Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAPSTEAD MORTGAGE CORP | d315030d8k.htm |

Exhibit 99.1

| 1 | C a p s t e a d M o r t g a g e C o r p o r a t i o n |

TO OUR STOCKHOLDERS:

Throughout 2011 and into 2012, market conditions have generally been favorable for investing in agency-guaranteed residential mortgage securities on a leveraged basis, with attractive financing spreads achievable in what has turned out to be a relatively resilient and stable financing environment.

This has been the case despite financial market volatility associated with rising government debt levels that have prompted credit downgrades, both here in the United States and abroad, and created conditions that could eventually lead to de facto defaults on the sovereign debt of peripheral European countries. Add to the mix domestic political wrangling over deficit spending and the size and role of the federal government, as well as continued weakness in the domestic job and housing markets, it is not surprising that the economic recovery in the United States has been tepid at best. Given these headwinds, future economic growth is likely to remain relatively slow, as evidenced by the recent announcement by the Federal Open Market Committee that economic conditions “are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.” With these expectations for continued low short-term interest rates, and provided financing remains plentiful, we have the opportunity to continue earning attractive financing spreads over an extended period of time.

| FINANCIAL HIGHLIGHTS | ||||||||||||

| (In thousands, except per share data ) |

2011 | 2010 | 2009 | |||||||||

| For the year ended December 31: |

||||||||||||

| Net interest margin |

$ | 177,298 | $ | 143,527 | $ | 185,765 | ||||||

| Net income |

160,204 | 126,896 | 129,263 | |||||||||

| Net income per diluted common share |

1.75 | 1.52 | 1.66 | |||||||||

| Cash dividends per common share |

1.76 | 1.51 | 2.24 | |||||||||

| As of December 31: |

||||||||||||

| Mortgage securities and similar investments |

12,264,906 | 8,515,691 | 8,091,103 | |||||||||

| Repurchase arrangements and similar borrowings |

11,352,444 | 7,792,743 | 7,435,256 | |||||||||

| Long-term investment capital: |

||||||||||||

| Unsecured borrowings, net |

99,978 | 99,978 | 99,978 | |||||||||

| Preferred stockholders’ equity |

184,514 | 179,323 | 179,333 | |||||||||

| Common stockholders’ equity |

1,108,193 | 848,102 | 834,608 | |||||||||

Our investment strategy focuses on investing on a leveraged basis in a portfolio of residential mortgage pass-through securities consisting almost exclusively of adjustable-rate mortgage (“ARM”) securities issued and guaranteed by government sponsored enterprises, either Fannie Mae or Freddie Mac (together, the “GSEs”), or by an agency of the federal government, Ginnie Mae. Residential mortgage pass-through securities guaranteed by the GSEs or Ginnie Mae are referred to as “Agency Securities,” and are considered to have limited, if any, credit risk, particularly in light of the government’s continued actions to support the GSEs. This support has largely alleviated concerns regarding the ability of the GSEs to fulfill their guarantee obligations.

Our focus on investing solely in ARM Agency Securities is what differentiates us from our mortgage REIT peers because the coupon interest rates on mortgage loans underlying ARM securities reset to more current interest rates within a relatively short period of time. This allows for a recovery of financing spreads diminished during periods of rising interest rates and provides for smaller fluctuations in portfolio values and better protection of our book value from changing interest rates, when compared with portfolios that contain a significant amount of fixed-rate mortgage securities. We believe our investment strategy can produce attractive risk-adjusted returns over the long term while reducing, but not eliminating, sensitivity to changes in interest rates.

| 2 | C a p s t e a d M o r t g a g e C o r p o r a t i o n |

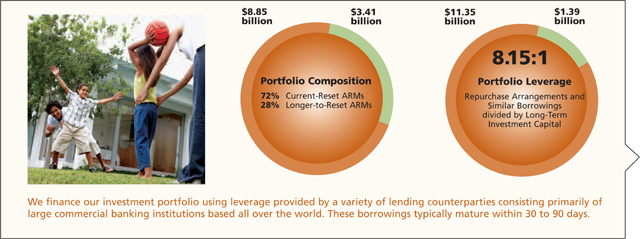

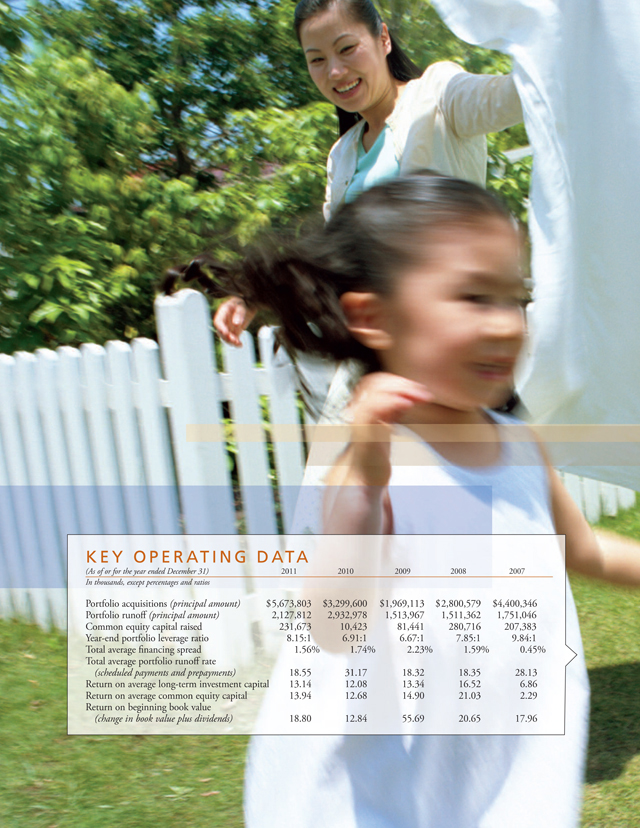

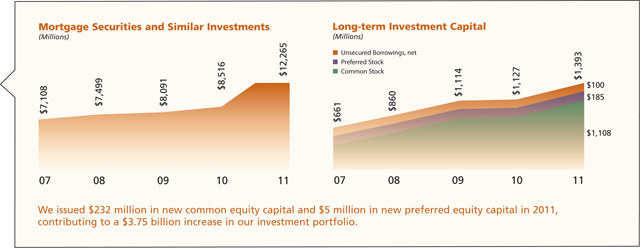

We increased our holdings of ARM Agency Securities in 2011 by $3.75 billion, or 44%, to $12.26 billion at December 31, 2011. These securities were backed by mortgage loans requiring borrowers to make payments predicated on mortgage rates averaging a relatively low 3.53%. Additionally, 72% of our portfolio was invested in what we refer to as our current-reset ARM securities that are backed by mortgage loans that will reset in rate in less than 18 months, typically to a lower interest rate in today’s environment. As a result, most borrowers with mortgage loans underlying securities in our portfolio lack the ability to meaningfully lower their mortgage payments, even if they can overcome other impediments to refinancing in today’s housing market, namely, tighter underwriting standards, lower home values and individual credit problems. Lower mortgage prepayments benefit future operating results because ARM Agency Securities are typically acquired at premiums to the underlying mortgage loan balances and the level of mortgage prepayments impacts how quickly these investment premiums are written off against earnings as yield adjustments. Overall, mortgage prepayments in the current low interest rate environment are expected to remain somewhat elevated on our newer origination mortgage securities backed by borrowers with good credit and adequate levels of home equity (limited to mortgage loans backing a portion of what we refer to as our longer-to-reset ARM securities), while prepayments on our more seasoned longer-to-reset and our current-reset ARM securities, which make up the vast majority of our portfolio, are expected to remain largely in check in 2012.

We finance our portfolio with borrowings under repurchase arrangements with numerous commercial banks and other financial institutions, both foreign and domestic, supported by our long-term investment capital. While our investment strategy involves a measured use of leverage, our experience and discipline in the use of this leverage, together with our growing capital base, has allowed us to successfully navigate the volatile financial markets seen in recent years.

We increased our long-term investment capital in 2011 by $265 million, or nearly 24%, to $1.39 billion at December 31, 2011. This increase was achieved primarily through the accretive issuance of $237 million in new common and preferred equity capital, which along with higher portfolio pricing levels, produced a $0.50 increase in our book value per common share to $12.52 at year end. Borrowings under repurchase arrangements and similar borrowings were sourced from 24 lending counterparties and totaled $11.35 billion at December 31, 2011, a year-over-year increase of $3.56 billion. With our portfolio growth in 2011, we increased portfolio leverage by one and a quarter turns to 8.15 to one by December 31, 2011, accomplishing the releveraging of our investment capital from the unusually low levels experienced the prior year as a consequence of high levels of mortgage prepayments associated with GSE programs to buyout backlogs of seriously delinquent loans from their guarantee portfolios during 2010. We believe borrowing at current levels represents an appropriate and prudent use of leverage for a portfolio of Agency Securities under current market conditions, particularly a portfolio consisting almost entirely of ARM Agency Securities.

Our net income in 2011 totaled $160 million, or $1.75 per diluted common share compared to $127 million, or $1.52 per diluted common share in 2010. The increase in net income can largely be attributed to increases in our investment portfolio, funded by newly raised equity capital and higher leverage levels. Total financing spreads (the

| 5 | C a p s t e a d M o r t g a g e C o r p o r a t i o n |

difference between yields on interest-earning assets and rates on interest-bearing liabilities) were lower, averaging 156 basis points in 2011, compared to 174 basis points during 2010. This reflects the effects on portfolio yields of ARM loan coupon interest rates underlying the portfolio continuing to reset lower to more current rates as well as lower yields on acquisitions. The effect on financing spreads of lower portfolio yields was partially offset by lower borrowing rates as higher cost interest rate swap agreements matured and were replaced with new swap agreements at lower rates.

Another differentiating factor between us and most other mortgage REITs is that we are internally managed, meaning all of our investing activities are performed by employees of the company, not an external advisor. We believe the internally managed structure not only avoids concerns regarding conflicts of interest unique to externally managed situations, it also provides a higher level of transparency regarding how we have aligned the financial interests of management with those of our stockholders through our compensation practices. Specifically, over 70% of our compensation for 2011 was performance-based, with a significant amount of this compensation awarded in shares of our stock. This strong alignment of interests through the use of performance-based compensation practices is reflected in an 11.2% increase in compensation costs in 2011 to $12.4 million, which compares favorably to a 15.1% increase in our net income per diluted common share in 2011. Our total general and administrative expenses increased to $16.3 million in 2011, but declined as a percentage of average long-term investment capital to 1.27%, making us one of the lowest cost providers as a percentage of average investment capital in the agency-REIT sector.

Our $0.50 increase in book value per common share, together with $1.76 in common dividends, produced a return on our beginning book value of nearly 19%. This compares to a nearly flat to down year for most of the market averages. Our future returns are predicated on our ability to continue to produce attractive dividends, which can fluctuate with changes in market conditions, and as such, are not immune to major disruptions in the financial markets. These returns may be augmented by accretive common and preferred capital raises when we can invest this new capital at attractive levels. We believe that by staying focused on our investment strategy of managing a prudently levered portfolio of ARM Agency Securities, we are giving our stockholders the opportunity to continue to prosper over time.

On behalf of our board of directors and all of our employees, thank you for your continued support and investment.

Sincerely,

Andrew F. Jacobs

President and CEO

February 24, 2012

| 6 | C a p s t e a d M o r t g a g e C o r p o r a t i o n |

Consolidated Balance Sheets

(In thousands, except per share amounts)

| December 31 | ||||||||

| 2011 | 2010 | |||||||

| Assets: |

||||||||

| Mortgage securities and similar investments |

$ | 12,264,906 | $ | 8,515,691 | ||||

| Cash collateral receivable from interest rate swap counterparties |

48,505 | 35,289 | ||||||

| Interest rate swap agreements at fair value |

617 | 9,597 | ||||||

| Cash and cash equivalents |

426,717 | 359,590 | ||||||

| Receivables and other assets |

100,760 | 76,078 | ||||||

| Investments in unconsolidated affiliates |

3,117 | 3,117 | ||||||

|

|

|

|

|

|||||

| $ | 12,844,622 | $ | 8,999,362 | |||||

|

|

|

|

|

|||||

| Liabilities: |

||||||||

| Repurchase arrangements and similar borrowings |

$ | 11,352,444 | $ | 7,792,743 | ||||

| Cash collateral payable to interest rate swap counterparties |

– | 9,024 | ||||||

| Interest rate swap agreements at fair value |

31,348 | 16,337 | ||||||

| Unsecured borrowings |

103,095 | 103,095 | ||||||

| Common stock dividend payable |

38,184 | 27,401 | ||||||

| Accounts payable and accrued expenses |

26,844 | 23,337 | ||||||

|

|

|

|

|

|||||

| 11,551,915 | 7,971,937 | |||||||

|

|

|

|

|

|||||

| Stockholders’ equity: |

||||||||

| Preferred stock - $0.10 par value; 100,000 shares authorized: |

||||||||

| $1.60 Cumulative Preferred Stock, Series A, 186 and 187 shares issued and outstanding ($3,056 and $3,073 aggregate liquidation preferences) at December 31, 2011 and December 31, 2010, respectively |

2,605 | 2,620 | ||||||

| $1.26 Cumulative Convertible Preferred Stock, Series B, 16,184 and 15,819 shares issued and outstanding ($184,175 and $180,023 aggregate liquidation preferences) at December 31, 2011 and December 31, 2010, respectively |

181,909 | 176,703 | ||||||

| Common stock - $0.01 par value; 250,000 shares authorized: |

||||||||

| 88,287 and 70,259 shares issued and outstanding at December 31, 2011 and December 31, 2010, respectively |

883 | 703 | ||||||

| Paid-in capital |

1,257,653 | 1,028,382 | ||||||

| Accumulated deficit |

(354,883 | ) | (354,883 | ) | ||||

| Accumulated other comprehensive income |

204,540 | 173,900 | ||||||

|

|

|

|

|

|||||

| 1,292,707 | 1,027,425 | |||||||

|

|

|

|

|

|||||

| $ | 12,844,622 | $ | 8,999,362 | |||||

|

|

|

|

|

|||||

| Book value per common share (based on common shares outstanding and calculated assuming liquidation preferences for the Series A and B preferred stock) |

$ | 12.52 | $ | 12.02 | ||||

See accompanying notes to consolidated financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 24, 2012.

| 7 | C a p s t e a d M o r t g a g e C o r p o r a t i o n |

Consolidated Statements of Income

(In thousands, except per share amounts)

| Year Ended December 31 | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Interest income: |

||||||||||||

| Mortgage securities and similar investments |

$ | 243,077 | $ | 199,300 | $ | 314,100 | ||||||

| Other |

301 | 478 | 495 | |||||||||

|

|

|

|

|

|

|

|||||||

| 243,378 | 199,778 | 314,595 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Interest expense: |

||||||||||||

| Repurchase arrangements and similar borrowings |

(57,328 | ) | (47,502 | ) | (120,083 | ) | ||||||

| Unsecured borrowings |

(8,747 | ) | (8,747 | ) | (8,747 | ) | ||||||

| Other |

(5 | ) | (2 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| (66,080 | ) | (56,251 | ) | (128,830 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| 177,298 | 143,527 | 185,765 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Other revenue (expense): |

||||||||||||

| Miscellaneous other revenue (expense) |

(1,023 | ) | (904 | ) | (40,641 | ) | ||||||

| Incentive compensation expense |

(5,697 | ) | (5,055 | ) | (4,769 | ) | ||||||

| Salaries and benefits |

(6,701 | ) | (6,097 | ) | (5,655 | ) | ||||||

| Other general and administrative expense |

(3,932 | ) | (4,834 | ) | (5,696 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| (17,353 | ) | (16,890 | ) | (56,761 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Income before equity in earnings of unconsolidated affiliates |

159,945 | 126,637 | 129,004 | |||||||||

| Equity in earnings of unconsolidated affiliates |

259 | 259 | 259 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 160,204 | $ | 126,896 | $ | 129,263 | ||||||

|

|

|

|

|

|

|

|||||||

| Net income available to common stockholders: |

||||||||||||

| Net income |

$ | 160,204 | $ | 126,896 | $ | 129,263 | ||||||

| Less cash dividends paid on preferred shares |

(20,369 | ) | (20,233 | ) | (20,239 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| $ | 139,835 | $ | 106,663 | $ | 109,024 | |||||||

|

|

|

|

|

|

|

|||||||

| Net income per diluted common share |

$ | 1.75 | $ | 1.52 | $ | 1.66 | ||||||

| Cash dividends per common share |

1.76 | 1.51 | 2.24 | |||||||||

| Average diluted common shares outstanding |

79,696 | 69,901 | 65,449 | |||||||||

See accompanying notes to consolidated financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 24, 2012.

| 8 | C a p s t e a d M o r t g a g e C o r p o r a t i o n |

| Directors |

||||||

| Jack Biegler |

Gary Keiser | Christopher W. Mahowald | Mark S. Whiting | |||

| Private Investments |

Private Investments | President, RSF Management | Managing Partner, | |||

| Chairman of the Board |

and RSF Partners | Drawbridge Partners, LLC | ||||

| Andrew F. Jacobs |

Paul M. Low | Michael G. O’Neil | ||||

| President and Chief |

Private Investments | Private Investments | ||||

| Executive Officer |

Chairman Emeritus | |||||

| Officers |

||||||

| President and CEO |

Executive Vice Presidents | Senior Vice Presidents | Vice Presidents | |||

| Andrew F. Jacobs |

Phillip A. Reinsch | Michael W. Brown | Diane F. Wilson | |||

| President and Chief |

Chief Financial Officer | Asset and Liability | Financial Accounting | |||

| Executive Officer |

and Secretary | Management and Treasurer | and Reporting | |||

| Robert R. Spears, Jr. | D. Christopher Sieber | Richard A. Wolf | ||||

| Director of Residential | Financial Accounting | Asset and Liability | ||||

| Mortgage Investments | and Reporting | Management | ||||

8401 North Central Expressway

Suite 800

Dallas, TX 75225

(800) 358-2323

www.capstead.com

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Forward-looking statements are based largely on the expectations of management and are subject to a number of risks and uncertainties including, but not limited to, the following: changes in general economic conditions; fluctuations in interest rates and levels of mortgage prepayments; the effectiveness of risk management strategies; the impact of differing levels of leverage employed; liquidity of secondary markets and credit markets; the availability of financing at reasonable levels and terms to support investing on a leveraged basis; the availability of new investment capital; the availability of suitable qualifying investments from both an investment return and regulatory perspective; changes in legislation or regulation affecting exemptions for mortgage REITs from regulation under the Investment Company Act of 1940; changes in legislation or regulation affecting the GSEs and similar federal government agencies and related guarantees; deterioration in credit quality and ratings of existing or future issuances of GSE or Ginnie Mae securities; and increases in costs and other general competitive factors.

In addition to the above considerations, actual results and liquidity are affected by other risks and uncertainties which could cause actual results to be significantly different from those expressed or implied by any forward-looking statements included herein. It is not possible to identify all of the risks, uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Forward-looking statements speak only as of the date the statement is made and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein.