Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - China Power Equipment, Inc. | Financial_Report.xls |

| EX-31.2 - China Power Equipment, Inc. | ex31-2.htm |

| EX-31.1 - China Power Equipment, Inc. | ex31-1.htm |

| EX-32.1 - China Power Equipment, Inc. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

S

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2011

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ________________ to ________________

Commission File Number 333-147349

CHINA POWER EQUIPMENT, INC.

(Name of small business issuer in its charter)

|

Maryland

|

20-5101287

|

|

(State or other jurisdiction of

|

(IRS. Employer

|

|

incorporation or organization)

|

Identification No.)

|

Room 602, 6/F, Block B, Science & Technology Park of Xi Dian University,

No. 168 Kechuang Road, Hi-tech Industrial Development Zone

Xi’an, Shaanxi, China 710065

(Address of principal executive offices)

Issuer’s telephone number, including area code +86-29-6261-9758/8831-0560

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes þ No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was Required to submit and post such files).* þ Yes o No *The Company has not yet been phased in to the Interactive Data requirements.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (as defined in Rule 12b-2 of the Exchange Act). Check one:

Large accelerated filer ¨ Accelerated Filer ¨ Non-accelerated filer ¨ Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant (12,791,972 shares) based on the price of $0.76 at which the registrant’s common stock was last sold as of the last business day of the registrant’s most recently completed second quarter, was $9,721,899. For purposes of this computation, all officers, directors, and 5% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed to be an admission that such officers, directors, or 5% beneficial owners are, in fact, affiliates of the registrant.

As of March 28, 2012, there were outstanding 19,412,013 shares of the registrant’s common stock, par value $0.001 per share.

Documents incorporated by reference: None.

China Power Equipment, Inc.

Form 10-K

Table of Contents

|

Page

|

||

|

PART I

|

||

|

ITEM 1.

|

3

|

|

|

ITEM 1A.

|

11

|

|

|

ITEM 1B.

|

20

|

|

|

ITEM 2.

|

20

|

|

|

ITEM 3.

|

20

|

|

|

ITEM 4.

|

20

|

|

|

PART II

|

||

|

ITEM 5.

|

21

|

|

|

ITEM 6.

|

21

|

|

|

ITEM 7.

|

22

|

|

|

ITEM 7A.

|

29

|

|

|

ITEM 8.

|

29

|

|

|

ITEM 9.

|

32

|

|

|

ITEM 9A.

|

32

|

|

|

ITEM 9B.

|

32

|

|

|

PART III

|

||

|

ITEM 10.

|

33

|

|

|

ITEM 11.

|

36

|

|

|

ITEM 12.

|

38

|

|

|

ITEM 13.

|

39

|

|

|

ITEM 14.

|

39

|

|

|

PART IV

|

||

|

ITEM 15.

|

40

|

|

|

41

|

||

PREDICTIVE STATEMENTS AND ASSOCIATED RISK

Certain statements in this Report, and the documents incorporated by reference herein, constitute predictive statements. Such predictive statements involve known and unknown risks, uncertainties and other factors which may cause deviations in actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied. Such factors include, but are not limited to: market and customer acceptance and demand for our products; our ability to market our products; the impact of competitive products and pricing; the ability to develop and launch new products on a timely basis; the regulatory environment, including government regulation in the PRC; our ability to obtain the requisite regulatory approvals to commercialize our products; fluctuations in operating results, including spending for research and development and sales and marketing activities; and other risks detailed from time-to-time in our filings with the Securities and Exchange Commission.

The words “believe, expect, anticipate, intend and plan” and similar expressions identify predictive statements. These statements are subject to risks and uncertainties that cannot be known or quantified and, consequently, actual results may differ materially from those expressed or implied by such predictive statements. Readers are cautioned not to place undue reliance on these predictive statements, which speak only as of the date they are made.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to “RMB” or “yuan” are to the Chinese renminbi (also known as the yuan). According to the currency exchange rate published by People’s Bank of China, as of December 31, 2011, US $1.00 = RMB 6.3009.

PART I

ITEM 1. BUSINESS

Corporate History

China Power Equipment, Inc. (“China Power”, the “Company”, or “we”) was incorporated in the State of Maryland on May 17, 2006 for the purpose of acquiring an existing company with continuing operations. China Power formed An Sen (Xi’an) Power Science & Technology Co., Ltd. (“An Sen”) which was granted a license as a wholly-owned foreign enterprise in the city of Xi’an under the laws of the People’s Republic of China (“PRC”) on November 3, 2006. An Sen is a wholly-owned subsidiary of China Power and a limited liability company organized under the laws of the PRC.

On November 8, 2006, An Sen entered into a Management Entrustment Agreement (“the Agreement”) with Xi’an Amorphous Alloy Zhongxi Transformer Co., Ltd. (“Zhongxi”) whereby An Sen assumed financial and operating control over Zhongxi. In exchange for entering into this agreement, shareholders of Zhongxi were issued 9,000,000 shares of China Power common stock, resulting in a change of control of China Power. Zhongxi was founded in Xi’an, China under the laws of the PRC on June 29, 2004, and currently manufactures 59 different products, including amorphous alloy core transformers and cores.

Pursuant to the Agreement, An Sen has the right to manage and control Zhongxi, receive the financial benefits and is exposed to the financial risks of Zhongxi, including, without limitation, the assumption of any risk of loss from Zhongxi’s operations, the obligation to pay the outstanding liabilities of Zhongxi, including debt, if Zhongxi does not have sufficient cash on hand to do so, and any deficiencies if net assets are less than registered capital as a result of any losses. While neither China Power nor An Sen will co-sign Zhongxi contracts, An Sen will continue to be exposed to the financial risks of Zhongxi for its future obligations with third parties through the operation of Management Entrustment Agreement. Mr. Song, the legal representative for Zhongxi and Yarong Feng, the legal representative for An Sen, hold positions as directors and executive officers of each of An Sen and Zhongxi; therefore the Management Entrustment Agreement was not entered into at arm’s length because the parties to the agreement were related prior to the transaction and under common control immediately thereafter. Under the Management Entrustment Agreement and pursuant to consent of the shareholders of Zhongxi, Zhongxi and its shareholders entrusted to An Sen its management rights, the rights and powers of its shareholders and board of directors, and the right to receive all of Zhongxi’s profits in exchange for An Sen’s assumption of the obligation to fund all operating losses and liabilities of Zhongxi. In addition, An Sen has the right to vote as if it holds 100% of the common stock of Zhongxi on all matters that are brought before Zhongxi’s shareholders. As a result of entering into the Management Entrustment Agreement, An Sen has functional control over Zhongxi and for purposes of US GAAP we can consolidate the financial results of Zhongxi. Our PRC counsel has advised us that in their opinion the Management Entrustment Agreement is legal and enforceable under PRC law. In the event of a breach of the Management Entrustment Agreement, the breaching party is liable for monetary damages and there is no right of termination for breach.

To date, none of Zhongxi’s profits have been paid to An Sen, nor has Zhongxi paid any other fees to An Sen pursuant to the Management Entrustment Agreement as available funds have been used for working capital.

The Management Entrustment Agreement was utilized instead of a direct acquisition of the assets or common stock of Zhongxi, because of the lack of clarity in the implementation of current PRC laws regarding the use of a non-PRC entity’s equity as consideration to acquire a PRC entity’s equity or assets. This makes it highly uncertain, if not impossible, for a non-PRC entity (such as China Power) to use its equity to acquire a PRC entity (such as Zhongxi). While PRC law does allow for the purchase of equity interests in, or assets of a PRC entity by a non-PRC entity for cash, the purchase price must be based on the appraised value of the equity or assets. Because the Company did not have sufficient cash to pay the estimated full value of all of the assets of Zhongxi, the Company, through An Sen, entered into the Management Entrustment Agreement in exchange for the right to exercise functional control over Zhongxi.

Neither China Power nor An Sen have any operations or plan to have any operations in the future other than acting as a holding company and management company for Zhongxi and raising capital for its operations. However, we reserve the right to change our operating plans regarding China Power and An Sen.

Business Overview

China Power Equipment, Inc. (“China Power”, the “Company”, or “we”) is a holding company. Through its wholly owned subsidiary, An Sen and its affiliated operating company, Zhongxi, it designs, manufactures, and distributes amorphous alloy transformer cores and amorphous alloy distribution transformers in the People’s Republic of China.

The use of amorphous alloy cores creates a new generation of energy saving electrical power transformers that are used to step down voltage in the final phase of electricity distribution – near consumers and companies.

In China, electricity is generated at 6,000 to 10,000 volts and then stepped up to high voltages for long-distance distribution. When the electricity reaches the user’s district, the voltage is stepped down, the electricity is sent onward to the transformer near the users, and then is stepped down again to either 220 volts or 380 volts to make the electricity safer and ready to use.

China Power creates a range of amorphous metal transformer cores for the transformers that perform this final voltage reduction.

A typical amorphous alloy transformer substantially reduces no-load electricity losses by up to 70% compared with traditional silicon steel transformer in operation, which gives more net electricity to the consumers. For example, for a 500KVA transformer, on a no-load basis, typical silicon steel transformer consumes 960W while comparable amorphous alloy transformers consume only 240W.

Since the amorphous alloy transformer consumes less electricity, it reduces the need to generate electricity. In turn, less coal is burned to provide the same net electricity to the consumers. The result is lower air pollution and more affordable electricity with greater availability.

Therefore, as energy-efficient power equipment, amorphous alloy transformers have received the same strong support from Chinese government as the new type clean energy has, which leads to significant potential demand in the market.

Products

China Power (through Zhongxi) designs, manufactures, and distributes amorphous alloy cores in the PRC that are the main component in a new generation of energy saving electrical power transformers. Zhongxi also sells amorphous alloy transformers and expanded its new transformer production lines in 2011.

|

China Power currently manufactures 59 different products, primarily amorphous alloy cores and amorphous alloy core transformers.

The amorphous alloy core, on the right, has 3,030 layers of amorphous alloy strip, weighs about 68 kilograms (149.94 pounds), and is used in an electric transformer to step down 10,000 volts to 220 volts. The assembly of the core is done by a combination of computer-controlled cutting and precision alignment of each delicate thin alloy strip, careful shaping by hand to the final form, computer-controlled heat treatment matched to the core’s specific application, then final assurance testing, finishing, and protective packaging. The typical price for this core is about RMB 2,448 (about $388).

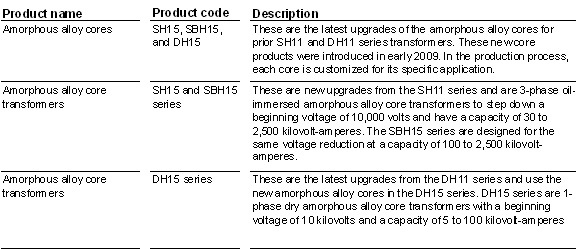

China Power currently produces the amorphous alloy core series SH15, SBH15, and DH15, as well as the transformer series that use those cores, as shown below. Since the new production lines of amorphous alloy transformers just commenced commercial production in the third quarter of 2011, part of the transformer production are still subcontracted to other companies but will be brought in-house when China Power’s transformer production lines ramp up.

|

|

Amorphous Alloy Cores and Transformer Products

Zhongxi uses a patented, innovative production technology for making amorphous alloy transformer cores and transformers. The underlying technology relies on the electrical and magnetic properties of amorphous alloy materials. Amorphous alloys exhibit conductivity properties that are far superior to silicon steel that is used in traditional power transformers. As a result, Zhongxi believes that an amorphous alloy transformer can result in energy savings for its customers. In addition, we use technologies that are more environmental friendly and energy-saving than technologies that are used to make traditional steel cores and transformers.

The amorphous alloy strip, the key raw material used in our manufacturing process, is made by our supplier using flat plate liquid state chilling technology to make the molten alloy steel. The molten alloy steel is then put through a super-freezing process where the cooling speeds are up to one million degrees per second. The micro-mechanism of the resulting metal possesses long range unordered glass state features, completely different from traditional metal alloy material. The resulting amorphous metal is characterized by high intensity, high saturation induction density, high magnetic permeability, rigidity, anticorrosion, wearability, resistivity, low coercivity, low loss, good frequency characteristics and temperature characteristics and good tenacity together with improved electromechanical coupling coefficients, thermal conductivity, and surfactivity. These qualities significantly improve the operational efficiencies of electrical power transformers. We believe this new material will replace silicon steel and permalloy, and will be extensively used in transformer, mutual-inductor, reactance unit, and similar products to further electronic product miniaturization, high frequency, high efficiency, environment protection and energy-saving, which is superior when compared with traditional core materials.

A series of Chinese government regulations have encouraged the use of amorphous alloy core transformers since 1998 because of their energy saving properties. These regulations specified new energy codes for the manufacture and sale of transformers, setting stricter regulations regarding a transformer’s maximum energy consumption limit. In 1998 the Chinese government confirmed the policy of proposing domestic amorphous alloy materials and transformers. In 2000 the Chinese government listed the amorphous alloy transformer as an important environmental protection product. In 2005 the Chinese government listed the energy saving transformer industry as an industry encouraged by the nation.

In the Eleventh Five-Year Plan (2006-2010) announced in 2006, the Chinese government set up the goal for all the local governments to reduce energy consumption by 20%. In 2007, the amorphous alloy industry was considered by the government as one of the industries with significant growing potential. In 2008, the Chinese government launched an “Economic Stimulation Program” that is expected to accelerate the construction of both infrastructure and the electric power grid in rural areas. In 2009, the State Grid Corporation of China entered into a letter of intent for a clean development mechanism program with the World Bank to install high-efficiency amorphous alloy transformers that will gradually replace 166,000 of the most inefficient transformers in China. In November 2010, China’s Development and Reform Commission( NDRC ) and relevant government officials announced “the Guidance for Power Supply Management” in order to accelerate the adoption of products and technologies that would dramatically improve the energy efficiency of electricity grid , reduce emissions, and increase the availability of electricity. The guidance is effective on January 1, 2011. In the guidance, the government not only sets up specific energy-saving targets for grid companies, but also encourages grid companies to install energy-saving transformers. The government also provides a series of incentives, including surcharges on users to encourage grid companies to adopt new technologies to reduce energy consumption.

Improving the energy efficiency of electric distribution systems is a key objective in China’s Twelfth Five-Year Plan (2011-2015), which set up the goals to reduce unit of GDP energy consumption to 16% and carbon dioxide emission per unit of GDP to 17%, together with a smart, efficient, and reliable electricity grid bolstered by improvements to the rural electric grids.

Exit Strategy For Silicon Steel Cores and Transformers Business

Zhongxi no longer manufactures, markets, sells, or distributes silicon steel cores or silicon steel transformers since it exited those product lines in 2009.

Zhongxi started the business of steel cores and transformers in 2004 and leased a piece of land and some equipment from Zhongxi Zhengliu Dianlu Transformer Factory Ltd. (“ZD”) to produce transformers with a lease fee of RMB 100,000 per year (“the 2005 Lease”). The 2005 Lease was effective on January 1, 2005 and runs to year 2028. The agreement can be terminated by mutual agreement or the breaching party will owe the non-breaching party 10% of the lease fee in liquidated damages.

In 2006, Zhongxi outsourced the production of traditional steel core transformers to ZD in order to be able to allocate Zhongxi’s resources to producing amorphous alloy cores and transformers. On March 25, 2006, in order to transform its primary business to the manufacture of amorphous alloy cores and transformers, Zhongxi subleased (the “2006 Sub-Lease”) its manufacturing facilities back to ZD for RMB 500,000 per year for a period of three years ending on March 31, 2009.

The 2006 Sub-Lease was renewed in 2009 on a month to month basis with a monthly rent payment of RMB 8333.33. Under the terms of the 2006 Sub-Lease, ZD will give priority to the steel core transformers ordered by Zhongxi. ZD is responsible for all of the costs and expenses related to the operation of the manufacturing facility. Upon termination of the 2006 Sub-Lease, ZD has a right of first refusal to re-lease the facilities from Zhongxi and manufacture steel core transformers for Zhongxi upon the same terms and conditions as in the 2006 Sub-Lease in the event that Zhongxi decides to continue to outsource these operations. In the event that ZD does not exercise its right of first refusal, the 2006 Sub-Lease terminates and the provisions of the 2005 Lease continue to apply.

Market For Zhongxi’s Products

China’s traditional steel core transformer market is extremely competitive, with several high profile participants. The rising price of raw materials used in steel core transformers has resulted in relatively narrow profit margins for the steel core transformer makers.

The energy-saving performance and environmental improvements that come from amorphous alloy transformers and China’s national policy guidance that encourages their use make traditional silicon steel transformers account less in the transformer market while the adoption of energy-saving transformers is continuously growing. As a result, we believe that demand for high-efficiency amorphous alloy cores and transformers greatly exceeds the current supply.

We made the strategic business decision to focus our manufacturing resources on amorphous alloy cores and amorphous alloy core transformers to gain a larger share of the lucrative amorphous alloy power products market, enjoy the financial benefits of premium pricing, earn an internal rate of return greater than the cost of capital, contribute to improving China’s environment by reducing air and solids pollution and to help China meet its commitment to reduce greenhouse gases, and help improve the quality of life for China’s citizens by increasing the net amount of electricity in both urban and rural regions, at affordable prices.

We believe that our decision to focus on the market for amorphous alloy transformer cores, and later transformers, will enable us to establish a leadership position in the market and to participate in this growth on a broad scale.

China Power’s strategy is designed to establish the Company as a leader in the global amorphous alloy core and transformer market.

China Power has completed its transition to manufacturing amorphous alloy cores and transformers. The Company expects to control the raw material cost by large-scale production and procurement as well as more application of lower priced domestically-produced raw material through the effort of R&D, and reduce the cost of amorphous alloy transformers by improving process and technology, and thus improve the gross margin.

The Company plans to strengthen its sales and marketing efforts, build relationships with appropriate state and national government agencies, and establish relationships with major transformer manufacturers and industrial customers.

China Power intends to continue to invest in R&D to improve transformer efficiency and diversify lines of products to meet customer and market demand.

In 2010, China Power was granted three patents regarding its products and specialized equipment, and has received patent certificates. China Power also applied for a new patent in 2011 and received patent certificate in February 2012. These new product designs are expected to effectively enrich our product portfolio, and should provide more options for our customers.

Meanwhile, our R&D department has achieved the milestone on application of domestic amorphous materials. Beginning from the third quarter of 2011, China Power used domestically-produced strips to process several models of cores for customers, which offers more options for the customers, thus, enhancing the Company’s competitiveness.

Amorphous alloy transformers are also attracting attention in other countries. Currently, installation of amorphous alloy transformers is growing rapidly in Asia. In 2007, the Company exported its products to South Korea as a policy of the South Korean government mandates that at least 3 percent of all newly-installed power transformers should be amorphous core transformers. The Company plans in the future to actively pursue markets outside of China.

Customers Of Zhongxi

China Power’s direct and indirect customers include China’s primary electricity generator and supplier, the State Grid Corporation of China, provincial electric suppliers, large suppliers of electrical equipment to the electrical power industry, and other electric power transformer manufacturers.

The State Grid Corporation of China (“State Grid”) builds and operates the electric power grids and provides a secure and reliable power supply for the development of the Chinese society. Its service area covers 26 provinces, autonomous regions, and municipalities directly under the jurisdiction of the Chinese Central Government, which accounts for 88 percent of China’s national territory. The State Grid is an entity owned and managed by the Chinese government and is the major buyer of electric power transformers in China.

Marketing And Production Strategy Of Zhongxi

Through Zhongxi, China Power’s strategy for marketing and production consists of the following:

· Increase its market share in amorphous alloy transformer cores by effective marketing and direct selling to the transformer makers, and by cooperating with their customers (the Chinese governments and their government agencies).

· Market to transformer makers by assisting them with the specification, design, engineering, prototyping, and final product performance validation for amorphous alloy transformers that needs specific applications. The customers accept China Power’s technical assistance in exchange for the customers’ commitments to purchase all their cores from China Power.

· Diversify the supply of amorphous alloy strip which provides more options to the customers.

· China Power will prudently expand capacity so that it can deliver all new orders promptly, consistent with the customers’ just-in-time specifications. Customers will then have high assurance that their high-quality cores and transformers will arrive on time.

· Expand its capacity in its production plants in phases to optimize the company’s return on assets.

· Increase its market share in high-performance electrical transformers that use the company’s amorphous alloy transformer cores by introducing its new line of amorphous alloy transformers and by expanding sales in Northwestern China first and later nationwide.

· Make transformer customers the first priority on its core production. China Power will fill all its customers’ orders for cores at the time specified – before it supplies cores to its own transformer production line.

· Actively design and produce transformers for different applications, including new energy applications. The company is also targeting manufacturers who are seeking to change from traditional transformers to energy-saving products, and making them potential customers for our amorphous alloy cores.

Raw Materials And Principal Suppliers Of Zhongxi

Zhongxi’s amorphous alloy cores have three main raw materials: amorphous alloy strip, silicon steel sheet, and epoxy resin. Except for amorphous alloy strip which is mostly purchased from overseas and only a small portion of it are purchased in China, other materials are currently readily available domestically in China.

The current main supplier of amorphous alloy strip for manufacturing amorphous alloy cores is Hitachi Metals Co., Ltd.(“Hitachi”), which is the biggest manufacturer of amorphous alloy strip in the world. As the biggest manufacturer of amorphous alloy cores in northwestern China, the Company has maintained a longstanding relationship with Hitachi. Notwithstanding the fact that the supply of Hitachi’s amorphous alloy strip is outpaced by the global demand for its product, we believe our relationship with Hitachi will generally permit us to purchase sufficient amounts of material to keep up with the demand for our products. Meanwhile, in 2011, we have begun to scale purchase amorphous alloy strip from Advanced Technology & Materials Co. Ltd. ("AT&M"), which is the largest domestic supplier in China. We expect that the alternative supplier of strip reduces any potential risks relating to the materials, and will enrich our product portfolios. We signed a strategic alliance cooperative agreement with AT&M whereby we have been given priority to purchase its amorphous alloy strip products.

In September 2009, AT&M completed their test production of amorphous alloy strip, using their facility that has an annual capacity of 10,000 metric tons. In 2010, AT&M expanded the annual capacity to 40,000 metric tons. With years’ of R&D efforts on testing the application of AT&M’s strip to manufacture cores and transformers, since the third quarter of 2011, we have started to use these domestically-produced strips to commercially manufacture several models of cores. Zhongxi believes that this second source for amorphous alloy strip, when mass production begins, is likely to help alleviate the raw material constraint that has been a concern in the global transformer industry.

Competition

Many manufacturers are capable of producing traditional transformers, but with the government’s increasing attention on energy-saving transformers, there are about 30 to 40 enterprises which have the manufacturing technology of amorphous alloy transformers in China, among which only a few of them are professional and sizable. After we finish the construction of new transformer cores and transformer factory, Zhongxi is among the top levels and is one of the major professional manufacturers of amorphous alloy cores in China. The largest two are Shanghai Zhixin Electric Co., Ltd. and Beijing ZJLG Amorphous Technology Co., Ltd.

Comparative data for Zhongxi and its two main competitors in the amorphous alloy core business is shown in the table below.

|

China Power

|

Shanghai Zhixin

Electric Co. Ltd.

|

Beijing ZJLG Amorphous Technology Co., Ltd. (1)

|

|

|||||||||

|

Year established

|

2004

|

1998

|

2005

|

|||||||||

|

Sales in 2011 in RMB

|

238,862,020

|

1,279,460,763

|

130,256,041

|

|||||||||

|

Sales in 2011 in US $ (2)

|

37,001,893

|

198,200,075

|

20,177,842

|

|||||||||

|

Geographic market coverage

|

National

|

National

|

National

|

|||||||||

|

Annual production capacity, in metric tons (3)

|

6,500

|

20,000

|

6,000

|

|||||||||

(1) 2011 sales for Beijing ZJLG Amorphous Technology Co., Ltd are projected sales for year ended December 31, 2011 as its fiscal year end is June 30.

(2) US$ amounts were translated using year 2011 average exchange rate of $1 = RMB 6.4554

(3) The annual production capacity is estimated by us per the industry knowledge.

While Zhongxi’s competitors are larger, we believe Zhongxi has a number of advantages over its competitors which will help expand our market in a short time.

(1) Geographic: The Company is located in Xi’an, a major city in northwestern China, and is the only professional manufacturer of amorphous alloy cores in northwestern China. As Xi’an lies in the center of the country, this unique geographic advantage best suits the energy-saving effect of amorphous alloy transformers since the transportation of the products is more convenient.

(2) Technology: The Company has seven patents, including design of the cores and transformers, equipment for core production and transformer production. The extensive coverage of our patents shows that our company has a comprehensive knowledge in the amorphous alloy transformer industry. In addition, the Company’s superior manufacturing and process technology largely ensure high quality and reliable amorphous alloy cores and transformers. These technologies have enabled the Company to lower production cost and provide comprehensive service and optimal design to our customers.

(3) Capacity: After the completion of capacity expansion for amorphous alloy cores in 2010 and for amorphous alloy transformers in 2011, the Company has become one of the top manufacturers in the amorphous industry.

(4) Extensive experiences: As a pioneer of the research and development of amorphous alloy transformers in China, the Company has maintained a good relationship with relevant state ministries and AT&M in Beijing. The Company has started the testing application of domestic amorphous alloy strip with AT&M since 2009, and begun to commercially produce cores and transformers using domestic amorphous alloy strip from AT&M since the third quarter of 2011. The technologies we have accumulated and the good relationship within the industry will effectively improve our competitiveness.

Research and Development

Research and development has been and continues to be a chief component of Zhongxi’s strategy, and it has strong independent research and development abilities. Zhongxi has seven Chinese national patents: 3-phase oil-immersed amorphous alloy transformer (patent number ZL01212922.4), dry type transformer (patent number ZL98234558.5), Consecutive Anneal Stove For Amorphous Metal Distribution Transformer Core (patent number ZL200620078995.4), a new amorphous alloy transformer (patent number ZL 2010 2 0195940), vacuum oiling device for amorphous alloy transformers (patent number ZL 2010 2 0195939.5), three-phase three-column amorphous alloy transformer core (patent number ZL 2010 2 0510531.2), and high-voltage coiling of 35KV amorphous oil-immersed transformers (patent number ZL201120150449.8).

Zhongxi’s leading researcher, Mr. Xu Zewei, is one of the forerunners in the research of amorphous alloy core transformers in China. He has extensive research experience in electromagnetism and has initiated and participated in more than 20 research projects and made ground-breaking discoveries. Zhongxi’s research team consists of PhDs and graduate students who collectively have decades of experience in transformer design and development. The Company is also dedicated to bringing new talent to the group; the newcomers have successfully served in helping to keep the research team at the leading edge of power transformer research and development.

In 2007, Zhongxi was recognized by the Xi’an municipal government as the only R&D and production technology center for amorphous alloy cores.

As of December 31, 2011, we had 6 full-time employees engaging in the company-sponsored research and development.

Intellectual Property

Trademarks

Zhongxi has registered a trademark for its logo. The trademark was effective on July 21, 2011 and will expire on July 20, 2021.

Patents

Zhongxi has seven Chinese national patents: (i) 3-phase oil-immersed amorphous alloy core transformer, patent number ZL01212922.4, which expired on January 10, 2011, (ii) dry type transformer, patent number ZL98234558.5, which will expire on June 30, 2012, (iii) Consecutive Anneal Stove For Amorphous Metal Distribution Transformer Core, patent number ZL200620078995.4, which will expire on May 18, 2016, (iv) a new amorphous metal transformer, patent number ZL 2010 2 0195940, which will expire on May 19, 2020, (v) vacuum oiling device for amorphous alloy transformers, patent number ZL 2010 2 0195939.5, which will expire on May 19, 2020, (vi) three-phase three-column amorphous alloy transformer core, patent number ZL 2010 2 0510531.2, which will expire on August 31, 2020, and (vii) high-voltage coiling of 35KV amorphous oil-immersed transformers, patent number ZL 201120150449.8, which will expire on May 12, 2021.

Domain Names

China Power owns and operates a website under the internet domain name of http://www.chinapower-equipment.com.

Government Regulation

Zhongxi is not subject to any requirements for governmental permits or approvals or any self regulatory professional associations for the manufacture and sale of amorphous alloy cores, but may be subject to requirement of self regulatory professional associations for manufacturing and selling amorphous alloy transformers. Zhongxi is not subject to any significant government regulation of the business or production, or any other government permits or approval requirements, except for the laws and regulations of general applicability for corporations formed under the laws of the PRC.

Compliance With Environmental Laws

To our knowledge, neither the production nor the sale of our products constitute activities or generate materials, in a material manner, which causes Zhongxi’s operations to be subject to the PRC environmental laws.

Risk Of Loss And Product Liability Insurance

Delivery of Zhongxi’s products is arranged by Zhongxi. Usually, Zhongxi delivers its products primarily through independent logistics companies. Its current shipping companies include Shaanxi Haoyuntong Logistic, Ltd. and Xi’an Haina Logistic Company.

Zhongxi currently does not carry any product liability or other similar insurance, nor does Zhongxi have property insurance covering our plants, manufacturing equipment, and office buildings. While product liability lawsuits in the PRC are rare and Zhongxi has never experienced significant failures of its products, we cannot assure you that Zhongxi would not face liability in the event of any failure of any of its products.

Employees

The table below presents the number of our employees on December 31, 2011 and 2010.

|

Category

|

2011

|

2010

|

||||||

|

Administration

|

20

|

17

|

||||||

|

Manufacturing

|

37

|

31

|

||||||

|

Research & development

|

6

|

6

|

||||||

|

Sales & support

|

6

|

8

|

||||||

|

Total

|

69

|

62

|

||||||

Executive Office

Our principal executive offices are located at: Room 602, 6/F, Block B, Science & Technology Park of Xi Dian University, No. 168 Kechuang Road, Hi-tech Industrial Development Zone, Xi’an, Shaanxi, China 710065. Our telephone number at that address is 86-2962619758.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider all of the risks described below, together with the other information contained in this report, before making a decision to purchase our common stock. You should only purchase our common stock if you can afford to lose your entire investment.

An Investment In Our Common Stock Involves A High Degree Of Risk. You Should Carefully Consider The Risks Described Below And The Other Information Contained In This Report Before Deciding To Invest In Our Common Stock.

The risks and uncertainties described below are not the only ones we may face. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also adversely affect our business, financial condition, and or operating results. If any of the following risks, or any other risks not described below, actually occur, it is likely that our business, financial condition, and operating results could be seriously harmed. As a result, the trading price of our common stock could decline, and you could lose part or all of your investment.

We Do Not Have Any Equity Ownership Interest in Zhongxi, Our Operating Business, And Our Executives Are Also Affiliates of Zhongxi and An Sen, The Parties To The Management Entrustment Agreement.

We do not have any equity ownership interest in Zhongxi. We control Zhongxi through a Management Entrustment Agreement between Zhongxi and our wholly owned subsidiary An Sen. Both An Sen and Zhongxi are controlled by affiliates of Zhongxi and Alloy Science, including Mr. Song, our CEO and Chairman who holds approximately 43.8% of the shares of common stock of Zhongxi and 15.2% of our common stock, and Ms. Yarong Feng and Mr. Gouan Zhang ,affiliates of Zhongxi and An Sen who manage approximately 19.6% of our common stock as trustees for the shareholders of Alloy Science. Mr. Song is also the President and CEO of An Sen, acting CEO and President of Alloy Science, and one of the trustees for 93.8% of the Alloy Science shares held by shareholders of Alloy Science. Ms. Feng is a Director of China Power, Director of An Sen, Chief Financial Officer and Director of Zhongxi, Secretary to the Board of Directors of Alloy Science, and a Trustee for the shareholders of Alloy Science. Mr. Zhang is a Vice General Manager of China Power, Vice General Manager of An Sen, Vice General Manager and director of Zhongxi, and Trustee under Voting Trust and Escrow Agreement for Alloy Science.

RISKS RELATED TO OUR BUSINESS

Our Limited Operating History May Not Serve As An Adequate Basis To Judge Our Future Prospects And Results Of Operations.

Zhongxi commenced its business operations in2004. Its limited operating history may not provide a meaningful basis on which to evaluate its business. We cannot assure you that Zhongxi will maintain our profitability or that it will not incur net losses in the future. We expect that the operating expenses of Zhongxi will increase as it expands. Any significant failure to realize anticipated revenue growth could result in significant operating losses. Zhongxi will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to: (a) raise adequate capital for expansion and operations; (b) implement the business model and strategy and adapt and modify them as needed; (c) increase awareness of the brands of Zhongxi, protect its reputation and develop customer loyalty; (d) manage the expanding operations and service offerings of Zhongxi, including the integration of any future acquisitions; (e) maintain adequate control of the expenses of Zhongxi; (f) anticipate and adapt to changing conditions in the transformer and electric power market in which Zhongxi operates as well as the effect of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments, and other significant competitive and market dynamics.

If Zhongxi is not successful in addressing any or all of these risks, our business may be materially and adversely affected.

The Failure Of Zhongxi To Compete Effectively May Adversely Affect Its Ability To Generate Revenue.

Zhongxi competes primarily on the basis of its ability to find purchasers for our transformer cores and transformers. There can be no assurance that it will continue to find such purchasers in new areas as we attempt to expand or that its competitors will not negotiate more favorable arrangements.

We expect that we will be required to continue to invest in expansion capacity and research and development efforts in order for Zhongxi to remain competitive. Zhongxi’s contemplated expansion will require large amounts of capital. Zhongxi’s competitors may have better resources and better strategies to raise capital which could have a material adverse effect on its business, results of operations and financial condition.

Zhongxi May Not Be Able To Effectively Control And Manage Its Growth.

If the business of Zhongxi and its markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. Any expansion would increase demands on the existing management, workforce, and facilities of Zhongxi. Failure to satisfy such increased demands could interrupt or adversely affect the operations of Zhongxi, cause delays in production and delivery of amorphous alloy cores and transformers and create administrative inefficiencies.

We May Require Additional Financing In The Future And A Failure To Obtain Such Required Financing Will Inhibit The Ability Of Zhongxi To Grow.

The continued growth of the business of Zhongxi may require additional funding from time to time. Funding would be used for general corporate purposes, which could include acquisitions, investments, repayment of debt, capital expenditures, and repurchase of our capital stock, among other things. Obtaining additional funding would be subject to a number of factors, including market conditions, operating performance, and investor sentiment, many of which are outside of our control. These factors could make the timing, amount, and terms and conditions of additional funding unattractive or unavailable to us.

The Terms Of Any Future Financing May Adversely Affect Your Interest As Stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon liquidation of the Company. In addition, indebtedness may be under terms that make the operation of the business of Zhongxi more difficult because the lender’s consent could be required before we take certain actions. Similarly, the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

The Protection Of Intellectual Property Rights In The PRC Is Not As Effective As In The United States Or Other Countries.

Our success depends, in part, on our ability to protect the proprietary technologies of Zhongxi. As of the date of this annual report, Zhongxi has seven patents (one expired on January 10, 2011), five patents for the production technology of amorphous alloy transformers and two patents for equipment for the production of amorphous alloy cores and transformers.

Protection of intellectual property in the PRC has historically been weak, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in the PRC may not be as effective as they are in the United States and other countries. Policing unauthorized uses of proprietary technology is difficult and expensive, and we might need to resort to litigation to enforce or defend patents issued to us or to determine the enforceability, scope and validity of Zhongxi’s proprietary rights or those of others. Such litigation could require significant expenditure of cash and management efforts and could harm our business, financial condition, and results of operations. An adverse determination in any such litigation would impair our intellectual property rights and could harm our business, competitive position, business prospects, and reputation. There is no guarantee that Zhongxi’s intellectual property is or will be sufficiently protected. Nor is there any guarantee that its current or potential competitors that do not have such technology, will not obtain or develop, similar technology, which could negatively impact our competitive advantage over such companies and our business.

We And Or Zhongxi May Be Exposed To Intellectual Property Infringement And Other Claims By Third Parties, Which, If Successful, Could Cause Us And or Zhongxi To Pay Significant Damage Awards And Incur Other Costs.

Although we believe that the technology Zhongxi uses, including its patented technology and technology for which Zhongxi has applied for patents, is significantly distinguished from other patented technology, and any infringement claim relating to the technology of Zhongxi would be unlikely to succeed, we cannot assure you that our assessment is or will remain correct. In addition, as litigation becomes more common in the PRC in commercial disputes, we face a higher risk of being the subject of intellectual property infringement claims. The validity and scope of claims relating to patents for amorphous alloy core and transformer technology and related devices and machines involve complex technical, legal, and factual questions and analysis and, therefore, may be highly uncertain. The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceeding to which we and/or Zhongxi may become a party could subject us and or Zhongxi to significant liability to third parties, including damage awards, and could require Zhongxi to seek licenses from third parties, pay ongoing royalties, or to redesign products or subject Zhongxi to injunctions preventing the manufacture and sale of its products. Protracted litigation could also result in the customers or potential customers of Zhongxi deferring or limiting their purchase or use of its products until resolution of such litigation.

Zhongxi Depends On A Concentration Of Raw Materials Suppliers. Any Significant Fluctuation In The Price Of Raw Materials May Have A Material Adverse Effect On The Manufacturing Cost Of The Products Of Zhongxi.

Zhongxi relies on raw materials, especially amorphous alloy strip, to produce its products. And for amorphous alloy transformers, the main raw materials include copper, silicon steel, transformer oil, etc., in addition to in-house produced cores. Zhongxi enters into supply contracts for these raw materials. Therefore, the availability of raw materials is subject to risks of contract fulfillment from the counterparties of Zhongxi. The support of government to the amorphous alloy transformer industry may increase the demand for amorphous alloy strip, silicon steel sheet and epoxy resin, which may bring an increase in price. For the major material, amorphous alloy strip, the only main supplier is Hitachi Metals Co., Ltd, Currently, Hitachi’s amorphous alloy strip global supply falls short of demand. In the event that Hitachi is unable to provide us with the amorphous alloy strip we require, Zhongxi may be unable to find alternate sources, or find alternate sources at reasonable prices. In such an event, the business and financial results of Zhongxi would be materially and adversely affected.

AT&M, a Chinese domestic amorphous alloy strip manufacturer, has been ramping up the supply of strip in recent years, which can be used for several models of amorphous alloy cores. The supply of amorphous alloy strip from AT&M may help relieve the potential shortage of amorphous alloy strip in the future. However, with the increasing demand in both China’s and the world’s market, a shortage for the raw material may still exist in the future. In such an event, if our company cannot find any alternatives, the business and financial results of Zhongxi would be materially and adversely affected.

While Zhongxi Has Some Long Term Supply Contracts With Its Suppliers Of Raw Materials, Any Significant Fluctuation In The Price Of Raw Materials May Have A Material Adverse Effect On Its Manufacturing Costs.

Silicon steel sheet and epoxy resin are two other raw materials that Zhongxi uses in cores manufacturing in addition to amorphous alloy strip, copper material and transformer oil are used to manufacture transformers. The prices of the sheet steel, epoxy resin, copper material and transformer oil are subject to market conditions. Our operating company has certain long-term contracts or arrangements with its suppliers; however, the contracts may not be sufficient to cover its needs. While some of these raw materials are generally available, other raw materials for the amorphous alloy cores and transformers produced by Zhongxi have limited suppliers, and we cannot assure you that prices will not rise because of changes in market conditions. An increase in component or raw material costs relative to the product prices of Zhongxi could have a material adverse effect on its gross margins and earnings.

Potential Environmental Liability Could Have A Material Adverse Effect On Operations And The Financial Condition Of Zhongxi.

To the knowledge of our management team, neither the manufacture of transformer cores and transformers nor the sale and distribution of transformer cores and transformers requires Zhongxi to comply with PRC environmental laws other than laws of general applicability. Zhongxi has never been the subject of allegations of any environmental regulation; however, there can be no assurance that the PRC government will not amend its current environmental protection laws and regulations. The business and operating results of Zhongxi could be materially and adversely affected if Zhongxi were to increase expenditures to comply with environmental regulations affecting its operations.

We May Engage In Future Acquisitions That Could Dilute The Ownership Interests Of Our Stockholders, Cause Us To Incur Debt, And Assume Contingent Liabilities.

We may review acquisition and strategic investment prospects that we believe would complement our current product offerings, augment our market coverage, or enhance our technical capabilities, or otherwise offer growth opportunities. From time to time we review investment opportunities in new businesses, and we expect to make investments in and or to acquire businesses, products, or technologies in the future. In the event of any future acquisitions, we could issue equity securities which would dilute current stockholders’ percentage ownership; incur substantial debt; assume contingent liabilities; or expend significant cash.

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including difficulties in the assimilation of acquired operations, technologies and or products; unanticipated costs associated with the acquisition or investment transaction; the diversion of management’s attention from other business concerns; adverse effects on existing business relationships with suppliers and customers; risks associated with entering markets in which we have no or limited prior experience; the potential loss of key employees of acquired organizations; and substantial charges for the amortization of certain purchased intangible assets, deferred stock compensation or similar items. We cannot ensure that we will be able to successfully integrate any businesses, products, technologies, or employees that we might acquire in the future, and our failure to do so could have a material adverse effect on our business, operating results, and financial condition.

We Are Responsible For The Indemnification Of Our Officers And Directors.

Our Articles of Incorporation provide for the indemnification and/or exculpation of our directors, officers, employees, and agents to the maximum extent provided, and under the terms provided, by the laws and decisions of the courts of the state of Maryland. This indemnification policy could result in substantial expenditures, which we may be unable to recoup, which could adversely affect our business and financial conditions.

We May Have Difficulty Establishing Adequate Management, Legal, And Financial Controls In The PRC.

The PRC historically has not adopted a western style of management and financial reporting concepts and practices, as well as modern banking, computer, and other control systems. Zhongxi may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, it may experience difficulty in establishing management, legal, and financial controls, collecting financial data, and preparing financial statements, books of account and corporate records, and instituting business practices that meet Western standards.

We May Not Have Adequate Internal Accounting Controls. While We Have Certain Internal Procedures In Our Budgeting And Forecasting And In The Management And Allocation Of Funds, Our Internal Controls May Not Be Adequate.

We are constantly striving to improve our internal accounting controls. We hope to develop an adequate internal accounting control to budget, forecast, manage, and allocate our funds and account for them. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast, and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under the US securities laws.

Our Internal Controls Over Financial Reporting May Not Be Effective, Which Could Have A Significant And Adverse Effect On Our Business.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting. The standards that must be met for management to assess the internal control over financial reporting as effective are complex, and require significant documentation, testing, and possible remediation to meet the detailed standards. Our lack of familiarity with Section 404 may unduly divert management’s time and resources in executing the business plan. If, in the future, management identifies one or more material weaknesses, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price and/or subject us to sanctions or investigation by regulatory authorities.

We Do Not Have Key Man Insurance On Our President And CEO, Mr. Song, On Whom We Rely For The Management Of Zhongxi’s Business.

We depend, to a large extent, on the abilities and participation of our current management team, but have a particular reliance upon Mr. Yongxing Song. The loss of the services of Mr. Song, for any reason, may have a material adverse effect on our business and prospects. We cannot assure you that we will be able to find a suitable replacement for Mr. Song. We do not carry key man life insurance for any of our key employees.

We May Not Be Able To Hire And Retain Qualified Employees To Support The Growth Of Zhongxi And If We Are Unable To Retain Or Hire These Employees In The Future, Our Ability To Improve Our Products And Implement Our Business Objectives Could Be Adversely Affected.

Competition for senior management and employees in the PRC is intense, the pool of qualified candidates in the PRC is very limited, and Zhongxi may not be able to retain the services of its senior executives or senior employees, or attract and retain high-quality senior executives or senior employees in the future. This failure could materially and adversely affect our future growth and financial condition.

Zhongxi Does Not Presently Maintain Fire, Theft, Product Liability, Or Any Other Property or Business Interruption Insurance, Which Leaves Us With Exposure In The Event Of Loss Or Damage To Its Properties, Those of Our Principal Suppliers or Customers Or Claims Filed Against Us And/Or Zhongxi.

Neither we nor Zhongxi maintains fire, theft, product liability, or other insurance of any kind. We bear the economic risk with respect to loss of or damage or destruction to our property and to the interruption of our business as well as liability to third parties for personal injury or damage or destruction to their property that may be caused by our personnel or products. This liability could be substantial and the occurrence of such loss or liability may have a material adverse effect on our business, financial condition and prospects. However, product liability lawsuits in the PRC are rare, and Zhongxi has never experienced significant failure of its products. In addition, catastrophic events, including natural disasters such as hurricanes and earthquakes; war or terrorist activities; unplanned outages; supply disruptions; and failures of equipment or systems at any of our facilities could adversely affect our results of operation. Hitachi Metals, headquartered in Tokyo, Japan, is our largest supplier of amorphous alloy strip, the primary raw material for making our amorphous alloy electricity transformer cores and is the largest manufacturer of amorphous alloy in the world. Its alloy manufacturing operations are located in southern Japan. Although to date Hitachi Metals appears not to have been affected by the earthquake, aftershocks, or the tsunami that hit northeastern Japan or the nuclear radiation leaks that have followed, the consequences of closing more nuclear power stations in Japan might eventually reduce Hitachi Metals' ability to produce or ship alloy to us. If these conditions persist, they may have an adverse effect on our result of operations.

Neither We Nor Zhongxi Maintains A Reserve Fund For Warranty Or Defective Equipment Claims. Zhongxi’s Costs Could Substantially Increase If We Experience A Significant Number Of Warranty Claims.

Currently, Zhongxi provides a one-year warranty to its customers who have purchased its transformers. The warranties require us to replace defective equipment. As of March 28, 2012, Zhongxi has received no warranty claims for its products. Consequently, the costs associated with its warranty claims have historically been minimal, and we have therefore not established any reserve funds for potential warranty claims. If Zhongxi begins to receive warranty claims, our financial condition and results of operations could be materially adversely affected.

RISKS RELATED TO OUR INDUSTRY

A Drop In The Retail Price Of The Traditional Transformer Cores or Transformers In The PRC May Have A Negative Effect On The Business Of Zhongxi.

If the retail price of traditional steel transformer cores or transformers is reduced, the purchaser may choose not to purchase the more expensive amorphous alloy transformer cores or transformers. Such decrease of demand may lead to a decrease in profits of Zhongxi and us. Although management of Zhongxi believes that current retail prices of amorphous alloy transformer cores and transformers support a reasonable return on investment for its products, there can be no assurance that future retail pricing will remain at such levels.

Existing Regulations And Changes To Existing Regulations May Significantly Reduce Demand For The Products Of Zhongxi.

The development of the market for amorphous alloy cores and transformers is supported by relevant government regulations. Even though we believe such supporting policies of the government will not change in the near future, there is no guarantee that changes will not happen in the long run. We are responsible for knowing the requirements of individual cities and must design equipment to comply with varying standards. Any new government regulations or utility policies that relate to our amorphous alloy transformer cores products may result in significant additional expenses to us, our resellers, and their customers and, as a result, could cause a significant reduction in demand for our products.

If Amorphous Alloy Technology Is Not Suitable For Widespread Adoption, Or Sufficient Demand For Amorphous Alloy Products Does Not Develop Or Takes Longer To Develop Than We Anticipate, The Sales Of Zhongxi Would Not Significantly Increase And Neither We Nor Zhongxi Would Be Able To Achieve Or Sustain Profitability.

The market for amorphous alloy products is emerging and rapidly evolving, and its future success is uncertain. If amorphous alloy technology proves to be unsuitable for widespread commercial deployment or if demand for amorphous alloy products fails to develop sufficiently, Zhongxi would be unable to generate enough revenues to achieve and sustain profitability. In addition, demand for amorphous alloy products in the markets and geographic regions Zhongxi targets may not develop or may develop more slowly than we anticipate. Many factors will influence the widespread adoption of amorphous alloy technologies and demand for amorphous alloy products, including (i) cost-effectiveness of amorphous alloy technologies as compared with conventional steel transformer technologies; (ii) performance reliability and maintenance of amorphous alloy products as compared with conventional steel transformer technologies; and (iii) capital expenditures by customers that tend to decrease if the PRC or global economy slows down.

RISKS RELATED TO DOING BUSINESS IN THE PRC.

Changes In The Policies Of The PRC Government Could Have A Significant Effect On The Business We May Be Able To Conduct In The PRC And The Profitability Of Such Business.

The PRC’s economy is in a transition from a planned economy to a market oriented economy, subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case. A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC’s political, economic, and social life.

The PRC Laws And Regulations Governing The Current Business Operations Of Zhongxi Are Sometimes Vague And Uncertain. Any Changes In Such PRC Laws And Regulations May Harm The Business Of Zhongxi.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including the laws and regulations governing the business of Zhongxi, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy, and criminal proceedings. We and any future subsidiaries are considered foreign persons or foreign funded enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations. New laws and regulations that affect existing and new businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses.

A Slowdown Or Other Adverse Developments In The PRC Economy May Harm Our Customers And The Demand For Our Services And Our Products.

All of our operations are conducted in the PRC and all of our revenues are currently generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that this growth will continue. The amorphous alloy industry in the PRC is relatively new and growing. However, a slowdown in overall economic growth, an economic downturn, a recession, or other adverse economic developments in the PRC could significantly reduce the demand for our products and harm our business.

Inflation In The PRC Could Negatively Affect Our Profitability And Growth.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth could lead to growth in the money supply and rising inflation. If prices for the products of Zhongxi rise at a rate that is insufficient to compensate for the rise in the costs of its supplies, it may harm the profitability of Zhongxi. In order to control inflation in the past, the PRC government has imposed controls on bank credit, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth. The NBS reported that the general level of consumer prices in China in 2011 increased by 5.4% over 2010. To control inflation, the Chinese government may raise interest rates, impose controls on credit and/or prices, or take other actions which could slow economy activity in China and materially increase our costs and also reduce demand for our products.

Governmental Control Of Currency Conversion May Affect The Value Of Your Investment.

The PRC government imposes controls on the convertibility of the renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive substantially all of our revenues in renminbi, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

The PRC government may also in the future restrict access to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

The Fluctuation Of The Renminbi May Harm Your Investment.

The value of the Chinese renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. As we rely entirely on revenues earned in the PRC, any significant revaluation of the renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. dollars we receive from an offering of our securities into renminbi for the operations of Zhongxi, appreciation of the renminbi against the U.S. dollar would diminish the value of the proceeds of the offering and this could harm the business, financial condition, and results of operations for us and Zhongxi. Conversely, if we decide to convert renminbi from Zhongxi into U.S. dollars for the purpose of making payments for dividends on our common shares or for other business purposes and the U.S. dollar appreciates against the renminbi, the U.S. dollar equivalent of the renminbi we convert would be reduced. In addition, the depreciation of significant U.S. dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the renminbi to the U.S. dollar. Under the new policy, the renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an appreciation of the renminbi against the U.S. dollar. While the international reaction to the renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the renminbi against the U.S. dollar.

PRC State Administration Of Foreign Exchange (“SAFE”) Regulations Regarding Offshore Financing Activities By PRC Residents May Increase The Administrative Burden We Face. The Failure By Our Shareholders Who Are PRC Residents To Make Any Required Applications And Filings Pursuant To Such Regulations May Prevent Us From Being Able To Distribute Profits And Could Expose Us And Our PRC Resident Shareholders To Liability Under PRC Law.

In October 2005, the PRC State Administration of Foreign Exchange (“SAFE”) issued a public notice, “Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China”, or the SAFE notice (“SAFE #75”), which requires PRC residents, including both legal persons and natural persons, to register with the competent local SAFE branch before establishing or controlling any company outside of China, referred to as an “offshore special purpose company,” for the purpose of overseas equity financing involving onshore assets or equity interests held by them. In addition, any PRC resident that is the shareholder of an offshore special purpose company is required to amend its SAFE registration with the local SAFE branch with respect to that offshore special purpose company in connection with any increase or decrease of capital, transfer of shares, merger, division, equity investment, or creation of any security interest over any assets located in China. Moreover, if the offshore special purpose company was established and owned the onshore assets or equity interests before the implementation date of the SAFE notice, a retroactive SAFE registration is required to have been completed before March 31, 2006. If any PRC shareholder of any offshore special purpose company fails to make the required SAFE registration and amendment, the PRC subsidiaries of that offshore special purpose company may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer, or liquidation to the offshore special purpose company. Moreover, failure to comply with the SAFE registration and amendment requirements described above could result in liability under PRC laws for evasion of applicable foreign exchange restrictions.

We believe that our PRC resident controlling shareholder, Mr. Song, has taken all necessary steps as instructed by the local SAFE branch to comply with SAFE #75 by filing a disclosure form regarding his ownership status; however, we cannot assure you that this disclosure document will be sufficient. It is also unclear exactly whether our other PRC resident shareholders must make disclosure to SAFE. While our PRC counsel has advised us that only the PRC resident shareholders who receive ownership of the foreign holding company in exchange for ownership in the PRC operating company are subject to SAFE #75, there can be no assurance that SAFE will not require our other PRC resident shareholders to register and make the applicable disclosure. In addition, SAFE #75 requires that any monies remitted to PRC residents outside of the PRC be returned within 180 days; however, there is no indication of what the penalty will be for failure to comply or if shareholder non-compliance will be considered to be a violation of SAFE #75 by us or otherwise affect us. In the event that the proper procedures are not followed under SAFE #75, we could lose the ability to remit monies outside of the PRC and would therefore be unable to pay dividends or make other distributions. Our PRC resident shareholders could be subject to fines, other sanctions and even criminal liabilities under the PRC Foreign Exchange Administrative Regulations promulgated January 29, 1996, as amended.

The PRC’s Legal And Judicial System May Not Adequately Protect The Business And Operations Of Zhongxi And The Rights Of Foreign Investors.