Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - China Energy CORP | v309892_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China Energy CORP | v309892_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - China Energy CORP | Financial_Report.xls |

| EX-32 - EXHIBIT 32 - China Energy CORP | v309892_ex32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x Quarterly report under Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal quarter ended February 29, 2012

¨ Transition report under Section 13 or 15(d) of the Securities

Exchange Act of 1934 for the transition period from ____ to______.

Commission file number: 000-52409

CHINA ENERGY CORPORATION

(Exact name of Registrant in its charter)

| Nevada | 98-0522950 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

|

No. 57 Xinhua East Street Hohhot, Inner Mongolia, People’s Republic of China |

010010 | |

| (Address of principal executive offices) | (Zip Code) | |

| +86-0471-466-8870 | ||

| (Registrant’s telephone number including area code) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. ¨Yes x No

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:

45,060,000 shares of Common Stock, $ 0.001 par value, outstanding as of April 16, 2012.

| TABLE OF CONTENTS | ||

| PART I. | FINANCIAL INFORMATION | |

| ITEM 1. | Interim Financial Statements | 3 |

| ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 32 |

| ITEM 3. | Quantitative And Qualitative Disclosure About Market Risk | 38 |

| ITEM 4T | Controls and Procedures | 38 |

| PART II. | OTHER INFORMATION | |

| ITEM 1. | Legal Proceedings | 39 |

| ITEM 1A | Risk Factors | 39 |

| ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 39 |

| ITEM 3. | Defaults Upon Senior Securities. | 39 |

| ITEM 4. | Mine Safety Disclosures | 39 |

| ITEM 5. | Other Information. | 39 |

| ITEM 6. | Exhibits | 39 |

| Signatures | 40 | |

| 1 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, among other things:

| · | general economic and business conditions, both nationally and in our markets, | |

| · | our expectations and estimates concerning future financial performance, financing plans and the impact of competition, | |

| · | our ability to implement our growth strategy, anticipated trends in our business, | |

| · | advances in technologies, and | |

| · | other risk factors set forth herein. |

In addition, in this report, we use words such as “anticipates,” “believes,” “plans,” “expects,” “future,” “intends,” and similar expressions to identify forward-looking statements.

China Energy Corporation and its subsidiaries (the “Company”) undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this prospectus. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

| 2 |

ITEM 1. INTERIM FINANCIAL STATEMENTS.

| 3 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| February 29, | November 30, | |||||||

| 2012 | 2011 | |||||||

| (Unaudited) | (Audited) | |||||||

| U.S.$ | U.S.$ | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 39,337,871 | $ | 31,007,269 | ||||

| Accounts receivables, net of allowance for doubtful accounts of $11,399 and $11,251, respectively | 17,565,411 | 17,364,962 | ||||||

| Other receivables | 14,750,155 | 24,562,536 | ||||||

| Inventories | 17,439,263 | 10,096,645 | ||||||

| Prepaid expenses | 230,745 | 323,072 | ||||||

| Advance to suppliers | 47,737,171 | 27,566,516 | ||||||

| Total current assets | 137,060,616 | 110,921,000 | ||||||

| Fixed assets, net | 64,318,280 | 62,937,747 | ||||||

| Other assets: | ||||||||

| Investment property, net of accumulated depreciation of $525,905 and $475,649, respectively | 5,758,019 | 5,730,169 | ||||||

| Mining right, net of amortization of $1,748,030 and $1,635,072, respectively | 3,040,943 | 3,091,565 | ||||||

| Restricted cash | 582,684 | 573,542 | ||||||

| Other long term assets | 3,818,898 | 3,889,144 | ||||||

| Total other assets | 13,200,544 | 13,284,420 | ||||||

| TOTAL ASSETS | $ | 214,579,440 | $ | 187,143,167 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Short term bank loans | $ | 30,158,100 | $ | 29,138,242 | ||||

| Accounts payable | 25,512,314 | 21,716,148 | ||||||

| Advance from customers | 23,205,729 | 10,321,920 | ||||||

| Accrued liabilities | 579,075 | 629,016 | ||||||

| Other payables | 15,483,790 | 13,111,017 | ||||||

| Stockholder loans | 9,676,101 | 9,452,712 | ||||||

| Current portion of finance obligation | 1,747,084 | 1,695,944 | ||||||

| Current portion of deferred income | 1,377,484 | 1,333,695 | ||||||

| Total current liabilities | 107,739,677 | 87,398,694 | ||||||

| Non-current liabilities | ||||||||

| Finance obligation, net of current portion | 6,550,337 | 6,906,957 | ||||||

| Deferred income, net of current portion | 8,814,964 | 8,804,664 | ||||||

| Total non-current liabilities | 15,365,301 | 15,711,621 | ||||||

| Total liabilities | 123,104,978 | 103,110,315 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock: no par value; 5,000,000 shares authorized; none issued and outstanding shares | - | - | ||||||

| Common stock: $0.001 par value; 195,000,000 shares authorized; 45,060,000 shares issued and outstanding at February 29, 2012 and November 30, 2011, respectively | 45,060 | 45,060 | ||||||

| Additional paid-in capital | 10,623,768 | 10,620,368 | ||||||

| Retained earnings | 63,046,274 | 56,818,378 | ||||||

| Statutory reserves | 9,107,174 | 9,032,855 | ||||||

| Accumulated other comprehensive income | 8,652,186 | 7,516,191 | ||||||

| Total stockholders’ equity | 91,474,462 | 84,032,852 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 214,579,440 | $ | 187,143,167 | ||||

See notes to the consolidated financial statements.

| 4 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the three months ended | ||||||||

| February 29, 2012 | February 28, 2011 | |||||||

| U.S.$ | U.S.$ | |||||||

| Revenues | $ | 38,687,151 | $ | 22,352,729 | ||||

| Cost of revenues | (25,134,850 | ) | (14,353,986 | ) | ||||

| Gross profit | 13,552,301 | 7,998,743 | ||||||

| Operating expenses: | ||||||||

| Selling and marketing | 3,312,157 | 1,243,806 | ||||||

| General and administrative | 1,724,894 | 1,117,130 | ||||||

| Total operating expenses | 5,037,051 | 2,360,936 | ||||||

| Income from operations | 8,515,250 | 5,637,807 | ||||||

| Other income and (expenses) | ||||||||

| Finance expenses, net | (801,632 | ) | (320,942 | ) | ||||

| Non-operating income | 177,899 | 433,204 | ||||||

| Non-operating expenses | (100,273 | ) | (79,999 | ) | ||||

| Income before provision for income taxes | 7,791,244 | 5,670,070 | ||||||

| Provision for income taxes | (1,489,029 | ) | (1,305,860 | ) | ||||

| Net income | 6,302,215 | 4,364,210 | ||||||

| Other comprehensive income | ||||||||

| Foreign currency translation adjustment | 1,135,995 | 808,004 | ||||||

| Total comprehensive income | $ | 7,438,210 | $ | 5,172,214 | ||||

| Net income per common share | ||||||||

| Basic and diluted | $ | 0.14 | $ | 0.10 | ||||

| Weighted average common shares outstanding | ||||||||

| Basic and diluted | 45,060,000 | 45,000,000 | ||||||

See notes to the consolidated financial statements.

| 5 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the THREE Months Ended FEBRUARY 29, 2012

(UNAUDITED)

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Other | Total | ||||||||||||||||||||||||||

| Common Stock | Paid-in | Retained | Statutory | Comprehensive | Stockholders’ | |||||||||||||||||||||||

| Shares | Amount | Capital | Earnings | Reserves | Income | Equity | ||||||||||||||||||||||

| (U.S.$) | (U.S.$) | (U.S.$) | (U.S.$) | (U.S.$) | (U.S.$) | |||||||||||||||||||||||

| Balance as of November 30, 2011 | 45,060,000 | $ | 45,060 | $ | 10,620,368 | $ | 56,818,378 | $ | 9,032,855 | $ | 7,516,191 | $ | 84,032,852 | |||||||||||||||

| Net income | - | - | - | 6,302,215 | - | - | 6,302,215 | |||||||||||||||||||||

| Other comprehensive income | - | - | - | - | - | 1,135,995 | 1,135,995 | |||||||||||||||||||||

| Stock-based compensation | - | - | 3,400 | - | - | - | 3,400 | |||||||||||||||||||||

| Appropriation of statutory reserves | - | - | - | (74,319 | ) | 74,319 | - | - | ||||||||||||||||||||

| Balance as of February 29, 2012 | 45,060,000 | $ | 45,060 | $ | 10,623,768 | $ | 63,046,274 | $ | 9,107,174 | $ | 8,652,186 | $ | 91,474,462 | |||||||||||||||

See notes to the consolidated financial statements.

| 6 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the three months ended | ||||||||

| February 29, | February 28, | |||||||

| 2012 | 2011 | |||||||

| U.S.$ | U.S.$ | |||||||

| Cash flows from operating activities: | ||||||||

| Net profit | $ | 6,302,215 | $ | 4,364,210 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Decrease in allowance for doubtful accounts | (44,110 | ) | ||||||

| Depreciation and amortization | 2,264,626 | 1,386,351 | ||||||

| Stock-based compensation | 3,400 | 18,274 | ||||||

| Interest accrued on shareholder loans | 98,291 | 410,925 | ||||||

| Loss on disposal of property, plant and equipment | 12,899 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Increase in restricted cash | (9,142 | ) | (7,952 | ) | ||||

| Increase in accounts receivable | (200,597 | ) | (3,956,272 | ) | ||||

| Decrease in other receivables | 9,812,381 | 1,609,480 | ||||||

| Decrease in prepaid expenses | 92,327 | - | ||||||

| (Increase) in advances to suppliers | (19,889,193 | ) | (2,039,626 | ) | ||||

| (Increase) in inventories | (7,342,618 | ) | (9,525,899 | ) | ||||

| Increase in deferred income | 54,089 | 288,620 | ||||||

| Increase (decrease) in accounts payable | 5,895,474 | (195,388 | ) | |||||

| Increase (decrease) in advances from customers | 12,883,808 | (149,974 | ) | |||||

| Increase (decrease) in accrual liabilities and other payables | 2,322,832 | (1,455,687 | ) | |||||

| Net cash provided by (used in) operating activities | 12,300,792 | (9,297,048 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Purchase of property, plant and equipment | (4,874,099 | ) | (2,109,950 | ) | ||||

| Increase in construction in progress | (92,340 | ) | - | |||||

| Payments made on other long term assets | (15,820 | ) | (721,500 | ) | ||||

| Payments received on notes receivable | - | 11,355,556 | ||||||

| Net cash (used in) provided by investing activities | (4,982,259 | ) | 8,524,106 | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from short term bank loans | 22,147,693 | 12,033,151 | ||||||

| Principal payments made on short term bank loans | (21,514,902 | ) | - | |||||

| Repayments of lease finance obligation | (417,101 | ) | - | |||||

| Repayments of shareholders loans | - | (58,305 | ) | |||||

| Net cash provided by financing activities | 215,690 | 11,974,846 | ||||||

| Effect of exchange rate changes on cash | 796,379 | (69,586 | ) | |||||

| Net change in cash and cash equivalents | 8,330,602 | 11,132,318 | ||||||

| Cash and cash equivalents, beginning of period | 31,007,269 | 4,580,540 | ||||||

| Cash and cash equivalents, end of period | $ | 39,337,871 | $ | 15,712,858 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for interest | $ | 534,045 | $ | 290,504 | ||||

| Cash paid for income taxes | $ | 2,096,253 | $ | 3,280,944 | ||||

See notes to the consolidated financial statements.

| 7 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

1. Organization and Business

Organization of the Company

China Energy Corporation (the “Company”) is a Nevada corporation, formed on October 11, 2002 under the name Omega Project Consultations, Inc. The name was changed to China Energy Corporation on November 3, 2004. On November 30, 2004, the Company entered into a share exchange agreement with Inner Mongolia Tehong Coal Group Co., Ltd. (“Coal Group”), and Inner Mongolia Zhunger Heat Power Co. Ltd. (“Heat Power”) and their respective shareholders. The transaction was accounted for as a reverse merger, a procedure that treats the transaction as though Coal Group had acquired the Company. Under the accounting for a reverse merger, the assets and liabilities of the Company, which were nil at the time, were recorded on the books of Coal Group, the continuing company, and the stockholders’ equity accounts of Coal Group were reorganized to reflect the shares issued in this transaction.

The share exchange agreement, which resulted in the Company’s acquisition of the Coal Group and Heat Power, was governed by and valid under Nevada law and was not perfected under the then People’s Republic of China (“PRC”) law. It was not until certain changes in PRC law, which became definitive in 2006, that the Company was made clear that a series of procedures of governmental approvals and certain additional corporate actions would be conditions precedent to that perfection. The Company does not believe the lack of perfection impairs its ability to exercise control over the Coal Group and Heat Power as it continues to exercise control over them, consistent with the intent of the original shareholders.

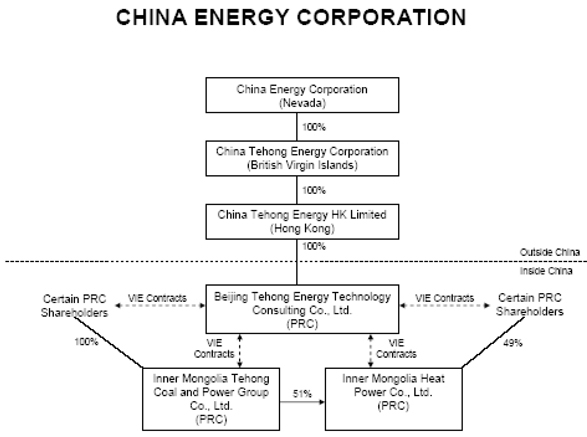

On July 13, 2009, the Company entered into a framework agreement which detailed the actions contemplated for the restructuring of the Company, Coal Group and Heat Power under a "variable interest entity" (“VIE”) structure to meet the current requirements of PRC law.

On November 30, 2010, the Company entered into a series of contractual arrangements pursuant to which the control and the economic benefits and costs of ownership of its two operating companies Coal Group and Heat Power (collectively, the “Operating Companies”) in the PRC would flow directly to Beijing Tehong Energy Technology Consulting Co., Ltd. (the “WFOE”), wholly owned through subsidiaries of the Company.

The Company first entered into a Termination And Restructuring Agreement with the Operating Companies, the WFOE, Pacific Projects Inc. (“PPI”) and the respective stockholders of the Operating Companies (collectively, the “PRC Shareholders”) dated November 30, 2010 pursuant to which the parties agreed (i) to terminate the Trust Agreement dated as of December 31, 2007 under which the PRC Shareholders agreed to hold their equity interests in the Operating Companies in trust for PPI, (ii) to the merger of PPI into the Company and (iii) to enter into Management and Control Agreements.

| 8 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

On November 30, 2010, the WFOE entered into (i) an Exclusive Business Cooperation Agreement with Coal Group, (ii) an Equity Interest Pledge Agreement and an Exclusive Option Agreement with Coal Group and the stockholders of Coal Group and (iii) a Power of Attorney, with each of the stockholders of the Coal Group. The WFOE also entered into (i) an Exclusive Business Cooperation Agreement with Heat Power, (ii) an Equity Interest Pledge Agreement and an Exclusive Option Agreement with Heat Power and the stockholders of Heat Power and (iii) a Power of Attorney with each of the stockholders of Heat Power. The foregoing agreements are herein collectively referred to as the “Management and Control Agreements.”

The Management and Control Agreements as described below allow the WFOE to exercise control over, and derive all economic benefits from Coal Group and Heat Power. Previously, the operating businesses were controlled pursuant to a trust arrangement which has been terminated as part of the restructuring described below.

Exclusive Business Cooperation Agreements: Pursuant to the Exclusive Business Cooperation Agreements, the WFOE provides technical and consulting services related to the business operations of Coal Group and Heat Power. In consideration for such services, Coal Group and Heat Power have agreed to pay an annual service fee to the WFOE in an amount equal 100% of Coal Group’s and Heat Power’s annual net income, respectively. Each Exclusive Business Cooperation Agreement has a term of 10 years, which automatically renews unless terminated by the WFOE. The WFOE may terminate the agreements at any time upon 30 days’ prior written notice to Coal Group or Heat Power, as the case may be.

Exclusive Option Agreements: Pursuant to the Exclusive Option Agreements, the WFOE has an exclusive option to purchase, or to designate another qualified person to purchase, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in each of the Coal Group and Heat Power held by the stockholders of Coal Group and the stockholders of Heat Power, respectively. To the extent permitted by the PRC laws, the purchase price for the entire equity interest is RMB1.00 or the minimum amount required by PRC law or government practice. Each of the exclusive option agreements has a term of 10 years, with renewal for an additional 10 years at the option of the WFOE.

Powers of Attorney: Each of the stockholders of the Coal Group and Heat Power, respectively, executed a Power of Attorney that provides the WFOE with the power to act as such stockholder’s exclusive agent with respect to all matters related to such stockholder’s ownership interest in each of Coal Group or Heat Power, including the right to attend stockholders’ meetings and the right to vote, dispose or pledge such shares.

Equity Interest Pledge Agreements: Pursuant to such agreements, each of the stockholders of Coal Group and Heat Power pledged their shares in Heat Power and Coal Group, respectively, to the WFOE, to secure their obligations under the Exclusive Business Cooperation Agreements. In addition, the stockholders of Coal Group and the Heat Power agreed not to transfer, sell, pledge, dispose of or create any encumbrance on any equity interests in Coal Group or Heat Power that would affect the WFOE’s interests. The Equity Interest Pledge Agreement expires when Coal Group and Heat Power, respectively, fully perform their obligations under the Exclusive Business Cooperation Agreements.

| 9 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Termination of Trust Arrangements: Prior to entering into the Management and Control Agreements, the Company controlled Coal Group and Heat Power through a series of trust agreements which were terminated contemporaneously with the execution of the Management and Control Agreements. In connection with the termination of such trust arrangements, ownership of 68% of the shares of the Company previously held by Georgia Pacific Investments Inc. and Axim Holdings Ltd. was transferred to Fortune Place Holdings Ltd. (“Fortune Place”).

Entrustment Agreement and Share Option Agreement: Ninghua Xu, owner of 100% equity interests of Fortune Place, entered into an entrustment agreement with WenXiang Ding, the Chief Executive Officer, pursuant to which Mr. Ding was entrusted to manage the Operating Companies and related entities as provided in the agreement as the agent of Mr. Xu. The agreement also appoints Mr. Ding as the exclusive agent with respect to all matters concerning 100% of Mr. Xu’s equity interest in Fortune Place. In addition, Mr. Xu and Mr. Ding entered into a share option agreement pursuant to which Mr. Ding has the option to purchase all of the shares of Fortune Place from Mr. Xu upon the achievement of certain performance targets by the Operating Companies and related entities.

Revised Corporate Structure: As a result of the entry into the foregoing agreements, and the termination of the trust arrangements, the Company has a revised corporate structure which is set forth below:

| 10 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Business

The Company’s business is made up of two segments: Coal Group and Heat Power.

Coal Group: Coal Group was organized in China on August 8, 2000 as Inner Mongolia Zhunger Tehong Coal Co., Ltd. The name was changed in December 2003 to Inner Mongolia Tehong Coal Group Co. Ltd. Coal Group has mining rights to a coal mine in the Inner Mongolia District from which it mines coal. It also buys, sells, and transports coal, serving the Inner Mongolia District.

Heat Power: During 2003, Heat Power was granted a license, to supply heating to the entire XueJiaWan area. To provide for this requirement, construction began in 2004 on a thermoelectric plant, which was completed in September 2006. Heat Power supplies heating directly to users and supplies electricity within the XueJiaWan area through a government controlled intermediary, Inner Mongolia Electric Power Group Co., Ltd. (“Electric Power Group”).

The Coal Group does not sell any coal to Heat Power.

2. Summary of Significant Accounting Policies

Basis of Accounting and Presentation

The unaudited interim financial statements of the Company as of February 29, 2012 and for the three months ended February 29, 2012 and February 28, 2011, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the Securities and Exchange Commission (the “SEC”), which apply to interim financial statements. In the opinion of management, such information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The results of operations for the three months ended February 29, 2012 are not necessarily indicative of the results to be expected for future quarters or for the year ending November 30, 2012.

Certain information and disclosures normally included in the notes to financial statements have been condensed or omitted as permitted by the rules and regulations of the SEC, although the Company believes the disclosure is adequate to make the information presented not misleading. The accompanying unaudited financial statements should be read in conjunction with the annual financial statements of the Company for the year ended November 30, 2011.

All financial statements and notes to the financial statements are presented in U.S. dollars.

| 11 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Basic of Consolidation

Pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 810, the Company is required to include in its consolidated financial statements the financial statements of variable interest entities. ASC Topic 810 requires a variable interest entity to be consolidated by a company if that company is subject to a majority of the risk of loss for the variable interest entity or is entitled to receive a majority of the variable interest entity’s residual returns. Variable interest entities are those entities in which the Company, through contractual arrangements, bear the risk of, and enjoy the rewards normally associated with ownership of the entity, and therefore the Company is the primary beneficiary of the entity.

The consolidated financial statements include the accounts of the Company’s WFOE and Coal Group and Heat Power since they are deemed variable interest entities and the Company is the primary beneficiary. All significant intercompany accounts and transactions have been eliminated in consolidation.

Recently Issued Accounting Standards

In December 2009, the FASB issued Accounting Standards Update (“ASU”) 2009-17, “Consolidations (Topic 810) – Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities” (“ASU 2009-17”). The Company adopted ASU 2009-17, which requires an enterprise to perform an analysis to determine whether the enterprise’s variable interest or interests give it a controlling financial interest in a VIE. This analysis identifies the primary beneficiary of a variable interest entity as the enterprise that has (1) the power to direct the activities of a variable interest entity that most significantly impact the entity’s economic performance and (2) the obligation to absorb losses of the entity that could potentially be significant to the variable interest entity or the right to receive benefits from the entity that could potentially be significant to the variable interest entity. In addition, the required changes provide guidance on shared power and joint venture relationships, remove the scope exemption for qualified special purpose entities, revise the definition of a variable interest entity, and require additional disclosures. The Company has assessed the terms contained in the Management and Control Agreements between the Company and Coal Group and Heat Power and determined that Coal Group and Heat Power are VIEs, and accordingly, are consolidated in these financial statements.

In January 2010, the FASB issued Accounting Standards Update No. 2010-6, “Improving Disclosures about Fair Value Measurements” (“ASU No. 2010-06”). ASU No. 2010-06 amends ASC Topic 820, “Fair Value Measurements and Disclosures,” to require additional information to be disclosed principally regarding Level 3 measurements and transfers to and from Level 1 and 2. In addition, enhanced disclosure is required concerning inputs and valuation techniques used to determine Level 2 and Level 3 measurements. This guidance is generally effective for interim and annual reporting periods beginning after December 15, 2009; however, requirements to disclose separately purchases, sales, issuances, and settlements in the Level 3 reconciliation are effective for fiscal years beginning after December 15, 2010 (and for interim periods within such years). The update did not have a material impact on the Company’s consolidated results of operations or financial position.

| 12 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

In February 2010, the FASB issued Accounting Standards Update No. 2010-09, “Amendments to Certain Recognition and Disclosure Requirements” (“ASU No. 2010-09”). ASU No. 2010-09 amends FASB ASC Topic 855-10, “Subsequent Events,” to remove the requirement for an SEC filer to disclose the date through which subsequent events have been evaluated in both issued and revised financial statements. This change alleviates potential conflicts between ASC 855-10 and the SEC’s requirements. The update did not have a material impact on the Company’s consolidated results of operations or financial position.

In May 2011, the FASB issued ASU No. 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S.GAAP and IFRSs” (“ASU No. 2011-04”) that provides clarification about the application of existing fair value measurements and disclosure requirements and expands certain other disclosure requirements. ASU No. 2011-04 amends U.S. GAAP to provide common fair value measurements and disclosure requirements with International Financial Reporting Standards. The amendments in this ASU are effective prospectively for interim and annual periods beginning after December 15, 2011, with no early adoption permitted. The Company does not believe that the adoption of this standard will not have any material impact on its consolidated financial statements.

In June 2011, the FASB issued ASU No. 2011-05, “Presentation of Comprehensive Income” (“ASU No. 2011-05”) that improves the comparability, consistency, and transparency of financial reporting and increases the prominence of items reported in other comprehensive income by eliminating the option to present components of other comprehensive income as part of the statement of changes in stockholders’ equity. ASU No. 2011-05 requires that all nonowner changes in stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In both methods, the entity is required to present on the face of the financial statements reclassification adjustments for items that are reclassified from other comprehensive income to net income in the statement(s) where the component of net income and the components of other comprehensive income are presented. ASU No. 2011-05 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2011 and is to be applied retrospectively, with early adoption permitted. The Company does not believe that the adoption of this standard will have a material impact on its consolidated financial statements.

In September 2011, the FASB issued ASU No. 2011-08, “Testing Goodwill for Impairment” (“ASU No. 2011-08”) that permits an entity to first assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform the required annual goodwill impairment test. ASU No. 2011-08 is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011; however, early adoption is permitted. The Company does not believe that the adoption of this standard will have a material impact on its consolidated financial statements.

In December 2011, the FASB issued ASU No. 2011-11, “Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities” (“ASU No. 2011-11”). The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. An entity is required to apply the amendments for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. An entity should provide the disclosures required by those amendments retrospectively for all comparative periods presented. The Company does not expect that the adoption of ASU No. 2011-11 will have a significant, if any, impact on its consolidated financial statements.

| 13 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Foreign Currency Translations

Substantially all Company assets are located in China. The functional currency for the majority of the Company’s operations is the Renminbi (“RMB”). The Company uses the United States dollar (“US Dollar” or “US$” or “$”) for financial reporting purposes. The financial statements of the Company’s foreign subsidiaries have been translated into US dollars in accordance with FASB ASC 830, “Foreign Currency Matters.” All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transaction occurred. Statements of operations amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company’s financial statements are recorded as other comprehensive income.

The exchange rates used to translate amounts in RMB into US dollars for the purposes of preparing the consolidated financial statements were as follows:

| February 29, 2012 |

November 30, 2011 |

February 28, 2011 | |||

| Balance sheet items, except for the common stock, additional paid-in capital, statutory reserves and retained earnings, as of period end | US$1=RMB 6.2935 |

US$1=RMB 6.3765 |

N/A | ||

| Amounts included in the statements of income, statements of changes in stockholders’ equity and statements of cash flows for the period | US$1=RMB 6.3212 |

N/A | US$1=RMB 6.6483 |

For the three months ended February 29, 2012 and February 28, 2011, foreign currency translation adjustments of approximately $1,135,995 and $808,004 have been reported as other comprehensive income in the consolidated statements of income and comprehensive income.

Although government regulations now allow convertibility of RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that RMB could be converted into US dollars at that rate or any other rate.

The value of RMB against the US dollars and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions. Any significant revaluation of RMB may materially affect the Company’s financial condition in terms of US dollar reporting.

| 14 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Cash and Cash Equivalents

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less as of the date of purchase to be cash equivalents.

Accounts Receivable

Accounts receivable is stated at cost, net of an allowance for doubtful accounts. The Company maintains an allowance for doubtful accounts for estimated losses resulting from the failure of customers to make required payments. The Company reviews the accounts receivable on a periodic basis and provides an allowance where there is doubt as to the collectibility of individual balances. In evaluating the collectibility of individual receivable balances, the Company considers many factors, including the age of the balance, the customer’s payment history, its current credit-worthiness and current economic trends. As of February 29, 2012 and November 30, 2011, the balance of allowance for doubtful accounts was $11,399 and $11,251, respectively. For the periods presented, the Company did not write off any accounts receivable as bad debts.

Included in accounts receivable are accounts receivable from an entity affiliated to the Company through a family member of the Company’s Chairman of $1,687,024 and $1,712,113 as of February 29, 2012 and November 30, 2011, respectively.

Inventories

Inventories consist of coal and operating supplies. Inventories are valued at the lower of cost or market, using the weighted average cost method. Provisions are made for excess, slow moving and obsolete inventory as well as inventory whose carrying value is in excess of market. The Company did not make any inventory provision for the three months ended February 29, 2012 and February 28, 2011.

Fixed Assets

Fixed assets are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire or construct the asset, including capitalized interest during the construction period, and any expenditures that substantially increase the assets value or extend the useful life of an existing asset. Depreciation is computed using the straight line method over the estimated useful lives of property, plant and equipment, which are approximately five years for electrical and office equipment, ten years for transportation equipment and pipelines, and 20 to 45 years for buildings. Leasehold improvements are amortized over the lesser of their estimated useful lives or the term of the lease. Capitalized costs related to assets under construction are not depreciated until construction is complete and the asset is ready for its intended use. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the period benefited. Maintenance and repairs are generally expensed as incurred. When property, plant and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations.

| 15 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Costs of mine development, expansion of the capacity of or extending the life of the mine (“Mining Structures”) are capitalized and amortized using the units-of-production (“UOP”) method over the productive life of the mine based on proven and probable reserves. Mining Structures include the main and auxiliary mine shafts, underground tunnels, ramps, and other integrant mining infrastructure.

Investment Property

Investment property represents rental real estate purchased or constructed by the Company for investment purposes. Depreciation is computed using the straight line method over the estimated useful life of 45 years. The related rental income is included in non-operating income in the accompanying consolidated statements of income and comprehensive income.

Mining Right

All land in China belongs to the government. To extract resources from land, the Company is required to obtain a mining right. The Company’s Coal Group acquired its mining right from the Provincial Bureau of National Land and Resource in November of 2005. The price of the mining right, which represents the acquisition cost of the mine, was assessed in 2005 by the Bureau to be $3,656,731. The mine acquisition cost is payable in instalments over a six year period from the date the mining right was granted. The mine acquisition cost is amortized using the UOP method over the productive life of the mine based on proven and probable reserves.

Restricted Cash

Long-term restricted cash represents the bank deposits placed as guarantee for the future payments of rehabilitation costs as required by the PRC government. The long-term deposits earn an interest rate of 0.50% per annum, which is determined by the PRC government.

Advance from Customers

Advance from customers primarily consists of payments received from customers by the Coal Group and Heat Power prior to the delivery of goods and services.

Deferred Income

Deferred income represents reimbursements received by Heat Power from various real estate development companies for the cost of constructing pipelines to connect to rural areas being developed. The income is recognized on a straight line basis over the estimated useful life of the pipelines of ten years.

| 16 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Impairment of Long-lived Assets

The Company utilizes FASB ASC 360, “Property, Plant and Equipment” (“ASC 360”), which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that carrying amount of an asset may not be recoverable. The Company may recognize impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to these assets. If the total of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a loss, if any, is recognized for the difference between the fair value of the asset and its carrying value. No impairment of long-lived assets was recognized for the three months ended February 29, 2012 and February 28, 2011.

Revenue Recognition

Revenues from sales of products are recognized when the products are delivered and the title is transferred, the risks and rewards of ownership have been transferred to the customer, the price is fixed and determinable and collection of the related receivable is reasonably assured.

Revenue associated with sales of coal is recognized when the title to the goods has been passed to customers, which is the date when the goods are delivered to designated locations and accepted by the customers and the previously discussed requirements are met.

Heat Power supplies heat to users directly and supplies electricity through a government controlled intermediary. Revenue from sales of heat and electricity represents the amount of tariffs billed for heat and electricity generated and transmitted to the users and the government controlled intermediary, respectively.

Resource Compensation Fees

In accordance with the relevant regulations in PRC, a company that is engaged in coal production business is required to pay a fee to the Inner Mongolia National Land and Resources Administration Bureau as compensation for the depletion of coal resources. Coal Group was required to pay resource compensation fees of $103,364 and $88,663 for the three months ended February 29, 2012 and February 28, 2011, respectively, which is included in cost of revenues in the consolidated statements of income and comprehensive income.

Environmental Costs

The PRC has adopted extensive environmental laws and regulations that affect the operations of the coal mining industry. The potential environmental liabilities under proposed or future environmental legislation cannot currently be reasonably estimated, and could be material. Under existing legislation, however, Company management believes that there are no probable liabilities that will have a material adverse effect on the Company.

| 17 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Fair Value of Financial Instruments

FASB ASC 820, “Fair Value Measurements and Disclosures,” specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

| Level 1 Inputs – | Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access. |

| Level 2 Inputs – | Inputs other than the quoted prices in active markets that are observable either directly or indirectly. |

| Level 3 Inputs – | Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements. |

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement.

The Company did not identify any assets or liabilities that are required to be presented at fair value at February 29, 2012 and November 30, 2011.

Income Taxes

Coal Group and Heat Power generate their income in China where a Value Added Tax, Income Tax, City Construction and Development Tax and Education Surcharge taxes are applicable. The Company, Coal Group and Heat Power do not conduct any operations in the U.S. and therefore, are not subject to U.S. taxes.

The Company accounts for income taxes in accordance with FASB ASC 740, “Income Taxes” (“ASC 740”), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequence for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

| 18 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Net Income (Loss) Per Share

The Company computes net income (loss) per common share in accordance with FASB ASC 260, “Earnings Per Share” (“ASC 260”) and SEC Staff Accounting Bulletin No. 98 (“SAB 98”). Under the provisions of ASC 260 and SAB 98, basic net income (loss) per common share is computed by dividing the amount available to common shareholders by the weighted average number of shares of common stock outstanding during the period. Diluted income per common share is computed by dividing the amount available to common shareholders by the weighted average number of shares of common stock outstanding plus the effect of any dilutive shares outstanding during the period. Accordingly, the number of weighted average shares outstanding as well as the amount of net income (loss) per share are presented for basic and diluted per share calculations for all periods reflected in the accompanying consolidated financial statements.

Statutory Reserves

Pursuant to corporate laws of the PRC, the Company is required to maintain statutory reserves by appropriating from its after-tax profit before declaration or payment of dividends. The statutory reserves, representing restricted retained earnings, consist of the following funds:

Surplus Reserve Fund: The Company is required to transfer 10% of its net income, as determined under PRC accounting rules and regulations, to a statutory surplus reserve fund until such reserve balance reaches 50% of the Company’s registered capital. The surplus reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any, and may be utilized for business expansion or converted into share capital by issuing new shares to existing shareholders in proportion to their shareholding or by increasing the par value of the shares currently held by them, provided that the remaining reserve balance after such issuance is not less than 25% of the registered capital.

Common Welfare Fund: The common welfare fund is a voluntary fund that the Company can elect to transfer 5% to 10% of its net income, as determined under PRC accounting rules and regulations, to this fund. This fund can only be utilized on capital items for the collective benefit of the Company’s employees, such as construction of dormitories, cafeteria facilities, and other staff welfare facilities. This fund is non-distributable other than upon liquidation.

Non-Surplus Reserve Fund (Safety and Maintenance): According to ruling No. 119 (2004) issued on May 21, 2004, and amended ruling No. 168 (2005) on April 8, 2005 by the PRC Ministry of Finance regarding “Accrual and Utilization of Coal Production Safety Expense” and “Criterion on Coal Mine Maintenance and Improvement,” the Company is required to set aside in a safety fund RMB 6 per ton of raw coal mined, and RMB 10.5 per ton for a maintenance fund. As defined under US GAAP, a liability for safety and maintenance expenses does not exist at the balance sheet date because there is no present obligation to transfer assets or to provide services as a result of any past transactions. Therefore, for financial reporting purposes, this statutory reserve has been recorded as an appropriation of retained earnings.

| 19 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

The statutory reserves consist of the following:

| February 29, 2012 | November 30, 2011 | |||||||

| Statutory surplus reserve and welfare fund | $ | 2,447,598 | $ | 2,447,598 | ||||

| Safety and maintenance reserve | 6,659,576 | 6,585,257 | ||||||

| Total statutory reserves | $ | 9,107,174 | $ | 9,032,855 | ||||

Stock Based Compensation

The Company records stock based compensation in accordance with FASB ASC 718, “Compensation – Stock Based Compensation,” which requires the measurement and recognition of compensation expense based on estimated fair values for all stock-based awards made to employees and directors, including stock options. FASB ASC 718 requires companies to estimate the fair value of stock-based awards on the date of grant using an option-pricing model. The Company uses the Black-Scholes option-pricing model as its method of determining fair value. This model is affected by the Company’s stock price as well as assumptions regarding a number of subjective variables. These subjective variables include, but are not limited to the Company’s expected stock price volatility over the term of the awards, and actual and projected stock option exercise behaviours. The value of the portion of the award that is ultimately expected to vest is recognized as an expense in the statements of income over the requisite service period.

Asset Retirement Cost and Obligation

The Company has adopted FASB ASC 410, “Asset Retirement and Environmental Obligations” (“ASC 410”). ASC 410 generally requires that the Company’s legal obligations associated with the retirement of long-lived assets are recognized at fair value at the time the obligations are incurred. Obligations are incurred at the time development of a mine commences for underground mines or construction begins for support facilities, refuse areas and slurry ponds. The obligation’s fair value is determined using discounted cash flow techniques and is accreted over time to its expected settlement value. Upon initial recognition of a liability, a corresponding amount is capitalized as part of the carrying amount of the related long-lived asset. The related asset is amortized using the UOP method over the productive life of the mine based on proven and probable reserves. The Company did not incur and does not anticipate incurring any material dismantlement, restoration and abandonment costs given the nature of its mining activities and the current PRC regulations surrounding such activities.

Vulnerability Due to Operations in PRC

The Company’s operations may be adversely affected by significant political, economic and social uncertainties in the PRC. Although the PRC government has been pursuing economic reform policies for more than twenty years, no assurance can be given that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption or unforeseen circumstances affecting the PRCs political, economic and social conditions. There is also no guarantee that the PRC government’s pursuit of economic reforms will be consistent or effective.

| 20 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

All of the Company’s businesses are transacted in RMB, which is not freely convertible into other currencies. The People’s Bank of China or other banks are authorized to buy and sell foreign currencies at the exchange rates quoted by the People’s Bank of China. Approval of foreign currency payments by the People’s Bank of China or other institutions requires submitting a payment application form together with suppliers’ invoices, shipping documents and signed contracts.

Since the Company has its primary operations in the PRC, its revenues will be settled in RMB, not US dollars. Due to certain restrictions on currency exchanges that exist in the PRC, the Company’s ability to use revenue generated in RMB to pay any dividend payments to its shareholders outside of China will be limited.

All of the Company’s bank accounts are in banks located in PRC and are not covered by protection similar to that provided by the FDIC on funds held in United States banks.

The Company's mining operations are subject to extensive national and local governmental regulations in China, which regulations may be revised or expanded at any time. Generally, compliance with these regulations requires the Company to obtain permits issued by government regulatory agencies. Certain permits require periodic renewal or review of their conditions. The Company cannot predict whether it will be able to obtain or renew such permits or whether material changes in permit conditions will be imposed. The inability to obtain or renew permits or the imposition of additional conditions could have a material adverse effect on the Company's ability to develop and operate its mines.

3. Segment Reporting

The Company is made up of two segments of business, Coal Group which derives its revenue from the mining and purchase and sale of coal, and Heat Power which derives its revenue by providing heating and electricity to residents and businesses of a local community. Each of these segments is conducted in a separate variable interest corporation and each functions independently of the other.

Except for the loans made to Heat Power by Coal Group in the principal amount of RMB 84 million (equivalent to $13.3 million) as of February 29, 2012, during the periods reported herein, there were no other transactions between the two segments. There also were no differences between the measurements used to report operations of the segments and those used to report the consolidated operations of the Company. In addition, there were no differences between the measurements of the assets of the reported segments and the assets reported on the consolidated balance sheets.

| 21 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

| Three Months Ended | ||||||||||||||||||||||||

| February 29, 2012 | February 28, 2011 | |||||||||||||||||||||||

| Heat | Coal | Heat | Coal | |||||||||||||||||||||

| Power | Group | Total | Power | Group | Total | |||||||||||||||||||

| US$ | US$ | US$ | US$ | US$ | US$ | |||||||||||||||||||

| Sales to external customers | $ | 7,242,178 | $ | 30,139,330 | $ | 37,381,508 | $ | 6,096,304 | $ | 16,256,425 | $ | 22,352,729 | ||||||||||||

| Sales – government subsidies | 1,305,643 | - | 1,305,643 | - | - | - | ||||||||||||||||||

| Interest expenses, net | 297,736 | 503,896 | 801,632 | 144,842 | 176,100 | 320,942 | ||||||||||||||||||

| Depreciation and amortization | 1,705,425 | 559,201 | 2,264,626 | 1,023,331 | 363,020 | 1,386,351 | ||||||||||||||||||

| Segment income | 531,230 | 5,926,774 | 6,458,004 | 563,009 | 4,033,853 | 4,596,862 | ||||||||||||||||||

| February 29, 2012 | November 30, 2011 | |||||||||||||||||||||||

| Heat | Coal | Heat | Coal | |||||||||||||||||||||

| Power | Group | Total | Power | Group | Total | |||||||||||||||||||

| Segment assets | $ | 78,680,467 | $ | 135,898,973 | $ | 214,579,440 | $ | 71,566,508 | $ | 115,576,659 | $ | 187,143,167 | ||||||||||||

| Construction in progress | 2,895,303 | 18,273 | 2,913,576 | 2,801,159 | 18,035 | 2,819,194 | ||||||||||||||||||

| Investment property, net | 3,768,361 | 1,989,658 | 5,758,019 | 3,754,281 | 1,975,888 | 5,730,169 | ||||||||||||||||||

Reconciliation of the total segment income to net income included in the consolidated financial statements is as follows:

| For the Three Months Periods Ended | ||||||||

| February 29, 2012 | February 28, 2011 | |||||||

| Total segment income | $ | 6,458,004 | $ | 4,596,862 | ||||

| Unallocated corporate expenses | (155,789 | ) | (232,652 | ) | ||||

| Net income | $ | 6,302,215 | $ | 4,364,210 | ||||

| 4. | Shareholder Loans |

Substantial portions of the cost of construction of the thermoelectric plant and of the costs of expansion projects at Heat Power and the coal mine were provided by stockholder loans. Balances are as follows:

| February 29, 2012 | November 30, 2011 | |||||||

| Ordos City YiYuan Investment Co., Ltd. | $ | 1,784,218 | $ | 1,702,421 | ||||

| Hangzhou Dayuan Group, Ltd. | 5,831,462 | 5,736,898 | ||||||

| Inner Mongolia Duoyida Mining Co. Ltd. | 2,060,421 | 2,013,393 | ||||||

| Total | $ | 9,676,101 | $ | 9,452,712 | ||||

The stockholder loans are due on demand and bore interest as follow:

| February 29, 2012 | November 30, 2011 | |||||||||||||

| Balance | Interest rate | Balance | Interest rate | |||||||||||

| Stockholder loans – interest bearing | $ | 7,023,119 | 5.31% and 7.32% | $ | 6,931,702 | 5.31 | % | |||||||

| Interest payable | 2,652,982 | 2,521,010 | ||||||||||||

| Total | $ | 9,676,101 | $ | 9,452,712 | ||||||||||

| 22 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

| 5. | Lease Obligation |

The Company leases office space under an operating lease expiring December 31, 2015. The minimum future annual rent payments under the lease as of February 29, 2012 are approximated as follows:

| Year Ending | Annual | |||

| November 30, | Amount | |||

| 2012 | $ | 77,461 | ||

| 2013 | 103,281 | |||

| 2014 | 103,281 | |||

| 2015 | 103,281 | |||

| 2016 | 8,607 | |||

| Total | $ | 395,911 | ||

Rent expense charged to operations for the three months ended February 29, 2012 and February 28, 2011 were $25,707 and $22,562, respectively.

| 6. | Other Payables |

Included in other payables are advances from a family member of the Company’s Chairman totalling $4,766,823 and $4,704,775 as of February 29, 2012 and November 30, 2011, respectively. Included in other payables is also an advance from an entity affiliated to the Company through a family member of the Company’s Chairman of $755,541 and $0 as of February 29, 2012 and November 30, 2011, respectively. Those advances are non-interest bearing and payable on demand. At February 29, 2012 and November 30, 2011, other payables amounted to $15,483,790 and $13,111,017, respectively.

| 7. | Advances to Suppliers |

As is customary in China, the Company has made advances to its suppliers for coal purchases, utility payments and other purchases. At February 29, 2012 and November 30, 2011, advances amounted to $47,737,171 and $27,566,516, respectively. There is no interest due on these advances and they are offset against billings as they are made by the suppliers.

| 8. | Other Receivables |

Other receivables consist of the following:

| February 29, 2012 | November 30, 2011 | |||||||

| Loans to suppliers and other associated firms | $ | 8,643,454 | $ | 20,499,415 | ||||

| Employee expense advances | 1,810,944 | 739,596 | ||||||

| Government subsidies receivable | 3,711,065 | 2,368,440 | ||||||

| Heat network access fee receivable | 570,445 | 955,085 | ||||||

| Rental fee receivable | 14,247 | - | ||||||

| Total | $ | 14,750,155 | $ | 24,562,536 | ||||

| 23 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Included in loans to suppliers and other associated firms are advances to an entity affiliated to the Company through a family member of the Company’s Chairman of $762,303 and $752,380 as of February 29, 2012 and November 30, 2011, respectively. Also included in loans to suppliers and other associated firms are advances to Heat Power’s Vice President and family members of the Company’s Chairman of $1,104,505 and $39,923 as of February 29, 2012 and November 30, 2011, respectively. Those advances are non-interest bearing and payable on demand.

On a periodic basis, management reviews the other receivable balances and establishes allowances where there is doubt as to the collectability of the individual balances. In evaluating collectability of the individual balances, the Company considers factors such as the age of the balance, payment history, and credit-worthiness of the creditor. The Company considers all other receivables at February 29, 2012 and November 30, 2011 to be fully collectible and, therefore, did not provide for an allowance for doubtful accounts.

| 9. | Fixed Assets |

Fixed assets, consisting principally of buildings and equipment and construction in progress, are summarized as follows:

| February 29, 2012 | November 30, 2011 | |||||||

| Buildings | $ | 10,901,911 | $ | 10,777,208 | ||||

| Machinery & equipment | 46,918,090 | 43,845,438 | ||||||

| Transferred assets (a) | 19,962,753 | 19,702,907 | ||||||

| Automotive equipment | 1,992,491 | 1,953,696 | ||||||

| Office Equipment | 1,398,612 | 1,379,812 | ||||||

| Construction in progress | 2,913,576 | 2,819,194 | ||||||

| 84,087,433 | 80,478,255 | |||||||

| Accumulated depreciation | (19,769,153 | ) | (17,540,508 | ) | ||||

| Fixed assets, net | $ | 64,318,280 | $ | 62,937,747 | ||||

(a) The real estate with equipment subject to a lease finance obligation as described in Note 12 under “Finance Obligation”.

Depreciation expense charged to operations for the three months ended February 29, 2012 and February 28, 2011 was $1,993,019 and $1,255,454, respectively.

| 24 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Land use rights of $248,553 and $245,318 at February 29, 2012 and November 30, 2011, respectively, are included in buildings and are depreciated over the useful lives along with the related buildings.

| 10. | Short Term Bank Loans |

The Company has bank loans collateralized by the investment property and guaranteed by a related party. Relevant terms of these bank loans are as follows:

| February 29, 2012 | November 30, 2011 | |||||||

| Bank loan due 1/17/12, with interest at 6.94% (a) | $ | - | $ | 12,546,068 | ||||

| Bank loan due 1/17/12, with interest at 6.94% (b) | - | 8,782,247 | ||||||

| Bank loan due 7/28/12, with interest at 7.22% (a) | 7,912,926 | 7,809,927 | ||||||

| Bank loan due 12/14/12, with interest at 7.22% (b) | 12,711,528 | - | ||||||

| Bank loan due 1/12/13, with interest at 7.22% (b) | 9,533,646 | - | ||||||

| Total | $ | 30,158,100 | $ | 29,138,242 | ||||

(a) Loan to Coal Group, collateralized by mining rights and the real estate properties of Coal Group

(b) Loan to Coal Group, collateralized by mining rights of Coal Group.

At February 29, 2012 and November 30, 2011, the Company had a letter of intent with a bank to provide the Company an additional line of credit in the amount of RMB10.2 million (US$1,620,720) and RMB 14.2 million (US$2,226,927), respectively (b).

| 11. | Finance Obligation |

On March 31, 2011, Heat Power entered into a Finance Leasing Contract (“Contract”) with a leasing company covering its thermoelectric plants, heat transfer stations, and related machinery and equipment (“Transferred Assets”), having a gross value of RMB 125,635,589 (US$19,392,398). Pursuant to the Contract, Heat Power sold its Transferred Assets used for its operations to the leasing company RMB 60,000,000 (US$9,261,260) in cash. Under the Contract, Heat Power leased back the Transferred Assets with a quarterly installment payment of RMB 3,555,163 (US$548,755) until April 2016, when the Contract expires. The Contract is guaranteed by Coal Group and an unrelated third party. Upon the repayment of all outstanding rental obligations, Heat Power may re-purchase the Transferred Assets at a purchase price of RMB 900,000, or RMB 1 if Heat Power timely pays the quarterly installments. Upon the execution of the Contract, Heat Power paid a servicing fee of RMB 3,300,000 (US$502,337) and a refundable deposit of RMB 9,000,000 (US$1,389,189).

Since Heat Power has an option to repurchase its Transferred Assets, Heat Power is considered to have “continuing involvement” pursuant to ASC 840-40, “Sales-Leaseback Transactions” (ASC 840-40). Accordingly, the lease did not qualify as a normal sale-leaseback transaction and is being accounted for under the financing method in which Heat Power reports the sales proceeds as a finance obligation, continues to report the Transferred Assets as its assets, and continues to depreciate the Transferred Assets. In addition, the lease payment, exclusive of the interest portion, decrease Heat Power’s liability with a portion of the lease payments being recognized under the interest method. The effective interest rate of this transaction is 6.70%.

| 25 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Future payments of the finance obligation as of February 29, 2012 are as follows:

| Year Ending | ||||

| November 30, | ||||

| 2012 | $ | 1,689,669 | ||

| 2013 | 2,259,578 | |||

| 2014 | 2,259,578 | |||

| 2015 | 2,259,578 | |||

| Thereafter | 1,128,118 | |||

| 9,596,521 | ||||

| Less: amount representing interest | 1,299,100 | |||

| Finance obligation | 8,297,421 | |||

| Less: current portion of finance obligation | 1,747,084 | |||

| Finance obligation, net of current portion | $ | 6,550,337 | ||

Interest expense related to the finance obligation amounted to US$199,948 and zero for the three months ended February 29, 2012 and February 29, 2011, respectively. The refundable deposit is included in other long term assets in the consolidated balance sheet as of February 29, 2012 and November 30, 2011. The costs related to the Contract of RMB 4,800,000 (US$740,901) are being amortized by the interest method over the life of the lease.

| 12. | Rental Income |

The Company entered into rental agreements with various unrelated parties to lease commercial space in its building under operating leases expiring through 2015.

Future minimum rental income is as follows:

| Year Ending | ||||

| November 30, | ||||

| 2012 | $ | 149,970 | ||

| 2013 | 198,618 | |||

| 2014 | 198,618 | |||

| 2015 | 37,208 | |||

| $ | 584,144 | |||

| 26 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

Rental income, under operating leases, included in non-operating income in the consolidated statements of income and other comprehensive income for the three months ended February 29, 2012 and February 28, 2011 was $70,608 and $88,368, respectively. The related rental fee receivable of $14,247 at February 29, 2012 is included in other receivables on the consolidated balance sheets.

| 13. | Government Subsidies |

Government subsidies are primarily comprised of financial support provided by the local government to Heat Power to ensure supply of heat to the XueJiaWan area as the price for heat charged is regulated and approved by the government. The financial support includes revenue subsidies to compensate for lower government regulated prices charged for heat and cost subsidies for purchase of coal used in providing heat. Government subsidies are intended to be an incentive for Heat Power to supply heat at the government regulated prices. Government subsidies amounted to $1,305,643 and $0 for the three months ended February 29, 2012 and February 28, 2011, respectively. All the government subsidies are included in revenues in the consolidated statements of income and other comprehensive income.

| 14. | Income Taxes |

The Company is required to file income tax returns in both the United States and the PRC. Its operations in the United States have been insignificant and income taxes have not been accrued. In the PRC, the Company files tax returns for Heat Power and Coal Group and, although it is part of Coal Group, a separate tax return is required for the operations of the coal mine. The laws of the PRC permit the carryforward of net operating losses for a period of five years. At November 30, 2011, the PRC entities had no net operating losses available for future use as confirmed by the local taxing authority.

Under ASC 740, recognition of deferred tax assets is permitted unless it is more likely than not that the assets will not be realized. There are no deferred tax assets or liabilities as of February 29, 2012 and November 30, 2011.

The following is a reconciliation of the statutory rate with the effective income tax rate for the periods presented:

| Three months ended February 29, 2012 | Tax Provision | Rate of Tax | ||||||

| Tax at statutory rate | $ | 1,947,811 | 25.00 | % | ||||

| Non deductible expenses | 850 | 0.01 | % | |||||

| Tax effect of loss of subsidiaries | 71,109 | 0.91 | % | |||||

| Tax effect of eliminated intercompany profit | (530,741 | ) | (6.81 | )% | ||||

| Tax at effective tax rate | $ | 1,489,029 | 19.11 | % | ||||

| Three months ended February 28, 2011 | Tax Provision | Rate of Tax | ||||||

| Tax at statutory rate | $ | 1,417,518 | 25 | % | ||||

| Non deductible expenses | 4,569 | 0.08 | % | |||||

| Tax effect of eliminated intercompany profit | (116,227 | ) | (2.04 | )% | ||||

| Tax at effective tax rate | $ | 1,305,860 | 23.04 | % | ||||

| 27 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

The Company has adopted Financial Accounting Standards Board Interpretation No. 48, “Accounting for Uncertainty in Income Taxes — an interpretation of SFAS 109.” (“FIN 48”), as codified in ASC 740. ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with tax positions. The Company does not have any accruals for uncertain tax positions as of February 29, 2012.

The Company did not file its U.S. federal income tax returns, including, without limitation, information returns on Internal Revenue Service (“IRS”) Form 5471, “Information Return of U.S. Persons With Respect to Certain Foreign Corporations” for the years ended November 30, 2002 through 2005. The Company was also late in filing for the years ended November 30, 2007 and 2008. Failure to furnish any information return with respect to any foreign business entity required, within the time prescribed by the IRS, subjects the Company to certain civil penalties. The Company is unable to determine the amount of any penalties that may be assessed at this time. Management is of the opinion that penalties, if any, that may be assessed would not be material to the consolidated financial statements.

In addition, because the Company did not generate any income in the United States or otherwise have any U.S. taxable income, the Company does not believe that it has any U.S. federal income tax liability in respect to any transactions that the Company or any of its subsidiaries may have engaged in through February 29, 2012. However, there can be no assurance that the IRS will agree with this position, and therefore the Company ultimately could be liable for U.S. federal income taxes, interest and penalties. The tax years ended November 30, 2002 to 2010 remain open to examination by tax authorities.

| 15. | Stock-Based Compensation |

On May 31, 2010, the Company granted to each of its three independent directors an option to purchase 20,000 shares of common stock at an exercise price of US$2.02 per share. The options vested over one year in equal, quarterly installments on the last day of the Company’s fiscal quarter, beginning with the fiscal quarter ending August 31, 2010, subject to their continued service as a director.

| 28 |

CHINA ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTH PERIODS ENDED

FEBRUARY 29, 2012 AND FEBRUARY 28, 2011

(UNAUDITED)

On September 5, 2011, the Company granted another option to two of its three independent directors to purchase 20,000 shares of common stock and to the other independent director to purchase 15,000 shares of common stock at an exercise price of US$0.39 per share. The options vest over one year in equal, quarterly instalments on the last day of the Company’s fiscal quarter, beginning with the fiscal quarter ending August 31, 2011, subject to their continued service as a director. The Compensation Committee of the Board of Directors has determined the performance conditions have been met.