Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - PENTAIR plc | form8-k.htm |

| EX-99.1 - PRESS RELEASE - PENTAIR plc | ex99-1.htm |

Exhibit 99.2

PENTAIR & TYCO FLOW

PENTAIR AND TYCO FLOW

A Powerful Combination, A Stronger Future

MARCH 28, 2012

PENTAIR & TYCO FLOW

2

Randall J. Hogan

Chairman and

Chief Executive Officer

Chief Executive Officer

Pentair, Inc.

Edward D. Breen

Chairman and

Chief Executive Officer

Chief Executive Officer

Tyco International, Ltd.

PENTAIR & TYCO FLOW

3

FORWARD-LOOKING STATEMENTS

|

FORWARD-LOOKING STATEMENTS

This presentation may contain certain statements about Pentair, Inc. (“Pentair”), Tyco Flow Control International Ltd. (“Tyco Flow”) and Tyco International Ltd. (“Tyco”) that are

“forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this presentation may include statements about the expected effects on Pentair, Tyco Flow and Tyco of the proposed merger of Pentair and Tyco Flow (the “Merger”), the anticipated timing and benefits of the Merger, Pentair’s and Tyco Flow’s anticipated standalone or combined financial results and all other statements in this document other than historical facts. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “intends”, “will”, “likely”, “may”, “anticipates”, “estimates”, “projects”, “should”, “would”, “expect”, “positioned”, “strategy”, “future” or words, phrases or terms of similar substance or the negative thereof, are forward-looking statements. These statements are based on the current expectations of the management of Pentair, Tyco Flow and Tyco (as the case may be) and are subject to uncertainty and changes in circumstances and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. In addition, these statements are based on a number of assumptions that are subject to change. Such risks, uncertainties and assumptions include: the satisfaction of the conditions to the Merger and other risks related to the completion of the Merger and actions related thereto; Pentair’s and Tyco’s ability to complete the Merger on anticipated terms and schedule, including the ability to obtain shareholder or regulatory approvals of the Merger and related transactions; risks relating to any unforeseen liabilities of Pentair or Tyco Flow; future capital expenditures, expenses, revenues, earnings, synergies, economic performance, indebtedness, financial condition, losses and future prospects; business and management strategies and the expansion and growth of Pentair's or Tyco Flow’s operations; Pentair’s and Tyco Flow’s ability to integrate successfully after the Merger and achieve anticipated synergies; the effects of government regulation on Pentair’s or Tyco Flow’s business; the risk that disruptions from the transaction will harm Pentair’s or Tyco Flow’s businesses; Pentair’s, Tyco Flow’s and Tyco’s plans, objectives, expectations and intentions generally; and other factors detailed in Pentair’s and Tyco’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including their Annual Reports on Form 10-K under the caption “Risk Factors”. Forward-looking statements included herein are made as of the date hereof, and none of Pentair, Tyco Flow or Tyco undertakes any obligation to update publicly such statements to reflect subsequent events or circumstances. |

|

ADDITIONAL INFORMATION

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of a vote or proxy. The Merger will be submitted to a

vote of Pentair shareholders and the proposed distribution of Tyco Flow to Tyco shareholders will be submitted to a vote of Tyco shareholders. In connection with the Merger, Tyco Flow will file a registration statement on Form S-4 with the SEC. Such registration statement will include a proxy statement of Pentair that also constitutes a prospectus of Tyco Flow, and will be sent to Pentair shareholders. In addition, Tyco Flow will file with the SEC a Form 10 and Tyco will file a proxy statement with the SEC related to the proposed distribution of the Tyco Flow shares that will be sent to Tyco shareholders. Shareholders of Pentair and Tyco are urged to read the proxy statements and other documents filed with the SEC when they become available because they will contain important information about Pentair, Tyco Flow, Tyco and the proposed transactions. Shareholders will be able to obtain copies of these documents (when they are available) and other documents filed with the SEC with respect to Pentair, Tyco Flow and Tyco free of charge from the SEC's website at www.sec.gov. These documents (when they are available) can also be obtained free of charge from Pentair upon written request to Investor Relations Department, Pentair, Inc., 5500 Wayzata Blvd., Suite 800, Minneapolis, MN, 55416, or by calling (763) 545-1730, or from Tyco or Tyco Flow upon written request to Investor Relations Department, Tyco International Ltd., 9 Roszel Road, Princeton, NJ, 08540, or by calling (609) 720-4200. |

|

PARTICIPANTS IN THE SOLICITATION

Pentair and Tyco and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders in connection

with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Pentair may be found in its Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC on February 21, 2012 and definitive proxy statement relating to its 2012 annual meeting of shareholders filed with the SEC on March 9, 2012. Information about the directors and executive officers of Tyco may be found in its Annual Report on Form 10-K for the year ended September 30, 2011 filed with the SEC on November 16, 2011 and definitive proxy statement relating to its 2012 annual general meeting of shareholders filed with the SEC on January 13, 2012. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants will also be included in the proxy statements when it becomes available. |

PENTAIR & TYCO FLOW

4

Well-Positioned to Serve the “New” New World

- Growing Population and Wealth of Developing Economies

A World-Leading ~$7.7B* Industrial Growth Company

GREAT INDUSTRIAL COMBINATION

A Global Leader in Flow, Filtration and Equipment Protection

Strong from the Start

- More Global, More Diverse and More Scale

Stronger in the Future

- Substantial Synergies Expected with Enhanced Financial Strength

1

2

3

4

* Combined projected 2012 pro forma revenues. Tyco Flow financials calendarized to December.

PENTAIR & TYCO FLOW

5

TRANSACTION SUMMARY

|

Structure and

Consideration |

• Stock-for-stock exchange using Reverse Morris Trust structure

• The Tyco Flow Control business will be distributed to Tyco International

shareholders through a tax-free spin-off; then immediately merged with Pentair • Total Consideration approximately $4.9B*, including ~$275M of Tyco Flow

net debt assumed and $94M of minority interest |

|

Ownership

(new Pentair) |

• Approximately 52.5% Tyco International shareholders

• Approximately 47.5% Pentair shareholders

• ~214 million total diluted shares expected to be outstanding

|

|

Governance

|

• Pentair’s Chairman/CEO and executive team to lead combined company

• Pentair Board of Directors plus two board members designated by Tyco

|

|

Merged

Company |

• Company Name: Pentair; Listing: NYSE (ticker: PNR)

• Incorporation: Switzerland; Main U.S. offices: Minneapolis, MN

|

|

Financial

Benefits |

• Projected ~$0.40 Accretive to 2013 EPS; Expect 2015 EPS of >$5.00

• Expect ~$250M annual synergies with full realization by Year 3

• Expect combined proforma 2015 EBITDA of ~$1.7B

|

|

Conditions and

Expected Closing |

• Pentair and Tyco International shareholder votes

• Customary closing conditions and relevant tax authority approvals

• Expected closing at the end of September 2012

|

Unique Value Creation Opportunity

* Consideration based on PNR $40.26/share

PENTAIR & TYCO FLOW

6

Edward D. Breen

Chairman and

Chief Executive Officer

Chief Executive Officer

Tyco International, Ltd.

PENTAIR & TYCO FLOW

7

TRANSACTION CONSIDERATION

• Implies total value for Tyco Flow of ~$4.9B*, before the benefit of synergies

- 52.5% ownership in the total merged company

- Pentair assumes $275M of Tyco’s net debt and $94M of minority interest

• Expected close at the end of September 2012, consistent with overall timing

of Tyco separation

of Tyco separation

• Tax efficient structure for Tyco and its shareholders

* Consideration based on PNR $40.26/share. Total value also includes value of net debt and minority interest.

** Tyco Flow financials calendarized to December. EBITDA excludes non-recurring items. 2012 “SpinCo” EBITDA includes ~$80M of total corporate standalone costs.

TYCO FLOW EBITDA**

IMPLIED EBITDA MULTIPLES

TEV = ~$4.9B*

2011

“Carve-Out”

Adj EBITDA

“Carve-Out”

Adj EBITDA

2012

“SpinCo”

“SpinCo”

Adj EBITDA

at 2012

“SpinCo”

“SpinCo”

Adj EBITDA

at 2011

“Carve-Out”

Adj EBITDA

“Carve-Out”

Adj EBITDA

$435M

~$515M

~11.3x

~9.5x

Immediate Value to Tyco Shareholders

Average

~10.4x

PENTAIR & TYCO FLOW

8

SIGNIFICANT BENEFITS TO TYCO SHAREHOLDERS

Combination Significantly More Compelling than Standalone

• Majority Ownership of the Highly Attractive Tyco Flow/Pentair

Combined Company

Combined Company

- Stronger, more attractive competitor than Tyco Flow on standalone basis

- Forms a premier global leader in flow, filtration & equipment solutions

- Greater exposure to higher growth geographies and end markets

• Participation in Considerable Value Creation Resulting From

the Combination

the Combination

- 52.5% ownership and enhanced multiple for Tyco Shareholders

- More than $1B in value on Day One on a combined basis

- Incremental $1.4B in value over next few years on a combined basis

• Combination with a Highly Complementary Strategic Partner

with Proven Track Record as a Public Company

with Proven Track Record as a Public Company

PENTAIR & TYCO FLOW

9

Randall J. Hogan

Chairman and

Chief Executive Officer

Chief Executive Officer

Pentair, Inc.

PENTAIR & TYCO FLOW

10

… A Powerful Combination

A Global Leader in Industrial

Valves and Controls

Valves and Controls

Strong Regional Leader in Water

and Environmental Solutions

and Environmental Solutions

A Global Leader in Industrial

Heat Management Solutions

Heat Management Solutions

Strong Lean/Six Sigma Journey

Strong Cash Flow Generation

Broad Global Reach

TWO GLOBAL LEADERS

Emerging Presence in Industrial

Fluid Processing Solutions

Fluid Processing Solutions

A Global Leader in Water Flow

and Filtration Applications

and Filtration Applications

A Global Leader in Equipment

Protection Solutions

Protection Solutions

Proven Operational Excellence

and Lean Discipline

and Lean Discipline

Strong Cash Flow Generation

Building Global Presence

STRENGTHENS FLUID

PROCESS SOLUTIONS

PROCESS SOLUTIONS

EXTENDS WATER

OFFERINGS

OFFERINGS

ADVANCES THERMAL

CAPABILITIES

CAPABILITIES

ENHANCES

GROWTH POTENTIAL

GROWTH POTENTIAL

PENTAIR & TYCO FLOW

11

STRONG STRATEGIC FIT

Complementary Capabilities to Best Serve Customers

PENTAIR

SALES BY SEGMENT

SALES BY SEGMENT

TYCO FLOW

SALES BY SEGMENT

SALES BY SEGMENT

COMBINED COMPANY SALES

2012 pro forma PROJECTED SALES ~$7.7B*

Water &

Fluid

Solutions,

~70%

Fluid

Solutions,

~70%

Technical

Products,

~30%

Products,

~30%

Valves &

Controls,

~60%

Controls,

~60%

Water &

Environ.,

~20%

Environ.,

~20%

Thermal

Controls,

~20%

Controls,

~20%

Projected 2012 Sales: ~$3.7B

Projected 2012 Sales: ~$4.0B*

Technical

Products,

~30%

Products,

~30%

EP

FC

W&F

Water &

Fluid

Solutions,

~45%

Fluid

Solutions,

~45%

Equipment

Protection

Solutions,

~25%

Protection

Solutions,

~25%

Flow

Control,

~30%

Control,

~30%

* Tyco Flow financials calendarized to December.

PENTAIR & TYCO FLOW

12

SERVING HIGHLY ATTRACTIVE GROWTH SECTORS

Driven By Strong Secular Growth Trends

• Increased Scale in Attractive Growth Sectors

• Sales Mix: Estimated 35% Project

DIVERSE VERTICALS

COMBINED 2012 pro forma PROJECTED SALES MIX

COMBINED 2012 pro forma PROJECTED SALES MIX

Industrial,

~35%

Energy,

~25%

Infrastructure,

~10%

~10%

Comm’l,

~10%

~10%

Industrial

ü Performance & Quality

ü Efficiency

ü Hazardous

Energy

ü Efficiency

ü Unconventional

ü Technology

Global Water

ü Scarcity

ü Regulation

ü Sustainability

Infrastructure

ü Aging

ü Capacity Needs

ü Urbanization

SECULAR TRENDS DRIVING DEMAND

Residential,

~20%

PENTAIR & TYCO FLOW

13

EXPANDED GLOBAL REACH

Fast Growth Regions ~25% of Combined Sales

~40%

US & CANADA

~35%

DEVELOPED

REST OF WORLD

REST OF WORLD

WORLDWIDE

>100 Manufacturing Facilities

>90 Service Centers

>30,000 Employees

ü Significant US Residential

Installed Base

Installed Base

ü US Industrial Sector

Strength

Strength

ü Continued Increase in

Demand for Oil and Gas,

Power

Demand for Oil and Gas,

Power

ü Broader Offering,

Recognized Brands, Plus

Service Centers in Large,

Fragmented Market

Recognized Brands, Plus

Service Centers in Large,

Fragmented Market

ü Rising GDP and

Urbanization Driving

Infrastructure, Energy

& Water Demands

Urbanization Driving

Infrastructure, Energy

& Water Demands

ü Robust Industrial Sector

ü Greater Scale in Fast

Growth Regions Across

All Businesses

Growth Regions Across

All Businesses

~25%

FAST GROWTH

REGIONS

REGIONS

PENTAIR & TYCO FLOW

14

POSITIONED TO SERVE THE “NEW” NEW WORLD

Presence, Breadth and Expertise to Serve “New” New World

Industrialization

Infrastructure

Resource Scarcity

Quality of Life

&

>4 Billion Reaching

Middle Class Globally

Middle Class Globally

Needs and Wants Are

Driving Demand

Driving Demand

Increasing Population and Wealth

of the “New” New World

of the “New” New World

Food

Infrastructure/Industry

(Transportation and Manufacturing)

(Transportation and Manufacturing)

Energy

PENTAIR & TYCO FLOW

15

VALUE CREATION ROADMAP

Clear Strategy, Focused Execution and Proven Framework

CLEAR VISION,

CONSISTENT STRATEGY

CONSISTENT STRATEGY

PERFORM AT A

HIGHER LEVEL

HIGHER LEVEL

EXECUTE OUR

PROVEN STRATEGY

PROVEN STRATEGY

LEVERAGE COMBINED

STRENGTHS

STRENGTHS

Focus on Key Value

Creation Metrics:

Creation Metrics:

- Organic Sales Growth +

Key Acquisitions

Key Acquisitions

- Op Margin Expansion

- Prioritized Growth

- Cash Flow > NI

- ROIC

Based on the Pentair

Integrated Management

System (PIMS)

Integrated Management

System (PIMS)

- Lean Enterprise

- Talent Process

- New Product

Development Roadmap

Development Roadmap

- Rapid Growth Process

Shared Vision and

“Win-Right” Culture

“Win-Right” Culture

Leverage Process and

Cash Flow Disciplines

Cash Flow Disciplines

Strong Customer-Centric

Business Models

Business Models

Clear, Simple, Global

Vision based on “New”

New World

Vision based on “New”

New World

Shareholder Value

Creation Has Always

Been Our #1 Goal

Creation Has Always

Been Our #1 Goal

NEW

PENTAIR & TYCO FLOW

16

• Both Companies’ Shareholders Expected to Benefit From Structure

– Tax-Free Distribution and Merger

• Immediate, Substantial Synergies Anticipated

– 1/3 of Synergies ‘Day One’ with One Corporate Structure + Greater Tax Efficiencies

– $250M Expected Annual Synergies by 2015 … Plus Revenue Synergies All Upside

• Focused Integration Planning Already Underway

– Structure, Sourcing & Standardization with Dedicated Resources

• Proven PIMS Framework and Experienced Management Team

– Maintained Op Expenses at <20% of Sales for Last 5 Years, while Consistently

Increasing R&D Investments and Resources

Increasing R&D Investments and Resources

– Customer-Centric, Market Focused Approach

SUBSTANTIAL VALUE-CREATION OPPORTUNITIES

Planning, Framework & Experience to Ensure Integration Success

PENTAIR & TYCO FLOW

17

INTEGRATION LEADERSHIP

Valves &

Controls

Controls

Thermal

Water &

Environ.

Environ.

Pentair

Dedicated Resources to Capture Synergistic Potential

Business

Process

Process

Sourcing/

Indirect

Indirect

Lean/RE

Logistics

Logistics

Finance/IT

Selling/

Marketing

Marketing

HR/

Culture

Culture

Legal/

Compliance

Compliance

Executive/

Board

Board

INTEGRATION TEAM

Reporting Directly to Chairman/CEO

Reporting Directly to Chairman/CEO

INTEGRATION LEADER

Program Management Office (PMO)

Integration Team Will Consist of

~25 - 40 Proven Leaders

~25 - 40 Proven Leaders

• Primary Focus on Structure,

Standardization, Indirect

Spend, Direct Materials and

On-Boarding

Standardization, Indirect

Spend, Direct Materials and

On-Boarding

• Function and Geographic

Region Focus

Region Focus

• Pentair + Tyco Flow

Leadership

Leadership

• Supported by PMO Office

• First 100 Days Plan Already

Underway

Underway

PENTAIR & TYCO FLOW

18

Safety, Quality, Delivery, Cost and Cash Focus

Attracting and Developing Top Talent

Prioritizing Investments & Innovation

Building Growth Capabilities

LEAN

ENTERPRISE

ENTERPRISE

PENTAIR INTEGRATED MANAGEMENT SYSTEM

Proven PIMS Framework To Drive Value

PENTAIR & TYCO FLOW

19

REVENUE SYNERGIES … FURTHER UPSIDE (NOT IN SYNERGY NUMBERS)

Tremendous Value Creation Potential

Oil & Gas

• Oil and Gas

Separation

Separation

• Protective

Enclosures

Enclosures

• Gas Recovery

• Dewatering ...

• Valves

• Heat Mgmt

• Sensing &

Controls

Controls

• Broad Service

Capabilities …

Capabilities …

• Water Supply &

Disposal

Disposal

• Water & Fluid

Separation

Separation

• Recycling &

Recovery …

Recovery …

• Transport &

Treatment

Treatment

• Automated

Valves/Control

Valves/Control

• Emission

Monitoring …

Monitoring …

Power

Water

Food & Bev.

1

2

3

4

A FEW CROSS-SELLING EXAMPLES

PENTAIR & TYCO FLOW

20

• More exposure to attractive markets

and customers

and customers

• Expected higher earnings and greater

end-market diversity in future

end-market diversity in future

• Stronger balance sheet with greater

financial flexibility

financial flexibility

• Ability to leverage PIMS across

larger enterprise

larger enterprise

• Tax-free merger with more efficient

structure going forward

structure going forward

A “WIN-WIN” COMBINATION

• Majority ownership of more attractive

company vs. standalone

company vs. standalone

• Expected higher earnings from the start

and more predictable earnings growth

and more predictable earnings growth

• Growing dividend at Pentair with 36

consecutive years of increases

consecutive years of increases

• SG&A leverage in corporate and

fast growth regions

fast growth regions

• Tax-free spin-off

PENTAIR SHAREHOLDERS

TYCO SHAREHOLDERS

Shareholder Value Creation is Our #1 Goal

PENTAIR & TYCO FLOW

21

John L. Stauch

Chief Financial Officer

Pentair, Inc.

PENTAIR & TYCO FLOW

22

FINANCIALLY COMPELLING

• Transaction Consideration ~$4.9B* ($4.5B in equity; $275M in net debt and $94M in minority interest assumed)

– ~8.8x Expected SpinCo Tyco Flow 2012 EBITDA**, plus Day 1 Cost Avoidance Synergy

– Favorable to Both Pentair’s and Tyco Flow’s Shareholders

• Expect Highly Accretive to Earnings … Adds Estimated $0.40 to 2013 EPS

– $200M in Anticipated Annual Cost Synergies … Expect Full Realization by Year 3

– Plus ~$50M in Expected Tax Synergies … Projected Ongoing Effective Tax Rate of ~24-26%

– Deleveraging of Balance Sheet Creates Incremental EPS Opportunity

• Expect ~$1.3B in Combined EBITDA in 2013

– Invest in High Growth Verticals and Return Cash to Shareholders

– Expected Deal ROIC >10% by Year 3, with Pentair ROIC ~13%

• Proven Management Team … Leading Processes

– Strong Track Record with PIMS, Lean and Significant Cost Reduction Programs

– Focused Integration Planning and Strategy

Unique Opportunity to Create Significant Shareholder Value

* Consideration based on PNR $40.26/share. Total value also includes value of net debt and minority interest.

** Tyco Flow financials calendarized to December. EBITDA excludes non-recurring items. 2012 “SpinCo” EBITDA includes ~$80M of total corporate standalone costs.

PENTAIR & TYCO FLOW

23

TRANSACTION CONSIDERATION

2012

“SpinCo”

Adj EBITDA

“SpinCo”

Adj EBITDA

~$515M

~$555M

at 2012

“SpinCo”

+ “Day 1” Cost

Avoidance

Avoidance

• Tyco Ownership in Combined Co. = 52.5%

PNR Ownership in Combined Co. = 47.5%

PNR Ownership in Combined Co. = 47.5%

• Tyco Flow Net Debt = $275M

• Tyco Flow Minority Interest = $94M

• Tyco Flow Total Enterprise Value = ~$4.9B*

~8.8x

• Tyco Flow Segment EBITDA Margin ~15%+

• Corporate Cost Adds Estimated at ~$80M or

~2% of Net Sales, Including Standalone

Public Company Costs

~2% of Net Sales, Including Standalone

Public Company Costs

Day 1 Value Locked + Synergies and Enhanced Growth Potential

IMPLIED EBITDA MULTIPLES

TEV = ~$4.9B*

TEV = ~$4.9B*

TYCO FLOW EBITDA**

~9.5x

at 2012

“SpinCo”

“SpinCo”

2012

“SpinCo”

“SpinCo”

Adj EBITDA

Includes

~$80M

Standalone

Corp Costs

~$80M

Standalone

Corp Costs

Includes

~$80M

Standalone

Corp Costs

~$80M

Standalone

Corp Costs

* Consideration based on PNR $40.26/share. Total value also includes value of net debt and minority interest.

** Tyco Flow financials calendarized to December. EBITDA excludes non-recurring items. 2012 “SpinCo” EBITDA includes ~$80M of total corporate standalone costs.

Plus Day 1

Cost

Avoidance

Synergy

Cost

Avoidance

Synergy

Plus Day 1

Cost

Avoidance

Synergy

Cost

Avoidance

Synergy

Average

~9.2x

PENTAIR & TYCO FLOW

24

• Operating/G&A Cost Synergies: ~$160M

– Direct/Indirect Sourcing Opportunities

– Lean/PIMS in Factories: Deploy in Tyco Flow

– IT/Finance/HR Standardization

– Management and Regional Business Integration

• ‘Day One’ Cost Avoidance: ~$40M

– ~$80M Public Company Corporate Cost Avoidance,

Net of ~$40M Integration/Corporate Investments

Net of ~$40M Integration/Corporate Investments

• ‘Day One’ Tax Synergies: ~$50M

(Below the Operating Line)

(Below the Operating Line)

– Expect Annualized Tax Rate of ~24-26% (vs. current PNR ~29%)

• Revenue Synergies … All Upside Potential

– Cross-Selling of Channels, Verticals, Products and Services

– Not Assumed in Accretion and Cash Flow Forecasts

VALUE CREATION POTENTIAL

~$250M

Corp Cost

Avoidance

Avoidance

Tax

Synergies

Synergies

Cost

Synergies

Synergies

~$1B in Value Day 1 from Corp Cost Avoidance + Taxes

RUN-RATE SYNERGY ESTIMATE

Estimated One Time Costs of $230M

(~1/3 is Non-Cash Inventory Step-Up Costs)

~$200M of

Operational

Synergies

pre-tax

Operational

Synergies

pre-tax

ANTICIPATED PRE-TAX SYNERGIES

PENTAIR & TYCO FLOW

25

• Direct/Indirect Sourcing

– Benefit from Global Procurement and Indirect

Sourcing Capabilities

Sourcing Capabilities

– Leverage Company-Wide Standard Vendor Lists

– Insource/Resource Common Buys

• Operations / Lean

– PIMS Works … Proven Processes Utilizing

Standard Work and Cultural Influence

Standard Work and Cultural Influence

• Global Structure … Significant Opportunity

– Drive to Standard Systems and Processes in

IT/Finance/HR to Reduce G&A

IT/Finance/HR to Reduce G&A

– Integrate and Leverage Regional Sales and Service

Locations … Focus in Fast Growth Regions

Locations … Focus in Fast Growth Regions

– Pentair G&A ~7.5% of Sales …

Tyco Flow “SpinCo” >10.5%

Tyco Flow “SpinCo” >10.5%

– No Reductions in R&D

COST SYNERGY DRIVERS

Expected Annual Synergies of ~$250M by 2015

2013

2014

2015

~$140M

~$200M

~$250M

Direct/

Indirect

Sourcing

Sourcing

Ops/

Lean

Lean

Global

Structure:

G&A,

Selling/

Mkting

Structure:

G&A,

Selling/

Mkting

EXPECTED SYNERGIES

Tax

Synergies

Synergies

Tax

Synergies

Synergies

Tax

Synergies

Synergies

~$90M

~$150M

Operational

Cost

Synergies

Cost

Synergies

Operational

Cost

Synergies

Cost

Synergies

~$200M

Operational

Cost

Synergies

Cost

Synergies

PENTAIR & TYCO FLOW

26

STRONG CASH FLOW GENERATION

2012

EBITDA

EBITDA

EBITDA

with Synergies + Growth

with Synergies + Growth

~$1.1B

~$1.3B

Expected

Debt/

EBITDA

EBITDA

• Target Solid Investment

Grade Rating

Grade Rating

• Committed to Dividend Growth

(36 Straight Years of Increases)

(36 Straight Years of Increases)

– Expect Annual Dividend to Equal

$0.88/Share at Start

$0.88/Share at Start

• Invest in High Return, Growth

Platforms, both Organic and M&A

Platforms, both Organic and M&A

• Projected Cash to be Returned to

Shareholders Through Share

Buybacks and Dividends (~$1.8B over

3 years estimated, in projections)

Shareholders Through Share

Buybacks and Dividends (~$1.8B over

3 years estimated, in projections)

Cash Flow Discipline and Enhanced Financial Strength

Yr 1 Cost

Synergies

+ Growth

Synergies

+ Growth

• Combined Annualized D&A of ~$285M in 2013

(includes estimated Deal Amortization of ~$90M)

(includes estimated Deal Amortization of ~$90M)

CAPITAL ALLOCATION

OF COMBINED COMPANY

PRO FORMA EBITDA PROJECTION

OF COMBINED COMPANY

OF COMBINED COMPANY

~$1.7B

2013

2015

~1.6x

~1.3x

~1.0x

PENTAIR & TYCO FLOW

27

A Great Industrial Combination … A Stronger Pentair

EXCITING VALUE CREATION POTENTIAL

• Expect Long Term Sales Growth of ~5 to 7%

• Enriched Mix of Businesses, Verticals and Geographies

• Opportunity to Deploy Capital Structure to Drive Growth

in Platforms and Return Cash to Shareholders

in Platforms and Return Cash to Shareholders

• Expect Full Year Run-Rate of Cost Synergies by 2015

• Estimated One-Time Costs Related to Transaction

• ~1/3 Transaction Costs (Yr 1); ~1/3 Restructuring & Other

(over 3 Yrs); ~1/3 Non-cash Inventory Step-up Costs (Yr 1)

(over 3 Yrs); ~1/3 Non-cash Inventory Step-up Costs (Yr 1)

• Combined Increased Earnings Power

• Balance Sheet Flexibility to Fuel Additional Growth

>$8B

~$1.3B

~$0.40

2013 Revenue

2013 EBITDA

2013 Adjusted

EPS Accretion

EPS Accretion

Estimated

Combined

Combined

Combined

Combined

One-Time

Costs

Costs

~$230M

pre-tax

pre-tax

PENTAIR & TYCO FLOW

28

Randall J. Hogan

Chairman and

Chief Executive Officer

Chief Executive Officer

Pentair, Inc.

PENTAIR & TYCO FLOW

29

• Mega Trends in Favor of

Combination

Combination

• Complementary

Extension of Product

Offerings & Solutions

Extension of Product

Offerings & Solutions

More Scale, More Global and More Diverse

• Broader Global Reach

• Fast Growth Region

Sales ~25%

Sales ~25%

• Global Service and

Sales Coverage

Sales Coverage

• Increased Scale in High

Growth Applications

Growth Applications

• Enhanced Product

Offerings and Solutions

Offerings and Solutions

• Diverse Customer Base

US and

Canada,

~40%

Canada,

~40%

Fast Growth

Regions,

Regions,

~25%

Western

Europe,

~20%

Europe,

~20%

COMBINED PENTAIR AND TYCO FLOW

Equipment

Protection

Solutions,

Protection

Solutions,

~25%

Flow Control,

~30%

Water &

Fluid

Solutions,

Fluid

Solutions,

~45%

BY APPLICATION

COMBINED 2012 pro forma PROJECTED SALES MIX

COMBINED 2012 pro forma PROJECTED SALES MIX

BY PLATFORM

COMBINED 2012 pro forma PROJECTED SALES MIX

BY GEOGRAPHY

COMBINED 2012 pro forma PROJECTED SALES MIX

COMBINED 2012 pro forma PROJECTED SALES MIX

Energy,

~25%

Infrastructure,

~10%

~10%

Comm’l,

~10%

~10%

Residential,

~20%

Industrial,

~35%

~35%

Developed

Non-US,

Non-US,

~15%

PENTAIR & TYCO FLOW

30

IN SUMMARY

Earnings Power >$5.00 Expected by 2015

• Two Global Industrial Leaders

- Strong Alignment with Mega Trends

- Positive 2012 and Beyond Outlook for Both Companies

• Combined Strengths = Unique Value Creation Potential

- $7.7B* Global Industrial Leader Serving High Growth, Attractive Markets

- Leading Company with Strong Filtration + Flow + Valves Platforms

• Expected Highly Accretive to Earnings and Future Growth

- Day One Winning Combination for Pentair and Tyco Shareholders

- Substantial Cost Synergies and Long-term Value Creation Opportunities

- Strong Balance Sheet and Cash Flow to Support Growth and

Cash Returned to Shareholders

Cash Returned to Shareholders

* Combined 2012 pro forma projected revenues. Tyco Flow financials calendarized to December.

PENTAIR & TYCO FLOW

31

Appendix

PENTAIR & TYCO FLOW

32

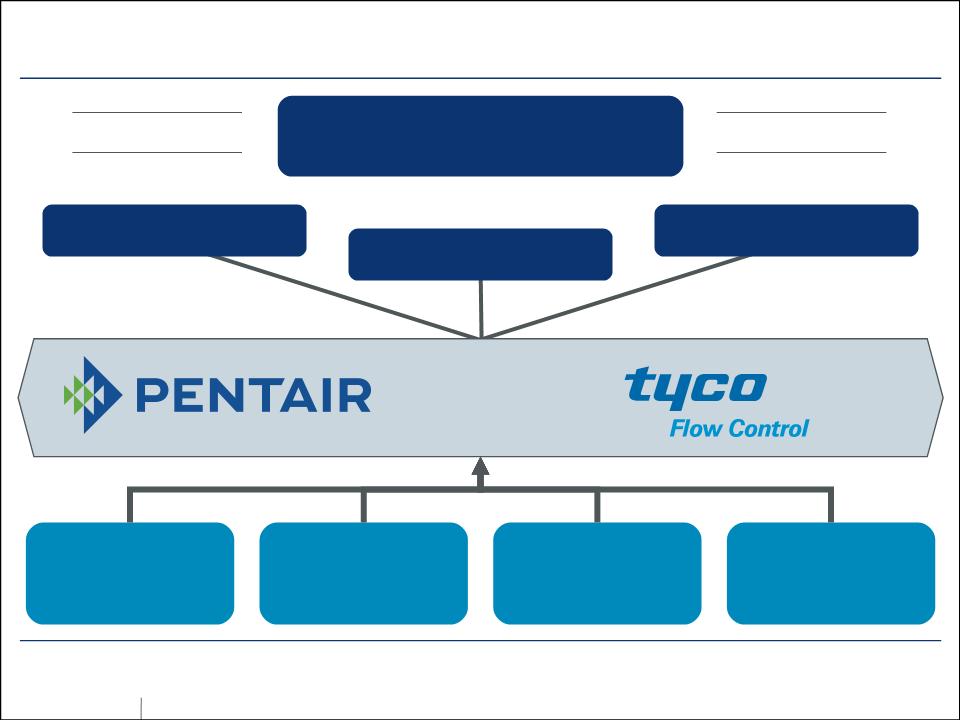

TRANSACTION STRUCTURE

Pentair

Shareholders

Shareholders

Tyco Shareholders

“New Pentair”

Newly Merged

Pentair/Tyco Flow Control

Pentair/Tyco Flow Control

~52.5%

Ownership

~47.5%

Ownership

• “Reverse Morris Trust” allows for a tax-free distribution of Tyco

Flow Control equity under US and Swiss law

Flow Control equity under US and Swiss law

• Transaction is tax-free to both Tyco and Pentair shareholders

• Newly combined company retains Switzerland domicile

• Retain Pentair Name

• NYSE Listing and

PNR Ticker Remains

PNR Ticker Remains

RMT Structure Enhances Value Creation Opportunities

“REVERSE MORRIS TRUST” TRANSACTION

POST-CLOSING

Tyco

Tyco

Shareholders

Shareholders

Other Tyco

Businesses

Businesses

Tyco Flow Control

Pentair

Tax-free

spin-off

spin-off

Merge

$275M net debt

pushdown

pushdown

Step 1

Step 2

Tyco Flow Control

(Changes name to Pentair)

(Changes name to Pentair)

Tyco

Shareholders

Shareholders

Pentair

Shareholders

Shareholders

Tyco

Shareholders

Shareholders

PENTAIR & TYCO FLOW

33

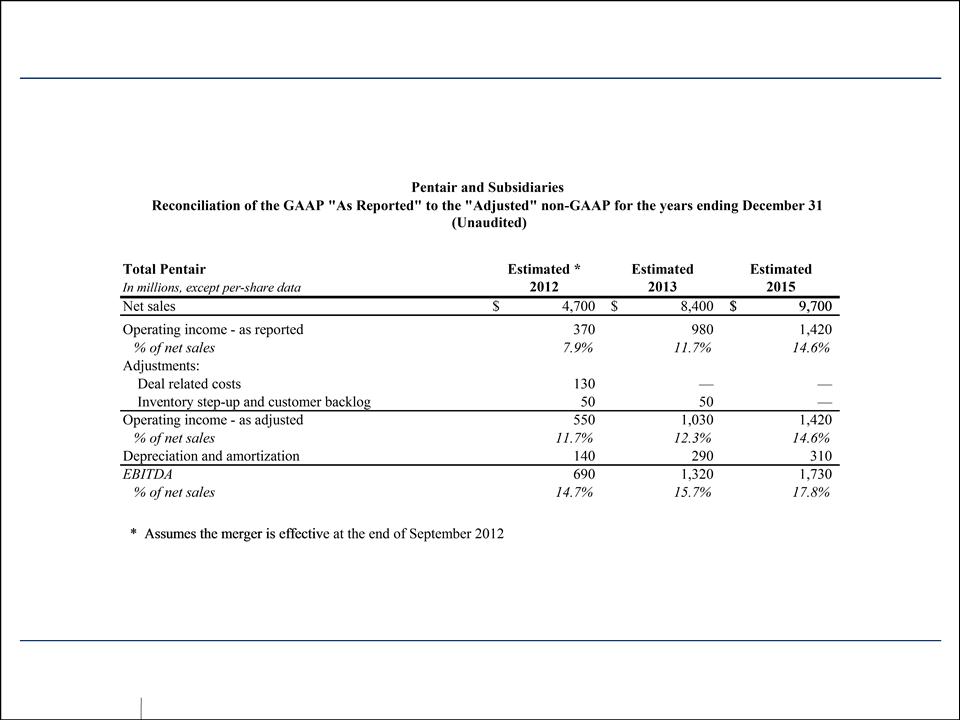

GAAP TO NON-GAAP RECONCILIATION

PENTAIR & TYCO FLOW

34

GAAP TO NON-GAAP RECONCILIATION

The table above sets forth a summary of certain combined financial data of the flow control business of Tyco

International Ltd. ("Flow Control"). The historical selected combined financial data have been prepared to include

all of Tyco’s flow control business, and are a combination of the assets and liabilities that have been used in

managing and operating this business. The historical combined financial data may not be indicative of Flow

Control's future performance and do not necessarily reflect what Flow Control's financial condition and results of

operations would have been had it operated as an independent entity during the periods presented.

International Ltd. ("Flow Control"). The historical selected combined financial data have been prepared to include

all of Tyco’s flow control business, and are a combination of the assets and liabilities that have been used in

managing and operating this business. The historical combined financial data may not be indicative of Flow

Control's future performance and do not necessarily reflect what Flow Control's financial condition and results of

operations would have been had it operated as an independent entity during the periods presented.