Attached files

| file | filename |

|---|---|

| 8-K - HINES REIT Q4 2012 SHAREHOLDER PRESENTATION - HINES REAL ESTATE INVESTMENT TRUST INC | hrq4_2011shpresentation.htm |

Exhibit 99.1

Hines Securities, Inc., Member FINRA/SIPC, is the Dealer Manager. 3/12

Hines Real Estate Investment Trust, Inc. (Hines REIT) is closed to new investors.

Hines REIT Update

As of December 31, 2011

As of December 31, 2011

Hines REIT Overview

§ Commenced capital raising in 2004

§ Raised and invested significant capital in 2006 and 2007

which represented a peak in the overall economic cycle and

real estate cycle

which represented a peak in the overall economic cycle and

real estate cycle

§ In 2008 and 2009, amidst the economic downturn towards the

recession, we experienced significant declines in capital

raising and significant increases in redemption requests

recession, we experienced significant declines in capital

raising and significant increases in redemption requests

§ At the end of 2009, capital raising ceased and we suspended

our redemption plan to prudently preserve liquidity

our redemption plan to prudently preserve liquidity

2

Hines REIT Overview

§ Since 2009, the Company has been keenly focused on the

following:

following:

– Leasing: keeping our tenants in occupancy to preserve and maintain

operating income

operating income

– Strategic asset sales: identifying opportunities to sell certain

stabilized assets to harvest liquidity and attractive profits

stabilized assets to harvest liquidity and attractive profits

– Liquidity: ensuring we have sufficient funds to meet liquidity needs for

operating expenses, leasing capital, and debt refinancings, while still

maintaining reasonable levels of distributions to our shareholders

operating expenses, leasing capital, and debt refinancings, while still

maintaining reasonable levels of distributions to our shareholders

§ We continue to be patient and disciplined in managing our

portfolio in order to benefit from the overall economic recovery

and recovery of the U.S. office markets

portfolio in order to benefit from the overall economic recovery

and recovery of the U.S. office markets

3

Hines REIT Portfolio Overview

as of December 31, 2011

as of December 31, 2011

§ 57 projects / 22 different geographic markets / U.S. and Brazil

§ Predominately Class A office, industrial and grocery-anchored

retail centers

retail centers

§ Over 26 million square feet / 87% leased / approximately 2%

above the national average

above the national average

§ Latest valuation of portfolio was as of March 2011 resulting in

estimated per share value of $7.78 effective May 2011

estimated per share value of $7.78 effective May 2011

§ Significant cash on hand for near-term liquidity needs resulting

in a strong balance sheet

in a strong balance sheet

4

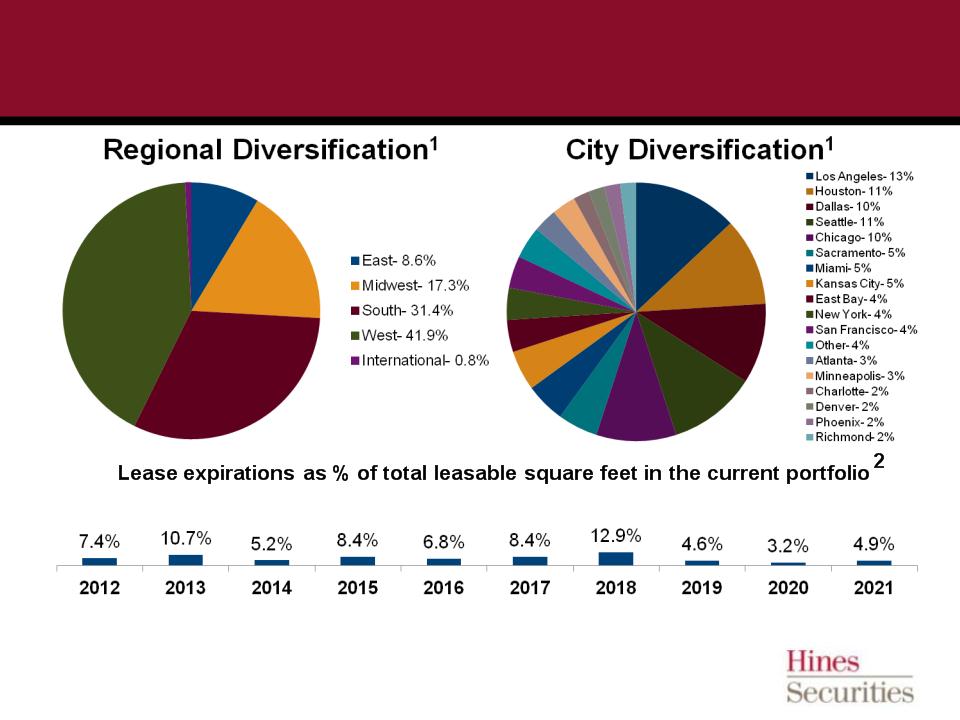

Regional Diversification and Lease Expirations

as of December 31, 2011

as of December 31, 2011

5

1Data is based on Hines REIT’s pro-rata share of the estimated aggregate value. 2Data is based on Hines REIT’s

effective ownership in each property and is compiled based on leased square feet.

effective ownership in each property and is compiled based on leased square feet.

5

Top 10 Tenants

as of December 31, 2011

as of December 31, 2011

1Based on Hines REIT’s effective ownership in each property and compiled based on leased square feet.

6

|

Top 10 Tenants1

|

|

|

Shook, Hardy & Bacon LLP

International law firm 2555 Grand 2024 Expiration

|

Honeywell International

Engineering services Daytona-Laguna Portfolio & 345 Inverness Drive 2016, 2017 Expirations

|

|

Williams Companies

Integrated natural gas Williams Tower 2018, 2021 Expirations

|

Oracle

Multinational technology company 2100 Powell 2013 Expiration

|

|

Raytheon Company

Defense aerospace systems Raytheon/DIRECTV Buildings 2018 Expiration

|

Kay Chemical

Private specialty cleaning 4050 & 4055 Corporate Drive 2018 Expiration

|

|

State of California

State government 1515 S. Street 2012, 2018 Expirations

|

Norwegian Cruise Line

Cruise line Airport Corporate Center 2019 Expiration

|

|

Microsoft Corporation

Multinational software development Daytona-Laguna Portfolio 2015, 2017 Expirations

|

Foley & Lardner

International law firm

321 North Clark 2018 Expiration

|

Tenant Industry Diversification1

1Based on Hines REIT’s pro rata share of the leased square feet of each property. 2Other includes Arts/Entertainment, Other

Services, Construction and Retail industries, as well as those accounting for less than 1% of the portfolio.

Services, Construction and Retail industries, as well as those accounting for less than 1% of the portfolio.

7

2

Hines REIT Leasing Update

§ Leasing has been a priority given the challenging economic environment which

had a broad impact on U.S. and International businesses

had a broad impact on U.S. and International businesses

§ Many businesses adversely impacted

– Layoff of employees

– Reduced space needs

– Move to lower quality / less expensive space

– Out of Business or Bankrupt

§ Leased percentage is down slightly from the beginning of the year; remains

above the national average

above the national average

§ During 2011

– Lease renewals for approximately 3.5 million square feet (13% of our gross square footage) to

keep tenants in occupancy and extend the term of their leases

keep tenants in occupancy and extend the term of their leases

– New leases for approximately 1.4 million square feet with new tenants moving into our assets from

other competitive space

other competitive space

8

2011 Proactive Leasing Highlights

9

Fleetpride Corporation

Early Renewal 200,000 SF

through 2019

through 2019

Shell Plaza (One and Two)

Houston, TX

Shell Corporation

Renewal 1.22 million SF and

extension to 2025

Renewal 1.22 million SF and

extension to 2025

Dune Energy

Renewal 15,000 SF

through 2016

through 2016

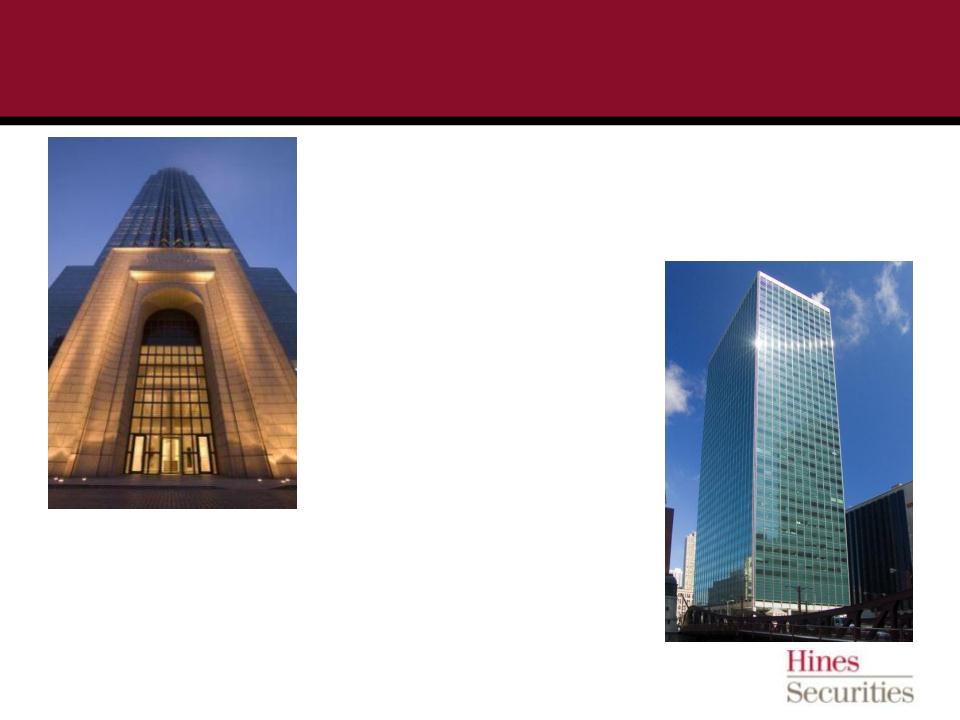

2011 Proactive Leasing Highlights

10

Williams Tower

Houston, TX

Williams Field Services

Expansion 60,000 SF

through 2018

through 2018

Ryan & Company

Renewal 32,000 SF

Renewal 32,000 SF

through 2019

Rowan Companies, Inc.

Expansion 10,000 SF

through 2020

through 2020

321 North Clark

Chicago, IL

American Bar Association

Renewal 200,000 SF

through 2024

Renewal 200,000 SF

through 2024

Claro Group

New lease 26,000 SF

through 2019

through 2019

2011 Proactive Leasing Highlights

11

Warner Center

Los Angeles, CA

Health Net Inc.

Renewal 334,000 SF through 2021

Renewal 334,000 SF through 2021

One North Wacker

Chicago, IL

PricewaterhouseCoopers, LLP

Renewal 279,000 SF through 2028

Airport Corporate Center

Miami, FL

§United Health Care Services, Inc.

Renewal 23,000 SF through 2013

Renewal 23,000 SF through 2013

§Corporate American Solutions

New lease 16,000 SF through 2019

New lease 16,000 SF through 2019

§Armani & Associati

New lease 10,000 SF through 2017

New lease 10,000 SF through 2017

The KPMG Building

San Francisco, CA

§Buchalter Nemer

New lease 30,000 SF through 2022

New lease 30,000 SF through 2022

§Funzio, Inc.

New lease 20,000 SF through 2015

New lease 20,000 SF through 2015

§RadiumOne

New lease 14,000 SF through 2017

New lease 14,000 SF through 2017

499 Park Avenue

New York, NY

Quadrant Capital Advisors, Inc.

Renewal 11,000 SF through 2022

Renewal 11,000 SF through 2022

Strategic Dispositions

§ Significant capital demand for high quality stabilized assets

§ Certain assets in the portfolio provided Hines REIT the

opportunity to capture significant gains and strengthen the

Company’s liquidity position

opportunity to capture significant gains and strengthen the

Company’s liquidity position

12

Strategic Dispositions

One North Wacker

Chicago, IL

Acquired: Mar. 2008

for $540 million

for $540 million

Sold 49% interest in Dec. 2011

for $298.9 million*

for $298.9 million*

Effective ownership: 22%**

*The Core Fund, in which Hines REIT invests, did not recognize a gain or loss on the sale due to the carrying amount of

the noncontrolling interest being adjusted to reflect the change in ownership of One North Wacker. Effective ownership as

of 9/30/11, prior to the sale. **This asset was owned indirectly through the Core Fund.

the noncontrolling interest being adjusted to reflect the change in ownership of One North Wacker. Effective ownership as

of 9/30/11, prior to the sale. **This asset was owned indirectly through the Core Fund.

13

Three First National

Chicago, IL

Acquired: Mar. 2005 for

$245 million

$245 million

Sold: Aug. 2011

for $344 million

for $344 million

Effective ownership:18%**

Acquired: Feb. 2004

for $92 million

for $92 million

Sold: May 2010 for

$193 million

$193 million

Effective ownership:11.67%*

Atrium on Bay,

Toronto, ON, Canada

Acquired: Feb. 2007

for $215 million USD

for $215 million USD

Sold: Jun. 2011

for $353 million USD

for $353 million USD

Effective ownership:100%

Strategic Dispositions

*This asset was owned indirectly through the Core Fund.

14

Brazilian Industrial Parks

Araucaria, Elouveira and Vinhedo

Acquired: Dec. 2008 for $115

Sold: Jan. 2010 and Apr. 2010 for $141 million

Effective ownership:100%

Land Parcel Adjacent

to Williams Tower

Houston, TX

to Williams Tower

Houston, TX

Acquired: May 2008

Sold: Sept. 2010 generating net

proceeds of $12 million

proceeds of $12 million

Effective ownership:100%

Strategic Dispositions

15

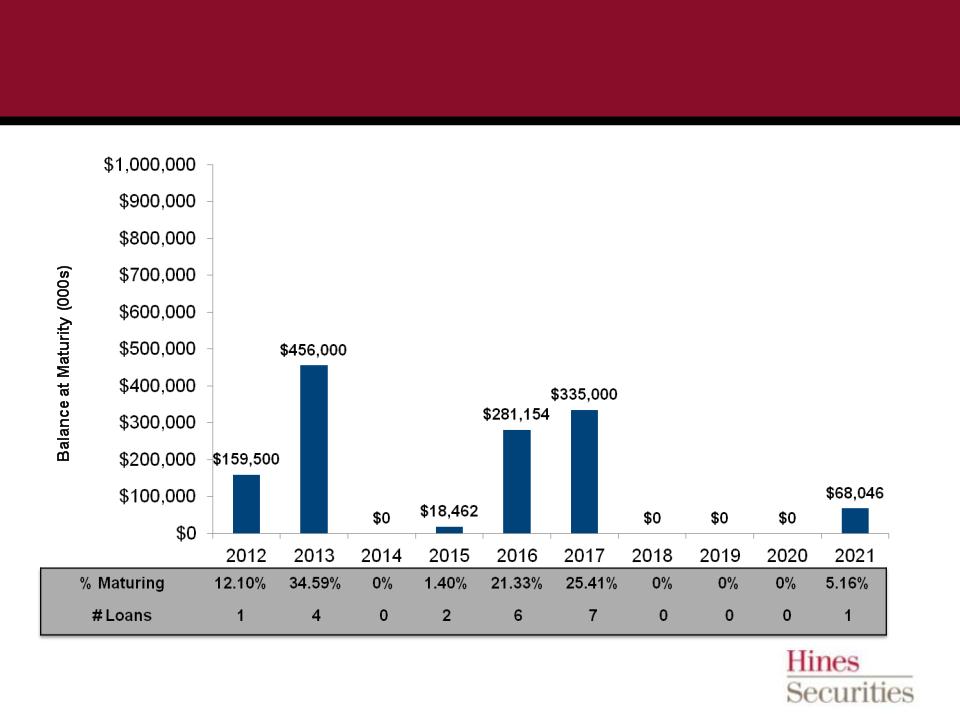

Hines REIT Leverage Overview

§ Leverage level as of December 31, 2011 was 55%

§ Consists primarily of asset level fixed rate mortgage loans and a

corporate level revolving credit facility which provides $45 million of

additional liquidity

corporate level revolving credit facility which provides $45 million of

additional liquidity

§ Average weighted interest rate of approximately 5.64%

§ Manageable debt maturities over the next few years

16

Debt Maturity Chart

as of December 31, 2011

as of December 31, 2011

17

The amounts represented above are the projected loan balances at maturity assuming all required principal and interest

payments are made prior to maturity.

payments are made prior to maturity.

Portfolio Average

Weighted Interest

Rate: 5.64%

Weighted Interest

Rate: 5.64%

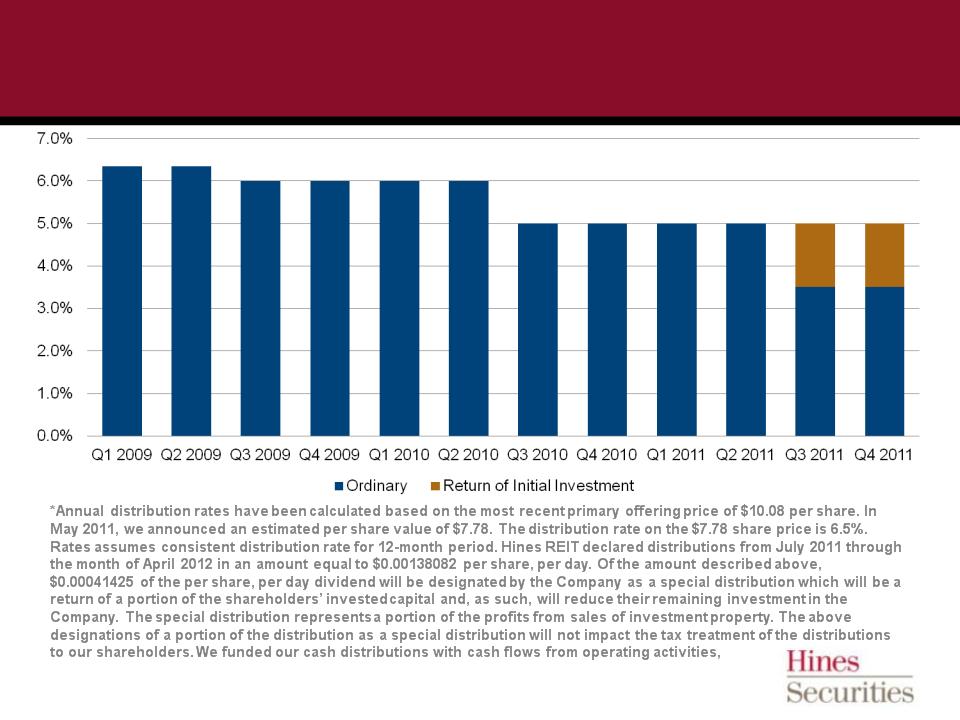

Distribution History*

distributions received from our unconsolidated investments, proceeds from the sales of our real estate

investments and cash generated during prior periods.

18

Looking Forward: Hines REIT Exit Strategy

19

§ Goal: maximize investor returns

§ Possible exit options:

─ Targeted sale of individual or

groups of assets

groups of assets

─ Sale or merger

─ Listing on a national exchange

§ Continue identifying opportunities for

strategic asset sales

strategic asset sales

Alignment of Interest

20

Hines’ alignment of interests with investors -

─ Hines has approximately $100 million invested in Hines REIT

─ Continues to earn half of its fees in equity / same as receiving

cash and reinvesting back into Hines REIT

cash and reinvesting back into Hines REIT

─ Waived 1/3 of cash asset management fees

from July 2011 through December 2012 in an effort to

enhance the REIT’s cash flows and distributions to

shareholders

from July 2011 through December 2012 in an effort to

enhance the REIT’s cash flows and distributions to

shareholders

─ Fee waiver is projected to total over $7.5 million

Long Term Priorities

21

§ Near-term priorities:

─ Lease-up existing assets

─ Strategic asset sales

─ Manage debt maturities

─ Manage liquidity

─ Maximize distributions to investors

§ Long-term priorities:

─ Evaluate exit strategies

─ Maximize return of capital

─ Maximize total return over the long term

Hines Securities, Inc., Member FINRA/SIPC, is the Dealer Manager. 3/12

Hines Real Estate Investment Trust, Inc. (Hines REIT) is closed to new investors.

Thank You

22