Attached files

| file | filename |

|---|---|

| EX-32.2 - PAN AMERICAN GOLDFIELDS LTD | exhibit32-2.htm |

| EX-32.1 - PAN AMERICAN GOLDFIELDS LTD | exhibit32-1.htm |

| EX-31.2 - PAN AMERICAN GOLDFIELDS LTD | cexhibit31-2.htm |

| EX-31.1 - PAN AMERICAN GOLDFIELDS LTD | cexhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

Form 10-K/A

(Amendment No. 1)

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 28, 2011

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to _____

Commission file number:000-23561

___________________________

PAN AMERICAN GOLDFIELDS LTD.

(Exact name of registrant as specified in its charter)

|

Delaware

|

84-1431797

|

||

|

(State or other jurisdiction of incorporation)

|

(IRS Employer Identification Number)

|

||

|

595 Howe Street, Unit 906

Vancouver, BC

|

V6C 2T5

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

||

Registrant’s telephone number, including area code: (604) 681-1163

Securities registered under Section 12(b) of the Act:

None

Securities registered under Section 12(g) of the Act:

Title of Each Class Name of Each Exchange on Which Registered

Common Stock, par value $0.01 per share None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities ExchangeAct of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has beensubject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. o

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reportingcompany. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the ExchangeAct.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of voting Common Stock held by non-affiliates of the Registrant, based upon the average of the closing bid and asked price of Common Stock on the OTC Bulletin Board system on August 31,2010 of $0.26 was approximately $14,040,995.

As of June 13, 2011, the Registrant had 61,118,826 shares of Common Stock issued and outstanding.

2

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Form 10-K/A”) to the Annual Report on Form 10-K for Pan American Goldfields Ltd. (“we” or the “Company”) for the fiscal year ended February 28, 2011, initially filed with the Securities and Exchange Commission (the “SEC”) on June 13, 2011 (the “Original Filing”), is being filed in connection with comments received from the staff of the SEC regarding the description of our business in accordance with Industry Guide 7.

For the convenience of the reader, this Form 10-K/A sets forth the Original Filing in its entirety. However, this Form 10-K/A only amends and restates the Original Filing, in each case, solely as a result of, and to reflect, the comments of the SEC. This Form 10-K/A has not been updated to reflect other events occurring after the Original Filing or to modify or update those disclosures affected by subsequent events. In addition, pursuant to the rules of the SEC, Item 15 of the Original Filings has been amended to contain currently dated certifications from the Company’s Chief Executive Officer and Chief Financial Officer, as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, and are attached as Exhibits 31.1, 31.2, 32.1 and 32.2 to this report.

Except for the foregoing amended information, this Form 10-K/A continues to speak as of the dates of the Original Filing, and the Company has not updated the disclosures contained herein to reflect events that occurred at a later date. Other events occurring after the filings of the Original Filing or other disclosures necessary to reflect subsequent events will be addressed in any reports filed with the SEC subsequent to this filing.

3

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Background

We are an exploration stage company focused on mineral exploration activities in Mexico and Argentina. Through our wholly owned Mexican subsidiary, Sunburst Mining de Mexico, S.A. de C.V., (“Sunburst”), we are currently engaged in the exploration oftwo gold and silver projects, named the Cieneguita Project and the Encino Gordo Project, each made up of several mining concessions, located in the Sierra Madre region of the State of Chihuahua, Mexico. We are also engaged in the exploration of a gold project located in Argentina, named the Cerro Delta Project.We previously owned another project in Mexico known as the Guazapares Project, which we agreed to sell pursuant to the terms of a definitive agreement, dated July 10, 2009, to Paramount Gold de Mexico, SA de C.V., the Mexican subsidiary of Paramount Gold and Silver Corp., for a total consideration of up to $5.3 million.

To help support our exploration activities, we entered into a development agreement with Minera Rio Tinto, S.A. de C.V. (“MRT”), a mining operator in Chihuahua, Mexico, which is owned by our Chairman, Mario Ayub. Under the development agreement, we authorized MRT to commence a small scale milling operation at our Cieneguita Project. As of February 2011 ,MRT’s start-up operations had progressed as planned, and all essential systems and construction for initial plant facilities for crushing, gravity and flotation circuits were complete. Operations had also commenced for one 12-hour shift per day with a processing rate up to 550 tons per day. The terms of our arrangement with MRT are discussed in detail below.

Recent Developments

On May 3, 2011, we appointed Dr. Alexander Becker as advisor to our board of directors, who has a Ph.D. in Structural Geology, and an extensive, history as an exploration geologist. He was a director of Perseus Mining Limited when it was formed in 2002 and identified and acquired the original assets of Perseus spin-out Manas Resources. He was also Vice President Exploration, Asia, for Apex Silver Mines, which went on to accumulate one of the largest, privately controlled portfolios of silver exploration properties in the world at that time. He is also credited with identifying the gold potential of a known antimony occurrence called the Chaarat, where a 4.4 million ounce gold resource was subsequently outlined. Dr. Becker has advised a variety of companies including Santa Fe Gold prior to its acquisition by Newmont and BarrickGold (Asia). He was a senior scientific researcher at Ben Gurion University and won the Peres Award for tectonic research. Dr. Becker has authored numerous papers in international scientific journals including Geological Society of America, Tectonophysics, Structural Geology, and International Geology Review.

In March 2011, we appointed Bruno Le Barber as a member of the board of directors. Mr. Le Barber has extensive financial expertise and is a co-founder of Vortex Capital (“Vortex”), a Hong Kong based gold fund. Previously he was a Vice President at Morgan Stanley in London where he advised trading desks and a large investor base while publishing macro-economic studies. Mr. Le Barber was also a global technical strategist with ABN Amro in Paris.He manages Vortex together with Emilio Alvarez, former Executive Director, Equity Research with Morgan Stanley in London.

In February 2011, weentered into an agreement with Compañia Minera Alto Rio Salado S.A., a private Argentine entity, for the acquisition of the 15,000 hectares Cerro Delta Project in northwest La Rioja Province, Argentina. Under the terms of the agreement, we are required to pay $150,000 upon signing (paid) the agreement, $200,000 on the first anniversary, $500,000 on the second anniversary, $750,000 on the third anniversary, $1.2 million on the fourth anniversary, and $2.2 million on the fifth anniversary of the signing, with a final option payment of $5 million to purchase a 100% interest in the Cerro Delta project payable on the sixth anniversary of the signing. The vendor will retain a 1% NSR.

In conjunction with the acquisition of the Cerro Delta project, we completed a private placement of 6,560,000 units at $0.20 per unit, for total proceeds of $1,312,000. Each unit consisted of one share of common stock and a warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at an exercise price of $0.30 per share for a period of two years from the closing date.

In October 2010, we appointed Miguel F. Di Nanno as President and Chief Operating Officer, replacing George Young effective as of October 15, 2010. Mr. Young remains on our board of directors. Mr. Di Nanno is an Argentina-based mining engineer with extensive mining experience in Argentina. He was the Country Manager in Argentina for Phelps Dodge Corporation developing the Arroyo Cascada Gold deposit, an early stage gold exploration project in Chubut Province he was also Commercial Development Manager, Argentina for the Queensland Government and the COO in Argentina for the Grosso Group. In the areas of acquisition, development and exploration, his clients included MIM Exploration, developing a comprehensive regional geological study of northern Patagonia in Argentina; COMINCO,

4

cooperating on a metallogenic Patagonia zone data base; Viceroy Resources, working on the acquisition of gold exploration projects in such as Cerro Choique, a disseminated gold deposit and others; Cyprus Minerals; Mauricio Hochschild, collaborating on issues related to permitting of the San Jose project; Bema Gold;, and Northern Orion, acquisition of polimetallic projects in Chubut Province. Mr. Di Nanno is credited with discovering the 3.2 million oz gold Aeropuerto deposit in Chubut Province when he was the Zone Manager for Canyon Resources. The Aeropuertodepositwas later renamed Esquel. He has a degree in Mining Engineering – Ore Dressing from the National University of San Juan - Argentina.

In July 2010, we appointed Neil Maedel, Randy Buchamer and Gary Parkison to our board of directors. Mr. Maedel is an investment banker specializing in international resource projects; Mr. Buchamer has extensive experience in business administration and finance; and Mr. Parkison is qualified geologist and project manager with expertise in exploration and development of minerals and metals projects. He is credited with the Terrazas discovery – now one of Mexico’s largest silver-zinc deposits, and he identified and outlined the San Javier the largest iron oxide copper gold deposit found to date in Mexico. All of the newly appointed directors have technical and financial industry experience base that will assist us with operations and our planned listing on either the Toronto Stock Exchange or the TSX Venture Exchange, consistent with our status as a producing resource company.

In July 2010, we reincorporated from the State of Colorado to the State of Delaware. The reincorporation was effected pursuant to an agreement and plan of merger (the “Merger Agreement”), by and between us and Pan American Goldfields Ltd.,a Colorado corporation (formerly Mexoro Minerals Ltd.), with Pan American Goldfields Ltd. (“Pan American”) being the surviving corporation. Accordingly, the rights of our shareholders are now governed by Delaware General Corporation Law and the certificate of incorporation and bylaws of Pan American filed with the State of Delaware.

In May 2010, management decided to drop the Sahuayacan project when results from a drilling program indicated that the main auriferous zone at the project did not contain economic concentrations of gold. By dropping this exploration project we eliminate any future concession payments on this project.

In May 2010, Mr. Francisco “Barry” Quiroz and Mr. John Clair resigned from our board of directors. Neither director resigned as a result of a disagreement with us on any matter relating to our operations, policies or practices.

5

Market Overview

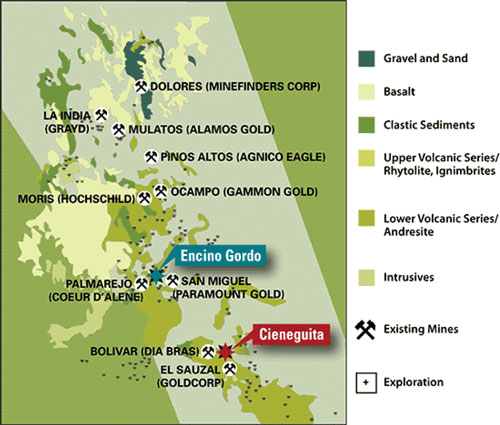

Chihuahua, Mexico: The Chihuahua region of Mexico is currently attracting significant mineral exploration, development and mining activities. Propelled by advances in mining technology and a resurgence of the global gold markets, a number of intermediate and major companies have returned to or commenced mining activities in this region, including: the San Miguel Project operated by Paramount Gold, the Pinos Altos Project operated by Agnico Eagle and the San Miguel Project operated by Paramount Gold. The map below shows the location of our Cieneguita and Encino Gordo Projects within the Sierra Madre Sierra region of the State of Chihuahua, Mexico.

6

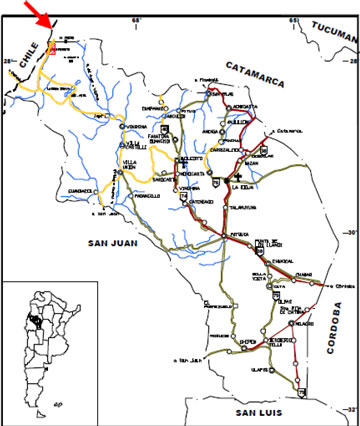

Argentina (Maricunga Belt): Similar the Chihuahua region in Mexico, in response to higher prices and improved methods of precious and base metals extraction, a number of exploration and mining projects are being pursued in eastern Argentina, in a region known as the Maricunga Belt. The Maricunga belt is approximately 20 miles wide and 120 miles long. The two largest discoveries to date in the Maricunga Belt are the Cerro Casale and Caspiche Projects. Our Cerro Delta Project is located in the east portion of the Maricunga Belt, in Argentina. It is approximately 12 miles to the east of the Cerro Casale Project, which is in Chile. The map below indicates the location of our Cerro Delta Project:

7

Our Strategy

Since taking effective management and board control of the company in 2010, Pan American has attracted an exceptional team of established explorationists and mine developers. Our strategy is to leverage this considerable capability, by searching, finding, acquiring and eventually developing major exploration assets in Mexico and South America. Our Cieneguita Project is our most advanced stage project. Using the considerable skill set we have available, our plan is, as economically as possible, to eliminate or if of sufficient merit, acquire and develop additional precious metals exploration and development projects. The priority is to identify projects with significant potential coupled with cost efficiency; that is where we can advance dramatically or eliminate an exploration project at minimal cost. The initial drilling at the Cerro Delta, for example is expected to cost approximately $700,000.

In Mexico, we have mineral concession rights for two Projects, Cieneguita and Encino Gordo. In Argentina we have one project called the Cerro Delta Project. Each of our three projectsis located near pre-existing or starting operations of large mining corporations. The presence of the existing mining companies already operating in the area or new mining companies commencing operations creates the prospects for us to either enter into development agreements or for such companies to acquire the projects from us outright. Our Cieneguita Project is smaller than the other exploration opportunities we are pursuing. However, because of what we view of its relative low risk compared to its potential value to the Company, a feasibility study is being initiated for our Cieneguita Project.

Our goal is to establish a pipeline of two new drill-stage or near-to-drill stage projects per year. Our proposed exploration program consists of three main components:

|

·

|

Create a pipeline of quality properties providing a steady stream of new prospects and/or projects to explore, contract-out and/or enter into development agreements with other mining companies in South America and Mexico.

|

|

·

|

Identify and acquire at low cost early to mid-stage properties in selected locations along the main gold-silver belts in the Americas.

|

|

·

|

Focus on medium-sized gold and/or silver deposits (minimum deposits containing 2,000,000 ounces gold-equivalent).

|

The proposed exploration program is being undertaken by our exploration team using in-house knowledge along with the support and guidance of consultants with expertise in these regions. We believe our existing management team and key advisors have the necessary exploration and mining expertise to locate, evaluate and bring mining properties to production.

For our Cerro Delta Project, we entered into an agreement with Compania Minera Alto Rio Salado S.A., a private Argentine entity, for the acquisition of the 15,000 hectares Cerro Delta project in northwest La Rioja Province, Argentina. This project is drill ready and we believe it is a high impact exploration project which contains a large anomalous gold zone and other similarities to other deposits in the area. We anticipate working aggressively on this property in concurrence with our work in Mexico. See Cerro Delta below.

We are continuing to evaluate potential new projects, but we currently do not have sufficient funds to implement our strategy of establishing two new drill-stage or near-to-drill stage projects per year.

8

Our Cieneguita Project

Summary

Our Cieneguita Project is located in the Baja Tarahumara in Cieneguita Lluvia De Oro, an area of canyons in the Municipality of Urique, in southwest Chihuahua, Mexico. The concessions on the Cieneguita Project cover a total area of 822 hectares (approximately 2,031 acres). A new gold discovery was made by our wholly-owned subsidiary Sunburst de Mexico in early 2008. As a feasibility study has not been completed nor is there any assurance that one can be successfully completed, there are no known reserves on the Cieneguita Project.

Property Ownership

The property associated with our Cieneguita Project is currently owned by Corporativo Minero. Our wholly-owned subsidiary, Sunburst, with the permission of Corporativo Minero, obtained an exclusive option to acquire the Cieneguita property for $2 million. We are required to make yearly payments to Corporative Minero on May 6th of each year in the amount of $120,000 until the outstanding balance owed on the $2 million is paid in full to keep the option in good standing. ,In the alternative, when the Cieneguita Projectis put into production, we are required to pay Corporativo Minero $20 per ounce of gold produced from the Cieneguita Project, in lieu of the yearly payment of $120,000, until we pay Corporativo Minero an aggregate of $2 million. In the event that the price of gold is above $400 per ounce, the payments payable from production will be increased by $0.10 for each dollar increment the spot price of gold trades over $400 per ounce. The total payment of $2 million does not change with fluctuations in the price of gold. Non-payment of any portion of the $2 million total payment will constitute a default, in which case we will lose our rights to the Cieneguita property and the associated concessions, but we will not incur any additional default penalty. Because of the mining operations being conducted by MRT at the Cieneguita Project discussed below, we are currently paying Corporativo Minero based on the gold being produced from the Cieneguita Project.

As of June 2011, we have paid $980,000 to Corporativo Minero. Once the full $2 million payment has been made, we will own the Cieneguita property and we will have no further obligation to Corporativo Minero. Corporativo Minero has the obligation to pay, from the funds they receive from us, any royalties that may be outstanding on the properties from prior periods. Corporativo Minero has informed us that there were royalties of up to 7% net smelter return (“NSR”) owned by various former owners of the Cieneguita property. They have informed us that the corporations holding those royalties have been dissolved and that there is no further legal requirement to make these royalty payments. We can make no assurance that these former owners will not contend that we are ultimately responsible to pay all or some of the 7% NSR to these former royalty holders if the Project was ever put into production and Corporativo Minero did not make the payments to the royalty holders. MRT no longer has any ownership interest or payment obligations with respect to the Cieneguita property. There is no affiliation between Corporativo Minero and Pan American or its officers, directors or affiliates.

Development Agreement and Project Ownership

To help fund our exploration activities, we entered into a development agreement with MRT in February 2009, which we amended in December 2009. Pursuant to the terms of the development agreement, as amended, MRT has agreed to invest up to $8 million to initiate the first phase of productionand to complete a feasibility study on the Cieneguita Project. The first phase of production is limited to the mining of the mineralized material that is available from the surface to a depth of 15 meters (“First Phase Production”). In exchange, we assigned MRT a 74%interest of the net cash flows from First Phase Production and a 54% ownership interest in the Cieneguita project.

To fund our continued operations, we issued $1.5 million of convertible debentures in March 2009, of which an aggregate of $880,000 was issued to Mario Ayub, one of our directors, and to his affiliated entity, MRT. Pursuant to the terms of the convertible debentures, the holders irrevocably converted the debentures into a 10% ownership interest in the Cieneguita Project and a 10% interest in the net cash flow from First Phase Production. In December 2009, Mario Ayub and MRT agreed to resell an aggregate 4% ownership interest in the Cieneguita Project back to us, along with 4% of the net cash flow from First Phase Production, in return for $550,000. In a private transaction not involving us, the other holders contributed their remaining 6% ownership interest in the Cieneguita Project to a newly formed entity, Marje Minerals SA (“Marje Minerals”).

9

As a result of our amended development agreement and our agreements with the debenture holders, the ownership interest in the Cieneguita project and the net cash flows from the First Phase Production are held by us, MRT and Marje Minerals as follows:

|

Holder

|

Ownership Percentage

|

Net Cash Flow Interest From First Phase Production

|

Net Cash Flow Interest Following First Phase Production

|

|||

|

MRT

|

54%

|

74%

|

54%

|

|||

|

Marje Minerals

|

6%

|

6%

|

6%

|

|||

|

Pan American

|

40%

|

20%

|

40%

|

Any additional costs for the First Phase Production and the feasibility study for the Cieneguita project, after MRT invests $8million, will be shared by us, MRT and Marje Minerals on a pro-rata basis based on their respective ownership percentages in the Cieneguita project.

The major terms of the development agreement with MRT and Marje Minerals are as follows:

|

·

|

MRT purchased $1 million of secured convertible debentures at 8% interest (payable in stock or cash). The proceeds from this investment were used for continued exploration and development of the Cieneguita Project and general working capital. In November 2009, MRT exercised its conversion rights on the debenture and MRT was issued 3,333,333 common shares and a warrant to purchase 1,666,667 shares of common stock at an exercise price of $0.50 per share.

|

|

·

|

MRT agreed to provide the necessary working capital to begin and maintain mining operations, estimated to be $3 million, to put the first phase of the Cieneguita Project into production. In exchange for these funds, we assigned MRT an interest to 74% of the net cash flow from First Phase Production. The agreement limits the mining during First Phase Production to the mineralized material that is available from the surface to a depth of 15 meters.

|

|

·

|

MRT committed to spend up to $4 million to take the Cieneguita Project through the feasibility stage. In doing so, we would assign MRT a 54% interest in our rights to the Cieneguita Project. After the expenditure of the $4 million, all costs will be shared on a pro-rata ownership basis (i.e. 54% to MRT, 40% to us and 6% to Marje Minerals). If any party cannot pay its portion of the costs after the $4 million has been spent, then their ownership position in the Cieneguita project will be reduced by 1% for every $100,000 invested by the other owners. Our ownership interest in the Cieneguita project, however, cannot be reduced below 25%. In addition, we have the right to cover Marje Minerals’ pro rata portion of costs if they cannot pay their portion of the costs. In return, we will receive 1% of Marje Minerals’ ownership position in the Cieneguita Project for every $100,000 we invest on their behalf.

|

|

·

|

The MRT agreement was contingent on our repaying a debenture to Paramount. In March 2009, we repaid $1 million, or approximately two-thirds of the debt, and Paramount released a security interest it had on the Cieneguita project. In October 2009, we repaid the remaining amount of the debt, and Paramount released its security interests on the Sahuayacan, Guazapares and Encino Gordo properties.

|

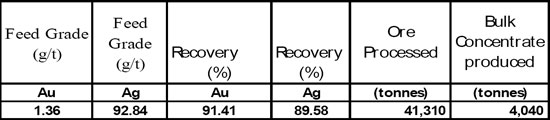

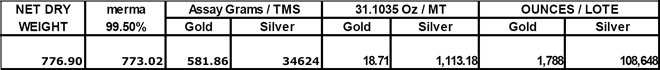

Current Operations

Under the development agreement, we authorized MRT to commence a small scale milling operation at our Cieneguita Project. As of February 2011,MRT’s start-up operations had progressed as planned, and all essential systems and construction of the initial plant facilities for crushing and gravity and flotation circuits were complete. Operations had also commenced for two 12-hour shifts per day with an approximate processing rate of 700 tons per day. As reported by the Company, MRT has periodically experienced water supply problems during the dry season that has forced it to limit or curtail the processing of ore. MRT’s right to conduct mining operations at our Cieneguita Project terminates on December 31, 2012. MRT is required to comply with applicable environmental laws and permits in conducting its operations at the Cieneguita Project.

All the plant and equipment utilized by MRT at the Cieneguita Project were paid for and are owned by MRT. Because MRT has a limited time on which to conduct operations at the Cieneguita Project (i.e., through December 31, 2012), MRT primarily utilizes used mining equipment that is more than 10 years old. MRT has also constructed and operates a tailings pond at the Cieneguita Project. Under the development agreement, MRT is required to remove all of its equipment from the Cieneguita Project at the end of 2012. As part of that obligation, MRT is required to remediate the tailings pond in accordance with applicable environmental laws by the end of 2012.

10

Under the development agreement, MRT is responsible for all mining operations though the sale of concentrate. MRT starts with primary ore mined from an open pit mine at the west end of the Cieneguita Project. In Cieneguita de los Trejo, Chihuahua, MRT produces a bulk sulfide flotation concentrate that it later ships to Choix Sinaloa, for cleaning and production of a saleable lead concentrate containing gold and silver. In accordance with the development agreement, MRT pays the Company 20% of the net cash flows from MRT’s mining operations at the Cieneguita Project. The revenues earned by the Company are the result of the extraction and sale of minerals from the Cieneguita Project, and are not incidental income related to the Company’s exploration activities.

Property Location

Cieneguita is located in the Baja Tarahumara in Cieneguita Lluvia De Oro, an area of canyons in the Municipality of Urique, in southwest Chihuahua State, Mexico. The property is located within one half mile of the small village of Cieneguita Lluvia de Oro. Access to the property is by an all-weather dirt road.

The concessions of the CieneguitaProject cover a total area of 822 Hectares (approximately 2,031 acres).The following table is a summary of the concessions on the Cieneguita Project:

|

Lot Name

|

Title Number

|

Area (Ha)

|

Term of Validity

|

|||

|

Aurifero

|

196356

|

492.00

|

7/16/1993 to 7/15/2043

|

|||

|

Aurifero Norte

|

196153

|

60.00

|

7/16/1993 to 7/15/2043

|

|||

|

La Maravilla

|

190479

|

48.00

|

4/29/1991 to 4/24/2041

|

|||

|

Aquilon Uno

|

208339

|

222.00

|

9/23/1998 to 9/22/2048

|

Claim Status and Licensing

In April 2006, we applied to the Mexican government for a change of use of land permit for 30 hectares of the La Maravilla concession. The La Maravilla concession is the concession that contains the mineralized rock that is the interest of our exploration. We are currently extracting mineralized material from the La Maravilla concession as well as our ongoing exploration program. The purpose of the change of use permit was to allow us, if necessary, to extract the rock from this concession for the purposes of processing the rock to extract the precious metals that it may contain. Because the permitting process takes a period of time, we made the application in advance of any known reserves being discovered on the property. We cannot assure you that we will have sufficient ore reserves, if any, to continue extraction. This permit required negotiations with the government and municipality concerning such things as the removal of timber, building and maintaining roads, and reclamation. The government agency responsible for this permit met with representatives of the Company and toured our property in May 2006 as part of the permit process. The application fee for this permit was approximately $800, but there was an additional negotiated fee charged for the permit in the approximate amount of $67,000 (720,000 Mexican Pesos). In January 2007, the government agency issued the change of use permit, and we subsequently made the required payment of approximately $67,000 (720,000 Mexican Pesos).

In July 2006, we submitted an environmental impact study and a risk analysis study to the Mexican government for a permit to build a heap leach mining operation on the Aurifero concession of our Cieneguita Project. The purpose of this permit is to allow us to construct an ore processing facility through heap leach mining methods. We do not have any ore reserves on our Cieneguita Project and applied for permits in advance of any conclusive results. In January 2007, the necessary permits to allow for the building and operation of a heap leach operation were granted to the Company. Currently, the permit has been updated to allow us to build a crushing and floatation mining operation. The permit is valid until 2016 as long as we continue to provide yearly reports to SEMERNANT (the governing Mexican environmental agency responsible for permitting).

History and Geology

The Cieneguita mines were in limited production in the 1990s. Over a four-year period, the Cieneguita Gold Mine was operated by Mineral Glamis La Cieneguita S. De R.L. De C.V. (“Glamis”), a subsidiary of the Canadian company Glamis Gold Ltd. (“Glamis Gold”). According to Glamis’ records, Glamis mined and processed ore on the property in 1995. Glamis stopped production in the mid-1990s. At that time, Corporativo Minero, the operator of the mine for Glamis, acquired the property. MRT entered into an agreement with Corporativo Minero on January 12, 2004 pursuant to which MRT acquired all of the mineral rights from Corporativo Minero to explore and exploit the Cieneguita concessions and to purchase them for $2 million. Under our agreements with MRT, MRT has assigned this agreement to our wholly-owned subsidiary, Sunburst de Mexico.

11

Our exploration work shows that the geology in the mineralization in the zone of sulfides includes pyrite, galena, sphalerite, tennantite and tetrahedrite, pirargirite and traces of chalcopyrite and pyrhotite. These minerals mainly occur as uniform disseminations and as micro-veins. The previous exploration drilling by Cominco and Glamis Gold delineated a zone of altered volcanics, represented by silica, sericite and argillite that are believed to be 1,000 meters long (strike length) and up to 200 meters wide. Within this zone, the oxidation has been shallow and reaches a maximum depth of 20 meters.

Glamis Gold performed a test pilot heap leach operation on the property in the mid 1990’s. The exploration on the property is still in its early stages and significant work needs to be completed before any type of ore reserve calculations, if any, could be made. Our operations are currently exploratory. We have done some initial sampling on the La Maravilla concessions as described below.

A total of 51 diamond drill holes (6,700 meters) drilled by Cominco (now Teck Cominco Ltd.) defined an auriferous zone approximately 1,000 meters long by 200 wide. On such a zone, two mineralized structures were drilled during their exploration program in 1981 and 1982. Later, two drilling programs were performed by Glamis: 135 holes were drilled during 1994 and 62 holes were drilled during 1997. Both programs confirmed the delineation of the two mineralized ore bodies. We have had access to these reports from Cominco and Glamis. The initial exploration conducted by our Company will focus on further delineating the oxide mixed mineralized structures and the sulfide structures.

We used the original data from Cominco and Glamis to delineate the mineralized zone and to plan our present trenching and sampling programs. In April 2006, we completed a sampling of the property that included more than 500 meters of deep trenches from which we took comprehensive channel sampling. The trenches comprised 8 trenches approximately 200 meters long and 2 to 10 meters deep spaced equally along the 1,000 meters strike length of the property. From the walls of these trenches, we took approximately 550 rock samples. We sent one half of these samples to ALS Chemex’s laboratory in Chihuahua for assaying. The sampling protocol followed the best mining practices. The purpose of the sampling was to further define the ore grade and potential of the property. The other half of the sample was used to complete column tests to determine the leachability of the precious metals from the rock. Subsequent drilling indicated that the mineralized material was much larger than originally anticipated and that the heap leaching process was not the best method for extracting the precious metals from the bulk of the mineralized material.

Infrastructure

The town site near the former mine has the following services: electrical power from the public utility, cellular phone, radio communication (CB), a health center and a school. Because the property was previously in production, it has existing infrastructure such as power, water, railroad transportation (within 20 kilometers), and all weather road access year round. We have an existing source of well water, which MRT is currently utilizing for the milling process it is conducting on the Cieneguita Project. Well water has been scarce during the dry season. There are all weather roads to the area that were previously mined allowing easy access for production and exploration. Also, the haul roads to the milling area have been significantly upgraded and are in good condition. We are not required to pay fees to use the roads.

If we put the Cieneguita Project into full development, it is our intention to use the existing heap leach pad area to build the mill site and tailings site to help reduce our costs to re-open the mine. Because some of the infrastructure exists, such as roads and pads, we believe that the investment needed to put this mine into production would be smaller than the investment which would be needed for a mine that was never in production. Because other operating mines exist in the area, infrastructure, such as roads, already exists. There is no other equipment or facilities available to us on the property. Further study needs to be done on the feasibility of using the existing infrastructure of the old mine. We do not own any of the plant or equipment currently be used by MRT to conduct its operations at the Cieneguita Project

Current Exploration

The main exploration activities for the Cieneguita Project are described below:

|

·

|

100 diamond drill holes completed for a total of 20,215 meters of drilling;

|

|

·

|

Broad mineralized intercepts identified, including 111.5 meters with 1.24 g/t Au, 99.6 g/t Ag, 0.45% Pb and 0.73% Zn (Drill Hole C-21) and 94 meters with 1.21 g/t Au, 79.8 g/t Ag, 0.78% Pb and 1.2% Zn (Drill Hole CI-30);

|

|

·

|

Mineralization has been traced over 900 meters along strike and still remains open to the southwest and to depth; and

|

|

·

|

Infill drilling program designed to identify size of the mineralized material.

|

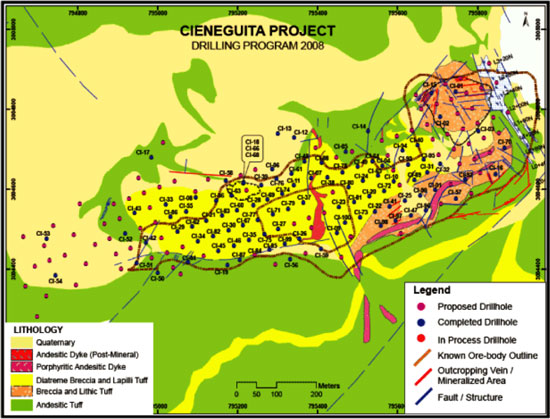

We have conducted a series of exploration programs at Cieneguita since March 2007. The drilling exploration program commenced in December 2007 with one drill rig and a second rig was added in July 2008. The drilling was completed in December 2008. The figure below shows the location of the 100 diamond drill holes on the Cieneguita Project:

12

Assay results and an analysis of the drilling and exploration work are compiled and described in our recently filed Technical Report on National Instrument Form NI43-101 (“NI 43-101”), which wascompleted following the end of fiscal 2010, and is in compliance with the standards and requirements of Canadian security regulatory authorities. The NI 43-101 report is also available on our website, www.panamericangoldfields.com.

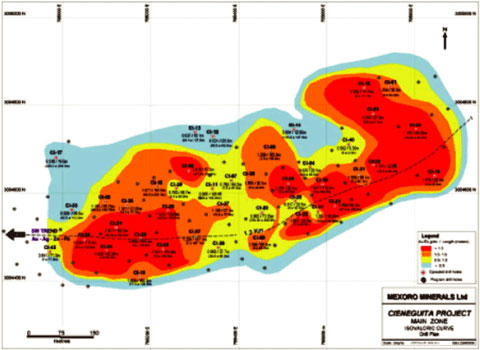

The figure below showsthe main mineralization zones our drilling work identified at the Cieneguita Project. Areas in red on the figure represent zones exhibiting mineralization areas where grades are>1.5 g/t Au.

13

Planned Exploration

The recent exploration activities in Cieneguita have shown that additional exploration is warranted. Considering the latest results and findings the proposed work program for Cieneguita will include:

· Completing the infill drilling program by doing an additional 10,000 meters of drilling to further identify and support mineralization zones;

· Continue conducting metallurgical tests; and

· Complete feasibility study and;

The proposed exploration budget for the Cieneguita Project for 2012 will be conducted by our joint venture partner, MRT. They are responsible for spending $4,000,000 to take the property through to feasibility. Pan American’s new management is suitably encouraged by its examination of the Cieneguita data that we are in discussions with MRT to increase our interest and corresponding participation in the Cieneguita’s development.

There are no known reserves on the Cieneguita property.

14

Encino Gordo Project

Summary

Our Encino Gordo Project is located in the Barranca section of ChihuahuaState in Mexico, and according to data publicly published by the Mexican Government, is at the interphase between the two main volcanic groups that form the bulk of the Sierra Madre Occidental. The location is 220 kilometers to the southwest of ChihuahuaCity.

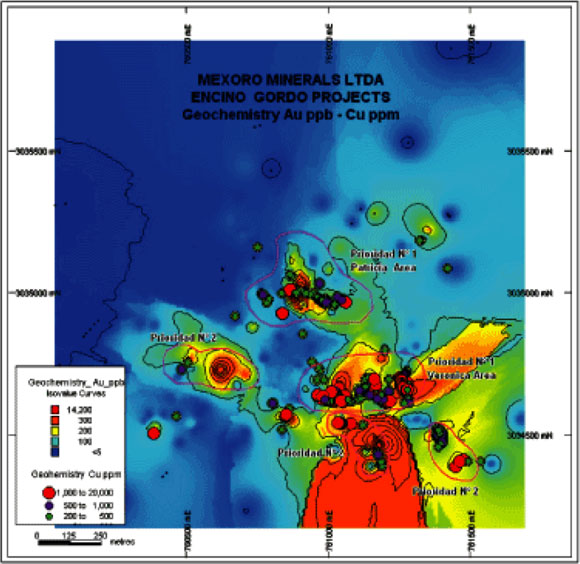

During fiscal 2007, the Company carried out a detailed and property scale mapping and sampling program outlining numerous gold, silver and gold-copper coincident geochemical anomalies. Phase 1 of the exploration program was undertaken in an effort to define the style and characteristics of the mineralization areas indicated by the geochemical anomalies. Within this stage several gold and sulphide mineralization areas including pyrite and chalcopyrite have been identified within an over 500 meters stockwork area and fault-veins structure.

All information and field evidence gathered during the mapping and sampling process suggest the presence of “porphyry” style alteration and mineralization characterized by the presence of concentric alteration patterns (potassic alteration grading outward to quartz-sericite and propylitic alteration), coincident Cu, Au and Mo geochemical anomalies and a multiple-event of veining. The property is at the very early stages of exploration, though, and much more work is needed before any decisions can be made as to the viability of the property.There are no known reserves on the Encino Gordo Project.

Concession Status

Sunburst de Mexico, our wholly-owned subsidiary, owns two concessions (Title #225277 and #292013) and has an option to acquire 100% of two additionalconcessionsfrom MRT, subject to a 2.5% net smelter royalty.The following table is a summary of the concessions on the Encino Gordo property:

|

Lot Name

|

Title Number

|

Area (Ha)

|

Term of Validity

|

Royalties and Payments

|

||||

|

Encino Gordo

|

225277

|

450

|

8/12/2005 to 8/11/2055

|

None (1)

|

||||

|

Encino Gordo

|

292013

|

382

|

8/12/2005 to 8/11/2055

|

None (1)

|

||||

|

El Camuchin

|

220149

|

100

|

6/17/2003 to 6/16/2053

|

Net Smelter Return of 2.5% (2)

|

||||

|

La Paloma

|

220148

|

100

|

6/17/2003 to 6/16/2053

|

Net Smelter Return of 2.5% (2)

|

|

(1)

|

Concessions are 100% owned by Sunburst de Mexico with no further payments to be made.

|

|

(2)

|

Sunburst de Mexico has the first right of refusal to acquire these two concessions from MRT in the event MRT receives an offer to purchase any portion of these mining concessions from a third party. Sunburst de Mexico will have 30 days to exercise its first right of refusal.

|

In August 2009, we dropped one of the concessions we previously owned at the Encino Gordo Project, Encino Gordo 2. We determined that the payments due to the concession holder were too expensive and it was not in the Company’s best interests to keep the concession. There is no plan, currently, to try and negotiate the payments for this Project.

History

The Encino Gordo Property, covering 1,042 hectares (approximately 2,575 acres), is situated near an old mining district with a lengthy production history, according to records in the public domain. Old mining records indicate that mining operations were commenced three kilometers east of this site in the 17th century. Most of the production from those mines came from high-grade vein deposits mined by crude underground methods. To the east of Encino Gordo, the main Guazapares breccia veins were discovered in about 1830. The major period of production was from 1870 to 1900 when there were four silver pan amalgamation mills in operation. Although those deposits contain both gold and silver, the early mills could not recover the gold as it is very fine and occurs along cleavage planes in the pyrite. The mills of the time could only process the oxidized portions of the veins, and the unoxidized, sulfide-bearing material was usually left in the mines as pillars. The principal mine owner of the properties east of Encino Gordo died in 1890, after which the mines of Guazapares slowly sank into disrepair and closed by 1900. In 1905, a U.S. mining company consolidated most of the properties to the east of Encino Gordo and reopened some of the mine workings. That company ran into financial difficulties during 1907 and work halted. Ramon Valenzuela then acquired the properties to the east of Encino Gordo and operated a five stamp mill until 1912. Noranda Exploration, Inc. briefly optioned concessions in the area in the early 1990’s. Kennecott optioned the core concessions east of Encino Gordo in 1993 to 1994, and drilled a few holes in one of the concessions to the east of Encino Gordo. The Encino Gordo property has never been in production.

15

Geological Setting and Deposit Types

The geology at the Encino Gordo Project is dominated by flows and tuff of andesitic to dacitic composition intruded by small plugs of porphyritic intrusions varying in composition from diorite to quartz-diorite. Small and localized areas exhibiting dacite porphyries are also common. The volcanic sequence which may be part of the Lower Volcanic Series (LVS) of the Sierra Madre Occidental Volcanic Complex (“SMOVC”) host most of the mineralization in the Encino Gordo area and in the whole Moris district host to Palmarejo deposit and the Guazapares gold hydrothermal system.

We have identified and characterized four main areas at the Encino Gordo Project:

La Junta Area — Most of the alteration and mineralization in this area is associated with andesitic rocks intruded by composite stock (diorite and quartz-diorite) and dacite porphyries. The alteration at La Junta is characterized by propylitic alteration (chlorite-calcite-pyrite) exhibiting small and localized areas with incipient K-silicate alteration, where K-feldspar is mainly replacing groundmass in the intrusion phases.

Mineralization is occurring at La Junta in different styles, including: stockwork, fault-veins, sheeted veins, dissemination and breccias. However, main mineralization consists of an approximately 500-meter wide stockwork fault-vein zone developed in a dilatant jog “flower structure”. In this mineralized area, multiple cross-cutting vein types are present including:

|

·

|

Pyrite-only veins

|

|

·

|

Quartz-only veins

|

|

·

|

Quartz + pyrite veins

|

|

·

|

Quartz + chalcopyrite veins

|

|

·

|

Quartz + pyrite + chalcopyrite veins

|

|

·

|

Calcite veins

|

|

·

|

Quartz + galena veins

|

|

·

|

Chlorite + calcite veins

|

16

The following map illustrates the coincident Cu and Au geochemical anomalies in La Junta area which are spatially associated to a potassic alteration core resembling the classical geochemical-alteration signature of the porphyry systems.

Supergene alteration is represented by an argillic alteration pervasive event developed by the oxidation and alteration of the primary sulfide zone observed at La Junta area. Limonites developed within this supergene event are dominated by goethite (± hematite — jarosite).

The alteration assemblages, the style of mineralization, the content and type of sulfide mineralization suggest that La Junta area might be a mesothermal to near-mesothermal system, resembling a “porphyry-style” alteration-mineralization.

Potential exists in La Junta Area to find a porphyry-style system and a similar gold mineralization, though, no assurance may be given that any mineralization whatsoever will be found.

Structure EmpalmeArea —TheEmpalme vein outcrops northwest of the Elyca structure, inside the Encino Gordo Property and has been mapped for approximately 150 meters. Workings on the breccia-vein consist of two old shafts now filled with water. The host rocks consist of a sequence of volcaniclastic sediments overlain by tuffaceousdacites with moderate silicification and supergene argillic alteration.

Cienega VeinArea —Our exploration shows that the Cienega vein outcrops at one location along a stream bed within the Encino Gordo Property. It consists of brecciated quartz and contains 2-3% disseminated pyrite hosted by brown volcaniclastics.

17

Arroyo Los Laureles VeinArea —The vein outcrops in the southeast limit of the San Miguel claim in Arryo Los Laurels. The host rocks consist of intensely fractured volcaniclasticarenites, tuffs and dacites.

The Encino Gordo Property is without known reserves. Our proposed exploration programs are exploratory in nature.

Infrastructure

The Encino Gordo Project is accessible year round by all-weather roads. There is no local electricity or water currently available. We will need to supply our own diesel generated electrical power.

Current Exploration

During fiscal 2007, the Company carried out a detailed and property scale mapping and sampling program outlining numerous gold, silver and gold-copper coincident geochemical anomalies. Phase 1 of the exploration program was undertaken in an effort to define the style and characteristics of the mineralization areas indicated by the geochemical anomalies. Within this stage several gold and sulphide mineralization areas including pyrite and chalcopyrite have been identified within an over 500 meters stockwork area and fault-veins structure.

All information and field evidence gathered during the mapping and sampling process suggest the presence of “porphyry” style alteration and mineralization characterized by the presence of concentric alteration patterns (potassic alteration grading outward to quartz-sericite and propylitic alteration), coincident Cu, Au and Mo geochemical anomalies and a multiple-event of veining. No assurance can be given, though, that we will find such a deposit, if at all.

There are no known reserves on the Encino Gordo property.

Planned Exploration Activities

At present we are re-evaluating the exploration program for Encino Gordo. We expect to revise the exploration budget of Encino Gordo in the second fiscal quarter of 2011.

18

Cerro Delta Project

Summary

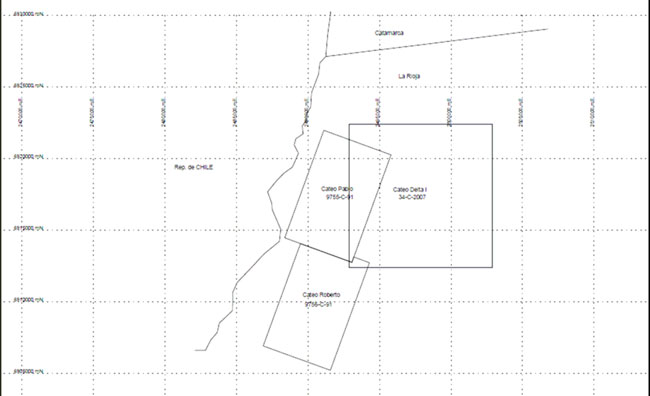

In February 2011, we entered into an agreement with Compania Minera Alto Rio Salado S.A., a private Argentine entity, for the acquisition of the 15,000 hectare Cerro Delta Project in northwest La Rioja Province, Argentina. Under the agreement, the Company paid $150,000 on signing (paid), and agreed to pay $200,000 on the first anniversary, $500,000 on the second, $750,000 on the third, $1.2 million on the fourth, and $2.2 million on the fifth anniversary, with a final option payment of $5 million due on the sixth anniversary to purchase a 100% interest in the Cerro Delta Project. The vendor will retain a 1% net smelter revenue. All payments are completely optional, and the Company has no work commitments beyond the minimal requirements to maintain the mining rights under Argentine law.The environmental permits and water rights are already in place for the Cerro Delta Project.

Property Location

The Cerro Delta Project is located approximately 20 kilometers east of the 28.8 million ounce (resource) Cerro Casale gold project which is being developed by Barrick and Kinross and 29 kilometers southeast of the even larger Caspiche project currently being evaluated by Exeter Resource Corporation. Cerro Delta is located along a regional fault structure trending west-northwest to east-southeast which is associated with theAldebaran, CerroCasale, QuebradaSeca, and Maricela deposits in Chile before crossing into Argentina and intersecting the Cerro Delta Project.

History

The first sampling campaigns of the Cerro Delta Project were conducted in 1993 and 1994 detecting strong gold anomalies in soils south of the Cerro Delta. The major sampling work was done by Minas Argentinas S.A. showing the gold mineralization in highly altered granitic rocks placed West and South of the Cerro Delta. In 1996 the company Campo de Oro Andino S.A. subsidiary of ElDorado (Canada) conducted a geochemical and geophysical and trenching program (magnetometry, resistivity and IP) defining two drilling targets.

Later, in 2008, Golden Peaks Minera conducted another geophysical study which confirmed the former results and added more detail and precision response.

Infrastructure

The Cerro Delta Project is located 35 kilometers north of the international paved road Nº 22 from Vinchina (La Rioja) to Copiapo, Chile. The Project can also be accessed with existing roads from the City of Copiapo.There is no local electricity or water currently available. We will need to supply our own diesel generated electrical power.

Claim Status

The Cerro Delta Project has three mining concessions:

|

Mining Concession

|

Title Number

|

Area (Ha)

|

Term of Validity

|

Royalties and Payments

|

||||

|

Pablo

|

· 9755-C-1991

|

4,000

|

-

|

1% NSR

|

||||

|

Roberto

|

· 9756-C-1991

|

3,850

|

-

|

1% NSR

|

||||

|

Delta 1

|

· 34-C-2007

|

10,000

|

-

|

1% NSR

|

19

The following figure shows the location of the mining concessions on the Cerro Delta Project.

Geological Setting and Mineral Deposit

The deposits of the Maricunga Belt are often very large but low grade porphyry gold-copper type deposits with variably oxidized sulfide stockwork or veinlets with or without associated copper (Maricunga, Volcan, Caspiche, Cerro Casale) or high sulfidation type epithermal quartz veins and stockworks with better grades and without copper (La Coipa, Lobo-Marte). It is common to have both deposit types in a single large deposit area such as is the case with the Cerro Delta project. In addition, most deposits in the Maricunga Belt exhibit a zoned alteration pattern with an area of potassic alteration flanked by argillic and advanced argillic alteration with some amount of silicification, which is also common to Cerro Delta. Also common to deposits of the Maricunga Belt are large scale faults and lineaments of a general north-south trend and which tend to localize the emplacement of mineralized intrusions. At Cerro Delta these regional structures are mostly N-S, NNW and E-W with several intersecting zones which appear related to alteration and mineralization.

Current Exploration

The main exploration activities for the Cerro Deltahave included soil sample and rock chip samples. Assay results and an analysis of the exploration work are compiled and described in our recently filed NI 43-101 for Cerro Delta, and is in compliance with the standards and requirements of Canadian security regulatory authorities. The NI 43-101 report is also available on our website, www.panamericangoldfields.com.

Planned Exploration Activities

The Cerro Delta project is drill ready and we intend to begin drilling in the fourth quarter of 2011.

20

Recent Financing Activities

In March 2011, wecompleted a private placement of 6,560,000 units at $0.20 per unit, for total proceeds of $1,312,000. Each unit consists of one share of common stock and a warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at an exercise price of $0.30 for a period of two years from the closing date. The securities were issued to U.S. “accredited investors” and Canadian and non-U.S. investors. We paid $89,000 in finders’ fees in conjunction with the private placement.

In September 2009, we entered into private placement subscription agreements, as thereafter amended, with certain U.S. accredited investors and certain non-U.S. investors for the private placement of 12,500,000 unregistered shares of the common stock with 100% warrant coverage at a purchase price of $0.20 per unit. The warrants have an exercise price of $0.30 per share, a two-year term and will not be exercisable until 12months after their date of issuance. The Company received aggregate gross proceeds, prior to any expenses, from the private placement of $2,500,000.

Principal Products

Our principal product is the exploration for precious minerals. Because our properties are in the exploration stage, there is no guarantee that any ore body will be found or extracted.The proposed exploration program is being undertaken by our exploration team using in-house knowledge along with the support and guidance of consultants with expertise in these regions. We believe our existing management team and key advisors have the necessary exploration and mining expertise to locate, evaluate and bring mining properties to production.

Competition

We compete with other mining and exploration companies in connection with the acquisition of mining claims and leases on gold and other precious metals prospects and in connection with the recruitment and retention of qualified employees. Many of these companies are much larger than we are, have greater financial resources and have been in the mining business much longer than we have. As such, these competitors may be in a better position through size, finances and experience to acquire suitable exploration properties. We may not be able to compete against these companies in acquiring new properties and/or qualified people to work on any of our properties.

Given the size of the world market for gold and silver relative to individual producers and consumers of gold and silver, we believe that no single company has sufficient market influence to significantly affect the price or supply of gold and silver in the world market.

Governmental Regulations

Our business is subject to various levels of government controls and regulations, which are supplemented and revised from time to time. Any mineral exploration activities conducted by the Company require permits from governmental authorities. The various levels of government controls and regulations address, among other things, the environmental impact of mining and mineral processing operations and establish requirements for the decommissioning of mining properties after operations have ceased. With respect to the regulation of mining and processing, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission standards and other design or operational requirements for various components of operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclamation and rehabilitation of mining properties following the cessation of operations, and may require that some former mining properties be managed for long periods of time. In addition, in certain jurisdictions, we may be subject to foreign investment controls and regulations governing our ability to remit earnings abroad.

The Company’s operations and properties are subject to a variety of governmental regulations including, among others, regulations promulgated by SEMARNAT, Mexico’s environmental protection agency; the Mexican Mining Law; and the regulations of the Comisión National del Agua with respect to water rights. Mexican regulators have broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards. If we put any of our properties into production, operations may also be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, environmental legislation and mine safety. In Argentina we are subject to comply with the Codigo de Mineria (Argentina´s Mining Law) and all the provincial regulations.

The need to comply with applicable laws, regulations and permits will increase the cost of operation and may delay exploration. All permits required for the conduct of mining operations, including the construction of mining facilities, may not be obtainable, which would have an adverse effect on any mining project we might undertake. Additionally, failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing exploration to cease or be curtailed. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

21

Amendments to current governmental laws and regulations affecting mining companies, or the more stringent application thereof, could adversely affect the Company’s operations. The extent of any future changes to governmental laws and regulations cannot be predicted or quantified. Generally, new laws and regulations result in increased compliance costs, including costs for obtaining permits, delays or fines resulting from loss of permits or failure to comply with the new requirements.

To keep our mineral concessions in good standing with the Government of Mexico, we must pay yearly property taxes. These taxes are based on a tariff per hectare and per the number of years (maturity)of each concession. The taxes are paid twice a year. We have paid:

|

July 2009

|

MXN $133,626 ($10,179)

|

|

|

January 2010

|

MXN $141,376 ($10,779)

|

|

|

July 2010

|

MXN $110,888 ($8,735)

|

|

|

January 2011

|

MXN $117,215 ($9,685)

|

We are in compliance with all of our tax payments to the government. We believe that we are in compliance with all material current government controls and regulations at each of our properties.

Compliance with Environmental Laws

Our current exploration activities and any future mining operations (of which we currently have none planned) are subject to extensive laws and regulations governing the protection of the environment, waste disposal, worker safety, mine construction, and protection of endangered and protected species. We have made, and expect to make in the future, significant expenditures to comply with such laws and regulations. Future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have an adverse impact on our financial condition or results of operations. In the event that we make a mineral discovery and decide to proceed to production, the costs and delays associated with compliance with these laws and regulations could stop us from proceeding with a project or the operation or further improvement of a mine or increase the costs of improvement or production.

In Mexico, we are required to submit, for government approval, a reclamation plan for each of our mining sites that establishes our obligation to reclaim property after minerals have been mined from the site. In some jurisdictions, bonds or other forms of financial assurances are required as security for these reclamation activities. We may incur significant costs in connection with these restoration activities. The unknown nature of possible future additional regulatory requirements and the potential for additional reclamation activities create uncertainties related to future reclamation costs.

In Argentina, every two years, we are required to submit an Environmental Study update for every exploration right for government approval and for every main exploration step (i.e., a new drilling campaign). The same requirement is applicable to every new exploration right we claim.

Employees

We currently have five persons working for Sunburst de Mexico, of which, one is a geologist and the rest are employed in administrative capacity. Except for our general manager, Manuel Flores, all of these persons are provided to Sunburst de Mexico under third party contract, either directly or via a personnel service agency. We have hired Miguel F. Di Nanno as our President and Chief Operating Officer, Salil Dhaumya as our Chief Financial Officer and Manuel Flores as our Operations Manager. Other than these employees and our geologists, all of the employees we hire are contracted from third parties specializing in providing employees for Mexican companies. In using third party contractors, we minimize our exposure to Mexican employment law, and all liabilities are undertaken by the third party contractors providing the services. Currently, we do not have any operations in Argentina. Other than our President and Chief Operating Officer, Mr. Di Nanno, who is based in Argentina, we have no employees or personnel contracted under third party contracts in Argentina. We pay a flat rate to the third parties for their services. In the event that our exploration projects are successful and warrant putting any of our properties into production, all such operations would be contracted out to third parties. Also, we rely on members of our management to handle all matters related to business development and business operations.

22

ITEM IA. RISK FACTORS

Risks Relating to Our Business and Industry

We have a limited operating history; therefore, it is difficult to evaluate our financial performance and prospects.

We have only completed the initial stages of exploration on our mineral concessions and have no way to evaluate the likelihood that we will be able to operate and develop a successful business. We are considered to be an exploration stage corporation because we are currently engaged in the search for mineral deposits. We will be in the exploration stage until we exploit commercially viable mineral deposits on our properties. Our limited operating history makes it difficult to evaluate our financial performance and prospects, as well as our ability to successfully identify and develop mining projects. We have earned minimal revenues from mineral extraction activities to date at our Cieneguita Project, and we have not emerged from being an exploration stage to a development stage corporation. Because of our limited financial history, we believe that period-to-period comparisons of our results of operations will not be meaningful in the short term and should not be relied upon as indicators of future performance.

Because of our recurring operating losses, stockholder’s deficit, working capital deficit and negative cash flows, our auditor has raised substantial doubt about our ability to continue our business.

We have received a report from our independent auditors on our financial statements for the fiscal years ended February 28, 2011 and February 28, 2010, in which our auditors have included explanatory paragraphs indicating that our recurring operating losses, working capital deficiency, and cumulative losses during our exploration stage cause substantial doubt about our ability to continue as a going concern. By issuing this opinion, our auditors have indicated that they are uncertain as to whether we have the capability to continue our operations.

We have a history of incurring net losses. We expect our net losses to continue as a result of planned increases in operating expenses, and therefore, may never achieve profitability.

We have a history of operating losses and have incurred significant net losses in each fiscal quarter since our inception. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing significant revenues. We expect to continue to incur net losses and negative cash flows for the foreseeable future. Our ability to generate and sustain significant revenues or to achieve profitability will depend upon numerous factors outside of our control, including the precious metals market and the economy. We have no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business, financial condition or results of operations could be materially adversely affected and the business will most likely fail.

If we do not obtain financing when needed, we will need to cease our operations.

As of February 28, 2011, we had cash on hand in the amount of approximately $408,000. In order for us to perform any further exploration or extensive testing, we will need to obtain additional financing. We will require additional financing if the costs of the exploration of our mineral concessions are greater than anticipated. We also will need supplementary financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering and extracting ore of commercial tonnage and grade, we will require a significant amount of additional funds in order to place our mineral concessions into commercial production. We currently do not have any arrangements for additional financing, and we may not be able to obtain financing when required. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all. These factors, among others, raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustment to reflect the possible future effect on the recoverability and classification of the assets or the amounts and classification of liabilities that may result should we cease to continue as a going concern. If we are unable to obtain additional financing when sought, we will be required to curtail our business plan. Any additional equity financing may involve substantial dilution to our then existing shareholders. There is a significant risk to investors who purchase shares of our common stock because there is a risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time.

23

If we are required for any reason to repay our outstanding promissory notes, we would be required to deplete our working capital, if available, or raise additional funds.

As of February 28, 2011, we have promissory notes outstanding in the amount of $884,022, including outstanding principal and interest. We do not have a sinking fund available to repay this debt. These promissory notes are in default and could require the immediate repayment of the promissory notes. If we are required to repay the promissory notes, we would be required to use our limited working capital and would also be required to raise additional funds to fully repay the promissory notes. If we were unable to repay the promissory notes when required, the noteholders could commence legal action against us. Any such action would require us to curtail or cease operations.

Our success is dependent on retaining key personnel and on hiring and retaining additional personnel.

Our ability to continue to explore and develop our mineral concessions is, in large part, dependent upon our ability to attract and maintain qualified key personnel. There is competition for such personnel, and there can be no assurance that we will be able to attract and retain them. Our development now and in the future will depend on the efforts of key management and directors. The loss of any of these key people could have a material adverse effect on our business, financial condition or results of operations. We do not currently maintain key-man life insurance on any of our key employees. We may not be able to find qualified geologists and mining engineers on a timely basis or at all to further expand our business plan. Furthermore, if we are able to find qualified employees, the cost to hire them may be too great as there may be other opportunities elsewhere at a higher rate than we are able to pay.

As we undertake exploration and potential development of our mineral claims, we will be subject to compliance with government regulations that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We expect to be subject to federal, state and local laws and regulations in Mexico and Argentina regarding environmental matters, the abstraction of water, and the discharge of mining wastes and materials and other similar laws and regulations. Amendments to current laws, regulations and permits governing operations and activities of exploration and development companies, or more stringent implementation thereof, could have a material adverse impact on us and our operating, increase our expenditures and costs and require abandonment or delays in developing new mining properties. Environmental laws and regulations change frequently, and the implementation of new, or the modification of existing, laws or regulations could harm our business, financial condition or results of operations. We cannot predict how agencies or courts in Mexico or Argentina will interpret existing laws and regulations or the effect that these adoptions and interpretations may have on our business, financial condition or results of operations. We may be required to make significant expenditures to comply with governmental laws and regulations.

Any significant mining operations that we undertake in the future will have some environmental impact, including land and habitat impact, arising from the use of land for mining and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. No assurances can be given that such environmental issues will not have a material adverse effect on our business, financial condition or results of operations in the future. MRT is required to comply with applicable environmental laws and permits in conducting its operations at the Cieneguita Project. While we believe we do not currently have any material environmental obligations, exploration and development activities may give rise in the future to significant liabilities on our part to the government and third parties and may require us to incur substantial costs of remediation.

Additionally, we do not maintain insurance against environmental risks. As a result, any claims against us may result in liabilities we will not be able to afford, resulting in the failure of our business. Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in exploration and development operations may be required to compensate those suffering loss or damage by reason of the exploration and development activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Because our directors and officers may serve as directors or officers of other companies, they may have a conflict of interest in making decisions for our business.

Our directors and officers may serve as directors or officers of other companies or have significant shareholdings in other resource companies and, to the extent that such other companies may participate in ventures in which we may participate, our directors or officers may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of our directors, we expect that the director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. Our directors are required to act honestly, in good faith and in our best interests. In determining whether or not we will participate in a particular program and the interest therein to be acquired by us, we expect that the directors and officers will be guided by their fiduciary duties and take into account such matters as they deem relevant, including considering the degree of risk to which we may be exposed and our financial position at that time.

24

Because our officers and directors may allocate their time to other business interests or may be employed by other companies, they may not be able or willing to devote a sufficient amount of time to our business operations, which may adversely affect our business, financial condition or results of operations and cause our business to fail.

It is possible that the demands on our officers and directors, from their existing employment and from other obligations could increase with the result that they would no longer be able to devote sufficient time to the management of our operations and business. This conflict of interest could adversely affect our business, financial condition or results of operations and cause our business to fail.

We are controlled by our directors and officers, and, as such, you may have no effective voice in our management.