Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - MINT LEASING INC | Financial_Report.xls |

| EX-31 - MINT LEASING INC | ex31.htm |

| EX-32 - MINT LEASING INC | ex32.htm |

| EX-10.13 - MINT LEASING INC | ex10-13.htm |

| 10-K - MINT LEASING INC | mint10k123111.htm |

Exhibit 10.12

FOURTH RENEWAL, EXTENSION AND MODIFICATION AGREEMENT

THE STATE OF TEXAS §

COUNTY OF HARRIS §

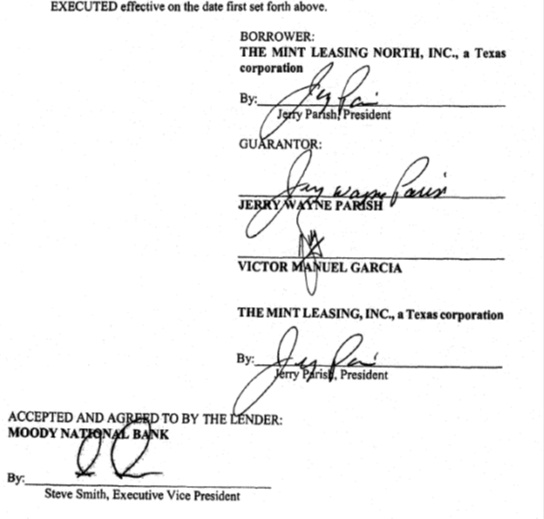

This Fourth Renewal, Extension and Modification Agreement (the "Agreement") is executed effective March 1, 2012 (the "Effective Date") by and among THE MINT LEASING NORTH, INC., a Texas corporation (hereinafter called the "Borrower"), JERRY WAYNE PARISH, VICTOR MANUEL GARCIA and THE MINT LEASING, INC., a Texas corporation (individually and collectively, hereinafter called the "Guarantor") and MOODY NATIONAL BANK (herei nafter called the "Lender") to evidence their agreement as follows:

W I TN E S S E T H:

WHEREAS, the Lender is the legal and equitable owner and holder of that certain Revolving

Line of Credit Promissory Note dated July 24, 2009 in the original principal amount of $10,000,000.00, made by the Borrower and payable to the order of the Lender (hereinafter called the "Note") which Note evidenced that certain revolving line of credit loan by the Lender to the Borrower (the "Loan") secured in part by that certain Collateral Assignment and Security Agreement of even date with the Note; and,

WHEREAS, each of the Guarantor executed certain guaranty agreements dated of even date with the Note, guaranteeing the obligations of the Borrower under the Note and all other obligations of the Borrower under any and all of the documents and instruments securing, evidencing and relating to the Loan (all such documents and instruments, including those executed in connection with the First Renewal, the Second Renewal, the Third Renewal, all as hereinafter defined, hereinafter collectively called the "Loan Documents");

WHEREAS, in connection with the Note, the Borrower, the Guarantor and the Lender also entered into that certain Loan Agreement dated of even date with the Note which stipulated the use of the funds advanced under the Note; and,

WHEREAS, effective December 31, 2009, the Lender, the Borrower and the Guarantor executed that certain Renewal , Extension and Modification Agreement (the "First Renewal") which renewed and extended the maturity of the Loan until February 28, 2010 and modified certain other terns of the Loan Documents, including, without limitation, the Note and the Loan Agreement; and,

WHEREAS, effective February 10, 2010, the Lender, the Borrower and the Guarantor executed that certain Second Renewal, Extension and Modification Agreement (the "Second Renewal") which renewed and extended the maturity of the Loan until February 28, 2011, removed the revolving line of credit aspect of the Loan and additionally modified certain other terms of some of the Loan Documents, including, without limitation the Note and the Loan Agreement; and,

WHEREAS, effective February 10, 2011, the Lender, the Borrower and the Guarantor executed that certain Third Renewal, Extension and Modification Agreement (the "Third Renewal") which renewed and extended the maturity of the Loan until March 1, 2012 and modified certain other terms of some of the Loan Documents, including, without limitation the Note and the Loan Agreement; and,

WHEREAS, the Borrower and the Guarantor have requested a further renewal of the Loan and an extension of the Scheduled Maturity Date (as defined herein) and to further modify certain other terms of the Loan Documents as provided for herein; and,

WHEREAS, the Lender is agreeable to the foregoing, subject to and in accordance with all of the terms and conditions of this Agreement.

NOW THEREFORE, for and in consideration of the premises and of the mutual covenants and agreements herein contained, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

(1) As of the Effective Date, the outstanding principal balance due and payable under the Note is $1,822,767.32. Any and all accrued interest has been paid current to the Effective Date.

(2) As of the Effective Date, the Note is hereby renewed, extended and modified as follows:

(a) The "Scheduled Maturity Date" shall be March 1, 2013, upon which date any and all unpaid principal and all unpaid accrued interest shall be due and payable in full.

(b) The "Base Rate" shall man a fixed six and 75/100ths percent (6.75%) per annum.

(c) Payments of principal and accrued interest on the indebtedness are payable in monthly installments of $57,500.00 each, the first installment to become due and payable on April 1, 2012 and one of said installments to bedome and payable on the same day of each and every succeeding calendar month thereafter until the Scheduled Maturity Date. As said installments are paid, they are to be applied first to the payment of interest accrued on the entire amount of said indebtedness unpaid at the time of said payment, and the balance, if any, shall be applied to the payment of principal.

The Borrower understands that the monthly installments of principal and interest referred to above are based upon a hypothetical amortization period proposed by the Borrower and agreed to by the Lender; that such installments will not amortize fully the unpaid principal balance of the Note by the Scheduled Maturity Date; that the final installment will be a "balloon" payment; and the the Lender has no obligation to refinance such "balloon" payment.

(3) All rights, remedies, titles, liens, security interests and equities evidenced by the Note or any of the remaining Loan Documents are hereby acknowledged by all parties hereto to be valid and subsisting and are hereby recognized to be continued in full force and effect.

(4) It is agreed and acknowledged by the parties hereto that the Lender's requirements in exchange for the consents and modifications herein contained are reasonable in all respects.

(5) The Borrower and the Guarantor agree that all of the Lender's rights and privileges arising by operation of law or arising out of or in connection with the Note, the Loan Agreement and/or the other Loan Documents (originally and as amended and modified by the First Renewal, the Second Renewal, the Third Renewal and this Agreement) shall be and remain in full force and effect as therein provided, unimpaired by the transaction described herein. Without limiting the generality of the foregoing, it is expressly agreed and understood that the Lender does not waive any existing event of default or breach under the Note, the Loan Agreement or any of the other Loan Documents.

(6) Nothing herein contained shall in any wise impair the Loan Agreement or the other Loan Documents or any security held therefor, or alter, waive, annul, vary or affect any provision, condition or covenant contained therein, except for, and to the extent of the matters provided herein or provided pursuant hereto, nor affect nor impair any rights, powers or remedies of the Lender thereunder, it being the express intent of the parties hereto that the Loan Agreement, the other Loan Documents, and all other instruments and documents executed by any party in connection therewith shall continue in full force and effect, except as may otherwise be expressly provided herein.

(7) This Agreement and the underlying documents to which defined terms herein refer (as modified herein) embody the entire agreement of the parties hereto concerning the subject matter hereof, and supercedes any prior understandings or written or oral agreements between the parties respecting the subject matter hereof. No variation, modification or alteration of the terms hereof shall be binding upon any party hereto unless set forth in an express formal amendment document executed by all parties hereto.

(8) The Borrower acknowledges and represents that the liens and security interests created and evidenced by the Loan Documents are valid and existing liens of the recited dignity and priority, and the Borrower acknowledges and agrees that there exists no offset, counterclaim or defense of any kind to the Note, the Loan Agreement or to any of the Loan Documents as modified hereby.

(9) By their execution of this Agreement, each of the Guarantor hereby (i) acknowledge and consent to the terms and provisions hereof; (ii) ratify and confirm their guaranty agreement, including all interest and costs of collection, to or for the benefit of the Lender; (iii) agree that their guaranty agreement are and shall remain in full force and effect and that the terms and provisions of their guaranty agreements cover and pertain to the Note, the Loan Agreement and the other Loan Documents as modified hereby; (iv) acknowledge that there are no claims or offsets against, or defenses or counterclaims to, the terms and provisions of their guaranty agreements or the other obligations created and evidenced by guaranty agreements; (v) certify that the representations and warranties contained in their guaranty agreements remain true and correct representations and warranties of each of the Guarantor as of the Effective Date hereof; and (vi) acknowledge that the Lender has satisfied and performed its covenants and obligations under their guaranty agreement, the Loan Agreement and the other Loan Documents, and that no action or failure to act by or on behalf of, the Lender has or will give rise to any cause of action or other claim against the Lender for breach of their guaranty agreements, the Loan Agreement or the other Loan Documents or otherwise.

(10) In consideration of the renewal and extension of the Loan, the Borrower and the Guarantor hereby waive and release the Lender from any and all claims and defenses, known or unknown, with respect to the Note, the Loan Agreement and the other Loan Documents and the transaction contemplated thereby and hereby.

(11) The Borrower and the Guarantor hereby acknowledge the terms of this Agreement and ratify and affirm their obligations under, and acknowledge, renew and extend their continued liability under, the Note, the Loan Agreement and each Loan Document to which they are a party and agree that the Note, the Loan Agreement and each Loan Document to which they are a party remains in full force and effect.

(12) This Agreement embodies the entire agreement and understanding among the Borrower, the Guarantor and the Lender relating to the subject matter sand supersedes all prior proposals, negotiations, agreements and understandings relating to such subject matter. The Borrower and the Guarantor certify that they are relying upon no representation, warranty, covenant or agreement except for those set forth in this Agreement.

(13) This Agreement may be executed in any number of counterparts and by any party hereto on a separate counterpart, each of which when so executed and delivered shall be deemed an original and all of which when taken together shall constitute one and the same instrument.

THIS WRITTEN LOAN AGREEMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.