Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HARVEST NATURAL RESOURCES, INC. | d334395d8k.htm |

IPAA

Oil and Gas Investment Symposium IPAA Oil and Gas Investment Symposium

April 16

th

-

18

th

, 2012

Exhibit 99.1 |

Forward Looking Statements

Forward Looking Statements

NYSE: HNR

www.harvestnr.com

1

Cautionary

Statements:

Certain

statements

in

this

presentation

are

forward-looking

and

are

based

upon

Harvest’s

current belief as to the outcome and timing of future events. All statements

other than statements of historical facts including

planned

capital

expenditures,

increases

in

oil

and

gas

production,

Harvest’s

outlook

on

oil

and

gas

prices,

estimates of oil and gas reserves, business strategy and other plans, estimates,

projections, and objectives for future operations, are forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. Important

factors that could cause actual results to differ materially from those in the

forward-looking statements herein include Harvest’s concentration of

assets in Venezuela; timing and extent of changes in commodity prices for

oil and gas; political and economic risks associated with international operations; and other risk

factors as described in Harvest’s Annual Report on Form 10-K and other

public filings. Should one or more of these risks or uncertainties

occur, or should underlying assumptions prove incorrect, Harvest’s actual results and plans could

differ materially from those expressed in the forward-looking statements.

Harvest undertakes no obligation to publicly update or revise any

forward-looking statements. Harvest may use certain terms such as

resource base, contingent resources, prospective resources, probable reserves,

possible reserves, non-proved reserves or other descriptions of volumes of

reserves. These estimates are by their nature more speculative than

estimates of proved reserves and accordingly, are subject to substantially greater risk of

being actually realized by the Company. Investors are urged to consider

closely the disclosure in our 2011 Annual Report on Form 10-K and other

public filings available from Harvest at 1177 Enclave Parkway, Houston, Texas, 77077

or from the SEC’s website at www.sec.gov.

Contingent resources are resources that are potentially recoverable but not yet

considered mature enough for commercial

development

due

to

technological

or

business

hurdles.

Prospective

resources

are

those

quantities

of

hydrocarbons which are estimated, as of a given date, to be potentially recoverable

from undiscovered accumulations by application of future development

projects. They indicate exploration opportunities and development potential in the

event a discovery is made and should not be construed as contingent resources or

reserves. The contingent and prospective resources included in this

presentation were internally developed by Harvest Natural Resources. |

About

Harvest About Harvest

NYSE: HNR

www.harvestnr.com

2

Market Data

Exchange/Ticker

NYSE: HNR

Market Capitalization *

$ 226 MM

Enterprise Value

$ 200 MM

Cash (12/31/2011)

$ 58 MM

Debt (12/31/2011)

$ 32 MM

Shares Outstanding

37 MM

Institutional Ownership

85%

*

As of April 9, 2012 |

2011/2012 Highlights

2011/2012 Highlights

NYSE: HNR

www.harvestnr.com

3

Closed the sale of Utah assets in May 2011:

Received proceeds of $217.8 million (net $205 million)

138% return on investment

Increased gross production in Venezuela to 11.4 million barrels of oil, an

increase of 33% over 2010

Current production 37,000 bopd, 18% above average 2011

Q1 2012 oil production of 32,790 bopd, 16% above Q1 2011

Production increases driven by drilling and infrastructure buildout

Exploration Program:

Discovered and appraised oil on Dussafu Block in Gabon. Acquired new 3D

survey. Drilled two wells on Budong-Budong Block in Indonesia which

confirmed the presence of a working petroleum system

Drilled two exploration wells on Block 64 in Oman; both plugged

Reduced debt to $15.5 million in March 2012, down from $81.2 million at

year-end 2009 |

2012

Outlook 2012 Outlook

NYSE: HNR

www.harvestnr.com

4

Petrodelta growing production, cash flow, EBITDA and

reserves

Analyze commercial development options of the discoveries in

Gabon. Process and evaluate new 3D followed by two well

program.

Evaluate exploration program to target the Pliocene and Miocene

oil potential of the Budong-Budong license.

Continue the evaluation of opportunities in Al Ghubar/Qarn Alam

license onshore Oman

Exposure to High Impact Exploration:

Continue to advance the Strategic Alternatives process |

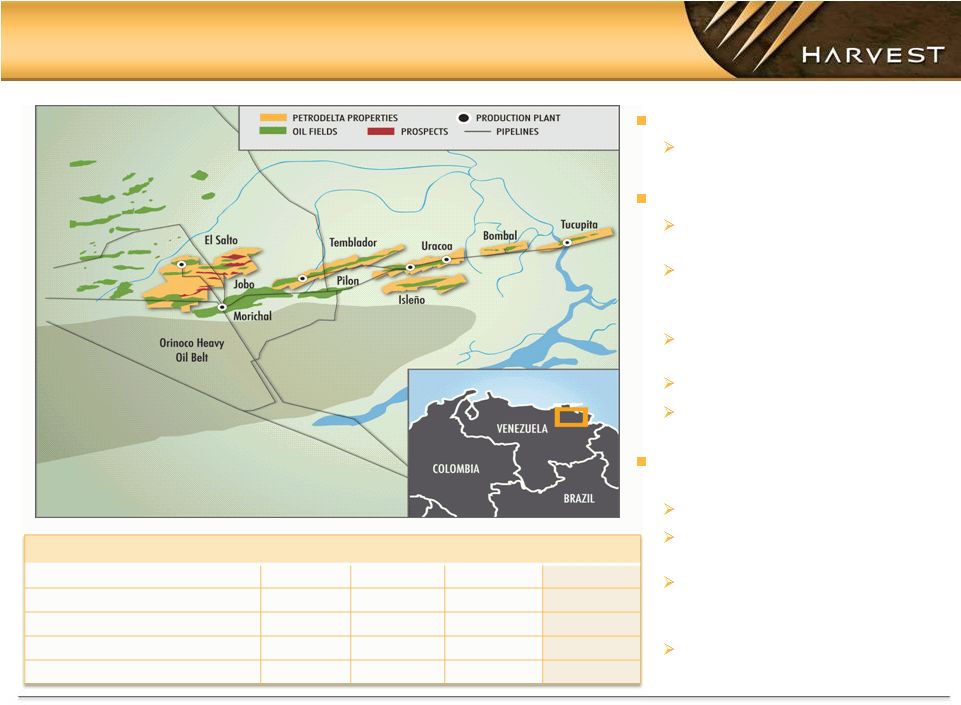

Venezuela -

Venezuela -

Petrodelta

Petrodelta

NYSE: HNR

www.harvestnr.com

5

32% Equity Interest in Petrodelta

Six fields, 9.1 billion barrels of gross

oil-in-place

Growth underway

Current production rate of 37,000

bopd, 18% above 2011 average

Successful development program

ongoing in Temblador, Isleño and El

Salto

Isleño producing 2,400 bopd from

two horizontal wells

Infrastructure build underway

Capital program funded 100% by

Petrodelta internal cash flow

Operations generating solid

financial performance

2011 CFO of $196 million (gross)

$84 million in dividends (net to HNR)

received since 2008

$9.8 million (net to HNR) in dividends

declared and receivable, still

outstanding

Cash surplus Jan 2010 -

Dec 2011:

$66 million net to HNR 32% interest

2008

2009

2010

2011

Cash From Operations ($MM, Gross)

94

140

192

196

Production (MMBOE, Gross)

7.3

8.6

8.9

11.8

Proved Reserves (MMBOE, net to (Harvest)

43.3

46.3

50.0

43.3

2P Reserves (MMBOE, net to Harvest)

70.1

83.3

103.6

103.8

3P Reserves (MMBOE, net to Harvest)

132.4

224.3

220.6

210.5 |

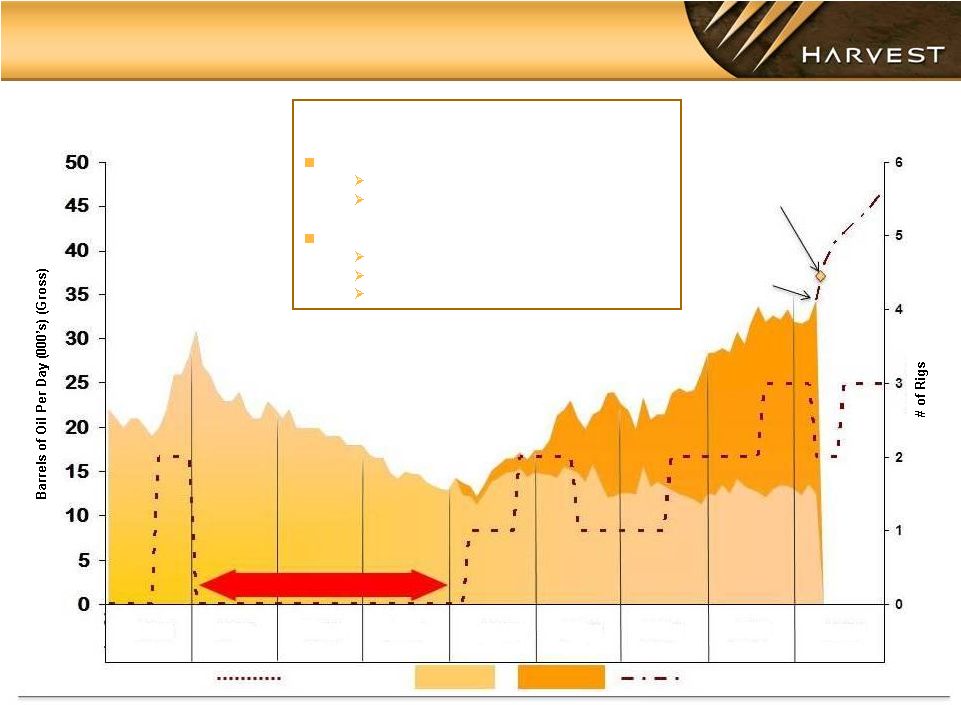

Petrodelta Production

Petrodelta Production

NYSE: HNR

www.harvestnr.com

6

Average

March 2012

34.4 MBOPD

Current

37.5 MBOPD

2012 Outlook

40,300 BOPD average full year

34,400 BOPD average March 2012

37,540 BOPD 1

st

week of April 2012

$300 million Capex for 2012

New fields Infrastructure

3 rigs for development wells

33 new oil wells

Conversion Process

# of Drilling Rigs

Production Outlook

SMU

New Fields

2004

2005

2006

2007

2008

2009

2010

2011

2012 |

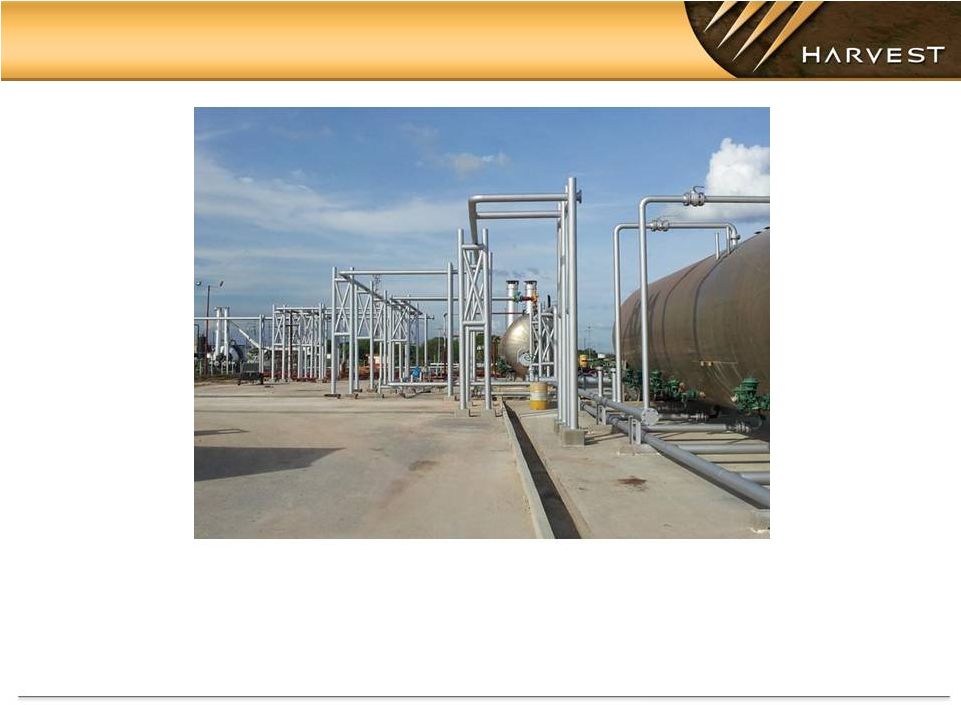

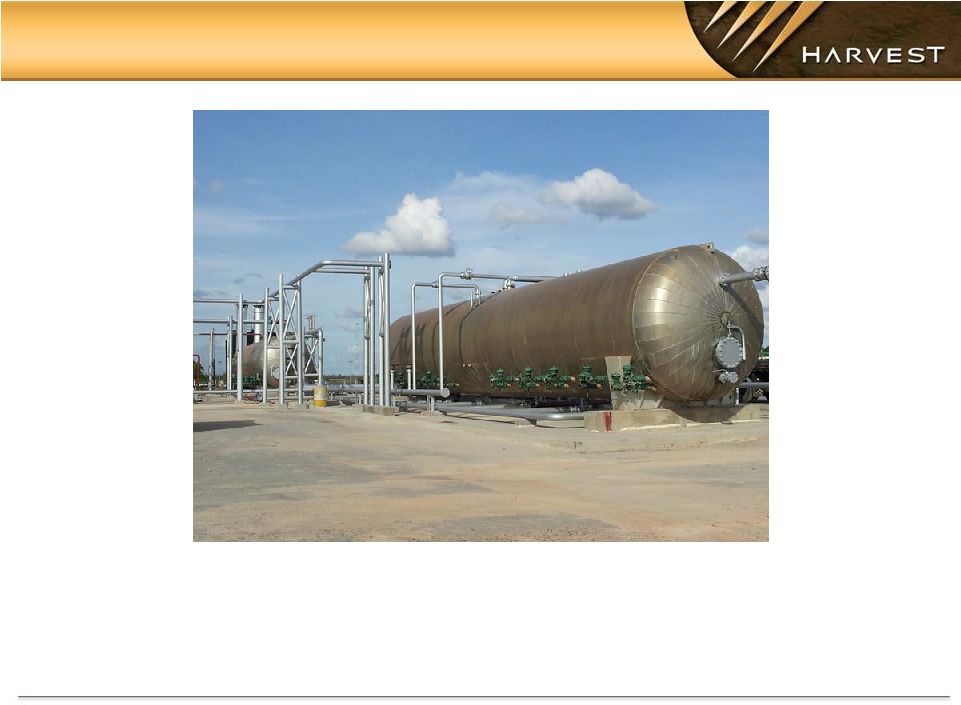

El

Salto Field El Salto Field

New FWKO and Separators with capacity of 20 MBOPD

NYSE: HNR

www.harvestnr.com

7

Petrodelta New Facilities

Petrodelta New Facilities |

El

Salto Field El Salto Field

ELS 31 Flaring Facility

NYSE: HNR

www.harvestnr.com

8

Petrodelta New Facilities

Petrodelta New Facilities |

NYSE: HNR

www.harvestnr.com

9

Petrodelta New Facilities

Petrodelta New Facilities

El Salto Field

El Salto Field

Planned Central Processing Facility Layout |

Temblador Field

Temblador Field

New FWKO and Treater with capacity of 15 MBOPD

NYSE: HNR

www.harvestnr.com

10

Petrodelta New Facilities

Petrodelta New Facilities |

Petrodelta Reserves Valuation

Petrodelta Reserves Valuation

NYSE: HNR

www.harvestnr.com

11

Ryder Scott reserve report @ 12/31/2011

WTI =

$96.2/BBL, Petrodelta oil price = $98.4/BBL

(Net to Harvest Natural Resources 32% Interest)

Net Resource Base*

Proved Probable Possible

Oil, MMBBL

38.7

53.5

101.9

Gas, BCF

27.8

41.9

29.5

Total, MMBOE

43.3

60.5

106.8

Proved

2P

3P

Reserves (MMBOE) *

43.3

103.8

210.5

After –

Tax PV10 ($MM):

As of 12/31/2011:

543

1,053

1,918

Per BOE

(1)

$12.5

$10.1

$9.1

* Net to HNR after 33.33% royalty.

(1)

Includes

the

new

Windfall

Profit

Tax.

The

impact

of

the

Windfall

Profit Tax change has been

calculated based on HNR’s current understanding of the new legislation. The

Venezuelan authorities have

yet

to

clarify

some

issues

related

to

the

implementation

of

the tax.

At December 31, 2011

Six fields with 9.1 billion barrels gross OOIP

43.3 million BOE net Proven, 167.2 million BOE net Probable and Possible

2012 Drilling Program at El Salto, Temblador and Isleño fields will continue to

drive reserve additions

Petrodelta Reserves Value

(After

Tax

(2)

-

Net

to

HNR

32%

Interest

)

(2)

After

Venezuelan

Income

Taxes

but

before U.S. Income Taxes |

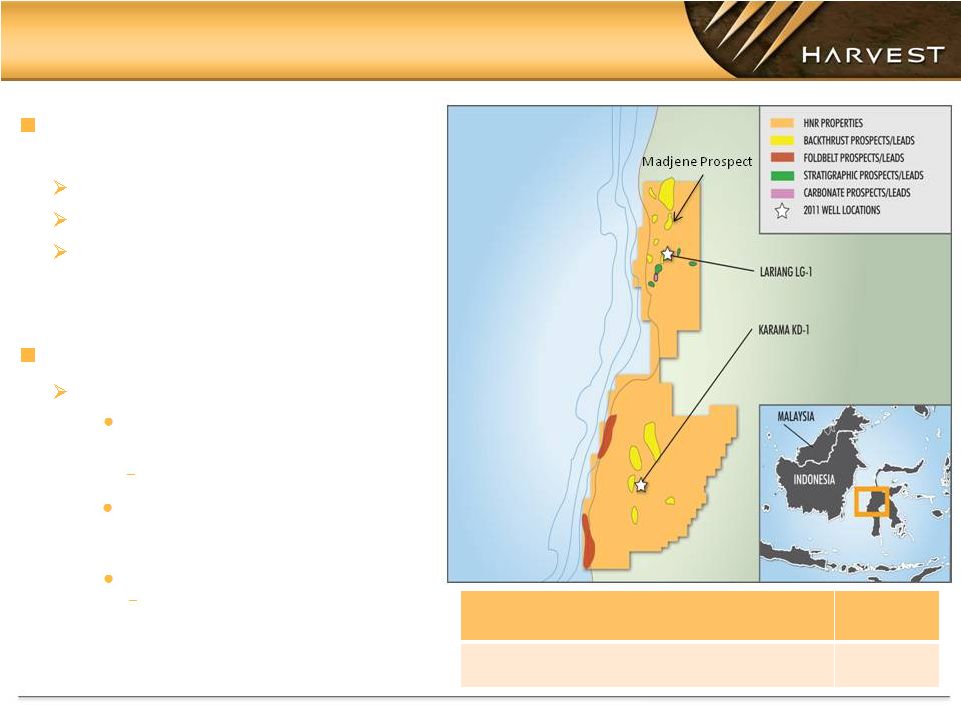

Indonesia -

Indonesia -

Budong-Budong

Budong-Budong

NYSE: HNR

www.harvestnr.com

12

747,862 acre PSC, Onshore West

Sulawesi, Indonesia

64.4% interest

License commitments fulfilled

Final relinquishment due in Jan 2013,

20% of original area to be retained

(271,429 acres)

2012 Activity

Prospects and leads being matured

Lariang Basin: Technical review

March 2012

Madjene prospect high graded

Karama Basin prospectivity being

worked: Technical review planned for

July 2012

Exploration well planned in 2013

Geological & operational preparations

under evaluation

Gross Unrisked Prospective Resources

(MMBBL) –

Lariang Sub-Basin

Mean

Prospects (9)

585 |

Gabon

- Gabon -

Dussafu

Dussafu

NYSE: HNR

www.harvestnr.com

13

680,000 acre PSC, Offshore

Gabon

66.667% operated interest

2

nd

Exploration Period extended until

May 27, 2012

Option to enter 3

rd

Exploration

Period

4 year term being negotiated

2012 Activity

Exploration drilling

Technical committee defined

additional prospects

Tortue prospect agreed as next

target

Well planning in progress

3D processing & reprocessing

Central 3D PSTM 66% complete

ITT issued for PSDM & inboard 3D

reprocessing

Tortue Prospect |

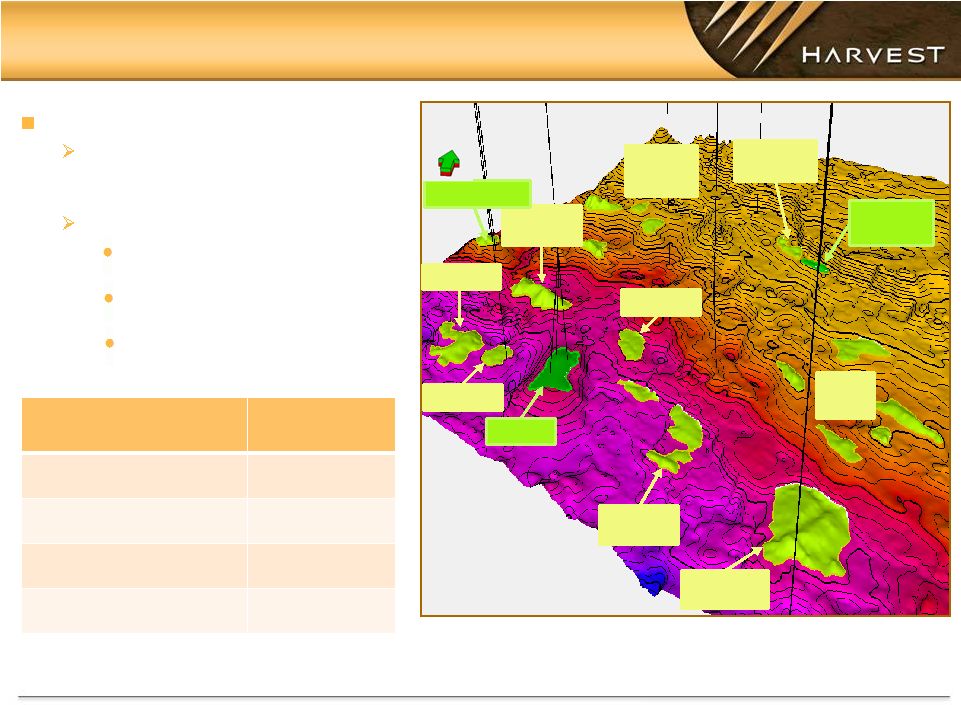

Dussafu Resources

Dussafu Resources

NYSE: HNR

www.harvestnr.com

14

Proven hydrocarbon system

Discoveries -

Ruche (oil), Moubenga

(oil), Walt Whitman (oil), GMC-1X

(gas/condensate)

Prospectivity at multiple levels

Post-Salt (Madiela) -

Secondary

target in Tchibobo

Gamba -

Dussafu 3D area >250

MMBBL

Syn-Rift Pre-Salt

Visualization of

Gamba structure with

Discoveries (green) and

Prospects (yellow)

Ruche

Walt

Whitma

n

Hibiscus

Mupale

Hibiscus

North

Moubenga

Lead 6

Lead 18

Tortue

Leads

12-15

N

Unrisked Resources

(MMBBL)

Mean

Contingent Resource

23

Prospects (12)

235

Leads (12)

170

TOTAL

428

NW Walt

Whitman

Leads

19-23 |

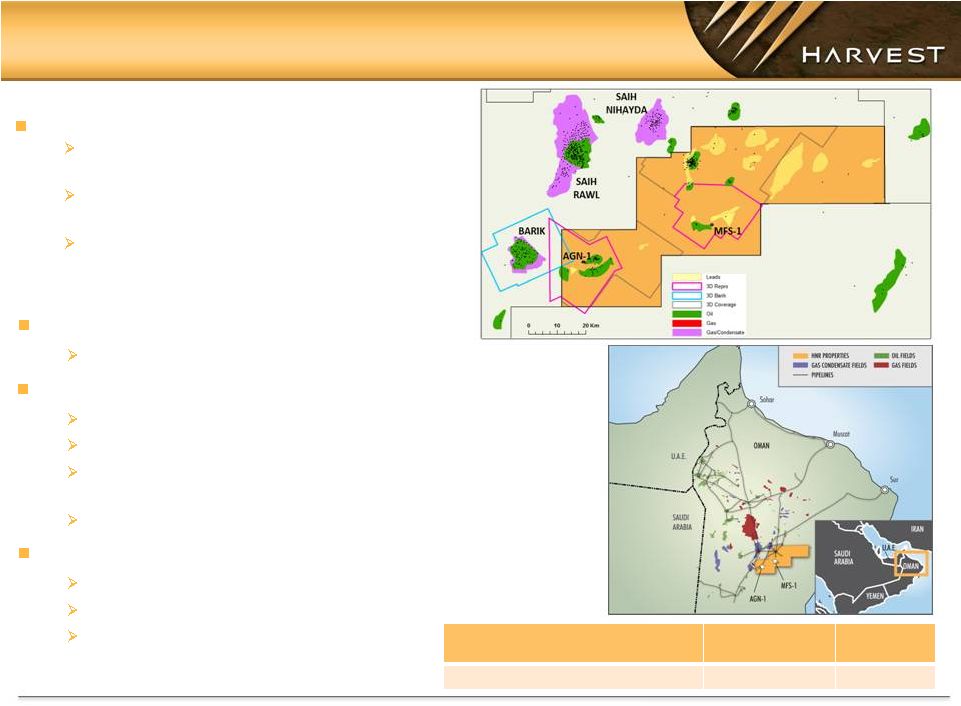

Oman

– Oman –

Block 64

Block 64

NYSE: HNR

www.harvestnr.com

15

956,000 acre EPSA, Onshore Oman

80% operated interest (Oman Oil has a 20%

interest)

Large Paleozoic gas and condensate play in

Ghaba Basin beneath shallow oil fields

Proximal to infrastructure for domestic and

LNG markets with offtake guaranteed by the

Omani Government

Mean Gross Unrisked Prospective

Resources

Condensate

(MMBBL)

Gas (BCF)

Prospects (12)

250

6,113

Initial Period Current To May 2013

Work commitment fulfilled

Post-well studies –

post-mortem

PI revision –

based on results of MFS-1 and AGN-1

Review potential for a pre-salt unconventional shale play on the

eastern portion of Block 64

G&G Studies for Ghaba Flank

200 km 2D seismic acquisition

Reprocess 100 km2 of existing 3D seismic data

1 exploration well to Haima Supergroup

GHABA FLANK

2012 Activity

Second

Phase

–

May

2013

to

May

2016 |

Value

Exposure of HNR Portfolio Value Exposure of HNR Portfolio

NYSE: HNR

www.harvestnr.com

16

AGQA

BUDONG

$/share

DUSSAFU

Share Price Exposure

Exploration EMV

(Based on Mean Resources, $96/BBL WTI and 37 MM shares)

The Expected Monetary Value (EMV) is a function of the dry hole cost of the well, the NPV of

the prospect/lead in the event of discovery and the chance of making a discovery. The value of the assets

presented in this chart is estimated by arithmetically adding the EMV10 of each of the

prospects and leads for which a chance of success is available. Only prospects and leads with positive EMV are

included. The NPV of a discovery has been estimated using the mean prospective resources of

the prospect/lead. When applicable, the estimated value of the contingent resources is also included.

There can be no assurance that the estimates presented or the underlying assumptions will be

realized and that actual results of operations or future events will not be materially different from the

estimates presented. These estimates have been internally developed by Harvest Natural

Resources.

|

2012

Program 2012 Program

NYSE: HNR

www.harvestnr.com

17

Project/Unit

Country

Activity

Q1

Q2

Q3

Q4

Seismic & G&G

Exploration Drilling

Appraisal Drilling

G&G

Development

Exploration Drilling

Appraisal Drilling

G&G/Seismic

Well Operations

Development

Exploration Drilling

Appraisal Drilling

G&G

Development

Seismic & G&G

Exploration Drilling

Appraisal Drilling

Development

Al Ghubar/Qarn Alam

(Block 64)

Dussafu

Gabon

Oman

Petrodelta

Venezuela

2012

Budong-Budong

Indonesia

LG-1 & KD-1 Evaluation, Surface structural & Oil

seep mapping, Lariang & Karama Basin evaluation

Exploration Plan Decision Point

Exploration Well: Tendering & Procurement

Engineering & Well Design

1 Well

Drilling and Infrastructure New Fields

2nd Expl/App Well

3D Processing and Reprocessing

Agree Locations and Objectives, Well Design, LLI

Well post-mortem, PI Revision, 2D Reprocessing, 3D Mapping

|

Why

Invest in Harvest? Why Invest in Harvest?

NYSE: HNR

www.harvestnr.com

18

Demonstrated ability to generate value through exploration

with exposure to high-potential exploration prospects in

Indonesia, Gabon and Oman

Building Pipeline of Future Oil-focused Plays

Strong Balance Sheet and Organization

Significant Valuation Gap

Petrodelta CFO funding strong growth in production

Significant weight towards oil relative to our peers

Portfolio provides for value exposure in excess of 10x current stock

price

Commitment to Long Term Shareholder Value |