Attached files

| file | filename |

|---|---|

| EX-10.7 - EXHIBIT 10.7 - ENDOCYTE INC | d316117dex107.htm |

| EX-32.1 - EXHIBIT 32.1 - ENDOCYTE INC | d316117dex321.htm |

| EX-10.9 - EXHIBIT 10.9 - ENDOCYTE INC | d316117dex109.htm |

| EX-23.1 - EXHIBIT 23.1 - ENDOCYTE INC | d316117dex231.htm |

| EX-31.1 - EXHIBIT 31.1 - ENDOCYTE INC | d316117dex311.htm |

| EX-31.2 - EXHIBIT 31.2 - ENDOCYTE INC | d316117dex312.htm |

| EXCEL - IDEA: XBRL DOCUMENT - ENDOCYTE INC | Financial_Report.xls |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2011 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file number 001-35050

ENDOCYTE, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 35-1969-140 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 3000 Kent Avenue, Suite A1-100 West Lafayette, IN 47906 | ||

| (Address of Registrant’s principal executive offices) | ||

Registrant’s telephone number, including area code: (765) 463-7175

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $.001 par value | NASDAQ Global Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes þ No

The aggregate market value of the registrant’s common stock, $0.001 par value per share, held by non-affiliates of the registrant, based upon the closing price of the Common Stock on the Nasdaq Global Market on June 30, 2011, was approximately $323.5 million (excludes shares of the registrant’s common stock held as of such date by officers, directors and stockholders that the registrant has concluded are or were affiliates of the registrant, exclusion of such shares should not be construed to indicate that the holder of any such shares possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.)

Number of shares of the registrant’s Common Stock, $0.001 par value, outstanding on March 1, 2012: 35,793,078

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to stockholders in connection with the 2012 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

ENDOCYTE, INC

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2011

INDEX

This annual report contains certain statements that are forward-looking statements within the meaning of federal securities laws. When used in this report, the words “may,” “will,” “should,” “could,” “would,” “anticipate,” “estimate,” “expect,” “plan,” “believe,” “predict,” “potential,” “project,” “target,” “forecast,” “intend” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include the important risks and uncertainties that may affect our future operations that we describe in Part I, Item 1A — Risk Factors of this report, including, but not limited to, statements regarding the progress and timing of clinical trials, the safety and efficacy of our product candidates, the goals of our development activities, estimates of the potential markets for our product candidates, estimates of the capacity of manufacturing and other facilities to support our product candidates, projected cash needs and our expected future revenues, operations and expenditures. Readers of this report are cautioned not to place undue reliance on these forward-looking statements. While we believe the assumptions on which the forward-looking statements are based are reasonable, there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this report.

| Page | ||||||

| PART I | ||||||

| ITEM 1. | 1 | |||||

| ITEM 1A. | 39 | |||||

| ITEM 1B. | 59 | |||||

| ITEM 2. | 59 | |||||

| ITEM 3. | 60 | |||||

| ITEM 4. | 60 | |||||

| PART II | ||||||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 60 | ||||

| ITEM 6. | 62 | |||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 64 | ||||

| ITEM 8. | 78 | |||||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 102 | ||||

| ITEM 9A. | 102 | |||||

| ITEM 9B. | 102 | |||||

| PART III | ||||||

| ITEM 10. | 103 | |||||

| ITEM 11. | 103 | |||||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 103 | ||||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 104 | ||||

| ITEM 14. | 104 | |||||

| PART IV | ||||||

| ITEM 15. | 105 | |||||

| SIGNATURES | 106 | |||||

| EXHIBIT INDEX | 107 | |||||

| Item | 1. Business |

Overview

We are a biopharmaceutical company developing targeted therapies for the treatment of cancer and inflammatory diseases. We use our proprietary technology to create novel small molecule drug conjugates, or SMDCs, and companion imaging diagnostics. Our SMDCs actively target receptors that are over-expressed on diseased cells, relative to healthy cells. This targeted approach is designed to enable the treatment of patients with highly active drugs at greater doses, delivered more frequently, and over longer periods of time than would be possible with the untargeted drug alone. We are also developing companion imaging diagnostics for each of our SMDCs that are designed to identify the patients whose disease over-expresses the target of the therapy and who are therefore more likely to benefit from treatment. This combination of an SMDC with its companion imaging diagnostic is designed to personalize the treatment of patients by delivering effective therapy, selectively to diseased cells, in the patients most likely to benefit.

Our lead SMDC, EC145, targets the folate receptor, which is frequently over-expressed in some of the most prevalent, and difficult to treat solid tumor indications. We identify the presence of the folate receptor in cancer patients by using EC20, our proprietary companion imaging diagnostic for EC145. We have chosen platinum-resistant ovarian cancer, or PROC, a highly treatment-resistant disease, as our lead indication for development of EC145 because of the high unmet need in treating this patient population and the high percentage of ovarian cancer patients whose tumors over-express the targeted folate receptor. In the final progression free survival, or PFS, analysis of PRECEDENT, our randomized phase 2 clinical trial in women with PROC, EC145 increased PFS from a median of 2.7 months to a median of 5.0 months, representing an 85 percent improvement over standard therapy (p=0.031). We studied a subset of patients in which 100 percent of their target lesions over-expressed the folate receptor as determined by an EC20 scan, patients which we refer to as FR(++). We treated these FR(++) patients with a combination of EC145 and pegylated liposomal doxorubicin, or PLD (marketed in the U.S. under the brand name Doxil), and observed a median PFS of 5.5 months compared to a median of 1.5 months for patients receiving PLD alone, an improvement of over 260 percent. The hazard ratio was 0.381 (p=0.018), or a reduction in the risk of progression of 61.9 percent.

In December 2011, we announced the results of supplemental analyses we had conducted of the PRECEDENT trial data. We believe these findings continue to support the robustness of the PRECEDENT trial results, particularity in the group of FR (++) patients. The primary endpoint of the open-label PRECEDENT trial was PFS based on investigator assessment. Sensitivity analyses demonstrated these results were robust when adjusted for a variety of potential imbalances (e.g., demographic, prognostic, etc.). The assessments made by the blinded independent review committee, or IRC, shared a high level of agreement with investigator assessments, confirming investigator-assessed progression for 74 percent of all patients. In addition, the metrics designed to identify an investigator's potential bias to delay assessed progressions for patients in the EC145 study arm or to accelerate assessed progressions in the PLD control arm did not reveal such a bias. The IRC results also correlate with the mechanism of action, reflecting greater reduction in the risk of progression with increasing presence of folate receptor. In FR(++) patients, the IRC reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.465 suggests a reduction in risk of progression in the EC145 study arm of 53 percent (p=0.0498). In the FR(+) patient population, which includes the FR(++) subgroup, the IRC also reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.652 was not statistically significant in this broader group.

The results of the supplemental analyses also confirmed the reliability of our companion imaging diagnostic EC20 to select targeted patients. In order to confirm the reliability of EC20 to select these patients, independent readers evaluated EC20 images from the PRECEDENT trial to measure the agreement rate between readers. The evaluation resulted in an 87 percent agreement rate in selecting patients with at least one tumor positive for the

folate-receptor, FR(+), and an 85 percent agreement rate for patients with all folate-receptor positive tumors, FR(++). These rates of agreement compare favorably to internal standards established for this evaluation. In addition, intra-reader agreement was measured. This is an assessment of the consistency of the same reader to select patients when reviewing images at different times. Intra-reader rates were 90 percent and 95 percent for the independent readers in selecting FR(+) patients and 95 percent and 100 percent in selecting FR(++) patients. These rates of agreement also compare favorably to internal standards established for this evaluation.

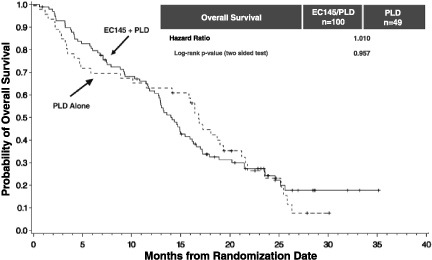

The PRECEDENT trial was not statistically powered to show a survival advantage and the results did not indicate a trend toward benefit in either arm. The hazard ratio was 1.010 for the intent-to-treat population and 1.097 for the FR(++) population. On an adjusted basis, which accounts for potential differences in demographics and prognostic factors, the overall survival hazard ratio was 0.864 in the intent-to-treat population and 0.481 in the FR(++) group, although these result were not statistically significant.

We are preparing applications for conditional marketing authorization to be filed with the European Medicines Agency, or EMA, for our lead drug candidate EC145 for the treatment of PROC and its companion imaging diagnostic EC20 for patient selection. The marketing authorization applications will be supported by four clinical studies: a Phase 1 study in solid tumors, two single-agent, single-arm Phase 2 studies in ovarian cancer and non small cell lung cancer, and the PRECEDENT trial, a randomized study in PROC. This plan was based on consultation with the EMA, including a meeting with the Scientific Advice Working Party and written advice from the Committee for Medicinal Products for Human Use, or CHMP. Discussions with European Health Authorities about the contents of the marketing applications occurred both before and after the supplemental analyses were finalized. We plan to seek conditional marketing authorization for treatment of patients with folate receptor positive PROC as selected by EC20. EC145 and EC20 have also both been granted orphan drug status for ovarian cancer by the European Commission, which provides ten years of marketing exclusivity of the product candidate if approved for marketing for the designated orphan indication in the European Union, or EU, and makes us eligible for protocol assistance and other benefits in connection with the application process. We expect to file both applications in the third quarter of 2012.

We began enrolling patients in PROCEED, our phase 3 registration trial for EC145 and EC20, in May 2011 but enrollment stopped later in the year due to global shortages of PLD. In March 2012, we announced that the U.S. Food and Drug Administration, or FDA, approved our plans to import our supply of PLD from Europe into the U.S. for use in this trial and we plan to resume enrollment in the U.S. PROCEED is a randomized, double-blinded trial of EC145 in combination with PLD compared to PLD plus placebo. The patient population, those with PROC, will be the same as in the PRECEDENT trial, and the primary endpoint will be PFS in patients selected by EC20 as folate receptor positive in all tumors, FR(++). The secondary endpoint will be overall survival, or OS, in this same population. Projected enrollment of FR(++) patients is more than 200. Based on feedback from EU health authorities and the FDA, we are evaluating the inclusion of additional patients for exploratory analysis in order to assess potential benefit in patients with less than all of their target tumors positive for the folate receptor. While those plans are being finalized, patients will be enrolled regardless of the FR status, although the primary endpoint will include only FR(++) patients. The trial will be conducted in approximately 150 sites in the United States, Canada, Europe and Asia. We expect final primary PFS data from this study in the first half of 2014.

We are also developing EC145 for use in non-small cell lung cancer, or NSCLC, where we have completed a phase 2 single-arm clinical trial in heavily pre-treated patients and observed a disease control rate, or DCR, of 57 percent at the eight week assessment in patients whose target tumors were all identified as over-expressing the folate receptor. This compares to historical DCRs ranging from 21 to 30 percent reported in other trials of approved therapies in less heavily pre-treated patients. In a subset of FR(++) patients who had received three or fewer prior therapies, the DCR was 70 percent. We also evaluated OS in FR(++) patients (n=14) compared to patients in which at least one of the target lesions, but not all, over-expressed the folate receptor, which patients we refer to as FR(+) (n=14). Median OS improved from 3.4 months for FR(+) patients to 10.9 months for FR(++) patients. The hazard ratio was 0.539, meaning FR(++) patients were 46.1 percent less likely to die when compared to FR(+) patients when receiving EC145 (p=0.209).

2

Based on results of our single-arm, single agent phase 2 clinical trial of EC145 in patients with heavily pre-treated NSCLC, we plan to begin enrollment in a randomized phase 2 trial in the second quarter of 2012. The trial is designed to enroll up to 200 patients with adenocarcinoma of the lung who have failed one prior line of therapy. Patients will be selected based on EC20 scan results and only FR(++) patients will be included. The trial design is intended to evaluate the safety and efficacy of EC145 in second line NSCLC as a single agent and in combination with docetaxel, an FDA approved and commonly used second line chemotherapy. The study will have three arms: docetaxel alone; EC145 alone; and EC145 plus docetaxel. The primary outcome measure will be PFS with secondary measures of OS, tumor response and duration of response. Final PFS data is expected to be available by early 2014.

Our imaging studies with our lead companion imaging diagnostic, EC20, and the analysis of tumor biopsies, have shown that the folate receptor is also over-expressed in a broad range of other solid tumors, including non-small cell lung, breast, colorectal, kidney, endometrial and other cancers. We are using companion imaging diagnostics that target the folate receptor and other target receptors, including prostate-specific membrane antigen, or PSMA, to guide future development of our SMDCs in other oncology indications and inflammatory diseases.

We currently have no commercial products and we have not received regulatory approval for, nor have we generated commercial revenue from, any of our product candidates.

Our Strategy

Our strategy is to develop and commercialize SMDCs to treat patients who suffer from a variety of cancers and inflammatory diseases that are not well addressed by currently available therapies. The critical components of our business strategy are to:

| • | Obtain marketing approval of our lead SMDC, EC145, for use in women with PROC. We plan to submit applications to the EMA for conditional marketing authorization of EC145 and EC20 in Europe in the third quarter of 2012. In addition, in May 2011 we initiated a randomized, controlled, double-blinded phase 3 registration trial, PROCEED, for the use of EC145 to treat women with PROC. Enrollment stopped later in the year due to global shortages of PLD, however, we announced in March 2012 that the FDA approved our plans to import our supply of PLD from Europe into the U.S. for use in this trial and we plan to resume enrollment in the U.S. If successful, we plan to submit the results of the PROCEED trial, supported by the results of a Phase 1 study in solid tumors, two single-agent, single-arm Phase 2 studies in ovarian cancer and non small cell lung cancer, and the PRECEDENT trial to the FDA as the basis for our application for marketing approval in the U.S. |

| • | Expand use of EC145 to other indications. We are also developing EC145 for the treatment of NSCLC, and plan to conduct a controlled, randomized, phase 2 trial of EC145 in patients with folate receptor positive second line NSCLC. In this trial, we will use EC20 to select and enroll patients whose cancer over-expresses the folate receptor and who we believe are therefore more likely to respond to EC145. Folate receptors are over-expressed on a wide variety of tumors, including breast, colorectal, kidney, endometrial and other cancers. We estimate, based on worldwide cancer incidence rates, our own imaging studies and analysis of tumor biopsies that there are over one million newly diagnosed cancer patients per year in the United States, Europe and Japan whose tumors over-express the folate receptor. We intend to use EC20 to identify additional cancer indications for EC145 and to identify individual patients within each cancer indication who may be most suitable for treatment. |

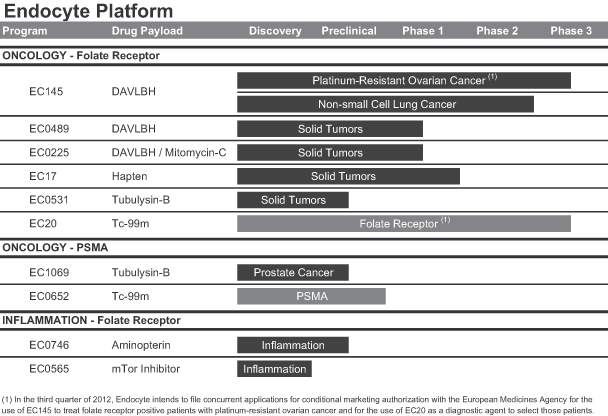

| • | Build a pipeline of SMDCs by leveraging our technology platform. We believe that the modular approach of our technology platform will allow us to quickly and efficiently expand our pipeline of SMDC candidates featuring various combinations of our targeting ligands, linker systems and drug payloads. We currently have four SMDCs and two companion imaging diagnostics in clinical development. |

3

| • | Develop companion imaging diagnostics for each of our therapies. We believe there is a significant opportunity to create targeted therapies where individual patients are selected based upon the use of non-invasive imaging diagnostic tools. Our companion imaging diagnostics may lower the risk of development of our SMDCs by allowing us to select for our clinical trials only those patients whose disease over-expresses the receptor targeted by our SMDCs. This benefit may, upon regulatory approval, extend to clinical practice by giving physicians the information they need to prescribe our SMDCs to patients who are most likely to respond to our therapy. |

| • | Build commercial capabilities and partner to maximize the value of our SMDCs. To date, we have retained all worldwide commercial rights to our SMDCs. We intend to commercialize our oncology SMDCs in the United States through our own focused sales force that we would build in connection with such commercialization efforts, or by co-promoting these SMDCs in collaboration with one or more larger pharmaceutical companies that have established capabilities in commercializing cancer therapies. Outside of the United States, we will consider partnering with established international pharmaceutical companies to maximize the value of our pipeline. In the large inflammatory disease markets, we currently expect to out-license our SMDCs in order to mitigate their higher costs of development and commercialization. |

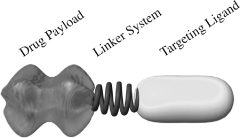

Our Technology Platform

Our technology platform has enabled us to develop multiple new SMDCs for a range of disease indications. Each SMDC is comprised of three modules: a targeting ligand, a linker and a drug payload. Our companion imaging diagnostics employ the same modular structure as our SMDCs replacing the drug payload with an imaging agent.

Targeting Ligand. Our technology is founded on our high-affinity small molecule ligands that bind to over-expressed receptors on target cells, while largely avoiding healthy cells. We are developing a number of targeting ligands to address a broad range of cancers and inflammatory diseases.

Linker System. Our linker system attaches the targeting ligand to the drug payload or imaging agent. It is designed to be stable in the bloodstream, and to release the active drug from the targeting ligand when the SMDC is taken up by the diseased cell. The linker system can be customized for each SMDC and each companion imaging diagnostic to improve its pharmacologic properties.

Drug Payload. This module is the biologically active component of our SMDCs. The majority of our drug payloads are highly active molecules that are too toxic to be administered in their untargeted forms at therapeutic dose levels. We are using drug payloads in our SMDCs that were shown in our in vitro preclinical studies to be between 10,000 and 100,000 times more potent than traditional cancer cell-killing drugs such as cisplatin.

With our modular approach, we use a variety of different targeting ligands, linker systems and drug payloads to create a pipeline of novel SMDC candidates for clinical development. For example, our PSMA targeting technology uses a targeting ligand that specifically binds to a receptor over-expressed on the surface of prostate cancer cells. We have developed alternative linker systems that modulate the pharmacologic and biodistribution properties of our SMDCs. In addition, we have developed a linker system that allows us to

4

conjugate multiple drug payloads to a single targeting ligand, thus offering the potential to simultaneously disrupt multiple pathways within cancer cells, forming a novel strategy for addressing drug resistance. We can also attach a wide variety of different drug payloads to our targeting ligands to address different disease indications. For example, we have SMDCs in preclinical development which incorporate proven anti-cancer and anti-inflammatory drug classes, such as microtubule destabilizers, DNA alkylators, proteasome inhibitors and mTOR inhibitors.

We own or have rights to 78 issued patents and 188 patent applications worldwide covering our core technology, SMDCs and companion imaging diagnostics. Our U.S. patent covering our core technology and our lead SMDC, EC145, expires in 2026, and our U.S. patents covering the EC145 companion imaging diagnostic, EC20, expire in 2024. In 2012, the United States Patent and Trademark Office awarded us a patent with claims specifically directed to EC145 entitled “Vitamin Receptor Binding Drug Delivery Conjugates”.

Companion Imaging Diagnostics

Our technology allows us to create companion imaging diagnostics intended for use with each of our SMDCs. To create our companion imaging diagnostics, we replace the drug payload of the SMDC with an imaging agent that is easily seen with widely available nuclear imaging equipment. Because the targeting ligand found on the companion imaging diagnostic is identical to that found on the therapeutic SMDC, our companion imaging diagnostics allow us to obtain full-body real-time images of tumors that over-express the target for that particular SMDC. This is accomplished without requiring an invasive tissue biopsy or reliance on archived tissue samples.

The information provided by our companion imaging diagnostics is used throughout the development of every new SMDC. In both preclinical and clinical trials, a companion imaging diagnostic is used to validate targeting of our SMDC to specific tissues and cells. These companion imaging diagnostics also allow for the screening of large patient populations to select diseases where a high percentage of the patient population have tumors or diseased cells that over-express the molecular target. These companion imaging diagnostics may also enable us to expand the use of our SMDCs to cancer indications where the percentage of patients who over-express a given receptor target of interest may be relatively low. Upon regulatory approval, we believe companion imaging diagnostics, such as EC20, will help to identify patients who will most likely benefit from treatment with our SMDCs. As a result, use of our companion imaging diagnostics may broaden the commercial use of our SMDCs. In our phase 2 single-arm and phase 2 randomized PRECEDENT clinical trials with EC145, we have seen correlations between favorable therapeutic outcomes and uptake of our companion imaging diagnostic, and, through supplemental analyses of the data, were able to validate with high rates of agreement through independent readers.

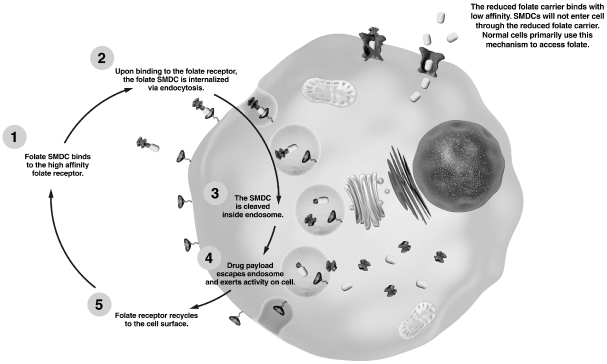

Lead SMDC Candidate (EC145)

Our lead SMDC candidate, EC145, consists of a highly cytotoxic anti-cancer drug, DAVLBH, joined by a linker system to the targeting ligand, folate. DAVLBH is a member of a class of proven anti-cancer drugs that destabilize microtubules within the cell, leading to cell death. As folate is required for cell division, many rapidly dividing cancer cell types have been found to over-express high-affinity folate receptors. In clinical trials using our companion imaging diagnostic, EC20, we found that ovarian, non-small cell lung, breast, colorectal, kidney, endometrial and other cancers over-express folate receptors. EC145 binds to these folate receptors on cancer cells with high-affinity and is internalized through a process known as endocytosis. Once EC145 is inside the cell, the linker system is cleaved, releasing the active drug payload within the cancer cell.

Advanced Clinical Trials

We have completed final PFS analysis for PRECEDENT, our randomized phase 2 clinical trial of 149 women with PROC. PRECEDENT is a randomized, controlled clinical trial in which patients received EC145 in combination with PLD, versus PLD alone. PLD is a current standard of care for PROC. The primary endpoint of

5

the trial is PFS which refers to the period of time that begins when a patient enters the clinical trial and ends when either the patient dies, or the patient’s cancer has grown by a RECIST-specified percentage or has spread to a new location in the body. RECIST refers to the response evaluation criteria in solid tumors, a set of published rules that define when the patients’ disease shrinks, remains stable, or progresses. Historically, PROC has proven difficult to treat, and no approved therapy has extended either PFS or OS in a randomized clinical trial. OS refers to the period of time that begins when a patient enters the clinical trial and ends when the patient dies.

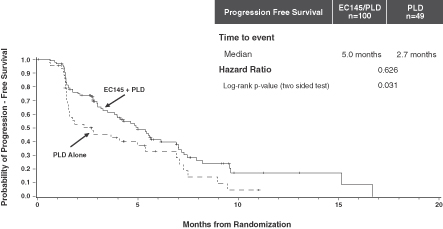

At PRECEDENT’s final PFS analysis of 149 patients and 95 PFS events, combination therapy with EC145 and PLD increased median PFS by 85 percent over therapy with PLD alone. PFS increased from a median of 2.7 months in the PLD control arm to a median of 5.0 months in the EC145 and PLD combination therapy arm (p=0.031). The hazard ratio was 0.626, meaning patients receiving EC145 were 37.4 percent less likely to have died or have their cancer progress compared to patients receiving only PLD.

Kaplan-Meier curve for PFS in PRECEDENT

This observed improvement in PFS was provided in the context of low additional toxicity over that seen in patients receiving PLD alone. There was no statistically significant difference in adverse events in the combination arm of the PRECEDENT trial compared with the control arm (p=0.210).

In December 2011, we announced the results of supplemental analyses of PRECEDENT data. We believe these findings continue to support the robustness of the PRECEDENT trial results, particularity in the group of FR (++) patients. The primary endpoint of the open-label PRECEDENT trial was PFS based on investigator assessment. Sensitivity analyses demonstrated these results were robust when adjusted for a variety of potential imbalances (e.g., demographic, prognostic, etc.). The IRC assessments shared a high level of agreement with investigator assessments, confirming investigator-assessed progression for 74 percent of all patients. In addition, the metrics designed to identify an investigator's potential bias to delay assessed progressions for patients in the EC145 study arm or to accelerate assessed progressions in the PLD control arm did not reveal such a bias. The IRC results also correlate with the mechanism of action, reflecting greater reduction in the risk of progression with increasing presence of folate receptor. In FR(++) patients, the IRC reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.465 suggests a reduction in risk of progression in the EC145 study arm of 53 percent (p=0.0498). In the FR(+) patient population, which includes the FR(++) subgroup, the IRC also reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.652 was not statistically significant in this broader group.

The predictive power of our EC20 companion imaging diagnostic was also evaluated in the PRECEDENT trial. In an analysis of FR(++) patients, an increased improvement in PFS was observed. In this subgroup of

6

38 patients, PFS improved from a median of 1.5 months for patients receiving PLD alone to a median of 5.5 months for patients receiving the combination of EC145 and PLD, an improvement of over 260 percent. The hazard ratio was 0.381 (p=0.018), or a reduction in the risk of progression of 61.9 percent.

The results of the supplemental analyses also confirmed the reliability of our companion imaging diagnostic EC20 to select targeted patients. In order to confirm the reliability of EC20 to select these patients, independent readers evaluated EC20 images from the PRECEDENT trial to measure the agreement rate between readers. The evaluation resulted in an 87 percent agreement rate in selecting patients with at least one tumor positive for the folate-receptor, FR(+), and an 85 percent agreement rate for patients with all folate-receptor positive tumors, FR(++). These rates of agreement compare favorably to internal standards established for this evaluation. In addition, intra-reader agreement was measured. This is an assessment of the consistency of the same reader to select patients when reviewing images at different times. Intra-reader rates were 90 percent and 95 percent for the independent readers in selecting FR(+) patients and 95 percent and 100 percent in selecting FR(++) patients. These rates of agreement also compare favorably to internal standards established for this evaluation.

The PRECEDENT trial was not statistically powered to show a survival advantage and the results did not indicate a trend toward benefit in either arm. The hazard ratio was 1.010 for the intent-to-treat population and 1.097 for the FR(++) population. On an adjusted basis, which accounts for potential differences in demographics and prognostic factors, the overall survival hazard ratio was 0.864 in the intent-to-treat population and 0.481 in the FR(++) group, although these result were not statistically significant.

PROCEED is our phase 3 registration trial for U.S. approval of EC145 for the treatment of women with PROC and U.S. approval of EC20 for patient selection. If EC145 and EC20 receive Conditional Marketing Authorisation in the EU, this phase 3 trial serves to provide comprehensive data for conversion to regular Marketing Authorisation. The study design was discussed with Health Authorities in EU and with FDA. Basic agreement on the trial design has been reached; however, final details of the statistical analyses are being discussed with the FDA’s imaging and oncology divisions. PROCEED shares the same fundamental design characteristics of the PRECEDENT trial, except that it is a double-blinded trial, it measures PFS based on radiological progression alone without including clinical progression, and the primary efficacy analysis will be on FR(++) patients. The endpoint, patient population, dose and schedule are the same as those used in the PRECEDENT trial. In contrast to PRECEDENT, the PLD control arm in PROCEED will include a placebo in order to blind the study, which will be dosed on the same schedule as EC145. As was the case with the PRECEDENT trial, PROCEED’s primary endpoint is PFS.

All patients in the PROCEED trial are being imaged with EC20 prior to treatment. In our clinical trials that incorporated EC20 to date, we saw that approximately 80 percent of ovarian cancer patients over-express the folate receptor, and approximately 40 percent of patients have tumors that are FR(++). The primary endpoint of the phase 3 PROCEED trial is PFS in the FR(++) patient population. Based on feedback from EU health authorities and the FDA, we are evaluating the inclusion of additional patients for exploratory analysis in order to assess potential benefit in patients with less than all of their target tumors positive for the folate receptor. While those plans are being finalized, patients will be enrolled regardless of the FR status, although the primary endpoint will include only FR(++) patients.

PROCEED is powered to demonstrate a minimum 67 percent improvement in median PFS and a hazard ratio of 0.60 in the FR(++) patient population, which compares to a 265 percent improvement in median PFS and a hazard ratio 0.381 observed in PRECEDENT. PROCEED is also powered to demonstrate a minimum 56 percent improvement in the secondary endpoint of median OS.

7

The table below compares the design characteristics of the PROCEED and PRECEDENT trials.

| PRECEDENT | PROCEED | |||

| Number of Patients |

149 | More than 200 FR(++) patients* | ||

| Clinical Sites |

65 | Approximately 150 | ||

| Patient Population |

Platinum-resistant ovarian cancer | |||

| Blinding |

Open-label | Double-blinded | ||

| Treatment Arm |

EC145 and PLD | |||

| Control Arm |

PLD | PLD and Placebo | ||

| Primary Endpoint |

PFS (radiologic and clinical) | PFS (radiologic only) | ||

| Powered for OS |

No | Yes | ||

| EC145 Dose |

2.5 mg intravenous, 3 times per week in weeks 1 and 3, on a 28 day cycle | |||

| PLD Dose |

50 mg/m(2) intravenous on day 1, on a 28 day cycle | |||

| FR(++) Hazard Ratio |

0.381 (actual) | 0.600 | ||

| Cross-Over |

Not allowed | |||

| EC20 Scan |

Enrolled regardless of scan results | Only FR(++) included in primary

end point* | ||

| * | Based on feedback from the EU health authorities and the FDA, we are evaluating the optimal process to assess potential benefit in patients with less than all of their target tumors positive for the folate receptor. This would be an exploratory analysis, not included in the primary efficacy endpoint of the trial. As this plan is being finalized, all patients, regardless of their FR status, may enroll. |

Regulatory Strategy

During the second quarter of 2011, we announced our plan to file applications with the EMA for conditional marketing authorization for our lead drug candidate EC145 for the treatment of PROC and its companion imaging diagnostic EC20 for patient selection. We confirmed this plan after meeting with EU health authorities following the supplemental analyses of the PRECEDENT trial, announced in December 2011. The filings will be supported by four clinical studies: a Phase 1 study in solid tumors, two single-agent, single-arm Phase 2 studies in ovarian cancer and non small cell lung cancer, and the PRECEDENT trial, a randomized study in PROC. This plan reflects consultation with the EMA, including the Scientific Advice Working Party, and written advice from the Committee for Medicinal Products for Human Use, or CHMP, as well as discussions with our assigned MAA rapporteures and co-rapporteures. We plan to seek conditional marketing authorization for treatment of patients with folate receptor positive PROC as selected by EC20. We expect to file both applications in the third quarter of 2012.

The therapeutic, EC145, and the diagnostic imaging agent, EC20, have also both been granted orphan drug status for ovarian cancer by the European Commission. EMA's Orphan Medicinal Product Designation is designed to promote the development of drugs that may provide significant benefit to patients suffering from rare, life-threatening diseases. This designation will provide ten years of marketing exclusivity if the product candidate is approved for marketing for the designated orphan indication in the European Union. It also provides special incentives for sponsors, including eligibility for protocol assistance and possible exemptions or reductions in certain regulatory fees during development or at the time of application for marketing approval.

In addition to data already available from the phase 2 trials, we conducted supplemental analyses of the PRECEDENT trial. These included the following data:

| • | EC20 validation: We conducted an inter-reader analysis to determine the reliability of EC20. Two independent radiologists read images from the PRECEDENT study and the evaluation resulted in an 87 percent agreement rate in selecting patients with at least one tumor positive for the folate-receptor, FR (+), and an 85 percent agreement rate in selecting patients with all folate-receptor positive tumors, FR (++). This provides evidence supporting the reliability of the EC20 scan process to consistently classify patients. |

8

| • | Blinded assessment of CT scans: Results from the PRECEDENT trial published to date have been based on analyses of CT scans by investigators who were not blinded to the treatment arm or EC20 scan status. Sensitivity analyses demonstrated these results were robust when adjusted for a variety of potential imbalances (e.g., demographic, prognostic, etc.). Radiologists blinded to the patients’ EC20 scan results and their treatment arm performed an independent assessment of the CT scans used to measure progression of disease in the PRECEDENT trial. The IRC assessments shared a high level of agreement with investigator assessments, confirming investigator-assessed progression for 74 percent of all patients. In addition, the metrics designed to identify an investigator’s potential bias to delay assessed progressions for patients in the EC145 study arm or to accelerate assessed progressions in the PLD control arm did not reveal such a bias. Also consistent with the site results, the IRC results also correlate with the mechanism of action, reflecting greater reduction in the risk of progression with increasing presence of folate receptor. In FR(++) patients, the IRC reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.465 suggests a reduction in risk of progression in the EC145 study arm of 53 percent (p=0.0498). In the FR(+) patient population, which includes the FR(++) subgroup, the IRC also reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.652 was not statistically significant in this broader group. |

| • | Overall survival: The PRECEDENT trial was not statistically powered to show a survival advantage and the results did not indicate a trend toward benefit in either arm. The hazard ratio was 1.010 for the intent-to-treat population and 1.097 for the FR(++) population. On an adjusted basis, which accounts for potential differences in demographics and prognostic factors, the overall survival hazard ratio was 0.864 in the intent-to-treat population and 0.481 in the FR(++) group, although these result were not statistically significant. |

In the U.S., if PROCEED meets the primary endpoint with limited additional toxicity over the PLD control arm, we intend to file new drug applications, or NDAs, for EC145 and EC20 with the FDA, for use of EC145 in combination with PLD for the treatment of positive patients with PROC. If final analyses indicate a broader FR definition also shows benefit, those patients will we included in the NDA. The PROCEED trial will also serve as the confirmatory trial for the potential conditional marketing authorization in Europe.

The FDA has stated that PROCEED must provide evidence of robust statistically significant and clinically meaningful benefit. If we fail to demonstrate a benefit of this magnitude, we would expect that the FDA would require us to conduct a second phase 3 clinical trial in order to file an NDA and receive marketing approval of EC145 for the treatment of PROC. In addition, the results of PROCEED may not yield safety and efficacy results sufficient to be approved by the FDA for commercial sale.

EC145 in Lung Cancer

Our second indication with EC145 is second line NSCLC. Lung cancer is the leading cause of cancer-related death worldwide and an area of high unmet medical need. Although several therapies are commercially available for the treatment of first and second line NSCLC, ultimately, in most patients the therapy fails and their cancer grows. In our clinical trials that incorporated EC20, approximately 80 percent of NSCLC patients over-express the folate receptor. As a result, we believe NSCLC is also an attractive indication for EC145 development. In a phase 2 single-arm trial in NSCLC patients who had at least one tumor that over-expressed the folate receptor, EC145 met the primary endpoint by demonstrating clinical benefit. At the eight week assessment of the patients, the DCR was 57 percent in the patients whose target tumors were all identified as over-expressing the folate receptor. This compares to historical DCRs ranging from 21 to 30 percent reported in other trials of approved therapies in less heavily pre-treated patients. In a subset of patients who had received three or fewer prior therapies and whose target tumors were all positive for the folate receptor, the DCR was 70 percent. DCR is the percentage of patients with complete response, partial response or stable disease, which has been shown to correlate with OS in NSCLC.

9

We also evaluated OS in FR(++) patients (n=14) compared to patients in which at least one of the target lesions, but not all, over-expressed the folate receptor, such patients we refer to as FR(+) (n=14). Median OS improved from 3.4 months for FR(+) patients to 10.9 months for FR(++) patients. The hazard ratio was 0.539, meaning FR(++) patients were 46.1 percent less likely to die when compared to FR(+) patients when receiving EC145 (p=0.209).

Based on results of our single-arm, single agent phase 2 clinical trial of EC145 in patients with heavily pre-treated NSCLC, we plan to begin enrollment in a randomized phase 2 trial in the second quarter of 2012. The trial is designed to enroll up to 200 patients with adenocarcinoma of the lung who have failed one prior line of therapy. Patients will be selected based on EC20 scan results and only FR(++) patients will be included. The trial design is intended to evaluate the safety and efficacy of EC145 in second line NSCLC as a single agent and in combination with docetaxel, an FDA approved and commonly used second line chemotherapy. The study will have three arms: docetaxel alone; EC145 alone; and EC145 plus docetaxel. The primary outcome measure will be PFS with secondary measures of OS, tumor response and duration of response. Final PFS data is expected to be available by early 2014.

Inflammatory Diseases

Beyond cancer, we have discovered that activated macrophages, a type of white blood cell found at sites of acute and chronic inflammation, also over-express the folate receptor. Activated macrophages release a variety of mediators of inflammation that contribute to a broad range of diseases, such as rheumatoid arthritis, osteoarthritis, inflammatory bowel disease and psoriasis. We have a number of SMDCs in preclinical development for autoimmune diseases that are designed to inhibit the production of pro-inflammatory cytokines by activated macrophages.

Our Small Molecule Drug Conjugate (SMDC) Technology

Traditional cytotoxic cancer chemotherapies kill rapidly dividing cancer and normal cells in an indiscriminate manner, leading to significant toxicity in patients. The need for patients to recover from this toxicity can limit the ability to deliver effectively-dosed cancer therapy. In addition, cancer therapies for a given tumor type are generally selected based on observations of efficacy and toxicity in that patient population and not, in most cases, based on an understanding of the differences between tumors on a molecular level. In response to these limitations, a number of targeted therapies were developed to be more selective, including monoclonal antibody-based therapies. Due to their selectivity against certain cancers, antibody therapies have achieved tremendous therapeutic and financial success in recent years. According to Roche Holdings’ publicly available information, the three largest cancer drugs in the world, Avastin, Herceptin and Rituxan, are monoclonal antibodies, with collective sales of $9.9 billion in 2010.

For certain cancers, antibodies alone are not sufficiently effective to achieve meaningful clinical benefit. This limitation has led to the development of a new class of agents called antibody drug conjugates, or ADCs. ADCs are comprised of a monoclonal antibody, which is used to target the specific cancer, attached via a linker system to a cell-killing drug. In clinical trials ADCs have enabled the targeted delivery of highly active anti-cancer drugs, improving response rates in several cancer indications, with generally less toxicity than standard chemotherapy. However, ADCs also have limitations. First, larger molecules, like ADCs, do not penetrate dense solid tumors as efficiently as small molecules, and as a result, ADC efficacy may be compromised due to limited accessibility to the target cells. Second, the slow clearance of antibodies from a patient’s bloodstream may lead to increased toxicity. The longer half-life of ADCs has also limited the development of antibody-based imaging diagnostics due to the poor image quality associated with the high background noise caused by ADCs remaining in a patient’s bloodstream. Third, ADCs are biologic molecules that are costly and often complex to manufacture.

10

We believe our SMDC platform represents a novel approach, comparable to ADCs in its ability to deliver highly active drug payloads in a targeted manner, but also with a number of potential advantages:

| • | Small size to better penetrate solid tumors. We believe a key characteristic of our SMDCs is their ability to penetrate deeply into dense solid tumors. The targeting ligands for our SMDCs are approximately 300 times smaller in molecular weight than a typical antibody incorporated in ADCs. This may result in greater uptake and higher concentrations of these molecules within solid tumors. |

| • | Rapid clearance for reduced toxicity. The circulating half-life of ADCs currently in development generally range from several hours to several days. In contrast, our SMDCs are engineered to provide rapid uptake in targeted cells and rapid clearance from the bloodstream with a half-life of approximately 20 minutes. As a result of this shorter half-life, we believe there is reduced risk that our SMDCs will release the unconjugated drug payload into the blood stream. In our phase 1 trial of EC145, only four of 410, or less than one percent, of the blood samples analyzed had quantifiable levels of the unconjugated drug payload, and all four of these positive samples had concentrations near the lowest level of detection, and at a level where no significant toxicity was found. |

| • | Companion imaging diagnostics for targeted therapy. A companion imaging diagnostic can be created for each of our SMDCs. Because of the modular nature of our SMDC technology, the drug payload can be replaced with a radioisotope imaging agent, such as technetium-99m, or Tc-99m, that we employ in EC20, to create a companion imaging diagnostic designed to target the same diseased cells as the SMDC. The companion imaging diagnostic is intended to allow for real-time, full-body assessment of the receptor target without requiring an invasive tissue biopsy. Using full-body imaging, the receptor expression can be measured in every tumor and monitored throughout treatment. In our clinical trials that combined EC145 with EC20, we have seen correlations between favorable therapeutic outcomes and increased uptake of EC20. |

| • | Cost-effective and simple to manufacture. Given the increasing pressure on drug pricing posed by payors, costs of development and manufacturing are increasingly important. Our SMDCs are relatively simple to manufacture and do not have the complexity and expense of biological molecules, like antibodies and ADCs. |

11

SMDC Pipeline

We have a pipeline of multiple SMDCs and companion imaging diagnostics that are in varying stages of clinical and preclinical development, all of which use our platform SMDC targeting technology. A summary of our most advanced development pipeline MDCs and companion imaging diagnostics are as follows:

EC145: Folate Receptor Targeted Therapy

EC145 is designed to deliver a highly cytotoxic drug payload directly to folate receptors that are over-expressed on cancer cells, with low toxicity to healthy cells. EC145 consists of a targeting ligand, folate, conjugated via a linker system to an anti-cancer drug payload, DAVLBH. DAVLBH is derived from a proven class of anti-cancer drugs and is a potent destabilizer of microtubules. Since microtubules are critical for the separation of chromosomes during cell division, disruption of this microtubule system with DAVLBH promotes cell death.

Folate Receptors in Cancer Cells

Folate is a nutrient required by all living cells, and it is essential for cellular division. As depicted in the image below, folate enters human cells via two distinct transport systems, the reduced folate carrier pathway, or RFC, which has low affinity for folate and the folate receptor pathway, which has high-affinity for folate. The RFC is the predominant route by which normal cells access folate circulating in the body. The RFC is a transport protein that is expressed on virtually all cells in the body. In contrast, rapidly dividing cancer cells over-express the high-affinity folate receptor. The folate receptor captures folate from outside the cell and transports it inside by engulfing it within a vesicle called an endosome. Once internalized, the folate receptor releases the folate and is then recycled back to the cell surface where it resumes its function of capturing circulating folates.

12

Cellular Uptake of Folate

The folate receptor is not significantly expressed on most normal tissues. Lung, brain, small intestine, kidney and activated macrophages are the normal tissues known to express the folate receptor. In the lung, brain and small intestine, the folate receptor does not face the bloodstream, thus these folate receptors are not accessible to our folate-targeted SMDCs. In the kidney, the folate receptor functions as a salvage receptor that captures folates and transports them back into the blood stream to prevent folate deficiency. Although our SMDCs are also shuttled from the urine back into the blood using this folate receptor-based system, the linker system remains stable during this re-absorptive process to prevent release of the drug payload within the kidney. As a result, we have not observed any SMDC-related kidney toxicities throughout our preclinical or clinical trials. Activated macrophages also express the folate receptor. SMDCs like EC145 target folate receptor-expressing activated macrophages; however, these types of cells are not rapidly dividing, and as a result, anti-cancer drug payloads that disrupt cellular division processes are inactive against this cell type.

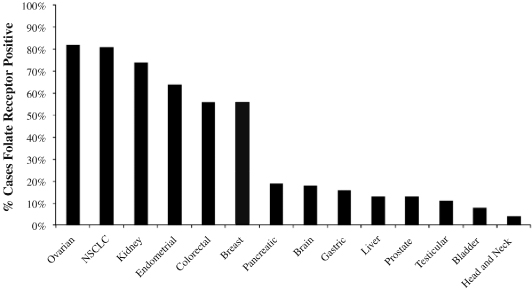

Elevated expression of the folate receptor occurs in several cancer types, and may be associated with the more aggressive growth characteristics of cancer cells as compared to normal cells. We believe that cancer cells over-express the folate receptor as a mechanism to capture additional folate to support rapid cell growth. The graph below shows the percentage of patients with different cancer types that are known to over-express the folate receptor. We estimate, based on worldwide cancer incidences combined with our own imaging studies that there are over one million newly diagnosed cancer patients per year in the United States, Europe and Japan whose tumors over-express the folate receptor.

13

Folate Receptor Positive Cancers by Cancer Type

Source: American Cancer Society and Endocyte estimates based upon imaging studies and tissue biopsies.

EC145 takes advantage of the natural process of enhanced uptake of folate by cancer cells via the folate receptor by linking an active drug to a folate targeting ligand to create a tumor-targeted SMDC. Following transit through the bloodstream and entry into tumor tissue, EC145 binds to the externally-oriented folate receptor with high-affinity. Endocytosis of EC145 entraps it within a vesicle. As shown in the image on the previous page, drug payload release occurs within that vesicular compartment. The other pathway for folate to be taken up into cells, the RFC, is highly specific to folate but will not readily take up EC145 into the cell due to its molecular structure. As a result, EC145 is highly specific to cancer cells that over-express the folate receptor compared with normal cells which express the RFC.

When tested preclinically as a single agent, EC145 therapy has been observed to eliminate human tumors in mice across multiple folate receptor positive tumor models, using regimens that caused little to no observable toxicity. In the same models, treatment at the maximum tolerated dose, or MTD, with the free drug, DAVLBH, generated only modest or temporary tumor responses, and always in association with substantial toxicity. In addition, EC145 therapy caused no anti-tumor responses in preclinical tumor models that did not express the folate receptor, thus confirming the SMDC’s specificity to the target receptor.

EC145 has also been evaluated in preclinical models for activity in combination with several approved chemotherapeutic agents. For example, EC145 has shown significant anti-tumor responses in animals when dosed in combination with approved drugs, such as PLD, cisplatin, topotecan, bevacizumab, docetaxel, carboplatin, erlotinib and paclitaxel protein-bound. The toxicity profile of EC145, particularly its lack of hematologic toxicity, makes this SMDC a good potential candidate for combination therapies.

If we are successful in obtaining regulatory approval for EC145 in second or third line therapies, we intend to explore combinations with other drugs, several of which are frequently used as first line therapies in a variety

14

of tumors that over-express the folate receptor. First line therapy refers to initial cancer treatments, while second or third line therapies refer to subsequent treatments following disease progression.

Ovarian Cancer

Market Opportunity

Ovarian cancer is a significant cause of patient morbidity, and is the leading cause of gynecologic cancer mortality in the United States. According to the American Cancer Society, approximately 22,280 new cases of ovarian cancer are projected in the United States in 2012. Of those ovarian cancer cases, approximately 50 percent of patients will eventually develop PROC. Mortality rates remain high, with nearly 15,000 deaths from ovarian cancer each year in the United States alone.

While the treatment of ovarian cancer depends on the stage of the disease, the initial therapy almost always involves surgical removal of the cancer from as many sites as possible followed by platinum-based chemotherapy. For women with advanced ovarian cancer who respond to initial platinum-based chemotherapy, most will eventually experience recurrence or progression of their cancer. Patients whose cancer recurs or progresses after initially responding to surgery and primary chemotherapy can be placed into one of two groups based on the time from completion of platinum therapy to disease recurrence or progression, referred to as the platinum-free interval:

| • | Platinum-sensitive. Women with platinum-sensitive ovarian cancer have a platinum-free interval of greater than six months. Upon disease recurrence or progression, these patients are believed to benefit from additional exposure to platinum-based chemotherapy. |

| • | Platinum-resistant. Women with platinum-resistant ovarian cancer have a platinum-free interval of six months or less. These patients are much more resistant to standard chemotherapy and will typically receive PLD or topotecan or participate in a clinical trial. Overall response rate measured by RECIST, or ORR, for these subsequent therapies is in the range of 10 to 20 percent with median OS of approximately 11 to 12 months. |

There are currently only two approved therapies for women with PROC, PLD and topotecan. In clinical trials, neither of these drugs has demonstrated a statistically significant increase in PFS or OS in this indication. The last drug approved in this patient population was PLD, which was granted accelerated approval in 1999 based on an ORR of 13.8 percent (n = 145). The “n” represents the total patient population utilized in the reported data. ORR refers to the sum of complete and partial tumor responses seen, divided by the total number of evaluated patients. More recently, phase 3 trials of gemcitabine, trabectedin, patupilone and phenoxodiol have shown no statistically significant benefit over PLD in terms of either PFS or OS in women with PROC.

We have chosen PROC as our lead indication for EC145 because of the large unmet need in treating this patient population, the high levels of over-expression of the folate receptor in this tumor type, the enhanced therapeutic effect EC145 had with PLD in preclinical studies, and the acceptable clinical safety profile seen to date with EC145, which may avoid increasing the toxicities seen with PLD. We chose to develop EC145 in conjunction with PLD because it is commonly used as a second line therapy and has a better safety profile than topotecan, the other approved second line therapy.

Phase 1 Clinical Trial

We completed a phase 1 safety and dose-finding trial in 32 patients designed to determine the MTD of EC145 in patients with a variety of different solid tumors. In the trial, we established a dose regimen of three times per week, every other week, at 2.5 mg per day, which was the MTD. This dose regimen showed preliminary signs of efficacy as a monotherapy in heavily pre-treated late-stage cancer patients with a variety of tumor types, including a partial tumor response and long-term disease stabilization in ovarian cancer (n=2) and long-term stabilization in other cancer types. This dose regimen was well tolerated. Toxicities most commonly

15

seen in the trial were constipation, fatigue, nausea, vomiting, abdominal pain and anemia, many of which are observed in late-stage cancer patients. The primary dose-limiting toxicity for EC145 was a significant but spontaneously reversible constipation/ileus observed at doses above the MTD.

Phase 2 Single-Arm Clinical Trial

We have completed a phase 2 single-arm clinical trial designed to evaluate the safety and efficacy of EC145 in women with advanced epithelial ovarian, fallopian tube or primary peritoneal cancer. The primary objectives were to collect data on the clinical benefit of EC145 therapy, defined as the number of patients who received six or more cycles of therapy, to explore the safety of EC145 in this drug-resistant patient population, and to assess the degree to which patients who had at least one tumor that over-expressed the targeted folate receptor responded to therapy, thereby enabling us to better identify a target population in which to conduct a randomized clinical trial of EC145 in the future.

Prior to treatment with EC145, patients were scanned with EC20 to determine whether their tumors over-expressed the folate receptor. In addition to standard eligibility criteria, patients were required to have PROC or refractory ovarian cancer, meaning disease that did not respond or progressed during the most recent platinum-based chemotherapy, and at least a single RECIST-measurable tumor. EC145 was administered as a bolus dose three days per week, on weeks one and three of a four-week cycle. Forty-nine women, with a median age of 62 years, were enrolled into the trial. Participants had been heavily pre-treated prior to participation in the trial, having received a median of four prior chemotherapeutic regimens. All of these patients had advanced disease and most had a heavy tumor burden. Although the trial did not achieve the threshold for efficacy, the effectiveness of EC145 was also evaluated based on DCR and ORR. These analyses indicated that a subset of patients exhibited evidence of anti-tumor effect such as tumor shrinkage and disease stabilization, with low toxicity.

In the final analysis of the trial data, the DCR for the 45 eligible patients was 42.2 percent with two women achieving a partial response, and the ORR for the eligible patients was 5 percent. An additional analysis established that EC145 was more active in patients previously treated with less than four therapies resulting in a DCR of 60.0 percent and an ORR of 13.3 percent. Safety data indicated that EC145 was very well tolerated, with no Grade 4 drug-related toxicities. The most frequent Grade 3 drug-related toxicities were fatigue in 8.2 percent of the patients and constipation in 8.2 percent of the patients. In addition, the safety data indicated that EC145 did not produce overlapping toxicity with the existing second line therapeutic agents used, such as topotecan and PLD.

Each patient who was scanned with EC20 was given a score, computed by dividing the number of positive tumors by the total number of target tumors. For example, a patient with a total of four target tumors, two of which over-expressed the folate receptor, would have a patient score of 50 percent. Patients were divided into three groups based on their EC20 scores as follows:

| • | the FR(++) group was characterized as having 100 percent of their tumors tested positive for the folate receptor; |

| • | the FR(+) group score was 1 to 99 percent positive or at least one, but not all of their tumors tested positive for the folate receptor; and |

| • | the FR(-) group score was 0 percent positive because none of their tumors tested positive for the folate receptor. |

Separate analyses were performed to assess the degree to which FR(++) and FR(+) patients responded to therapy with EC145. Of the 145 evaluable tumors, only tumors in FR(++) and FR(+) patients treated with EC145 showed tumor shrinkage of greater than 20 percent. No tumors of FR(-) patients showed a decrease of greater than 20 percent. These results were statistically significant, indicating that EC20 uptake by tumors correlates with response to EC145 treatment (p=0.0022).

16

The ORR and DCR were calculated for each of the three groups. FR(++) patients had the highest DCR, 57 percent, followed by FR(+) at 36 percent and FR(-) patients at 33 percent. In a subgroup analysis of less heavily pre-treated patients, those treated with three or fewer prior regimens, the DCR for the FR(++) group was 86 percent versus 50 percent and zero percent in the FR(+) and FR(-) groups, respectively. Similarly, the ORR in the FR(++) subgroup was the highest at 14 percent, while the ORR for the FR(+) subgroup and for the FR(-) subgroup was 13 percent and zero percent, respectively. Results from this trial indicate a potential correlation between EC20 binding levels and anti-tumor response at the level of the individual patient and the individual tumor.

Platinum REsistant Ovarian Cancer Evaluation of Doxil and EC145 CombiNation Therapy (PRECEDENT): Randomized Phase 2 Clinical Trial in PROC

PRECEDENT is a multicenter, open-label, randomized phase 2 clinical trial of 149 patients comparing EC145 and PLD in combination, versus PLD alone, in women with PROC. The trial completed enrollment in June 2010 and final PFS analysis of the data has been conducted and was presented at the annual meeting of the American Society of Clinical Oncology in June 2011.

We chose PFS as the primary endpoint of the trial as PFS is a clinically meaningful endpoint in this patient population and allows for a more rapid assessment of results than OS. PFS was measured based upon investigator assessment using both radiological measurements based on RECIST, as well as assessment of clinical progression. Secondary endpoints include OS, ORR and safety and tolerability of EC145 in combination with PLD. To minimize the potential for bias and to ensure the integrity of the OS measurement, cross-over was not allowed. In addition, the trial explored the correlation between therapeutic response and EC20 imaging results.

Eligible patients were randomized in a 2 to 1 ratio to either the EC145 and PLD arm or to the PLD alone arm. PLD was selected as the comparator because it is approved and widely used in PROC and EC145 in combination with PLD was more effective than PLD alone in our preclinical studies. Patients are dosed with EC145 three times per week every other week and PLD is administered once every 28 days in both population arms, consistent with the standard of care. All patients enrolled at clinical centers with nuclear imaging capabilities were scanned with our EC20 companion imaging diagnostic within 28 days prior to the initiation of treatment (113 patients).

PRECEDENT is a multicenter trial involving 65 sites in the United States, Canada and Poland. Patients were stratified based upon their geographic location, primary versus secondary platinum resistance and level of the tumor marker (CA-125). Most of the demographics and disease characteristics were well-balanced between the arms. There were two characteristics slightly imbalanced in the arms of the trial, both of which should have contributed to a poorer prognosis for patients receiving the combination of EC145 and PLD versus patients receiving PLD alone. Specifically, the number of patients with hepatic and pulmonary metastases at enrollment were greater in the combination arm (38.0 percent) compared to the PLD alone arm (22.4 percent). Also, the median cumulative length of tumor at enrollment in the combination arm was 9.3 cm compared to 5.6 cm in the PLD alone arm.

A Data Safety Monitoring Board, or DSMB, monitored the trial and conducted multiple safety reviews and a pre-specified interim analysis. This interim analysis was prepared by an independent biostatistician and reviewed by the DSMB on February 26, 2010. The DSMB recommendation was to continue the trial to full accrual with no protocol modifications.

At PRECEDENT’s final PFS analysis of 149 patients and 95 PFS events, we reported an 85 percent increase of median PFS from 2.7 months in the PLD arm to 5.0 months in the EC145 and PLD treatment arm (p=0.031). The hazard ratio was 0.626, meaning patients receiving EC145 were 37.4 percent less likely to have died or have their cancer progress compared to patients receiving only PLD. The median PFS seen in the control arm was consistent with historical data in this disease setting. This benefit in PFS was provided in the context of low additional toxicity over the current standard of care. We believe that EC145 and PLD is the first combination to show a meaningful improvement in PFS over standard therapy for the treatment of PROC.

17

In December 2011, we announced the results of supplemental analyses we had conducted of the PRECEDENT trial data. We believe these findings continue to support the robustness of the PRECEDENT trial results, particularity in the group of FR (++) patients. The primary endpoint of the open-label PRECEDENT trial was PFS based on investigator assessment. Sensitivity analyses demonstrated these results were robust when adjusted for a variety of potential imbalances (e.g., demographic, prognostic, etc.). The assessments made by the blinded independent review committee, or IRC, shared a high level of agreement with investigator assessments, confirming investigator-assessed progression for 74 percent of all patients. In addition, the metrics designed to identify an investigator's potential bias to delay assessed progressions for patients in the EC145 study arm or to accelerate assessed progressions in the PLD control arm did not reveal such a bias. The IRC results also correlate with the mechanism of action, reflecting greater reduction in the risk of progression with increasing presence of folate receptor. In FR(++) patients, the IRC reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.465 suggests a reduction in risk of progression in the EC145 study arm of 53 percent (p=0.0498). In the FR(+) patient population, which includes the FR(++) subgroup, the IRC also reflected a 2.5 months improvement in median PFS from 1.5 months in the PLD control arm to 4.0 months in the EC145 study arm. The hazard ratio of 0.652 was not statistically significant in this broader group.

Kaplan-Meier curve for PFS in PRECEDENT

EC145’s companion imaging diagnostic, EC20, was used to correlate folate receptor over-expression with EC145 efficacy in PROC. Patients in the PRECEDENT trial were imaged with EC20 prior to enrollment and target lesions were read to determine whether patients were FR(++), FR(+) or FR(-). In the FR(++) subgroup of 38 patients, patients whose target lesions all over-expressed the folate receptor, PFS improved from a median of 1.5 months for patients receiving PLD alone to a median of 5.5 months for patients receiving the combination of EC145 and PLD, an improvement of over 260 percent. The hazard ratio was 0.381 (p=0.018) or a reduction in the risk of progression of 61.9 percent.

The PRECEDENT trial was not statistically powered to show a survival advantage and the results did not indicate a trend toward benefit in either arm. The hazard ratio was 1.010 for the intent-to-treat population and 1.097 for the FR(++) population. On an adjusted basis, which accounts for potential differences in demographics and prognostic factors such as platinum free intervals, the overall survival hazard ratio was 0.864 in the intent-to-treat population and 0.481 in the FR(++) group, although these result were not statistically significant.

18

Kaplan-Meier curve for OS in PRECEDENT

We also examined other secondary endpoints, including ORR. The ORR at the initial scan was 28.0 percent in the treatment arm as compared to 16.3 percent in the control arm. Consistent with RECIST, the protocol required follow-up scans at least four weeks later to confirm responses. The ORR at the confirmatory scan was 18.0 percent in the treatment arm as compared to 12.2 percent in the control arm.

At the final PFS analysis, the combination therapy was generally well tolerated. The EC145 and PLD combination arm received a 62 percent greater cumulative dose of PLD because these patients remained in the trial for a longer duration due to improved PFS. Despite this higher cumulative dose of PLD in the combination arm, total drug-related adverse events and serious adverse events were similar between arms. Review of toxicity data indicate that the number of patients reporting at least one treatment-emergent drug-related serious adverse event resulting in discontinuation from the trial was 2.8 percent (n=3) for the EC145 and PLD combination arm versus 4.0 percent (n=2) for the PLD single agent arm of the trial. No patient in either arm was known to have died from drug-related adverse events while receiving treatment or within 30 days of receiving treatment. Toxicity levels in the combination arm are similar to historical levels of toxicity experienced in patients receiving PLD as a single agent.

19

PRECEDENT Trial Grade 3-4 Toxicities(1)

(At final PFS Analysis)

| Hematological Toxicities |

EC145 and PLD (n=107) |

PLD (n=50) |

||||||

| Neutropenia < 1,000/mm3 |

13 (12.1%) | 2 (4.0%) | ||||||

| Febrile neutropenia |

1 (0.9%) | 1 (2.0%) | ||||||

| Anemia < 8 g/dL |

7 (6.5%) | 2 (4.0%) | ||||||

| Thrombocytopenia < 50,000/mm3 |

2 (1.9%) | 1 (2.0%) | ||||||

| Leukopenia < 2,000/mm3 |

18 (16.8%) | 2 (4.0%) | ||||||

| Lymphopenia < 500/mm3 |

19 (17.8%) | 9 (18.0%) | ||||||

| Non-Hematological Toxicities |

EC145 and PLD (n=107) |

PLD (n=50) |

||||||

| Stomatitis |

6 (5.6%) | 2 (4.0%) | ||||||

| PPE syndrome |

12 (11.2%) | 1 (2.0%) | ||||||

| (1) | Hematological toxicities are based on lab values regardless of causality. Non-hematological toxicities were drug-related toxicities occurring in five percent or more of patients in at least one arm of the trial. |

Trial for Women With Platinum Resistant Ovarian Cancer Evaluating EC145 in Combination with Doxil (PROCEED): Phase 3 Clinical Trial for Approval of EC145 in PROC

The PROCEED trial is designed to support the approval of EC145 in combination with PLD for the treatment of women with PROC. PROCEED is a double-blinded, multicenter, international, randomized phase 3 clinical trial in more than 200 folate receptor positive patients at approximately 150 sites comparing EC145 and PLD to placebo and PLD in women with PROC. We initiated enrollment of the PROCEED trial in May 2011 but enrollment stopped later in the year due to global shortages of PLD. In March 2012, we announced that the FDA approved our plans to import our supply of PLD from Europe into the U.S. for use in this trial and we plan to resume enrollment in the U.S.

We designed our phase 3 registration trial following our end of phase 2 meeting with the FDA held on May 24, 2010 and an additional meeting on March 9, 2012. Fundamental design characteristics of the PROCEED trial closely match those of the PRECEDENT trial. The endpoint, patient population, dose and schedule, are the same as those used in the PRECEDENT trial. The only significant design changes are that the phase 3 trial will utilize a placebo in order to double-blind the investigators and patients to which treatment arm they are on, the PFS endpoint will be based only on radiologic assessments with no clinical progression allowed, FR(-) and FR(+) patients will be excluded from the primary endpoint, and the trial will be powered for OS as a secondary endpoint. In addition, we expect to add additional countries to those used in the PRECEDENT trial, which included the United States, Canada and Poland.