Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Astex Pharmaceuticals, Inc | Financial_Report.xls |

| EX-23.1 - EX-23.1 - Astex Pharmaceuticals, Inc | a2208169zex-23_1.htm |

| EX-31.1 - EX-31.1 - Astex Pharmaceuticals, Inc | a2208169zex-31_1.htm |

| EX-31.2 - EX-31.2 - Astex Pharmaceuticals, Inc | a2208169zex-31_2.htm |

| EX-32.1 - EX-32.1 - Astex Pharmaceuticals, Inc | a2208169zex-32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended December 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 0-27628

ASTEX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

91-1841574 (IRS Employer Identification Number) |

|

4140 Dublin Blvd., Suite 200, Dublin, CA (Address of principal executive offices) |

94568 (Zip Code) |

|

Registrant's telephone number, including area code: (925) 560-0100 |

||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

|---|---|---|

| Common Stock, $0.001 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý.

The aggregate market value of the voting stock held by non-affiliates of the Registrant (based on the closing sale price of the Common Stock as reported on the Nasdaq Stock Market on June 30, 2011, the last business day of the Registrant's most recently completed second fiscal quarter) was approximately $178,168,419. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of outstanding shares of the Registrant's Common Stock as of the close of business on March 5, 2012 was 93,065,967.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III incorporate by reference information from the definitive proxy statement for the Registrant's 2011 Annual Meeting of Stockholders. The proxy statement will be filed within 120 days of the Registrant's fiscal year ended December 31, 2011.

ASTEX PHARMACEUTICALS, INC.

2011 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

1

Special Note Regarding Forward-Looking Statements

Our disclosure and analysis in this report contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, and within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide our current expectations or forecasts of future events. When we use the words "anticipate," "estimate," "project," "intend," "expect," "plan," "believe," "should," "likely" and similar expressions, we are making forward-looking statements. In particular, these statements include statements such as: our estimates about profitability; our forecasts regarding our revenues and research and development expenses; and our statements regarding the sufficiency of our cash to meet our operating needs. Our actual results could differ materially from those predicted in the forward-looking statements as a result of risks and uncertainties including, but not limited to, delays and risks associated with conducting and managing our clinical trials; the commercial success of Dacogen; developing products and obtaining regulatory approval; our ability to establish and maintain collaboration relationships; competition; our ability to protect our intellectual property; our expectations about the joint development program with GSK; our dependence on third party suppliers; risks associated with the hiring and loss of key personnel; adverse changes in the specific markets for our products; and our ability to launch and commercialize our products. Certain unknown or immaterial risks and uncertainties can also affect our forward-looking statements. Consequently, no forward-looking statement can be guaranteed and you should not rely on these forward-looking statements.

The forward-looking statements reflect our position as of the date of this report, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, or other filings. Also note that we provide a cautionary discussion of risks and uncertainties relevant to our business under Item 1A—Risk Factors in this report. These are currently known and material risks that we believe could cause our actual results to differ materially from expected and historical results. Other unknown and immaterial risks besides those listed in this report could also adversely affect us.

We incorporated in March 1991 as a California corporation and changed our state of incorporation to Delaware in May 1997. We changed our name from SuperGen, Inc. to Astex Pharmaceuticals, Inc. in September 2011. Our executive offices are located at 4140 Dublin Blvd., Suite 200, Dublin, CA, 94568 and our telephone number at that address is (925) 560-0100. We maintain a website on the internet at www.astx.com. This is a textual reference only. We do not incorporate the information on our website into this annual report on Form 10-K, and you should not consider any information on, or that can be accessed through, our website as part of this annual report on Form 10-K.

Overview

We are dedicated to the discovery and development of novel small molecule therapeutics with a focus on oncology and hematology. We believe we are developing a proprietary pipeline of novel medicines for partnership with leading pharmaceutical companies. We believe we are a leader in the application of fragment-based drug discovery and development of small-molecule therapeutics. Fragment-based drug discovery is considered by many in our sector to be one of the most important advances in discovery chemistry in the last 20 years.

We currently receive revenue from partnered programs and royalty revenues relating to sales of Dacogen® (decitabine) for Injection, a product approved by the FDA for the treatment of patients with myelodysplastic syndromes ("MDS"), which we licensed to MGI PHARMA Inc. ("MGI") in 2004.

2

On July 20, 2011, we completed the acquisition of all of the outstanding shares of Astex Therapeutics Limited ("ATL"), a privately held UK-based biotechnology company with particular expertise in fragment-based drug discovery. Pursuant to the acquisition, we paid approximately $24.9 million in cash and issued 32.4 million shares of our common stock (representing approximately 35% of our issued and outstanding stock as of the closing of the acquisition after giving effect to the issuance of such shares) to the securityholders of ATL. In addition, we will pay deferred consideration of $30 million in stock, cash, or a combination of stock and cash, to be determined at the discretion of the Company, no later than 30 months after the closing of the acquisition (January 2014).

ATL discovers and develops novel small molecule therapeutics. Using its fragment-based drug discovery platform, Pyramid™, ATL has built a pipeline of molecularly-targeted drugs for large pharmaceutical partners and internal development that are at various stages of clinical, pre-clinical and early discovery development.

Our primary developmental efforts revolve around the products progressing out of our small-molecule drug discovery programs. Our two lead internal programs are AT13387, a novel HSP 90 inhibitor, coming out of our ATL acquisition, and SGI-110, a novel second generation hypomethylating agent.

- •

- AT13387 is currently completing a Phase I study designed to assess the safety and tolerability in patients with

advanced refractory tumors. This study, which is investigating two different dosing schedules, is being conducted at multiple clinical sites in the US. The study is also intended to provide early

evidence of clinical efficacy. Based upon the preliminary results of this initial Phase I study, we have initiated a Phase II study in patients with refractory gastrointestinal stromal

tumors ("GIST").

- •

- SGI-110 is the subject of a Phase I/II trial in both MDS and acute myeloid leukemia ("AML"). This study is escalating doses in both a weekly and daily subcutaneous administration schedule. Following the Phase I dose escalation phase of the study, a fixed dose will be set for accrual of treatment naive patients in both MDS and AML.

Preliminary data should be forthcoming in the fourth quarter of 2012 for both the SGI-110 and AT13387 trials.

The third product in our clinical pipeline is amuvatinib (MP-470), our multi-targeted kinase inhibitor and DNA repair suppressor. We are currently conducting a Phase II trial in small cell lung cancer called ESCAPE. We also have partnered clinical trials ongoing for AT7519, a CDK inhibitor, and AT9283, an aurora/JAK2 inhibitor.

In addition to our own clinical pipeline, we maintain several partnerships with pharmaceutical companies and may receive development and license revenue in the future based on program advancement.

Strategy

Our founding strategy was to in-license late-stage clinical products and commercialize these products by executing selective developmental and commercialization strategies that might allow these products to come into the market and be utilized by the widest possible patient populations. However, the competition for late-stage compounds that can be obtained through licensure or acquisition, that have shown initial efficacy in humans, has increased significantly with most major pharmaceutical companies and emerging biotechnology companies taking positions in this market. Our current strategy attempts to mitigate the competitive risk of in-licensure and positions us to out-license selective products to our licensing competitors or other pharmaceutical companies. Our primary objective is to

3

become a leading developer and seller or licensor of medicines for patients suffering from cancer. Key elements of our strategy include the following:

Focus on oncology molecular targets that academia has generated and are not readily tractable by traditional drug discovery methods. Most established pharmaceutical companies use some version of high throughput screening for potential drug candidates. This methodology does not work well for many complex molecular targets. Pyramid enables us to create an advantage by designing inhibitors of difficult oncology targets that are not tractable by standard drug discovery methods and to identify molecules with superior drug-like properties.

Focused discovery research. We will build on our world leading position in fragment-based drug discovery. We believe our Pyramid discovery platform provides a clear advantage in tackling newly emerging classes of targets. We will deploy this in several ways focused in the oncology field for internal development and in other therapeutic areas in collaboration with pharmaceutical company partners. We have a particular strength in the field of epigenetics which led to Dacogen and SGI-110. We will continue to explore new ways to exploit our leading position in targeting DNA methyltransferase enzymes ("DNMTs") and to investigate other epigenetic mechanisms that are linked to disease. Secondly we will continue to use the platform to investigate targets that are less amenable to traditional drug discovery technologies e.g. protein/protein interactions, building on experience gained in our many pharma collaborations and on internal targets such as hepatitis C virus ("HCV") non-structural protein 3 ("NS3") and the inhibitors of apoptosis proteins ("IAP"). We will also continue to seek strategic alliances with world class academic institutes in order to access target identification and validation technologies and skill sets.

Capitalize on our existing drug development expertise to maximize the commercial value of our products. Models are only modestly predictive of how effective a product may be in humans. We have developed significant expertise in planning and managing clinical trials as well as regulatory filings in both the United States and Europe. Proving the concept that a specific drug will translate into an approvable, commercially viable product in humans is a difficult task. Some drug candidates demonstrate this "proof of concept" very early in non-clinical development, while other drug candidates will need to be compared clinically to existing therapies to achieve such a proof of concept. Typically, this proof of concept comes in Phase II trials where it is demonstrated that drug treatment leads to a desired pharmacologic effect and a safe dose. As product candidates move from non-clinical into Phase I and Phase II clinical studies, their potential value increases once proof of concept is established. We believe our clinical and regulatory expertise facilitates efficient use of our resources to achieve appropriate proof of concept.

Cultivate and maintain strong pharmaceutical partnerships. We have aggressively pursued and maintained relationships with large multinational pharmaceutical companies to de-risk the development of selected compounds and projects. This practice allows us to focus our efforts on the discovery and early development of select compounds with larger companies performing the largest most expensive trials, preparing the market for commercialization and distributing the product to the global market.

4

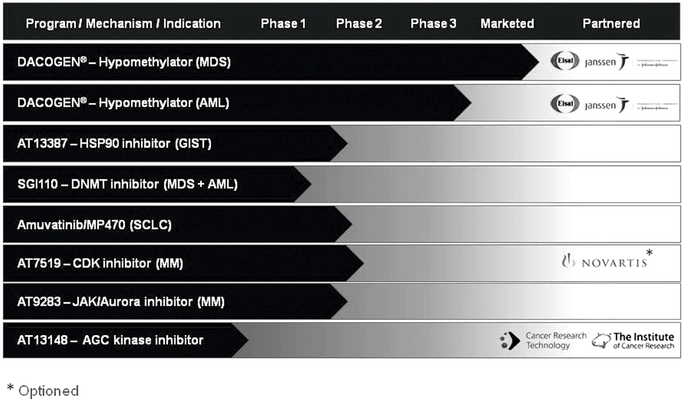

Product Pipeline

Dacogen—Hypomethylator (MDS)

Dacogen is a DNA hypomethylating agent currently approved in selected markets for treatment of patients with MDS, including previously treated and untreated, de novo and secondary MDS of all French-American-British (FAB) subtypes (refractory anemia, refractory anemia with ringed sideroblasts, refractory anemia with excess blasts, refractory anemia with excess blasts in transformation, chronic myelomonocytic leukemia), and Intermediate-1, Intermediate-2 and High-Risk International Prognostic Scoring System (IPSS) groups. Dacogen is approved for the treatment of MDS in more than 30 countries worldwide including key markets such as the United States, Brazil, China, India, Russia and Turkey.

Eisai Inc. manages the product rights in the United States, Canada and Mexico and Janssen-Cilag International NV and other affiliates of Cilag GmbH International manage the marketing and development rights for Dacogen in all other markets. Janssen-Cilag International NV is one of the Janssen Pharmaceutical Companies of Johnson & Johnson.

Dacogen—Hypomethylator (AML)

A 485-patient Phase III trial in elderly patients with AML has been completed. Our partners Eisai and Janssen-Cilag have previously filed for regulatory approval for this indication in the United States and the European Union. On March 6, 2012, Eisai was notified that the FDA declined approval of the supplemental New Drug Application ("sNDA") because the pre-specified analysis of the primary endpoint in the study did not demonstrate statistically significant superiority of Dacogen over the control arm. It is expected that Janssen-Cilag will hear results of its Marketing Authorization Application ("MAA") submission to the European Medicines Agency ("EMA") later in 2012.

5

AT13387—Hsp90 inhibitor (GIST)

AT13387 is a small molecule inhibitor of Hsp90, a so called "Heat Shock" protein, believed to be responsible for supporting many tumor cells becoming cancerous. Hsp90 acts as a "molecular chaperone" stabilizing and preventing the breakdown of key cancer-forming (oncogenic) proteins. These client proteins and their association with different tumor types include HER2 (the target for Herceptin® in breast cancer), the androgen receptor (the target for hormone therapy in prostate cancer), mutant B-raf (melanoma), c-kit (the target for Gleevec® in gastrointestinal tumors) and mutant EGFr (the target for Tarceva® and Iressa® in the treatment of non small cell lung cancers). Although AT13387 is a targeted inhibitor of Hsp90, the functional role of Hsp90 means the product has the potential to control the proliferation of multiple solid tumors and hematological malignancies where uncontrolled cell growth is dependent on the interaction between Hsp90 and its client proteins. These include tumor types that have become resistant to initial therapy.

We are completing a Phase I dose escalation safety and tolerability study with AT13387 in advanced cancer patients and have initiated a Phase II study in combination with imatinib (Gleevec®) for treatment of refractory GIST patients.

In November 2009, we entered into a CRADA with the US National Cancer Institute (NCI) to support the further clinical development of AT13387 over the next five years with a number of single agent and combination Phase I/IIa and Phase II studies planned outside of our primary commercial areas of interest.

SGI-110—DNMT Inhibitor (MDS and AML)

In normal cells, silencing of unnecessary genes is commonly carried out by DNA methylation through the action of DNMTs. However, this machinery can be usurped during the process of tumorigenesis, resulting in the inactivation of tumor suppressor genes and ultimately, cancer or the progression of cancers. Inhibition of DNMT activity in cancer cells can cause the silenced genes to become unmethylated and re-expressed. These re-expressed tumor suppressor genes can interfere with the cancer cells proliferative pathways and lead to cell death. We have developed a compound called SGI-110 which targets and blocks the mechanism by which methylation is copied to newly forming cells, thus allowing re-expression of silenced genes in tumors. We received clearance from the FDA in 2010 to commence Phase I clinical trials for SGI-110, and the first patients were dosed in early January 2011. The initial Phase I/II study will evaluate multiple schedules in patients with intermediate-2 or high-risk MDS and AML. We are developing SGI-110 in collaboration with the Epigenetics Dream Team from Stand Up to Cancer, the charitable program established by the Entertainment Industry Foundation to raise funds for cancer research.

Amuvatinib—Multi-targeted Kinase Inhibitor and DNA Repair Suppressor (SCLC)

Amuvatinib is an oral multi-targeted Tyrosine Kinase Inhibitor that was designed to hit mutant forms of protein kinase targets called c-kit and PDGFRa. These protein kinase targets are involved in the growth and proliferation of cancer cells. Amuvatinib is also a suppressor of Rad51, a DNA repair protein which is involved in resistance to a variety of chemotherapy agents and radiation. We submitted an Investigational New Drug Application ("IND") to the FDA in March 2007, and initiated a first-in-human Phase I single agent amuvatinib trial in June 2007, and Phase Ib trials in late 2007. Non-clinical experimentation has shown that amuvatinib in combination with etoposide has a synergistic effect on human small cell lung cancer cell lines in vitro. In addition, better tumor growth inhibition has been observed in animal studies in the group treated with a combination of etoposide and amuvatinib when compared to etoposide as a single agent in tumor-bearing nude mice.

Amuvatinib has a wide therapeutic window and shows minimal toxicity in the expected therapeutic dose range, despite suppressing several signaling pathways within cells. We have evaluated amuvatinib

6

as a dry powder mix and as a lipid suspension formulation in multiple Phase I studies as a single agent in healthy volunteers and in cancer patients, as well as in combination with five standard of care chemotherapy regimens in different tumor types. Across these studies, over 180 patients and healthy volunteers received at least one dose of amuvatinib. As a single agent in cancer patients, gastrointestinal toxicity was the major adverse event noted at doses up to 1500 mg/day with the dry powder formulation. In the combination Phase Ib trial, preliminary data indicated twelve partial responses and numerous durable stable disease per response evaluation criteria in solid tumors, or RECIST, including responses with the paclitaxel/carboplatin and carboplatin/etoposide standard of care chemotherapy regimens in combination with oral amuvatinib. Tumor types demonstrating clinical benefit include small cell lung cancer, neuroendocrine, non-small cell lung, breast, and endometrial carcinoma. The safety profile of amuvatinib in combination with standard of care was consistent with historical published data for each chemotherapeutic with no apparent increase in severity or prolongation of reported events.

We conducted additional clinical safety and oral pharmacokinetic studies with both the dry powder and the lipid suspension formulations of amuvatinib. The studies confirmed that the lipid suspension capsule formulation provided better overall exposure and that 300 mg three times a day was safe and achieved blood levels of the drug within the therapeutic range expected from non-clinical studies.

We are currently conducting a Phase II, multi-center, open-label, single-arm study of amuvatinib in combination with platinum-etoposide in up to 50 subjects with small cell lung cancer who are not responding to standard treatment or relapsed shortly after standard treatment. Eligible subjects receive amuvatinib lipid suspension capsules at the dose of 300 mg orally three times a day on a continuous basis in 21 day cycles together with their platinum-etoposide treatment. The primary endpoint will be tumor objective response.

AT7519—CDK inhibitor (Multiple Myeloma)

AT7519 is a small molecule targeted inhibitor of several cyclin-dependent kinases ("CDK's) that regulate two important disease processes—the cell replication cycle and gene expression. The normal regulation of the cell cycle is disrupted in all cancers allowing the uncontrolled tissue growth characteristic of the disease. CDK's 1 and 2 act as key controls of the cell cycle, and the inhibition of these enzymes both prevents cell proliferation and initiates cell death. AT7519 is an inhibitor of both CDK1 and 2 and in preclinical testing induces tumor shrinkage in multiple animal models of cancer.

In addition to its direct effects on the cell cycle, AT7519 is also a potent inhibitor of RNA polymerase II dependent transcription. This activity results from inhibition by AT7519 of another cyclin-dependent kinase, CDK9. The survival of several tumor types is very dependent on the cellular levels of certain anti-apoptotic proteins, which require RNA polymerase II activity for their generation. This is true for hematological malignancies in particular and AT7519 has been found to induce rapid cell death in leukemia cell lines and tumor shrinkage in relevant animal models.

We have investigated AT7519 in two Phase I clinical trials, evaluating different dosing regimens as monotherapy in patients with advanced solid tumors. These studies were conducted at multiple sites in the UK, USA and Canada. Evidence of clinical activity was observed in these trials. A Phase II study of AT7519 in combination with bortezomib in patients with multiple myeloma has commenced at multiple centers in the US with funding support from the Multiple Myeloma Research Foundation. In addition, two Phase II trials of AT7519 to treat patients with chronic lymphocytic leukemia and mantle cell lymphoma are starting, sponsored by the NCIC Clinical Trials Group in Canada. Novartis has an option to develop and commercialize AT7519. The option is exercisable by Novartis following Phase II clinical trial results (end of Phase II meeting with the FDA), and would be a worldwide license, if exercised. Otherwise, the option will expire.

7

AT9283—Aurora/Jak2 inhibitor (MM)

AT9283 is a small molecule inhibitor of kinases including aurora A and B, and JAK2. Initial clinical trials have demonstrated early signals of efficacy in patients with hematological malignancies.

Solid tumors—AT9283 has been investigated as monotherapy in patients with advanced solid tumors in two Phase I, open-label, dose-escalation trials at centers in the UK, US and Canada. The two trials confirmed AT9283 is safe and well tolerated in patients with advanced solid malignancies. Oral bioavailability of AT9283 in humans has also been demonstrated. In conjunction with Cancer Research UK ("CRUK"), we are also investigating the activity of single agent AT9283 in pediatric patients with solid tumors in a trial being conducted at multiple sites in the UK.

Hematological malignancies—AT9283 has been investigated in a US Phase I/II open-label, dose-escalation trial to assess the initial safety, tolerability and preliminary efficacy of AT9283 as monotherapy in patients with acute leukemia. AT9283 is also being investigated in a Phase II study in a chemotherapy refractory, multiple myeloma patient population sponsored by the NCIC Clinical Trials Group in Canada.

AT13148—ACG Kinase Inhibitor

AT13148 is an orally active small molecule inhibitor of PKB/Akt and p70S6 kinase, key enzymes in the PI3K/PKB/mTOR tumor cell survival pathway. More than 50 percent of all tumors have an abnormality in this pathway leading to increased Akt activity and enhanced potential for tumor cell survival. In addition, clinical trials have highlighted that activation of this survival pathway is a common resistance mechanism for some cytotoxics (for example, platinum agents) and targeted therapies (for example, BRAF and EGFr inhibitors). By targeting the pathway at two key steps, AT13148 may have the potential to be a very effective inhibitor of AKT dependent tumors. PKB inhibitors such as AT13148 have potential for use as both single agents and in combination with cytotoxics and other molecularly targeted agents in the treatment of a range of solid tumors.

Our PKB inhibitor program began in 2003 through a collaboration with The Institute of Cancer Research ("ICR") and Cancer Research Technology Limited ("CRT") and the program was later partnered with AstraZeneca in 2005. AstraZeneca started clinical trials of a clinical candidate, AZD5363, in April 2011. We retained rights to a second chemical series based on research carried out under the original agreement between Astex, ICR and CRT, and AT13148 was selected from this series. Astex retains all commercial rights for AT13148. At the same time, Astex, the ICR and CRT are eligible to receive further milestones and royalties during clinical development and commercialization of AZD5363.

In September 2008 we announced a partnership with CRUK and CRT to take AT13148 into development under the charity's Clinical Development Partnerships program. Under the terms of this agreement, CRUK's Drug Development Office has carried out further development work on the agent, some of which is done in collaboration with the ICR. CRUK plans to commence Phase I clinical trials of AT13148 in the UK during 2012.

8

Partnered Products and Programs

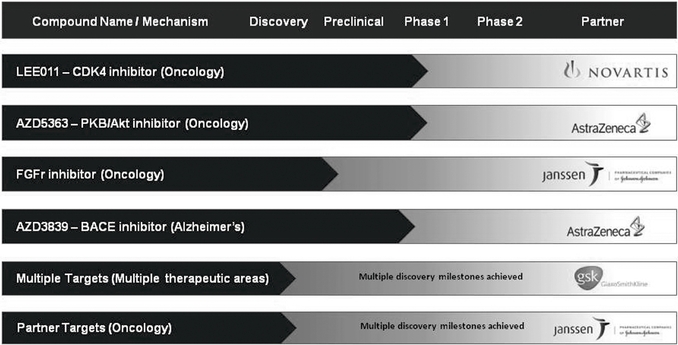

LEE011—CDK4 Inhibitor(Oncology)

LEE011, a selective inhibitor of the key cell cycle enzyme CDK4, derived from our collaboration with Novartis announced in December 2005 aimed at developing novel cancer therapies targeting the cell cycle. LEE011 entered Phase I human clinical trials in January 2011.

AZD5363—PKB/Akt Inhibitor (Oncology)

AZD5363 is an orally active, selective protein kinase B (PKB, also known as Akt) inhibitor derived from a collaborative drug discovery program with AstraZeneca, ICR, and CRT. The program began in 2003 through our collaboration with ICR and CRT, and AstraZeneca's collaboration on a drug discovery program targeting PKB/Akt began in 2005. Inhibition of the PKB/Akt pathway has potential in the treatment of a broad range of tumor types. In April 2011 AstraZeneca announced that it had commenced a Phase I study of AZD5363 in patients with advanced solid tumors.

FGFr Inhibitor (Oncology)

We have entered into a research alliance with Janssen Pharmaceutica NV, a Johnson and Johnson company ("Janssen"), focused on the research, development, and commercialization of novel drugs for the treatment of cancer. The agreement grants Janssen a worldwide exclusive license to compounds arising from our novel Fibroblast Growth Factor Receptor ("FGFr") inhibitor program, and calls for the application of Pyramid to other targets of interest to Janssen. Janssen selected an FGFr development candidate, which triggered a milestone payment earlier in 2011, prior to the acquisition of ATL. We are also eligible to receive additional future milestones during clinical development and royalties on commercialization of approved products derived from the collaboration. The FGFr inhibitor program originated from a collaboration initiated in 2005 with the Cancer Research UK Drug Discovery Group at the Newcastle Cancer Centre (NCC), Northern Institute for Cancer Research, Newcastle University, UK.

9

AZD3839—Beta-Secretase Inhibitor (Alzheimer's)

AstraZeneca has commenced a phase I study of AZD3839, a clinical candidate selected in October 2010 and derived from the collaborative program on beta-secretase—a key enzyme implicated in the progression of Alzheimer's disease. The commencement of the Phase I trial triggered a milestone payment earlier in 2011, prior to the acquisition of ATL. We are eligible to receive additional future milestones during the clinical development of AZD3839 as well as royalties on commercialization of approved products, if any.

Beta-secretase, also called BACE1 (beta-site of amyloid precursor protein cleaving enzyme) or memapsin-2, is an aspartic-acid protease important in the formation of myelin sheaths in peripheral nerve cells and in the pathogenesis of Alzheimer's disease. Inhibitors to block the action of this enzyme could prevent the buildup of beta-amyloid, which may help slow the progression of, or stop, the disease.

Multiple Targets (Multiple Therapeutic Areas)

We have entered into a collaboration agreement with GlaxoSmithKline ("GSK") to discover, develop and commercialize novel compounds directed against multiple therapeutic targets of interest to GSK. Under the collaboration, we will apply our world-leading fragment chemistry platform, Pyramid™, to multiple targets identified by GSK, with the objective of identifying and developing new candidate drugs. The targets have been selected from multiple therapeutic areas within GSK.

Partner Targets (Oncology)

As previously indicated, we have entered into a research alliance with Janssen focused on the research, development and commercialization of novel drugs for the treatment of cancer. In addition to the FGFr inhibitor previously described, the agreement also calls for the application of Pyramid to other targets of interest to Janssen. Currently, work continues on one target under the agreement.

Pyramid Platform—Fragment-Based Drug Discovery

Traditional high-throughput screening generally has not delivered on its promise of increasing the numbers and quality of new drugs that result in successful clinical trials and ultimate regulatory approvals. This lack of success is due in part to the complexity and the relatively large size of the compounds routinely being screened. We believe this problem can be addressed by an alternative approach—fragment-based drug discovery.

- •

- Starts with very small, low molecular weight drug fragments.

- •

- These fragments have the potential to keep the overall complexity and molecular weight of each drug candidate low.

- •

- These are key factors in successful drug development.

Traditional bioassays used in high-throughput screening are generally unable to detect such small drug fragments because of their low potency binding to the protein target. The Pyramid platform integrates biophysical techniques, such as X-ray crystallography, nuclear magnetic resonance spectroscopy and calorimetry, with fragment library design and a range of computational methodologies. This integration creates a proprietary approach for fragment-based drug discovery.

Due to the high sensitivity of Pyramid, fragment binding, not generally detectable using conventional screening techniques, can be routinely identified.

- •

- Pyramid affords a detailed understanding of the fragment's binding environment at an atomic level.

10

- •

- These structural insights support a very efficient chemistry optimization process in which each additional functional

group is designed to contribute to protein binding in a defined and productive manner.

- •

- Drug candidates are designed to have lower molecular weight, reduced metabolic liability, improved target selectivity and ease of chemical synthesis.

Dacogen License and Sublicense

In September 2004, we executed a license agreement granting MGI exclusive worldwide rights to the development, manufacture, commercialization and distribution of Dacogen. Under the terms of the agreement, MGI made a $40 million equity investment in us and agreed to pay up to $45 million in connection with the achievement of specific regulatory and commercialization milestones. To date, we have received $32.5 million in payments related to the achievement of these milestones.

In July 2006, MGI entered into an agreement to sublicense Dacogen to Cilag GmbH International ("Cilag"), a Johnson & Johnson company, granting exclusive development and commercialization rights in all territories outside North America. In accordance with our license agreement with MGI, we are entitled to receive 50% of certain payments MGI receives as a result of any sublicenses. We received $5 million, or 50% of the $10 million upfront payment MGI received, and, as a result of both the original agreement with MGI and this sublicense with Cilag, we may receive up to $17.5 million in future payments if they are achieved for Dacogen globally. Cilag is responsible for conducting regulatory and commercial activities related to Dacogen in all territories outside North America, while MGI retains all commercialization rights and responsibility for all activities in the United States, Canada and Mexico. MGI was acquired by Eisai Corporation of North America ("Eisai") in January 2008.

Dacogen was approved by the FDA in May 2006 for the treatment of patients with MDS. The Dacogen license to Eisai has created for us a royalty income stream on worldwide net sales starting at 20% and escalating to a maximum of 30%. Outside of the United States, Dacogen is approved for sale in 30 countries. These international territories are managed by Cilag.

Research and Development

Because of the nature of our business, we expend significant resources on research and development activities. We incurred $43.9 million in 2011, $28.4 million in 2010, and $29.7 million in 2009 in research and development expenses. A primary reason for the increase in research and development expenses during 2011 when compared to year prior periods is the inclusion of incremental operating expenses related to the acquisition of ATL effective July 20, 2011. We conduct research internally and also through collaborations with third parties, and we intend to maintain a strong commitment to research and development efforts in the future. Our major research and development projects have been focused on drug discovery, non-clinical activities, and Phase I and Phase Ib clinical trials for amuvatinib, SGI-110, AT13387, AT7519, and AT9283.

Sales and Marketing

We currently have no employees focused on commercial sales, marketing, and sales support. Our marketing efforts are handled by our Corporate Communications and Business Development groups.

11

Manufacturing

We currently outsource manufacturing of all our drug compounds to qualified United States and foreign suppliers. We expect to continue to outsource manufacturing in the near term. We believe our current suppliers will be able to efficiently manufacture our proprietary compounds in sufficient quantities and on a timely basis, maintaining product quality and compliance with applicable FDA and foreign regulations. We maintain oversight of the quality of our third-party manufacturers through ongoing audits, rigorous review, control over documented operating procedures, and thorough analytical testing by qualified, contracted laboratories. We believe that our current strategy of outsourcing manufacturing is cost-effective because we avoid the high costs for plant, equipment, and large manufacturing staffs.

The FDA and the Competent Authorities outside the United States have authority to regulate the third-party suppliers of our compounds used in clinical studies, and these regulators must approve our drug manufacturing sites and deem a manufacturer acceptable under current good manufacturing practices ("GMPs") before release of active pharmaceutical ingredients ("API") and finished dosage forms for clinical testing.

Government Regulation: New Drug Development and Approval Process

Regulation by governmental authorities in the United States and other countries is a significant factor in the manufacture and marketing of pharmaceuticals and in our ongoing research and development activities. All of our drug products will require regulatory approval by governmental agencies in the United States and other countries where our drugs will be sold prior to commercialization. In particular, human therapeutic products are subject to rigorous non-clinical testing, clinical trials, and other pre-marketing approval requirements by the FDA and regulatory authorities in other countries. In the United States, various federal, and in some cases state statutes and regulations, also govern or have an impact upon the manufacturing, safety, labeling, storage, distribution, record-keeping and marketing of such products. The lengthy process of seeking required approvals and the continuing need for compliance with applicable statutes and regulations require the expenditure of substantial resources. Regulatory approval, when and if obtained, may be limited in scope which may significantly limit the indicated uses for which a product may be marketed. Further, approved drugs, as well as their manufacturers, are subject to ongoing review and inspections which could reveal previously unknown problems with such products, which may result in restrictions on their manufacture, sale or use or in their withdrawal from the market.

The process for new drug development and approval has three major stages: discovery, non-clinical testing and clinical testing.

Drug discovery. In the initial stages of small molecule drug discovery, potential biological targets are identified, these targets are characterized, and then large numbers of potential compounds are screened for activity. This drug discovery process can take several years. Once a company defines a lead compound, the next steps are to conduct further preliminary studies on the mechanism of action, in vitro (test tube) screening against particular disease targets and some in vivo (animal) screening. If results are satisfactory, the compound progresses from discovery to non-clinical development.

Non-clinical development and testing. During the non-clinical testing stage, laboratory and animal studies are conducted to determine biological activity of the compound against the disease target and the compound is evaluated for safety. These tests can take several years to complete and must be conducted in compliance with Good Laboratory Practice ("GLP") regulations. If the compound passes these hurdles, animal toxicology studies are initiated. If the results demonstrate acceptable types and levels of toxicity, the compound emerges from non-clinical testing and moves into the clinical phase.

12

Clinical testing—The Investigational New Drug Application. To expand the development programs to a clinical setting in the United States, an IND is submitted to the FDA. IND applications include the known chemistry of the compound, how the compound is manufactured, the results of animal studies and other previous experiments, the method by which the drug is expected to work in the human body, a proposed clinical development plan and how, where and by whom the proposed new clinical studies will be conducted. Health authorities in Europe and the rest of the world require a similar clinical trial application. If the regulatory controlling authority does not object, a company may initiate human testing. All clinical trials must be conducted in accordance with globally-accepted standards of good clinical practices ("GCPs"). This means there are specific obligations to protect trial subjects and patients, monitor the study, collect the data and prepare a report of the study. Clinical trial applications and IND's must be updated with new information obtained during the course of the trials.

Clinical protocols must be approved by independent reviewers, referred to as Institutional Review Boards ("IRB") in the United States and Ethics Committees ("EC") in Europe. The IRB/EC is charged with providing an independent assessment of the appropriateness of the trial, particularly focusing on the safety of the subjects that might enroll in the study. The IRB's/EC's responsibilities continue while the study is ongoing, focusing on protecting the rights and safety of those enrolled in the study.

Companies have an obligation to provide progress reports on clinical trials at least annually to the FDA and foreign authorities. The FDA or other controlling regulatory authority may, at any time during a clinical trial, impose a "clinical hold" if it has serious safety concerns about a trial. If this occurs, the clinical trial cannot continue until the FDA or other authority is satisfied that it is appropriate to proceed.

Clinical Development Plan. Clinical trials are typically conducted in three sequential phases, but the phases may overlap.

- •

- Phase I clinical trials. After an IND becomes

effective, Phase I human clinical trials can begin. When developing drugs to treat cancer, these trials generally involve 20 to 40 heavily pre-treated cancer patients who may have a

wide variety of cancers and typically take approximately one year to complete. These trials are designed to evaluate a drug's safety profile and may include studies to assess the optimal safe dosage

range. Phase I clinical trials may evaluate how a drug is absorbed, distributed, metabolized and excreted from the body. Phase I trials may be expanded to Phase Ib trials that test the

research compound in combination with other agents to define the safety and dosing parameters of the combination.

- •

- Phase II clinical trials. Phase II clinical

trials are conducted in patients who have the specific targeted disease. The primary purpose of these trials is to demonstrate preliminary efficacy of the drug in the target patient population and to

identify an appropriate dose. These trials typically take a few years to complete. Once trial data is obtained that a specific dose and dosing schedule is creating clinical efficacy, the program will

advance to Phase III.

- •

- Phase III clinical trials. These trials are typically large, involving several hundred or even thousands of patients and can take several years to complete. Phase III trials typically compare an investigational agent against a control product or the standard of care, which could be a product or treatment already approved for use in that disease. The data generated in all trials are monitored regularly by clinical monitors as well as the participating physician. There are specific requirements for the reporting of any adverse reactions that may result from the use of the drug. Clinical monitors visit the sites regularly and transmit the data back to the company for analysis and ultimately for presentation to the FDA and other authorities.

13

Marketing application. Companies have the opportunity to interact with health authorities during the course of a drug development program. Most companies take advantage of this access to gain further insights about the kind of data that will be expected in their marketing application. After completion of the clinical trial phase, a company must compile all of the chemistry, manufacturing, non-clinical and clinical data into a marketing application. In the United States, this is called a New Drug Application ("NDA"); in the EU it is called an MAA. These applications involve a significant amount of information, often in excess of 100,000 pages, and are independently reviewed by the health authorities to which they are submitted.

The FDA, EMA, and other regulatory authorities review these submissions for overall content and completeness before accepting them for substantive review and may request additional information. Once an application is accepted for filing, each agency independently begins its in-depth review. In both the United States and Europe, there are specified timeframes for the completion of review. The review period may be extended if new data or analyses are submitted during the review.

In the United States, the FDA often refers the application to an appropriate advisory committee to consider specific aspects of the application. The FDA is not bound by the advice that may be derived from this meeting, but generally follows the advice of the advisory committee. The review process concludes with the issuance of a "complete response" letter from the FDA. If FDA evaluations of the NDA, the manufacturing facilities, and non-clinical and clinical sites are favorable, the FDA will approve the application. If the FDA's evaluation of the application or manufacturing facilities is not favorable, the FDA will reject the application in the complete response. This complete response will describe specific deficiencies that the applicant must address before the application can be approved. The applicant may submit a supplemental application or a new application that addresses stated deficiencies. The FDA will commence a new review cycle and may issue an approval letter authorizing commercialization of the drug for a specific indication. The review and approval process in Europe has substantial similarities to that outlined for the United States.

Marketing approval. Once a health authority grants marketing approval for a drug, it can then be made available in that country or region. Periodic safety reports must be submitted to health authorities as a way to monitor the safety of use of new drugs introduced to the market. Regulatory agencies around the world place great emphasis on pharmacovigilance, the process of monitoring the safety of a drug when it is released for general use, as the real world setting can be, and often is, different from the controlled environment of clinical trials.

Phase IV clinical trials and post marketing studies. In addition to studies that might have been requested by health authorities as a condition of approval, clinical trials may be conducted to generate more information about the drug after initial approval of the product, including use for additional indications, the use of new dosage forms, or new dosing regimens. These studies may generate approved label changes and publications that provide further information to patients and the medical community. More recently, targeted clinical safety studies and analyses are being required to address specific issues that are identified during the application review.

Fast Track. The FDA Modernization Act specifies that the FDA can assign a fast track designation to a new drug or biologic product that is intended for the treatment of a serious or life-threatening condition and has the potential to address unmet medical needs for such a condition. Under this program, the sponsoring company may request this designation at any time during the development of the product. The FDA must determine whether the product qualifies within 60 days of receipt of the sponsoring company's request. For a product designated as fast track, the FDA has the ability to define a potentially faster review, which includes allowing the sponsor to provide the NDA in discrete sections. This process is called a "rolling" NDA and is intended to accelerate the review and approval process.

14

Priority Review. Priority review is given where preliminary estimates indicate that a product, if approved, has the potential to provide a safe and effective therapy where no satisfactory alternative therapy exists, or a significant improvement compared to marketed products is possible. An application designated for priority review will be targeted by the FDA for review within six months. If criteria for priority review are not met, the standard FDA review period is ten months. Priority review designation does not change the scientific/medical standard for approval or the quality of evidence necessary to support approval.

Accelerated Approval. Under the FDA's accelerated approval regulations, the FDA is authorized to approve products that have been studied for their safety and effectiveness in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit to patients over existing treatments based upon either a surrogate endpoint that is reasonably likely to predict clinical benefit or on the basis of an effect on a clinical endpoint other than patient survival. In clinical trials, surrogate endpoints are alternative measurements of the symptoms of a disease or condition that are substituted for measurements of observable clinical symptoms. Accelerated approval of an application will be subject to Phase 4 or post-approval studies to validate the surrogate endpoint or confirm the effect on the clinical endpoint. Failure to validate a surrogate endpoint or confirm a clinical benefit during post-marketing studies will allow the product to be withdrawn from the market by the FDA on an expedited basis.

Approvals in the European Union. In 1993, the EU established a system for the registration of medicinal products in the EU whereby marketing authorization may be submitted at either a centralized or decentralized level. The centralized procedure is administered by the EMA and is mandatory for the approval of biotechnology products and is available, at the applicant's option, for other innovative products. The centralized procedure provides for the granting of a single marketing authorization that is valid in all EU member states. A mutual recognition procedure is available at the request of the applicant for all medicinal products that are not subject to the mandatory centralized procedure, but fall under a decentralized procedure.

Approvals outside of the United States and European Union. Applications to market a new drug product must be approved in all countries prior to marketing. The approval procedure and the time required for approval vary and may involve additional testing and cost. There can be no assurance that approvals will be granted on a timely basis or at all. In addition, reimbursement and pricing approval is required in many countries and there can be no assurance that the reimbursement decisions or resulting prices would be sufficient to generate an acceptable return on investment.

Off-Label Use. Drugs are approved for a specific use ("labeled use") that is then set forth in the drug labeling that accompanies the dispensed drug. Physicians may prescribe drugs for uses that are not approved in the product's label. Such "off-label" prescribing may be used by physicians across medical specialties. The FDA does not regulate the behavior of physicians in their choice of treatments but it does limit a manufacturer's communications on the subject of off-label use. Companies cannot market, advertise, or promote FDA approved drugs for off-label uses, nor can companies promote a drug before it is approved.

Other Government Regulations

As a United States-based company, in addition to laws and regulations enforced by the FDA, we are also subject to regulation by other agencies under the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act and other present and potential future federal, state or local laws and regulations. These agencies have specialized responsibilities to monitor the controlled use of hazardous materials such as chemicals, viruses and various radioactive compounds.

15

Market Exclusivity

The commercial success of a product, once it is approved for marketing, will depend primarily on a company's ability to create and sustain market share and exclusivity. Market exclusivity can be gained and maintained by a number of methods, including, but not limited to: patents, trade secrets, know-how, trademarks, branding and special market exclusivity provided by regulations.

Data Exclusivity and Generic Copies

There is an abbreviated regulatory review and approval process for a generic copy of an approved innovator drug product. The generic copy can be approved on the basis of an application that is usually limited to manufacturing and biologic equivalence data. The copy can be approved after expiration of relevant patents and any regulatory data exclusivity afforded the innovator by special circumstances. A new chemical entity has five years of regulatory exclusivity in the United States which precludes approval of a generic copy and in the EU, eight years of data exclusivity and two years of marketing exclusivity provides ten years before a generic copy can be placed on the market. Additional exclusivity can be afforded in the United States by approval of a product or use that has orphan drug status (seven years), that requires review of new clinical data (three years), or that is an expansion of use to a pediatric population (six months), and similar provisions have been enacted in other jurisdictions including the EU. These exclusivities are independent, and could run sequentially, effectively extending the period of regulatory exclusivity. There is no assurance that such special regulatory exclusivities are applicable for our compounds. A company seeking to market a generic might, after the lapse of regulatory data exclusivity, successfully challenge the patent protection of the marketed drug, thereby shortening its exclusive marketing period.

Orphan Drug Designation

The United States, European Union, Japan and Australia have all enacted regulations to encourage the development of drugs intended to treat rare diseases or conditions. In the United States, an orphan disease or condition is generally a disease or condition that affects fewer than 200,000 individuals. Orphan drug designation must be requested before submitting an application for marketing approval. After the granting of an orphan drug designation, the chemical identity of the therapeutic agent and its potential treatment use are disclosed publicly. Orphan drug designation does not convey any advantage in, or shorten the duration of, the regulatory review and approval process. If and when a product with orphan drug status receives marketing approval for the orphan indication, the product is entitled to marketing exclusivity, which means the regulatory authority may not approve any other applications to market the same drug for the same indication for seven years in the United States, ten years in Europe and Japan, and four years in Australia.

Patent Term Restoration

Separate from regulatory data exclusivity is the exclusivity conferred by the 1984 Drug Price Competition and Patent Restoration Act, also known as the Hatch-Waxman Act. Depending upon the timing, duration and specifics of FDA approval of the use of our drugs, some of our US patents may be eligible for limited patent term extensions. The Hatch-Waxman Act permits a patent restoration term of up to five years as compensation for patent term lost during product development and the FDA regulatory review process. The restoration period cannot exceed five years, and the total patent term including the restoration period cannot exceed fourteen years following agency approval. Similar patent term restoration periods are available in other jurisdictions including the EU, Australia and Japan. We have not requested a patent term restoration extension but may do so in the future to add patent life to patents for our drug products.

16

Patents and Proprietary Rights

Patents and other proprietary rights are very important to our business in establishing rights to the products we develop or license. The patent positions of pharmaceutical and biotechnology companies, including ours, can be uncertain and involve complex legal, scientific, and factual questions. See "Risk Factors—Our ability to protect our intellectual property rights will be critically important to the success of our business, and we may not be able to protect these rights in the United States or abroad."

We actively pursue patent protection when applicable for our proprietary products and technologies, whether they are developed in-house or acquired from third parties. We attempt to protect our intellectual property position by filing United States and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development of our business. Importantly, we are prosecuting a number of patent applications directed to various compounds in our pipeline, including those from our discovery group. Additionally, we have been granted patents and have received patent licenses relating to our proprietary formulation technology, non-oncology and non-core technologies.

There can be no assurance that the patents granted or licensed to us will afford adequate legal protection against competitors or provide significant proprietary protection or competitive advantage. The patents granted or licensed to us could be held invalid or unenforceable by a court, or infringed or circumvented by others. In addition, third parties could also obtain patents that we would need to license or circumvent. Competitors or potential competitors may have granted patents or pending applications, and may obtain additional patents and proprietary rights relating to proteins, small molecules, compounds, or processes that are competitive with the products we are developing.

In general, we obtain licenses from various parties we deem necessary or desirable for the development, manufacture, use, or sale of our products or product candidates. Some of our proprietary products are dependent upon compliance with other licenses and agreements. These licenses and agreements may require us to make royalty and other payments, to reasonably exploit the underlying technology of applicable patents, and to comply with regulatory filings. If we fail to comply with these and other terms in these licenses and agreements, we could lose the underlying rights to one or more of these potential products, which would adversely affect our product development and harm our business.

We have patents, granted and pending, licenses to patents and pending patent applications in the United States, and other countries such as Europe, Australia, Japan, Canada, China, Israel and India. Limitations on patent protection in countries outside the United States, and the differences in what constitutes patentable subject matter in these countries, may limit the protection we have on patents granted or licensed to us outside the United States. In addition, laws of foreign countries may not protect our intellectual property to the same extent as those laws in the United States. In determining whether or not to seek a patent or to license any patent in other specific foreign countries, we weigh the relevant costs and benefits, and consider, among other things, the market potential and profitability, the scope of patent protection afforded by the law of the jurisdiction and its enforceability, and the nature of terms with any potential licensees. Failure to obtain adequate patent protection for our proprietary drugs and technology would impair our ability to be commercially competitive in these markets.

Our patent portfolio has over 300 issued patents and 560 pending patent applications. Of the total patents and pending patent applications, those that relate to Dacogen, amuvatinib, SGI-110, AT13387, AT9283, AT7519, and AT13148 are described in further detail below:

- •

- Dacogen portfolio (exclusively licensed to Eisai)—40 issued patents and 37 pending patent applications, having projected expiration dates ranging from February 21, 2021 to December 8,

17

- •

- Amuvatinib—30 issued patents and three pending patent applications, having projected expiration date of

October 14, 2024(1), granted or pending in the jurisdictions of the U.S., Australia, Canada, Europe, and Japan. We have a patent filing directed to amuvatinib related inventions including new

uses, combinations and formulations which if allowed has the potential to provide additional patent protection until March 2028.

- •

- SGI-110 - 4 issued patents and 19 pending applications, having projected expiration

dates ranging from September 29, 2025 to September 25, 2026(1) granted or pending in the jurisdictions of the U.S., Australia, Canada, China, Europe, India, Israel, Japan and other

countries designated from the Patent Cooperation Treaty ("PCT") .

- •

- AT13387 - 7 issued patents and 18 pending patent applications, having compound protection until

at least April 13, 2026(1), granted or pending in the jurisdictions of the U.S., Australia, Canada, China, Europe, India, Israel, Japan and other countries designated from the PCT, and Taiwan.

We have a number of patent filings directed to AT13387 related inventions including new uses, combinations, salts, and processes which if allowed have the potential to provide additional patent

protection until October 2027.

- •

- AT9283 - 7 issued patents and 9 pending patent applications which generically claim AT9283,

having projected expiration dates ranging from July 2, 2024 to July 5, 2024(1), granted or pending in the jurisdictions of the U.S., Australia, Canada, China, Europe, India, Israel,

Japan and other countries designated from the PCT, and Taiwan, and five issued patents and fourteen pending patent applications which specifically claim AT9283, having compound protection until at

least December 30, 2025(1), granted or pending in the jurisdictions of the U.S., Australia, Canada, China, Europe, India, Israel, Japan and other countries designated from the PCT, and Taiwan.

We have a number of patent filings directed to AT9283 related inventions including new uses and combinations which if allowed have the potential to provide additional patent protection ranging from

December 2026 to October 2027.

- •

- AT7519 - 14 issued patents and 18 pending patent applications, having compound protection until

at least July 22, 2024(1), granted or pending in the jurisdictions of the U.S., Australia, Canada, China, Europe, India, Israel, Japan and other countries designated from the PCT, and Taiwan.

We have a number of patent filings directed to AT7519 related inventions including new uses, combinations, salts and processes which if allowed have the potential to provide additional patent

protection ranging from January 2026 until October 2027.

- •

- AT13148 - 13 issued patents and 21 pending patent applications which generically claim AT13148, having compound protection ranging from December 23, 2024(1) to June 22, 2005(2), granted or pending in the jurisdictions of the U.S., Australia, Canada, China, Europe, Israel, India, Japan, other designated PCT and non-PCT countries, and sixteen pending applications which specifically claim AT13148, which have the potential to provide compound protection until March 14, 2028(1), in the jurisdictions of the U.S., Australia, Canada, China, Europe, India, Israel, Japan and other designated PCT countries. We have a number of patent filings directed to AT13148 related inventions including new uses and combinations which if allowed have the potential to provide additional patent protection until June 2026.

2025, granted or pending in the jurisdictions of the U.S., Australia, Canada, China, Europe, and Japan. Royalty revenues relating to the sales of Dacogen are independent of this portfolio.

- (1)

- The dates listed above do not reflect extensions or adjustments which are available in a number of countries; for example, extensions under 35 U.S.C 156 or adjustments under 35 U.S.C 154 in the U.S. and supplementary protection certificates which are available in the European Union.

18

- (2)

- Non-PCT filings were made prior to publication of the PCT on 7 July 2005.

We also rely on know how and trade secret protection of our Pyramid platform and other proprietary technology and information. To protect know how, trade secrets and other confidential information, we pursue a policy of having our employees, consultants, collaborative partners and other advisors execute confidentiality agreements. These parties may breach these agreements, and we may not have adequate remedies for any breach. Our trade secrets may otherwise become known or be independently discovered by competitors.

Competition

The pharmaceutical industry in general and the oncology sector in particular is highly competitive and subject to significant and rapid technological change. There are many companies, both public and private, including well-known pharmaceutical companies that are engaged in the discovery and development of products for some of the applications that we are pursuing. Some of our competitors and probable competitors include ArQule, Inc., Array BioPharma, Crystal Genomics, Exelixis, Infinity Pharmaceuticals, Daiichi Sankyo Group, Vertex Pharmaceuticals, Sanofi, Bristol-Myers Squibb Company, Celgene Corporation, Eli Lilly & Co., GSK, Novartis AG, Pfizer, Synta Pharmaceuticals, and others.

Many of our competitors have substantially greater financial, research and development, and manufacturing resources than we do and may represent substantial long-term competition for us. Some of our competitors have received regulatory approval for products or are developing or testing product candidates that compete directly with our product candidates. For example, amuvatinib faces competition from a multitude of other investigational drugs which are multi-targeted tyrosine kinase inhibitors and inhibitors of the DNA repair pathway, and Dacogen faces competition from 5-aza-cytidine and other drugs in development to treat MDS. We also expect that there will be other compounds that will emerge as competition to investigational drugs progressing through our discovery pipeline.

Many of these competitors, either alone or together with their customers and partners, have significantly greater experience than we do in discovering products, undertaking non-clinical testing and clinical trials, obtaining FDA and other regulatory approvals, and manufacturing and marketing products. Accordingly, our competitors may succeed in obtaining patent protection, receiving FDA or other foreign marketing approval or commercializing products before we do. If we elect to commence commercial product sales of our product candidates, we could be at a disadvantage relative to many companies with greater marketing and manufacturing capabilities, areas in which we have limited or no experience.

Factors affecting competition in the pharmaceutical industry vary depending on the extent to which competitors are able to achieve an advantage based on superior differentiation of their products' greater institutional knowledge or depth of resources. If we are able to establish and maintain a competitive advantage based on the ability of Pyramid to discover new drug candidates more quickly and against targets not accessible by many competitors, our advantage will likely depend primarily on the ability of our Pyramid technology to make accurate predictions about the effectiveness and safety of our drug candidates as well as our ability to effectively and rapidly develop investigational drugs.

Extensive research and development efforts and rapid technological progress characterize the industry in which we compete. Although we believe that our proprietary drug discovery capabilities afford us certain advantages relative to other discovery and development companies competing in oncology, we expect competitive intensity in this pharmaceutical segment to continue and increase over time. Discoveries by others may render Pyramid and our current and potential products noncompetitive. Our competitive position also depends on our ability to attract and retain qualified

19

scientific and other personnel at all our geographic locations, develop effective proprietary products, implement development plans, obtain patent protection and secure adequate capital resources.

Employees

As of December 31, 2011, we had 149 full-time employees, consisting of 113 employees in research and development and 36 employees in general and administrative functions. We use consultants and temporary employees to complement our staffing. Our employees are not subject to any collective bargaining agreements, and we consider our relations with employees to be good.

Executive Officers

Name

|

Age | Position | |||

|---|---|---|---|---|---|

James S. J. Manuso, Ph.D., MBA. |

63 | Chief Executive Officer and Chairman of the Board | |||

Harren Jhoti, Ph.D |

49 | President and Director | |||

Mohammad Azab, M.D., M.Sc., MBA |

56 | Chief Medical Officer | |||

Martin Buckland, D.Phil., MBA |

57 | Chief Business Officer | |||

Michael Molkentin |

57 | Chief Financial Officer | |||

James S.J. Manuso, Ph.D., MBA, currently serves as chairman and chief executive officer. He served as president, chairman, and chief executive officer from January 2004 to July 2011, as chief executive officer-elect from September 2003 to December 2003 and as a director since February 2001. He is co-founder and immediate past president and chief executive officer of Galenica Pharmaceuticals, Inc. Dr. Manuso co-founded and was general partner of PrimeTech Partners, a biotechnology venture management partnership, from 1998 to 2002, and co-founder and managing general partner of The Channel Group LLC, an international life sciences corporate advisory firm. He was also president of Manuso, Alexander & Associates, Inc., management consultants and financial advisors to pharmaceutical and biotechnology companies. Dr. Manuso was a vice president and director of Health Care Planning and Development for The Equitable Companies (now Group Axa), where he also served as an acting medical director. He currently serves on the boards of Novelos Therapeutics, Inc. (NVLT:OB) and privately held KineMed, Inc. Previously, he served on the boards of Merrion Pharmaceuticals Ltd. (MERR:IEX; Dublin, Ireland), Inflazyme Pharmaceuticals, Inc., Symbiontics, Inc. (subsequently sold to BioMarin as ZyStor Therapeutics, Inc.), Quark Pharmaceuticals, Inc., Galenica Pharmaceuticals, Inc., and Supratek Pharma, Inc. Dr. Manuso earned a BA with Honors in Economics and Chemistry from New York University, a Ph.D. in Experimental Psychophysiology from the Graduate Faculty of The New School University, a Certificate in Health Systems Management from Harvard Business School and an Executive MBA from Columbia Business School. Dr. Manuso is the author of over 30 chapters, articles and books on topics including health care cost containment and biotechnology company management. He has taught and lectured at Columbia, New York University, Georgetown, Polytechnic University, Waseda University (Japan) and elsewhere. He has delivered invited addresses at meetings of the American Management Association, the American Medical Association, the Securities Industry Association, the Biotechnology Industry Organization and many other professional associations. Dr. Manuso serves on the Board of Directors of the Biotechnology Industry Organization (BIO) and its Health Section Governing Board. He previously served as vice president and a member of the Board of Trustees of the Greater San Francisco Bay Area Leukemia & Lymphoma Society.

Harren Jhoti, Ph.D., has served as president and member of the board of directors since July 2011. He co-founded Astex Therapeutics Limited in 1999 and was chief scientific officer until November 2007 when he was appointed chief executive. Dr. Jhoti was named by the Royal Society of Chemistry as "Chemistry World Entrepreneur of the Year" for 2007. He has published widely including in leading

20

journals such as Nature and Science and has also been featured in TIME magazine after being named by the World Economic Forum a Technology Pioneer in 2005. Dr. Jhoti served as a non-executive director of Iconix Inc. Before starting up Astex Therapeutics Limited in 1999, he was head of Structural Biology and Bioinformatics at GlaxoWellcome in the United Kingdom (1991-1999). Prior to Glaxo, Dr. Jhoti was a post-doctoral scientist at Oxford University. He received a BSc (Hons) in Biochemistry in 1985 and a Ph.D. in Protein Crystallography from the University of London in 1989.

Mohammad Azab, M.D., M.Sc., MBA, joined the Company as chief medical officer in July 2009. He possesses more than 20 years of experience in worldwide drug development, clinical research, and medical affairs, resulting in eight approved drugs, including six in oncology. Most recently, he was president and chief executive officer of Intradigm Corporation, a privately held Palo Alto, CA company developing siRNA cancer therapeutics. Previously, Dr. Azab served as executive vice president of research and development, and chief medical officer of Vancouver, British Columbia-based QLT Inc., where he led clinical development for now-approved drugs in oncology, gastro-intestinal, and ophthalmologic indications. He also served as oncology drug team leader at UK-based Zeneca Pharmaceuticals, now Astra Zeneca, where he held responsibilities in global clinical development and regulatory submissions. In this capacity, he managed the development of drugs for prostate, breast, colorectal, and lung cancer indications. Before Zeneca, Dr. Azab was an international medical manager in oncology at Sanofi Pharmaceuticals, now Sanofi-Aventis, in Gentilly, France. Dr. Azab received his medical degree in 1979 from Cairo University. He practiced as a medical oncologist and received post-graduate training and degrees in oncology research and statistics from the University of Paris-Sud and the University of Pierre and Marie Curie in France. He has published more than 100 medical papers and abstracts. He is an active member of the American Society of Clinical Oncology, the American Association of Cancer Research, the European Society of Medical Oncology, and the American Society of Hematology. Dr. Azab received an MBA, with Distinction, from the Richard Ivey School of Business, University of Western Ontario.

Martin Buckland, D.Phil., MBA, has served as chief business officer since in July 2011. Previously, Dr. Buckland served as chief business officer of Astex Therapeutics Limited since September 2004 and was appointed to its board of directors in July 2008. He has more than 20 years of commercial and business development experience in the pharmaceutical industry and joined Astex Therapeutics Limited from Elan Pharmaceuticals, where he previously held the position of vice president of Global Business Development. His prior experience includes a variety of business development and commercial management roles with Quintiles, Xenova and Celltech. He has a BA in Chemistry and a D.Phil. from the University of Oxford, and an MBA from the Open Business School.