Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INFINITY PHARMACEUTICALS, INC. | d338118d8k.htm |

Building a Fully Integrated Biopharmaceutical

Company

April 2012

Exhibit 99.1 |

2

•

This presentation contains forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. •

These statements involve risks and uncertainties that could cause actual results to

be materially different from historical results or from any future results

expressed or implied by such forward-looking statements. •

Such

forward-looking

statements

include

statements

regarding:

the

therapeutic

potential

of

Infinity’s

Hedgehog

pathway,

Hsp90

and

PI3K

inhibitors

and

the

ability

to

achieve

proof

of

concept

in

each

of

these

programs

by

the

end

of

2013;

the

potential

for

data

from

the

ongoing

clinical

trials to lead to multiple registration paths; the potential of saridegib and

Hedgehog pathway inhibition in addressing chondrosarcoma and myelofibrosis;

the potential of IPI-145 and PI3K inhibition in addressing hematologic malignancies and inflammation; the potential of combination

therapy based on retaspimycin HCl in addressing non-small cell lung cancer, the

future market size of non-small lung cancer therapeutics, and the

expectation that Infinity: will report data in the second half of 2012 from the

Phase 2 trial of saridegib in patients with myelofibrosis, the dose-

escalation portion of the Phase 1b/2 trial of retaspimycin HCl in combination with

everolimus in patients with NSCLC, and each of the Phase 1 trials

of

IPI-145;

will

complete

enrollment

in

the

second

half

of

2012

in

the

Phase

2

trial

of

saridegib

in

patients

with

chondrosarcoma

and

the

Phase 2 trial of retaspimycin HCl in combination with docetaxel in patients with

NSCLC; and will commence future clinical development of its product

candidates, including a Phase 2 trial of IPI-145 in inflammation in the second half of this year. Such forward-looking statements also

include

estimates

of

2012

financial

performance

and

the

expectation

that

Infinity

will

have

a

cash

runway

to

support

its

current

operating

plan

through key inflection points.

•

Such statements are subject to numerous factors, risks and uncertainties that may

cause actual events or results to differ materially from the company’s

current expectations. For example, there can be no guarantee that Infinity’s strategic alliance with Mundipharma will continue for its

expected term or that it will fund Infinity’s programs as agreed, that any

product candidate Infinity is developing will successfully complete

necessary preclinical and clinical development phases, or that development of any

of Infinity’s product candidates will continue. Further, there can be

no guarantee that any positive developments in Infinity’s product portfolio will result in stock price appreciation. Management’s expectations

could also be affected by risks and uncertainties relating to: Infinity’s

results of clinical trials and preclinical studies, including subsequent analysis

of existing data and new data received from ongoing and future studies; the content

and timing of decisions made by the U.S. Food and Drug Administration

and other regulatory authorities, investigational review boards at clinical trial

sites and publication review bodies; Infinity’s ability to enroll

patients in its clinical trials; unplanned cash requirements and expenditures, including in connection with business development activities;

development of agents by Infinity’s competitors for diseases in which Infinity

is currently developing its product candidates; and Infinity’s ability to

obtain, maintain and enforce patent and other intellectual property protection for

any product candidates it is developing. •

These

and

other

risks

which

may

impact

management's

expectations

are

described

in

greater

detail

under

the

caption

"Risk

Factors"

included

in

Infinity's annual report on Form 10-K for the year ended December 31, 2011,

filed with the U.S. Securities and Exchange Commission on March 13, 2012.

•

Further, any forward-looking statements contained in this presentation speak

only as of the date hereof, and Infinity expressly disclaims any obligation

to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward Looking Statements |

Sustainable model

for value creation

3

Breakthrough

Science

Deep,

Diverse

Pipeline

High-value,

Enabling

Partnerships

Full U.S.

Commercial

Rights

Building a Fully Integrated

Biopharmaceutical Company |

•

Broad pipeline

–

Six ongoing clinical trials across three novel targets

•

Tailored development strategies

–

Randomized, double-blind, placebo controlled trials based on

compelling scientific or clinical data

–

Single-arm, exploratory trials designed to confirm intriguing

hypotheses with minimal investment

•

Data anticipated from all ongoing trials by YE13

4

Advancing a Diverse Pipeline: R&D Strategy |

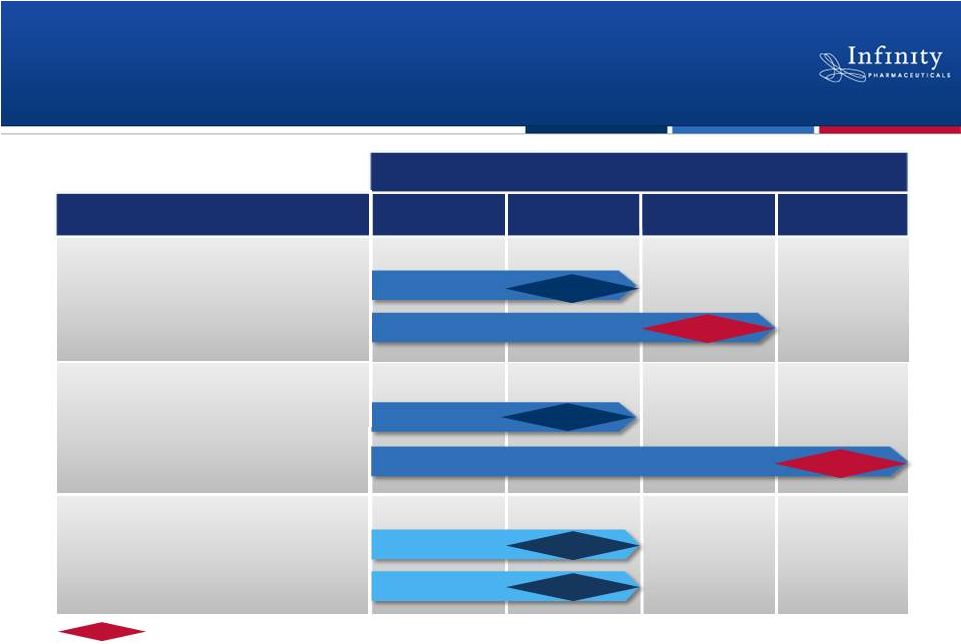

5

1H’12

1H’13

2H’13

2H’12

Hedgehog: Saridegib

Hsp90: Retaspimycin HCl

PI3K: IPI-145

Chondrosarcoma

NSCLC (mKRAS)

Myelofibrosis

NSCLC (Heavy smokers)

Inflammation

Hematologic Malignancies

2012

2013

Randomized, double-blind, placebo-controlled trial.

Data

Data

Data

Data

Data

Data

Promising Pipeline Based on Breakthrough

Science

Phase 1

Phase 1

Phase 2

Phase 2

Phase 1b/2

Phase 2 |

Saridegib (IPI-926):

Addressing Cancers with High Unmet

Need by Targeting the Hedgehog Pathway |

Importance of the Hedgehog pathway

7

Saridegib: Establishing a Leadership Position

in Underserved, Life-Threatening Diseases

•

Known to drive a broad range of cancers through multiple mechanisms,

including signaling to

–

Tumor cells directly

–

Tumor microenvironment

–

Tumor progenitor cells

Program status

•

Well-tolerated and clinically active in Phase 1

•

Two Phase 2 trials ongoing exploring distinct biological mechanisms

•

Robust biomarker strategy

•

Disrupts malignant activation of the Hedgehog pathway by

inhibiting the target Smoothened

Saridegib (IPI-926) |

•

Randomized, double-blind, placebo-controlled trial

–

Enrolling patients with metastatic or locally advanced, unresectable

chondrosarcoma

–

Primary endpoint: Progression-free survival

–

Trial design reviewed with FDA and EMA prior to study

•

Anticipate enrollment completion 2H’12 and data 1H’13

~140 Patients

Saridegib 160 mg

(QD)

(N = ~94)

Placebo

(N = ~46)

Progression -

crossover

to

saridegib

8

Saridegib: Global, Randomized Phase 2 Trial in

Chondrosarcoma

2:1

Randomization |

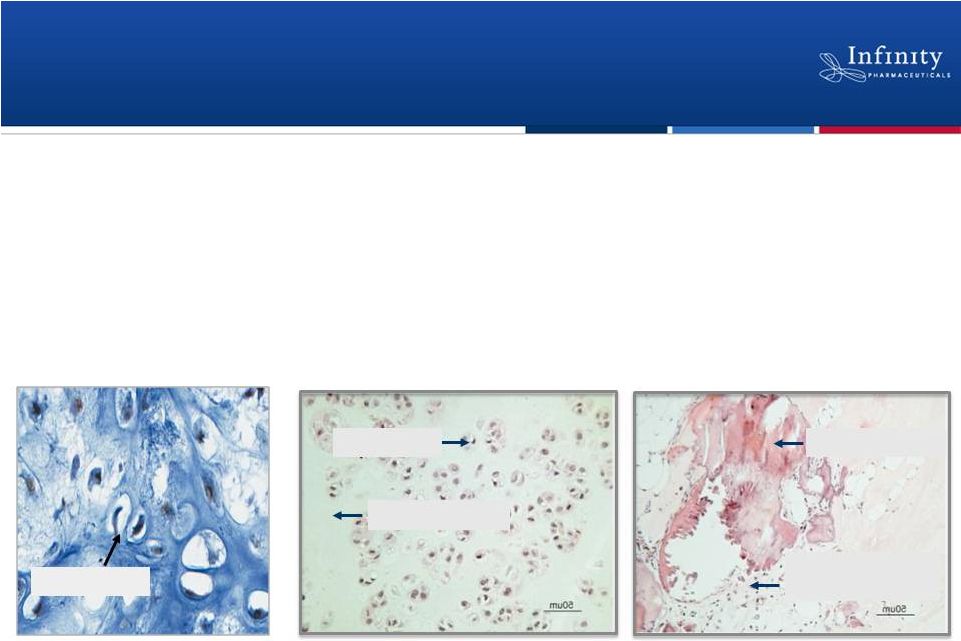

•

Hedgehog signaling is activated in ~ 70% chondrosarcomas

•

In xenografts derived from primary human chondrosarcoma

tumors, administration of saridegib led to:

–

Down-regulation of the Hedgehog pathway in tumor cells

–

Loss of tumor cells; decreased in tumor growth

9

Read, AACR 2011.

Saridegib

Control

Activated Gli-1 in

Chondrosarcoma

Saridegib in Chondrosarcoma: Strong

Preclinical Rationale

Tumor cells

Cartilage matrix

Calcified matrix

Decreased tumor

cells

Nuclear Gli-1 |

Saridegib 160 mg (QD)

(N = up to 35)

Saridegib 160 mg (QD)

(N = up to 35)

Saridegib 160 mg (QD)

(N = 12)

10

•

Open-label, exploratory trial with option for expansion

–

Primary endpoint: Response rate according to International Working Group

Criteria

–

No spontaneous remissions in this disease

•

First cohort of patients enrolled

•

Data anticipated in 2H’12

Expansion

Saridegib: Phase 2 Trial in Myelofibrosis |

•

Blood cancer characterized by bone

marrow failure and enlarged spleen due

to pathogenic fibrosis

•

In myelofibrosis, Hedgehog ligand

expressed in bone marrow

•

Current treatments target symptoms,

not underlying disease

11

Tkachuk and Hirshmann, Wintrobe’s Atlas of Clinical

Hematology, 2007. Saridegib in Primary Myelofibrosis: Hedgehog Pathway

Plays Key Role in Pathogenic Fibrosis

Healthy Bone Marrow

Myelofibrosis

Fibrosis

Bone

Bone

Red and

white

blood cells |

*Estimates based upon G7 countries (US, UK, IT, DE, ES, FR, JP)

12

Saridegib: First-in-Class Potential in

Chondrosarcoma and Myelofibrosis

Chondrosarcoma

Myelofibrosis

Market size

Ultra-orphan*

~30,000 patients*

Unmet need

Resistant to radiation

and chemotherapy

Primary treatment option

is surgery

No current treatments

address underlying

cause of disease

Potential for

franchise expansion

Other sarcomas

Other fibrotic diseases

and heme

malignancies |

Retaspimycin HCl (IPI-504)

Targeting Non-Small Cell Lung Cancer Through

Hsp90 Inhibition |

Function of Hsp90

•

“Chaperone”

protein necessary for stability

and function of certain ‘client’

proteins,

including oncoproteins

Retaspimycin HCl (IPI-504)

•

Selective, potent, naturally-derived

Hsp90 inhibitor

•

Well-defined and manageable safety

profile with QW dosing

Program status:

•

Well-tolerated and clinically active in

combination with docetaxel in NSCLC

•

Two clinical trials in NSCLC

14

Retaspimycin HCl: Leading the Field in

Hsp90 |

•

Randomized, double-blind, placebo-controlled trial

•

Anticipate enrollment completion 2H’12 and data 2H’13

15

~200 smokers w/

2

nd

-

or

3

rd

-line

NSCLC

(docetaxel naïve)

Follow-up for OS

Follow-up for OS

Docetaxel +

Retaspimycin HCl

(N = ~100)

Docetaxel +

placebo

(N = ~100)

Retaspimycin HCl: Phase 2 Trial in NSCLC

Patients with a Smoking History

R

Primary endpoint: Overall survival

Secondary endpoints: Predictive biomarkers, progression free

survival,

overall response rate |

16

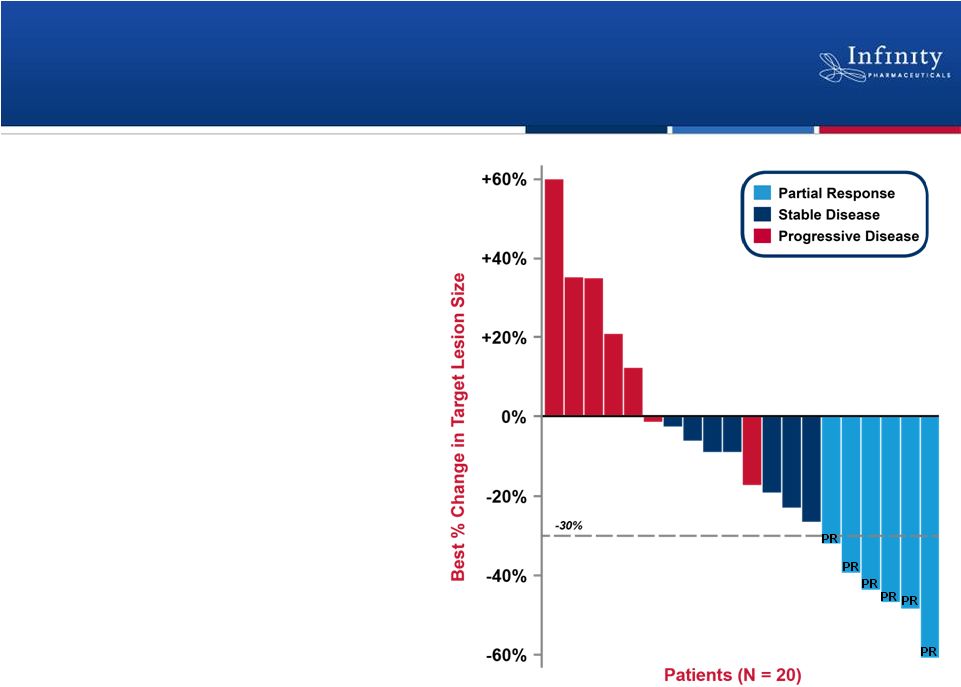

Encouraging Phase 1b data

•

Partial response in 6 patients

(ORR = 26%)

•

Stable disease in 7 patients

•

Well-tolerated

–

No unexpected or overlapping

toxicities

–

No dose reductions or

discontinuations due to liver

function tests

–

No ocular toxicities

Riely et al., ASCO 2011.

Retaspimycin HCl Phase 1b Trial: Clinically

Active in Combination with Docetaxel |

17

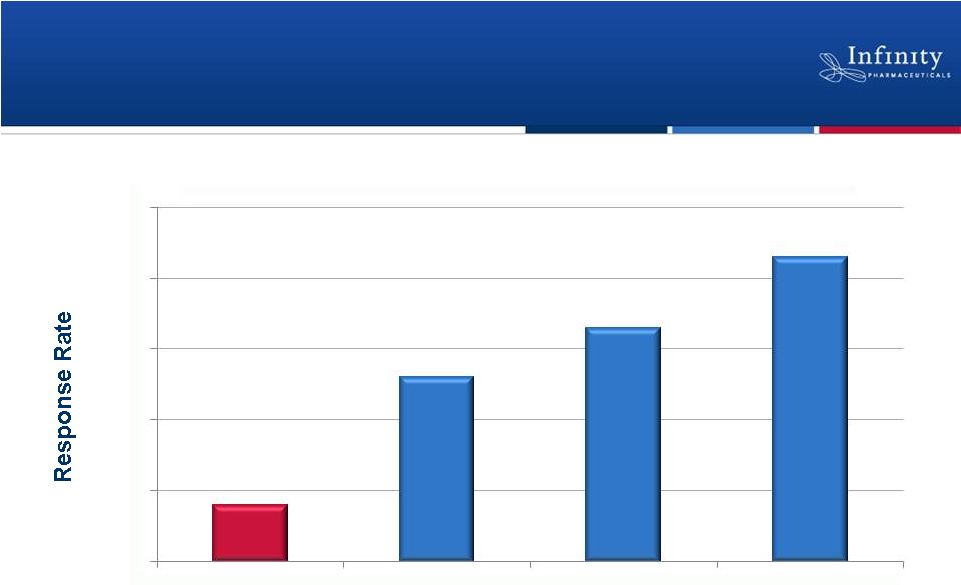

*Hanna et al, J Clin Oncol, 22:1589-97.

Retaspimycin HCl: Responses Observed in

Patients with Historically Poor Prognoses

8%

26%

33%

43%

0%

10%

20%

30%

40%

50%

Historical 2nd-line

Docetaxel*

NSCLC patients in

trial (N=23)

Smokers (N=18)

Squamous Cell

Carcinoma (N=7)

Patient Populations

Retaspimycin HCl Plus Docetaxel: Overall Response Rate

|

Retaspimycin HCl

+ everolimus

(N = 12)

Retaspimycin HCl

+ everolimus

(N = 12)

Determine

recommended

Phase 2 dose in

mKRAS NSCLC

•

Small, open-label exploratory trial with option for expansion

–

Primary efficacy endpoint: Response rate

–

Neither drug active as single agent in these patients

•

Strong preclinical rationale: Evidence of substantial tumor regression in a

NSCLC model*

•

Topline data from dose-escalation portion of trial anticipated 2H’12

18

Retaspimycin HCl

+ everolimus

(N = up to 45)

Retaspimycin HCl

+ everolimus

(N = up to 45)

Expansion

Phase 1b

Phase 2

*De Raedt et al., 2011; Cancer Cell 13;20(3):400-13.

Retaspimycin HCl: Phase 1b/2 Trial in

NSCLC Patients with mKRAS |

Current NSCLC market is ~ $3.5B and is projected to grow to $9.8B in 2018

References:

Decision

Resources

NSCLC

Pharmacor

Report,

March

2011.

G7

regions:

US,

UK,

IT,

DE,

ES,

FR,

JP;

Roberts

et

al.,

2010;

J

Clin

Oncol

28(31):4769-4777.

Janjigian

et

al.,

2010;

Cancer

116(3):670-675.

19

Retaspimycin HCl Has Significant

Commercial Potential

Patient

Population

% of Overall

NSCLC

Population

Number of

Patients

Number of

Stage IIIb/IV

Patients

Heavy smokers

Squamous cell

KRAS mutant

70%

35%

30%

~291,000

~145,000

~125,000

~183,000

~91,000

~79,000 |

IPI-145:

Potential Best-in-Class Opportunity for Inflammation

and Hematologic Malignancies |

21

ADAPTIVE

Graft vs. Host Disease

INNATE

Atherosclerosis

Sepsis

Cancer

Asthma

Crohn’s Disease

Lupus

Rheumatoid Arthritis

The Power of PI3K-

,

Inhibition |

Function

of

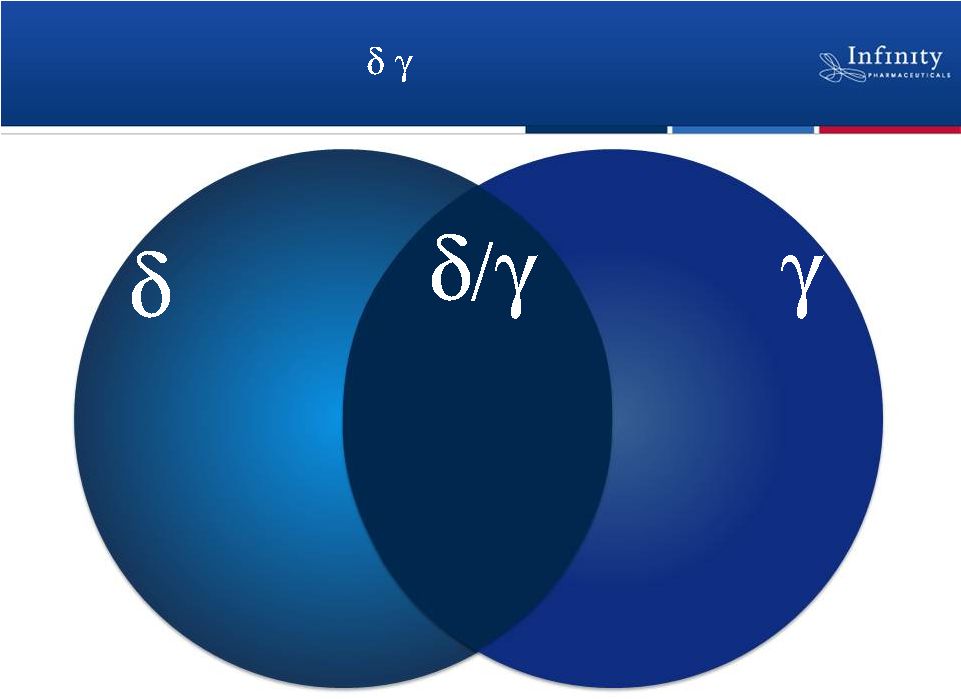

PI3K-

and

PI3K-

•

Involved in key immune cell functions, including cell proliferation,

survival and cellular trafficking

•

Inhibiting both isoforms may be beneficial in both hematologic

cancers and inflammatory conditions

IPI-145

•

Potent, oral inhibitor of both delta and gamma isoforms

•

Active in preclinical models of inflammation

Program status:

•

Phase 1 trial in healthy volunteers completed to enable development

in inflammation

•

Phase 1 in patients with hematologic malignancies ongoing

22

IPI-145: Only PI3K-

Inhibitor in the Clinic

, |

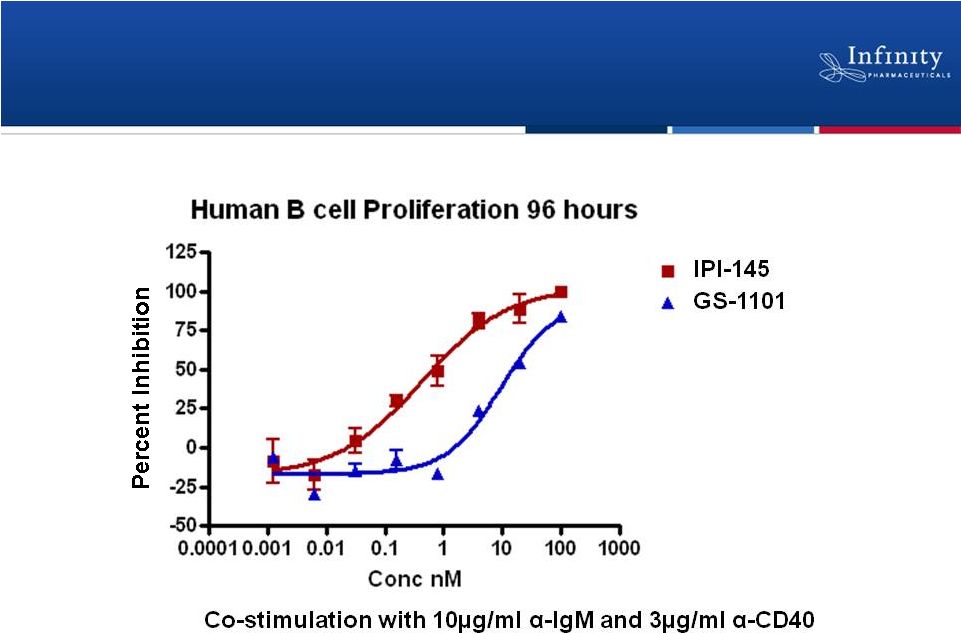

23

In-house data

IPI-145 Is More Potent than Delta-Selective

Inhibitor with Promising Clinical Activity |

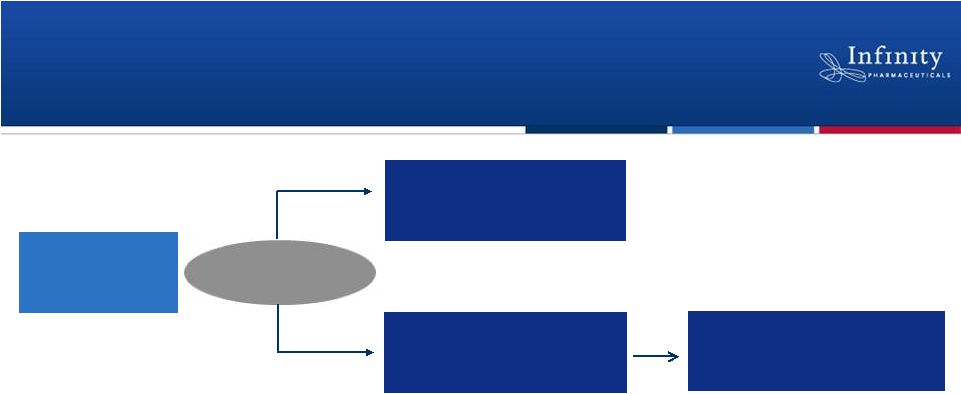

IPI-145

Phase 2 in

Inflammation

24

•

Phase 1 double-blind, randomized, placebo controlled trial

–

Trial completed

–

Data anticipated in 2H’12

•

Phase 2 trial in inflammation expected to begin this year

•

Multiple large commercial opportunities

IPI-145: Dual Clinical Development Paths in

Inflammation and Hematological Malignancies

Phase 1 in

Healthy Subjects

•

Single Ascending Dose

•

Multi Ascending Dose |

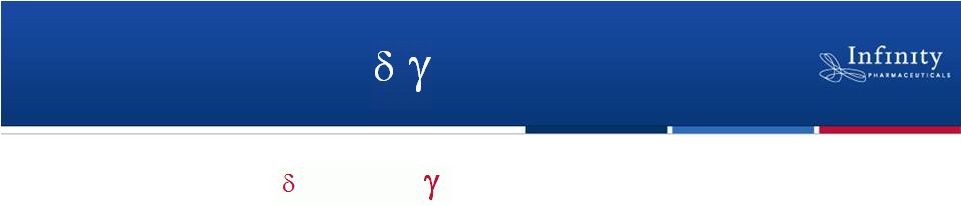

25

•

Phase 1 dose escalation under way

•

Phase 1 data anticipated 2H’12

•

First-in-class and best-in-class commercial opportunities

–

Indications validated with a

-specific inhibitor (e.g., CLL, iNHL, mantle cell)

–

Indications in which a

-specific inhibitor showed little activity (e.g., DLBC, AML, MM)

–

Indications untested by a

-specific inhibitor

IPI-145: Dual Clinical Development Paths in

Inflammation and Hematological Malignancies

IPI-145

Phase 1 in Hematologic

Malignancies

•

Dose escalation

Phase 1 Expansion

in Select Cohorts |

Strong Financial Foundation to

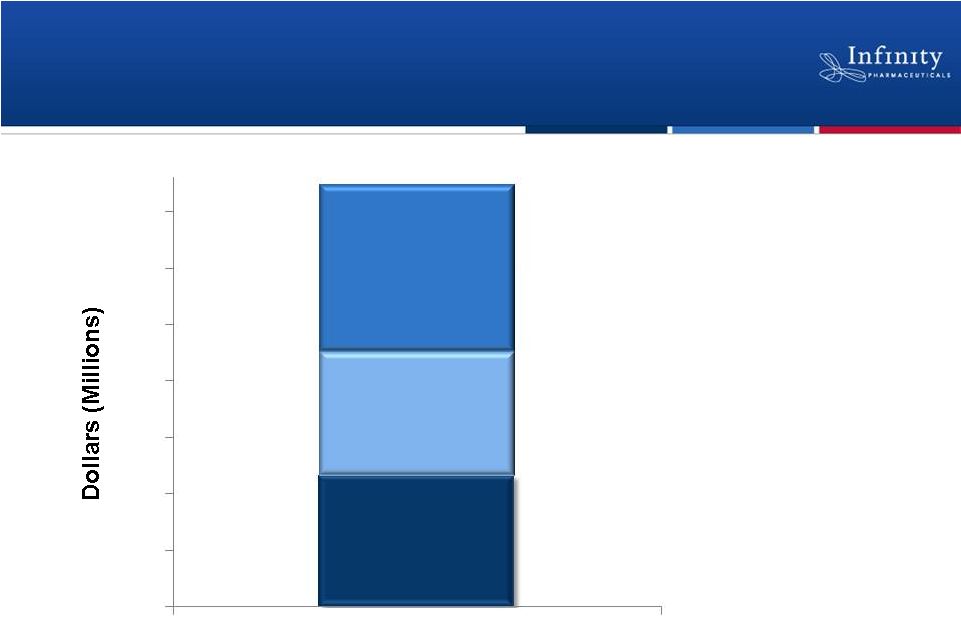

Reach Key Inflection Points |

2012 Committed R&D

Funding from Mundipharma

Cash and Investments

Current and Committed Capital*

>$370 Million

*

As of December 31, 2011.

2013 Committed R&D

Funding from Mundipharma

27

Cash Runway Into 2014

$115.9M

$110.0M

$147.5M

0

50

100

150

200

250

300

350 |

•

Projected 2012 revenue of ~$114M

•

Anticipate year-end cash and investments balance of

$75M

-

$85M

•

Projected

2012

cash

burn

of

$30M

-

$40M

•

Approximately 26.9 million shares outstanding as

of March 31, 2012

28

2012 Financial Guidance |

29

1H’12

1H’13

2H’13

2H’12

Hedgehog: Saridegib

Hsp90: Retaspimycin HCl

PI3K: IPI-145

Chondrosarcoma

NSCLC (mKRAS)

Myelofibrosis

NSCLC (Heavy smokers)

Inflammation

Hematologic Malignancies

2012

2013

Randomized, double-blind, placebo-controlled trial.

Promising Pipeline Based on Breakthrough

Science

Phase 2

Phase 1b/2

Phase 2

Phase 1

Phase 1

Data

Data

Data

Data

Data

Data

Phase 2 |

Building a Fully Integrated Biopharmaceutical

Company

April 2012 |