Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Titanium Group LTD | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Titanium Group LTD | v307446_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Titanium Group LTD | v307446_ex32-2.htm |

| EX-23.1 - EXHIBIT 23.1 - Titanium Group LTD | v307446_ex23-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Titanium Group LTD | v307446_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Titanium Group LTD | v307446_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________________ to ____________________

Commission file number: 0-52415

TITANIUM GROUP LIMITED

(Exact name of registrant as specified in its charter)

| British Virgin Islands | Not applicable |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Suite 2101, 21/F, Chinachem Century Tower, 178 Gloucester Road, Wanchai, Hong Kong

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (852) 3679 3110

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨Yes xNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨Yes xNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes ¨No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).¨Yes¨No (not required)

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨Yes xNo

As of June 30, 2011, the number of outstanding shares of the registrant’s common stock held by non-affiliates (excluding shares held by directors, officers and other holding more than 5% of the outstanding shares of the class) was 100,000,000. However, since there was no trading market for the common stock on that date, it is impracticable to ascertain the aggregate market value of those shares as of that date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 100,000,000 as of March 30, 2012

TITANIUM GROUP, INC.

TABLE OF CONTENTS

| Forward-Looking Statements | 1 | ||

| PART I | 3 | ||

| Item 1. | Business | 3 | |

| Item 1A. | Risk Factors | 6 | |

| Item 2. | Properties | 9 | |

| Item 3. | Legal Proceedings | 9 | |

| PART II | 11 | ||

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 11 | |

| Item 8. | Financial Statements and Supplementary Data | 17 | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 17 | |

| Item 9A. | Controls and Procedures | 18 | |

| Item 9B. | Other Information | 19 | |

| PART III | 20 | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 20 | |

| Item 11. | Executive Compensation | 21 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 22 | |

| Item 13. | C Certain Relationships and Related Transactions, and Director Independence | 24 | |

| Item 14. | Principal Accountant Fees and Services | 25 | |

| PART IV | 26 | ||

| Item 15. | Exhibits, Financial Statement Schedules | 26 | |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements (as such term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). The statements herein which are not historical reflect our current expectations and projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our management and our interpretation of what we believe to be significant factors affecting our business, including many assumptions about future events. Such forward-looking statements include statements regarding, among other things:

| · | our ability to develop, acquire and/or introduce new products; |

| · | our projected future sales, profitability and other financial metrics; |

| · | our future financing plans; |

| · | our plans for expansion of our manufacturing facilities; |

| · | our anticipated needs for working capital; |

| · | the anticipated trends in our industry; |

| · | our ability to expand our sales and marketing capability; |

| · | acquisitions of other companies or assets that we might undertake in the future; |

| · | our operations in China and the regulatory, economic and political conditions in China; |

| · | our ability as a U.S. company to operate our business in China through our subsidiary; |

| · | competition existing today or that will likely arise in the future; and |

| · | other factors discussed under Item 1A—“Risk Factors” and elsewhere herein. |

Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “should,” “will,” “plan,” “could,” “target,” “contemplate,” “predict,” “potential,” “continue,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these or similar words. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue the Company’s operations. These statements may be found under Item 1—“Business,” Item 1A—“Risk Factors” and Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as elsewhere in this Annual Report on Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under Item 1A—“Risk Factors” and matters described in this Annual Report on Form 10-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report on Form 10-K will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

| 1 |

The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. Such statements are presented only as a guide about future possibilities and do not represent assured events, and we anticipate that subsequent events and developments will cause our views to change. You should, therefore, not rely on these forward-looking statements as representing our views as of any date after the date of this Annual Report on Form 10-K.

This Annual Report on Form 10-K also contains estimates and other statistical data prepared by independent parties and by us relating to market size and growth and other data about our industry. These estimates and data involve a number of assumptions and limitations, and potential investors are cautioned not to give undue weight to these estimates and data. We have not independently verified the statistical and other industry data generated by independent parties and contained in this Annual Report on Form 10-K. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk.

Potential investors should not make an investment decision based solely on our projections, estimates or expectations.

| 2 |

PART I

| ITEM 1. | BUSINESS |

Background and Key Events

Our Predecessor Company

We were incorporated on May 17, 2004 as an international business company pursuant to the International Business Companies Act of the British Virgin Islands (“BVI”) and subsequently registered under the BVI Business Companies Act (“BVIBC Act”) on January 1, 2007 when the IBC Act was repealed and replaced with the BVIBC Act. On June 22, 2005, we acquired all of the entire issued share capital of Titanium Technology Limited, a company incorporated in Hong Kong on February 14, 2001 with limited liability (“Titanium Technology”). On September 20, 2002, Titanium Technology and EAE Productions (HK) Limited, a company incorporated in Hong Kong on October 8, 1997, established Titanium Technology (Shenzhen) Co., Ltd., a wholly foreign owned enterprise in China, to conduct research and development operations. Beginning in the third quarter of 2004, it began to conduct business operations in China. EAE Productions (HK) Limited owns 8% of Titanium Technology (Shenzhen) Co., Ltd.

Titanium Technology engaged in developing products utilizing biometrics technologies, licensing of technologies, professional services, and project contracting. Based in Hong Kong with a research and development center in Shenzhen, China, Titanium Technology developed and sold Automatic Face Recognition Systems, or AFRS, and other biometric and security solutions to governments, law enforcement agencies, gaming companies, and other organizations in China and other parts of Asia.

Private Placements

We raised net proceeds of US$517,425 (HK$4,035,915) through a private placement of securities during the third quarter of 2005. These proceeds were used to provide the funds necessary to become a publicly-held company in the United States. Our common stock commenced trading on the OTC Bulletin Board in July 2006 under the symbol “TTNUF.” Funds were used for legal, accounting, and corporate consulting services and working capital. We believed that by becoming a publicly-held company, we would be able to enhance the visibility of our products and services and our ability to obtain additional financing in the future.

We obtained financing of US$1,225,000 (HK$9,555,000) in April 2007. These proceeds were used for working capital and for the further development of our proprietary technology. We found that the amount of financing received in 2007 was not sufficient to allow us to pursue larger, more profitable contracts. This forced us to bid for smaller, less profitable projects during 2007, 2008 and 2009. When coupled with the worldwide economic downturn that began in 2008 and continued into 2009, our operations were severely affected. In late 2009, we decided to completely reassess our method of operations and the way in which we market our products. Accordingly, we laid off most of our staff and moved to smaller office space. We did not generate any revenues in 2010.

Memorandum of Understanding

In 2010, we decided to seek another business and negotiated with the holders of our convertible debentures that matured in April 2010, resulting in a Memorandum of Understanding (“MOU”) dated September 1, 2010 and amended on November 18, 2010 and March 18, 2011. Under the terms of the MOU, we have agreed to effect a 1-for-10 consolidation of our issued and outstanding shares of common stock. The holders of our convertible debentures in the aggregate principal amount of US$1,400,000 (HK$10,920,000) have agreed to accept a total of 3,500,000 post-consolidation common shares as full and complete payment of the debentures and all accrued and unpaid interest thereon. Zili Industrial Co., Limited, an entity owned and/or controlled by Mr. Xu Zhigang, has agreed to purchase 38,700,000 post-consolidation common shares for US$387,000. Huabao Asia Limited, an entity owned and controlled by Mr. Chen Tianju, has agreed that it would transfer ownership of Shenzhen Kanglv Technology Ltd. (“Shenzhen Kanglv”) to us, in exchange for 52,635,560 post-consolidation common shares. The transaction closed on May 31, 2011.

| 3 |

The acquisition of Shenzhen Kanglv was accounted for as a recapitalization effected by a share exchange, wherein Shenzhen Kanglv is considered the acquirer for accounting and financial reporting purposes. As a result of the transaction, Shenzhen Kanglv became a wholly-owned subsidiary of the Company. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

Corporate History of Kanglv Technology Limited

Shenzhen Kanglv was registered as a limited liability company in Shenzhen City, People’s Republic of China (the “PRC”) on June 16, 2005. It is engaged in the manufacture and sales of electronic cable products in the PRC, with its principal place of business in Shenzhen City, the PRC. Its principal products are various types of computer cables, such as HDMI, DVI, VGA and USB cables, as well as electric power cables.

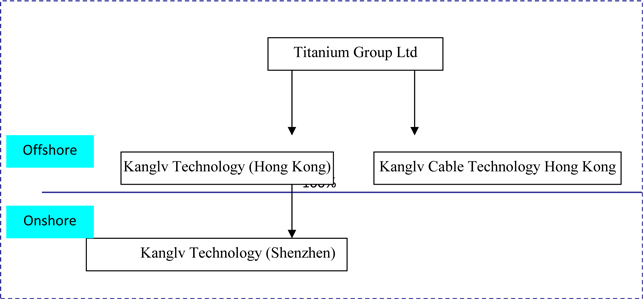

In September 2010, we formed Kanglv Technology (Hong Kong) Limited (“Hong Kong Kanglv”) as our wholly-owned subsidiary. Shenzhen Kanglv was a domestic limited liability company registered in Shenzhen City, China that was 100% owned by Huabao Asia Ltd. (“Huabao”). In May 2011, Huabao transferred 100% ownership of Shenzhen Kanglv to Hong Kong Kanglv in exchange for issuance of 52,635,560 shares of our Common Stock . In January 2011, PRC local government approved Shenzhen Kanglv to become a WOFE wholly-owned by Hong Kong Kanglv.

On september 17, 2010,we formed kanglv cable Technology (Hong kong) Limited to develop importing of copper business. kanglv cable is a development stage company with no business operations, kanglv cable is currenty seeking potential business opportunities and partners.

Our Corporate Structure

Business Overview

Shenzhen Kanglv was registered as a limited liability company in Shenzhen City, People’s Republic of China (the “PRC”) on June 16, 2005. It is engaged in the manufacture and sales of electronic cable products in the PRC, with its principal place of business in Shenzhen City, the PRC. Its principal products are various types of computer cables, such as HDMI, DVI, VGA and USB cables, as well as electric power cables.

Shenzhen Kanglv is a subcontractor for Cancare Electric Wire (Shenzhen) Co., Ltd. and manufactures the products for Cancare Electric to its specifications and customization requirements. Cancare Electric provides the core components and materials to Shenzhen Kanglv. Cancare Electric sells the products to companies in the PRC, such as Great Wall Tech, Chi Yuan Technology Limited, and Ya lid Co., limited.

Our suppliers are principally comprised of wire and cable manufacturing companies. During the year ended December 31, 2011, our top suppliers include Cancare Electric Wire Ltd., Ling Ya Electronic Technology Co., Ltd., and Dongyuan City Jie Shi Mei Electronics Co., Ltd.

| 4 |

| Supplier Name | Percentage of 2011 Purchases | Supplier Name | Percentage of 2010 Purchases | |||||||

| Cancare Electric Wire Ltd. | 49 | % | Cancare Electric Wire Ltd. | 69.05 | % | |||||

| Ling Ya Electronic Technology Co., Ltd. | 20 | % | Dongyuan City Jie Shi Mei Electronics Co., Ltd. | 18.59 | ||||||

| Dongyuan City Jie Shi Mei Electronics Co., Ltd. | 13 | % | ||||||||

For the year ended December 31, 2011 and 2010, the Company sold its products at its current market value totaling $5,689,514 and $1,625,011 to Cancare Electric Wire in a normal course of business.

For the year ended December 31, 2011 and 2010, the Company purchased certain material at its current market value totaling $2,578,516 and $1,103,439 from Cancare Electric Wire in a normal course of business.

For the year ended December 31, 2011 and 2010, the Company leased the office and factory premises from and paid rental and utilities expense of $44,965 and $44,521 to Cancare Enterprise Limited, which is controlled by the major owner of the Company, at the market price in accordance with the lease agreement in a normal course of business.

Shenzhen Kanglv borrowed a short-term line of credit in maxim amount of US$4.4 million from the Shenzhen Branch of China Industrial and Commerce Bank valid from August 29, 2011 until August 31, 2012, guaranteed by Steven Clothes (Shenzhen) Co., Ltd. Shenzhen Kanglv is allowed to draw down RMB 50,000 each installment for seven days to one year borrowing terms. The line of credit is secured by the assets of Shenzhen Kanglv and guaranteed by Steven Clothes (Shenzhen) Co. at a floating interest rate priced at three month China People’s Bank Benchmark Interest Rate plus a spread.

Products

Shenzhen Kanglv manufactures various types of computer cables, such as HDMI, DVI, VGA and USB cables, as well as electric power cables.

| · | HDMI (High Definition Multimedia Interface) is a compact audio/video interface for transmitting uncompressed digital data. It is a digital alternative to consumer analog standards, such as radio frequency (RF), coaxial cable, composite video, S-Video, SCART, component video, D-Terminal, or VGA. HDMI connects digital audio/video sources (such as set-top boxes, up convert DVD players, HD DVD players, Blu-ray Disc players, AVCHD camcorders, personal computers (PCs), video game consoles such as PlayStation e and Xbox 360, and AV receivers) to compatible digital audio devices, computer monitors, video projectors and digital televisions. |

| · | DVI (Digital Visual Interface) is a video interface standard covering the transmission of video between a source device (such as a personal computer) and a display device. The DVI standard has achieved widespread acceptance in the PC industry, both in desktop/laptop PCs and monitors. |

| · | VGA (Video Graphics Array) refers specifically to the display hardware first introduced with the IBM PS/2 line of computers in 1987, but through its widespread adoption has also come to mean either an analog computer display standard, the 15-pin D-subminiature VGA connector or the 640x480 resolution itself. While this resolution was superseded in the personal computer market in the 1990s, it is becoming a popular resolution on mobile devices. |

| · | USB (Universal Serial Bus) is a specification to establish communication between devices and a host controller (usually a personal computer). USB has effectively replaced a variety of interfaces such as serial and parallel ports. |

| · | Electric power cables are assemblies of two or more electrical conductors, usually held together with an overall sheath. The assemblies are used for transmission of electrical power. Power cables may be installed as permanent wiring within buildings, buried in the ground, run overhead, or exposed. |

Patents, Trademarks, and Licenses

Shenzhen Kanglv does not own any patents or trademarks.

Shenzhen does not have any union labor contracts.

| 5 |

Government Regulation

Shenzhen Kanglv is subject to regulations on safety production permit and production safety laws of the PRC and the products generally must comply with the safety requirement of countries in which they are produced. It complies with the regulations on the administration of production license for industrial products of the PRC.

Government approval is not required for its principal products.

Research and Development

While Shenzhen Kanglv continuously tries to improve its production processes, it does not engage in research and development activities as such.

Compliance with Environmental Laws

Shenzhen Kanglv adopted the U.S. LEED Green Building Standards for the construction and design of its plant. These standards are intended to improve performance in metrics such as energy savings, water efficiency, carbon dioxide emissions reduction, improved indoor environmental quality, and stewardship of resources and sensitivity to their impacts.

Shenzhen Kanglv is subject to the environmental laws of the PRC, which set certain emission standards in order to reduce air, water and land pollution. If Shenzhen Kanglv were to violate the emission standards, it could be forced to stop production until it resolved the pollution problem.

Employees

As of the date of this report, Shenzhen Kanglv had 192 full-time employees, including 21 members of the management staff. None of shenzhen kanglv’s employees are required by a union and we consider our relationship with our employees satisfactory.

| ITEM 1A. | RISK FACTORS |

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report on Form 10-K, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Shenzhen Kanglv has only a limited operating history, which makes it difficult to evaluate an investment in the Company’s stock.

An evaluation of the Company’s business will be difficult because Shenzhen Kanglv, the operating entity, has a limited operating history. While Shenzhen Kanglv was registered as a limited liability company in June 2005, it did not commence manufacturing operations until August 2010. It faces a number of risks encountered by early-stage companies, including the need to develop infrastructure to support growth and expansion; the need to obtain long-term sources of financing; the need to establish its marketing, sales and support organizations, as well as its distribution channels; the need to manage expanding operations; and its dependence on technology which could become incompatible or out of date. The Company’s business strategy may not be successful, and it may not successfully address these risks.

Shenzhen Kanglv derives substantially all of its revenues from one customer, the loss of which could have an adverse effect on its revenues.

For the year ended December 31, 2011, sales to Cancare Electric Wire (Shenzhen) Co., Ltd. accounted for 100% of the revenues of Shenzhen Kanglv. Cancare Electric also provided the core components and materials for the products of kanglv, accounting for 49% of Shenzhen Kanglv’s purchases. As a subcontractor of Cancare Electric Wire (Shenzhen) Co., Ltd., Shenzhen Kanglv is completely dependent upon this company for its revenues and operations.

| 6 |

Shenzhen Kanglv has been dependent upon advances from its former owners to provide working capital needed for operations.

During the year ended December 31, 2010 and three months ended March 31, 2011, financing for the operations of Shenzhen Kanglv came from its former owners who advanced funds and not charged interest on the advances. While operations have been modestly profitable, Shenzhen Kanglv requires cash for working capital. There can be no assurance that related parties will continue to provide the cash necessary for future operations or that funds will be provided on these terms.

Shenzhen Kanglv faces substantial competition from existing and potential competitors in the electronic cable products industry, which could force it to offer lower prices and/or narrow its focus, resulting in reduced revenues.

Due to its small size, it can be assumed that most if not all of the competitors of Shenzhen Kanglv have significantly greater financial, technical, marketing and other competitive resources. Its competitors and potential competitors have greater name recognition and more extensive customer bases that could be leveraged, for example, to position themselves as being more experienced, having better products, and being more knowledgeable than Shenzhen Kanglv. To compete, it may be forced to offer lower prices and narrow its marketing focus, resulting in reduced revenues.

A limited number of stockholders collectively own over 90% of the Company’s common stock and may enact, or prevent certain types of corporate actions, to the detriment of other stockholders.

As of May 30, 2012, two stockholders own more than 90% of the Company’s outstanding common stock. Accordingly, these stockholders may exercise significant influence over all matters requiring stockholder approval, including the election of a majority of the directors and the determination of significant corporate actions. This concentration could also have the effect of delaying or preventing a change in control that could otherwise be beneficial to stockholders of the Company.

There is a limited public market for the Company’s common shares, which limits the ability of the Company’s stockholders to resell their shares or pledge them as collateral.

While the Company’s stock is quoted on the OTCQB, the volume of stock that trades fluctuates widely. The Company cannot assure investors that a market for its stock will increase. Consequently, investors may not be able to use their shares for collateral for loans and may not be able to liquidate at a suitable price in the event of an emergency. In addition, investors may not be able to resell their shares at or above the price they paid for them or may not be able to sell their shares at all.

Regulations relating to “penny stocks” may limit the ability of the Company’s stockholders to sell their shares and, as a result, stockholders may have to hold their shares indefinitely.

The Company’s common stock is subject to rules promulgated by the SEC relating to “penny stocks,” which apply to non-NASDAQ companies whose stock trades at less than US$5.00 per share or whose tangible net worth is less than US$2,000,000 (HK$15,600,000). These rules require brokers who sell “penny stocks” to persons other than established customers and “accredited investors” to complete certain documentation, make suitability inquiries of investors, and provide investors with certain information concerning the risks of trading in the security. These rules may discourage or restrict the ability of brokers to sell the Company’s common stock and may affect the secondary market for the common stock.

The Company is a British Virgin Islands company and investors may have fewer protections as a stockholder as compared to a stockholder of a U.S. company because the British Virgin Islands has a less developed body of corporate law.

The rights of stockholders to take action against the directors, actions by minority stockholders and the fiduciary responsibilities of the Company’s directors to the Company under British Virgin Islands law are to a large extent governed by the common law of the British Virgin Islands and the BVIBC Act (which provides minority stockholders with certain statutory rights to bring derivative actions where the Company or a director engages in or propose to engage in conduct that contravenes the BVIBC Act or the memorandum and articles of association), as opposed to provisions in the Company’s memorandum and articles of association. The common law of the British Virgin Islands is derived in part from comparatively limited judicial precedent in the British Virgin Islands as well as from English common law, which has persuasive, but not bin ing, authority on a court in the British Virgin Islands. The rights of the Company’s stockholders and the fiduciary responsibilities of its directors under British Virgin Islands law, though set out in the BVIBC Act and common law, are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States, due to the fact that the British Virgin Islands has a less developed body of corporate and securities common laws that define these concepts, as compared to the United States. In particular, some states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate and securities law as a result of the large number of court cases that have been litigated and decided in those states.

| 7 |

British Virgin Islands companies may not be able to initiate stockholder derivative actions, thereby depriving stockholders of the ability to protect their interests.

British Virgin Islands companies may not have standing to initiate a stockholder derivative action in a federal court of the United States. The circumstances in which any such action may be brought, and the procedures and defenses that may be available in respect of any such action are established by British Virgin Islands case law and the BVIBC Act. Due to the limited body of British Virgin Islands case law, this may result in the rights of stockholders of a British Virgin Islands company being more limited than those of stockholders of a company organized in the US. Accordingly, stockholders may have fewer alternatives available to them if they believe that corporate wrongdoing has occurred.

As a British Virgin Islands corporation, stockholders may have difficulty in enforcing judgments against the Company, thereby rendering any judgments useless.

The British Virgin Islands courts are also unlikely to recognize or enforce against the Company judgments of courts of the United States based on the civil liability provisions of U.S. securities laws; and to impose liabilities against the Company, in original actions brought in the British Virgin Islands, based on certain civil liability provisions of U.S. securities laws that are penal in nature. There is no statutory recognition in the British Virgin Islands of judgments obtained in the United States, although the courts of the British Virgin Islands will generally recognize and enforce a non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits. This means that even if stockholders were to sue the Company successfully, they may not be able to recover anything to make up for losses suffered.

Since none of the Company’s officers and directors is a United States resident, it may be difficult to enforce any liabilities against them.

All of the Company’s officers and directors reside in Hong Kong or China. Accordingly, if events should occur that give rise to any liability on the part of these persons, stockholders would likely have difficulty in enforcing such liabilities. If a stockholder desired to sue these persons, the stockholder would have to serve such persons with legal process. Even if personal service is accomplished and a judgment is entered against that person, the stockholder would then have to locate assets of that person, and register the judgment in the foreign jurisdiction where assets are located.

Our officers and directors may be subject to a lower standard of care owed to the stockholders, which may result in decreased corporate performance.

In most jurisdictions in the United States, directors owe a fiduciary duty to the corporation and its stockholders, including a duty of care, under which directors must properly apprise themselves of all reasonably available information, and a duty of loyalty, under which they must protect the interests of the corporation and refrain from conduct that injures the corporation or its stockholders or that deprives the corporation or its stockholders of any profit or advantage. Under British Virgin Islands law, liability of a corporate director to the corporation is primarily limited to cases of willful malfeasance in the performance of his duties or to cases where the director has not acted honestly and in good faith and with a view to the best interests of the company.

As a result of this risk and other discussed above, public stockholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling stockholders than they would if we were incorporated and operating in the United States.

| 8 |

Currency conversion control policy in the PRC and exchange rate risk may adversely affect our financial condition.

The PRC Government has strict restrictions on free conversion of RMB into foreign currencies and vice versa. On January 1, 1994, the PRC implemented a unified controlled exchange rate system based on market supply and demand. Based on such system, the People’ Bank of China (“PBOC”) quoted a daily exchange rate of RMB against US dollars based on the market rate for foreign exchange transaction conducted by the designated banks in the PRC foreign exchange market during the preceding day. The PBOC also quoted the exchange rates of RMB against other foreign currencies based on the international market rate.

On July 21, 2005, PBOC announced that the PRC government reformed the exchange rate regime by moving into a managed floating exchange rate regime based on market supply and demand with reference to a basket of foreign currencies. As a result, RMB appreciated against U.S. dollars and Hong Kong dollars by approximately 2% on July 21, 2005. The value of RMB may continue to appreciate or depreciate in the future, subject to many factors, including future changes in the currency value of the basket of currencies with reference to which the RMB exchange rate is floated, changes in the PRC government’s policy, domestic and international economic and political developments, as well as market supply and demand. Moreover, foreign exchange transactions under capital account (including principal payments in respect of foreign currency-denominated obligations) continue to be subject to foreign exchange controls and the approval of State Administration of Foreign Exchange of the PRC.

The existing restrictions on the conversion of RMB into foreign currencies (and thus restrictions on the subsequent repatriation of those funds), and any tightening of such restrictions may have an adverse effect on the Company’s ability to obtain sufficient foreign currencies to meet its needs. Alternatively, in the event that RMB continues to appreciate in the future currencies (U.S. dollars, Hong Kong dollars or otherwise) and if RMB continues to appreciate in the future, the Company may incur exchange losses thereby affecting its profitability.

Investors in the company could be harmed if management should engage in competing businesses.

The Company’s officers and directors are not prohibited from engaging in competing businesses. The Company does not have a right of first refusal pertaining to opportunities that come to their attention and related to the operations of the Company. The BVI corporate statute applicable to the Company requires officers and directors, in performing their functions, to act honestly and in good faith with a view to the best interests of the Company and exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances, but this may be difficult to enforce.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not required for smaller reporting companies.

| ITEM 2. | PROPERTIES |

Our principal offices are located at No. 666 Dalang South Road, Longhua County, Shenzhen City. The facilities are leased from Cancare Enterprise Co., Limited for US$4,200 per month. The term of the lease expires December 31, 2016.

| ITEM 3. | LEGAL PROCEEDINGS |

In July 2010, Hong Kong Communications Company Limited initiated proceedings in High Court of the Hong Kong Special Administrative Region (“SAR”) to wind up Titanium Technology. ELM Computer Technologies Limited, a creditor of Titanium Technology, has made a claim for a sum of US$292,393 (HK$2,280,666) and has applied to substitute as the petitioner in this action. Its application was to be heard on April 8, 2011 and then was extended to September 2011.

| 9 |

In August 2010, ELM Computer Technologies Limited initiated proceedings in High Court of the Hong Kong SAR against Titanium Technology for wrongful repudiation of a subcontractor agreement and default in a maintenance service agreement, claiming damages of US$407,983 (HK$3,182,266). Titanium Technology has applied for a stay of all further proceedings in this action. The application was to be heard on May 11, 2011 and then was extended to September 2011.

The High Court of Hong Kong SAR issued an order for winding up on September 2, 2011 that the Company, Titanium Technology Limited registered at Suite 2101, 21/F, Chinachen Century Tower, 178 Gloucester Road, Wanchai, Hong Kong be wound up by the Court under the provisions of the Companies Ordinance (Chapter 32). The Official Receiver is constituted provisional liquidators of the affairs of the Company and the cost of the Substituted Petitioner is taxed and paid out of the assets of the Company.

| 10 |

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Shares of our common stock are quoted on the OTC Markets - OTCQB under the symbol “TTNUF.” In addition, our shares were quoted on the OTC Bulletin Board from July 10, 2006 to February 22, 2011.

The following table sets forth the range of high and low bid quotations for our common stock for each fiscal quarter for the fiscal years ended December 31, 2011 and 2010. These quotations reflect inter-dealer prices quoted on the OTC Bulletin Board and OTCQB without retail mark-up, markdown, or commissions and may not necessarily represent actual transactions.

| High Bid | Low Bid | |||||||

| 2010 | ||||||||

| First Quarter | $ | 0.0162 | $ | 0.0025 | ||||

| Second Quarter | $ | 0.0027 | $ | 0.001 | ||||

| Third Quarter | $ | 0.0012 | $ | 0.0011 | ||||

| Fourth Quarter | $ | 0.0015 | $ | 0.001 | ||||

| 2011 | ||||||||

| First Quarter | $ | 0.015 | $ | 0.015 | ||||

| Second Quarter | $ | 0.015 | $ | 0.01 | ||||

| Third Quarter | $ | 0.02 | $ | 0.0005 | ||||

| Fourth Quarter | $ | 0.10 | $ | 0.0005 | ||||

As of March 27, 2012, there were 42 holders of record of our common stock and as of that date, the closing bid price of our common stock was $0.025.

We have never paid cash dividends on our common stock. We currently intend to retain earnings, if any, for use in our business and do not anticipate paying any cash dividends in the foreseeable future. Any future declaration and payment of dividends will be subject to the discretion of our Board of Directors, will be subject to applicable law and will depend upon our results of operations, earnings, financial condition, contractual limitations, cash requirements, future prospects and other factors deemed relevant by our Board of Directors.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of financial condition and results of operations relates to the operations and financial condition reported in the audited condensed consolidated financial statements of the Company for the fiscal year ended December 31, 2011 and 2010, and should be read in conjunction with such financial statements and related notes included in this report. Those statements in the following discussion that are not historical in nature should be considered to be forward looking statements that are inherently uncertain. Actual results and the timing of the events may differ materially from those contained in these forward looking statements due to a number of factors, including those discussed in the “Cautionary Note on Forward Looking Statements” set forth elsewhere in this Annual Report.

| 11 |

Overview

Shenzhen Kanglv Technology Company Limited (“Shenzhen Kanglv”) was registered as a limited liability company in Shenzhen City, the People’s Republic of China (the “PRC”) on June 16, 2005. Since August 2010, Shenzhen Kanglv engages in the manufacture and sales of electric wire products in the PRC, with its principal place of business in Shenzhen City, the PRC Shenzhen city, the PRC. The Company is a sub-contractor to manufacture and sells the electric wire products to its single customer. Under the sub-contracting agreement between Shenzhen Kanglv and Cancare Electric Wire (Shanzhen) Co., Ltd (“Cancare”), which is controlled by the same beneficial owner who owns a majority outstanding of our shares. Cancare provided the core components and materials to Shenzhen Kanglv for the production and Shenzhen Kanglv exclusively sold these finished products, based upon the reauired specification and customization to Cancare at the current market value in the normal course of business.

On May 31, 2011, Shenzhen Kanglv entered into a Memorandum of Understanding dated September 1, 2010 and amended on November 18, 2010 and March 18, 2011 (the “ MOU ”) with Titanium Group Limited (“TTNUF”), which was incorporated as an International Business Company with limited liability in the British Virgin Islands (“BVI”) under the International Business Companies Act (“IBC Act”) of the British Virgin Islands on May 17, 2004 and subsequently registered under the BVI Business Companies Act (“BVIBC Act”) on January 1, 2007 when the IBC Act was repealed and replaced with the BVIBC Act. TTNUF, through its subsidiaries, mainly engages in the manufacture and sales of electric wire products in the PRC, with its principal place of business in Shenzhen City, the PRC.

As used herein, the “Group” refers to TTNUF and its wholly-owned subsidiaries, Hong Kong Kanglv Technology Limited, Shenzhen Kanglv Technology Limited and Kanglv Cable Technology (Hong Kong) Limited.

Pursuant to the MOU, TTNUF agreed to issue 52,635,560 common shares to Huabao Asia Limited, an entity owned and controlled by Mr. CHEN Tianju, in exchange of the ownership of Shenzhen Kanglv. Although Shenzhen Kanglv became the Company’s wholly-owned subsidiary, the transaction was accounted for as a recapitalization in the form of a reverse merger of Shenzhen Kanglv, whereby Shenzhen Kanglv was deemed to be the accounting acquirer and was deemed to have retroactively adopted the capital structure of TTNUF. Since the transaction was accounted for as a reverse merger, the accompanying consolidated financial statements reflect the historical consolidated financial statements of Shenzhen Kanglv for all periods presented, and do not include the historical financial statements of TTNUF.

Pursuant to the MOU, TTNUF also agreed the following terms:

| 1. | TTNUF agreed to effect a 1-for-10 consolidation of its issued and outstanding shares of common stock. |

| 2. | The holders of TTNUF’s outstanding convertible debentures in the aggregate principal amount of US$1,400,000 agreed to accept a total of 3,500,000 common shares as full and complete payment of the debentures and all accrued and unpaid interest thereon. |

| 3. | Zili Industrial Co., Limited, an entity owned and/or controlled by Mr. XU Zhigang, agreed to purchase 38,700,000 common shares and deposit the purchase price of US$387,000 into escrow. |

On May 31, 2011, the acquisition of Shenzhen Kanglv was completed, and on 2 September, 2011, the subsidiary, Titanium Technology Limited, was winding up by the Hong Kong Special Administrative Region Government.

Accordingly, the accompanying consolidated financial statements include the following:

The consolidated balance sheets, consolidated statements of operations and comprehensive loss, and consolidated statements of cash flows of the accounting acquirer for all periods presented as if the recapitalization had occurred at the beginning of the earliest period presented and the operations of the accounting acquiree from the date of stock exchange transaction.

As such, the following discussion is focused on the current and historical operations of Shenzhen Kanglv, and excludes prior operations of Titanium Group Limited.

Shenzhen Kanglv is engaged in the manufacture and sales of electronic cable products in the PRC, with its principal place of business in Shenzhen City, the PRC. Its principal products are various types of computer cables, such as HDMI, DVI, VGA and USB cables, as well as electric power cables.

Shenzhen Kanglv is a subcontractor for Cancare Electric Wire (Shenzhen) Co., Ltd., an affiliate (“Cancare Electric”), and manufactures the products for Cancare Electric to its specifications and customization requirements. Cancare Electric provides the core components and materials to Shenzhen Kanglv. Cancare Electric sells the products to companies in the PRC, such as Great Wall Tech, Chi Yuan Technology Limited, and Ya lid a company limited.

| 12 |

As of December, 2011, details of the Company’s subsidiaries are as follows:

| Name | Date of incorporation/ establishment | Place of incorporation/ registration and operation | Percentage of equity interest attributable to the Company | Principal activities | ||||||

| Hong Kong Kanglv Technology Limited | September 17, 2010 | Hong Kong | 100% | Investment holding | ||||||

| Shenzhen Kanglv Technology Limited | June 16, 2005 | PRC | 100% | Manufacture and sales of electric wire products | ||||||

| Kanglv Cable Technology (Hong Kong) Limited | September 17, 2010 | Hong Kong | 100% | Dormant | ||||||

Critical Accounting Policies

Inventories. Inventories consist primarily of raw materials, work-in-process and finished goods of electric wire products and are stated at the lower of cost or net realizable value, with cost being determined on a weighted average basis. Costs include material, direct labor and manufacturing overhead costs. Allowance for slow-moving and obsolescence is an estimated amount based on an analysis of current business and economic risks, the duration of the inventories held and other specific identifiable risks that may indicate a potential loss. The allowance is reviewed regularly to ensure that it adequately provides for all reasonable expected losses. For the years ended December 31, 2011 and 2010, Shenzhen Kanglv did not record an allowance for obsolete inventories, nor have there been any write-offs.

| 13 |

Revenue Recognition. In accordance with ASC Topic 605, “Revenue Recognition,” Shenzhen Kanglv recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable and collectability is reasonably assured.

(a) Sales of products – Revenue from the sales of electric wire products is recognized when the products are delivered to and received by the customers, collectability is reasonably assured and the prices are fixed and determinable.

Revenue represents the invoiced value of goods, net of value-added tax (“VAT”). Shenzhen Kanglv’s products that are locally sold in the PRC are subject to VAT, which is levied at the rate of 17% on the invoiced value of sales. Output VAT is borne by customers in addition to the invoiced value of sales and input VAT is borne by Shenzhen Kanglv in addition to the invoiced value of purchases to the extent not refunded for export sales.

(b) Interest income – Interest income is recognized on a time apportionment basis, taking into account the principal amounts outstanding and the interest rates applicable.

Cost of revenue. Cost of revenue includes cost of raw materials, direct labor, packing cost and production overhead directly attributable to the manufacture of electric wire products. Shipping and handling cost are recorded in cost of revenue and are recognized when the related product is delivered to the customer.

Comprehensive income or loss. ASC Topic 220, “Comprehensive Income,” establishes standards for reporting and display of comprehensive income or loss, its components and accumulated balances. Comprehensive income or loss as defined includes all changes in equity during a period from non-owner sources. Accumulated comprehensive income, as presented in the statements of owners’ equity consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income or loss is not included in the computation of income tax expense or benefit.

Income taxes. Income taxes are determined with the provisions of ASC Topic 740, “Income Taxes” (“ASC 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclose in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

For the years ended December 31, 2011 and 2010, Shenzhen Kanglv did not have any interest and penalties associated with tax positions. As of December 31, 2011 and 2010, Shenzhen Kanglv did not have any significant unrecognized uncertain tax positions.

Shenzhen Kanglv conducts its major businesses in the PRC and is subject to tax in this jurisdiction. As a result of its business activities Shenzhen Kanglv files tax returns that are subject to examination by the local tax authority.

| 14 |

Foreign currencies translation. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statements of operations.

The reporting currency of Shenzhen Kanglv is the United States Dollar (“US$”) and the financial statements of Shenzhen Kanglv have been expressed in US$. Shenzhen Kanglv maintains its books and records in its local currency, Renminbi Yuan (“RMB”), which is a functional currency as being the primary currency of the economic environment in which its operations are conducted. In accordance with ASC Topic 830-30, “Translation of Financial Statement,” assets and liabilities of a company whose functional currency is not US$ are translated into US$, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements are recorded as a separate component of accumulated other comprehensive income within the statements of owners’ equity.

Translation of amounts from the local currency of Shenzhen Kanglv into US$1 has been made at the following exchange rates for the respective periods:

| December 31, 2011 | December 31, 2010 | |||||||

| Year-end RMB: US$1 exchange rate | 6.3523 | 6.6118 | ||||||

| Annual average RMB: US$1 exchange rate | 6.4544 | 6.7788 | ||||||

Related Parties. Parties, which can be a corporation or individual, are considered to be related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

Results of Operations

Fiscal Year Ended December 31, 2011 Compared to Fiscal Year Ended December 31, 2010.

Net revenue for year ended December 31, 2011 were US$5.7 million compared to US$1.6 million for the year ended December 31, 2010, an increase of 250.1%. The increase in net revenue for the year ended December 31, 2011 over the year ended December 31, 2010 was mainly due to the full commitments of businesses of Shenzhen Kanglv Technology Limited in 2011, and this subsidiary did not commence manufacturing operations until August, 2010.

Cost of revenue were US$5.7 million for the year ended December 31, 2011 as compared to US$1.6 million for the comparable period in 2010, an increase of 259.8%. This was attributed by the commitments of businesses of Shenzhen Kanglv Technology Limited for two comparable periods.

Gross loss for the year ended December 31, 2011 was $36,000, or 0.6% of net revenue, compared to gross profit of $34,000, or 2.1% of net revenue, respectively, for the comparable period in 2010.

Selling, general and administrative expenses were US$1,355,666, or 23.8% of net revenue, for the year ended December 31, 2011, compared to US$5,000, or 0.3% of net revenue, for the comparable period in 2010. The increase of expenses were mainly attributed by the recapitalization effect of US$757,804.

Interest expense was US$95,000 for the year ended December 31, 2011, as compared to $nil for the respective comparable period in 2010. The increase was primarily due to bank borrowings. We obtained our borrowings by US$4.4 million in the year ended December 31, 2011 as compared to $nil for the year ended December 31, 2010.

| 15 |

Net loss for the year ended December 31, 2011 was US$573,000, compared to a net profit of US$28,000 for the comparable period in 2010.

Going Concern

As a result of the losses incurred over the past several years and the accumulated deficit of US$900,210 at December 31, 2011, the report of our independent registered public accounting firm on the financial statements for the year ended December 31, 2011 includes an explanatory paragraph indicating substantial doubt as to our ability to continue as a going concern. Our continued existence is dependent upon the continuing financial support from our stockholders and/or negotiation of repayment terms with the holders of the convertible debentures. Management believes that our stockholders will continue to provide the additional cash to meet our obligations as they become due.

Liquidity and Capital Resources

At December 31, 2011, we had a working capital deficit of US$152,781 as compared to working capital deficit of US$33,989 at December 31, 2010. The working capital deficit increased by US$118,792 due primarily to the additions of short-term bank loan of US$4.4 million which was offset by the increase of amount due from related parties of US$4,631,639 substantially.

During the year ended December 31, 2011, operating activities used cash of US$3,876,302, primarily due to the loss of US$572,641. In comparison, operating activities in 2010 used cash of US$19,957, primarily due to the movements of inventories and amount due from related parties of US$363,662 and US$313,093 respectively.

In 2011, US$424,920 were provided by or used in investing activities, which were for payments on issuance of 47,364,400 shares. In 2010, no cash was provided by or used in investing activities.

Financing activities, consisting of proceeds from bank loans, provided cash of US$4,407,852 in 2011. In 2010, no cash was provided by or used in financing activities.

Recent Accounting Pronouncements

Fair Value Measurement

In May 2011, the Financial Accounting Standard Board ("FASB") issued Accounting Standards Update ASU 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. ASU 2011-04 generally provides a uniform framework for fair value measurements and related disclosures between U.S. GAAP and International Financial Reporting Standards ("IFRS"). Additional disclosure requirements in the update include: (1) for Level 3 fair value measurements, quantitative information about unobservable inputs used, a description of the valuation process used by the entity, and a qualitative discussion about the sensitivity of the measurements to changes in the unobservable inputs; (2) for an entity's use of a nonfinancial asset that is different from the asset's highest and best use, the reason for the difference; (3) for financial instruments not measured at fair value but for which disclosure of fair value is required, the fair value hierarchy level in which the fair value measurements were determined; and (4) the disclosure of all transfers between Level 1 and Level 2 of the fair value hierarchy. This update is effective for annual and interim periods beginning on or after December 15, 2011. The effect of ASU 2011-04 on the consolidated financial statements and related disclosures is not expected to be significant.

Comprehensive Income

In June 2011, the FASB issued ASU 2011-05,Comprehensive Income (Topic 220). ASU 2011-05 gives an entity the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements; the option to present components of other comprehensive income as part of the statement of changes in stockholders' equity was eliminated. The items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income were not changed. Additionally, no changes were made to the calculation and presentation of earnings per share. This update is effective for annual and interim periods beginning on or after December 15, 2011. The effect of ASU 2011-05 on the consolidated financial statements and related disclosures is not expected to be significant.

Intangibles—Goodwill and Other

In September 2011, the FASB issued ASU No. 2011-08, Intangibles—Goodwill and Other (Topic 350) that permits an entity to make a qualitative assessment of whether it is more likely than not that a reporting unit's fair value is less than its carrying amount before applying the two step goodwill impairment test. The updated guidance requires that, if an entity concludes that it is more likely than not that the fair value of a reporting unit exceeds its carrying amount; it would not be required to perform the two-step impairment test for the reporting unit. The provisions of the updated guidance are effective for annual and interim periods beginning after December 15, 2011 with early adoption permitted. The Company adopted ASU 2011-08 in the third quarter of 2011. The adoption of this guidance did not affect the Company's results of operations, financial position or liquidity.

| 16 |

Off-Balance Sheet Arrangements

At December 31, 2011, we did not have any off-balance sheet arrangements.

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

The financial statements and supplementary data of Titanium Group Ltd. required by this item are described in Item 15 of this Annual Report on Form 10-K and are presented beginning on page F-1.

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

(a) Effective October 28, 2011, upon the approval of the board of directors of the Company, the Company dismissed HKCMCPA Company Limited (“HKCMCPA”) as the Company’s independent registered public accountant.

The report of HKCMCPA on the Company’s financial statements for the fiscal year ended December 31, 2010 and 2009 included an explanatory paragraph that noted substantial doubt about the Company’s ability to continue as a going concern. The audit reports of HKCMCPA on the financial statements of the Company for the fiscal years ended December 31, 2010 and 2009 did not otherwise contain any adverse opinion or a disclaimer of opinion, nor were they modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2010, 2009 as well as the subsequent interim period preceding our decision to dismiss HKCMCPA, there have been no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K) between the Company and HKCMCPA on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of HKCMCPA, would have caused them to make reference thereto in their report on financial statements for such years.

On October 31, 2011, the Company provided HKCMCPA with a copy of the foregoing disclosures it is making in response to Item 4.01 on Form 8-K filed with the SEC on November 3, 2011, and requested HKCMCPA to furnish it with a letter addressed to the SEC stating whether or not it agrees with the above statements. A copy of HKCMCPA response letter, dated November 1, 2011, was attached as Exhibit 16.1 to the Form 8-K filed with the SEC on November 3, 2011.

(b) On October 28, 2011, upon the approval of the board of directors of the Company, Dominic K. F. Chan & Co. (“Dominic”) was appointed as the independent registered public accounting firm for the Company.

During the years ended December 31, 2010 and 2009 and through the date hereof, neither the Company nor anyone acting on its behalf consulted Dominic with respect to (i) the application of accounting principles to a specified transaction, either completed or proposed, nor the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report was provided to the Company or oral advice was provided that Dominic concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a disagreement or reportable events set forth in Item 304(a)(1)(iv) and (v), respectively, of Regulation S-K.

| 17 |

| ITEM 9A. | CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures.

The Company maintains disclosure controls and procedures as required under Rule 13a-15(e) and Rule 15d-15(e) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are designed to ensure that information required to be disclosed in the Company’s Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

As of December 31, 2011, the Company’s management carried out an evaluation, under the supervision and with the participation of the Company’s Chief Executive Officer and Chief Financial Officer, of the effectiveness of its disclosure controls and procedures. Based on the foregoing, its Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective as of December 31, 2011.

Management is aware that there is a lack of segregation of duties due to the small number of employees dealing with general administrative and financial matters. However, at this time, management has decided that considering the employees involved, the control procedures in place, and the outsourcing of certain financial functions, the risks associated with such lack of segregation are low and the potential benefits of adding additional employees to clearly segregate duties do not justify the expenses associated with such increases. Management will periodically reevaluate this situation. If the volume of the business increases and sufficient capital is secured, it is our intention to increase staffing to mitigate the current lack of segregation of duties within the general administrative and financial functions.

A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations in all control systems no evaluation of controls can provide absolute assurance that all control issues, if any, within a company have been detected. Such limitations include the fact that human judgment in decision-making can be faulty and that breakdowns in internal control can occur because of human failures, such as simple errors or mistakes or intentional circumvention of the established process.

Management’s Report on Internal Control Over Financial Reporting; Changes in Internal Controls Over Financial Reporting.

The Company maintains disclosure controls and procedures as required under Rule 13a-15(e) and Rule 15d-15(e) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are designed to ensure that information required to be disclosed in the Company’s Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

The Company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U. S. generally accepted accounting principles (“US GAAP”). The Company’s internal control over financial reporting includes those policies and procedures that: (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Company’s assets, (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U. S. generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and, (iii) provide reasonable assurance regarding prevention of timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. Internal control over financial reporting includes the controls themselves, monitoring and internal auditing practices and actions taken to correct deficiencies as identified.

Because of its inherent limitations, internal control over financial reporting, no matter how well designed, may not prevent or detect misstatements. Accordingly, even effective internal control over financial reporting can provide only reasonable assurance with respect to financial statement preparation. Also, the effectiveness of internal control over financial reporting was made as of a specific date. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

| 18 |

As of December 31, 2011, the Company’s management conducted an assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2011, based on criteria for effective internal control over financial reporting described in “ Internal Control—Integrated Framework “ issued by the Committee of Sponsoring Organizations of the Treadway Commission. Management’s assessment included an evaluation of the design of the Company’s internal control over financial reporting and testing of the operational effectiveness of its internal control over financial reporting.

Based on this assessment, management determined that, as of December 31, 2011, the Company maintained effective internal control over financial reporting, although we did recognize a significant deficiency. A significant deficiency is a deficiency, or a combination of deficiencies, that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of the registrant’s financial reporting.

Although currently we do not identify any material weaknesses in the process of self assessment, we have recognized a significant deficiency in our internal controls. Currently we do not have sufficient in-house expertise in US GAAP reporting. Instead, we rely very much on the expertise and knowledge of external financial advisors in US GAAP conversion. External financial advisors have helped prepare and review the consolidated financial statements. Although we have not identified any material errors with our financial reporting or any material weaknesses with our internal controls, no assurances can be given that there are no such material errors or weaknesses existing. In addition, we do not believe we have sufficient documentation with our existing financial processes, risk assessment and internal controls. We plan to work closely with external financial advisors to document the existing financial processes, risk assessment and internal controls systematically.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit us to provide only management’s report in this annual report.

Changes in Internal Control Over Financial Reporting

There were no changes in the Company’s internal control over financial reporting that occurred during the fourth fiscal quarter of 2011 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

| ITEM 9B. | OTHER INFORMATION |

None.

| 19 |

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Our executive officers, directors, and key employees are:

| Name | Age | Position | ||

| LAI Huamin | 29 | Chairman of the Board of Directors and Chief Executive Officer | ||

| CHEN Tianjun | 32 | Chief Financial Officer |

Our shareholders elect our directors annually and our board of directors appoints our officers annually. Vacancies in our board are filled by the board itself. Set forth below are brief descriptions of the recent employment and business experience of our executive officers and directors.

LAI Huamin was appointed to serve as the Chairman of the Board of Directors in June 2009 and assumed the responsibilities of Chief Executive Officer in May 2010. Mr. LAI received a bachelor’s degree in science in 2005 from the Northwest Telecommunications Engineering College. His experience is in the areas of electronic information, electronic product development, finance and project planning. We have concluded that Mr. Lai should serve as a director because of his background in electronic product development and finance.

TIANJUN CHEN was appointed to serve as the Chief Financial Officer in March 28, 2012. Mr. Chen received a bachelor’s degree in business and commerce in 2002.Mr. Chen served as international business manager of Cancare Enterprise (Shenzhen) Limited from 2008 to 2012. He served as managing director of Kanglv Technology (Hong Kong) Ltd. and Kanglv Cable Technology (Hong Kong) Ltd. from 2008 to current.

Mr. Mingzheng Lan resigned as director and Chief Financial Officer of the Company effective as of March 6, 2012.

Conflicts of Interest

Members of our management are associated with other firms involved in a range of business activities. Consequently, there are potential inherent conflicts of interest in their acting as officers and directors of our company. While the officers and directors are engaged in other business activities, we anticipate that such activities will not interfere in any significant fashion with the affairs of our business.

Our officers and directors are now and may in the future become shareholders, officers or directors of other companies, which may be formed for the purpose of engaging in business activities similar to us. Accordingly, additional direct conflicts of interest may arise in the future with respect to such individuals acting on behalf of us or other entities. Moreover, additional conflicts of interest may arise with respect to opportunities which come to the attention of such individuals in the performance of their duties or otherwise. Currently, we do not have a right of first refusal pertaining to opportunities that come to their attention and may relate to our business operations.

Our officers and directors are, so long as they are our officers or directors, subject to the restriction that all opportunities contemplated by our plan of operation which come to their attention, either in the performance of their duties or in any other manner, will be considered opportunities of, and be made available to us and the companies that they are affiliated with on an equal basis. A breach of this requirement will be a breach of the fiduciary duties of the officer or director. If we or the companies with which the officers and directors are affiliated both desire to take advantage of an opportunity, then said officers and directors would abstain from negotiating and voting upon the opportunity. However, all directors may still individually take advantage of opportunities if we should decline to do so. Except as set forth above, we have not adopted any other conflict of interest policy with respect to such transactions.

| 20 |

Committees of the Board of Directors

We have not yet established any committees of our board of directors.

Director Nomination Process

Neither our Memorandum of Association nor Articles of Association set forth a director nomination process.

Code of Ethics

We have not yet adopted a Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer, and persons performing similar functions.

| ITEM 11. | EXECUTIVE COMPENSATION |

The following table sets forth information about the remuneration of our principal executive officers for services rendered during the years ended December 31, 2011 and 2010. None of our other executive officers had total compensation of $100,000 or more. Certain columns as required by the regulations of the Securities and Exchange Commission have been omitted as no information was required to be disclosed under those columns.

SUMMARY COMPENSATION TABLE

(IN UNITED STATES DOLLARS)

| Name and principal position | Year | Salary (HKD) | Option Awards (HKD) | All Other Compensation (HKD) | Total (HKD) | |||||||||||||||

| LAI Huamin (1) | 2011 | -50,000- | -0- | -0- | -50,000- | |||||||||||||||

| 2010 | -0- | -0- | -0- | -0- | ||||||||||||||||

| (1) | Mr. Lai assumed the position of Chief Executive Officer in May 2010 and resigned in March 2012. |

| We did not grant any stock options during the year ended December 31, 2011. |

The following table sets forth information with respect to options that remained unexercised at December 31, 2011 for the executive officers named above. No options were exercised during the year ended December 31, 2011.

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | ||||||||||||

| LAI Huamin | -0- | -0- | — | — | ||||||||||||