Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d318828d8k.htm |

| EX-99.1 - PRESS RELEASE - IBERIABANK CORP | d318828dex991.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - IBERIABANK CORP | d318828dex21.htm |

Acquisition of

Acquisition of

Florida Gulf Bancorp, Inc.

Florida Gulf Bancorp, Inc.

March 19, 2012

Exhibit 99.2 |

Safe Harbor Language

Safe Harbor Language

2

Statements contained in this presentation which are not historical facts and

which pertain to future operating

results

of

IBERIABANK

Corporation

and

its

subsidiaries

constitute

“forward-looking

statements”

within the meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve

significant

risks

and

uncertainties.

Actual

results

may

differ

materially

from

the

results

discussed

in

these forward-looking statements. Factors that might cause such a

difference include, but are not limited to, those discussed in

IBERIABANK Corporation’s periodic filings with the SEC. In

connection with the proposed merger, IBERIABANK Corporation will file a Registration Statement

on

Form

S-4

that

will

contain

a

proxy

statement/prospectus.

INVESTORS

AND

SECURITY

HOLDERS

ARE

URGED

TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED

TRANSACTION WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT

INFORMATION. Investors and security holders may obtain a free copy of

the proxy statement/prospectus (when it is available) and other documents

containing information about IBERIABANK Corporation and Florida Gulf Bancorp,

Inc., without charge, at the SEC's web site at http://www.sec.gov.

Copies of the proxy statement/prospectus and the SEC filings that will be

incorporated by reference in the proxy statement/prospectus may also be

obtained for free from the IBERIABANK

Corporation

website,

www.iberiabank.com,

under

the

heading

“Investor

Information”.

This communication is not a solicitation of any vote or approval, is not an

offer to purchase shares of Florida Gulf Bancorp, Inc. common stock, nor

is it an offer to sell shares of IBERIABANK Corporation common stock

which may be issued in any proposed merger with Florida Gulf Bancorp, Inc. Any issuance of IBERIABANK

Corporation common stock in any proposed merger with Florida Gulf Bancorp, Inc.

would have to be registered under the Securities Act of 1933, as

amended, and such IBERIABANK Corporation common stock would be offered

only by means of a prospectus complying with the Act. |

Transaction Rationale

Transaction Rationale

In-market acquisition of a Fort Myers, Florida based community

bank Attractive, established client base; complements our client

base Focus on C&I, owner-occupied CRE and professional and

executive clients Completes our distribution system in the Fort

Myers-Cape Coral MSA Pro forma 11 offices in the MSA; market

share move from 18 th

to 6

th

Approximately $350 million in assets, $279 million of deposits

Enhances our ability to compete with an experienced in-market team

Significant identified cost savings and opportunity to utilize our product

set Expected to be accretive to EPS, excluding one-time costs and

after cost savings Partial deployment of proceeds from common stock

sold in March 2010 Maintains strong pro forma capital ratios

Anticipate mid-teens internal rate of return

Limited ownership dilution: 3.3%-3.7% of balance sheet and 2.2% of

ownership They have aggressively addressed credit issues

Comprehensive due diligence completed, including detailed credit

analysis

Limited loss content expected (11%)

Similar cultures and strong business fit; retain executive management

team Compelling

Strategic

Rationale

Financially

Attractive

Low Risk

3 |

Transaction Overview

Transaction Overview

Consideration:

Tax-free, stock-for-stock exchange

Fixed value of $23.00 in IBKC common stock for each Florida Gulf

share

within price collars and fixed exchange ratio outside collars

(1)

Plus potential contingency cash consideration

Deal Value:

$35 million

(2)

for common stock outstanding

$4 million preferred stock outstanding redeemed at closing

Additional cash consideration of up to $4 million based on

performance of certain acquired loans over a 3-year period

Valuation Multiples:

Price/Total

Book:

1.41x

(adjusted

(3)

:

1.43x)

Price/Tangible

Book:

1.41x

(adjusted

(3)

:

1.43x)

Core

Deposit

Premium:

4.9%

(adjusted

(3)

:

5.7%)

Due Diligence:

Completed comprehensive due diligence

Required Approvals:

Florida Gulf shareholder approval

Customary regulatory approvals

Timing:

Expected closing in third quarter of 2012

(1) Based on 15 day average closing price prior to closing; if IBKC stock

price is greater than $61.25 the exchange ratio is fixed at 0.376, if

IBKC stock price is below $47.15 the exchange ratio is fixed at 0.488 shares of IBKC common stock for each Florida Gulf share.

(2)

Does not include options and warrants

(3)

Adjusted assuming the exercise of outstanding stock options and warrants

4 |

Overview

Florida Gulf Bancorp, Inc.

Florida Gulf Bancorp, Inc.

Markets

Headquartered in Fort Myers, Florida

One-bank holding company with a

state-chartered commercial bank

Bank founded in 2001 -

capitalizing

on ‘big bank’

consolidation and

disruption in the market.

Specializing in C&I, owner-occupied

CRE, professional and executive and

private banking clientele

Avoided C&D and non-owner

occupied CRE lending issues in the

volatile Florida market

CEO Bill Valenti and leadership team

have significant large bank and local

market experience

8 branches in the Fort-Myers-Cape

Coral MSA

Complete MSA coverage with a

comprehensive distribution system

Financial Highlights

Total Loans: $262 million

Total Assets: $350 million

Total Deposits: $279 million

Total Equity: $24 million common

plus $4 million preferred stock

At December 31, 2011

5 |

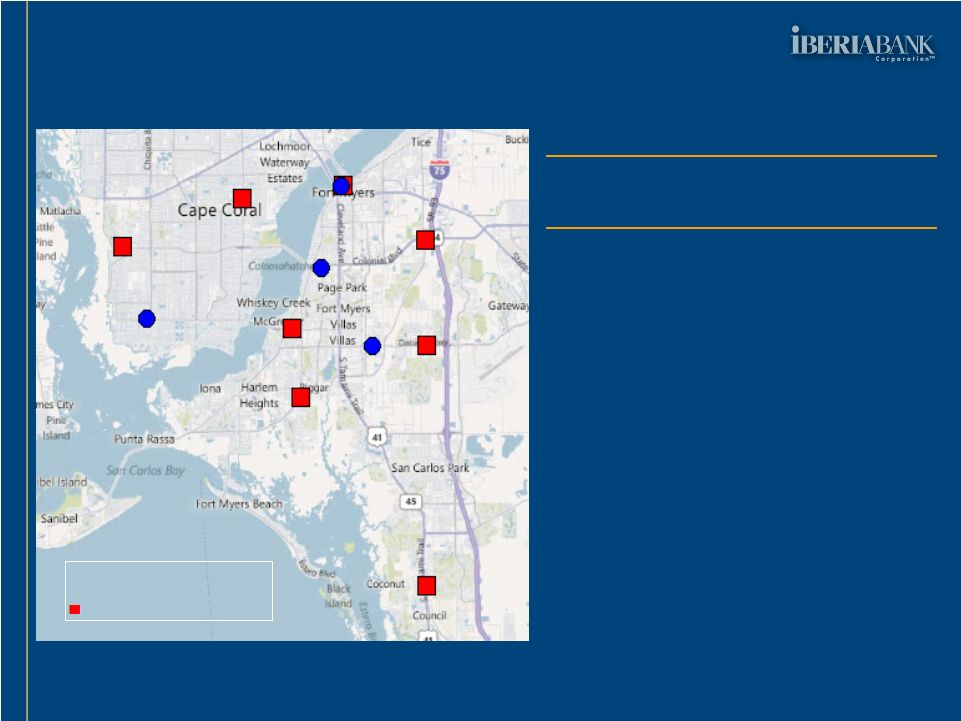

Strengthens Our Florida Franchise

Strengthens Our Florida Franchise

Source: SNL Financial Deposit Data as of June 2011

Fort

Myers

–

Cape

Coral,

FL

MSA

Rank

Company

Branches

Deposits

Mkt.

Share

1

Wells Fargo

34

$1.7

15%

2

Bank of America

30

$1.7

15

3

SunTrust

24

$1.6

14

4

Fifth Third

19

$0.9

8

5

BB&T

20

$0.8

7

Pro Forma

IBERIABANK

12

$0.4

4

6

Regions

13

$0.4

3

7

First Citizens

4

$0.4

3

8

FineMark Holdings

3

$0.3

3

9

Northern Trust

4

$0.3

3

10

North American Finl

8

$0.3

3

12

Florida Gulf

8

$0.3

2

18

IBERIABANK

4

$0.2

1

6

• IBERIABANK

branches Florida Gulf branches |

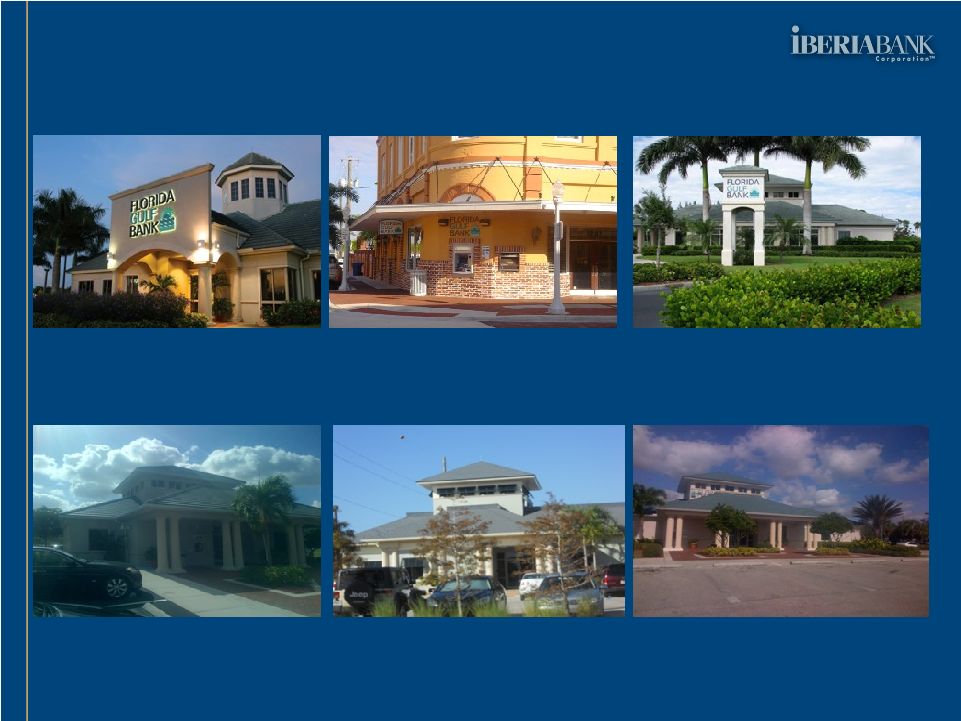

Fort Myers-Cape Coral MSA

Fort Myers-Cape Coral MSA

Distribution

Distribution

College Pointe

Deposits: $92 million

First Street

Deposits: $65 million

Daniels Parkway

Deposits: $27 million

Del Prado Blvd

Deposits: $21 million

Winkler Road

Deposits: $30 million

Dani Drive

Deposits: $20 million

7 |

Diligence Scope

Credit Summary

Credit Summary

Total 57 people over 2 weeks; credit

team included 9 people over 1 week

Reviewed approximately 65% of the

loan portfolio’s outstanding balances

Vast majority are in-market loans

Primarily small business/commercial

focused; little speculative lending

No industry concentrations

Addressed problem credits aggressively

NPA/Assets = 4.7%

Loans Past Due/Loans = 0.0%

Allowance for Loan Losses $7.4 million

Credit mark: approx. $28 million (b/t)

Loan Portfolio Comments

Loan Portfolio Composition

8

(Include unfunded commitments)

Loans

$ mm

%Total

#Notes

Avg. ($000)

Commercial RE

150

57.5%

296

506

Residential RE

30

11.3

110

268

Home Equity

19

7.3

279

68

Commercial Term

15

5.8

211

72

Commercial LOC

10

4.0

169

62

Consumer Secured

8

3.2

294

28

1-4 Family Residential

8

2.9

57

132

Commercial Unsecured

4

1.7

103

42

Construction RE -

Comml

4

1.5

2

2,005

Consumer Equity Loan

3

1.3

30

115

Construction RE -

Res

3

1.1

31

95

15 Year Fixed Rate

2

0.8

3

679

Line of Credit -

Secured

2

0.7

18

108

Consumer Unsecured

1

0.4

41

23

Other

1

0.4

56

20

Total Loans

261

100%

1,700

$153 |

Merger -Related Costs

Costs And Synergies

Costs And Synergies

Merger Considerations

Approximately $6 million in costs:

Pay all outstanding Change in Control

agreements totaling $1.3 million

$1.0 million in contract terminations

$0.9 million in systems conversion

$0.3 million lease terminations

$0.3 million in marketing/communications

$2.1 million other merger-related costs

Costs incurred primarily between merger

announcement and conversion

Annual Synergies

Approximately $3 million annually:

$1.9 million in compensation/benefits

$1.1 million IT, equipment, occupancy

and outside services

$0.8 million in other cost savings

No corporate or bank board seats

Form Lee County Advisory Board

Two employment agreements

No branch divestitures anticipated

Consolidate one office downtown

9 |

Financial Assumptions & Impact

Financial Assumptions & Impact

Credit Mark:

$28 million, pre-tax; 11% of total Florida Gulf loans

Including prior NCOs, represents cumulative loss of 11% of Florida

Gulf’s legacy portfolio

Other Marks:

Estimated to be immaterial in aggregate

No Core Deposit Intangible

Cost Savings:

Cost savings of approximately $3 million, pre-tax annually

Represents approximately 30% of Florida Gulf’s 2011

operating non-interest expenses

Fully achieved by the first quarter of 2013

Revenue synergies identified, but not included in estimates

Merger Related Costs:

Approximately $6 million, pre-tax

Conservative

Financial

Assumptions

Attractive

Financial

Impact

Accretive to EPS, excluding impact of merger-related costs in the first

year and after fully phased-in cost savings; approximately 1%

accretive when full savings phased in Slightly dilutive to tangible

book value per share (approximately 1%) Strong pro forma capital

ratios: Tangible Common Equity Ratio 9.34% (down 17 bps)

Total Risk Based Capital Ratio 15.92% (down 29 bps)

Internal rate of return in mid-teens; well in excess of our cost of

capital 10 |