Attached files

| file | filename |

|---|---|

| 8-K - STW RESOURCES HOLDING CORP. | stws8kapril102012.htm |

| EX-99.3 - STW RESOURCES HOLDING CORP. | ex99-3.htm |

| EX-99.1.4 - STW RESOURCES HOLDING CORP. | ex99-14.htm |

| EX-99.1.1 - STW RESOURCES HOLDING CORP. | ex99-11.htm |

| EX-99.1.2 - STW RESOURCES HOLDING CORP. | ex99-12.htm |

| EX-99.1.3 - STW RESOURCES HOLDING CORP. | ex99-13.htm |

Exhibit 99.2

SUBSCRIPTION AGREEMENT

Master Note Agreement with Revenue Participation Interest

February 02, 2012

Total Offering: $280,000.00

SUBSCRIPTION AGREEMENT (this “Agreement”) made as of the last date set

forth on the signature page hereof between STW RESOURCES HOLDING CORP., a Nevada

corporation (the “Company”), and the undersigned (the “Subscriber”).

W I T N E S S E T H:

WHEREAS, the Company has executed a Master Note Agreement with Revenue

Participation Interest (the “Note/Revenue Agreement”) as of January 31, 2012 between the

Company and the Participant or Participants (hereinafter referred to as “Participant”) subscribing

to all or a portion of the $280,000.00 Corporate Promissory Note contained therein, a true and

correct copy of which is attached as Exhibit “1” to the Agreement and incorporated by reference

as if fully set forth in this Agreement.

WHEREAS, the Company has arranged a series of Pilot Tests to demonstrate to

oil and gas producers and oil and gas servicing companies the Company’s ability to process

brackish and/or produced water for use in oil and gas well drilling and/or fracturing operations,

and the Company reasonably believes that the successful Pilot Tests will lead to long term water

processing agreements, as set forth more fully in the Pilot Project Presentation Package, attached

as Exhibit “A” to the Note/Revenue Agreement.

WHEREAS, the Company has teamed up with Bob J. Johnson & Associates, Inc.

(BJJA), a well-established and well-known Texas water processing and treatment equipment and

engineering company. BJJA will be designing and engineering the systems for the long term

water processing agreements and will maintain and operate the systems, as reflected in the Joint

Statement of the Company and BJJA, contained in the Pilot Project Presentation Package,

attached as Exhibit “A” to the Note/Revenue Agreement.

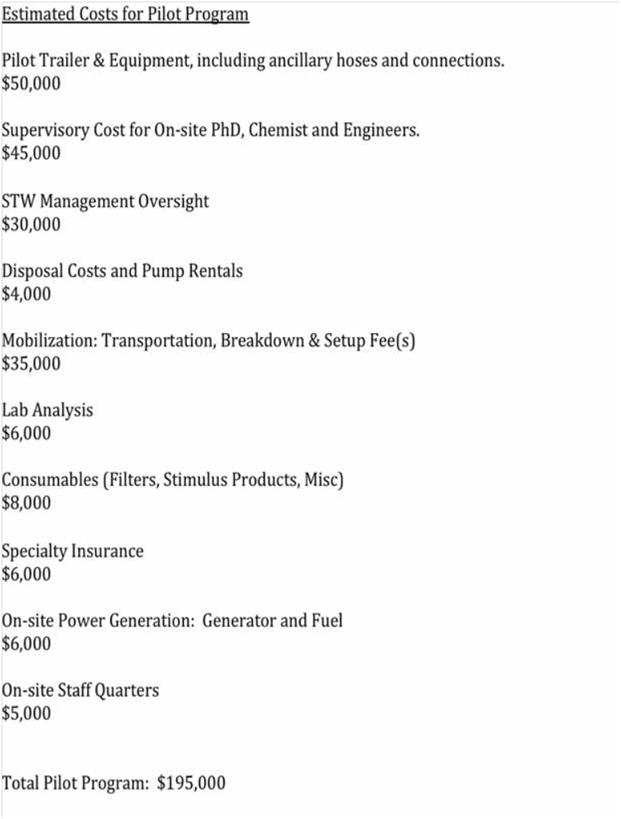

WHEREAS, in order for the Company to conduct its Pilot Tests, it needs

approximately $280,000.00 in funding, as set forth in its Estimated Costs for Pilot Program,

contained in the Pilot Project Presentation Package, attached as Exhibit “A” to the Note/Revenue

Agreement, together with contingencies for unanticipated costs or compliance costs.

WHEREAS, the Master Services Agreements (“MSA’s) which the Company

contemplates receiving as a direct result of the pilot will provide a stream of gross revenues,

from which the Company can dedicate to repaying Participant for its capital investment, plus a

long-term, post-payout source of revenue.

NOW, THEREFORE, in consideration of the premises and the mutual

representations and covenants hereinafter set forth, the parties hereto do hereby agree as follows:

I. MASTER NOTE AGREEMENT WITH REVENUE PARTICIPATION INTEREST

AND REPRESENTATIONS AND COVENANTS BY SUBSCRIBER

-1-

1.1 Subject to the terms and conditions hereinafter set forth, the Subscriber

hereby agrees to subscribe to and invest with Company the sum of $_____________ (the

“Subscription Amount”), which represents ___% of the $280,000.00 total amount of the

Master Note Agreement with Revenue Participation Interest, and indicated by Subscriber’s

signature page hereof. The Subscription Amount shall also serve as the face amount of the

Company’s Note obligation to Subscriber under the Master Note Agreement with Revenue

Participation Interest, the terms of which are incorporated as if fully set forth herein.

1.1.1 Stock Warrants. As additional consideration, Subscriber requests that STW

issue Subscriber ____ two-year stock warrants to purchase shares of STW’s common stock at

$0.20 per share, with up to 280,000 of such stock warrants to be issued. Subscriber will be

issued warrants on a one warrant for every dollar invested of the $280,000.00 investment

amount, listed in paragraph 1.1 above. The form of the Warrant is attached as Exhibit “2” to this

Subscription Agreement.

1.2 Offering Period; This Offering will be open until February 29, 2012 (the

“Termination Date”).

1.3 Closing. The Company may hold closings with respect to any Securities

at any time prior to the Termination Date as determined by the Company, with respect to

subscriptions accepted prior to the Termination Date (each such closing being referred to as a

“Closing”). The last Closing of the Offering, occurring on or prior to the Termination Date,

shall be referred to as the “Final Closing”. Any subscription documents received after the

Final Closing will be returned, without interest or deduction.

1.4 The Subscriber recognizes that the purchase of the Securities involves a

high degree of risk including, but not limited to, the following: (a) the Company has limited

operating history and requires substantial funds in addition to the proceeds of the Offering; (b)

an investment in the Company is highly speculative, and only investors who can afford the

loss of their entire investment should consider investing in the Company and the Securities; (c)

the Subscriber may not be able to liquidate its investment; (d) transferability of the Securities

is extremely limited; (e) in the event of a disposition, the Subscriber could sustain the loss of

its entire investment; and (f) the Company has not paid any dividends since its inception and

does not anticipate paying any dividends. Without limiting the generality of the

representations set forth in Section 1.5 below, the Subscriber represents that the Subscriber has

carefully reviewed the Company’s business plan including “Risk Factors.”

1.5 The Subscriber represents that the Subscriber is an “accredited investor”

as such term is defined in Rule 501 of Regulation D (“Regulation D”) promulgated under the

Securities Act, as indicated by the Subscriber’s responses to the questions contained in Article

VII hereof, and that the Subscriber is able to bear the economic risk of an investment in the

Securities.

1.6 The Subscriber hereby acknowledges and represents that (a) the

Subscriber has knowledge and experience in business and financial matters, prior investment

experience, including investment in securities that are non-listed, unregistered and/or not

traded on a national securities exchange nor on the National Association of Securities Dealers,

Inc. automated quotation system (“NASDAQ”), or the Subscriber has employed the services

of a “purchaser representative” (as defined in Rule 501 of Regulation D), attorney and/or

accountant to read all of the documents furnished or made available by the Company both to

the Subscriber and to all other prospective investors in the Securities to evaluate the merits and

risks of such an investment on the Subscriber’s behalf; (b) the Subscriber recognizes the

highly speculative nature of this investment; and (c) the Subscriber is able to bear the

economic risk that the Subscriber hereby assumes.

-2-

1.7 The Subscriber hereby acknowledges receipt and careful review of this

Agreement, the business plan (which includes the “Risk Factors”), including the Warrant and

the Note and all other exhibits thereto, and any documents which may have been made

available upon request as reflected therein (collectively referred to as the “Offering

Materials”) and hereby represents that the Subscriber has been furnished by the Company

during the course of the Offering with all information regarding the Company, the terms and

conditions of the Offering and any additional information that the Subscriber has requested or

desired to know, and has been afforded the opportunity to ask questions of and receive

answers from duly authorized officers or other representatives of the Company concerning the

Company and the terms and conditions of the Offering.

1.8 (a) In making the decision to invest in the Securities the Subscriber

has relied solely upon the information provided by the Company in the Offering Materials. To

the extent necessary, the Subscriber has retained, at its own expense, and relied upon

appropriate professional advice regarding the investment, tax and legal merits and

consequences of this Agreement and the purchase of the Securities and Warrants hereunder.

The Subscriber disclaims reliance on any statements made or information provided by any

person or entity in the course of Subscriber’s consideration of an investment in the Securities

and Warrants other than the Offering Materials.

(b) The Subscriber represents that (i) the Subscriber was contacted

regarding the sale of the Securities by the Company (or an authorized agent or representative

thereof) with whom the Subscriber had a prior substantial pre-existing relationship and (ii) no

Securities and Warrants were offered or sold to it by means of any form of general solicitation or

general advertising, and in connection therewith, the Subscriber did not (A) receive or review

any advertisement, article, notice or other communication published in a newspaper or magazine

or similar media or broadcast over television or radio, whether closed circuit, or generally

available; or (B) attend any seminar meeting or industry investor conference whose attendees

were invited by any general solicitation or general advertising.

1.9 The Subscriber hereby represents that the Subscriber, either by reason of

the Subscriber’s business or financial experience or the business or financial experience of the

Subscriber’s professional advisors (who are unaffiliated with and not compensated by the

Company or any affiliate or selling agent of the Company, directly or indirectly), has the

capacity to protect the Subscriber’s own interests in connection with the transaction

contemplated hereby.

1.10 The Subscriber hereby acknowledges that the Offering has not been

reviewed by the United States Securities and Exchange Commission (the “SEC”) nor any state

regulatory authority since the Offering is intended to be exempt from the registration

requirements of Section 5 of the Securities Act, pursuant to Regulation D. The Subscriber

understands that the Securities and Warrants have not been registered under the Securities Act

or under any state securities or “blue sky” laws and agrees not to sell, pledge, assign or

otherwise transfer or dispose of the Securities and Warrants unless they are registered under

the Securities Act and under any applicable state securities or “blue sky” laws or unless an

exemption from such registration is available.

1.11 The Subscriber understands that the Securities and Warrants have not been

registered under the Securities Act by reason of a claimed exemption under the provisions of

the Securities Act that depends, in part, upon the Subscriber’s investment intention. In this

connection, the Subscriber hereby represents that the Subscriber is purchasing the Securities

and Warrants for the Subscriber’s own account for investment and not with a view toward the

resale or distribution to others. The Subscriber, if an entity, further represents that it was not

formed for the purpose of purchasing the Securities.

-3-

1.12a The Subscriber understands that the Common Stock issuable upon

exercise of the Warrants (the “Warrant Shares” and the “Common Shares”) is not listed on any

national securities exchange or quoted on any over-the-counter market or the Pink Sheets, LLC

and that there is no market for the Common Stock. The Subscriber understands that even if a

public market develops for the Common Shares, Rule 144 (“Rule 144”) promulgated under the

Securities Act requires for non-affiliates, among other conditions, a holding period prior to the

resale (subject to certain limitations) of securities acquired in a non-public offering without

having to satisfy the registration requirements under the Securities Act. The Subscriber

understands and hereby acknowledges that the Company is under no obligation to register any of

the Securities or the Common Shares under the Securities Act or any state securities or “blue

sky” laws.

1.12 b The Subscriber understands that the repayment of the Corporate

Promissory Note and the Revenue Participation Interests is to come entirely from the net

Operating Revenues from the Company’s Water Processing Master Service Agreements

(MSA’S) with oil and gas producers and servicing companies, and not from the general

revenues of the Company. Subscriber also understands that the Security Agreement related to

the Corporate Promissory Note and the Revenue Participation Interests is only in the

Company’s Water Processing MSA’S with oil and gas producers and servicing companies,

and not from the general assets of the Company. Subscriber understands that its investment is

a 100% AT RISK INVESTMENT. The Subscriber understands and hereby acknowledges that

the Company is under no obligation to register any of the Securities under the Securities Act

or any state securities or “blue sky” laws.

1.13 The Subscriber consents to the placement of a legend on any certificate or

other document evidencing the Securities and the Common Shares that such securities have

not been registered under the Securities Act or any state securities or “blue sky” laws and

setting forth or referring to the restrictions on transferability and sale thereof contained in this

Agreement. The Subscriber is aware that the Company will make a notation in its appropriate

records with respect to the restrictions on the transferability of such Securities. The legend to

be placed on each certificate shall be in form substantially similar to the following:

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED

UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE

“ACT”) OR ANY STATE SECURITIES OR “BLUE SKY LAWS,” AND MAY NOT

BE OFFERED, SOLD, TRANSFERRED, ASSIGNED, PLEDGED OR

HYPOTHECATED ABSENT AN EFFECTIVE REGISTRATION THEREOF UNDER

SUCH ACT OR COMPLIANCE WITH RULE 144 PROMULGATED UNDER SUCH

ACT, OR UNLESS THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL,

REASONABLY SATISFACTORY TO THE COMPANY AND ITS COUNSEL, THAT

SUCH REGISTRATION IS NOT REQUIRED.”

1.14 It is agreed that the Company, at its sole discretion, reserves the

unrestricted right, without further documentation or agreement on the part of the Subscriber, to

reject or limit any subscription, and to close the Offering to the Subscriber at any time.

1.15 The Subscriber hereby represents that the address of the Subscriber

furnished by Subscriber on the signature page hereof is the Subscriber’s principal residence if

Subscriber is an individual or its principal business address if it is a corporation or other entity.

1.16 The Subscriber represents that the Subscriber has full power and authority

(corporate, statutory and otherwise) to execute and deliver this Agreement and to purchase the

Securities. This Agreement constitutes the legal, valid and binding obligation of the

Subscriber, enforceable against the Subscriber in accordance with its terms.

-4-

1.17 If the Subscriber is a corporation, partnership, limited liability company,

trust, employee benefit plan, individual retirement account, Keogh Plan, or other tax-exempt

entity, it is authorized and qualified to invest in the Company and the person signing this

Agreement on behalf of such entity has been duly authorized by such entity to do so.

1.18 The Subscriber acknowledges that if he or she is a Registered

Representative of a FINRA member firm, he or she must give such firm the notice required by

the FINRA’s Rules of Fair Practice, receipt of which must be acknowledged by such firm in

Section 7.4 below.

1.19 The Subscriber acknowledges that at such time, if ever, as the Securities

are registered, sales of the Securities will be subject to state securities laws.

1.20 The Subscriber agrees not to issue any public statement with respect to the

Subscriber’s investment or proposed investment in the Company or the terms of any

agreement or covenant between them and the Company without the Company’s prior written

consent, except such disclosures as may be required under applicable law or under any

applicable order, rule or regulation.

1.21 The Subscriber agrees to hold the Company and its directors, officers,

employees, affiliates, controlling persons and agents and their respective heirs, representatives,

successors and assigns harmless and to indemnify them against all liabilities, costs and

expenses incurred by them as a result of (a) any sale or distribution of the Securities by the

Subscriber in violation of the Securities Act or any applicable state securities or “blue sky”

laws; or (b) any false representation or warranty or any breach or failure by the Subscriber to

comply with any covenant made by the Subscriber in this Agreement (including the

Confidential Investor Questionnaire contained in Article VII herein) or any other document

furnished by the Subscriber to any of the foregoing in connection with this Agreement.

II. REPRESENTATIONS BY AND COVENANTS OF THE COMPANY

The Company hereby represents and warrants to the Subscriber that:

2.1 Organization, Good Standing and Qualification. The Company is a

corporation duly organized, validly existing and in good standing under the laws of the State

of Nevada and has full corporate power and authority to own and use its properties and its

assets and conduct its business as currently conducted. Each of the Company’s subsidiaries

(the “Subsidiaries”) is an entity duly organized, validly existing and in good standing under

the laws of the jurisdiction of its incorporation with the requisite corporate power and

authority to own and use its properties and assets and to conduct its business as currently

conducted. Neither the Company, nor any of its Subsidiaries is in violation of any of the

provisions of their respective articles of incorporation, by-laws or other organizational or

charter documents (as defined below). Each of the Company and its Subsidiaries is duly

qualified to conduct business and is in good standing as a foreign corporation in each

jurisdiction in which the nature of the business conducted or property owned by it makes such

qualification necessary, except where the failure to be so qualified or in good standing, as the

case may be, would not result in a direct and/or indirect (i) material adverse effect on the

legality, validity or enforceability of any of the Securities and/or this Agreement, (ii) material

adverse effect on the results of operations, assets, business or financial condition of the

Company or its Subsidiaries, or (iii) material adverse effect on the Company’s ability to

perform in any material respect on a timely basis its obligations under this Agreement, the

Warrants and the Notes.

-5-

2.2 Authorization; Enforceability. The Company has all corporate right,

power and authority to enter into, execute and deliver this Agreement and each other

agreement, document, instrument and certificate to be executed by the Company in connection

with the consummation of the transactions contemplated hereby, including, but not limited to

the Offering Materials and to perform fully its obligations hereunder and thereunder. All

corporate action on the part of the Company, its directors and stockholders necessary for the

(a) authorization execution, delivery and performance of this Agreement and the Offering

Materials by the Company; and (b) authorization, sale, issuance and delivery of the Securities

contemplated hereby and the performance of the Company’s obligations under this Agreement

and the Offering Materials has been taken. This Agreement and the Offering Materials have

been duly executed and delivered by the Company and each constitutes a legal, valid and

binding obligation of the Company, enforceable against the Company in accordance with its

respective terms, subject to laws of general application relating to bankruptcy, insolvency and

the relief of debtors and rules of law governing specific performance, injunctive relief or other

equitable remedies, and to limitations of public policy. The Securities, when issued and fully

paid for in accordance with the terms of this Agreement, will be validly issued, fully paid and

nonassessable. The issuance and sale of the Securities contemplated hereby will not give rise

to any preemptive rights or rights of first refusal on behalf of any person.

2.3 No Conflict; Governmental Consents.

(a) The execution and delivery by the Company of this Agreement and

the Offering Materials and the consummation of the transactions contemplated hereby will not (i)

result in the violation of any material law, statute, rule, regulation, order, writ, injunction,

judgment or decree of any court or governmental authority to or by which the Company is

bound, (ii) conflict with or violate any provision of the Company’s Articles of Incorporation (the

“Articles”), as amended or the Bylaws, (and collectively with the Articles, the “Charter

Documents”) of the Company, and (iii) will not conflict with, or result in a material breach or

violation of, any of the terms or provisions of, or constitute (with or without due notice or lapse

of time or both) a default or give to others any rights of termination, amendment, acceleration or

cancellation (with or without due notice, lapse of time or both) under any agreement, credit

facility, lease, loan agreement, mortgage, security agreement, trust indenture or other agreement

or instrument to which the Company is a party or by which it is bound or to which any of its

properties or assets is subject, nor result in the creation or imposition of any lien upon any of the

properties or assets of the Company.

(b) No approval by the holders of Common Stock, or other equity

securities of the Company is required to be obtained by the Company in connection with the

authorization, execution and delivery of this Agreement or the Offering Materials or in

connection with the authorization, issue and sale of the Securities, except as has been previously

obtained,

(c) No consent, approval, authorization or other order of any

governmental authority is required to be obtained by the Company in connection with the

authorization, execution and delivery of this Agreement or the Transaction Documents or in

connection with the authorization, issue and sale of the Securities, except such filings as may be

required to be made with the SEC, FINRA, NASDAQ and with any state or foreign blue sky or

securities regulatory authority.

2.4 Privacy. The Company agrees not to disclose the names, addresses or any

other information about the Subscribers, except as required by law.

2.5 No Additional Agreements. The Company does not have any agreement

or understanding with any Subscribers with respect to the transactions contemplated by this

Agreement other than as specified in this Agreement.

-6-

III. TERMS OF SUBSCRIPTION

3.1 Subscriber’s participation in the Corporate Promissory Note and the

Revenue Participation Interest will be effective upon receipt of payment by the Company from

Subscriber of all funds due from Subscriber.

3.2 The Note and Warrants received by the Subscriber pursuant to this

Agreement will be prepared for delivery to the Subscriber as soon as practicable following the

Closing at which such exchanges takes place. The Subscriber hereby authorizes and directs

the Company to deliver the Note due to Subscriber pursuant to this Agreement directly to the

Subscriber’s residential or business or brokerage house address indicated on the signature page

hereto.

IV. CONDITIONS TO OBLIGATIONS OF THE SUBSCRIBERS

4.1 The Subscriber’s obligation to purchase the Securities and Warrants at the

Closing at which such purchase is to be consummated is subject to the fulfillment on or prior

to such Closing of the following conditions, which conditions may be waived at the option of

each Subscriber to the extent permitted by law:

(a) Covenants. All covenants, agreements and conditions contained in

this Agreement to be performed by the Company on or prior to the date of such Closing shall

have been performed or complied with in all material respects.

(b) No Legal Order Pending. There shall not then be in effect any

legal or other order enjoining or restraining the transactions contemplated by this Agreement.

(c) No Law Prohibiting or Restricting Such Sale. There shall not be in

effect any law, rule or regulation prohibiting or restricting such sale or requiring any consent or

approval of any person, which shall not have been obtained, to issue the Securities (except as

otherwise provided in this Agreement).

(d) Adverse Changes. Since the date of execution of this Agreement,

no event or series of events shall have occurred that reasonably could have or result in a material

adverse effect.

(e) Blue Sky. The Company shall have completed qualification for

the Securities and the Common Shares under applicable Blue Sky laws.

V. COVENANTS OF THE COMPANY

5.1 Integration. The Company shall not, and shall ensure that no affiliate of

the Company shall, sell, offer for sale or solicit offers to buy or otherwise negotiate in respect

of any security (as defined in Section 2 of the Securities Act) that would be integrated with the

offer or sale of the Securities in a manner that would require the registration under the

Securities Act of the sale of the Securities to the Subscribers, or that would be integrated with

the offer or sale of the Securities for purposes of the rules and regulations of any trading

market in a manner that would require stockholder approval of the sale of the securities to the

Subscribers.

5.2 Rescission and Withdrawal Right. Notwithstanding anything to the

contrary contained in (and without limiting any similar provisions of) this Agreement,

whenever any Subscriber exercises a right, election, demand or option under this Agreement

and the Company does not timely perform its related obligations within the periods therein

provided, then such Subscriber may rescind or withdraw, in its sole discretion from time to

time upon written notice to the Company, any relevant notice, demand or election in whole or

in part without prejudice to its future actions and rights.

-7-

5.3 Replacement of Securities. If any certificate or instrument evidencing any

Securities is mutilated, lost, stolen or destroyed, the Company shall issue or cause to be issued

in exchange and substitution for and upon cancellation thereof, or in lieu of and substitution

therefor, a new certificate or instrument, but only upon receipt of evidence reasonably

satisfactory to the Company of such loss, theft or destruction and customary and reasonable

indemnity, if requested. The applicants for a new certificate or instrument under such

circumstances shall also pay any reasonable third-party costs associated with the issuance of

such replacement Securities. If a replacement certificate or instrument evidencing any

Securities is requested due to a mutilation thereof, the Company may require delivery of such

mutilated certificate or instrument as a condition precedent to any issuance of a replacement.

5.4 Indemnification.

(a) The Company agrees to indemnify and hold harmless the Subscriber, its

affiliates and their respective officers, directors, employees, agents and controlling persons

(collectively, the “Indemnified Parties”) from and against , any and all loss, liability, damage

or deficiency suffered or incurred by any Indemnified Party by reason of any

misrepresentation or breach of warranty by the Company or nonfulfillment of any covenant or

agreement to be performed or complied with by the Company under this Agreement, the

Transaction Documents; and will promptly reimburse the Indemnified Parties for all expenses

(including reasonable fees and expenses of legal counsel) as incurred in connection with the

investigation of, preparation for or defense of any pending or threatened claim related to or

arising in any manner out of any of the foregoing, or any action or proceeding arising

therefrom (collectively, “Proceedings”), whether or not such Indemnified Party is a formal

party to any such Proceeding.

(b) If for any reason (other than a final non-appealable judgment finding any

Indemnified Party liable for losses, claims, damages, liabilities or expenses for its gross

negligence or willful misconduct) the foregoing indemnity is unavailable to an Indemnified

Party or insufficient to hold an Indemnified Party harmless, then the Company shall contribute

to the amount paid or payable by an Indemnified Party as a result of such loss, claim, damage,

liability or expense in such proportion as is appropriate to reflect not only the relative benefits

received by the Company on the one hand and the Advisor on the other, but also the relative

fault by the Company and the Indemnified Party, as well as any relevant equitable

considerations.

VI. MISCELLANEOUS

6.1 Any notice or other communication given hereunder shall be deemed

sufficient if in writing and sent by registered or certified mail, return receipt requested, or

delivered by hand against written receipt therefore, addressed as follows:

if to the Company, to it at:

STW RESOURCES HOLDING CORP.

619 West Texas Avenue Suite 126

Midland, Texas 79701

Attn: Stan Weiner, CEO

if to the Subscriber, to the Subscriber’s address indicated on the signature page of

this Agreement.

Notices shall be deemed to have been given or delivered on the date of receipt.

-8-

6.2 No provision of this Agreement may be waived, modified, supplemented

or amended except in a written instrument signed, in the case of an amendment, by the

Company and the Purchasers holding at least 50% in interest of the Securities then outstanding

or, in the case of a waiver, by the party against whom enforcement of any such waived

provision is sought. No waiver of any default with respect to any provision, condition or

requirement of this Agreement shall be deemed to be a continuing waiver in the future or a

waiver of any subsequent default or a waiver of any other provision, condition or requirement

hereof, nor shall any delay or omission of any party to exercise any right hereunder in any

manner impair the exercise of any such right

6.3 This Agreement shall be binding upon and inure to the benefit of the

parties hereto and to their respective heirs, legal representatives, successors and assigns. This

Agreement sets forth the entire agreement and understanding between the parties as to the

subject matter hereof and merges and supersedes all prior discussions, agreements and

understandings of any and every nature among them.

6.4 Upon the execution and delivery of this Agreement by the Subscriber and

the Company, this Agreement shall become a binding obligation of the Subscriber with respect

to the purchase of Securities as herein provided, subject, however, to the right hereby reserved

by the Company to enter into the same agreements with other subscribers and to reject any

subscription, in whole or in part, provided the Company returns to Subscriber any funds paid

by Subscriber with respect to such rejected subscription or portion thereof, without interest or

deduction.

6.5 NOTWITHSTANDING THE PLACE WHERE THIS AGREEMENT

MAY BE EXECUTED BY ANY OF THE PARTIES HERETO, THE PARTIES

1EXPRESSLY AGREE THAT ALL THE TERMS AND PROVISIONS HEREOF SHALL BE

CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE

STATE OF TEXAS WITHOUT REGARD TO SUCH STATE’S PRINCIPLES OF

CONFLICTS OF LAW. IN THE EVENT THAT A JUDICIAL PROCEEDING IS

NECESSARY, THE SOLE FORUM FOR RESOLVING DISPUTES ARISING OUT OF OR

RELATING TO THIS AGREEMENT IS THE COURTS STATE OF TEXAS IN AND FOR

THE COUNTY OF MIDLAND OR THE FEDERAL COURTS FOR SUCH STATE AND

COUNTY, AND ALL RELATED APPELLATE COURTS, THE PARTIES HEREBY

IRREVOCABLY CONSENT TO THE JURISDICTION OF SUCH COURTS AND AGREE

TO SAID VENUE. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY

JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE

PARTIES EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST

EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY,

UNCONDITIONALLY, IRREVOCABLY AND EXPRESSLY WAIVES FOREVER

TRIAL BY JURY

6.6 In order to discourage frivolous claims the parties agree that unless a

claimant in any proceeding arising out of this Agreement succeeds in establishing his claim

and recovering a judgment against another party (regardless of whether such claimant

succeeds against one of the other parties to the action), then the other party shall be entitled to

recover from such claimant all of its/their reasonable legal costs and expenses relating to such

proceeding and/or incurred in preparation therefor.

6.7 The holding of any provision of this Agreement to be invalid or

unenforceable by a court of competent jurisdiction shall not affect any other provision of this

Agreement, which shall remain in full force and effect. If any provision of this Agreement

shall be declared by a court of competent jurisdiction to be invalid, illegal or incapable of

being enforced in whole or in part, such provision shall be interpreted so as to remain

enforceable to the maximum extent permissible consistent with applicable law and the

remaining conditions and provisions or portions thereof shall nevertheless remain in full force

-9-

and effect and enforceable to the extent they are valid, legal and enforceable, and no

provisions shall be deemed dependent upon any other covenant or provision unless so

expressed herein.

6.8 The Company agrees to execute and deliver all such further documents,

agreements and instruments and take such other and further action as may be necessary or

appropriate to carry out the purposes and intent of this Agreement.

6.9 Nothing in this Agreement shall create or be deemed to create any rights

in any person or entity not a party to this Agreement, except for the holders of Registrable

Securities.

6.10 In addition to being entitled to exercise all rights provided herein or

granted by law, including recovery of damages, each of the Subscribers and the Company will

be entitled to specific performance under this Agreement. The parties agree that monetary

damages may not be adequate compensation for any loss incurred by reason of any breach of

obligations described in the foregoing sentence and hereby agrees to waive in any action for

specific performance of any such obligation the defense that a remedy at law would be

adequate.

6.11 The obligations of each Subscriber under this Agreement are several and

not joint with the obligations of any other Subscriber, and no Subscriber shall be responsible

in any way for the performance of the obligations of any other Subscriber under this

Agreement. The decision of each Subscriber to purchase Securities pursuant to this

Agreement has been made by such Subscriber independently of any other Subscriber. Nothing

contained herein, and no action taken by any Subscriber pursuant thereto, shall be deemed to

constitute the Subscribers as a partnership, an association, a joint venture or any other kind of

entity, or create a presumption that the Subscribers are in any way acting in concert or as a

group with respect to such obligations or the transactions contemplated herein. Each

Subscriber acknowledges that no other Subscriber has acted as agent for such Subscriber in

connection with making its investment hereunder and that no Subscriber will be acting as

agent of such Subscriber in connection with monitoring its investment in the Securities or

enforcing its rights under this Agreement. Each Subscriber shall be entitled to independently

protect and enforce its rights, including without limitation the rights arising out of this

Agreement, and it shall not be necessary for any other Subscriber to be joined as an additional

party in any proceeding for such purpose. The Company acknowledges that each of the

Subscribers has been provided with this same Agreement for the purpose of closing a

transaction with multiple Subscribers and not because it was required or requested to do so by

any Subscriber.

6.12 The parties agree that each of them and/or their respective counsel has

reviewed and had an opportunity to revise the Offering Materials and, therefore, the normal rule

of construction to the effect that any ambiguities are to be resolved against the drafting party

shall not be employed in the interpretation of the Offering Materials or any amendments hereto.

6.13 Notwithstanding any provision to the contrary contained in any

Transaction Document, it is expressly agreed and provided that the total liability of the Company

under the Transaction Documents for payments in the nature of interest shall not exceed the

maximum lawful rate authorized under applicable law (the “Maximum Rate”), and, without

limiting the foregoing, in no event shall any rate of interest or default interest, or both of them,

when aggregated with any other sums in the nature of interest that the Company may be

obligated to pay under the Transaction Documents exceed such Maximum Rate.

-10-

6.14 The headings herein are for convenience only, do not constitute a part of

this Agreement and shall not be deemed to limit or affect any of the provisions hereof.

6.15 This Agreement may be executed in two or more counterparts, all of

which when taken together shall be considered one and the same agreement and shall become

effective when counterparts have been signed by each party and delivered to the other party, it

being understood that both parties need not sign the same counterpart.

VII. CONFIDENTIAL INVESTOR QUESTIONNAIRE

7.1 The Subscriber represents and warrants that he, she or it comes within one

category marked below, and that for any category marked, he, she or it has truthfully set forth,

where applicable, the factual basis or reason the Subscriber comes within that category. ALL

INFORMATION IN RESPONSE TO THIS SECTION WILL BE KEPT STRICTLY

CONFIDENTIAL. The undersigned agrees to furnish any additional information which the

Company deems necessary in order to verify the answers set forth below.

Category A The undersigned is an individual (not a partnership, corporation, etc.) whose

individual net worth, or joint net worth with his or her spouse, excluding the

value of their principal residence, presently exceeds $1,000,000.

Explanation. In calculating net worth you may include equity in personal

property and real estate, but not including your principal residence, cash,

short-term investments, stock and securities. Equity in personal property and real

estate should be based on the fair market value of such property less debt secured

by such property.

Category B The undersigned is an individual (not a partnership, corporation, etc.) who had an

income in excess of $200,000 in each of the two most recent years, or joint

income with his or her spouse in excess of $300,000 in each of those years (in

each case including foreign income, tax exempt income and full amount of

capital gains and losses but excluding any income of other family members and

any unrealized capital appreciation) and has a reasonable expectation of reaching

the same income level in the current year.

Category C The undersigned is a director or executive officer of the Company which is

issuing and selling the Securities.

Category D The undersigned is a bank; a savings and loan association; insurance company;

registered investment company; registered business development company;

licensed small business investment company (“SBIC”); or employee benefit plan

within the meaning of Title 1 of ERISA and (a) the investment decision is made

by a plan fiduciary which is either a bank, savings and loan association,

insurance company or registered investment advisor, or (b) the plan has total

assets in excess of $5,000,000 or (c) is a self-directed plan with investment

decisions made solely by persons that are accredited investors. (describe entity)

Category E The undersigned is a private business development company as defined in

section 202(a)(22) of the Investment Advisors Act of 1940. (describe entity)

Category F The undersigned is either a corporation, partnership, Massachusetts business

trust, or non-profit organization within the meaning of Section 501(c)(3) of the

Internal Revenue Code, in each case not formed for the specific purpose of

acquiring the Securities and with total assets in excess of $5,000,000. (describe

entity)

-11-

Category G The undersigned is a trust with total assets in excess of $5,000,000, not formed

for the specific purpose of acquiring the Securities, where the purchase is

directed by a “sophisticated investor” as defined in Regulation 506(b)(2)(ii)

under the Act.

Category H The undersigned is an entity (other than a trust) in which all of the equity owners

are “accredited investors” within one or more of the above categories. If relying

upon this Category alone, each equity owner must complete a separate copy of

this Agreement. (describe entity)

Category I The undersigned is not within any of the categories above and is therefore not an

accredited investor.

The undersigned agrees that the undersigned will notify the Company at any time

on or prior to the Closing in the event that the representations and warranties in

this Agreement shall cease to be true, accurate and complete.

7.2 SUITABILITY (please answer each question)

(a) For an individual Subscriber, please describe your current employment, including the

company by which you are employed and its principal business:

(b) For an individual Subscriber, please describe any college or graduate degrees held by

you:

(c) For all Subscribers, please list types of prior investments:

Subscription Agreement

15

(d) For all Subscribers, please state whether you have participated in other private

placements before:

YES_______ NO_______

(e) If your answer to question (d) above was “YES”, please indicate frequency of such prior

participation in private placements of:

Public

Companies

Private

Companies

Public or Private Companies

with no, or insignificant,

assets and operations

Frequently

Occasionally

Never

(f) For individual Subscribers, do you expect your current level of income to significantly

decrease in the foreseeable future:

YES_______ NO_______

(g) For trust, corporate, partnership and other institutional Subscribers, do you expect your

total assets to significantly decrease in the foreseeable future:

YES_______ NO_______

-12-

(h) For all Subscribers, do you have any other investments or contingent liabilities which you

reasonably anticipate could cause you to need sudden cash requirements in excess of cash readily

available to you:

YES_______ NO_______

(i) For all Subscribers, are you familiar with the risk aspects and the non-liquidity of

investments such as the securities for which you seek to subscribe?

YES_______ NO_______

(j) For all Subscribers, do you understand that there is no guarantee of financial return on

this investment and that you run the risk of losing your entire investment?

YES_______ NO_______

7.3 MANNER IN WHICH TITLE IS TO BE HELD. (circle one)

(a) Individual Ownership

(b) Common Share Property

(c) Joint Tenant with Right of

Survivorship (both parties

must sign)

(d) Partnership*

(e) Tenants in Common

(f) Company*

(g) Trust*

(h) Other*

*If Securities are being subscribed for by an entity, the attached Certificate of

Signatory must also be completed.

7.4 FINRA AFFILIATION.

Are you affiliated or associated with an FINRA member firm (please check one):

Yes _________ No __________

If Yes, please describe:

_____________________________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

*If Subscriber is a Registered Representative with an FINRA member firm, have the following

acknowledgment signed by the appropriate party:

The undersigned FINRA member firm acknowledges receipt of the notice required by Article 3, Sections

28(a) and (b) of the Rules of Fair Practice.

_________________________________

-13-

Name of NASD Member Firm

By: ______________________________

Authorized Officer

Date: ____________________________

7.5 The undersigned is informed of the significance to the Company of the

foregoing representations and answers contained in the Confidential Investor Questionnaire

contained in this Article VII and such answers have been provided under the assumption that

the Company will rely on them.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

-14-

AGGREGATE FACE AMOUNT OF THE NOTE = $_________ (the “Purchase Price”)

Signature Signature (if purchasing jointly)

Name Typed or Printed Name Typed or Printed

Title (if Subscriber is an Entity) Title (if Subscriber is an Entity)

Entity Name (if applicable) Entity Name (if applicable

Address Address

City, State and Zip Code City, State and Zip Code

Telephone-Business Telephone-Business

Telephone-Residence Telephone-Residence

Facsimile-Business Facsimile-Business

Facsimile-Residence Facsimile-Residence

Tax ID # or Social Security # Tax ID # or Social Security #

Name in which securities should be issued:

Dated: , 2012

This Subscription Agreement is agreed to and accepted as of ________________ , 2012.

STW RESOURCES HOLDING CORP.

By:____________________________________

Name:

Title:

Subscription Agreement 18

-15-

CERTIFICATE OF SIGNATORY

(To be completed if Securities are

being subscribed for by an entity)

I, ____________________________, am the ____________________________ of

__________________________________________ (the “Entity”).

I certify that I am empowered and duly authorized by the Entity to execute and carry out the terms of the

Subscription Agreement and to purchase and hold the Notes, and certify further that the Subscription

Agreement has been duly and validly executed on behalf of the Entity and constitutes a legal and binding

obligation of the Entity.

IN WITNESS WHEREOF, I have set my hand this ________ day of _________________, 2012

_______________________________________

(Signature)

Master Note Agreement with Revenue Participation Interest -- Page 1

-16-

Exhibit “1”

NEITHER THIS MASTER NOTE AGREEMENT NOR THE REVENUE

PARTICIPATION INTERESTS HAVE BEEN REGISTERED UNDER

THE SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES

ACT"). NEITHER THIS NOTE NOR THE REVENUE PARTICIPATION

INTERESTS MAY BE SOLD, OFFERED FOR SALE, PLEDGED OR

HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE

REGISTRATION STATEMENT AS TO THIS NOTE OR THE REVENUE

PARTICIPATION INTERESTS UNDER SAID ACT OR AN OPINION OF

COUNSEL REASONABLY SATISFACTORY TO THE BORROWER

THAT SUCH REGISTRATION IS NOT REQUIRED.

-17-

Issue Date: February 02, 2012

MASTER NOTE AGREEMENT

WITH REVENUE PARTICIPATION INTEREST

This Master Note Agreement with Revenue Participation Interest (the “Agreement”) is

made as of February 02, 2012 between STW RESOURCES HOLDING CORP. (“STW”), a

Nevada corporation with an address of 2101 Cedar Springs Rd., Suite 1050, Dallas, Texas

75201, and the Participant or Participants (hereinafter referred to as “Participant”) subscribing to

all or a portion of the $280,000.00 Corporate Promissory Note herein, as indicated by the

inclusion and incorporation of this Agreement into Participant(s) related Subscription

Agreement(s).

RECITALS

STW has arranged a series of Pilot Tests to demonstrate to oil and gas producers and oil

and gas servicing companies STW’s ability to process brackish and/or produced water for use in

oil and gas well drilling and/or fracturing operations, and STW reasonably believes that the

successful Pilot Tests will lead to long term water processing agreements, as set forth more fully

in the Pilot Project Presentation Package, attached as Exhibit “A” to this Agreement.

STW has teamed up with Bob J. Johnson & Associates, Inc. (BJJA), a well-established

and well-known Texas water processing and treatment equipment and engineering company.

BJJA will be designing and engineering the systems for the long term water processing

agreements and will maintain and operate the systems, as reflected in the Joint Statement of

STW and BJJA, contained in the Pilot Project Presentation Package, attached as Exhibit “A” to

this Agreement.

In order for STW to conduct its Pilot Tests, it needs approximately $280,000.00 in

funding, as set forth in its Estimated Costs for Pilot Program, contained in the Pilot Project

Presentation Package, attached as Exhibit “A” to this Agreement, together with contingencies for

unanticipated costs or compliance costs.

The Master Services Agreements (“MSA’s) which STW contemplates receiving as a

direct result of the pilot will provide a stream of gross revenues, from which STW can dedicate

to repaying Participant for its capital investment, plus a long-term, post-payout source of

revenue.

Participant, individually or in combination with other Participants has loaned STW an

amount of Two Hundred and Fifty Thousand Dollars ($280,000.00). STW has executed within

this Agreement a Corporate Loan Note with Covenants (the "Note"), a Continuing Security

Agreement (the “Security Agreement”) and other documents relating thereto (the Note,

Continuing Security Agreement, and all other documents related thereto are referred to

collectively as the "Loan Documents"); and

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the

parties agree as follows:

TERMS

1. Transaction Documents. Unless otherwise separately defined herein, all capitalized

terms used in this Agreement shall have the same meaning as is set forth in the related

Subscription Agreement, which together with the Subscription Agreement, will be referred to as

the "Transaction Documents".

-18-

2. Corporate Promissory Note. Participant agrees to loan the amount indicated on

Participant’s Subscription to STW for use in the STW Pilot Project, which represents all or a

percentage of the $280,000.00 Pilot Project Cost (“Investment Amount”). STW promises to pay

Participant that amount indicated on Participant’s Subscription Agreement on or before January

31, 2017, with the Note carrying a stated percentage interest rate of 12% per annum, with the

further provision that any and all payments on the Note shall come solely from Participant’s

share of the Revenue Participation Fees, as set forth in following Section 5.

3. Security Interest. To secure payment of STW's Note obligations under this

Agreement, STW pledges and grants to Participant a continuing security interest in those Water

Processing Agreements and the proceeds thereof, until such time as STW’s obligations to pay

Participant on the Note ceases.

4. Deemed Interest. Participant’s investment hereunder shall be considered a 100% AT

RISK INVESTMENT, not subject to any general guarantees other than the performance of STW

under the Water Processing MSA’s derived from the Pilot Tests funded in whole or in part by

Participant’s investment. It is not intended by the parties hereto that the Revenue Sharing

payments due under this Agreement be deemed to constitute "interest" on the Note or other Loan

Documents. However, in the event a Court of competent jurisdiction determines that the

Revenue Participation Fees due and payable hereunder are deemed to be "interest" arising with

respect to the obligations evidenced by the Note and other Loan Documents, and as a direct

result thereof such payments under this Agreement results in Borrower having paid interest in

excess of that permitted by applicable law, then all excess amounts theretofore collected by

Participant shall be credited on the principal balance owing under the Note and remaining Loan

Documents (or, if all sums owing thereunder have been paid in full, refunded to STW), and the

amounts thereafter collectible under this Agreement shall immediately be deemed reduced,

without the necessity of the execution of any new document so as to comply with applicable law

and permit the recovery of the fullest amount otherwise called for hereunder.

5. Revenue Participation Fees. In order to provide payment on the Note and an enhanced

return on the Participant’s investment, STW will pay the following Revenue Participation Fees:

A. During the term hereof STW agrees to pay to Participant Revenue

Participation Fees equal to the following amounts, based on Net Saleable Barrels of water

processed from its MSA’s with oil and gas producers and oil and gas servicing companies

(“Water Processing MSA’s”) to process brackish and/or produced water into water suitable for

drilling and/or fracking operations (“Processing Revenues”):

B. Revenue Participation Fees: STW will pay one-half (50%) of the Net

Operating Revenues from the Water Processing MSA’s to all Participants generally (with each

Participant’s percentage of the $280,000 investment being paid on a pro-rata basis) until such

time as each Participant’s share of the $280,000.00 Note has been paid in full, and until such

further time as an additional $280,000.00 has been paid to the Participants in relation to each

Participant’s share of the $280,000.00 investment. Thereafter, STW will pay ten percent (10%)

of its Net Operating Revenues under the Water Processing MSA’s to all Participants generally

(with each Participant’s percentage of the $0.025 Revenue Fee being paid on a pro-rata basis)

until such time as a total of an additional $500,000.00 has been paid out to all Participants

generally (with each Participant’s percentage share being paid on a pro-rata basis). Thereafter,

all further Revenue Fees shall cease and this Agreement shall be terminated in all respects.

C. The term "Net Barrels" shall mean all net saleable barrels of water

processed by any systems that are a direct result of the pilot program.

-19-

D. The Participants’ share(s) of Net Operating Revenues from the Water

Processing MSA’s shall be paid monthly on or before the fifteenth of the month following the

month of receipt during the term hereof. In the event payment of the Revenue Participation Fees

are not received by Participant on or before the date due, interest shall accrue on the late payment

at twelve percent (12%) per annum until the Revenue Participation Fees due and accrued interest

are paid in full. In the event payment of the Revenue Participation Fees are not received by

Participant within thirty (30) days after the date due, interest shall then begin to accrue on the

late payment at the rate of eighteen percent (18%) per annum until the Revenue Participation

Fees due and accrued interest are paid in full.

E. Upon receipt of STW’s annual audited financial statements, if the Net

Operating Revenues upon which the Revenue Participation Fees are calculated, are shown to be

incorrect, STW shall immediately pay any shortfall, if any, in Revenue Participation Fees and if

there was an overpayment, STW may deduct the overpayment from its next due payment(s) of

Master Note Agreement with Revenue Participation Interest -- Page 4

Revenue Participation Fees. However, in no event shall the recalculated fees in any month result

in an obligation of Participant to pay over to STW any previously paid Revenue Participation

Fees.

F. Stock Warrants. As additional consideration, STW will issue two-year

stock warrants to purchase shares of STW’s common stock at $0.20 per share, with up to

280,000 stock warrants to be issued. Each Participant will be issued warrants on one warrant for

one dollar invested basis upon his dollar amount participation interest in the $280,000.00

investment amount.

6. Term and Termination. The term of this Agreement shall commence immediately and

shall terminate upon the later of payment in full of sums due under this Agreement, per Section

5.B or five (5) years from the date hereof, whichever is shorter. This Agreement may not be

terminated prior to the expiration of its term without the written agreement of the parties.

7. Default and Remedies Upon Default. In the event STW is in default of any of the

terms of this Agreement, Participant shall have all the remedies provided in this Agreement.

8. Notices. Any notice to be given hereunder by either party to the other shall be in

writing and personally delivered, sent by certified mail, return receipt requested or by reliable

overnight delivery service, to the respective address above or to any other address required by

the respective party, or by facsimile transmission with confirmation of receipt, and notice shall

be deemed given on the earlier of: a) three (3) business days after notice is mailed as set forth

above; or, b) upon actual receipt.

9. Compliance with Securities Laws. Participant, as the holder of this Note, by

acceptance hereof, acknowledges that this Note and the Revenue Participation Interests are being

acquired solely for the Participant’s own account and not as a nominee for any other party, and

for investment, and that the Participant will not offer, sell or otherwise dispose this Note and/or

Revenue Participation Interest except pursuant to an effective registration statement, or an

exemption from registration, under the Securities Act and any applicable state securities laws.

10. Jurisdiction. The terms and provisions of this agreement shall be governed by Texas

law without giving effect to any choice or conflict of law provision or rule (whether of Texas or

any other jurisdiction) that would cause the application of the laws of any other jurisdiction other

than Texas to apply. Each of the parties submits to the exclusive jurisdiction of the state district

courts sitting in Dallas County, Texas. Each party also agrees not to bring any such action or

proceeding arising out of or relating to this Agreement in such court. Each of the parties waives

any defense of inconvenient forum to the maintenance of any action or proceeding so brought.

-20-

IN WITNESS WHEREOF, the parties have executed this Agreement upon the date set

forth above.

STW RESOURCES HOLDING CORP.

By: ________________________

Stanley T. Weiner, its CEO

PARTICIPANTS

[Agreements indicated by their signatures on the Subscription Agreements]

-21-

EXHIBIT “A”

Press Release: January 4, 2012

Press Release: Continued

-22-

-23-

-24-

-25-

-26-

-27-

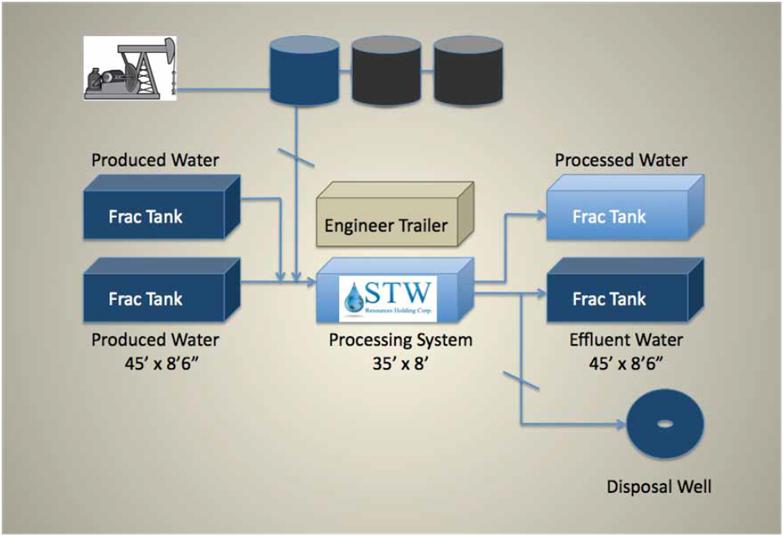

20 gpm Produced Water Pilot Trailer

-28-

Pilot Footprint

-29-

Exhibit “2”

NEITHER THIS SECURITY NOR THE SECURITIES FOR WHICH THIS SECURITY IS

EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE

COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE

UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF

1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE

OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE

EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION

REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH

APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF

COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH

SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY.

-30-

COMMON STOCK PURCHASE WARRANT

STW RESOURCES HOLDING CORP.

Warrant Shares: _______ Initial Exercise Date: February __, 2012

THIS COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies

that, for value received, _____________ (the “Holder”) is entitled, upon the terms and subject to

the limitations on exercise and the conditions hereinafter set forth, at any time on or after the date

hereof (the “Initial Exercise Date”) and on or prior to the close of business on the two year

anniversary of the Initial Exercise Date (the “Termination Date”) but not thereafter, to subscribe

for and purchase from STW RESOURCES HOLDING CORP., a Nevada corporation (the

“Company”), up to ______ shares (the “Warrant Shares”) of Common Stock. The purchase

price of one share of Common Stock under this Warrant shall be equal to the Exercise Price, as

defined in Section 2(b).

Section 1. Definitions. Capitalized terms used and not otherwise defined herein shall

have the meanings set forth in that certain Subscription Agreement (the “Subscription

Agreement”), dated February 02, 2012, among the Company and the purchasers signatory

thereto.

Section 2. Exercise.

a) Exercise of Warrant. Exercise of the purchase rights represented by this

Warrant may be made, in whole or in part, at any time or times on or after the Initial

Exercise Date and on or before the Termination Date by delivery to the Company (or

such other office or agency of the Company as it may designate by notice in writing to

the registered Holder at the address of the Holder appearing on the books of the

Company) of a duly executed facsimile copy of the Notice of Exercise Form annexed

hereto; and, within 3 Trading Days of the date said Notice of Exercise is delivered to the

Company, the Company shall have received payment of the aggregate Exercise Price of

the shares thereby purchased by wire transfer or cashier’s check drawn on a United States

bank. Notwithstanding anything herein to the contrary, the Holder shall not be required

to physically surrender this Warrant to the Company until the Holder has purchased all of

the Warrant Shares available hereunder and the Warrant has been exercised in full, in

which case, the Holder shall surrender this Warrant to the Company for cancellation

within 3 Trading Days of the date the final Notice of Exercise is delivered to the

Company. Partial exercises of this Warrant resulting in purchases of a portion of the total

number of Warrant Shares available hereunder shall have the effect of lowering the

outstanding number of Warrant Shares purchasable hereunder in an amount equal to the

applicable number of Warrant Shares purchased. The Holder and the Company shall

maintain records showing the number of Warrant Shares purchased and the date of such

purchases. The Company shall deliver any objection to any Notice of Exercise Form

within 1 Business Day of receipt of such notice. In the event of any dispute or

discrepancy, the records of the Holder shall be controlling and determinative in the

absence of manifest error. The Holder and any assignee, by acceptance of this

Warrant, acknowledge and agree that, by reason of the provisions of this

paragraph, following the purchase of a portion of the Warrant Shares hereunder,

the number of Warrant Shares available for purchase hereunder at any given time

may be less than the amount stated on the face hereof.

b) Exercise Price. The exercise price per share of the Common Stock under

this Warrant shall be $0.20, subject to adjustment hereunder (the “Exercise Price”).

c) Mechanics of Exercise.

-31-

i. Delivery of Certificates Upon Exercise. Certificates for

shares purchased hereunder shall be transmitted by the Transfer Agent to

the Holder by physical delivery to the address specified by the Holder in

the Notice of Exercise within 3 Trading Days from the delivery to the

Company of the Notice of Exercise Form, surrender of this Warrant (if

required) and payment of the aggregate Exercise Price as set forth above

(the “Warrant Share Delivery Date”). This Warrant shall be deemed to

have been exercised on the date the Exercise Price is received by the

Company. The Warrant Shares shall be deemed to have been issued, and

Holder or any other person so designated to be named therein shall be

deemed to have become a holder of record of such shares for all purposes,

as of the date the Warrant has been exercised by payment to the Company

of the Exercise Price and all taxes required to be paid by the Holder, if

any, pursuant to Section 2(e)(v) prior to the issuance of such shares, have

been paid.

ii. Delivery of New Warrants Upon Exercise. If this Warrant

shall have been exercised in part, the Company shall, at the request of a

Holder and upon surrender of this Warrant certificate, at the time of

delivery of the certificate or certificates representing Warrant Shares,

deliver to Holder a new Warrant evidencing the rights of Holder to

purchase the unpurchased Warrant Shares called for by this Warrant,

February 02, 2012 $0.20 Warrant Agreement 3

which new Warrant shall in all other respects be identical with this

Warrant.

iii. Rescission Rights. If the Company fails to cause the Transfer

Agent to transmit to the Holder a certificate or the certificates representing

the Warrant Shares pursuant to Section 2(e)(i) by the Warrant Share

Delivery Date, then, the Holder will have the right to rescind such

exercise.

iv. No Fractional Shares or Scrip. No fractional shares or scrip

representing fractional shares shall be issued upon the exercise of this

Warrant. As to any fraction of a share which Holder would otherwise be

entitled to purchase upon such exercise, the Company shall, at its election,

either pay a cash adjustment in respect of such final fraction in an amount

equal to such fraction multiplied by the Exercise Price or round up to the

next whole share.

v. Charges, Taxes and Expenses. Issuance of certificates for

Warrant Shares shall be made without charge to the Holder for any issue

or transfer tax or other incidental expense in respect of the issuance of

such certificate, all of which taxes and expenses shall be paid by the

Company, and such certificates shall be issued in the name of the Holder

or in such name or names as may be directed by the Holder; provided,

however, that in the event certificates for Warrant Shares are to be issued

in a name other than the name of the Holder, this Warrant when

surrendered for exercise shall be accompanied by the Assignment Form

attached hereto duly executed by the Holder and the Company may

require, as a condition thereto, the payment of a sum sufficient to

reimburse it for any transfer tax incidental thereto.

vi. Closing of Books. The Company will not close its stockholder

books or records in any manner which prevents the timely exercise of this

Warrant, pursuant to the terms hereof.

-32-

Section 3. Certain Adjustments.

a) Reorganization, Consolidation, Merger, etc.; Reclassification. In case at

any time or from time to time, the Company shall effect any merger, reorganization,

restructuring, reverse stock split, consolidation, sale of all or substantially all of the

Company’s assets or any similar transaction or related transactions (each such

transaction, a “Fundamental Change”), then, in each such case, as a condition to the

consummation of such a transaction, proper and adequate provision shall be made by the

Company whereby the Holder of this Note, on the conversion hereof, at any time after the

consummation of such Fundamental Change, shall receive, in lieu of the Conversion

Shares issuable on such conversion prior to such consummation or such effective date,

the stock and other securities and property (including cash) to which such Holder would

have been entitled upon such consummation of a Fundamental Change if such Holder had

so converted this Note, immediately prior thereto, all subject to further adjustment

thereafter as provided in Section 3(d).

If the Company at any time shall, by reclassification or otherwise, change the

Common Stock into the same or a different number of securities of any class or classes

that may be issued or outstanding, this Note, as to the unpaid principal portion thereof

and accrued interest thereon, shall thereafter be deemed to evidence the right to purchase

an adjusted number of such securities and kind of securities as would have been issuable

as the result of such change with respect to the Common Stock immediately prior to such

reclassification or other change.

b) Dissolution. In the event of any dissolution of the Company following the

transfer of all or substantially all of its properties or assets, the Company, prior to such

dissolution, shall at its expense deliver or cause to be delivered the stock and other

securities and property (including cash, where applicable) receivable by the Holder of

this Note after the effective date of such dissolution pursuant to this Article to a bank or

trust company (a “Trustee”) as trustee for the Holder of this Note.

c) Continuation of Terms. Upon any Fundamental Change or transfer (and

any dissolution following any transfer) referred to in this Article, this Note shall continue

in full force and effect and the terms hereof shall be applicable to any other securities and

property receivable on the conversion of this Note after the consummation of such

Fundamental Change or transfer or the effective date of dissolution following any such

transfer, as the case may be, and shall be binding upon the issuer of any other securities,

including, in the case of any such transfer, the person acquiring all or substantially all of

the properties or assets of the Company, whether or not such person shall have expressly

assumed the terms of this Note as provided in Section 3(c). In the event this Note does

not continue in full force and effect after the consummation of the transaction described

in this Section 3, then only in such event will the Company’s securities and property

(including cash, where applicable) receivable by the Holder of the Notes be delivered to

the Trustee as contemplated by Section 3(b).

d) Extraordinary Events Regarding Common Stock. In the event that the

Company shall (a) issue additional shares of Common Stock as a dividend or other

distribution on outstanding Common Stock, (b) subdivide its outstanding shares of

Common Stock, or (c) combine its outstanding shares of the Common Stock into a

smaller number of shares of the Common Stock, then, in each such event, the Exercise

Price shall, simultaneously with the happening of such event, be adjusted by multiplying

the then Exercise Price by a fraction, the numerator of which shall be the number of

shares of Common Stock outstanding immediately prior to such event and the

denominator of which shall be the number of shares of Common Stock outstanding

immediately after such event, and the product so obtained shall thereafter be the Exercise

-33-

Price then in effect. The Exercise Price, as so adjusted, shall be readjusted in the same

manner upon the happening of any successive event or events described in this Section

3(d). The number of Warrant Shares that the Holder of this Warrant shall thereafter, on

the exercise hereof as provided herein, be entitled to receive shall be adjusted to a number

determined by multiplying the number of Warrant Shares that would otherwise (but for

the provisions of this Section 3(d)) be issuable on such exercise by a fraction of which (a)

the numerator is the Exercise Price that would otherwise (but for the provisions of this

Section 3(d) be in effect, and (b) the denominator is the Exercise Price in effect on the

date of such exercise.

e) Calculations. All calculations under this Section 3 shall be made to the nearest

cent or the nearest 1/100th of a share, as the case may be. For purposes of this

Section 3, the number of shares of Common Stock deemed to be issued and

outstanding as of a given date shall be the sum of the number of shares of

Common Stock (excluding treasury shares, if any) issued and outstanding.

Section 4. Transfer of Warrant.

a) Transferability. Subject to compliance with any applicable securities laws

and the conditions set forth in Section 4(d) hereof and to the provisions of Section 4.1 of

the Subscription Agreement, this Warrant and all rights hereunder (including, without

limitation, any registration rights) are transferable, in whole or in part, upon surrender of

this Warrant at the principal office of the Company or its designated agent, together with

a written assignment of this Warrant substantially in the form attached hereto duly

executed by the Holder or its agent or attorney and funds sufficient to pay any transfer

taxes payable upon the making of such transfer. Upon such surrender and, if required,

such payment, the Company shall execute and deliver a new Warrant or Warrants in the

name of the assignee or assignees, as applicable, and in the denomination or

denominations specified in such instrument of assignment, and shall issue to the assignor

a new Warrant evidencing the portion of this Warrant not so assigned, and this Warrant

shall promptly be cancelled. The Warrant, if properly assigned, may be exercised by a

new holder for the purchase of Warrant Shares without having a new Warrant issued.

b) New Warrants. This Warrant may be divided or combined with other

Warrants upon presentation hereof at the aforesaid office of the Company, together with a

written notice specifying the names and denominations in which new Warrants are to be

issued, signed by the Holder or its agent or attorney. Subject to compliance with Section

4(a), as to any transfer which may be involved in such division or combination, the

Company shall execute and deliver a new Warrant or Warrants in exchange for the

Warrant or Warrants to be divided or combined in accordance with such notice. All

Warrants issued on transfers or exchanges shall be dated the Initial Exercise Date and

shall be identical with this Warrant except as to the number of Warrant Shares issuable

pursuant thereto.

c) Warrant Register. The Company shall register this Warrant, upon records

to be maintained by the Company for that purpose (the “Warrant Register”), in the name

of the record Holder hereof from time to time. The Company may deem and treat the

registered Holder of this Warrant as the absolute owner hereof for the purpose of any

exercise hereof or any distribution to the Holder, and for all other purposes, absent actual

notice to the contrary.

-34-

d) Transfer Restrictions. If, at the time of the surrender of this Warrant in

connection with any transfer of this Warrant, the transfer of this Warrant shall not be