Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - China Executive Education Corp | ex31x2.htm |

| EX-32.1 - EXHIBIT 32.1 - China Executive Education Corp | ex32x1.htm |

| EX-31.1 - EXHIBIT 31.1 - China Executive Education Corp | ex31x1.htm |

| EX-32.2 - EXHIBIT 32.2 - China Executive Education Corp | ex32x2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 3

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 000-54086

CHINA EXECUTIVE EDUCATION CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

75-3268300

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

c/o Hangzhou MYL Business Administration Consulting Co. Ltd.

Room 307, Hualong Business Building

110 Moganshan Road, Hangzhou 310005

People’s Republic of China

(Address of principal executive offices)

(+86) 0571-8880-8109

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o | |

|

Non-Accelerated Filer o

(Do not check if a smaller reporting company)

|

Smaller reporting company x |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes o No x

As of June 30, 2010 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing price of such shares as quoted on the OTC Bulletin Board maintained by the Financial Industry Regulatory Authority) was approximately $8.48 million. Shares of the registrant’s common stock held by each executive officer and director and each by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 22,834,100 shares of the registrant’s common stock outstanding as of April 12, 2011.

None.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2010

TABLE OF CONTENTS

| Explanatory Note | 1 | |

| Special Note Regarding Forward Looking Statements | 2 | |

| Use of Terms | 2 | |

| PART I | ||

| Item 1. |

Business.

|

3 |

| Item 1A. |

Risk Factors

|

10 |

| Item 1B |

Unresolved Staff Comments.

|

23 |

| Item 2 |

Properties.

|

23 |

| Item 3 |

Legal Proceedings.

|

24 |

| Item 4 |

(Removed and Reserved).

|

24 |

| PART II | ||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

24 |

| Item 6. |

Selected Financial Data.

|

25 |

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

25 |

| Item 7A |

Quantitative and Qualitative Disclosures About Market Risk.

|

38 |

| Item 8 |

Financial Statements and Supplementary Data.

|

38 |

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

38 |

|

Item 9A.

|

Controls and Procedures.

|

39 |

| Item 9B. |

Other Information.

|

40 |

| PART III | ||

| Item 10. |

Directors, Executive Officers and Corporate Governance.

|

41 |

| Item 11. |

Executive Compensation.

|

44 |

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

46 |

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence.

|

47 |

| Item 14. |

Principal Accounting Fees and Services.

|

48 |

| PART IV | ||

| Item 15. |

Exhibits, Financial Statement Schedules.

|

48 |

1

EXPLANATORY NOTE

China Executive Education Corp. is filing this Amendment No. 3 on Form 10-K/A (the "Amendment") to its Annual Report on Form 10-K for the year ended December 31, 2010, originally filed on April 15, 2011 (the "Original Filing") to respond to certain comments received from the Staff of the Securities and Exchange Commission.

For the convenience of the reader, this Form 10-K/A sets forth the Original Filing in its entirety. However, this Form 10-K/A only amends and restates Items 7, 8 and 15 of the Original Filing, in each case, solely as a result of, and to reflect, the restatement and comments of the SEC, and no other information in the Original Filing is amended hereby. The foregoing items have not been updated to reflect other events occurring after the Original Filing or to modify or update those disclosures affected by subsequent events. In addition, pursuant to the rules of the SEC, Item 15 of the Original Filings has been amended to contain currently dated certifications from the Company’s Chief Executive Officer and Chief Financial Officer, as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, and are attached as Exhibits 31.1, 31.2, 32.1 and 32.2 to this report.

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A, “Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except where the context otherwise requires and for the purposes of this report only:

|

·

|

the “Company,” “we,” “us,” and “our” refer to the combined business of China Executive Education Corp., a Nevada corporation, and its consolidated subsidiaries and variable interest entity;

|

|

·

|

“SLM” refers to our subsidiary Surmounting Limit Marketing Adviser Limited, a Hong Kong limited company;

|

|

·

|

“MYL Business” refers to our indirect subsidiary Hangzhou MYL Business Administration Consulting Co., Ltd., a PRC limited company;

|

|

·

|

“Shanghai MYL” refers to our indirect subsidiary Shanghai MYL Business Administration Consulting Co. Ltd., a PRC limited company;

|

|

·

|

“MYL Commercial” refers to our variable interest entity Hangzhou MYL Commercial Services Co., Ltd., a PRC limited company;

|

|

·

|

“MYL Training School” refers to MYL Commercial’s subsidiary Hangzhou Gongshu MYL Training School;

|

|

·

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

|

|

·

|

“PRC” and “China” refer to the People's Republic of China;

|

|

·

|

“SEC” refers to the Securities and Exchange Commission;

|

|

·

|

“Exchange Act” refers the Securities Exchange Act of 1934, as amended;

|

|

·

|

“Securities Act” refers to the Securities Act of 1933, as amended;

|

|

·

|

“Renminbi” and “RMB” refer to the legal currency of China; and

|

|

·

|

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

|

2

PART I

|

|

|

ITEM 1.

|

BUSINESS.

|

We are a fast-growing executive education company with operations in Hangzhou and Shanghai, China. We operate comprehensive business training programs that are designed to fit the needs of Chinese entrepreneurs and to improve their leadership, management and marketing skills, as well as bottom-line results. Our comprehensive business training initiatives integrate research-based, proprietary content with processes that are specifically connected to the critical business issues that most private Chinese companies are facing. Our programs enable the trainees to better achieve their potential and better align their individual goals and competencies with the organizational objectives of their employers or business.

Our open-enrollment training programs include our proprietary training courses and comprehensive training courses. Our comprehensive training courses include one package of 16 courses for CEO and C-Level managers, as well as 23 leadership and personal development courses, focusing on management skills, negotiation skills, leadership skills and public speaking skills, among others. Featured lectures, delivered to large audiences, are presented by experts or well-known speakers in each relevant field. In 2010, we organized four such lectures in Shanghai. We believe that our network of speaking professionals is a leading platform for inspiring audiences to new levels of motivation and commitment.

We market our executive training programs directly to business executives through promotional seminars. We maintain two websites www.magicyourlife101.com and www.myl101.com. Since the formal launching of our operations in April 2009, our client base has continued to climb. During the years ended December 31, 2010 and 2009, we provided our training programs to 6,148 and 2,874 Chinese business owners and executives, respectively.

Our principal executive offices are located at c/o Hangzhou MYL Business Administration Consulting Co. Ltd., Room 307, Hualong Business Building, 110 Moganshan Road, Hangzhou 310005, People’s Republic of China and our telephone number is (86) 0571-8880-8109.

Our Corporate History and Background

We were incorporated in the state of Nevada on May 9, 2008 under the name “On Demand Heavy Duty Corp.” We originally intended to commence business operations by purchasing and distributing eco-friendly building supplies for sale throughout Europe and North America. However, from our inception until completion of the acquisition of SLM and the merger described below, we did not engage in any active business operations.

On February 12, 2010, we acquired all of the outstanding capital stock of Surmounting Limit Marketing Advisor Limited (“SLM”) through our wholly-owned Nevada subsidiary, China Executive Education Corp., or the Merger Sub. In connection with the acquisition, the Merger Sub issued 20 shares of its common stock, which constituted no more than 10% ownership interest in the Merger Sub, to the shareholders of SLM, in exchange for all of the capital stock of SLM. Immediately following such exchange, the Merger Sub was merged into our Company and the 20 shares of common stock of the Merger Sub were converted into 21,560,000 shares of our common stock, so that upon completion of the merger, the shareholders of SLM owned approximately 98% of our common stock.

As part of the merger, pursuant to a stock purchase agreement, we transferred all of the outstanding capital stock of our subsidiary, On Demand Heavy Duty Holdings, Inc. to certain of our shareholders in exchange for the cancellation of 6,070,000 shares of our common stock owned by them.

Following these transactions, we discontinued our former business and now engage in the executive education business. In connection with the merger, we changed our name to “China Executive Education Corp.” in order to more accurately reflect our new business operations.

SLM is a holding company and holds 100% of the equity interests of Hangzhou MYL Business Administration Consulting Co., Ltd. (“MYL Business”). MYL business was incorporated in the PRC on April 23, 2009. Substantially all of our operations are conducted through MYL Business, and through contractual arrangements with Hangzhou MYL Commercial Services Co., Ltd.(“MYL Commercial”), a PRC company incorporated on March 25, 2009, and its subsidiary.

3

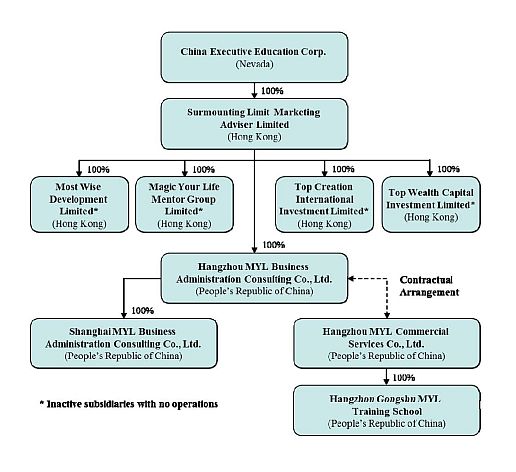

Our Corporate Structure

All of our business operations are conducted through our PRC operating subsidiaries and variable interest entity. The chart below presents our current corporate structure.

We do not own any of the equity interests of MYL Commercial. Instead, MYL Business has entered into a series of exclusive contractual arrangements with MYL Commercial, pursuant to which we exercise effective control over the operations of MYL Commercial and receive the economic benefits of MYL Commercial. As a result of these contractual arrangements, under U.S. GAAP, we are considered the primary beneficiary of MYL Commercial and thus consolidate its results in our consolidated financial statements. These agreements are summarized in the following paragraphs.

Exclusive Services Agreement. Pursuant to an exclusive services agreement by and among MYL Business, MYL Commercial and its subsidiary, dated May 1, 2009, MYL Commercial and its subsidiary irrevocably entrusted to MYL Business the management and operation of MYL Commercial and its subsidiary and the responsibilities and authorities of their shareholders and directors. The service fee to be paid by MYL Commercial and its subsidiary is equal to 95% of their total income which can be waived by MYL Business from time to time in its sole discretion.

Call Option Agreement. Pursuant to a call option agreement by and among MYL Business, MYL Commercial and MYL Commercial’s shareholders and subsidiary, dated as of May 1, 2009, each of MYL Commercial and MYL Commercial’s shareholders have granted MYL Business or its designee an exclusive option to purchase all or part of their equity interests in MYL Commercial and its subsidiary, or all or part of the assets of MYL Commercial, in each case, at any time determined by MYL Business and to the extent permitted by PRC law.

4

Voting Rights Proxy Agreement. Pursuant to a voting rights proxy agreement by and among MYL Business, MYL Commercial and MYL Commercial’s shareholders and subsidiary, dated as of May 1, 2009, the shareholders of MYL Commercial and its subsidiary have granted the personnel designated by MYL Business the right to appoint directors and senior management of MYL Commercial and its subsidiary and to exercise all of their other voting rights as shareholders of MYL Commercial and its subsidiary, as the case may be, as provided under the articles of association of each such entity. Under the voting rights proxy agreement, there are no restrictions on the number, to the extent allowed under the respective articles of association of MYL Commercial and its subsidiary, or identity of those persons we can appoint as directors and officers.

Equity Pledge Agreement. Pursuant to an equity pledge agreement by and among MYL Business, MYL Commercial and MYL Commercial’s shareholders and subsidiary, dated as of May 1, 2009, each of the shareholders has pledged his or its equity interest in MYL Commercial and its subsidiary as the case may be, to MYL Business to secure their obligations under the relevant contractual control agreements to which each is a party, including but not limited to, the obligations of MYL Commercial and its subsidiary under the exclusive services agreement, call option agreement and voting rights proxy agreement. Under this equity pledge agreement, the shareholders have agreed not to transfer, assign, pledge or otherwise dispose of their interest in MYL Commercial or its subsidiary, as the case may be, without the prior written consent of MYL Business.

Our Industry

We operate in China’s professional training industry, which is one of the fastest growing sectors in China’s education industry. According to the China Education & Training Industrial Report, China’s total educational expenditures were approximately RMB 680 billion in 2009 (approximately $103.6 billion) and are expected to reach RMB 960 billion in 2012 (approximately $146.2 billion), representing a compound annual growth rate, or CAGR, of approximately 12%.

According to the Report of Investment Analysis and Prospect of China Training Industry 2010-2015, as of the end of 2007, the estimated size of the vocational training and professional training market was around RMB 300 billion (approximately $44 billion). And as one of the major segments of the professional training industry, China’s executive training has emerged and grown rapidly in the last few years. The market was estimated with a size about RMB 2 billion (approximately $294 million) in 2002; then was increased to over RMB 16 billion (approximately $2.35 billion) in 2004, and jumped to RMB 30 billion (approximately $4.41 billion) in 2006.

China’s professional training industry has also been further divided in more sub-segments, such as, career development training, foreign language training, technique and skills training, and executive training. As Chinese companies and China’s workforce confront competition in the global market, we believe that the need for steady improvement of the skills and efficiency of China’s workforce will stimulate continuing growth in the demand for specialized professional education services in different fields.

Executive training is a special business segment. The target clients for executive training businesses are corporate executives, C-level managers and private business owners. The training programs mainly include leadership development, corporate strategy, decision making and other personal skills development. China’s executive education sector is characterized by the following:

|

(1)

|

Young and in an early development stage. Compared to other professional training segments, China’s executive training industry is young and has only approximately 10 years of history. It was first introduced by the foreign education institute to top Chinese business schools in the late 1990s, then expanded to the private sector with many active participants.

|

|

(2)

|

Strong market demand. Driven by the booming Chinese economy and spirit of entrepreneurship in the private business sector, demand for open-enrollment and easy access high-level education programs from more than 6 million of Chinese’s private business owners and over ten million business executives in China is strong.

|

|

(3)

|

Fragmented market. Because of a low entry barrier, now there are thousands of executive training providers in China. There is no dominant player in the national market yet. According to a study conducted by China Investment & Industry Research Center, there were more than 70,000 training companies nationwide in 2010, of which more than 10,000 located in Beijing and Shanghai, but quite few of them have generated RMB ten million or more of sales revenue annually.

|

5

Our Growth Strategy

We believe that China’s highly fragmented professional training industry and rapidly growing market provide us with significant growth opportunities. We intend to pursue the following strategies to achieve our goal:

|

·

|

We plan to increase our market coverage. We plan to increase our market coverage through extensive telemarketing campaigns and mass mailings. We also intend to establish and expand our sales agent network in inland provinces. We believe that there are many untouched opportunities in those areas.

|

|

·

|

We plan to expand our course offerings. We plan to expand our executive training programs by adding more courses, such as effective corporation finance management, strategic investment and capital market operation, among others. We also intend to add our course offerings to the second generation of the affluent families.

|

|

·

|

We plan to pursue strategic acquisitions. We plan to make strategic acquisitions to expand into the C-level management training segment, which has a large potential client base. We will also seek acquisition opportunities in other major commercial centers to expand our business presence.

|

|

·

|

We plan to strengthen our international network. We plan to establish strategic alliances with major international executive training and leadership development institutions. We believe that leveraging their capacities and bringing them to our classes will generate more value to our clients. We will also seek opportunities for business cooperation with major international education institutions to develop some jointly operated programs.

|

|

·

|

We plan to promote our brand name to attract more clients. We plan to promote our brand name, Magic Your LifeTM in China. We believe that the enhancement of public awareness to our brand name will help to broaden our client base all over China.

|

Our Training Programs

We operate comprehensive business training programs that are designed to fit the needs of Chinese entrepreneurs and to improve their leadership, management and marketing skills, as well as bottom-line results. Our comprehensive business training initiatives integrate research-based, proprietary content with processes that are specifically connected to the critical business issues that most private Chinese companies are facing.

Generally, we provide two kinds of training programs, including: (1) proprietary training courses which normally take several days to complete and primarily consist of featured lectures; and (2) a comprehensive training course package that includes courses to be conveyed to the students by both Chinese lecturers and invited foreign lecturers.

Our comprehensive training courses include one package of 16 courses for CEO and C-Level managers, as well as 23 leadership and personal development courses, including the following courses:

ForBoss Comprehensive Courses taught by Chinese lecturers:

|

·

|

Magic Your Life——Goals Setting

|

|

·

|

Magic Your Life——Improvement

|

|

·

|

Public Speaking

|

|

·

|

Marketing

|

|

·

|

(Sales) Super Persuasion for CEOs

|

|

·

|

Super Leadership for CEOs

|

|

·

|

Investing

|

|

·

|

Motivation

|

|

·

|

Negotiation

|

|

·

|

Fortune and Ocean View——How to go public

|

6

Courses taught by world renowned lecturers:

|

·

|

John Maxwell

|

|

·

|

John Gray

|

|

·

|

Tom Peters

|

|

·

|

Mark Viator Harsen

|

|

·

|

Robert Kiyosaki

|

|

·

|

Stephen R.Covey

|

|

·

|

General Colin Powell

|

|

·

|

Tony Robbins

|

Other courses taught by Chinese lecturers:

|

·

|

Speakers Club

|

|

·

|

Customer Service System

|

|

·

|

I would like to beg you to sell

|

|

·

|

Hybrid Concert and Speech Event of 50,000 people

|

|

·

|

7 Essential Classes for CEOs

|

|

·

|

How to enhance children’s’ leadership

|

|

·

|

Mr Der’s Customer Service Proposal

|

|

·

|

TPS Management System

|

|

·

|

Super Quick Memory

|

|

·

|

Professor Lee’s Proposal

|

Featured lectures, delivered to large audiences, are presented by experts or well-known speakers in each relevant field. In 2010, we organized four such lectures in Shanghai. Noted speakers included John Maxwell, John Gray and Gen. Colin Powell. We believe that our network of speaking professionals is a leading platform for inspiring audiences to new levels of motivation and commitment.

Our Customers and Marketing Efforts

During the years ended December 31, 2010 and 2009, we provided our training programs to 6,148 and 2,874 customers, respectively. These clients come from various provinces and from diverse industries.

We market our executive training programs directly to business executives primarily through promotional seminars. We outsourced some of our sales and marketing efforts to Zhejiang Foreign Service Company in 2009 and built our own sales and marketing team in 2010. As of December 31, 2010, we had 220 sales and marketing personnel. Our sales team generates sales and sales leads through mass-mailing campaigns and business referrals. We also market our training program by organizing or sponsoring business seminars or other social and business events.

We will further increase the size of our sales and marketing team as we continuously grow our business and add more training programs.

We face the competition on two different fronts. First is from major Chinese universities and business schools. They provide EMBA programs targeting corporate executives and entrepreneurs. The most popular Executive Master of Business Administration programs (“EMBA” programs) available in China are from Euro-China International Business College in Shanghai, Cheung Kong Graduate School of Business, Tsinghua University and Shanghai Jiaotong University. These universities’ EMBA programs provide their students with approximately 300 hours of formal in-class training programs in the curriculum and issue degree certificates to students at graduation. The tuition ranges from RMB 60,000 (approximately $9,000) to RMB 568,000 (approximately $85,000) for the entire program. The top business schools enroll 400–600 students annually. Due to the strict admission requirements, many young and less qualified candidates are turned away. We believe that this increases market opportunities for our programs.

7

Open-enrollment programs provided by private education institutions, like ours, have emerged and constitute serious competition to the top business schools that provide formal executive training programs. These peer companies also constitute direct competition with us. Jucheng Group (founded in 2003 in Shenzhen), Action Success International Education Group (founded in 2001 in Shanghai) and Sparta Group (founded in 2002 in Beijing) are the most prominent companies in our business sector. We compete with them primarily on the basis of training courses, lecturers, prices, effectiveness of training execution and our brand name. Since those three companies have been in business longer than us and they have cross-region presence, they have strengths in market coverage and pricing. We believe that we have a competitive advantage in our international network and broad offering.

Intellectual Property

We maintain two websites www.magicyourlife101.com and www.myl101.com. The domain name of www.magicyourlife101.com was registered by Mr. Kaien Liang in the name of SLM. The registered operator of this website is Shanghai Kaiye Investment Consulting Co., Ltd. The domain name of www.myl101.com is registered by Dreamer Marketing Adviser (Shanghai) Co., Ltd. The registered operator of this website is MYL Commercial.

MYL Business has officially filed with the respective trademark offices in the PRC, Hong Kong, and the U.S. the application for registration of (FORBOSS Business Mentor Group) as a registered trademark. Such application is subject to review and authorization by the respective trademark offices. In Hong Kong, the trademark application is pending as it has been challenged by third parties. The trademark has been registered with the US Patent and Trademark Office on March 8, 2011.

Ms. Chiayeh Lin, one of officers of MYL Business, has officially filed with the trademark office of the PRC the application for registration of [Missing Graphic Reference] (Magic You Life) as registered trademark. Such application is subject to review and authorization by the trademark office of the PRC. The Company is in the process of having the registrant’s name changed from Ms. Lin to MYL Business.

Mr. Kaien Liang, our Chairman and controlling shareholder of MYL, is of the author of the books Who Is The Next Magic? and Never Say Impossible, which sell in thousands. Meanwhile, Mr. Pokai Hsu, is the author of How to be No.1 in China.

As of December 31, 2010, we employed a total of 294 full-time employees. The following table sets forth the number of our employees by function:

|

Function

|

Number of Employees

|

|

|

Sales and Marketing

|

220

|

|

|

Customer Service

|

9

|

|

|

Research and Development

|

17

|

|

|

Network

|

13

|

|

|

Financial and Accounting

|

9

|

|

|

Administration and Human Resources

|

26

|

|

|

Total

|

294

|

We consider our relations with our employees to be good. None of our employees is represented by a labor union.

Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to contribute monthly to the plan. In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Regulation

Because our primary operating subsidiaries are located in China, we are regulated by China’s national and local laws, including those outlined below.

8

Licenses and Permits

In order to conduct business in the PRC, we need licenses from the appropriate government authorities, including general business licenses and an education service provider license. We believe that we are in material compliance with all registrations and requirements for the issuance and maintenance of all licenses required by the governing bodies, and that all license fees and filings are current.

Foreign Currency Exchange

All of our sales revenue and expenses are denominated in RMB. Under the PRC foreign currency exchange regulations applicable to us, RMB is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Currently, our PRC operating subsidiaries and variable interest entities may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, employee salaries (even if employees are based outside of China), and payment for equipment purchases outside of China, without the approval of the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, by complying with certain procedural requirements. Conversion of RMB for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of SAFE. In particular, if our PRC operating subsidiaries or variable interest entities borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local branches. These limitations could affect our PRC operating subsidiaries and variable interest entities’ ability to obtain foreign exchange through debt or equity financing. In the event of a liquidation of our PRC subsidiaries or variable interest entities, SAFE approval is required before the remaining proceeds can be expatriated from China.

On March 16, 2007, the National People's Congress of China passed a new Enterprise Income Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed its implementing rules, which took effect on January 1, 2008. Before the implementation of the EIT Law, foreign invested enterprises, or FIEs, established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The EIT Law and its implementing rules impose a unified EIT of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions. Despite these changes, the EIT Law gives FIEs established before March 16, 2007, or Old FIEs, a five-year grandfather period during which they can continue to enjoy their existing preferential tax treatments. During this five-year grandfather period, the Old FIEs which enjoyed tax rates lower than 25% under the original EIT law will be subject to gradually increased EIT rates over a 5-year period until their tax rate reaches 25%. In addition, the Old FIEs that are eligible for other preferential tax treatments by the PRC government under the original EIT law are allowed to continue enjoying their preference until these preferential treatment periods expire.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see Item 1A, “Risk Factors—Risks Related to Doing Business in China—Under the New Enterprise Income Tax Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

In addition, the EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. TEC Tower and STT are considered FIEs and are directly held by our subsidiary in Hong Kong. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to TEC by TEC Tower and STT, but this treatment will depend on our status as a non-resident enterprise.

9

Dividend Distributions

Substantially all of our sales are earned by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

We have a short operating history.

We did not begin our business operations until April 2009. Accordingly, we have a limited operating history for our current operations upon which you can evaluate the viability and sustainability of our business and its acceptance by private business owners and executives. It is also difficult to evaluate the viability of our business model because we do not have sufficient experience to address the risks frequently encountered by early stage companies using new means to deliver education programs and entering new and rapidly evolving markets. These circumstances may make it difficult for you to evaluate our business and prospects.

Our senior management and employees have worked together for a short period of time.

Due to our limited operating history and recent additions to our management team, certain of our senior management and employees have worked together at our company for only a relatively short period of time. As a result, it may be difficult for you to evaluate the effectiveness of our senior management and other key employees and their ability to address future challenges to our business.

Failure to manage our growth could strain our management, operational and other resources, which could materially and adversely affect our business and growth potential.

We have been rapidly expanding, and plan to continue expansion of our operations in China. We will continue to expand our operations to meet the demands of customers for executive training programs for larger and more diverse market coverage. This expansion has resulted in substantial demands on our management resources. To manage our growth, we must develop and improve our existing administrative and operational systems and, our financial and management controls and further expand, train and manage our work force. We have already begun selling our executive education training program through our sales agents who operate in the inland provinces and may in the future expand our presence to some major cities in China. As we continue this effort, we may incur substantial costs and expend substantial resources in connection with any such expansion. We may encounter difficulties when we expand into other cities or if we begin operations in other inland provinces in China due to different business practice, local government regulations and cultural factors. We may not be able to manage our current or future cross-region operations effectively and efficiently or compete effectively in such markets. We cannot assure you that we will be able to efficiently or effectively manage the growth of our operations, recruit top talent and train our personnel. Any failure to efficiently manage our expansion may materially and adversely affect our business and future growth.

10

We may need additional capital and we may not be able to obtain it, which could adversely affect our liquidity and financial position.

To further expand our executive education business, we may require additional cash resources. If our operations are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities or convertible debt securities could result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations and liquidity.

Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

|

·

|

investors’ perception of, and demand for, securities of executive education companies;

|

|

·

|

conditions of the U.S. and other capital markets in which we may seek to raise funds;

|

|

·

|

our future results of operations, financial condition and cash flows;

|

|

·

|

PRC governmental regulation of foreign investment in executive education companies in China;

|

|

·

|

economic, political and other conditions in China; and

|

|

·

|

PRC governmental policies relating to foreign currency borrowings.

|

We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us could have a material adverse effect on our liquidity and financial condition.

The terms on which we may raise additional capital may result in significant dilution and may impair our stock price.

We cannot assure you that we will be able to obtain additional financing on any terms, and, if we are able to raise funds, it may be necessary for us to sell our securities at a price which is at a significant discount from the market price and on other terms which may be disadvantageous to us. In connection with any such financing, we may be required to provide registration rights to the investors and pay damages to the investors in the event that the registration statement is not filed or declared effective by specified dates. The price and terms of any financing which would be available to us could result in both the issuance of a significant number of shares and significant downward pressure on our stock price.

Our business is dependent upon the PRC government’s educational policies and programs.

As a provider of educational services, we are dependent upon governmental educational policies. Almost all of our revenue to date has been generated from the sale of lectures and materials relating to executive training. To the extent that the government adopts policy changes that significantly alter what is allowed in China, our products could become obsolete, which would affect our ability to generate revenue and operate profitably. We cannot assure you that PRC government agencies would not adopt such changes.

Our business is subject to the health of the PRC economy and our growth may be inhibited by the inability of potential customers to fund purchases of our products and services.

The purchase of educational materials is largely discretionary and dependent upon the ability and willingness of executives and businesses to spend available funds on extra educational products. A general economic downturn either in our market or a general economic downturn in the PRC could have a material adverse effect on our revenue, earnings, cash flow and working capital.

In addition, many businesses in the PRC do not have sufficient funds to purchase textbooks, educational materials or lectures and course materials. In addition, provincial and local governments may not have the funds to support the implementation of a curriculum using our educational products or may allocate funds to programs which are different from our products. Our failure to be able to sell our products and services to students in certain areas of the PRC may inhibit our growth and our ability to operate profitably.

11

Price controls may affect both our revenues and net income.

The laws of the PRC provide the government broad power to fix and adjust prices. We need to obtain government approval in setting our prices for classroom coursework and tutorials. Although the sale of educational materials over the Internet is not presently subject to price controls, we cannot give you any assurance that they will not be subject to controls in the future. To the extent that we are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our services will be limited and we may face no limitation on our costs. As a result, we may not be able to pass on to our students any increases in costs we incur, or any increases in the costs of our faculty. Further, if price controls affect both our revenue and our costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable PRC regulatory authorities.

If we are unable to attract and retain senior management and qualified personnel, our operations, financial condition and prospects will be materially adversely affected.

Our success depends on the management skills of Mr. Kaien Liang, Chairman and Chief Executive Officer, and his relationships with educators, administrators and other business contacts. We also depend on successfully recruiting and retaining highly skilled and experienced authors, teachers, managers, sales persons and other personnel who can function effectively in the PRC. In some cases, the market for these skilled employees is highly competitive. We may not be able to retain or recruit such personnel, which could materially and adversely affect our business, prospects and financial condition. We do not maintain key person insurance on these individuals. The loss of Mr. Liang would delay our ability to implement our business plan and would adversely affect our business.

We may not be successful in protecting our intellectual property and proprietary rights.

Our intellectual property consists of lectures and formats, which are contained in our library, and courseware which we developed by engaging authors and educators to develop these materials. Our proprietary products are primarily protected by trade secret laws. Although we require our authors and employees to sign confidentiality and non-disclosure agreements, we cannot assure you that we will be able to enforce those agreements or that our authors and software development employees will not be able to develop competitive products that do not infringe upon our proprietary rights. We do not know the extent that PRC courts will enforce our proprietary rights.

Others may bring defamation and infringement actions against us, which could be time-consuming, difficult and expensive to defend.

As a distributor of educational materials, we face potential liability for negligence, copyright, patent or trademark infringement and other claims based on the nature and content of the materials that we publish or distribute. We cannot be certain that our lectures or other aspects of our business do not or will not infringe upon patents, copyrights or other intellectual property rights held by third parties. Although we are not aware of any such claims, we may become subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives. Moreover, any claims could require us to incur significant costs to investigate and defend, regardless of the final outcome. We do not carry general liability insurance that would cover any potential or actual claims. The commencement of any legal action against us or any of our affiliates, whether or not we are successful in defending the action, could both require us to suspend or discontinue the distribution of some or a significant portion of our educational materials and require us to allocate resources to investigating or defending claims.

If we make acquisitions, they may disrupt or have a negative impact on our business.

If we make acquisitions, we could have difficulty integrating personnel and operations of the acquired companies with our own. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot predict the affect expansion which may have on our core business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business, distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions are accompanied by a number of inherent risks, including, without limitation, the following:

|

·

|

difficulty of integrating acquired products, services or operations;

|

12

|

·

|

potential disruption of the ongoing businesses and distraction of our management and the management of acquired companies;

|

|

·

|

difficulty of incorporating acquired rights or products into our existing business;

|

|

·

|

difficulties in disposing of the excess or idle facilities of an acquired company or business and expenses in maintaining such facilities;

|

|

·

|

difficulties in maintaining uniform standards, controls, procedures and policies;

|

|

·

|

potential impairment of relationships with employees and customers as a result of any integration of new management personnel;

|

|

·

|

potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products to new and existing customers;

|

|

·

|

effect of any government regulations which relate to the business acquired; and

|

|

·

|

potential unknown liabilities associated with acquired businesses, or the need to spend significant amounts to retool, reposition or modify the marketing and sales of acquired products or the defense of any litigation, whether or not successful, resulting from actions of the acquired company prior to our acquisition.

|

Our business could be severely impaired to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with these acquisitions, many of which cannot be presently identified, these risks and problems could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations.

We have limited insurance coverage in China.

We do not have any business liability, interruption or litigation insurance coverage for our operations in China. While business interruption insurance and other types of insurance are available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Therefore, our existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

We have identified material weaknesses in our internal control over financial reporting. If we fail to develop or maintain an effective system of internal controls, we may not be able to accurately report our financial results and prevent fraud. As a result, current and potential stockholders could lose confidence in our financial statements, which would harm the trading price of our common stock.

Companies that file reports with the SEC, including us, are subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404. SOX 404 requires management to establish and maintain a system of internal control over financial reporting and annual reports on Form 10-K filed under the Exchange Act to contain a report from management assessing the effectiveness of a company’s internal control over financial reporting. Separately, under SOX 404, as amended by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, public companies that are large accelerated or accelerated filers must include in their annual reports on Form 10-K an attestation report of their regular auditors attesting to and reporting on management’s assessment of internal control over financial reporting. Non-accelerated filers and smaller reporting companies are not required to include an attestation report of their auditors in annual reports.

A report of our management is included under Item 9A “Controls and Procedures” of this report. We are a smaller reporting company and, consequently, are not required to include an attestation report of our auditor in this annual report. However, if and when we become subject to the auditor attestation requirements under SOX 404, we can provide no assurance that we will receive an unqualified report from our independent auditors.

During its evaluation of the effectiveness of internal control over financial reporting as of December 31, 2010, management identified material weaknesses relating to our lack of sufficient accounting personnel with an appropriate understanding of U.S. GAAP and SEC reporting requirements.

13

We are undertaking remedial measures, which measures will take time to implement and test, to address these material weaknesses. There can be no assurance that such measures will be sufficient to remedy the material weaknesses identified or that additional material weaknesses or other control or significant deficiencies will not be identified in the future. If we continue to experience material weaknesses in our internal controls or fail to maintain or implement required new or improved controls, such circumstances could cause us to fail to meet our periodic reporting obligations or result in material misstatements in our financial statements, or adversely affect the results of periodic management evaluations and, if required, annual auditor attestation reports. Each of the foregoing results could cause investors to lose confidence in our reported financial information and lead to a decline in our stock price. See Item 9A “Controls and Procedures” for more information.

RISKS RELATED TO OUR CORPORATE STRUCTURE

We operate our businesses through companies with which we have contractual relationships, but in which we do not have controlling ownership. If the PRC government determines that our agreements with these companies are not in compliance with applicable regulations, our business in the PRC could be materially adversely affected.

We operate our business through a series of contractual arrangements with MYL Commercial, its shareholders and MYL Training School. While our indirect PRC operating subsidiaries are eligible for the required licenses for providing executive education services in China and some of our indirect PRC operating subsidiaries have obtained such licenses, we have been using and are expected to continue to use MYL Commercial and MYL Training School to operate a significant portion of our executive education business for the foreseeable future. We are able to control these entities and operate their businesses through these contractual arrangements, but we have no equity control over these companies. See Item 1 “Business—Corporate Structure” for a description of these contractual arrangements.

While we believe that our ownership structure complies with all existing PRC laws and regulations, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Accordingly, there can be no assurance that the PRC regulatory authorities will not in the future take a view that is contrary to ours. If the PRC government finds that the agreements that establish the structure for operating our business in the PRC do not comply with PRC government restrictions, the relevant PRC regulatory authorities would have broad discretion in dealing with such violations, including:

|

·

|

levy fines on us;

|

|

·

|

revoke our business and operating licenses;

|

|

·

|

require us to discontinue or restrict our operations;

|

|

·

|

restrict our right to collect revenues;

|

|

·

|

require us to restructure our business, corporate structure or operations; and

|

|

·

|

impose additional conditions or requirements with which we may not be able to comply

|

The imposition of any of these penalties could result in a material and adverse effect on our ability to conduct our business and our financial condition and results of operations.

We rely on contractual arrangements with MYL Commercial and MYL Training School for our operations, which may not be as effective in providing control over these entities as direct ownership.

Our operations are dependent on MYL Commercial and MYL Training School, in which we have no equity ownership interest and must rely on contractual arrangements to control and operate the businesses of these entities. These contractual arrangements may not be as effective in providing control over these entities as direct ownership. For example, MYL Commercial and MYL Training School may be unwilling or unable to perform their obligations under our commercial agreements with them, in which case we will not be able to conduct our operations in the manner currently planned. In addition, they may seek to renew their agreements on terms that are disadvantageous to us. Although we have entered into a series of agreements that provide us with substantial ability to control MYL Commercial and MYL Training School, we may not succeed in enforcing our rights under them by relying on legal remedies under Chinese law, which may not be adequate. In addition, if we are unable to renew these agreements on favorable terms when these agreements expire, or to enter into similar agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly increase.

14

Uncertainties in the PRC legal system may impede our ability to enforce the commercial agreements that we have entered into with MYL Commercial and MYL Training School or any arbitral award thereunder and any inability to enforce these agreements could materially and adversely affect our business and operation.

While disputes under the contractual arrangements with MYL Commercial and MYL Training School are subject to binding arbitration before the Shanghai Branch of the China International Economic and Trade Arbitration Commission, or CIETAC, in accordance with CIETAC’s arbitration rules, the agreements are governed by PRC law and an arbitration award may be challenged in accordance with PRC law. For example, a claim that the enforcement of an award in our favor will be detrimental to the public interest, or that an issue does not fall within the scope of the arbitration would require us to engage in administrative and judicial proceedings to defend an award. China’s legal system is a civil law system based on written statutes and unlike common law systems, it is a system in which decided legal cases have little value as precedent. As a result, China’s administrative and judicial authorities have significant discretion in interpreting and implementing statutory and contractual terms, and it may be more difficult to evaluate the outcome of administrative and judicial proceedings and the level of legal protection available than in more developed legal systems. These uncertainties may impede our ability to enforce the terms of the contracts that we enter into with MYL Commercial and MYL Training School. Any inability to enforce the contractual arrangements with MYL Commercial and MYL Training School or an award thereunder could materially and adversely affect our business and operation.

The shareholders of MYL Commercial may have potential conflicts of interests with us, which may adversely affect our business.

We operate our businesses in China through MYL Commercial and its subsidiary, MYL Training School. MYL Commercial is owned by SLM. Conflicts of interests between their duties to us and to MYL Commercial may arise. We cannot assure you that when conflicts of interest arise, any or all of these persons will act in the best interests of our company or that any conflict of interest will be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations and potentially result in the loss of opportunities.

Our arrangements with MYL Commercial, its shareholders and MYL Training School and may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses.

We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with MYL Commercial, its shareholders and MYL Training School were not entered into based on arm’s length negotiations. Although our contractual arrangements are similar to other companies conducting similar operations in China, if the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

The exercise of right to purchase part or all of the equity interests in MYL Commercial under the call option agreement might be subject to approval by the PRC government. Our failure to obtain this approval may impair our ability to substantially control MYL Commercial and MYL Training School and could result in actions by MYL Commercial and MYL Training School that conflict with our interests.

Our call option agreement with MYL Commercial and MYL Training School gives our Chinese operating subsidiary, MYL Business, the right to purchase all or part of the equity interests in MYL Commercial and MYL Training School, however, the option may not be exercised by MYL Business if the exercise would violate any applicable laws and regulations in China. Under Chinese laws, if a foreign entity, through a foreign investment company that it invests in, acquires a domestic related company, China’s regulations regarding mergers and acquisitions would technically apply to the transaction. Application of these regulations requires an examination and approval of the transaction by MOFCOM, or its local counterparts. Although an appraisal of the equity to be acquired is mandatory, the local counterparts of MOFCOM hold the view that such a transaction would not require their approval. Therefore, we do not believe at this time that an approval and an appraisal are required for MYL Business to exercise its option to acquire MYL Commercial and MYL Training School. In light of the different views on this issue, however, it is possible that the central MOFCOM office in Beijing will issue a standardized opinion imposing the approval and appraisal requirement. If we are not able to purchase the equity of MYL Commercial and MYL Training School, then we will lose a substantial portion of our ability to control MYL Commercial and MYL Training School and our ability to ensure that MYL Commercial and MYL Training School will act in our interests.

15

RISKS RELATED TO DOING BUSINESS IN CHINA

Changes in China's political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

|

·

|

level of government involvement in the economy;

|

|

·

|

control of foreign exchange;

|

|

·

|

methods of allocating resources;

|

|

·

|

balance of payments position;

|

|

·

|

international trade restrictions; and

|

|

·

|

international conflict.

|

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy, and weak corporate governance and the lack of a flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of the OECD member countries.

We depend upon the acquisition and maintenance of licenses to conduct our business in the PRC.

In order to conduct business in the PRC, we need licenses from the appropriate government authorities, including general business licenses and an education service provider license. The loss or failure to obtain or maintain these licenses in full force and effect will have a material adverse impact on our ability to conduct our business and on our financial condition.

Future government regulations or other standards could have an adverse effect on our operations.

Our operations are subject to a variety of laws, regulations and licensing requirements of national and local authorities in the PRC. We are required to obtain licenses or permits from the PRC central government and from Hangzhou province, where we operate, and to meet certain standards in the conduct of our business. The loss of such licenses, or the imposition of conditions to the granting or retention of such licenses, could have an adverse effect on us. In the event that these laws, regulations and/or licensing requirements change, we may be required to modify our operations or to utilize resources to maintain compliance with such rules and regulations. In addition, new regulations may be enacted that could have an adverse effect on us.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our subsidiaries and variable interest entities in the PRC. Our subsidiaries and variable interest entities are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations, and rules are not always uniform, and enforcement of these laws, regulations, and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

16

You may have difficulty enforcing judgments against us.

Most of our assets are located outside of the United States and all of our current operations are conducted in the PRC. In addition, all of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Our counsel as to PRC law has advised us that the recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as -0.8%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Restrictions on currency exchange may limit our ability to receive and use our sales effectively.

The majority of our sales will be settled in RMB, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

17

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between the U.S. dollar and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars, as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.