Attached files

| file | filename |

|---|---|

| 8-K - CIRRUS LOGIC, INC. 8-K - CIRRUS LOGIC, INC. | a50252878.htm |

| EX-10.1 - EXHIBIT 10.1 - CIRRUS LOGIC, INC. | a50252878ex101.htm |

| EX-99.1 - EXHIBIT 99.1 - CIRRUS LOGIC, INC. | a50252878ex991.htm |

Exhibit 99.2

1 Letter to Shareholders Q4 FY12 in memory of Michael L. Hackworth 1941 - 2012 April 25, 2012

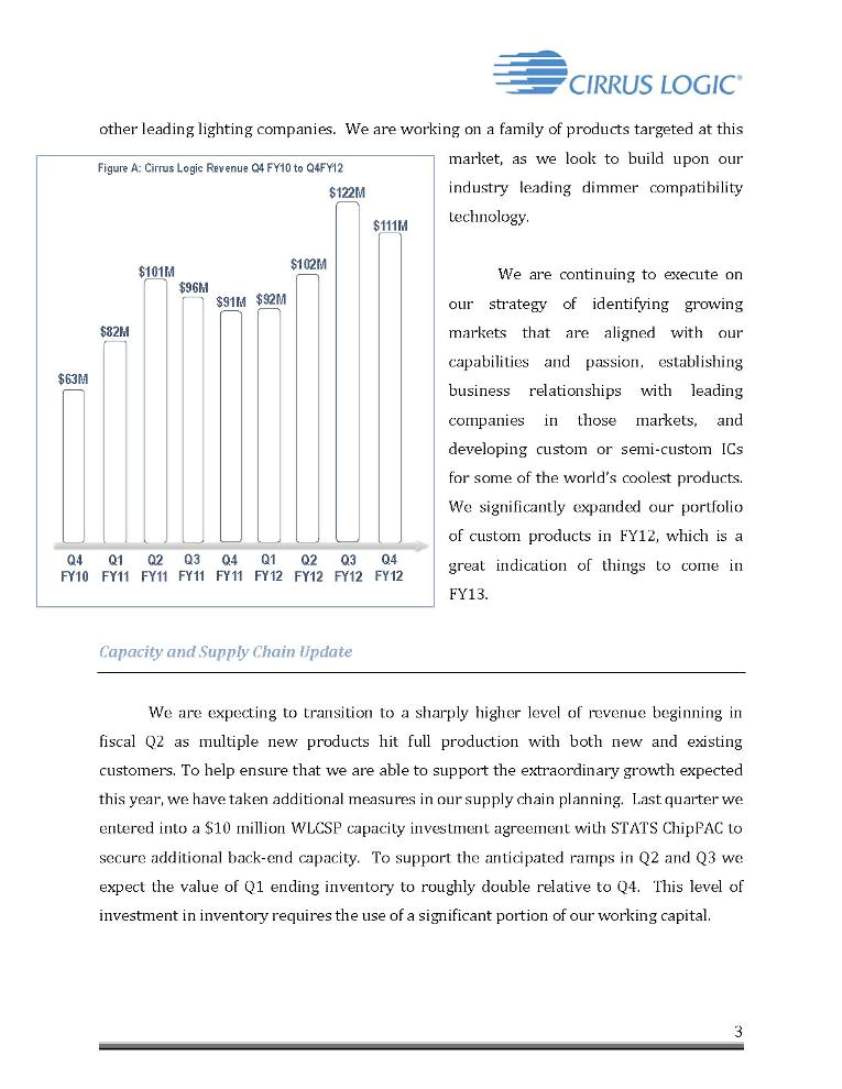

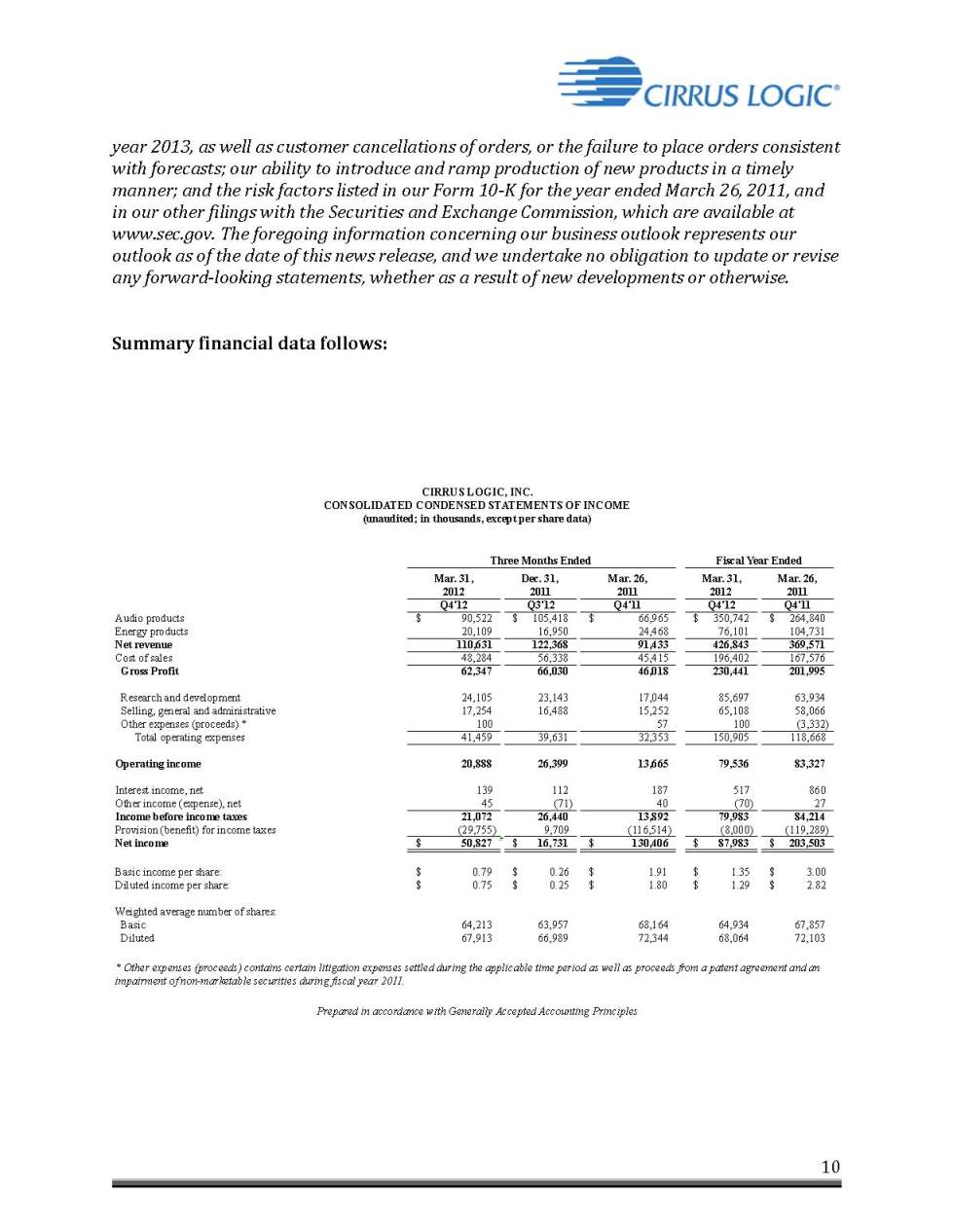

2 April 25, 2012 Dear Shareholders, It was with tremendous sadness and regret that we recently announced that our company co-founder and current Chairman of the Board of Directors Michael L. Hackworth passed away. It’s hard to overstate the achievements that Mike has made not only to Cirrus Logic but also to the semiconductor industry at large. He was a true visionary. Among his many accomplishments, Mike pioneered the fabless semiconductor model at Cirrus Logic, and with the company's success proved that "real men really don't need fabs." Mike was president and CEO of Cirrus Logic between 1985 and 1999, and he remained with the company as chairman until his passing. Above all, Mike was one of the good guys – a trusted leader with tremendous wisdom. Mike steered Cirrus Logic through the boom of the chip industry in the 1980s and through the ups and downs of changing market cycles for the next three decades. Today, Cirrus Logic is stronger than ever due in no small part to Mike's leadership. Financial Results We are pleased with our progress in fiscal year 2012. Quarterly revenue in Q4 grew 21 percent on a year-over-year basis, and revenue for the full fiscal year grew at our target goal of 15 percent, well ahead of the semiconductor industry. Our earnings per share for the year were up on a non-GAAP basis and gross margins remained strong for the overall year at 54 percent. While these financial results are impressive, we’re even more excited about the progress we’ve made this year related to products in development. One key highlight was the recent public launch of our first LED controller. This product is now shipping in production to our first lead customer, and design activity is continuing with

3 other leading lighting companies. We are working on a family of products targeted at this market, as we look to build upon our industry leading dimmer compatibility technology. We are continuing to execute on our strategy of identifying growing markets that are aligned with our capabilities and passion, establishing business relationships with leading companies in those markets, and developing custom or semi-custom ICs for some of the world’s coolest products. We significantly expanded our portfolio of custom products in FY12, which is a great indication of things to come in FY13. Capacity and Supply Chain Update We are expecting to transition to a sharply higher level of revenue beginning in fiscal Q2 as multiple new products hit full production with both new and existing customers. To help ensure that we are able to support the extraordinary growth expected this year, we have taken additional measures in our supply chain planning. Last quarter we entered into a $10 million WLCSP capacity investment agreement with STATS ChipPAC to secure additional back-end capacity. To support the anticipated ramps in Q2 and Q3 we expect the value of Q1 ending inventory to roughly double relative to Q4. This level of investment in inventory requires the use of a significant portion of our working capital.

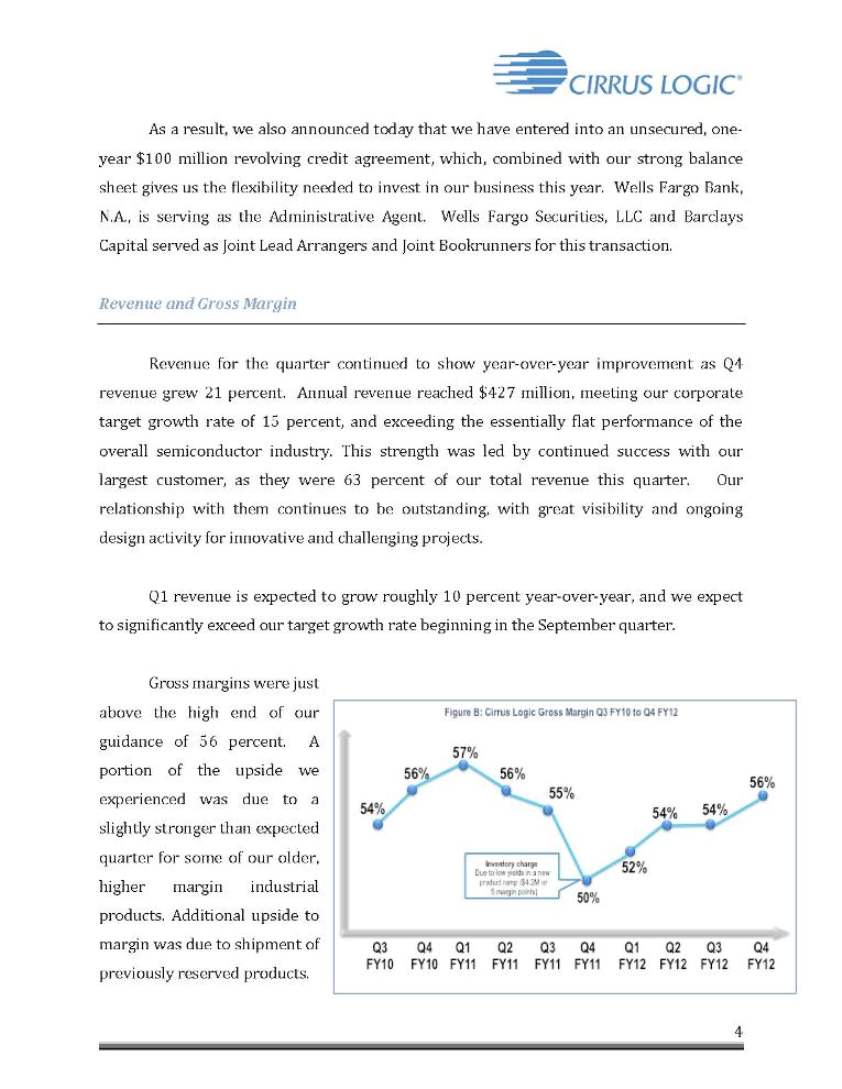

4 As a result, we also announced today that we have entered into an unsecured, one-year $100 million revolving credit agreement, which, combined with our strong balance sheet gives us the flexibility needed to invest in our business this year. Wells Fargo Bank, N.A., is serving as the Administrative Agent. Wells Fargo Securities, LLC and Barclays Capital served as Joint Lead Arrangers and Joint Bookrunners for this transaction. Revenue and Gross Margin Revenue for the quarter continued to show year-over-year improvement as Q4 revenue grew 21 percent. Annual revenue reached $427 million, meeting our corporate target growth rate of 15 percent, and exceeding the essentially flat performance of the overall semiconductor industry. This strength was led by continued success with our largest customer, as they were 63 percent of our total revenue this quarter. Our relationship with them continues to be outstanding, with great visibility and ongoing design activity for innovative and challenging projects. Q1 revenue is expected to grow roughly 10 percent year-over-year, and we expect to significantly exceed our target growth rate beginning in the September quarter. Gross margins were just above the high end of our guidance of 56 percent. A portion of the upside we experienced was due to a slightly stronger than expected quarter for some of our older, higher margin industrial products. Additional upside to margin was due to shipment of previously reserved products.

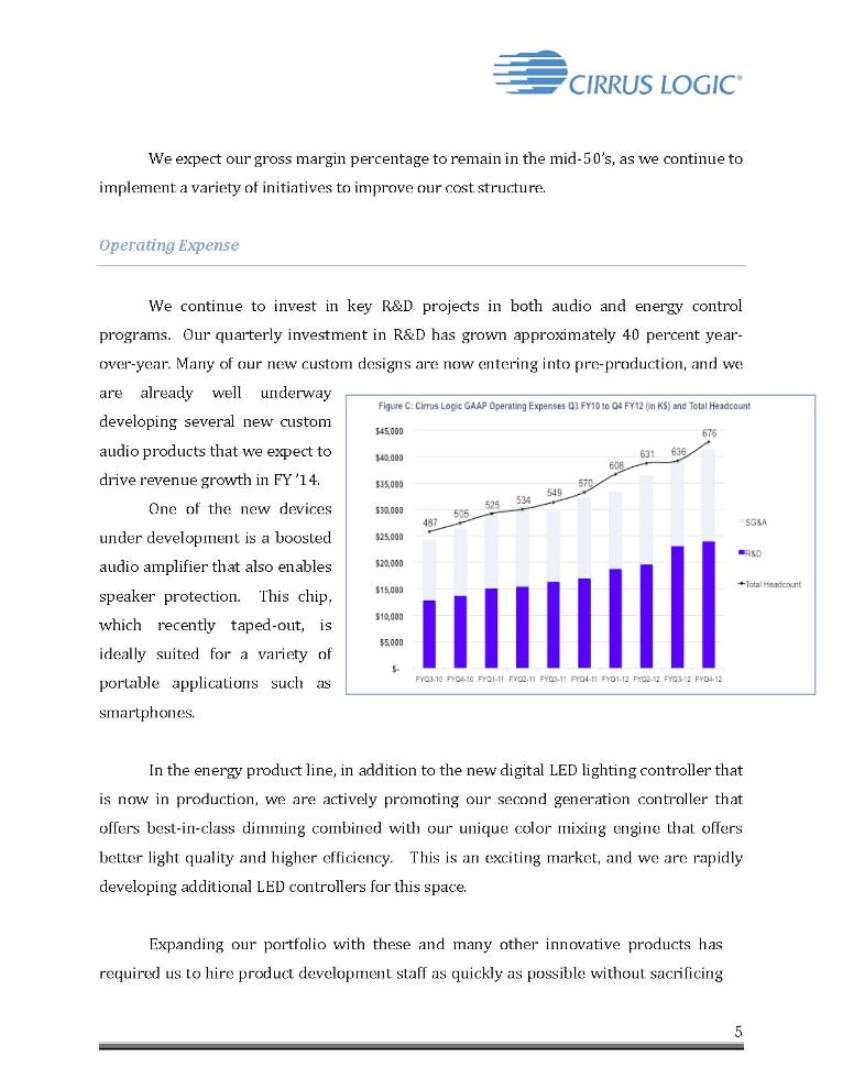

5 We expect our gross margin percentage to remain in the mid-50’s, as we continue to implement a variety of initiatives to improve our cost structure. Operating Expense We continue to invest in key R&D projects in both audio and energy control programs. Our quarterly investment in R&D has grown approximately 40 percent year-over-year. Many of our new custom designs are now entering into pre-production, and we are already well underway developing several new custom audio products that we expect to drive revenue growth in FY ’14. One of the new devices under development is a boosted audio amplifier that also enables speaker protection. This chip, which recently taped-out, is ideally suited for a variety of portable applications such as smartphones. In the energy product line, in addition to the new digital LED lighting controller that is now in production, we are actively promoting our second generation controller that offers best-in-class dimming combined with our unique color mixing engine that offers better light quality and higher efficiency. This is an exciting market, and we are rapidly developing additional LED controllers for this space. Expanding our portfolio with these and many other innovative products has required us to hire product development staff as quickly as possible without sacrificing

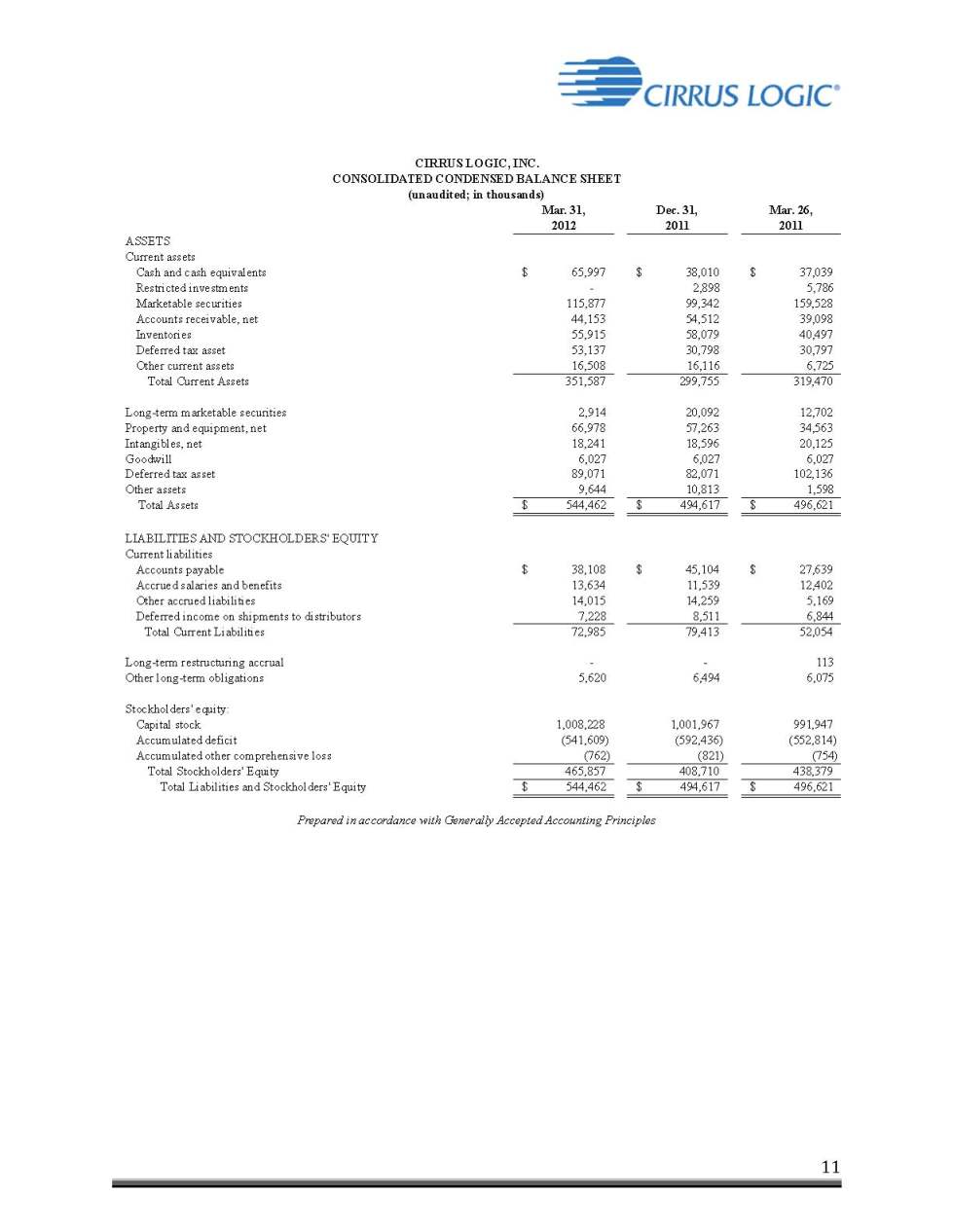

6 quality or our award-winning culture. Our positive corporate culture that both challenges and rewards our employees has allowed us to attract and retain outstanding talent, and we have made great progress in the past year on staffing for our success in the future. It can take between two and three years from project kick-off to production shipments. With that type of development timeline, the investment comes well before the financial return. Developing a larger number of more complex products requires even more engineers, more tape-outs, and more investment in development tools. Therefore, we expect operating expenses, mainly associated with R&D spending, to continue to grow, in with operating expenses for the June quarter expected to increase at least 5 percent. Our target for combined R&D and SG&A expenses is 35 percent of revenue, and while we expect to exceed this target in the June quarter, we expect to be significantly under-spending relative to this target as revenue grows in Q2 and for the balance of our fiscal year. Operating Margin and Taxes Our operating profit and earnings per share (EPS) remained outstanding this past quarter, with operating margins of 19 percent GAAP and 23 percent non-GAAP. This performance highlights our ability to leverage our investment in R&D and technology to deliver strong operating results. Our growth and ability to deliver shareholder value are a direct result of executing on our strategy of targeting growing markets, partnering with tier one accounts in those markets and delivering innovative components that help our customers differentiate their products. Due to our recent financial performance, as well as further improvements to our business outlook, we have revalued the deferred tax asset to the full value we expect to use, which resulted in a non-cash, net tax benefit of approximately $30 million in Q4. This places the value recorded on our balance sheet at approximately $142 million. For FY ‘13 we expect our effective quarterly cash tax rate to be less than 4 percent.

7 Company Strategy Our strategy is somewhat different from many mixed-signal semiconductor companies. In addition to developing a few catalog-type products that can be used by a broad array of customers, we are particularly focused on providing innovative custom products to market leading customers in the various markets we serve. Specifically, we target growing markets where we can showcase our expertise in analog and digital signal processing to solve challenging problems. Our approach has been to develop new catalog components that embody our latest innovations, which we then use to engage with the leading customers in a particular market or application. We then focus on building a strong engineering relationship with the design teams at these customers and work to develop highly differentiated products that address their specific needs using our own IP, sometimes in combination with theirs. When we are successful with this approach, one initial design win expands into many additional products. This strategy gives us the opportunity to increase our content per box over time through the addition of new features and the integration or elimination of external components. In Energy, we worked with one of the leading OEMs in the lighting space as we developed our digital LED lighting controllers. While this has been a long process, we’re pleased to have already shipped half a million units of our first LED lighting controller. We are now pursuing more design wins with our initial lighting customer and we are actively promoting these products to many additional lighting companies. The successful launch of our first product highlights the fact that our solution offers superior dimming compatibility with the global installed base of dimmers, which is a key requirement among premier lighting companies.

8 Summary and Guidance Looking to next quarter, we expect the following results: Revenue to range between $96 million and $106 million; Gross margin to be between 53 percent and 55 percent; Combined R&D and SG&A expenses to range between $43 million and $45 million, which includes approximately $4 million in share-based compensation and amortization of acquired intangibles expenses. Ending inventory is expected to roughly double. Q4 was another good quarter for our company, both in terms of financial performance, as well as engineering performance. We’ve continued to keep our existing customers happy and we’re making great progress on adding new ones. We’ve launched key new products, such as our first LED controller, and our product development team is hard at work on many new innovative devices. With a variety of new audio and energy products ramping into full production later this year, we expect a sharp transition to a higher level of revenue during fiscal 2013. Our product development team has done an excellent job of developing innovative new components, and our supply chain team now has the task of supporting a significant ramp of a wide range of products. In short, we are very excited about our outlook for FY‘13. Sincerely, Jason Rhode Thurman Case President and Chief Executive Officer Chief Financial Officer

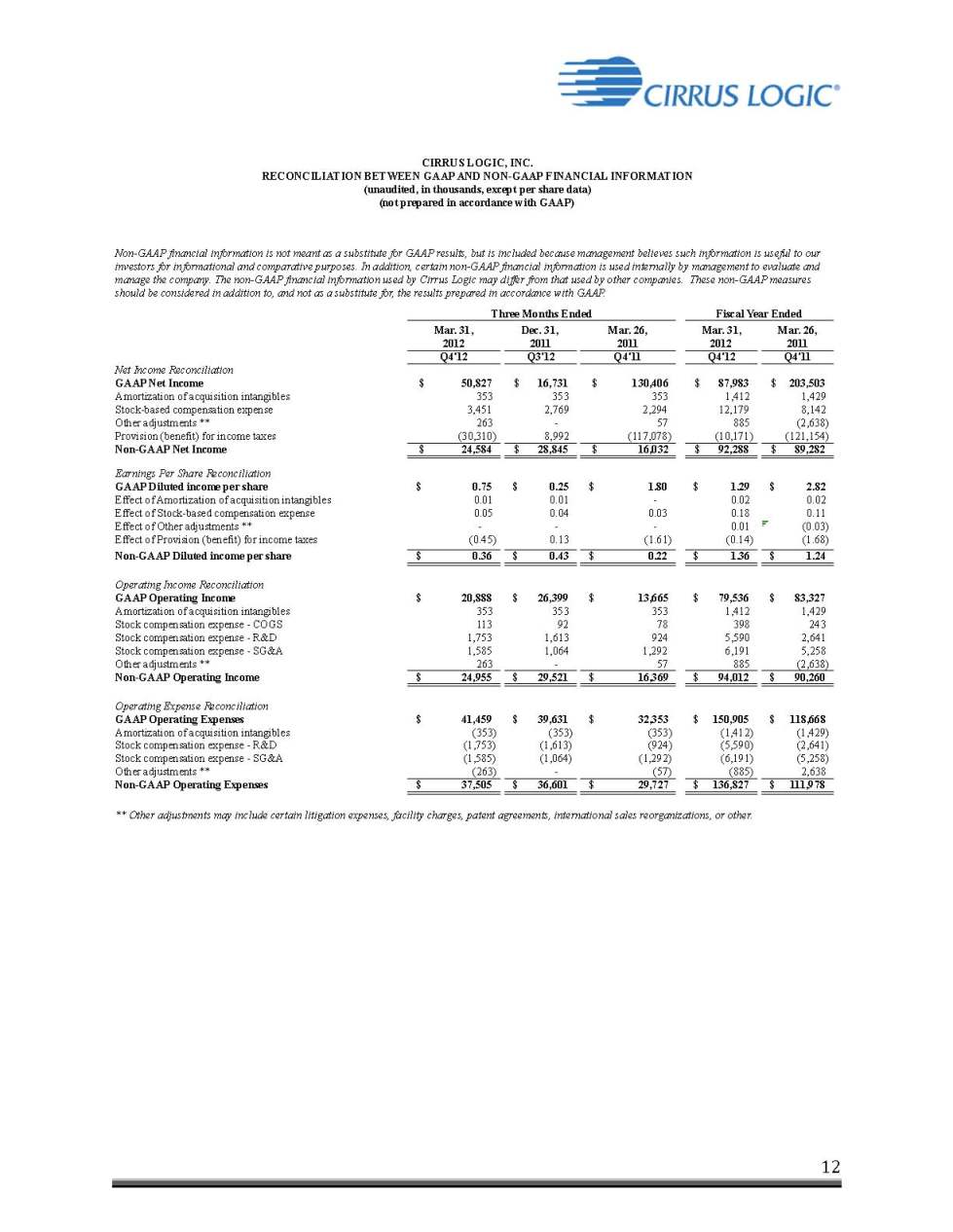

9 Conference Call Q&A Session Cirrus Logic management will host a live Q&A session today at 5:00 p.m. EDT to answer questions about the Company’s financial results and business outlook. Shareholders who would like to submit a question to be addressed during this session are requested to email the company at investor.relations@cirrus.com. A live webcast of the Q&A session can be accessed on the Cirrus Logic website, and a replay will be available approximately one hour following its completion, or by calling (303) 590-3030, or toll-free at (800) 406-7325 (Access Code: 4531962). Use of Non-GAAP Measures This shareholder letter and its attachments include references to non-GAAP financial information, including operating expenses, net income, operating margin and diluted earnings per share. A reconciliation of the adjustments to GAAP results is included in the tables below. Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. Safe Harbor Statement Except for historical information contained herein, the matters set forth in this news release contain forward-looking statements, including our estimates of first quarter fiscal year 2013 revenue, gross margin, combined research and development and selling, general and administrative expense levels, share-based compensation expense, amortization of acquired intangible expenses, and ending inventory, as well as estimates for fiscal year 2013 annual revenue growth rate, operating expenses, and inventory increases. In some cases, forward-looking statements are identified by words such as “expect,” “anticipate,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, but are not limited to, the following: the level of orders and shipments during the first quarter and complete fiscal

10 year 2013, as well as customer cancellations of orders, or the failure to place orders consistent with forecasts; our ability to introduce and ramp production of new products in a timely manner; and the risk factors listed in our Form 10-K for the year ended March 26, 2011, and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise. Summary financial data follows:

11

12