Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2011

For the transition period from ___________to __________

Commission file number 001-34386

CHINA PRINTING & PACKAGING, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

35-2298521

|

|

|

(State or other jurisdiction of

Incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

Xiandong Road, Shangsong VillageBaoji City, Fufeng County

Shaanxi Province, The People’s Republic of China 722205

|

|

(Address of principal executive offices)

|

011-86-0907-547-1054

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. x Yes ¨ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

1

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

||

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $12,932,316 (32,330,792 shares of common stock held by non-affiliates with a closing price on June 30, 2011 of $0.40, reflecting a 2.5-for-1 stock dividend issued on June 15, 2011).

Note. —If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

The number of shares of common stock outstanding as of April 13, 2012 is 51,002,502.

2

Table of Contents

|

|

Page

|

|

|

PART I

|

||

|

Item 1.

|

Business

|

5

|

|

Item 1A.

|

Risk Factors

|

14

|

|

Item 1B.

|

Unresolved Staff Comments

|

22

|

|

Item 2.

|

Properties

|

22

|

|

Item 3.

|

Legal Proceedings

|

22

|

|

Item 4.

|

Mine Safety Disclosures

|

22

|

|

PART II

|

||

|

Item 5.

|

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

23

|

|

Item 6.

|

Selected Financial Data

|

24

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

24

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

26

|

|

Item 8.

|

Financial Statements and supplementary Data

|

26

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

27

|

|

Item 9A.

|

Controls and Procedures

|

27

|

|

Item 9B.

|

Other Information

|

27

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers, and Corporate Governance.

|

28

|

|

Item 11.

|

Executive Compensation

|

30

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

32

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

32

|

|

Item 14.

|

Principal Accountant Fees and Services

|

33

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

34

|

3

Cautionary Statement Regarding Forward Looking Statements

The discussion contained in this Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Form 10-K. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Form 10-K describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Form 10-K could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Form 10-K or the date of documents incorporated by reference herein that include forward-looking statements.

4

PART I

|

Item 1.

|

Business.

|

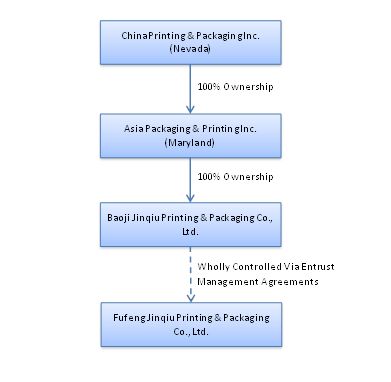

Background of China Printing & Packaging, Inc. and Corporate Structure

China Printing & Packaging, Inc. (the “Company”) was incorporated on May 3, 2007 in the State of Nevada under the name USA Therapy, Inc.

Prior to August 6, 2010, the Company was a development stage company with no revenue or profits. The Company’s initial business plan was to serve as a provider of short to long-term and temporary, screened and qualified, licensed therapists (including, but not limited to, physical, occupational and speech therapists) for hospitals, nursing homes, board and care facilities and other similar community resources. The Company also owned USA Estate Plans, LLC, a wholly owned subsidiary of the Company, which was dissolved pursuant to a unanimous written consent of the members of USA Estate Plans, LLC on March 5, 2011.

On August 6, 2010, the Company entered into a Share Exchange Agreement (the “Exchange Agreement”) with Asia Packaging & Printing, Inc. (“APPI”), a Maryland corporation, and as a result the Company adopted the business of Fufeng Jinqiu Printing & Packaging Co., Ltd. (“Jinqiu”)

In light of the our acquisition of Jinqiu, which is engaged in the business of manufacturing, marketing and sales of containerboard boxes and cartons, we decided to change the name of the Company from “USA Therapy, Inc.” to “China Printing & Packaging, Inc.” (the “Name Change”). On September 20, 2010 the board of directors unanimously authorized the Name Change, and the majority shareholders of the Company’s common stock ratified the board of directors’ written consent and further authorized the Name Change by written consent of the majority shareholders. The name change became effective on November 22, 2010.

Background of Jinqiu

Jinqiu was incorporated in the PRC on August 19, 2003, and is our operating company. Jinqiu is in the business of manufacturing, marketing and sales of containerboard boxes and cartons in China. APPI was incorporated in Maryland on August 21, 2009. Baoji (JV), an entity that is controlled by APPI, was incorporated in the PRC on April 1, 2010.

Control of Baoji (JV)

Under the laws of the PRC, certain restrictions are placed on round trip investments, which are defined under PRC law as an acquisition of a PRC entity by an offshore special purpose vehicle owned by one or more PRC residents.

To comply with these restrictions, APPI acquired control of Baoji (JV) by establishing Baoji (JV) as a joint venture, whereby APPI directly owns a minority equity interest, or 32%, in Baoji (JV), and Jinqiu, our operating entity, owns the remaining 68%. APPI subsequently entered into a series of agreements with Jinqiu which we believe give us effective control over the business of Baoji (JV) despite our current minority ownership in Baoji (JV). These agreements are described in more detail below.

On April 22, 2010, Jinqiu, Baoji (JV) and APPI entered into a Management Entrustment Agreement. Pursuant to the Agreement, Jinqiu agrees to exclusively entrust the operation and management of Baoji (JV) to APPI. Under the agreement, APPI manages the operations and assets of Baoji (JV), is entitled to 100% of earnings of Baoji (JV) as a management fee, controls all of the cash flows of Baoji (JV) through a bank account controlled by APPI, manages recruitment and professional training of the management staff of Baoji (JV), chooses distributors for the sales of the products manufactured by Jinqiu, and is obligated to pay all payables and loan payments of Baoji (JV). In addition, under the terms of the Management Entrustment Agreement, APPI has been granted certain rights which include, in part, the right to appoint members of Baoji (JV) Board of Directors, hire management and administrative personnel and control decisions relating to entering and performing customer contracts and other instruments. The agreement does not terminate unless the business of Baoji (JV) is terminated or APPI exercises its option to acquire all of the assets or equity of Baoji (JV) under the terms of the Exclusive Option Agreement as described herein.

In order for Baoji (JV) to become a wholly owned subsidiary of APPI when permitted under PRC law, on April 22, 2010, APPI, Jinqiu and Baoji (JV) entered into an Exclusive Option Agreement (the “Baoji Option Agreement”) whereby Jinqiu granted APPI an irrevocable and exclusive purchase option to acquire all or part of the assets or equity of Baoji (JV) currently owned by Jinqiu. The option may be exercised for up to $100 and pursuant to such arrangements as may be determined by APPI, provided that the exercise will not violate any PRC laws or regulations then in effect.

In order to comply with restrictions placed on foreign exchange in the PRC, APPI opted not to exercise its right under the Baoji Option Agreement. On July 11, 2011, APPI and Jinqiu entered into an Equity Transfer Agreement, pursuant to which Jinqiu transferred 68% of the equity interest in Baoji (JV) to APPI for a consideration of RMB 6,240,000 and Baoji (JV) became a wholly own subsidiary of APPI.

5

Control of Jinqiu

To comply with the restrictions imposed by PRC laws, APPI indirectly controls Jinqiu, our operating entity, via a number of contractual arrangements between Baoji (JV) and Jinqiu. These agreements are described in more detail below. Bao Dian & Partners, our PRC counsel, has advised us that in their opinion all of the Management Entrustment Agreements and Option Agreements described below are legal and enforceable under PRC law. Through these contractual arrangements, we have the ability to substantially influence these companies’ daily operations and financial affairs, appoint their senior executives and approve all matters requiring stockholder approval. As a result of these contractual arrangements, which enable us to control Jinqiu and operate our business in the PRC through Jinqiu, we are considered the primary beneficiary of Jinqiu.

On April 22, 2010, Baoji (JV) entered into a Management Entrustment Agreement with Jinqiu and the shareholders of Jinqiu, in which Jinqiu and its shareholders agreed to transfer control, or entrust, the operations and management of its business to Baoji (JV). Under the agreement, Baoji (JV) manages the operations and assets of Jinqiu, controls all of the cash flows of Jinqiu through a bank account controlled by Baoji (JV), is entitled to 100% of earnings of Jinqiu as a management fee, manages recruitment and professional training of the management staff of Jinqiu, chooses distributors for the sales of the products manufactured by Jinqiu, and is obligated to pay all payables and loan payments of Jinqiu. In addition, under the terms of the Management Entrustment Agreement, Baoji (JV) has been granted certain rights which include, in part, the right to appoint and terminate members of Jinqiu’s Board of Directors, hire management and administrative personnel and control decisions relating to entering and performing customer contracts and other instruments. The Management Entrustment Agreement does not terminate unless the business of Jinqiu is terminated or Baoji (JV) exercises its option to acquire all of the assets or equity of Jinqiu under the terms of the Exclusive Option Agreement as more fully described below.

In order to enable Jinqiu to become an indirectly wholly owned subsidiary of Baoji (JV) when permitted under PRC law, Baoji (JV), Jinqiu and the Jinqiu shareholders entered into an Exclusive Option Agreement whereby the Jinqiu shareholders granted Baoji (JV) an irrevocable and exclusive purchase option to acquire Jinqiu equity and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. The option may be exercised for up to $100 and pursuant to such arrangements as may be determined by Baoji (JV), provided that the exercise will not violate any PRC laws or regulations then in effect. Accordingly, we will consider exercising the option under such circumstances we believe will be in our best interests and our shareholders. The Exclusive Option Agreement has been drafted to give us such flexibility. In considering whether or not we will exercise the option we may consider such factors as (1) if the exercise price can be lower than the appraised value under current PRC law (2) availability of funds, (3) any relevant tax considerations at the time, (4) any other relevant PRC laws that may exist at the time, (5) the value of our shares that were previously paid to shareholders of Jinqiu, and (6) whether or not the exercise of the option will provide any other additional benefits to us or our shareholders. Upon exercise of the option, the parties will prepare transfer documents to be submitted for governmental approval and work together to obtain all approvals and permits. The Exclusive Option Agreement may be terminated by agreement of all parties or by 30 days’ notice.

The consolidated financial statements include the accounts of the Company, Baoji (JV), and Jinqiu, the Company’s variable interest entities (“VIEs”), for which the Company is the primary beneficiary. A primary beneficiary is the enterprise that consolidates a VIE. All inter-company accounts and transactions have been eliminated in consolidation. The Company has adopted ASC810, which require a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns.

Although we have no equity ownership interest in Jinqiu, through Baoji (JV), we are entitled to manage the operations of Jinqiu, manage and dispose of its assets, nominate officers and directors, make decisions as to the use of funds and manage cash flows and receive a management fee equal to 100% of earnings before tax of Jinqiu and we are obligated to pay all of its debts. As a result, we are required to consolidate the financial statements of Jinqiu under US GAAP. When we sell our equity or borrow funds we expect the proceeds will be forwarded to Jinqiu and accounted for as a loan to Jinqiu and eliminated during consolidation. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds, we expect to be the primary obligor on any debt.

Thus, by causing our subsidiary APPI and Baoji (JV) to enter into a Management Entrustment Agreement and Exclusive Option Agreement with Jinqiu, we are required to consolidate the financial results of Jinqiu as our VIEs.

6

Current Structure

Organizational History of Jinqiu

Fufeng Jinqiu Printing & Packaging Co., Ltd. was incorporated on August 19, 2003 in the People’s Republic of China. Its original registered capital was RMB 600,000 and in August 2006 it increased to RMB 6.24 million. The stock ownership of the company was jointly held by 10 shareholders including Yongming Feng and Jinhao Zhang, the largest shareholders of the company, representing 28% and 20% of the equity interests of the company, respectively. The company’s original business scope included the color printing and manufacture and distribution of cardboard boxes, cartons, and related printing labels.

Overview of Jinqiu’s Business

Jinqiu is in the business of manufacturing paperboard boxes and cartons for various uses, including exterior packaging needs of the processed food, fruit, ceramic, building material, light electronics and mechanical industries. It produces final product boxes and cartons as well as the paperboard and other subgrades from which the boxes and cartons are made.

Jinqiu is located in the Jiangzhang Economic Development Zone, Shaanxi Province, the People’s Republic of China. It occupies a land area of approximately 10,000 square meters.

With a total production capacity to manufacture up to 150 million square meters of corrugated board and two billion containers, Jinqiu is one of the largest general board/packaging manufacturers in the Shaanxi Province and in the northwest PRC.

Products

Jinqiu manufactures its boxes and cartons from two major categories of paperboard: containerboard and white boxboard. Containerboard is generally used to make corrugated and solid fiber boxes, while white boxboard is used to make folding cartons.

Below is a diagram of the paper and paper packaging industry, with the products we manufacture highlighted:

7

Paper Industry’s Flow Chart

Manufacturing Process

We manufacture not only the paper packaging products that we sell to our customers, but also the paperboard that we shape and assemble into packaging products, and the intermediary components that comprise the paperboard.

Paperboard Making

We produce two major types of paperboard: containerboard and white boxboard. The quality of the paperboard (and the quality of the finished packaging products) is determined by the quality of paper that is used in making the paperboard.

Corrugated containers

The most common of packaging material that Jinqiu makes is corrugated fiber boxes, used as shipping containers. These boxes are shaped and assembled out of corrugated board, which Jinqiu manufactures in-house. There are two major subgrades for corrugated board: linerboard and corrugated medium. Linerboard and corrugated medium are made from containerboard, a paper-like material that is usually over 0.25 mm thick.

Both the linerboard and corrugated medium are also produced in-house from containerboard. Containerboard is a form of paperboard specially manufactured for the production of solid and corrugated fiberboard. The term encompasses both linerboard and corrugating medium, the two types of paper that make up corrugated board. The containerboard we manufacture is primarily used to make our container products, however we do resell a small portion, approximately 2%, of our containerboard to third party vendors. Since containerboard is mainly made out of natural unbleached wood fibers, it is generally brown, though the shade can vary depending on the type of wood, recycling rate and impurities level. For certain boxes requiring good presentation, white bleached pulp or coating is used on the top ply of the paper that goes on the box surface.

Production of containerboard is the highest among all kinds of paper in the world, with more than 100 million tons per year (Source: www.wikipedia.com). It is mainly manufactured in specialized paper machines out of virgin as well as recycled fibers. Linerboard made of virgin pulp is called kraftliner, whereas recycled linerboard is named testliner. Jinqiu primarily purchases kraft paper to produce the linerboard, which, due to its high virgin fiber content, tends to be stronger and have greater moisture resistance than testliner.

Corrugating medium may likewise be recycled or virgin, the latter being normally called semi-chemical medium, making reference to the pulping process involved in its production. Jinqiu manufactures and produces corrugating medium from semi-recycled paper that we purchase from our suppliers.

8

Retrieved from: http://en.wikipedia.org/wiki/Containerboard

In order to manufacture corrugated containers the paper we purchase from our suppliers is wound onto a reel. The reel is then mounted in a roll-slitting machine for rewinding during which time cutters are used to cut the paper into the desired widths.

Our corrugating machines flute the containerboard through compression to produce corrugated medium. It then adheres the corrugated medium to a flat linerboard to form a single-faced board. A second flat linerboard is then adhered to the other side of the corrugated medium, forming what is called a single-wall (double-faced) corrugated board. Depending on how strong the final packaging product needs to be, we may add additional walls to the corrugated board or additional layers to the corrugated medium for reinforcement.

Boxboard

Boxboard is a dense, rigid paperboard produced from flat layers of paper. It is commonly used to make folding cartons and gift boxes. Boxboard is produced using similar processes as corrugated board. However, unlike corrugated board, boxboard does not contain any corrugated medium and therefore does not have the same flexibility as corrugated board.

Box design and manufacture

Once the requisite paperboard has been produced, we will cut down and shape the board to meet the particular specifications required by our customers. Generally, we will print the board with the desired template, then crease or score the paperboard to enable controlled bending of the board. As needed, slots are cut to provide flaps on the box. As needed we may also join the different boards together with adhesive, tape or stitching. The boxes are then packaged and stored until shipment.

For those customer orders that require color printing, we employ both sheet-fed and web-pressed processes. We generally print the color graphic directly on the corrugated board. For higher-grade containers, we may preprint the color graphic on a paperboard sheet, which is then laminated, or adhered, either to a single-faced board or to a double-faced corrugated board.

Production Lines

Jinqiu currently has one paperboard production line that can produce about 5-6 million square meters (“m2”) of corrugated board a day. We estimate that we have a total annual production capacity of corrugated board of up to 150 million m2 and up to 2 billion color-printed boxes. In the near future we plan to make preparations to roll-out an inside packing production line. Although we plan to cooperate with other producers, the line will be purchased by Jinqiu and located on Jinqiu’s manufacturing premises.

Our existing production line has the capability to produce paperboard, then score, slot, cut, fold and glue the boards into boxes for any application, according to customer needs. We are equipped with the following automatic machines, including a high-speed, computer-operated corrugator, which can make up to 50,000 m2 of paperboard per day (equivalent to 100,000 to 200,000 sets of boxes/cartons), as well as automatic printing, die-cutting, creasing, slotting machines. We have the ability to produce double-walled (five-layer) corrugated boards to suit the stacking strength and puncture resistance that is required for our boxes and cartons. We also own one automatic, high speed four-color flexo printer slotter which can process up to 150 sheets of paperboard per minute.

9

Below is a table of our primary machines used in our production:

|

Machine Type

|

Quantity

|

Purpose

|

||||

|

Five-Layer Paperboard Production Line

|

1

|

Primarily used in the production of cardboard, corrugated medium, and five-layer paperboard in a one-pass operation. Includes a computerized cutting capability to shape 2, 3, 4, and 5-layer paperboard according to customer requirements.

|

||||

|

Four-Color Flexo Printer Slotter

|

1

|

High-speed, four-color printing, slotting, rolling, notching, and coating. Uses environmentally friendly watercolor printing and produces bright color and precise chromaticity.

|

||||

|

Automatic Swinging Machine

|

1

|

High-speed and high-volume creasing and bending.

|

||||

|

Die-cutting Machine

|

2

|

Precise and burr-free carton sizing with multi-function folding and composing.

|

||||

|

Offset Press

|

2

|

Multi-network, high grade, multi-color gift box and carton printing.

|

Jinqiu also has complete accessory facilities including its own water supply station, pipes, and boiler facilities.

Quality Control

We maintain a rigorous standard of quality controls. Our quality assurance staff tracks each process throughout the production according to our strict standards. We conduct quality control of our raw materials, and then test-sample our semi-finished products (such as linerboard and corrugating medium) prior to proceeding with production of our finished paperboard containers. Prior to entering the warehouse, we conduct tests on our finished containers according to industry standards and customer specifications such as exterior appearance, interior finishing, and compressive strength. Any product that does not meet such standards is immediately rejected. All our quality assurance staff is required to sign off on acceptance documents as an indication of their review and assessment that our standards have been complied with. As a result of our quality controls, we have historically never had issues with the quality of our products.

Sales of Products

Our customers are primarily regionally-based companies in Shaanxi and neighboring Gansu province from various industries who use our containerboard products to package their finished products. Shaanxi province is home to many pharmaceutical, food processing, and ceramic industries. Shaanxi is also China’s second-largest fruit-producing province and accounts for approximately one-eighth of the world’s total apple production; more than 80 apple factories reside in Fufeng County alone, where Jinqiu is located. Our largest customers have historically been those in the fruit business, and the harvest months of May through August have traditionally been our high season. Recently, however, we have been providing products to a growing ceramics industry in Baoji, which in 2009 overtook the fruit industry as the predominant source of our revenue and has tempered the seasonality of our business.

We typically have long-term annual contracts with our major customers pursuant to which they will provide us with a forecast of the type and size of paperboard containers they require. We then fulfill their orders using various technologies according to their particular requirements.

We reserve the right to adjust the prices of our products and will notify the customer(s) at least a week in advance.

We generally employ a “roll-over” payment policy, pursuant to which at the time that we deliver the customer order, we collect payment for the prior order. We have not experienced any difficulty in receiving payment for our products.

Delivery Methods

We fulfill each order according to the requirements set by the particular purchase order. Delivery of our products may be through a third-party logistics company or picked up by our customer. Delivery charges are borne by the customer. Our boxes and cartons are delivered flat, to be assembled by the customer.

Major Customers

Our customers are primarily end-users who use our containerboard and boxes/cartons to package and ship their own products. We sell substantially all of our products to customers in the Shaanxi Province.

In the fiscal year ended December 31, 2011, none of our customers accounted for more than 10% of our revenue.

10

Our major customers who accounted for more than 10% of our revenue in fiscal year 2010 are as follows:

|

Name of Customer

|

Sales (US$)*

|

Percentage

|

||||||

|

Baoji Jianzhong Jiajiale Food Products Co., Ltd.

|

$

|

1,611,721

|

19.55

|

%

|

||||

|

Shaanxi Jintai Ceramics Holding Ltd.

|

$

|

1,514,551

|

18.37

|

%

|

||||

|

Total

|

$

|

3,126,272

|

||||||

*Calculated applying RMB to USD exchange rate as of December 31, 2010, 6.60231:1.

We regularly sell our products to over 250 customers. Although we have a handful of customers who each comprise more than 10% of our sales revenue, we do not believe there is a large risk of losing these customers since they are locally situated and enjoy the cost benefits of purchasing our locally-manufactured products. Even if we were to lose these customers, we believe it would not be difficult to replace them due to the low supply of packaging manufacturers in the region, primarily a result of early stage of development of the packaging industry in the Northwest region of China and the multitude of industries in the region that require packaging products. Accordingly, we do not believe that the loss of any one customer would have a material adverse effect on us.

Marketing and Sales

We have a team of approximately 28 sales personnel, divided into 5 teams, who work full-time on a salaried basis and receive discretionary bonuses based on their achievement of certain sales targets. We do not have independent sales agents or distributors. Because our customers are mostly local, our sales personnel work out of our headquarters and commute out to visit customers.

Marketing expenses for fiscal years 2011 and 2010 were approximately $159,259 and $3,870, respectively.

Raw Materials

Our primary raw materials include tea paperboard, recycled paper, sized paper, bleached and unbleached pulp paper, grey coated paper, yellow coated paper, and kraft liner. Our auxiliary raw materials include packaging starch, ink, coal, flat filament, aiguillette, polyvinyl alcohol, and optical film. We purchase all of these raw materials from domestic suppliers in the Xi’an and Baoji municipalities of Shaanxi Province. We have not experienced any shortage in raw materials as they are readily available from a host of various suppliers in the local market. We typically enter into one-year contracts with our suppliers, with August being the month that we purchase the most inventories. Raw material prices for paper are subject to market forces, though we mitigate the risk of short-term price fluctuation by entering into one-year contracts. Any increases in costs of raw materials are passed on to our customers.

In the fiscal year ended December 31, 2011, none of our suppliers of raw materials accounted for more than 10% of our total raw material purchases.

Our major suppliers of raw materials who accounted for more than 10% of our total raw material purchases in fiscal year 2010 are:

|

Supplier Name

|

Raw Material

|

Total Purchases (US$)

|

Percentage of Purchases

|

||||||

|

Shaanxi Famensi Temple Paper Co., Ltd.

|

Paper

|

$

|

1,107,615

|

25.55

|

%

|

||||

|

Xi’an Brothers Paper Co., Ltd.

|

Paper

|

$

|

728,385

|

16.80

|

%

|

||||

|

Qishan Huaxiang Paper Containers Corporation

|

Paper

|

$

|

714,211

|

16.48

|

%

|

||||

|

Xi’an Hengfeng Paper Corporation

|

Paper

|

$

|

534,047

|

12.32

|

%

|

||||

|

Total

|

$

|

3,084,258

|

|||||||

Market Analysis

PRC Containerboard and Paper Packaging Sector

Demand for containerboard and fiber boxes is highly correlated with the performance of economic activities, such as industrial production and consumer spending. The PRC’s successful reforms have led to rapid economic growth, especially in the segments of merchandise exports and consumer spending, which in turn, have resulted in strong demand growth for containerboard and paper packaging products.

11

In the decade following 1978, when the PRC started making its transition to a market economy, domestic demand for containerboard more than doubled, rising from less than 1.0 million tons to 2.3 million tons by 1988. Since then, demand for containerboard has continued to experience very rapid growth, reaching an industrial output value exceeding 1.26 trillion RMB (US$190,842,296) in 2010. Chinese consumers are now buying processed food, beverages, clothing, footwear and durables that were unavailable during the pre-reform decades and most of these are packed in fiber-based boxes, which are lighter and easier to transport than boxes made of other materials. In addition, the open economy of the reform era has been driven, in part, by high levels of merchandise exports, such as footwear and toys. The exporting sectors are demanding quality packaging with added strength and better printability required to achieve competitiveness in the foreign markets.

The containerboard sector accounts for a considerable portion of the total paper output in the People’s Republic of China. In 2006, it accounted for 35.08% and in 2010, it accounted for 39.87%. Continued growth in containerboard continues to appear likely over the medium and long term, primarily due to the favorable outlook of China’s merchandise exports and consumer spending.

Meanwhile, demand for paper packaging goods in China has been growing about 11% each year, while output has increased by about 8% per year. According to projections from the China Packaging Federation, China’s output of cardboard boxes will need to reach 20 to 50 million tons over the next few years in order to meet current per capita consumption levels in Asia of 384 kg. It is expected that output will reach 80 million tons by 2015.

According to a survey conducted by the China Paper Association, between 2000 and 2010, total output of paper and paperboard in China increased by 10.54% with an average annual growth rate of 2.27%, while total consumption experienced an increase of 18.19% over the same period with an average annual growth rate of 10.2%.

The significant increase in demand for containerboard and packaging products is attributed to (1) a healthy growth in industrial production for durable and non-durable goods, (2) rising exports of merchandise goods resulting from the People’s Republic of China’s WTO membership, which in turn increased demand for packaging materials, (3) changing distribution systems and packaging methods, and (4) the increasing popularity of large scale retail outlets relative to traditional open markets. Demand growth for containerboard could be even stronger if fiber boards do not meet significant competition from alternative packaging materials (particularly plastics) in some end users.

Competition

We are located in the Shaanxi province, which is located in the northwest region of the People’s Republic of China. Although large domestic enterprises in the paper packaging industry, such as Xianmen Hexing Packaging, Shenzhen Meiyingsen, and Shanghai Huali Packaging, dominate the market share and retain large Fortune 500 companies in the southern, northern, central, southwest, and the Pearl River Delta regions of China, these large packaging companies occupy a relatively small market share in the northwest region of China due to the concentration of small enterprises and a weaker brand awareness in this geographic area. As such, there is a large potential for growth in the northwest region of China. Shaanxi Province is one of the first areas where the packaging industry has begun to develop, and there are ample human and technical resources to draw on in this province. Impeded by geographic factors (desert to the north, mountains to the south), to-date Shaanxi Province has developed at a slower pace than the coastal cities of China.

Currently there are two large packaging enterprises in the Shaanxi region, Haomao Industrial Group Co., Ltd. and Xi’an Tingjin Food Co., Ltd ("Kangshifu"). These companies manufacture and supply packaging products primarily for use by their affiliated companies: Baoji Haomao Industry Group Co., Ltd. primarily produces cigarette and liquor packaging for the company’s other branded products, while Kangshifu primarily produces packaging for its Master Kong brand of instant noodle and beverage products. These two companies operate on a large scale to service their parent companies’ needs.

In contrast, Jinqiu does not source exclusively to one company, but to various customers from different sectors in the northwest region of China, including the medical, food packaging, agricultural, and ceramic industries. Although it is of a smaller production scale than the above-mentioned competitors, Jinqiu, which had revenue of over $8 million in 2010, is a relatively large company in the Baoji municipality compared to the average revenue of Baoji companies of about $4.4 million. The northwest region is ripe for development with industrial zones, such as the Jiangxiang Food Industry Zone and the Agricultural Hi-tech Industrial Demonstration Zone that we anticipate will provide a growing source of demand for our packaging products. In June 2009 the State Council approved the "Guanzhong - Tianshui Economic Zone Development Plan" which, as one of western China’s three key economic development zones, will promote inland development in the region. The planned area for this zone includes Shaanxi and the neighboring Gansu province and encapsulates Xi’an, Baoji, and the Yangling Agricultural Hi-tech Industrial Demonstration Zone. Construction has commenced and is charted to be completed in 2020.

As a relatively early entrant to the northwest packaging industry, we have capitalized on our local positioning to attract a stable local labor and customer base. We minimize our labor costs by recruiting a flexible labor force from the local regions, which enables us to employ workers as our seasonal needs arise and helps foster good relations with our local government. We also attract local and regional customers who wish to save on transportation costs as well as overall costs when purchasing our goods.

We have a robust team of 21 technical staff who are highly experienced in their respective fields and a research and development center comprised of 3 full-time design engineers who design new packaging products that satisfy our customers’ needs as well as innovate and improve upon our existing technology.

12

Intellectual Property

We applied to register our company logo as a trademark in the People’s Republic of China and received approval on December 7, 2009 from the Trademark Bureau of the State Administration of Industry and Commerce (“SAIC”). The use of this trademark is authorized from March 28, 2010 to March 27, 2020. The details of our protected trademark are accessible on the SAIC’s website.

Research and Development Activities

We have a research and development center comprising 3 full-time design engineers, which we believe ensures that we stay ahead of the curve by constantly innovating and improving our technology.

Our research and development expenditures are a part of our daily operating expenses.

Government Regulations

In recent years, the State Environmental Protection Administration promulgated a series of environmental protection laws, regulations and policies, including the Catalogue of Environment-Friendly Industries to Be Developed as of the Present Time, Technical Guiding Catalog of Cleaner Production of National Key Industry and Catalogue of Outdated Production Capacity, Technologies and Products to Be Phased Out.

The PRC government strictly regulates the papermaking industry, which can be highly pollutive. Since we obtain as our raw material already processed kraft paper and our business produces relatively low amounts of pollution, we are not subject to the same level of environmental regulation as others in the paper industry. We are not aware of any investigations, prosecutions, disputes, claims or other proceedings in respect of environmental protection, nor have we been subject to any action by any environmental administration authorities of the PRC.

Jinqiu is also subject to standard business license and approval regulations that are required for all corporations in the People’s Republic of China. We have a printing license issued by the News Publishing Regulatory Bureau, License No. 618200212, which enables us to engage in color printing and label printing and is valid through March 31, 2013.

Jinqiu is subject to People’s Republic of China environmental laws, rules and regulations that are standard to manufacturing facilities. To our knowledge, our operations meet or exceed the existing requirements of the PRC.

Approvals, Licenses and Certificates

We require a number of approvals, licenses and certificates in order to operate our business. Our principal approvals, licenses and certificates are set forth below.

|

●

|

Business License (No. 610324100001325) issued on April 2, 2009 by the Fufeng County Industry and Commerce Administration.

|

|

●

|

Printing Operations License (No. Shaan Xin Chu Ying Zhi No. 618200212) issued on April 12, 2010, by Shaanxi News and Publications Bureau, valid through March 31, 2013.

|

|

|

●

|

Organization Code Certificate issued by Fufeng County Quality and Technical Supervisory Bureau (code No. 22149587-9, and registration No. 610324-0011397-1), the valid period of which is from March 6, 2008 to March 6, 2012.

|

|

●

|

Taxation Registration Certificate (Bao Feng Di Shui Zi No. 610324221495879-030011824) issued by the Fufeng County Industry and Commerce Administration on October 29, 2006.

|

|

|

●

|

Taxation Registration Certificate (Bao Feng Di Shui Zi No. 610324221495879) issued by the Fufeng County Industry and Commerce Administration on November 4, 2006 (for land).

|

Employees

Due to the relative seasonality of our business, Jinqiu has between 150 and 200 full-time employees. We may retain more or less workers depending on our seasonal needs. Our employees are generally broken down into:

|

Management

|

- 8

|

|

|

Sales personnel

|

- 28

|

|

|

Technicians

|

- 21

|

|

|

Financial

|

- 7

|

|

|

Production

|

- 100 to 150

|

|

|

Procurement

|

- 3

|

13

|

Item 1A.

|

Risk Factors

|

You should consider carefully each of the following business and investment risk factors and all of the other information in this report. If any of the following risks and uncertainties develops into actual events, the business, financial condition or results of our operations could be materially and adversely affected. If that happens, the trading price of our shares of common stock could decline significantly. The risk factors below contain forward-looking statements regarding our business. Actual results could differ materially from those set forth in the forward-looking statements. See "Cautionary Note Regarding Forward-Looking Statements."

Risks Related to the Company's Business and Industry

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

We are in our early stages of development and face risks associated with a new company in a growth industry. We may not successfully address these risks and uncertainties or successfully implement our operating strategies. If we fail to do so, it could materially harm our business to the point of having to cease operations and could impair the value of our common stock to the point investors may lose their entire investment. Even if we accomplish these objectives, we may not generate positive cash flows or the profits we anticipate in the future.

Although our revenues have grown rapidly since our inception from the increasing demand for our containerboard products, we cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

|

●

|

expand our product offerings and maintain the high quality of our products;

|

|

●

|

manage our expanding operations, including the integration of any future acquisitions;

|

|

●

|

obtain sufficient working capital to support our expansion and to fill customers' orders in time;

|

|

●

|

maintain adequate control of our expenses;

|

|

●

|

implement our product development, marketing, sales, and acquisition strategies and adapt and modify them as needed;

|

|

●

|

anticipate and adapt to changing conditions in the containerboard and paper products markets in which we operate as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

Intense competition in our market could harm our ability to maintain profitability.

We face competition in the containerboard and packaging industries and expect to face more intense competition with more market entrants in the packaging industry in northwest China as construction of the Guanzhong-Tianshui Economic Zone nears completion. Although we view ourselves in a favorable position vis-à-vis our competition due to our early market entry, some of the other companies that sell into our market may be more successful than us and/or have more experience and money than we do. The additional experience and money may enable our competitors to produce more cost-effective products and market their products with more success than we are able to, which would decrease our sales. In particular, since the packaging industry is labor-intensive, our competitors may be more successful in optimizing their production efficiency and thereby maximizing their competitiveness. We expect that we will be required to continue to invest in product development and productivity improvements to compete effectively in our markets. However, we cannot give you assurance that we can successfully remain competitive. If our competitors could develop a more efficient product or undertake more aggressive and costly marketing campaigns than us, which may adversely affect our marketing strategies and could have a material adverse effect on our business, results of operations or financial condition.

14

Our inability to fund our capital expenditure requirements may adversely affect our growth and profitability. Our continued growth is dependent upon our ability to raise capital from outside sources. Our ability to obtain financing will depend upon a number of factors, including:

|

●

|

our financial condition and results of operations,

|

|

|

●

|

the condition of the People’s Republic of China economy and the containerboard/paper packaging sector in the PRC,

|

|

|

●

|

conditions in relevant financial markets; and

|

|

|

●

|

relevant People’s Republic of China laws regulating the same.

|

If we are unable to obtain financing, as needed, on a timely basis and on acceptable terms to our investors or lenders, our financial position, competitive position, growth and profitability may be adversely affected.

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. In addition, we may face challenges in managing expanding product offerings and in integrating acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies.

Significant fluctuations in raw material prices may have a material adverse effect on us.

We typically enter into one-year supply contracts with our raw material suppliers. Any significant fluctuation in price of our raw materials may have a material adverse effect on the manufacturing cost of our products. In particular, our primary raw materials, teaboard paper, kraft liner, semi-recycled paper, and coated paper, are highly affected by international market conditions and although these raw materials are generally available and we have not experienced any raw material shortage in the past, we cannot assure you that the necessary materials will continue to be available to us at prices currently in effect or acceptable to us.

We may have limited options in the short-term for alternative supply if our suppliers fail for any reason, including their business failure or financial difficulties, to continue the supply of materials or components. Moreover, identifying and accessing alternative sources may increase our costs. In the event our cost of materials is increased, we may have to raise prices of our products, making us less competitive price-wise.

We may not be able to adjust our product prices, especially in the short-term, to recover the costs of any increases in raw materials. Our future profitability may be adversely affected to the extent we are unable to pass on higher raw material costs to our customers.

Our revenue is dependent, in large part, on significant orders from customers within 60 km of our facilities. We believe that revenue derived from such customers will continue to represent a significant portion of our total revenue although we plan to diversity our customer base by, among other things, expanding our sales. Our inability to continue to secure and maintain a sufficient number of large customers or increase our customer base would have a material adverse effect on our business, operating results and financial condition. Moreover, our success will depend in part upon our ability to obtain orders from new customers, as well as the financial condition and success of our customers and general economic conditions.

We usually enter into annual contracts with our customers. If there is an unforeseen circumstance e.g. in the dramatic increase of the costs of our raw materials, we may have to honor these contracts and suffer a loss if we are unable to renegotiate the terms.

We may be exposed to intellectual property infringement and other claims by third parties, which, if successful, could cause us to pay significant damage awards and incur other costs.

Our success also depends in large part on our ability to use and develop our technology and know-how without infringing the intellectual property rights of third parties. As litigation becomes more common in the People’s Republic of China in resolving commercial disputes, we face a higher risk of being the subject of intellectual property infringement claims. The validity and scope of claims relating to the manufacturing of containerboard products involve complex technical, legal and factual questions and analysis and, therefore, may be highly uncertain. The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability, including damage awards, to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or subject us to injunctions preventing the manufacture and sale of our products. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase or use of our products until resolution of such litigation. Further, we do not have adequate product liability insurance coverage against defective products as our products are manufactured according to fairly basic formulas. Any disputes so far have been resolved through friendly negotiations. There is no guarantee that we will not be involved in any legal proceedings should such negotiations fail one day.

15

Potential environmental liability could have a material adverse effect on our operations and financial condition.

To the knowledge of our management team, neither the production nor the sale of our products constitute activities, or generate materials in a material manner, that requires our operation to comply with the People’s Republic of China environmental laws. Although it has not been alleged by People’s Republic of China government officials that we have violated any current environmental regulations, we cannot assure you that the People’s Republic of China government will not amend the current People’s Republic of China environmental protection laws and regulations. Our business and operating results may be materially and adversely affected if we were to be held liable for violating existing environmental regulations or if we were to increase expenditures to comply with environmental regulations affecting our operations.

We rely on Mr. Yongming Feng, our chairman and chief executive officer, for the management of our business, and the loss of his services may significantly harm our business and prospects.

We depend, to a large extent, on the abilities and participation of our current management team, but have a particular reliance upon Mr. Yongming Feng for the direction of our business. The loss of the services of Mr. Feng, for any reason, may have a material adverse effect on our business and prospects. We cannot assure you that the services of Mr. Feng will continue to be available to us, or that we will be able to find a suitable replacement for Mr. Feng.

We do not have key man insurance on Mr. Feng, our chairman and chief executive officer, upon whom we rely primarily for the direction of our business. If Mr. Feng dies and we are unable to replace Mr. Feng for a prolonged period of time, we may be unable to carry out our long term business plan and our future prospect for growth, and our business, may be harmed.

We may not be able to hire and retain qualified personnel to support our growth and if we are unable to retain or hire such personnel in the future, our ability to improve our products and implement our business objectives could be adversely affected.

Our future success depends heavily upon the continuing services of the members of our senior management team, in particular our chairman and chief executive officer, Mr. Feng. If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all, and our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Competition for senior management and personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. Such failure could materially and adversely affect our future growth and financial condition.

Our management is comprised almost entirely of individuals residing in the People’s Republic of China with very limited English skills.

Our management is comprised almost entirely of individuals born and raised in the PRC. As a result of differences in culture, educational background and business experiences, our management may analyze, evaluate and present business opportunities and results of operations differently from the way they are analyzed, evaluated and presented by management teams of public companies in Europe and the United States. In addition, our management has very limited skills in English. Consequently, it is possible that our management team will emphasize or fail to emphasize aspects of our business that might customarily be emphasized in a different manner by comparable public companies from different geographical and political areas.

Our management is not familiar with the United States securities laws.

Our management and the former owners of the businesses we acquire are generally unfamiliar with the requirements of the United States securities laws and may not appreciate the need to devote the resources necessary to comply with such laws. A failure to adequately respond to applicable securities laws could lead to investigations by the Securities and Exchange Commission and other regulatory authorities that could be costly, divert management's attention and disrupt our business.

We have inadequate insurance coverage.

We do not presently maintain product liability insurance, and our property and equipment insurance does not cover the full value of our property and equipment, which leaves us with exposure in the event of loss or damage to our properties or claims filed against us.

16

We currently do not carry any product liability or other similar insurance. We cannot assure you that we would not face liability in the event of the failure of any of our products. This is particularly true given our plan to significantly expand our sales into international markets, like the United States, where product liability claims are more prevalent.

Except for property and automobile insurance, we do not have other insurance such as business liability or disruption insurance coverage for our operations in the PRC.

We do not maintain a reserve fund for warranty or defective products claims. Our costs could substantially increase if we experience a significant number of warranty claims. We have not established any reserve funds for potential warranty claims since historically we have experienced few warranty claims for our products so that the costs associated with our warranty claims have been low. If we experience an increase in warranty claims or if our repair and replacement costs associated with warranty claims increase significantly, it would have a material adverse effect on our financial condition and results of operations.

We will continue to incur significant costs as a result of operating as a public company, and management will be required to devote substantial time to new compliance requirements. If we fail to comply in a timely manner, our business could be harmed and our stock price could decline.

As a public company, we incur significant legal, accounting and other expenses under the Sarbanes-Oxley Act of 2002, together with rules implemented by the Securities and Exchange Commission and applicable market regulators. These rules impose various requirements on public companies, including requiring certain corporate governance practices. Management and other personnel will need to devote a substantial amount of time to these new compliance requirements. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of U.S. public companies’ internal control over financial reporting, and attestation of this assessment by their independent registered public accountants. While the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts smaller reporting companies with respect to the attestation by their independent registered public accountants as to our financial controls, this exception does not affect the requirement that we include a report of management on our internal controls over financial reporting and will not affect the requirement to include the auditor's attestation if our public float exceeds $75 million and we cease to be smaller reporting company. Existing standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. For the year ended December 31, 2011, our CEO and CFO have concluded that there was a material weakness in our internal control and therefore our internal control over financial reporting was not effective. Please refer to item 9A.

Risks Related to Doing Business in the PRC

Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

Our business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the PRC’s Communist Party. The Chinese government exerts substantial influence and control over the manner in which we and it must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1988. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in the PRC may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The PRC's economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case.

A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social life.

17

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm its business.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. The PRC’s legal system is a civil law system based on written statutes, in which system decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We are considered a foreign persons or foreign funded enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on its businesses. If the relevant authorities find that we are in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

|

●

|

levying fines;

|

|

●

|

revoking Baoji (JV) or Jinqiu’s business and other licenses;

|

|

●

|

requiring that we restructure our ownership or operations; and

|

|

●

|

requiring that we discontinue any portion or all of our business.

|

Among the material laws that we are subject to are the Price Law of The People’s Republic of China, Measurement Law of The People’s Republic of China, Tax Law, Environmental Protection Law, Contract Law, Patent Law, Accounting Laws and Labor Law.

Our contractual arrangements with Jinqiu and its shareholders may not be as effective in providing control over Jinqiu as direct ownership.

Since the law of the PRC limits foreign equity ownership in companies in China, we operate our business through Jinqiu. We have no equity ownership interest in Jinqiu and rely on contractual arrangements to control and operate its business. These contractual arrangements may not be effective in providing control over Jinqiu as direct ownership. For example, Jinqiu could fail to take actions required for our business despite its contractual obligation to do so. If Jinqiu fails to perform under their agreements with us, we may have to incur substantial costs and resources to enforce such arrangements and may have to rely on legal remedies under the law of the PRC, which may not be effective. In addition, we cannot assure you that the Jinqiu shareholders would always act in our best interests.

Because we may rely on the management entrustment agreement with Baoji (JV) and Jinqiu for essentially all of our revenue and cash flows, any difficulty for Jinqiu to pay management fees to Baoji (JV) or for Baoji (JV) to pay management fees to APPI under the management entrustment agreements may have a material adverse effect on our operations.

We are a holding company and currently do not conduct any business operations other than the contractual arrangements between Baoji (JV) and Jinqiu. As a result, we may rely entirely for our revenues on dividend payments from Baoji (JV) for any payment from Jinqiu pursuant to the management entrustment agreement which forms a part of the contractual arrangements between Baoji (JV) and Jinqiu. Likewise, we rely on the contractual agreements between APPI and Baoji (JV) to ensure that any payments from Jinqiu are passed up to USTP. Since Baoji (JV) is not a legal shareholder of Jinqiu under PRC statutes, the arrangement for Jinqiu to pay a substantial portion of its net income to Baoji (JV) may be challenged by the PRC government, which could prevent us from issuing dividends to our shareholders or making required payments to some of our service providers.

A slowdown, inflation or other adverse developments in the PRC economy may harm our customers and the demand for our services and products.

All of our operations are conducted in the PRC and all of our revenue is generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that this growth will continue. A slowdown in overall economic growth, an economic downturn, a recession or other adverse economic developments in the PRC could significantly reduce the demand for our products and harm our business.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth could lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may harm our profitability. In order to control inflation in the past, the PRC government has imposed controls on bank credit, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth. In October 2004, the People's Bank of China, the PRC's central bank, raised interest rates for the first time in nearly a decade and indicated in a statement that the measure was prompted by inflationary concerns in the Chinese economy. Repeated rises in interest rates by the central bank would likely slow economic activity in the PRC which could, in turn, materially increase its costs and also reduce demand for its products.

18

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive substantially all of our revenue in Renminbi, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency dominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

The PRC government may also in the future restrict access to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

The fluctuation of the Renminbi may harm your investment.