Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20120326.htm |

EXHIBIT 99.1

Occidental Petroleum Corporation

Howard Weil

40th Annual Energy Conference

Howard Weil

40th Annual Energy Conference

Stephen I. Chazen

President and Chief Executive Officer

President and Chief Executive Officer

March 27, 2012

1

2

Full Year 2011 Results - Summary

Full Year 2011 Results - Summary

|

|

FY 2011

|

FY 2010

|

|

• Core Results

|

$6,828

|

$4,664

|

|

• Core EPS (diluted)

|

$8.39

|

$5.72

|

|

|

|

|

|

• Net Income

|

$6,771

|

$4,530

|

|

• Reported EPS (diluted)

|

$8.32

|

$5.56

|

|

|

|

|

|

• Oil and Gas production volumes

(mboe/d) +4% |

733

|

706

|

|

|

|

|

|

• Capital Spending

|

$7,518

|

$3,940

|

|

• Cash Flow from Operations

|

$12,281

|

$9,566

|

|

|

|

|

|

• Return on Equity

|

19.3%

|

14.7%

|

|

• Return on Capital Employed

|

17.2%

|

13.2%

|

|

|

|

|

($ in millions, except EPS data)

See attached for GAAP reconciliation

2

3

Overriding Goal is to Maximize Total Shareholder Return

• We believe this can be achieved through a combination of:

• Growing our oil and gas production by 5 to 8% per year on

average over the long term;

average over the long term;

• Allocating and deploying capital with a focus on achieving

well above cost-of-capital returns (ROE and ROCE);

well above cost-of-capital returns (ROE and ROCE);

– Return Targets*

• Domestic - 15+%

• International - 20+%

• Consistent dividend growth, that is superior to that of our

peers.

peers.

*Assumes Moderate Product Prices

What Is Our Philosophy & Strategy?

What Is Our Philosophy & Strategy?

3

4

Oxy’s Three Main Performance Criteria -

Production Growth, Returns & Dividend Growth

Production Growth, Returns & Dividend Growth

• We finished a strong year in terms of the three main

performance criteria outlined last quarter.

performance criteria outlined last quarter.

• Our domestic oil and gas production grew by about 12%

for 2011 to 428 mboe/d.

for 2011 to 428 mboe/d.

– 4Q11 domestic production of 449 mboe/d was the highest U.S. total

production volume in Oxy’s history, reflecting the highest ever

quarterly volume for liquids of 310 mb/d and the second highest

quarterly volume for gas.

production volume in Oxy’s history, reflecting the highest ever

quarterly volume for liquids of 310 mb/d and the second highest

quarterly volume for gas.

– Total company production increased about 4% for the year.

• Our chemical business delivered exceptional results

for the year, achieving one of their highest earnings

levels ever.

for the year, achieving one of their highest earnings

levels ever.

• Our ROE was 19% for the year and ROCE was 17%.

4

5

Net Income Return on Assets

U.S. 14%

International 37%

Total E&P 20%

Cash Flow* Return on Assets

U.S. 21%

International 54%

Total E&P 29%

* Net Income + DD&A

5 Year Average

5 Year Average

Return on Assets

See attached for GAAP reconciliation

(2007 - 2011)

5

6

• Our ability to pay dividends is indicated by our free cash

flow generation.

flow generation.

• Free cash flow after interest, taxes and capital spending,

but before dividends, acquisitions and debt activity for

2011 was about $4.8 billion.

but before dividends, acquisitions and debt activity for

2011 was about $4.8 billion.

• Last month the Board of Directors increased the

company’s dividend 17% to an annualized rate of $2.16

per share, compared to the previous annual rate of $1.84.

company’s dividend 17% to an annualized rate of $2.16

per share, compared to the previous annual rate of $1.84.

• We have now increased our dividend every year for 10

consecutive years, and a total of 11 times during that

period.

consecutive years, and a total of 11 times during that

period.

• This increase brings the company’s compound annual

dividend growth rate over the last 10 years to 15.8%.

dividend growth rate over the last 10 years to 15.8%.

Consistent Dividend Growth

See attached for GAAP reconciliation

6

7

Consistent Dividend Growth

Note: Dividends paid as per the Record Date

($/share)

7

8

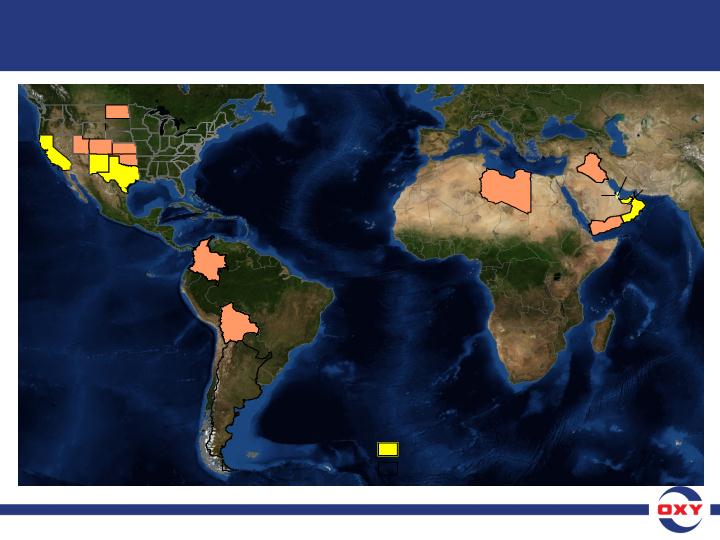

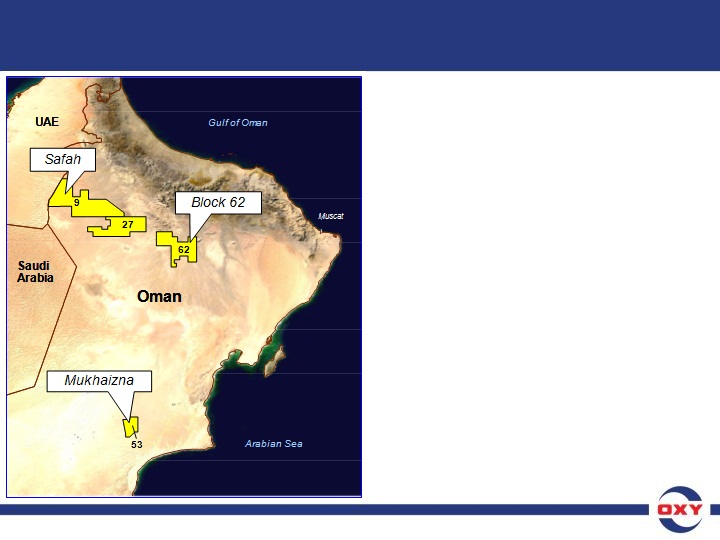

Worldwide Oil & Gas Producing Areas

Colombia

Colombia

Libya

Libya

Oman

Oman

UAE

UAE

Yemen

Yemen

Bolivia

Bolivia

Qatar

Qatar

Iraq

Iraq

Bahrain

Bahrain

Focus Areas

United States

United States

Permian

Permian

Basin

Basin

California

California

8

9

Oil & Gas Production - 1Q12 Outlook

Oil & Gas Production - 1Q12 Outlook

• During our 4Q11 earnings conference call held in late

January, we indicated:

January, we indicated:

– “At current prices, total 1Q12 sales volumes to be comparable

to 4Q11 volumes of 749 mboe/d, depending on the scheduling

of liftings.

to 4Q11 volumes of 749 mboe/d, depending on the scheduling

of liftings.

– Our 4Q11 Colombia production was 28 mb/d, up slightly

from 3Q11 levels, although both periods included pipeline

interruptions caused by insurgent activity.

from 3Q11 levels, although both periods included pipeline

interruptions caused by insurgent activity.

– In 1Q12, Colombia volumes should be about 3 mboe/d higher

than 4Q11, although insurgent activity has picked up recently.”

than 4Q11, although insurgent activity has picked up recently.”

• As a result of repeated pipeline interruptions caused

by insurgent activity, we now expect our 1Q12

Colombia production volumes to be about 23 mb/d,

roughly 9 mb/d below capacity.

by insurgent activity, we now expect our 1Q12

Colombia production volumes to be about 23 mb/d,

roughly 9 mb/d below capacity.

9

10

Oil & Gas Production *

Full Year 2011

(Million barrels of oil equivalent)

Full Year 2011

(Million barrels of oil equivalent)

*Excludes Argentina

Oxy Is Primarily An Oil Company

Oxy Is Primarily An Oil Company

156

58%

193

72%

111

42%

74

28%

10

11

• About 60% of Oxy’s oil production tracks world oil prices

and 40% is indexed to WTI. For example:

and 40% is indexed to WTI. For example:

– In California our realized price was 109% of WTI and 94% of

Brent in 2011.

Brent in 2011.

– In Oman our average price was 104% of WTI and 89% of Brent.

• Our overall differentials for 2011, resulted in realized oil

prices representing 103% of the average WTI and 88% of

the average Brent price.

prices representing 103% of the average WTI and 88% of

the average Brent price.

Realized Oil Prices & Differentials

Realized Oil Prices & Differentials

11

12

• We have ample legitimate opportunities in our domestic

oil and gas business where we could deploy capital.

oil and gas business where we could deploy capital.

• We try to manage the program to a level that is realistic at

current price levels, and as a result, have deferred some

projects that otherwise would have met our hurdle rates.

current price levels, and as a result, have deferred some

projects that otherwise would have met our hurdle rates.

• We continue to have substantial inventory of high return

projects going forward to fulfill our growth objectives.

projects going forward to fulfill our growth objectives.

Capital Spending - 2012 Outlook

12

13

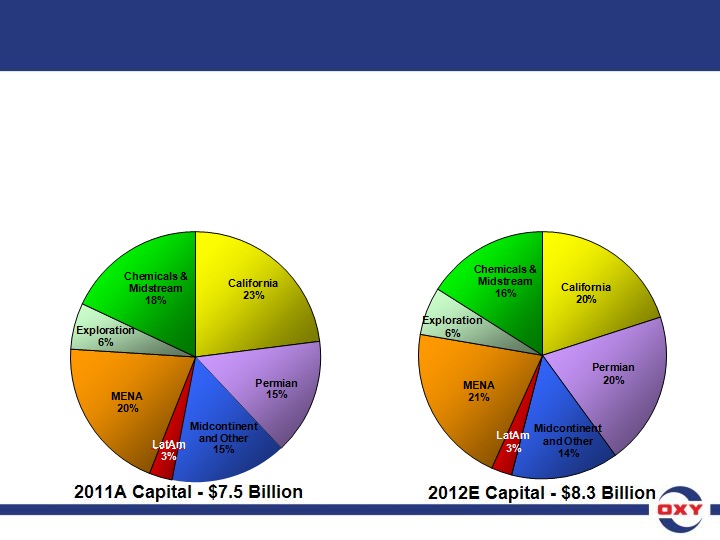

Capital Spending - 2012E vs. 2011 Actual

• We increased our capital program approximately 10% in 2012 to

$8.3 billion from the $7.5 billion spent in 2011.

$8.3 billion from the $7.5 billion spent in 2011.

• About $500 million of this increase will be in the US, mainly in the

Permian basin, and the rest in international projects including the

Al Hosn gas project and Iraq.

Permian basin, and the rest in international projects including the

Al Hosn gas project and Iraq.

• We will review our capital program around mid-year and adjust as

conditions dictate.

conditions dictate.

13

14

• Base 5 - 8% Compounded Average Annual Growth

– Current California risked prospects

– Non-CO2 & CO2 in the Permian

– Williston Basin

– Oman

– Iraq

• Upside from Existing Holdings

– New California conventional and unconventional prospects

– Permian exploration

– Rockies

– Oman exploration

• Additional opportunities from balance sheet and cash

generation

generation

– Domestic properties acquisitions

– New Middle East projects

Oil & Gas Volume Growth Drivers

14

15

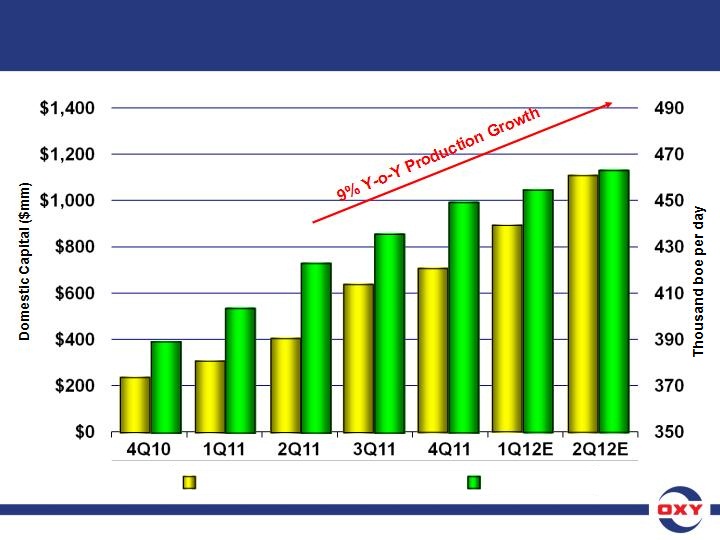

• US oil and gas production -

– In 1H12, we expect our domestic production to grow 3 to 4 mboe/d

each month from the current quarterly average of 449 mboe/d,

which would correspond to a 6 to 8 mboe/d increase per quarter.

each month from the current quarterly average of 449 mboe/d,

which would correspond to a 6 to 8 mboe/d increase per quarter.

– 4Q11 was relatively free of significant operational disruptions

resulting in better than expected domestic production. A more

typical experience with respect to such issues could moderate the

growth somewhat in 1Q12.

resulting in better than expected domestic production. A more

typical experience with respect to such issues could moderate the

growth somewhat in 1Q12.

– If the production growth rate continued at a comparable pace in

2H12, our year-over-year average domestic production growth

would be between 8% and 10% in 2012.

2H12, our year-over-year average domestic production growth

would be between 8% and 10% in 2012.

US Oil & Gas Production - 1H12 Outlook

US Oil & Gas Production - 1H12 Outlook

15

16

US Oil & Gas Capital and Production

$310

389

$403

403

$640

424

$704

436

$884

449

$1,100

456

463

Note: 1Q12E and 2Q12E production based on midpoint of guidance range of 6 to 8 mboe/d of production growth.

Capital (3 quarters earlier)

Production

$259

16

17

US Oil & Gas Capital and Production

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12E

2Q12E

CapEx as % of US Capital Employed (3 quarters earlier)

Production

0.0%

2.0%

4.0%

6.0%

8.0%

350

375

400

425

450

475

389

403

424

436

449

456

463

4.0%

Note: 1Q12E and 2Q12E production based on midpoint of guidance range of 6 to 8 mboe/d of production growth.

1.4%

1.7%

2.1%

3.0%

2.8%

3.3%

17

38

72

70

Oxy’s US Operated Rig Activity

Oxy’s US operated rigs represent approximately 6% of the total Liquids directed rigs operating in the Lower 48.

18

19

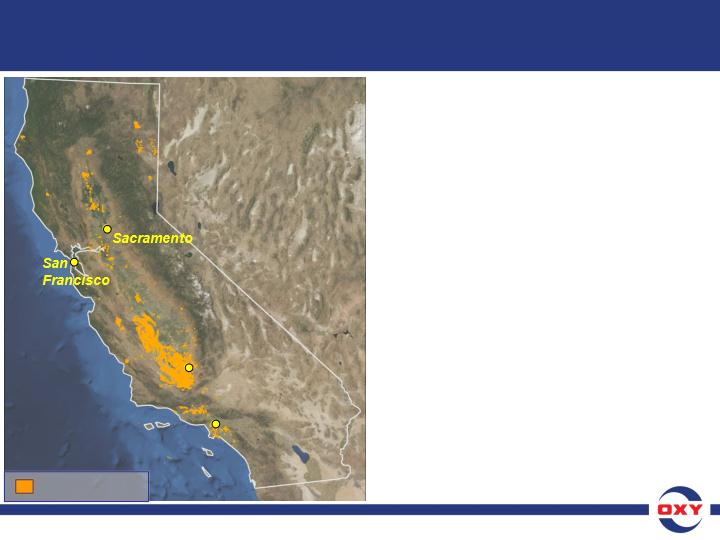

California Overview

California Overview

Los Angeles

Los Angeles

Bakersfield

Bakersfield

Oxy Acreage

• Largest acreage holder in CA

with ~1.7 mm acres, majority of

which are net mineral interests.

with ~1.7 mm acres, majority of

which are net mineral interests.

• 2011 production of 138 mboe/d.

• 78% interest in the Elk Hills

Field — the largest producer of

gas and NGLs in CA.

Field — the largest producer of

gas and NGLs in CA.

• Currently operating ~30 drilling

rigs in the state.

rigs in the state.

• Drilled ~675 wells and

performed ~500 workovers in

2011

performed ~500 workovers in

2011

• Construction of first new gas

processing plant to be brought

on line in 2012; building a

second plant in the next 2 yrs.

processing plant to be brought

on line in 2012; building a

second plant in the next 2 yrs.

19

2012E Total Capital - $8.3 Billion

• We currently expect the rig count to

remain at ~30 in 1H12, roughly the same

as what we were running at YE-2011;

remain at ~30 in 1H12, roughly the same

as what we were running at YE-2011;

• We are seeing improvement with

respect to permitting issues in the state;

respect to permitting issues in the state;

• We have received approved field rules

and new permits for both injection wells

and drilling locations;

and new permits for both injection wells

and drilling locations;

• The regulatory agency is responsive

and committed to working through the

backlog of permits;

and committed to working through the

backlog of permits;

• We expect to maintain our capital

program at current levels for about

1H12, which will enable us to continue

to grow our production volumes;

program at current levels for about

1H12, which will enable us to continue

to grow our production volumes;

• We will reassess our capital program

when the number of permits in hand

allows it.

when the number of permits in hand

allows it.

• In CA, we expect to spend about

21% of our total capital program.

21% of our total capital program.

*Includes both oil & gas development and midstream capital.

California Capital Program

California Capital Program

20

20

21

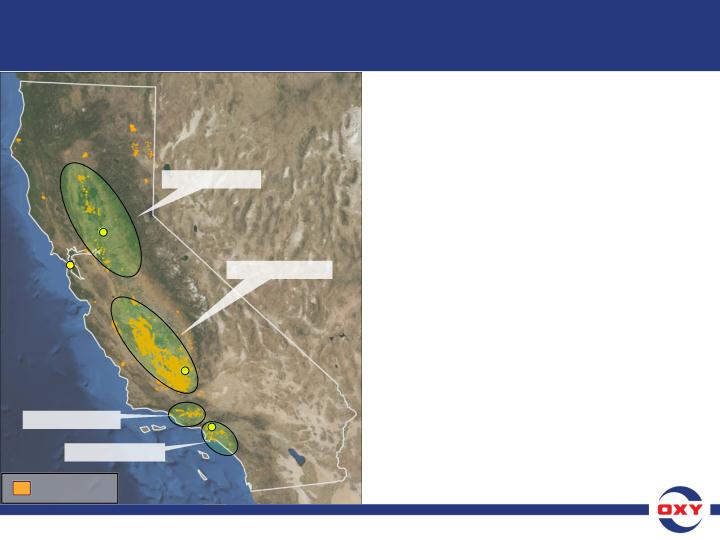

California Conventional Exploration

• World Class Province

– 35+ Billion BOE discovered

– 5 of top 12 U.S. oil fields

• Significant Remaining Potential

– Large undiscovered resources

– Multiple play and trap types

• Underexplored

• Oxy

– Major producer

– Largest acreage holder

– Successful explorer

– Multi-year prospect inventory

Sources:

California Division of Oil, Gas & Geothermal Resources

Gibson Consulting

Oxy Fee/Lease

2 Billion BOE

20 Billion BOE

3 Billion BOE

10 Billion BOE

Major Producing

Basins

Sacramento

Sacramento

San

Francisco

Francisco

San

Francisco

Francisco

Los Angeles

Los Angeles

Bakersfield

Bakersfield

21

22

Field Size (MMBOE)

<0.1

0.1

1

10

100

1 Billion

10 Billion

Discovery Play

Oxy Play Type and Prospect Exposure

Sources:

California Division of Oil, Gas & Geothermal Resources

Occidental Estimates

California Division of Oil, Gas & Geothermal Resources

Occidental Estimates

California Field Sizes

22

23

• Multi-year inventory of drill sites in

CA, many of which are both outside

of Elk Hills proper & the Kern County

Discovery Area

CA, many of which are both outside

of Elk Hills proper & the Kern County

Discovery Area

• Expect to drill 80+ shale wells outside

Elk Hills proper, and ~140 total shale

wells including Elk Hills in 1H12

Elk Hills proper, and ~140 total shale

wells including Elk Hills in 1H12

• 30-day initial production rate for

these wells is between 300 and 400

BOE per day

these wells is between 300 and 400

BOE per day

• For the shale wells outside Elk Hills,

~80% of the BOE production is a

combination of black oil and high-

value condensate

~80% of the BOE production is a

combination of black oil and high-

value condensate

• Cost of drilling and completing the

wells has run ~$3.5 million per well,

which we expect to decline over time;

largely vertical wells

wells has run ~$3.5 million per well,

which we expect to decline over time;

largely vertical wells

California Unconventional “Shale” Program

23

24

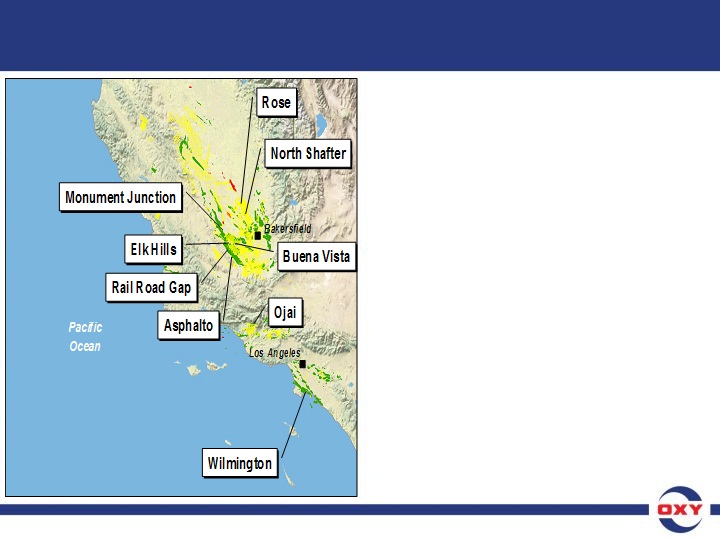

Permian Basin Overview

• 2011 production of 198,000 boe/d

• Largest oil producer in Permian

(~15% net share of total)

(~15% net share of total)

• Largest operator in Permian

(of 1,500+ operators)

(of 1,500+ operators)

• Drilled ~409 wells on operated

properties in 2011

properties in 2011

• ~64% of Oxy’s Permian oil

production is from CO2 related

EOR projects

production is from CO2 related

EOR projects

• Have another 2.5 BBOE of likely

recoverable resource

recoverable resource

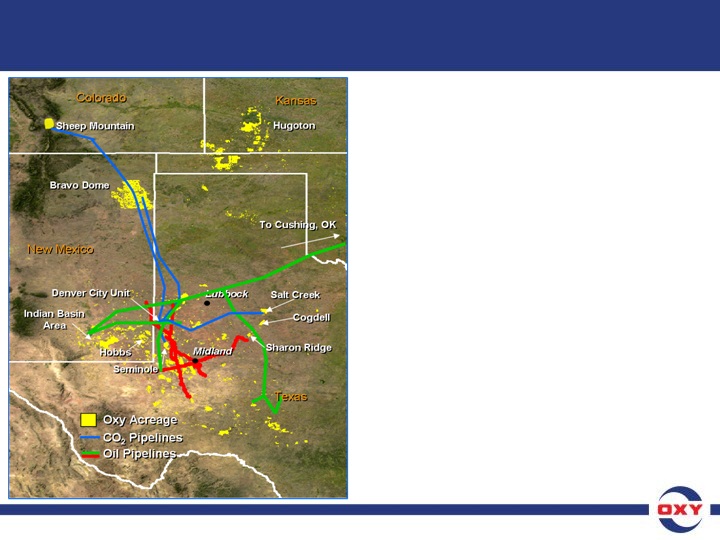

• 1.7 bcf/d (0.5 tcf/year) of CO2

• Ample supply of CO2 accelerates

project implementations

project implementations

24

2012E Total Capital - $8.3 Billion

• Our rig count at year-end 2011

was 23;

was 23;

• We expect our rig count to ramp up

during the year to around 27 rigs by

year end;

during the year to around 27 rigs by

year end;

• Our CO2 flood capital should remain

comparable to the 2011 levels;

comparable to the 2011 levels;

• In our non-CO2 operations we are

seeing additional opportunities for

good return projects;

seeing additional opportunities for

good return projects;

• This includes an extensive Wolfberry

drilling program, as well as

Delaware/Bone Springs sands

and Avalon Shale;

drilling program, as well as

Delaware/Bone Springs sands

and Avalon Shale;

• As a result, we have stepped up

their development program and 2012

capital will be about 75% higher than

the 2011 level.

their development program and 2012

capital will be about 75% higher than

the 2011 level.

• In the Permian operations, we

expect to spend about 20% of

our total capital.

expect to spend about 20% of

our total capital.

*Includes both oil & gas development and midstream capital.

Permian Basin Capital Program

25

25

26

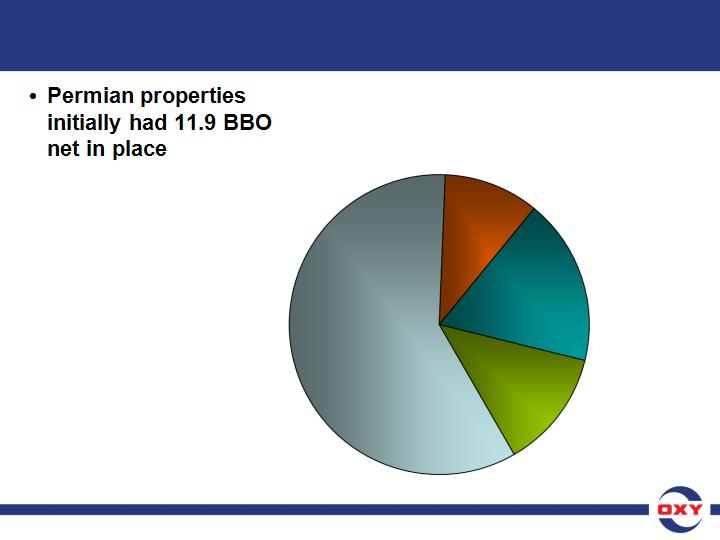

• 4.1 BBO have been

produced,

produced,

• leaving 7.8 BBO net

remaining

remaining

4.6 BBO

3P Reserves

EOR Likely

EOR Potential

0.8 BBO

1.4 BBO

1.0 BBO

Residual

7.8 BBO Net Remaining

Permian EOR Opportunities

26

2012E Total Capital - $8.3 Billion

• In the Midcontinent and Other

operations, we plan to spend about

14% of our total capital program.

operations, we plan to spend about

14% of our total capital program.

Midcontinent and Other Capital Program

*Includes both oil & gas development and midstream capital.

27

27

2012E Total Capital - $8.3 Billion

International Development and, Exploration

Capital Program

Capital Program

International Development and, Exploration

Capital Program

Capital Program

• Total international development

capital will be about 30% of the

total company capital program.

capital will be about 30% of the

total company capital program.

*Includes both oil & gas development and midstream capital.

28

28

29

Abu Dhabi - Al Hosn Gas Project (Shah Field)

29

• Shah Gas Field one of the largest in

the Middle East;

the Middle East;

• Oxy holds a 40% participating

interest under a 30-year contract;

interest under a 30-year contract;

• The project involves development of

high-sulfur content reservoirs within

the Shah field, located onshore

~180 km so. west of Abu Dhabi;

high-sulfur content reservoirs within

the Shah field, located onshore

~180 km so. west of Abu Dhabi;

• Production start-up is scheduled in

late 2014;

late 2014;

• Anticipated to produce over 500

mmcf/d of sales gas and 50 mboe/d

of NGLs and condensate - of which

Oxy’s net share would be over 200

mmcf/d of gas and over 20 mboed of

NGLs and condensate;

mmcf/d of sales gas and 50 mboe/d

of NGLs and condensate - of which

Oxy’s net share would be over 200

mmcf/d of gas and over 20 mboed of

NGLs and condensate;

• Spending for the project will rise in

2012 as planned, making up ~7% of

our total capital program.

2012 as planned, making up ~7% of

our total capital program.

29

30

• World Class Steam flood project;

• 2 B bo ROIP;

• Discovered in 1975 in South

Central Oman;

Central Oman;

• Oxy assumed operation

September 1, 2005 at 8,500 b/d;

September 1, 2005 at 8,500 b/d;

• Steam flood commenced May

2007, and had drilled 1,400+ new

wells through 2011;

2007, and had drilled 1,400+ new

wells through 2011;

• Gross Production: ~124,000 b/d at

year-end 2011;

year-end 2011;

• Oxy plans to steadily increase

production through continued

expansion of the steam flood

project.

production through continued

expansion of the steam flood

project.

!

Oxy Oman - Mukhaizna Project

30

31

Oxy Oman Gross Production Growth

31

32

1. Base/Maintenance Capital

2. Dividends

3. Growth Capital

4. Acquisitions

5. Share Repurchase

Cash Flow Priorities

32

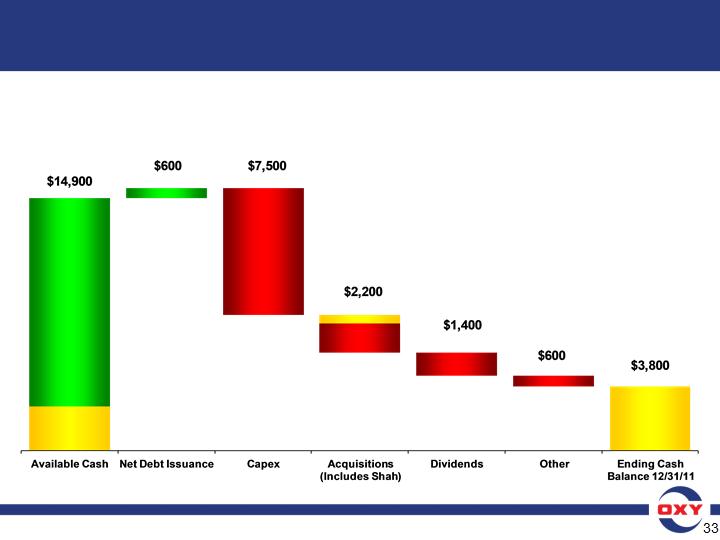

Summary - 2011 Cash Flow

Summary - 2011 Cash Flow

– Free cash flow from continuing operations after capex and dividends,

but before acquisition and debt activity, was about $3.4 billion.

but before acquisition and debt activity, was about $3.4 billion.

Note: See attached GAAP reconciliation.

($ in millions)

Cash Flow

From

Operations

$12,300

From

Operations

$12,300

Shah - $500

Beginning

Cash $2,600

12/31/10

Cash $2,600

12/31/10

33

34

• Company’s core business is acquiring assets that can

provide future growth through improved recovery.

provide future growth through improved recovery.

– Foreign contracts

– Domestic add-ons

– Small incremental additions to production in short term

• Generate returns of at least 15% in the US and 20% overseas.

• Overall average finding & development costs of less than

25% of selling price.

25% of selling price.

• Even with the additional capital shown, program will

generate a significant amount of free cash flow.

generate a significant amount of free cash flow.

• Acquisitions are measured against reinvesting in the existing

business with the goal of enhancing company value.

business with the goal of enhancing company value.

• Large number of opportunities over 5-year period.

Acquisition Strategy

34

35

• 5 - 8% base annual production growth over the long term

• Opportunity for additional volume growth

• Returns on invested capital significantly in excess of

Company’s cost of capital

Company’s cost of capital

• Consistent, annual increases in dividends

• Significant financial flexibility for opportunities in distressed

periods

periods

• Conservative financial statements

• Committed to generating stock market value which is greater

than earnings retained

than earnings retained

• We believe this will generate top quartile returns for our

shareholders

shareholders

Oxy - Investment Attributes

35

36

Oxy’s Shareholder Equity versus Equity Market Value

3 - Year

5 - Year

10 - Year

Change in Equity

Market Value

Market Value

($ in millions)

A History of Generating Shareholder Value

Creating Shareholder Value

Market Value per $ of Equity Retained

Change in

Shareholder Equity

Shareholder Equity

Financial Data for period ended December 31, 2011.

$27,385

$10,303

$34,978

$18,092

$66,066

$31,994

2.7

1.9

2.1

36

Portions of this presentation contain forward-looking statements and involve risks and uncertainties that could materially affect

expected results of operations, liquidity, cash flows and business prospects. Factors that could cause results to differ

materially include, but are not limited to: global commodity pricing fluctuations; supply and demand considerations for

Occidental’s products; general domestic political and regulatory approval conditions; political events; not successfully

completing, or any material delay of, any development of new fields, expansion projects, capital expenditures, efficiency-

improvement projects, acquisitions or dispositions; potential failure to achieve expected production from existing and future oil

and gas development projects; exploration risks such as drilling unsuccessful wells; any general economic recession or

slowdown domestically or internationally; higher-than-expected costs; potential liability for remedial actions under existing or

future environmental regulations and litigation; potential liability resulting from pending or future litigation; general domestic and

international political conditions; potential disruption or interruption of Occidental’s production or manufacturing or damage to

facilities due to accidents, chemical releases, labor unrest, weather, natural disasters or insurgent activity; failure of risk

management; changes in law or regulations; or changes in tax rates. The United States Securities and Exchange Commission

(SEC) permits oil and natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically

producible, as of a given date, by application of development projects to known accumulations. We use certain terms in this

presentation, such as net-in-place, net risked reserves, de-risked, EUR (expected ultimate recovery), likely recoverable

resources, net remaining and oil in place, that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These

terms represent our internal estimates of volumes of oil and gas that are not proved reserves but are potentially recoverable

through exploratory drilling or additional drilling or recovery techniques and are not intended to correspond to probable or

possible reserves as defined by SEC regulations. By their nature these estimates are more speculative than proved, probable

or possible reserves and subject to greater risk they will not be realized. You should not place undue reliance on these forward

-looking statements, which speak only as of the date of this presentation. Unless legally required, Occidental does not

undertake any obligation to update any forward-looking statements, as a result of new information, future events or otherwise.

U.S. investors are urged to consider carefully the disclosures in our 2010 Form 10-K, available through the following toll-free

number 1-888-OXYPETE (1-888-699-7383) or on the internet at http://www.oxy.com. You also can obtain a copy form the

SEC by calling 1-800-SEC-0330. We post or provide links to important information on our website including investor and

analyst presentations, certain board committee charters and information that SEC requires companies and certain of its officers

and directors to file or furnish. Such information may be found in the “Investor Relations” and “Social Responsibility” portions of

the website.

expected results of operations, liquidity, cash flows and business prospects. Factors that could cause results to differ

materially include, but are not limited to: global commodity pricing fluctuations; supply and demand considerations for

Occidental’s products; general domestic political and regulatory approval conditions; political events; not successfully

completing, or any material delay of, any development of new fields, expansion projects, capital expenditures, efficiency-

improvement projects, acquisitions or dispositions; potential failure to achieve expected production from existing and future oil

and gas development projects; exploration risks such as drilling unsuccessful wells; any general economic recession or

slowdown domestically or internationally; higher-than-expected costs; potential liability for remedial actions under existing or

future environmental regulations and litigation; potential liability resulting from pending or future litigation; general domestic and

international political conditions; potential disruption or interruption of Occidental’s production or manufacturing or damage to

facilities due to accidents, chemical releases, labor unrest, weather, natural disasters or insurgent activity; failure of risk

management; changes in law or regulations; or changes in tax rates. The United States Securities and Exchange Commission

(SEC) permits oil and natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically

producible, as of a given date, by application of development projects to known accumulations. We use certain terms in this

presentation, such as net-in-place, net risked reserves, de-risked, EUR (expected ultimate recovery), likely recoverable

resources, net remaining and oil in place, that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These

terms represent our internal estimates of volumes of oil and gas that are not proved reserves but are potentially recoverable

through exploratory drilling or additional drilling or recovery techniques and are not intended to correspond to probable or

possible reserves as defined by SEC regulations. By their nature these estimates are more speculative than proved, probable

or possible reserves and subject to greater risk they will not be realized. You should not place undue reliance on these forward

-looking statements, which speak only as of the date of this presentation. Unless legally required, Occidental does not

undertake any obligation to update any forward-looking statements, as a result of new information, future events or otherwise.

U.S. investors are urged to consider carefully the disclosures in our 2010 Form 10-K, available through the following toll-free

number 1-888-OXYPETE (1-888-699-7383) or on the internet at http://www.oxy.com. You also can obtain a copy form the

SEC by calling 1-800-SEC-0330. We post or provide links to important information on our website including investor and

analyst presentations, certain board committee charters and information that SEC requires companies and certain of its officers

and directors to file or furnish. Such information may be found in the “Investor Relations” and “Social Responsibility” portions of

the website.

Cautionary Statement

37

37

Occidental Petroleum Corporation

38

38

|

Occidental Petroleum Corporation

|

|||||||||||||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

|||||||||||||

|

For the Twelve Months Ended December 31,

|

|||||||||||||

|

($ Millions)

|

|||||||||||||

|

2011

|

2010

|

||||||||||||

|

Diluted

|

Diluted

|

||||||||||||

|

EPS

|

EPS

|

||||||||||||

|

Reported Income

|

$

|

6,771

|

$

|

5.56

|

$

|

4,530

|

$

|

5.56

|

|||||

|

Add: significant items affecting earnings

|

|||||||||||||

|

Asset impairments

|

-

|

275

|

|||||||||||

|

Libya exploration write-off

|

35

|

-

|

|||||||||||

|

Gain on sale of Colombia pipeline interest

|

(22

|

)

|

-

|

||||||||||

|

Foreign tax

|

29

|

-

|

|||||||||||

|

Premiuim on debt extinguishments

|

163

|

-

|

|||||||||||

|

Tax effect of pre-tax adjustments

|

(50

|

)

|

(100

|

)

|

|||||||||

|

State income tax charge

|

33

|

-

|

|||||||||||

|

Benefit from foreign tax credit carry-forwards

|

-

|

(80

|

)

|

||||||||||

|

Discontinued operations, net *

|

(131

|

)

|

39

|

||||||||||

|

Core Results

|

$

|

6,828

|

$

|

8.39

|

$

|

4,664

|

$

|

5.72

|

|||||

|

* Amount shown after-tax

|

|||||||||||||

|

Average Diluted Common Shares Outstanding

|

812.9

|

813.8

|

|||||||||||

|

Occidental Petroleum Corporation

|

|||||

|

Return on Capital Employed (ROCE)

|

|||||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

|||||

|

2010

|

2011

|

||||

|

RETURN ON CAPITAL EMPLOYED (%)

|

13.2

|

17.2

|

|||

|

GAAP measure - net income attributable

|

4,530

|

6,771

|

|||

|

to common stock

|

|||||

|

Interest expense

|

93

|

284

|

|||

|

Tax effect of interest expense

|

(33

|

)

|

(99

|

)

|

|

|

Earnings before tax-effected interest expense

|

4,590

|

6,956

|

|||

|

GAAP stockholders' equity

|

32,484

|

37,620

|

|||

|

Debt

|

5,111

|

5,871

|

|||

|

Total capital employed

|

37,595

|

43,491

|

|||

|

ROCE

|

13.2

|

17.2

|

|||

|

Occidental Petroleum Corporation

|

|||||||||||||

|

Oil & Gas

|

|||||||||||||

|

Return on Assets

|

|||||||||||||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

|||||||||||||

|

($ Millions)

|

|||||||||||||

|

5-Year

|

|||||||||||||

|

2007

|

2008

|

2009

|

2010

|

2011

|

Average

|

||||||||

|

Revenues

|

12,583

|

17,378

|

10,984

|

14,245

|

18,419

|

14,722

|

|||||||

|

Production costs

|

2,011

|

2,428

|

2,214

|

2,622

|

3,428

|

2,541

|

|||||||

|

Other operating expense

|

516

|

536

|

628

|

655

|

838

|

635

|

|||||||

|

Depreciation, depletion and amortization

|

1,754

|

1,993

|

2,258

|

2,668

|

3,064

|

2,347

|

|||||||

|

Taxes other than income

|

401

|

569

|

413

|

472

|

590

|

489

|

|||||||

|

Charges for impairments

|

58

|

81

|

-

|

275

|

-

|

83

|

|||||||

|

Exploration expenses

|

361

|

308

|

254

|

262

|

258

|

289

|

|||||||

|

Pretax income

|

7,482

|

11,463

|

5,217

|

7,291

|

10,241

|

8,339

|

|||||||

|

Income tax expense

|

3,121

|

4,426

|

1,972

|

2,845

|

3,834

|

3,240

|

|||||||

|

Results of operations

|

4,361

|

7,037

|

3,245

|

4,446

|

6,407

|

5,099

|

|||||||

|

Depreciation, depletion and amortization

|

1,754

|

1,993

|

2,258

|

2,668

|

3,064

|

2,347

|

|||||||

|

Charges for impairments

|

58

|

81

|

-

|

275

|

-

|

83

|

|||||||

|

Gross Cash

|

6,173

|

9,111

|

5,503

|

7,389

|

9,471

|

7,529

|

|||||||

|

Capitalized costs

|

|||||||||||||

|

Current year

|

19,137

|

24,216

|

25,228

|

29,901

|

37,490

|

||||||||

|

Prior year

|

17,375

|

19,137

|

24,216

|

25,228

|

29,901

|

||||||||

|

Average capitalized costs

|

18,256

|

21,677

|

24,722

|

27,565

|

33,696

|

25,558

|

|||||||

|

5-Year Average

|

U.S.

|

International

|

Total

|

||||||||||

|

Results of operations

|

2,705

|

2,394

|

5,099

|

(a)

|

|||||||||

|

Depreciation, depletion and amortization

|

1,307

|

1,040

|

2,347

|

||||||||||

|

Charges for impairments

|

67

|

16

|

83

|

||||||||||

|

Gross Cash

|

4,079

|

3,450

|

7,529

|

(b)

|

|||||||||

|

Average capitalized costs

|

19,151

|

6,407

|

25,558

|

(c)

|

|||||||||

|

Net income return on assets (a) / (c)

|

14%

|

37%

|

20%

|

||||||||||

|

Cash flow return on assets (b) / (c)

|

21%

|

54%

|

29%

|

||||||||||

|

Occidental Petroleum Corporation

|

||

|

Free Cash Flow

|

||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

||

|

($ Millions)

|

||

|

Twelve Months

|

||

|

2011

|

||

|

Consolidated Statement of Cash Flows

|

||

|

Cash flow from operating activities

|

12,281

|

|

|

Cash flow from investing activities

|

(9,903

|

)

|

|

Cash flow from financing activities

|

(1,175

|

)

|

|

Change in cash

|

1,203

|

|

|

Free Cash Flow

|

||

|

Cash flow from operating activities - continuing operations

|

12,306

|

|

|

Capital spending

|

(7,518

|

)

|

|

Free cash flow before dividends

|

4,788

|

|

|

Dividends

|

(1,436

|

)

|

|

Free cash flow after dividends

|

3,352

|

|