Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BlackRock Inc. | d333385d8k.htm |

| EX-99.1 - PRESS RELEASE DATED APRIL 18, 2012 ISSUED BY THE COMPANY - BlackRock Inc. | d333385dex991.htm |

Q1

2012 Earnings Press Release Supplement

April 18, 2012

Exhibit 99.2 |

1

Important Notes

This presentation, and other statements that BlackRock may make, may contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or expectations.

Forward-looking statements are typically identified by words or phrases such as “trend,”

“potential,” “opportunity,” “pipeline,” “believe,”

“comfortable,” “expect,” “anticipate,” “current,”

“intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,”

“sustain,” “seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may” or

similar expressions.

BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and

uncertainties, which change over time. Forward-looking statements speak only as of

the date they are made, and BlackRock assumes no duty to and does not undertake to update

forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and

future results could differ materially from historical performance. In

addition to risk factors previously disclosed in BlackRock’s Securities and Exchange Commission (“SEC”) reports and those identified

elsewhere in this presentation the following factors, among others, could cause actual results to

differ materially from forward-looking statements or historical performance: (1) the

introduction, withdrawal, success and timing of business initiatives and strategies; (2)

changes and volatility in political, economic or industry conditions, the interest rate environment, foreign exchange rates or financial

and capital markets, which could result in changes in demand for products or services or in the value

of assets under management; (3) the relative and absolute investment performance of

BlackRock’s investment products; (4) the impact of increased competition; (5) the impact of

future acquisitions or divestitures; (6) the unfavorable resolution of legal proceedings; (7) the extent and timing of any share

repurchases; (8) the impact, extent and timing of technological changes and the adequacy of

intellectual property and information security protection; (9) the impact of legislative

and regulatory actions and reforms, including the Dodd-Frank Wall Street Reform and

Consumer Protection Act, and regulatory, supervisory or enforcement actions of government agencies

relating to BlackRock, Barclays Bank PLC or The PNC Financial Services Group, Inc.; (10)

terrorist activities, international hostilities and natural disasters, which may adversely

affect the general economy, domestic and local financial and capital markets, specific industries or BlackRock; (11) the ability

to attract and retain highly talented professionals; (12) fluctuations in the carrying value of

BlackRock’s economic investments; (13) the impact of changes to tax legislation, including

taxation on products or transactions which could affect the value proposition to clients and,

generally, the tax position of the Company; (14) BlackRock’s success in maintaining the

distribution of its products; (15) the impact of BlackRock electing to provide support to its

products from time to time; and (16) the impact of problems at other financial institutions or

the failure or negative performance of products at other financial institutions. This

presentation also includes non-GAAP financial measures. You can find our presentations on the most directly comparable GAAP

financial measures calculated in accordance with GAAP and our reconciliations in our current earnings

release dated April 18, 2012, and BlackRock’s

other periodic reports, which are available on BlackRock’s web site at www.blackrock.com |

2

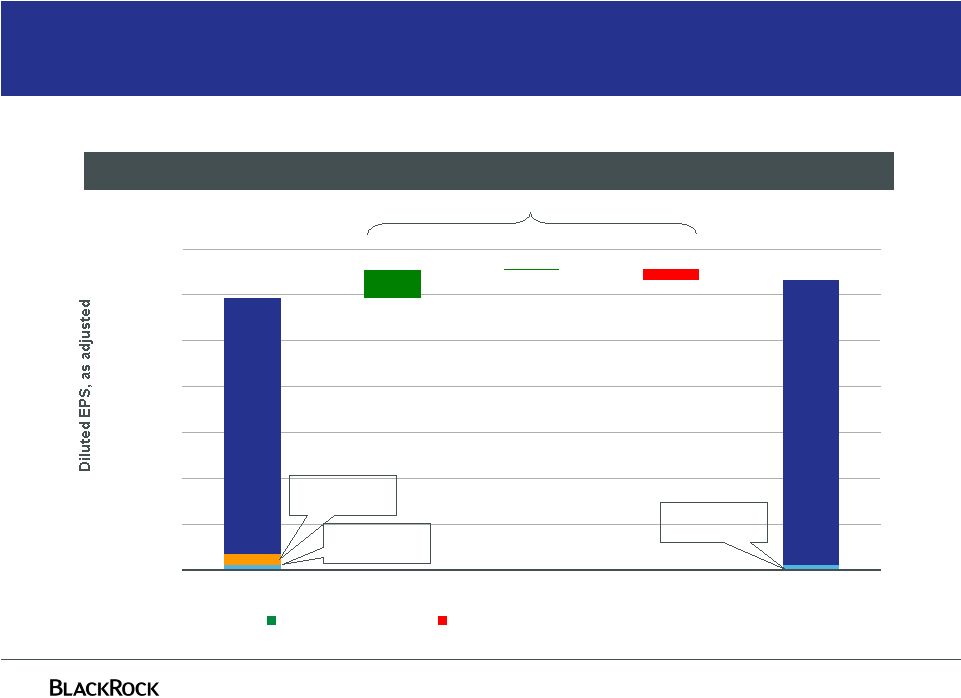

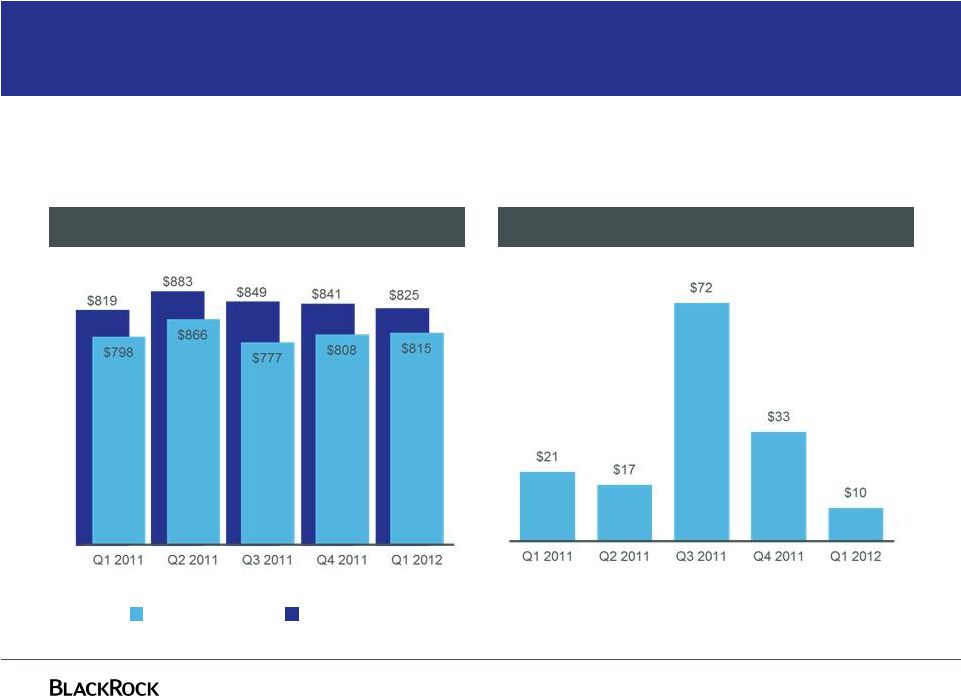

Diluted EPS increased to $3.16

Operating and Net Income, as adjusted ($ in millions)

Diluted Earnings Per Share, as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

appendix, notes (a) through (e) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks.

Operating Income

Net Income |

3

40.0%

38.6%

40.1%

39.7%

37.4%

38.7%

38.2%

36.8%

39.3%

39.1%

2007

2008

2009

2009

2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Sequential operating margin reflected strength in core business and seasonal

factors Operating Margin, as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

appendix, notes (a) through (e) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks.

Full Year 2011 = 39.7%

BGI/BLK

Pro Forma

Sequential operating margin reflected seasonal effect of performance fees and payroll

taxes |

Equity

markets trended higher in Q1 2012 but non-US markets still below Q1 2011

level 4

All equity markets trended higher in Q1 2012 compared to Q4 2011. While US markets

are above levels of Q1 2011, major non-US markets are still below the

levels of Q1 2011 Average Index Level

Q1 12 vs.

Q1 11

Q4 11

Q1 12

Q1 11

Q4 11

S&P 500

1,303

1,225

1,347

3.3%

9.9%

MSCI Barra World Index

1,320

1,169

1,268

(3.9%)

8.5%

MSCI Europe Index

97

82

90

(7.2%)

10.1%

MSCI AC Asia Pacific Index

137

115

124

(9.4%)

7.3%

S&P Global Natural Resources

3,958

3,291

3,533

(10.7%)

7.4%

MSCI Emerging Markets Index

1,128

931

1,026

(9.1%)

10.2%

Index |

Year-over-year

Q1 2012 vs. Q1 2011

5 |

6

Year-over-year EPS up 7%

Q1-12 Compared to Q1-11, as adjusted

$0.31

$0.01

($0.12)

$2.79

$3.10

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

Q1-11 EPS

Operating EPS

Non-Operating EPS

Tax Adjustment

Q1-12 EPS

Total EPS:

$3.16

Total EPS:

$2.96

Non-Operating:

$0.05

Operating

EPS:

Operating

EPS:

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release.

Non-Operating:

$0.06

Decreasing EPS

$0.20

Tax Adjustment:

$0.12

Increasing EPS |

7

Year-over-year

operating

income

reflected

expense

discipline

and

market

effects

Q1-12 Compared to Q1-11, as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release.

Decreasing Expenses

Decreasing Revenue

$0

$6 million

$825

$819

$39

($33)

$600

$700

$800

$900

Q1-11

Revenue

Expenses

Q1-12 |

8

Year-over-year long-term base fee growth offset by market trends out of

cash products

Q1-12 Compared to Q1-11

Total Revenue

Q1-11

$2.28 billion

Q1-12

$2.25 billion

Decreasing Revenue

Increasing Revenue |

9

Year-over-year base fees up in majority of long-term asset classes

Decreasing Base Fees

Increasing Base Fees

Q1-12 Compared to Q1-11

Q1-12

$1.98 billion

Base fees

Q1-11

$1.98 billion

$0

$1,600

$1,700

$1,800

$1,900

$2,000

$2,100 |

$0

10

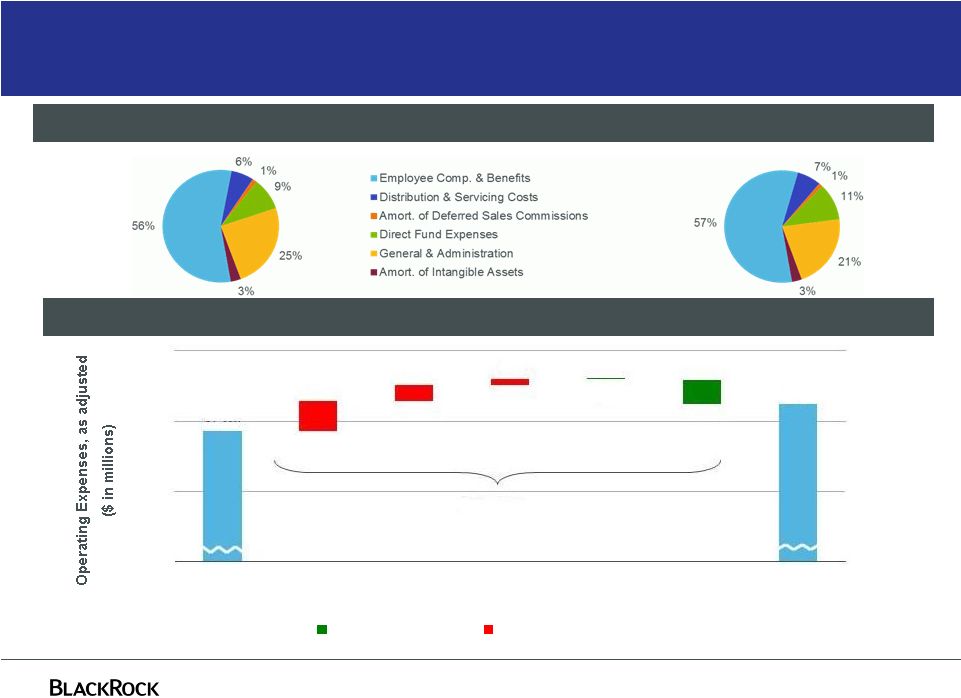

Year-over-year expenses declined in the majority of categories

Increasing Expenses

Decreasing Expenses

Q1-12

$1.42 billion

Expenses, as adjusted, by Category

Q1-12 Compared to Q1-11, as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release. ($39)

million Q1-11

$1.46 billion

$1,424

$1,463

($33)

($14)

($6)

($1)

$6

$9

$1,300

$1,400

$1,500

Q1-11

Direct Fund

Expenses

Compensation

& Benefits

Amort.-

Intangible

Assets

Amort.-

Deferred

Commissions

Distribution

& Servicing

G&A

Q1-12 |

Sequential Quarters

Q1 2012 vs. Q4 2011

11 |

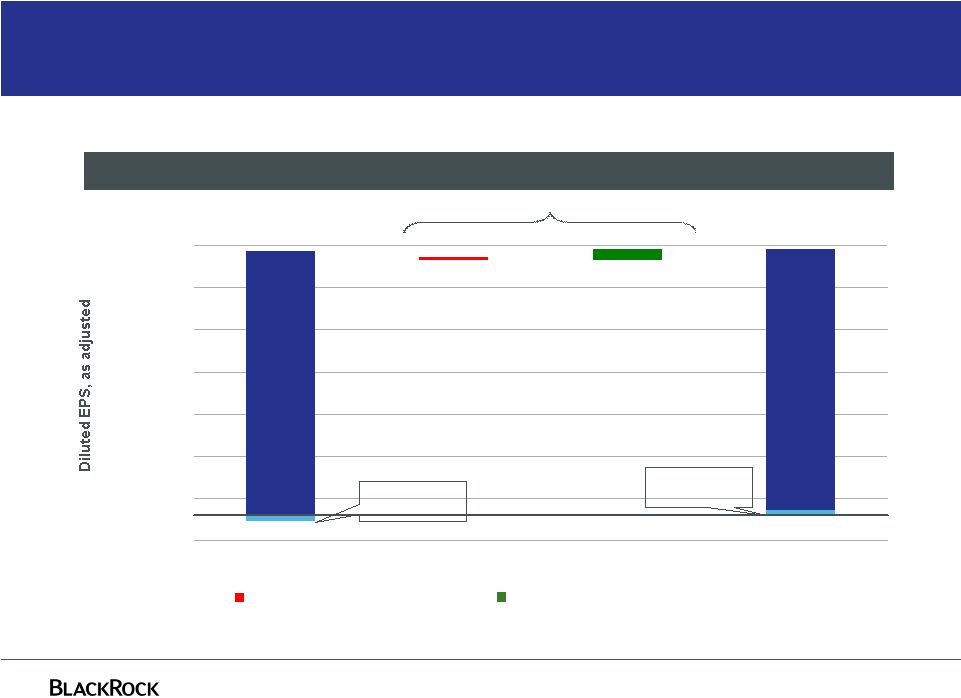

12

Sequential EPS growth of 3% benefited from improved global markets

Increasing EPS

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release. Q1-12

Compared to Q4-11, as adjusted ($0.04)

$0.14

$3.14

$3.10

($0.30)

$0.20

$0.70

$1.20

$1.70

$2.20

$2.70

$3.20

Q4-11 EPS

Operating EPS

Non-Operating EPS

Q1-12 EPS

Total EPS:

$3.06

Total EPS:

$3.16

Operating

EPS:

Non-Operating:

($0.08)

Non-Operating:

$0.06

Operating

EPS:

Decreasing EPS

$0.10 |

13

Q1 2012 operating income reflected higher base fees offset by seasonal factors

Q1-12 Compared to Q4-11, as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release.

Increasing Expense

Increasing Revenue

$0

$600

$700

$800

$900

($16) million

$841

$825

($38)

$22

Q4-11

Revenue

Expenses

Q1-12 |

14

Sequential growth in base fees partially offset by seasonally high Q4 performance fee

“locks” Decreasing Revenue

Q1-12 Compared to Q4-11

Increasing Revenue

Total Revenue

Q1-12

$2.25 billion

Q4-11

$2.23 billion

$0

$2,000

$2,200

$2,400

$22 million

$2,249

$2,227

$1

($26)

$114

($67)

Q4-11

Base Fees

Other Revenue /

Distribution Fees

BRS & Advisory

Performance Fees

Q1-12 |

15

Sequential base fees increased across all products

$114 million

Increasing Base Fees

Base Fees

$0

Q1-12 Compared to Q4-11

Q4-11

$1.86 billion

Q1-12

$1.98 billion

$1,863

$1,700

$1,800

$1,900

$2,000

Q4-11

iShares

Equity

Multi-Asset

Active

Equity

Institutional

Index Equity

iShares

Fixed

Income

Alternatives

Cash

Institutional

Index Fixed

Income

Active

Fixed

Income

Q1-12

$1,977

$1

$2

$4

$10

$11

$16

$23

$43

$4 |

16

Sequential expenses reflected revenue growth, seasonal factors and cost

discipline

Increasing Expenses

Decreasing Expenses

$0

Q4-11

$1.39 billion

Expense, as adjusted, by Category

Q1-12 Compared to Q4-11, as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release. $38

million Q1-12

$1.42 billion

$1,424

$1,386

($34)

($2)

$8

$24

$42

$1,300

$1,400

$1,500

Q4-11

Compensation &

Benefits

Direct Fund

Expenses

Distribution &

Servicing

Amort.-

Deferred

Commissions

G&A

Q1-12 |

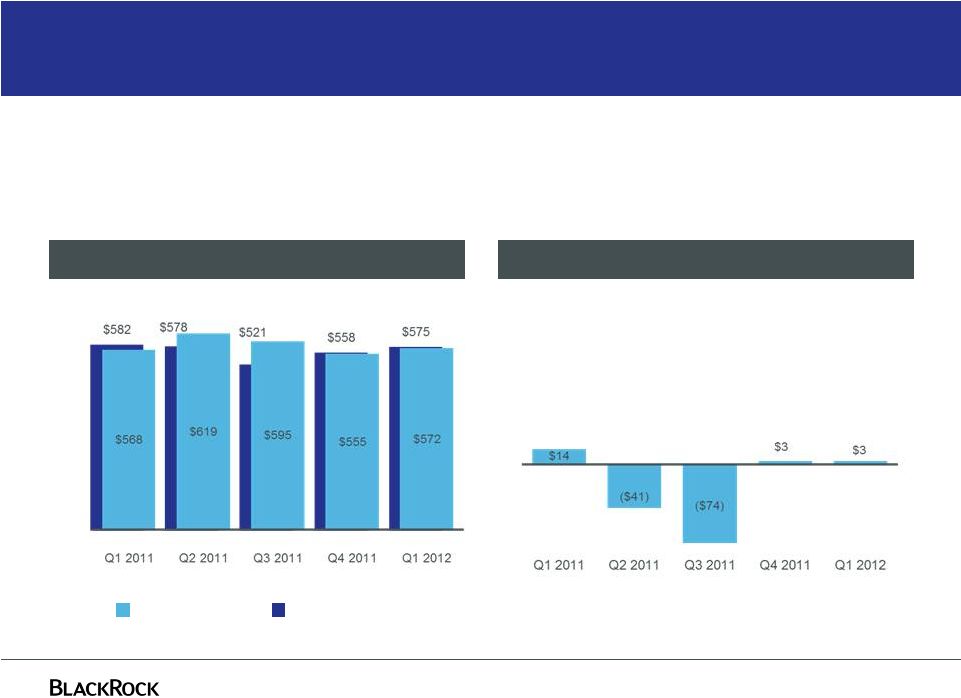

Non-operating and cash flow

17 |

18

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release. Q1 2012

investment gains reflected favorable market movements $21

$28

$1

$6

($1)

($40)

($40)

($30)

($20)

($10)

$0

$10

$20

$30

Private Equity

Real Estate

Distressed Credit/

Mortgage Funds

Hedge Funds/

Funds of Hedge

Funds

Other Investments

Net Interest

Expense

Q1-12 $15 million Non-Operating Income by Category, as adjusted

Investment

Losses/

Net

Interest

Expense

Investment Gains

$55 million Net

Investment Gains |

19

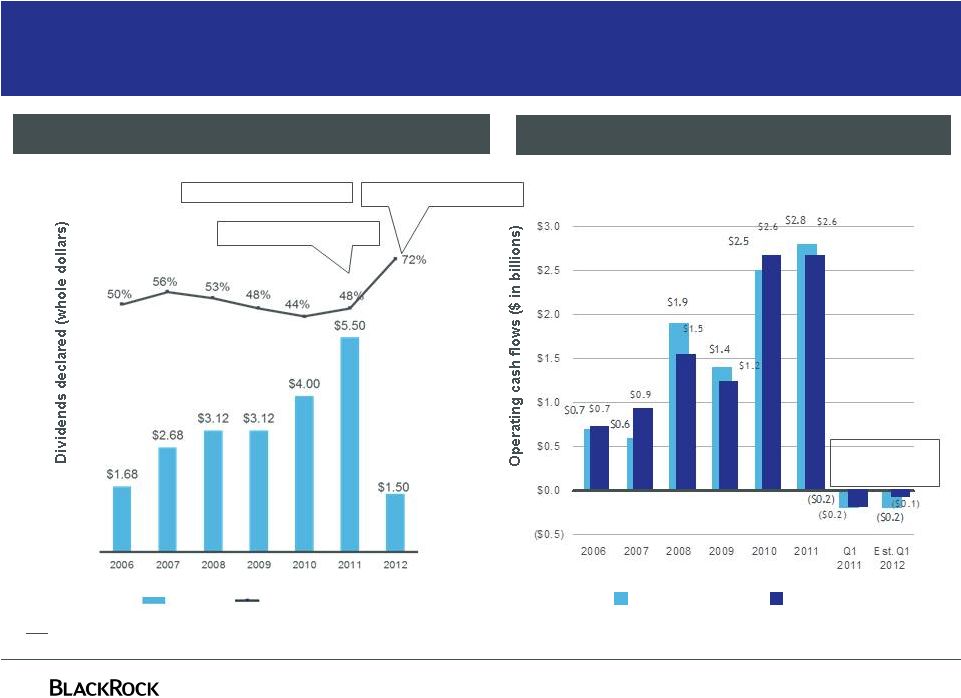

Operating cash flow and payout ratio

Notes:

(A)

(B)

Strong cash flow supports Q1 2012 increase in dividend and

increase in share repurchase authorizations

Operating cash flow

GAAP

as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

Company’s previously filed Form 10-Ks, Form 10-Qs and

8-Ks. 157% with $2.5 bn May buyback

Includes $125 m Q1 buyback

Excludes $2.5 bn May buyback

Annual incentive

compensation payout

in Q1

Payout Ratio (A)

Dividend

Payout ratio = (dividends + share repurchases) / GAAP net income.

2/17/06 2/27/07

2/15/08 N/A 2/25/10 2/24/11

2/23/12

Dividend Change

Declared:

Q1 |

Appendix

20 |

21

Quarterly operating income –

GAAP and as adjusted

GAAP

as adjusted

Operating Income ($ in millions)

Non-GAAP Adjustments ($ in millions)

Non-GAAP adjustments include PNC LTIP funding obligation, Merrill Lynch

compensation contribution, UK lease exit costs, restructuring charges, and

compensation related to appreciation (depreciation) on certain deferred compensation

plans

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks. |

22

Quarterly net income –

GAAP and as adjusted

Net Income ($ in millions)

Non-GAAP Adjustments ($ in millions)

Non-GAAP adjustments include PNC LTIP funding obligation, Merrill Lynch

compensation contribution, UK lease exit costs,

restructuring

charges,

income

tax

law

changes

and

a

state

tax

election

GAAP

as adjusted

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks. |

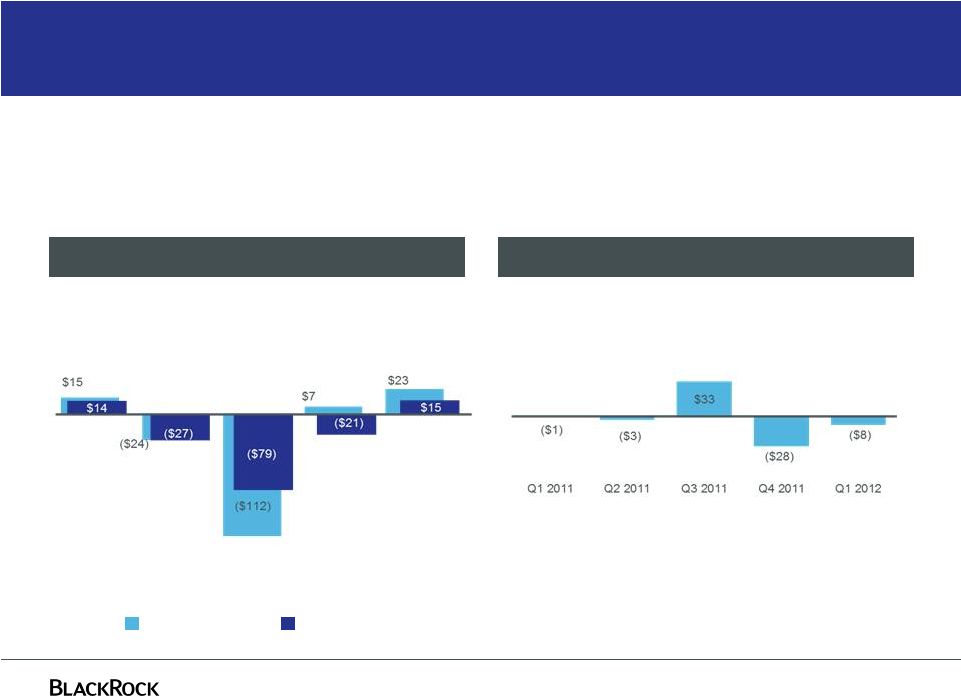

23

GAAP

as adjusted

Quarterly non-operating income –

GAAP and as adjusted

Non-Operating Income (Expense) ($ in millions)

Non-GAAP Adjustments ($ in millions)

Non-GAAP adjustments include net income (loss) attributable to

non-controlling interests and compensation expense related to

(appreciation) depreciation on certain deferred compensation plans Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

For further information and reconciliation between GAAP and as adjusted, see the

appendix and notes (a) through (e) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks. |

24

Q1 2012 long-term AUM up 7% from prior quarter

Q4-11 Compared to Q1-12

$207 billion

Long-term AUM

Q4-11

$3.138 trillion

Q1-12

$3.345 trillion

Decreasing AUM

Increasing AUM

Q1 2012 net new business excludes the effect of a previously announced institutional

fixed income index redemption that totaled $36.0 billion from a single client resulting from the decision to insource.

($36)

$3,345

$3,138

$26

$201

$8

$8

$3,100

$3,200

$3,300

$3,400

Q4-11

Net New Business

Acquisition

Market

FX

Q1-12

$0 |

25

Q1 2012 long-term AUM up 3% year-over-year

Q1-11 Compared to Q1-12

$0

$100 billion

Long-term AUM

Q1-11

$3.245 trillion

Q1-12

$3.345 trillion

Decreasing AUM

Increasing AUM

M/Q represents outflows due to manager concentration considerations prior to third

quarter 2011. Q1 2012 net new business excludes the effect of a previously

announced institutional fixed income index redemption that totaled $36.0 billion from a single client resulting from the decision to insource.

($36)

$3,345

($16)

($10)

$8

$58

$96

$3,245

$3,100

$3,200

$3,300

$3,400

Q1-11

Net New

Business

M/Q

Acquisition

Market

FX

Q1-12 |

Q1

2012 mix by product, client type, style and region 26

Base and performance fees of $2.0

billion

Long-term Assets Under Management

of $3.345 trillion

Q1 2012 Long-term Base and

Performance Fees of $1.968 billion

Long-term Assets Under Management

of $3.345 trillion at March 31, 2012 |

|