Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EDIETS COM INC | d325455d8k.htm |

Exhibit 99.1

Forward Looking Statements

This presentation contains “forward-looking statements” within within the meaning of the federal securities laws and is intended to qualify for the Safe Harbor from liability established by the Private Securities

Litigation Reform Act of 1995, including statements and assumptions regarding (ii) ) our need for additional financial support to continue in business, (ii) our expectation that our total gross margins and advertising efficiency will improve in the future, (iii) iii) our assumption that we will acquire new customers at an acceptable cost, (iv) ) our expectations regarding the effectiveness of our advertising and our call center conversion strategies, (v) v) our assumption that we are well-positioned to compete and capture market share, (vi) vi) our expectation regarding our ability to comply comply with regulatory requirements, (vii vii)) our assumptions regarding market size, projected results and the demand for our products and services. These statements and assumptions are based on management’s estimates and projections with respect to future events and financial performance and are believed to be reasonable, although they are inherently uncertain and difficult to predict. Actual results could differ materially from those projected as a result of certain certain factors, including (ii) ) our ability to raise additional capital, (ii) ) our ability to attract and retain customers at an acceptable cost, (iii) our ability to maintain or improve meal delivery margins and advertising efficiency, (iv) our ability to manage our business effectively at reduced staff levels, (v) our ability to manage fluctuations in advertising costs, (vi vi)) our ability to sufficiently increase revenues and maintain expenses and cash capital expenditures at appropriate levels, (vii vii) ) the state of the credit credit and capital markets, including the level of volatility, illiquidity and interest rates, (viii) our ability to maintain compliance with regulatory requirements and (ix) our ability to rapidly secure alternate technology infrastructure vendors if we experience call center or Web site service interruption.

A discussion of factors that could cause results to vary is included in the Company’s filings with the Securities and Exchange Commission. All forward-looking statements in this presentation speak only as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements.

This presentation also contains non-GAAP financial measures. For a reconciliation of the non-GAAP measures to the most comparable GAAP measure, please refer to the eDiets.com website at www.ediets.com, , under the Events and Presentation Presentation section of the Investor Investor Relations page.

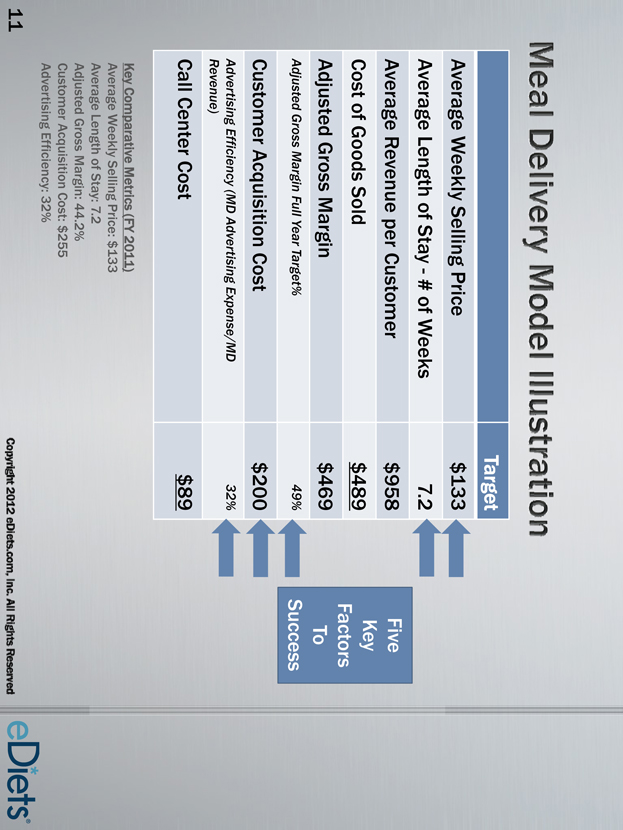

Meal Delivery Model Illustration

Target Average Weekly Selling Price $133 Average Length of Stay—# of Weeks 7.2 Average Revenue per Customer $958 Cost of Goods Sold $489 Adjusted Gross Margin $469

Adjusted Gross Margin Full Year Target% 49%

Customer Acquisition Cost $200

Advertising Efficiency (MD Advertising Expense/MD 32% Revenue)

Call Center Cost $89

Key Comparative Metrics (FY 2011) Average Weekly Selling Price: $133 Average Length of Stay: 7.2 Adjusted Gross Margin: 44.2% Customer Acquisition Cost: $255 Advertising Efficiency: 32%

Five Key Factors To Success

Major 2011/2012 Meal Delivery Initiatives

Increasing Length of Stay

– Getting the product to the consumer faster. Fewer cancellations

– Customer centered product development – giving them what they want y Optimizing the customer base

– Mining the database to turn leads into sales

– Mining the database to reactivate old customers y Improving call center efficiency

– Implemented commission-only compensation structure for sales associates

– Continually modifying call scripts to be more insistent on getting to “yes”

– Upgraded training to include more situational training

– Changed hiring criteria for sales associates to incorporate a focus on finding staff that can successfully confront the answer “no”

– Elevate talent and ability to close sales through better recruiting and forced attrition

– Retention group focused on preventing cancellations

Major 2011/2012 Meal Delivery Initiatives

Improving advertising content

– Re-energized testimonial campaign with FIRST NEW

COMMERCIAL in two years

– Continually testing television, magazine and online advertising channels and content to find optimal mix for driving customers to the call center economically

yImproving meal delivery margins

– Increased price to allow for stronger promotions while maintaining margin

– Introduced premium program for greater margin

– Create cost effective meal occasions

– Expect to achieve large volume discounts as business grows

– Expect to initiate bi-coastal production, which will reduce shipping costs, as business grows

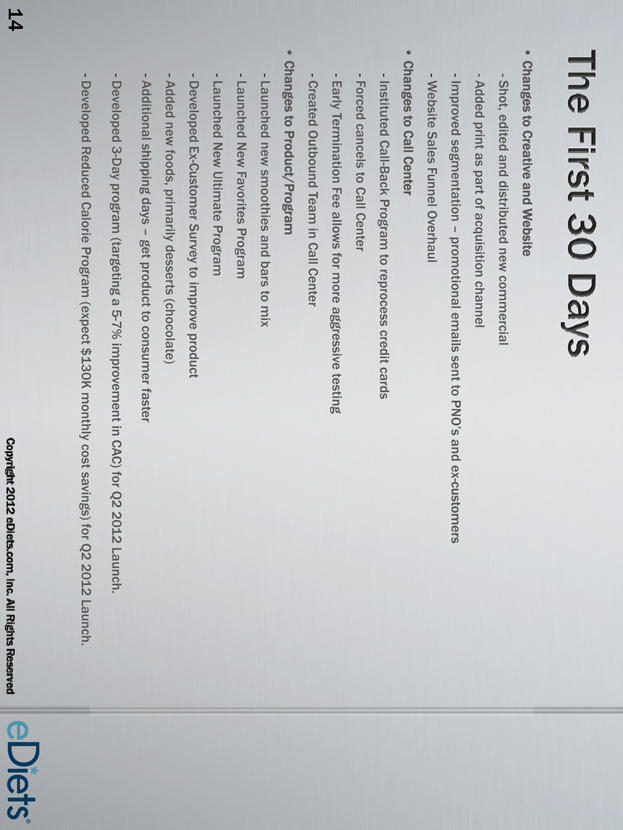

The First 30 Days

• Changes to Creative and Website

Shot,, edited and distributed new commercial—Added print as part of acquisition channel

Improved segmentation – promotional emails sent to PNO’s and ex-customers Website Sales Funnel Overhaul

• Changes to Call Center

Instituted Call-Back Program to reprocess credit cards Forced cancels to Call Center Early Termination Fee allows for more aggressive testing Created Outbound Team in Call Center

• Changes to Product/ProgramProgram

Launched new smoothies and bars to mix Launched New Favorites Program Launched New Ultimate Program

Developed Ex-Customer Survey to improve product Added new foods, primarily desserts (chocolate) Additional shipping days – get product to consumer faster

Developed 3-Day program (targeting a 5-7% improvement in CAC)) for Q2 2012 Launch.

Developed Reduced Calorie Program (expect $130K monthly cost savings) for Q2 2012 Launch.

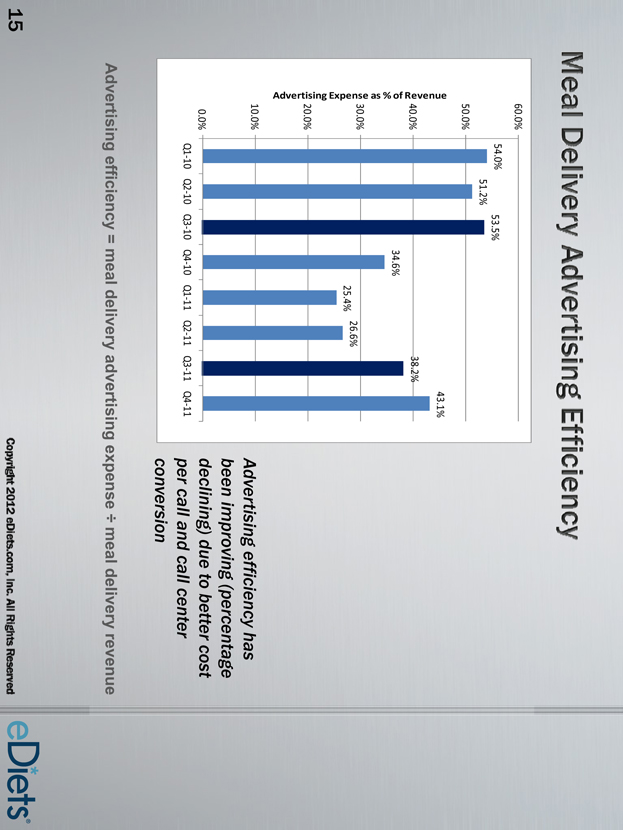

Meal Delivery Advertising Efficiency

60.0%

54.0% 53.5%

51.2%

50.0%

43.1% Revenue 40.0% 38.2% of 34.6%

% as se 30.0%

26.6%

Expen 25.4% Advertising 20.0%

10.0%

0.0%

Q1? 10 Q2? 10 Q3? 10 Q4? 10 Q1? 11 Q2? 11 Q3? 11 Q4? 11

Advertising efficiency has been improving (percentage declining) due to better cost per call and call center conversion

Advertising efficiency = meal delivery advertising expense ÷ meal delivery revenue

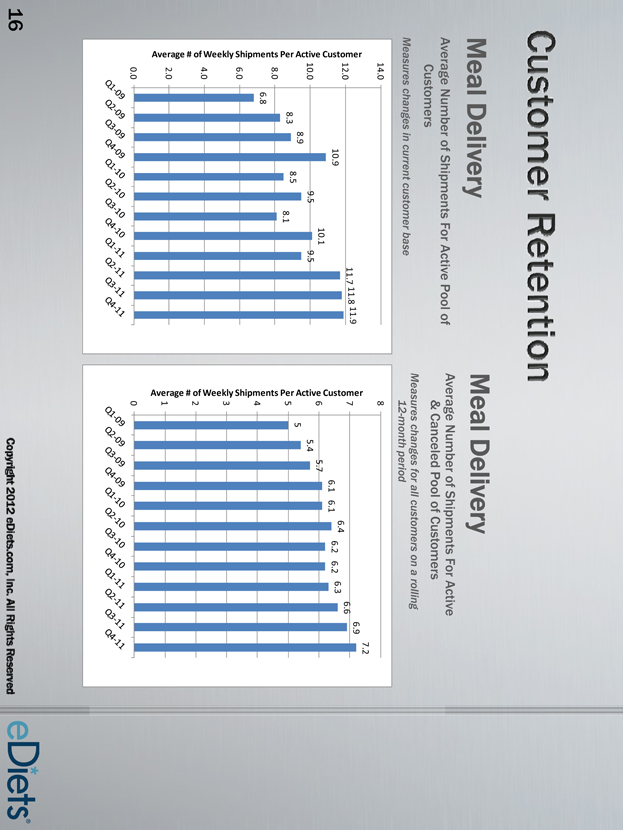

Customer Retention

Meal Delivery

Average Number of Shipments For Active Pool of Customers

Measures changes in current customer base

Meal Delivery

Average Number of Shipments For Active

& Canceled Pool of Customers

Measures changes for all customers on a rolling

12-month period

14.0

r

12.0 11.7 11.8 11.9

Custome 10.9

10.1

10.0 9.5 9.5

Active 8.9 8.5

Per 8.3 8.1

ts 8.0

6.8

Shipmen 6.0

Weekly 4.0

of

#

e

Averag 2.0

0.0

| 8 |

|

r 7.2 |

6.9

| 7 |

|

6.6 |

6.4 6.3 Custome 6.1 6.1 6.2 6.2

| 6 |

|

5.7 |

Active 5.4 5

Per 5 ts Shipmen 4 Weekly 3 of 2 # e Averag 1 0

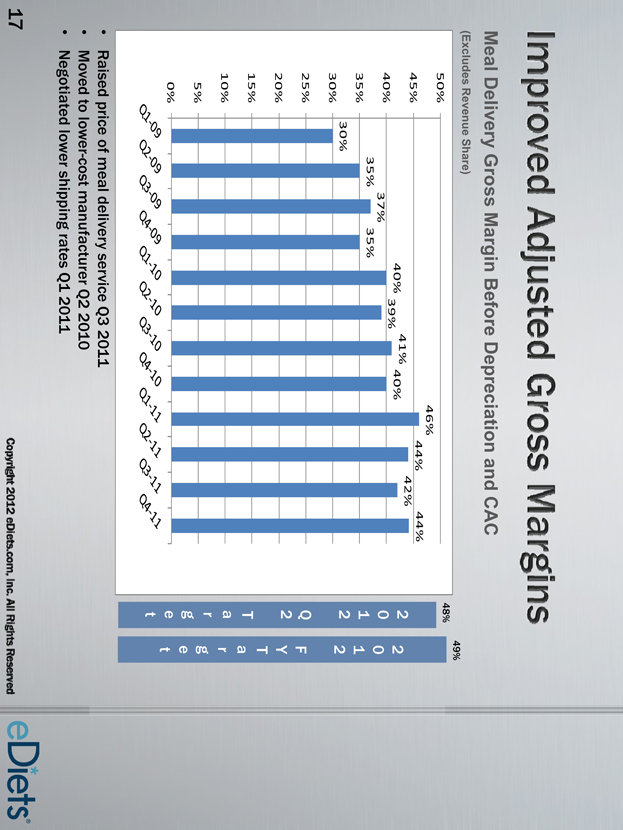

Improved Adjusted Gross Margins

Meal Delivery Gross Margin Before Depreciation and CAC

(Excludes Revenue Share)

50%

46%

44% 44% 45% 42% 41% 40% 40% 39% 40% 37% 35% 35% 35% 30% 30%

25% 20% 15% 10% 5% 0%

49% 48%

| 2 |

|

2 |

0 0

| 1 |

|

1 |

| 2 |

|

2 Q F |

| 2 |

|

Y |

T T a a r r g g e e t t

• Raised price of meal delivery service Q3 2011

• Moved to lower-cost manufacturer Q2 2010

• Negotiated lower shipping rates Q1 2011

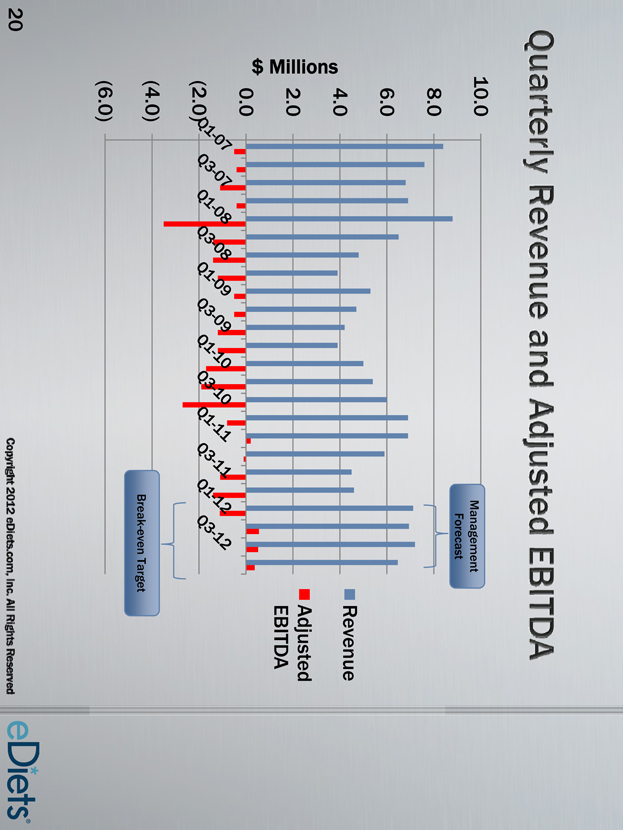

Quarterly Revenue and Adjusted EBITDA

10.0 Management Forecast

8.0

6.0

4.0 Millions 2.0 $

0.0

(2.0) (4.0)

(6.0)

Revenue

Adjusted EBITDA

Break-even Target

Investment Highlights

Large target market

– $60 billion weight loss market6

– $2 billion income meal delivery7

Focus on meal delivery

– Low capital requirements and a relatively latively quick cash conversion cycle

Continued improvement in operations

– Continued improvement expected to meal delivery adjusted gross margin due to volume discounts and shipping cost reductions

– Continued improvement to meal delivery advertising efficiency expected due to call center improvements

| 6 |

|

MarketData January 2011 Survey |

7 What is the size of the diet meal home delivery market?. (2009). Retrieved March 27, 2012, from http://quezi.com/4411