Attached files

| file | filename |

|---|---|

| 8-K - HIGHER ONE HOLDINGS, INC 8-K 3-25-2012 - Higher One Holdings, Inc. | form8k.htm |

Higher One Holdings, Inc.

Barclays Capital Emerging Payments Forum

March 28, 2012

Barclays Capital Emerging Payments Forum

March 28, 2012

®

0

®

Forward-looking statements

This presentation includes forward-looking statements, as defined by the Securities and Exchange Commission. Management’s projections and expectations are subject to a number of risks and uncertainties that could cause actual performance to differ materially from those predicted or implied. These statements speak only as of the date they are made, and the company does not intend to update or otherwise revise the forward-looking information to reflect actual results of operations, changes in financial condition, changes in estimates, expectations or assumptions, changes in general economic or industry conditions or other circumstances arising and/or existing since the preparation of this presentation or to reflect the occurrence of any unanticipated events. The forward-looking statements in this presentation do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. Information about the factors that could affect future performance can be found in our recent SEC filings, available on our website at http://ir.higherone.com/. This presentation includes certain metrics presented on a non-GAAP basis, including non-GAAP adjusted EBITDA, non-GAAP adjusted EBITDA margin, non-GAAP adjusted net income,©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc. MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners. non-GAAP adjusted diluted EPS, and non-GAAP Free Cash Flow. We believe that these non-GAAP measures, which exclude amortization of intangibles, stock based compensation, and certain one-time or non-cash impacts to our results, all net of taxes, provide useful information regarding normalized trends relating to the company’s financial condition and results of operations. Reconciliations of these non-GAAP measures to their closest comparable GAAP measure are included in the appendix of this presentation.

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

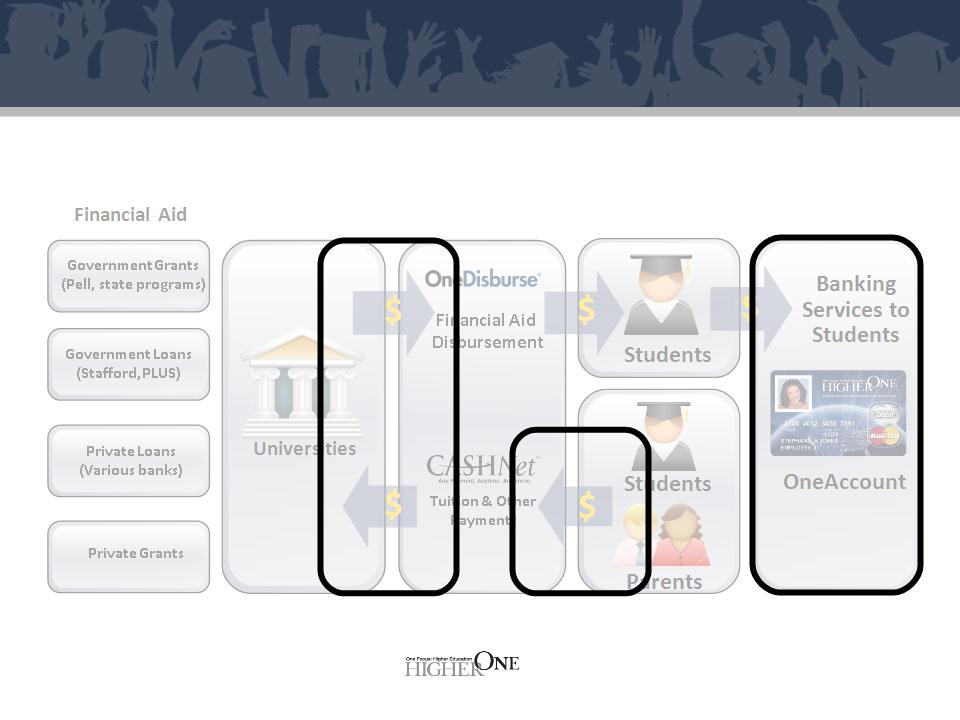

Financial Aid

Financial Aid

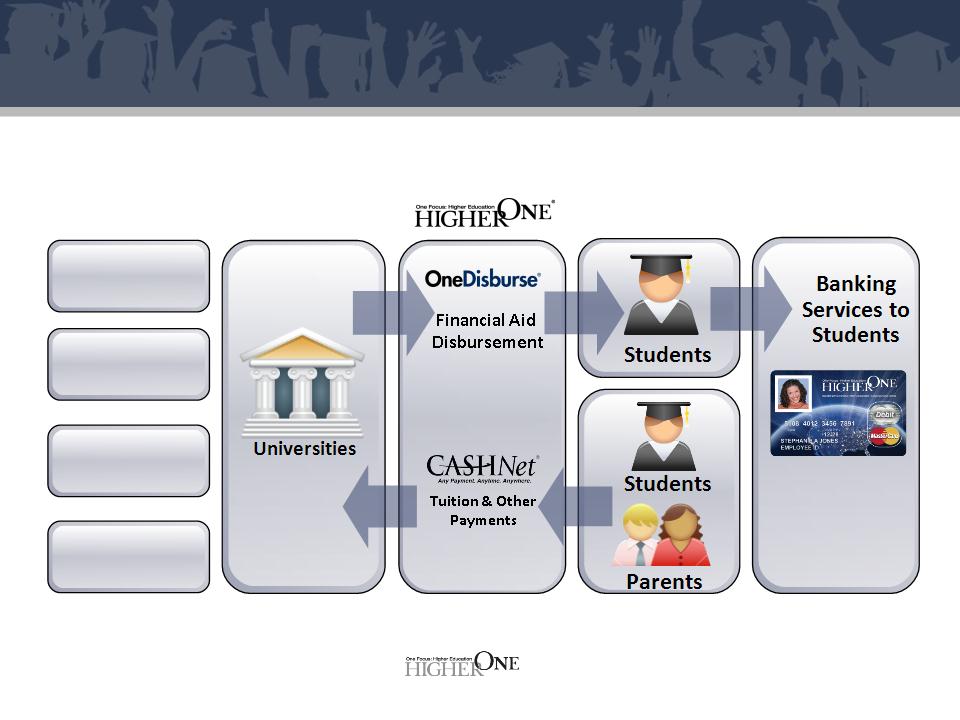

Higher One provides electronic financial aid disbursements

and payment services to the higher education industry

and payment services to the higher education industry

Higher One provides electronic financial aid disbursements

and payment services to the higher education industry

and payment services to the higher education industry

OneAccount

OneAccount

Government Grants

(Pell, state programs)

Government Loans

(Stafford, PLUS)

Private Loans

(Various banks)

Private Grants

$

$

$

$

$

What we do

2

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

How we make money

Account Rev

~80%*

Higher Ed.

Institution Rev

~10%*

Payment

Trxn Rev

~10%*

*As a percent of total revenue, including pre-acquisition CASHNet revenue, on a trailing twelve month basis, rounded

3

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

Value proposition to schools

|

Pitch

|

Benefits to School/Students

|

|

Cost Savings

|

• Increased efficiency from making paper-based process

electronic • Experience/specialization that comes with outsourcing

• Allows schools to reallocate headcount

|

|

Student Services

|

• Students receive refunds faster, easier, and have more choice

• High-Touch® customer service

• Access to a no minimum balance checking account

|

|

Data Security/

Compliance

|

• School no longer has to collect/store sensitive financial

information from students • Higher One assures regulatory compliance

• Audit report for Dept. of Ed. submitted on behalf of the school

|

4

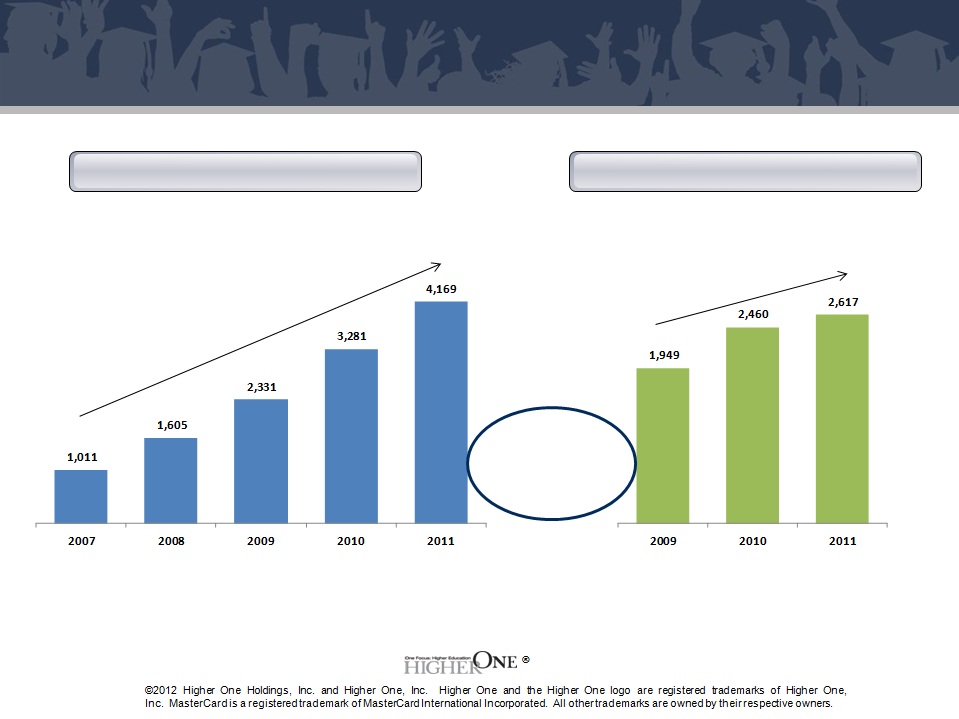

Signing new schools is a top strategic priority

*SSE stands for Signed School Enrollment, and is recorded each quarter as the total student enrollment at all schools that are contracted at year-end for

either our OneDisburse or at least one of our CASHNet® payment suite of products, as of the date the contract is signed (using the most up-to-date IPEDS

data at that point in time).

either our OneDisburse or at least one of our CASHNet® payment suite of products, as of the date the contract is signed (using the most up-to-date IPEDS

data at that point in time).

43% CAGR

16% CAGR

OneDisburse SSE*

(in thousands)

CASHNet Suite SSE*

(in thousands)

5

13% cross-

penetration

penetration

5

5

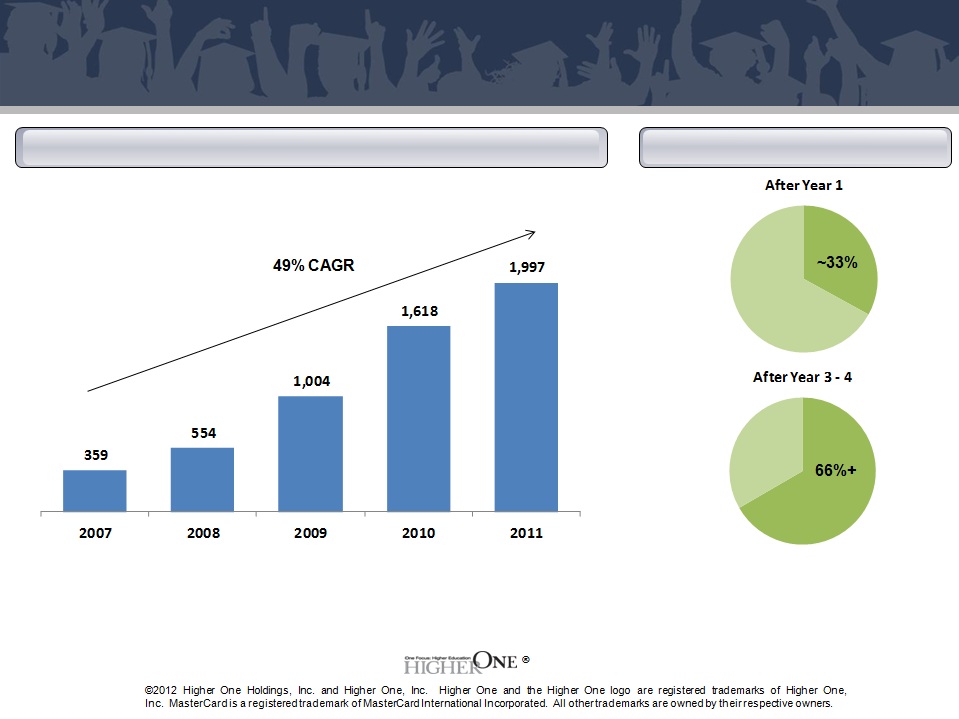

OneAccount growth from new sales, adoption growth

OneAccount Growth

(in thousands)

8

Adoption Curve*

*Adoption curve data is an approximation of average adoption rates of OneAccounts per SSE based on typical results of numerous historical cohorts

~33%

66%+

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

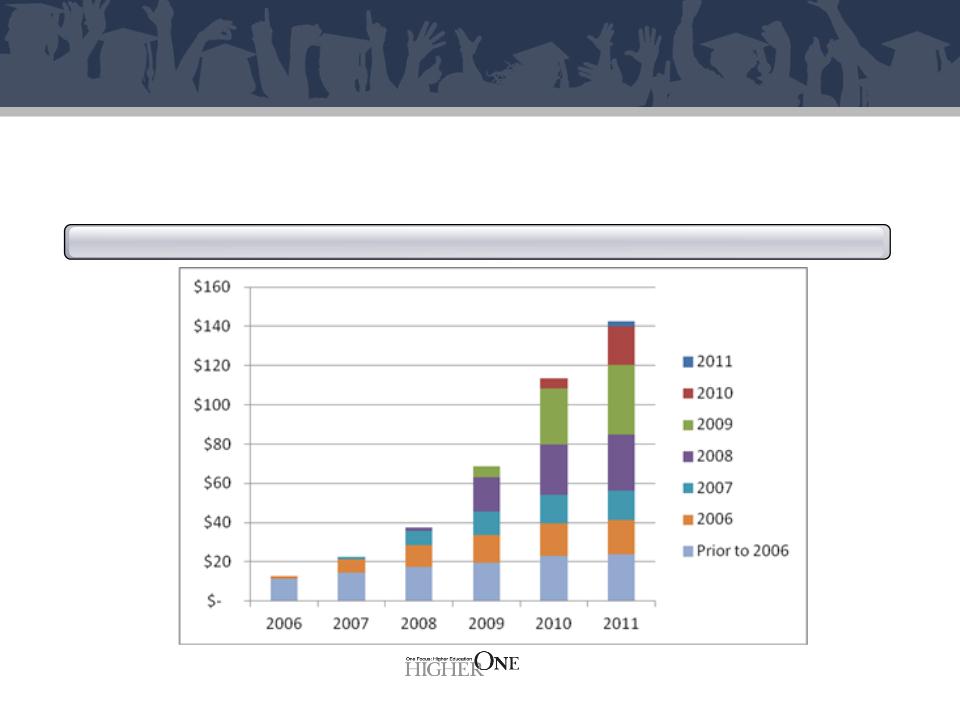

Recurring revenue from long-standing contracts

• Years of visibility from existing contracts

• Over 95% of 2011 Account Revenue was generated from contracts signed in prior years

• 98%+ retention rate since 2003

Higher One Account Revenue by School Signed Year

($ in millions)

($ in millions)

9

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

Competitive strengths

10

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

How we view the competition

11

|

Bucket

|

Shortcomings

|

|

Traditional Banks

|

• School still responsible for handling disbursements

• Lack of flexibility, service for schools

• Less interested in student demographic

|

|

• School still responsible for much of disbursement process

• Lack of focus, experience

• Offers little for students

|

|

|

• Lower level of service for university business office

• Lack of focus, experience

• Main focus is on creating, servicing student debt

|

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

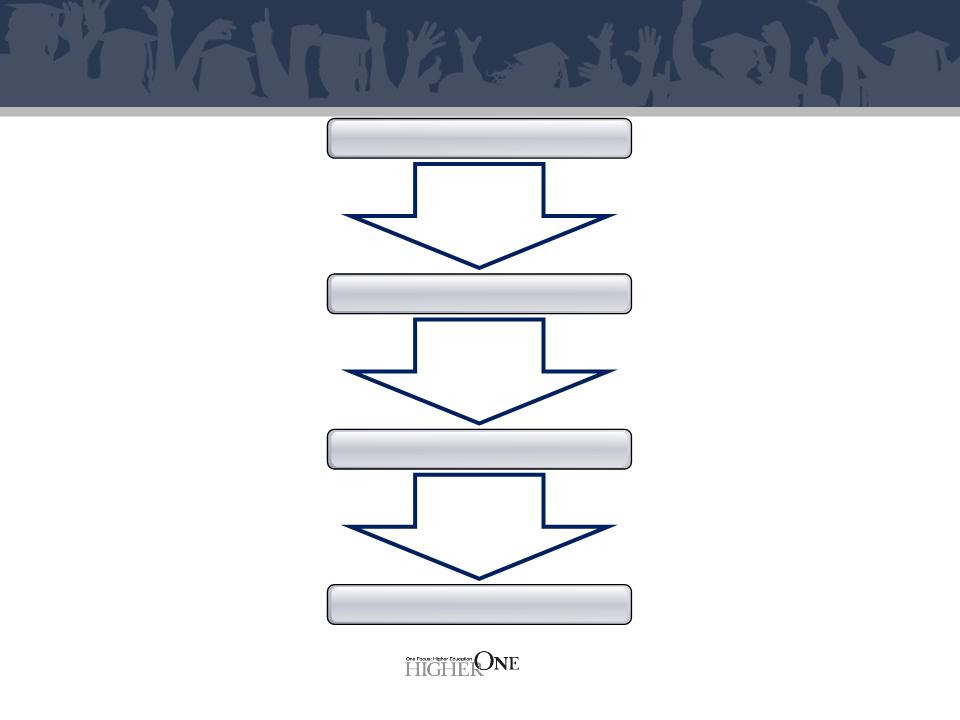

Thinking through the model

School

Penetration

Penetration

Adoption

Rate

Rate

Acct Rev per

OneAccount

OneAccount

Total Student Population

OneDisburse SSE

Number of OneAccounts

Account Revenue

12

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

Recent enrollment and refund trends

13

Unique enrollment headwinds will impact short-term growth trends, but don’t

impact strategy or long-term opportunity:

• Changing industry dynamics are expected to lead to near term lower

enrollment, requiring recalibration of our short-term models

enrollment, requiring recalibration of our short-term models

o Revised Dept of Ed “Satisfactory Academic Progress” standards

make it harder for some students to remain enrolled in the near-term

make it harder for some students to remain enrolled in the near-term

o Publicly-traded colleges continue to report lower enrollments

o Changes in disbursement timing are creating less predictable

disbursement patterns, which is impacting our forecasting ability

disbursement patterns, which is impacting our forecasting ability

o Trend and timing differences between 2 and 4 year schools make

monthly and quarterly disbursement volumes less predictable

monthly and quarterly disbursement volumes less predictable

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

Business model intact

14

Business remains well positioned for growth:

• Win rate healthy, and increasing

• Student adoption rate of OneAccounts at historical rates

• Avg refund size and spending patterns of students receiving

disbursements remain relatively consistent

disbursements remain relatively consistent

• Economics per student receiving a disbursement remain consistent

• Enrollment impacts believed to be short-term, while long-term projections

point to gradual enrollment growth

point to gradual enrollment growth

o More high school grads will ultimately go to college, and the avg

student will stay in college longer

student will stay in college longer

• Expected growth in Q3 from backlog of signed schools that have yet to

launch

launch

o Approximately 30% of new SSE in 2011 will launch after 3/31/12

(versus less than 10% of new SSE in 2010 launched after 3/31/11)

(versus less than 10% of new SSE in 2010 launched after 3/31/11)

• Initiatives to increase deposits from other sources

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

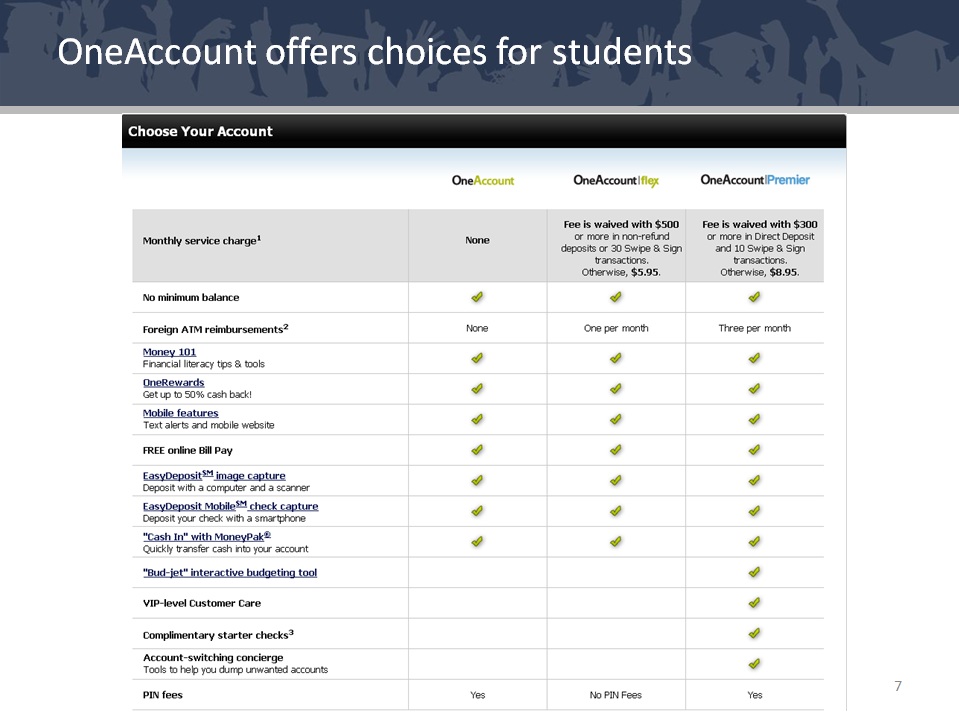

Initiatives to accelerate growth in 2H’12

New account types - Flex and Premier

• Incentive for direct deposit, and more transactions

• Strong usage patterns during soft launch indicate improved revenue

opportunity and customer value

opportunity and customer value

• Broad launch in process

Continued focus on sales momentum

• Clients signed by June generally launch for Fall semester

Focus on revenue generating CASHNet modules

• Opportunity to grow Payment transaction revenue through wider

adoption of existing and new services

adoption of existing and new services

15

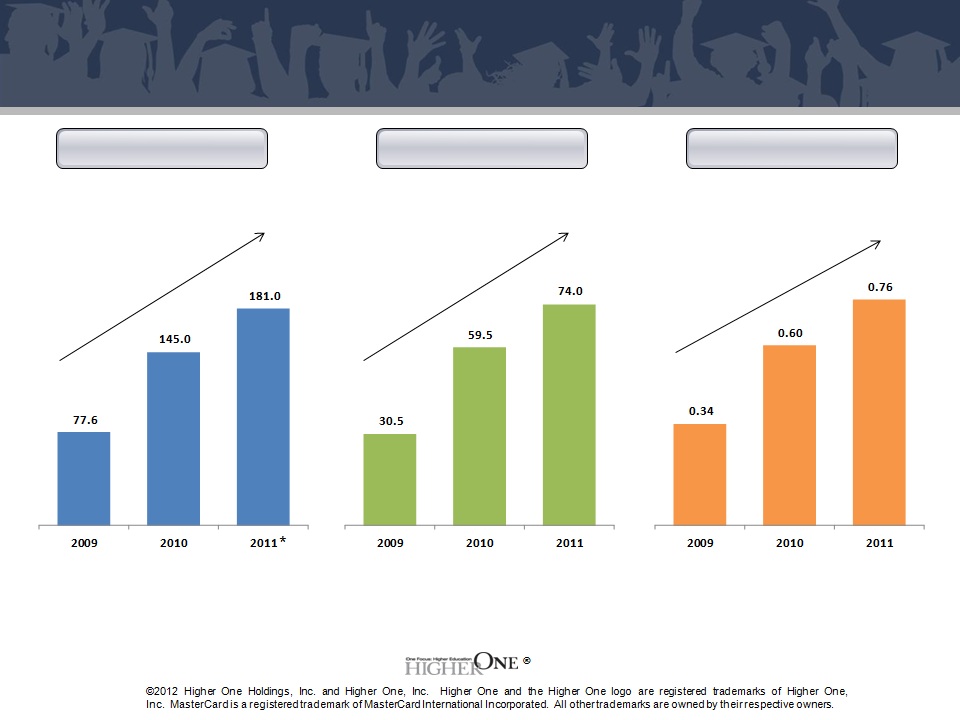

Track record of strong financial performance

Revenue

(in $ millions)

Adj. EBITDA

(in $ millions)

Adj. EPS

(in $)

*2011 Revenue excludes $4.7 million impact from customer credit plan

16

*

53% CAGR

56% CAGR

49% CAGR

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

Appendix

17

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

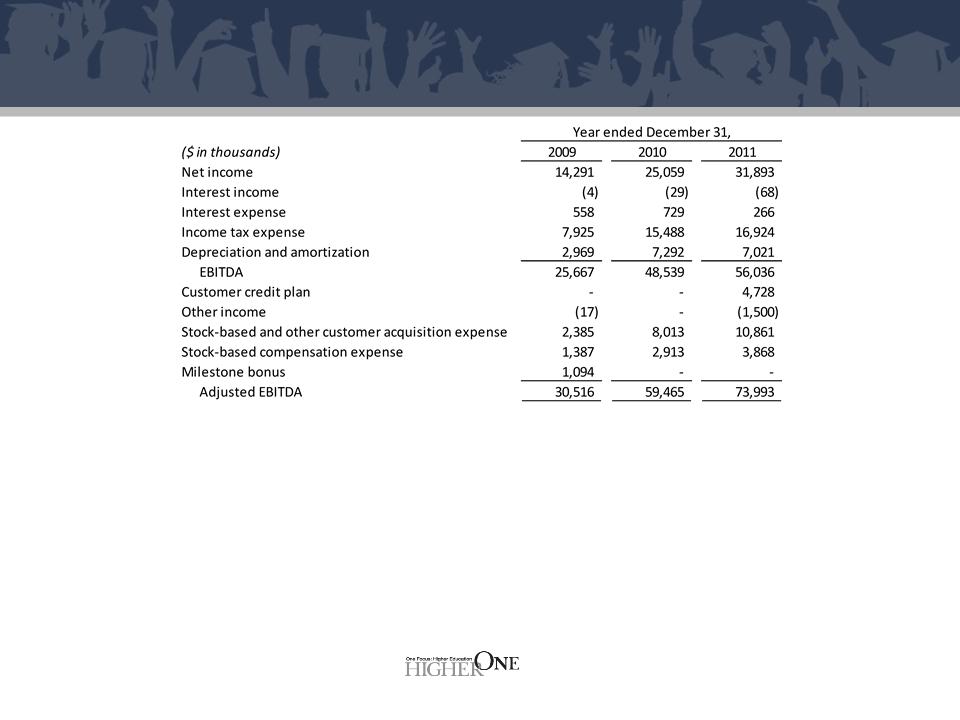

Calculation of Adjusted EBITDA

18

®

©2012 Higher One Holdings, Inc. and Higher One, Inc. Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

MasterCard is a registered trademark of MasterCard International Incorporated. All other trademarks are owned by their respective owners.

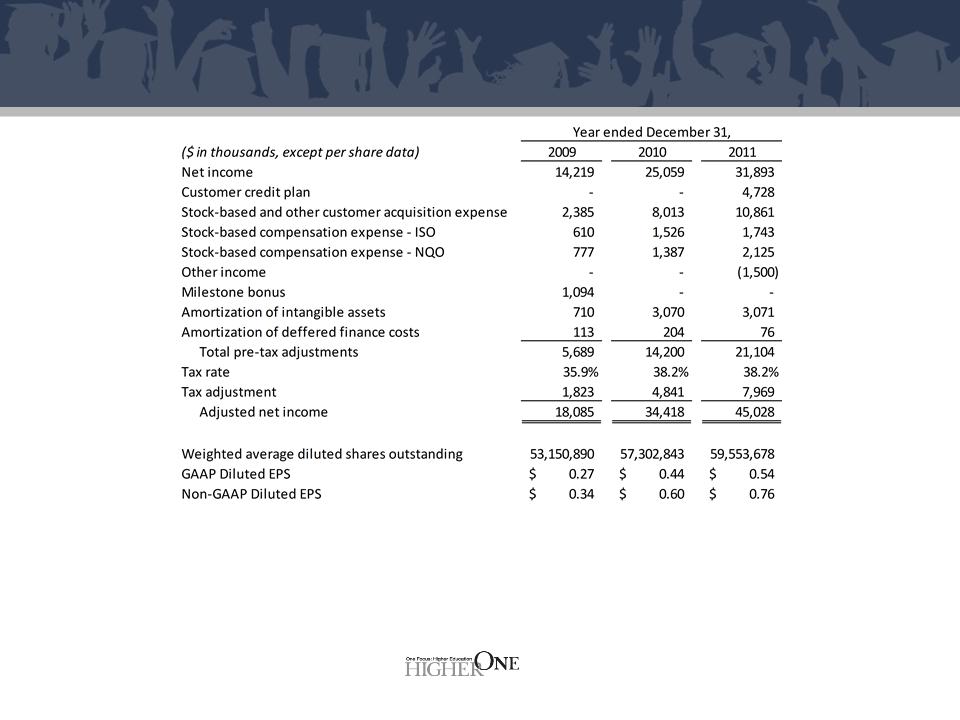

Calculation of Adjusted Diluted EPS

19