Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - K-V Pharmaceutical Co | d329143d8k.htm |

K-V Pharmaceutical

Investor Presentation

April 2012

Exhibit 99.1 |

Safe

Harbor Statement 2

Cautionary Note Regarding Forward-looking Statements

This presentation contains various forward-looking statements within the meaning of the United

States Private Securities Litigation Reform Act of 1995 (the “PSLRA”) and which may

be based on or include assumptions concerning our operations, future results and prospects. Such statements may be identified by the use of words like “plan,”

“expect,” “aim,” “believe,” “project,” “anticipate,”

“commit,” “intend,” “estimate,” “will,” “should,” “could,” “potential” and other expressions that indicate future events and

trends.

All statements that address expectations or projections about the future, including, without

limitation, statements about product launches, governmental and regulatory actions and

proceedings, market position, revenues, expenditures and the impact of the recall and suspension of shipments on revenues, adjustments to the financial

statements, and other financial results, are forward-looking statements.

All forward-looking statements are based on current expectations and are subject to risk and

uncertainties. In connection with the PSLRA’s “safe harbor” provisions, we

provide the following cautionary statements identifying important economic, competitive, political,

regulatory and technological factors, among others, that could cause actual results or events

to differ materially from those set forth or implied by the forward-looking statements and related assumptions. Such factors include (but are not

limited to) the following:

(1) our ability to continue as a going concern;

(2) risks associated with the introduction and growth strategy related to the Company’s

Makena ® product, including: (a) the impact of competitive, commercial payor,

governmental (including Medicaid program), physician, patient, public or political responses and reactions, and

responses and reactions by medical professional associations and advocacy groups, on the

Company’s sales, marketing, product pricing, product access and strategic efforts;

(b) the possibility that the benefit of any period of exclusivity resulting from the

designation of Makena® as an orphan drug may not be realized as a result of the FDA’s

decision to decline to take enforcement action with regards to compounded alternatives;

(c) the Center for Medicare and Medicaid Services’ (“CMS”) policy regarding Medicaid

reimbursement for Makena®, and the resulting coverage decisions for Makena® by

various state Medicaid and commercial payors; (d) the satisfaction or waiver of the terms

and conditions for our continued ownership of the full U.S. and worldwide rights to Makena® set forth in the previously

disclosed Makena® acquisition agreement, as amended; and

(e) the number of preterm births for which Makena® may be prescribed and its safety profile

and side effects profile and acceptance of the degree of patient access to and pricing;

(3) the possibility of delay or inability to obtain U.S. Food and Drug Administration

(the “FDA”) approvals of Clindesse and Gynazole-1 and the possibility that any

product relaunch may be delayed or unsuccessful;

(4) risks related to compliance with various agreements and settlements with governmental

entities including: (a) the consent decree between the Company and the FDA and the

Company’s suspension in 2008 and 2009 of the production and shipment and the nationwide

recall of all of the products that it formerly manufactured, as well as the related material adverse

effect on our revenue, assets and liquidity and capital resources; (b) the agreement between

the Company and the Office of Inspector General of the U.S. Department of Health and Human Services (“HHS OIG”) to resolve the risk

of potential exclusion of the Company from participation in federal healthcare programs; and

(c) our ability to comply with the plea agreement between a now-dissolved subsidiary of the

Company and the U.S. Department of Justice; (5) the availability of raw materials

and/or products manufactured for the Company under contract manufacturing agreements with third parties;

|

Safe

Harbor Statement (cont.) 3

(6) risks that the Company may not ultimately prevail in or that insurance proceeds

will be insufficient to cover potential losses that may arise from litigation, including:

(a) the series of putative class action lawsuits alleging violations of the federal securities

laws by the Company and certain individuals; (b) product liability lawsuits;

(c) lawsuits pertaining to indemnification and employment agreement obligations involving

the Company and its former Chief Executive Officer ; (d)

the possibility that the pending lawsuits and investigation by HHS OIG regarding potential false claims under the Title 42 of the U.S. Code could result in significant

civil fines or penalties, including exclusion from participation in

federal healthcare programs such as Medicare and Medicaid and the possibility; and

(e) challenges to our intellectual property rights by actual or potential competitors and

challenges to other companies’ introduction or potential introduction of generic or

competing products by third parties against products sold by the

Company; (7) the possibility that our current estimates of the financial effect of previously

announced product recalls could prove to be incorrect; (8) risks related to the Company’s highly leveraged capital structure,

including: (a) the risk that our debt obligations may be accelerated due to our

inability to comply with covenants and restrictions contained in our loan agreements;

(b) restrictions on the ability to increase our revenues through certain transactions, including

the acquisition or in-licensing of products; and (c) risks that present or

future changes in the Board of Directors may lead to an acceleration of the Company’s debt;

(9) the risk that we may not be able satisfy the quantitative listing standards of

the New York Stock Exchange, including with respect to minimum share price and public float;

and

(10) the risks detailed from time to time in the Company’s filings with the SEC. This

discussion is not exhaustive, but is designed to highlight important factors that may impact

our forward-looking statements.

Because the factors referred to above, as well as the statements included under the captions Part I,

Item 7A—“Risk Factors,” Item 2—“Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and elsewhere in our Form 10-K/A for the

fiscal year ended March 31, 2011, as supplemented by our subsequent SEC filings,

could cause actual results or outcomes to differ materially from those expressed in any

forward-looking statements made by us or on our behalf, you should not place undue

reliance on any forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by the

cautionary statements in this “Cautionary Note Regarding Forward-Looking

Statements” and the risk factors that are included under the caption Part I, Item

7A—“Risk Factors” in our Form 10-K/A for the fiscal year ended March 31, 2011, as

supplemented by our subsequent SEC filings. Further, any forward-looking statement speaks only as

of the date on which it is made and we are under no obligation to update

any of the forward-looking statements after the date of this Report. New factors emerge from time

to time, and it is not possible for us to predict which factors will arise, when

they will arise and/or their effects. In addition, we cannot assess the impact of each factor on our

future business or financial condition or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those contained in any forward-looking statements. |

Strategic Direction

Leading Branded Specialty Pharmaceutical

Company with a Focus in Women’s Health

Synergistic product portfolio

anchored by Makena

®

and

supported by Anti-Infective

Franchise & Evamist

®

Commercialization strategy

with history of building

brands in Women’s Health

4

Nationally deployed sales force

supported by an experienced

commercial organization

Strong compliance and corporate governance |

Strategic Priorities

1.

Increase

Makena

®

penetration:

Reinforce information highlighting differences between compounded 17P and

FDA-approved

Makena

®

with

physician

community

Grow state Medicaid payer relationships

Leverage

expanded

payer

coverage

of

Makena

®

to

drive

volume

Utilize nationally deployed sales organization led by recently hired National

Sales Director

2.

Return our anti-infective products to market

Working with our contract manufacturers to return products to market during

calendar year 2012

3.

Continue to actively manage our financial position and improve liquidity

5 |

Key

Recent Events 1

2

3

FDA Approval of

Makena®

and

Product Launch

February/March

2011

Divested generics

business

August

2011

Products:

•

Ramp up Makena®

•

Return

anti-infective

products to market

Financial:

•

Continued efforts to

reduce cost structure

•

Financing initiatives

2012

4

6

October

2011

•

ACOG and SMFM

Clarification Statements

•

Medicaid contract signed

with Florida

November

2011

•

Independent testing

results announced

•

FDA issues update

and commences

review and testing

6

5 |

Women’s Health

Product Portfolio Addresses Key Therapeutic Areas

7 |

Makena

®

Overview

Makena

®

is a progestin indicated to reduce the risk of preterm

birth in women with a singleton pregnancy who have a history

of singleton spontaneous preterm birth

-

Demonstrated efficacy and safety profile

-

Not for multiple pregnancies (twins, etc.)

-

Granted Orphan Drug Exclusivity

-

Patients identifiable based on their obstetric history

-

Many of these patients are highly motivated

to do what

they can to help prevent another preterm birth

Very high cost condition

-

-

Sterile injectable

Sterile injectable

(1)

Behrman

RE,

Butler

AS,

eds.

Committee

on

Understanding

Premature

Birth

and

Assuring

Healthy

Outcomes.

Preterm

Birth:

Causes,

Consequences,

and

Prevention.

Washington,

DC:

National

Academies

Press;

2007.

8

Preterm

birth

costs

average

over

$51,600

(1)

and

can

reach

hundreds of thousands of dollars

Financial burden falls on payors and employers

Administered via weekly IM injections, starting between weeks

16-20 of gestation and continuing through week 37 or delivery,

whichever comes first |

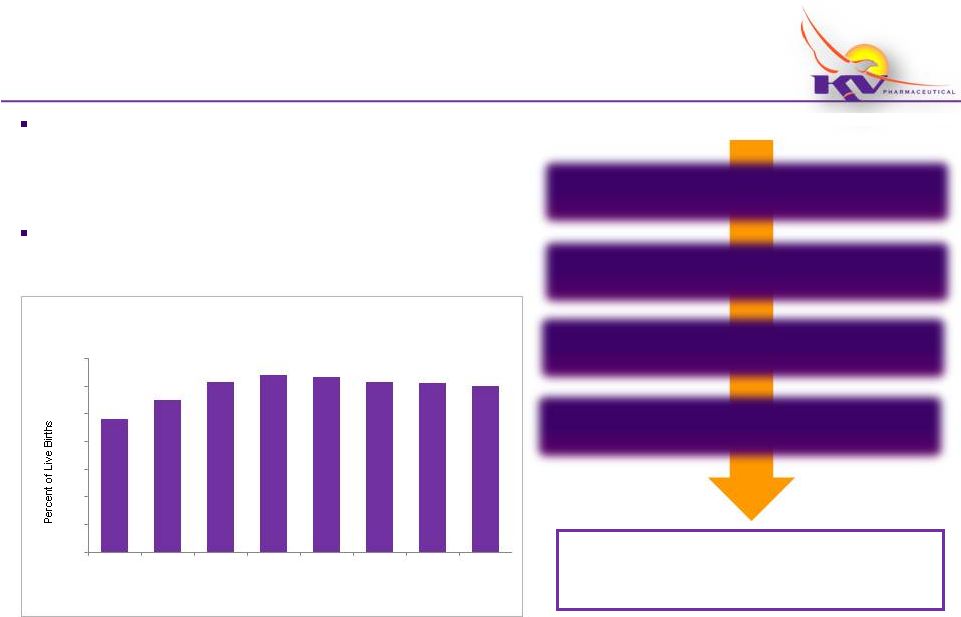

Makena

®

Market Opportunity

Preterm Birth is Costly and Prevalent

Preterm Birth is a growing concern in the U.S. impacting

+12% of births each year

-

Clinically defined as < 37 weeks

-

Highest risk of PTB are those with a history of PTB

Results

in

$26

billion

in

annual

direct

and

indirect

costs

(2)

-

Emotional costs for families are immeasurable

Makena

®

is an orphan drug with an estimated

patient population of up to

~140,000 annually

~140,000 women with a singleton pregnancy who

have a history of singleton SPTB in U.S. per year

~450,000 singleton preterm births in U.S. per year

~545,000 preterm births in U.S. per year

4.3 million births in U.S. per year

9

Decline in rate of PTB in recent years believed to be primarily attributable

to efforts to reduce elective “C-sections”

prior to 39 weeks

Preterm

Births

in

the

United

States

from

1983–2010

(1)

9.6

11.0

12.3

12.8

12.7

12.3

12.2

12.0

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

1983

1993

2003

2006

2007

2008

2009

2010

(1)

Data highlights preterm birth in general, including recurrent preterm birth.

www.marchofdimes.com. Accessed 09/04/11. (2)

Behrman RE, Butler AS, eds. Committee on Understanding Premature Birth and Assuring Healthy

Outcomes. Preterm Birth: Causes, Consequences ,and Prevention. Washington, DC:

National Academies Press; 2007. Calculations

estimated based on: Petrini et al. Estimated Effect of 17 Alpha-Hydroxyprogesterone

Caproate on Preterm Birth in the United States

Obstetrics and Gynecology VOL. 105, NO.2, FEBRUARY 2001

|

Recent Makena

®

Events

American College of Obstetricians and Gynecologists (ACOG) and Society for

Maternal-Fetal Medicine (SMFM) issue information update clarifying

misconceptions and

highlighting

inherent

differences

between

Makena

®

and

compounded

17P

Ther-Rx

announces

results

of

independently

commissioned

study

testing

API

and finished products from compounding pharmacies

FDA announces receipt of K-V’s study of API and finished products from

compounding pharmacies

Reviewing the results of K-V testing

Conducting own independent analysis

Pending –

FDA follow-up on independent test results

Signed

Medicaid

contract

with

Florida

–

top

10

state

covering

an

estimated

2

to

3

million lives

3 state contracts in total

20

states

have

reimbursed

Makena

®

10 |

Makena

®

The Facts…

Exact formulation demonstrated to be safe and

effective in NICHD MFMU Network Study

Manufactured in compliance with FDA’s current Good

Manufacturing Practices Dispensed with complete and

consistent FDA-approved prescribing information

Standardized distribution

National availability

Financial assistance programs with no household

income caps

11

FDA-approved

Makena

®

provides

important

benefits

to patients and healthcare providers

Evidence-

Based

Medicine

Manufacturing

and Safety /

Assurance of

Quality

Distribution

and Support |

Makena

®

The Facts…

Exclusive sourcing agreement with Organon

API manufactured in FDA approved facilities

Same API manufacturer as NICHD MFMU Network

Study

12

KV

is

fully

committed

to

ensuring

access

to

Makena

®

for

all

eligible patients and to maximizing its value

K-V

Commitment to

FDA

Obligations

FDA Regulated

Supply Chain

Ongoing Phase 3b studies including the largest clinical

trial in preterm birth

1,700

Moms

and

>

500

infants

Enrolled ~500

moms to date |

Makena

®

The Facts…

Originated primarily from facilities in China

Facilities

were

not

registered

and

not inspected by

the FDA

Unreliable

potency

Unreliable

purity –

unknown identity/toxicity

Outdated

40-year old USP standards

13

Study commissioned by Ther-Rx served as basis for

FDA’s

November

8

th

statement

on

Makena

®

API

Sourcing

Drug

Identity

Drug Purity

and Potency

One

API

sample

was

the

wrong

ingredient

(glucose) |

Makena

®

The Facts…

14

Bottle labeled in Chinese as

hydroxyprogesterone caproate

(HPC); upon analysis, the

substance in the bottle was found

to be glucose

Shipment delivered to the U.S. of

API for use in compounded 17P (in

unlabeled bag) from non-FDA

inspected or registered Chinese

manufacturer |

Why

Makena ®

?

The Facts…

15

Alignment with

Evidence-Based Medicine

Assurance of

FDA’s Quality Standards

National Sales Force Advancing

Education and Awareness

Economic Value

and Commitment to Affordable

Access |

Makena

®

Performance to Date (Launch -

3/31/12)

16

Current Penetration

>3,800 physicians have written

prescriptions

> 4,500 patients have either started

therapy or are pending start

Patient Access

Patient copays averaging $10 per

injection before financial assistance

~ 43% of patients have had a copay

of $0

Unit Volume

~11,300 vials have shipped to

Specialty Pharmacies/Distributors

~9,900 vials have shipped to

patients; ~20% were financially

assisted

Payer Coverage

Over 250 commercial payers have

reimbursed Makena

®

19 of top 20 commercial payers

have reimbursed Makena

®

Medicaid –

20 states have

reimbursed Makena

® |

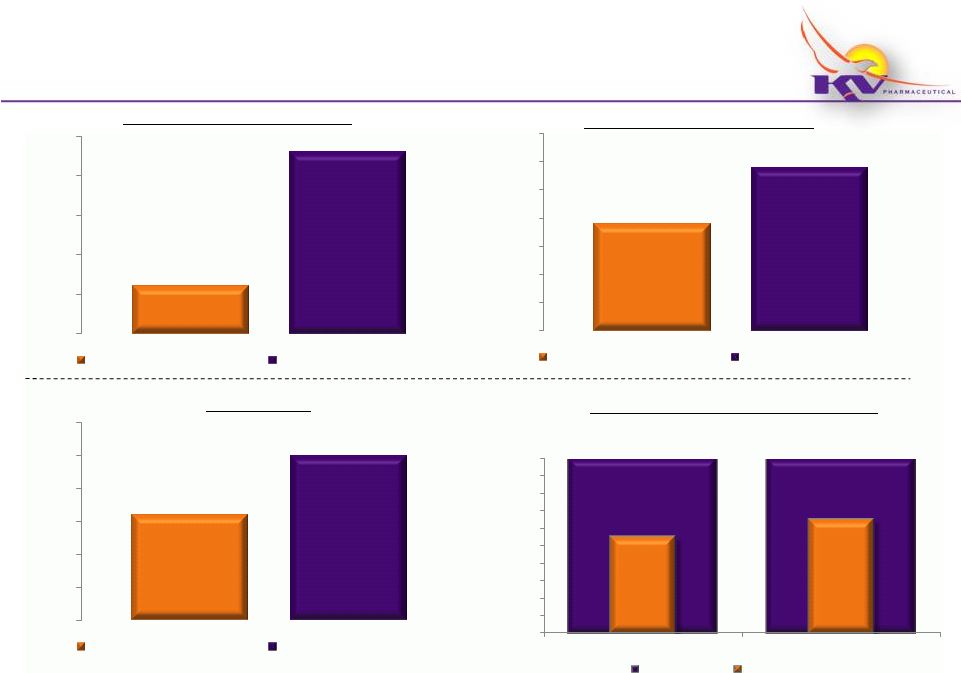

Makena

®

Key Metrics Dashboard

(Fiscal 2012)

17

Vials Shipped to Ther-Rx Customers

Vials Shipped to Physicians/Patients

Net Enrollments

Net Enrollments as a % of Gross Enrollments

~600

~2,300

0

500

1,000

1,500

2,000

2,500

October 2011 -

March 2012

~3,800

~5,800

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

April 2011 -

September 2011

October 2011 -

March 2012

~1,600

~2,500

0

500

1,000

1,500

2,000

2,500

3,000

April 2011 -

September 2011

October 2011 -

March 2012

~55

%

~65%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

October

2011

-

March

2012

Gross Enrollments

Net Enrollments

April 2011 -

September 2011

* Product

launch occurred in March 2011; does

not

include

launch

quantities

* Totals shown above are estimated based upon activity through 3/30/12

April 2011 -

September 2011 |

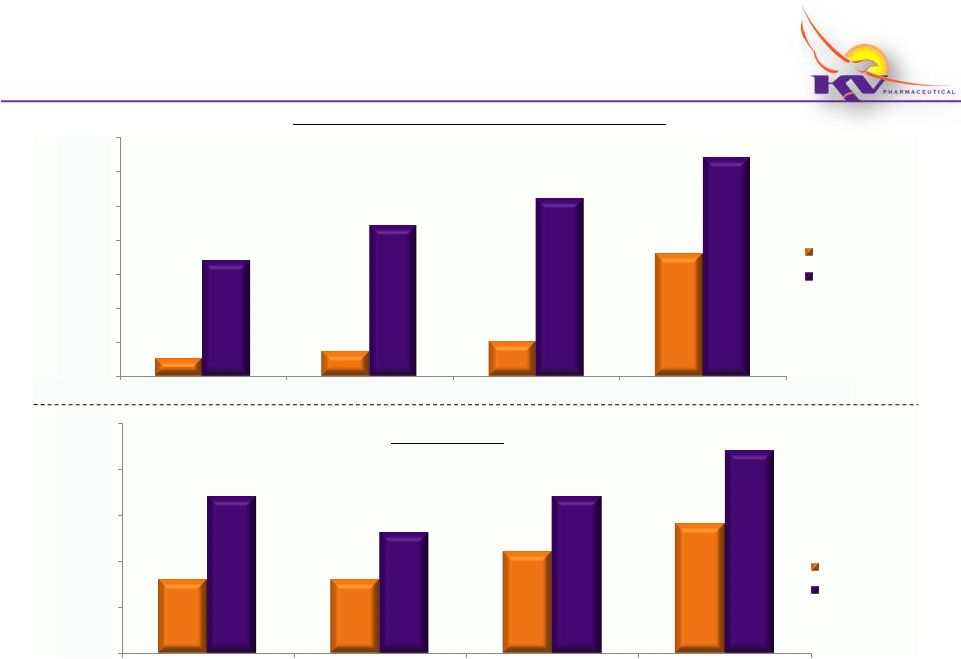

Makena

®

Key Metrics Dashboard

(Fiscal 2012)

Vials Shipped to Customers and Patients

18

Enrollments

~250

~350

~500

~1,800

~1,600

~2,200

~2,600

~3,200

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Q1

Q2

Q3

Q4

Ther-

~800

~800

~1,100

~1,400

~1,700

~1,300

~1,700

~2,200

0

500

1,000

1,500

2,000

2,500

Q1

Q2

Q3

Q4

Rx Customers

Patients / Physicians

Net Enrollments

Gross Enrollments

* Product

launch occurred in March 2011; does

not

include

launch

quantities

* Totals shown above are estimated based upon activity through 3/30/12

|

Makena

®

: Key Takeaways

19

-

FDA testing is in progress

Company completed independent testing of API and compounded 17P and

provided to the FDA

Efforts supported by clarification statements from the American College of

Obstetricians and Gynecologists (ACOG) and Society for Maternal-Fetal

Medicine (SMFM)

-

Out-of-pocket costs for patients remain in-line or less than the costs

of compounded 17

Successful execution of Makena

®

commercialization strategy generating positive

momentum across key business metrics

Focused on communicating the fundamental quality and safety differences

between FDA-approved Makena

®

and compounded 17P while maintaining an

affordable out-of-pocket cost for eligible patients

|

20

White House and the F.D.A. Often at Odds

By GARDINER HARRIS

Published: April 2, 2012

Page A1

“

…

to the agency, the only issue was that [Makena] offered guaranteed

safety while those made by pharmacists were riskier. Though FDA

officials were then not aware of safety complaints about the pharmacy

made 17P, they worried about repeated instances over the years when

other pharmacy-made drugs had been found to lack potency or be

contaminated with deadly bacteria …

…

FDA officials said they had often been wrongly accused of

considering price in drug approval deliberations and had always been

able to reply that price was never a factor. ‘We can’t say that

anymore,’ a top F.D.A. official said unhappily.”

|

Focused on re-building specialty product portfolio targeting critical and unmet

therapeutic needs in the women’s health category, where historically

K-V has played a leadership role

Current strategic priorities include securing FDA approval to re-launch

anti- infective

franchise

and

driving

Evamist

®

volume

Future strategy centered on potential in-licensing, product acquisition

opportunities, and re-launch of other existing products

Beyond Makena

®

21 |

Other

Women’s Health Products (1)

http://www.cdc.gov/std/stats09/tables/43.html

22

Evamist

®

is a once-daily estrogen spray

indicated for the treatment of moderate to

severe vasomotor symptoms due to

menopause

Competes in the +$300MM Transdermal /

Topical Estrogen Therapy market

Novel delivery mechanism provides an

opportunity to differentiate with patients

and prescribers

Net revenue was ~$8 million through the

first nine months of FY12

Anti-infective Franchise

Clindesse

®

and

Gynazole-1

®

Evamist

®

(estradiol transdermal spray)

Both products offer convenient treatment for

frequently diagnosed conditions

Generated annual combined net sales of

$68MM through the end of 2008

-

An estimated 3.2 million physician office

visits

in

2009

for

women

ages

15

-

44

(1)

Re-launch pursuant to FDA review and

approval

Both products provide high patient satisfaction

and effectiveness

Each became the #1 prescribed branded intra-

vaginal product in its respective category |

Financial Position

(1)

(in millions)

Expected Cash Position –

3/31/12

Cash and Cash Equivalents

Restricted Cash

Total Cash

Financial

Obligations

–

3/31/12

12% Senior Notes (mature March 2015)

2.5% Convertible Notes (put date May 2013)

Mortgage

Other Material Obligations:

Hologic Milestone Payments

DOJ Settlement

Other Government Settlement

(1) Source: 3Q FY 2012 Form 10-Q

23

40.0 -

$50.0

8.0

48.0 -

$58.0

225.0

200.0

31.0

95.0

18.0

17.0

586.0

$

$

$

$

$

$

$

$

$

$

Total Debt and Other Obligations |

Reduced Cost Structure

($ in millions)

Operating Costs

Headcount

$ 90 -

100

$ 50 -

60

$ 30 -

40

$ 30 -

35

1,075

675

375

225

24

60 -

70%

~80%

$ 20 -

25

200 -

225

FY 2009

FY 2010

Average Quarterly Cash Costs

FY 2011

FY 2012

Target

% Reduction

2009 -

2012

Divestiture

of

generics

business

reduced

quarterly

costs

by

$8

to

$10

million

and reduced headcount by ~ 150

Continued

focus

by

management

team

to

further

reduce

cash

costs

Resolution

of legacy issues

Consolidation of physical infrastructure |

Strategic Priorities

1.

Increase Makena

®

penetration:

Reinforce information highlighting differences between compounded 17P and

FDA-approved Makena

®

with physician community

Grow state Medicaid payer relationships

Leverage expanded payer coverage of Makena

®

to drive volume

Utilize nationally deployed sales organization led by recently hired National

Sales Director

2.

Return our anti-infective products to market

Working with our contract manufacturers to return products to market during

calendar year 2012

3.

Continue to actively manage our financial position and improve liquidity

25 |

26

THE RIGHT DRUG.

THE RIGHT DOSE.

EVERY DOSE.

Only FDA-Approved Makena

®

Delivers … |

K-V Pharmaceutical

Investor Presentation

April 2012 |