Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - MEDCO HEALTH SOLUTIONS INC | d324940dex314.htm |

| EX-31.3 - EX-31.3 - MEDCO HEALTH SOLUTIONS INC | d324940dex313.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

Commission File Number: 1-31312

MEDCO HEALTH SOLUTIONS, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 22-3461740 | |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | |

| 100 Parsons Pond Drive, Franklin Lakes, NJ | 07417-2603 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 201-269-3400

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, Par Value $0.01 7.25% Senior Notes Due 2013 |

New York Stock Exchange New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-Accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ¨ No x

The aggregate market value of the Registrant’s voting stock held by non-affiliates as of June 25, 2011 was $20,806,818,951. The Registrant has no non-voting common equity.

As of March 23, 2012, the Registrant had 391,934,491 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

Explanatory Note

Medco Health Solutions, Inc. (the “Company,” “Medco,” “we,” “us” or “our”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend our Annual Report on Form 10-K for the year ended December 31, 2011, originally filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2012 (the “Original Filing”), to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year-end. We are filing this Amendment to include Part III information in our Form 10-K because a definitive proxy statement containing such information will not be filed by Medco within 120 days after the end of the fiscal year covered by the Form 10-K. The reference on the cover of the Original Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14 of the Original Filing are hereby amended and restated in their entirety, and Part IV, Item 15 of the Original Filing is hereby amended and restated in its entirety, with the only changes being the addition of Exhibits 31.3 and 31.4 filed herewith and related footnotes. This Amendment No. 1 does not amend or otherwise update any other information in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing.

i

Table of Contents

MEDCO HEALTH SOLUTIONS, INC.

ANNUAL REPORT ON FORM 10-K/A

AMENDMENT NO. 1

ii

Table of Contents

Item 10. Directors, Executive Officers and Corporate Governance.

Directors

The directors of the Company, and their ages as of March 23, 2012, are as follows:

Howard W. Barker, Jr., CPA, 65, was employed by KPMG LLP from July 1972 and served as a partner of KPMG LLP from 1982 until his retirement in September 2002. Mr. Barker is currently a director of the following public companies: priceline.com Incorporated since 2003 (Chairman of the Audit Committee; Nominating and Corporate Governance Committee) and Chiquita Brands International, Inc. since 2007 (Chairman of the Audit Committee). In addition, Mr. Barker is a member of the American Institute of Certified Public Accountants and the Florida Institute of Certified Public Accountants. Mr. Barker has served as a director of the Company since August 2003, and is currently Chairman of the Audit Committee, as well as a member of the Compensation Committee and the Mergers and Acquisitions Committee.

John L. Cassis, 63, has served since 1994 as a partner of Cross Atlantic Partners, Inc., a healthcare and life sciences venture capital firm. Mr. Cassis was formerly a director of Salomon Brothers Venture Capital, which he joined in 1986 and headed from 1990 to 1994. Prior to Salomon Brothers Venture Capital, Mr. Cassis was a managing director of Ardshiel Associates, Inc., a merchant bank, as well as a founder of J&J Development Corporation, the venture capital arm of Johnson & Johnson. He previously has served on the boards of many public and private companies and currently holds directorships at LifeMed Media, Inc., BioMedical Enterprises, Inc., and IntegriChain, Inc., and served on the board of Nutrition 21 Inc. from 2005 to 2009. Mr. Cassis has served as a director of the Company since August 2003, and is currently Chairman of the Compensation Committee, as well as a member of the Audit Committee and the Mergers and Acquisitions Committee.

Michael Goldstein, CPA, 70, served as Chairman of the Toys “R” Us Children’s Fund from 2001 until 2006. Mr. Goldstein was Chairman of Toys “R” Us, Inc. from 1998 to 2001, Chief Executive Officer from 1999 to 2000, Vice Chairman and Chief Executive Officer from 1994 to 1998 and Chief Financial Officer from 1983 to 1994. Mr. Goldstein was also employed by Ernst & Young (and its predecessor firms) from 1963 to 1979, including six years as an audit partner. Mr. Goldstein is currently a director of the following public companies: Charming Shoppes, Inc. since 2008 (Chairman of the Board; Compensation Committee); Pacific Sunwear of California, Inc. since 2004 (Chairman of the Audit Committee); and 4 Kids Entertainment, Inc. since 2003 (Chairman of the Board; Chairman of the Audit Committee; Nominating and Governance Committee). Mr. Goldstein is also a director of various private companies and not-for-profit charitable organizations. He has also served on the boards of the following public companies within the last five years: Martha Stewart Omnimedia, Inc. from 2004 to 2010; Bear Stearns & Co. from 2007 to 2008; and United Retail Group from 1999 to 2007. Mr. Goldstein has served as a director of the Company since 2003, and is currently the Lead Director, Chairman of the Corporate Governance and Nominating Committee and a member of the Audit Committee and the Mergers and Acquisitions Committee.

Charles M. Lillis, Ph.D., 70, is a co-founder and principal of LoneTree Capital Management LLC, a private equity investing group formed in 2000. Mr. Lillis also served as co-founder and Managing Partner of Castle Pines Capital LLC, from its inception in 2004 until its acquisition by Wells Fargo in 2011. Previously, Mr. Lillis served as Chairman of the Board of Directors and Chief Executive Officer of MediaOne Group, Inc. from its inception in 1995 through its acquisition by AT&T Corp., which was completed in 2000. Mr. Lillis has served on the boards of the following public companies within the last five years: SUPERVALU Inc. from 1995 to 2011; Washington Mutual, Inc. from 2005 to 2009; and The Williams Companies Inc. from 2000 to 2009. Mr. Lillis has served as a director of the Company since January 2005, and is currently a member of the Compensation Committee and the Mergers and Acquisitions Committee.

Myrtle S. Potter, 53, founded Myrtle Potter and Company, LLC in 2005, a private consulting firm where she serves as an advisor specializing in corporate strategy, corporate governance and product commercialization in the U.S. and global healthcare sectors. Since 2006, Ms. Potter has also been Chief Executive Officer of Chapman Properties, Inc., which is part of a group of real estate sales, financing and development companies owned by Ms. Potter. In 2009, Ms. Potter formed Myrtle Potter Media, Inc., a consumer healthcare company. Previously, Ms. Potter served at Genentech, Inc. as President, Commercial Operations from 2004 to 2005, and as Executive Vice President, Commercial Operations and Chief Operating Officer, from 2000 to 2004. Ms. Potter is also a director of various private companies. She has also served on the boards of the following public companies within the last five years: Amazon.com from 2004 to 2009; ev3 Inc. from 2007 to 2008; and FoxHollow Technologies, Inc. from 2005 to 2007. Ms. Potter has served as a director of the Company since December 2007, and is currently a member of the Compensation Committee and the Public Policy Committee.

1

Table of Contents

William L. Roper, MD, MPH, 63, has served as Dean of the School of Medicine and Vice Chancellor for Medical Affairs of the University of North Carolina (“UNC”) at Chapel Hill, and as Chief Executive Officer of the UNC Health Care System, all since 2004. In addition, he has served as a Professor of Pediatrics and Social Medicine in the School of Medicine and Professor of Health Policy and Administration in the UNC School of Public Health. Before joining UNC in 1997, Dr. Roper served as Senior Vice President of Prudential Health Care and in other roles from 1993 to 1997. He also served as director of the Centers for Disease Control and Prevention from 1990 to 1993, on the senior White House staff in 1989 and 1990 and as the administrator of CMS from 1986 to 1989. Dr. Roper is a member of the American Academy of Pediatrics and the American Medical Association. Dr. Roper has been a director of Davita, Inc. since 2001 (Nominating and Governance Committee; Public Policy Committee; Chairman of the Compliance Committee; Chairman of the Clinical Performance Committee). He is also currently Chairman of the Board of Directors of the National Quality Forum, a private, not-for-profit, public benefit corporation established to standardize healthcare quality measurement and reporting. He has also served on the board of another public company, Delhaize Group from 2003 to 2008, within the last five years. Dr. Roper has served as a director of the Company since December 2007, and is currently Chairman of the Public Policy Committee and a member of the Corporate Governance and Nominating Committee.

David B. Snow, Jr., 57, has served as Chief Executive Officer and as a director of the Company since March 2003. Mr. Snow was appointed Chairman of the Company’s Board of Directors in June 2003 and also served as the Company’s President from 2003 to 2006. Prior to joining the Company, Mr. Snow served as President and Chief Operating Officer at WellChoice, Inc. (formerly Empire BlueCross BlueShield) where he held the position of Executive Vice President and Chief Operating Officer beginning in 1999 and then held the position of President and Chief Operating Officer from 2001 through 2003. From 1993 to 1998, Mr. Snow was an Executive Vice President of Oxford Health Plans, a health maintenance organization, and was responsible for marketing, medical delivery systems, medical management and government programs. Mr. Snow has served in executive leadership roles for a number of other healthcare companies throughout his career, including American International Healthcare, Inc. and US HealthCare, Inc. He also co-founded and served as President and CEO of Managed Healthcare Systems, Inc., which was later renamed AmeriChoice. Mr. Snow is currently a director of Pitney Bowes Inc. (Chairman of the Governance Committee; Executive Compensation Committee; Executive Committee). Mr. Snow is also a director of various private companies and not-for-profit charitable organizations.

David D. Stevens, 58, was employed in various capacities at Le Bonheur Health Systems, Inc. and its wholly owned subsidiaries from 1979 until 1996 (including Senior Vice President of the holding company, Vice President of the hospital entity and President of the for-profit entities). In May 1996, Mr. Stevens led a management buyout of Accredo Health, Inc., a leading provider of specialty pharmacy services to patients and payors, which in 1999 became a publicly traded company. Mr. Stevens served as Chief Executive Officer of Accredo from the time of the Company’s acquisition of the company in 2005 until 2006, and then as Chairman of Accredo’s primary operating subsidiary from March 2006 until August 2006, at which time he became a private investor working with private equity firms in the investment in, and operation of, healthcare service companies. Mr. Stevens is also a director of various private companies and not-for-profit charitable organizations including member of the board of Le Bonheur Children’s Medical Center Foundation, Inc., member of the board of Methodist Le Bonheur Healthcare, Inc. and member of the board of the University of Tennessee Research Foundation. Mr. Stevens is currently a director of the following public companies: Thomas & Betts Corporation since 2004 (Chairman of the Audit Committee; Nominating and Governance Committee) and Wright Medical Group, Inc. since 2004 (Chairman of the Board; Compensation Committee). He also served as Interim President and Chief Executive Officer of Wright Medical Group, Inc. from April 5, 2011 to September 19, 2011. Mr. Stevens has served as a director of the Company since May 2006, and is currently Chairman of the Mergers and Acquisitions Committee and a member of the Audit Committee and the Public Policy Committee.

2

Table of Contents

Blenda J. Wilson, Ph.D., 71, has a background in higher education, philanthropy and healthcare. Her higher education experience includes the following: Assistant Provost and Assistant to the President of Rutgers University (N.J.) from 1969 to 1972; Senior Associate Dean of the Graduate School of Education at Harvard University from 1972 to 1982; Executive Director of the Colorado Commission on Higher Education and member of the Governor’s Cabinet from 1984 to 1988; Chancellor of the University of Michigan-Dearborn, 1988 to 1992; President of California State University, Northridge, 1992 to 1999; and Acting President of Cedar Crest College, 2007 to 2008. From 1999 to 2006, Dr. Wilson served as the inaugural President of the Nellie Mae Education Foundation. Dr. Wilson’s involvement in healthcare and health policy includes sixteen years (1982 to 1998) as a Director of the Commonwealth Fund, a research and grant making foundation which promotes an improved healthcare system. Dr. Wilson has also served on numerous boards of not-for-profit organizations involved in education and/or the advancement of women. Dr. Wilson was previously a Director of Union Bank of California (1993 to 1999) and of the Federal Reserve Bank of Boston (2003 to 2006), serving as Chair of the Board in 2006. She is past Chair of the Board of HERS, a professional development organization for women administrators in higher education and serves on the Trusteeship committee of the board of trustees of Cedar Crest College. Dr. Wilson has served as a director of the Company since 2003 and is currently a member of the Corporate Governance and Nominating Committee and the Public Policy Committee.

Executive Officers

The executive officers of the Company, and their ages and positions as of March 23, 2012, are as follows:

| Name |

Age | Position | ||||

| David B. Snow, Jr. |

57 | Chairman and Chief Executive Officer | ||||

| Kenneth O. Klepper |

58 | President and Chief Operating Officer | ||||

| Gabriel R. Cappucci |

49 | Senior Vice President and Controller, Chief Accounting Officer | ||||

| Mary T. Daschner |

53 | Group President, Medicare & Medicaid Solutions | ||||

| John P. Driscoll |

52 | President, New Markets | ||||

| Robert S. Epstein |

56 | President, United BioSource Corporation®, President, Advanced Clinical Science and Research and Chief Clinical Research and Development Officer | ||||

| Brian T. Griffin |

52 | President, International | ||||

| Laizer D. Kornwasser |

40 | Senior Vice President, Consumer Solutions and Retail Markets | ||||

| Thomas M. Moriarty |

48 | General Counsel, Secretary and President, Global Pharmaceutical Strategies | ||||

| Karin V. Princivalle |

55 | Senior Vice President, Human Resources | ||||

| Richard J. Rubino |

54 | Senior Vice President, Finance and Chief Financial Officer | ||||

| Frank Sheehy |

49 | President, Accredo Health Group, Inc. | ||||

| Jack A. Smith |

64 | Senior Vice President, Chief Marketing Officer | ||||

| Glen D. Stettin |

48 | Senior Vice President, Health Businesses and Practice and Chief Medical Officer | ||||

| Glenn C. Taylor |

60 | Group President, Health Plans | ||||

| Timothy C. Wentworth |

51 | Group President, Employer/Key Accounts | ||||

David B. Snow, Jr. See “Directors” above for biographical information about Mr. Snow.

Kenneth O. Klepper has served as President and Chief Operating Officer since March 2006. He joined the Company in June 2003 and served as Executive Vice President, Chief Operating Officer from June 2003 through March 2006. Mr. Klepper oversees the Company’s sales and account groups, the Company’s Retiree Solutions group, Therapeutic Research Centers, Advanced Clinical Solutions, information technology, customer service, pharmacy operations, and Accredo Health Group, Inc. (“Accredo Health Group”), the Company’s specialty pharmacy organization. Mr. Klepper joined the Company from WellChoice, Inc. where he held the position of Senior Vice President, Process Champion from March 1995 to August 1999, and then held the position of Senior Vice President for Systems, Technology and Infrastructure from August 1999 to April 2003.

Gabriel R. Cappucci has served as Medco’s Senior Vice President and Controller, Chief Accounting Officer since March 2008, and is directly responsible for accounting and financial reporting, client and pharmaceutical manufacturer accounts receivable, accounts payable, and client rebate and performance guarantee reporting and analysis. Mr. Cappucci joined Medco in July 1993 and has held a variety of accounting, financial reporting, and financial planning roles. Most recently, since June 2004, Mr. Cappucci was Vice President, Financial Reporting with responsibility for Medco’s financial reporting and accounting standards. Prior to joining the Company, Mr. Cappucci was a Senior Manager with KPMG LLP where he had been employed since August 1985. Mr. Cappucci is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

3

Table of Contents

Mary T. Daschner has served as Group President, Medicare & Medicaid Solutions since October 2010, and in this role is responsible for overseeing the strategy and business results for Medco’s retiree and Medicare eligible population. The current portfolio includes Medco’s national Medicare Part D plan, Medco Medicare Prescription Plan®, as well as Part D solutions for health plans and employer clients, including Employer Group Waiver Plans (EGWPs), Prescription Drug Plans (PDPs), Medicare Advantage (MA) Plans, Retiree Drug Subsidy (RDS) and secondary wraparound products. She also served as Group President, Retiree Solutions from September 2008 to September 2010. Ms. Daschner joined the Company in December 1999, initially serving as Senior Director of Business and Product Development, and later as Vice President, Health Plans and Government Programs since 2001, where she managed service and drug trend strategy supporting more than six million UnitedHealth Group Incorporated members, including Medicare, Managed Medicaid and commercial fully insured populations. Ms. Daschner came to the Company from Senior Market Strategies, a healthcare consulting business focused on reimbursement, outcomes and patient access in the over 50 marketplace, where she served as President.

John P. Driscoll has served as President, New Markets since April 2008, and in this role is responsible for the Company’s insured solutions and business development, both domestically and internationally, and consumer-driven programs. Mr. Driscoll joined the Company in June 2003 as Senior Vice President, Product and Business Development and served as President, Insured and Emerging Markets from June 2006 to April 2008. Mr. Driscoll came to the Company from Oak Investment Partners, a venture capital firm, where he served as an advisor on healthcare investments from January 2002 through May 2003. Mr. Driscoll held the position of Executive Vice President of Walker Digital from January 2000 to December 2001. Prior to that, Mr. Driscoll served in a number of senior positions at Oxford Health Plans from 1991 through 1999, including, most recently, as its Corporate Vice President, Government Programs.

Robert S. Epstein, M.D., M.S. has served as President, United BioSource Corporation® (“UBC”) since September 2011 and is responsible for the strategic direction of all of UBC’s business operations. In addition, he has served as President, Advanced Clinical Science and Research and Chief Clinical Research and Development Officer since December 2010. In this role Dr. Epstein oversees Medco’s research initiatives in personalized medicine, drug safety, health economics, outcomes, and comparative effectiveness conducted by researchers worldwide. In addition, Dr. Epstein served as Senior Vice President and Chief Medical Officer from 1997 through 2010 and was appointed President of the Medco Research Institute® in 2009. Dr. Epstein joined the Company in 1995 as Vice President of Outcomes Research. Dr. Epstein was trained as an epidemiologist and worked in public health and academia before joining the private sector. He is a past President of the International Society of Pharmacoeconomics and Outcomes Research, and has served on the Board of Directors for the Drug Information Association. In 2008, Dr. Epstein was nominated and elected to the Federal CDC EGAPP (Evaluation of Genomic Applications in Practice & Prevention) Stakeholder Committee, and the AHRQ CERT (Centers for Education and Research on Therapeutics) Committee. He has published more than 50 peer reviewed medical articles and book chapters, and serves as a reviewer for several influential medical journals.

Brian T. Griffin has served as President, International since October 2010 and in this role is responsible for delivering innovative clinical services designed to improve patient adherence, safety and efficiency across the international healthcare system. Mr. Griffin also served as Chief Executive Officer, Medco Celesio B.V. from October 2010 through September 2011. Prior to these positions, Mr. Griffin served as the Company’s Group President, Health Plans since January 2004, with responsibility for national and regional health plan clients. From January 1999 through December 2003 he served as Senior Vice President, Sales and was responsible for sales on a national basis. From November 1995 to December 1998, Mr. Griffin led the Insurance Carrier customer group and was responsible for sales within the Insurance Carrier Blue Cross/Blue Shield and Third-Party Administrator Markets. Mr. Griffin joined the Company in 1987.

Laizer D. Kornwasser has served as Senior Vice President, Consumer Solutions and Retail Markets since July 2011 and in this role is responsible for retail network and mail pharmacy strategy and margin. He oversees network pricing, negotiations, plan design and programs that maximize the retail and mail channels. Mr. Kornwasser is also responsible for the integrated care solution for Medco’s six million members with diabetes. Mr. Kornwasser joined Medco in August 2003, initially serving as Vice President of Business Development, and later as Senior Vice President of Business Development and Retail Networks. Prior to joining Medco, Mr. Kornwasser held positions at Merrill Lynch and Coopers & Lybrand, and served as an associate professor at Yeshiva University. Mr. Kornwasser is a board member of the Yeshiva of North Jersey.

4

Table of Contents

Thomas M. Moriarty has served as General Counsel and Secretary since March 2008, and is responsible for overseeing the Company’s legal affairs. In addition, he has served as President, Global Pharmaceutical Strategies since March 2011 and as Senior Vice President, Pharmaceutical Strategies and Solutions from September 2007 to March 2011, with responsibility for negotiations with pharmaceutical manufacturers, drug purchasing analysis and consulting with clients on formulary drug lists and plan design. He also served as Senior Vice President, Business Development responsible for mergers and acquisitions and strategic alliances from August 2006 until March 2008. Prior to that, he was Deputy General Counsel, Vice President and Managing Counsel, responsible for mergers and acquisitions and client and commercial contracting from December 2005 until August 2006. From November 2002 until December 2005, Mr. Moriarty served as Vice President and Counsel, Client Contracting. Mr. Moriarty joined the Company in June 2000 as Assistant Counsel, Client Contracting. Prior to joining the Company, Mr. Moriarty served as Assistant General Counsel, Pharma & North America for Merial Limited (a Merck & Co., Inc. and Sanofi Aventis Company) and as Assistant Counsel for Merck & Co., Inc.

Karin V. Princivalle has served as Senior Vice President, Human Resources since joining the Company in May 2001, and is responsible for company-wide human resource activities. Ms. Princivalle joined the Company from TradeOut.com, an online business-to-business marketplace, where she served as Vice President for Human Resources from February 2000 to May 2001. Previously, she served as Vice President of Human Resources for Citigroup’s North America bankcards business from May 1998 to August 2000 and Vice President of Human Resources for Citigroup’s Consumer Businesses in Central/Eastern Europe, Middle East, Africa and Asia from March 1997 to May 1998.

Richard J. Rubino has served as Senior Vice President, Finance and Chief Financial Officer since March 2008. Mr. Rubino has oversight responsibility for all financial activities, including accounting, reporting, accounts receivable, treasury, tax, planning, analysis, procurement, audit, investor relations and financial evaluation. Prior to this position he served as Senior Vice President and Controller, Chief Accounting Officer since April 2005 and in that role was directly responsible for accounting and financial reporting, financial systems, and client and pharmaceutical manufacturer accounts receivable. From June 1998 to April 2005, Mr. Rubino served as Vice President and Controller with responsibility for accounting and financial reporting. His previous roles with the Company include Vice President, Planning with responsibility for financial, business and strategic planning, and Director of Planning. Prior to joining the Company, Mr. Rubino held various positions at International Business Machines Corporation and Price Waterhouse & Co. Mr. Rubino is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants. Mr. Rubino is also a director of a not-for-profit charitable organization.

Frank Sheehy has served as President of Accredo Health Group, the Company’s specialty pharmacy organization, since July 2011 and in this role is responsible for Accredo Health Group’s overall business results while overseeing the organization’s sales, strategy, marketing and branch operations. Prior to this position, Mr. Sheehy served as Senior Vice President, General Manager since 2004 with responsibility for management and growth of Medco’s Central/West Region’s National Account. Mr. Sheehy joined the Company as Vice President in July 1998. Prior to joining Medco, Mr. Sheehy served as Senior Vice President, General Manager for Aetna US Healthcare.

Jack A. Smith has served as Senior Vice President, Chief Marketing Officer since joining the Company in June 2003 and is responsible for all branding, corporate and product marketing and communications, medco.com®, and related creative and production services. Mr. Smith served as the Senior Vice President, Chief Marketing Officer for WellChoice, Inc. from August 1999 to November 2002, and was the Senior Vice President, Marketing Director for RR Donnelley & Sons from June 1997 to July 1999. Mr. Smith worked as a consultant for the Gartner Group, an information and consulting company, during 2003 prior to joining the Company. He has also held marketing positions at The Readers Digest Association, Inc., Nestle USA and Unilever PLC.

Glen D. Stettin, M.D. has served as Senior Vice President, Health Businesses and Practice and Chief Medical Officer since December 2010 and in this role is responsible for Medco’s clinical practice areas and clinical PBM services, including Medco’s independent Pharmacy and Therapeutics Committee, and all of Medco’s non-research-related analytics, client reporting and data quality. Prior to this position he served as Senior Vice President and General Manager, Advanced Clinical Solutions from September 2005 to November 2010. From April 1998 to August 2005, he served as Vice President, Clinical Products. Dr. Stettin joined the Company as Senior Director, Health Strategies in 1995. Prior to joining Medco, Dr. Stettin was a clinician, researcher and instructor at the University of California, San Francisco.

5

Table of Contents

Glenn C. Taylor has served as Group President, Health Plans since October 2010 and in this role is responsible for all national and regional health plan clients, including UnitedHealth Group and Federal Government clients. He also served as Group President, Key Accounts from January 2004 to September 2010. From April 2002 through December 2003, he served as Senior Vice President, Account Management. Mr. Taylor served as President of the Company’s UnitedHealth Group Division from February 1999 to April 2002. From April 1997 to January 1999, Mr. Taylor held positions with Merck & Co., Inc. as Regional Vice President of the Southeast and Central business groups. From May 1993 to March 1997, Mr. Taylor was the Company’s Senior Vice President of Sales and Account Management. Mr. Taylor joined the Company in May 1993 as a result of the Company’s acquisition of FlexRx, Inc., a pharmacy benefit manager in Pittsburgh, Pennsylvania, where Mr. Taylor was President.

Timothy C. Wentworth has served as Group President, Employer/Key Accounts since October 2010 and in this role is responsible for all activities related to Medco’s employer clients, large and small, and the company’s state, municipal and labor union clients, including sales, account management, marketing, clinical and pricing. In addition, he has served as Group President, Employer Accounts since September 2008. Prior to this position, he served as the President and Chief Executive Officer of Accredo Health Group from March 2006 to September 2008. From January 2004 to March 2006, Mr. Wentworth served as the Company’s Group President, National Accounts. From April 2002 through December 2003, he served as Executive Vice President, Client Strategy and Service and was responsible for client relationships and developing and implementing strategies to acquire and renew clients. Mr. Wentworth joined the Company as Senior Vice President, Account Management in December 1998 from Mary Kay, Inc., where he spent five years, serving initially as Senior Vice President of Human Resources and subsequently as President-International.

Family Relationships

There are no family relationships among any directors or executive officers of the Company.

Involvement in Certain Legal Proceedings

There are no legal proceedings to which any director or executive officer, or any affiliate thereof, is a party that would be material and adverse to the Company.

Section 16 (a) Beneficial Ownership Reporting Compliance

The members of the Board of Directors, the executive officers and persons who hold more than ten percent of the outstanding Common Stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which requires them to file reports with respect to their ownership of the Common Stock and their transactions in such Common Stock. Based upon a review of (i) the copies of Section 16(a) reports that Medco has received from such persons or entities for transactions in its Common Stock and their Common Stock holdings for the fiscal year ended December 31, 2011 and (ii) the representations received from one or more of such persons or entities that no annual Form 5 reports were required to be filed by them for the fiscal year ended December 31, 2011, the Company believes all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by its directors, executive officers and beneficial owners of more than ten percent of its Common Stock.

6

Table of Contents

Standards of Business Conduct; Code of Conduct

The Company has adopted Standards of Business Conduct that include a Code of Conduct that requires all directors, employees and officers (including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or person performing similar functions) to adhere to the Code of Conduct in discharging their work-related responsibilities. The Code of Conduct promotes, among other things, full, fair, accurate, timely and understandable disclosure in the reports and documents that the Company files with authorities such as the SEC, and in all public communications that the Company makes. The Company’s Code of Conduct can be accessed under “Corporate Governance” in the “Investors” section of the Company’s website at www.medcohealth.com/investor. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of our Code of Conduct by posting such information on our website at http://www.medcohealth.com.

The Company has also established a confidential ethics phone line to respond to employees’ questions and reports of ethical concerns. In accordance with the Sarbanes-Oxley Act of 2002, the Audit Committee has established a policy with procedures to receive, retain and treat complaints received by the Company regarding accounting, internal controls or auditing matters, and to allow for the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters.

Audit Committee

The Audit Committee of the Company’s Board of Directors has been established in accordance with section 3(a)(58)(A) of the Exchange Act. The Audit Committee is comprised entirely of independent directors in accordance with applicable SEC and New York Stock Exchange (“NYSE”) requirements. The current members of the Audit Committee are Mr. Barker (Chairman), Mr. Cassis, Mr. Goldstein and Mr. Stevens. The Audit Committee held nine meetings during the 2011 fiscal year.

All of the Audit Committee members meet the NYSE requirements for financial literacy. Mr. Barker, Mr. Cassis, Mr. Goldstein and Mr. Stevens each has accounting or related financial management expertise, as required by NYSE listing standards. In addition, Mr. Barker, Mr. Cassis, Mr. Goldstein and Mr. Stevens are each “audit committee financial experts” under applicable SEC rules. The SEC has determined that the audit committee financial expert designation does not impose on a person with that designation any duties, obligations or liabilities that are greater than those otherwise imposed on such person as an audit committee member in the absence of such designation.

7

Table of Contents

Item 11. Executive Compensation.

COMPENSATION DISCUSSION AND ANALYSIS

The following section provides a discussion and analysis of compensation paid or awarded to the named executive officers for 2011. This discussion also includes other periods relevant to the 2011 compensation decisions discussed in this section and further amplified in the tables and narrative following this section.

In order to provide our shareholders with a more complete view of our compensation practices, we often indicate when programs are applicable to our employees generally or to our executive officers. “Executive officers” are our 16 most senior officers as set forth in Part III, Item 10 of this Annual Report on Form 10-K/A. Each named executive officer (“NEO”) is an executive officer. The named executive officers are: David B. Snow, Jr., Chairman and Chief Executive Officer; Kenneth O. Klepper, President and Chief Operating Officer; Richard J. Rubino, Senior Vice President, Finance and Chief Financial Officer; Thomas M. Moriarty, General Counsel, Secretary and President, Global Pharmaceutical Strategies; and Timothy C. Wentworth, Group President, Employer/Key Accounts.

Executive Compensation Philosophy

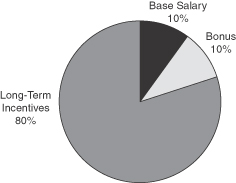

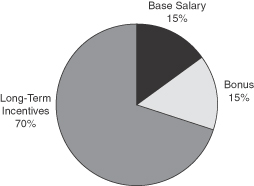

Our compensation programs for the Company’s executive officers are based on the fundamental principle of pay-for-performance. Base salary is the only fixed compensation and it represents no more than 15 percent of total target compensation for named executive officers. The remaining portion of each named executive officer’s total compensation is tied to the Company’s performance and his individual performance. As reflected in the following chart, our programs are directly supportive of our business strategies and the creation of shareholder value.

| Compensation Program |

Principle | |

| Base Salary • Represents 10% to 15% of Total Target Compensation |

• Attract and retain top executives | |

| Executive Annual Incentive Plan • Represents 10% to 15% of Total Target Compensation |

• Metrics support significant business strategies and fundamental year over year growth • Opportunity for above target payout rewards superior performance | |

| Long-Term Incentive Plan • Represents 70% to 80% of Total Target Compensation |

• Stock options and restricted stock units keep executives focused on the long-term success of the Company and long-term stock price appreciation | |

| Stock Ownership Guidelines • Ranges from 3× to 5× base salary |

• Aligns stockholder and executive interests to create and sustain long-term stock price appreciation and shareholder value | |

| Recoupment Policy • Provides for recoupment of any incentive pay obtained fraudulently |

• Discourages excessive risk taking | |

We use the programs to attract, retain and motivate executives who possess the skills and talents necessary to achieve business success. The programs are designed to be competitive with the companies we compete with for executive talent.

We provide a competitive package of benefits to all of our employees, including the named executive officers. Our executive officers participate in the same benefit programs (health, life, disability and retirement) using the same benefit formulas as other Medco employees. We maintain separate severance programs for our most senior executives (including the named executive officers) and provide very limited perquisites.

Performance Year 2011 Highlights

| • | GAAP diluted EPS of $3.62 increased 14.6 percent; Diluted EPS of $3.74, excluding $80.2 million of expenses associated with the pending merger with Express Scripts, Inc., increased 18.4 percent over $3.16 in 2010 |

| • | Diluted EPS, excluding all intangible amortization and merger-related expenses, increased 17.5 percent to $4.17 from $3.55 in 2010 |

8

Table of Contents

| • | Total net revenues increased 6.2 percent to $70.1 billion, with service revenues up 39.0 percent to $1.5 billion |

| • | Gross margin increased to $4.62 billion, representing a gross margin percentage of 6.6 percent |

| • | Earnings before interest income/expense, taxes, depreciation and amortization (“EBITDA”) increased 6.6 percent to $3.2 billion and EBITDA per adjusted prescription increased 3.9 percent to $3.23 when excluding merger-related expenses |

| • | Mail-order prescriptions increased 3.0 percent to 113.1 million, with generic volumes increasing 8.3 percent to 73.2 million |

| • | Generic dispensing rate increased 2.8 percentage points to 73.8 percent |

| • | Specialty pharmacy revenues increased 18.5 percent to $13.4 billion, with an increase in operating income of 27.9 percent to $560.6 million |

2011 Compensation—Summary of Decisions

Following is a summary of the decisions made by the Compensation Committee relating to 2011 compensation.

Mr. Snow’s 2011 Compensation

| 2011 Salary |

Percentage Change in Salary from 2010 |

Executive Annual Incentive Plan Performance Year 2011 Bonus |

Executive Annual Incentive Plan Performance Year 2011 Bonus as a Percentage of Base Salary |

2002 Long- Term Incentive Plan Awards Granted in 2011 (Grant Date Present Value) |

Percentage Change in Present Value of 2002 Long- Term Incentive Plan Awards Granted in 2011 from 2010 |

In Compliance with Ownership Guidelines | ||||||||||||||||

| $1,500,000 |

15.4 | % | $ | 4,875,000 | 325 | % | $ | 12,503,905 | 1.5 | % | ü | |||||||||||

Mr. Klepper’s 2011 Compensation

| 2011 Salary |

Percentage Change in Salary from 2010 |

Executive Annual Incentive Plan Performance Year 2011 Bonus |

Executive Annual Incentive Plan Performance Year 2011 Bonus as a Percentage of Base Salary |

2002 Long-Term Incentive Plan Awards Granted in 2011 (Grant Date Present Value) |

Percentage Change in Present Value of 2002 Long- Term Incentive Plan Awards Granted in 2011 from 2010 |

In Compliance with Ownership Guidelines | ||||||||||||||||

| $838,100 |

2.0 | % | $ | 2,095,250 | 250 | % | $ | 4,675,662 | 27.8 | % | ü | |||||||||||

Mr. Rubino’s 2011 Compensation

| 2011 Salary |

Percentage Change in Salary from 2010 |

Executive Annual Incentive Plan Performance Year 2011 Bonus |

Executive Annual Incentive Plan Performance Year 2011 Bonus as a Percentage of Base Salary |

2002 Long-Term Incentive Plan Awards Granted in 2011 (Grant Date Present Value) |

Percentage Change in Present Value of 2002 Long- Term Incentive Plan Awards Granted in 2011 from 2010 |

In Compliance with Ownership Guidelines | ||||||||||||||||

| $695,700 |

6.0 | % | $ | 1,565,325 | 225 | % | $ | 3,156,072 | 15.0 | % | ü | |||||||||||

9

Table of Contents

Mr. Moriarty’s 2011 Compensation

| 2011 Salary |

Percentage Change in Salary from 2010 |

Executive Annual Incentive Plan Performance Year 2011 Bonus |

Executive Annual Incentive Plan Performance Year 2011 Bonus as a Percentage of Base Salary |

2002 Long-Term Incentive Plan Awards Granted in 2011 (Grant Date Present Value) |

Percentage Change in Present Value of 2002 Long- Term Incentive Plan Awards Granted in 2011 from 2010 |

In Compliance with Ownership Guidelines | ||||||||||||||||

| $617,000 |

2.0 | % | $ | 1,156,875 | 187.5 | % | $ | 2,805,397 | 2.2 | % | ü | |||||||||||

Mr. Wentworth’s 2011 Compensation

| 2011 Salary |

Percentage Change in Salary from 2010 |

Executive Annual Incentive Plan Performance Year 2011 Bonus |

Executive Annual Incentive Plan Performance Year 2011 Bonus as a Percentage of Base Salary |

2002 Long-Term Incentive Plan Awards Granted in 2011 (Grant Date Present Value) |

Percentage Change in Present Value of 2002 Long- Term Incentive Plan Awards Granted in 2011 from 2010 |

In Compliance with Ownership Guidelines | ||||||||||||||||

| $597,400 |

1.9 | % | $ | 1,120,125 | 187.5 | % | $ | 2,454,723 | (2.4 | )% | ü | |||||||||||

Executive Compensation Programs

Components of Compensation

Our executive compensation program has three key components: base salary; performance-based annual cash bonus; and long-term incentives in the form of stock-based awards including stock options and restricted stock units. Our pay-for-performance philosophy places a majority of an executive officer’s compensation at risk and emphasizes long-term incentives. As a result, the only fixed compensation paid is base salary, which represents approximately 15 percent of an executive officer’s total target compensation. Mr. Snow’s base salary represents approximately 10 percent of his total target compensation. The greater emphasis on at-risk compensation for Mr. Snow is consistent with his ultimate responsibility for the Company’s success and is supported by our stock ownership requirements and other elements of our compensation program (such as the recoupment policy), that disincentivize excessive risk taking and otherwise align Mr. Snow’s interests (and those of the other named executive officers) with those of long-term shareholders.

The remaining total target compensation (annual bonus and the value of long-term incentives) for our named executive officers is not guaranteed and the ultimate value to the executive is based on the Company’s and the executive’s performance. The Compensation Committee does not apply specific weightings to Company and individual performance factors. To support our focus on long-term sustained growth, we place a greater emphasis on long-term incentives compared to short-term incentives as indicated in the chart below:

| Target Compensation Mix – CEO | Target Compensation Mix – NEO’s | |

|

| |

10

Table of Contents

Total Compensation Benchmarks

Compensation for the named executive officers is evaluated in comparison to a healthcare sector peer group comprised of Aetna Inc., AmerisourceBergen Corporation, Cardinal Health, Inc., CIGNA Corporation, CVS Caremark Corporation, Express Scripts, Inc., Health Net, Inc., Humana Inc., McKesson Corporation, UnitedHealth Group, Incorporated, and WellPoint, Inc. (together, the “Peer Group”). The Peer Group reflects companies with which we compete for executive talent and includes our largest direct competitors. Benchmarking examines the percentile level of pay for each of Medco’s named executive officers for salary, total cash compensation, and total direct compensation. Specific comparisons are made to the market median and 75th percentiles. In addition, the Company performs a three-year look-back at actual pay “realizable” from salary, incentives and equity compared to the peer group versus actual performance for the same period. This enables the Company to assess whether our pay and performance for the same time period are aligned.

Use of Compensation Consultants

The Compensation Committee retained and was assisted in its review of performance year 2011 executive compensation by independent consultants at Pay Governance. Pay Governance developed benchmarks and pay recommendations for Mr. Snow. Pay Governance also assisted the Committee in its review of management’s pay recommendations for the other named executive officers.

Base Salary

Base salaries are generally targeted at the 50th percentile of salaries of similar positions at the benchmark companies. Base salary may be adjusted annually to reflect the executive’s contribution to the Company, experience, expertise and relative position against competitive market rates. Mr. Snow’s salary is set by the Board of Directors; we note that Mr. Snow’s employment agreement does not guarantee a minimum salary.

The Compensation Committee reviewed Mr. Snow’s base salary in January 2011 against salaries of chief executive officers of the Company’s Peer Group and determined that it was under competitive. As a result, Mr. Snow received a salary increase of $200,000 per year effective April 1, 2011. The Committee reviewed the salary recommendations for the other named executive officers and adjustments for the named executive officers (other than Mr. Snow) ranged between 1.9 percent and 6 percent. The adjustments were based primarily on external market competitiveness.

Annual Bonuses

Executive Annual Incentive Plan Performance Targets and Actual Results

The executive officers of the Company, including the named executive officers, are eligible each year for an annual cash bonus pursuant to the Company’s Executive Annual Incentive Plan. At the beginning of the performance year, the Compensation Committee and the Board of Directors approved the following performance goals for 2011: earnings per share (excluding the amortization of intangible assets that existed when Medco became a publicly traded company in 2003); net-new sales; generic mail-order prescription volume; and return on invested capital. Each metric is closely tied to the execution of strategic business objectives and in the aggregate are designed to drive shareholder value. The metrics were weighted by points (as set out in the chart below) and bonuses would only be paid if at least 50 points were attained collectively across all the metrics. For performance year 2011, actual performance resulted in the achievement of 90 points under the plan. Accordingly, each named executive officer was eligible for a bonus under the Executive Annual Incentive Plan. Bonuses are not guaranteed and they can range from 0 percent to 250 percent of the executive’s individual target bonus opportunity based on the executive’s performance.

11

Table of Contents

| 2011 Performance Metric |

Target Weighting (points) |

2011 Weighting Results (points) |

Target Performance Goal |

2011 Performance Results |

Attained | |||||||||||||||

| Earnings Per Share (for Fiscal Year 2011)(1) |

52.5 | 52.5 | $ | 4.12 | $ | 4.24 | ü | |||||||||||||

| Net-New Sales (for Performance Year 1/2/11 to 1/1/12) |

37.5 | — | $ | 1,500,000,000 | $ | (174,000,000 | ) | — | ||||||||||||

| Generic Mail-Order Prescription Volume (for Fiscal Year 2011) |

37.5 | 37.5 | 69,000,000 | 72,200,000 | ü | |||||||||||||||

| Return on Invested Capital (for Fiscal Year 2011) |

22.5 | — | 32.5 | % | 31.6 | % | — | |||||||||||||

| (1) | Represents Earnings Per Share (Net Income per share excluding all amortization of intangible assets and merger-related expenses and adjusted for share repurchases in operating plan) |

Executive Annual Incentive Plan 2011 Target Bonus Opportunities and Bonus Amounts

Target bonus opportunities are generally set at the 50th percentile of competitive compensation practices as measured by our Peer Group. Since market compensation practices, including incentive opportunity, differ by job, our target bonus opportunities as a percentage of base salary vary for each of our named executive officers (see the table below). For 2011, the target bonus opportunity, maximum bonus range, 2011 earned bonus (each expressed as a percentage of base salary), and the actual dollar amount of the bonus for each of the named executive officers was as follows:

| Name |

Target Bonus Opportunity (as a percentage of base salary) |

Maximum Bonus Range 0% to 250% of Target (as a percentage of base salary) |

2011 Earned Bonus (as a percentage of base salary) |

2011 Earned Bonus $ |

||||||||||

| Mr. Snow |

130 | % | 0% - 325.0% | 325.0 | % | $ | 4,875,000 | |||||||

| Mr. Klepper |

100 | % | 0% - 250.0% | 250.0 | % | $ | 2,095,250 | |||||||

| Mr. Rubino |

90 | % | 0% - 225.0% | 225.0 | % | $ | 1,565,325 | |||||||

| Mr. Moriarty |

75 | % | 0% - 187.5% | 187.5 | % | $ | 1,156,875 | |||||||

| Mr. Wentworth |

75 | % | 0% - 187.5% | 187.5 | % | $ | 1,120,125 | |||||||

The Compensation Committee exercises judgment in determining individual bonus awards and does not assign specific weights to the factors it considers. The Committee awarded the actual bonus for each named executive officer after conducting a review of each executive officer’s individual performance for the year and considering the recommendations of the CEO (as to executives other than himself). The Compensation Committee considered the results of the performance metrics under the EAIP. In addition, in awarding bonuses, the Committee considered the overall contribution of each of the named executive officers to, and the significant shareholder value created by, the merger with Express Scripts.

Long-Term Incentive Compensation

The grant date fair value of long-term incentives account for 75 percent of Mr. Snow’s total target compensation and 70 percent of total target compensation for the other executive officers, including the named executive officers. The Committee establishes long-term incentive award targets for each executive officer expressed as a percentage of salary, without weighting any of the performance criteria. Actual awards reflect each executive’s individual performance and potential future contributions to the Company and may be above or below target. The actual grant date values depend upon our closing stock price on the day of the grant. Accordingly, the value of the actual grant may vary slightly from the value established by the Committee.

12

Table of Contents

Mix of Restricted Stock Units and Stock Options

For the named executive officers other than Mr. Snow, the grants made in February 2011 were approximately 65 percent of the grant date fair value in options and 35 percent of the grant date fair value in restricted stock units. Since fewer restricted stock units are used to deliver the same value as stock options, this approach helps the Company manage the number of shares granted under our stock incentive plans. In addition, restricted stock units promote retention because they use cliff vesting (100 percent after three years of service after the grant date) and they retain value even when market volatility and other economic factors beyond management’s control cause a drop in the Company’s stock price that does not reflect operating performance. Mr. Snow’s grants were weighted 80 percent of the grant date fair value in stock options and 20 percent of the grant date fair value in restricted stock units to align his total compensation closer to the interests of the Company’s shareholders (because the value of options is only realized if the stock price increases).

All stock options were granted with an exercise price equal to the closing price of the Company’s common stock on the grant date. Options vest in three annual installments beginning on the first anniversary of the grant. Generally, upon termination of employment, unvested options are forfeited and vested options remain exercisable for a limited period of time (three months or six months depending on the circumstances of the termination). Options are generally not forfeited in the case of death or disability, though they only remain outstanding for up to 24 months. Options, whether or not vested, do not count toward an executive’s stock ownership requirements.

Restricted stock units are subject to three year cliff vesting to enhance their retention value. That means that they vest 100 percent on the third anniversary of their grant. Restricted stock units provide for pro-rated vesting in the case of an involuntary separation from employment that is not for cause, but are forfeited if the executive voluntarily resigns. Restricted stock units granted to executive officers do not provide for accelerated payment, except in the case of death or a termination of employment following a change in control. Executive officers may defer payment of restricted stock units at their election. Deferred restricted stock units are paid in shares on a one for one basis and are automatically paid out on the death of an executive. No additional earnings (either in the form of accrued dividends or dividend equivalents) are paid on deferred restricted stock units. Vested, deferred stock units are counted toward an executive’s stock ownership requirements.

All of the Company’s long term incentive awards, including the 2011 awards, provide for acceleration of vesting of all unvested stock options and restricted stock units in the case of a termination of employment within two years after a change in control. In such a case, the 2011 options remain outstanding for their full term and the restricted stock units would become payable six months after the termination of employment. The merger with Express Scripts is a change in control for purposes of the equity awards.

2011 Long-Term Incentives

The 2011 long-term incentives were granted on February 25, 2011. In 2011, the Committee maintained its philosophy of emphasizing stock options over restricted stock with the intention of aligning the value of the equity award to future stock price appreciation. The Compensation Committee recommended the stock option and restricted stock unit awards for the named executive officers identified below and in the Grants of Plan-Based Awards table located in the Executive Compensation section below. In making its recommendations, the Compensation Committee considered competitive market data on total compensation packages at the Peer Group, the individual performance factors described in this Compensation Discussion and Analysis, future contributions of the executive officers and, except in the case of the award to Mr. Snow, the recommendations of Mr. Snow. No one factor was more or less significant than any other in this analysis. All awards were approved by the Board of Directors.

| Name |

Target Long Term Incentive (Present value as a multiple of base salary) |

Actual Long Term Incentive Compensation Granted in 2011 (Present value as a multiple of base salary) |

Stock Options (# of shares) |

Restricted Stock Units (# of shares) |

||||||||||||

| Mr. Snow |

8.00 | 8.34 | 575,540 | 38,710 | ||||||||||||

| Mr. Klepper |

5.00 | 5.58 | 174,000 | 26,000 | ||||||||||||

| Mr. Rubino |

4.25 | 4.54 | 117,450 | 17,550 | ||||||||||||

| Mr. Moriarty |

4.00 | 4.55 | 104,400 | 15,600 | ||||||||||||

| Mr. Wentworth |

4.00 | 4.11 | 91,350 | 13,650 | ||||||||||||

13

Table of Contents

Compensation Committee’s Evaluation of Individual Performance

The Compensation Committee considered a variety of quantitative and qualitative performance results for each named executive officer. No factor was given any specific weighting and the Committee did not consider the quantitative factors any more or less important than the qualitative factors.

In arriving at its compensation recommendation for Mr. Snow, the Committee evaluated his performance and considered his current base salary, details about Mr. Snow’s bonus and long term incentive compensation targets, prior bonus as a percentage of target, prior year’s long term incentive compensation (i.e., stock option and restricted stock unit grants), and a summary of Mr. Snow’s outstanding equity awards. Mr. Snow provided the Committee with a self-assessment and the Committee independently reviewed his performance. The Committee also considered a competitive analysis of CEO compensation in the Peer Group companies prepared and presented by its compensation consultant. Finally, the Committee considered the shareholder value creation of the merger with Express Scripts.

Mr. Snow’s 2011 Performance

In assessing Mr. Snow’s performance, the Committee considered the significant shareholder value created by the merger with Express Scripts. The Committee also considered the accomplishment of the specific financial targets under the Executive Annual Incentive Plan:

| Performance Goal |

Significant Considerations | |

| Earnings Per Share |

Overachieved target by 2.9%, or $0.12 | |

| Net-New Sales |

Not achieved | |

| Generic Mail-Order Prescription Volume |

Overachieved target by 4.6%, or 3.2 million prescriptions | |

| Return on Invested Capital |

Underachieved target by 2.8%, or 0.9 percentage points | |

With respect to Mr. Snow’s 2011 performance, the Committee also considered Mr. Snow’s leadership and strategic thinking as he assessed the long-term competitive landscape of the PBM industry. Recognizing that the Affordable Care Act would continue to impact Medco’s business model in the long-term, Mr. Snow conducted an intensive and exhaustive review of strategic alternatives that ultimately led to the planned merger with Express Scripts.

In arriving at compensation decisions for the named executive officers (other than Mr. Snow), the Committee considered information it deemed relevant including the following:

| • | contribution to the Company’s 2011 performance; |

| • | contribution to shareholder value creation, including through the proposed merger with Express Scripts; |

| • | the relevant terms of the merger agreement with Express Scripts, including the section that permitted maximum bonus funding; and |

| • | total compensation levels before and after any recommendations. |

14

Table of Contents

The Compensation Committee did not apply a specific weighting to the considerations. However, the Committee considered the terms of the merger agreement as a significant factor. They noted that the provision permitting maximum bonus funding was intended to motivate the named executive officers and employees generally to, among other things, work toward the successful consummation of the merger and to retain them during an extended period between the signing and closing of the merger.

The Committee has identified below the instances in which it considered performance targets or goals for the specific named executive officers. In such cases, the Committee has also identified below the target or goal and the actual performance results. Performance against the targets was just one factor considered by the Committee and it was not given any greater weight than other factors.

Each named executive officer had one or more performance goals that were specifically tied to the Executive Annual Incentive Plan: earnings per share, net new sales, generic mail prescription volume and return on investment capital. Unless otherwise specified, the named executive officer’s target and actual results were the same as the target and results under the Executive Annual Incentive Plan.

15

Table of Contents

Mr. Klepper’s 2011 Performance

In assessing Mr. Klepper’s 2011 performance, the Committee specifically considered the following performance goals and objectives:

| Performance Goal |

Significant Considerations | |

| Implement programs to retain and grow lives from retiree benefit programs |

Expanded lives through employer group waiver programs; developed new services for health plan partners; continued to enhance Medco Prescription Drug Plan open enrollment capabilities | |

| Manage distribution costs |

Overachieved operating plan by 2.1% | |

| Maintain positive client satisfaction |

Commercial customer groups continued strong client satisfaction rates above 97%; maintained satisfaction rating for Medco Prescription Drug Plan | |

| Drive innovation and agility |

Continued the implementation of the strategic five-year plan for technology innovation that is designed to create sustained growth and savings for the Company; completed reorganization of Operations into a networked, workstream model | |

| Achieve specialty revenue target |

Specialty revenue target of $13.6 billion was underachieved by $0.4 billion, however, results represent an 18% increase over 2010 | |

| Meet client retention target – 98% |

Underperformed by 5.2 percentage points | |

| Executive Annual Incentive Plan Targets: |

||

| • Earnings Per Share |

Overachieved target by 2.9%, or $0.12 per share | |

| • Net-New Sales |

Not achieved | |

| • Generic Mail-Order Prescription Volume |

Overachieved target by 4.6%, or 3.2 million prescriptions | |

| • Return on Invested Capital |

Underachieved target by 2.8%, or 0.9 percentage points | |

With respect to Mr. Klepper’s 2011 performance, the Committee considered his accomplishments with respect toproviding innovative solutions for our clients. The Committee also considered Mr. Klepper’s contribution to the successful completion of the merger with Express Scripts, in particular his leadership role in the pre-integration planning phase of the merger.

16

Table of Contents

Mr. Rubino’s 2011 Performance

In assessing Mr. Rubino’s 2011 performance, the Committee specifically considered the following performance goals and objectives:

| Performance Goal |

Significant Considerations | |

| Manage cash balances |

Cash balances were successfully managed; record low interest rates and ready access to capital made it unnecessary to build significant cash reserves | |

| Manage selling, general and administrative expense (“SG&A”) |

SG&A expense for the enterprise was 4.4% better than operating plan | |

| Manage leverage ratio |

Managed leverage ratio at an average 1.6% | |

| Manage share repurchase program |

Successful management of 2011 share repurchase program until it was suspended in connection with the announced merger | |

| Executive Annual Incentive Plan Targets: |

||

| • Earnings Per Share |

Overachieved target by 2.9%, or $0.12 per share | |

| • Return on Invested Capital |

Underachieved target by 2.8%, or 0.9 percentage points | |

With respect to Mr. Rubino’s 2011 performance, the Committee took a number of factors into consideration including his leadership in driving the execution of financial strategies that are designed to drive long-term shareholder value and provide a framework for sustained long-term growth. The Committee considered Mr. Rubino’s leadership role in negotiating the financial terms of the merger. The Committee also considered that Mr. Rubino’s financial strategies contributed to strong earnings per share performance.

Mr. Moriarty’s 2011 Performance

In assessing Mr. Moriarty’s 2011 performance, the Committee specifically considered the following performance goals and objectives:

| Performance Goal |

Significant Considerations | |

| Manage rebate contracts and fees |

Gross rebates and brand discounts increased over 8% | |

| Drive integrated pharma initiatives across enterprise |

Significant progress in the specialty category including several exclusive distribution and services agreements; completed comprehensive services offerings for biosimilar manufacturers | |

| Manage legal risks |

Continued cost effective management of litigation; supported significant transactional activity in addition to the merger; significant contribution from favorable regulatory results | |

| Executive Annual Incentive Plan Targets: |

||

| • Earnings Per Share |

Overachieved target by 2.9%, or $0.12 per share | |

| • Return on Invested Capital |

Underachieved target by 2.8%, or 0.9 percentage points | |

With respect to Mr. Moriarty’s performance, the Committee noted Mr. Moriarty leadership role in managing a diverse portfolio of functions throughout the organization. In addition, the Committee recognized Mr. Moriarty’s leadership role in negotiating the merger agreement with Express Scripts as well as his significant contribution to the government and regulatory approval process.

17

Table of Contents

Mr. Wentworth’s 2011 Performance

In assessing Mr. Wentworth’s 2011 performance, the Committee specifically considered the following performance goals and objectives:

| Performance Goal |

Significant Considerations | |

| Ensure Medco meets client retention target (98%) |

Significant contribution to a greater than 99% retention rate | |

| Maintain positive client satisfaction |

Employer and Key Account groups each had satisfaction rates of at least 99% | |

| Manage selling, general and administrative expense (“SG&A”) |

SG&A was successfully managed below plan | |

| Executive Annual Incentive Plan Targets: |

||

| • Earnings Per Share |

Overachieved target by 2.9%, or $0.12 per share | |

| • Net-New Sales (individual goal to deliver 50% of EAIP target) |

Underperformed as a result of losses. New sales in the Employer/Key Accounts group exceeded plan by more than $500 million | |

| • Generic Mail-Order Prescription Volume (individual goal to deliver 54.9% of EAIP target) |

Delivered 100% of individual goal, total corporate results for EAIP exceeded target by 4.6%, or 3.2 million prescriptions | |

With respect to Mr. Wentworth’s performance, the Committee noted that although the Company did not achieve its net-new sales target, Mr. Wentworth achieved positive net-new sales results and above plan new sales in the Employer/Key Accounts group. The Committee also noted that Mr. Wentworth’s group achieved its generic mail prescription volume target and maintained high client satisfaction.

Benefits and Perquisites

With limited exceptions described below, the Committee’s policy is to provide benefits to executive officers that are the same as those offered to all employees of the Company. We provide comprehensive health benefits, as well as life insurance and a disability program for all benefits-eligible employees, including the named executive officers. In addition, we offer retirement benefits through a 401(k) savings plan and maintain a frozen qualified and non-qualified cash balance retirement plan which was offered to a broad employee population in 2011, including the named executive officers. Our retirement plan benefits are based on base salary only; bonus, stock option gain and other incentive compensation are not taken into account under our retirement plans. We review our benefit plans in comparison to those offered by the companies we compete with for talent. The named executive officers do not receive any special life, health or retirement benefits.

We provide annual physical health exams for our senior executives, including the named executive officers. Under that program, our senior executives can receive a comprehensive physical at a contracted executive health facility. Alternatively, we will pay up to the contracted rate for a similar examination at a facility selected by the executive. We provide physicals because the ongoing health and well being of our executives is critically important to our long-term success. Mr. Rubino, Mr. Moriarty and Mr. Wentworth received an annual physical exam under the executive program.

18

Table of Contents

We lease a corporate aircraft for the exclusive business use of our employees, including but not limited to the named executive officers. Personal use of the aircraft is not permitted under company policy. Family members are not permitted on the corporate aircraft. We also maintain a corporate apartment for use by our employees broadly. We lease an apartment in Mahwah, New Jersey near our headquarters in New Jersey which is cost effective when compared to hotel expenses or longer term efficiency lodging. None of the named executive officers used the corporate apartment in 2011.

Mr. Snow has been provided with an automobile allowance in accordance with his employment agreement (see “Employment Agreement with David B. Snow, Jr.”). Mr. Snow is also entitled to be reimbursed for up to $10,000 for financial planning and tax preparation services. In 2011, Mr. Snow received $22,620 for his annual car allowance and was reimbursed $10,000 for financial planning.

Severance and Change in Control Benefits

We maintain an executive severance plan for our most senior executives, including the named executive officers (other than Mr. Snow who has severance and change in control protections through his employment agreement, see “Employment Agreement with David B. Snow, Jr.”). The plan provides for salary and benefit continuation for a one-year period and a pro rata bonus following termination of employment without cause. We also maintain an executive change in control severance plan that provides enhanced benefits to executive officers (other than Mr. Snow) who are terminated in connection with a change in control. Payments and benefits under the change in control plan are inclusive of the regular severance benefits and include a prorated bonus for the year of the executive’s termination of employment, severance pay equal to two times the executive’s base salary and annual bonus, and continued health benefits for 12 months. All severance payments are conditioned on the executive’s termination of employment (double trigger) and the executive signing a general release of claims and agreeing to the terms of certain restrictive covenants regarding non-competition, non-solicitation and confidentiality. Severance pay is made in installments, in part to support the enforcement of the restrictive covenants. Finally, an executive can only receive payments from one of the severance plans and neither plan provides for golden parachute gross-up payments. The merger with Express Scripts, Inc. constitutes a change in control for purposes of the 2006 Change in Control Executive Severance Plan, the 2002 Stock Incentive Plan and Mr. Snow’s employment agreement.

We maintain the severance plans for several reasons. First, a basic severance plan is necessary at the senior level to attract and retain talent. Second, we recognize that senior executives who lose their jobs will need a period of time to find subsequent employment. The change in control benefit provides an additional level of financial security for our most senior executives. These are the executives who could be asked to evaluate a transaction that may maximize shareholder value while resulting in the elimination of their jobs. The change in control plan is intended to minimize the distraction caused by concerns over personal financial security in the context of a change in control. The change in control benefits, including any accelerated vesting of equity awards, are subject to both a change in control and loss of employment.

Mr. Snow’s employment agreement, which expires March 31, 2015, provides for lump sum severance pay and benefits. Severance pay of two times base salary and annual bonus, and continued health benefits for 12 months is payable if he is terminated without cause. Severance pay is increased to three times base salary and annual bonus if Mr. Snow’s employment is terminated in connection with a change in control. Severance is limited to one times base salary and annual bonus if Mr. Snow’s employment terminates as a result of his disability. In order to comply with IRS regulations, payments over $500,000 are deferred for six months following termination of employment. Mr. Snow is subject to a two-year non-compete and non-solicitation agreement and the payment of severance is also subject to him signing a general release of claims. Mr. Snow is not entitled to a gross-up for golden parachute payments.

Stock Ownership and Holding Policy

Executive officers (including the named executive officers) and other senior executives are subject to mandatory share ownership guidelines. Executives are not required to purchase Company stock and there is no deadline for achieving the target. However, each time an executive acquires shares through Company stock plans, such as by exercising a stock option, the executive is required to retain a percentage of the net profit shares (i.e., shares remaining after the payment of the exercise price and taxes) until the executive reaches the stock ownership target. The ownership guidelines apply during the executive’s employment and for six months after they cease to be subject to the guidelines, such as when their employment ends.

19

Table of Contents

The following table summarizes the stock ownership guidelines applicable to all executives covered by our stock ownership policy. All named executive officers are in compliance with the stock ownership guidelines. In fact, Mr. Snow holds stock with a value in excess of 15 times his base salary.

| Executive Level |

Ownership Target (Multiple of Salary) |

Retention Ratio Until Stock Ownership Target Achieved |

||||||

| Chairman & CEO |

5.0x | 100 | % | |||||

| Executive Officers |

3.0x | 75 | % | |||||