Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CTI BIOPHARMA CORP | d338631d8k.htm |

| EX-10.2 - FORM OF REGISTRATION RIGHTS AGREEMENT - CTI BIOPHARMA CORP | d338631dex102.htm |

| EX-99.1 - PRESS RELEASE - CTI BIOPHARMA CORP | d338631dex991.htm |

| EX-10.3 - FORM OF DESIGNATION OF PREFERENCES, RIGHTS AND LIMITATIONS OF PREFERRED STOCK - CTI BIOPHARMA CORP | d338631dex103.htm |

Exhibit 10.1

| ** | Indicates that certain information contained herein has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. |

ASSET PURCHASE AGREEMENT

between

S*BIO PTE LTD.

and

CELL THERAPEUTICS, INC.

Dated as of April 18, 2012

Table of Contents

| Page | ||||||||||

| ARTICLE I | DEFINITIONS AND TERMS | 1 | ||||||||

| Section 1.1 | Certain Definitions | 1 | ||||||||

| Section 1.2 | Other Terms | 15 | ||||||||

| Section 1.3 | Other Definitional Provisions | 15 | ||||||||

| ARTICLE II | PURCHASE AND SALE | 15 | ||||||||

| Section 2.1 | Purchase and Sale of Assets | 15 | ||||||||

| Section 2.2 | Excluded Assets | 17 | ||||||||

| Section 2.3 | Assumption of Liabilities | 18 | ||||||||

| Section 2.4 | Excluded Liabilities | 18 | ||||||||

| Section 2.5 | Purchase Price | 18 | ||||||||

| Section 2.6 | Closing | 19 | ||||||||

| Section 2.7 | Deposit | 19 | ||||||||

| Section 2.8 | Allocation of Purchase Price | 19 | ||||||||

| Section 2.9 | Deliveries by Buyer | 19 | ||||||||

| Section 2.10 | Deliveries by Seller | 20 | ||||||||

| Section 2.11 | Affiliate Acquisitions | 20 | ||||||||

| Section 2.12 | Milestone Payments | 21 | ||||||||

| Section 2.13 | Royalty Payments | 22 | ||||||||

| Section 2.14 | Diligence | 23 | ||||||||

| Section 2.15 | Update Reports | 24 | ||||||||

| Section 2.16 | Exchange Rate; Manner and Place of Payment | 24 | ||||||||

| Section 2.17 | Audit | 24 | ||||||||

| Section 2.18 | Late Payments | 25 | ||||||||

| Section 2.19 | Milestone Cash or Stock Election | 25 | ||||||||

| Section 2.20 | Set-off | 26 | ||||||||

| ARTICLE III | REPRESENTATIONS AND WARRANTIES OF SELLER | 26 | ||||||||

| Section 3.1 | Organization and Qualification | 26 | ||||||||

| Section 3.2 | Corporate Authorization | 26 | ||||||||

| Section 3.3 | Consents and Approvals | 26 | ||||||||

| Section 3.4 | Non-Contravention | 26 | ||||||||

| Section 3.5 | Binding Effect | 27 | ||||||||

| Section 3.6 | Litigation and Claims | 27 | ||||||||

| Section 3.7 | Taxes | 27 | ||||||||

| Section 3.8 | Compliance with Laws | 28 | ||||||||

| Section 3.9 | Intellectual Property | 28 | ||||||||

| Section 3.10 | Regulatory Compliance | 32 | ||||||||

| Section 3.11 | FDA Compliance | 33 | ||||||||

| Section 3.12 | Clinical Studies | 33 | ||||||||

| Section 3.13 | Contracts | 34 | ||||||||

| Section 3.14 | Territorial Restrictions | 34 | ||||||||

-i-

Table of Contents

(continued)

| Page | ||||||||||

| Section 3.15 | Absence of Certain Changes and Events | 34 | ||||||||

| Section 3.16 | Confidentiality | 35 | ||||||||

| Section 3.17 | Insurance Claims | 35 | ||||||||

| Section 3.18 | Title to Transferred Assets | 35 | ||||||||

| Section 3.19 | Suppliers | 35 | ||||||||

| Section 3.20 | Solvency | 35 | ||||||||

| Section 3.21 | Foreign Corrupt Practices | 35 | ||||||||

| Section 3.22 | Securities Law Matters | 36 | ||||||||

| Section 3.23 | Finders’ Fees | 36 | ||||||||

| Section 3.24 | No Other Representations or Warranties | 36 | ||||||||

| ARTICLE IV | REPRESENTATIONS AND WARRANTIES OF BUYER | 36 | ||||||||

| Section 4.1 | Organization and Qualification | 36 | ||||||||

| Section 4.2 | Corporate Authorization | 37 | ||||||||

| Section 4.3 | Consents and Approvals | 37 | ||||||||

| Section 4.4 | Non-Contravention | 37 | ||||||||

| Section 4.5 | Binding Effect | 37 | ||||||||

| Section 4.6 | Litigation and Claims | 37 | ||||||||

| Section 4.7 | Capitalization | 37 | ||||||||

| Section 4.8 | SEC Filings; Financial Statements | 38 | ||||||||

| Section 4.9 | Access | 39 | ||||||||

| Section 4.10 | Reliance | 39 | ||||||||

| Section 4.11 | No Buyer Vote Required | 39 | ||||||||

| Section 4.12 | Financing | 39 | ||||||||

| Section 4.13 | No Other Representations or Warranties | 39 | ||||||||

| ARTICLE V | COVENANTS | 39 | ||||||||

| Section 5.1 | Access and Information | 39 | ||||||||

| Section 5.2 | Conduct of Business | 40 | ||||||||

| Section 5.3 | No Shop | 41 | ||||||||

| Section 5.4 | Commercially Reasonable Best Efforts | 41 | ||||||||

| Section 5.5 | Tax Matters | 41 | ||||||||

| Section 5.6 | Ancillary Agreement | 43 | ||||||||

| Section 5.7 | Notification | 43 | ||||||||

| Section 5.8 | Non-Competition | 44 | ||||||||

| Section 5.9 | Further Assurances | 44 | ||||||||

| Section 5.10 | Confidentiality | 44 | ||||||||

| Section 5.11 | Springing SB1518 Grant-Back | 45 | ||||||||

| Section 5.12 | Assistance in Proceedings | 45 | ||||||||

| Section 5.13 | Transfer of Regulatory Materials; Interim Responsibility | 46 | ||||||||

| Section 5.14 | Communication With Agencies | 46 | ||||||||

| Section 5.15 | Adverse Experience Reporting | 47 | ||||||||

Table of Contents

(continued)

| Page | ||||||||||

| Section 5.16 | Financial Statement Reporting | 47 | ||||||||

| Section 5.17 | Certain Intellectual Property Covenants | 48 | ||||||||

| ARTICLE VI | CONDITIONS TO CLOSING | 48 | ||||||||

| Section 6.1 | Conditions to the Obligations of Buyer | 48 | ||||||||

| Section 6.2 | Conditions to the Obligations of Seller | 49 | ||||||||

| ARTICLE VII | SURVIVAL; INDEMNIFICATION; CERTAIN REMEDIES | 50 | ||||||||

| Section 7.1 | Survival | 50 | ||||||||

| Section 7.2 | Indemnification by Seller | 50 | ||||||||

| Section 7.3 | Indemnification by Buyer | 51 | ||||||||

| Section 7.4 | Third Party Claim Indemnification Procedures | 51 | ||||||||

| Section 7.5 | Direct Claims | 54 | ||||||||

| Section 7.6 | Limitations | 54 | ||||||||

| Section 7.7 | Indemnification in Case of Strict Liability or Indemnitee Negligence | 55 | ||||||||

| Section 7.8 | Payments | 55 | ||||||||

| Section 7.9 | Characterization of Indemnification Payments | 56 | ||||||||

| Section 7.10 | Mitigation | 56 | ||||||||

| Section 7.11 | Effect of Waiver of Condition | 56 | ||||||||

| Section 7.12 | Right of Set-Off | 56 | ||||||||

| Section 7.13 | Specific Performance | 56 | ||||||||

| ARTICLE VIII | TERMINATION | 57 | ||||||||

| Section 8.1 | Termination | 57 | ||||||||

| Section 8.2 | Effect of Termination | 57 | ||||||||

| ARTICLE IX | MISCELLANEOUS | 58 | ||||||||

| Section 9.1 | Notices | 58 | ||||||||

| Section 9.2 | Amendment; Waiver; Remedies Cumulative | 59 | ||||||||

| Section 9.3 | No Assignment or Benefit to Third Parties | 59 | ||||||||

| Section 9.4 | Entire Agreement | 60 | ||||||||

| Section 9.5 | Fulfillment of Obligations | 60 | ||||||||

| Section 9.6 | Public Disclosure | 60 | ||||||||

| Section 9.7 | Expenses | 60 | ||||||||

| Section 9.8 | Bulk Sales | 60 | ||||||||

| Section 9.9 | Governing Law: Submission to Jurisdiction: Selection of Forum; Waiver of Trial by Jury | 61 | ||||||||

| Section 9.10 | Counterparts | 61 | ||||||||

| Section 9.11 | Headings | 61 | ||||||||

| Section 9.12 | Severability | 61 | ||||||||

| Section 9.13 | Disclosure Schedules | 61 | ||||||||

ASSET PURCHASE AGREEMENT, dated as of April 18, 2012, between S*BIO Pte Ltd., a Singapore private limited company (“Seller”), and Cell Therapeutics, Inc., a Washington corporation (“Buyer”).

WITNESSETH:

WHEREAS, Seller possesses certain assets, including, without limitation, the proprietary technology and know-how related to the research, discovery, identification, syntheses and development of compounds that inhibit Janus kinase 2, commonly referred to as JAK2 (“JAK2”), including the Seller compounds designated as SB1518 and SB1578; and

WHEREAS, Seller desires to sell to Buyer and Buyer desires to purchase and assume from Seller certain assets and liabilities related to SB1518 and SB1578, as more particularly set forth herein.

NOW, THEREFORE, in consideration of the premises and the mutual representations, warranties, covenants and undertakings contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, agree as follows:

ARTICLE I

DEFINITIONS AND TERMS

Section 1.1 Certain Definitions. As used in this Agreement, the following terms have the meanings set forth below:

“Acute Myeloid Leukemia” means the disease or condition referred to and recognized by the FDA as acute myeloid leukemia as of the date of this Agreement (whether or not such disease or condition continues to be known by such name in the United States after the date of this Agreement, and whether or not any Regulatory Authority outside of the United States refers to such disease or condition by that name or another name as of or after the date of this Agreement).

“Affiliate” means, with respect to any Person, any Person directly or indirectly controlling, controlled by, or under common control with, such other Person as of the date on which, or at any time during the period for which, the determination of affiliation is being made. For purposes of this definition, the term “control” (including the correlative meanings of the terms “controlled by” and “under common control with”), as used with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management policies of such Person, whether through the ownership of voting securities or by contract or otherwise.

“Agreement” means this Asset Purchase Agreement, as the same may be amended or supplemented from time to time in accordance with the terms hereof.

“Ancillary Agreement” means the registration rights agreement attached hereto as Exhibit A to be entered into at Closing between Buyer and Seller.

-1-

“Asia” means all countries in Asia east of the westernmost boundary of India (including all countries portions of which lie to the east of such boundary but not including the former U.S.S.R. or any U.S. Territories) and all countries in East Asia, South Asia and Southeast Asia, including Asian countries, and shall include, but shall not be limited to, the following countries: Bangladesh, Bhutan, Brunei Darussalam, Cambodia, People’s Republic of China, Cyprus, Hong Kong, India, Indonesia, Japan, Democratic People’s Republic of Korea, Republic of Korea, Lao People’s Democratic Republic, Macau, Malaysia, Maldives, Mongolian People’s Republic, Union of Myanmar (Burma), Kingdom of Nepal, Pakistan, Philippines, Singapore, Sri Lanka, Republic of China (Taiwan), Thailand, and Vietnam.

“Assigned Contracts” has the meaning set forth in Section 2.1(e).

“Assumed Liabilities” means only the Liabilities that Buyer has expressly assumed or agreed to assume under Section 2.3 of this Agreement.

“Authorizations” means Governmental Authorizations and Non-Governmental Authorizations.

“Bankruptcy Exception” shall have the meaning set forth in Section 3.5.

“Books and Records” means all books, ledgers, files, reports, plans, records, manuals and other materials, including books of account, records, files, invoices, correspondence and memoranda, scientific records and files (including laboratory notebooks and invention disclosures), customer and supplier lists, data, specifications, operating history information and inventory records (in any form or medium) of, or maintained for, or relating to, the Transferred Assets, but excluding any such items to the extent (i) they are included in or primarily related to any Excluded Assets or Excluded Liabilities, or (ii) any Law prohibits their transfer.

“Business Day” means any day other than a Saturday, a Sunday or a day on which banks in New York are authorized or obligated by Law or executive order to close.

“Buyer” has the meaning set forth in the Preamble.

“Buyer Indemnified Parties” has the meaning set forth in Section 7.2.

“Buyer Required Approvals” means all consents, approvals, waivers, authorizations, notices and filings from or with a Government Entity that are required to be and are listed on Schedule 4.3.

“Change of Control Transaction” has the meaning set forth in Section 5.8(a).

“Chosen Courts” has the meaning set forth in Section 9.9.

“Chronic Myelogenous Leukemia” means the disease or condition referred to and recognized by the FDA as chronic myelogenous leukemia as of the date of this Agreement (whether or not such disease or condition continues to be known by such name in the United States after the date of this Agreement, and whether or not any Regulatory Authority outside of the United States refers to such disease or condition by that name or another name as of or after the date of this Agreement).

2.

“Claim Notice” has the meaning set forth in Section 7.4(a).

“Clinical Data” means data resulting from any pre-clinical study or clinical trial of any Seller Compound, generated by or for Seller or its Subsidiaries or any of their licensees (including Onyx), together with the applicable protocol for each such study or trial, as well as all associated site related documentation, investigator brochures, investigational review board correspondence, and data monitoring committee minutes and documentation.

“Closing” means the closing of the Transaction.

“Closing Date” has the meaning set forth in Section 2.6.

“Commercially Reasonable Efforts” has the meaning set forth in Section 2.14.

“Competing Business” has the meaning set forth in Section 5.8(a).

“Competing Compound” has the meaning set forth in Section 5.8(a).

“Confidentiality Agreement” means the confidentiality agreement, dated February 16, 2012, between Seller and Buyer.

“Contracts” means all agreements, contracts, leases and subleases, purchase orders, arrangements, commitments and licenses (other than this Agreement and the Ancillary Agreement), whether written or oral.

“Control” or “Controlled,” means with respect to any Intellectual Property, possession by a Person of the ability (whether by ownership, license or otherwise) to transfer ownership of, to grant access to, to grant use of, or to grant a license or a sublicense of or under such Intellectual Property without violating the terms of any agreement or other arrangement with any third party.

“Copyrights” means copyrights and registrations and applications therefor, works of authorship, content (including website content) and mask work rights.

“Development” means pre-clinical and clinical drug development activities, including clinical trials, relating to the development of pharmaceutical compounds and submission of information to a Regulatory Authority for the purpose of obtaining Regulatory Approval of a Product, and activities to develop manufacturing capabilities for Products. Development includes, but is not limited to, optimization and pre-clinical activities, pharmacology studies, toxicology studies, formulation, manufacturing process development and scale-up (including bulk compound production), quality assurance and quality control, technical support, pharmacokinetic studies, clinical trials and regulatory affairs activities.

“Direct Claim” has the meaning set forth in Section 7.5.

3.

“Effective Time” means the time at which the Closing is consummated.

“EMA” means the European Medicines Agency of the EU, and any successor agency thereto.

“Encumbrance” means any charge, claim, community or other marital property interest, condition, easement, encroachment, encumbrance, equitable interest, lien, mortgage, option, pledge, security interest, servitude, right of way, right of first option, right of first refusal, or other restriction or third party right of any kind, including any right of first refusal or restriction on voting. For the avoidance of doubt, “Encumbrance” shall not include any claim that a Transferred Asset infringes on the Intellectual Property rights of any third Person.

“Environmental Law” means any Law (including but not limited to the Comprehensive Environmental Response, Compensation and Liability Act of 1980) and any Governmental Authorization relating to (x) the protection of the environment or human health and safety (including air, surface water, groundwater, drinking water supply, and surface or subsurface land or structures), (y) the exposure to, or the use, storage, recycling, treatment, generation, transportation, processing, handling, labeling, management, release or disposal of any Hazardous Substance or waste material or (z) noise, odor or electromagnetic emissions.

“EU” means the European Union.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Excluded Assets” has the meaning set forth in Section 2.2.

“Excluded Liabilities” means all Liabilities of Seller or any of its Affiliates other than the Assumed Liabilities.

“Exploit” or “Exploitation” means develop, design, test, modify, improve, make, use, sell, have made, used and sold, import, reproduce, market, distribute, and commercialize.

“FDA” means the U.S. Food and Drug Administration or any successor entity thereto.

“Form S-1” has the meaning set forth in Section 2.19.

“Fundamental Representations” has the meaning set forth in Section 7.1.

“GAAP” means United States generally accepted accounting principles.

“Governing Documents” means with respect to any particular entity, (a) if a corporation, the articles or certificate of incorporation and the bylaws; (b) if a general partnership, the partnership agreement and any statement of partnership or other organizational documents; (c) if a limited partnership, the limited partnership agreement and the certificate of limited partnership or other organizational documents; (d) if a limited liability company, the articles of organization and operating agreement or other organizational documents; (e) if another type of Person, any other charter or similar document adopted or filled in connection

4.

with the creation, formation or organization of the Person; (f) all equityholders’ agreements, voting agreements, voting trust agreements, joint venture agreements, registration rights agreements or other agreements or documents relating to the organization, management or operation of any Person or relating to the rights, duties and obligations of the equityholders of any Person; and (g) any amendment or supplement to any of the foregoing.

“Government Entity” means any:

(a) nation, state, county, city, town, borough, village, district or other jurisdiction;

(b) federal, state, local, municipal, foreign or other government;

(c) governmental or quasi-governmental authority of any nature (including any agency, branch, department, board, commission, court, tribunal or other entity exercising governmental or quasi-governmental powers);

(d) multinational organization or body;

(e) Regulatory Authority;

(f) body exercising, or entitled or purporting to exercise, any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power; or

(g) official of any of the foregoing.

“Governmental Authorizations” means all licenses, permits, certificates and other authorizations, consents, waivers and approvals issued by or obtained from a Government Entity or Self-Regulatory Organization.

“Hazardous Substance” means any substance that is listed, defined, designated or classified as hazardous, toxic or otherwise harmful under applicable Laws or is otherwise regulated by a Government Entity, including petroleum products and byproducts, asbestos-containing material, polychlorinated byphenyls, lead-containing products and mold.

“Healthcare Laws” means any U.S., foreign or other Law or regulation related to the development, manufacturing or commercialization of healthcare products and services, including, without limitation, (i) the U.S. Federal Food, Drug and Cosmetic Act and any regulations promulgated thereunder and any amendments or successors thereto, (ii) the federal Anti-kickback Statute (42 U.S.C. § 1320a-7b(b)) and any regulations promulgated thereunder and any amendments or successors thereto, the Anti-Inducement Law (42 U.S.C. § 1320a-7a(a)(5)) and any regulations promulgated thereunder and any amendments or successors thereto, (iii) the civil False Claims Act (31 U.S.C. §§ 3729 et seq.) and any regulations promulgated thereunder and any amendments or successors thereto, (iv) the administrative False Claims Law (42 U.S.C. § 1320a-7b(a)) and any regulations promulgated thereunder and any amendments or successors thereto, (v) the Health Insurance Portability and Accountability Act of 1996 (42 U.S.C. § 1320d et seq.) and any regulations promulgated thereunder and any amendments or successors thereto, and (vi) any foreign equivalents of any of the above.

5.

“Inbound Licenses” has the meaning set forth in Section 3.9(e).

“IND” means any Investigational New Drug Application filed by any Person with the FDA pursuant to 21 CFR Part 312 with respect to any of the Seller Compounds, as submitted to the FDA by any Person, including all amendments thereto.

“Indemnified Parties” has the meaning set forth in Section 7.2.

“Indemnified Taxes” means (i) any Taxes of Seller or any of its Subsidiaries with respect to any Tax period, (ii) any Taxes for which Seller or any of its Subsidiaries is held liable under Treasury Regulations Section 1.1502-6 (or any corresponding or similar provision of state, local or foreign Tax Law) by reason of such entity being included in any consolidated, affiliated, combined or unitary group in any Tax period, (iii) any liability for Taxes of any Person imposed on Seller or any of its Subsidiaries as a transferee or successor, or by contract or otherwise, (iv) any Taxes allocated to Seller pursuant to Section 5.5 of this Agreement, or (v) any Taxes imposed with respect to any Royalty Payment or Milestone Payment.

“Indemnifying Party” has the meaning set forth in Section 7.4(a).

“Independently Active Pharmaceutical Ingredient” means an active pharmaceutical ingredient having a different target or a mode of action, or is otherwise treated or designated by the applicable Regulatory Authority as a separate active ingredient, than the applicable Seller Compound.

“Indication” means a specific disease, infection or other condition which is recognized by Regulatory Authorities in the United States as being a disease, infection or condition. For avoidance of doubt, the term “Indication” includes each of Acute Myeloid Leukemia, Chronic Myelogenous Leukemia, Myelofibrosis, Non-Hodgkin’s Lymphoma, Psoriasis and Rheumatoid Arthritis. All variants of a single disease, infection or condition (whether classified by severity or otherwise) will be treated as the same Indication, except that different types of cancer (e.g., as defined by site or cancer cell origin) will be treated as different Indications. The treatment or prevention of a disease, infection or other condition in adults and the treatment or prevention of the same disease, infection or other condition in a pediatric population will not be treated as separate Indications.

“Intellectual Property” means all worldwide intellectual property rights, including without limitation, rights in and to the following: (a) Patents; (b) Marks; (c) Copyrights; (d) Know-How; (e) data exclusivity, databases and data collections, and (f) any similar, corresponding or equivalent rights to any of the foregoing.

“Inventory” means all inventory related to the Seller Compounds, wherever located, including all quantities of Seller Compound active pharmaceutical ingredient, quantities of Seller Compound drug product, finished placebo capsules, finished goods, work in process, raw materials, packaging, pre-clinical and clinical supplies and all other materials and supplies and parts to be used or consumed by Seller or its agents in the production of finished goods whether held at any location or facility of Seller and of its Subsidiaries or in transit to Seller or any of its Subsidiaries, in each case as of the Closing Date, except to the extent included in Excluded Assets.

6.

“Know-How” means inventions (whether or not patentable); invention disclosures; proprietary processes, methods, algorithms and formulae; know-how, trade secrets, technology, proprietary information, technical data, designs, drawings, computer programs, apparatus, results of experiments, test data, including pharmacological, toxicological and clinical data, analytical and quality control data, manufacturing data and descriptions, market data, devices, assays, chemical formulations, notes of experiments, specifications, compositions of matter, physical, chemical and biological materials and compounds, whether in intangible, tangible, written, electronic or other form.

“Knowledge” of Seller shall mean the actual knowledge of a fact or other matter, after a reasonable inquiry, of the individuals listed on the attached Schedule 1.1(a) (“Knowledge Individuals”); provided, however, that if a Knowledge Individual has failed to conduct a reasonable inquiry, such Knowledge Individual shall be deemed to have the knowledge of a fact or other matter if such Knowledge Individual would reasonably be expected to discover or otherwise become aware of that fact or matter by making a reasonable inquiry regarding such fact or matter. With respect to matters involving Intellectual Property, Knowledge does not require that the Knowledge Individuals have conducted, obtain or have obtained any freedom-to-operate opinions or similar opinions of counsel or any Intellectual Property clearance searches, and no knowledge of any third party Intellectual Property that would have been revealed by such inquiries, opinions or searches will be imputed to the Knowledge Individuals or the direct reports of any of the foregoing.

“Law” means any law, statute, ordinance, rule, regulation, code, order, judgment, injunction, writ, permit license or decree enacted, issued, promulgated, enforced or entered by a Government Entity or Self-Regulatory Organization.

“Liabilities” means any and all debts, liabilities, commitments and obligations of any kind, character or description, whether fixed, contingent or absolute, matured or unmatured, liquidated or unliquidated, secured or unsecured, accrued or not accrued, joint or several, due or to become due, vested or unvested, asserted or not asserted, disputed or undisputed, known or unknown, executory, determined, determinable or otherwise, whenever or however arising (including, whether arising out of any contract or tort based on negligence or strict liability) and whether or not the same would be required by GAAP to be reflected in financial statements or disclosed in the notes thereto.

“Losses” means any damages, losses, charges, Liabilities, claims, demands, actions, suits, proceedings, payments, judgments, settlements, assessments, deficiencies, taxes, interest, penalties, and costs and expenses (including removal costs, remediation costs, closure costs, fines, penalties and expenses of investigation and ongoing monitoring, reasonable attorneys’ fees, and out of pocket disbursements), but excluding unforeseeable, speculative, special, indirect, consequential, exemplary and punitive damages (“Special Damages”), except in the case of Special Damages imposed on, sustained, incurred or suffered by, or asserted against, any Indemnified Party in respect of a Third Party Claim.

“Major EU Market” means any of England, France, Germany, Italy and Spain.

7.

“Marks” means all United States and foreign trademarks, service marks, trade names, service names, brand names, trade dress rights, logos, Internet domain names and corporate names, together with the goodwill associated with any of the foregoing, and all applications, registrations and renewals thereof.

“Material Adverse Effect” means an effect that is materially adverse to the Program or would reasonably be expected to impair the ability of Seller to consummate the Transaction or its performance of obligations under this Agreement; provided, however, that none of the following (individually or in combination) shall be deemed to constitute, or shall be taken into account in determining whether there has been, a Material Adverse Effect: (a) any adverse effect resulting directly from general business or economic conditions, except to the extent such general business or economic conditions have a disproportionate effect on the Program; (b) any adverse effect resulting directly from conditions generally affecting any industry or industry sector to which the Program relates, except to the extent such adverse effect has a disproportionate effect on the Program; (c) any adverse effect resulting directly from the announcement, execution or delivery of this Agreement or the pendency or consummation of the transactions contemplated hereunder; (d) any adverse effect resulting directly from any change in accounting requirements or principles or any change in applicable Laws or the interpretation thereof; (e) any adverse effect resulting directly from any action taken by Seller at Buyer’s direction (other than any such action Seller is obligated to take under the terms and conditions of this Agreement); (f) any adverse effect resulting directly from any breach by Buyer of any provision of this Agreement; or (g) any adverse data, event or outcome, arising out of or related to the Program, including pre-clinical and clinical trials, which data, event or outcome is disclosed in the Clinical Data or Regulatory Materials made available by Seller to Buyer prior to the date of this Agreement.

“Milestone Payment” means any of the potential payments set forth in Section 2.12.

“Myelofibrosis” means the disease or condition referred to and recognized by the FDA as myelofibrosis as of the date of this Agreement (whether or not such disease or condition continues to be known by such name in the United States after the date of this Agreement, and whether or not any Regulatory Authority outside of the United States refers to such disease or condition by that name or another name as of or after the date of this Agreement).

“NDA” means any New Drug Application (as more fully defined in 21 CFR 314.5, et seq.) relating to any of the Seller Compounds, as submitted to the FDA by any Person, including all amendments and supplements thereto.

“Net Sales” means the gross amount invoiced for sales of Product by Buyer or its Affiliates or Sublicensees to Third Parties, less the following deductions from such gross amounts to the extent attributable to such Product and to the extent actually incurred, allowed, accrued or specifically allocated:

(a) trade, cash and quantity discounts actually given, credits, price adjustments or allowances actually granted customers for damaged products, returns or rejections of Products;

8.

(b) chargeback payments and rebates (or the equivalent thereof) for the Product granted to group purchasing organizations, Third Party payors (including managed health care organizations) or federal, state/provincial, local and other governments, including their agencies, or to trade customers;

(c) reasonable and customary freight, shipping insurance and other transportation charges directly related to the sale of the Product separately stated on the invoice to the Third Party; and

(d) sales, value-added, excise taxes, tariffs and duties, and other taxes and government charges directly related to the sale, to the extent that such items are included in the gross invoice price of the Product and actually borne by Buyer or its Affiliates, Sublicensees or distributors without reimbursement from any Third Party (but not including taxes assessed against the income derived from such sale);

all as determined in accordance with GAAP on a basis consistent with Buyer’s annual audited financial statements.

The transfer of Product between or among Buyer and its Affiliates and Sublicensees for resale (which resale will give rise to Net Sales), use in a clinical trial, or use as free marketing samples will not be considered a sale.

Upon the sale or other disposal of Product, such sale, disposal or use will be deemed to constitute a sale with the consideration for the sale being the consideration for the relevant transaction and constituting Net Sales hereunder, or if the consideration is not a monetary amount, a sale will be deemed to have occurred for a price assessed on the value of whatever consideration has been provided in exchange for the sale. Disposal of Product for or use of Product in Clinical Trials or as free samples will not give rise to any deemed sale under this definition. For clarity, there will be no limit on the quantity of Product which may be used in clinical trials but the quantity of Product to be given away as free samples will be such quantities customary in the industry for this sort of Product. Such amounts will be determined from the books and records of Buyer, its Affiliates and Sublicensees maintained in accordance with GAAP, consistently applied throughout the organization.

In the event a Product is sold in a finished dosage form containing a Seller Compound in combination with one or more other Independently Active Pharmaceutical Ingredients (a “Combination Product”), Net Sales, for purposes of determining Royalty Payments on such Product, will be calculated by multiplying the Net Sales of the end-user product by the fraction A over A+B, in which A is the net selling price of the Product portion of the Combination Product when such Product is sold separately during the applicable accounting period in which the sales of the Combination Product were made, and B is the net selling price of the other Independently Active Pharmaceutical Ingredients of the Combination Product sold separately during the accounting period in question. All net selling prices of the Product portion of the Combination Product and of the other Independently Active Pharmaceutical Ingredients of such Combination Product will be calculated as the average net selling price of the said ingredients during the applicable accounting period for which the Net Sales are being calculated in the particular country where the Combination Product is sold. In the event that, in any country

9.

or countries, no separate sale of either such above-designated Product or such above-designated other Independently Active Pharmaceutical Ingredients of the Combination Product are made during the accounting period in which the sale was made or if the net retail selling price for an Independently Active Pharmaceutical Ingredient cannot be determined for an accounting period, Net Sales allocable to the Product in each such country will be determined by mutual agreement reached in good faith by the Buyer and Seller prior to the end of the accounting period in question based on an equitable method of determining same that takes into account, on a country-by-country basis, variations in potency, the relative contribution of the Seller Compound and each other Independently Active Pharmaceutical Ingredient in the combination, and relative value to the end user of the Seller Compound and each such other Independently Active Pharmaceutical Ingredient. The Buyer and Seller agree that, for purposes of this paragraph, drug delivery vehicles, devices, adjuvants, half-life extenders, solubilizers and excipients will not be deemed to be “Independently Active Pharmaceutical Ingredients.”

“Non-Governmental Authorizations” means all licenses, permits, certificates and other authorizations, consents, waivers, and approvals other than Governmental Authorizations.

“Non-Hodgkin’s Lymphoma” means the disease or condition referred to and recognized by the FDA as non-Hodgkin’s lymphoma as of the Effective Date (whether or not such disease or condition continues to be known by such name in the United States after the date of this Agreement, and whether or not any Regulatory Authority outside of the United States refers to such disease or condition by that name or another name as of or after the date of this Agreement).

“Notice Period” has the meaning set forth in Section 7.4(a).

“Occupational Safety and Health Law” means any Law designed to provide safe and healthful working conditions and to reduce occupational safety and health hazards, including the Occupational Safety and Health Act, and any program, whether governmental or private (such as those promulgated or sponsored by industry associations and insurance companies), designed to provide safe and healthful working conditions.

“Onyx” means Onyx Pharmaceuticals, Inc., a Delaware corporation.

“Order” means any order, writ, injunction, judgment, decree, ruling, award, assessment or arbitration award of any Government Entity or arbitrator.

“Other Seller Materials” means (i) all research and development reports and disclosure memoranda in the possession of or controlled by Seller relating to the Seller Compounds, including, but not limited to, study reports, clinical trial related documents including consent forms, study contracts, site agreements, manuscripts and in process publications, (ii) all of the marketing and promotional documents owned by Seller, such as customer lists, marketing and promotional plans, documents and materials, field force training manuals and materials, and the like, to the extent relating to the Seller Compounds, (iii) all worldwide safety reports in the possession of Seller with respect to the Seller Compounds in existence as of the Closing, and (iv) all of Seller’s manufacturing information used in connection with the Seller Compounds.

10.

“Outbound Licenses” has the meaning set forth in Section 3.9(d).

“Partnership Arrangement” means any transaction in which Buyer or its Affiliates grants to a Third Party or Third Parties any option, license, sublicense, asset sale or assignment under or with respect to any of the Seller Compounds and/or any of the Transferred Intellectual Property.

“Patent Term Extension” means any term extensions, supplementary protection certificates, and equivalents thereof offering patent or patent-like protection beyond the initial term with respect to any issued Patents.

“Patents” means all United States and foreign patents and applications therefor, including continuations, divisionals, continuations-in-part, reexaminations or re-issues of patent applications and patents issuing thereon.

“Permitted Encumbrances” means, each of the following as are immaterial, individually or in the aggregate, in amount and would not impair the ownership or use of the Transferred Assets: (a) liens for current Taxes not yet due and payable or that are being contested in good faith by appropriate proceedings; (b) deposits or pledges made in connection with, or to secure payment of, workers’ compensation, unemployment insurance or similar programs mandated by applicable Law or governmental regulations; (c) statutory or common Law liens in favor of carriers, warehousemen, mechanics and materialmen, to secure claims for labor, materials or supplies, and other like liens; (d) the terms and conditions of (i) the Inbound Licenses and Outbound Licenses, (ii) licenses for off-the-shelf software or generally available software, (iii) non disclosure agreements, and (iv) materials transfer agreements on customary terms; (e) liens in favor of customs and revenue authorities arising as a matter of Law to secure payment of customs duties in connection with the importation of goods; and (f) liens and encumbrances arising under the Assigned Contracts.

“Person” means an individual, a corporation, a partnership, an association, a limited liability company, business trust, joint stock company, a Government Entity, joint venture, a trust or other entity or organization.

“Proceeding” means any action, arbitration, audit, hearing, investigation, inquiry, litigation or suit (whether civil, criminal, administrative, judicial or investigative, whether formal or informal, whether public or private) commenced, brought, conducted or heard by or before, or otherwise involving, any Government Entity or arbitrator.

“Product” means any pharmaceutical product containing or comprising any Seller Compound, whether or not as the sole active ingredient and in any dosage, form or formulation.

“Program” means all of Seller’s activities (including activities performed by any third Person on behalf of Seller) directed specifically to the Development and manufacture (including synthesis, formulation, finishing or packaging), use, offer for sale, sale or import of the Seller Compounds up to the Closing Date.

“Program Know-How” shall mean Know-How not included in the Program Patents, which Know-How is: (a) Controlled by Seller or its Subsidiaries immediately prior to

11.

the Closing; and (b) directed to the Development, manufacture (including synthesis, formulation, finishing or packaging), use, offer for sale, sale, export or import of any Seller Compound, or otherwise primarily used or held for use in the Program; including the items listed on Exhibit B, but excluding, in any event, any Know-How that is an Excluded Asset.

“Program Patents” shall mean: (a) the patents and patent applications listed on Exhibit C; (b) any and all divisionals, continuations and continuations-in-part of the patents and patent applications referenced in the preceding clause (a); (c) the foreign patent applications associated with the patent applications referenced in the preceding clauses (a) and (b); (d) the patents issued or issuing from the patent applications referenced in the preceding clauses (a) through (c); and (e) reissues, reexaminations, restorations (including supplemental protection certificates) and extensions of any patent or patent application referenced in the preceding clauses (a) through (d).

“Provisional Application” has the meaning set forth in Section 2.1(b).

“Psoriasis” means the disease or condition referred to and recognized by the FDA as psoriasis as of the date of this Agreement (whether or not such disease or condition continues to be known by such name in the United States after the date of this Agreement, and whether or not any Regulatory Authority outside of the United States refers to such disease or condition by that name or another name as of or after the date of this Agreement).

“Purchase Price” has the meaning set forth in Section 2.5.

“Registered IP” means those United States, international and foreign: (a) patents and patent applications (including provisional applications); (b) registered trademarks, registered service marks, registered tradenames, applications to register trademarks, service marks or tradenames, intent-to-use applications, or other registrations or applications related to trademarks or service marks; (c) registered copyrights and applications for copyright registration; and (d) registered domain names and applications for domain name registrations, in each case registered to or in the name of Seller or its Subsidiaries that are included in the Transferred Intellectual Property.

“Regulatory Approval” means any and all approvals, licenses, registrations, or authorizations of any Regulatory Authority that are necessary to market and sell a particular Product in a particular jurisdiction.

“Regulatory Authority” means the FDA, and any health regulatory authority in any country in that is a counterpart to the FDA and holds responsibility for granting regulatory marketing approval for a Product in such country, and any successor(s) thereto, including EMA and the European Commission.

“Regulatory Materials” means all U.S. and foreign regulatory applications, submissions and approvals (including all INDs and NDAs, and foreign counterparts thereof, and all Regulatory Approvals) for Seller Compounds, and all correspondence with the FDA and other Regulatory Authorities relating to the Seller Compounds or any of the foregoing regulatory applications, submissions and approvals; that, in each case, are in the possession of or controlled by, or held by or for Seller at the Closing Date, whether generated, filed or held by or for Seller or its Subsidiaries or any of their licensees (including Onyx).

12.

“Representative” means with respect to a particular Person, any director, officer, manager, employee, agent, consultant, advisor, accountant, financial advisor, legal counsel or other Representative of that Person.

“Rheumatoid Arthritis” means the disease or condition referred to and recognized by the FDA as rheumatoid arthritis as of the date of this Agreement (whether or not such disease or condition continues to be known by such name in the United States after the date of this Agreement, and whether or not any Regulatory Authority outside of the United States refers to such disease or condition by that name or another name as of or after the date of this Agreement).

“Royalty Payments” means the potential royalties payable pursuant to Section 2.13.

“Royalty Term” has the meaning set forth in Section 2.13.

“SB1317” means Seller’s proprietary CDK/FLT3 inhibitor compound designated by Seller as “SB1317.”

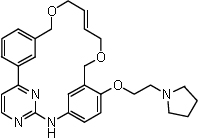

“SB1518” means the small molecule compound designated by Seller as “SB1518” as more particularly described in Exhibit D attached hereto, together with all pharmaceutically active metabolites, prodrugs, acid forms, base forms, esters, salts, stereoisomers, racemates, tautomers, polymorphs, hydrates or solvates thereof.

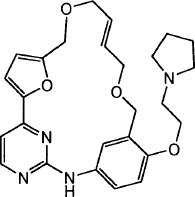

“SB1578” means the small molecule compound designated by Seller as “SB1578” as more particularly described in Exhibit E attached hereto, as well as all pharmaceutically active metabolites, prodrugs, acid forms, base forms, esters, salts, stereoisomers, racemates, tautomers, polymorphs, hydrates or solvates thereof.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Self-Regulatory Organization” means the Financial Industry Regulatory Authority, Inc., the National Futures Association, the Chicago Board of Trade, the New York Stock Exchange, the National Association of Securities Dealers Automated Quotations Stock Market, Inc. and national securities exchange (as defined in the Exchange Act), any other securities exchange, futures exchange, contract market, any other exchange or corporation or similar self-regulatory body or organization.

“Seller” has the meaning set forth in the Preamble.

“Seller Compounds” means SB1518 and SB1578.

“Seller Disclosure Schedule” has the meaning set forth in Article III.

13.

“Seller Indemnified Parties” has the meaning set forth in Section 7.3.

“Seller Required Approvals” means all Authorizations, notices and filings that are required to be listed and are listed on Schedules 3.3(a) and 3.3(b).

“Seller Subsidiary” means any Subsidiary of Seller.

“Service Contracts” has the meaning set forth in Section 3.9(f).

“Sublicensee” means, with respect to a particular Product, a Third Party to whom Buyer has granted a sublicense or license under any Transferred Intellectual Property, but excluding distributors.

“Subsidiary” means any Person (i) whose securities or other ownership interests having by their terms the power to elect a majority of the board of directors or other persons performing similar functions are owned or controlled, directly or indirectly, by Seller and/or one or more Subsidiaries, or (ii) whose business and policies Seller and/or one or more Subsidiaries have the power to direct.

“Tax Returns” means all reports and returns required to be filed with respect to Taxes.

“Taxes” means all federal, state or local and all foreign taxes of any kind whatsoever, including, without limitation, income, gross receipts, windfall profits, value added, severance, property, production, sales, use, duty, license, excise, franchise, employment, withholding or similar taxes, together with any interest, additions or penalties with respect thereto and any interest in respect of such additions or penalties.

“Termination Agreement” means that certain Termination and Separation Agreement, dated May 2, 2011, by and between Seller and Onyx.

“Third Party” means any Person other than Seller or Buyer or an Affiliate of Seller or Buyer.

“Third Party Acquiror” has the meaning set forth in Section 5.8(a).

“Third Party Claim” has the meaning set forth in Section 7.4(a).

“Trading Day” means a day on which the New York Stock Exchange is open for business.

“Transaction” means the purchase and sale of the Transferred Assets, the assumption of the Assumed Liabilities, and the execution and delivery of the Ancillary Agreement, each pursuant to this Agreement.

“Transfer Taxes” has the meaning set forth in Section 5.5(e).

“Transferred Assets” has the meaning set forth in Section 2.1.

14.

“Transferred Intellectual Property” means (a) the Program Patents, Program Know-How and Clinical Data, and (b) other than any Excluded Assets, any and all other Intellectual Property in or to the Seller Compounds or that is primarily used or held for use in or necessary to the Program and that is Controlled by Seller at the Closing Date.

“Upfront Cash Consideration” has the meaning set forth in Section 2.5.

“Upfront Consideration” has the meaning set forth in Section 2.5

“Upfront Equity Consideration” has the meaning set forth in Section 2.5.

“Valid Claim” means any claim within a pending, allowed or issued U.S. Patent application or Patent or pending, accepted or issued Patent application or Patent in a jurisdiction outside the United States that has not expired, lapsed, been cancelled or abandoned, or been held unenforceable, invalid, or cancelled by a court of competent jurisdiction in an order or decision from which no appeal has been or can be taken. For purposes of this definition, a “pending” Patent application will include any such Patent application that has been pending for five (5) or fewer years in the case of U.S. Patent applications or eight (8) or fewer years in the case of all other Patent applications.

Section 1.2 Other Terms. Other terms may be defined elsewhere in the text of this Agreement and, unless otherwise indicated, shall have such meaning throughout this Agreement.

Section 1.3 Other Definitional Provisions. Unless the express context otherwise requires:

(a) the words “hereof,” “herein” and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not to any particular provision of this Agreement;

(b) the terms defined in the singular have a comparable meaning when used in the plural, and vice versa;

(c) the terms “Dollars” and “$” mean United States Dollars;

(d) References herein to a specific Section, Subsection or Schedule shall refer, respectively, to Sections, Subsections or Schedules of this Agreement;

(e) wherever the word “include,” “includes,” or “including” is used in this Agreement, it shall be deemed to be followed by the words “without limitation;” and

(f) references herein to any gender includes each other gender.

ARTICLE II

PURCHASE AND SALE

Section 2.1 Purchase and Sale of Assets. On the terms and subject to the conditions set forth herein, at the Closing, Seller shall, or shall cause one or more of its Subsidiaries to, sell,

15.

convey, transfer, assign and deliver to Buyer or one or more of its Affiliates, and Buyer or one or more of its Affiliates shall purchase and acquire from Seller or any of its Subsidiaries all right, title and interest, as of the Closing, in and to the following assets, whether tangible or intangible, real, personal or mixed, of every kind and description, wherever located, free and clear of all Encumbrances other than Permitted Encumbrances (collectively, the “Transferred Assets”):

(a) the Seller Compounds;

(b) all Transferred Intellectual Property, wherever held or registered, and the right to sue and collect damages related thereto for past, present and future infringement of any of the foregoing;

(c) the right to claim priority to the provisional applications listed on Schedule 2.1(c) (the “Provisional Applications”) with respect solely to any subject matter disclosed therein that is disclosed in the Program Patents, including subject matter that covers Seller Compounds (including the composition or formulation of, or any method of making or using, the Seller Compounds), but excluding subject matter that solely covers SB1317 (including the composition or formulation of, or any method of making or using, SB1317);

(d) all Regulatory Materials, including, without limitation, the items listed on Schedule 2.1(d);

(e) the Contracts listed on Schedule 2.1(e) (the “Assigned Contracts”);

(f) all Inventory, including, without limitation, the items listed on Schedule 2.1(f), but excluding any Inventory not manufactured in accordance with current good manufacturing practices unless mutually agreed by Seller and Buyer in writing on or after Closing;

(g) all Other Seller Materials;

(h) all causes of action, lawsuits, judgments, claims and demands of any nature available to or being pursued by Seller or any of its Subsidiaries to the extent related to the Seller Compounds, or (a) through (g) or (i) through (l) of this Section 2.1, or the Assumed Liabilities or the ownership, use, function or value of any Seller Compounds or (a) through (g) and (i) through (l) of this Section 2.1, whether arising by way of counterclaim or otherwise, whether choate or inchoate, known or unknown, contingent or noncontingent, except to the extent included in the Excluded Assets;

(i) all credits, prepaid expenses, deferred charges, advance payments, security or other deposits, prepaid items, duties, and right to offset, to the extent exclusively related to the Seller Compounds, or to (a) through (h) or (j) and (l) of this Section 2.1;

(j) all guaranties, warranties, indemnities and similar rights in favor of Seller or any of its Subsidiaries to the extent primarily related to any Seller Compound or to (a) through (i) or (k) and (l) of this Section 2.1;

(k) all Books and Records; and

16.

(l) all other assets of Seller that are primarily used or held for use or necessary for the Program.

Notwithstanding the foregoing or anything elsewhere to the contrary, the transfer of the Transferred Assets pursuant to this Agreement shall not include the assumption of any Liability related to the Transferred Assets unless Buyer expressly assumes that Liability pursuant to Section 2.3.

Section 2.2 Excluded Assets. Notwithstanding anything in Section 2.1, this Section 2.2 or anywhere else in this Agreement or the Ancillary Agreement to the contrary, from and after the Closing, Seller and its Subsidiaries shall retain all of their existing right, title and interest in and to, and there shall be excluded from the sale, conveyance, assignment or transfer to Buyer and its Affiliates hereunder, and the Transferred Assets shall not include, the following (collectively, the “Excluded Assets”):

(a) any asset or class of assets excluded from the definition of Transferred Assets set forth in Section 2.1 by virtue of the limitations expressed therein;

(b) all Contracts (including the Termination Agreement) other than the Assigned Contracts;

(c) all rights of Seller under this Agreement and the Ancillary Agreement;

(d) all cash, cash equivalents, accounts receivable, marketable securities and intercompany accounts receivable of Seller;

(e) all minute books, stock books, Tax returns and similar corporate records of Seller other than the Books and Records;

(f) all assets (including, without limitation, Intellectual Property) of Seller that are both (i) not primarily used or held for use in the Program and (ii) not necessary for the Program, including to the extent applicable, without limitation, all assets (including, without limitation, Intellectual Property) of Seller primarily used or held for use in Seller’s mTOR/PI3K inhibitor program, mTOR inhibitor program, HDAC inhibitor program, and CDK/FLT3 inhibitor program (including SB1317);

(g) the right to claim priority to the Provisional Applications solely with respect to any subject matter disclosed therein that is disclosed in the Patents listed on Schedule 3.9(b)-2, including subject matter that solely covers SB1317 (including the composition or formulation of, or any method of making or using, SB1317), but excluding subject matter that solely covers Seller Compounds (including the composition or formulation of, or any method of making or using, Seller Compounds);

(h) all rights under insurance policies, including, without limitation, all claims, refunds and credits due or to become due under such policies;

(i) any refund of Tax liabilities of Seller relating to any pre-Closing period;

17.

(j) all leasehold interests and, other than the Transferred Assets, all biological or chemical materials, machinery, equipment, furniture, furnishings, fixtures and other tangible property; and

(k) any asset identified on Schedule 2.2(k).

Section 2.3 Assumption of Liabilities. On the terms and subject to the conditions set forth herein, at the Closing, Buyer shall assume and agrees to discharge or perform when due the following obligations and liabilities, whether known, unknown, accrued, absolute, matured, unmatured, contingent or otherwise, but only to the extent arising out of the ownership or use of the Transferred Assets after the Closing Date and not on or before the Closing Date (the “Assumed Liabilities”):

(a) all obligations and other liabilities of Seller (i) under the Assigned Contracts, but only to the extent arising out of obligations performed or required to be performed by Buyer under the Assigned Contracts after the Closing and not on or before the Closing Date, or (ii) exclusively arising out of or relating to the ownership or use of the Transferred Assets or the operation of the Program by or on behalf of Buyer after the Closing Date and not on or before the Closing Date; and

(b) all Liabilities for Taxes exclusively arising out of or relating to the use, ownership, sale or lease of any of the Transferred Assets or the operation of the Program by Buyer after the Closing Date and not on or before the Closing Date.

For the avoidance of doubt, it is hereby clarified that Buyer’s assumption of liabilities under this Section 2.3 shall be considered part of the consideration paid for the Transferred Assets. Neither Buyer nor its Affiliates will assume or have any responsibility of any nature with respect to any other Liability (including any Liability relating to the Transferred Assets) that exists, or arises out of the Closing or the operation or ownership of the Transferred Assets, on or prior to the Closing. For the avoidance of doubt, the Assumed Liabilities shall not include any obligations under the Termination Agreement.

Section 2.4 Excluded Liabilities. Seller and its Affiliates shall retain and be responsible for all Excluded Liabilities and shall, and shall cause each of its Affiliates to, pay and satisfy in full any Excluded Liabilities.

Section 2.5 Purchase Price. (a) On the terms and subject to the conditions set forth herein, in consideration of the sale of the Transferred Assets, at the Closing, in addition to the assumption of the Assumed Liabilities, (i) Buyer shall pay to Seller an amount in cash equal to $15,000,000, less the Deposit (the “Upfront Cash Consideration”), and (ii) Buyer shall issue to Seller shares of preferred stock automatically convertible into common stock of Buyer in the amount of $15,000,000 (the “Upfront Equity Consideration,” and together with the Upfront Cash Consideration, the “Upfront Consideration”), and (b) Seller shall receive the contingent right to potentially receive the Milestone Payments and Royalty Payments (the Upfront Consideration, together with the Milestone Payments and Royalty Payments is referred to collectively as the “Purchase Price”). The value of the Buyer preferred stock issued for the purpose of the Upfront Equity Consideration shall be determined based on the consolidated closing bid price per share

18.

of Buyer common stock on Nasdaq immediately prior to the signing of this Agreement. The shares of Buyer’s preferred stock comprising the Upfront Equity Consideration will not be registered under the Securities Act, but the common stock issuable upon conversion of such shares will be covered by the Ancillary Agreement, to be executed and delivered at Closing.

Section 2.6 Closing. The Closing shall take place at the offices of O’Melveny & Myers, LLP, San Francisco, California at 10:00 A.M. Pacific time, on the second (2nd) Business Day following the date on which the conditions set forth in Section 6.1 and Section 6.2 have been satisfied or waived (other than those conditions that by their nature are to be satisfied at the Closing but subject to the fulfillment or waiver of those conditions) but no later than forty-five (45) days after the date of this Agreement, or at such other time and place as the parties hereto may mutually agree in writing. The date on which the Closing occurs is called the “Closing Date.”

Section 2.7 Deposit. The parties acknowledge that Buyer wishes to have up to forty-five (45) days from the date of this Agreement to the Closing Date in order to provide Buyer with the opportunity to verify the transferability (subject only to Permitted Encumbrances) of the Transferred Assets and to ascertain the location of all tangible Transferred Assets, with Seller using commercially reasonable best efforts to cooperate with and assist Buyer with the foregoing. Accordingly, and in consideration of Seller accommodating Buyer’s desire to have up to forty-five (45) days from the date of this Agreement to the Closing Date, Buyer shall pay to Seller no later than the next Business Day after the date of this Agreement an amount in cash equal to $2,000,000 (the “Deposit”) in immediately available funds by wire transfer to an account or accounts which have been designated by Seller. The Deposit shall be non-refundable, regardless of when or whether the Closing occurs, unless the Closing has not occurred within forty-five (45) days from the date of this Agreement as a result of (i) a material breach by Seller of any covenant under this Agreement, (ii) the failure of any of the conditions to Buyer’s obligation to effect the Closing, as set forth in Section 6.1, or (iii) the failure of Seller stockholders to approve the Transaction. The Deposit shall be fully creditable toward the Upfront Cash Consideration.

Section 2.8 Allocation of Purchase Price. The Purchase Price shall be allocated in accordance with Schedule 2.8. After the Closing, the parties shall make consistent use of the allocation, fair market value and useful lives specified in Schedule 2.8 for all Tax purposes and in all filings, declarations and reports with the appropriate taxing authority. In any Proceeding related to the determination of any Tax, neither Buyer nor Seller nor any of their Affiliates shall contend or represent that such allocation is not a correct allocation.

Section 2.9 Deliveries by Buyer. At the Closing, Buyer shall deliver to Seller the following:

(a) the Upfront Cash Consideration, less the Deposit, in immediately available funds by wire transfer to an account or accounts which have been designated by Seller at least two (2) Business Days prior to the Closing Date;

(b) share certificates bearing appropriate legends representing the Upfront Equity Consideration;

19.

(c) such instruments of assumption and other instruments or documents, in form and substance reasonably acceptable to Seller, as may be necessary to effect Buyer’s assumption of the Assumed Liabilities and the effective assignment of any Assigned Contracts;

(d) a duly executed counterpart of the Ancillary Agreement;

(e) evidence of the obtaining of or the filing with respect to, the Buyer Required Approvals;

(f) the certificate to be delivered pursuant to Section 6.2(e); and

(g) such other customary instruments of transfer, assumptions, filings or documents, in form and substance reasonably satisfactory to Seller, as may be required to give effect to this Agreement.

Section 2.10 Deliveries by Seller. At the Closing, Seller shall deliver, or cause to be delivered, to Buyer the following:

(a) bills of sale or other appropriate documents of transfer, in form and substance reasonably acceptable to Buyer, transferring the Inventory included in the Transferred Assets to Buyer;

(b) assignments, in form and substance reasonably acceptable to Buyer and, if applicable, as required by any Government Entity with which Seller’s or any of its Subsidiaries’ rights to any Transferred Intellectual Property, Regulatory Materials, Books and Records or Other Seller Materials have been filed, submitted or held, assigning to Buyer the Transferred Intellectual Property, Regulatory Materials or Other Seller Materials;

(c) assignment and assumption agreements, in form and substance reasonably acceptable to Buyer and Seller, assigning to Buyer all rights of Seller and its Subsidiaries in and to all of the Assigned Contracts, exclusive of any Excluded Liabilities;

(d) a duly executed counterpart of the Ancillary Agreement;

(e) evidence of the obtaining of or the filing with respect to, the Seller Required Approvals;

(f) the certificate to be delivered pursuant to Section 6.1(f); and

(g) such other customary instruments of transfer, assumptions, filings or documents, in form and substance reasonably satisfactory to Buyer, as may be required to give effect to this Agreement and the Ancillary Agreement.

Section 2.11 Affiliate Acquisitions. Notwithstanding anything to the contrary contained in this Agreement or the Ancillary Agreement or otherwise, Buyer may elect to have any or all of the Transferred Assets conveyed or otherwise transferred to, or any of the Assumed Liabilities assumed by, one or more of its Affiliates so long as no such election results in any greater cost or obligation than Seller or any of its Affiliates would otherwise have had.

20.

Section 2.12 Milestone Payments. Following the first occurrence of each of the events set forth in the table below (each, a “Milestone Event”) achieved by Buyer, or any of its Affiliates or Sublicensees, Buyer shall pay to Seller the amount corresponding to such Milestone Event no later than (i) ** Business Days after the achievement by Buyer of the corresponding Milestone Event in the case of a regulatory Milestone Event, or (ii) ** days after the end of the applicable Buyer fiscal year in the case of a worldwide Net Sales Milestone Event; provided, however, that (i) there will only be one such potential Milestone Payment for each of the Milestone Events listed below, and (ii) any Milestone Event below may be achieved by the same Product that achieved any other Milestone Event or by a different Product, provided that each Milestone Payment shall be paid only one time, and only for the first achievement of the applicable Milestone Event by the first Product to achieve such Milestone Event.

| U.S. Regulatory Milestone Payments: |

||||

| Regulatory Approval for a Product in the United States for any Indication (“First U.S. Indication”): |

$ | * | * | |

| Regulatory Approval for a Product in the United States for any Indication other than the First U.S. Indication (“Second U.S. Indication”): |

$ | * | * | |

| Regulatory Approval for a Product in the United States for any Indication other than the First U.S. Indication and the Second U.S. Indication: |

$ | * | * | |

| EU Regulatory Milestone Payments: |

||||

| Regulatory Approval of a Product in the EU or any Major EU Market for any Indication (“First EU Indication”): |

$ | * | * | |

| Regulatory Approval of a Product in the EU or any Major EU Market for any Indication other than the First EU Indication (“Second EU Indication”): |

$ | * | * | |

| Regulatory Approval of a Product in the EU or any Major EU Market for any Indication other than the First EU Indication and the Second EU Indication |

$ | * | * | |

| Japan Regulatory Milestone Payments: |

||||

| Regulatory Approval of a Product in Japan for any Indication (“First Japan Indication”): |

$ | * | * | |

| Regulatory Approval of a Product in Japan for any Indication other than the First Japan Indication (“Second Japan Indication”): |

$ | * | * | |

| Regulatory Approval of a Product in Japan for any Indication other than the First Japan Indication and the Second Japan Indication: |

$ | * | * | |

| ** | Indicates that certain information contained herein has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. |

21.

| Worldwide Net Sales Milestones: |

||||

| First time worldwide Net Sales of a Product reach $100 million in any fiscal year of Buyer: |

$ | * | * | |

| First time worldwide Net Sales of a Product reach $250 million in any fiscal year of Buyer: |

$ | * | * | |

| First time worldwide Net Sales of a Product reach $500 million in any fiscal year of Buyer: |

$ | * | * |

Section 2.13 Royalty Payments.

(a) Royalties. During the applicable royalty term provided in Section 2.13(b) below (the “Royalty Term”), in addition to the Milestone Payments and subject to the achievement of one or more of the Milestone Events, Buyer will pay to Seller royalties on Net Sales of the Product in each fiscal year of Buyer at the incremental rates set forth below. Royalties payable under this Section 2.13 will be payable only once with respect to a particular unit of the Product and will be paid only once regardless of the number of Patents applicable to such Product.

| Worldwide Net Sales of a Product up to and including $** in any fiscal year of Buyer: |

* | *% | ||

| Worldwide Net Sales of a Product over $** and up to and including $** in any fiscal year of Buyer: |

* | *% | ||

| Worldwide Net Sales of a Product over $** in any fiscal year of Buyer: |

* | *% | ||

(b) Royalty Term. On a Product-by-Product and country-by-country basis, Buyer’s royalty payment obligations under Section 2.13(a) with respect to a Product in a country will commence on the date of the first commercial sale of the Product in such country and expire on the later of (i) expiration of the last-to-expire Valid Claim of the Program Patents that covers the manufacture, use, sale, offer for sale, or import of such Product in such country, and (ii) ** years after the first commercial sale of such Product in such country.

(c) Taxes. If a Law requires Buyer to withhold Taxes of any type from Royalty Payments or Milestone Payments payable hereunder to Seller, Buyer shall (i) deduct such Tax from the payment made to Seller, (ii) timely pay such Taxes for and on behalf of Seller to the proper Government Entity, and (iii) furnish Seller with documentation of such payment within thirty (30) days following such payment.

| ** | Indicates that certain information contained herein has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. |

22.

(d) Royalty Reports and Payment. Within forty-five (45) calendar days following the end of each calendar quarter during the period in which royalties accrue, Buyer shall provide Seller with a report containing the following information for the applicable calendar quarter: the amount of gross sales of Product on a country-by-country basis, an itemized calculation of Net Sales showing deductions provided for in the definition of “Net Sales,” a calculation of the royalty payment due on such sales, an accounting of the number of units and prices for Product sold, the exchange rate for each country in which Product was sold, and any other information reasonably required by Seller for the purpose of calculating royalties and Net Sales Milestone Payments due under this Agreement. Any Royalty Payments due to Seller will be paid on the date of delivery of such report. In the event that either party determines that the calculation of Net Sales for a calendar quarter deviates from the amounts previously reported to Seller for any reason (such as, on account of additional amounts collected or Product returns), Buyer and Seller shall reasonably cooperate to reconcile any such deviations to the extent necessary under applicable legal or financial reporting requirements.

(e) No Projections. Buyer and Seller acknowledge and agree that nothing in this Agreement or the Ancillary Agreement shall be construed as representing an estimate or projection of anticipated sales of any Product, and that the Net Sales levels set forth in Section 2.13 or elsewhere in this Agreement or the Ancillary Agreement or that have otherwise been discussed by the Parties are merely intended to define the royalty obligations to Seller in the event such Net Sales levels are achieved. NEITHER BUYER NOR SELLER MAKES ANY REPRESENTATION OR WARRANTY, EITHER EXPRESS OR IMPLIED, THAT IT WILL BE ABLE TO SUCCESSFULLY COMMERCIALIZE ANY PRODUCT OR, IF COMMERCIALIZED, THAT ANY PARTICULAR NET SALES LEVEL OF SUCH PRODUCT WILL BE ACHIEVED.

Section 2.14 Diligence.

(a) Buyer shall use Commercially Reasonable Efforts to cause all of the Milestone Events to be achieved. “Commercially Reasonable Efforts” shall mean, with respect to Buyer’s efforts to cause the Milestone Events to occur, a level of efforts consistent with the efforts Buyer typically devotes to a product of similar market potential, resulting from its own research efforts, at a similar stage in its development or product life, taking into account conditions then prevailing, including its safety and efficacy, product profile, cost to develop, cost and availability of supply, the time required to complete development, the competitiveness of the marketplace, the Buyer’s patent position with respect to such product (including the Buyer’s ability to obtain or enforce, or have obtained or enforced, such patent rights), the third-party patent landscape relevant to the product, the regulatory structure involved, the likelihood of regulatory approval, the anticipated or actual profitability of the applicable product, and other technical, legal, scientific and medical considerations. Buyer shall not consolidate with or merge into any other Person, assign, convey, transfer, license or lease its properties and assets substantially as an entirety to any Person or assign, convey, transfer, license or lease substantially all the Transferred Assets or substantially all the assets of the Program as operated by Buyer following the Closing Date, to any Person, unless: (i) such Person has expressly assumed the obligation to pay all Royalty Payments when due and each previously unpaid Milestone Payment when due and the obligation to perform every other duty and covenant of Buyer under this Agreement; provided, however, that any such Person that receives rights in

23.

respect of one or more geographic regions, but not the entire world, will not be liable for the payment of Royalty Payments with respect to Net Sales outside of such geographic region(s), worldwide Net Sales Milestone Payments, or Regulatory Milestone Payments for Milestone Events occurring outside of such geographic region(s); and (ii) in the event Buyer conveys, transfers, licenses or leases its properties and assets in accordance with the terms and conditions of this Section 2.14(a), Buyer shall remain liable for the payment of Royalty Payments when due and each previously unpaid Milestone Payment when due and the performance of every duty and covenant of Buyer under this Agreement.

(b) Buyer’s obligations under Section 2.14(a) shall terminate and be of no further effect as of expiration of all Royalty Payment obligations of Buyer under Section 2.13, provided that if there has been no commercial sale of a Product before expiration of the last-to-expire Valid Claim of the Program Patents, then Buyer’s obligations under Section 2.14(a) shall terminate and be of no further effect as of expiration of the last-to-expire Valid Claim of the Program Patents.

Section 2.15 Update Reports. Until the earlier of (a) termination of diligence obligations pursuant to Section 2.14(b), and (b) such time as all Milestone Payments have been paid in full, Buyer shall send to Seller a status report of the development, manufacture and commercialization of Seller Compounds and Products and the status of efforts to achieve the Milestone Events in January and June of each year (each such report, an “Update Report”), with the first such Update Report due in January 2013. Within thirty (30) days after receipt of an Update Report, if Seller requests a meeting with representatives of Buyer to discuss such report, Buyer shall use its commercially reasonable best efforts to make available for such a meeting, upon reasonable notice during regular business hours, those of its employees and representatives as are responsible for the applicable activities set forth in the Update Report.