Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ORANGEHOOK, INC. | Financial_Report.xls |

| EX-21.1 - EXHIBIT211 - ORANGEHOOK, INC. | exhibit211.htm |

| EX-32.1 - EXHIBIT321 - ORANGEHOOK, INC. | exhibit321.htm |

| EX-10.9 - EXHIBIT109 - ORANGEHOOK, INC. | exhibit109.htm |

| EX-31.1 - EXHIBIT311 - ORANGEHOOK, INC. | exhibit311.htm |

| EX-31.2 - EXHIBIT312 - ORANGEHOOK, INC. | exhibit312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One)

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2011

|

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from _________ to __________

|

|

Commission file number: 0-54249

Nuvel Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

27-1230588

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

315 University Avenue

Los Gatos, California 95030

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (408) 899-5981

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated

filer o

Non-accelerated filer o Smaller reporting

company x

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the registrant’s Common Stock held by non-affiliates was $932,250, based on the price of $0.30 per share of Common Stock on June 30, 2011. Shares of Common Stock known by the registrant to be beneficially owned as of June 30, 2011 by the registrant’s directors and the registrant’s executive officers subject to Section 16 of the Securities Exchange Act of 1934 are not included in the computation. The registrant, however, has made no determination that such persons are “affiliates” within the meaning of Rule 12b-2 under the Securities Exchange Act of 1934.

At April 13, 2012, there were 11,764,706 shares of the registrant’s Common Stock issued and outstanding.

Nuvel Holdings, Inc.

FORM 10-K

For The Fiscal Year Ended December 31, 2011

|

Page

|

||||

|

PART I

|

||||

|

Item 1.

|

3 | |||

|

Item 1A.

|

12 | |||

|

Item 1B.

|

12 | |||

|

Item 2.

|

12 | |||

|

Item 3.

|

12 | |||

|

Item 4.

|

12 | |||

|

PART II

|

||||

|

Item 5.

|

12 | |||

|

Item 6.

|

13 | |||

|

Item 7.

|

13 | |||

|

Item 7A.

|

17 | |||

|

Item 8.

|

17 | |||

|

Item 9.

|

17 | |||

|

Item 9A.

|

17 | |||

|

Item 9B.

|

18 | |||

|

PART III

|

||||

|

Item 10.

|

19 | |||

|

Item 11.

|

22 | |||

|

Item 12.

|

24 | |||

|

Item 13.

|

25 | |||

|

Item 14.

|

25 | |||

|

PART IV

|

||||

|

Item 15.

|

26 | |||

Explanatory Notes

In this Annual Report on Form 10-K, Nuvel Holdings, Inc. is sometimes referred to as the “Company”, “Nuvel”. “we”, “our”, “us” or “registrant” and U.S. Securities and Exchange Commission is sometimes referred to as the “SEC”.

PART I

Item 1. BUSINESS

Our History

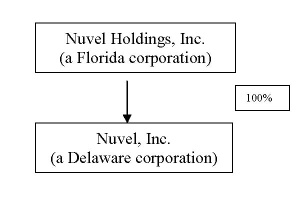

The Company is a Florida corporation incorporated on October 19, 2009. On December 30, 2011, the Company completed an acquisition of Nuvel, Inc. (“Nuvel DE”) pursuant to a Share Exchange Agreement, among the Company, certain shareholders of the Company, Nuvel DE and all shareholders of Nuvel DE (the “Share Exchange Transaction”). As a result of the Share Exchange Transaction, Nuvel DE, which was incorporated in Delaware on January 20, 2010, became our direct wholly-owned subsidiary effective on December 30, 2011. Such acquisition of Nuvel DE was accounted for as a reverse merger and recapitalization effected by a share exchange transaction. Nuvel DE is considered the acquirer for accounting

and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

The Company used to conduct its operations through a sole operating subsidiary, Harmony Metals Design, Inc., a Florida corporation, which was incorporated on June 17, 2010. On February 1, 2012, the Company assigned to Sahej Holdings, Inc. all of the outstanding shares of Harmony Metals Design, Inc. that it owned pursuant to an Assignment and Assumption Agreement. Harmony Metals Design, Inc. therefore ceased to be a wholly owned subsidiary of the Company then.

On March 20, 2012, the Company acquired the 100% outstanding shares of HRMY Sub, Inc. (“HRMY Sub”), a newly set up Florida corporation. On April 10, 2012, the Company merged HRMY Sub into itself and changed the Company’s name into “Nuvel Holdings, Inc.” to better reflect the business and operations of the Company. The Company’s CUSIP number was changed from 413248 105 to 67091E 108. The stock symbol of the Company was changed from “HRMY.OB” to “NUVL.OB,” effective on April 10, 2012.

The following diagram sets forth the structure of the Company as of the date of this Report herein:

Business Operations

Overview

The Company, through its wholly-owned subsidiary Nuvel DE, engages in the business of designing, developing and selling a family of proxy and other appliances, and related software and services that secure, accelerate and optimize the delivery of business applications, web content and other information to distributed users over a Wide Area Network (“WAN”), or across an enterprise’s gateway to the public Internet (also known as the "Web"). Our products provide our end user customers with information about the applications and Web traffic running on their networks, including the ability to discover, classify, manage and control communications between users and applications across internal

networks, the WAN and the Internet. Our products are also designed to accelerate and optimize the performance of our end users’ business applications and content, whether used internally or hosted by external providers. We have also developed and designed personal safety applications that are accessible via various mobile and tablet platforms. We are a development stage enterprise. Our primary activities have been the design and development of our products, negotiating strategic alliances and other agreements and raising capital. We have not commenced our principal operations, nor have we generated any material revenues.

Products Offerings

Our principal product offerings are the following:

Nuvel WAN acceleration and optimization

The Company designs, develops, markets, and sells Internet acceleration applications and management solutions which include specialized software tools that are purpose-built to accelerate and optimize the flow of information over the Internet. Our products improve response time for Internet users and provide network administrators and managers a high degree of control over the access, flow and delivery of Internet content. Our products work in conjunction with caching technologies to reduce the number of redundant requests for information that must be processed and delivered, thus reducing the load on the Internet and corporate networks. We have developed an innovative and comprehensive solution that broadly

addresses the inter-related root causes of poor performance of wide-area distributed computing: latency and protocol inefficiencies, and bandwidth limitations. By simultaneously addressing these causes, we are able to improve significantly the performance of applications and access to data across WANs and enable the consolidation of costly IT infrastructure.

Network Data Tunnel (“NDT”)

Our purpose-built Network Data Tunnel application is designed from inception for high-performance WAN acceleration. Our NDT application provides high data throughput and reduced latency, or the time between initiating a request for data and the completion of the actual data transfer. Our application simultaneously retrieves numerous objects from the origin server. In many cases, our solution offers upward of 10 times to 150 times speed improvement. Our products are designed for easy installation and maintenance, reducing the costs and time required for implementation and use. Network managers at Internet service providers (“ISPs”) and enterprises generally will install our application on their existing

servers. In many cases, our Network Data Tunnel can be installed in under ten minutes. All of our products provide customers with a range of management features, functions, user interfaces and modes of operation. In addition, our application solutions are designed to efficiently interact with our customers' existing networking equipment. By accelerating the transfer of data, especially in longer distance (Hops), enterprises and ISPs employing our Network Data Tunnel require less network capacity and can reduce data transmission costs. Our customers better utilize the capacity of their existing network and are able to move data far more efficiently and quickly. The need for enterprises engaged in e-commerce to purchase additional servers could be reduced since our Network Data Tunnel eliminates a significant amount of traffic that could otherwise overload their existing servers,

requiring incremental server capacity. Our NDT products also help to improve the productivity of Internet users by reducing web response time. Faster downloading of web content increases productivity and end-user satisfaction. Our applications run on existing customer-deployed data center equipment, which means that it is designed to be less vulnerable to unauthorized entry than the deployment of new hardware or dedicated appliances. The Network Data Tunnel Solution was designed specifically for WAN acceleration. In addition, NDT employs authentication and filtering capabilities that prohibit unauthorized users from accessing or penetrating the application by adhering to the clients’ security protocols.

NDT Packaging

Enterprise Edition (Available in 50Mbps, 100Mbps & 1Gbps)

The Nuvel Network Data Tunnel Enterprise Edition is focused on the larger corporate bandwidth customers looking to move time sensitive and very large data sets. The Enterprise Edition is available in three options based on bandwidth.

Small Business Edition (Available in 5Mbps & 10Mbps)

Targeted at the small business market where Internet upload and download speeds are limited and yet the demand still warrants efficient use and time is most important.

Service Provider Edition

Our XaaS edition is tailored to each service provider based on their unique challenges and target customers.

Mobile Application Products

vSOS Emergency Response Service

vSOS is an emergency response application on mobile and tablet platforms that provides the user 24 hours a day and 7 days a week emergency response service in North America, South America, and Europe, through a dedicated International Emergency Response Coordination Center. vSOS is available as a free application where the user can send SMS or email to up to 5 contacts identified in their profile. An upgrade to the GEOS International Emergency Response Service is available for $12.99/month. Family Plans are also available for less than $5.00 per user on a monthly basis. The GEOS emergency response is available 24 hours 7 days a week in 101 countries. vSOS is a personal mobile emergency system. A user simply needs to

hold the vSOS button for 3 seconds and it automatically contacts the International Emergency Response Center with the user’s current location and the user’s private profile information. They take over coordinating the appropriate response to the user’s emergency.

vSOS is currently available for download from iTunes and Android Marketplace. We expect vSOS to be available for download on the Blackberry App World in May 2012. The monthly subscription service is available through these stores but we also offer various other plans such as the Family Plan and other yearly plans from our web site and our partner’s web sites. We are in discussions with a variety of channel partners, handset manufacturers and wireless companies exploring private label opportunities with them. We are also discussing these opportunities with companies for foreign distribution.

Distracted Driver Application

This application that Nuvel developed prevents the use of a mobile phone while the user is driving in a vehicle therefore giving the driver their full attention to the task at hand. In order to prevent the use of the mobile phone, when the speed gets over 8 mph, all distracting signals, visual (pop-ups or flashes), auditory (beeps, pings, rings) and kinesthetic (vibrations) will be disabled while the mobile phone is in motion. This application will be purchased and controlled primarily by parents and we suspect that the teenagers that have such application on their phones will try and delete it or disable it. We counter any efforts to have the application deleted or disabled and a notice or alert will be sent to the

parents or insurance companies when this happens.

Technologies

Our products are based on three core technologies:

WAN optimization

The new global enterprise is burdened with several challenges, which include a diverse workforce, multiple software applications and varying means of data access. Driven by an increasing demand for bandwidth to reliably and effectively support remote offices, the need for a better-functioning, faster, cheaper, and easier to implement and use WAN solution, has never been greater. Hardware-based application acceleration and WAN optimization solutions available today address only a part of the problem faced by the modern global enterprises. What these traditional solutions do not address are the needs for ease of deployment, ease of use and operation, better economics and fit for purpose – crucial requirements of

modern businesses. The hardware approach to WAN optimization requires numerous costly and complex appliances resulting in geometrically multiplying hardware, operations and maintenance costs. Furthermore, the “optimization in hardware” approach results in other undesirable characteristics that include costly and often delayed upgrades, and significant staff and time commitments to provide, manage and maintain complex installations of appliances. Our WAN optimization products are deployed by our customers throughout their network infrastructures to improve the performance of their networks and reduce network costs, while enhancing network security. Our target customers include large and small ISPs, large corporate enterprises and small and medium size businesses in industries such as finance, engineering, professional services, manufacturing, media, healthcare, utilities,

telecom, retail, and technology. These companies would purchase our products in order to improve the performance of their networks and to accelerate and optimize the delivery of content to other companies or end-users over the Internet. Our WAN optimization products are designed to help distributed enterprises optimize the transferring of data both internally and externally.

Compared with the traditional WAN optimization solutions, our WAN optimization and acceleration technology provides key capabilities that are designed to optimize the delivery of data to users across the distributed enterprise, and to customers. As compared to traditional solutions, the NDT gets up to 150X speed and is not bound by either point to point transmission or network equipment constraints including:

|

●

|

Bandwidth management—the ability to assign a set level of bandwidth to specific users and applications and prioritize delivery of that traffic over the WAN;

|

|

●

|

Protocol optimization—a technique that enhances the efficiency of protocols by reducing the communication required between the user and the application; and

|

|

●

|

Compression—a technique that uses an industry standard algorithm to package and unpackage information for efficient transmission across the WAN.

|

The Network Data Tunnel enhances the performance of the TCP protocol by increasing the amount of data carried per TCP round trip, thereby reducing the number of round trips required to move a given amount of data over the WAN.

Enterprises and ISPs have varying capacity, reliability and data throughput needs, depending on the size and nature of their operations. We offer a wide range of products to meet different price, performance and reliability requirements, and provide an upgrade path to our customers as they expand their networks. Our products can be deployed in a variety of environments, ranging from small or remote network locations to large ISPs or enterprise headquarters. Trying to Cache content closer to the user may increase network efficiency, but creates the risk that the content delivered is not up-to-date, or fresh. Network Data Tunnel avoids this by increasing the speed in which original content can be moved to

the serving location. Unlike traditional software or hardware cache solutions that have no mechanisms to monitor and ensure freshness, our Network Data Tunnel can actively check the origin servers and update content through efficient and sophisticated algorithms.

Cloud Computing

Based on a model commonly known as “cloud computing,” we are releasing a revolutionary approach to WAN optimization and acceleration, and a fundamental architectural shift in the delivery of this solution. Instead of a WAN optimization Controller or a managed appliance model per customer, Nuvel is a true innovator in software-based WAN optimization, designed for an enterprise. It offers WAN optimization, as well as cost-effective, scalable and reliable connectivity between enterprise locations. Our revolutionary technology offers enterprises enhanced performance throughout their global network. With Nuvel, users can start with a network of any size, configuration and scale based on the

organization’s demands. Users in branch offices or remote locations exchanging vital information with headquarters need a reliable and fast solution that can keep pace with the increasing demands.

Mobile Applications

We continue to deliver cutting-edge mobile applications on the most innovative platforms of smart phones and tablet devices. With more than 20 years of experience designing enterprise-grade software applications, our leadership team made substantial investments in research and development to build the best in class products for the top selling devices. Nuvel started with the iPhone and Android phones because of their dominance in market share and functionality and currently have Blackberry and Windows mobile applications under development. By the middle of 2012, we plan to launch multiple products running on smart phones and soon thereafter launch on tablet devices. According to the Gartner Group, just under 500

million smart-phones were shipped in 2011 compared to 300 million units in 2010. Android phones will grow an estimated 40 percent in the second half of 2011. With the launch of the new iPhone and the increase in Android phones, we can take advantage of this exploding market with our innovative mobile products. Data is going mobile and moving to the Cloud. Nuvel is positioned to capitalize on these key areas of the industry.

Our personal safety application featuring advanced, patent-pending technology, provides users ranging from school age children to the elderly with the peace of mind that help for medical emergencies, personal safety and accidents is available with the push of a button. Through its partnership with GEOS Alliance, Nuvel’s feature-rich application provides emergency response services in North America, South America, and Europe and soon in Asia. The vSOS subscription fee includes both the application and the personal emergency response services.

vSOS is designed to be the gold standard against which all mobile personal response applications are compared and has set itself apart from the competition with HIPAA compliance and the ability to input personal medical information such as allergies, health conditions, medications, etc. This information is critical for first responders. For added value, the GEOS Search and Rescue (SAR) feature is included at no additional cost. GEOS and the GEOS International Emergency Response Coordination Center (IERCC) have been providing rescue coordination and other services internationally for years. The IERCC has operated in 101 countries accounting for nearly 4,000 rescue operations.

With the SAR feature, if the official emergency services need to be supplemented to ensure the user’s safety, the GEOS IERCC will authorize additional personnel and equipment (including private aircraft/helicopter charter, private search teams, etc.). During the past 18 months, more than 400 lives have been saved as a result of the IERCC.

When an iPhone or Android phone is enhanced with vSOS, users send a distress alert simply by pressing down on the red vSOS emergency alert icon for three seconds. This triggers the vSOS HIPAA-compliant server to automatically send a distress alert to the GEOS IERCC. With the vSOS technology, the critical information is always stored on the HIPAA compliant servers and never resides on the phone. Leveraging advanced GPS technology, vSOS provides the user’s physical location to the first responders to guide emergency personnel. Access to the user’s personalized health information and the user’s name, mobile phone number and address is also included with the

alert. In addition, vSOS will send a text or email message to alert up to five contacts (physicians, family, friends) listed in the user’s profile.

Services and Support

We provide a comprehensive range of service and support options to our end user customers and our channel partners, which are delivered directly by our service and support organization. Our service and support options are for software support.

Research and Development

We believe that innovation and strong internal product development capabilities are essential to our continued success and growth. We continue to add new features, strengthen existing features of our products and invest in exploring new and adjacent markets and products that build on our core competence. In year 2011, we invested in developing our cloud-based service, although we anticipate that this subscription-based service will not generate material revenue in the next few years.

Our research and development team consists of engineers with extensive technical backgrounds in relevant disciplines. We believe that the experience and capabilities of our research and development professionals is one of our significant competitive advantages. We also work closely with our beta customers to understand their business needs and to focus our development of new products and product enhancements to better meet customer needs.

For the year ended December 31, 2011, for the period from January 20, 2010 (Inception) through December 31, 2010, and for the period from January 20, 2010 (Inception) through December 31, 2011 the Company incurred research and development expenses of $345,455, $188,908, and $534,363, respectively.

Intellectual Property

We depend significantly on our ability to develop and maintain the proprietary aspects of our technology. To protect our proprietary technology, we rely primarily on a combination of contractual provisions, confidentiality procedures, trade secrets, copyright and trademark laws and patents. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or obtain and use information that we regard as proprietary.

We currently have two pending U.S. patent applications (provisional and non-provisional) and when these are issued, we will apply for foreign patents.

|

Title of Patent Application

|

Date of Filing

|

Application No.

|

||||

|

System and method for providing personal alerts

|

04/28/2011

|

13/096,924

|

||||

|

System and method for providing a network proxy data tunnel

|

12/14/2011

|

13/326,189

|

||||

There can be no assurance that any of our pending patent applications will be issued or that the patent examination process will not result in our narrowing the claims applied for. Furthermore, there can be no assurance that we will be able to detect any infringement of patents or, if infringement is detected, that our patents will be enforceable or that any damages awarded to us will be sufficient to adequately compensate us. In addition, the laws of some foreign countries do not protect our proprietary rights as fully as do the laws of the United States. Any issued patent may not preserve our proprietary position, and competitors or others may develop technologies similar to or superior to our technology. Our

failure to enforce and protect our intellectual property rights could harm our business, operating results and financial condition.

Sales and Marketing

Our objective is to be a leading provider of Internet acceleration and WAN optimization by delivering a high-performance, innovative Network Data Tunnel solution. Key elements of our strategy include applying our WAN acceleration focus to targeted market segments. Since our inception, we have focused on developing a software only WAN acceleration product line. We believe this focus helps us to rapidly identify and target attractive market opportunities. We are directing our product development, marketing and sales activities at specific market segments that we believe represent attractive opportunities based on a demonstrated need for WAN acceleration, the opportunity to sell to numerous customers and the level of

existing competition. We focus on three market segments: service providers, enterprise proxy server replacement, and “Ground to Cloud.” We intend to use our customer relationships in these market segments to further penetrate these segments as well as other related markets.

We utilize a combination of our direct sales force, resellers, systems integrators and original equipment manufacturers as appropriate for each of our target markets. We will support our distribution channels with systems engineers and customer support personnel that provide technical service and support to our customers.

We intend to pursue relationships with additional resellers and original equipment manufacturers to implement our distribution strategy and to expand our customer base. We have also been expanding our sales force, and plan to continue to do so in the future. Our marketing efforts focus on increasing the market awareness of our products and technology and promoting the Nuvel brand. Our strategy is to create this awareness by distinguishing our products based on their high level of performance.

Broaden Distribution Channels

We intend to extend our distribution channels to meet the anticipated growth in demand for WAN acceleration. We plan to continue to expand both our direct and indirect sales channels in order to continue to extend our marketing reach and increase our volume distribution. In particular, we plan to enter into relationships with additional resellers, systems integrators and original equipment manufacturers to increase penetration of the enterprise and ISP markets.

Marketing Programs

We have a number of marketing programs to support the sale and distribution of our products and to inform existing and potential customers within our target market segments about the capabilities and benefits of our products. Our marketing efforts include participation in industry trade shows, sales training, maintenance of our website, on-line advertising and public relations. Affiliate programs and marketing efforts through them will be key for Nuvel’s growth going forward.

Our Business Strategy

We intend to establish Nuvel as the premier brand in the Internet acceleration and mobile applications markets. We believe that brand awareness is important to increase market acceptance of Network Data Tunnel and to identify us as a leading provider of WAN acceleration solutions. We also believe that it takes unique marketing programs and campaigns to make our mobile applications successful when competing with 500,000 other apps. The amount of noise and confusion in this market makes it very challenging. We intend to continue to educate customers, resellers, systems integrators and original equipment manufacturers about the value of implementing all of our current and future products. We believe a thorough

process of explanation and education of our products will help to promote brand recognition and to further an overall acceptance and understanding of our solutions. To this end, we intend to increase our investments in a broad range of marketing and educational programs.

Customers

Our NDT products are installed for beta testing in some of the largest companies worldwide in major industries including: finance, engineering, professional services, manufacturing, media, healthcare, utilities, telecom, retail, and technology. Our products will be deployed in a wide range of organizations, from large global organizations with hundreds or thousands of locations to smaller organizations with as few as two locations.

In 2011, we signed up key beta customers to test the full capability of our product. These beta customers represent major market segments and include such clients as SAP, DPIX, Digital Creations and Intouch Labs.

Industry Background

The Global Demand for Data

Organizations have become more geographically dispersed, and increasingly mobile workforces depend on access to data from remote locations and a variety of client devices such as cellular telephones, personal digital assistants and notebook computers. In addition, we believe the growth of Internet usage will continue to be driven by new applications, such as “Web Services” and “Voice over IP”, the growth of mobile and broadband Internet access, and new usage and infrastructure models such as “cloud computing.” In conjunction with the growth of Internet traffic, the proliferation of data and, in particular, unstructured data such as voice, video, images, email, spreadsheets and

formatted text files, presents an enormous and increasing challenge to IT organizations. Along with the growing volume of unstructured data that is business critical and must be retained and readily accessible to individuals and applications, new regulations mandate that company email, web pages and other files must be retained indefinitely.

Gartner, Inc. (“Gartner”), a leading technology information group, estimates the number of U.S. companies with remote offices in excess of 4 million and many indications are that the mobile workforce is here to stay. The increased demand for WAN acceleration is not just domestic but spans the globe. The good news for Nuvel is this means a growing dependence on the performance of every network, real-time access to data, anytime and anywhere.

The Internet is dramatically changing the way businesses and individuals communicate and conduct commerce. As a result, the increasing volume of Internet traffic is much more than just web surfing; it's big business. According to Gartner, the amount of data produced across the world will grow by 650 percent over the next few years, and 80 percent of it will be unstructured. The research firm adds that 40 exabytes of new data are expected over the next five years, which is greater than all the data of the past 5,000 years. With this rising volume of traffic, Internet and Intranet infrastructures are quickly reaching capacity. Slow response times and site outages due to heavy demand are common outcomes of these

overburdened network infrastructures. For organizations that rely on the web for commerce and/or operational purposes, these problems can be expected to have a direct, adverse impact on both the top and bottom lines. In the past, sites that wanted to avoid these issues had few choices but to invest in more infrastructure--more servers, more network equipment, more staff and more data center space. Now, through the emergence of WAN acceleration technology, these sites can effectively address the problems of performance, scaling and management. WAN acceleration optimizes how content is delivered by accelerating it either direction. There are two primary types of WAN acceleration solutions: software-based solutions and hardware based groups. Software-based approaches consist of a software application running on a general-purpose operating system like Solaris, Linux or Windows. These

systems offer superior flexibility. Hardware providers promote a singular design, simple install, but have been significantly overpriced for many companies. Much as network routing has evolved from a general-purpose to a purpose-built solution, so is WAN acceleration. The advantages of a specialized application are clear. When an application is designed to perform a dedicated task, it will perform that task more effectively than a multi-function alternative. The results of a proxy-based application approach to optimization are significant: reduced web response times, simpler administration and management, lower network and data center costs, higher reliability, robust data security and always-accurate content.

Increasingly Distributed Organizations and Workforces

Organizations are becoming more geographically distributed, placing operations closer to customers and partners to improve efficiency and responsiveness. Businesses are becoming more global by expanding into new markets, migrating manufacturing facilities to lower-cost locations and outsourcing certain business processes. In addition, mergers, acquisitions, partnerships and joint ventures continue to expand the geographic scope of existing enterprises.

Organizations are Increasingly Dependent on Timely Access to Critical Data and Applications

Application performance and effective access to data are critical to executing, maintaining and expanding business operations. Employees are increasingly dependent on a wide array of software applications to perform their jobs effectively, such as E-mail, document management, enterprise resource planning and customer relationship management.

Wide-Area Distributed Computing Challenges

Technological advances in computing, networking, semiconductor and storage technologies have improved users’ ability to access data and use applications rapidly across their Local Area Networks (“LANs”) and store enormous amounts of information economically. However, these same applications and storage technologies, which were often designed to operate optimally on LANs, perform slowly across WANs and frequently exhibit performance challenges such as: delays in accessing, saving and transferring files, incomplete or inconsistent back-up and recovery of sensitive data and loss of worker productivity and increased end-user frustration.

Although many companies have attempted to solve these problems solely by adding bandwidth, we believe these performance problems can best be solved by addressing not only bandwidth challenges but also, and usually more importantly, the effects of latency and protocol inefficiencies:

Latency and protocol inefficiencies — “Latency” is the amount of time it takes data to travel distances across a WAN. The inefficiencies come from the numerous interactions between clients and servers that are often required by applications or network transport protocols to complete an operation or transfer data. When combined in geographically distributed computing environments, latency and these inefficiencies result in dramatically slower performance. For example, a simple request to open a file may require hundreds if not thousands of sequential round-trip interactions that, when aggregated, can result in substantial delays. This problem arises from two distinct sources:

|

●

|

Network Protocol inefficiencies — Most business applications were designed for optimal use within LAN environments and employ unique communications procedures that result in slow performance when transmitted over a WAN. Transmission Control Protocol (TCP), the underlying transport protocol for most WAN traffic, divides data into relatively small packets that are sent sequentially across the WAN, and require return acknowledgement from the recipient. These numerous round trips across the WAN result in slow performance for the end-user.

|

|

●

|

Bandwidth limitations — Bandwidth is defined as the amount of data that can traverse a network in a given amount of time and is typically measured in megabits per second (Mbps). While most organizations’ LANs typically operate at 100 or 1,000 Mbps, their remote office WAN connections typically operate at 2 Mbps or less. This often results in WAN congestion and poor application and data services performance. In addition, WAN outages limit the effectiveness of workers who are dependent on remote access to data and applications.

|

Mobile market

Applications for mobile devices and tablets are one of the fastest growing segments in technology today. According to a new research report, the number of mobile application downloads worldwide will grow at a compound annual growth rate of 56.6 percent between 2010 and 2015 to reach 98 billion at the end of the period. Berg Insight estimates that revenues from paid applications, in-app purchases and subscription services – so called direct revenues – reached 2.5 billion in 2010. Berg Insight forecasts direct app store revenues to grow at a compound annual growth rate of 40.7 percent to reach 13.8 billion in 2015. Apple’s iOS is the current leader in direct monetization of mobile applications and

will keep the number one position during the forecast period. The Android and Windows Phone operating systems are anticipated to be number two and three, respectively, in 2015.

"Even though the download numbers will increase during the forecast period, most apps are free to download and app monetization will be a challenge for developers," said Johan Svanberg, Senior Analyst at Berg Insight. "Free to download monetization strategies such as in-app advertising and in-app purchasing will be increasingly important. This is especially true in the Asian and Pacific region, which will account for over 40 percent of all mobile application downloads in 2015." He adds that for the next coming years, the native mobile application is here to stay. New web technologies such as HTML5 are promising and will eventually be relevant alternatives to native applications. It is also important to remember that

web applications and native applications are not mutually exclusive and publishers looking for maximizing reach should develop for the web as well as for the major mobile platforms.

Critical Partners

We believe that our business benefits greatly from working closely with other leading companies and suppliers in each market. By collaborating with others, we are able to design products that integrate more easily with other devices, add features and functionality to our products and expand our distribution channels, enabling us access to additional customers and markets. We are focusing our strategic relationships internationally with the intent to have more than 50% of our revenue from international sales within 2 years. Below are some of the critical strategic partners of Nuvel:

GEOS Alliance – International Emergency Response Provider

GEOS provides best-of-breed services that encompass security, safety and reliable communications for all travelers, whether they are corporate or private individuals traveling either within North America, Europe, Australia, Asia or remote areas of the world. The GEOS programs are delivered through a fusion of state-of-the-art technology with the unparalleled experience of the very best and most respected specialists in the fields of international, personal and corporate protection, communications, international Search and Rescue (SAR) and worldwide emergency response.

Saggezza – development

Saggezza is a global technology services company providing consulting, systems integration, and outsourcing solutions. Headquartered in Chicago, Illinois, with offices in San Jose, California, London and Bangalore, and a presence in several other cities worldwide. Saggezza is committed to building a diverse team with the experience and reach to service even the most demanding multinational clients in the most competitive industries.

Pursuant to a consulting agreement entered into as of April 29, 2010, the Company retained Saggezza to develop the vSOS App for iPhone and Android, along with the vSOS Server. The agreement provides for compensation of $53,000. On August 16, 2010, the Company entered into another consulting agreement with Saggezza to develop the product NDT – Network Data Tunnel. The project requires six dedicated engineers and provides for compensation of $27,000 a month through January 30, 2012, as amended.

Digital River – e-commerce

Digital River, Inc., a leading provider of global e-commerce solutions, builds and manages online businesses for software and game publishers, consumer electronics manufacturers, distributors, online retailers and affiliates. Its multi-channel e-commerce solution, which supports both direct and indirect sales, is designed to help companies of all sizes maximize online revenues as well as reduce the costs and risks of running an e-commerce operation. Its comprehensive platform offers site development and hosting, order management, fraud management, export controls, tax management, physical and digital product fulfillment, multi-lingual customer service, advanced reporting and strategic marketing services. Founded in

1994, Digital River is headquartered in Minneapolis with offices across the U.S., Asia, Europe and South America.

Apptology – development

Based in Folsom, CA, Apptology Inc. (“Apptology”) is a leading mobile application development, training and marketing company. Unique in their service offering is a comprehensive suite of solutions for the mobile application industry. The management team includes industry pioneers from Silicon Valley and Fortune 500 companies working with and developing mobile, interactive and new media technologies. The 100+ person development team has created hundreds of applications for various companies around the world on all platforms.

Pursuant to a consulting agreement entered into as of January 10, 2011, the Company retained Apptology to create an integration to vSOS for iPhone and PayPal as well as to assist in improving the logo design. In addition, the development company is to write and distribute one press release discussing the product (with Nuvel’s written permission). The agreement provides for compensation of $2,500 per month. On April 14, 2011, the Company entered into another consulting agreement with Apptology to develop a new product called Distracted Driver Android App. The agreement provides for compensation of $8,000 per month.

Overtime Marketing – Marketing partner

AFCA/FBI National Child ID Program

Overtime Marketing manages the FBI/ National Child ID Program of which vSOS is now an integral part as the next step in Family Safety. The American Football Coaches Association, which represents 32 professional and 681 collegiate football teams and thousands of high school coaching staff, launched the National Child Identification Program in 1997 as a community service initiative dedicated to helping protect America's youth. According to AFCA Executive Director Grant Teaff, AFCA coaches have embraced the National Child Identification Program. Since its inception, the National Child Identification Program has distributed over 30 million ID Kits and has a goal of 62 million.

In the fall of 2001, the FBI took an active role in support of child identification and partnered with the National Child Identification Program. The partnership allows the National Child Identification Program to supply ID Kits to more than 18,000 state and local law enforcement agencies across the country.

Competition

The expanding capabilities of our product offerings have enabled us to address a growing array of opportunities, many of which are not addressed by our competitors. The design of the Network Data Tunnel is unique compared to the other products in this market and we are truly a disruptive technology for existing solutions. Our competitor’s product offerings include hardware appliances as a major part of their solution. The major benefits of our Network Data Tunnel are: software only solution, easy to install and implement, scalable from very small to very large networks, and priced extremely competitive with a subscription model. With this model, we can easily migrate down to the consumer level, which

is where the biggest demand will come in the future.

In the WAN Acceleration market, we compete with large companies such as Cisco Systems, Citrix Systems, Riverbed Technology, Silver Peak and Blue Coat Systems. The principal competitive factors in the market in which we compete include: product performance and features; customer support; brand recognition; the scope of distribution and sales channels; and pricing. Many of our competitors have a longer operating history and greater financial, technical, marketing and other resources than we do. These larger competitors also have a more extensive customer base and broader customer relationships, including relationships with many of our current and potential customers.

In the mobile application arena, it is a new and dynamically changing marketplace. The cost of entry is low and we see many competitors already with pieces of our solution but not with a patented, well thought out complete system with a world class International Emergency Response Center like we have created. The biggest competitors will come from other security and safety systems such as On-Star and Agero from the automotive market and companies migrating from medical device systems like Lifeline Medical Alert. We also will see competition from handset manufacturers like Great Call and stand alone systems like My Force. We believe many of these companies would be open to discuss business development opportunities if

they see our solution as a less expensive and superior offering for their customers.

Employees

The Company has currently 7 employees.

Private Placement of Convertible Notes and Warrants of Nuvel DE

From February 2010 through December 2011, Nuvel DE conducted a bridge offering of approximately $2,700,000 of its Secured Convertible Promissory Notes (the “Bridge Notes”) and Warrants (the “Bridge Warrants”) to 24 accredited investors (the “Bridge Investors”) pursuant to certain Subscription Agreements as amended on July 5, 2011 and December 30, 2011. The Bridge Notes may be convertible into the Company's securities sold in a Qualified Financing at a conversion price of the lower of $0.54 or the price of the securities sold in a Qualified Financing. The Qualified Financing is defined as an offering of the Company’s securities for gross proceeds of no less

than $1,500,000 (including the debt canceled through conversion of principal and interest with respect to the Bridge Notes but deducting any repayment in cash of principal and interest of the Bridge Notes and the Paragon Note). In the event of a Qualified Financing, the Bridge Investors may elect to convert the Bridge Notes or to request the Company to repay all outstanding principal and interests of the Bridge Notes. The Bridge Warrants entitle the Bridge Investors to purchase the number of shares that are calculated by dividing (x) 50% of the outstanding principal plus interest of the Bridge Notes by (y) the conversion price of the Bridge Notes. The Warrants will expire on the earlier of the seventh year anniversary or the closing of a Sale or Merger Transaction, as defined in the Warrants.

In addition, from April 29, 2010 through April 5, 2012, Nuvel DE took short term loans of a total of approximately $750,000 from eight accredited investors (of which $305,000 have been repaid) and all such investors elected to convert their outstanding short term loans into Bridge Notes. Some of such converted short term loans will mature on approximately April 18, 2012 and some are extendable for a 60-day period. These investors also received certain number of warrants in the form of the Bridge Warrant in connection with the short term loans.

In connection with the consummation of the Share Exchange Transaction, Nuvel DE received a loan of $390,000 from Paragon Capital, LP and its affiliate Paragon Capital Offshore LP (collectively, “Paragon”) bearing interest at an annual rate of 8% pursuant to a note dated December 30, 2011 (the “Paragon Note”). The loan will be due on December 31, 2012, and this loan is secured pursuant to a Security Agreement, dated December 30, 2011. In addition, Paragon and its designated person received an aggregate of 1,739,706 shares of common stock of the Company and a warrant to purchase 2,000,000 shares of common stock at an exercise price of $0.40 per share with a term of 7 years (the “Paragon

Warrant”). In addition, the Company provided a guaranty to Paragon for securing the Paragon Note, and certain shareholders of the Company signed lockup agreements with the Company (each, a “Lockup Agreement”), covenanting not to sell or transfer their shares of Common Stock until 180 days after the Paragon Note is fully paid off.

Not applicable.

None.

Our principal executive offices are located at 315 University Ave, Los Gatos, California. We occupy the premises pursuant to a one year lease that expires on October 31, 2012 and provides for a base monthly rent of $1,050. Pursuant to the lease, we have the right to extend the term of the lease any time prior to its expiration.

We are not a party to any legal proceedings, nor are we aware of any threatened litigation whatsoever.

Not applicable

PART II

Market Information

Our common stock has been approved for quotation on the over-the-counter bulletin board market under the symbol, initially as "HRMY" and currently as “NUVL,” but there has been no reported trading in the Company’s Common Stock since it was quoted on June 20, 2011 until December 31, 2011.

The transfer agent for the Company's common stock is Globex Transfer, LLC at the address of 780 Deltona Blvd., Suite 202, Deltona, FL 32725.

Stockholders

As of April 13, 2012, there were approximately 18 holders of record of our Common Stock.

Dividends

The Company has never paid a cash dividend on its common stock and has no present intention to declare or pay cash dividends on the common stock in the foreseeable future. The Company intends to retain any earnings which it may realize in the foreseeable future to finance its operations. Future dividends, if any, will depend on earnings, financing requirements and other factors.

Not applicable.

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those consolidated financial statements appearing elsewhere in this Annual Report on Form 10-K.

Certain statements in this Report, and the documents incorporated by reference herein, constitute forward-looking statements. Such forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,”

“continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Overview

The Company, through its wholly-owned subsidiary Nuvel DE, engages in the business of designing, developing and selling a family of proxy and other appliances, and related software and services that secure, accelerate and optimize the delivery of business applications, Web content and other information to distributed users over a Wide Area Network (“WAN”), or across an enterprise’s gateway to the public Internet (also known as the Web). Our products provide our end user customers with information about the applications and Web traffic running on their networks, including the ability to discover, classify, manage and control communications between users and applications across internal networks, the

WAN and the Internet. Our products are also designed to accelerate and optimize the performance of our end users’ business applications and content, whether used internally or hosted by external providers. We have also developed and designed personal safety applications that are accessible via various mobile and tablet platforms.

We are a development stage enterprise. Our primary activities have been the design and development of our products, negotiating strategic alliances and other agreements and raising capital. We have not commenced our principal operations, nor have we generated any material revenues.

Since inception, we have incurred substantial losses. As of December 31, 2011 and December 31, 2010, our accumulated deficit was $6,970,260 and $1,364,729, respectively, our stockholders’ deficiency was $5,077,380 and $1,364,629, respectively, and our working capital deficiency was $5,077,380 and $1,364,629, respectively. We have not yet generated revenues and our losses have principally been operating expenses incurred in design, development, marketing and promotional activities in order to commercialize our products. We expect to continue to incur additional costs for operating and marketing activities over at least the next year.

Based upon our working capital deficiency as of December 31, 2011 and December 31, 2010, and the lack of any revenues, we require equity and/or debt financing to continue our operations. Subsequent to December 31, 2011 and through April 5, 2012, we received aggregate debt financing of $270,000 and advances from a director in the amount of approximately $60,000. The Company currently has notes payable and convertible notes totaling $1,875,000 that are past maturity and in default. The Company expects that its current cash on hand will fund our operations only through April 2012. Due to the impending lack of funds, we are currently considering several different financing

alternatives to support our operations thereafter. If we are unable to obtain such additional financing on a timely basis and, notwithstanding any request we may make, our debt holders do not agree to convert their notes into equity or extend the maturity dates of their notes, we may have to curtail our development, marketing and promotions activities, which would have a material adverse effect on our business, financial condition and results of operations, and ultimately we could be forced to discontinue our operations and liquidate. See “Liquidity and Capital Resources” and “Availability of Additional Funds” below.

Year Ended December 31, 2011 compared with the period from January 20, 2010 (inception) to December 31, 2010

Marketing and promotion expenses

Marketing and promotion expenses include costs related to the advertising, marketing, and promotion of our products. For the year ended December 31, 2011, marketing and promotion expenses increased by $51,765, or 191%, as compared to the period from January 20, 2010 (inception) to December 31, 2010. The increase resulted primarily from the engagement of a creative services consultant for the entire twelve months of 2011 as compared to five months in 2010. In addition, the monthly fee doubled at the beginning of 2011 relating to this consultant.

We expect that marketing and promotion expenses will continue to increase in the future as we increase our marketing activities following full commercialization of our products and services.

Payroll and benefits

Payroll and benefits consist primarily of salaries and benefits to employees. For the year ended December 31, 2011, payroll and benefits increased by $441,493, or 59%, as compared to the period from January 20, 2010 (inception) to December 31, 2010. The increase resulted primarily from the Company initially hiring consultants for the first half of 2010 who then became full time employees of the Company. The Company currently has 7 full time employees.

Merger Expenses

Merger expenses consist of $2,224,780 recorded for the stock and warrants that were issued to Paragon, $350,000 for other costs related to the reverse merger, and $40,000 in legal fees.

General and administrative expenses

General and administrative expenses consist primarily of corporate support expenses such as legal and professional fees, investor relations and telecommunications expenses. For the year ended December 31, 2011, general and administrative expenses increased by $202,372, or 137%, as compared to the period from January 20, 2010 (inception) to December 31, 2010. The increase resulted primarily from an increase in professional fees related to our initial SEC filings. In addition, an investor relations firm was engaged in 2011.

We expect that our general and administrative expenses will continue to increase as we incur additional costs to support the growth in our business.

Research and development expenses

Research and development expenses consist primarily of consulting fees paid to develop our software products. Research and development expenses are expensed as they are incurred. For the year ended December 31, 2011, research and development expenses increased by $156,547, or 83%, as compared to the period from January 20, 2010 (inception) to December 31, 2010. The increase resulted primarily from the addition of a second development firm at the beginning of 2011.

Other expense

Other expense represents the change in fair value of warrants, amortization of debt discount and deferred financing charges, and interest expense. For the year ended December 31, 2011, other expenses increased by $773,845, or 301%, as compared to the period from January 20, 2010 (inception) to December 31, 2010. The Company marked certain warrants to fair value which accounted for $216,150 of the expense relating to the change in fair value of warrant liabilities. The amortization of the debt discount increased by $276,316 as additional convertible notes were issued and the acceleration of the debt discount from the cancellation of notes and warrants. The amortization of

deferred financing costs increased by $116,167 as additional charges related to raising funds were incurred. Interest expense increased by $165,212 as additional new convertible notes were issued and the certain maturity dates were extended.

Liquidity and Capital Resources

We measure our liquidity in a number of ways, including the following:

|

December 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Cash

|

$

|

34,792

|

$ |

10,083

|

||||

|

Working Capital Deficiency

|

$

|

(5,077,380

|

)

|

$ |

(1,364,629

|

)

|

||

|

Debt (Current)

|

$

|

3,265,000

|

$ |

1,200,000

|

||||

From January 20, 2010 (inception) through December 31, 2011, we raised a total of $3,570,000 from the issuance of notes payable and convertible notes (of which $305,000 was repaid). As of December 31, 2011, we had $34,792 in unrestricted cash, and a working capital deficiency of $5,077,380. As of December 31, 2010, we had $10,083 in unrestricted cash, and a working capital deficiency of $1,364,629. Subsequent to December 31, 2011 and through April 5, 2012, we secured additional debt financing of $270,000 and advances from a director in the amount of approximately $60,000.

Net Cash Used in Operating Activities

We experienced negative cash flow from operating activities for the year ended December 31, 2011, for the period from January 20, 2010 (inception) to December 31, 2010, and for the period from January 20, 2010 (inception) to December 31, 2011 in the amounts of $1,803,291, $1,010,017, and $2,813,308, respectively.

The cash used in operating activities in the year ended December 31, 2011 was due to cash used to fund a net loss of $5,605,531, adjusted for non-cash expenses related to amortization of debt discount, amortization of deferred financing costs, the change in fair value of warrant liabilities, and merger costs in the aggregate amount of $3,020,163 as well as a change in accounts payable, accrued expenses, and prepaid expenses of $782,077.

The cash used in operating activities for the period from January 20, 2010 (inception) to December 31, 2010 was due to cash used to fund a net loss of $1,364,729, adjusted for non-cash expenses related to amortization of debt discount, amortization of deferred financing costs, and the change in fair value of warrant liabilities in the aggregate amount of $186,750 as well as a change in accounts payable, accrued expenses, and prepaid expenses of $167,962.

Net Cash Used in Investing Activities

The Company did not use any funds for investing activities.

Net Cash Provided by Financing Activities

Cash provided by financing activities for the year ended December 31, 2011 and for the period from January 20, 2010 (inception) to December 31, 2010 was $1,828,000 and $1,020,100, respectively, primarily from the issuance of notes payable and convertible notes.

Availability of Additional Funds

Based upon our working capital deficiency as of December 31, 2011 and the lack of any revenues, we require equity and/or debt financing to continue our operations. Subsequent to December 31, 2011 and through April 5, 2012, we received aggregate debt financing of $270,000 and an advances from a Director in the amount of approximately $60,000. The Company currently has notes payable and convertible notes payable totaling $1,875,000 that are past due and in default. The Company expects that its current cash on hand will fund our operations only through April 2012. Due to the impending lack of funds, we will need to raise further capital, through the sale of additional

equity securities or otherwise, to support our future operations and to repay our debt (unless, if requested, the debt holders agree to convert their notes into equity or extend the maturity dates of their notes). Our operating needs include the planned costs to operate our business, including amounts required to fund working capital and capital expenditures. Our future capital requirements and the adequacy of our available funds will depend on many factors, including our ability to successfully commercialize our products and services, and competing technological and market developments.

We may be unable to raise sufficient additional capital when we need it or to raise capital on favorable terms. Debt financing may require us to pledge certain assets and enter into covenants that could restrict certain business activities or our ability to incur further indebtedness, and may contain other terms that are not favorable to our stockholders or us. If we are unable to obtain adequate funds on reasonable terms, we may be required to significantly curtail or discontinue operations or to obtain funds by entering into financing agreements on unattractive terms.

These matters raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements included elsewhere in this Annual Report have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate our continuation as a going concern and the realization of assets and satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the consolidated financial statements do not necessarily purport to represent realizable or settlement values. The consolidated financial statements do not include any adjustment that might result from the outcome

of this uncertainty.

Critical Accounting Policies and Estimates

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at dates of the consolidated financial statements and the reported amounts of revenue and expenses during the periods. Actual results could differ from these estimates. Our significant estimates and assumptions include amortization, the fair value of our stock, debt discount, warrant liabilities, and the valuation allowance relating to the Company’s deferred tax assets.

Recently Issued Accounting Pronouncements

Reference is made to the “Recent Accounting Pronouncements” in Note 3 to the Financial Statements included in this Annual Report for information related to new accounting pronouncements, none of which had a material impact on our consolidated financial statements, and the future adoption of recently issued accounting pronouncements, which we do not expect will have a material impact on our consolidated financial statements.

Off Balance Sheet Arrangements

As of December 31, 2011 and 2010, there were no off balance sheet arrangements.

Contractual Obligations

The following is a summary of our contractual obligations and their respective maturity dates as of December 31, 2011:

|

Contractual Obligations

|

Total

|

2012

|

2013

|

2014

|

2015

|

2016

|

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Short-term debt obligations

|

$

|

3,265,000

|

$

|

3,265,000

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||

|

Interest obligations (1)

|

306,060

|

306,060

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

Operating lease obligations (2)

|

10,500

|

10,500

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

|

$

|

3,581,560

|

$

|

3,581,560

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||

_______________

|

(1)

|

Interest rate obligations are presented through the maturity dates of each component of short-term debt.

|

|

(2)

|

Operating lease obligations represent payment obligations under non-cancelable lease agreements classified as operating leases and disclosed pursuant to ASC 840 “Accounting for Leases,” as may be modified or supplemented. These amounts are not recorded as liabilities as of the current balance sheet date.

|

Not applicable.

The Company's consolidated financial statements, together with the report of the independent registered public accounting firm thereon and the notes thereto, are presented beginning at page F-1.

Previous Independent Accountants

On February 21, 2012, in connection with the Company’s acquisition of the assets and operations of Nuvel DE and the related change in control of the Company, Board of Directors of Harmony Metals, Inc. approved to terminate Lake & Associates, CPA’s LLC (“LACPA”) as the Company’s independent registered public accounting firm.

The Company’s consolidated financial statements since inception through the fiscal year ended September 30, 2011 were audited by LACPA. The LACPA’s reports on our financial statements for each of the past two fiscal years did not contain an adverse opinion, a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended September 30, 2011 and 2010 and through February 21, 2012, (a) there were no disagreements with LACPA on any matter of accounting principles or practices, financial statement disclosure, auditing scope or procedure, which disagreements, if not resolved to the satisfaction of LACPA, would have caused it to make reference to the subject matter of the disagreement in connection with its report on the financial statements for such years and (b) there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

New Independent Registered Public Accounting Firm

On February 21, 2012, the Board of Directors of the Company ratified the appointment of Marcum LLP (“Marcum”) as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2011 and the period from January 20, 2010 (inception) to December 31, 2010. Marcum is located at 750 Third Avenue, 11th Floor, New York, NY 10017.

During the Company's previous fiscal years ended September 30, 2011 and 2010 and through February 21, 2012, neither the Company nor anyone on the Company's behalf consulted with Marcum regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements or (ii) any matter that was either the subject of a disagreement or a reportable event as defined in Item 304(a)(1)(v) of Regulation S-K. Prior to the Share Exchange Transaction, Nuvel DE had been audited by Marcum.

Disclosure Controls and Procedures

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act, is accumulated and communicated to management, including our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required

disclosure.

As required by Rule 13a-15 under the Exchange Act, we are required to carry out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report. Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in Company reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Based on the Company’s evaluation, management concluded that the Company’s disclosure controls and procedures were not

effective at a reasonable assurance level such that the information relating to us and our consolidated subsidiary required to be disclosed in our Exchange Act reports (i) is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and (ii) is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure as of December 31, 2011.

Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. Internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15(d)-15(f)) includes those policies and procedures that: (a) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (b) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), and that receipts and expenditures of the

Company are being made only in accordance with authorizations of management and directors of the Company; and (c) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

Internal control over reporting, because of its inherent limitations, may not prevent or detect misstatements. Projections of any evaluation of effectiveness for future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

As of December 31, 2011 we had identified certain matters that constituted a material weakness in our internal controls over financial reporting. Specifically, we have limited segregation of duties within our accounting and financial reporting functions. Segregation of duties within our company is limited due to the small number of employees that are assigned to positions that involve the processing of financial information. Although we are aware that segregation of duties within our company is limited, we believe (based on our current roster of employees and certain control mechanisms we have in place), that the risks associated with having limited segregation of duties are currently

insignificant. We have taken steps to address this matter, including the hiring of a Chief Financial Officer in December 2011. We believe that we have made significant progress towards remediating this weakness; however, we must still complete the process of design-specific control procedures and testing them for effectiveness before we can report that this weakness has been fully remediated. Although we believe that these steps have enabled us to improve our internal controls, additional time is still required to fully document our systems, implement control procedures and test their operating effectiveness before we can definitively conclude that we have remediated our material weakness.