Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIFTH THIRD BANCORP | d335543d8k.htm |

Fifth Third Bank | All Rights Reserved

Annual Meeting of Shareholders

April 17, 2012

Please refer to earnings release dated January 20, 2012

and 10-K dated February 29, 2012 for further information,

including full results reported on a U.S. GAAP basis

Exhibit 99.1 |

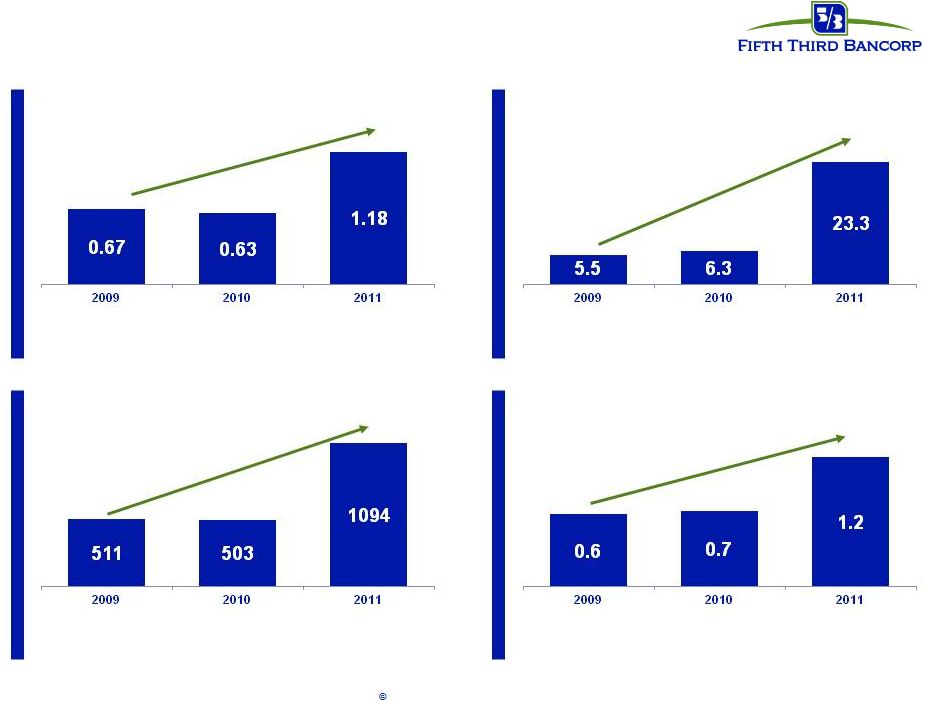

2011:

A year of strong performance Dividend payout ratio (%)

Diluted earnings per share ($)

Return on assets (%)

Net income to common ($)

Earnings per share nearly doubled

compared with 2010

Increased quarterly dividend twice during 2011

resulting in $0.32 annualized dividend

Net income available to common shareholders

more than doubled compared with 2010

ROA of 1.2% increased nearly 50 bps

compared with 2010

2

Fifth Third Bank | All Rights Reserved |

3

Fifth Third Bank | All Rights Reserved

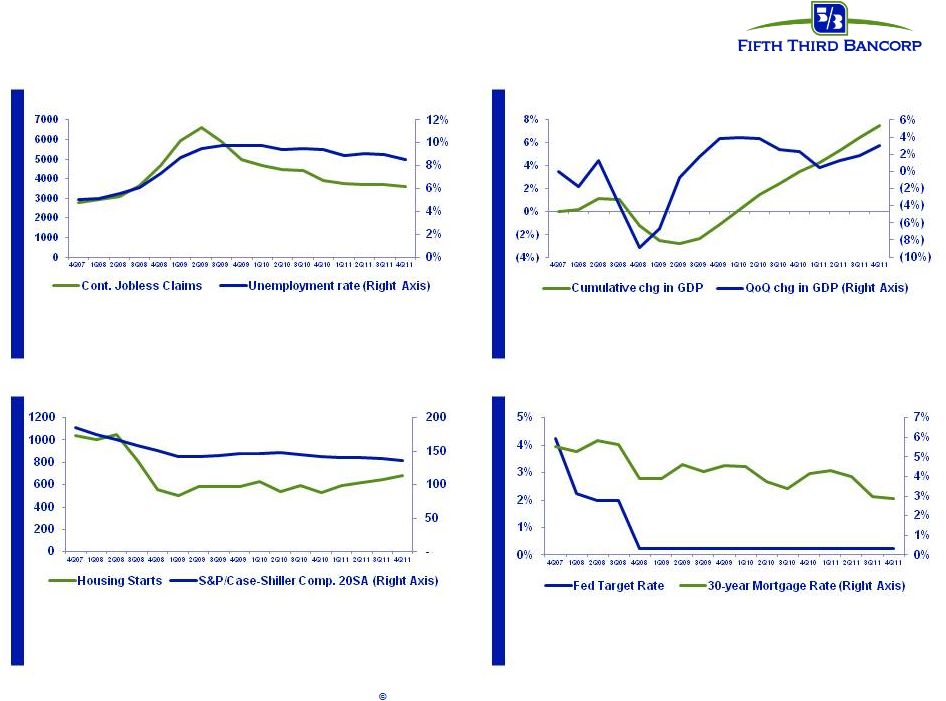

The environment is improving…

but remains challenging

Gross Domestic Product

Employment

Rate Environment

Real Estate

Unemployment has declined, but still

remains elevated vs. pre-crisis levels

GDP has grown consistently

but sluggishly since 4Q08

Home prices have stabilized, but new

construction continues to lag

Prolonged low rate environment reduces value

of bank deposits and lowers asset yields |

4

Fifth Third Bank | All Rights Reserved

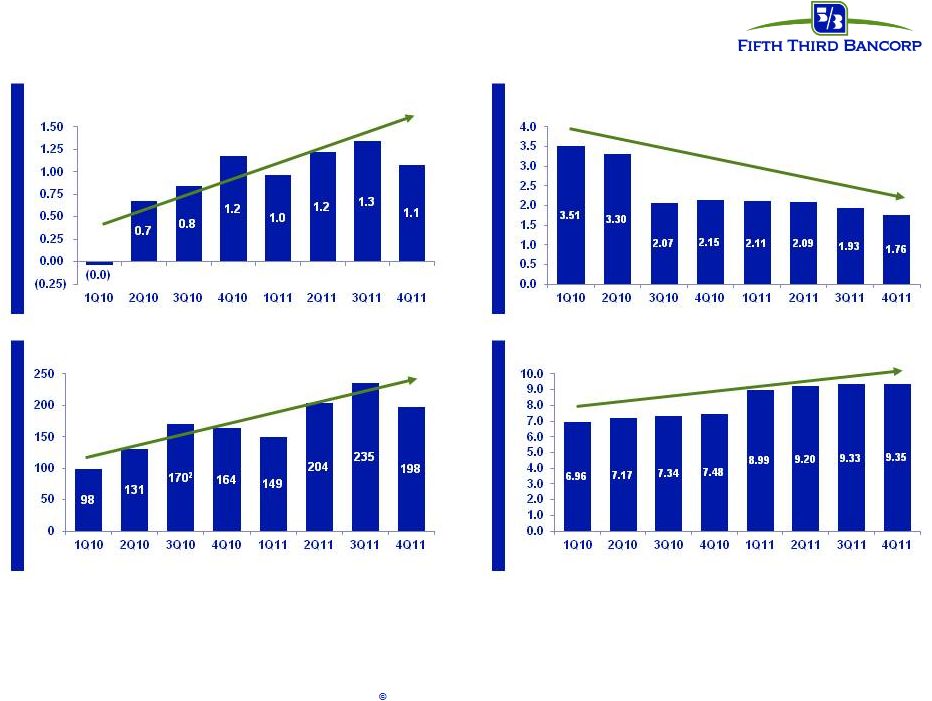

We relentlessly pursue positive outcomes

1

Nonperforming

loans

and

leases

as

a

percent

of

portfolio

loans,

leases

and

other

assets,

including

other

real

estate

owned

(does

not

include

nonaccrual

loans

held-for-

sale)

2

Excluding $510mm net charge-offs attributable to credit actions

* Non-GAAP measure. See Reg. G reconciliation in the Appendix to the

presentation Tier 1 common ratio (%)*

Return on assets (%)

PPNR / Net charge-offs (%)*

NPLs / Loans

1

(%)

2011 was most profitable year since 2006 |

5

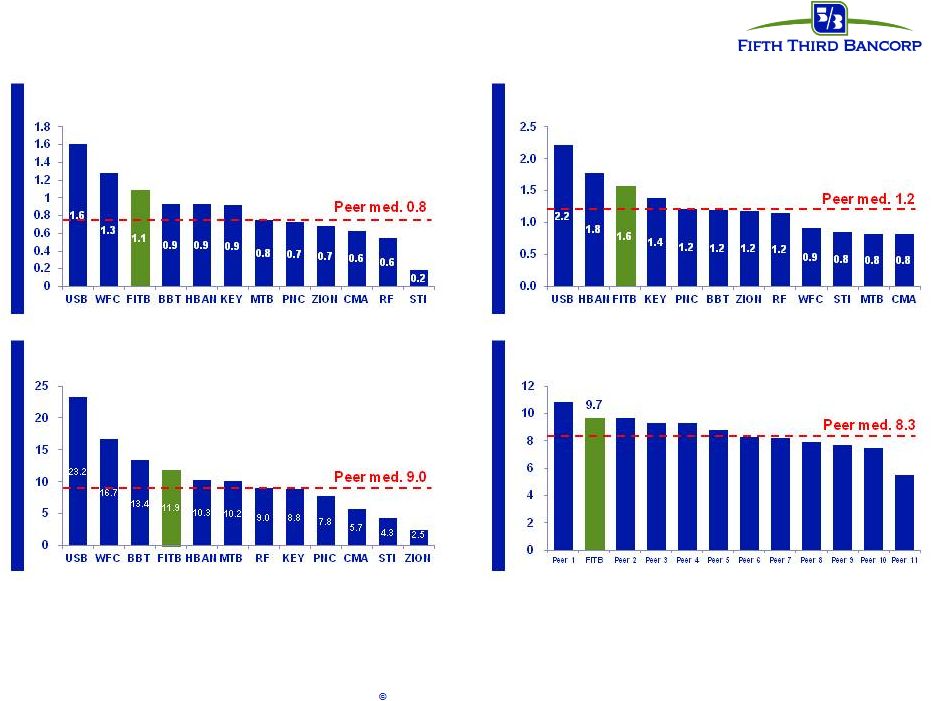

Fifth Third Bank | All Rights Reserved

We aim to set ourselves apart

4Q11 Tier 1 common (%)*

(adjusted for Basel III^)

4Q11 Return on assets (%)

4Q11 Reserves / NPLs (%)

4Q11 Return on tangible common equity (%)*

Industry leader in earnings power

Source: SNL Financial and Company Reports.

* Non-GAAP measure. See Reg. G reconciliation in the Appendix to the

presentation ^ Estimates based on current Basel III rules released by the

Basel Committee; actual rules subject to U.S. banking regulation. Assumes unrealized securities gains

included

in

Tier

1

common.

Not

adjusted

for

potential

mitigation

efforts. |

6

Fifth Third Bank | All Rights Reserved

We are focused on

effective capital management

* Subject to Board of Directors and regulatory approval

** Comprehensive Capital Analysis & Review by Federal Reserve

Organic growth opportunities

•

Support growth of core banking franchise

•

Continued loan growth despite sluggish

economy

Strategic opportunities

*

•

Prudently expand franchise or increase

density in core markets via disciplined

acquisitions or selective de novos

•

Expect future acquisition activity although

less likely in near-term

•

Attain top 3 market position in 65% of

markets or more longer term

Return to more normal dividend policy

*

•

Strong levels of profitability would support

higher dividend than current level

•

Move towards levels more consistent with

Fed’s near-term payout ratio guidance of

30%

Repurchases / Redemptions

*

Recommendations for increased shareholder distributions upon

Federal Reserve approval of capital plan**

Capital Deployment

Capital Return

Manage common equity in light of

regulatory environment, other

alternatives, maintenance of desired /

required buffers, and stock price

Initiate common share repurchases to

manage growing excess capital levels;

retain amount of common equity to

accommodate asset growth |

7

Fifth Third Bank | All Rights Reserved

We are positioned well for industry changes

No significant changes to business model or asset mix

Traditional banking activities, consistent with direction of

financial reform

No direct European sovereign exposure;

very modest exposures overall

Little to no impact

Mortgage risks are manageable

No significant business at Fifth Third impaired during crisis

Dodd-Frank Act /

Basel III

Volcker rule

Effect of crisis on core

business

Mortgage Putback /

Litigation risk

Financial system

interconnectedness

European crisis |

8

Fifth Third Bank | All Rights Reserved

You don’t get to new ideas

by using the same old ideas. |

9

Fifth Third Bank | All Rights Reserved

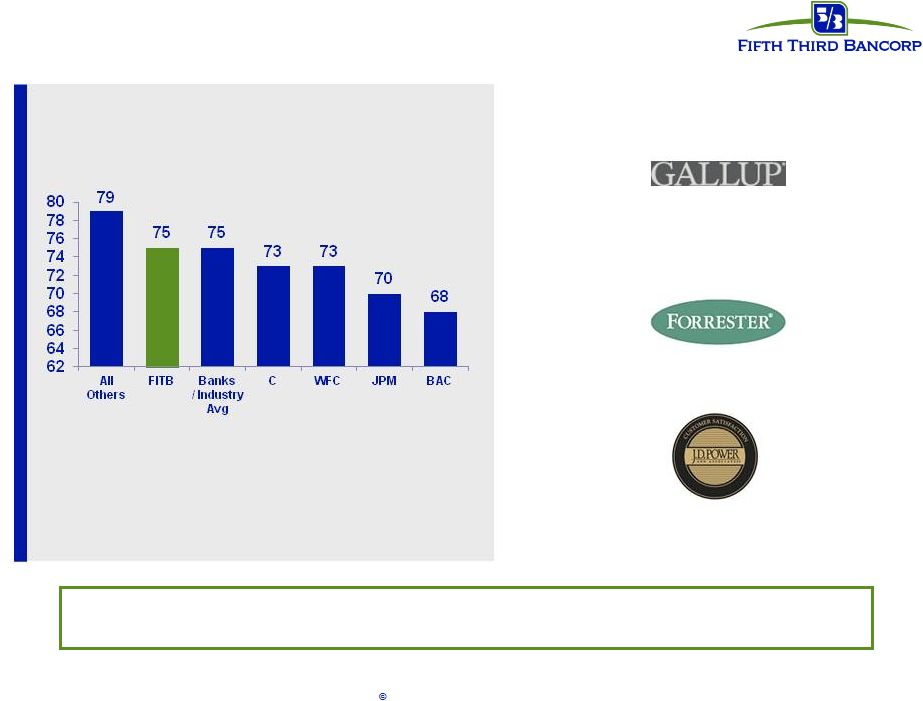

We are focused on the customer experience

Fifth

Third

Bank

engaged

the

American

Customer Satisfaction

Index

(ACSI)

in

custom

research

projects

surveying

Fifth

Third

Bank

customers

in

the

3

quarter

of

2011.

In

the

surveys,

ACSI

used the same statistical methodology as the independently measured banks, Bank of

America, J.P. Morgan Chase, Wells Fargo, and Citigroup. The Customer Experience Index, 2012”,

Forrester Research, Inc., January 23, 2012

Consistently achieving leading customer satisfaction scores through focus

on providing valuable products and services at fair prices

Fifth Third outscored

the bank industry average

Fifth Third recipient of

“Great Workplace Award”

(March 2011)

Fifth Third improved

consistently over last 4 years

Third-Party Recognition

Fifth Third’s score was in line with the ACSI

Banks industry average (Bank of America,

Citi, Wells Fargo, J.P. Morgan Chase and an

aggregate of smaller banks)

2011 ACSI Scores

Customer Satisfaction Scores

rd |

10

Fifth Third Bank | All Rights Reserved

Well-positioned for success and leadership in new banking landscape

Resilient business model provides strength

Strong levels of

profitability

Broad-based

credit

improvements

Exceed fully

phased-in Basel

III capital

standards today

All crisis-era

government

support

programs exited;

no TLGP

No significant

business at Fifth

Third impaired

by crisis

Continued

investments to

maintain and

enhance

revenue-

generation

Disciplined

expense control

Traditional

banking focus

consistent with

direction of

financial reform |

Fifth Third Bank | All Rights Reserved |

12

Fifth Third Bank | All Rights Reserved

Cautionary statement

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule

3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans,

objectives, future performance or business. They usually can be identified by the use of

forward-looking language such as “will likely result,” “may,” “are

expected to,” “is anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or

phrases such as “believes,” “plans,” “trend,” “objective,”

“continue,” “remain,” or similar expressions, or future or conditional verbs

such as “will,” “would,” “should,” “could,” “might,”

“can,” or similar verbs. You should not place undue reliance on these statements, as

they are subject to risks and uncertainties, including but not limited to the risk factors set forth

in our most recent Annual Report on Form 10-K. When considering these forward-looking

statements, you should keep in mind these risks and uncertainties, as well as any cautionary

statements we may make. Moreover, you should treat these statements as speaking only as of the date they are

made and based only on information then actually known to us. There

are a number of important factors that could cause future results to differ materially from historical performance and these

forward-looking statements. Factors that might cause such a difference include, but are not

limited to: (1) general economic conditions and weakening in the economy, specifically the real

estate market, either nationally or in the states in which Fifth Third, one or more acquired

entities and/or the combined company do business, are less favorable than expected; (2) deteriorating credit

quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in

securities markets or other economic conditions; (4) changes in the interest rate environment

reduce interest margins; (5) prepayment speeds, loan origination and sale volumes,

charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of

funding and liquidity; (7) maintaining capital requirements may limit Fifth Third’s operations

and potential growth; (8) changes and trends in capital markets; (9) problems encountered by

larger or similar financial institutions may adversely affect the banking industry and/or Fifth

Third; (10) competitive pressures among depository institutions increase significantly; (11) effects of critical

accounting policies and judgments; (12) changes in accounting policies or procedures as may be

required by the Financial Accounting Standards Board (“FASB”) or other regulatory

agencies; (13) legislative or regulatory changes or actions, or significant litigation,

adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth

Third, one or more acquired entities and/or the combined company are engaged, including the

Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”);

(14) ability to maintain favorable ratings from rating agencies; (15) fluctuation of Fifth

Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to receive

dividends from its subsidiaries; (18) potentially dilutive effect of future acquisitions on

current shareholders’ ownership of Fifth Third; (19) effects of accounting or financial

results of one or more acquired entities; (20) difficulties from the separation of Vantiv Holding, LLC, formerly Fifth Third

Processing Solutions, LLC, from Fifth Third; (21) loss of income from any sale or potential sale of

businesses that could have an adverse effect on Fifth Third’s earnings and future growth;

(22) ability to secure confidential information through the use of computer systems and

telecommunications networks; and (23) the impact of reputational risk created by these developments on such matters

as business generation and retention, funding and liquidity. You

should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further

information on other factors, which could cause actual results to be significantly different from

those expressed or implied by these forward-looking statements.

|

13

Fifth Third Bank | All Rights Reserved

Appendix |

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

$ in millions

(unaudited)

For the Three Months Ended

December

September

June

March

December

September

June

March

2011

2011

2011

2011

2010

2010

2010

2010

Income before income taxes (U.S. GAAP)

418

530

506

377

417

303

242

(22)

Add: Provision expense (U.S. GAAP)

55

87

113

168

166

457

325

590

Pre-provision net revenue (a)

473

617

619

545

583

760

567

568

Net charge-offs (b)

239

262

304

367

356

446

434

582

Ratios:

Pre-provision net revenue / net charge-offs (a) / (b)

198%

235%

204%

149%

164%

170%

131%

98%

Note: 3Q10 net-charge offs exclude $510mm net charge-offs attributable to

credit actions. Including these actions, 3Q10 net charge-offs were $956mm and pre-provision

net revenue / net charge-offs was 79%.

14 |

15

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

$ in millions

(unaudited)

December

2011

Net income available to common shareholders (U.S. GAAP)

305

Add: Intangible amortization, net of tax

3

Tangible net income available to common shareholders

308

Tangible net income available to common shareholders (annualized) (a)

1,222

Average Bancorp shareholders' equity (U.S. GAAP)

13,147

Less: Average preferred stock

398

Average goodwill

2,417

Average intangible assets

42

Average tangible common equity (b)

10,290

Ratios:

Return on average tangible common equity (a) / (b)

11.9% |

16

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

$ in millions

(unaudited)

For the Three Months Ended

December

September

June

March

December

September

June

March

2011

2011

2011

2011

2010

2010

2010

2010

Total Bancorp shareholders' equity (U.S. GAAP)

13,201

13,029

12,572

12,163

14,051

13,884

13,701

13,408

Goodwill and certain other intangibles

(2,514)

(2,514)

(2,536)

(2,546)

(2,546)

(2,525)

(2,537)

(2,556)

Unrealized gains

(470)

(542)

(396)

(263)

(314)

(432)

(440)

(288)

Qualifying trust preferred securities

2,248

2,273

2,312

2,763

2,763

2,763

2,763

2,763

Other

38

20

20

12

11

8

(25)

(30)

Tier I capital

12,503

12,266

11,972

12,129

13,965

13,698

13,462

13,297

Less: Preferred stock

(398)

(398)

(398)

(398)

(3,654)

(3,642)

(3,631)

(3,620)

Qualifying trust preferred securities

(2,248)

(2,273)

(2,312)

(2,763)

(2,763)

(2,763)

(2,763)

(2,763)

Qualifying noncontrolling interest in consolidated subsidiaries

(50)

(30)

(30)

(30)

(30)

(30)

-

-

Tier I common equity (a)

9,807

9,565

9,232

8,938

7,518

7,263

7,068

6,914

Unrealized gains

470

Disallowed deferred tax assets

-

Disallowed MSRs

70

Other

12

Less: 10% of individual deferred tax assets, MSRs, investment in financial

entities -

15% of aggregate deferred tax assets, MSRs, investment in financial entities

-

Tier 1 common equity, Basel III proforma (b)

10,359

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (c)

104,945

102,562

100,320

99,392

100,561

98,904

98,604

99,281

Add: Regulatory deductions not deducted from Tier 1 common equity,

risk-weighted at 250% 1,453

Risk-weighted assets, Basel III proforma (d)

106,398

Ratios:

Tier I common equity (a) / (c)

9.35%

9.33%

9.20%

8.99%

7.48%

7.34%

7.17%

6.96%

Tier I common equity, Basel III proforma (b) / (d)

9.7% |