Attached files

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2011 |

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-33790

SoundBite Communications, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 04-3520763 | |

| (State or Other Jurisdiction | (I.R.S. Employer | |

| of Incorporation or Organization) | Identification Number) |

| 22 Crosby Drive | ||

| Bedford, Massachusetts | 01730 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(781) 897-2500

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated Filer ¨ | Non-accelerated Filer ¨ | Smaller Reporting Company þ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of March 1, 2012, the aggregate market value of common stock (the only outstanding class of common equity of the registrant) held by non-affiliates of the registrant was $23.7 million based on a total of 9,802,886 shares of common stock held by non-affiliates and on a closing price of $2.42 on June 30, 2011 for the common stock as reported on The NASDAQ Global Market.

As of March 1, 2012, 16,464,504 shares of common stock were outstanding.

Documents Incorporated by Reference

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after December 31, 2011. Portions of such proxy statement are incorporated by reference in Items 10, 11, 12, 13 and 14 of Part III of this annual report on Form 10-K.

Table of Contents

SOUNDBITE is our registered service mark in the United States, and SOUNDBITE AGENT PORTAL, SOUNDBITE DIALOG ENGINE, SOUNDBITE ENGAGE and SOUNDBITE INSIGHT are our service marks. This annual report also includes trademarks, trade names and service marks of other entities.

i

Table of Contents

Forward-Looking Information

This annual report contains, in addition to historical information, forward-looking statements within the meaning of Section 21E of the Securities Exchange Act, including information relating to revenues generated from our services to businesses, our efforts to expand our presence in mobile marketing, our expected gross margins for the foreseeable future, our ability to remain competitive and achieve future growth, information with respect to other plans and strategies for our business, and factors that may influence our revenues for 2012 and thereafter. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate” and variations of these words and similar expressions are intended to identify our forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks and uncertainties including those described in “Item 1A. Risk Factors” and elsewhere in this annual report and that may be described from time to time in our reports filed with the SEC after the filing of this annual report. The forward-looking statements included in this annual report represent our estimates as of the date of this annual report. We specifically disclaim any obligation to update these forward-looking statements in the future, except as specifically required by law or the rules of the SEC. These forward-looking statements should not be relied upon as representing our estimates or views as of any date subsequent to the date of this annual report.

This annual report also contains market data related to the industries in which we operate. These market data include projections that are based on a number of assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result, our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow at these projected rates may have a material adverse effect on our business, results of operations, financial condition and the market price of our common stock.

1

Table of Contents

| Item 1. | Business |

Overview

We provide cloud-based, multi-channel services that enable businesses to design, execute and measure customer communication campaigns for a variety of marketing, customer care, payment and collection processes. Clients use the SoundBite Engage and SoundBite Insight platforms to communicate proactively with their customers through automated voice messaging, predictive dialing, emails, text messaging and web communications that are relevant, timely, personalized and engaging.

Our services are provided using a multi-tenant, cloud-based architecture that enables us to serve all of our clients cost-effectively. “Cloud-based” refers to the delivery of technology services through the Internet, which includes delivery of software as a service or SaaS. Because our services are cloud-based, businesses using our services do not need to invest in or maintain new hardware or to hire and manage additional dedicated information technology staff. In addition, we are able to implement new features on our platforms that become part of our services automatically and can benefit all clients immediately. Our secure platforms are designed to serve increasing numbers of clients and growing demand from existing clients, enabling the platforms to scale reliably and cost-effectively.

We serve two global markets: hosted contact centers and mobile marketing. Our hosted contact center services are used primarily by companies in the accounts receivable management (or collections), energy and utilities, financial services, retail, and telecommunications and media industries. Our mobile marketing client base consists principally of companies in the consumer package goods, retail, and telecommunications and media industries.

In 2011 our services were used by more than 400 businesses located in the United States and Europe, including approximately 25 Global 500 and 50 Fortune 500 companies. These businesses included 7 of the 10 largest global issuing banks, 5 of the 10 largest U.S. telecommunications and media providers, 5 of the 10 largest U.S. retailers, 12 of the 20 largest U.S. utility providers, and approximately 60 accounts receivable management agencies. We use our direct sales channel principally to target large business-to-consumer companies, and we leverage our partnership channel to offer our services more broadly within our target markets, to enter new vertical markets, to augment our international expansion and to sell to smaller businesses cost effectively.

We were founded in Delaware in April 2000. Our principal executive offices are located at 22 Crosby Drive, Bedford, Massachusetts 01730, and our telephone number is +1 781 897 2500. Our website address is www.soundbite.com. We are not, however, including the information contained on our website, or information that may be accessed through links on our website, as part of, or incorporating it by reference into, this annual report.

Industry Background and Trends

Improving customer communications is a key strategy by which businesses can increase revenue, drive market share and control operational costs. Businesses operate contact centers to serve as central points from which they can manage all customer contacts. A customer contact center typically includes one or more online call centers and also may include other types of customer contact such as email, postal mail, website inquiries and social media.

Traditionally, businesses have focused their customer contact centers on responding quickly and effectively to consumer inquiries and requests. A business cannot, however, afford to simply wait to be contacted by consumers. In recent years, increased competition, heightened expectations for — and costs of — customer service, dynamic regulatory environments, and a weakened economy have been helping to drive the implementation

2

Table of Contents

of “proactive” communication solutions that can help businesses increase customer loyalty and satisfaction and generate more revenue at a lower cost.

Development of Mobile Marketing

At the same time as they are seeking to address changing market dynamics, businesses have been trying to respond to — and take advantage of — continuing technological developments, most notably the emergence of mobile phones, smartphones, tablet computers and other mobile devices as the primary communications device of consumers worldwide. In an October 2011 publication, the International Telecommunication Union estimated that there would be close to 6 billion mobile cellular subscriptions around the world as of December 31, 2011. Consumers increasingly rely on their mobile devices and mobile device applications and no longer consider the home phone, if it exists, as their primary communications devices.

Mobile devices provide access to multiple communications channels, and consumers increasingly access and exchange information over a variety of communications channels, including email, text messaging, web, instant messaging, social media and voice. Moreover, as consumers have gained experience with the multiple communications channels offered by their mobile devices, they increasingly are developing and expressing preferences for the types of communications they wish to receive and the channels over which those communications are to be received.

By communicating with consumers through different channels and honoring customer communications preferences, businesses can provide relevant and timely information to consumers effectively and efficiently and can achieve higher response rates, stronger customer relationships and improved customer experiences — all of which can result in increased revenue and profitability.

In response to the trend across all demographics to utilize their mobile device as their primary communications device, businesses have increasingly sought to leverage the mobile medium as a means of communication to consumers. ABI Research estimated in the second quarter of 2011 that U.S. mobile marketing and advertising revenues totaled $1.6 billion in 2011 and will grow to $4.5 billion in 2015, representing a compound annual growth rate of 29%. Gartner projected in April 2011 that worldwide mobile advertising revenues will grow from $3.3 billion in 2011 to $20.6 billion in 2015, representing a compound annual growth rate of 58%.

Emergence of Hosted Contact Centers

Over the past several years, businesses have been able to begin communicating with customers proactively due not only to the proliferation of mobile devices but also to the emergence and enhancement of technologies that enable businesses to initiate outbound messages to consumers rather than waiting to respond to inbound consumer inquiries. Outbound messaging initially became feasible through the introduction of on-premise predictive dialers. On-premise predictive dialers are, however, costly to implement and maintain.

More recently, many contact center vendors have begun to offer hosted services that are alternatives to on-premise solutions and are delivered via the cloud in order to improve the time to deployment, reduce the maintenance burden and expedite the delivery of new features that can integrate seamlessly into an existing technology infrastructure. Hosted contact center solutions can support the automated placement of outbound consumer contacts using automated voice messaging, predictive dialing, email and text messaging. Based on third-party reports, we estimate that revenues from hosted outbound customer contact applications totaled $220 million in 2011 and will grow to $425 million in 2015, representing a compound annual growth rate of 18%.

Requirements of Proactive Communication

In order to establish and build trusted, long-term, profitable relationships with customers, businesses increasingly require a comprehensive solution that will enable them to communicate proactively throughout the

3

Table of Contents

customer life-cycle via marketing, customer care, payments and collections applications. With a proactive communication, a business can send a timely message to a consumer’s preferred access device using one or more communications channels. The consumer can respond immediately over his or her preferred communications channel. By proactively communicating timely and relevant information to their customers, businesses can increase customer satisfaction and loyalty to drive revenue and reduce inbound communications, resulting in operational cost savings.

A proactive communication solution must enable businesses to manage all digital communications through key channels such as voice, text, email and the web, and must be designed with the ability to add support for other channels as they emerge and gain broad-based market acceptance. The solution must offer businesses the flexibility to use the most appropriate channel based on a customer’s communication preferences, the channel’s efficacy, the message content and other business goals. The solution should provide a business with a unified view of its customers’ communications in order to facilitate consistent and personalized communications at every stage in the customer lifecycle. It should have the ability to capture and manage an increasing variety of both customer and client preferences related to the communication outreach. In addition, the solution should increase contact center efficiencies not only by further increasing the productivity of contact center agents, but also by facilitating “agent-less” communications where appropriate.

In order to support coherent, preference-based multi-channel communications, a communications solution should be delivered using a multi-tenant, cloud-based model. This model enables proactive communications to be delivered and deployed to a business quickly and cost-effectively. Moreover, this model can provide the flexible, robust architecture needed to respond to — and take advantage of — current and future technological advances and customer communication trends.

Our Solution

We provide cloud-based, multi-channel services that enable businesses to design, execute and measure customer communication campaigns for a variety of marketing, customer care, payment and collection processes. Clients use the SoundBite Engage and SoundBite Insight platforms to communicate proactively with their customers through automated voice messaging, predictive dialing, text, email messages and web communications that are relevant, timely, personalized and engaging.

Our multi-channel communications platform, SoundBite Engage, enables clients to design, execute and measure customer communications across the customer lifecycle. Our preference management platform, SoundBite Insight, helps businesses design relevant and targeted customer communications strategies. SoundBite Insight centralizes the ongoing tracking and management of consumer profile data, stated preferences and observed customer behavior. Our client management team assists clients in selecting service features and adopting best practices that enable them to use our multi-channel cloud-based platforms effectively. We offer performance analytical capabilities to assist clients in improving the design and execution of their campaigns. Our secure platforms are designed to scale reliably and cost-effectively.

Key benefits of our services for clients include:

Acquisition and Segmentation of Customers. Businesses can use our services to support a variety of marketing programs targeted at converting consumers to customers. Market realities and regulatory restrictions can make it difficult for businesses to communicate with consumers who are not customers. Our services support the efforts of a business to obtain “opt-in” consents that will allow the business to communicate with a potential customer and make that consumer a customer. Once a customer is acquired, the business can use our services to identify segments of customers that the business wishes to target with a particular program.

Unified Communications Across Multiple Channels. Using our services, a business can interact with its customers by automated voice messaging, predictive dialing, text, web or email, or by blending a combi-

4

Table of Contents

nation of those channels. As a result, the business can select a channel or channels based on a combination of a customer’s channel preferences, the channel’s efficacy, the message content and other business goals.

Lower Total Cost of Ownership. Our services do not require a business to invest in or maintain new hardware, or to hire and manage dedicated information technology staff. Because new features are implemented on our cloud-based platforms, those features become part of our services automatically and benefit clients immediately.

Automation of Communications. Businesses can reduce their contact center expense by using our services to fully automate a variety of customer communications, ranging from simple one-way notifications to more sophisticated customer interactions such as surveys or payments.

Improvement of Contact Center Performance. Our services automate many of the routine tasks otherwise handled by a contact center agent, thus reducing operating costs and freeing agents to focus on more significant tasks. By intelligently routing messages to the appropriate agent, our services provide those agents with access to customer data and alternative channels to interact with customers, thereby increasing agent productivity.

Burstable Capacity. Our services can initiate more than one million outbound messages each hour. This capacity enables clients to “burst” extremely large campaigns during short time periods, when customers are most likely to be responsive.

Rapid Initiation and Modification of Campaigns. A new client can initiate its first campaign using our services in a period as short as a week, using only its existing contact center infrastructure and Internet connections. New clients avoid the delay associated with installing the hardware and software required for an on-premise solution. Using the performance analytics of our services, clients can improve the design and execution of existing campaign strategies immediately by self service or quickly through our professional services organization.

Our Strategy

Our objective is to become the leading global provider of multi-channel customer communications solutions. To achieve this goal, we are pursuing the following:

Target Mobile Marketing Opportunities. Our platforms offer a wide array of features that facilitate interactive communications between clients and their customers, including automated and agent-assisted customer dialog over multiple delivery channels. In June 2011 we acquired key assets of SmartReply, a provider of text messaging and mobile communications solutions, and in February 2012 we acquired 2ergos Americas, a provider of mobile business and marketing solutions. In February 2012 we also added comprehensive support for the web channel to SoundBite Engage, and we will continue to enhance our services to provide additional interactive mobile messaging capability.

Expand Internationally. In recent years, we have enhanced our services to enable the delivery of multi-channel proactive customer communications in countries outside of North America. We now offer support for 40 countries. We will continue to invest in marketing and selling our services internationally, both directly and through partners, in order to broaden and deepen relationships we have established as well as to expand our penetration into new clients and resellers.

Extend Technology Leadership. In 2011 we released multiple updates to the SoundBite Engage platform that improved internationalization support, introduced support for the web channel, and enhanced our voice channel offering by adding support for preview and progressive dialing, session transfer and call recording. In 2012 we intend to broaden our hosted customer contact offerings by con-

5

Table of Contents

tinuing to enhance the SoundBite Engage and SoundBite Insight platforms through additional capabilities for the voice channel, extended support for self-service for the text channel, and advanced support for the web channel. We also intend to broaden our service offerings based upon core technology obtained through our acquisition of 2ergo Americas in February 2012.

Extend Indirect Channel. In 2009 we made a strategic decision to begin partnering with resellers, solution providers, original equipment manufacturers or OEMs, and international distributors in order to broaden our distribution reach. Our Business Partner Program enables us to offer our services more broadly within our target markets, to enter new vertical markets, to augment our international expansion, and to sell cost effectively to smaller businesses. We will seek to increase our revenues from the indirect channel by both leveraging existing relationships and selectively recruiting additional new partners.

Selectively Seek Strategic Acquisitions. To complement and accelerate our internal growth, we will selectively pursue acquisitions of businesses, technologies and products that will provide access to new markets or clients, expand the feature set of our services, or otherwise complement our existing operations. We have accelerated our growth in mobile marketing through our acquisition of key assets of SmartReply in June 2011 and our acquisition of 2ergo Americas in February 2012.

Our Services

We provide cloud-based, multi-channel services that enable businesses to design, execute and measure customer communication campaigns for a variety of marketing, customer care, payment and collection processes. Clients use the SoundBite Engage and SoundBite Insight platforms to communicate with their customers through automated voice messaging, predictive dialing, text, email messages and web communications that are relevant, timely, personalized and engaging.

Our multi-channel communications platform, SoundBite Engage, enables clients to design, execute and measure customer communications across the customer lifecycle. Our preference management platform, SoundBite Insight helps businesses design relevant and targeted customer communications strategies. SoundBite Insight centralizes the ongoing tracking and management of consumer profile data, stated preferences and observed customer behaviors.

Our services are provided using a multi-tenant architecture, which enables us to serve our clients cost-effectively. To use our services, a business does not need to invest in or maintain new hardware or to hire and manage additional dedicated information technology staff. In addition, we are able to implement new features on our platforms that become part of our services automatically and can benefit all clients immediately. As a result, a new client can begin using our services within a week and take advantage of new features as they become available.

Our secure platforms are designed to serve increasing numbers of clients and growing demand from existing clients, enabling the platforms to scale reliably and cost-effectively. We provide our services under a combination of usage- and subscription-based models.

SoundBite Insight

Clients use the SoundBite Insight platform to design relevant and targeted proactive customer communications that can improve business results. SoundBite Insight helps businesses create a comprehensive view of their customer communications by centralizing the ongoing tracking and management of consumer profile data, stated preferences and observed consumer behaviors.

Designed to enable quick implementation and results, the cloud-based SoundBite Insight platform has the flexibility and scalability to be deployed on a departmental or enterprise-wide basis. It supports the growing needs of businesses seeking to manage and honor changing customer communications preferences.

6

Table of Contents

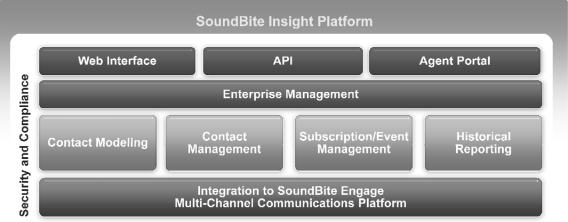

The following diagram illustrates the key elements of the SoundBite Insight platform:

Client Access Layer. Clients access SoundBite Insight using one of the following secure interfaces:

Client Web Interface enables a client, using a web browser, to prime contact lists, manage individual contacts and generate near real-time reports. All of the SoundBite Insight features can be accessed through this secure, easy-to-use interface, which makes the service available to clients on a self-service basis.

Web Services API allows a client’s systems to interact directly with SoundBite Insight and permits the SoundBite Engage platform to interrogate SoundBite Insight for data related to the current interaction. Web Services API is an application programming interface that provides clients with the ability to exchange information directly with any customer relationship management system.

Agent Portal is a web-based user interface that enables an agent to access and manage limited data pertaining to an individual customer. The agent can use this interface to manage each customer’s attributes, such as opt-ins.

Enterprise Management. This component provides a client with the ability to manage access and identity across the SoundBite Insight platform.

Core Components. The SoundBite Insight platform includes the following core components, each of which can be accessed via the web or by integrating a client’s customer management system with the platform:

Contact Modeling manages the importing and updating of a client’s model of its customer. This component enables a client to define the particular attributes of each customer that need to be captured or managed. These attributes consist of the following:

| Ÿ | Consumer Profile Data are common across all clients and include, for example, consumer identification, last name, first name and date of birth, together with a set of client-specific attributes. These data may be preloaded and reflect the universe of customers with a relationship to the client. |

| Ÿ | Stated Preferences are provided by customers and typically are collected over time. For example, a customer’s opt-in consent on a text channel is an attribute that, once captured, enables the client to target the customer for an outbound campaign. As a business builds its opt-in consent databases, SoundBite Insight can capture and record the customer consents in order to enable the business to comply with Federal Trade Commission and other applicable regulations. |

7

Table of Contents

| Ÿ | Observed Consumer Behaviors are those attributes that are inferred from examining consumer behavior. For example, if a consumer never responds to an outbound email but regularly responds to text, we could record this fact as a channel affinity attribute. |

Contact Management enables a client to review and update the attributes of a particular customer.

Subscription and Event Management defines the set of subscriptions and events that a consumer can subscribe to receive. For example, a client may define an event that reflects a late departure of an airline flight and a consumer could elect to subscribe to text notifications of the event on the consumer’s mobile device.

Historical Reporting provides a client with reports in a variety of formats that can be exported at any time. These reports typically include details regarding consumer profile data, stated preferences and observed consumer behaviors. These types of reports often are used to review the performance of other marketing campaigns in order to provide insight into the number of opt-ins consents received with respect to a particular campaign.

SoundBite Engage

Clients use the SoundBite Engage platform to create and manage integrated, multi-channel customer communication campaigns for a variety of marketing, customer care, payments and collections processes. A campaign is a series of communications with a targeted group of customers, typically for a defined period of time. The targeted group is identified by a contact list containing customer-specific attributes, including first and last names, telephone numbers, email addresses and other information specific to the campaign. A campaign often encompasses multiple passes through the contact list. Campaigns can be conducted using contact center agents or on an agent-less basis. Sample campaigns include:

| Marketing |

Customer Care |

Payments | Collections | |||

| • Loyalty programs |

• Delivery notifications | • Payment reminders | • Contingent collections | |||

| • Promotions |

• Program enrollment | • Self-service payments | • Early-stage collections | |||

| • Service activations |

• Surveys | • Expedited payments | • Settlement offers |

The following diagram illustrates the key elements of the SoundBite Engage platform:

Client Access Layer. Clients access SoundBite Engage using one of the following secure interfaces:

Client Web Interface enables a client, using a web browser, to upload contact lists, initiate and manage campaigns, and generate near real-time customized reports. All of the platform features can be accessed

8

Table of Contents

through this secure, easy-to-use interface, which makes the SoundBite Engage service available to clients on a self-service basis.

FTP Automation facilitates a client’s uploading of contact lists and other information by providing the ability for a client to transfer at a pre-determined time a file using a variety of transfer protocols. Protocols supported include FTP, FTPS and SFTP.

Web Services API allows a client’s systems to interact directly with the SoundBite Engage platform. Web Services API is an application programming interface that provides clients with the ability to load information directly from any customer information management system. This approach also enables additional applications, such as fraud notifications and enhanced computer telephony integrations, that rely on real-time data exchange.

Agent Portal is a web-based user interface that enables automated and agent-assisted interactive customer communications over the voice and text messaging channels. Clients use Agent Portal in concert with predictive dialing or to support messages that, because of message content or business rules, are best handled by a customer support agent. Agent Portal allows agents to log in and to interact with customers in near real-time and to transfer a customer to another agent. SoundBite Engage can seamlessly transition between fully automated and agent-assisted dialogs, and supervisors can monitor agent activity as well as overall campaign status.

CTI Connect bridges a client’s contact center infrastructure to the SoundBite Engage platform, enabling a high-quality customer service experience while reducing operational costs. Through computer telephony integration, or CTI functionality, contact centers can match caller needs to agent resources and easily integrate functions such as screen pops, intelligent call routing and dynamic call pacing.

Enterprise Management. This component provides a client with the ability to manage, using a single control panel, all campaigns in any of the client’s accounts. Accounts and privileges can be created and customized at the enterprise level for greater security. The Enterprise Management component allows a client to share interaction scripts and suppression lists across the client’s entire enterprise and reports covering all of the client’s accounts can be provided on an enterprise-wide basis.

Core Components. The SoundBite Engage platform includes the following core components, each of which can be accessed via the web or by integrating a client’s customer management system with the platform:

Contact and Preference Management manages the importing and accessing of a client’s contact list. This component also manages contact suppression, which removes one or more contacts from a campaign either before the campaign begins or while the campaign is progressing. For example, contacts may be suppressed due to a customer who previously expressed a preference not to receive the proposed type of communication or a recipient who takes the requested action before all of the passes within a campaign are completed.

Campaign Strategy Manager defines the frequency and nature of the customer interactions to be employed to achieve the goals of a campaign. This component includes the following features:

| Ÿ | Flexible Scripting Languages control client interactions and enable those interactions to be highly personalized and dynamic in nature. |

| Ÿ | Multi-Pass Campaigns effects multiple overlapping passes through a contact list in accordance with client-defined parameters, in order to maximize contact list penetration and response rates. These passes may span different channels and occur over multiple days, and they can define the escalation conditions in which our services move to a different phone number or email address within a campaign. |

9

Table of Contents

| Ÿ | Contact Ordering prioritizes contacts based on client-specified criteria or on the likelihood that customers will be reached at a particular time. |

Campaign and Contact Center Management supports the initiation and management of campaigns. For those campaigns that require agents, this component manages the routing of qualified customers to agents and seeks to maximize the use of agents’ time while minimizing customers’ wait time. This component includes the following features:

| Ÿ | Pacing provides a client with the ability to select a model to control the rate of outgoing messages. The model selected may be either fixed-rate, time-based (rate determined by a time window) or agent-based. For Pacing involving contact center agents, adjustments are made based on factors such as agent availability, current abandon rate, average talk time and average hold time. |

| Ÿ | Call Forecasting provides continuously refreshed data concerning current and anticipated future contact attempts. Contact center managers use the data for contact center agent resource planning. |

| Ÿ | Contact Center Reports, which are available in near real-time, provide details on customer interactions with contact centers and furnish performance metrics related to contact center performance. |

Analytics and Reporting produces reports in a variety of formats that can be exported at any time during or after a campaign. We offer flexible report formatting, scheduling and delivery options. Reports typically contain details regarding contact attempts and outcomes. Reports are available for a specific campaign or for all of the campaigns of a department, group or other client account. This component also includes performance analytics capabilities to assist clients in improving the design and execution of their campaigns. For example, a client might determine, based on our analysis of campaign data, that the client’s next campaign should be executed at a different time of day or should target wireless customers via text rather than voice.

Dialog Engine tests and manages any number of contact scripts to be used to determine the content presented during customer interactions. In a telephone call, for example, a script specifies the sequence of audio prompts that are played and the step or action to result when a customer takes a particular action, such as pressing a button on the telephone or saying “yes.” An individual customer interaction is supported by a flexible scripting language and personalized messaging. Scripts can be modified and repurposed over time. Our personalized voice messages use professional voice talent recordings or text-to-speech technology to insert customer-specific information into an interaction. In a typical text interaction, a script may specify the action to be taken based upon a customer’s response to an initial outbound text message, such as requiring some form of authentication. This component supports the following activities:

| Ÿ | Automated Right-Party Verification enables the identity of a customer to be verified without contact center agent involvement by, for example, having a recipient enter a billing zip code. |

| Ÿ | Direct Connect to Contact Center allows a voice recipient to connect directly to a contact center in order to speak with an agent. |

Delivery Channels. The SoundBite Engage platform supports automated voice messaging, inbound voice, predictive dialing, outbound and inbound text (both standard and Free-to-End User or FTEU), web and outbound email communications. The predictive dialing channel supports both predictive and preview dialing. An outbound voice or text channel can be used for either a contact center agent-assisted or an agent-less campaign. An inbound channel typically is used in support of outbound campaigns or as part of an inbound-only agent-less campaign. These delivery channels can be used individually or combined on the SoundBite Engage platform.

Security and Compliance. Our SoundBite Insight and SoundBite Engage platforms include a number of security features designed to keep customer data safe and confidential, such as encryption of sensitive data, secure

10

Table of Contents

transmission, audit trails, non-shared accounts, need-to-know access policies and formal incident response. Clients can elect to use supplemental security features such as email and FTP address restrictions for report deliveries and encryption of reports. Compliance management provides a client with the ability to define a set of rules to control when a customer is contacted based on the customer’s location, which is determined either by reference to the phone number being contacted or by reference to the address of the customer. In September 2011, we renewed our compliance status as a Payment Card Industry Data Security Standard, or PCI/DSS, compliant Level 1 Service Provider, which enables us to work closely and exchange extensive data with banks and credit card companies. We have registered with the U.S. Department of Commerce and incorporate the European Union Safe Harbor Principles relating to the protection of personal data. In addition, we have instituted periodic internal and third-party reviews of our security structure, including an annual voluntary external Type II audit of our information technology-related control activities for our platforms under the Statement on Auditing Standards for Attestation Engagements No. 7016, also referred to as Service Organization Control No. 1, Reports on the Processing of Transactions by Service Organizations.

Our Client Management Services

Our client management organization helps clients select service features and adopt best practices that will enable the clients to use our multi-channel services effectively. This organization provides varying levels of support, such as managing entire campaigns, providing best practice recommendations and supporting self-service clients. It offers a range of services that includes script development, campaign strategy, professional voice talent recording, custom reporting and detailed analysis of campaign results. By hiring former employees of SmartReply and retaining employees of 2ergo Americas, we have augmented our client management services in mobile marketing to include strategic services that enable our clients to grow their mobile marketing databases and then leverage those databases with investment in marketing programs that can provide high returns on investment. At March 1, 2012, our client management organization had 45 employees.

Our client management organization consists of three principal teams:

Enterprise Program Directors help key clients fully understand their customer communications needs and then assist those clients in designing solutions to meet defined goals. This team works with sales personnel to help design successful program strategies and ensure effective execution. The team also works directly with prospective and existing clients to determine the most effective use of our platforms in their businesses. Demonstrations of our platforms are used to highlight features and functionality that are available in current or will be available in future releases.

Professional Services members provide implementation services and project management, including detailed requirements gathering, test, design and setup script development, voice talent recording, and all aspects of file interchange. This team builds and maintains a library of best practices based upon experience gained in helping design and optimize campaigns.

Training, Documentation and General Help Desk members provide clients with training both initially and on a continuing basis, in order to assist the clients in using our services more effectively and efficiently. Training modules include self-paced tutorials, on-line job aids and live instructor led classes. Our help desk is available around-the-clock to provide immediate support to clients.

Business Segments and Geographic Information

We manage our operations on a consolidated, single operating segment basis for purposes of assessing performance and making operating decisions. Accordingly, we have only one reporting segment. Businesses in the United States accounted for more than 90% of our revenues in 2011 and substantially all of our revenues in each of 2010 and 2009.

11

Table of Contents

Clients

We target companies in industries that are characterized by the need for regular interactions with large consumer bases throughout all of the phases of the customer lifecycle. Our Hosted Contact Center services are used primarily by companies in the accounts receivable management (or collections), energy and utilities, financial services, retail, and telecommunications and media industries. Our Mobile Marketing client base consists principally of companies in the consumer package goods, retail, and telecommunications and media industries.

In 2011 our services were used by more than 400 businesses located in the United States and Europe, including approximately 25 Global 500 and 50 Fortune 500 companies. Our clients include approximately 60 accounts receivable management agencies. Our services are used by a number of the largest business-to-consumer companies (measured by revenue) in our targeted industries, including:

| Ÿ | 7 of the 10 largest global issuing banks; |

| Ÿ | 5 of the 10 largest U.S. retailers; |

| Ÿ | 5 of the 10 largest U.S. telecommunications and media providers; and |

| Ÿ | 12 of the 20 largest U.S. utility providers. |

We use our direct sales channel principally to target large business-to-consumer companies, and we leverage our partnership channel to offer our services more broadly within our target markets, to enter new vertical markets, to augment our international expansion and to sell to smaller businesses cost effectively.

We provide our services under a combination of usage- and subscription-based models. Our pricing agreements with the significant majority of our clients do not require minimum levels of usage or payments.

T-Mobile USA, Inc., a provider of mobile telephone services, and NCO Group, a provider of business process outsourcing services, each accounted for more than ten percent of our revenues in each of 2011, 2010 and 2009. Neither T-Mobile USA, Inc. nor NCO Group accounted for twenty percent or more of our revenues in any of those years.

Sales and Marketing

We offer our services principally through our industry-aligned direct sales force. Sales leads are generated through cold calling, client and other referrals, and a variety of marketing programs. Once a lead is qualified, the sales process typically involves a web-based or in-person presentation and demonstration, together with pre-sales support from our client management organization. These presentations focus on explaining the benefits of our service offerings, including the speed with which the services can be deployed and demonstrating the potential return on investment from the use of our services. We encourage prospective clients to engage in a pilot campaign to evaluate the efficacy of our services. As of March 1, 2012, our direct sales force consisted of 24 employees located in the United States and the United Kingdom.

In order to broaden our distribution reach, we also offer our services through an indirect channel comprised of resellers, solution providers, OEMs and international distributors. Using our Web Services API, OEMs can integrate their applications into the SoundBite Engage platform. Since we launched our Business Partner Program in January 2009, our indirect channel has enabled us to offer our services more broadly within our target markets, enter new vertical markets, augment our international expansion and sell to smaller businesses cost effectively. During 2011, we continued to successfully transition to certain partners a number of smaller clients that were better suited working with a channel partner and added a number of resellers both in the U.S. and internationally.

12

Table of Contents

Our marketing communications and programs strategy has been designed to increase awareness of our services, generate qualified sales leads and expand relationships with existing clients. We reinforce our brand identity through our website and public relations, which are intended to build market awareness of our company. We host webinars, sponsor white papers, build relationships with leading analysts, and participate in industry events and associations. We distribute communications to prospects and to our clients through social media networks such as Twitter and Facebook. At March 1, 2012, our marketing group had 7 employees.

Our sales and marketing expenses totaled $14.1 million in 2011, $14.2 million in 2010 and $14.8 million in 2009.

Technology, Development and Operations

Technology

We launched our first multi-tenant, cloud-based service in 2000. Our services are provided through a secure, scalable platform written primarily in Java using the Java 2 Enterprise Edition, or J2EE, development framework. We use a combination of proprietary and commercially available software, including Apache web servers, Oracle WebLogic and JBoss application servers, Nuance text-to-speech and automated speech recognition software, and Oracle and MySQL databases. The software runs primarily on Linux servers.

Our services manage clients as separate tenants within our platforms. As a result, we amortize the cost of delivering our services across our entire client base. In addition, because we do not have to manage thousands of distinct applications with their own business logic and database schemas, we believe that we can scale our solution faster than on-premise solutions.

Our services enable clients to import and access data independent of format and to customize the script interaction and reporting output of their campaigns. The web user interface of our platforms can be customized for a client that wishes to have a specific “look and feel” across its enterprise.

Research and Development

Our research and development organization is responsible for developing new features and other new offerings for our platforms. The research and development organization also is responsible for performing platform functionality and load testing, as well as quality assurance activities. The organization currently is working on a number of enhancements, including work related to further enhancement of the SoundBite Engage and SoundBite Insight platforms through additional capabilities for the voice channel, extended support for self-service for the text channel, and advanced support for the web channel. In addition the organization is continuing to enhance the scalability and reliability of our core platforms. At March 1, 2012, our research and development organization had 38 employees.

Our research and development expenses totaled $6.1 million in 2011, $5.9 million in 2010 and $5.6 million in 2009.

Operations

We serve our clients from five third-party hosting facilities. One facility is located in Ashburn, Virginia, and is leased under an agreement that expires in March 2012. Another facility is located in Somerville, Massachusetts, and is leased under an agreement that expires in May 2012. Our agreements for these two facilities automatically renew for one-month periods under current terms unless written notification is made by either party 90 days prior to renewal. Our third hosting facility is located in Slough, United Kingdom and leased under an agreement that automatically renews for twelve-month periods unless written notification is made by either party three months prior to the expiration date. Our fourth facility is located in Las Vegas, Nevada and is leased under

13

Table of Contents

an agreement that automatically renews for monthly periods unless written notification is made 30 days prior to the expiration date. Our fifth facility, which also is located in Ashburn, Virginia, is leased by 2ergo Americas under an agreement that expires in 2014.

Facilities in the United States and United Kingdom have multiple Tier 1 interconnects to the Internet and are connected by a SONET ring. All of the hosting facilities provide around-the-clock security personnel, video surveillance and biometric access screening, and are serviced by uninterrupted power supplies, which are backed up by diesel-electrical generators for extended power loss. Each facility employs fire detection apparatus as well as dry-pipe pre-action fire suppression systems. We maintain insurance policies covering substantially all of the assets deployed at our hosting facilities. For information regarding the facility locations, operators and agreement terms, see “Item 2. Properties.”

We have multiple telecommunication carriers for voice termination, including Global Crossing, Level 3, Qwest and Equinix. We have selected our mix of telecommunication carriers to limit service interruptions, even in the event of a localized loss of a major provider.

We own all the hardware deployed in support of our platforms, except that we lease certain equipment at the third-party hosting facility used by 2ergo Americas. We continuously monitor the performance and availability of our services. We designed our service infrastructure using load-balanced service pools, redundant interconnected network switches and firewalls, clustered application servers and fault-tolerant storage devices. Production databases are backed up on a daily basis to ensure transactional integrity and restoration capability.

We have deployed a security infrastructure that includes internal and perimeter firewalls, network intrusion detection, and host intrusion detection systems. We maintain on-site as well as off-site third party log-aggregation services for audits and forensics. All inter-site connectivity is over a private wide area network. We perform at least three internal vulnerability scans of our production equipment every week. See “— Our Services — Security and Compliance” above.

We have service level agreements or arrangements with a small number of clients under which we warrant certain levels of system reliability and performance. If we fail to meet those levels, those clients are entitled to either receive credits or terminate their agreements with us. We did not provide any material credits in 2011, 2010 or 2009 pursuant to any service level provisions.

At March 1, 2012, our operations organization had 10 employees.

Competition

The market for our service offerings is intensely competitive, changing rapidly and fragmented. The following summarizes the principal products and services that compete with our hosted contact center and mobile marketing services.

On-Premise Predictive Dialers

Our voice service competes with on-premise predictive dialers from established vendors such as Aspect and Avaya as well as a number of smaller vendors. Our voice service competes with on-premise predictive dialers on the basis of both available features and delivery model, including:

| Ÿ | breadth of features; |

| Ÿ | speed of deployment; |

| Ÿ | capital investment required; |

14

Table of Contents

| Ÿ | pricing model for customers; and |

| Ÿ | capacity, including burstability. |

A number of predictive dialer vendors offer forms of hosted solutions, which we believe are typically services in which predictive dialers are hosted by first-generation application service providers, or ASPs, rather than on a multi-tenant basis. We believe these ASP-hosted services are deployed on individual servers and application infrastructures, using dedicated predictive dialers. We compete with ASP-hosted predictive dialer services on the same basis as on-premise predictive dialers, except that deployment speed and required capital investment are less significant in differentiating our services from these ASP-hosted services.

Predictive dialers have been the basic method of automated customer communications for the last two decades, particularly for collections activity. The vast majority of telephony customer contact today is completed using predictive dialer technology. Many businesses are likely to continue using on-premise predictive dialers that have been purchased and are still operative, despite the availability of new features and functionality in alternative services.

Some vendors of predictive dialers, particularly Aspect and Avaya, have significantly greater financial, technical, marketing, service and other resources than we have. Many of these vendors also have larger installed client bases and longer operating histories. Competitors with greater financial resources may be able to offer lower prices, additional products or services, or other incentives that we cannot match or offer. These competitors may be in a stronger position to respond quickly to new technologies and may be able to undertake more extensive marketing campaigns.

Hosted Customer Communications Solutions

Our services compete with a number of hosted customer communications solutions in both the hosted contact center and mobile marketing markets. Most vendors of hosted customer communications solutions focus on providing a basic service with limited features and compete principally on the basis of price. These vendors consist principally of a number of relatively small, privately held companies and a small number of larger, multi-product line companies such as CSG Systems, Nuance Communications and West Corporation. We compete with these vendors on the basis of the following:

| Ÿ | return on investment; |

| Ÿ | breadth of features; |

| Ÿ | price; |

| Ÿ | brand awareness based on referenceable customer base; and |

| Ÿ | security and reliability. |

We also compete directly with a small number of vendors in the customer communications and hosted contact center market, such as Adeptra and Varolii, that deliver services utilizing one or more channels on a SaaS delivery model similar to ours.

In the past few years, there have been a number of new entrants in the hosted customer communications market. Most of these new entrants offer basic, price-oriented customer communications services hosted on an ASP model. We believe that companies wishing to target this portion of the market may seek to acquire existing vendors. It is likely any such acquiring companies would have greater financial, technical, marketing, service and other resources than we have and may be able to offer lower prices, additional products or services, or other incentives that we cannot match or offer.

15

Table of Contents

Mobile Marketing Solutions

The market for mobile marketing solutions is developing rapidly and highly fragmented, and we compete with a wide array of companies in selling our mobile marketing offering. For example, we compete with a large number of vendors that focus on providing point solutions, each of which addresses a specific element of the mobile marketing solution set. These vendors typically compete on the basis of technology features and price. Some vendors focus on providing packaged solutions that target a broader range of mobile marketing and advertising applications. These vendors generally compete on the basis of the breadth of their offerings and the return on investment. For example, our mobile marketing offering competes directly with mobile marketing applications provided by Augme Technologies (in part through its acquisition of HipCricket in August 2011), Lenco Mobile (principally through its acquisition of iLoop Mobile in December 2011) and Velti. We compete with these vendors based on the breadth of our multi-channel functionality, our strategic client management services, the flexibility of our pricing model and our referenceable client base.

Intellectual Property

Our success depends in part on our ability to protect our intellectual property and to avoid infringement of the intellectual property of third parties. We rely on a combination of trade secret laws, trademarks and copyrights in the United States and other jurisdictions, as well as contractual provisions and licenses, to protect our proprietary rights and brands. We cannot, however, be sure that steps we take to protect our proprietary rights will prevent misappropriation of our intellectual property.

We have adopted a strategy of seeking patent protection with respect to certain technologies used in or relating to our products. We have three issued U.S. patents, which relate to: (a) a voice message delivery method and system (patent number U.S. 6,785,363 B3) that was issued in August 2004 and will expire in January 2021; (b) an address book for a voice message delivery method and system (patent number U.S. 6,829,331 B2) that was issued in December 2004 and will expire in January 2022; and (c) answering machine detection for voice message delivery and system (patent number U.S. 7,054,419) that was issued in May 2006 and will expire in April 2021. We have eleven pending U.S. patent applications that relate to the optimization of interactive communications campaigns and the provision of messages to mobile devices in an enterprise-centric architecture. Additionally, we evaluate ideas and inventions for patent protection with a team of engineers and product managers, in consultation with our outside patent counsel. We expect to file additional patent applications in the ordinary conduct of our business.

“SoundBite” is our sole registered service mark in the United States. We have unregistered service marks identifying some of our service offerings. None of our unregistered service marks is material to our business. We seek to protect our source code for our platforms, as well as documentation and other written materials, under trade secret and copyright laws.

We may not receive competitive advantages from the rights granted under our intellectual property rights. Others may develop technologies that are similar or superior to our proprietary technologies or duplicate our proprietary technologies. Our pending and any future patent applications may not be issued with the scope of claims sought by us, if at all, or the scope of claims we are seeking may not be sufficiently broad to protect our proprietary technologies. Our issued patents and any future patents we are granted may be circumvented, blocked, licensed to others or challenged as to inventorship, ownership, scope, validity or enforceability. We may be advised of, or otherwise become aware of, prior art or other literature that could negatively affect the scope or enforceability of any patent. If our issued patents, any future patents we are granted, our current or any future patent applications, or our services are found to conflict with any patents held by third parties, we could be prevented from selling our services, any current or future patent may be declared invalid, or our current or any future patent application may not result in an issued patent. In addition, in foreign countries, we may not receive effective patent and trademark protection. We may be required to initiate litigation in order to enforce any patents issued to us, or to determine the scope or validity of a third party’s patent or other proprietary rights. In addition, in the future we may be subject to lawsuits by third parties seeking to enforce their own intellectual property

16

Table of Contents

rights, as described in “Item 1A. Risk Factors — Our product development efforts could be constrained by the intellectual property of others, and we could be subject to claims of intellectual property infringement, which could be costly and time-consuming.”

We seek to avoid disclosure of our intellectual property by requiring employees and consultants with access to our proprietary information to execute nondisclosure and assignment of intellectual property agreements and by restricting access to our source code. Other parties may not comply with the terms of their agreements with us, and we may not be able to enforce our rights adequately against these parties.

Our service offerings incorporate technology licensed from third-party providers. If these providers were no longer to allow us to use these technologies for any reason, we would be required to:

| Ÿ | identify, license and integrate equivalent technology from another source; |

| Ÿ | rewrite the technology ourselves; or |

| Ÿ | rewrite portions of our source code to accommodate the change or no longer use the technology. |

Any one of these outcomes could delay further sales of our services, impair the functionality of our services, delay the introduction of new features or offerings, result in our substituting inferior or more costly technologies, or injure our reputation. In addition, we may be required to license additional technology from third parties, and we cannot assure you that we could license that technology on commercially reasonable terms or at all. Because of the relative immateriality of this third-party licensed technology as well as the availability of alternative equivalent technology, we do not expect that our inability to license this technology in the future would have a material effect on our business or operating results.

Government Regulation

Our business operations are affected, directly or indirectly, by a wide range of U.S. federal, state and international laws and regulations, including regulations that restrict customer communications activities using our services, our handling of information and other aspects of our business. On the U.S. federal level, for example, regulatory measures include:

| Ÿ | the Fair Debt Collection Practices Act, which regulates the timing and content of debt collection communications; |

| Ÿ | the Telephone Consumer Protection Act, which restricts the circumstances under which automated telephone dialing systems and artificial or prerecorded messages may be used in placing calls to residences and wireless telephone numbers and which, under FCC rules, treats text messages as “calls”; |

| Ÿ | Federal Trade Commission and Federal Communications Commission telemarketing regulations promulgated under the authority of the Telemarketing and Consumer Fraud and Abuse Prevention Act and the Telephone Consumer Protection Act, which regulations restrict the timing, content and manner of telemarketing calls, including the use of automated dialing systems, predictive dialing techniques and artificial or prerecorded voice messages, and which, over the course of the past four years, have increasingly encompassed text messaging; |

| Ÿ | the Controlling the Assault of Non-Solicited Pornography and Marketing (CAN-SPAM) Act, which sets standards for the sending of commercial email; |

| Ÿ | the Gramm-Leach-Bliley Act, which regulates the disclosure of consumer nonpublic personal information received from our financial institution clients and requires those clients to impose administrative, technical and physical data security measures in their contracts with us; and |

17

Table of Contents

| Ÿ | the Fair Credit Reporting Act, which defines permissible uses of consumer information furnished to or obtained from consumer reporting agencies. |

Many states and state agencies in the U.S, have also adopted and promulgated laws and regulations governing debt collection, contact with wireless, business and residential telephone numbers, telemarketing, and data privacy. These laws and regulations may, in certain cases, impose restrictions that are more stringent than the federal measures discussed above. To date, our employees have performed a significant portion of our activities in complying with U.S. federal and state laws and regulations and we have not incurred material out-of-pocket compliance costs.

Our foreign business operations are affected, directly or indirectly, by foreign laws and regulations. For example, our current telemarketing activities in the United Kingdom are subject to a comprehensive telemarketing regulation, which includes a prohibition on calls to numbers on the U.K.’s national do-not-call registry, the Telephone Preference Service, and other regulations imposed by the U.K. regulatory authority, Ofcom. Canada has also established a similar national do-not-call registry, which was first implemented on September 30, 2008. Furthermore, we may in the future determine to commence or expand our operations to other countries, and these countries may have laws or regulations comparable to or more stringent than those affecting our domestic business.

Our business, operating results and reputation may be significantly harmed if we violate, or are alleged to violate, U.S. federal, state or foreign laws or rules covering customer communications. In the pricing agreements they enter into with us, our clients typically agree to comply in all material respects with all applicable legal and regulatory requirements relating to their use of our services. We cannot be certain, however, that our clients comply with these obligations, and typically we cannot verify whether clients are complying with their obligations. Violations by our clients may subject us to costly legal proceedings and if we are found to be wholly or partially responsible for such violations, may subject us to damages, fines or other penalties. For a further description of some of the governmental regulations that may affect our business operations, see “Item 1A. Risk Factors — Risks Related to Regulation of Use of Our Services.”

Employees

As of March 1, 2012, we had a total of 140 employees, consisting of 45 employees in client management, 38 employees in research and development, 31 employees in sales and marketing, 10 employees in operations, and 16 employees in general and administrative. A total of 99 of our employees are based at our headquarters in Bedford, Massachusetts.

From time to time we also employ independent contractors and temporary employees to support our operations. None of our employees are subject to collective bargaining agreements. We have never experienced a work stoppage and believe that our relations with our employees are good.

Our History

We were founded in Delaware in April 2000. Our principal executive offices are located at 22 Crosby Drive, Bedford, Massachusetts 01730, and our telephone number is +1 781 897 2500. Our website address is www.soundbite.com, and we make available through the investor relations section of our website, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act as soon as reasonably practicable after such reports are electronically filed with the SEC. We also make our code of ethics and certain other governance documents and policies available through this site. We are not, however, including the information contained on our website, or information that may be accessed through links on our website, as part of, or incorporating it by reference into, this annual report.

18

Table of Contents

| Item | 1A. Risk Factors |

An investment in our common stock involves a high degree of risk. Investors should consider carefully the risks and uncertainties described below and all of the other information contained in this report before deciding whether to purchase our common stock. The market price of our common stock could decline due to any of these risks and uncertainties, and investors might lose all or part of their investments in our common stock.

Risks Related to Our Business and Industry

Our hosted contact center services face intense competition, and our failure to compete successfully would make it difficult for us to add and retain clients and would impede the growth of our business.

The market for hosted contact center services is intensely competitive, changing rapidly and highly fragmented. It is subject to rapidly developing technology, shifting client requirements, frequent introductions of new products and services, and increased marketing activities of industry participants. Increased competition could result in pricing pressure, reduced sales or lower margins, and could prevent our current or future services from achieving or maintaining broad market acceptance. If we are unable to compete effectively, it will be difficult for us to add and retain clients and our business, financial condition and operating results will be seriously harmed.

Predictive dialers have been the basic method of automated customer communications for the last two decades, particularly for collections activity. The vast majority of telephony customer contact today is completed using predictive dialer technology. Our hosted customer contact services compete with on-premise predictive dialers from a limited number of established vendors and a number of smaller vendors, as well as predictive dialers hosted by some of those smaller vendors on an application service provider basis. Many businesses have invested in on-premise predictive dialers and are likely to continue using those dialers until the dialers are no longer operational, despite the availability of additional functionality in our hosted customer contact services.

We also compete with a number of providers of hosted contact center services. A limited number of established vendors and a number of smaller, privately held companies offer hosted services that compete principally on the basis of price rather than features. In addition, a small number of vendors focus on providing hosted services with features more comparable to ours. These vendors generally compete on the basis of return on investment, features and price. Other companies may enter the market by offering competing products or services based on emerging technologies, such as open-source frameworks, or by competing on the basis of either features or price. Clients could also potentially employ a multi-vendor strategy for risk mitigation purposes.

We increasingly compete with companies providing hosted contact center services focused on specific vertical markets, such as healthcare, or on a single communications channel, such as text messaging. Because these solutions are targeted to more narrowly defined markets and enable their providers to develop targeted domain expertise, those providers may be able to develop and offer targeted customer contact solutions than a company, such as ours, that seeks to offer a broad range of hosted customer contact services to businesses across a variety of vertical markets.

Some of our competitors have significantly greater financial, technical, marketing, service and other resources than we have. These vendors also have larger installed client bases and longer operating histories. Competitors with greater financial resources might be able to offer lower prices, additional products or services, or other incentives that we cannot match or offer. These competitors could be in a stronger position to respond quickly to new technologies and could be able to undertake more extensive marketing campaigns.

We have begun to invest in our mobile marketing offerings, and our business could be negatively affected if the market does not develop as we expect or if we fail to offer services that successfully address the needs of a rapidly changing market.

In June 2011 we acquired key assets of SmartReply, a provider of text messaging and mobile communications solutions, and in February 2012 we acquired 2ergos Americas, a provider of mobile business and marketing

19

Table of Contents

solutions. As a result of these acquisitions and our internal development of mobile messaging solutions based on our existing technology, we have invested, and expect to continue to invest, significant financial and management resources in building and offering our mobile marketing services.

Our mobile marketing business is at an early stage of development, and we may not achieve or sustain demand for our mobile marketing offerings. Our success in this effort will depend in part on the performance, availability and pricing of our mobile marketing services in comparison to a wide array of competing products and services. It will also depend on the willingness of businesses to increase their use of mobile marketing applications. The market for these types of services is changing and developing rapidly, as competitors introduce new and enhanced products and services and react to changes in technology, client demands and regulatory requirements. To succeed, we need to enhance our current services and develop new services on a timely basis to keep pace with market needs and satisfy the increasingly sophisticated requirements of clients. New products and services based on emerging technologies or industry standards could render our existing services obsolete and unmarketable.

Our mobile marketing endeavors involve significant risks and uncertainties, including distraction of management from other operations, insufficient revenues to offset associated expenses and inadequate return on capital. We cannot assure you that our mobile marketing strategies and offerings will be successful and will not materially adversely affect our reputation, financial condition or operating results.

Our quarterly operating results can be difficult to predict and can fluctuate substantially, which could result in volatility in the price of our common stock.

Our quarterly revenues and other operating results have varied in the past and are likely to continue to vary significantly from quarter to quarter. Our agreements with clients typically do not require minimum levels of usage or payments, and our revenues therefore fluctuate based on the actual usage of our services each quarter by existing and new clients. Quarterly fluctuations in our operating results also might be due to numerous other factors, including:

| Ÿ | our ability to attract new clients, including the length of our sales cycles; |

| Ÿ | our ability to sell new applications and increased usage of existing applications to existing clients; |

| Ÿ | technical difficulties or interruptions in our cloud-based services; |

| Ÿ | changes in privacy protection and other governmental regulations applicable to the communications industry; |

| Ÿ | changes in our pricing policies or the pricing policies of our competitors; |

| Ÿ | changes in the rates we incur for services provided by telecommunication or data carriers or by text or email aggregators; |

| Ÿ | the financial condition and business success of our clients; |

| Ÿ | purchasing and budgeting cycles of our clients; |

| Ÿ | acquisitions of businesses and products by us or our competitors; |

| Ÿ | competition, including entry into the market by new competitors or new offerings by existing competitors; |

| Ÿ | our ability to hire, train and retain sufficient sales, client management and other personnel; |

20

Table of Contents

| Ÿ | restructuring expenses, including severance and other costs attributable to terminations of employment; |