.61

|

92

|

368,489

|

6.5%

|

8.3%

|

17.53

|

116

|

1,217,830

|

8.2%

|

10.1%

|

12.70

|

|||||||||||||||

|

2018

|

14

|

498,903

|

5.4%

|

6.7%

|

10.31

|

34

|

152,999

|

2.7%

|

3.4%

|

17.35

|

48

|

651,902

|

4.4%

|

5.1%

|

11.96

|

|||||||||||||||

|

2019

|

12

|

602,164

|

6.6%

|

7.3%

|

9.29

|

24

|

106,810

|

1.9%

|

2.4%

|

17.45

|

36

|

708,974

|

4.8%

|

4.8%

|

10.52

|

|||||||||||||||

|

2020

|

6

|

354,080

|

3.9%

|

3.0%

|

6.56

|

30

|

155,811

|

2.7%

|

3.5%

|

17.54

|

36

|

509,891

|

3.4%

|

3.3%

|

9.91

|

|||||||||||||||

|

2021

|

19

|

681,160

|

7.4%

|

8.7%

|

9.77

|

26

|

134,101

|

2.4%

|

2.8%

|

16.08

|

45

|

815,261

|

5.5%

|

5.7%

|

10.81

|

|||||||||||||||

|

2022+

|

26

|

1,640,728

|

17.9%

|

20.6%

|

9.60

|

45

|

285,667

|

5.0%

|

6.7%

|

17.77

|

71

|

1,926,395

|

13.0%

|

13.4%

|

10.81

|

|||||||||||||||

|

Sub-Total

|

202

|

8,778,761

|

95.6%

|

100.0%

|

$ 8.71

|

1,330

|

4,716,520

|

83.1%

|

100.0%

|

$ 16.40

|

1,532

|

13,495,281

|

90.8%

|

100.0%

|

$ 11.40

|

|||||||||||||||

|

Leased [3]

|

1

|

40,461

|

0.4%

|

N/A

|

N/A

|

14

|

86,000

|

1.5%

|

N/A

|

N/A

|

15

|

126,461

|

0.8%

|

N/A

|

N/A

|

|||||||||||||||

|

Vacant

|

9

|

369,026

|

4.0%

|

N/A

|

N/A

|

316

|

875,217

|

15.4%

|

N/A

|

N/A

|

325

|

1,244,243

|

8.4%

|

N/A

|

N/A

|

|||||||||||||||

|

Total

|

212

|

9,188,248

|

100.0%

|

100.0%

|

N/A

|

1,660

|

5,677,737

|

100.0%

|

100.0%

|

N/A

|

1,872

|

14,865,985

|

100.0%

|

100.0%

|

N/A

|

|||||||||||||||

|

(1)

|

Anchor is defined as a tenant leasing 19,000 square feet or more.

|

|

(2)

|

Tenants currently under month to month lease or in the process of renewal.

|

|

(3)

|

Lease has been executed, but space has not yet been delivered.

|

Page 15 of 28

|

Ramco-Gershenson Properties Trust

|

||||||||||||||

|

Top Twenty-Five Tenants (ranked by annualized base rent)

|

||||||||||||||

|

Consolidated and Unconsolidated Properties

|

||||||||||||||

|

March 31, 2012

|

||||||||||||||

|

Tenant Name

|

Credit Rating

S&P/Moody's (1)

|

Number of

Leases

|

GLA

|

% of Total

Company

Owned

GLA

|

Total

Annualized

Base

Rent

|

Annualized

Base

Rent

PSF

|

% of

Annualized

Base Rental

Revenue

|

|||||||

|

T.J. Maxx/Marshalls

|

A/A3

|

22

|

695,879

|

4.7%

|

$ 6,632,414

|

$ 9.53

|

4.3%

|

|||||||

|

Home Depot

|

A-/A3

|

3

|

384,690

|

2.6%

|

3,110,250

|

8.09

|

2.0%

|

|||||||

|

Publix Super Market

|

NR/NR

|

8

|

372,141

|

2.5%

|

2,790,512

|

7.50

|

1.8%

|

|||||||

|

Dollar Tree

|

NR/NR

|

29

|

312,699

|

2.1%

|

2,762,440

|

8.83

|

1.8%

|

|||||||

|

Jo-Ann Stores

|

B/B2

|

6

|

218,993

|

1.5%

|

2,542,174

|

11.61

|

1.7%

|

|||||||

|

PetSmart

|

BB+/NR

|

8

|

174,661

|

1.2%

|

2,511,142

|

14.38

|

1.6%

|

|||||||

|

OfficeMax

|

B-/B1

|

10

|

229,115

|

1.5%

|

2,415,851

|

10.54

|

1.6%

|

|||||||

|

Burlington Coat Factory

|

NR/NR

|

5

|

360,867

|

2.4%

|

2,390,179

|

6.62

|

1.6%

|

|||||||

|

Bed Bath & Beyond/Buy Buy Baby

|

BBB+/NR

|

6

|

192,753

|

1.3%

|

2,245,794

|

11.65

|

1.5%

|

|||||||

|

Best Buy

|

BBB-/Baa2

|

5

|

176,677

|

1.2%

|

2,238,008

|

12.67

|

1.5%

|

|||||||

|

Staples

|

BBB/Baa2

|

9

|

181,569

|

1.2%

|

2,146,087

|

11.82

|

1.4%

|

|||||||

|

Michaels Stores

|

B-/B2

|

9

|

199,724

|

1.3%

|

2,124,876

|

10.64

|

1.4%

|

|||||||

|

Kmart/Sears

|

CCC+/B3

|

5

|

475,511

|

3.2%

|

2,086,159

|

4.39

|

1.4%

|

|||||||

|

Gander Mountain

|

NR/NR

|

2

|

159,791

|

1.1%

|

1,899,745

|

11.89

|

1.2%

|

|||||||

|

SUPERVALU

|

B+/B1

|

5

|

201,041

|

1.4%

|

1,869,936

|

9.30

|

1.2%

|

|||||||

|

Lowe's Home Centers

|

A-/A3

|

2

|

270,394

|

1.8%

|

1,822,956

|

6.74

|

1.2%

|

|||||||

|

Meijer

|

NR/NR

|

2

|

397,428

|

2.7%

|

1,731,560

|

4.36

|

1.1%

|

|||||||

|

Hobby Lobby

|

NR/NR

|

5

|

276,173

|

1.9%

|

1,640,038

|

5.94

|

1.1%

|

|||||||

|

Office Depot

|

B-/B2

|

5

|

131,792

|

0.9%

|

1,590,652

|

12.07

|

1.0%

|

|||||||

|

Whole Foods

|

BB+/NR

|

3

|

92,675

|

0.6%

|

1,585,908

|

17.11

|

1.0%

|

|||||||

|

LA Fitness Sports Club

|

NR/NR

|

2

|

76,833

|

0.5%

|

1,581,552

|

20.58

|

1.0%

|

|||||||

|

Kroger

|

BBB/Baa2

|

3

|

201,469

|

1.4%

|

1,548,497

|

7.69

|

1.0%

|

|||||||

|

Kohl's

|

BBB+/Baa1

|

5

|

276,972

|

1.9%

|

1,491,739

|

5.39

|

1.0%

|

|||||||

|

The Sports Authority

|

B-/NR

|

3

|

126,653

|

0.9%

|

1,383,219

|

10.92

|

0.9%

|

|||||||

|

Ross Stores

|

BBB+/NR

|

5

|

138,058

|

0.9%

|

1,339,880

|

9.71

|

0.9%

|

|||||||

|

Sub-Total top 25 tenants

|

167

|

6,324,558

|

42.7%

|

$ 55,481,568

|

$ 8.77

|

36.2%

|

||||||||

|

Remaining tenants

|

1,365

|

7,170,723

|

48.1%

|

98,365,768

|

13.72

|

63.8%

|

||||||||

|

Sub-Total all tenants

|

1,532

|

|

13,495,281

|

90.8%

|

$ 153,847,336

|

$ 11.40

|

100.0%

|

|||||||

|

Vacant

|

340

|

1,370,704

|

9.2%

|

N/A

|

N/A

|

N/A

|

||||||||

|

Total including vacant

|

1,872

|

14,865,985

|

100.0%

|

$ 153,847,336

|

N/A

|

100.0%

|

||||||||

|

(1)

|

Source: Latest Company filings per CreditRiskMonitor.

|

Page 16 of 28

|

Ramco Gershenson Properties Trust

|

|||||||

|

Leasing Activity - Consolidated and Unconsolidated Portfolios

|

|||||||

|

March 31, 2012

|

|||||||

|

Total Comparable Leases (1)

|

Leasing

Transactions

|

Square Footage

|

Base Rent

PSF

|

Prior Rent

PSF (2)

|

Rent Growth

%

|

Wtd. Avg.

Lease Term

|

TI's

PSF

|

|

1st Quarter 2012

|

78

|

483,299

|

$10.83

|

$10.47

|

3.4%

|

5.1

|

$1.20

|

|

4th Quarter 2011

|

73

|

392,702

|

$14.28

|

$14.09

|

1.3%

|

5.5

|

$3.79

|

|

3rd Quarter 2011

|

61

|

264,870

|

$14.17

|

$13.19

|

7.4%

|

4.2

|

$3.41

|

|

2nd Quarter 2011

|

64

|

360,795

|

$11.28

|

$11.05

|

2.1%

|

4.5

|

$0.43

|

|

Total

|

276

|

1,501,666

|

$12.43

|

$12.03

|

3.3%

|

4.9

|

$2.08

|

|

Renewals

|

Leasing

Transactions

|

Square Footage

|

Base Rent

PSF

|

Prior Rent

PSF (2)

|

Rent Growth

%

|

Wtd. Avg.

Lease Term

|

TI's

PSF

|

|

1st Quarter 2012

|

69

|

457,219

|

$10.41

|

$10.13

|

2.8%

|

4.9

|

$0.26

|

|

4th Quarter 2011

|

61

|

337,660

|

$14.28

|

$14.21

|

0.5%

|

5.0

|

$0.06

|

|

3rd Quarter 2011

|

48

|

213,511

|

$13.78

|

$13.36

|

3.1%

|

3.4

|

$0.37

|

|

2nd Quarter 2011

|

52

|

290,837

|

$11.67

|

$11.48

|

1.7%

|

3.8

|

$0.07

|

|

Total

|

230

|

1,299,227

|

$12.25

|

$12.02

|

1.9%

|

4.4

|

$0.18

|

|

New Leases-Comparable

|

Leasing

Transactions

|

Square Footage

|

Base Rent

PSF

|

Prior Rent

PSF (2)

|

Rent Growth

%

|

Wtd. Avg.

Lease Term

|

TI's

PSF

|

|

1st Quarter 2012

|

9

|

26,080

|

$18.26

|

$16.38

|

11.5%

|

9.9

|

$17.74

|

|

4th Quarter 2011

|

12

|

55,042

|

$14.26

|

$13.36

|

6.7%

|

8.4

|

$26.71

|

|

3rd Quarter 2011

|

13

|

51,359

|

$15.81

|

$12.48

|

26.7%

|

7.6

|

$16.05

|

|

2nd Quarter 2011

|

12

|

69,958

|

$9.66

|

$9.24

|

4.5%

|

7.4

|

$1.94

|

|

Total

|

46

|

202,439

|

$13.58

|

$12.10

|

12.2%

|

8.0

|

$14.29

|

|

Total Comparable and Non-Comparable

|

Leasing

Transactions

|

Square Footage

|

Base Rent

PSF

|

Prior Rent

PSF (2)

|

Rent Growth

%

|

Wtd. Avg.

Lease Term

|

TI's

PSF

|

|

1st Quarter 2012

|

102

|

549,340

|

$11.76

|

N/A

|

N/A

|

5.3

|

$5.49

|

|

4th Quarter 2011

|

104

|

495,697

|

$14.17

|

N/A

|

N/A

|

5.6

|

$8.23

|

|

3rd Quarter 2011

|

91

|

435,092

|

$13.22

|

N/A

|

N/A

|

5.6

|

$13.87

|

|

2nd Quarter 2011

|

84

|

495,208

|

$10.75

|

N/A

|

N/A

|

5.1

|

$4.58

|

|

Total

|

381

|

1,975,337

|

$12.43

|

N/A

|

N/A

|

5.4

|

$7.80

|

|

(1)

|

Comparable leases represent those leases signed on spaces for which there was a former tenant within the last twelve months.

|

|

(2)

|

Prior rent represents minimum rent, if any, paid by the prior tenant in the final 12 months of the term.

|

|

|

|||||||

|

|

|||||||

Page 17 of 28

|

Ramco-Gershenson Properties Trust

|

|||||||||||||

|

Portfolio Summary Report

|

|||||||||||||

|

March 31, 2012

|

|||||||||||||

| Company Owned GLA | |||||||||||||

|

Property Name

|

Location

|

Ownership

%

|

Year Built /

Acquired /

Redeveloped

|

Number of

Units |

Total

|

Anchor

|

Non-Anchor

|

%

Leased

|

%

Occupied

|

ABR

psf

|

|

Anchor Tenants (1)

|

|

|

Consolidated Core Portfolio

|

|||||||||||||

|

Florida

|

|||||||||||||

|

Coral Creek Shops

|

Coconut Creek

|

100%

|

1992/2002/NA

|

33

|

109,312

|

42,112

|

67,200

|

98.1%

|

98.1%

|

$ 16.48

|

Publix

|

||

|

Naples Towne Centre

|

Naples

|

100%

|

1982/1996/2003

|

11

|

134,707

|

102,027

|

32,680

|

89.8%

|

89.8%

|

5.94

|

Beall's, Save-A-Lot, (Goodwill)

|

||

|

River City Marketplace

|

Jacksonville

|

100%

|

2005/2005/NA

|

71

|

551,428

|

323,907

|

227,521

|

98.8%

|

98.8%

|

16.24

|

Ashley Furniture Home Store, Bed Bath & Beyond, Best Buy, Gander Mountain, Michaels, OfficeMax, PetSmart, Ross Dress For Less, Wallace Theaters, (Lowe's), (Wal-Mart Supercenter)

|

||

|

River Crossing Centre

|

New Port Richey

|

100%

|

1998/2003/NA

|

16

|

62,038

|

37,888

|

24,150

|

97.7%

|

97.7%

|

12.28

|

Publix

|

||

|

Rivertowne Square

|

Deerfield Beach

|

100%

|

1980/1998/2010

|

15

|

148,643

|

107,583

|

41,060

|

89.3%

|

89.3%

|

8.00

|

Beall's Outlet, Winn-Dixie

|

||

|

The Crossroads

|

Royal Palm Beach

|

100%

|

1988/2002/NA

|

33

|

120,092

|

42,112

|

77,980

|

94.3%

|

94.3%

|

14.57

|

Publix

|

||

|

Village Lakes Shopping Center

|

Land O' Lakes

|

100%

|

1987/1997/NA

|

26

|

186,496

|

109,735

|

76,761

|

47.7%

|

47.7%

|

9.35

|

Beall's Outlet

|

||

|

Total / Average

|

205

|

1,312,716

|

765,364

|

547,352

|

89.0%

|

89.0%

|

$ 13.37

|

||||||

|

Georgia

|

|||||||||||||

|

Centre at Woodstock

|

Woodstock

|

100%

|

1997/2004/NA

|

14

|

86,748

|

51,420

|

35,328

|

88.6%

|

88.6%

|

$ 11.51

|

Publix

|

||

|

Conyers Crossing

|

Conyers

|

100%

|

1978/1998/NA

|

15

|

170,475

|

138,915

|

31,560

|

99.4%

|

99.4%

|

5.13

|

Burlington Coat Factory, Hobby Lobby

|

||

|

Holcomb Center

|

Roswell

|

100%

|

1986/1996/2010

|

22

|

106,003

|

39,668

|

66,335

|

78.6%

|

78.6%

|

11.65

|

Studio Movie Grill

|

||

|

Horizon Village

|

Suwanee

|

100%

|

1996/2002/NA

|

22

|

97,001

|

47,955

|

49,046

|

73.9%

|

73.9%

|

10.91

|

Movie Tavern (3)

|

||

|

Mays Crossing

|

Stockbridge

|

100%

|

1984/1997/2007

|

21

|

137,284

|

100,244

|

37,040

|

94.8%

|

94.8%

|

6.95

|

Big Lots, Dollar Tree, Value Village-Sublease of ARCA Inc.

|

||

|

Total / Average

|

94

|

597,511

|

378,202

|

219,309

|

88.9%

|

88.9%

|

$ 8.30

|

||||||

|

Illinois

|

|||||||||||||

|

Liberty Square

|

Wauconda

|

100%

|

1987/2010/2008

|

26

|

107,369

|

54,522

|

52,847

|

85.8%

|

85.8%

|

$ 12.94

|

Jewel-Osco

|

||

|

Total/Average

|

26

|

107,369

|

54,522

|

52,847

|

85.8%

|

85.8%

|

$ 12.94

|

||||||

|

Indiana

|

|

||||||||||||

|

Merchants' Square

|

Carmel

|

100%

|

1970/2010/NA

|

45

|

278,875

|

69,504

|

209,371

|

81.7%

|

81.7%

|

$ 9.97

|

Cost Plus, Hobby Lobby (2), (Marsh Supermarket)

|

||

|

Total/Average

|

45

|

278,875

|

69,504

|

209,371

|

81.7%

|

81.7%

|

$ 9.97

|

||||||

|

Michigan

|

|||||||||||||

|

Beacon Square

|

Grand Haven

|

100%

|

2004/2004/NA

|

16

|

51,387

|

-

|

51,387

|

95.3%

|

91.8%

|

$ 17.26

|

(Home Depot)

|

||

|

Clinton Pointe

|

Clinton Township

|

100%

|

1992/2003/NA

|

14

|

135,330

|

65,735

|

69,595

|

96.8%

|

96.8%

|

9.77

|

OfficeMax, Sports Authority, (Target)

|

||

|

Clinton Valley

|

Sterling Heights

|

100%

|

1977/1996/2009

|

19

|

200,582

|

106,027

|

94,555

|

93.6%

|

93.6%

|

11.54

|

DSW Shoe Warehouse, Hobby Lobby, Office Depot

|

||

|

Edgewood Towne Center

|

Lansing

|

100%

|

1990/1996/2001

|

17

|

85,757

|

23,524

|

62,233

|

93.1%

|

93.1%

|

9.52

|

OfficeMax, (Sam's Club), (Target)

|

||

|

Fairlane Meadows

|

Dearborn

|

100%

|

1987/2003/2007

|

31

|

157,246

|

56,586

|

100,660

|

98.3%

|

98.3%

|

14.37

|

Best Buy, Citi Trends, (Burlington Coat Factory), (Target)

|

||

|

Fraser Shopping Center

|

Fraser

|

100%

|

1977/1996/NA

|

8

|

68,326

|

32,384

|

35,942

|

100.0%

|

100.0%

|

6.92

|

Oakridge Market

|

||

|

Gaines Marketplace

|

Gaines Township

|

100%

|

2004/2004/NA

|

15

|

392,169

|

351,981

|

40,188

|

100.0%

|

100.0%

|

4.67

|

Meijer, Staples, Target

|

||

|

Hoover Eleven

|

Warren

|

100%

|

1989/2003/NA

|

47

|

288,184

|

157,341

|

130,843

|

92.8%

|

78.7%

|

12.09

|

Kroger, Marshalls, OfficeMax

|

||

|

Jackson Crossing

|

Jackson

|

100%

|

1967/1996/2002

|

61

|

398,526

|

222,192

|

176,334

|

93.9%

|

93.9%

|

9.89

|

Bed Bath & Beyond, Best Buy, Jackson 10 Theater, Kohl's, T.J. Maxx, Toys "R" Us, (Sears), (Target)

|

||

|

Jackson West

|

Jackson

|

100%

|

1996/1996/1999

|

6

|

210,374

|

175,001

|

35,373

|

97.5%

|

97.5%

|

7.41

|

Lowe's, Michaels, OfficeMax

|

||

|

Lake Orion Plaza

|

Lake Orion

|

100%

|

1977/1996/NA

|

9

|

141,073

|

126,195

|

14,878

|

100.0%

|

100.0%

|

4.04

|

Hollywood Super Market, Kmart

|

||

|

Lakeshore Marketplace

|

Norton Shores

|

100%

|

1996/2003/NA

|

21

|

346,854

|

244,089

|

102,765

|

96.9%

|

91.1%

|

8.32

|

Barnes & Noble, Dunham's, Elder-Beerman, Hobby Lobby, T.J. Maxx, Toys "R" Us, (Target)

|

||

|

Livonia Plaza

|

Livonia

|

100%

|

1988/2003/NA

|

20

|

136,422

|

93,380

|

43,042

|

94.9%

|

94.9%

|

10.40

|

Kroger, TJ Maxx

|

||

|

New Towne Plaza

|

Canton Township

|

100%

|

1975/1996/2005

|

15

|

192,587

|

145,389

|

47,198

|

100.0%

|

100.0%

|

10.48

|

DSW Shoe Warehouse, Jo-Ann, Kohl's

|

||

|

Oak Brook Square

|

Flint

|

100%

|

1982/1996/2008

|

20

|

152,373

|

79,744

|

72,629

|

96.3%

|

96.3%

|

8.97

|

Hobby Lobby, T.J. Maxx

|

||

|

Roseville Towne Center

|

Roseville

|

100%

|

1963/1996/2004

|

9

|

246,968

|

206,747

|

40,221

|

91.5%

|

91.5%

|

6.79

|

Marshalls, Wal-Mart

|

||

|

Southfield Plaza

|

Southfield

|

100%

|

1969/1996/2003

|

14

|

165,999

|

128,339

|

37,660

|

98.0%

|

98.0%

|

7.64

|

Big Lots, Burlington Coat Factory, Marshalls

|

||

|

Tel-Twelve

|

Southfield

|

100%

|

1968/1996/2005

|

21

|

523,411

|

479,869

|

43,542

|

99.5%

|

99.5%

|

10.65

|

Best Buy, DSW Shoe Warehouse, Lowe's, Meijer, Michaels, Office Depot, PetSmart

|

||

|

The Auburn Mile

|

Auburn Hills

|

100%

|

2000/1999/NA

|

7

|

90,553

|

64,315

|

26,238

|

100.0%

|

100.0%

|

10.89

|

Jo-Ann, Staples, (Best Buy), (Costco), (Meijer), (Target)

|

||

|

West Oaks I

|

Novi

|

100%

|

1979/1996/2004

|

8

|

243,987

|

213,717

|

30,270

|

100.0%

|

100.0%

|

9.70

|

Best Buy, DSW Shoe Warehouse, Gander Mountain, Old Navy, Home Goods & Michaels-Sublease of JLPK-Novi LLC

|

||

|

West Oaks II

|

Novi

|

100%

|

1986/1996/2000

|

30

|

167,954

|

90,753

|

77,201

|

96.0%

|

96.0%

|

17.19

|

Jo-Ann, Marshalls, (Bed Bath & Beyond), (Big Lots), (Kohl's), (Toys "R" Us), (Value City Furniture)

|

||

|

Total / Average

|

408

|

4,396,062

|

3,063,308

|

1,332,754

|

96.9%

|

95.5%

|

$ 9.49

|

||||||

Page 18 of 28

|

Ramco-Gershenson Properties Trust

|

|||||||||||||

|

Portfolio Summary Report

|

|||||||||||||

|

March 31, 2012

|

|||||||||||||

|

Company Owned GLA

|

|||||||||||||

|

Property Name

|

Location

|

Ownership

%

|

Year Built /

Acquired /

Redeveloped

|

Number of

Units |

Total

|

Anchor

|

Non-Anchor

|

%

Leased

|

%

Occupied

|

|

ABR

psf

|

|

Anchor Tenants (1)

|

|

Missouri

|

|||||||||||||

|

Heritage Place

|

Creve Coeur (St Louis)

|

100%

|

1989/2011/2005

|

38

|

269,254

|

157,946

|

111,308

|

90.9%

|

90.9%

|

$ 13.32

|

Dierberg's Market, Marshalls, Office Depot, T.J. Maxx

|

||

|

Town & Country Crossing

|

Town & Country

|

100%

|

2008/2011/2011

|

36

|

141,996

|

55,012

|

86,984

|

84.4%

|

84.4%

|

24.55

|

Whole Foods, (Target)

|

||

|

Total / Average

|

74

|

411,250

|

212,958

|

198,292

|

88.6%

|

88.6%

|

$ 17.01

|

||||||

|

Ohio

|

|||||||||||||

|

Crossroads Centre

|

Rossford

|

100%

|

2001/2001/NA

|

20

|

344,045

|

244,991

|

99,054

|

89.9%

|

89.9%

|

$ 9.04

|

Giant Eagle, Home Depot, Michaels, T.J. Maxx, (Target)

|

||

|

Rossford Pointe

|

Rossford

|

100%

|

2006/2005/NA

|

6

|

47,477

|

41,077

|

6,400

|

100.0%

|

100.0%

|

10.21

|

MC Sporting Goods, PetSmart

|

||

|

Spring Meadows Place

|

Holland

|

100%

|

1987/1996/2005

|

27

|

211,808

|

110,691

|

101,117

|

94.6%

|

94.6%

|

11.65

|

Ashley Furniture, OfficeMax, PetSmart, T.J. Maxx, (Best Buy), (Big Lots), (Dick's Sporting Goods), (Guitar Center), (Kroger), (Sam's Club), (Target)

|

||

|

Troy Towne Center

|

Troy

|

100%

|

1990/1996/2003

|

18

|

144,485

|

86,584

|

57,901

|

99.0%

|

99.0%

|

6.57

|

Kohl's, (Wal-Mart Supercenter)

|

||

|

Total / Average

|

71

|

747,815

|

483,343

|

264,472

|

93.6%

|

93.6%

|

$ 9.36

|

||||||

|

Tennessee

|

|||||||||||||

|

Northwest Crossing

|

Knoxville

|

100%

|

1989/1999/2006

|

12

|

124,453

|

89,846

|

34,607

|

100.0%

|

100.0%

|

$ 9.60

|

HH Gregg, OfficeMax, Ross Dress For Less, (Wal-Mart Supercenter)

|

||

|

Total / Average

|

12

|

124,453

|

89,846

|

34,607

|

100.0%

|

100.0%

|

$ 9.60

|

||||||

|

Virginia

|

|||||||||||||

|

The Town Center at Aquia Office (4)

|

Stafford

|

100%

|

1989/1998/NA

|

13

|

98,147

|

62,184

|

35,963

|

91.8%

|

91.8%

|

$ 26.39

|

TASC

|

||

|

The Town Center at Aquia

|

Stafford

|

100%

|

1989/1998/NA

|

3

|

40,518

|

24,000

|

16,518

|

100.0%

|

100.0%

|

10.64

|

Regal Cinemas

|

||

|

Total / Average

|

16

|

138,665

|

86,184

|

52,481

|

94.2%

|

94.2%

|

$ 21.50

|

||||||

|

Wisconsin

|

|||||||||||||

|

East Town Plaza

|

Madison

|

100%

|

1992/2000/2000

|

19

|

208,675

|

117,000

|

91,675

|

84.3%

|

76.6%

|

$ 8.47

|

Burlington Coat Factory, Jo-Ann, Marshalls, (Menards), (Shopko), (Toys "R" Us)

|

||

|

The Shoppes at Fox River

|

Waukesha

|

100%

|

2009/2010/2011

|

20

|

135,566

|

61,045

|

74,521

|

97.3%

|

97.3%

|

16.60

|

Pick N' Save, (Target)

|

||

|

West Allis Towne Centre

|

West Allis

|

100%

|

1987/1996/2011

|

29

|

326,271

|

179,818

|

146,453

|

91.3%

|

91.3%

|

8.29

|

Burlington Coat Factory, Kmart, Office Depot

|

||

|

Total / Average

|

68

|

670,512

|

357,863

|

312,649

|

90.4%

|

88.0%

|

$ 10.20

|

||||||

|

Consolidated Core Portfolio Subtotal / Average

|

1,019

|

8,785,228

|

5,561,094

|

3,224,134

|

93.4%

|

92.5%

|

$ 10.59

|

||||||

|

Joint Venture Core Portfolio at 100%

|

|||||||||||||

|

Florida

|

|||||||||||||

|

Cocoa Commons

|

Cocoa

|

30%

|

2001/2007/2008

|

23

|

90,116

|

51,420

|

38,696

|

78.9%

|

78.9%

|

$ 11.78

|

Publix

|

||

|

Cypress Point

|

Clearwater

|

30%

|

1983/2007/NA

|

22

|

167,280

|

103,085

|

64,195

|

94.3%

|

94.3%

|

11.76

|

Burlington Coat Factory, The Fresh Market

|

||

|

Kissimmee West

|

Kissimmee

|

7%

|

2005/2005/NA

|

17

|

115,586

|

67,000

|

48,586

|

92.7%

|

92.7%

|

11.62

|

Jo-Ann, Marshalls, (SuperTarget)

|

||

|

Marketplace of Delray

|

Delray Beach

|

30%

|

1981/2005/2010

|

49

|

238,901

|

107,190

|

131,711

|

90.5%

|

89.3%

|

12.36

|

Office Depot, Ross Dress For Less, Winn-Dixie

|

||

|

Martin Square

|

Stuart

|

30%

|

1981/2005/NA

|

15

|

331,105

|

291,432

|

39,673

|

91.2%

|

91.2%

|

6.28

|

Home Depot, Sears, Staples

|

||

|

Mission Bay Plaza

|

Boca Raton

|

30%

|

1989/2004/NA

|

59

|

263,721