Attached files

| file | filename |

|---|---|

| EX-21.1 - LIST OF SUBSIDIARIES - Zeltiq Aesthetics Inc | d264789dex211.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - Zeltiq Aesthetics Inc | d264789dex231.htm |

| EX-31.2 - CERTIFICATE OF PRINCIPAL FINANCIAL OFFICER PURSUANT TO SECTION 302 - Zeltiq Aesthetics Inc | d264789dex312.htm |

| EX-32.1 - CERTIFICATE OF PEO AND PFO PURSUANT TO 18 U.S.C. SECTION 1350 - Zeltiq Aesthetics Inc | d264789dex321.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Zeltiq Aesthetics Inc | Financial_Report.xls |

| EX-31.1 - CERTIFICATE OF PRINCIPAL EXECUTIVE OFFICER PURSUANT TO SECTION 302 - Zeltiq Aesthetics Inc | d264789dex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35318

ZELTIQ Aesthetics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 27-0119051 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

4698 Willow Road, Suite 100

Pleasanton, CA 94588

(Address of principal executive offices and Zip Code)

(925) 474-2500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 par value | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore, the registrant cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

On March 9, 2012, 34,016,332 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2012 Annual Meeting of Stockholders, to be filed subsequent to the date hereof, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

ZELTIQ Aesthetics, Inc.

FORM 10-K

For the Year Ended December 31, 2011

TABLE OF CONTENTS

This Annual Report on Form 10-K for the year ended December 31, 2011, or “Form 10-K,” contains forward-looking statements concerning our business, operations, and financial performance and condition as well as our plans, objectives, and expectations for business operations and financial performance and condition. Any statements contained herein that are not of historical facts may be deemed to be forward-looking statements. You can identify these statements by words such as “aim,” “anticipate,” “assume,” “believe,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking statements are based on current expectations, estimates, forecasts, and projections about our business and the industry in which we operate and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Form 10-K may turn out to be inaccurate. Factors that could materially affect our business operations and financial performance and condition include, but are not limited to, financial results are included less than anticipated growth in the number of physicians electing to purchase CoolSculpting Systems, insufficient patient demand for CoolSculpting procedures, our failure to correctly estimate and control our future expenditures, and the success of our sales and marketing as well as those other risks and uncertainties described herein under “Risk Factors”. You are urged to consider these factors carefully in evaluating the forward- looking statements and are cautioned not to place undue reliance on the forward-looking statements. These forward- looking statements speak only as of the date of this Form 10-K. Unless required by law, we do not intend to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise. You should, however, review the factors and risks we describe in the reports we will file from time to time with the Securities and Exchange Commission, or SEC, after the date of this Form 10-K.

| ITEM 1. | BUSINESS |

Overview

ZELTIQ Aesthetics, Inc. (“We”, “Our”, “ZELTIQ” or the “Company”) is a medical technology company focused on developing and commercializing products utilizing our proprietary controlled-cooling technology platform. Our first commercial product, the CoolSculpting System, is designed to selectively reduce stubborn fat bulges that may not respond to diet or exercise. CoolSculpting is based on the scientific principle that fat cells are more sensitive to cold than the overlying skin and surrounding tissues. CoolSculpting utilizes precisely controlled cooling to reduce the temperature of fat cells in the treated area, which is intended to cause fat cell elimination through a natural biological process known as apoptosis, without causing scar tissue or damage to the skin, nerves, or surrounding tissue. We developed CoolSculpting to safely, noticeably, and measurably reduce the fat layer within a treated fat bulge without requiring the patient to diet or exercise. In our pivotal U.S. clinical trial involving 60 patients, physicians were able to accurately differentiate between pre- and post-treatment photographs in 88% of the patients, while unable to identify aesthetic benefits in the remaining 12%. There have been several published clinical studies conducted by us and independent physicians, involving more than 100 patients collectively, evaluating the efficacy of CoolSculpting. Certain of these published studies showed that patients achieved noticeable aesthetic benefits from a CoolSculpting procedure only 80% of the time. We received clearance from the FDA in September 2010 to market CoolSculpting for the selective reduction of fat around the flanks, an area commonly referred to as the “love handles.” We sell our CoolSculpting System to select dermatologists, plastic surgeons, and aesthetic specialists and generate revenue from capital sales of our CoolSculpting System and from procedure fees our physician customers pay us for each CoolSculpting procedure they perform.

The global market for aesthetic procedures is significant and growing. In the United States alone, the American Society of Aesthetic Plastic Surgery, or the ASAPS estimates that consumers spent more than $10.7 billion on aesthetic procedures in 2010. Fat reduction and body contouring are popular aesthetic procedures. Invasive procedures (such as liposuction and tummy, arm, and thigh tucks) and minimally-invasive procedures (such as

1

laser assisted liposuction) effectively reduce fat but involve surgical procedures that require significant physician skill and resources, may involve pain, downtime, and expense for the patient, and carry the risks associated with any surgical procedure. Existing non-invasive procedures, which currently include those based on radiofrequency, laser, or ultrasound energy, avoid the patient downtime and high costs of invasive and minimally-invasive procedures, but often are painful, produce limited or inconsistent results, and require multiple treatments, ongoing maintenance treatments, or special patient diet or exercise programs. In addition, existing non-invasive procedures are not capable of selectively targeting fat cells, which can lead to damage to the surrounding tissues. Further, the treatment methods used by many existing invasive, minimally-invasive, and non-invasive procedures acutely injure fat cells in the treated area, which leads to fat cell elimination through a biological process known as necrosis. Unlike apoptosis, necrosis triggers the body’s wound-healing response and can result in scar tissue formation in the treated area. This scar tissue can lead to stiffening of the treated area and limits the number of times a patient can undergo these types of procedures in one area or the efficacy of any repeat treatments.

We developed CoolSculpting to provide patients with a safe, effective, non-invasive, and convenient procedure to reduce stubborn fat bulges that are not satisfactorily served by existing fat reduction and body contouring procedures. CoolSculpting is clinically proven to reduce fat bulges in a 60-minute procedure, allowing most patients to achieve noticeable and measurable aesthetic results without the pain, expense, downtime, and risks associated with invasive and minimally-invasive procedures. Further, these results are achieved without the pain, multiple procedures, maintenance, and diet and exercise programs required with other non-invasive procedures. Because the fat layer in the treated area is reduced by eliminating fat cells that will not be replaced by the body, we believe the aesthetic benefits patients achieve through CoolSculpting will be durable. In addition, patients can elect to repeat the CoolSculpting procedure multiple times on the same treatment area if they desire further fat reduction. Due to these advantages, we believe CoolSculpting is appealing to both aesthetic veterans, those existing consumers who have previously had one or more aesthetic procedures, and to aesthetic neophytes, those consumers who have not previously elected to undergo an aesthetic procedure.

We designed our CoolSculpting System to specifically treat fat bulges. While there are no technical or regulatory restrictions on the use of CoolSculpting based on patient weight, patients who are obese are not typically good candidates for CoolSculpting because these individuals may not have specific fat bulges but typically have body areas that require significant fat reduction. As a result, these individuals are unlikely to obtain noticeable aesthetic results from a CoolSculpting treatment. We offer training to our physician customers to better enable them to identify those patients whose aesthetic appearance will be noticeably improved by the reduction of their fat bulges through CoolSculpting.

Physicians can market CoolSculpting as a premium, highly-differentiated, non-invasive fat reduction procedure. Based on our commercial data, we believe physicians can recoup their capital expenditures within six months on average assuming modest use. In addition, the CoolSculpting procedure is not technique-dependent, does not require significant training or skill, and is largely automated. Once the procedure is initiated, the CoolSculpting System is self-monitoring, allowing the physician to see and treat other patients or perform concurrent procedures (such as injections or other dermal treatments) on the same patient during the balance of the 60-minute CoolSculpting procedure. Further, we believe CoolSculpting’s appeal will allow physicians to target the aesthetic neophyte market and expand their aesthetic practices.

We selectively market CoolSculpting to dermatologists, plastic surgeons, and aesthetic specialists. Aesthetic specialists are physicians who elect to offer aesthetic procedures as a significant part of their practices but are not board-certified dermatologists or plastic surgeons. According to a market research study we commissioned through Easton Associates, there are currently over 70,000 physicians who perform aesthetic procedures at approximately 30,000 practice sites worldwide, including over 16,000 physicians and approximately 8,000 practice sites within the United States and Canada. We intend to place our CoolSculpting System with 4,000 to 5,000 physician practice sites on a global basis. Some of our target practices have purchased or may elect to purchase more than one CoolSculpting System. We utilize our direct sales organization to selectively market and

2

sell CoolSculpting in the United States and Canada, our North American markets. In our markets located outside of North America, we market and sell CoolSculpting through a network of distributors. Currently, we are transitioning to direct sales in select key international markets. Our sales force and distributors target dermatologists, plastic surgeons and aesthetic specialists who have practices focused on aesthetic procedures and who express a willingness to position CoolSculpting as a premium, differentiated treatment and participate in our practice marketing and support programs. Our 47 markets outside of North America are located in Asia-Pacific (including Korea and Singapore), Europe, the Middle East, and Africa (including Russia, the United Kingdom and Germany), and South America (including Brazil). Revenues from markets outside of North America comprised 26%, 34%, and 59% of our total revenues for the years ended December 31, 2011, 2010, and 2009, respectively. We are driving growth in CoolSculpting procedures through our physician marketing programs, which provide physicians with sales training, practice marketing, and support services. After we establish a significant installed base of CoolSculpting Systems in specific markets, we plan to use targeted consumer marketing, advertising, and promotional activities in these markets to drive demand for CoolSculpting.

We generate revenues from capital sales of our CoolSculpting System and from procedure fees our physician customers pay for each CoolSculpting procedure they perform. As of December 31, 2011, we had an installed base of 967 CoolSculpting Systems. As of December 31, 2011, over 245,000 CoolSculpting procedures had been shipped to our physician customers and distributors. We generated revenues of $68.1 million, $25.5 million, and $1.6 million for the years ended December 31, 2011, 2010, and 2009, respectively. Procedure fees comprised 32% of our revenues for the year ended December 31, 2011, 17% of our revenues for the year ended December 31, 2010, and 8% of our revenues for the year ended December 31, 2009. We had net losses of approximately $9.6 million, $13.5 million, and $17.6 million, respectively, for the same periods.

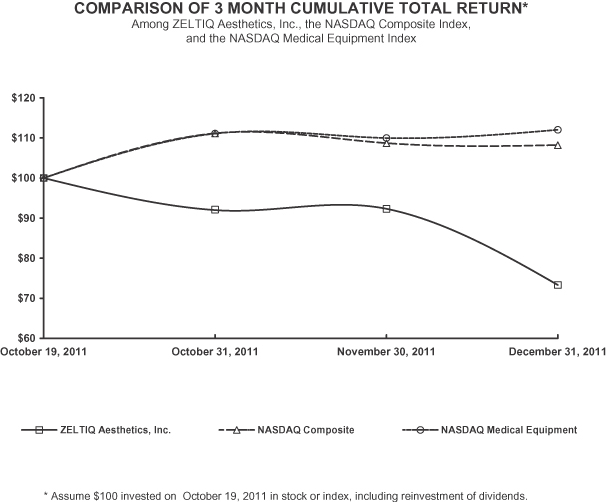

On October 24, 2011, we completed our initial public offering (“IPO”) of 8,050,000 shares of common stock at an offering price of $13.00 per share, of which 7,743,000 shares were sold by us and 307,000 shares were sold by existing stockholders. We received net proceeds of approximately $90.7 million, after deducting underwriting discounts, commissions, and offering related transaction costs.

Our business is dependent upon the success of CoolSculpting, and we cannot assure you that we will be successful in significantly expanding physician and patient demand for CoolSculpting. In addition, we will continue to incur significant expenses for the foreseeable future as we expand our commercialization and other business activities, and as a result, we cannot assure you that we will be able to achieve or maintain our profitability.

Market Overview

The global market for aesthetic procedures is significant and growing. The ASAPS estimates that U.S. consumers spent more than $10.7 billion on 9.3 million aesthetic procedures in 2010. According to the ASAPS, total aesthetic procedures in the United States have experienced a 12% compound annual growth rate between 1997 and 2010, with non-surgical aesthetic procedures experiencing a 16% compound annual growth rate during this same period. The International Society of Aesthetic Plastic Surgery, or the ISAPS, conducted a survey of plastic surgeons in the top 25 countries for aesthetic procedures, including the United States, and reported that this group performed 17.1 million procedures, including 8.5 million surgical procedures and 8.6 million non-surgical procedures, in 2009. Of these total procedures, approximately 33% (5.7 million) were performed in Asia, 24% (4.2 million) were performed in North America, 21% (3.5 million) were performed in Europe, and 20% (3.4 million) were performed in South America. The aesthetic procedures reported by the ASAPS and ISAPS represent many different types of treatment options and technologies for a variety of conditions. According to the ASAPS, the top five surgical procedures in 2010 were breast augmentation, liposuction, eyelid surgery, abdominoplasty, and breast reduction, and the top five non-surgical procedures in 2010 were Botox® injections, hyaluronic acid injections, laser hair removal, laser skin resurfacing, and chemical peels. No one treatment procedure is offered by all physicians, and treatments vary in terms of the treatment goal and desired effect. As a result, the total aesthetic market as reported by the ASAPS and ISAPS does not represent the market potential for CoolSculpting or any other single product or treatment, but illustrates that each year patients elect to have millions of procedures to enhance their appearance.

3

We believe several factors are contributing to the ongoing growth in aesthetic procedures, including:

| • | Continuing focus on body image and appearance. Both women and men continue to be concerned with their body image and appearance, fueled in part by popular culture’s perpetuation of the ideal thin body type for women and the ideal lean and defined body type for men. Research data indicates that the current media ideal of thinness is achieved by less than 5% of the American population. In addition, the size and wealth of the aging “baby boomer” demographic segment and its desire to retain a youthful appearance have driven the growth in aesthetic procedures. |

| • | Wide acceptance of aesthetic procedures. According to the ASAPS survey in 2010, 51% of Americans (including 53% of women and 49% of men) approved of cosmetic surgery, and 67% of Americans responded that they would not be embarrassed if their friends or family knew they had undergone a cosmetic procedure. |

| • | Broader availability of safe non-invasive procedures. Technological developments have resulted in the introduction of a broader range of safe non-invasive aesthetic procedures. According to the ASAPS, non-invasive treatments are growing faster than invasive surgical procedures. |

| • | Increased physician focus on aesthetic procedures. Increased restrictions imposed by managed care and government agencies on reimbursement for medical treatments are motivating physicians to establish or expand their elective aesthetic practices, which generally consist of procedures paid for directly by patients. We expect this trend to continue as physicians look for ways to expand their practices and improve profitability. |

Limitations of Existing Fat Reduction and Body Contouring Procedures

Fat reduction and body contouring procedures, including invasive, minimally-invasive, and non-invasive procedures, have become increasingly popular. The following discussion outlines the benefits of these existing procedures, as well as our opinion of the inherent limitations of these procedures when compared to CoolSculpting. Many of the companies marketing these procedures have greater resources and brand recognition than we do. In addition, some of the procedures offered by our competitors have broad market acceptance with our target physician customers and their patients.

Invasive and Minimally-Invasive Procedures

Physicians currently perform a number of invasive surgical procedures for fat reduction and body contouring, including liposuction, abdominoplasty (tummy tucks), gluteoplasty (buttock lifts), brachioplasty (arm lift), and thighplasty (thigh lift). Laser-assisted liposuction, laser lipolysis, and ultrasound lipolysis are minimally-invasive alternatives for fat reduction and body contouring. These minimally-invasive procedures require the physician to surgically insert a cannula, or metal tube, into the area to be treated and to use heat or ultrasound energy from the cannula to damage fat cells. Patients who are obese and require significant fat reduction to achieve aesthetic results are candidates for invasive and minimally-invasive procedures. Although effective at reducing a significant amount of fat, these invasive and minimally-invasive procedures present the following limitations:

| • | Surgical risks. Like all surgical procedures, invasive and minimally-invasive procedures carry risks of infection, local or widespread scarring, perforation, and hemorrhage. These procedures generally require a general or local anesthesia, which carries additional risks. |

| • | Pain and downtime. Invasive procedures may involve pain and may require weeks of post-surgical recovery. As a result, patients may need to spend significant time away from work and take prescribed pain medications for extended periods of time post-surgery. In addition, body lifts may severely limit muscle movement in the treated area during recovery, which can limit a patient’s mobility for a significant period of time. Minimally-invasive procedures require a surgical incision, and may cause patient pain. Patients generally require at least two days of recovery time after a minimally-invasive procedure, which may require the patient to miss work and necessitate prescribed pain medications post-surgery. |

4

| • | Potentially undesired results. Invasive procedures may cause non-uniform fat reduction, dimpling, lumpiness, numbness, scarring, discoloration, or sagging skin in the treated area. Follow-up surgeries may be required to correct these problems. Minimally-invasive procedures can cause skin or tissue damage if, among other things, the physician does not carefully control the heat or ultrasound energy delivered in the treatment area. |

| • | Limited repeatability. The process of removing or destroying fat cells with invasive or minimally-invasive procedures triggers the body’s wound healing response, which leads to the formation of scar tissue in the treated area. If a patient desires further fat reduction or is not satisfied with the aesthetic results from a procedure, the scar tissue in the treated area may prevent the patient from undergoing follow-up procedures to enhance or correct the original treatment results. |

| • | Physician skill and technique dependent. The aesthetic results achieved through invasive and minimally-invasive procedures are dependent upon a physician’s skill and training, which can vary from physician to physician. In addition, these procedures require a significant amount of direct physician time to perform. |

| • | High cost. Invasive and minimally-invasive procedures are significantly more expensive for patients than non-invasive aesthetic procedures. In addition, there is an opportunity cost for physicians as these procedures require direct physician involvement and supervision. |

Non-Invasive Procedures

Patients who do not require significant fat reduction to achieve aesthetic results explore non-invasive fat reduction and body contouring procedures to avoid the pain, expense, downtime, and surgical risks associated with invasive and minimally-invasive procedures. Existing non-invasive procedures used for body contouring or fat reduction, other than CoolSculpting, currently include those based on various forms of energy, including radiofrequency, laser, or ultrasound. Although these procedures are generally safer and less expensive than invasive and minimally-invasive procedures, these procedures have the following limitations:

| • | Limited, inconsistent, and unpredictable results. We believe existing non-invasive procedures have limited efficacy and produce inconsistent fat reduction results. In addition, these procedures are not capable of selectively targeting fat cells, which can lead to unpredictable results, including damage to surrounding tissue. |

| • | Multiple steps required. Existing non-invasive procedures based on radio frequency or laser energy often require multiple steps spread over several weeks before the patient obtains noticeable aesthetic results, requiring the patient to schedule and coordinate multiple, time-consuming office visits. |

| • | Maintenance or diet and exercise required. Some existing non-invasive procedures have only a temporary treatment effect, and thus require periodic maintenance treatments to sustain the desired aesthetic results. Additionally, some of these procedures require the patient to change their diet habits and exercise routines during the several-week treatment period. |

| • | Technique dependent. Existing non-invasive procedures often require highly trained personnel to conduct the treatment. Poor technique may lead to reduced efficacy and inconsistent aesthetic results. |

| • | Limited repeatability and pain. Ultrasound energy-based products utilize heat or mechanical energy to acutely injure fat cells in the treatment area, causing fat cell elimination through a biological process known as necrosis. Unlike apoptosis, necrosis triggers the body’s wound-healing response and can result in scar tissue formation. This scar tissue can lead to stiffening of the treated area and limit the number of times a patient can undergo these types of procedures in one area or the efficacy of any repeat treatments if a patient desires further fat reduction or is not satisfied with the initial aesthetic results. In addition, these procedures may involve patient pain. |

5

Our Solution

CoolSculpting is a fat reduction procedure that is clinically proven to be safe and effective and provides most patients with noticeable and measureable aesthetic results. CoolSculpting utilizes our proprietary controlled-cooling technology to selectively reduce stubborn fat bulges that may not respond to diet or exercise. CoolSculpting is based on the scientific principle that fat cells are more sensitive to cold than the overlying skin and surrounding tissues. CoolSculpting precisely cools the targeted fat bulge, and is designed to eliminate fat cells through a natural biological process known as apoptosis, without causing scar tissue or damage to the skin, nerves, or surrounding tissues. As of December 31, 2011, we have shipped over 245,000 CoolSculpting procedures to our physician customers and distributors.

We designed our CoolSculpting System to address the aesthetic concerns of individuals who have stubborn fat bulges that may not respond to diet or exercise. Although there are no technical or regulatory restrictions on the use of CoolSculpting based on patient weight, we believe patients who are obese and who do not have specific fat bulges are not typically good candidates for CoolSculpting. These individuals typically have body areas that require significant fat reduction. As a result, these individuals are unlikely to obtain noticeable aesthetic results from a CoolSculpting treatment and are better candidates for invasive and minimally invasive procedures. We offer training to our physician customers to better enable them to identify those patients whose aesthetic appearance will be improved by the reduction of their fat bulges through CoolSculpting.

We believe that CoolSculpting provides the following benefits to our physician customers and their patients:

| • | Clinically proven, consistent, and durable results. Clinical studies involving more than 300 patients demonstrate that a single CoolSculpting procedure can noticeably and measurably reduce the fat layer within a treated fat bulge without requiring diet or exercise. In our pivotal U.S. clinical trial involving 60 patients, physicians were able to accurately differentiate between pre and post treatment photographs in 88% of the patients. There have been several published clinical studies conducted by us and independent physicians, involving more than 100 patients collectively, evaluating the efficacy of CoolSculpting. Certain of these published studies showed that patients achieved noticeable aesthetic benefits from a CoolSculpting procedure only 80% of the time. Patients typically notice results as soon as three weeks following the CoolSculpting procedure, with the most dramatic results occurring over a period of two to four months for most patients. Because the fat layer in the treated area is reduced by eliminating fat cells that will not be replaced by the body, we believe the aesthetic benefits patients achieve in the treated area will be durable. |

| • | Safety profile. CoolSculpting selectively targets fat cells. Our proprietary treatment algorithms are designed to ensure that fat cells in the treated area are sufficiently cooled to obtain the desired aesthetic results while preserving the skin and surrounding tissues. We designed the CoolSculpting System to constantly monitor the controlled-cooling process and to automatically terminate the procedure if it detects any errors and warm the treated area if the detected temperature falls below our cooling algorithms. As of December 31, 2011, we have shipped approximately 245,000 treatment cycles. 272 clinical complaints have been reported to us, representing 0.11% of all cycles. Nine cases were unconfirmed, with six still pending investigation. Of the remaining 257 cases, more than half were due to procedure-related discomfort (135 complaints). Other less common complaints consisted of skin effects including bruising, erythema and edema (30 complaints), subcutaneous induration (20 complaints), vasovagal reactions including feelings of lightheadedness and nausea (19 complaints), treatment area demarcations (17 complaints), gastrointestinal symptoms (seven complaints), freeze events (six complaints), hernia-related symptoms (five complaints), dissatisfaction with treatment outcome (five complaints), sensory effects (four complaints), and other (nine complaints). |

6

| • | Patient satisfaction. CoolSculpting allows most patients to achieve noticeable and measurable aesthetic results without the pain, expense, downtime, and risks associated with invasive and minimally-invasive procedures for fat reduction. In addition, unlike many other non-invasive procedures, patients are not required to undergo multiple treatment procedures or adopt special diet or exercise programs following the procedure to obtain aesthetic results. Patients have the flexibility to undergo a CoolSculpting procedure discreetly, scheduling an appointment for the 60-minute procedure in the morning before work, during a lunch break, or in the evening. In our pivotal clinical study, 82% of the participating patients reported satisfaction with the CoolSculpting procedure. As a further indication of patient satisfaction, our physician customers reported that 45% of their patients returned for an additional CoolSculpting treatment, according to the market research study we commissioned through Easton Associates. |

| • | Repeatability enabled by natural biological process. CoolSculpting is designed to reduce the fat layer in the treated area through apoptosis, a natural biological process that leads to gradual elimination of the fat cells from the body. Unlike other treatment methods, we designed CoolSculpting to avoid triggering the body’s wound-healing response, which can lead to the formation of scar tissue. As a result, patients can elect to have the CoolSculpting procedure repeated multiple times on the same treatment area if they desire further fat reduction. Because fat cells are gradually eliminated from the body following a CoolSculpting treatment over a three to 16 week period, we recommend that patients wait at least six weeks before repeating a CoolSculpting procedure on the same treatment area. |

| • | Results not technique-dependent. The CoolSculpting procedure is not technique-dependent and requires limited training and skill to obtain successful aesthetic results. We designed the CoolSculpting System to be easy to operate and largely automated. Once the procedure is started, the clinician is not required to monitor or make any adjustments to the CoolSculpting System during the balance of the 60-minute procedure. The CoolSculpting System also pages the clinician a few minutes prior to the conclusion of the procedure. |

| • | Differentiated, high-value product for physician practices. Our selective distribution strategy is designed to enable our physician customers to market CoolSculpting as a premium, highly-differentiated, non-invasive fat reduction procedure. Based on our commercial data, we believe physicians can recoup their capital expenditures within six months assuming modest use. In addition, the physician can see and treat other patients or perform concurrent procedures, such as injections or other dermal treatments, on the same patient during the 60-minute CoolSculpting procedure. |

| • | Ability to expand the aesthetic market. We believe there is strong consumer demand for a non-invasive procedure that can address the aesthetic concerns of individuals who have stubborn fat bulges that may not respond to diet or exercise. In a survey of 1,076 adults in the United States that we conducted through Rabin Research Company, an independent full-service marketing research company, more than 40% of the participants indicated that they were likely to seek more information about the CoolSculpting procedure to enhance the shape of their body. We achieved this positive response despite the fact that 90% of the participants in our survey were aesthetic neophytes, who had never previously elected to undergo an aesthetic procedure and exactly 50% were men, a group that accounted for less than 10% of the total aesthetic procedures performed in the United States in 2010. According to the market research study we commissioned through Easton Associates, our physician customers participating in the study reported that 30% of their CoolSculpting patients were aesthetic neophytes. Based on these results, we believe physicians will be able to target the aesthetic neophyte market and expand their aesthetic practice due to CoolSculpting’s appeal. |

Our Strategy

Our goal is to become a leading medical technology company focused on developing and commercializing products utilizing our proprietary controlled-cooling technology platform. To achieve this goal, we intend to:

| • | Establish CoolSculpting as a premium, highly-differentiated treatment through selective distribution. We selectively market and sell our CoolSculpting System to dermatologists, plastic surgeons, and aesthetic |

7

| specialists. A market research study we commissioned from Easton Associates estimates that there are currently over 70,000 physicians that perform aesthetic procedures at approximately 30,000 practice sites worldwide, and we expect to target 4,000 to 5,000 of these physician practice sites on a global basis. Some of our target practice sites have purchased or may elect to purchase more than one CoolSculpting System. Our sales force and distributors target dermatologists, plastic surgeons and aesthetic specialists who have practices focused on aesthetic procedures and who express a willingness to position CoolSculpting as a premium, differentiated treatment and participate in our practice marketing and support programs. As of December 31, 2011, we had an installed base of 967 CoolSculpting Systems worldwide. |

| • | Increase utilization of CoolSculpting through our targeted physician marketing and support programs. |

We are driving demand for CoolSculpting procedures through our targeted marketing and physician support programs. Our Sales Training and Enhanced Practices (S.T.E.P.) Program provides physicians with patient training and sales, practice marketing, and support services to help our physician customers make CoolSculpting a key component of their practices. We also intend to extend co-op advertising programs designed to encourage our physician customers to promote CoolSculpting to aesthetic patients. We will also continue to participate in industry tradeshows, clinical workshops, and company-sponsored conferences with expert panelists.

| • | Increase consumer awareness and demand for CoolSculpting. During the first quarter of 2012, we have launched a targeted and strategic direct-to-consumer marketing program in the specific markets to generate awareness of CoolSculpting among aesthetic veterans and aesthetic neophytes, after we established a significant installed base of CoolSculpting Systems in those markets. We also intend to continue our active media presence and our social media programming, such as Facebook, Twitter, YouTube, and targeted blogs through pay-per-click advertising, testimonials, and video presentations. |

| • | Increase our international presence. There is strong global demand for aesthetic procedures outside of North America, especially in Asia, Latin America, and Europe. We intend to increase our market penetration outside of North America and build global brand recognition. We have received regulatory approval or are otherwise free to market CoolSculpting in 47 international markets, where use of the product is generally not limited to specific treatment areas. Physicians in these markets commonly perform CoolSculpting procedures on the abdomen, inner thighs, back, and chest, in addition to the flanks. We intend to seek regulatory approval to market CoolSculpting in additional international markets, including China. We also intend to grow our international sales and marketing organization to focus on increasing sales and strengthening our physician relationships. As part of that strategy, we are and will continue to opportunistically deploy a direct sales force in select international markets. |

| • | Expand our FDA-cleared indications for CoolSculpting. We currently have FDA clearance to market CoolSculpting in the United States for the selective reduction of fat in the flanks, an area commonly known as the “love handles.” We intend to seek additional regulatory clearances from the FDA to expand our U.S. marketable indications for CoolSculpting to other areas on the body. |

| • | Leverage our technology platform. We are exploring additional uses of our proprietary controlled-cooling technology platform for the dermatology, plastic surgery, and aesthetic markets. We are also exploring potential therapeutic uses for our platform technology, either directly or through collaborative arrangements with strategic partners. |

The CoolSculpting Experience

Patient Consultation

The first step of the CoolSculpting process is a patient consultation. We designed our CoolSculpting System to address the aesthetic concerns of individuals who are not considered obese but have stubborn fat bulges that may not respond to diet or exercise. We train our physician customers to properly identify those patients who would be good candidates for CoolSculpting and explain to their patients the aesthetic results they should expect from a

8

CoolSculpting procedure. We also instruct our physician customers to advise their patients regarding the natural process of fat cell elimination triggered by a CoolSculpting procedure, so that they understand the expected time period before they will notice the full aesthetic results as well as the potential to repeat the procedure for additional aesthetic results. While some patients may notice results as soon as three weeks following a CoolSculpting procedure, the full aesthetic results are generally achieved over a period of two to four months following treatment. Because we believe the consultation process is an important step in ensuring patients are pleased with their CoolSculpting procedure, we encourage our physician customers to personally conduct the patient consultation. Our physician customers participating in the market research study we commissioned through Easton Associates reported that 95% of their patients were happy with the results of their CoolSculpting procedure, with the degree of satisfaction based in part on the physician’s management of the patient’s expectations.

The CoolSculpting Procedure

CoolSculpting is a single 60-minute, non-invasive procedure that is clinically proven to be safe and effective and provides most patients with noticeable and measureable aesthetic results. Once the desired treatment area has been identified, the clinician applies our consumable CoolGel to the skin surface of the treatment area to ensure consistent thermal contact and to protect the skin from freezing. The CoolSculpting vacuum applicator is then positioned on the treatment area over the CoolGel, and the fat bulge is drawn into the vacuum applicator and positioned between its two cooling panels. Once the vacuum applicator is affixed on the treatment area, no further clinician intervention is required for the duration of the procedure. The rate of the controlled cooling is modulated by thermoelectric cooling elements and controlled by sensors in the vacuum applicator that monitor the cooling of the fat bulge. Just prior to the end of the 60-minute procedure, the CoolSculpting System signals the clinician to return to the treatment room. When the procedure is completed, the CoolSculpting System automatically terminates the cooling, and the clinician then removes the CoolSculpting vacuum applicator from the treatment area.

Patient Experience

Our surveys indicate that most patients find the CoolSculpting procedure easy to tolerate. Generally, anesthesia and pain medications are not required before, during, or after a CoolSculpting procedure. Patients feel a tugging sensation from the suction created when the CoolSculpting vacuum applicator is placed on the treatment area. At the onset of the procedure, patients also experience a chilling sensation in the treatment area that subsides after a few minutes, as the cooling produces an anesthetic effect. Patients can talk on their cell phones, read, listen to music, work on their laptop, relax, or sleep during the 60-minute procedure.

After completion of a CoolSculpting procedure, patients may resume their normal activities, including work and exercise. CoolSculpting patients generally do not experience any significant adverse side effects.

9

Our CoolSculpting System

We generate revenues from capital sales of our CoolSculpting System and from procedure fees our physician customers pay for each CoolSculpting procedure they perform. Capital sales of our CoolSculpting System include the CoolSculpting control unit and our CoolSculpting vacuum applicators. We generate procedure fees through sales of CoolSculpting procedure packs, which include our consumable CoolGels and CoolLiners and a disposable computer cartridge that we market as the CoolCard. The CoolCard contains enabling software that permits our physician customer to perform a fixed number of CoolSculpting procedures.

CoolSculpting Control Unit

The CoolSculpting control unit is the base of the CoolSculpting System and contains the simple user interface, power management and control functions, and chiller unit that is responsible for the controlled cooling. Our CoolSculpting control unit also contains software that tracks and collects data about each procedure performed and any error messages that may be generated during the procedure. We collect and analyze this information to help physicians better understand their usage patterns and improve their marketing plans, utilization, and profitability.

|

1. The color touch screen on the CoolSculpting control unit provides operators with clear visual directions to initiate a CoolSculpting procedure, continuous status updates, and easy to follow notifications or corrective actions in the rare event of a procedure interruption.

2. Vents are built into the CoolSculpting control unit to provide airflow and reduce heat build-up. Our CoolSculpting System can be used in a standard physician treatment room without any special ventilation requirements or room modifications.

3. The drawer provides storage space for our CoolSculpting CoolGels and CoolLiners and user documentation.

4. The unit is mobile, allowing a physician to easily transfer the CoolSculpting unit between treatment rooms and reach different treatment areas on a patient. |

10

CoolSculpting Vacuum Applicators

Our CoolSculpting System includes three CoolSculpting vacuum applicators.

|

1. The CoolSculpting vacuum applicator delivers vacuum suction and cooling to the fat bulge being treated.

2. Controls on the CoolSculpting vacuum applicator can be used to start and stop a CoolSculpting procedure and to turn the vacuum suction on and off.

3. Thermoelectric cooling panel with temperature and pressure sensors provide precise thermal control and monitoring of the fat bulge being treated and automatically stop the procedure if a problem is detected. |

We currently offer three CoolSculpting vacuum applicators for use with our CoolSculpting System. Each CoolSculpting vacuum applicator is designed to allow the physician to treat a different size fat bulge.

|

CoolCurve |

1. Our CoolCurve applicator is designed to fit tightly curved contours. | |

|

CoolCore |

2. Our CoolCore applicator is designed for use on small and medium fat bulges. | |

|

CoolMax |

3. Our CoolMax applicator is designed for use on larger fat bulges. | |

11

CoolSculpting Procedure Packs

Our CoolSculpting procedure packs facilitate the pay-per-procedure feature of our CoolSculpting System. Our CoolSculpting procedure packs include our CoolCard and our consumable CoolGels and CoolLiners.

|

1. A CoolCard is required to operate the CoolSculpting control unit. Each CoolCard is programmed with enabling software that permits the CoolSculpting control unit to perform a fixed number of procedures. In addition, each CoolCard is programmed with an encrypted security certificate that prevents the performance of a CoolSculpting procedure unless the CoolCard is recognized and authenticated by the specific CoolSculpting control unit and CoolSculpting vacuum applicator. The security certificate is designed to ensure that physicians pay for each CoolSculpting procedure and prevent the use of counterfeit CoolCards. | |

|

2. Our consumable CoolGels are cotton sheets saturated in a solution that protects the skin and ensures proper thermal coupling during a CoolSculpting procedure. One CoolGel is required for each treated area and is not reusable. | |

|

3. Our consumable plastic CoolLiners protect the applicator from gel contact. One CoolLiner is recommended per patient for hygienic reasons. | |

Our Technology

Our Technology Platform

Our controlled-cooling technology platform is based on the scientific principle that cooling can be delivered safely and non-invasively to achieve specific biological outcomes, selectively affecting certain cells, tissues, or structures in and below the skin. The ability to predict and control the impact of cold exposure by developing algorithms to control the rate and period of the cooling is well established in the field of cryobiology and cryogenic medicine. Moderate cold has been demonstrated to trigger cellular apoptosis (programmed cell death), whereas more extreme cold causes cellular necrosis. Additionally, certain cells and tissue types exhibit particular sensitivity or resistance to cold injury. This principle enables the selective elimination of certain cells or tissues via a desired biologic pathway using precise cooling temperatures. In addition, the function of certain biological systems can be affected by cold exposure. Cold is known to reduce nerve conduction, and can produce either a transient or a prolonged interruption in nerve function depending on the specific thermal parameters applied. We believe the ability to control tissue effects by modulating the cooling algorithm with our technology platform enables multiple potential therapeutic applications in addition to our CoolSculpting fat reduction application.

Our CoolSculpting Technology

Our CoolSculpting technology utilizes the sensitivity of fat cells to cold injury in order to selectively eliminate subcutaneous fat tissue without affecting the skin or other surrounding tissues. Termed cryolipolysis, this technology enables a non-invasive alternative for subcutaneous fat reduction through cellular apoptosis. Cellular

12

apoptosis is a normally occurring biological process whereby cells are eliminated as part of normal cell turnover. When injurious external stimuli (such as cold) are applied to a target cell, the apoptotic process may be triggered. If triggered, the injured cell consequently enters an orderly, regulated process of gradual degradation into smaller bodies which are absorbed by the body’s immune system over time. This pathway to cellular elimination is in contrast to cellular necrosis, or uncontrolled cell death, in which an acute injury to the cell leads to lysis of the cell. Cellular necrosis triggers an aggressive inflammatory response leading to fibrotic scar tissue formation, which is not observed with cellular apoptosis. The cold treatment algorithm implemented by the CoolSculpting technology is designed to trigger apoptosis, eliminating fat cells without generating a wound healing reaction.

The CoolSculpting technology has been clinically demonstrated to cause reductions in fat layer thickness without impacting the skin or other tissues or structures in the treatment area. Fat cells are particularly sensitive to cold injury due to their composition; they contain a large lipid droplet within the cell membrane which constitutes the majority of the cell’s volume. When cooled, lipids crystallize (undergo phase transition to an ordered molecular state) at a temperature well above the freezing point of water. Exposure of fat cells to these moderately cold temperatures causes the lipid droplets to crystallize, causing a subtle molecular injury which triggers the apoptotic sequence. However, the cooling does not affect cell types without high lipid content, preserving the health of the epidermis, dermis, and the underlying tissue. The interactions between cold and different cell and tissue types have been investigated extensively in scientific studies and are well documented in the literature.

A simplified description of the CoolSculpting process is as follows:

| Step 1. |

The cooling applicator is applied and the fat bulge being treated is suctioned into the applicator head. | |

| Step 2. |

The subcutaneous fat in the treatment area is precisely cooled at a rate that does not cause scar tissue or damage to the skin, nerves, or surrounding tissues. | |

| Step 3. |

Maintained cooling causes lipid crystallization in the fat cells and triggers apoptosis of the fat cells. | |

| Step 4. |

The body’s natural immune response leads to gradual elimination of the fat cells, resulting in a reduction in the fat layer thickness and an improvement in the appearance of the treated fat bulge. | |

Clinical History and Development of CoolSculpting

The founding principles of controlled cooling for the non-invasive and selective reduction of fat cells were originated at the Wellman Center for Photomedicine at the Massachusetts General Hospital, or MGH, a teaching affiliate of Harvard Medical School. Researchers at MGH were prompted by published reports of cold-induced panniculitis, or inflammation of subcutaneous adipose tissue, in a syndrome frequent in young children called popsicle panniculitus, whereby inflammation of the fatty tissue in the lower cheek occurred after children sucked for a prolonged time on frozen treats. Clinical reports of popsicle panniculitus suggested that human adipose tissue may be preferentially damaged by exposure to cold. Based on these reports, research scientists at MGH conducted further research and patented certain aspects of cyrolipolysis technology. In May 2005, we secured an exclusive, worldwide license to the cyrolipolysis technology developed at MGH.

Following our licensing of the cryolipolysis technology from MGH, we initiated animal and human clinical testing to support the development of the CoolSculpting procedure. These scientific studies used objective endpoints, including histologic and ultrasound assessments and outcome evaluation by blinded, independent panel review, and provided evidence of the safety and efficacy of the CoolSculpting procedure. As of December 31, 2011, there were seven peer-reviewed scientific journal articles discussing the effects of our CoolSculpting technology and 13 abstracts had been presented at medical conferences, both by physicians affiliated with our company as clinical and scientific advisors, as well as by unaffiliated physicians.

13

Preclinical Studies

We conducted animal testing primarily in pig models. In the original MGH studies, Manstein et al. investigated the feasibility of cryolipolysis, established correlations between cold treatment parameters (temperature, time) and fat reduction, and evaluated the impact on serum lipid levels in Yucatan pigs (see Manstein D, Laubach H, Watanabe K, et al: Selective cryolysis: A novel method of non-invasive fat removal. Lasers Surg Med 40:595-604, 2009). All sites treated with cold exposure less than -1°C developed panniculitis and fat layer reduction. No significant changes in the lipid profiles of the animals were noted immediately post-treatment or at any time point studied.

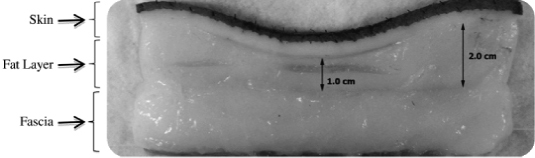

A subsequent study was performed by Zelickson et al. (see Zelickson B, Egbert BM, Preciado J, et al: Cryolipolysis for non-invasive fat cell destruction: Initial results from a pig model. Dermatol Surg 35:1462-1470, 2009). In this study, three pigs underwent a single cryolipolysis treatment, while the fourth pig underwent seven treatments with the cryolipolysis device at different time points before euthanasia. Histopathology demonstrated an approximate reduction of 50% in the thickness of the superficial fat layer. No adverse impact on the skin was observed and lipid panels revealed no significant variations in lipid profiles at any time in the study. Figure 1 shows ultrasound and gross pathology images demonstrating a significant reduction in fat layer thickness at three months post-treatment.

Figure 1. Zelickson et al. study results. Gross pathology demonstrates ~50% reduction in fat layer thickness at three months post-treatment.

Clinical Studies

We have conducted multiple institutional review board-approved (IRB-approved), non-significant risk human clinical studies to assess the use of controlled cooling for selective fat reduction.

14

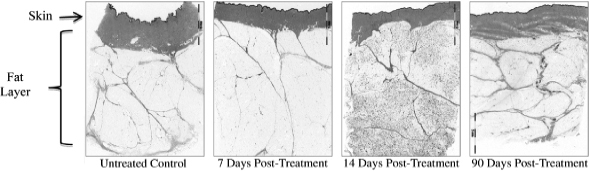

Pre-abdominoplasty study. An initial exploratory human clinical study of cryolipolysis was performed at a single site in the United States on 180 patients. In this study, patients who were scheduled to undergo abdominoplasty were treated with our technology in the lower abdomen at different intervals up to 180 days prior to their scheduled surgery date. At the time of abdominoplasty, the treated tissue was excised and processed for histologic evaluation. Images of human histologic specimens are shown in Figure 2. These images show no significant changes in the fat tissue at seven days post-treatment, relative to the untreated control. This supports that controlled cooling triggers an apoptotic mechanism of fat cell elimination, as this process occurs gradually and is not evident immediately after cold exposure. At 14 days post-treatment, infiltration of immune cells (macrophages) are observed in the fat layer, as indicated by intense nuclei staining (purple stain). These cells are responsible for the removal of the apoptotic fat cells via phagocytosis. At 90 days post-treatment, the fibrous septae (connective tissue fibers) in the fat layer are condensed due to elimination of fat cells. There is no evidence of dermal, epidermal, nerve, or blood vessel inflammation, and there is no evidence of fibrosis (scar tissue formation).

Figure 2. Human histology specimens after CoolSculpting in the abdomen.

Pivotal study. To support our 510(k) application, we completed a prospective, multi-center U.S. human clinical trial in 2007. A total of 60 patients were treated at 12 dermatology or plastic surgery centers in the United States Follow-up periods for both safety and efficacy were at two and six months. An additional one-week assessment was performed via telephone interview to document potential side effects. The primary endpoint was assessed on the basis of blinded, independent panel review of photographs. Patients were treated with our technology for 30 to 60 minutes. Patients were treated on one flank only to aid in the assessment of the primary endpoint. Outcomes were assessed via photographs, ultrasound measurements, and patient satisfaction questionnaires.

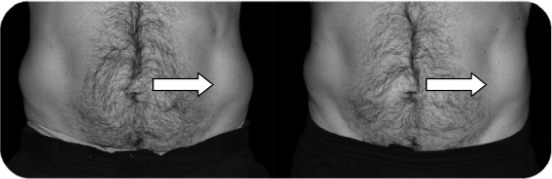

Primary endpoint. The primary effectiveness endpoint was the correct identification of the series of pre-treatment images versus six-month post-treatment images by the three independent physician reviewers who specialize in dermatology or plastic surgery. High resolution digital photographs were made of the patients’ abdomens at specific degrees of rotation. An example of baseline and post-treatment images (front view) obtained outside the trial are presented in Figure 3 below. The physicians were blinded to the identification of which photograph corresponded to the baseline image. Each reviewer was then asked to determine which photograph corresponded to the baseline photograph series and record their selections onto individual data collection forms. Intra-rater consistency among reviewers was determined by the inclusion of repeat sets. The order in which the patients were presented to the reviewer was randomized; within each patient, the set presentation was also randomized (e.g., left or right side of the presentation slide). It was expected that the percentage of correct identification of the pre-treatment images would be at least 80% based on past identification rates.

15

For all patients, regardless of weight change during the study period, reviewers were able to correctly identify baseline photos in 88% of the cases. Because fluctuations in weight can confound photo identifications, the primary endpoint outcome was also calculated for the patients who maintained their weight within five pounds of their baseline weight, and found that the correct identification percentage rose to 92%. These results suggest that clinically-meaningful changes were produced in the vast majority of patients regardless of subsequent weight change.

| ||

| Baseline | Post Treatment | |

Figure 3. Patient photographs at baseline and post treatment reflect treatment on the left flank only.

Secondary endpoints. The study also evaluated the following secondary outcome measures: reduction in the fat layer thickness as demonstrated by comparison of pre-treatment and post-treatment ultrasound measurements and patient satisfaction as determined by the results of a patient satisfaction questionnaire at the six-month follow-up visit. Standardized techniques for obtaining ultrasound images were developed and validated to ensure consistency throughout the study. A percent change in fat layer thickness was determined for an untreated area of the abdomen to account for patient weight variation during the study. A percent change in fat layer thickness was determined for the treated area to account for fat layer thickness reduction due to fat cell elimination through cryolipolysis and patient weight variation during the study. Fat layer thickness changes were normalized for each patient by subtracting the percent change in fat layer thickness in the untreated area from the percent change in fat layer thickness in the treated area to remove the influence of weight variations.

Ultrasound results demonstrated a mean reduction in the fat layer of 19% for the entire study population. These fat layer reductions were statistically significant as compared to the control region. Since the pivotal study, we have continued to enhance and optimize the CoolSculpting procedure. The CoolSculpting algorithms used during the pivotal study used a lower CIF (Cooling Intensity Factor) and/or shorter treatment times than our CoolSculpting algorithm currently in commercial use with our CoolSculpting System. As a result, we believe the average percentage fat layer reduction produced by our current commercial version of the CoolSculpting System exceeds the percentage fat layer reduction measured by ultrasound in our pivotal study. Patient surveys showed that 82% of the participants were satisfied with the CoolSculpting procedure, and 79% agreed that there was a noticeable improvement in the appearance of their treated fat bulge.

Safety results. Treatment sites were evaluated immediately after treatment and at subsequent follow-up visits. Evidence of local inflammation was anticipated after a CoolSculpting treatment based on the body’s reaction to a cold stimulus, and resolved spontaneously in all cases. Erythema, in most cases minor or moderate, was seen immediately post-treatment in virtually all patients. However, this condition had resolved itself by one week in the large majority of cases (93%). Purpura/bruising occurred in 27% of patients after the procedure was performed, and by the one week assessment had resolved in all but 5% of the patients. Minor or moderate edema was reported in only 13% of patients immediately after the procedure, and had universally resolved within a week. Numbness was common immediately after the CoolSculpting procedure, occurring in 87%. A week later

16

only approximately half of the patients still experienced some degree of numbness (in no case marked), and by two months only 7% still had numbness; in all cases it was mild. At the six-month follow-up visit, no patient complained of numbness or tingling.

Blood was drawn from a subset of patients (n=10) for evaluation of serum lipids and liver tests. The mean values in all patient groups show no trends over time and there were no clinically meaningful differences between baseline and post-treatment values.

A total of four adverse events (AEs) were reported in our pivotal study. Two involved pain during the initial cooling exposure; in both cases treatment was discontinued. These events resolved without intervention approximately one week after treatment. One patient reported bruising in the treated area one-day post treatment. Resolution was documented at an optional follow-up conducted four weeks post treatment. The fourth AE involved a report of pain and muscle spasm in the treatment area rated as a one (minor in severity) occurring once a month for three months. In a follow-up visit three weeks after the complaint, the patient stated the muscle spasm had resolved and the patient did not feel that the spasms were related to the treatment. None of the AEs reported during this study were considered serious.

Conclusions. The clinical findings of our pivotal study confirmed the safety and effectiveness of our CoolSculpting technology and procedure. Photographic review and ultrasound measurements demonstrated clinically significant and measurable reductions in the fat layer thickness in the treated area. Independent photo review of baseline and post-treatment images (the primary endpoint) yielded a correct identification percentage exceeding the 80% criteria, and a statistically significant achievement of the success criteria. No serious AEs were reported. Side effects and AEs were typically mild and transient and all resolved spontaneously without medical intervention. Post-treatment lipid profile and liver function test results exhibited only normal variations with no discernible difference from baseline. Patient survey results supported overall patient satisfaction with the treatment.

Research and Development

Our ongoing research and development activities are primarily focused on improving and enhancing our CoolSculpting System and the CoolSculpting procedure. Our research and development efforts related to CoolSculpting currently include:

| • | Additional treatment indications. We intend to seek additional regulatory clearances from the FDA to expand our marketed indications for CoolSculpting in the United States to other areas of the body. |

| • | Additional applicators. We are developing additional applicators for the CoolSculpting System to expand our range of available applicator sizes, which will provide physicians with additional flexibility in selecting the applicator that best fits the body contour to be treated. |

| • | Enhanced algorithms. CoolSculpting utilizes our proprietary treatment algorithms to ensure the fat cells in the treated area are sufficiently cooled to obtain the desired aesthetic results while preserving the overlying skin and surrounding tissues. We are continuing to examine the interaction between controlled cooling and tissue response in order to enhance our proprietary treatment algorithms. |

| • | The CoolConnect feature. Our CoolSculpting System currently records information regarding each treatment procedure, including information regarding procedure and patient statistics. Our direct sales force and our distributors currently collect this information for our analysis. We are in the process of adding wireless communication and networking functionality to each CoolSculpting System so that information regarding each treatment procedure is electronically transferred to our corporate headquarters. |

| • | Procedure tracking. To help ensure we capture each procedure performed with our CoolSculpting System, we are continuing to optimize the security encryption in our CoolCards to protect against third- party manipulation or the use of counterfeit cartridges with our CoolSculpting System. |

17

| • | Design improvements. We are continuing to optimize the design of our CoolSculpting System to improve reliability and to reduce our manufacturing and repair costs. |

| • | Enhanced physician alert feature. We are redesigning and globalizing the remote alert feature of the CoolSculpting System to page physicians at the end of a treatment cycle through the use of a smart phone or tablet. |

In addition to these development activities related to CoolSculpting, we are exploring additional uses of our proprietary controlled-cooling technology platform for the dermatology, plastic surgery, and aesthetic markets. We are also exploring potential therapeutic uses for our platform technology, either directly or through collaborative arrangements with strategic partners. Although MGH cannot restrict our future product development efforts, the terms of our license agreement with MGH may require us to pay MGH a royalty on commercial sales of future products we develop or that may be developed by our strategic partners. Whether we are required to pay a royalty will depend on whether our future products incorporate the intellectual propriety we license from MGH. Any royalty we are required to pay will reduce our proceeds from sales of such future products and may make it more difficult for us to successfully commercialize these products directly or through a strategic partner.

As of December 31, 2011, we had 33 employees focused on research and development. In addition to our internal team, we retain third-party-contractors from time to time to provide us with assistance on specialized projects. We also work closely with experts in the medical community to supplement our internal research and development resources. Research and development expenses for the years ended December 31, 2011, 2010, and 2009 were $10.5 million, $8.2 million, and $8.0 million, respectively.

Sales and Marketing

We selectively market and sell our CoolSculpting System to dermatologists, plastic surgeons, and aesthetic specialists. A market research study we commissioned from Easton Associates estimates that there are currently over 70,000 physicians who perform aesthetic procedures at approximately 30,000 practice sites worldwide, including over 16,000 physicians and approximately 8,000 practice sites within the United States and Canada. We intend to place our CoolSculpting System with 4,000 to 5,000 physician practice sites on a global basis. Some of our target practice sites have purchased or may elect to purchase more than one CoolSculpting System. As of December 31, 2011, we had an installed base of 967 CoolSculpting Systems worldwide.

Sales

In North America, we utilize our direct sales force to sell CoolSculpting to our target physicians. As of December 31, 2011, we had a 37-person North American direct sales force. To support the continued roll-out of CoolSculpting, we anticipate that our North America direct sales force will increase to between 45 and 55 sales professionals in the next 12 months.

In international markets, we sell CoolSculpting primarily through a network of distributors. As of December 31, 2011, we had an international sales team of six employees supporting 24 independent distributors. The percentage of our revenues from customers located outside North America was approximately 26% in 2011, 34% in 2010, and 59% in 2009. We are increasing and intend to continue to increase penetration of our installed base in international markets in which CoolSculpting is currently sold and expand into attractive new international markets by identifying and training qualified distributors. We require our distributors to provide customer training, to invest in equipment and marketing, and to attend certain exhibitions and industry meetings. In addition, we are opportunistically pursuing direct sales and expanding our marketing campaigns in select foreign markets.

We enter into distribution agreements with our distributors outside of North America. Our distribution agreements generally provide the distributor with a right to distribute our product for a term of three years and

18

are renewable by written agreement and terminable upon a material breach by either party, insolvency of the distributor, or a change of control of the distributor. Following the expiration or termination of the agreement, the distributor has an obligation to continue servicing existing customers for a period ranging from two to three months, upon our written request. Our distribution agreements generally provide the exclusive right to distribute our products within a designated territory, with certain distributors only receiving non-exclusive rights within a designated territory. Distributors are required to purchase an initial stocking order of CoolSculpting Systems upon execution of the agreement. We require distributors that have an exclusive territory right to purchase a fixed number of CoolSculpting Systems each year over the term of the agreement to maintain their exclusivity. In such a case, the agreement sets forth the minimum quarterly purchase obligations for the first calendar year of the term, and the parties will agree each year on the minimum quarterly purchase obligations for the remaining quarters during the term of the agreement. If the distributor fails to meet one of its minimum quarterly purchase obligations, we can convert the distributor to a non-exclusive distributor during the remaining term or terminate the agreement. These agreements also provide customary indemnities to the distributor including claims of patent infringement in the designated territory, material product defects, and our negligence or willful misconduct.

Physician Marketing and Support Programs

We intend to drive CoolSculpting procedures through our targeted marketing and physician support programs. Our Sales Training and Enhanced Practices (S.T.E.P.) Program provides physicians and their staff with product training and sales, practice marketing, and support services to help them make CoolSculpting a key component of their practices. We have hired and trained a group of S.T.E.P. support specialists who are focused on implementing our S.T.E.P. program. As the first step of the S.T.E.P. Program, our S.T.E.P. support specialists train our physician customers on the use of the CoolSculpting System when the CoolSculpting System is first delivered to the physician’s practice site. Following this initial training, our S.T.E.P. support specialists, at no additional cost to the physician, educate our physician customers on current CoolSculpting best practices and provide physicians and their staff with sales and marketing training and support to help them increase patient demand for CoolSculpting procedures. In June 2011, we launched a comprehensive S.T.E.P. certification program. A physician’s participation in this certification program and our other S.T.E.P. programs, other than the initial training program, is voluntary. To become certified, physicians must commit to engage in quarterly business strategy meetings with one of our S.T.E.P. support specialists, educate members of their office in our CoolSculpting best practices, and adopt our guidelines for before and after patient photographs. Once certified, physicians receive distinction on our website and preference in our online geographic physician locator service.

We implemented our S.T.E.P. Select Partner Blueprint program in July 2011. This program will provide physicians with quarterly sales and utilization reports, an automated tool for improving patient conversion rates, ready-to-go marketing materials and advertisements, ideas for building awareness of their practice as a CoolSculpting provider, and assistance with setting sales goals. We also intend to extend our co-op advertising programs designed to stimulate physicians to promote CoolSculpting to new aesthetic patients through advertising and cross-promotions with salons, fitness centers, and health food stores. We also will continue to participate in industry tradeshows, clinical workshops, and company-sponsored conferences with expert panelists.

Direct-to-Consumer Marketing

As we grow our installed base of CoolSculpting Systems, we intend to utilize a targeted and strategic direct-to-consumer marketing program to create awareness of CoolSculpting among consumers, notably those consumers who have not previously elected to undergo an aesthetic procedure and who may not presently visit our physician customers. We have an active public relations campaign and have been highlighted on national broadcasts as well as numerous local news programs. We also intend to continue our active media presence and our social media programming, such as Facebook, Twitter, YouTube, and targeted blogs through pay-per-click advertising, testimonials, and video presentations.

19

Customer Support