Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - BIRCH BRANCH INC | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - BIRCH BRANCH INC | v307487_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - BIRCH BRANCH INC | v307487_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - BIRCH BRANCH INC | v307487_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - BIRCH BRANCH INC | v307487_ex32-1.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File No.: 333-126654

BIRCH BRANCH, INC.

(Exact name of Registrant as specified in its charter)

| Colorado | 84-1124170 |

| (State or other jurisdiction of | (IRS Employer Identification Number) |

| incorporation or organization) |

c/o Henan Shuncheng Group Coal Coke Co., Ltd.

Henan Shuncheng Group Coal Coke Co., Ltd. (New Building), Cai Cun Road Intersection,

Anyang County, Henan Province, China 455141

(Address of principal executive offices)

+86 372 323 7890

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of the Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Exchange Act Rule 12b-2).

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

As of the last business day of the registrant’s most recently completed second fiscal quarter, there was no active public trading market for our common stock.

As of March 28, 2012, the registrant has 32,047,222 shares of its common stock outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

| PAGE | |||

| PART I | |||

| ITEM 1. | Business. | 4 | |

| ITEM 1A. | Risk Factors. | 14 | |

| ITEM 2. | Properties. | 33 | |

| ITEM 3. | Legal Proceedings. | 34 | |

| ITEM 4. | (Removed and Reserved). | 34 | |

| PART II | |||

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 34 | |

| ITEM 6. | Selected Financial Data. | 35 | |

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation. | 35 | |

| ITEM 8. | Financial Statements and Supplementary Data. | 47 | |

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 48 | |

| ITEM 9A. | Controls and Procedures. | 48 | |

| PART III | |||

| ITEM 10. | Directors, Executive Officers and Corporate Governance. | 49 | |

| ITEM 11. | Executive Compensation. | 50 | |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 52 | |

| ITEM 13. | Certain Relationships and Related Transactions. | 54 | |

| ITEM 14. | Principal Accounting Fees and Services. | 54 | |

| PART IV | |||

| ITEM 15. | Exhibits, Financial Statement Schedules. | 55 | |

| SIGNATURES | 57 | ||

| 2 |

FORWARD LOOKING STATEMENTS

This annual report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

| · | the uncertainty of profitability based upon our history of losses; |

| · | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms to continue as going concern; |

| · | risks related to our international operations and currency exchange fluctuations; and |

| · | other risks and uncertainties related to our business plan and business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

References in this annual report to “we”, “us”, “our”, the “Company” refer to Birch Branch, Inc., unless otherwise indicated.

References to China or the PRC refer to the People’s Republic of China.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common stock” refer to the common shares in our capital stock.

| 3 |

PART I

ITEM 1. BUSINESS

Company Overview

Operating through Henan Shuncheng Group Coal Coke Co., Ltd. (“SC Coke”), a variable interest entity incorporated under the laws of People’s Republic China (“PRC”), Birch Branch, Inc. (hereinafter referred to as “BRBH”, “we”, “us” or “our”) is a vertically integrated coke producer with its facilities and operations are based solely in the PRC, principally in Henan Province. SC Coke, which operates and derives its revenue solely in the PRC, has a coke production plant with current capacity of approximately 1.7 million tons of coke annually, equity ownership in a coal mine and two coal washing plants (producing refined coal).

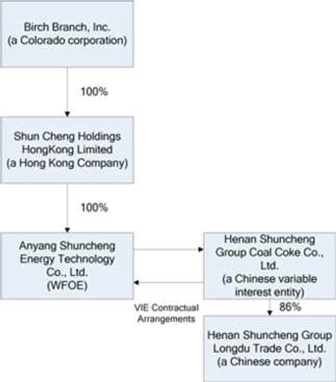

We control SC Coke and its operations through a series of contractual arrangements between Anyang Shuncheng Energy Technology Co., Ltd. (“Anyang WFOE”), our Chinese wholly-foreign owned enterprise subsidiary, and SC Coke and its shareholders. SC Coke owns 86% of Henan Shuncheng Group Longdu Trade Co., Ltd., a Chinese company (“Longdu”). Xinshun Wang, our Chairman of the Board of Directors, also owns 5% of Longdu.

Corporate History

We were incorporated in the State of Colorado on September 28, 1989. We were previously a residential real estate holding company. In September 2006, we sold our real estate assets to our then president. Effective December 6, 2006, our plan was to evaluate the structure and complete a merger with, or acquisition of, prospects consisting of private companies, partnerships or sole proprietorships.

On May 14, 2010, we entered into a Share Exchange Agreement with the principal shareholders of the Company, Shun Cheng Holdings HongKong Limited, a privately-held company organized under the laws of Hong Kong (“Shun Cheng HK”), and the shareholders of Shun Cheng HK (the “Share Exchange Agreement”). Pursuant to the terms of the Share Exchange Agreement, we agreed to acquire all of the issued and outstanding shares of Shun Cheng HK from the Shun Cheng HK shareholders in exchange for the issuance by us to the Shun Cheng HK shareholders of an aggregate of 30,233,750 newly-issued shares of our common stock (the “Share Exchange”), which, upon completion of the transactions contemplated by the Share Exchange Agreement, will constitute approximately 95% of our issued and outstanding shares of common stock. Upon consummation of the Share Exchange, Shun Cheng HK will become a wholly-owned subsidiary of the Company.

On June 28, 2010, we entered into an Amendment (the “Amendment”) to the Share Exchange Agreement dated May 14, 2010 to provide for certain changes to the Share Exchange Agreement regarding, among other things, our management after the closing of the transactions contemplated by the Share Exchange Agreement and the updating of certain information pursuant to the Share Exchange Agreement. Unless the context requires otherwise, the Amendment to the Share Exchange Agreement and the Share Exchange Agreement are collectively referred to as the “Share Exchange Agreement.”

The transactions contemplated by the Share Exchange Agreement closed on June 28, 2010 (the “Closing Date”). On the Closing Date, simultaneously with the closing of the Share Exchange, we entered into a Cancellation Agreement with certain shareholders of BRBH (the “Cancellation Agreement”), pursuant to which 435,123 shares of our common stock held by such shareholders were cancelled (the “Share Cancellation”). In connection with the Share Exchange, on the Closing Date, Timothy Brasel resigned as our sole director and Xinshun Wang was appointed as Chairman of our Board of Directors. In addition, Feng Wang, Qifa Huang, David Chen and Dexin Li were appointed as members of the Board of Directors effective on July 13, 2010, 10 days after the date of the filing of a Schedule 14(f) with the SEC. Effective on the Closing Date, Timothy Brasel also resigned as our sole executive officer and Feng Wang and Dexin Li were appointed as our Chief Executive Officer and Chief Operating Officer, respectively.

On the Closing Date, in connection with the Share Exchange Agreement, we also changed our fiscal year end from June 30 to December 31 to conform to the fiscal year end of SC Coke.

On July 20, 2010, SC Coke entered into a loan agreement with Bank of China, Anyang Branch. The principal amount of the secured loan is approximately $2,937,461. The secured loan carries an interest rate of 5.841% per annum, is due on July 20, 2011, and is personally guaranteed by the SC Coke shareholders, one of whom is the Chairman of our Board of Directors, and a third party guarantor.

On July 28, 2010, SC Coke entered into a loan agreement with China Construction Bank, Anyang Branch. The principal amount of the loan is approximately $2,937,461. The loan carries an interest rate of the PRC prime rate, which was 5.310% per annum on July 28, 2010, and is due on July 28, 2011.

On August 4, 2010, we dismissed Cordovano and Honeck, LLP (“Cordovano”) as our independent registered public accounting firm and engaged Samuel H. Wong & Co., LLP (“SHW”) as our new independent registered public accounting firm. The dismissal of Cordovano is not the result of any disagreement between us and Cordovano on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure with respect to the Company.

| 4 |

On August 12, 2010, we appointed Feng Wang, a director of the Company and the Company’s Chief Executive Officer, as President of the Company.

On November 15, 2010, Feng Wang resigned as the Chief Financial Officer of the Company and Lei Wang was appointed as the new Chief Financial Officer, effective immediately.

On March 2, 2011, David Chen was dismissed by the Board as a director of the Company and Senshan Gong was appointed as a member of the Board.

Organization & Subsidiaries

Our relationships with SC Coke and its shareholders are governed by a series of contractual arrangements, described below, through which we exercise management rights over SC Coke. None of BRBH, Shun Cheng HK, nor Anyang WFOE owns any direct equity interest in SC Coke. On March 19, 2010, Anyang WFOE entered into the following contractual arrangements with SC Coke and its shareholders:

Entrusted Management Agreement. Pursuant to the entrusted management agreement between Anyang WFOE, on the one hand, and SC Coke and Xinshun Wang, Xinming Wang and Junsheng Cheng (collectively, the “SC Coke Shareholders”), on the other hand, (the “Entrusted Management Agreement”), SC Coke and the SC Coke Shareholders agreed to entrust the business operations of SC Coke and its management to Anyang WFOE until Anyang WFOE acquires all of the assets or equity of SC Coke (as more fully described under “Exclusive Option Agreement” below). Under the Entrusted Management Agreement, Anyang WFOE manages SC Coke’s operations and assets, and controls all of SC Coke’s cash flow and assets through entrusted or designated bank accounts. In turn, it is entitled to any of SC Coke’s net earnings as a management fee, and is obligated to pay all SC Coke’s debts to the extent SC Coke is not able to pay such debts. Such management fees payable by SC Coke shall accrue until such time as the parties shall mutually agree. The Entrusted Management Agreement will remain in effect until the acquisition of all assets or equity of SC Coke by Anyang WFOE is completed.

Shareholders’ Voting Proxy Agreement. Under the shareholders’ voting proxy agreement (the “Shareholders’ Voting Proxy Agreement”) between Anyang WFOE and the SC Coke Shareholders, the SC Coke Shareholders irrevocably and exclusively appointed the board of directors of Anyang WFOE as their proxy to vote on all matters that require SC Coke shareholder approval. The Shareholders’ Voting Proxy Agreement shall not be terminated prior to the completion of the acquisition of all assets or equity of SC Coke by Anyang WFOE.

Exclusive Option Agreement. Under the exclusive option agreement (the “Exclusive Option Agreement”) between Anyang WFOE, on the one hand, and SC Coke and the SC Coke Shareholders, on the other hand, the SC Coke Shareholders granted Anyang WFOE an irrevocable exclusive purchase option to purchase all or part of the shares or assets of SC Coke. The option is exercisable at any time on or after June 28, 2010, but only to the extent that such purchase does not violate any PRC law then in effect. The exercise price shall be the minimum price permitted under the PRC law then applicable, and such price, subject to applicable PRC law, shall be refunded to Anyang WFOE or SC Coke for no consideration or the minimum consideration permitted under the PRC law then applicable, whichever is more, in a manner decided by Anyang WFOE, at its reasonable discretion.

Shares Pledge Agreement. Under the shares pledge agreement between Anyang WFOE, on the one hand, and SC Coke and the SC Coke Shareholders, on the other hand, (the “Shares Pledge Agreement”), the SC Coke Shareholders pledged all of their equity interests in SC Coke, including the proceeds thereof, to guarantee all of Anyang WFOE’s rights and benefits under the Entrusted Management Agreement, the Exclusive Option Agreement and the Shareholders’ Voting Proxy Agreement. Prior to termination of the Shares Pledge Agreement, the pledged equity interests cannot be transferred without Anyang WFOE’s prior consent.

The Company’s organizational structure was developed to permit the infusion of foreign capital under the laws of the PRC and to maintain an efficient tax structure, as well as to foster internal organizational efficiencies. The Company’s organization structure, after taking into account the Share Exchange, is summarized in the figure below:

| 5 |

Market Summary

The Chinese coking industry is also a regionalized business where supply of raw materials and the demands for coke become uneconomical at long distances as transportation costs become prohibitive. SC Coke estimates that supply of raw materials and demand for coke to be delivered by truck transportation is uneconomical beyond 800 kilometers (approximately 500 miles); and access to and delivery by rail becomes a critical competitive factor. SC Coke is located in close proximity to the main coal mining provinces of Shanxi and Henan in China and has a private railway line, approximately 1.7 kilometers (approximately 1 mile) in length, which provides connection to the national railway network.

As the coke industry is highly dependent on the iron and steel industries, it is affected by many of the same factors that impact the iron and steel industries. Iron and steel are basic commodities that are required in many other industries, such as construction, infrastructure works, automotive and aerospace. The iron and steel industries are highly cyclical and have historically been very volatile. Similarly, the price and demand for coke has also experienced such cyclicality and volatility. SC Coke intends to focus on better recycling and use of its secondary products, in particular coke byproducts. The applications for coke byproducts are expected to be more diverse; therefore, demand factors for coke byproducts are likely to be different from the factors applicable to the iron and steel industries; for example, coal tar is used for the treatment of psoriasis and amsulfate is used as agricultural fertilizer.

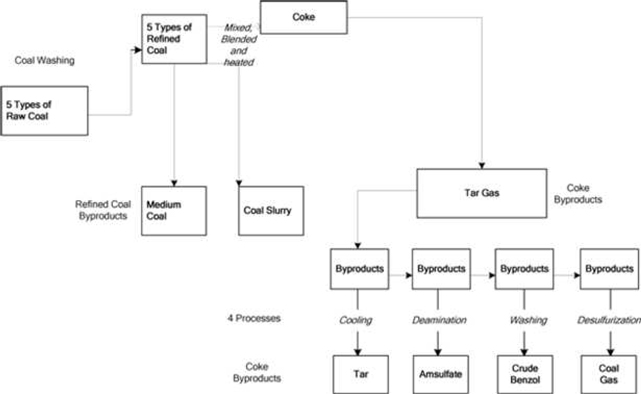

Principal Products

Our principal products are “refined coal” (which is coal processed by coal washing) and coke (which results from the blending of various types of refined coal and subsequently heating such mixed refined coal at high temperatures in a brick oven to produce coke). The majority of refined coal is used by us in our coke manufacturing process. Metallurgical coke is primarily used in iron and steel manufacturing. Over the past three years, refined coal and coke have contributed an average of approximately more than 80% of our annual revenues. SC Coke also sells medium coal and coal slurry (which are byproducts produced from its refined coal process), tar, crude benzol and ammonium sulfate (“amsulfate”) (which are byproducts produced from its coke manufacturing process) and both sell and use coal gas to provide electricity for its internal operations (which is a byproduct produced from its coke manufacturing process). During the fiscal year ended December 31, 2011, SC Coke produced approximately 1,104,227 metric tons (“tons”) of coke, 673,765 tons of refined coal (inclusive of Longdu), 51,056 tons of tar, 13,673 tons of crude benzol, 11,949 tons of amsulfate and 450 million cubic meters of coal gas.

Description of Operations

Production Process

Our production process is described as follows:

| 6 |

SC Coke is based in the Henan Province in the central part of China. SC Coke’s operations are located in Tongye Town, Anyang County, Henan Province, PRC, which is 40 kilometers from Anyang City. SC Coke and Longdu purchase raw coal from numerous mines and suppliers deliver coal to SC Coke’s facilities in Tongye Town and Longdu’s facility in Matoujian Town, where the coal is processed, through a coal washing process, to obtain refined coal which is used by SC Coke to make coke or is sold to third parties. The production of refined coal also results in two byproducts - medium coal and coal slurry. The coke produced by SC Coke is either loaded onsite onto railcars on its private rail line and transported to customers through the connected national railway system or loaded onto trucks and transported to customers by highway. Byproducts of the coking process are either sold to customers or recycled for consumption by SC Coke. The tar gas emitted during the coking process results in four byproducts - tar, crude benzol, amsulfate, and coal gas. Coal gas is also consumed internally by SC Coke, providing an energy source for its ovens, and is utilized to produce electricity through onsite electric power generators to provide electricity for SC Coke’s operations. Excess coal gas remaining is then piped and sold to Angang Steel.

Coke Manufacturing

Metallurgical coke is primarily used in iron and steel manufacturing. China has a national standard for coke, based upon a variety of metrics including, ash and sulfur content, mechanical strength, volatility, moisture content and end-coke content. According to the national standard, metallurgical coke is classified into three grades – Grade I, Grade II and Grade III, with Grade I being the highest quality. SC Coke currently only produces Grade II metallurgical coke.

In 2011, SC Coke has completed the construction of a Coke Dry Quenching (“CDQ”) facility which allows SC Coke to reduce emissions, generate Certified Emission Reductions (“CER”) which can be sold, and potentially improves the coke quality, and so that it can possibly produce Grade I metallurgical coke. The CDQ facility expansion is discussed in additional detail under “Expansion Plans” below.

SC Coke’s current annual production capacity is approximately 1.3 million tons.

In SC Coke’s coke production process, five types of raw coal (with different levels of volatility) are currently purchased and blended by SC Coke in the following approximate proportions:

| Type | Proportion | |||

| Coking coal | 17 to 20% | |||

| One-third coke coal (high volatility) | 20 to 35% | |||

| Low sulfur rich coal (medium to high volatility) | 10% | |||

| High sulfur rich coal (medium to high volatility) | 13% | |||

| Lean coal (low volatility) | 20 to 25% | |||

| 7 |

After the five types of raw coal have been unloaded at SC Coke’s plant, they are stored on site in an open air storage facility with wind prevention retention walls, and transported into batching towers by a mechanical conveyer where the raw coal is subsequently mixed into a refined coal blend. The blended refined coal is crushed and mixed before being sent, by mechanical conveyor, into delivery coke carts and tamped into the correct size and shape according to the specifications of SC Coke’s ovens. After tamping, the refined coal is mechanically delivered into the ovens where it is treated at a high temperature for a period of between 18 to 24 hours to produce coke. The coke is transported by receiving coke carts to a coke quenching tower located adjacent to the plant where water is currently used to quench the coke. After cooling, the coke is transported by mechanical conveyor to the distribution center near the private rail line owned by SC Coke, and thereafter it is transported by rail or road to customers.

SC Coke currently produces coke onsite from a series of five coke ovens with an annual capacity of up to approximately 1.3 million tons. SC Coke produces coke between the size of 25 to 40 millimeters which complies, and is consistent, with the Chinese national specifications for Grade II coke. Such coke must comply with the following national standards:

| · | less than 13.5% ash; |

| · | less than 0.8% sulfur; |

| · | a specified mechanical strength; |

| · | a volatility less than 1.8%; |

| · | a moisture content less than 12.0%; and |

| · | an end-coke content less than 86.0%. |

Tar gas is emitted during the coke production process. SC Coke processes the tar gas to produce byproducts which can be sold or recycled. This process consists of: (i) air cooling and condensation of the tar gas to extract tar, (ii) deaminating the residual gas (using sulfuric acid which produces a chemical reaction when mixed with ammonia) to produce amsulfate, (iii) “washing” the residual gas to produce crude benzol, and (iv) removing the sulfur from the residual gas to produce coal gas which can be recycled for use in connection with heat generation in the coke production process and to generate electricity for SC Coke’s self consumption. Excess coal gas is then piped and sold to Angang Steel. Based on the normal range of volatility in SC Coke’s refined coal blend, as currently constituted, 100 tons of coke will generally yield to SC Coke approximately the following amounts of coke byproducts: 4 to 4.5 tons of tar, 1 ton of crude benzol, 1.1 tons of amsulfate, and 400 to 420 cubic meters of coal gas.

SC Coke’s annual production volumes of coke for the fiscal years ended December 31, 2007, 2008, 2009, 2010 and 2011, were approximately as follows:

| Annual | |||||

| Fiscal | Production | ||||

| Year | (Tons) | ||||

| 2007 | 514,820 | ||||

| 2008 | 545,643 | ||||

| 2009 | 722,175 | ||||

| 2010 | 1,104,227 | ||||

| 2011 | 1,286,861 | ||||

Refined Coal

Raw coal contains impurities, such as shale, that require separation to obtain refined coal. Both water-based jig and dense medium separation washing processes are used to produce refined coal. The water-based jig process relies on the use and flow of water to separate coal from shale as they have different densities; it is a more conventional process that has the advantages of requiring simpler equipment and a faster process, which enables large scale production. We are permitted by the local government to utilize underground water at their sites. In contrast, the dense medium separation process is a newer technology that has the advantage of higher recovery rates and a smaller area required for operations. Dense medium separation utilizes the differences in the densities of coal and shale, which when processed, allows the coal, which is lighter, to be separated from the heavier shale.

| 8 |

Approximately 1.3 tons of raw coal yield 1 ton of refined coal. We use refined coal to produce Coke, and we sold unused refined coal, if any, to customers. In fiscal year 2011, SC Coke consumed approximately 1,692,919 tons of refined coal (from internal production and external purchase). In addition to refined coal, the coal-washing process produces two byproducts:

| · | “Medium” coal, a PRC coal industry classification, is coal that does not have sufficient thermal value for coking, and is mixed with raw coal and coal slurry (described below), and sold for home and industrial heating purposes; and |

| · | Coal slurry, sometimes called coal slime, are the castoffs and debris from the coal washing process. Coal slurry can be used as a fuel with low thermal value, and is sold “as is” or mixed with “medium” coal. |

SC Coke’s annual production volumes of refined coal for the fiscal years ended December 31, 2007, 2008, 2009, 2010, and 2011, were approximately as follows:

| Annual | |||||

| Fiscal | Production | ||||

| Year | (Tons) | ||||

| 2007 | 810,186 | ||||

| 2008 | 555,316 | ||||

| 2009 | 595,518 | ||||

| 2010 | 673,765 | ||||

| 2011 | 708,574 | ||||

Coke Byproducts

Tar

Tar is an ingredient of asphalt, and is commonly used in the treatment of psoriasis, as an ingredient in certain disinfectants and for roofing and insulation applications.

SC Coke’s annual production volumes of tar for the fiscal years ended December 31, 2007, 2008, 2009, 2010 and 2011, were approximately as follows:

| Annual Production | |||||

| Fiscal Year | (Tons) | ||||

| 2007 | 10,024 | ||||

| 2008 | 19,105 | ||||

| 2009 | 42,103 | ||||

| 2010 | 51,056 | ||||

| 2011 | 55,724 | ||||

Amsulfate

Amsulfate is used mainly as an agricultural fertilizer and can also be used in garment manufacturing, and in the leather and medical industries. SC Coke’s annual production volumes of amsulfate for the fiscal years ended December 31, 2007, 2008, 2009, 2010 and 2011, were approximately as follows:

| 9 |

| Annual Production | |||||

| Fiscal Year | (Tons) | ||||

| 2007 | 4,935 | ||||

| 2008 | 6,536 | ||||

| 2009 | 8,555 | ||||

| 2010 | 11,949 | ||||

| 2011 | 16,235 | ||||

Crude Benzol

Crude benzol is a base material which, when further processed, can produce products such as benzene. Derivative products made from crude benzol are used in dyes, pesticides, spice production, solvents or bonds in paint making, paint spraying, shoemaking, and furniture manufacturing. SC Coke’s annual production volumes of crude benzol for the fiscal years ended December 31, 2007, 2008, 2009, 2010 and 2011, were approximately as follows:

| Annual Production | |||||

| Fiscal Year | (Tons) | ||||

| 2007 | 1,671 | ||||

| 2008 | 1,557 | ||||

| 2009 | 7,915 | ||||

| 2010 | 13,673 | ||||

| 2011 | 17,573 | ||||

Coal Gas

SC Coke uses coal gas for internal use to generate heat for its ovens and to produce electricity. Any excess gas is piped and sold to Angang Steel. Prior to 2008, there were no external sales of coal gas and the excess coal gas was flared off to minimize discharge into the environment. In 2008, SC Coke purchased a 19% interest in Angang Steel and entered into a contract with Angang Steel to pipe and sell the excess coal gas produced by SC Coke to Angang Steel.

SC Coke’s annual production of coal gas for the fiscal years ended December 31, 2007, 2008, 2009, 2010 and 2011, were approximately as follows:

| Annual Production | |||||

| (Million Cubic | |||||

| Fiscal Year | Meters) | ||||

| 2007 | 214 | ||||

| 2008 | 227 | ||||

| 2009 | 300 | ||||

| 2010 | 450 | ||||

| 2011 | 460 | ||||

| 10 |

Electricity Generation

Electricity that is generated by SC Coke is used to power SC Coke’s operations at its plant. SC Coke estimates that the replacement cost of this electricity, if it had to be purchased from the state-owned utility, would be in excess of $800,000 (based on usage and prices in 2009) per year. For the fiscal year ended December 31, 2011, SC Coke generated approximately 11, 638, 108 kilowatt-hours of useable electrical power for self consumption. In 2011, SC Coke consumed approximately $1,947,586 of electricity from the state electricity grid.

Expansion Plans

In December 2009, SC Coke started construction on the two additional 5.5 meter coke ovens. The total cost of such plant expansion is substantial and we expect to construct the facilities with the funds financed by debt and/or equity financings and internally generated cash flow. To date, SC Coke has not completed the construction. If additional financing is not obtained, SC Coke may need to reduce, defer or cancel its expansion plans.

In 2011, SC Coke has completed its construction of the CDQ facility. Previously, SC Coke utilized water quenching, and the water containing coke dust vaporizes and is released into the atmosphere. In the CDQ facility, red-hot coke will be cooled by gas circulating within an enclosed system, thereby preventing the release of airborne coke dust. The thermal energy of the red-hot coke, which is lost in the conventional system, will be collected and reused as steam to be used as heat and to generate electricity in the CDQ system. This technology uses less fossil fuel and results in lower carbon dioxide emissions. The CDQ project has received approval from the PRC government and has been designated a Clean Development Mechanism project by the Chinese government, which qualifies for CERs. The cost of constructing this facility approximately $30 million. Because the CDQ is an environmental conservation project, a portion of the total cost of the project is expected to be provided pursuant to grants by the Chinese government. , SC Coke has received grants in the amount of approximately $1.1 million for the CDQ facility construction. See discussion below under the heading “Clean Development Mechanism.”

An additional benefit of the CDQ facility is that it allows SC Coke to reduce emissions, generate Certified Emission Reductions which can be sold, and potentially improves the coke quality, and so that SC Coke can possibly produce Grade I metallurgical coke. However, there is no assurance that the CDQ facility will, by itself, enable SC Coke to produce Grade I metallurgical coke.

Product and Suppliers Quality Control

SC Coke adopts rigorous and frequent sampling and testing to ensure quality control over its products in the coke and coke byproduct manufacturing processes. SC Coke maintains an onsite testing laboratory to perform the testing.

Raw materials received from suppliers are subject to testing for suitability prior to their use by SC Coke. This pre-qualification process can take between two weeks to several months, depending on the type of raw material. Different raw materials are subject to different testing criteria. SC Coke also maintains a list of suppliers who are able to produce coal suitable for SC Coke’s needs if its regular suppliers are unable to meet its demands.

Samples of raw materials and products are numerically tagged, identified and stored for internal audit purposes to ensure that sample testing errors are minimized. Internal audits generally take place on a bi-weekly basis. Samples are typically kept for approximately one month at the laboratory before transfer to SC Coke’s warehouse for reuse in the coke or coke byproduct manufacturing processes.

In the coke production process, refined coal is sampled and tested before transfer into SC Coke’s stockpile. Samples at the stockpile are tested before blending. Once the blending and crushing is completed before tamping, the blended refined coal is tested every two hours. To the extent any issues are identified during the testing process, SC Coke refines the incorrect blend at separate batching towers. Coke at the distribution center is tested before transport to customers. This testing is usually performed every 4 hours.

| 11 |

Suppliers

SC Coke purchased raw coal and refined coal from unrelated external suppliers. In fiscal year of 2011, the top four suppliers of the company were: Yizhong Energy Group, ZaoZhuang Mining (Group) Co., Ltd., Xuzhou Yuantong Burning Co., Ltd., and Hebi Fuyuan Coke Co., Ltd. The first three suppliers each accounted for at least 10% of the company’s total purchases.

Generally, SC Coke’s suppliers contract for its main raw materials, on a monthly basis with monthly renewals. The prices and volumes fluctuate each month, and prices are based on then-prevailing market conditions. Purchases from most suppliers require 100% advance payments.

SC Coke believes that it has established stable cooperative relationships with its suppliers, but also expects it could, if necessary, readily find alternative sources of coal near its plant, as Henan Province is one of China’s main coal producing centers.

SC Coke’s other principal raw materials include water drawn from underground sources, for which SC Coke has the requisite permits, and electricity, approximately 80% of which SC Coke generates onsite from its own power stations and which is supplemented from the local state-owned utility as necessary. SC Coke also uses raw materials, such as sulfuric acid, in the manufacture of amsulfate. These materials are readily available and there is no shortage of other suppliers to choose from if there is any shortfall.

Customers

SC Coke sells all of its products within China. Its customers are concentrated in North China, East China, Central China and South China. SC Coke sells its coke to mostly national and provincial steel manufacturing companies and sells its refined coal to coke producers and others.

In fiscal year 2011, SC Coke’s top five major customers, aggregately, accounted for approximately 85.7% of its revenues, among which are Henan Fengbao Steel Co., Ltd., Changzhou zhongfa Iron Co., Ltd, Zhejiang Huatuo Engergy Co., Ltd, Shagang Group Anyang Yongxing Iron & Steel Co., Ltd. and Anyang xinpu Iron & Steel Co., Ltd.

SC Coke’s largest coke customer was Henan Fengbao Steel Co. Ltd., which accounted for 22.58% of coke revenue sales in 2011. SC Coke’s top five coke customers accounted for approximately 65% of coke revenue sales in 2011.

Company sales personnel conduct routine visits to customers. SC Coke has long-standing relationships with these customers, and management believes that these relationships are stable.

Non-renewal or termination of SC Coke’s arrangements with these customers would have a materially adverse effect on SC Coke’s revenue. In the event that any one of its major customers does not renew or terminates its arrangement with SC Coke, there can be no assurance that SC Coke will be able to enter into another arrangement similar in scope. Additionally, there can be no assurance that SC Coke’s business will not remain largely dependent on a limited customer base accounting for a substantial portion of its revenue.

Transportation and Distribution

SC Coke owns and operates a private rail track approximately 1.7 kilometers in length that connects SC Coke’s plant to the Chinese national railway system at the Henan An-Li Railway Lizhen Railway Station. Refined coal and coke are loaded from SC Coke’s platform onto railcars to be transported to customers primarily in Central Eastern China, which includes the provinces of Hebei, Henan, Shandong, Hubei, Anhui, Guangdong, Jiangsu and Zhejiang. SC Coke also transports its products to customers by truck. In 2011, approximately 60% of SC Coke’s product sales were delivered to customers by railway network and 40% of products were delivered by road transportation.

Competition

The PRC coke manufacturing industry is highly competitive. The average sale prices for products are driven by a number of factors, including the particular composition and grade or quality of the coal or coke being sold, prevailing market prices for these products in the Chinese local, national and global marketplace, timing of sales, delivery terms, negotiations between SC Coke and its customers, and relationships with those customers.

SC Coke is primarily a coke producer and intends to continue to expand its coke production volumes and internal consumption of refined coal. Refined coal sales as part of SC Coke’s total revenue has been declining since 2007 and decreased to 0 in year 2011 when all the refined coal produced by SC Coke was used internally for its coke production. . As such, SC Coke’s main competitors are now, and likely to be for the foreseeable future, coke producers.

| 12 |

SC Coke competes in the coke market at the national, provincial and local levels. There are several large coke producers, such as Shanxi Coking Co., Ltd and Shenhua Group that provide and sell coke on a national level. However, the availability and cost of transportation to customers may often be a factor which limits these large producers from competing effectively in local markets. A key provincial competitor is Pingmei Group, part of the Pingdingshan Coal Group, a large state-owned company which produces coal, refined coal and coke. Pingdingshan Coal Group’s operations are located in Pingdingshan City, Henan Province, which is approximately 300 kilometers from SC Coke. Local competitors include Linzhou Xinda Coking Co. Ltd, Henan Province Xinlei Group Co. Ltd, Henan Province Liyuan Coking Co. Ltd and Henan Province Yulong Coking Co. Ltd. Competitive factors that influence coke sales include geographic location and available transportation to customers, product prices, long-standing client relationships, payment terms, reliability of delivery, quality and grade of coke, and quality of customer service. The principal competitive factor that influences SC Coke’s sale of its byproducts is price.

Government Regulation

The following is a summary of the principal governmental laws and regulations that are or may be applicable to SC Coke’s operations. The scope and enforcement of many of the laws and regulations in the PRC described below are uncertain.

Coal Business

According to the Coal Trading Supervision Regulation issued by the National Development and Reform Commission, any enterprise engaging in the business of the sale of coal, washed and selected coal products, and processing and sale of coal for civilian use is required to obtain a Coal Trading Qualification Certificate, which is valid for three years and may be renewable upon application 30 days before expiration. Currently, SC Coke holds a valid Coal Trading Qualification Certificate, which expires June 30, 2012. .

Under the Work Safety Law of the PRC, the Work Safety Permit Regulation and Work Safety Permit Implemental Regulation for Dangerous Chemical Products Manufacturer, an enterprise which manufactures flammable and/or explosive chemical products is required to obtain a Work Safety Permit before it starts producing such products. A Work Safety Permit is valid for three years and may be renewed after application and documentation and on-site examination as needed by the relevant authority. Currently, SC Coke has a valid Work Safety Permit for coke, tar, benzol and gas, which expires April 18, 2013.

According to the National Industrial Product Manufacture License Regulation of the PRC and its implementing rules, enterprises producing dangerous chemical products are required to obtain a National Industrial Product Manufacture License, which is valid for five years and renewable upon application to the provincial Administration of Quality Supervision, Inspection and Quarantine six months before expiration. Currently, SC Coke has a valid National Industrial Product Manufacture License for organic dangerous chemicals, which expires August 27, 2013.

Under the Prevention and Control of Radioactive Pollution Law of the PRC and the Regulation for Safety and Protection of Radioisotopes and Radiation Apparatus, any enterprise engaging in the business of the sale, manufacture and use of radioisotopes and radiation apparatus is required to obtain a Radiation Safety License, which is valid for five years and may be renewed upon application within three months before expiration. Currently, SC Coke holds a valid Radiation Safety License, which expires June 27, 2013.

Environmental Impact Assessment

According to the Environment Protection Law of the PRC, the Environment Impact Assessment Law of the PRC and the Construction Project Environment Protection Regulations promulgated by the State Council on November 29, 1998, any enterprise which constructs a fixed asset investment project is required to submit an environmental impact assessment to an environmental protection administrative authority for approval. If such enterprise embarks on the construction without submission of the environmental impact assessment or approval by the applicable environmental protection administrative authority, they will be required to provide the environmental impact assessment and may be subject to a fine ranging from approximately $7,310 to $29,240. For each new construction and expansion of a fixed asset investment project, SC Coke is required to conduct an environmental impact assessment.

On May 10, 2010, the Environmental Protection Bureau of Anyang County (the “EPBAC”) issued an environmental protection administrative penalty notice to SC Coke for the construction of five coke ovens and related facilities without obtaining the approval of an environmental impact assessment and ordered SC Coke to stop construction and imposed a fine from approximately $7,310 to $29,240. SC Coke has been exempted from the administrative penalty.

Other than as described above, SC Coke has conducted environmental impact assessments for its current production projects, which have been approved by the relevant environmental protection administrative authorities.

| 13 |

Pollution Emission

According to the Tentative Plan of Pollution Emission License issued by the State Administration of Environment Protection (currently the Ministry of Environment Protection), on January 2, 2004, the local environmental protection government department may issue a pollution emission license for a period of two years. However, there is no formal legislation concerning the pollution emission license. In practice, enterprises will apply for a new pollution emission license to the local environment protection government department prior to the permit’s expiration. A pollution emission license is valid for two years and may be renewed after application and on-site examination as needed by the relevant authority. Currently, SC Coke has a pollution emission license issued by the Environmental Protection Bureau of Henan Province which expires on August 14, 2012.

On April 23, 2010, the EPBAC issued a pollutant over-limit rectification notice to SC Coke for coke oven gas and dust emissions and required SC Coke to rectify and control emissions within accepted limits. SC Coke rectified the condition and reported to EPBAC on May 13, 2010. SC Coke estimates that there will be no contingent liability resulting from such notice, although there can be no assurance that the EPBAC will not assess a penalty for the excess emissions.

Clean Development Mechanism (“CDM”)

To implement the 1992 United Nations Framework Convention on Climate Change and the 1997 Kyoto Protocol to which China is a signatory, the National Development and Reform Commission, Ministry of Science and Technology, Ministry of Finance and Ministry of Foreign Affairs promulgated the Clean Development Mechanism Projects Administration Regulation on October 12, 2005. According to such regulation, a CDM project is required to be approved by the National Development and Reform Commission and the Chinese government is entitled to collect 2% of the revenue from the sale of CERs by a Chinese entity. On April 9, 2009, the National Development and Reform Commission issued an approval to certify the CDQ project of SC Coke as a CDM project.

Dividend Distribution

The Company’s operations are conducted through SC Coke. It relies on dividends and other distributions from Anyang WFOE and SC Coke to provide it with its cash flow and allow it to pay dividends on the shares and meet its other obligations. The principal regulations governing distribution of dividends paid by wholly foreign-owned enterprises include:

| · | Wholly Foreign-Owned Enterprise Law (1986), as amended; and | |

| · | Implementation Rules on Wholly Foreign-Owned Enterprise Law (1990), as amended. |

Under these regulations, wholly foreign-owned enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, wholly foreign-owned enterprises in China are required to set aside at least 10% of their after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends.

Foreign Currency Exchange

On August 29, 2008, the State Administration of Foreign Exchange (“SAFE”) issued the Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-funded Enterprises (“Circular 142”). Circular 142 requires that RMB converted from the foreign currency-denominated capital of a foreign-invested company may only be used for purposes within the business scope approved by the applicable governmental authority and may not be used for equity investments within the PRC unless specifically provided for otherwise. The use of such Renminbi capital may not be changed without SAFE’s approval and may not in any case be used to repay Renminbi loans if the proceeds of such loans have not been used.

Regulation of Foreign Exchange in Certain Onshore and Offshore Transactions

In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Return Investment Activities of Domestic Residents Conducted by Offshore Special Purpose Companies (“SAFE Notice 75”) which became effective as of November 1, 2005, and was further supplemented by two implementation notices issued by the SAFE on November 24, 2005 and May 29, 2007, respectively. Under SAFE Notice 75, prior registration with the local SAFE branch is required for PRC residents to establish or to control an offshore company for the purposes of financing that offshore company with assets or equity interests in an onshore enterprise located in the PRC. An amendment to registration or filing with the local SAFE branch by such PRC resident is also required for the injection of equity interests or assets of an onshore enterprise in the offshore company or overseas funds raised by such offshore company, or any other material change involving a change in the capital of the offshore company.

| 14 |

Under SAFE Notice 75, PRC residents are further required to repatriate into the PRC all of their dividends, profits or capital gains obtained from their shareholdings in the offshore entity within 180 days of their receipt of such dividends, profits or capital gains. The registration and filing procedures under SAFE Notice 75 are prerequisites for other approval and registration procedures necessary for capital inflow from the offshore entity, such as inbound investments or shareholders loans, or capital outflow to the offshore entity, such as the payment of profits or dividends, liquidating distributions, equity sale proceeds, or the return of funds upon a capital reduction. The failure to comply with such registration requirements may subject Anyang WFOE to restrictions including, but not limited to, the increase of the registered capital of Anyang WFOE, loans to Anyang WFOE, and dividend distributions abroad from Anyang WFOE.

Regulations of Overseas Investments and Listings

On August 8, 2006, six PRC regulatory agencies, including the Ministry of Commerce (“MOFCOM”), the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission (“CSRC”) and SAFE, jointly adopted the Provisions on the Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “New M&A Rule”), which became effective on September 8, 2006. This regulation, among other things, includes provisions that purport to require that an offshore special purpose company (“SPV”) which is formed for purposes of listing of equity interests in PRC companies through the acquisition of PRC company equity with foreign equity as consideration and which is controlled directly or indirectly by PRC companies or individuals obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on a stock exchange outside of the PRC.

On September 21, 2006, the CSRC published procedures regarding its approval of listings by SPVs outside of the PRC. The CSRC approval procedures require the filing of a number of documents with the CSRC. It would generally take several months to complete the approval process. Based on our understanding of current PRC laws and as advised by our PRC counsel, SC Coke believes the structure of our restructuring, including the VIE Agreements and Call Option Agreements, is not subject to the New M&A Rule.

Employees

We currently have approximately 1625 employees, of which approximately 153 are professional technicians who possess national professional certification within their area of expertise, including such areas as high pressure coke oven operators, heavy equipment and crane operators and chemical, civil and electrical engineers. Of the total employees, 1215 are employed in our plant while 377 employees serve in administrative and executive services capacities. Our sales department currently has approximately 33employees, of which 12 are responsible for customer accounts and relationships.

In compliance with the Employment Contract Law of PRC, we have written contracts with all of our employees for a term of 3 to 5 years. The employment agreements include the positions, responsibilities and salaries of the respective employees, as well as the circumstances under which employment may be terminated, and in compliance with the Employment Contract Law of PRC.

Under the Employment Contract Law of PRC, upon the termination of an employment agreement by us without cause or expiration of an employment agreement without an offer to renew, we are obligated to pay the applicable employee compensation equal to one month’s salary for each year the employee has been employed by us, up to a maximum of twelve years (“Compensation”), except where (1) the employee has committed a crime or the employee’s actions or inactions have resulted in a material adverse effect on us; (2) the employee receives pension payments; (3) the employee dies or is declared dead or missing; or (4) we offer to renew the employment agreement with equal or higher consideration and the employee does not accept it. In these cases, we are not required to pay any Compensation and may terminate an employment agreement without prior notice. If the employee’s salary is greater than three times the average salary for the last year in Anyang City, the Compensation will be calculated by multiplying such average salary by three, and then multiplying the product obtained by the number of years the employee was employed by us, up to a maximum of twelve years.

We may terminate an employment agreement upon 30 days prior written notice or without prior notice upon an extra payment of one month salary and with Compensation payable to such employee, for any of the following reasons: (1) sickness or non-working injury and after medical treatment an employee is not able to do the original work or other assignments designated by us; (2) an employee is unable to perform his job and after training or position adjustment and is still unable to perform his job at a suitable level; and (3) the employment cannot be performed due to a fundamental change of circumstances and the employer and employee fail to reach an agreement to change the original employment contract.

If we terminate an employment agreement prior to its expiration for any reason other than as described above, the employee has the right to either enforce the agreement or to terminate the agreement and require us to pay an amount equal to twice the Compensation.

An employee may at any time terminate the employee’s employment agreement upon 30 days prior written notice.

ITEM 1A. RISK FACTORS

There are numerous and varied risks, known and unknown, that may prevent the Company from achieving its goals. The risks described below are not the only ones the Company will face. If any of these risks actually occurs, the Company’s business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of the Company’s common stock could decline and investors in the Company’s common stock could lose all or part of their investment.

| 15 |

Risks Relating to SC Coke’s Business

SC Coke’s future operating results have been and may continue to be affected by fluctuations in raw material prices. SC Coke may not be able to pass on cost increases to customers.

SC Coke’s operating profits have been and may continue to be negatively affected by fluctuations in the price of raw materials which consist primarily of raw coal and refined coal. SC Coke is subject to short-term coal price volatility. SC Coke may, based on operations and prevailing market conditions, periodically purchase raw materials at higher prices. In the past, SC Coke has been unable to pass the cost increase of raw materials on to customers and may not be able to do so in the future. This has adversely affected and may continue to adversely affect SC Coke’s gross margins, profitability and operations. SC Coke’s sales agreements with customers generally contain provisions that permit the parties to adjust the contract price of the coke that SC Coke produces upward or downward at specified times. For example, SC Coke may adjust these contract prices because of increases or decreases in the price of raw materials from SC Coke’s mining suppliers, general inflation or deflation, or changes in the cost of producing coke caused by such things as changes in taxes, fees, royalties or the laws regulating the mining, production, sale or use of raw coal and refined coal. However, SC Coke may not be able to pass on cost increases to customers. A general rise in coking coal prices also may adversely affect the price of, and demand for, coke and products made with coke such as iron and steel. This may in turn lead to a fall in demand for SC Coke’s products.

Factors beyond our control could impact the amount and pricing of coal supplied by third parties.

SC Coke purchases coal, including raw coking coal and refined coal, from third parties. Operational difficulties, changes in demand for contract mine operators from SC Coke’s competitors and other factors beyond SC Coke’s control could affect the availability, pricing and quality of coal suppliers, including raw coking coal, produced for it by independent contract mine operators. Disruptions in supply, increases in prices paid for raw coal and refined coal produced by or purchased from third parties, or the availability of more lucrative direct sales opportunities for SC Coke’s purchased coal sources could increase its costs or lower SC Coke’s volumes, either of which could negatively affect SC Coke’s profitability and operations. In addition, mine accidents, weather-related problems, strikes, lock-outs or other events experienced by SC Coke’s suppliers could impair SC Coke ability to supply coal to customers if it is not able to find substitute sources to obtain its coal.

The demand for SC Coke’s products are cyclical and is affected by industrial economic conditions. Downturns in the economy may reduce demand for SC Coke’s products and its revenues could decline.

Because SC Coke does not export its products out of China, its business and operating results are primarily dependent upon China’s domestic demand for metallurgical coke. However, because the domestic demand for metallurgical coke in China is impacted by the international demand for metallurgical coke, SC Coke is also susceptible to fluctuations in the international markets. The domestic and international metallurgical coke markets are cyclical and exhibit fluctuations in supply and demand from year to year and are subject to numerous factors beyond SC Coke’s control, including, but not limited to, economic conditions in China, global economic conditions and fluctuations in industries with high demand for metallurgical coke, such as the steel, iron and power industries. A significant decline in demand or excess supply for metallurgical coke may have a material adverse effect on SC Coke’s business and results of operations.

In addition, nearly all of SC Coke’s sales are concentrated in the North China, East China, Central China and South China. Accordingly, SC Coke is susceptible to fluctuations in business caused by adverse economic conditions in those regions. Difficult economic conditions in other geographic areas into which SC Coke may expand may also adversely affect its business, operations and finances.

If any of SC Coke’s sales agreements for its primary products of coke and refined coal terminates or expires, its revenues and operating profits could suffer.

A substantial portion of SC Coke’s primary product sales are made to customers under short term monthly sales agreements. It is common business practice in China that metallurgical coke and refined coal sale agreements are entered into for monthly terms, with monthly renewals. This practice makes it difficult for SC Coke to forecast long-term purchase and sale quantities and can negatively affect its ability to manage inventory. These agreements may be terminated or breached by a customer. We cannot provide any assurances that SC Coke will be able to renew any of these agreements on terms equally or more favorable to SC Coke. Non-renewal or termination of SC Coke’s agreements with any of, or a material breach by, these customers could have a material adverse effect on SC Coke’s revenue.

In the past, SC Coke has derived a significant portion of its sales from a few large customers. If SC Coke were to lose any such customers, its business, operating results and financial condition could be materially and adversely affected.

SC Coke’s customer base for its primary products, which contribute a high percentage of revenues, has been highly concentrated. As of December 31, 2011, SC Coke’s top five customers for its primary products contributed approximately 85.69 % of its sales revenue, while its largest customer contributed approximately 22.58% of its sales revenue. SC Coke’s total number of customers is relatively concentrated and limited, and any adverse developments to any one of their business operations, or any material breach, termination or non-renewal of agreements by such customers, could have an adverse impact on SC Coke's business, operating results and financial condition.

| 16 |

Consolidation in the Chinese iron and steel industries may adversely affect SC Coke's business operations.

Many of SC Coke’s customers are iron and steel manufacturing companies. On March 20, 2009, the General Office of the State Council issued the Blueprint for the Adjustment and Revitalization of the Iron and Steel Industry which sets forth the PRC government’s objectives of, among other things, controlling the total national capacity of, and encouraging consolidation in, the steel industry from 2009 to 2011. As a result, the number of iron and steel manufacturers will likely decrease, with an emergence of larger iron and steel companies formed by strategic alliances and mergers and acquisitions. This consolidation may have the effect of reducing the number of customers available to purchase SC Coke’s products and may result in the loss of current customers who are acquired by other iron and steel manufacturing companies, which have their own suppliers. If any of the foregoing occurs, SC Coke's business, market position, growth prospects and operating results may be adversely affected.

PRC coal mining industry consolidation may adversely affect SC Coke's business operations.

In order to enhance coal mining safety, coal exploration efficiency and environmental protection, the PRC government has taken initiatives to consolidate the coal mining industry. This consolidation may have the effect of reducing the supply of coal available to SC Coke. In addition, if a supplier of SC Coke is acquired, the terms of any supply contracts may no longer be available as part of the consolidation. If any of the foregoing occurs, SC Coke's business, market position, growth prospects and operating results may be adversely affected.

Iron and steel consumption is highly cyclical, and worldwide overcapacity in the iron and steel industries and the availability of alternative products have resulted in intense competition.

Iron and steel consumption is highly cyclical and volatile and generally follows economic and industrial conditions both worldwide and in regional markets. The iron and steel industries have often been characterized by excess global supply, which has led to substantial price decreases during periods of economic weakness. Substitute materials are increasingly available for many iron and steel products, which further reduces demand for iron and steel. Any downturn in the iron and steel industries may have an adverse effect on SC Coke's business, market position, growth prospects and operating results.

Restrictions on financing in the real estate industry may affect SC Coke's business operations.

In order to address concerns regarding the real estate market, the PRC government has placed certain restrictions on the ability of purchasers to obtain financing for the acquisition of residential and commercial real estate. These restrictions, in turn, may negatively impact the demand for iron and steel. Many of SC Coke’s customers are national and provincial iron and steel manufacturing companies. If SC Coke’s iron and steel company customers reduce their purchases from SC Coke as a result of any such restrictions, SC Coke’s business and operations would be adversely affected.

There can be no assurance that any byproducts of the coking process SC Coke plans to sell will achieve significant market acceptance or will generate significant revenue.

SC Coke plans to increase its coke production capacity which will increase byproducts available for sale to third party customers. SC Coke can offer no assurances that customers will purchase such byproducts from it or will purchase the increased volume of such byproducts that it may offer for sale. SC Coke's inability or failure to position and/or price any byproducts competitively could have a material adverse effect on its business, results of operations or financial position.

SC Coke is unable to shut down its coke production process if demand for its coke products decreases.

SC Coke produces coke using coke ovens which are made of brick. Since the bricks must be maintained at a relatively constant temperature, any prolonged significant reduction in the temperature could permanently damage the coke ovens. Accordingly, in the event demands for SC Coke’s products were to decrease, SC would be unable to stop production, even if such production is uneconomical.

A reduction in coke production would result in a lower volume of SC Coke’s byproducts available for sale.

SC Coke sells the byproducts of its coke production process to third parties. If SC Coke were to decrease production of coke, the amount of byproducts available for sale would be reduced. Any reduction in coke production will adversely impact SC Coke’s revenue which will be exacerbated by the consequential reduction in coke byproducts available for sale, which in turn may have a material adverse effect on its business and results of operations.

| 17 |

SC Coke relies on a limited number of third-party suppliers for its supply of coal and refined coke and the loss of any such supplier could have a material adverse effect on our operations.

SC Coke is dependent upon its relationships with a limited number of local third parties for its supply of coal. While SC Coke expects to increase the number of suppliers it uses as its business expands, if any of these suppliers, and in particular its largest supplier, terminate their supply relationship with SC Coke, it may be unable to procure sufficient amounts of coal to fulfill its needs. If SC Coke is unable to obtain adequate quantities of coal to meet the demand for its products, SC Coke's customers could seek to purchase products from other suppliers, which could have a material adverse effect on SC Coke's revenues.

Disruption in the transportation of SC Coke's coking products or difficulties experienced with respect to the transportation of its coke ore refined coal could make its operations less competitive and result in the loss of customers.

Coke and refined coal producers and processors primarily depend upon rail and trucking to deliver coal to markets. While SC Coke's customers typically arrange and pay for transportation of coke and refined coal from its facilities to the point of use, any disruption of these transportation services because of natural disasters, weather-related problems, strikes, lock-outs or other events could temporarily impair SC Coke's ability to supply coke and refined coal to customers and thus could adversely affect its results of operations. If transportation for SC Coke's coke and refined coal becomes unavailable or uneconomic for its customers, its ability to sell coke and refined coal could suffer. Transportation costs can represent a significant portion of the total cost of coke and refined coal. Since SC Coke’s customers typically pay that cost, it is a critical factor in a distant customer’s purchasing decision. If transportation costs SC Coke charges its customers are not competitive, the customer may elect to purchase from another company.

SC Coke may not complete plant construction or expansion projects, or it may complete projects on materially different terms or on a different schedule than initially anticipated, and it may not be able to achieve the intended benefits of any such project, if completed.

SC Coke is currently in the process of expanding its plant and may undertake additional expansion projects in the future. SC Coke anticipates that it will be required to seek additional financing in the future to fund current and future plant construction and expansion projects and may not be able to secure such financing on favorable terms, if at all. If additional financing is not obtained, SC Coke may need to limit, defer, or cancel its expansion plans. In addition, projects may not be able to be completed on time as a result of natural disasters, weather conditions, delays in obtaining or failure to obtain regulatory approvals, delays in obtaining key materials, labor difficulties, difficulties with partners or potential partners, a decline in the credit strength of counterparties or vendors, or other factors beyond SC Coke’s control. Even if plant construction and expansion projects are completed, the total costs of the projects may be higher than anticipated and the performance of SC Coke's business following the completion of any projects may not meet expectations. Also, SC Coke may not be able to continue to meet the requirements for incentives granted by the PRC government or such programs could be modified or eliminated altogether. Further, SC Coke may not be able to timely and effectively integrate the projects into its operations and such integration may result in unforeseen operating difficulties or unanticipated costs. Any of these or other factors could adversely affect SC Coke's ability to realize the anticipated benefits from the plant construction and expansion projects.

SC Coke may not be able to meet quality specifications required by its customers and as a result could incur economic penalties or the cancellation of agreements which would reduce its sales and profitability.

Most of SC Coke’s coke sales agreements contain provisions requiring it to deliver coke meeting quality thresholds for certain characteristics such as sulfur content, ash content, mechanical strength, volatility, moisture content and end-coke content. If SC Coke is not able to meet these specifications, because, for example, it is not able to source coal of the proper quality, it may incur penalties, including price adjustments, the rejection of deliveries or termination of the contracts.

SC Coke’s business is highly competitive and increased competition could reduce its sales, earnings and profitability.

The coal washing and coke businesses are highly competitive in China, and SC Coke faces substantial competition in connection with the marketing and sale of its products. Most of SC Coke’s competitors are well established, have greater financial, marketing, personnel and other resources, have been in business for longer periods of time than it has, and have products that have gained wide customer acceptance in the marketplace. The greater financial resources of SC Coke’s competitors permit them to implement extensive marketing and promotional programs. SC Coke could fail to expand its market share, and could fail to maintain its current share. Increased competition could also result in overcapacity in the Chinese coke industry in general. Any overcapacity could reduce processed coke prices in the future and SC Coke’s profitability would be impaired.

SC Coke's success depends on attracting and retaining qualified personnel.

SC Coke is highly dependent on the knowledge of governmental issues of Xinshun Wang, its Chairman, and the operational expertise of its Chief Executive Officer, Feng Wang and Dexin Li, its Chief Operating Officer, and the loss of any of their services and support would have a material and adverse impact on SC Coke's operations. If one or more of SC Coke's key personnel are unable or unwilling to continue in their present positions, it may not be able to easily replace them, and it may incur additional expenses to recruit and train new personnel. The loss of SC Coke's key personnel could severely disrupt its business and its financial condition and results of operations could be materially and adversely affected. Furthermore, since the industries SC Coke invests in are characterized by high demand and intense competition for talent, it may need to offer higher compensation and other benefits in order to attract and retain key personnel in the future. There can be no assurances that SC Coke will be able to attract or retain the key personnel needed to achieve its business objectives. If SC Coke were to lose the services of its key senior managers, its ability to operate would be impaired. SC Coke does not have key-man life insurance on the lives of its executives.

| 18 |

SC Coke's future success will depend in large part on its continued ability to attract and retain other highly qualified management and operational personnel, as well as personnel with expertise in SC Coke's field and industry. SC Coke faces competition for personnel from other companies and organizations. If SC Coke's recruitment and retention efforts are unsuccessful, its business operations could suffer.

SC Coke does not have any registered patents and it may not be able to maintain the confidentiality of its processes.

SC Coke has no patents covering its coking and washing processes and it relies on the confidentiality of its coking and cleaning processes in producing a competitive product. The confidentiality of its know-how may not be maintained and it may lose any meaningful competitive advantage which might arise through its proprietary processes.

A prolonged downturn in global economic conditions may materially adversely affect SC Coke's business.

SC Coke's business and results of operations are affected by international, national and regional economic conditions. Financial markets in Asia, the United States and Europe have recently been experienced extreme disruption, including, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, ratings downgrades of certain investments and declining values of others. These economic developments affect businesses such as SC Coke's and those of its customers in a number of ways that could result in unfavorable consequences to it. Current economic conditions or a deepening economic downturn in the PRC and elsewhere may cause SC Coke's current or potential customers to delay or reduce purchases which could, in turn, result in reductions in SC Coke's sales volumes or prices, materially and adversely affecting its results of operations and cash flows. Volatility and disruption of global financial markets could limit SC Coke's customers’ ability to obtain adequate financing to maintain their operations and proceed with capital spending initiatives, leading to a reduction in sales volume that could materially and adversely affect its results of operations and cash flow. In addition, a decline in SC Coke's customers’ ability to pay as a result of the economic downturn may lead to increased difficulties in SC Coke’s collection of its accounts receivable, higher levels of reserves for doubtful accounts and write-offs of accounts receivable, as well as higher operating costs as a percentage of revenues.

SC Coke may be required to repay obligations under guarantees it has executed in favor of other local entities.