Attached files

| file | filename |

|---|---|

| 8-K - Gulf United Energy, Inc. | gulfunited8k.htm |

| EX-10.2 - Gulf United Energy, Inc. | ex10-2.htm |

| EX-10.1 - Gulf United Energy, Inc. | ex10-1.htm |

Exhibit 99.1

Gulf United Energy

February 2012

Confidential

Gulf United Energy

Forward Looking Statements

This presentation may contain forward-looking statements about the business, financial condition and prospects of the Company. Forward-looking statements, can be identified by the use of forward-looking terminology such as “believes,” “projects,” “expects,” “may,” “goal,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” or “anticipates,” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Forward-looking statements relate to anticipated or expected events, activities, trends or results. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Forward-looking statements in this presentation include, without limitation, the Company’s expectations of the oil initially in place, undiscovered resources, gross prospective barrels of oil equivalent, net prospective barrels of oil equivalent, net risked prospective barrels of oil equivalent, drilling success rates, resource information and other performance results. These statements are made to provide the public with management’s current assessment of the Company’s business, and it should not be assumed that these reserves are proven recoverable as defined by SEC guidelines or that actual drilling results will prove these statements to be correct. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, there can be no assurances that such expectations will prove to be accurate. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this presentation speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this presentation. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan.

• Founding Director of Nuevo Energy, a NYSE listed Houston based E&P company• Founder and former CEO of Pure Energy and Pure Gas Partners, a private E&P company with operations in New Mexico• Associations with Back Nine Energy Partners, Pin Oak Energy, and Commodore Energy Partners• Director, Chairman of Compensation Committee and member of the Audit Committee of Endeavour International Corp.• Former Partner at Baker Botts, specializing in corporate finance and M&A in the energy space• Professional geophysicist and geologist with over 30 years of experience in petroleum exploration• Previous tenures at Exxon, British Gas, and Nippon Oil Exploration

• Consultant to SK Energy, Teikoku, and Consolidated Contractors Company• Expertise in acquisition and interpretation of seismic data for onshore/offshore and domestic/international

• Proven record of accomplishment of oil discovery in South America, North Africa, and Middle East• Speaks, reads, and writes Spanish fluently• 20 years of development, operations, and financial experience with energy companies in the US, Canada, and United Kingdom• Partner in Rodeo Development, a private E&P company that was sold in 2008• Former Director of Finance at Calpine specializing in project finance and A&D of natural gas reserves• Associations with Daytona Energy, BPZ Energy, and Tiger Midstream• Over 30 years of experience in the energy sector• Senior international negotiator with Santa Fe Energy Resources Inc.• Extensive international exposure in South America, Africa, Former Soviet Union, and Asia• Responsible for the negotiations of the first ever production sharing agreement in onshore China• Associations with Rodeo Development, Riata Resources, Intercap Resource Management, and Daytona EnergyJohn B. Connally III Chief Executive OfficerJames C. Fluker III Vice President ExplorationErnest B. Miller IV Executive Vice PresidentJim D. Ford Executive Vice President

Contemplated Offering Issuer: Gulf United Energy, Inc. OTCBB Symbol: GLFE Security Offered: Common Stock Offering Size: $15,000,000

Offering Type: Private Placement Use of Proceeds: Pay obligations under existing farmout agreements, capital expenditures , and general corporate purposes Fully Diluted Shares Outstanding: ~460,268,000 Placement Agent: Wunderlich Securities, Inc. Expected Pricing Date: March 1, 2012 Potential Buyers : Accredited investor only Registration Rights : Unregistered; Company to file registration statement 60 days following the closing of this offering and use all reasonable efforts to cause the registration to become effective within 180 days of close

Offering Type: Private Placement Use of Proceeds: Pay obligations under existing farmout agreements, capital expenditures , and general corporate purposes Fully Diluted Shares Outstanding: ~460,268,000 Placement Agent: Wunderlich Securities, Inc. Expected Pricing Date: March 1, 2012 Potential Buyers : Accredited investor only Registration Rights : Unregistered; Company to file registration statement 60 days following the closing of this offering and use all reasonable efforts to cause the registration to become effective within 180 days of close

Company Overview

Gulf United Energy (“Gulf United” or the “Company”) is a development stage oil and gas exploration company. The Company’s oil and gas exploration activities are primarily focused on development of concessions in central Colombia and offshore Peru. Gulf United has entered into definitive agreements to participate in two hydrocarbon exploration blocks operated by SK Innovation of Seoul, South Korea. Market Data as of February 14, 2012 Exchange / Ticker: OTCBB / GLFE Price:$0.25 / share Shares Outstanding: ~460.268 million Market Capitalization: ~$115.1 million Debt Outstanding:None 52 Week Price Range:$0.16 – $0.56 Avg. Daily Volume (3 mos.):0.162 million Operations Summary Colombia Operations Summary • Block CPO-4 (12.5% non-operated WI) • 345,592 gross acres (43,200 net) in Llanos Basin • Operated by SK Innovation Peru • Block Z-46 (40% non-operated WI) • 2,803,411 gross acres (1,121,364 net) in Trujillo Basin • Operated by SK Innovation • Block 24 (5% non-operated WI) • 276,137 gross acres (80,000 offshore) • Operated by Upland Energy • TEA I, II, III, IV (2% non-operated WI) • Comprises 40,000,000 gross acres • Onshore, western flank of Andes • Operated by Upland Energy

Strong Operating PartnerSK Innovation (formerly SK Energy)- Subsidiary of SK Group, one of South Korea’s largest industrial conglomerates• Integrated business model includes refining, petrochemical, and E&P• Average daily production of 74,000 bbls at the end of 2010• Currently active in 29 oil and gas blocks in 16 countries

• Over 500 million BOE of proved reserves• Korea’s largest petroleum refiner operating over 1 million barrels of capacity• Currently involved in 4 LNG projects• SK Innovation’s revenues exceeded $38 billion in 2010• SK Innovation Bogotá branch office oversees operations of three blocks, including CPO-4

• Over 500 million BOE of proved reserves• Korea’s largest petroleum refiner operating over 1 million barrels of capacity• Currently involved in 4 LNG projects• SK Innovation’s revenues exceeded $38 billion in 2010• SK Innovation Bogotá branch office oversees operations of three blocks, including CPO-4

CPO-4 Trend Characteristics • Multiple stacked reservoirs (Mirador, Guadalupe, and Une)• High quality light oil (30-45 API) • Favorable reservoir characteristics: 30% porosity and 2D permeabilityLlanos Basin Profile• Basin covers ~125,000 square miles • Geographic formations: Upper Cretaceous, Paleocene, and Eocene

• Currently over 25 operators including: Exxon, Chevron, Shell, Petro Bras, Repsol, Total, Occidental, BP, and Ecopetrol

CP0-4 Reservoir Distribution Thrust Plan Corcel Play Negritos Play Barco Une Guadalupe Marador

CP0-4 MULTI RESERVOIR CROSS SECTION BASAMENTO CRISTALINO GACHETA GENERADOR SOURCE: HOUSTON AMERICAN ENERGY

Peru Z-46 Overview• Offshore Peru- Trujillo Basin• Water Depth: 50m - 1,000m• Area – 2,803,411 acres• SK Innovation 60%• Gulf United 40%

|

Phase 1

|

• Existing 2D Data reprocessed– 5,684 km completed

• Sea bed Coring– MET method (Microbial Exploration Technology) (1stStage Completed)

|

|

Phase 2

|

• New 2D seismic– Acquisition• 56 lines: 2,904 km (Acquired)– Processing (Q1 2011)– Interpretation (Q2 2011)

|

|

Phase 3

|

• Focused 3D based on 2D interpretation to identify well location

|

|

Phase 4

|

• 1st Exploration Well

|

Asset Base - Z-46

Multiple tertiary prospects and multiple Cretaceous/Paleozoic•Two Repsol wells (1999) on the block reported oil shows •Recently reprocessed 2D data indicates sand rich fan deposition that was previously undetected

Peru Block 24 Overview• Gulf United owns a 5% non-operating working interest• Comprised of 276,137 acres (~80,000 offshore)• Operator estimates offshore risked prospective resource of 50 MMBO• Recent oil and gas discoveries• Onshore (Olympic)- North & South of Block 24• Offshore (Petrotech)- South of Block 24

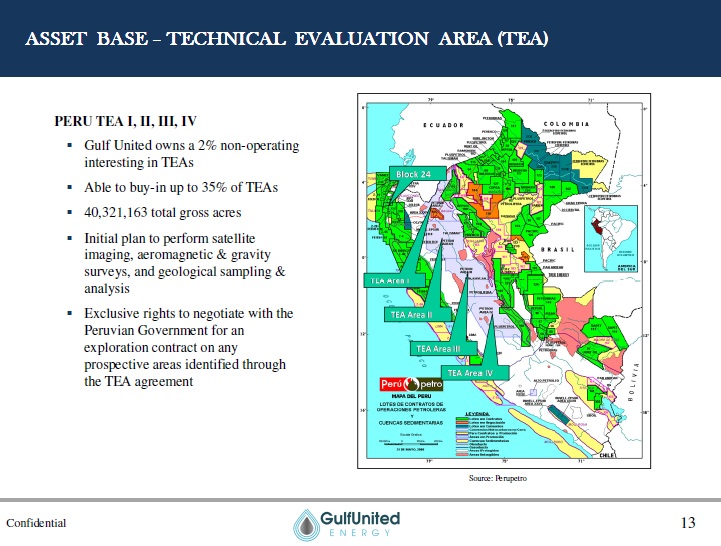

Asset Base - Techinical Evaluation Area (TEA)PERU TEA I, II, III, IV• Gulf United owns a 2% non-operating interesting in TEAs• Able to buy-in up to 35% of TEAs• 40,321,163 total gross acres• Initial plan to perform satellite imaging, aeromagnetic & gravity surveys, and geological sampling & analysis• Exclusive rights to negotiate with the Peruvian Government for an exploration contract on any prospective areas identified through the TEA agreement

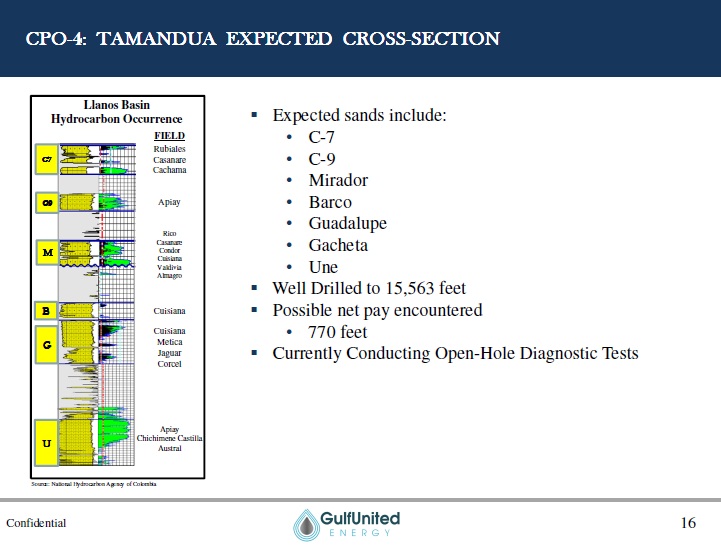

Recent Developments • Tamandua-1 Exploration Well• Well drilled to total depth of 15,563 feet • LWD and mud log indications of ~770 feet of possible net pay

• Significant indicators of oilo Mud log showso Gas Chromatograph data

o High resistivity of sands• Currently running open-hole diagnostic tools to evaluate multiple reservoirs• Scheduled rig mobilization to second site (Negritos)

• Anticipated extended well test of Tamandua-1 to commence in mid-February• 5 additional wells permitted and 3 additional locations built• Strong correlation between Tamandua-1 and Apiay field

CPO-4: Planned Drilling Locations Drilling Schedule 1) Tamandue-1 2) Cachire-1 3) Zorro Gris-1 4) Chacharo-1

Expected sands include:• C-7• C 9• Mirador• Barco• Guadalupe• Gacheta• Une• Well Drilled to 15,563 feet• Possible net pay encountered• 770 feet• Currently Conducting Open-Hole Diagnostic Tests

Llanos Foothills Well Profile (1) Well Cost ($MM) $15-$20Area (acres) 100-500Pay Sand Thickness (ft.) 150-350Bbls per Acre-ft. 500 Recoverable Oil (MMBO) 7.5-90 EUR/well (MMBO)2.5-10S ection Pay (ft.)C-7 200C-9 140Primary Zones 430Total 770 (1) Llanos Basin Foothills type well profile reflects economic and reserve information derived from company presentations, analyst reports, and other industry publications (2) Possible net pay sand thickness is based on analysis of LWD and mud logging data from the Tamandua-1 well and does not necessarily equate to pay sand thickness

2011 Operations Summary CPO-4 Z-46 Achievements February 2011 Capital Raise and Share Registration Delivery and Refurbishment of Rig Drilled and Logged Tamandua #1 6 Wells Permitted, 4 Sites Designated, and 3 Locations Built Additional 3-D Seismic Analysis Expanded prospect mapping on CPO-4 based on Tamandua-1 drilling results Completed Infill 2-D Seismic Shoot on a portion of Z-4 Validated multiple prospects and structures on Z-46 Scheduled: 3-D Seismic Acquisition for October 2012 Outstanding Items 0 ANH Approval of CPO-4 Assignment 0 Testing of Tamandua #1 0 Drilling and Testing of Cachire-1 (Negritos) 0 Perupetro Approval of Block Z-46 Assignment

|

(in millions)

|

||||

|

Sources

|

Us es

|

|||

|

Contemplated Offering

|

$ 15.0

|

CPO-4: Seis mic Reimburs ement

|

$ 4.0

|

|

|

CPO-4: Drilling Cos ts

|

3.2

|

|||

|

Z-46: Pas t Cos ts , Seis mic & JOE

|

4.1

|

|||

|

General Corporate & WC

|

2.4

|

|||

|

Offering Expens es

|

1.3

|

|||

|

Offering Sources & Us es

|

$ 15.0

|

$ 15.0

|

||