Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF PMB HELIN DONOVAN - ENOVA SYSTEMS INC | d320064dex231.htm |

| EX-10.23 - AGREEMENT RELATING TO THE APPOINTMENT OF A NOMINATED ADVISER AND BROKER - ENOVA SYSTEMS INC | d320064dex1023.htm |

| EXCEL - IDEA: XBRL DOCUMENT - ENOVA SYSTEMS INC | Financial_Report.xls |

| EX-32 - CERTIFICATION OF CEO AND CFO PURSUANT TO SECTION 906 - ENOVA SYSTEMS INC | d320064dex32.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - ENOVA SYSTEMS INC | d320064dex311.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - ENOVA SYSTEMS INC | d320064dex312.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file no. 1-33001

ENOVA SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| California | 95-3056150 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification Number) |

1560 West 190th Street, Torrance, California 90501

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(310) 527-2800

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, no par value | The NYSE Amex |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company þ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes ¨ No þ

As of June 30, 2011, the approximate aggregate market value of common stock held by non-affiliates of the Registrant was $9,426,000 (based upon the closing price for shares of the Registrant’s common stock as reported by The NYSE Amex). As of February 29, 2012, there were 42,765,223 shares of common stock, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

2011 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

12 | |||||

| Item 1B. |

14 | |||||

| Item 2. |

14 | |||||

| Item 3. |

14 | |||||

| Item 4. |

15 | |||||

| PART II | ||||||

| Item 5. |

15 | |||||

| Item 6. |

16 | |||||

| Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 16 | ||||

| Item 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 24 | ||||

| Item 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 25 | ||||

| Item 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 44 | ||||

| Item 9A. |

CONTROLS AND PROCEDURES | 44 | ||||

| Item 9B. |

45 | |||||

| PART III | ||||||

| Item 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 45 | ||||

| Item 11. |

EXECUTIVE COMPENSATION | 48 | ||||

| Item 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 52 | ||||

| Item 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 54 | ||||

| Item 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES | 54 | ||||

| PART IV | ||||||

| Item 15. |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 55 | ||||

2

Table of Contents

General

In July 2000, we changed our name to Enova Systems, Inc. (“Enova” or “the Company”). Our company, previously known as U.S. Electricar, Inc., a California corporation, was incorporated on July 30, 1976.

Enova believes it is a leader in the development, design and production of proprietary, power train systems and related components for electric and hybrid electric buses and medium and heavy duty commercial vehicles. Electric drive systems are comprised of an electric motor, electronics control unit and a gear unit which power a vehicle. Hybrid electric systems, which are similar to pure electric drive systems, contain an internal combustion engine in addition to the electric motor, and may eliminate external recharging of the battery system. A hydrogen fuel cell based system is similar to a hybrid system, except that instead of an internal combustion engine, a fuel cell is utilized as the power source. A fuel cell is a system which combines hydrogen and oxygen in a chemical process to produce electricity.

A fundamental element of Enova’s strategy is to develop and produce advanced proprietary software and hardware for applications in these alternative power markets. Our focus is powertrain systems including digital power conversion, power management and system integration, focusing chiefly on vehicle power generation.

Specifically, we develop, design and produce drive systems and related components for electric, hybrid electric and fuel cell powered vehicles in both the new and retrofit markets. We also perform internal research and development (“R&D”) and funded third party R&D to augment our product development and support our customers.

Our product development strategy is to design and introduce to market successively advanced products, each based on our core technical competencies. In each of our product/market segments, we provide products and services to leverage our core competencies in digital power management, power conversion and system integration. We believe that the underlying technical requirements shared among the market segments will allow us to more quickly transition from one emerging market to the next, with the goal of capturing early market share.

Enova’s primary market focus centers on aligning ourselves with key customers and integrating with original equipment manufacturers (“OEMs”) in our target markets. We believe that alliances will result in the latest technology being implemented and customer requirements being met, with an optimized level of additional time and expense. As we penetrate new market areas, we are continually refining both our market strategy and our product line to maintain our leading edge in power management and conversion systems for vehicle applications.

Our website, www.enovasystems.com, contains up-to-date information on our company, our products, programs and current events. Our website is a prime focal point for current and prospective customers, investors and other affiliated parties seeking additional information on our business. We have also added a supplementary section to our website via www.greenforfree.com. The Green for Free™ program allows fleet executives to purchase all-electric vehicles for the cost of a diesel-powered commercial vehicle. The savings that fleets benefit through the reduced maintenance and fuel savings of the electric vehicles (EVs) is then used over a period of time to cover the incremental expense for the technology.

We continue to develop existing relationships and enter into new development programs with both governmental and private industry with regards to both commercial and military application of our electric and hybrid electric drive systems and fuel cell power management technologies. Although we believe that current negotiations with several parties may result in development and production contracts during 2012 and beyond, there are no assurances that such additional agreements will be realized.

During 2011, we continued to produce electric and hybrid electric drive systems and components for First Auto Works of China (“FAW”), Smith Electric Vehicles (“Smith”), Freightliner Custom Chassis Corporation (“Freightliner”), Navistar Corporation (“Navistar”), Optare Bus (“Optare”) and the US Military as well as other domestic and international vehicle and bus manufacturers. Our various electric and hybrid-electric drive systems, power management and power conversion systems are being used in applications including several light, medium and heavy duty trucks, train locomotives, transit buses and industrial vehicles.

3

Table of Contents

Enova continues to believe that its business outlook will improve in line with the recovery of the world economy and in light of messages from the governments in the United States, China and the United Kingdom regarding their intentions to mandate the reduction of greenhouse gas emissions in the future as well as intentions to provide government incentives that may induce consumption of our products and services.

In 2011, the Company delivered a total of 305 full systems and 85 additional motor controller units of Enova drive systems to its customers. Enova delivered 170 all-electric drive systems to Smith in 2011. Enova also delivered 112 pre-transmission hybrid drive systems to FAW for their Jiefang 103 passenger hybrid bus and 11 charge depleting bus systems to Navistar during 2011.

For the year ended December 31, 2011, the following customers each accounted for more than ten percent (10%) of our total revenues:

| Customer |

Percent | |||

| Smith Electric Vehicles N.A. Inc. |

52% | |||

| Navistar, Inc. |

16% | |||

| First Auto Works Group Corporation |

16% | |||

Please refer to the Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7 below and our financial statements in Item 8 below for further analysis of our results.

Climate Change Initiatives and Environmental Legislation

Because vehicles powered by internal combustion engines cause pollution (greenhouse gasses), there has been significant public pressure in Europe and Asia to reduce these emissions. Thus, the US (federal and state levels) and countries in Europe and Asia have enacted legislation to promote the use of zero or low emission vehicles. We believe legislation requiring or promoting zero or low emission vehicles is necessary to create a significant market for both hybrid electric (“HEV”) and electric vehicles (“EV”).

As our products reduce emissions and dependence on foreign energy, they are subject to federal, state, local and foreign laws and regulations, governing, among other things, emissions as well as laws relating to occupational health and safety. Regulatory agencies may impose special requirements for implementation and operation of our products or may significantly impact or even eliminate some of our target markets. We may incur material costs or liabilities in complying with government regulations. In addition, potentially significant expenditures could be required in order to comply with evolving environmental and health and safety laws, regulations and requirements that may be adopted or imposed in the future.

Strategic Alliances, Partnering and Technology Developments

Our continuing strategy is to adapt ourselves to the ever-changing environment of alternative fuel markets for mobile applications. Originally focusing on pure electric drive systems, we are currently positioned as a global supplier of drive systems for electric, hybrid and fuel cell applications.

We continue to seek and establish alliances with major players in the automotive and fuel cell fields. In 2011, Enova furthered its penetration into the U.S. and Asian markets. We believe the medium and heavy-duty hybrid market’s best chances of significant growth lie in identifying and pooling the largest possible numbers of early adopters in high-volume applications. We seek to utilize our competitive advantages, including customer alliances, to gain greater market share. By aligning ourselves with key customers in our target market(s), we believe that the alliance will result in the latest technology being implemented and customer requirements being met, with a minimal level of additional time or expense.

Some highlights of our accomplishments in 2011:

| • | Green For Free™. In November 2011, Enova announced its Green for Free™ Program, which is designed to allow fleet executives to operate full 100% electric commercial vehicles (EVs) for similar life cycle costs as those of diesel-powered commercial vehicles. The anticipated savings fleets are expected to realize from the reduced maintenance and fuel cost of electricity of the electric vehicles are used over a period of time to cover the incremental expense for the technology. Fleet vehicles targeted with the Green for Free™ Program stand out as possessing unique characteristics that make them clear beneficiaries of electric drive technology. With more than 16.3 million vehicles in operation, the nation’s fleets possess enough capacity to drive initial ramp-up scale in the EV OEM supply chains. This is the first program that is engineered to eliminate the overall incremental costs associated with buying and operating an all-electric vehicle, making the Green for Free™ Program attractive to fleets that are both large and small. |

4

Table of Contents

| • | Freightliner Custom Chassis Corporation (“FCCC”), a division of Daimler Trucks North America. Enova and FCCC began deploying new and retrofit all-electric vehicles to major fleet customers. The resulting integration of our all-electric drive system into the MT-45 chassis provides FCCC an all-electric product offering: the FCCC MT-EV. The MT-EV (the FCCC model name) chassis boasts a GVWR of 14,000 to 19,500 lbs. The durable steel straight-rail chassis frame reduces flex and bowing to minimize stress while carrying heavy payloads. The quiet operation of the all-electric MT-EV also makes for an enjoyable driver experience. The MT-EV has a flat-leaf spring front and rear suspension, allowing for a smooth, solid ride that minimizes cargo shifts on uneven road surfaces. Enova and FCCC also jointly announced intentions to deploy 3000 vehicles via the Green for Free™ Program (described above). |

| • | First Auto Works (“FAW”) - Enova continues to supply FAW drive systems for their hybrid buses. Since the 2008 Olympics in Beijing, Enova Systems and First Auto Works have deployed nearly 500 vehicles, all utilizing Enova’s pre-transmission hybrid drive system components. First Auto Works is one of China’s largest vehicle producers, manufacturing in excess of 1,000,000 vehicles annually. The Enova drive system is integrated and branded under the name of Jiefang CA6120URH hybrid. The Jiefang 40 ft. long hybrid city bus can carry up to 103 passengers and travel at a speeds of over 50 miles per hour. With the Enova hybrid system components, the Jiefang bus meets Euro III emission standards, consumes only 7.84 miles per gallon and achieves a reduction of 20 percent in harmful emissions. |

| • | U.S. General Services Administration (“GSA”). GSA extended its contract with Enova as the exclusive supplier contract of the all-electric step van. GSA procures vehicles for government agencies and the armed forces. Under this contract, Enova will coordinate the supply of MT-EV all-electric walk-in step vans to GSA under the Cargo Vans category. Enova continues to benefit from federal fleet penetration via GSA with the Smith Newton product offering in the Medium and Heavy Duty vehicle category. The Smith Newton is another exclusive, all-electric medium and heavy duty truck offering on the GSA product menu. Moreover, Navistar continued to demonstrate its leadership in the American school bus market with its exclusive GSA contract to supply hybrid school buses. Enova is supplies hybrid electric drive systems to IC Bus, an affiliated division of Navistar. |

| • | Remy Inc. (“Remy”). Enova and Remy signed a long-term electric motor supply agreement. Under the five-year agreement, Remy will provide its electric motors to Enova for its all-electric drive systems. With more than 2500 drive systems sold, deployed, and integrated, Enova's clean electric and hybrid electric vehicle technologies are powering fleets around the globe. Remy motors feature the company's patented High Voltage Hairpin (HVH) winding technology, which is claimed to increase torque and power density for greater speed and range in electric vehicles. |

| • | Smith Electric Vehicles N.A. Inc. (“Smith”) – Enova continues to supply Smith with electric drive systems. Smith has deployed several hundred vehicles utilizing Enova's electric drive system. Smith develops, produces and sells zero-emission commercial electric vehicles that are designed to be an alternative to traditional diesel trucks, providing higher efficiency and lower total cost of ownership. Smith has manufacturing facilities in Kansas City, Missouri, and outside of Newcastle, UK. Smith's vehicle designs leverage more than 80 years of market knowledge from selling and servicing electric vehicles in the United Kingdom. Smith produces the Newton and the Edison. |

Smith most recently announced its intention to deploy vehicles in the all-electric school bus sector. The 42-passenger Newton school bus travels up to 100 miles on a single charge at speeds of up to 50 mph, and is intended for the fixed routes in urban areas most school buses take each day.

| • | Optare plc (“Optare”) awarded Enova a contract as the production drive system supplier for their all electric buses. Enova has shipped systems to Optare that are currently being integrated into buses. Optare designs, manufactures and sells single deck and double deck buses and mini coaches. Its buses operate in the UK, Continental Europe, and North America. |

Throughout 2011, we finalized the development of our next generation Omni power management and drive system component. We are also finalizing design of a next generation on-board 10kW charger. Our various electric and hybrid-electric drive systems, power management and power conversion systems continue to be used in applications including Class 3-6 trucks, transit buses and heavy industrial vehicles. We also are continuing our current research and development programs and formulating new programs with the U.S. government and other private sector companies for electric and hybrid systems.

5

Table of Contents

Some technological developments in 2011:

Omni Inverter. Enova Systems introduced its next-generation of power electronics with the new Omni-series 200kVA-capable power inverter for hybrid-electric and all-electric vehicles. Power-source agnostic, the new Omni-series controller also offers increased flexibility and ease-of-integration. With plug-and-play connectivity, it is compatible with a wide range of vehicle drive systems and motors, and can be configured for HEV, PHEV and EV applications. The inverter has undergone a series of rigorous tests, based on specifications from FCCC, Navistar, Ford and Enova’s own internal requirements. Features include:

| • | Proprietary new liquid cooling strategy enabling leading power density; |

| • | Software configurable control allowing common hardware to be used across many sizes of hybrid or electric vehicles; |

| • | Compatible with a wide range of induction and permanent magnet motors; |

| • | True continuous power output of 110 kW, with peak over 200 kVA making the Omni capable of powering the Enova P90, P120, and even P240 drive systems; and |

| • | Heavy-duty cast aluminum chassis and robust design using minimal harnesses and interconnects allows flexible vehicle mounting in any orientation. |

Omni On-Board Charger. The new Omni-series charger is expected to increase flexibility and ease-of-integration. With plug-and-play connectivity, it is compatible with a wide range of vehicle drive systems and motors, and can be configured for HEV, PHEV and EV applications. Features will include:

| • | Charger unit, single phase 208-240V input @ 48A, single output, regulated 250-450Vdc, CAN controlled (2 CAN lines), liquid cooled (as little as 4 lpm at 60 degrees C ambient temperature) |

| • | Independent unit instead of module and compatible with any power inverter |

| • | Compliant with SAE J1772 and CENELEC standards |

| • | Ruggedized and environmentally tested to SAE J1455 standards/IP67 |

| • | Higher efficiency with reduced cooling requirements |

| • | Higher power, accommodates US standard single phase outlets up to 60A for faster charging |

| • | Integrated 600W DC/DC converter charges 12V or 24V battery configurations |

Omni DC/DC Converter. Enova is developing a DC/DC converter unit either within the housing of the Omni charger or as a standalone unit. Key features of the product will include:

| • | Independent unit instead of module and compatible with any power electronics |

| • | Compliant with SAE standards (environmental and electrical) |

Battery Suppliers

LG Chem Power Inc. (“LGCPI”). Enova continues to work with LGCPI, the North American subsidiary of LG Chem Ltd., for power oriented battery packs on Enova’s charge sustaining hybrid systems. LG Chem’s client list includes major domestic and international OEMs. Combined with Enova’s new Omni inverter, we believe these LGCPI battery packs will provide Enova’s customers with an advanced and robust medium duty truck and bus hybrid systems while presenting strong value and performance to the end user.

Enova also continues to mature its long standing relationship with Valence for their battery packs, as well as evaluating technologies offered by A123, Tesla, Samsung Bosch and Dow Kokam.

Research and development programs included our advanced power management systems for fuel cells and upgrades and improvements to our current power conversion and management components. We also continued evaluation of new technologies for electric motors, gear drive units and peripheral mechanical components to improve product performance and manufacturing efficiency. Additionally, we continue to optimize our technologies to be more universally adaptable to the requirements of our current

6

Table of Contents

and prospective customers. By modifying our software, we believe we should be able to provide a more comprehensive, adaptive and effective solution to a larger base of customers and applications. We intend to continue to research and develop new technologies and products, both internally and in conjunction with our alliance partners and other manufacturers as we deem beneficial to our global growth strategy.

Electric and Hybrid-Electric Drive Products

Enova’s hybrid and electric drive systems provide all the functionality one would find under the hood of an internal combustion engine powered vehicle. The hybrid and electric power system consists of an enhanced electric motor and the electronic controls that regulate the flow of electricity to and from the batteries at various voltages and power to propel the vehicle. In addition to the motor and controller, the system includes a gear reduction/differential unit which ensures the desired propulsion and performance. The system is designed to be installed as a “drop in,” fully integrated turnkey fashion, or on a modular, “as-needed” basis. Regardless of power source (battery, fuel cell, diesel generator or turbine) the hybrid and electric power system is designed to meet the customer’s drive cycle requirements. Enova’s all electric drive systems use largely the same designs as the hybrid systems, except that there is no internal combustion engine in the vehicle.

Hybrid vehicles are those that utilize an electric motor and batteries in conjunction with an internal combustion engine (“ICE”), whether piston or turbine. With a hybrid system, a small piston or turbine engine — fueled by gasoline or diesel, CNG, methane, etc., in a tank — supplements the electric motor and battery. These systems are self-charging, in that the operating ICE recharges the battery.

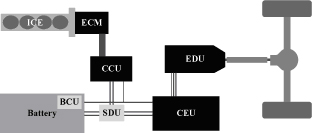

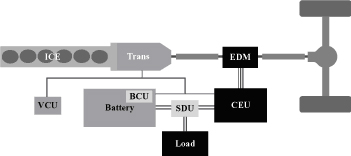

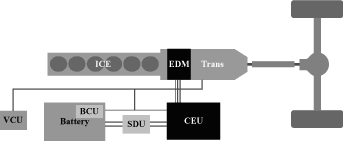

There are two types of hybrid systems: series and parallel. In a series hybrid system, only the electric motor connects to the drive shaft and in a parallel hybrid system, both the internal combustion engine and the electric motor connect to the drive shaft. In a series hybrid system, the ICE turns the generator, which charges the battery, which — through a control unit — powers the electric motor that turns the wheels. In a parallel hybrid system, both the electric motor and the ICE can operate simultaneously to drive the wheels (see diagrams below). In both hybrid systems and in pure electric systems, regenerative braking occurs which assists in the charging of the batteries.

The parallel hybrid system is ideally suited for conditions where most of the driving is done at constant speed cruising, with a smaller amount of the driving involving random acceleration, such as “uphill” or with “stop and go” conditions. For acceleration, the controller causes the electric motor to assist the ICE, both running simultaneously. When speed is steady or the ground is flat, only the ICE runs. Additionally, when the batteries are low, the controller causes the ICE and motor to charge the batteries. As a result, the series hybrid system is best suited for starts and stops, and is ideal for applications such as urban transit buses and urban garbage trucks. The design of the series hybrid system is based on a driving cycle with a high percentage of random acceleration conditions.

Hybrid and Electric Drive Configurations

Enova has identified four primary configurations based upon how well they meet market needs economic requirements. We have developed all of the relevant technology required to produce these drive systems and we are currently introducing the Hybrid Power product line worldwide. All of our innovative hybrid drive systems are compatible with a wide range of fuel sources and engine configurations.

7

Table of Contents

Series Hybrid with Diesel Generator

The Series Hybrid is typically ideal for low floor vehicles with a driving cycle that has a high percentage of stop and go and/or hilly terrain. Refuse trucks, urban delivery trucks and intra-city buses are the primary target markets for these drive systems.

Post Transmission Parallel Hybrid

The Post Transmission Parallel Hybrid is ideal for vehicles with a driving cycle with a high percentage of stop and go, as well as constant speed cruising. Target markets include refuse trucks, urban delivery trucks, school buses and intra-city buses.

Pre Transmission Parallel Hybrid

The Pre-Transmission Parallel Hybrid is ideal for vehicles with a driving cycle having a small percentage of constant speed cruising and a large percentage of stop and go. Target markets include inter-city transit buses and trucks as well as military vehicles.

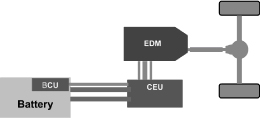

All Electric Vehicle Drive System

8

Table of Contents

The Electric Drive Systems works well with vehicles with a disciplined driving route that has a high percentage of stop and go conditions. Refuse trucks, urban delivery trucks and intra-city vehicles are the primary markets for these drive systems.

Definitions:

BCU — Battery Care Unit; HCU — Hybrid Control Unit; SDU — Safety Disconnect Unit; VCU — Vehicle Control Unit

CEU — Control Electronics Unit (Houses MCU, DC-DC, and Charger); MCU — Motor Control Unit;

EDM — Electric Drive Motor; EDU — Electric Drive Unit (Includes EDM & GDU); GDU — Gear Drive Unit

GCU — Generator Control Unit; EGM — Electric Generator Motor; ICE — Internal Combustion Engine

Electric Drive Motors

The electric drive unit is essentially an electric motor with additional features and functionality. The motor is liquid-cooled, environmentally sealed, designed to handle automotive shock and vibration, and includes parking pawl, which stops the vehicle when the driver parks the car. It also permits regenerative braking to provide power recovery, in which the mechanical energy of momentum is converted into electrical energy as the motor slows during braking or deceleration. The optional gear reduction unit takes the electric motor’s high rpm and gears it down to the lower rpm required by the vehicle’s conventional drive shaft. As the revolutions per minute (“rpm”) go down, the torque of the electric motor increases.

The hybrid electric drive systems exclusively utilize Permanent Magnet or induction motor technology. The drive system is scalable and can be customized for different applications. Due to the large operating range that these propulsion systems offer, all parameters can be optimized; the user will not have to choose between acceleration, torque or vehicle speed.

Motor Controllers

The controller houses all the components necessary to control the powering of a vehicle, in one easy-to-install package. Our main component is an inverter, which converts DC electricity to AC electricity. We also offers optional controllers for the air conditioning, power steering and heat pumps, 12VDC/24VDC DC-to-DC converter for vehicle auxiliary loads such as cell phones, radio, lights, and a 6.6kW AC-to-DC on-board conductive charger which allows for direct 110 VAC or 220 VAC battery charging. These are located in the same housing as the controller, thus extra interconnects are not required. This approach simplifies the vehicle wiring harness and increases system reliability. Using our proprietary Windows based software package, vehicle interfaces and control parameters can be programmed in-vehicle. Real-time vehicle performance parameters can be monitored and collected.

Drive System Accessories

Enova’s drive system accessories range from battery management systems to hybrid controllers, to rapid charging systems. These critical components are designed to complement the drive system family by providing the elements necessary to create a complete technical solution for alternative energy drive systems.

Enova’s drive system accessories are not only integral, but also are the perfect complement to our drive systems and are designed to provide our customers with a complete solution to their drive system needs.

Manufacturing Strategy

We have developed a multi-tiered manufacturing strategy that allows us to meet the market’s demand for high quality production goods while optimizing cost of goods sold across the spectrum of low to high volumes. At the core of this strategy is a strong reliance on pre-selected highly qualified outside manufacturing houses that specialize in various aspects of the manufacturing process. This closely managed outsourcing strategy helps Enova control product costs while also minimizing fixed costs within the organization.

Competitive Conditions

The competition to develop and market electric, hybrid and fuel cell powered vehicles continued to accelerate during the last year and we expect this trend to continue as governments in our target markets adopt initiatives to reduce greenhouse gas emissions. In the event governments in our target markets completely rescinded their support for the reduction of greenhouse gas emissions and sustainability initiatives, our business model would be adversely and significantly affected. Moreover, although competition within the

9

Table of Contents

mobile hybrid sector is still somewhat fragmented, there are indications of some consolidation at this time. The competition consists of development stage companies as well as major U.S. and international companies. The larger companies tend to focus on single solutions and maintain the capital and wherewithal to aggressively market such. The smaller competitors offer a more diversified product line, but do not have the market presence to generate significant penetration at this juncture.

Our research and experience has indicated that our target market segments certainly focus on price, but would buy based on reliability, performance and quality support when presented the life-cycle business model for EV-HEV technologies for their application. Our future prospects are highly dependent upon the successful development and introduction of new products that are responsive to market needs and can be manufactured and sold at a profit. There can be no assurance that we will be able to successfully develop or market any such products.

The development of hybrid-electric and alternative fuel vehicles, such as compressed natural gas, fuel cells and hybrid cars poses a competitive threat to our markets for low emission vehicles or LEVs but not in markets where government mandates call for zero emission vehicles or ZEVs. Enova is involved in the development of hybrid vehicles and fuel cell systems in order to meet future government requirements and applications.

Various providers of electric vehicles have proposed products or offer products for sale in this emerging market. These products encompass a wide variety of technologies aimed at both consumer and commercial markets. As the industry matures, key technologies and capabilities are expected to play critical competitive roles. Our goal is to position ourselves as a long term competitor in this industry by focusing on all-electric, hybrid and fuel cell powered drive systems and related sub systems, component integration, technology application and strategic alliances.

We believe the hybrid and electric vehicle market is poised for growth over the medium and long term and that Enova’s products are positioned to capitalize on demands being placed on the market by offering solutions. Enova believes that our competitive advantages include:

| • | Providing a full product line of power management and power conversion, and supporting system integration |

| • | Providing products that allow the hardware to be software programmable and configurable |

| • | Offering a product line designed for the most advanced new fuel systems: electric, hybrid, fuel cell and solar power applications |

| • | Providing fully integrated, “drop-in” energy management and conversion system in “one box” |

| • | Offering systems with reduced footprint and weight, high functionality and low cost — characteristics essential for all market applications |

| • | Meeting changing and sophisticated requirements of emerging alternative power markets and applications. |

| • | Positioning ourselves as a strategic ally with our global customer base, manufacturers and our R&D partners. |

By building a business based on long-standing relationships with clients such as Freightliner Custom Chassis Corporation, Smith Electric Vehicles, First Auto Works and Optare, we believe we are building defenses against competition by securing customers with global reach and OEM status. Teaming with recognized global manufacturers allows Enova to avoid devoting resources to manufacturing infrastructure and allows us access to production capacity at relatively low costs.

Research and Development

Enova maintains a strategy of continual enhancement of its current product line and development of more efficient and reliable products for the ever-changing alternative energy sectors. Management believes R&D must be continued in order to be remain competitive, minimize production costs and meet our customers’ specifications. Because microprocessors and other components continue to advance in speed, miniaturization and reduction of cost, we must re-examine our designs to take advantage of such developments. We seek to provide internal funding where technology development is critical to our future.

For the years ended December 31, 2011, and 2010, we spent $2,039,000 and $1,838,000, respectively, on internal research and development activities. Enova is continually evaluating and updating the technology and equipment used in developing each of its products. The electric and hybrid vehicle industry utilizes rapidly changing technology and we will endeavor to modernize our current products as well as continue to develop new leading edge technologies to maintain our competitive position in the market.

10

Table of Contents

Intellectual Property

Enova is actively evaluating and applying for technology protection on its Omni Drive System. The Omni system contains many areas where Enova will have unique advantages in comparison to existing technologies and the company is working to fully protect these areas. This process involves complex legal and factual questions, and the breadth of claims allowed is uncertain. Accordingly, there can be no assurance that patent applications filed by us will result in patents being issued. Moreover, there can be no assurance that third parties will not assert claims against us with respect to existing and future products. Although we intend to vigorously protect our rights, there can be no assurance that these measures will be successful. In the event of litigation to determine the validity of any third party claims, such litigation could result in significant expense to Enova. Additionally, the laws of certain countries in which our products are or may be developed, manufactured or sold may not protect our products and intellectual property rights to the same extent as the laws of the United States.

Enova currently holds three U.S. patents relating to power management and control that will expire in 2015. We also have trademarks or service marks in the United States. We continually review and append our protection of proprietary technology. We continue to place emphasis on the development and acquisition of patentable technology. A majority of our intellectual property is contained within our software which we believe is best protected under trade secret intellectual property law. Under such provisions, Enova does not have to publish its proprietary code in order to maintain protection. In light of advancements and initiatives to produce our next-generation Omni drive system, Enova made an immaterial adjustment to bring the three U.S patents to a zero book value balance as of December 31, 2010.

Enova’s pending or future patent applications may not be approved and the claims covered by such applications may be reduced. If allowed, patents may not be of sufficient scope or strength, others may independently develop similar technologies or products, duplicate any of Enova’s products or design around its patents, and the patents may not provide Enova with competitive advantages. Further, patents held by third parties may prevent the commercialization of products incorporating Enova’s technologies or third parties may challenge or seek to narrow, invalidate or circumvent any of Enova’s pending or future patents. Enova also believes that foreign patents, if obtained, and the protection afforded by such foreign patents and foreign intellectual property laws, may be more limited than that provided under United States patents and intellectual property laws. Litigation, which could result in substantial costs and diversion of effort by Enova, may also be necessary to enforce any patents issued or licensed to Enova or to determine the scope and validity of third-party proprietary rights. Any such litigation, regardless of outcome, could be expensive and time-consuming, and adverse determinations in any such litigation could seriously harm Enova’s business. Enova relies on unpatented trade secrets and know-how and proprietary technological innovation and expertise which are protected in part by confidentiality and invention assignment agreements with its employees, advisors and consultants and non-disclosure agreements with certain of its suppliers and distributors. If these agreements are breached, Enova may not have adequate remedies for any breach and Enova’s unpatented proprietary intellectual property may otherwise become known or independently discovered by competitors.

Employees

As of December 31, 2011, we had a total of 30 employees comprising of 27 full-time, 1 part-time and 2 temporary employee positions. In addition, we employ one individual as an independent contractor engaged on a monthly basis.

Available and Additional Information

Included in Item 8 of this 10K are audited financial statements which include revenues, a measure of profit or loss and total assets.

We file electronically with the SEC our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. We make available free of charge on or through our website copies of these reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov. You may also read and copy any of our materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information regarding the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. Our website address is www.enovasystems.com. Information found on, or that can be accessed through, our website is not incorporated by reference into this annual report.

11

Table of Contents

| ITEM 1A. RISK | FACTORS |

The statements in this Section describe the major risks to our business and should be considered carefully. In addition, these statements constitute our cautionary statements under the Private Securities Litigation Reform Act of 1995 and apply to all sections of this Form 10-K.

This annual report on Form 10-K, including the documents that we incorporate by reference, contains statements indicating expectations about future performance and other forward-looking statements that involve risks and uncertainties. We usually use words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “future,” “intend,” “potential,” or “continue” or the negative of these terms or similar expressions to identify forward-looking statements. These statements appear throughout the Form 10-K and are statements regarding our current intent, belief, or expectation, primarily with respect to our operations and related industry developments. Examples of these statements include, but are not limited to, statements regarding the following: our expansion plans, our future operating expenses, our future losses, our future expenditures for research and development and the sufficiency of our cash resources. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this annual report. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us and described in this “Risk Factors” section and elsewhere in this annual report.

We cannot guarantee that any forward-looking statement will be realized, although we believe we have been prudent in our plans and assumptions. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated or projected. You should bear this in mind as you consider forward-looking statements.

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our 10-Q and 8-K reports to the SEC. Also note that we provide the following cautionary discussion of risks, uncertainties and possibly inaccurate assumptions relevant to our businesses. These are factors that, individually or in the aggregate, we think could cause our actual results to differ materially from expected and historical results. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties.

Our history of operating losses and our expectation of continuing losses may hurt our ability to reach profitability or continue operations.

We have experienced significant operating losses since our inception. Our net loss was $6,984,000 for the fiscal year ended December 31, 2011 and our accumulated deficit was $151,112,000 as of December 31, 2011. It is likely that we will continue to incur substantial net operating losses for the foreseeable future, which may adversely affect our ability to continue operations. To achieve profitable operations, we must successfully develop and market our products at higher margins. We may not be able to generate sufficient product revenue to become profitable. Even if we do achieve profitability, we may not be able to sustain or increase our profitability on a quarterly or yearly basis.

We are dependent on access to capital markets in order to fund continued operations of the Company.

We do not currently have adequate internal liquidity to fund the Company’s operations on an ongoing basis. We will need to continue to look for partnering opportunities and other external sources of liquidity, including the public and private financial markets and strategic partners. We may not be able to obtain financing arrangements in amounts or on terms acceptable to us in the future. In the event we are unable to obtain additional financing when needed, and without substantial reductions in development programs and strategic initiatives, we do not expect that our cash and cash equivalents and short-term investments will be sufficient to fund our operating and capital needs for the twelve months following December 31, 2011.

Because we depend upon sales to a limited number of customers, our revenues will be reduced if we lose a major customer

Our revenue is dependent on significant orders from a limited number of customers. We typically enter into supply agreements with major customers establishing product and price standards for future periods. Subsequent events may change the needs of the customer, requiring us to make corresponding adjustments. In the fiscal year ended December 31, 2011, Smith accounted for 52% of our total revenues and our four largest customers, inclusive of Smith, comprised 94% of revenues. We believe that revenues from major customers will continue to represent a significant portion of our revenues. This customer concentration increases the risk of quarterly

12

Table of Contents

fluctuations in our revenues and operating results. The loss or reduction of business from one or a combination of our significant customers could adversely affect our revenues, financial condition and results of operations. Moreover, our success will depend in part upon our ability to obtain orders from new customers, as well as the financial condition and success of our customers and general economic conditions.

Our future growth depends on consumers’ willingness to accept hybrid and electric vehicles

Our growth is highly dependent upon the acceptance by consumers of, and we are subject to an elevated risk of any reduced demand for, alternative fuel vehicles in general and electric vehicles in particular. If the market for electric vehicles does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be materially and adversely affected. The market for alternative fuel vehicles is relatively new, rapidly evolving, characterized by rapidly evolving and changing technologies, price competition, additional competitors and changing consumer demands or behaviors. Factors that may influence the acceptance of alternative fuel vehicles include:

| • | perceptions about alternative fuel vehicles safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of alternative fuel vehicles; |

| • | volatility in the cost of oil and gasoline; |

| • | consumer’s perceptions of the dependency of the United States on oil from unstable or hostile countries; |

| • | improvements in fuel of the internal combustion engine; |

| • | the environmental consciousness of consumers; |

| • | government regulation |

| • | macroeconomics |

We extend credit to our customers, which exposes us to credit risk

Most of our outstanding accounts receivable are from a limited number of large customers. At December 31, 2011, the two highest outstanding accounts receivable balances totaled approximately $780,000 which represents 91% of our gross accounts receivable. If we fail to monitor and manage effectively the resulting credit risk and a material portion of our accounts receivable is not paid in a timely manner or becomes uncollectible, our business would be significantly harmed, and we could incur a significant loss associated with any outstanding accounts receivable.

Our business is affected by current economic and financial market conditions in the markets we serve

Current global economic and financial markets conditions, including severe disruptions in the credit markets and the significant and potentially prolonged global economic recession, may materially and adversely affect our results of operations and financial condition. We are particularly impacted by any global automotive slowdown and its effects on OEM inventory levels, production schedules, support for our products and decreased ability to accurately forecast future product demand.

The nature of our industry is dependent on technological advancement and is highly competitive

The mobile power market, including electric vehicle and hybrid electric vehicles, continue to be subject to rapid technological changes. Most of the major domestic and foreign automobile manufacturers: (1) have already produced electric and hybrid vehicles, (2) have developed improved electric storage, propulsion and control systems, and/or (3) are now entering or have entered into production, while continuing to improve technology or incorporate newer technology. Various companies are also developing improved electric storage, propulsion and control systems.

Our industry is affected by political and legislative changes

In recent years there has been significant legislation enacted in the United States and abroad to reduce or eliminate automobile pollution, promote or mandate the use of vehicles with no tailpipe emissions (“zero emission vehicles”) or reduced tailpipe emissions (“low emission vehicles”). Although states such as California have enacted such legislation, we cannot assure you that there will not be further legislation enacted changing current requirements or that current legislation or state mandates will not be repealed or amended, or that a different form of zero emission or low emission vehicle will not be invented, developed and produced, and achieve greater market acceptance than electric or hybrid electric vehicles.

13

Table of Contents

We may be unable to effectively compete with other companies who have significantly greater resources than we have

Many of our competitors, in the automotive, electronic, and other industries, have substantially greater financial, personnel, and other resources than we do. Because of their greater resources, some of our competitors may be able to adapt more quickly to new or emerging technologies and changes in customer requirements, or to devote greater resources to the promotion and sales of their products than we can.

We may be exposed to product liability or tort claims if our products fail, which could adversely impact our results of operations

A malfunction or the inadequate design of our products could result in product liability or other tort claims. Any liability for damages resulting from malfunctions could be substantial and could materially adversely affect our business and results of operations. In addition, a well-publicized actual or perceived problem could adversely affect the market’s perception of our products.

We are highly dependent on a few key personnel and will need to retain and attract such personnel in a labor competitive market

Our success is largely dependent on the performance of our key management and technical personnel, the loss of one or more of whom could adversely affect our business. Additionally, in order to successfully implement our anticipated growth, we will be dependent on our ability to hire additional qualified personnel. There can be no assurance that we will be able to retain or hire other necessary personnel. We do not maintain key man life insurance on any of our key personnel. We believe that our future success will depend in part upon our continued ability to attract, retain, and motivate additional highly skilled personnel in an increasingly competitive market.

We are highly dependent on a few vendors for key system components made to our engineering specifications and disruption of vendor supply could adversely impact our results of operations.

Our product specifications often involve upfront investment in tooling and machinery, which result in our commitment to a limited number of high quality vendors that can meet our manufacturing standards. Any disruption to our supply of key components from the suppliers would have an adverse impact on our business and results of operations.

There are minimal barriers to entry in our market

We presently license or own only certain proprietary technology, and therefore have created little or no barrier to entry for competitors other than the time and significant expense required to assemble and develop similar production and design capabilities.

Our competitors may enter into exclusive arrangements with our current or potential suppliers, thereby giving them a competitive edge which we may not be able to overcome, and which may exclude us from similar relationships.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

Our corporate offices are located at an office and manufacturing facility at 1560 West 190th Street, Torrance, California. We lease this 43,000 square foot office and manufacturing facility. Enova also rented an office in Hawaii on a month-to-month basis, but closed the office in November 2011.

Given the nature of our business, we are subject from time to time to lawsuits, investigations and disputes (some of which involve substantial amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions. Other than the Arens matter outlined below, we are not aware of any other pending legal matters. We recognize a liability for any contingency that is probable of occurrence and reasonably estimable. We continually assess the likelihood of adverse outcomes in these matters, as well as potential ranges of probable losses (taking into consideration any insurance recoveries), based on a careful analysis of each matter with the assistance of outside legal counsel and, if applicable, other experts.

14

Table of Contents

Most contingencies are resolved over long periods of time, potential liabilities are subject to change due to new developments, changes in settlement strategy or the impact of evidentiary requirements, which could cause us to pay damage awards or settlements (or become subject to equitable remedies) that could have a material adverse effect on our results of operations or operating cash flows in the periods recognized or paid.

The Company reported in an 8-K filed January 20, 2011 with date of earliest event reported being January 14, 2011, on January 6, 2011, that we entered into a Partial Settlement Agreement, dated January 5, 2011 (the “Settlement Agreement”), with Arens Controls Company, L.L.C. (“Arens”) to resolve certain claims made by Arens in connection with its action captioned Arens Controls Company, L.L.C. v. Enova Systems, Inc., filed in 2008 with the Northern District of Illinois of the U.S. District Court (the “Legal Action”). The Settlement Agreement was amended by Amendment No. 1 to Partial Settlement Agreement (the “Amendment”) dated January 14, 2011.

In the Legal Action, Arens asserted eight counts against Enova, including certain claims regarding inventory asserted by Arens to be valued at $1,671,000 (the “Inventory Claim”), a claim for payment under certain invoices, and claims for certain other monetary obligations of Enova to Arens.

Under the terms of the Settlement Agreement, we paid $327,000 directly to Arens and Arens dismissed with prejudice all but two of the counts under the Legal Action. Additionally, under the Settlement Agreement (as amended), on January 14, 2011, we acquired the inventory that was the subject of the Inventory Claim (the “Inventory”) for payment of $1,498,000, net of an agreed upon reduction of $173,000 for the acquisition price of such Inventory. In return, Arens was deemed to have released us from any further liability on the Inventory Claim. However, per the terms of the Settlement Agreement (as amended), Arens is not deemed to have released us from (but instead is deemed to have preserved its claims under) two of the counts in the Legal Action.

The two counts that were not settled remain outstanding and there have been no material developments with respect thereto during the period covered by this report. The Company has meritorious defenses and intends to contest all remaining matters vigorously.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

| Shares of our common stock now trade on the NYSE Amex under the same and previous trading symbol “ENA” and on the London Stock Exchange AIM Market under the symbol “ENVS.L” or “ENV.L”. Our common stock became listed on the NYSE Amex on August 29, 2006. The following table sets forth the high and low sales closing prices of our Common Stock as reflected on the NYSE Amex. |

||||||||

| Common Stock | ||||||||

| High Price | Low Price | |||||||

| Calendar 2011 |

||||||||

| Fourth Quarter |

$ | 0.39 | $ | 0.15 | ||||

| Third Quarter |

$ | 0.87 | $ | 0.40 | ||||

| Second Quarter |

$ | 1.40 | $ | 0.82 | ||||

| First Quarter |

$ | 1.49 | $ | 0.86 | ||||

| Calendar 2010 |

||||||||

| Fourth Quarter |

$ | 1.47 | $ | 0.64 | ||||

| Third Quarter |

$ | 1.05 | $ | 0.60 | ||||

| Second Quarter |

$ | 1.57 | $ | 0.89 | ||||

| First Quarter |

$ | 2.22 | $ | 1.42 | ||||

As of February 29, 2012, there were approximately 1,000 holders of record of our Common Stock. As of February 29, 2012, approximately 100 shareholders held our Series A Preferred Stock and approximately 32 shareholders held our Series B Preferred Stock. The number of holders of record excludes beneficial holders whose shares are held in the name of nominees or trustees.

15

Table of Contents

Dividend Policy

To date, we have neither declared nor paid any cash dividends on shares of our Common Stock or Series A or B Preferred Stock. We presently intend to retain all future earnings for our business and do not anticipate paying cash dividends on our Common Stock or Series A or B Preferred Stock in the foreseeable future. We are required to pay dividends on our Series A and B Preferred Stock before dividends may be paid on any shares of Common Stock. At December 31, 2011, Enova had an accumulated deficit of approximately $151,112,000 and, until this deficit is eliminated, will be prohibited from paying dividends on any class of stock except out of net profits, unless it meets certain asset and other tests under Section 500 et. seq. of the California Corporations Code.

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data tables set forth selected financial data for the years ended December 31, 2011, 2010 and 2009. The statement of operations data and balance sheet data for and as of the years ended December 31, 2011, 2010, and 2009 are derived from the audited financial statements of Enova. The following selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, including the notes thereto, appearing elsewhere in this Form 10-K.

| For and as of the Years

Ended December 31, | |||||||||||||||

| 2011 | 2010 | 2009 | |||||||||||||

| (In thousands, except per share data) | |||||||||||||||

| Statement of Operations Data |

|||||||||||||||

| Net revenues |

$ | 6,622 | $ | 8,572 | $ | 5,622 | |||||||||

| Cost of revenues |

6,364 | 7,159 | 5,016 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| Gross profit (loss) |

258 | 1,413 | 606 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| Operating expenses |

|||||||||||||||

| Research and development |

2,039 | 1,838 | 1,228 | ||||||||||||

| Selling, general and administrative |

5,075 | 6,558 | 6,223 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| Total operating expenses |

7,114 | 8,396 | 7,451 | ||||||||||||

| Other income and (expense) |

|||||||||||||||

| Interest and other income (expense), net |

(128 | ) | (437 | ) | (196 | ) | |||||||||

| Equity in losses of non-consolidated joint venture, net |

— | — | (4 | ) | |||||||||||

|

|

|

|

|

|

|

||||||||||

| Total other income and (expense) |

(128 | ) | (437 | ) | (200 | ) | |||||||||

|

|

|

|

|

|

|

||||||||||

| Net loss |

$ | (6,984 | ) | $ | (7,420 | ) | $ | (7,045 | ) | ||||||

|

|

|

|

|

|

|

||||||||||

| Per common share: |

|||||||||||||||

| Basic and diluted loss per share |

$ | (0.22 | ) | $ | (0.24 | ) | $ | (0.33 | ) | ||||||

|

|

|

|

|

|

|

||||||||||

| Weighted average number of common shares outstanding |

31,537 | 31,422 | 21,385 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| Balance Sheet Data |

|||||||||||||||

| Total assets |

$ | 9,340 | $ | 17,690 | $ | 22,011 | |||||||||

|

|

|

|

|

|

|

||||||||||

| Long-term debt |

$ | 1,286 | $ | 1,286 | $ | 1,286 | |||||||||

|

|

|

|

|

|

|

||||||||||

| Shareholders’ equity |

$ | 5,298 | $ | 10,646 | $ | 17,247 | |||||||||

|

|

|

|

|

|

|

||||||||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read this Management’s Discussion and Analysis of Financial Condition and Results of Operations in conjunction with our 2011 Financial Statements and accompanying Notes. The matters addressed in this Management’s Discussion and Analysis of Financial Condition and Results of Operations may contain certain forward-looking statements involving risks and uncertainties.

Overview

Enova Systems believes it is a leading innovator of proprietary hybrid and electric drive systems propelling the alternative energy industry. Our core competencies are focused on the development and commercialization of power management and conversion systems for mobile applications. Enova applies unique ‘enabling technologies’ in the areas of alternative energy propulsion systems for medium and heavy-duty vehicles as well as power conditioning and management systems for distributed generation systems. Our products can be found in a variety of OEM vehicles including those from Freightliner Customer Chassis Corporation, Navistar Corporation, First Auto Works, trucks and buses for Smith Electric Vehicles, Wright Bus, Optare Plc. and the U.S. Military, as well as digital power systems for EDO and other major manufacturers.

16

Table of Contents

We continue to support our customers in their efforts to maximize exposure in the market. We have been involved in large shows throughout the USA and look to continue increasing our exposure at future worldwide events. The exposure via shows and direct interface were aggressively pursued throughout 2011 in an effort to promote our drive system for medium and heavy duty applications.

Some notable highlights of Enova’s accomplishments in 2011, as noted earlier are:

| • | Green For Free™. In November 2011, Enova announced its Green for Free™ Program, which is designed to allow fleet executives to operate full 100% electric commercial vehicles (EVs) for similar life cycle costs as those of diesel-powered commercial vehicles. The anticipated savings fleets are expected to realize from the reduced maintenance and fuel cost of electricity of the electric vehicles are used over a period of time to cover the incremental expense for the technology. Fleet vehicles targeted with the Green for Free™ Program stand out as possessing unique characteristics that make them clear beneficiaries of electric drive technology. With more than 16.3 million vehicles in operation, the nation’s fleets possess enough capacity to drive initial ramp-up scale in the EV OEM supply chains. This is the first Program that is engineered to eliminate the overall incremental costs associated with buying and operating an all-electric vehicle, making the Program attractive to fleets that are both large and small. |

| • | Freightliner Custom Chassis Corporation (“FCCC”), a division of Daimler Trucks North America. Enova and FCCC began deploying new and retrofit all electric vehicles to major fleet customers. The resulting integration of our all-electric drive system into the MT-45 chassis provides FCCC an all-electric product offering: the FCCC MT-EV. The MT-EV (the FCCC model name) chassis boasts a GVWR of 14,000 to 19,500 lbs. The durable steel straight-rail chassis frame reduces flex and bowing to minimize stress while carrying heavy payloads. The quiet operation of the all-electric MT-EV also makes for an enjoyable driver experience. The MT-EV has a flat-leaf spring front and rear suspension, allowing for a smooth, solid ride that minimizes cargo shifts on uneven road surfaces. Enova and FCCC also jointly announced intentions to deploy 3000 vehicles via the Green for Free™ Program (described above). |

| • | First Auto Works (“FAW”) - Enova continues to supply FAW drive systems for their hybrid buses. Since the 2008 Olympics in Beijing, Enova Systems and First Auto Works have deployed nearly 500 vehicles, all utilizing Enova’s pre-transmission hybrid drive system components. First Auto Works is one of China’s largest vehicle producers, manufacturing in excess of 1,000,000 vehicles annually. The Enova drive system is integrated and branded under the name of Jiefang CA6120URH hybrid. The Jiefang 40 ft. long hybrid city bus can carry up to 103 passengers and travel at a speeds of over 50 miles per hour. With the Enova hybrid system components, the Jiefang bus meets Euro III emission standards, consumes only 7.84 miles per gallon and achieves a reduction of 20 percent in harmful emissions. |

| • | U.S. General Services Administration (“GSA”). GSA extended its contract with Enova as the exclusive supplier contract of the all-electric step van. GSA procures vehicles for government agencies and the armed forces. Under this contract, Enova will coordinate the supply of MT-EV all-electric walk-in step vans to GSA under the Cargo Vans category. Enova continues to benefit from federal fleet penetration via GSA with the Smith Newton product offering in the Medium and Heavy Duty vehicle category. The Smith Newton is another exclusive, all-electric medium and heavy duty truck offering on the GSA product menu. Moreover, Navistar continued to demonstrate its leadership in the American school bus market with its exclusive GSA contract to supply hybrid school buses. Enova is supplies hybrid electric drive systems to IC Bus, an affiliated division of Navistar. |

| • | Remy Inc. (“Remy”). Enova and Remy signed a long-term electric motor supply agreement. Under the five-year agreement, Remy will provide its electric motors to Enova for its all-electric drive systems. With more than 2500 drive systems sold, deployed, and integrated, Enova’s clean electric and hybrid electric vehicle technologies are powering fleets around the globe. Remy motors feature the company’s patented High Voltage Hairpin (HVH) winding technology, which is claimed to increase torque and power density for greater speed and range in electric vehicles. |

| • | Smith Electric Vehicles N.A. Inc. (“Smith”) – Enova continues to supply Smith with electric drive systems. Smith has deployed several hundred vehicles utilizing Enova’s electric drive system. Smith develops, produces and sells zero-emission commercial electric vehicles that are designed to be an alternative to traditional diesel trucks, providing higher efficiency and lower total cost of ownership. Smith has manufacturing facilities in Kansas City, Missouri, and outside of Newcastle, UK. Smith’s vehicle designs leverage more than 80 years of market knowledge from selling and servicing electric vehicles in the United Kingdom. Smith produces the Newton and the Edison. |

17

Table of Contents

Smith most recently announced its intention to deploy vehicles in the all-electric school bus sector. The 42-passenger Newton school bus travels up to 100 miles on a single charge at speeds of up to 50 mph, and is intended for the fixed routes in urban areas most school buses take each day.

| • | Optare plc. (“Optare”) awarded Enova a contract as the production drive system supplier for their all electric buses. Enova has shipped systems to Optare that are currently being integrated into buses. Optare designs, manufactures and sells single deck and double deck buses and mini coaches. Its buses operate in the UK, Continental Europe, and North America. |

| • | The Company delivered a total of 305 full systems and 85 additional motor controller units of Enova drive systems to its broad range of customers. Enova delivered 170 all-electric drive systems plus additional motor control units and other components to Smith in 2011. Enova also delivered 120 pre-transmission hybrid drive systems to FAW for their Jiefang 112 passenger hybrid bus and 11 charge depleting bus systems to Navistar during the year. |

Enova’s product focus is digital power management and power conversion systems. Its software and hardware manage and control the power that drives a vehicle. They convert the power into the appropriate forms required by the vehicle or device and manage the flow of this energy to optimize efficiency and provide protection for both the system and its users. Our products and systems are the enabling technologies for power systems.

The latest state-of-the-art technologies in hybrid and electric vehicles and fuel cell systems all require some type of power management and conversion mechanism. Enova Systems supplies these essential components. Enova drive systems are ‘fuel-neutral,’ meaning that they have the ability to utilize any type of fuel, including diesel, liquid natural gas or bio-diesel fuels. Enova also performs significant research and development to augment and support others’ and our internal product development efforts.

Our products are “production-engineered.” This means they are designed so they can be commercially produced (i.e., all formats and files are designed with manufacturability in mind, from the start). For the automotive market, Enova designs its products to ISO 9001 manufacturing and quality standards. We believe Enova’s redundancy of systems and rigorous quality standards result in high performance and reduced risk. For every component and piece of hardware, there are detailed performance specifications. Each piece is tested and evaluated against these specifications, which enhances and confirms the value of the systems to OEM customers. Our engineering services focus on system integration support for product sales and custom product design.

In light of our efforts to grow market share in our target markets and penetrate emerging ones, the Company continues to acknowledge the principal barrier to commercialization of our drive systems is cost. The cost of engineering proprietary software and hardware for our drive systems is high because economies of production in specialized hybrid drive system component parts, batteries, and vehicle integration have not been achieved. Therefore, the cost of our products and engineering services are currently higher than our gasoline and diesel competitor counterparts. We also believe maturation into commercialization of our drive systems will result in decreases to our long run average costs of materials and services as volume increases over time.

Critical Accounting Policies

The preparation of consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to product returns, bad debts, inventories, intangible assets, income taxes, stock-based compensation, warranty obligations, contingencies, and litigation. We base our estimates on historical experience and on various other assumptions believed to be reasonable under the circumstances, including current and anticipated worldwide economic conditions, both in general and specifically in relation to the hybrid and electric vehicle markets, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Our significant accounting policies are described in Note 2 to the consolidated financial statements included in Item 8 of this Form 10-K. We believe the following critical accounting policies necessitated that significant judgments and estimates be used in the preparation of its consolidated financial statements. We have reviewed these policies with our Audit Committee.

Revenue Recognition — We generally recognizes revenue at the time of shipment when title and risk of loss have passed to the customer, persuasive evidence of an arrangement exists, performance of our obligation is complete, our price to the buyer is fixed or determinable, and we are reasonably assured of collection. If a loss is anticipated on any contract, a provision for the entire loss is made immediately. Determination of these criteria, in some cases, requires management’s judgment. Should changes in conditions cause management to determine that these criteria are not met for certain future transactions, revenue for any reporting period could be adversely affected.

18

Table of Contents

The Company also recognizes engineering and construction contract revenues using the percentage-of-completion method, based primarily on contract costs incurred to date compared with total estimated contract costs. Customer-furnished materials, labor, and equipment, and in certain cases subcontractor materials, labor, and equipment, are included in revenues and cost of revenues when management believes that the company is responsible for the ultimate acceptability of the project. Contracts are segmented between types of services, such as engineering and construction, and accordingly, gross margin related to each activity is recognized as those separate services are rendered.

Changes to total estimated contract costs or losses, if any, are recognized in the period in which they are determined. Claims against customers are recognized as revenue upon settlement. Revenues recognized in excess of amounts billed are classified as current assets under contract work-in-progress. Amounts billed to clients in excess of revenues recognized to date are classified as current liabilities on contracts.