Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - RENMIN TIANLI GROUP, INC. | Financial_Report.xls |

| EX-31.1 - RENMIN TIANLI GROUP, INC. | e609441_ex31-1.htm |

| EX-31.2 - RENMIN TIANLI GROUP, INC. | e609441_ex31-2.htm |

| EX-32.2 - RENMIN TIANLI GROUP, INC. | e609441_ex32-2.htm |

| EX-32.1 - RENMIN TIANLI GROUP, INC. | e609441_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

OR

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION FROM _______ TO ________.

COMMISSION FILE NUMBER: 001-34799

TIANLI AGRITECH, INC.

(Exact name of registrant as specified in its charter)

|

British Virgin Islands

|

N/A

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

Suite F, 23rd Floor, Building B, Jiangjing Mansion

228 Yanjiang Ave., Jiangan District, Wuhan City

Hubei Province, China 430010

(Address of principal executive offices) (Zip code)

Issuer's telephone number, including area code: (+86) 27 8274 0726

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common shares, $0.001 par value

|

Nasdaq Global Market

|

Securities registered pursuant to section 12(g) of the Act:

(Title of class): None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2011, the aggregate market value of the outstanding shares of the registrant's common stock held by non-affiliates (excluding shares held by directors, officers and others holding more than 5% of the outstanding shares of the class) was $16,484,138, based upon a closing price of $2.37 per common share on June 30, 2011. At March 13, 2012, the registrant had outstanding 10,135,000 common shares.

Documents incorporated by reference: Not Applicable.

Form 10-K

Tianli Agritech, Inc.

Index

|

Page

|

||

|

PART I

|

3 | |

|

Item 1. Business

|

3 | |

|

Item 1A. Risk Factors

|

18 | |

|

Item 2. Properties

|

35 | |

|

Item 3. Legal Proceedings

|

37 | |

|

Item 4. [Removed and Reserved]

|

||

|

PART II

|

FINANCIAL INFORMATION

|

38 |

|

Item 5. Market for registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

38 | |

|

Item 6. Selected Financial Data

|

39 | |

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

39 | |

|

Item 7A. Qualitative and Quantitative Disclosures About Market Risk

|

51 | |

|

Item 8. Financial Statements and Supplementary Data

|

51 | |

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

51 | |

|

Item 9A. Controls and Procedures

|

53 | |

|

Item 9B. Other Information

|

54 | |

|

PART III

|

OTHER INFORMATION

|

55 |

|

Item 10. Directors, Executive Officers and Corporate Governance

|

55 | |

|

Item 11. Executive Compensation

|

62 | |

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

63 | |

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

|

64 | |

|

Item 14. Principal Accountant Fees and Services

|

65 | |

|

PART IV

|

67 | |

|

Item 15. Exhibits and Financial Statement Schedules

|

67 |

Forward-Looking Statements

We have made statements in this report that constitute forward-looking statements, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “will,” “could” and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

Except where the context otherwise requires and for purposes of this report only:

|

·

|

the terms “we,” “us,” “our company,” and “our” collectively refer to Tianli Agritech, Inc. (“Tianli” when referring solely to our British Virgin Islands company); our wholly-owned subsidiary, HC Shengyuan Limited, a Hong Kong limited liability company (“HCS”); HCS’ wholly-owned subsidiary, Wuhan Fengxin Agricultural Science and Technology Development Co., Ltd., a Chinese limited liability company (“WFOE”); our affiliated entity, Wuhan Fengze Agricultural Science and Technology Development Co., Ltd., a Chinese limited liability company (“Fengze”), which WFOE controls by virtue of contractual arrangements; and our affiliated entity, Hubei Tianzhili Breeder Hog Co., Ltd., a Chinese limited liability company (“Tianzhili”), which is wholly owned by Fengze.

|

|

·

|

“shares” and “common shares” refer to our common shares, $0.001 par value per share;

|

|

·

|

“China” and “PRC” refer to the People’s Republic of China, and for the purpose of this report only, excluding Taiwan, Hong Kong and Macau; and

|

|

·

|

all references to “RMB,” “Renminbi” and “¥” are to the legal currency of China and all references to “USD,” “U.S. dollars,” “dollars,” and “$” are to the legal currency of the United States.

|

Unless otherwise stated, we have translated balance sheet amounts with the exception of equity at December 31, 2011 at RMB 6.35 to $1.00 as compared to RMB 6.60 to $1.00 at December 31, 2010. The equity accounts are stated at their historical rate. The average translation rates applied to income statement accounts for the year ended December 31, 2011 and the year ended December 31, 2010 were RMB 6.45 and RMB 6.76, respectively. We make no representation that the RMB or U.S. dollar amounts referred to in this report could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

PART I

Item 1. Business

Our Company

Our Company is in the business of breeding, raising, and selling hogs in the People’s Republic of China. We operate our business through contractual arrangements between our wholly-owned subsidiary, WFOE, and our variable interest entity, Fengze and its wholly owned subsidiary, Tianzhili. Our efforts are focused on growing healthy, hearty hogs for sale for breeding and meat purposes. We believe our location in Hubei and our investment in breeding and farming technology position us well to reach these goals.

Fengze entered the hog breeding and production business in 2005 when it built its first hog farm. Fengze now currently owns and operates eleven commercial farms in Wuhan. Our farms, in the aggregate, will have an annual production capacity of approximately 170,000 hogs when the most recently acquired tenth and eleventh farms reach full capacity. We conduct genetic, breeding and nutrition research to improve our hog production capabilities. Our animal nutrition research consists of the development of a premix we feed our hogs. In coordination with a local institute, we developed this product to improve our feed to meat conversion ratio, thus reducing our feed costs, and to improve the health of our hogs.

We currently derive our revenues from hog farming. We believe we have developed a reputation for quality in our market by investing in high quality breeding stock and in technology to improve the health of our hogs by, for example, using temperature controls to increase comfort and to speed piglet rearing, and by creating a biofeed premix that has improved our success in growing hogs while reducing costs. We believe we have a reputation for low pollution by virtue of receiving a certificate of pollution-free agricultural product from Hubei province. We believe we have a reputation for low-additive pork products as a result of the use of our biofeed premix, which allows us to reduce our reliance on antibiotics, and by efforts we have undertaken to reduce disease risks among our hogs that do not require chemicals, such as maintaining geographic separation between our farms to prevent cross-contamination.

On December 29, 2010, we completed the acquisition of the assets of the Hengdian Farm, located in Wuhan City, which represents our tenth farm and which produces up to 20,000 hogs annually at full production. This farm had reached full production capacity but is now below full capacity due to food contamination which occured at a number of our farms in late 2011.

On May 12, 2011, we completed the acquisition of our eleventh farm from An Puluo Food Processing Co., Ltd. (“An Puluo”), located in Enshi Tujia and Miao Autonomous Prefecture of Hubei Province. This farm will produce up to 20,000 hogs annually once it reaches full production. We paid a total of approximately $2.2 million for the rights to the land, structures and equipment.

On June 22, 2011, Fengze established its wholly owned subsidiary, Tianzhili. Tianzhili is engaged in the business of raising black hogs in conjunction with local farmers near Enshi City, Hubei Province. Tianzhili will sell black hogs to An Puluo or other slaughter houses.

Corporate Information

Our principal executive office is located at Suite F, 23rd Floor, Building B, Jiangjing Mansion, 228 Yanjiang Ave., Jiangan District, Wuhan City, Hubei Province, China 430010. Our telephone number is (+86) 27 8274 0726 and Fax number is (+86) 27 8274 0906. Our website address is www.tianli-china.com.

Our Corporate Structure

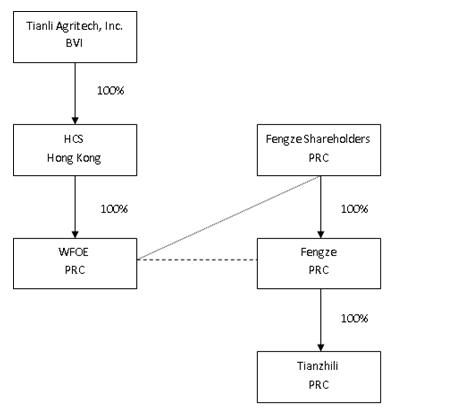

Tianli is a holding company incorporated in the British Virgin Islands in November 2009. Tianli owns all of the outstanding capital stock of HCS, which was incorporated in Hong Kong in November 2009 as a limited liability company. HCS, in turn, owns all of the outstanding capital stock of WFOE, which was incorporated in 2005 as a domestic Chinese company. In January 2010, the Wuhan Administrator for Industry and Commerce, and the Wuhan Municipal Commission of Commerce approved the transfer of all of the equity of WFOE to HCS, at which time WFOE became a wholly foreign-owned enterprise. Fengze was organized in 2005 as a domestic limited liability company in China. Tianzhili was incorporated in 2011 as a domestic limited liability company in China and is wholly owned by Fengze. WFOE has entered into a series of control agreements with Fengze and all of the owners of Fengze, which agreements allow WFOE to control Fengze. Through our ownership of HCS, HCS’ ownership of WFOE and WFOE’s agreements with Fengze, we believe that Tianli controls Fengze and therefore, we consolidate the results of operations of Fengze’s with ours as a variable interest entity.

Our current corporate structure is as follows:

|

|

Equity interest

|

|

|

Contractual arrangements including Entrusted Management Agreement and Exclusive Option Agreement.

|

|

|

Contractual arrangements including Exclusive Option Agreement, Shareholders’ Voting Proxy Agreement and Pledge of Equity Interest Agreement.

|

Although Chinese laws and regulations prevent direct foreign investment in certain industries, they currently do not prohibit or restrict foreign ownership in hog breeding businesses. To protect our shareholders from adverse consequences resulting from possible future ownership restrictions, rather than acquire an equity interest in Fengze, we caused WFOE to enter into certain control agreements with Fengze and its shareholders, pursuant to which we control Fengze and are entitled to the benefit of the results of its operations. The control agreements include an Entrusted Management Agreement, an Exclusive Option Agreement, a Shareholders’ Voting Proxy Agreement and a Pledge of Equity Agreement, each of which is described below. As a result of these agreements, WFOE is entitled to receive 100% of the profits of Fengze and is obligated for 100% of the losses of Fengze. Thus, although WFOE and Fengze are independent legal entities and neither is liable for the obligations of the other, as a consequence of the control agreements, though not responsible for Fengze’s obligations, WFOE is obligated for its losses.

Entrusted Management Agreement. Fengze and WFOE entered into an Entrusted Management Agreement, which provides that WFOE will be fully and exclusively responsible for the management of Fengze. As consideration for such services and WFOE’s agreement to bear all losses of Fengze, Fengze has agreed to pay WFOE an annual fee equal to Fengze’s earnings. This agreement will terminate upon the earliest of: (1) the winding up of Fengze; (2) the termination date of the Entrusted Management Agreement, as agreed by the parties thereto; or (3) the date on which WFOE completes the acquisition of Fengze.

Exclusive Option Agreement. Fengze and each of Fengze’s shareholders entered into an Exclusive Option Agreement with WFOE, which provides that WFOE will be entitled to acquire all of the outstanding shares of Fengze from the current shareholders upon certain terms and conditions. In addition, WFOE was granted an irrevocable option to purchase all or part of the assets and business of Fengze at a price based on the circumstances at the time of the exercise of the option. Such option may be exercised at any time we determine to do so, provided it is then allowable under PRC laws and regulation. The Exclusive Option Agreement prohibits Fengze and its shareholders from transferring any portion of the equity interests, business or assets of Fengze to anyone other than WFOE. WFOE has not yet taken any action to exercise these rights of purchase, and there is no guarantee that it will do so, that it will be permitted to do so by applicable law at such times as it may wish to do so or that Fengze or one or more of its shareholders will not default under its obligations under such agreement.

Shareholders’ Voting Proxy Agreement. All shareholders of Fengze executed a Shareholders’ Voting Proxy Agreement to irrevocably appoint persons designated by WFOE with the exclusive right to exercise, on their behalf, all of their Voting Rights in accordance with applicable law and Fengze’s Articles of Association, including but not limited to the rights to sell or transfer all or any of their equity interests in Fengze and to appoint and elect the directors and Chair as the authorized legal representative of Fengze. This agreement will be only terminated upon the acquisition of all of the equity interests in, or all assets and business of Fengze by WFOE.

Pledge of Equity Agreement. WFOE and all shareholders of Fengze entered into a Pledge of Equity Agreement, pursuant to which each shareholder pledged all (100%) of its shares in Fengze to WFOE. If Fengze or any of its respective shareholders breaches its respective contractual obligations in the “Entrusted Management Agreement”, “Exclusive Option Agreement” and “Shareholders’ Voting Proxy Agreement”, WFOE, as Pledgee, will be entitled to foreclose on the pledged equity interests. The Fengze shareholders cannot dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest. This pledge has been recorded with applicable authorities in China to perfect WFOE’s security interest.

Industry and Market Background

China is the world’s largest hog producing and pork consuming country. China has accounted for nearly half of the world’s pork production and consumption for more than five years. Not only does China consume more pork than any other country, Chinese per-capita pork consumption is among the highest in the world, as pork is China’s most popular meat. In terms of meat consumption in China, during the past 10 years, the annual per-capita pork consumption increased 20.5%. It is expected that in 2020, pork consumption will account for approximately 55% of total Chinese meat consumption, while poultry will represent approximately 23%, according to the China Animal Agriculture Association. According to the National Statistics Bureau of China, in 2011 China consumed over 50.5 million tons of pork, a reduction of 0.4% from the amount consumed in 2010. In 2011; the retail price of pork has increased 37% from its price in 2010.

Consumption of pork per person in China has grown from 31.2 kilograms in 2000 to an estimated 38.7 kilograms per person in 2011. The USDA said it expects China's pork consumption in 2012 to rise 4% from 2010's level of consumption.

Because pork represents such a large portion of the meat consumed by Chinese, both national and local governments have adopted policies and taken actions in an effort to balance the desire of consumers for low prices against the farmers’ need to operate profitably while seeking to increase the efficiencies of the industry. The Chinese government has established a national pork reserve program to balance the market demand and supplies of pork and to keep the price of pork stable. For example, in 2009, ministries of the PRC entered the market and purchased pork to increase its price to what they perceived to be an appropriate level. Alternatively the government could decide to take steps to reduce the price of pork. We cannot predict what policies the government may choose to adopt in the future. Nevertheless, as food makes up a large portion of the budget for many Chinese families, we anticipate the government is likely to remain involved in the development of the pork industry. Even though the central government periodically supports an artificial floor price with its strategic pork reserves, there is no guarantee that this support will continue in the future. If such support is terminated, our industry could see fluctuations in the price of pork, which could dramatically affect our operations.

China’s Hog Industry

China’s hog industry is in the midst of a transition from a large number of relatively small farms, to larger, more commercial farms. Meat hog production in the PRC is currently dominated by backyard farms (those that sell 5-10 hogs annually) and small farms (those that sell less than 100 hogs annually). We believe that farms that sell less than 100 hogs per year comprise approximately 75% of the hog farms in China and account for approximately one-third of the hogs sold annually in China. Farms that sell between 100 and 500 head a year account for approximately 21% of China’s hog farms and approximately one-third of the hogs sold annually in China. Farms that sell between 500 and 3,000 hogs annually represent less than 3% of China’s hog farms but account for approximately 19% of the hogs sold in China. Those that sell more than 3,000 hogs annually account for less than one-half of one percent of all hog farms but sell more than 15% of China’s hogs annually.

According to the USDA, China’s hog industry is transitioning toward larger commercial farms partly as a result of government policies and incentives. We believe that the Company is well positioned to benefit from this trend.

Our Geographic Market

Our farms are located in Wuhan City, which is the capital of and largest city in Hubei Province. With a population of nearly 10 million, Wuhan City is one of China’s ten largest cities, and is considered an important center for economy, trade, finance, transportation, information technology and education in Central China. Wuhan City is located less than 800 miles from Shanghai, Beijing, Guangzhou, Tianjin, Chongqing and Xi’an, some of China’s largest cities. Hubei Province includes thirteen cities that range in population from approximately 300,000 to nearly 10 million residents.

Due to its central location, Hubei is well-known in China for the adaptability of its breeder hogs. Breeder hogs from the southern part of China tend to not tolerate the cold weather in northern China; similarly, breeder hogs from the northern part of China tend not to tolerate the heat of southern China. We have found that breeder hogs raised in Hubei tend to adapt well to variations in both the north and south of China.

Wuhan City’s government was one of the first local governments to provide economic incentives to hog farms that reached certain production levels. Farms located within Wuhan prefecture that reach an annual production capacity of 10,000 hogs are eligible for a one-time grant of RMB 1.5 million (approximately $230,000). When a farm reaches 20,000 hog capacity, it is eligible for a grant of RMB 3 million (approximately $460,000), less any grant it received when its capacity reached 10,000 hogs.

Breeder Hogs and Market Hogs

We utilize a variety of purebred hogs at our farms. The primary purebred varieties that we utilize are the Yorkshire, Landrace and Duroc. We breed both purebred and cross-bred hogs in order to attain what we feel are the most desirable traits in the hogs produced in our farms.

In 2011, we sold approximately 29.82% of our hogs as breeder hogs, which are predominately females, approximately 61.28% as market hogs, and approximately 8.90% as retail pork products. Breeder hogs are sold to other hog farms throughout China for use in their reproductive programs, and used in our own farms as breeder sows. We prefer to sell hogs as breeders, as they command a higher price and are sold when they are younger and have consumed less feed and other resources, leading to a higher profit margin than market hogs. Breeder hogs weigh approximately 110 – 120 pounds at the time of sale while market hogs weight about 220 – 240 pounds.

Male hogs are nearly always sold as market hogs as substantially fewer boars are required than sows for breeding purposes. Female hogs that do not meet breeder hog standards are also sold as market hogs.

Our Breeding Efforts

A key element of breeding hogs is to utilize sows which are most likely to give birth frequently to large, healthy litters that display the attributes that customers prefer. As a result, we genetically catalogue our sows, so that we can identify purebred and first-cross hogs to maintain our purebred nucleus herd for fidelity to breed standards and to develop the most favorable parent line sows and boars for commercial market hog production.

We screen all potential breeders for favorable qualities. We rely on a combination of performance data and visual appraisals of breeder hogs for selection purposes. We index purebred sows monthly and select the top 20% to maintain our nucleus herd. Having established the baseline herd level, we experiment with combinations of boars and sows to continue to improve the characteristics of our hogs.

In addition to selecting the most favorable breeding stock, we constantly monitor our breeding sows and replace any that have disease related problems or that display other unfavorable breeding characteristics. A quality sow can give birth for 3 to 4 years, and can give birth 6 to 8.5 times during her life typically to a litter of 10-12 piglets each time. If a sow consistently gives birth to small litters, we remove it from the breeding stock. Likewise, if a sow repeatedly fails to get pregnant during fertile periods or displays false pregnancy (a condition that can last for up to two months) we will remove it from the breeding herd and replace it with a more productive sow.

Our Premix

We believe one of the most challenging issues in the hog production industry is the growing variety and variability of swine diseases. Many hog farms manage diseases through the use of antibiotic drugs. In addition to administering antibiotics directly, many commercial hog farms also use antibiotics in premix feed, without regard to whether particular hogs require treatment. Heavy use of these drugs in China has resulted in pork with drug residues and excess levels of heavy metals and other contaminants.

We seek to avoid the use of what we view as excessive amounts of antibiotics in our hogs. After years of research and development in cooperation with our consultant, Professor Ming Li of China Central Teachers University, we have developed our own premix, which we use instead of commercially available biofeed premixes. Our premix contains no antibiotics and, according to testing by Hubei Province Import and Export Commodity Inspection and Quarantine Bureau, our pork products test negative for drug residues and meet the industry limits for heavy metals.

By developing our own premix, we reduced our feed costs. Our premix adds live microbes to swine feed, which we believe result in better absorption of feed and a generally healthier intestinal system. Better absorption of feed results in lower waste and we believe that we have realized a 10% to 12% reduction in feed costs as a result. In addition, because these bacteria improve the hogs’ health, we have seen savings on drug costs of approximately RMB 10 (approximately $1.50) per hog.

Our Hog Farms

Fengze built its first hog farm in 2005. In 2006, Fengze purchased the land rights, farm structures and related equipment and inventory of five additional hog farms from separate sellers. In 2008, Fengze built one hog farm and acquired land rights, long-lived assets and inventory of another. In 2009 Fengze constructed its ninth hog farm. This farm will have an annual capacity of 20,000 hogs once it attains full production level. In December 2010, Fengze completed the acquisition of the assets of a tenth farm, the Hengdian Farm, which produces up to 20,000 hogs annually when at full production. In May 2011, we completed the acquisition of our eleventh farm. This farm will produce up to 20,000 hogs annually once it reaches full production. Our tenth farm reached full production during 2011. During the fourth quarter of 2011, several of our farms, including the tenth farm, were not operating at full capacity due to the receipt of contaminated food stock that resulted in diseased hogs that required disposal, causing these farms to fall below full capacity as of December 31, 2011.

At present, we, through Fengze, operate six hog farms with an annual capacity of 20,000 hogs each and five hog farms with an annual capacity of 10,000 hogs each.

Each of our hog farms is designed to raise hogs from breeding through preparation for sale as breeder or market hogs. While there are differences among our farms, they follow the same basic organizational model, with separate buildings dedicated to sow operations, nursery operations and finishing operations. In addition to these specific functional buildings, our farms also feature housing for some of our farmers for the benefit of our farm operations. To minimize the risk of contamination, access to our farms is very limited to outsiders, including Company staff. To limit the number of personnel that enter our farms, and thus the risk of contamination, we provide on-site housing to a large portion of our farm employees.

Each farm has a farm manager who is responsible for monitoring animal care, animal health and equipment. Specialized crews trained in moving hogs assist with the loading, unloading, health care and sanitation for each unit.

Our Strategies

We plan to enhance our position as one of Wuhan’s largest hog farming companies. We intend to achieve this goal by implementing the following strategies:

|

•

|

We plan to increase hog production quality and capacity by continuing to

upgrade our genetic breeding base. We plan to purchase and import purebred hogs to improve the genetic strength and diversity of our breeding pool, increasing our ability to maintain quality purebred stock within our breeding operations. This will enable us to breed superior breeding hogs that can be used in our operations or sold to other breeder farms, resulting in improved margins.

|

||

|

|

•

|

We expect to continue to acquire or construct hog farms. We expect to focus on constructing new black hog rearing facilities in accordance with our joint development agreements with several cooperatives in Enshi Autonomous Prefecture in Hubei Province.

|

|

|

|

•

|

We intend to develop our sow replacement program to continually replace

less-productive sows with more productive ones. It requires significant effort to identify, track and measure the attributes of our breeder hogs. We have found that the more data we capture, the greater the rewards of our breeding program and the more successful we are in implementing sow replacement strategies, with resulting improvement in operations.

|

|

|

|

•

|

We will position our brand image in order to command a premium for branded meat products at retail if we decide to supply pork products to selected existing third party retail outlets. We have registered the trademark “Tianli An Puluo” for pork products. As a result of the recognition we have received for our products in Wuhan, we believe this trademark will be valuable and may allow us to charge a premium price for Fengze’s products if and when we distribute pork to retail operators. If we elect to supply pork products to retailers, we expect to utilize third party processing plants rather than acquire and operate one ourselves.

|

Principal Suppliers

The following are the principal suppliers we rely upon to obtain raw materials for hog feed and veterinary supplies. We believe the materials provided by these suppliers are widely available and do not anticipate that we would be unable to obtain these materials from other suppliers in the event they are unable or unwilling to supply our needs.

|

Supplier

|

Item

|

|

|

Wuhan Zhu Brothers Feed Technology Co., Ltd.

|

|

Feed supplies (corn, beans, bran and other commodities)

|

|

Wuhan Maozhu Agritech Research Co., Ltd.

|

|

Feed supplies

|

Purchases from Wuhan Zhu Brothers Feed Technology Co., Ltd. (“Wuhan Zhu Brothers”) accounted for approximately 51% and 64% of our purchase of inventories in 2011 and 2010, respectively. We are not subject to any long-term agreement with Wuhan Zhu Brothers. All purchases are on a “spot” basis and are not subject to long terms agreements.

Purchases from Wuhan Maozhu Agritech Research Co., Ltd. accounted for approximately 13% of our purchases of inventories during 2011.

Research and Development

We focus our research and development efforts on improving the genetic composition of our hogs and the quality of the feed provided to the hogs. As of December 31, 2011, our research and development team consisted of 49 employees. These research and development employees do not work exclusively on research and development and participate in other general administrative functions of the Company. In addition, some of our operating employees regularly participate in our research and development programs.

In the fiscal years ended December 31, 2011 and 2010, we spent $98,053 and $66,286, respectively, on research and development activities.

Sales and Marketing

Purchasers come to our farms to purchase breeder and market hogs. The purchasers of breeder hogs consist of farmers who purchase for their own accounts and brokers who sell the hogs to other hog farms. The purchasers of market hogs include slaughterhouses and brokers who sell the hogs to slaughterhouses. Purchases are paid for at the time of the sale. Purchasers are responsible for transporting hogs from our farms. In this way, we have been able to reduce our transportation costs and risks associated with delivering hogs. Return of product is not permitted.

Because we have primarily relied upon having purchasers come to our farms, to date our expenditures on marketing and advertising have not been significant. If our capacity should grow or we should otherwise determine it is in our interests to do so, we may rely more upon advertising and marketing in the future and our expenditures for such efforts will increase.

Competition

We compete based on the quality of our product, especially as it pertains to breeder hogs, and on price. Our products are to some degree commodities and there is extensive competition from other hog farms in the region.

We believe that Wuhan has 75 farms with annual production capacities of at least 10,000 hogs and, of these, 21 farms have annual production capacities of at least 20,000 hogs. Inclusive of the farms in Wuhan, we believe that Hubei province has approximately 439 hog farms with annual production capacities of 10,000 or more hogs. We believe our annual capacity of approximately 170,000 hogs as of December 31, 2011 makes us one of Hubei province’s largest hog farming companies.

Customers

Our five largest customers collectively represented approximately 25% and 35% of our sales for the years ended December 31, 2011 and 2010, respectively. There were no customers who represented more than 10% of our sales in 2010.

In 2011, the customers that accounted for more than 10% of our revenues were:

|

Client’s Name

|

Percentage of Revenues in Year ended December 31, 2011

|

||

|

Wuhan Mingxiang Meat Factory Co., Ltd.

|

13

|

%

|

|

|

Huangpi Hengdian Slaughtering Center

|

12

|

%

|

Regulation

Restriction on Foreign Ownership

The principal regulation governing foreign ownership of agricultural businesses in the PRC is the Foreign Investment Industrial Guidance Catalogue, effective December 11, 2007 (the “Catalogue”). The Catalogue classifies various industries into four categories: encouraged, permitted, restricted and prohibited. We are engaged in an encouraged industry. Such a designation offers businesses distinct advantages. For example, businesses engaged in encouraged industries:

|

•

|

are not subject to restrictions on foreign investment, and, as such, foreigners can own a majority in Sino-foreign joint ventures or establish wholly-owned foreign enterprises in the PRC;

|

|

•

|

with total investment of less than $100 million, are subject to regional (not central) government examination and approval which are generally more efficient and less time-consuming; and

|

|

•

|

may import certain equipment while enjoying a tariff and import-stage value-added tax exemption.

|

The National Development and Reform Commission and the Ministry of Commerce periodically jointly revise the Catalogue. As such, there is a possibility that our company’s business may fall outside the scope of the definition of an encouraged industry in the future. Should this occur, we would no longer benefit from such designation.

Taxation and Subsidies

The PRC government has provided tax incentives and subsidies to domestic companies in our industry to encourage the development of agricultural businesses in China. We have received business tax exemptions or reductions, subsidies, and government incentives in connection with Fengze’s ownership of hog farms and WFOE’s management of those operations. An example is that both Fengze and WFOE were exempted from income taxes for 2010 and prior years.

The PRC government authorities may reduce or eliminate these incentives through new legislation or other regulatory actions at any time in the future. In the event that we are no longer exempt from income taxation, our applicable tax rate would increase from 0% to up to 25%, the standard business income tax rate in the PRC.

Regulation of Foreign Currency Exchange and Dividend Distribution

Foreign Currency Exchange. The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations (1996), as amended, and the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996). Under these regulations, Renminbi are freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for most capital account items, such as direct investment, loans, repatriation of investment and investment in securities outside China, unless the prior approval of SAFE or its local counterpart is obtained. In addition, any loans to an operating subsidiary in China that is a foreign invested enterprise, cannot, in the aggregate, exceed the difference between its respective approved total investment amount and its respective approved registered capital amount. Furthermore, any foreign loan must be registered with SAFE or its local counterparts for the loan to be valid. Any increase in the amount of the total investment and registered capital must be approved by the PRC Ministry of Commerce or its local counterpart. We may not be able to obtain these government approvals or registrations on a timely basis, if at all, which could result in a delay in the process of making loans to our subsidiary or VIE..

Dividend Distribution. The principal regulations governing the distribution of dividends by foreign holding companies include the Foreign Investment Enterprise Law (1986), as amended, and the Administrative Rules under the Foreign Investment Enterprise Law (2001).

Under these regulations, foreign investment enterprises in China may pay dividends only out of their retained profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, foreign investment enterprises in China are required to allocate at least 10% of their respective retained profits each year, if any, to fund certain reserve funds unless these reserves have reached 50% of the registered capital of the enterprise. These reserves are not distributable as cash dividends.

Notice 75. On October 21, 2005, SAFE issued Notice 75, which became effective as of November 1, 2005. According to Notice 75, prior registration with the local SAFE branch is required for PRC residents to establish or to control an offshore company for the purposes of financing that offshore company with assets or equity interests in an enterprise located in the PRC. An amendment to registration or filing with the local SAFE branch by such PRC resident is also required for the injection of equity interests or assets of an onshore enterprise in the offshore company or overseas funds raised by such offshore company, or any other material change involving a change in the capital of the offshore company.

Under the relevant rules, failure to comply with the registration procedures set forth in Notice 75 may result in restrictions being imposed on the foreign exchange activities of the relevant onshore company, including the increase of its registered capital, the payment of dividends and other distributions to its offshore parent or affiliate and capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations.

PRC residents who control our company are required to register with SAFE in connection with their investments in us. Such individuals began this registration process on March 8, 2010. If we use our stock or other equity interest to purchase the assets or equity interest of a PRC company owned by PRC residents in the future, such PRC residents will be subject to the registration procedures described in Notice 75.

New M&A Regulations and Overseas Listings. On August 8, 2006, six PRC regulatory agencies, including the Ministry of Commerce, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, CSRC and SAFE, jointly issued Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the New M&A Rule, which became effective on September 8, 2006. This New M&A Rule, among other things, includes provisions that purport to require that an offshore special purpose vehicle formed for purposes of overseas listing of equity interests in PRC companies and controlled directly or indirectly by PRC companies or individuals obtain the approval of CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange.

On September 21, 2006, CSRC published on its official website procedures regarding its approval of overseas listings by special purpose vehicles. The CSRC approval procedures require the filing of a number of documents with the CSRC and it would take several months to complete the approval process. The application of this new PRC regulation remains unclear with no consensus currently existing among leading PRC law firms regarding the scope or the applicability of the CSRC approval requirement.

Based on our understanding of the current PRC laws and regulations, we believe that because we currently control our Chinese affiliate, Fengze, by virtue of WFOE’s VIE agreements with Fengze and not through an equity interest acquisition nor an asset acquisition as described in the New M&A Rule, and CSRC currently has not issued any definitive rule or interpretation concerning whether structures like ours are subject to this new procedure, we are in compliance with the new M&A Rule.

Intellectual Property Rights

Trademarks. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets. The PRC is also a signatory to all of the world’s major intellectual property conventions, including:

|

•

|

Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 4, 1980);

|

|

•

|

Paris Convention for the Protection of Industrial Property (March 19, 1985);

|

|

•

|

Patent Cooperation Treaty (January 1, 1994); and

|

|

•

|

The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (November 11, 2001).

|

The PRC Trademark Law, adopted in 1982 and revised in 2001, and implementation rules adopted in 2002, protect registered trademarks. The Trademark Office of the State Administration of Industry and Commerce (“SAIC”) handles trademark registrations and grants trademark registrations for a term of ten years.

We, through Fengze, have used “Hanxi” for years on swine products. In 2009, Fengze applied for and registered “Hanxi” as a trademark with China’s SAIC Trademark Office, in Class No. 31, which relates to live animals, live poultry, live fish, trees, cereals, plants, fresh fruits, fresh vegetables, fodder and crustaceans. The registration is valid from April 21, 2009 to April 20, 2019. As a registered trademark “Hanxi” is exclusively owned by Fengze for products within the range limited by Class No. 31; any identical or similar trademark may not be used on commodities involved in Class No. 31. Fengze does not currently own any trademark on “Hanxi” outside of Class No. 31. In the event of trademark infringement, the SAIC has the authority to fine the infringer and to confiscate or destroy the infringing products. In addition to actions taken by SAIC, Fengze would be entitled to sue an infringer for compensation.

On August 1 and August 30, 2011, we entered into a collaborative agreement and a supplemental agreement (the “Agreements”) with An Puluo Food Processing Co., Ltd. (“An Puluo”) to pursue retail business. Pursuant to the Agreements we are allowed to apply to register “Tianli An Puluo” as a exclusive trademark with China’s SAIC Trademark Office. We began to use “Tianli An Puluo” at our retail sales departments in local major supermarkets in greater Wuhan City.

In accordance with our collaborative agreement with An Puluo, we were able to establish retail operations within existing retail facilities with whom An Puluo had ongoing business arrangements. In these retail facilities, we are permitted to retail their pork products. The owners of these retail facilities are responsible for collection of all retail sales made by us. These retail facilities are responsible for remitting to us the sales that they collect on behalf of us, less any fees for operating a retail operation in their facility.

Business Trade Secrets, We have not applied for any patent protection for our premix; however, we rely on Chinese business secret laws to protect our interest in this premix.

Our premix was developed in conjunction with Professor Ming Li of China Central Teachers University. In return for providing financial and other support to Professor Li’s research, Professor Li assigned the rights to the results of his research and development (specifically, the premix) to us. In connection with this assignment, Professor Li agreed to protect the secrecy of our premix formula and to indemnify us against any damages caused if he discloses that information to third parties.

In addition to the terms under which we obtained rights to the premix, we have taken a number of measures to maintain the premix as a business secret under Chinese law.

Notwithstanding these measures, if we are required to sue to protect our rights in the premix, the ultimate determination of whether the premix constitutes a business secret protected under Chinese law will be made on the facts of the case itself. We cannot guarantee that we will be found to have a business secret or that any court will protect our rights in the premix formula.

Regulations on Offshore Parent Holding Companies’ Direct Investment in and Loans to Their PRC Subsidiaries. An offshore company may invest equity in a PRC company which will become the PRC subsidiary of the offshore holding company after investment. Such equity investment is subject to a series of laws and regulations generally applicable to any foreign-invested enterprise in China, which include the Wholly Foreign Owned Enterprise Law, the Sino-foreign Equity Joint Venture Enterprise Law, the Sino-foreign Contractual Joint Venture Enterprise Law, all as amended from time to time, and their respective implementing rules; the Tentative Provisions on the Foreign Exchange Registration Administration of Foreign-Invested Enterprise; and the Notice on Certain Matters Relating to the Change of Registered Capital of Foreign-Invested Enterprises.

Under the aforesaid laws and regulations, the increase of the registered capital of a foreign-invested enterprise is subject to the prior approval of the authority which approved the initial investment. In addition, the increase in registered capital and the total investment amount must both be registered with SAIC and SAFE.

Shareholder loans made by offshore parent holding companies to their PRC subsidiaries are regarded as foreign debts in China for regulatory purposes which are subject to a number of PRC laws and regulations, including the PRC Foreign Exchange Administration Regulations, the Interim Measures on Administration on Foreign Debts, the Tentative Provisions on the Statistics Monitoring of Foreign Debts and the Administration Rules on the Settlement, Sale and Payment of Foreign Exchange.

Under these regulations, shareholder loans made by offshore parent holding companies to their PRC subsidiaries are to be registered with SAFE. Furthermore, the total amount of foreign debts that can be incurred by such PRC subsidiaries, including any shareholder loans, shall not exceed the difference between the total investment amount and the registered capital amount of the PRC subsidiaries, both of which are subject to governmental approval.

A failure to comply with increasingly stringent environmental regulations and related litigation could result in penalties, damages and adverse publicity for our business. Our operations and properties are subject to extensive and increasingly stringent laws and regulations pertaining to, among other things, the discharge of materials into the environment and the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to protection of the environment.

Fengze has incurred, and we will continue to incur, capital and operating expenditures to comply with these laws and regulations. We typically expend approximately $150,000 or more to construct hog waste systems at each hog farm we build and there are also ongoing expenses to comply with environmental regulations. If we were to build a farm, or purchase a farm without the necessary waste equipment, we would expect to spend $150,000 or more in connection with such farm for environmental compliance purposes in addition to ongoing maintenance.

The hog farming industry in the PRC is subject to extensive government regulation, which is still evolving and could adversely affect our ability to sell products in the PRC or could increase our production costs. The hog farming industry in the PRC is regulated by a number of governmental agencies, including the Ministry of Agriculture, the Ministry of Commerce, the Ministry of Health, the General Administration of Quality Supervision, Inspection and Quarantine, and the State Environmental Protection Administration. These regulatory bodies have broad discretion and authority to regulate many aspects of the hog farming industry in the PRC, including, without limitation, setting hygiene and quality standards. In addition, the regulatory framework in the PRC is evolving. If the relevant regulatory authorities set standards with which we are unable to comply or which increase our costs so as to render our products non-competitive, our profitability and our ability to sell products in the PRC may be impacted.

Each province in the PRC requires hog farmers to obtain and maintain a license for each hog farm owned and operated in that province. Currently, all of our hog farms are located in the city of Wuhan in Hubei province, and we have obtained a license to own and operate each of our hog farms. We need to maintain our licenses to operate our current hog farms. If we pursue acquisitions of other hog farms, we will need to obtain additional licenses to operate those farms.

Employees

As of December 31, 2011, we had approximately 466 employees, of whom 411 were full-time employees. All of our employees are based in China. Of the total, 8 were in management and administration, 11 were farm managers, 11 served as deputy farm managers, 49 were in technical support (including the research and development staff, and veterinarians located on the farms), 30 were engaged in administration, and 302 were in farming. We believe that our relations with our employees are good. We have never had a work stoppage, and our employees are not subject to a collective bargaining agreement.

ITEM 1A. Risk Factors

The purchase of our common shares involves a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and other information and our consolidated financial statements and related notes included elsewhere in this report. If any of the following events actually occurs, our financial condition or operating results may be materially and adversely affected, our business may be severely impaired, and the price of our common stock may decline, perhaps significantly. This means you could lose all or a part of your investment.

Risks Related to Our Industry

If there are any interruptions to or a decline in the amount or quality of our breeding stock or feed components, our production or sales could be materially and adversely affected.

Swine feed components and breeding stock are the principal raw materials used in our business. We purchase all of our swine feed components from a number of third-party suppliers. We generally breed and raise our own hogs and periodically purchase new breeding stock from third parties, including stock sourced from Europe and the United States. These third-party suppliers may not continue to be able or willing to satisfy our need for breeding stock and swine feed components. The supply of breeding stock may be affected by outbreaks of diseases or epidemics. Suppliers may not be able to provide live hogs or swine feed components of sufficient quantity or quality to meet our requirements. Any interruptions to or decline in the amount or quality of live hogs or swine feed components could materially disrupt our production and adversely affect our business. We are vulnerable to increases in the price of raw materials (particularly of swine feed components and occasionally live hogs) and other operating costs, and we may not be able to entirely offset increasing costs by increasing prices. If we are unable to entirely offset cost increases by raising prices, our profit margins and financial condition could be adversely affected.

If the pork market in the PRC does not grow as we expect, our results of operations and financial condition may be adversely affected.

We believe pork products have strong growth potential in the PRC and, accordingly, we have acquired farms. If the pork market in the PRC does not grow as we expect, our business may be harmed, we may need to adjust our growth strategy, and our results of operation may be adversely affected.

We may be unable to maintain our profitability in the face of a consolidating retail environment in the PRC.

We sell substantial amounts of our hogs to slaughterhouses, which sell to smaller retailers and supermarkets and large retailers. The supermarket and food retail industry in the PRC has been and is expected to continue consolidating.

As the supermarket and food retail industry continue to consolidate and retail customers grow larger and become more sophisticated, they may demand lower prices and increased promotional programs from our slaughterhouse customers, which may demand lower prices from us. If we are forced to lower prices in response to pressure from customers, our profitability could decline.

The hog farming industry in the PRC may face increased competition, as well as increased industry consolidation, which may affect our market share and profit margin.

The hog farming industry in the PRC is highly competitive. We believe that our ability to maintain our market share and grow our operations within this landscape of intense competition depends largely upon our ability to distinguish our hogs from our competitors’ hogs, especially as to our breeders.

We cannot assure you that our current or potential competitors will not develop hog breeding and farming technology of a quality comparable or superior to ours, or adapt more quickly than we do to evolving consumer preferences or market trends. In addition, our competitors may merge or form alliances among farms to achieve a scale of operations which would make it difficult for us to compete. Competition may also lead to price wars, which may adversely affect our market share and profit margin. We cannot assure you that we will be able to compete effectively with our current or potential competitors.

The outbreak of animal diseases could adversely affect our operations.

An occurrence of serious animal diseases or any outbreak of other animal epidemics in the PRC might result in material disruptions to our operations, to the operations of our customers or suppliers or a decline in our industry or a slowdown in economic growth in the PRC and surrounding regions, any of which could have a material adverse effect on our operations. In 2007, tens of millions of pigs were killed in China as a result of Blue Ear disease, which resulted in inflation in pork prices and affected 25 of China’s 33 provinces. While we take measures at each of our farms to prevent the outbreak of disease, there can be no assurance that our facilities or products will not be affected by an outbreak of disease in the future, or that the market for pork products in the PRC will not decline as a result of fear of disease. In either case, our business, results of operations and financial condition would be adversely and materially affected.

Outbreaks of swine flu could adversely affect our business, results of operations and financial condition.

An occurrence of a serious animal disease, such as swine influenza or H1N1 virus, a respiratory disease of pigs caused by influenza viruses, or any outbreak of other epidemics in the PRC affecting animals or humans might result in material disruptions to our operations, to the operations of our customers or suppliers or a decline in the supermarket or food retail industry or a slowdown in economic growth in the PRC and surrounding regions, any of which could have a material adverse effect on our operations and turnover.

Consumer concerns regarding the safety and quality of food products or health concerns could adversely affect sales of our products.

Our sales performance could be adversely affected if consumers lose confidence in the safety and quality of our products. Consumers in the PRC are increasingly conscious of food safety and nutrition. Consumer concerns about, for example, the safety of pork products could discourage them from buying pork products and cause our results of operations to suffer.

We may be subject to substantial liability should the consumption of pork products made from our hogs cause personal injury or illness and, unlike most food companies in the United States, we do not maintain product liability insurance to cover potential liabilities.

The sale of food products for human consumption involves an inherent risk of injury to consumers. Such injuries may result from tampering by unauthorized third parties or product contamination or degeneration, including the presence of foreign contaminants, chemical substances or other agents or residues during the various stages of the production process. While we are subject to governmental inspections and regulations, we cannot assure you that consumption of our products will not cause a health-related illness, or that we will not be subject to claims or lawsuits relating to such matters.

Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertions that our products caused personal injury or illness could adversely affect our reputation with customers and our corporate and brand image. Furthermore, our products could potentially suffer from product tampering, contamination or degeneration or be mislabeled or otherwise damaged. Under certain circumstances, our products may be recalled. Even if a situation does not necessitate a recall, we cannot assure you that product liability claims will not be asserted against us. A product liability judgment against us or a product recall could have a material adverse effect on our revenues, profitability and business reputation.

We purchase many commodities for raw materials and packaging, and price changes for the commodities we depend on may adversely affect our profitability.

We have not entered into long term contracts for the purchase of raw materials at fixed prices. The raw materials used in our feed are largely commodities that can experience significant price fluctuations caused by external conditions and changes in governmental agricultural programs over which we exercise no influence. We attempt to recover commodity cost increases by increasing hog prices and creating additional operating efficiencies, but cannot assure that we will always be successful in offsetting these cost increases.

Our hog farming business could be adversely affected by fluctuations in pork commodity prices.

The price at which hogs are sold is directly affected by the supply and demand for pork products and other meat products in the PRC, all of which are determined by market forces and other factors over which we have little or no control. A downward fluctuation in the demand for pork may adversely impact our results of operations.

Risks Related to Our Business

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

We have a limited operating history. Fengze and WFOE were established in 2005, and HCS and Tianli were established in 2009. Additionally we have been a US public company only since July 2010. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by new companies in evolving markets such as the growing market for pork products in the PRC. Some of these risks and uncertainties relate to our ability to:

|

•

|

produce breeder hogs that will be responsive to the needs of other hog farmers;

|

|

•

|

attract additional customers and increased spending per customer;

|

|

•

|

increase awareness of the quality of our hogs and to continue to develop customer loyalty;

|

|

•

|

respond to competitive actions of other hog farmers;

|

|

•

|

respond to changes in our regulatory environment;

|

|

•

|

manage risks associated with intellectual property rights;

|

|

•

|

maintain effective control of our costs and expenses;

|

|

•

|

raise sufficient capital to sustain and expand our business;

|

|

•

|

attract, retain and motivate qualified personnel;

|

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

We may require additional financing in the future and our operations could be curtailed if we are unable to obtain required additional financing when needed.

We may need to obtain additional debt or equity financing to fund future capital expenditures. Any additional equity may result in dilution to the holders of our shares of capital stock. Additional debt financing may include conditions that would restrict our freedom to operate our business, such as conditions that:

|

•

|

limit our ability to pay dividends or require us to seek consent for the payment of dividends;

|

|

•

|

increase our vulnerability to general adverse economic and industry conditions;

|

|

•

|

require us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow for capital expenditures, working capital and other general corporate purposes; and

|

|

•

|

may limit our flexibility in planning for, or reacting to, changes in our business and our industry.

|

We cannot guarantee that we will be able to obtain any additional financing on terms that are acceptable to us, or at all.

Potential disruptions in the capital and credit markets may adversely affect our business, including the availability and cost of short-term funds for liquidity requirements, which could adversely affect our results of operations, cash flows and financial condition.

We may need to rely on the credit markets, particularly for short-term borrowings from banks within the PRC, as well as the capital markets, to meet our financial commitments and short-term liquidity needs if internal funds are not available from operations. Disruptions in the credit and capital markets could adversely affect our ability to draw on short-term bank facilities. Further, our access to funds under any such credit facilities is dependent on the ability of banks that are parties to those facilities to meet their funding commitments, which is dependent on governmental economic policies in the PRC. Banks that choose to enter into agreements with us may not be able to meet their funding commitments if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests from us and other borrowers within a short period of time.

Our operating results may fluctuate from period to period.

Our operating results have fluctuated from period to period and are likely to continue to fluctuate as a result of a wide range of factors. For example, the pricing for hogs has experienced significant fluctuations. Additionally demand for pork in general is relatively high before the Chinese New Year in January or February and lower thereafter. Our production and sales are generally lower in the summer due to a slight drop in meat consumption during the warmer summer months.

If WFOE is required to make a payment under its agreement to bear the losses of Fengze, our liquidity may be adversely affected, which could harm our financial condition and results of operations.

Under the terms of the Entrusted Management Agreement with Fengze, WFOE agreed to bear the losses of Fengze. WFOE may be required to absorb the losses at a time when WFOE does not have sufficient cash to make such payment and at a time when we or WFOE may be unable to borrow such funds on terms that are acceptable, if at all. As a result, any losses of Fengze that must be absorbed, under the Entrusted Management Agreement may have an adverse effect on our liquidity, financial condition and results of operations.

The loss of any key customer could reduce our revenues and our profitability.

Our key customers are principally hog brokers, hog farmers and slaughterhouses in the PRC. There can be no assurance that we will maintain or improve the relationships with these customers or other customers, or that we will be able to continue to supply these customers at current levels or at all.

If we cannot maintain long-term relationships with our larger customers, the loss of our sales to them could have an adverse effect on our business, financial condition and results of operations.

Our bank accounts are not insured or protected against loss.

We maintain cash with various banks and trust companies located in the PRC and in Hong Kong. These cash accounts are not insured or otherwise protected. Should any bank or trust company holding our cash deposits become insolvent, or if we are otherwise unable to withdraw funds, we would lose the cash on deposit with that particular bank or trust company.

We are substantially dependent upon our senior management and key research and development personnel.

We are highly dependent on our senior management to manage our business and operations. In particular, we rely substantially on our chief executive officer, Ms. Hanying Li, and our chief financial officer, Mr. Bihong Zhang, to manage our operations.

We also depend on our key research and development personnel for the development of new breeding, nutrition and farming technologies and the enhancement of our existing products and technologies personnel. We do not maintain key man life insurance on any of our senior management or key personnel. The loss of the services of one of them would have a material adverse effect on our business and operations. Competition for senior management and our other key personnel is intense and the pool of suitable candidates is limited. We may be unable to locate a suitable replacement for any senior management or key personnel that we lose. In addition, if any member of our senior management or key personnel joins a competitor or forms a competing company, they may compete with us for customers, business partners and other key professionals and staff members of our company. Although each of our senior management and key personnel has signed a confidentiality and non-competition agreement in connection with his employment with us, we cannot assure you that we will be able to successfully enforce these provisions in the event of a dispute between us and any member of our senior management or key personnel.

We compete for qualified personnel with other agricultural companies and research institutions. Competition for these personnel could cause our compensation costs to increase, which could have a material adverse effect on our results of operations. Our future success and ability to grow our business will depend in part on our ability to identify, hire and retain additional qualified personnel. If we are unable to attract and retain qualified employees, we may be unable to meet our business and financial goals.

We may not be able to adequately protect and maintain our intellectual property, trade secrets, and brand names.

We rely on a combination of trademark, trade secret, nondisclosure agreement and patent laws to protect our trade secrets and other valuable intellectual property and in particular, our premix formula. We have not applied for patents for our products or formulas, as our management believes an application for such patents would result in public knowledge of our proprietary technology and formulas. Our management has concluded that the risk of infringement of our proprietary technology in China in such a case outweighs the risk of being unable to protect our rights legally in China. Since we do not have patent protection for our technology or formulas, we may not be able to protect our rights to this intellectual property if our competitors discover or illegally obtain our technology or formulas. Our inability to protect our rights to this intellectual property may adversely affect our ability to prevent competitors from using our products and developments.

Our senior management lacks experience managing a public company and complying with laws applicable to operating as a U.S. public company domiciled in the British Virgin Islands.

Prior to the completion of our initial public offering in July 2010, Fengze operated as a private company located in China. In connection with our initial public offering, the senior management of Fengze formed Tianli in the British Virgin Islands, HCS in Hong Kong and caused WFOE to become Tianli’s subsidiary in the PRC. They also caused Fengze and WFOE to enter into agreements that gave Tianli effective control over the operations of Fengze by virtue of its ownership of HCS and HCS’ ownership of WFOE. In the process of taking these steps to prepare our company for our initial public offering, Fengze’s senior management became the senior management of Tianli. None of Tianli’s senior management has experience managing a public company or managing a British Virgin Islands company.

Our Company is subject to laws, regulations and obligations that prior to our initial public offering did not apply to it, and our senior management has no experience in complying with such laws, regulations and obligations. For example, Tianli must comply with British Virgin Islands laws applicable to companies that are domiciled in that country. By contrast, prior to our initial public offering, senior management was experienced in operating the business of Fengze in compliance with Chinese law. Similarly, by virtue of our initial public offering, Tianli is required to file quarterly and annual reports and to comply with U.S. securities and other laws, which were not applicable to Tianli prior to our initial public offering. These obligations can be burdensome and complicated, and failure to comply with such obligations could have a material adverse effect on Tianli. In addition, the process of learning about such new obligations as a public company in the United States will require senior management to devote time and resources to such efforts that might otherwise be spent on the operation of the business of hog farming.

We may not pay dividends.

We have not previously paid any cash dividends, and we do not anticipate paying any dividends on our common shares. Although we achieved net profitability in 2006, we cannot assure you that our operations will continue to result in sufficient revenues to enable us to operate profitably or to generate positive cash flows. Furthermore, there is no assurance our Board of Directors will declare dividends even if we are profitable. Dividend policy is subject to the discretion of our Board of Directors and will depend on, among other things, our earnings, financial condition, capital requirements and other factors. If we determine to pay dividends on any of our common shares in the future, we will be dependent, in large part, on receipt of funds from our operations.

Our growth strategy may prove to be disruptive and divert management resources, which could adversely affect our existing businesses.

Over the last six years, we constructed or acquired eleven farms in Wuhan City. Our growth strategy includes the continued expansion of our annual hog production, largely by constructing black hog rearing facilities with local cooperatives in the Enshi Autonomous Prefecture in Hubei Province. The implementation of such strategy may involve large transactions and present financial, managerial and operational challenges, including diversion of management attention from existing businesses, difficulty with integrating personnel and financial and other systems, increased expenses, including compensation expenses resulting from newly-hired employees, assumption of unknown liabilities and potential disputes. We also could experience financial or other setbacks if any of our growth strategies incur problems of which we are not presently aware.

As part of our growth strategy, we have acquired assets within the PRC. If any of our acquisitions are found not to comply with applicable laws or regulations, we might be required to make filings or submissions to PRC regulators or amend the terms of such acquisitions to meet PRC regulatory requirements.

We expect to continue to expand our operations in the PRC and have in recent years completed several farm acquisitions. While we believe that each of these acquisitions complied with all PRC laws and regulations, the regulatory environment that governs transactions in the PRC has continued to evolve in recent years and remains subject to interpretation by the agencies that have responsibility for reviewing or approving such transactions. If any of the acquisitions we completed were reviewed by a PRC regulator, it is possible that we may be required to demonstrate how the transaction complied with applicable PRC laws. This could require us to expend resources that would otherwise be used to manage our company. Further, if regulators determine that any of our transactions did not comply with applicable regulations, we may be required to renegotiate or revise the terms of the acquisition with the counterparties to the affected transaction. If such a scenario were to occur, we cannot be sure that our efforts to meet the regulator’s requirements would be successful, or that such efforts would not have an adverse effect on our operations.

Foreign Operational Risks

We are dependent on the state of the PRC’s economy as all of our business is conducted in the PRC.