Attached files

| file | filename |

|---|---|

| 8-K - OCWEN FINANCIAL CORP | ocn_8k.htm |

Exhibit 99.1

Investor Presentation March 2012 © 2012 Ocwen Financial Corporation. All rights reserved.

2 Who we are and what we do Leading provider of residential and commercial mortgage loan servicing and special servicing » Publicly - traded (NYSE: OCN) pure play mortgage servicer with about $2.0 billion in market capitalization » 20+ years of innovation in loss mitigation » #1 in servicing quality in third party studies of servicers » Low cost, scalable servicing platform and technology $102 billion servicing portfolio, including recent acquisition of Litton Loan Servicing LP (“Litton”) Employer of over 5,000 professionals and staff worldwide Management and the Board have a 18% ownership in Ocwen and strong alignment of interests Applies psychological principles to overcome borrower fear and objections » Delivered via artificial intelligence and dialogue engine ensuring reliability and consistency Utilizes advanced models to reduce variability and losses by evaluating loan resolution alternatives Ocwen maximizes value for mortgage owners by keeping borrowers in their homes… …through the intelligent use of scalable technology Home retention Relationship Managers are hired based on intellect and personality profile – not necessarily experience Ocwen can create a best - in - class collector in three months Technology and global resources enable Ocwen to dedicate more staff to keep people in their homes and lower delinquency rates

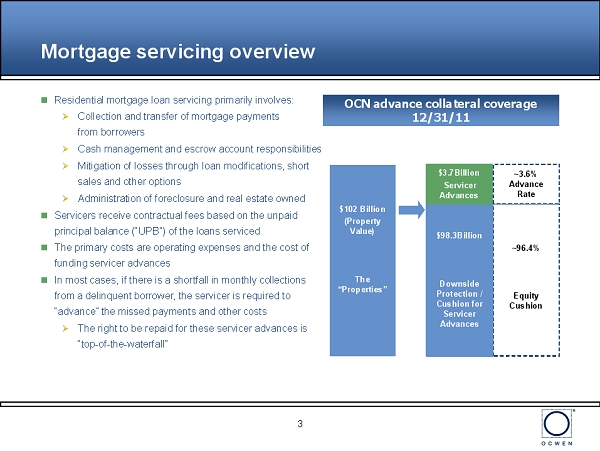

3 Mortgage servicing overview Residential mortgage loan servicing primarily involves: » Collection and transfer of mortgage payments from borrowers » Cash management and escrow account responsibilities » Mitigation of losses through loan modifications, short sales and other options » Administration of foreclosure and real estate owned Servicers receive contractual fees based on the unpaid principal balance (“UPB”) of the loans serviced The primary costs are operating expenses and the cost of funding servicer advances In most cases, if there is a shortfall in monthly collections from a delinquent borrower, the servicer is required to “advance” the missed payments and other costs » The right to be repaid for these servicer advances is “top - of - the - waterfall” OCN advance collateral coverage 12/31/11 $102 Billion (Property Value) The “Properties” ~ 96.4% Equity Cushion $98.3Billion Downside Protection / Cushion for Servicer Advances ~3.6% Advance Rate $3.7Billion Servicer Advances

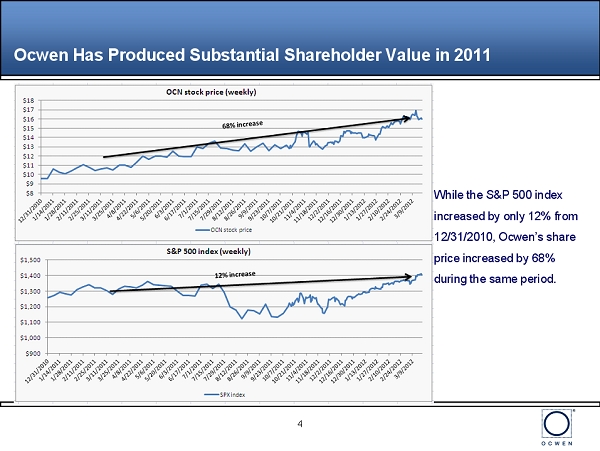

4 Ocwen Has Produced Substantial Shareholder Value in 2011 While the S&P 500 index increased by only 12% from 12/31/2010, Ocwen’s share price increased by 68% during the same period.

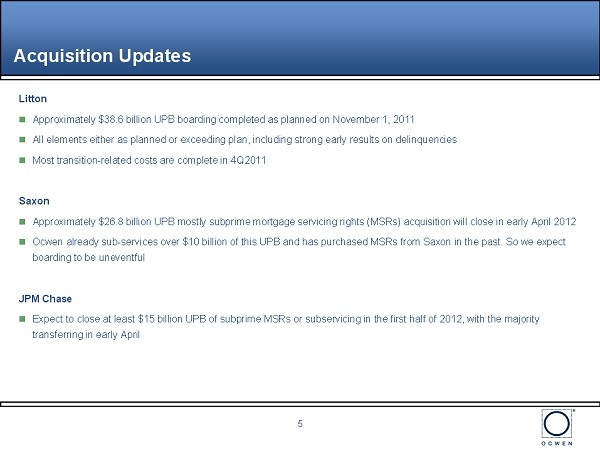

Acquisition Updates LITTON Approximately $38.6 billion UPB boarding completed as planned on November 1, 2011 All elements either as planned or exceeding plan, including strong early results on delinquencies Most transition - related costs are complete in 4Q2011 Saxon Approximately $26.8 billion UPB mostly subprime mortgage servicing rights (MSRs) acquisition will close in early April 2012 Ocwen already sub - services over $10 billion of this UPB and has purchased MSRs from Saxon in the past. So we expect boarding to be uneventful JPM Chase Expect to close at least $15 billion UPB of subprime MSRs or subservicing in the first half of 2012, with the majority transferring in early April 5

Summary of investment highlights 6 Ocwen is well positioned to take advantage of attractive growth opportunities Highly scalable platform with lowest operating cost in the industry Deploying capital to take advantage of attractive opportunities Substantial cash flow generation Superior servicing and loss mitigation practices effective at driving down delinquencies and advances Proven ability to close transactions and effectively board loans 1 2 3 4 5 6 7 Low risk balance sheet with strong collateral protection and upside potential

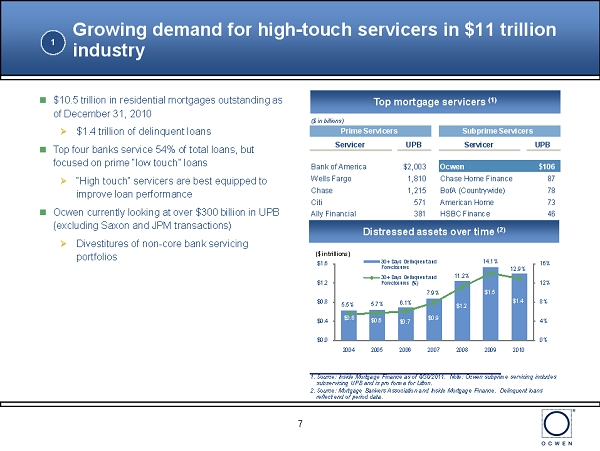

7 $10.5 trillion in residential mortgages outstanding as of December 31, 2010 » $1.4 trillion of delinquent loans Top four banks service 54% of total loans, but focused on prime “low touch” loans » “High touch” servicers are best equipped to improve loan performance Ocwen currently looking at over $350 billion in UPB (excluding Saxon and JPM transactions) » Divestitures of non - core bank servicing portfolios Top mortgage servicers (1) Distressed assets over time (2 ) $0.6 $0.6 $0.7 $0.9 $1.2 $1.5 $1.4 5.5% 5.7% 6.1% 7.9% 11.2% 14.1% 12.9% 0% 4% 8% 12% 16% $0.0 $0.4 $0.8 $1.2 $1.6 2004 2005 2006 2007 2008 2009 2010 ($ in trillions) 30+ Days Delinquent and Foreclosures 30+ Days Delinquent and Foreclosures (%) 1. Source: Inside Mortgage Finance as of 6/30/2011 . Note: Ocwen subprime servicing includes subservicing UPB and is pro forma for Litton. 2. Source: Mortgage Bankers Association and Inside Mortgage Finance. Delinquent loans reflect end of period data. Growing demand for high - touch servicers in $11 trillion industry 1 ($ in billions) Prime Servicers Subprime Servicers Servicer UPB Servicer UPB Bank of America $2,003 Ocwen $106 Wells Fargo 1,810 Chase Home Finance 87 Chase 1,215 BofA (Countrywide) 78 Citi 571 American Home 73 Ally Financial 381 HSBC Finance 46

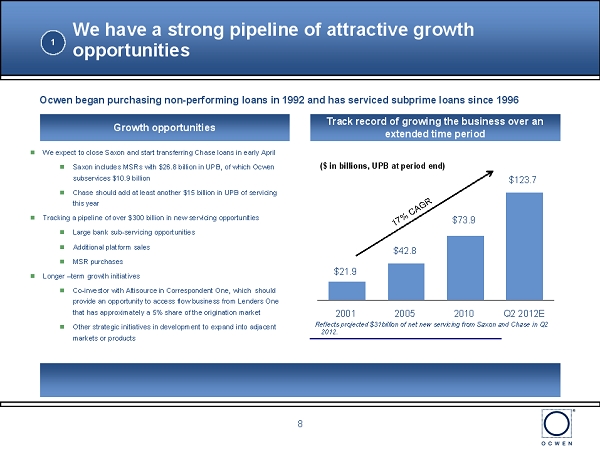

8 We have a strong pipeline of attractive growth opportunities Ocwen began purchasing non - performing loans in 1992 and has serviced subprime loans since 1996 Track record of growing the business over an extended time period $21.9 $42.8 $73.9 $123.7 2001 2005 2010 Q2 2012E ($ in billions, UPB at period end) Growth opportunities We expect to close Saxon and start transferring Chase loans in early April Saxon includes MSRs with $26.8 billion in UPB, of which Ocwen subservices $10.9 billion Chase should add at least another $15 billion in UPB of servicing this year Tracking a pipeline of over $350 billion in new servicing opportunities Large bank sub - servicing opportunities Additional platform sales MSR purchases Longer – term growth initiatives Co - investor with Altisource in Correspondent One, which should provide an opportunity to access flow business from Lenders One that has approximately a 5% share of the origination market Other strategic initiatives in development to expand into adjacent markets or products Reflects projected $31billion of net new servicing from Saxon and Chase in Q2 2012. 1 Acquisitions priced at 25% or higher return on equity

9 Ocwen’s key differentiators are directly proportional to delinquency of target portfolios Ocwen has » A 70% cost advantage in servicing non - performing loans » A proven ability to reduce delinquencies and advances » Best in class 90+ day to current roll rates of 14% for subprime adjustable rate loans and 15% for subprime fixed rate loans » Reduced advances of the HomEq portfolio more than 38% within the first 13 months after on - boarding » Unmatched ability to finance advances across cycles » Ability to integrate portfolios without meaningful disruption to platform or efficiency » Ocwen has grown UPB from $21.9 billion in 2001 to a projected $123.7 billion in Q2 2012. » Maintained strong cash and debt capacity and a demonstrated ability to close large, complex transactions Ocwen is well positioned to benefit from these opportunities 1

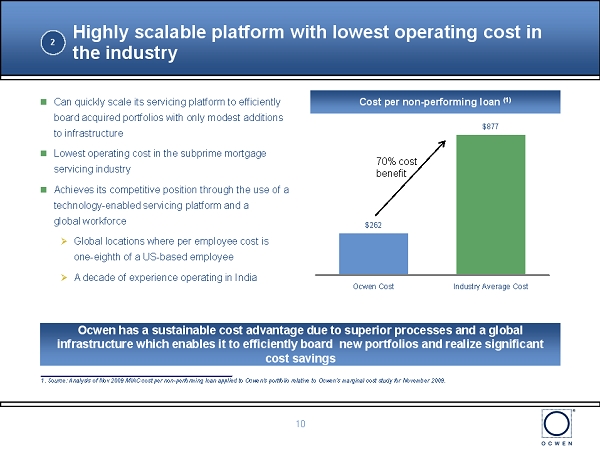

Highly scalable platform with lowest operating cost in the industry 10 10 1. Source: Analysis of Nov 2009 MIAC cost per non - performing loan applied to Ocwen's portfolio relative to Ocwen's marginal cost study for November 2009. Can quickly scale its servicing platform to efficiently board acquired portfolios with only modest additions to infrastructure Lowest operating cost in the subprime mortgage servicing industry Achieves its competitive position through the use of a technology - enabled servicing platform and a global workforce » Global locations where per employee cost is one - eighth of a US - based employee » A decade of experience operating in India Cost per non - performing loan (1) Ocwen has a sustainable cost advantage due to superior processes and a global infrastructure which enables it to efficiently board new portfolios and realize significant cost savings 2 $262 $877 Ocwen Cost Industry Average Cost 70% cost benefit

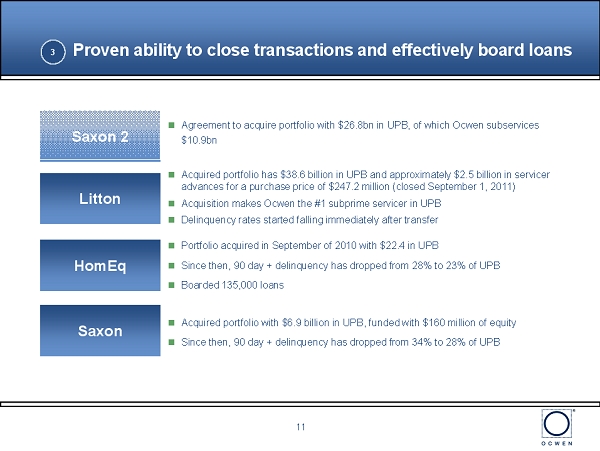

Litton Saxon HomEq Proven ability to close transactions and effectively board loans 3 Acquired portfolio has $38.6 billion in UPB and approximately $2.5 billion in servicer advances for a purchase price of $247.2 million (closed September 1, 2011) Acquisition makes Ocwen the #1 subprime servicer in UPB Delinquency rates started falling immediately after transfer Portfolio acquired in September of 2010 with $22.4 in UPB Since then, 90 day + delinquency has dropped from 28% to 23% of UPB Boarded 135,000 loans Acquired portfolio with $6.9 billion in UPB, funded with $160 million of equity Since then, 90 day + delinquency has dropped from 34% to 28% of UPB 11 Saxon 2 Agreement to acquire portfolio with $26.8bn in UPB, of which Ocwen subservices $10.9bn

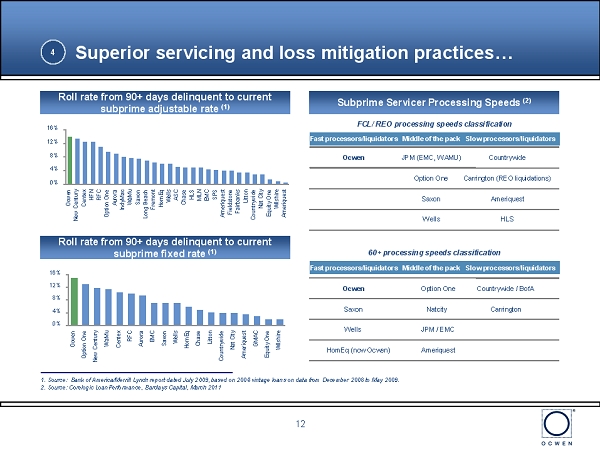

0% 4% 8% 12% 16% Ocwen New Century Centex HFN RFC Option One Aurora IndyMac WaMu Saxon Long Beach Fremont HomEq Wells ASC Chase HLS MLN EMC SPS Ameriquest Fieldstone Fairbanks Litton Countrywide Nat City Equity One Wilshire Ameriquest 12 Superior servicing and loss mitigation practices… 0% 4% 8% 12% 16% Ocwen Option One New Century WaMu Centex RFC Aurora EMC Saxon Wells HomEq Chase Litton Countrywide Nat City Ameriquest GMAC Equity One Wilshire 1. Source: Bank of America/Merrill Lynch report dated July 2009, based on 2006 vintage loans on data from December 2008 to May 200 9 . 2. Source: Corelogic LoanPerformance , Barclays Capital, March 2011 Roll rate from 90+ days delinquent to current subprime adjustable rate (1) Roll rate from 90+ days delinquent to current subprime fixed rate (1) 4 Subprime Servicer Processing Speeds (2) FCL/ REO processing speeds classification 60+ processing speeds classification Fast processors/liquidators Middle of the pack Slow processors/liquidators Ocwen JPM (EMC, WAMU) Countrywide Option One Carrington (REO liquidations) Saxon Ameriquest Wells HLS Fast processors/liquidators Middle of the pack Slow processors/liquidators Ocwen Option One Countrywide / BofA Saxon Natcity Carrington Wells JPM / EMC HomEq (now Ocwen) Ameriquest

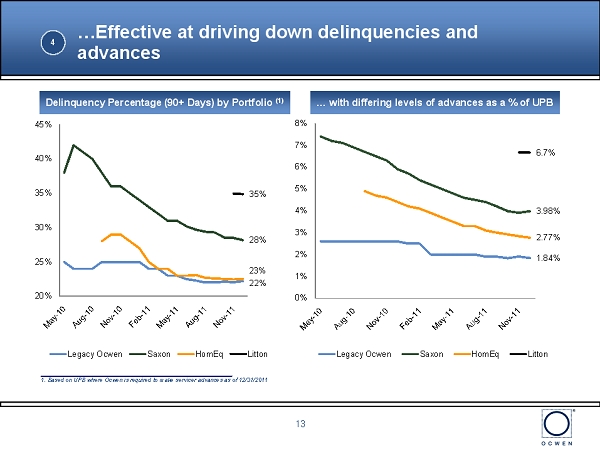

13 … with differing levels of advances as a % of UPB 1. Based on UPB where Ocwen is required to make servicer advances as of 12/31/2011 Delinquency Percentage (90+ Days) by Portfolio ( 1) …Effective at driving down delinquencies and advances 4 1.84% 3.98% 2.77% 6.7% 0% 1% 2% 3% 4% 5% 6% 7% 8% Legacy Ocwen Saxon HomEq Litton 22% 28% 23% 35% 20% 25% 30% 35% 40% 45% Legacy Ocwen Saxon HomEq Litton

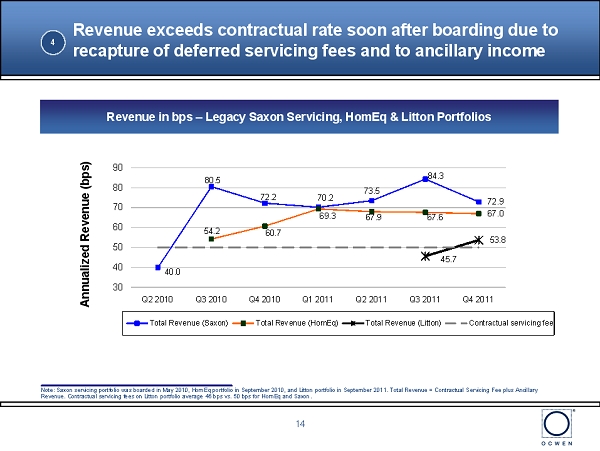

14 Revenue in bps – Legacy Saxon Servicing, HomEq & Litton Portfolios Annualized Revenue (bps) 4 14 Revenue exceeds contractual rate soon after boarding due to recapture of deferred servicing fees and to ancillary income Note: Saxon servicing portfolio was boarded in May 2010, HomEq portfolio in September 2010, and Litton portfolio in September 20 11. Total Revenue = Contractual Servicing Fee plus Ancillary Revenue. Contractual servicing fees on Litton portfolio average 46 bps vs. 50 bps for HomEq and Saxon. 40.0 80.5 72.2 70.2 73.5 84.3 72.9 54.2 60.7 69.3 67.9 67.6 67.0 45.7 53.8 30 40 50 60 70 80 90 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Annualized Revenue (bps) Total Revenue (Saxon) Total Revenue (HomEq) Total Revenue (Litton) Contractual servicing fee

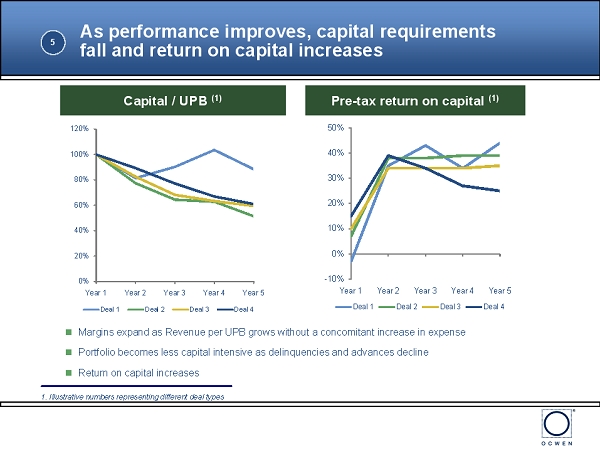

1. Illustrative numbers representing different deal types 0% 20% 40% 60% 80% 100% 120% Year 1 Year 2 Year 3 Year 4 Year 5 Deal 1 Deal 2 Deal 3 Deal 4 Capital / UPB (1) As performance improves, capital requirements fall and return on capital increases Pre - tax return on capital (1) - 10% 0% 10% 20% 30% 40% 50% Year 1 Year 2 Year 3 Year 4 Year 5 Deal 1 Deal 2 Deal 3 Deal 4 Margins expand as Revenue per UPB grows without a concomitant increase in expense Portfolio becomes less capital intensive as delinquencies and advances decline Return on capital increases 5

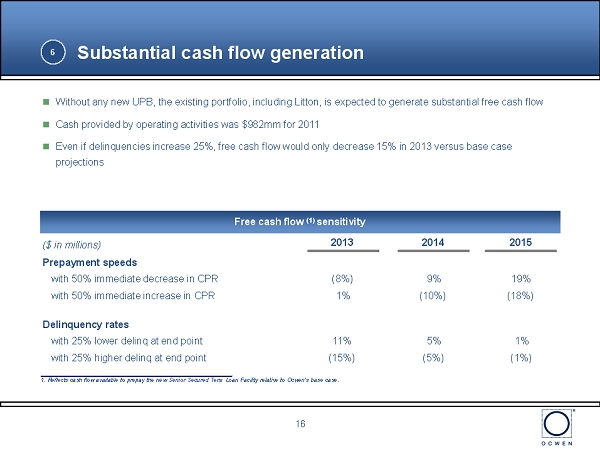

Substantial cash flow generation 16 16 Without any new UPB, the existing portfolio, including Litton, is expected to generate substantial free cash flow Cash provided by operating activities was $982mm for 2011 Even if delinquencies increase 25%, free cash flow would only decrease 15% in 2013 versus base case projections 1. Reflects cash flow available to prepay the new Senior Secured Term Loan Facility relative to Ocwen’s base case. Free cash flow (1) sensitivity 6 ($ in millions) 2013 2014 2015 Prepayment speeds with 50% immediate decrease in CPR (8%) 9% 19% with 50% immediate increase in CPR 1% (10%) (18%) Delinquency rates with 25% lower delinq at end point 11% 5% 1% with 25% higher delinq at end point (15%) (5%) (1%)

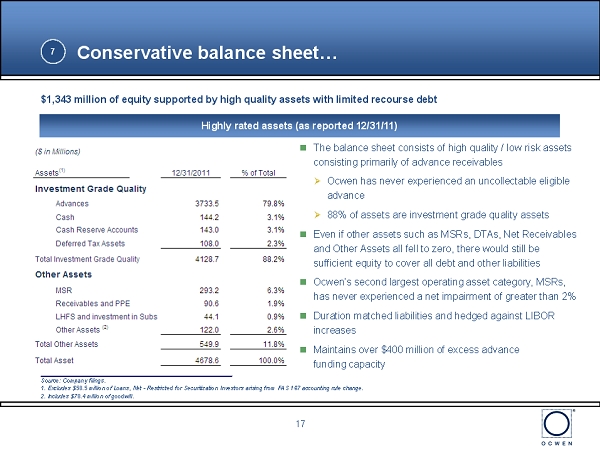

Conservative balance sheet… 17 Highly rated assets (as reported 12/31/11) Source: Company filings. 1. Excludes $58.5 million of Loans, Net - Restricted for Securitization Investors arising from FAS 167 accounting rule change. 2. Includes $78.4 million of goodwill. The balance sheet consists of high quality / low risk assets consisting primarily of advance receivables » Ocwen has never experienced a net impairment of its advances » 88% of assets are investment grade quality assets Even if other assets such as MSRs, DTAs, Net Receivables and Other Assets all fell to zero, there would still be sufficient equity to cover all debt and other liabilities Ocwen’s second largest operating asset category, MSRs, has never experienced a net impairment of greater than 2% Duration matched liabilities and hedged against LIBOR increases Maintains over $400 million of excess advance funding capacity $1,343 million of equity supported by high quality assets with limited recourse debt 7

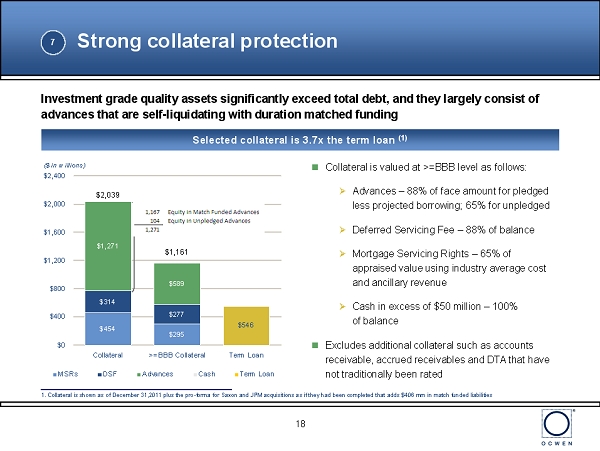

18 $454 $295 $314 $277 $1,271 $589 $546 $0 $400 $800 $1,200 $1,600 $2,000 $2,400 Collateral >=BBB Collateral Term Loan ($ in millions) MSRs DSF Advances Cash Term Loan Strong collateral protection 1. Collateral is shown as of December 31,2011 plus the pro - forma for Saxon and JPM acquisitions as if they had been completed that adds $406 mm in match funded liabilities Investment grade quality assets significantly exceed total debt, and they largely consist of advances that are self - liquidating with duration matched funding Collateral is valued at >=BBB level as follows: » Advances – 88% of face amount for pledged less projected borrowing; 65% for unpledged » Deferred Servicing Fee – 88% of balance » Mortgage Servicing Rights – 65% of appraised value using industry average cost and ancillary revenue » Cash in excess of $50 million – 100% of balance Excludes additional collateral such as accounts receivable, accrued receivables and DTA that have not traditionally been rated Selected collateral is 3.7x the term loan (1) $ 2,039 $ 1,161 7

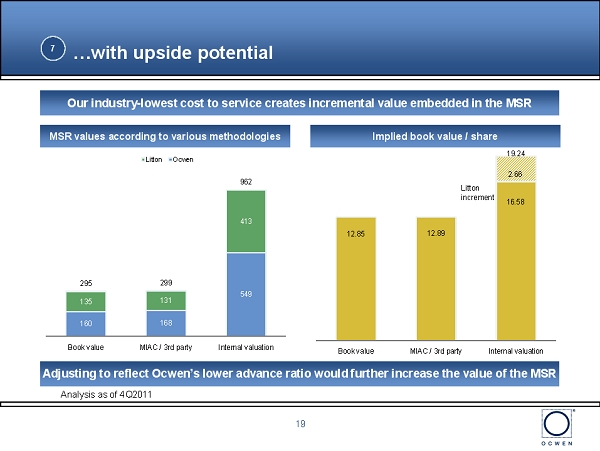

19 …with upside potential 7 160 168 549 135 131 413 295 299 962 Book value MIAC / 3rd party Internal valuation Litton Ocwen 16.58 2.66 12.85 12.89 19.24 Book value MIAC / 3rd party Internal valuation MSR values according to various methodologies Implied book value / share Our industry - lowest cost to service creates incremental value embedded in the MSR Adjusting to reflect Ocwen’s lower advance ratio would further increase the value of the MSR Litton increment Analysis as of 4Q2011

Proven ability to close transactions and effectively board loans Summary of investment highlights 20 Why now – Ocwen is well positioned to take advantage of attractive growth opportunities Highly scalable platform with lowest operating cost in the industry Deploying capital to take advantage of attractive opportunities Substantial cash flow generation Superior servicing and loss mitigation practices effective at driving down delinquencies and advances Low risk balance sheet with strong collateral protection and upside potential 1 2 3 4 5 6 7

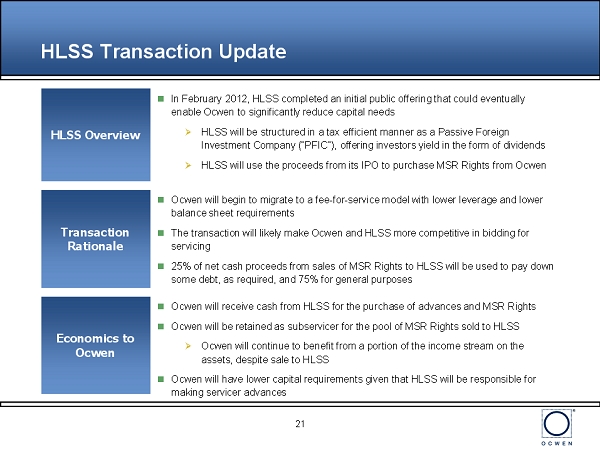

21 21 HLSS Transaction Update In February 2012, HLSS completed an initial public offering that could eventually enable Ocwen to significantly reduce capital needs » HLSS will be structured in a tax efficient manner as a Passive Foreign Investment Company (“PFIC”), offering investors yield in the form of dividends » HLSS will use the proceeds from its IPO to purchase MSR Rights from Ocwen Ocwen will begin to migrate to a fee - for - service model with lower leverage and lower balance sheet requirements The transaction will likely make Ocwen and HLSS more competitive in bidding for servicing 25% of net cash proceeds from sales of MSR Rights to HLSS will be used to pay down some debt, as required, and 75% for general purposes Economics to Ocwen Ocwen will receive cash from HLSS for the purchase of advances and MSR Rights Ocwen will be retained as subservicer for the pool of MSR Rights sold to HLSS » Ocwen will continue to benefit from a portion of the income stream on the assets, despite sale to HLSS Ocwen will have lower capital requirements given that HLSS will be responsible for making servicer advances Transaction Rationale HLSS Overview