Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CTS CORP | d320216d8k.htm |

Investor Presentation

March 2012

Exhibit 99.1 |

2

Safe Harbor Statement

This

presentation

contains

statements

that

are,

or

may

be

deemed

to

be,

forward-looking

statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to, any

financial or other guidance, statements that reflect our current

expectations concerning future results and events and any other statements that are not based

solely on historical fact. Readers are cautioned not to place undue reliance on

these forward-looking statements,

which

speak

only

as

of

the

date

hereof

and

are

based

on

various

assumptions

as

to

future

events, the occurrence of which necessarily are subject to uncertainties. These

forward-looking statements are made subject to risks, uncertainties and

other factors, which could cause our actual results, performance or

achievements to differ materially from those presented in the forward-looking

statements, including, without limitation: changes in the economy generally and in

respect to the businesses in which CTS operates; rapid technological change;

general market conditions in the automotive, communications, and computer

industries, as well as conditions in the industrial, defense and aerospace,

and medical markets; reliance on key customers; unanticipated natural or other events such

as the Japan earthquake and the Thailand flood; the ability to protect our

intellectual property; pricing pressures

and

demand

for

our

products;

and

risks

associated

with

our

international

operations,

including

trade and tariff barriers, exchange rates and political and geographical

risks. For more detailed information

on

the

risks

and

uncertainties

associated

with

CTS’

business,

see

the

reports

CTS

files

with

the

SEC

available

at

http://www.ctscorp.com/investor_relations/investor.htm.

CTS

undertakes

no

obligation to publicly update its forward-looking statements to reflect new

information or events or circumstances

that

arise

after

the

date

hereof,

including

market

or

industry

changes. |

3

CTS Corporation -

Profile

Sensors &

Actuators

Electronic

Components

49%

A global designer and manufacturer of highly engineered:

•

Sensors & Actuators,

•

Electronic Components,

•

and a provider of Electronics Manufacturing Services

Established in 1896 with 4,200 employees worldwide

Projected

Sales

Segments

Components &

Sensors

EMS

19%

32% |

4

Global Operations

San Jose

Moorpark

Matamoros, Mexico

Nogales, Mexico

Elkhart

Lisle

Londonderry

Toronto, Canada

Albuquerque

Tucson

Scotland

Czech Republic

Thailand

Singapore

Taiwan

China

India

Auburn Hills

Japan

Sales Office

Manufacturing

Headquarters

Switzerland

Boston

Global footprint and diversified customer base. |

5

Sales By Market and Geographic Regions

6%

6%

29%

22%

18%

19%

Other

Communications

Automotive

Industrial

Defense/

Aerospace

Medical

Sales by Market

5%

12%

58%

12%

30%

North

America

Asia

Europe

Sales By Region

Low Cost Manufacturing 47%

Diversified markets and a global (lower cost)

manufacturing footprint |

6

Sensors and Actuators

•

Macro Trend Driving Growth

–

Tougher emissions standards

–

Need for increased fuel economy

•

New Products and New Customers

–

On and off highway diesel engine applications

–

Small turbocharger applications / Active grill

shutter actuators

Growth through new technology, customers and

penetration of new markets

32%

Sensors/

Actuators

Actuator

Sales

Rotary & Linear

Position Sensors

BLDC High Torque

Actuators

Heavy Duty

Hall-effect Sensors

Pedal

Modules

Miniature Rotary

Resistive Sensors

Integrated Sensor

Sub-assemblies

Turbocharger

Sensor

Expect double-digit sales growth over the next 3-5 years

|

7

Total

Available

Market

(Including Pedal Sensors)

Growth Drivers -

Pedal Modules

130

142

120

49

72

67

98

91

30

2006

2007

2008

2009

2010

2011

2012

2013

2014

Target

Captured

CTS Pedal Modules offer performance, quality and cost advantages

CTS Pedal Sales $M

M

a

j

o

r

c

u

s

t

o

m

e

r

s

i

n

N

o

r

t

h

A

m

e

r

i

c

a,

E

u

r

o

p

e

a

nd

A

s

i

a.

$339

$385

$369

$325

$411

$438

$479

$511

$541 |

8

Diversifying into new markets with new technologies

New Growth Drivers –

Sensors and Actuators

•

Organic growth driven by strong research and development

R&D 7.1% of Components and Sensors sales –

7 year high

•

Highly engineered products improve fuel economy and reduce emissions

•

Serves light vehicles and commercial markets

Applications

Turbocharger Sensor

Diesel Engines for

European Vehicles

$0

$20

$40

$60

2009

2010

2011

2012

2013

2014

Sales

$ in Millions

Actuator

Smart Actuator

Diesel Engines for

Commercial Vehicles

Products

Grill Shutter System

For N.A. Vehicles |

9

Electronic Components

Double-digit sales growth over the next 3-5 years

•

Macro Trends Driving Growth

–

Strong wireless communication growth in emerging markets

–

Global markets driving higher data traffic

Smart phones, Social networking; YouTube, Facebook

EC

19%

Launching innovative new products

Expanding into new customers and applications

Sales

New Piezo Application for Hard Disk Drives

New Electrocomponent –

Product Applications

–

Mobility scooters, portable medical devices, industrial joysticks

•

New Growth Drivers:

Acquisitions –

Precision Frequency Products (Fordahl / Valpey Fisher)

|

10

Electronic Components –

Communications Infrastructure

OCXO

Ceramic

Duplexer

Wireless

Base Station

Sales

$ in Millions

Key Customers: Alcatel–Lucent, Cisco, Nokia Siemens Networks, Juniper, Tellabs,

Emerson, Ciena, Rockwell Collins Increasing market share and winning new

customers Satellite

Communications

WiMAX

EMI

Filters

Clock

Oscillators

ActiPlex

®

Filters

Defense

Communications

ACQUISITION UPDATE

•

Valpey Fisher –

($15M annual sales)

Specializes in low-noise solutions for portable

military equipment / guidance systems

$0

$15

$30

$45

$60

$75

$90

2009

2010

2011

2012

2013 |

11

Electronic Components –

Piezoceramic Products

0

10

20

30

40

2009

2010

2011

2012

2013

Sales

$ in Millions

Medical Ultrasound

Wide Format

Inkjet Printer Head

Undersea Energy

Exploration

Aerospace

Soft

And

Hard

Piezo

Ceramic

Materials

Hard Disk Drive Actuation

-

New generation of HDD actuation for computer market

New

Products

•

Class 1K cleanroom capability now operational in China

New applications are emerging for piezoceramic devices

spurring innovation and profitable growth

Piezo ceramic components for hard disk drive application launched – New Product / New

Customer |

12

Electronics Manufacturing Solutions

EMS

49%

Sales

•

Strategic Focus

–

Target customers with complex needs

–

Target niche sectors –

defense & aerospace, medical, industrial

–

Provide turnkey services, design to direct ship

•

Specialized Tier 2 Global EMS Provider

Mid single-digit sales growth business over the next 3-5 years

Diversified business, improved cost structure and global

capabilities are improving EMS performance |

13

Electronics Manufacturing Solutions

Communications

Industrial

Medical

Computer/

Other

2011

Defense/

Aerospace

•

Diversified business

•

Focus on segments requiring design

capabilities and special certification

Improved customer / market mix

Computer

Communications

Other

68%

29%

3%

2004

Targeted Area > 65%

•

Improving capacity utilization

•

Repositioning capacity

•

Thailand / Mexico expansion

Improving Performance

Operating Margin Before Corporate Charges

Target

Market Diversification

2.2%

5.2%

2.5%

7.0%

5.0%

2007-2009

2010

2011

Short-

Term

Long-

Term

4%

31%

9%

24%

32% |

Financial Summary

Definitions and reconciliation of non-GAAP financial terms are included on

CTS’

Web site at www.ctscorp.com |

15

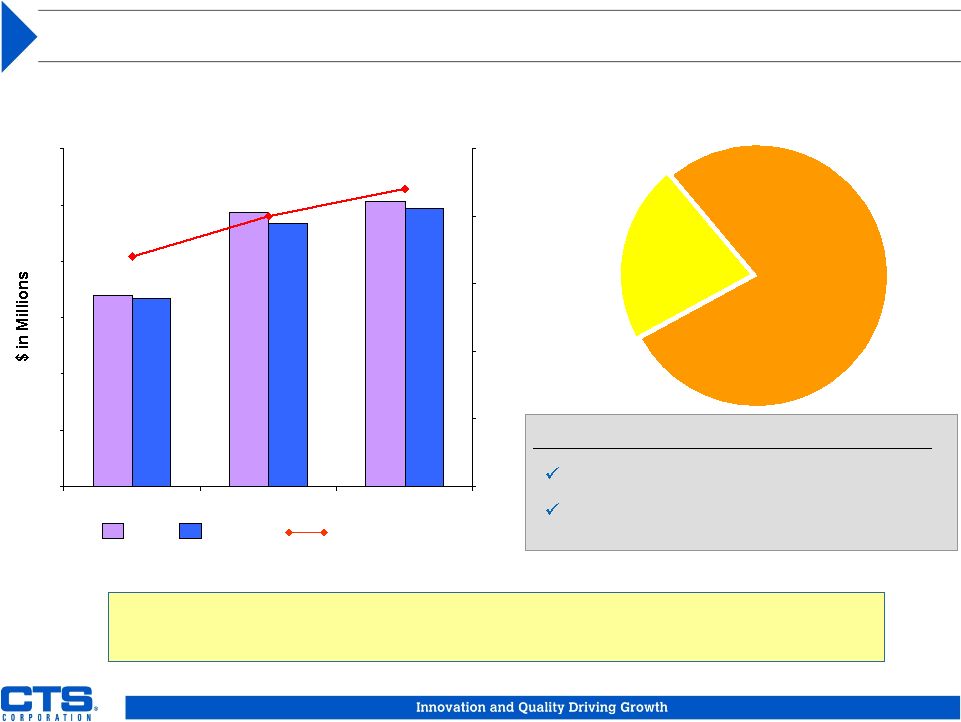

Financial Performance Trend

Sales ($M)

Adjusted EPS

•

2011

growth

tempered

by

impact

of

Japan

earthquake

/

tsunami

and

Thailand

floods

•

2012 growth driven by new products, new programs, and new customers

$665

$647

$0.80

$0.75

$499

$553

$589

2009

2010

2011

2012

Guidance

$0.36

$0.66

$0.67

2009

2010

2011

2012

Guidance |

16

Balance Sheet Trends

Capital Expenditures

Controllable Working Capital*

*

Controllable

Working

Capital

Defined

as

Accounts

Receivable

+

Inventories

-

Accounts

Payable.

2% -

3%

13%-14%

•

Higher working capital in 2010-2011 due to product launch and transfer

•

Capital expenditure remains on target despite new products and growth

initiative 0%

2%

2009

2010

2011

Target

8%

10%

12%

14%

16%

18%

20%

2009

2010

2011

Target |

17

Free Cash Flow

$ in Millions

Recession/

Recovery

Average

$18M

Normal

Approx. $20M

Guidance

•

Free cash flow returns to pre-recession levels in 2012

•

Cash flow utilized for organic growth, acquisitions, stock buyback & dividend

increases Pre-Recession

Average

$20-25M

Note: Free Cash Flow defined as net cash provided by operations, less capital

expenditures $40

$6

$9

$21

$23

$0

$10

$20

$30

$40

2006-2008

2009

2010

2011

2012

$16 |

18

Capital Structure

Strong balance sheet and conservative capital structure

Current Capital Structure

Total Debt to Capitalization

$51

$50

$73

$76

$74

$70

20%

22%

17%

$0

$15

$30

$45

$60

$75

$90

2009

2010

2011

0%

5%

10%

15%

20%

25%

Total Debt

Cash

Debt to Capitalization

Bank

Debt

$74

Equity

Amended

Bank

Agreement

in January

2012

Increased

our

facility

from

$150M

to

$200M

Lowered pricing by 25 bps |

19

Target Adjusted Return on Invested Capital (ROIC)

OPERATING

MARGIN

AFTER-TAX

(NOPAT

Margin)

INVESTED CAPITAL TURNOVER

Overall ROIC improvement on track

4%

2%

6%

8%

0.5

1.0

1.5

2.0

2.5

3.0

3.5

ROIC

10%

12%

4.0

EMS

Components

& Sensors

2009

5.0%

2010

8.9%

09

10

2011

8.5%

11

2012

12

10% -

11%

Target Range

2011 ROIC impacted by Japan earthquake / tsunami and Thailand floods

2012 ROIC benefiting from new product launches, new programs, acquisitions

|

20

Positioned For Profitable Growth

•

Winning new business and new customers with innovative

products and technology

Smart actuators, turbocharger sensors, grill shutter actuators, electromagnetic

filters, hard piezo micro actuators, digital encoders, industrial joysticks,

precision TCXOs

Penetrated new global customers: Honda, Honeywell, Western Digital,

Caterpillar, etc.

•

Effectively managing costs and reinvesting for future growth

•

Research and development focus and strong intellectual property

portfolio

•

Global footprint and diversified business model

•

Conservative balance sheet and positive cash flow

Announced dividend increase and continued stock buyback

•

Pursuing accretive, bolt-on acquisitions

Completed Valpey Fisher acquisition

Focused on enhancing shareholder value |

21 |

22

2011 Governance Enhancements

•

Change in Control Severance Agreement

–

Revised change in control

severance agreements for named executive officers to eliminate all excise

tax gross-ups

and reduce change in control benefits.

•

Officer and Director Stock Ownership

–

Increased the stock ownership

guidelines for the CEO to 5.5 times base salary, directors to 5.5 times the

annual board retainer (and other officers to 3.0 times base salary).

•

Lead Director Role

–

Expanded the role of lead director to enhance

effectiveness of that position, including increasing the lead director’s

involvement in key strategic initiatives and communication with major

shareholders when needed.

•

Director Resignation Policy

–

Adopted a director resignation policy so that

directors who receive a majority of withhold and/or against votes in a

director election will immediately tender their resignation. The Board of

Directors will then evaluate whether to accept the resignation.

For many years, CTS has maintained robust corporate governance policies.

During 2011, CTS’

Board of Directors took the following actions to further

strengthen CTS’

corporate governance. |

23

Sample Applications:

Products:

Sensors and Actuators

Technologies:

•

Thick Film Resistive Ink Systems

•

Hall-effect Non-contacting Systems

•

BLDC High-Torque Electromagnetics

Capabilities:

•

Research, Design & Engineering

•

Custom Molding

•

Highly Automated Manufacturing

•

Global Footprint: N. America, Asia, Europe

Pedal

Modules

Miniature Rotary

Resistive Sensors

BLDC High Torque

Actuators

Rotary & Linear

Position Sensors

Integrated Sensor

Sub-assemblies

Heavy Duty Hall-effect Sensors

Passenger Vehicles

Light-Duty Delivery

Vehicles

On-Road Commercial

Vehicles

Off-Road Commercial Vehicles &

Industrial Equipment

Small Engine

Vehicles & Machinery |

24

Sample Applications:

Products:

Technologies:

•

Thick Film Resistive Ink Systems

•

Quartz, Hard & Soft Piezoceramics

•

Electronic-grade Ceramics

•

Precision Coatings

Capabilities:

•

Research, Design & Engineering

•

Custom Packaging

•

ISO 13485, 9001, 14001 Certifications

•

North America and Asia Footprint

Wireless Broadband and

HDD Actuation

Industrial

Instrumentation

Defense and Aerospace

Communication & Guidance Systems

Medical Diagnostics &

Instrumentation

Electronic Components

Thermal

Management

Components

Ceramic RF

Filters

Piezoceramic

Components

EMI/RFI Filter

Components

Resistive/

Capacitive

Networks

Frequency

Modules

Switches &

Variable

Resistors |

25

Sample Applications:

Major Markets:

Quality /

Regulatory:

•

ISO 13485, 9001

•

CFR 820

•

FDA Class I to III

•

IPC Class III

Capabilities:

•

Complex PCB’s and Boxbuilds

•

Custom Design & Engineering

•

Secure Manufacturing

•

Turnkey Services –

Design thru Direct Ship

•

High Technology Environment

•

Global Footprint: N. America, Asia, Europe

Communication

Infrastructure

Industrial Equipment

Defense and Aerospace

Medical Devices and

Equipment

Electronic Manufacturing Solutions

•

AS9100

•

ITAR / NISP

•

Mil Spec

•

List X

WiFi Arrays

Building & HVAC

Control Systems

Identity Recognition

Systems

Insulin Pumps &

Glucose Monitoring

Enterprise IP Video

on Demand

Aircraft Collision

Avoidance Systems

Products:

BoxBuilds

Complex PCB’s

Backplanes |

26

Major CTS Competitors

PRODUCTS

Sensors and Actuators

COMPETITION

AB Electronics, Alps, Bosch, Bourns, Delphi, Denso,

Continental, CST, Hella, Mikuni

Electronic Components

Electronics Manufacturing Services

Axiom, Celestica, DuCommun, Flextronics, Jabil,

Keytronic, Plexus, Sanmina-SCI, Sparton, STI Ltd.,

Sypris Solutions, TT EMS

Frequency Products -

Infrastructure

Mini-circuits, Mtron, Morion, NDK, Rakon, RFMD, Vectron

Piezo electronics

APC, Edo, Morgan ElectroCeramics, Sumitomo, TRS

Ceramic Filters

Murata, Partron, TDK, UBE

EMI / RFI Filters

AVX, Corrymicro, Ferroperm, API Technologies, Stelco

BI Tech, Bourns, Grayhill, KOA

Resistor Networks |

27

Supplying the ‘Green’

Energy Market

Sensors

And

Actuators

EMS

Battery -

Electric

All-Electric Vehicles

Electric Vehicle

Charging Systems

& Power Systems

‘Green’

Energy Sales

$ in Millions

New Electric Vehicle Market

Strengthening;

Providing Opportunities in

Fast Growing Market

Hybrid Gas/Electric

Vehicles

8

Program

Wins

2

Program

Wins

Zero-

Emissions

$1

$5

$9

$15

$18

2009

2010

2011

2012

2013 |

28

Financial Summary

Note: Adjusted data excludes restructuring and related charges,

asset impairments and income tax adjustments.

2011

2010

2009

2008

2007

Net Sales

$588.5

$552.6

$499.0

$691.7

$685.9

Adjusted Operating Earnings

$28.7

$29.5

$17.6

$37.0

$34.9

Adjusted Operating Earnings % of Sales

4.9%

5.3%

3.5%

5.3%

5.1%

Adjusted Net Earnings

$23.4

$23.1

$12.0

$26.5

$26.0

Adjusted Net Earnings % of Sales

4.0%

4.2%

2.4%

3.8%

3.8%

Adjusted EPS, Diluted

$0.67

$0.66

$0.36

$0.77

$0.71

Free Cash Flow

$8.7

$6.1

$40.1

$16.5

$32.5

Total Debt / Capitalization

22.0%

20.3%

16.9%

22.4%

17.5%

Depreciation and Amortization

$17.5

$17.6

$19.5

$24.2

$22.8

Adjusted EBITDA

$49.5

$48.4

$36.4

$62.8

$60.9

Adjusted EBITDA % of Sales

8.4%

8.8%

7.3%

9.1%

8.9%

Controllable Working Capital - % of Sales

17.4%

16.8%

13.8%

14.4%

12.7%

Capex

$15.6

$13.3

$6.5

$17.6

$16.1

Capex - % of Sales

2.6%

2.4%

1.3%

2.6%

2.3%

$ in Millions |

29

Other Financial Data –

Income Statement

Note: Adjusted data excludes restructuring and related charges,

asset impairments and income tax adjustments.

$ in Millions

Q4

Q3

Q2

Q1

Q4

Q3

Q2

Q1

Net Sales

$144.0

$146.1

$146.9

$151.5

$145.0

$139.4

$138.9

$129.4

Adjusted Gross Margin Percentage

19.6%

19.4%

19.4%

19.2%

20.3%

21.5%

21.9%

23.6%

Adjusted Operating Earnings

$9.6

$7.8

$5.5

$5.8

$7.7

$7.8

$7.7

$6.3

Adjusted Operating Earnings % of Sales

6.7%

5.3%

3.8%

3.8%

5.3%

5.6%

5.6%

4.9%

Adjusted Net Earnings

$7.7

$5.9

$4.8

$5.1

$5.9

$6.9

$5.9

$4.4

Adjusted Net Earnings % of Sales

5.3%

4.0%

3.3%

3.4%

4.1%

4.9%

4.2%

3.4%

Adjusted EPS, Diluted

$0.22

$0.17

$0.14

$0.15

$0.17

$0.20

$0.17

$0.13

Depreciation and Amortization

$4.4

$4.4

$4.4

$4.4

$4.3

$4.4

$4.5

$4.4

Adjusted EBITDA

$14.6

$12.5

$10.9

$11.5

$12.1

$13.9

$12.0

$10.3

Adjusted EBITDA % of Sales

10.1%

8.5%

7.4%

7.6%

8.3%

10.0%

8.6%

8.0%

2010

2011 |

30

Other

Financial

Data

–

Balance

Sheet

Metrics

$ in Millions

Q4

Q3

Q2

Q1

Q4

Q3

Q2

Q1

Accounts Receivable, net

$88.3

$90.3

$87.8

$96.4

$95.9

$90.1

$84.6

$74.1

Inventories, net

$92.5

$91.4

$88.6

$87.9

$76.9

$76.6

$68.8

$60.0

Accounts Payable

$80.5

$78.9

$77.1

$79.4

$75.4

$70.5

$68.2

$59.5

Free Cash Flow

$5.4

$1.0

$8.0

($5.7)

$8.5

($2.5)

($3.7)

$3.8

Total Debt

$74.4

$89.7

$74.7

$80.3

$70.0

$77.1

$65.9

$56.0

Equity

$263.3

$291.1

$285.7

$281.5

$274.3

$265.1

$256.9

$251.2

Total Debt / Capitalization

22%

24%

21%

22%

20%

23%

20%

18%

2011

2010 |

CTS CORPORATION

APPENDIX 1

REGULATION G

CTS Corporation

Reconciliation of Gross Margin to Adjusted Gross Margin

($ in millions)

| 2011 | 2011 | 2010 | 2010 | 2009 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full year | Q4 | Q3 | Q2 | Q1 | Full year | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | |||||||||||||||||||||||||||||||||||||||||||

| Gross Margin |

$ | 109.8 | $ | 25.8 | $ | 27.5 | $ | 27.4 | $ | 29.2 | $ | 119.9 | $ | 29.1 | $ | 30.0 | $ | 30.3 | $ | 30.5 | $ | 30.9 | $ | 26.2 | $ | 21.9 | $ | 19.8 | ||||||||||||||||||||||||||||

| Charges (credits) to reported Gross Margin : |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring-related costs included in cost of goods sold |

0.3 | 0.3 | — | — | — | 0.3 | 0.3 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Insurance recovery for business interruption |

4.1 | 2.2 | 0.8 | 1.1 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total adjustments to reported Gross Margin |

4.3 | 2.5 | 0.8 | 1.1 | — | 0.3 | 0.3 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Adjusted Gross Margin |

$ | 114.2 | $ | 28.3 | $ | 28.3 | $ | 28.5 | $ | 29.2 | $ | 120.2 | $ | 29.4 | $ | 30.0 | $ | 30.3 | $ | 30.5 | $ | 30.9 | $ | 26.2 | $ | 21.9 | $ | 19.8 | ||||||||||||||||||||||||||||

| Total Sales |

$ | 588.5 | $ | 144.0 | $ | 146.1 | $ | 146.9 | $ | 151.5 | $ | 552.6 | $ | 145.0 | $ | 139.4 | $ | 138.9 | $ | 129.4 | $ | 133.9 | $ | 126.6 | $ | 120.4 | $ | 118.1 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Adjusted Gross Margin as a percentage of total sales |

19.4 | % | 19.6 | % | 19.4 | % | 19.4 | % | 19.2 | % | 21.7 | % | 20.3 | % | 21.5 | % | 21.9 | % | 23.6 | % | 23.1 | % | 20.7 | % | 18.2 | % | 16.8 | % | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

Note: Q2 2011 reclass to conform with current period reclassification.

CTS Corporation

Reconciliation of Operating Earnings (Loss) to Adjusted Operating Earnings (Loss)

($ in millions)

| 2011 | 2010 | 2009 | Full year | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating earnings / (loss) |

$ | 7.2 | $ | 7.8 | $ | 4.5 | $ | 5.8 | $ | 6.0 | $ | 7.8 | $ | 7.7 | $ | 6.3 | $ | 8.3 | $ | 6.3 | $ | 3.2 | $ | (35.5 | ) | $ | 25.2 | $ | 27.8 | $ | (17.8 | ) | $ | 30.9 | $ | 32.3 | ||||||||||||||||||||||||||||||||

| Charges (credits) to reported operating earnings (loss): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring, restructuring-related, and asset impairment charges |

2.4 | — | 0.7 | — | 1.7 | — | — | — | — | — | — | 2.2 | 3.1 | 1.7 | 2.2 | 6.1 | 2.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill impairment |

— | — | — | — | — | — | — | — | — | — | 33.2 | — | 33.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on sale of excess equipment less LTCC severance |

— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional legal costs |

— | 0.3 | 0.3 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Total adjustments to reported operating (loss) / earnings |

2.4 | — | 1.0 | — | 1.7 | — | — | — | — | — | — | 35.4 | 3.5 | 1.7 | 35.4 | 6.1 | 2.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Adjusted operating earnings / (loss), excluding above referenced items |

$ | 9.6 | $ | 7.8 | $ | 5.5 | $ | 5.8 | $ | 7.7 | $ | 7.8 | $ | 7.7 | $ | 6.3 | $ | 8.3 | $ | 6.3 | $ | 3.2 | $ | (0.1 | ) | $ | 28.7 | $ | 29.5 | $ | 17.6 | $ | 37.0 | $ | 34.9 | |||||||||||||||||||||||||||||||||

| Total Sales |

$ | 144.0 | $ | 146.1 | $ | 146.9 | $ | 151.5 | $ | 145.0 | $ | 139.4 | $ | 138.9 | $ | 129.4 | $ | 133.9 | $ | 126.6 | $ | 120.4 | $ | 118.1 | $ | 588.5 | $ | 552.6 | $ | 499.0 | $ | 691.7 | $ | 685.9 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Adjusted operating earnings / (loss), excluding above referenced items, as a percentage of total sales |

6.7 | % | 5.3 | % | 3.8 | % | 3.8 | % | 5.3 | % | 5.6 | % | 5.6 | % | 4.9 | % | 6.2 | % | 5.0 | % | 2.7 | % | -0.1 | % | 4.9 | % | 5.3 | % | 3.5 | % | 5.3 | % | 5.1 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

CTS Corporation

Reconciliation of Net (Loss) Earnings to Adjusted Net Earnings (Loss)

($ in millions)

| 2011 | 2010 | 2009 | Full Year | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings / (loss) (A) |

5.9 | 5.9 | 4.1 | 5.1 | 4.8 | 6.9 | 5.9 | 4.4 | 4.1 | 4.5 | (7.0 | ) | (35.6 | ) | 21.0 | 22.0 | (34.1 | ) | 28.1 | $ | 24.0 | |||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Charges (credits) to reported net earnings (loss): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring, restructuring-related, and asset impairment charges |

2.4 | — | 0.7 | — | 1.7 | — | — | — | — | — | 2.2 | 3.1 | 1.7 | 2.2 | 6.1 | 2.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill impairment |

— | — | — | — | — | — | — | — | — | — | 33.2 | 33.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on sale of excess equipment less LTCC severance |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional legal costs |

— | — | 0.3 | 0.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Total adjustments to reported net earnings |

2.4 | — | 1.0 | — | 1.7 | — | — | — | — | — | — | 35.4 | 3.5 | 1.7 | 35.4 | 6.1 | 2.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total adjustments, tax affected (B) |

1.8 | — | 0.7 | 1.1 | 34.5 | 2.5 | 1.1 | 34.5 | 3.9 | 2.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impact of tax repatriation (C) |

— | — | 9.1 | 9.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impact of tax treaty (D) |

(1.4 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impact of reversal of tax reserves (E) |

2.5 | 2.5 | (4.1 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Adjusted net earnings / (loss) (A+B+C+D+E) |

$ | 7.7 | $ | 5.9 | $ | 4.8 | $ | 5.1 | $ | 5.9 | $ | 6.9 | $ | 5.9 | $ | 4.4 | $ | 6.6 | $ | 4.5 | $ | 2.1 | $ | (1.1 | ) | $ | 23.4 | $ | 23.1 | $ | 12.0 | $ | 26.5 | $ | 26.0 | |||||||||||||||||||||||||||||||||

| Total Sales |

$ | 144.0 | $ | 146.1 | $ | 146.9 | $ | 151.5 | $ | 145.0 | $ | 139.4 | $ | 138.9 | $ | 129.4 | $ | 133.9 | $ | 126.6 | $ | 120.4 | $ | 118.1 | $ | 588.5 | $ | 552.6 | $ | 499.0 | $ | 691.7 | $ | 685.9 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Adjusted net earnings / (loss) as a percentage of total sales. |

5.3 | % | 4.0 | % | 3.3 | % | 3.4 | % | 4.1 | % | 4.9 | % | 4.2 | % | 3.4 | % | 4.9 | % | 3.6 | % | 1.7 | % | -0.9 | % | 4.0 | % | 4.2 | % | 2.4 | % | 3.8 | % | 3.8 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| 2010 | 2009 | 2009 | ||||||||||

| 1st Half | 2nd Half | 1st Half | ||||||||||

| Net earnings / (loss) (A) |

10.3 | 8.6 | (42.6 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Charges (credits) to reported net earnings (loss): |

||||||||||||

| Restructuring, restructuring-related, and asset impairment charges |

— | 2.2 | ||||||||||

| Goodwill impairment |

— | 33.2 | ||||||||||

| Gain on sale of excess equipment less LTCC severance |

||||||||||||

| Gain on sale of excess Canadian land |

||||||||||||

|

|

|

|

|

|

|

|||||||

| Total adjustments to reported net (loss) / earnings |

— | — | 35.4 | |||||||||

| Total adjustments, tax affected (B) |

34.5 | |||||||||||

| Impact of tax repatriation (C) |

||||||||||||

| Impact of tax treaty (D) |

9.1 | |||||||||||

| Impact of reversal of tax reserves (E) |

2.5 | |||||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted net earnings / (loss) (A+B+C+D+E) |

$ | 10.3 | $ | 11.1 | $ | 1.0 | ||||||

| Total Sales |

$ | 268.3 | $ | 260.5 | $ | 238.5 | ||||||

|

|

|

|

|

|

|

|||||||

| Adjusted net earnings / (loss) as a percentage of total sales. |

3.8 | % | 4.3 | % | 0.4 | % | ||||||

|

|

|

|

|

|

|

|||||||

CTS Corporation

Reconciliation of Diluted (Loss) Earnings Per Share to Adjusted Diluted Earnings (Loss) Per Share

| 2011 | 2010 | 2009 | Full Year | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings/(loss) per share |

$ | 0.17 | $ | 0.17 | $ | 0.12 | $ | 0.15 | $ | 0.14 | $ | 0.20 | $ | 0.17 | $ | 0.13 | $ | 0.12 | $ | 0.13 | $ | (0.21 | ) | $ | (1.06 | ) | $ | 0.60 | $ | 0.63 | $ | (1.01 | ) | $ | 0.81 | $ | 0.66 | |||||||||||||||||||||||||||||||

| Tax affected charges (credits) to reported (loss) / earnings per share: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring, restructuring-related, and asset impairment charges |

0.05 | — | 0.01 | — | 0.03 | — | — | — | — | — | 0.05 | 0.06 | 0.03 | 0.05 | 0.10 | 0.05 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill impairment |

— | — | — | — | — | — | — | — | — | — | 0.98 | 0.98 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on sale of excess equipment less LTCC severance |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional legal costs |

— | — | 0.01 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Total tax affected adjustments to reported (loss) / earnings per share |

0.05 | — | 0.02 | — | 0.03 | — | — | — | — | — | — | 1.03 | 0.07 | 0.03 | 1.03 | 0.10 | 0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax impact of cash repatriation |

— | — | 0.27 | 0.27 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impact of reversal of tax reserves and change in tax treaty |

0.07 | 0.07 | (0.14 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| Adjusted diluted earnings / (loss) per share |

$ | 0.22 | $ | 0.17 | $ | 0.14 | $ | 0.15 | $ | 0.17 | $ | 0.20 | $ | 0.17 | $ | 0.13 | $ | 0.19 | $ | 0.13 | $ | 0.06 | $ | (0.03 | ) | $ | 0.67 | $ | 0.66 | $ | 0.36 | $ | 0.77 | $ | 0.71 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

CTS Corporation

ADJUSTED EBITDA YEAR-TO-DATE

($ in millions)

| Full Year | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Net (loss) / earnings |

$ | 21.0 | $ | 22.0 | $ | (34.1 | ) | $ | 28.1 | $ | 23.9 | |||||||||

| Depreciation and amortization expense |

17.5 | 17.6 | 19.5 | 24.2 | 22.8 | |||||||||||||||

| Interest expense |

2.1 | 1.1 | 1.9 | 6.2 | 5.5 | |||||||||||||||

| Tax expense / (benefit) |

5.4 | 6.0 | 13.6 | (1.8 | ) | 6.1 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 46.0 | $ | 46.7 | $ | 1.0 | $ | 56.7 | $ | 58.3 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Charges (credits) to reported EBITDA: |

||||||||||||||||||||

| Restructuring and asset impairment charges |

$ | 3.1 | $ | 1.7 | 2.2 | 6.1 | 2.6 | |||||||||||||

| Additional legal costs |

$ | 0.3 | ||||||||||||||||||

| Goodwill impairment |

33.2 | |||||||||||||||||||

| Gain on sale of excess equipment less LTCC severance |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments to reported EBITDA |

3.5 | 1.7 | 35.4 | 6.1 | 2.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 49.5 | $ | 48.4 | $ | 36.4 | $ | 62.8 | $ | 60.9 | ||||||||||

| Total Sales |

$ | 588.5 | $ | 552.6 | $ | 499.0 | $ | 691.7 | $ | 685.9 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA as a percentage of total sales. |

8.4 | % | 8.8 | % | 7.3 | % | 9.1 | % | 8.9 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

CTS Corporation

ADJUSTED EBITDA QUARTER-TO-DATE

($ in millions)

| 2011 | 2010 | 2009 | ||||||||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | |||||||||||||||||||||||||||||||||||||

| Net earnings / (loss) |

$ | 5.9 | $ | 5.9 | $ | 4.1 | $ | 5.1 | $ | 4.8 | $ | 6.9 | $ | 5.9 | $ | 4.4 | $ | 4.1 | $ | 4.5 | $ | (7.0 | ) | $ | (35.6 | ) | ||||||||||||||||||||||

| Depreciation and amortization expense |

4.4 | 4.4 | 4.4 | 4.4 | 4.3 | 4.3 | 4.5 | 4.4 | 4.6 | 4.4 | 5.2 | 5.3 | ||||||||||||||||||||||||||||||||||||

| Interest expense |

0.6 | 0.5 | 0.5 | 0.5 | 0.4 | 0.3 | 0.2 | 0.2 | 0.2 | 0.3 | 0.5 | 0.9 | ||||||||||||||||||||||||||||||||||||

| Tax expense / (benefit) |

1.4 | 1.6 | 0.9 | 1.5 | 0.9 | 2.4 | 1.4 | 1.3 | 3.8 | 1.2 | 9.7 | (1.0 | ) | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| EBITDA |

$ | 12.1 | $ | 12.5 | $ | 9.9 | $ | 11.5 | $ | 10.4 | $ | 13.9 | $ | 12.0 | $ | 10.3 | $ | 12.7 | $ | 10.4 | $ | 8.4 | $ | (30.4 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Charges (credits) to reported EBITDA: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring, restructuring-related, and asset impairment charges |

2.4 | — | 0.7 | — | 1.7 | — | — | — | — | — | — | 2.2 | ||||||||||||||||||||||||||||||||||||

| Additional legal costs |

— | — | 0.3 | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Goodwill impairment |

— | — | — | — | — | — | — | — | — | — | — | 33.2 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total adjustments to reported EBITDA |

2.4 | — | 1.0 | — | 1.7 | — | — | — | — | — | — | 35.4 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted EBITDA |

14.6 | 12.5 | 10.9 | 11.5 | 12.1 | $ | 13.9 | $ | 12.0 | $ | 10.3 | $ | 12.7 | $ | 10.4 | $ | 8.4 | $ | 5.0 | |||||||||||||||||||||||||||||

| Total Sales |

$ | 144.0 | $ | 146.1 | $ | 146.9 | $ | 151.5 | $ | 145.0 | $ | 139.4 | $ | 138.9 | $ | 129.4 | $ | 133.9 | $ | 126.6 | $ | 120.4 | $ | 118.1 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted EBITDA as a percentage of total sales |

10.1 | % | 8.5 | % | 7.4 | % | 7.6 | % | 8.3 | % | 9.9 | % | 8.6 | % | 8.0 | % | 9.5 | % | 8.2 | % | 7.0 | % | 4.2 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

CTS Corporation

Free Cash Flow

($ in millions)

| 2011 | 2010 | 2009 | Full Year | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3-YTD | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash flows provided from (used by) operations |

$ | 8.9 | $ | 13.4 | $ | 4.5 | $ | 11.3 | $ | (2.5 | ) | $ | 11.2 | $ | 1.7 | $ | 1.0 | $ | 5.3 | $ | 12.5 | $ | 18.4 | $ | 19.7 | $ | (4.0 | ) | $ | 22.2 | $ | 19.3 | $ | 46.6 | $ | 34.1 | $ | 48.6 | ||||||||||||||||||||||||||||||||||

| Capital expenditures |

(5.4 | ) | (10.2 | ) | (3.7 | ) | (3.4 | ) | (3.2 | ) | (2.8 | ) | (4.3 | ) | (4.7 | ) | (1.5 | ) | (1.9 | ) | (1.8 | ) | (1.4 | ) | (1.4 | ) | (15.6 | ) | (13.3 | ) | (6.5 | ) | (17.6 | ) | (16.1 | ) | ||||||||||||||||||||||||||||||||||||

| Capital expenditures to replace property damaged by casualty |

(1.8 | ) | (2.9 | ) | (2.9 | ) | — | — | — | — | — | — | — | — | — | — | (4.7 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Insurance proceeds for property damage due to casualty |

3.7 | 3.1 | 3.1 | — | — | — | — | — | — | — | — | — | — | 6.8 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Net capital expenditures |

(3.5 | ) | (10.1 | ) | (3.5 | ) | (3.4 | ) | (3.2 | ) | (2.8 | ) | (4.3 | ) | (4.7 | ) | (1.5 | ) | (1.9 | ) | (1.8 | ) | (1.4 | ) | (1.4 | ) | (13.5 | ) | (13.3 | ) | (6.5 | ) | (17.6 | ) | (16.1 | ) | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Free cash flow |

$ | 5.4 | $ | 3.3 | $ | 1.0 | $ | 8.0 | $ | (5.7 | ) | $ | 8.5 | $ | (2.5 | ) | $ | (3.7 | ) | $ | 3.8 | $ | 10.7 | $ | 16.6 | $ | 18.3 | $ | (5.4 | ) | $ | 8.7 | $ | 6.1 | $ | 40.1 | $ | 16.5 | $ | 32.5 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

CTS Corporation

Definition of Financial Term—“Total Debt to Capitalization”

($ in millions)

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Notes payable |

$ | — | $ | — | $ | 0.2 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 0.2 | $ | — | $ | — | $ | — | $ | — | $ | 1.0 | $ | 1.9 | $ | 1.5 | $ | 3.5 | ||||||||||||||||||||||||||||||||||||||||

| Current portion of long-term debt |

— | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt |

74.4 | 89.7 | 74.5 | 80.3 | 70.0 | 77.1 | 65.9 | 56.0 | 50.4 | 49.5 | 51.0 | 85.9 | 80.0 | 98.4 | 90.0 | 113.7 | 68.3 | 55.7 | 55.1 | 54.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

| Total debt |

74.4 | 89.7 | 74.7 | 80.3 | 70.0 | 77.1 | 65.9 | 56.0 | 50.4 | 49.5 | 51.0 | 86.1 | 80.0 | 98.4 | 90.0 | 113.7 | 69.3 | 57.6 | 56.6 | 57.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders’ equity |

263.3 | 291.1 | 285.7 | 281.5 | 274.3 | 265.1 | 256.9 | 251.2 | 247.5 | 241.9 | 237.1 | 242.6 | 277.5 | 340.0 | 335.2 | 326.1 | 326.4 | 332.1 | 328.4 | 326.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

| Total capitalization |

$ | 337.7 | $ | 380.8 | $ | 360.5 | $ | 361.8 | $ | 344.3 | $ | 342.2 | $ | 322.8 | $ | 307.2 | $ | 297.9 | $ | 291.4 | $ | 288.1 | $ | 328.7 | $ | 357.5 | $ | 438.4 | $ | 425.2 | $ | 439.8 | $ | 395.7 | $ | 389.7 | $ | 385.0 | $ | 384.7 | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

| Total debt to capitalization |

22.0 | % | 23.6 | % | 20.7 | % | 22.2 | % | 20.3 | % | 22.5 | % | 20.4 | % | 18.2 | % | 16.9 | % | 17.0 | % | 17.7 | % | 26.2 | % | 22.4 | % | 22.4 | % | 21.2 | % | 25.9 | % | 17.5 | % | 14.8 | % | 14.7 | % | 15.1 | % | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

CTS Corporation

Definition of Financial Term—“Controllable Working Capital as a Percentage of Annualized Sales”

($ in millions)

Controllable working capital is defined as accounts receivable plus inventories less accounts payable

| Full Year | October 2, | July 3, | April 3, | Full Year | October 3, | July 4 | April 4, | Full Year | September 27, | June 28, | March 29, | Full Year | Full Year | |||||||||||||||||||||||||||||||||||||||||||

| 2011 | 2011 | 2011 | 2011 | 2010 | 2010 | 2010 | 2010 | 2009 | 2009 | 2009 | 2009 | 2008 | 2007 | |||||||||||||||||||||||||||||||||||||||||||

| Net Accounts Receivables |

$ | 88.3 | $ | 90.3 | $ | 87.8 | $ | 96.4 | $ | 95.9 | $ | 90.1 | $ | 84.6 | $ | 74.1 | $ | 71.7 | $ | 75.9 | $ | 73.6 | $ | 76.7 | $ | 94.2 | $ | 100.7 | ||||||||||||||||||||||||||||

| Net Inventory |

92.5 | 91.4 | 88.6 | 87.9 | 76.9 | 76.6 | 68.8 | 60.0 | 54.3 | 60.5 | 61.7 | 70.2 | 70.9 | 73.8 | ||||||||||||||||||||||||||||||||||||||||||

| Accounts Payable |

(80.5 | ) | (78.9 | ) | (77.1 | ) | (79.4 | ) | (75.4 | ) | (70.5 | ) | (68.2 | ) | (59.5 | ) | (52.3 | ) | (62.2 | ) | (53.0 | ) | (53.4 | ) | (71.3 | ) | (84.2 | ) | ||||||||||||||||||||||||||||

| Controllable Working Capital |

100.4 | 102.8 | 99.3 | 104.9 | 97.4 | 96.2 | 85.2 | 74.5 | 73.7 | 74.2 | 82.3 | 93.5 | 93.8 | 90.3 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Quarterly sales |

$ | 144.0 | $ | 146.1 | $ | 146.9 | $ | 151.5 | $ | 145.0 | $ | 139.4 | $ | 138.9 | $ | 129.4 | $ | 133.9 | $ | 126.6 | $ | 120.4 | $ | 118.1 | $ | 162.8 | $ | 178.3 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Acquisition Adjustments |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted quarterly sales |

$ | 144.0 | $ | 146.1 | $ | 146.9 | $ | 151.5 | $ | 145.0 | $ | 139.4 | $ | 139.4 | $ | 129.4 | $ | 133.9 | $ | 126.6 | $ | 120.4 | $ | 118.1 | $ | 162.8 | $ | 178.3 | ||||||||||||||||||||||||||||

| Multiplied by 4 |

4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | ||||||||||||||||||||||||||||||||||||||||||

| Annualized sales |

576.00 | 584.28 | 587.68 | 606.00 | 580.10 | 557.45 | 557.45 | 517.61 | 535.55 | 506.40 | 481.60 | 472.40 | 651.20 | 713.20 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Controllable Working Capital %—Annual |

17.4 | % | 17.6 | % | 16.9 | % | 17.3 | % | 16.8 | % | 17.3 | % | 15.3 | % | 14.4 | % | 13.8 | % | 14.7 | % | 17.1 | % | 19.8 | % | 14.4 | % | 12.7 | % | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

CTS Corporation

Definition of Financial Term—“Capex as Percentage of Sales”

($ in millions)

| Full Year | Q3 | Q2 | Q1 | Full Year | Full Year | Full Year | Full Year | |||||||||||||||||||||||||

| 2011 | 2011 | 2011 | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||||||||

| Capex |

$ | 15.6 | $ | 3.7 | $ | 3.4 | $ | 3.2 | $ | 13.3 | $ | 6.5 | $ | 17.6 | $ | 16.1 | ||||||||||||||||

| Total Sales |

588.5 | 146.1 | 146.9 | 151.5 | 552.6 | 499.0 | 691.7 | 685.9 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Capex as % of Sales |

2.6 | % | 2.5 | % | 2.3 | % | 2.1 | % | 2.4 | % | 1.3 | % | 2.6 | % | 2.3 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

CTS Corporation

Definition of Financial Term—

Adjusted Return on Invested Capital

| Full Year | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Operating earnings |

$ | 25.2 | $ | 27.8 | $ | (17.8 | ) | |||||

| Charges (credits) to reported operating earnings: |

||||||||||||

| Restructuring and asset impairment charges |

3.1 | 1.7 | 2.2 | |||||||||

| Additional Legal Costs |

0.3 | |||||||||||

| Gain on sale of excess equipment less LTCC severance |

||||||||||||

| Goodwill Impairment |

33.2 | |||||||||||

|

|

|

|

|

|

|

|||||||

| Total adjustments to reported operating earnings |

3.5 | 1.7 | 35.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted operating earnings |

$ | 28.7 | $ | 29.5 | $ | 17.6 | ||||||

| *Tax rate |

21 | % | 22 | %* | 20 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Tax effected adjusted operating earnings |

$ | 22.6 | $ | 23.0 | $ | 14.1 | ||||||

|

|

|

|

|

|

|

|||||||

| Invested Capital: |

||||||||||||

| Current Year: |

||||||||||||

| Shareholders’ equity |

$ | 263.3 | $ | 274.3 | $ | 247.5 | ||||||

| Long-term debt |

74.4 | 70.0 | 50.4 | |||||||||

| Less: Cash |

(76.4 | ) | (73.3 | ) | (51.2 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Invested capital |

261.3 | 270.9 | 246.7 | |||||||||

| Prior Year: |

||||||||||||

| Shareholders’ equity |

$ | 274.3 | $ | 247.5 | $ | 277.5 | ||||||

| Long-term debt |

70.0 | 50.4 | 80.0 | |||||||||

| Less: Cash |

(73.3 | ) | (51.2 | ) | (44.6 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Invested capital |

270.9 | 246.7 | 312.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted invested capital |

$ | 266.1 | $ | 258.8 | $ | 279.8 | ||||||

|

|

|

|

|

|

|

|||||||

| Adjusted return on invested capital |

8.5 | % | 8.9 | % | 5.0 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Sales |

$ | 588.5 | $ | 552.6 | $ | 499.0 | ||||||

| Tax effected adjusted operating earnings |

22.6 | 23.0 | 14.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Tax effected adjusted operating margin as a percentage of sales (a) |

3.8 | % | 4.2 | % | 2.8 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Sales |

$ | 588.5 | $ | 552.6 | $ | 499.0 | ||||||

| Adjusted invested capital |

266.1 | 258.8 | 279.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Invested capital turns (b) |

2.21 | 2.14 | 1.78 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted return on invested capital (a) x (b) |

8.5 | % | 8.9 | % | 5.0 | % | ||||||

|

|

|

|

|

|

|

|||||||

| * | For 2011, 2010 & 2009, Tax rates are Adjusted Effective Tax Rates |