Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PROGRESS SOFTWARE CORP /MA | d340313dex991.htm |

| 8-K - FORM 8-K - PROGRESS SOFTWARE CORP /MA | d340313d8k.htm |

Exhibit 99.2

Progress Software Presentation to Investors Jay Bhatt President & Chief Executive Officer April 25, 2012 BUSINESS MAKING PROGRESS PROGRESS software

BUSINESS MAKING PROGRESS. © 2012 Progress Software Corporation. All rights reserved. 2 Forward Looking Statements This presentation contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Progress has identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “should,” “expect,” “intend,” “plan,” “target,” “anticipate” and “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Forward-looking statements in this presentation include, but are not limited to, statements regarding Progress’s strategic plan and the expected timing for completion; the components of that plan including operational restructuring, product divestitures and return of capital to shareholders; acquisitions; future revenue growth, operating margin and cost savings; product development, strategic partnering and marketing initiatives; the growth rates of certain markets; and other statements regarding the future operation, direction and success of Progress’s business. There are a number of factors that could cause actual results or future events to differ materially from those anticipated by the forward-looking statements, including, without limitation: (1) Progress’s ability to realize the expected benefits and cost savings from its strategic plan; (2) market acceptance of Progress’s strategic plan and product development initiatives; (3) disruption caused by implementation of the strategic plan and related restructuring and divestitures on relationships with employees, customers, vendors and other business partners; (4) pricing pressures and the competitive environment in the software industry and Platform-as-a-Service market; (5) Progress’s ability to complete the proposed product divestitures in a timely manner, at favorable prices or at all; (6) Progress’s ability to make technology acquisitions and to realize the expected benefits and anticipated synergies from such acquisitions; (7) the continuing weakness in the U.S. and international economies, which could result in fewer sales of Progress’s products and/or delays in the implementation of Progress’s strategic plan and may otherwise harm Progress’s business; (8) business and consumer use of the Internet and the continuing adoption of Cloud technologies; (9) the receipt and shipment of new orders; (10) Progress’s ability to expand its relationships with channel partners and to manage the interaction of channel partners with its direct sales force; (11) the timely release of enhancements to Progress’s products and customer acceptance of new products; (12) the positioning of Progress’s products in its existing and new markets; (13) variations in the demand for professional services and technical support; (14) Progress’s ability to penetrate international markets and manage its international operations; and (15) changes in exchange rates. For further information regarding risks and uncertainties associated with Progress’s business, please refer to Progress’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended November 30, 2011, as amended and its Quarterly Report on Form 10-Q for the fiscal quarter ended February 29, 2012. Progress undertakes no obligation to update any forward-looking statements, which speak only as of the date of this presentation. This presentation is not a commitment to deliver any specified code or functionality and should not be relied upon in making purchasing decisions. The development, release and timing of features or functionality described for our products remains at the sole discretion of Progress.

© 2012 Progress Software Corporation. All rights reserved. 3 Important Shareholder Information Progress will hold its 2012 Annual Meeting of Shareholders on May 31, 2012. Progress has filed with the Securities and Exchange Commission and mailed to its shareholders a definitive proxy statement in connection with the Annual Meeting. The proxy statement contains important information about Progress, the Annual Meeting and related matters. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT SOLICITATION MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. The proxy statement and other relevant solicitation materials (when they become available), and any and all documents filed by Progress with the SEC, may be obtained by investors and security holders free of charge at the SEC’s web site at www.sec.gov. In addition, Progress’s filings with the SEC, including the proxy statement and other relevant solicitation materials (when they become available), may be obtained, without charge, from Progress by directing a request to Progress at 14 Oak Park, Bedford, Massachusetts 01730, c/o Corporate Secretary. Progress and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Progress in connection with the Annual Meeting. Information regarding Progress’s directors and executive officers is contained in Progress’s annual report on Form 10-K filed with the SEC on January 30, 2012, as amended, and definitive proxy statement filed with the SEC on April 20, 2012. BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 4 Business Overview Corporate Governance Agenda BUSINESS MAKING PROGRESS.

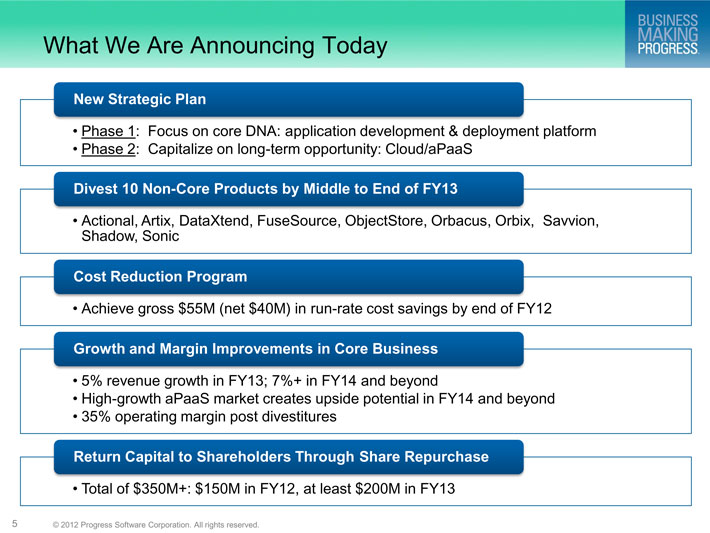

© 2012 Progress Software Corporation. All rights reserved. 5 What We Are Announcing Today •Phase 1: Focus on core DNA: application development & deployment platform •Phase 2: Capitalize on long-term opportunity: Cloud/aPaaS New Strategic Plan •Actional, Artix, DataXtend, FuseSource, ObjectStore, Orbacus, Orbix, Savvion, Shadow, Sonic Divest 10 Non-Core Products by Middle to End of FY13 •Achieve gross $55M (net $40M) in run-rate cost savings by end of FY12 Cost Reduction Program •5% revenue growth in FY13; 7%+ in FY14 and beyond •High-growth aPaaS market creates upside potential in FY14 and beyond •35% operating margin post divestitures Growth and Margin Improvements in Core Business •Total of $350M+: $150M in FY12, at least $200M in FY13 Return Capital to Shareholders Through Share Repurchase BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 6 Operating Philosophy ?Customer focus and innovation ?Growth better than market rates ?Continuous improvement in operating margins ?Prudent and responsible investment ?Operational excellence ?Accountability Commitment to driving shareholder value BUSINESS MAKING PROGRESS.

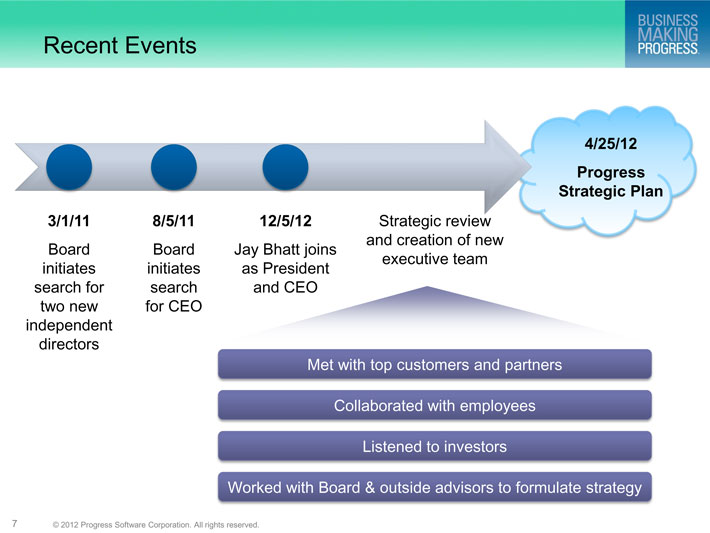

© 2012 Progress Software Corporation. All rights reserved. 7 Recent Events 12/5/12 Jay Bhatt joins as President and CEO Strategic review and creation of new executive team 8/5/11 Board initiates search for CEO Met with top customers and partners 4/25/12 Progress Strategic Plan Collaborated with employees Listened to investors Worked with Board & outside advisors to formulate strategy 3/1/11 Board initiates search for two new independent directors BUSINESS MAKING PROGRESS.

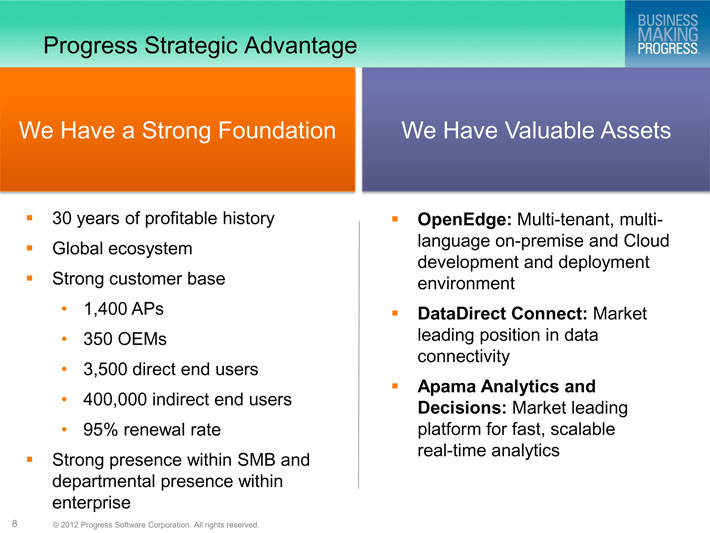

© 2012 Progress Software Corporation. All rights reserved. 8 We Have a Strong Foundation We Have Valuable Assets Progress Strategic Advantage ?30 years of profitable history ?Global ecosystem ?Strong customer base •1,400 APs •350 OEMs •3,500 direct end users •400,000 indirect end users •95% renewal rate ?Strong presence within SMB and departmental presence within enterprise ?OpenEdge: Multi-tenant, multi-language on-premise and Cloud development and deployment environment ?DataDirect Connect: Market leading position in data connectivity ?Apama Analytics and Decisions: Market leading platform for fast, scalable real-time analytics BUSINESS MAKING PROGRESS.

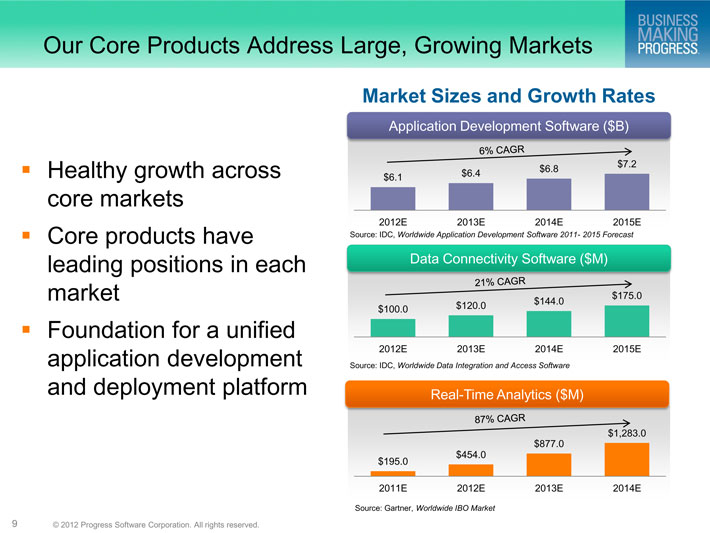

© 2012 Progress Software Corporation. All rights reserved. 9 $195.0 $454.0 $877.0 $1,283.0 2011E 2012E 2013E 2014E Our Core Products Address Large, Growing Markets Market Sizes and Growth Rates ?Healthy growth across core markets ?Core products have leading positions in each market ?Foundation for a unified application development and deployment platform $6.1 $6.4 $6.8 $7.2 2012E 2013E 2014E 2015E Application Development Software ($B) Source: IDC, Worldwide Application Development Software 2011- 2015 Forecast $ 100.0 $120.0 $144.0 $175.0 2012E 2013E 2014E 2015E Data Connectivity Software ($M) Source: IDC, Worldwide Data Integration and Access Software R eal-Time Analytics ($M) Source: Gartner, Worldwide IBO Market BUSINESS MAKING PROGRESS. 6% CAGR 21% CAGR 87% CAGR

© 2012 Progress Software Corporation. All rights reserved. 10 Progress Mission Progress Software will be a leading independent application development and deployment platform in the Cloud (Progress aPaaS) … BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 11 Progress Mission …in order to reach our goal, we will invest in our core strengths and build on our foundation to achieve annual revenue growth of 7%+ with 35% operating margins BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 12 Phase 2: Strengthen Cloud Application Platform Two-Phase Execution Plan Phase 1: Focus and Strengthen Our Core Business BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 13 Phase 1 – Business Roadmap FY12 Application Development and Deployment •Expand formal partner program via technical & business enablement •Accelerate partners’ adoption of SaaS business model •Build brand awareness of platform Data Access •Improve web marketing and lead generation •Focus on sales enablement •Expand further in EMEA and APJ Real-Time Analytics •Refocus and expand leadership in capital markets •Expand early success in other horizontal use cases that can be translated to the Cloud BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 14 Phase 1 – Business Roadmap FY13+ Application Development and Deployment •Drive up-sell opportunities with direct customers through add-on module and other product offerings •Focus on application modernization by partnering with and/or acquiring service organizations with core competencies Data Access •Expand OEM contracts to include new SaaS connectivity •Partner with and/or acquire companies that expand data source and Big Data footprint Real-Time Analytics •Expand horizontal use cases in the Cloud and scale through systems integrators BUSINESS MAKING PROGRESS.

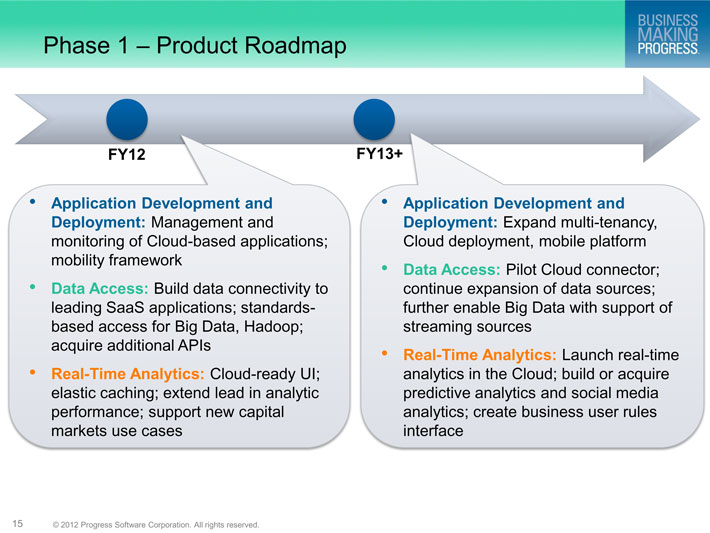

© 2012 Progress Software Corporation. All rights reserved. 15 Phase 1 – Product Roadmap FY12 FY13+ •Application Development and Deployment: Management and monitoring of Cloud-based applications; mobility framework •Data Access: Build data connectivity to leading SaaS applications; standards-based access for Big Data, Hadoop; acquire additional APIs •Real-Time Analytics: Cloud-ready UI; elastic caching; extend lead in analytic performance; support new capital markets use cases •Application Development and Deployment: Expand multi-tenancy, Cloud deployment, mobile platform •Data Access: Pilot Cloud connector; continue expansion of data sources; further enable Big Data with support of streaming sources •Real-Time Analytics: Launch real-time analytics in the Cloud; build or acquire predictive analytics and social media analytics; create business user rules interface BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 16 Two-Phase Execution Plan Phase 1: Focus and Strengthen Our Core Business Phase 2: Strengthen Cloud Application Platform BUSINESS MAKING PROGRESS.

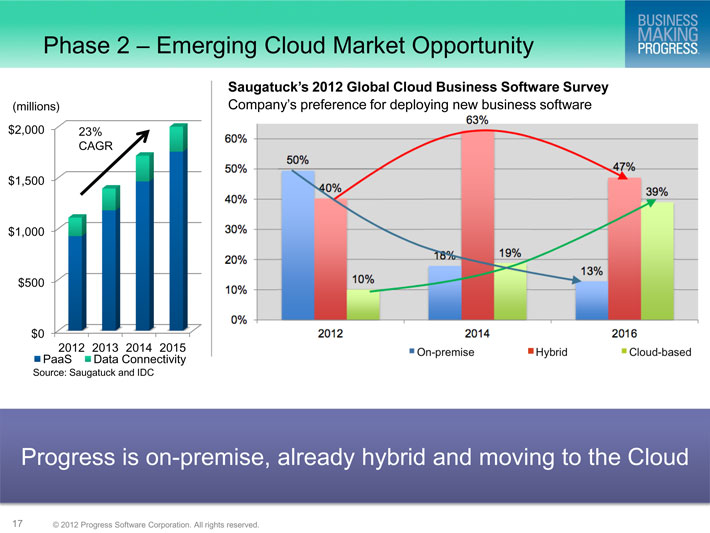

© 2012 Progress Software Corporation. All rights reserved. 17 Phase 2 – Emerging Cloud Market Opportunity $0 $500 $1,000 $1,500 $2,000 2012 2013 2014 2015 PaaS Data Connectivity 23% CAGR (millions) Saugatuck’s 2012 Global Cloud Business Software Survey Company’s preference for deploying new business software Progress is on-premise, already hybrid and moving to the Cloud Source: Saugatuck and IDC BUSINESS MAKING PROGRESS.

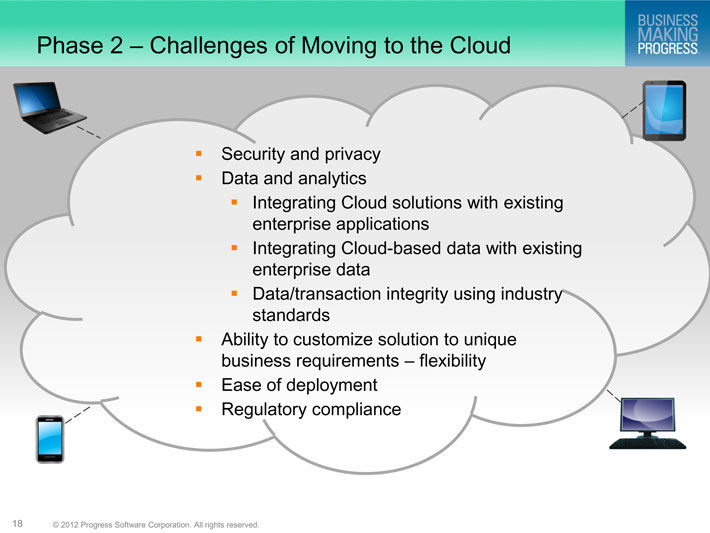

© 2012 Progress Software Corporation. All rights reserved. 18 Phase 2 – Challenges of Moving to the Cloud ?Security and privacy ?Data and analytics ?Integrating Cloud solutions with existing enterprise applications ?Integrating Cloud-based data with existing enterprise data ?Data/transaction integrity using industry standards ?Ability to customize solution to unique business requirements – flexibility ?Ease of deployment ?Regulatory compliance BUSINESS MAKING PROGRESS.

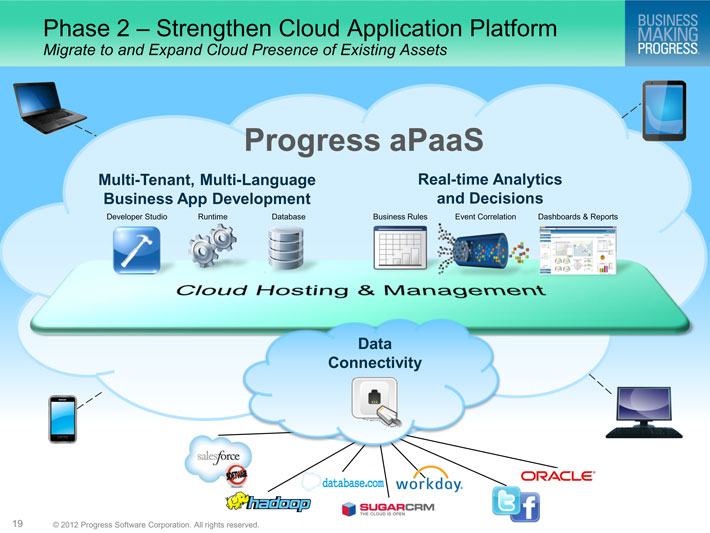

© 2012 Progress Software Corporation. All rights reserved. 19 Phase 2 – Strengthen Cloud Application Platform Migrate to and Expand Cloud Presence of Existing Assets Multi-Tenant, Multi-Language Business App Development Database Developer Studio Runtime Real-time Analytics and Decisions Business Rules Event Correlation Dashboards & Reports Data Connectivity Progress aPaaS BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 20 ?Core products are the foundation of the Progress aPaaS platform ?~400,000 end-user customers are driving demand for Cloud applications ?600 applications running in the Cloud today – the third-largest aPaaS ISV application base in the world ?Only 15% of our 1,400 ISVs have moved to the Cloud Progress’ Ability to Be a Leader in aPaaS BUSINESS MAKING PROGRESS.

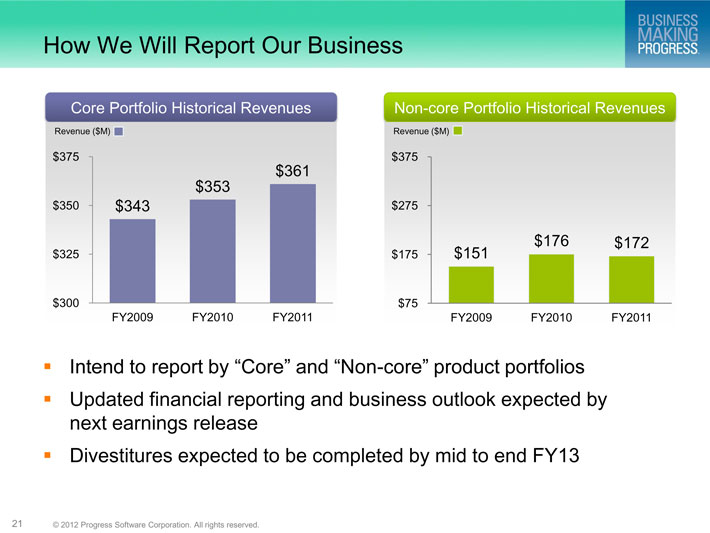

© 2012 Progress Software Corporation. All rights reserved. 21 How We Will Report Our Business ?Intend to report by “Core” and “Non-core” product portfolios ?Updated financial reporting and business outlook expected by next earnings release ?Divestitures expected to be completed by mid to end FY13 Core Portfolio Historical Revenues Non-core Portfolio Historical Revenues $343 $353 $361 $300 $325 $350 $375 FY2009 FY2010 FY2011 Revenue ($M) $151 $176 $172 $75 $175 $275 $375 FY2009 FY2010 FY2011 Revenue ($M) BUSINESS MAKING PROGRESS.

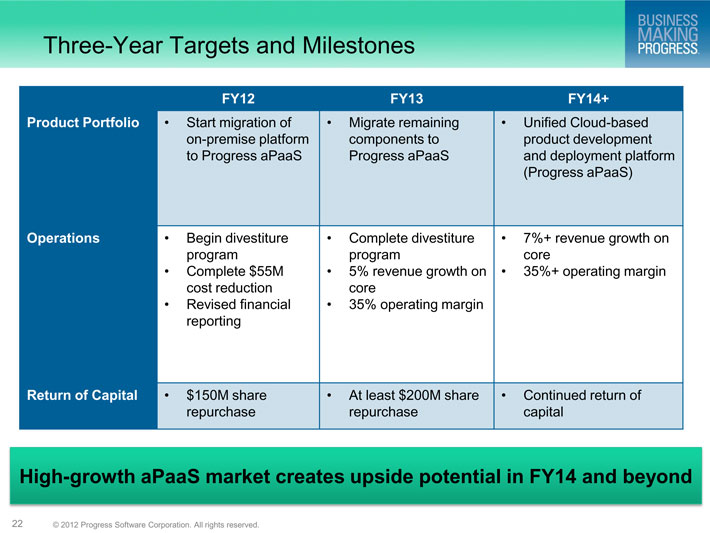

© 2012 Progress Software Corporation. All rights reserved. 22 Three-Year Targets and Milestones FY12 FY13 FY14+ Product Portfolio •Start migration of on-premise platform to Progress aPaaS •Migrate remaining components to Progress aPaaS •Unified Cloud-based product development and deployment platform (Progress aPaaS) Operations •Begin divestiture program •Complete $55M cost reduction •Revised financial reporting •Complete divestiture program •5% revenue growth on core •35% operating margin •7%+ revenue growth on core •35%+ operating margin Return of Capital •$150M share repurchase •At least $200M share repurchase •Continued return of capital High-growth aPaaS market creates upside potential in FY14 and beyond BUSINESS MAKING PROGRESS.

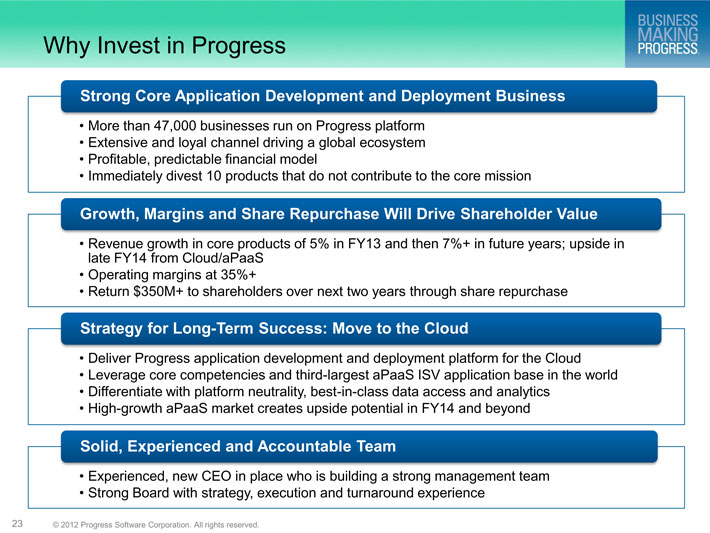

© 2012 Progress Software Corporation. All rights reserved. 23 Why Invest in Progress •More than 47,000 businesses run on Progress platform •Extensive and loyal channel driving a global ecosystem •Profitable, predictable financial model •Immediately divest 10 products that do not contribute to the core mission Strong Core Application Development and Deployment Business •Revenue growth in core products of 5% in FY13 and then 7%+ in future years; upside in late FY14 from Cloud/aPaaS •Operating margins at 35%+ •Return $350M+ to shareholders over next two years through share repurchase Growth, Margins and Share Repurchase Will Drive Shareholder Value •Deliver Progress application development and deployment platform for the Cloud •Leverage core competencies and third-largest aPaaS ISV application base in the world •Differentiate with platform neutrality, best-in-class data access and analytics •High-growth aPaaS market creates upside potential in FY14 and beyond Strategy for Long-Term Success: Move to the Cloud •Experienced, new CEO in place who is building a strong management team •Strong Board with strategy, execution and turnaround experience Solid, Experienced and Accountable Team BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 24 Business Overview Corporate Governance Agenda BUSINESS MAKING PROGRESS.

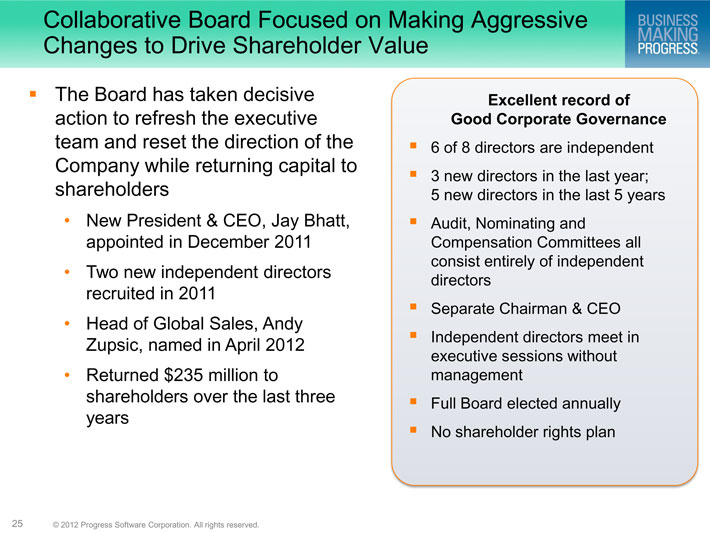

© 2012 Progress Software Corporation. All rights reserved. 25 Collaborative Board Focused on Making Aggressive Changes to Drive Shareholder Value ?The Board has taken decisive action to refresh the executive team and reset the direction of the Company while returning capital to shareholders •New President & CEO, Jay Bhatt, appointed in December 2011 •Two new independent directors recruited in 2011 •Head of Global Sales, Andy Zupsic, named in April 2012 •Returned $235 million to shareholders over the last three years Excellent record of Good Corporate Governance ?6 of 8 directors are independent ?3 new directors in the last year; 5 new directors in the last 5 years ?Audit, Nominating and Compensation Committees all consist entirely of independent directors ?Separate Chairman & CEO ?Independent directors meet in executive sessions without management ?Full Board elected annually ?No shareholder rights plan BUSINESS MAKING PROGRESS.

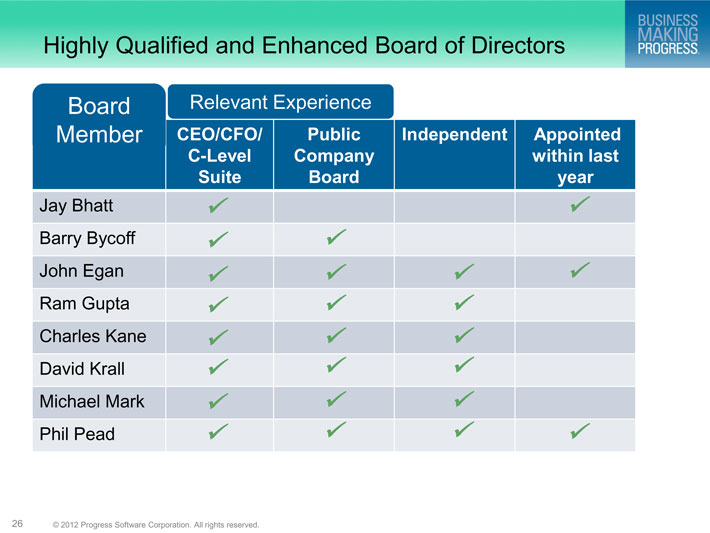

© 2012 Progress Software Corporation. All rights reserved. 26 CEO/CFO/ C-Level Suite Public Company Board Independent Appointed within last year Jay Bhatt Barry Bycoff John Egan Ram Gupta Charles Kane David Krall Michael Mark Phil Pead Board Member Relevant Experience Highly Qualified and Enhanced Board of Directors BUSINESS MAKING PROGRESS.

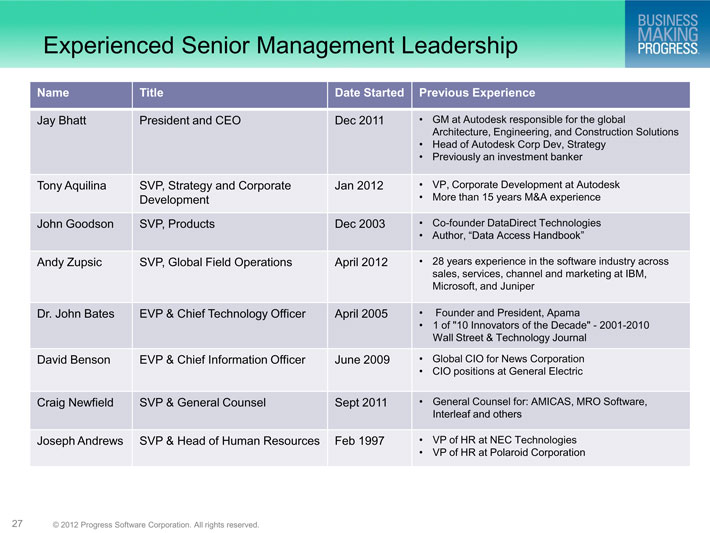

© 2012 Progress Software Corporation. All rights reserved. 27 Experienced Senior Management Leadership Name Title Date Started Previous Experience Jay Bhatt President and CEO Dec 2011 •GM at Autodesk responsible for the global Architecture, Engineering, and Construction Solutions •Head of Autodesk Corp Dev, Strategy •Previously an investment banker Tony Aquilina SVP, Strategy and Corporate Development Jan 2012 •VP, Corporate Development at Autodesk •More than 15 years M&A experience John Goodson SVP, Products Dec 2003 •Co-founder DataDirect Technologies •Author, “Data Access Handbook” Andy Zupsic SVP, Global Field Operations April 2012 •28 years experience in the software industry across sales, services, channel and marketing at IBM, Microsoft, and Juniper Dr. John Bates EVP & Chief Technology Officer April 2005 • Founder and President, Apama •1 of “10 Innovators of the Decade”—2001-2010 Wall Street & Technology Journal David Benson EVP & Chief Information Officer June 2009 •Global CIO for News Corporation •CIO positions at General Electric Craig Newfield SVP & General Counsel Sept 2011 •General Counsel for: AMICAS, MRO Software, Interleaf and others Joseph Andrews SVP & Head of Human Resources Feb 1997 •VP of HR at NEC Technologies •VP of HR at Polaroid Corporation BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 28 Starboard’s Nominees Do Not Add Value to the Progress Board ?Starboard nominees do not offer additional expertise to Progress Board ?Starboard originally proposed plan is simplistic and lacks credibility ?Starboard nominees have extensive history and allegiances with Starboard •Jeff Smith: CEO and CIO of Starboard; Self-nominated to 15 campaigns •Ed Terino: Starboard nominee in 5 previous campaigns •Dale Fuller: Starboard nominee in 2 previous campaigns The Progress Board of Directors unanimously recommends that shareholders vote FOR Progress’ independent, experienced nominees BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 29 Our Board, Management and Plan Are Best for Shareholders ?We have made significant improvements in our management and board ?We undertook very comprehensive evaluation of our business and our strategy, with our external advisors including J.P. Morgan ?We are already executing the new plan, which includes a complex set of divestitures as well as a refocusing of our business and employees ?It would be unproductive to add Starboard nominees, who are unfamiliar with our products and the work that has been done, and the job ahead ?The full Board is up for election annually ?We are 100% prepared to be held accountable to our shareholders ?We unanimously believe this plan will maximize shareholder value The Progress Board of Directors unanimously recommends that shareholders vote FOR Progress’ independent, experienced nominees BUSINESS MAKING PROGRESS.

© 2012 Progress Software Corporation. All rights reserved. 30 Why Invest in Progress •More than 47,000 businesses run on Progress platform •Extensive and loyal channel, driving a global ecosystem •Profitable, predictable financial model •Immediately divest 10 products that do not contribute to the core mission Strong Core Application Development and Deployment Business •Revenue growth in core products of 5% in FY13 and then 7%+ in future years; upside in late FY14 from Cloud/aPaaS •Operating margins at 35%+ •Return $350M+ to shareholders over next two years through share repurchase Growth, Margins and Share Repurchase will Drive Shareholder Value •Deliver Progress application development and deployment platform for the Cloud •Leverage core competencies and third-largest aPaaS ISV application base in the world •Differentiate with platform neutrality, best-in-class data access and analytics •High-growth aPaaS market creates upside potential in FY14 and beyond Strategy for Long-Term Success: Move to the Cloud •Experienced, new CEO in place who is building a strong management team •Strong Board with strategy, execution and turnaround experience Solid, Experienced and Accountable Team BUSINESS MAKING PROGRESS.

BUSINESS MAKING PROGRESS. PROGRESS software