Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - BTU INTERNATIONAL INC | Financial_Report.xls |

| EX-32.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 906 - BTU INTERNATIONAL INC | d270227dex321.htm |

| EX-32.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 906 - BTU INTERNATIONAL INC | d270227dex322.htm |

| EX-23.1 - CONSENT OF KPMG LLP - BTU INTERNATIONAL INC | d270227dex231.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - BTU INTERNATIONAL INC | d270227dex312.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - BTU INTERNATIONAL INC | d270227dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO .

COMMISSION FILE NUMBER 000-17297

BTU INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

| DELAWARE | 04-2781248 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

| 23 ESQUIRE ROAD, NORTH BILLERICA, MASSACHUSETTS | 01862-2596 | |

| (Address of principal executive offices) | (Zip Code) |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (978) 667-4111

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class |

Name of Each Exchange on which Registered | |

| Common Stock, $0.01 Par Value |

NASDAQ Global Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None.

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period than the registrant was required to submit and post such files.) Yes ¨ No ¨ (Registrant is not subject to the requirements of Rule 405 of Regulation S-T at this time)

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act). Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the shares of Common Stock, $0.01 par value, of the Company held by non-affiliates of the Company was $54,303,136 on July 3, 2011.

Indicate number of shares outstanding of the Registrant’s Common Stock, par value $0.01 per share, as of the latest practicable date: As of February 27, 2012: 9,503,061 shares.

DOCUMENTS INCORPORATED HEREIN BY REFERENCE

The following documents are incorporated herein by reference: Part III—Portions of the Proxy Statement for the 2012 Annual Meeting of Stockholders, which is to be filed with the Securities and Exchange Commission.

Table of Contents

BTU INTERNATIONAL, INC.

2011 FORM 10-K ANNUAL REPORT

| Part I |

||||

| Item 1 | 1 | |||

| Item 1A | 8 | |||

| Item 1B | 12 | |||

| Item 2 | 12 | |||

| Item 3 | 12 | |||

| Item 4 | 12 | |||

| Item 4A | 13 | |||

| Part II |

||||

| Item 5 | 15 | |||

| Item 6 | 16 | |||

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 | ||

| Item 7A | 25 | |||

| Item 8 | 25 | |||

| Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

47 | ||

| Item 9A | 47 | |||

| Item 9B | 48 | |||

| Part III |

||||

| Item 10 | 49 | |||

| Item 11 | 49 | |||

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

49 | ||

| Item 13 | Certain Relationships and Related Transactions, and Director Independence Matters |

49 | ||

| Item 14 | 50 | |||

| Part IV |

||||

| Item 15 | 50 | |||

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Overview

BTU International, Inc. (“BTU” or the “Company”), founded in 1950 and headquartered in North Billerica, Massachusetts, is a market-leading, global supplier of advanced thermal processing equipment to the alternative energy and electronics manufacturing markets. BTU equipment is used in the production of solar cells and nuclear fuel, as well as in printed circuit board assembly and semiconductor packaging.

Our customers require high throughput, high yield and highly reliable thermal processing systems with tightly controlled temperature and atmospheric parameters. In the solar market, BTU offers processing equipment for both silicon and thin film photovoltaics. Also in alternative energy, our customers use our thermal systems for the processing of nuclear fuels. Our convection solder reflow systems are used to attach electronic components to the printed circuit boards, primarily in the advanced, high-density, surface mount segments of this market. In the semiconductor market, we participate in both wafer level and die level packaging, where our thermal processing systems are used to connect and seal integrated circuits into a package.

Industry Background

Alternative Energy Markets

BTU’s alternative energy business primarily addresses two markets: the manufacturing of solar cells and nuclear fuels.

Photovoltaics. Silicon photovoltaic applications are served by BTU’s metallization furnaces and in-line diffusion systems. The MERIDIAN™ thermal processing system is used for phosphorous diffusion. This system is targeted for customers transitioning from batch to in-line processing. The MERIDIAN™ sells in the range of $700,000 to $1.4 million.

BTU’s metallization products include the TRITAN™ and PVD systems. The TRITAN™ is the latest generation product, featuring a unique multiple belt transport system with optimized wavelength thermal heating. The TRITAN™ is capable of processing two lanes of wafers in parallel and sells in the range of $200,000 to $400,000. The PVD series is BTU’s first generation metallization drying and firing solution. It offers a wide variety of configurations from lab scale to mass production. The PVD series sells in the range of $100,000 to $275,000.

BTU offers solar processing equipment for both silicon and thin film photovoltaics. In thin film photovoltaics, BTU’s equipment is used for both the Copper Indium Gallium Selenide (CIGS) and Cadmium Telluride (CdTe) processes. These thin film systems generally sell in the range of $800,000 to $2.0 million.

Nuclear Fuel. Another application for BTU systems is for sintering nuclear fuel. These sintering processes operate at approximately 1750°C in a hydrogen reduction atmosphere. Our market leading product for this application is our patented Walking Beam system, which is ideally suited for the high volume manufacture of nuclear fuels. It uses a walking beam transport system to eliminate friction associated with the conveyance of heavy loads through the process chamber. Walking Beam systems, which are used to sinter gadolinium and uranium pellets used for nuclear fuel generation, generally sell in the range of $2.4 million to $3.3 million.

Electronics Markets

Demand for increasingly sophisticated electronic devices continues, and we expect that new technologies such as wireless networks, next generation cellular phones, personal digital assistants and tablets will help to

1

Table of Contents

drive future growth. Electronic equipment continues to become more complex, yet end users are still demanding smaller, lighter and less expensive devices. This, in turn, requires increased performance and reduced cost, size, weight and power requirements of electronic assemblies, printed circuit boards and semiconductors. In response to these developments, manufacturers are increasingly employing more sophisticated production and assembly techniques requiring more advanced manufacturing equipment, such as that supplied by BTU.

Printed Circuit Board Assembly. In the printed circuit board assembly process, semiconductor and discrete-devices plus other components are attached to printed circuit boards. The attachment process, which creates a permanent physical and electrical bond, is called solder reflow or surface mount reflow. Manufacturers rely on high throughput and highly reliable equipment to get the maximum efficiency in their production process.

Wafer Level and Die Level Semiconductor Packaging. Semiconductor packaging processes include precision thermal processing steps. In advanced semiconductor packaging, processing takes place at both the wafer level and die level. At the wafer level, deposited solder must be thermally treated to form perfectly spherical “bumps.” At the die level, these bumps allow the integrated circuits to be bonded to the semiconductor package. Advancements in the semiconductor industry toward higher chip speeds, smaller form factors and reduced costs are driving the transition to wafer level packaging from the traditional wire bonding technique.

Across all markets, the need for more versatile, more reliable and more advanced capital equipment persists. In addition, the continued globalization of manufacturing and the shift to low cost regions such as China, particularly for electronics and silicon photovoltaic producers, has driven the demand for equipment with a lower cost of ownership.

Technological Challenges

Continuous thermal processing systems present significant engineering challenges related to temperature control, atmosphere control, product handling, flux containment and disposal, and high system up time. Thermal processing systems must maintain accurate and uniform temperatures within their process chambers. The temperature within the process chamber is influenced by the rate at which components are moved through the system and the weight and density of the product. In addition, the thermal processing system’s heat convection and/or radiation rate must be varied and controlled as components and materials are processed. The chamber must also dispense heat uniformly across the product at precise temperatures to ensure maximum process uniformity. Products must be heated and cooled at closely preset rates in order to avoid damage caused by thermal stress.

Another technological challenge for continuous thermal processing systems is achieving precisely controlled atmospheric conditions within the process chamber. In order to facilitate thermal processing without contamination of or damage to the product, many thermal processing systems use a substantially oxygen-free atmosphere of nitrogen or hydrogen in their process chambers. If such gases are used, the exit of process gases and/or the entry of contaminating air must be minimized, even though the product enters and exits the system continuously from the ambient atmosphere. Maintaining a pure, safe and controlled atmosphere in the open process chamber, while minimizing the consumption of nitrogen or hydrogen gases in order to reduce operating costs, presents significant engineering challenges.

Handling products in thermal processing systems requires highly reliable conveyance systems that can easily be converted to process a wide variety of products having different specifications, sometimes on side-by-side tracks through the process chamber. The product handling system must also fully support a wide variety of product sizes.

The mechanical components in thermal processing systems must operate almost continuously in a demanding, elevated temperature environment with frequent thermal cycles. The use of materials that are resistant to high temperature and thermal stress is important to achieving high reliability.

2

Table of Contents

In applications using flux or other process chemicals, the volatile compounds that are vaporized during the thermal processing cycle must be safely contained and collected so that they do not condense in the system or damage the environment. The efficient containment, collection and disposal of the flux or other process chemicals are important factors in achieving high system up time, high throughput and reliability.

Our Solution

We deliver a broad range of thermal processing systems to serve the needs of manufacturers that require high throughput, process yields and reliability with tightly controlled process parameters. Our systems are designed to enable our customers to increase product performance, throughput and yield for solar cell processing, nuclear fuel sintering and electronics assembly by providing precise atmospheric and temperature control. In addition to the expected high performance of our products, we believe maintaining the quality standards of our organization and our worldwide service and support are important to our success with industry leading global manufacturers.

We believe our customers continue to choose our products because of the following factors:

Accurate and Uniform Temperature. Our systems use convection, radiation and infrared heating technologies. Our high-rate convection and fully-enclosed coil heating modules are designed to provide controlled heating capacities across many different applications, thereby enabling our customers to maximize process uniformity and throughput. In addition, our systems are designed to apply heat uniformly across the product load, which is critical to ensure optimum processing. Heat up and cool down profiles are also closely controlled for process consistency and the protection of product.

Atmosphere Uniformity and Control. Our thermal processing systems are designed to provide precision control over atmospheric conditions within their process chambers by integrating our gas and physical curtain technologies. Our systems are designed to be capable of excluding virtually all oxygen from the critical process steps to maintain the safety and integrity of the process chamber atmosphere. In addition, our systems are intended to minimize the consumption of nitrogen or hydrogen, thereby reducing the operating cost of maintaining the atmosphere.

Repeatability from System to System. We design our systems to provide a high degree of repeatability from system to system through our atmospheric and temperature controls and the expected reliability of our systems. This repeatability is achieved through our industry leading closed loop convection technology that is intended to ensure the same convection rate regardless of change in altitude or temperature. This is a critical attribute because our customers must achieve consistent, uniform manufacturing performance in plants located throughout the world.

Processing Flexibility. Major electronics and solar cell manufacturers process many sizes of products and often need rapid product changeover capabilities. Our systems can process printed circuit boards or solar cells of different sizes with minimal or no reconfiguration. Rapid changeover reduces down time and increases manufacturing volume. In addition, our solar cell processing equipment can be configured for multiple process applications allowing for versatility in materials manufacturing.

Reliability. Our customers place a high premium on reliability. Reliability is a major contributor to low cost of ownership because high up time can increase the productivity and efficiency of an entire production line. We believe our systems are the most reliable advanced thermal processing systems in the world.

Systems Integration. We provide fully integrated systems that include automated handling of our products, as well as full software integration with our customers’ factory management systems. This allows our customers to monitor and analyze the process in real time from a central location.

3

Table of Contents

Worldwide Customer Support. Our goal is to provide our customers with global technical service support, in-depth process engineering support and rapid delivery of our systems and parts. We provide our customer support through our on-site direct service organization and our independent sales and service representatives, supplemented with twenty-four hours a day, seven days a week telephone support and extensive customer training programs.

Our Strategy

Our objective is to be the leading provider of thermal and other processing systems to the alternative energy and electronics assembly markets. To achieve this goal and maximize value for our shareholders, our strategy includes the following elements:

| 1. | Continue to focus on expanding our alternative energy related business, especially solar; |

| 2. | Deepen relationships with key partners to facilitate product and process development for next generation technologies, particularly in the rapidly growing energy generation markets; |

| 3. | Continue to focus on cost reduction initiatives, including the improvement of our global supply chain and reduction in materials costs; |

| 4. | Further penetrate existing markets, such as electronics, and new customers by developing innovative products with a low cost of ownership and by offering exceptional customer support; and |

| 5. | Expand our low-cost manufacturing and engineering operations in China. |

Products

We supply a broad range of primarily thermal processing systems for the alternative energy and electronics assembly markets. Our products are used for such applications as solar cell manufacturing, nuclear fuel processing, printed circuit board assembly, and semiconductor packaging. Most of our products are used for thermal processing operations; most have a processing chamber that allows products to enter and exit in a continuous mode through the process chamber via a transport mechanism—typically a conveyor belt. A control system regulates a series of electric heaters to produce a consistent, even temperature profile, as required by the customers’ process. We also provide equipment that is used for coating operations produced by BTU or purchased from a 3rd party.

Alternative Energy Products

The processing of advanced materials used in non-fossil fuel power generation applications is a significant target market. The cost fluctuations of fossil fuels and environmental concerns have increased demand for “clean” power. For power generation applications, we serve the solar cell and nuclear fuel markets. We support our worldwide alternative energy customers through our global sales and service network.

Solar Cells. BTU offers solar processing equipment for both silicon and thin film photovoltaics. Silicon photovoltaic applications are served by BTU’s metallization , in-line diffusion, and next generation processes and systems. BTU’s solar cell processing equipment includes not only in-line thermal systems but spray-coating systems produced either by BTU or purchased from a 3rd party. Our MERIDIAN™ In-line Diffusion system, introduced in late 2008, features the MERIDIAN™ phosphorus coater, which includes key advances such as back-side and top-side coating and an integrated dryer. The system can be configured to achieve up to 1500 (156mm) wafers per hour. The in-line process offers reduced wafer handling and greater throughput than traditional batch processing. Reduced handling translates into lower breakage rates, improved yield and lower cost of ownership. The MERIDIAN™ system price starts at $700,000 and varies depending on configuration. In thin film photovoltaics, BTU’s equipment is used for both the CIGS and CdTe processes.

4

Table of Contents

For the metallization process, BTU offers a complete line of Rapid Thermal Processing furnaces utilizing near infrared heating technology. Systems come in varying lengths and widths to suit specific throughput requirements. The product line has been specifically designed for the solar cell metallization process and is used for contact drying and firing. Specialized features include rapid heating via densely spaced tungsten lamps and rapid cooling rates obtained through proprietary water cooling technology. These systems generally range in price from $180,000 to $650,000.

To improve solar cell efficiency and reduce manufacturing cost, the solar market invests aggressively in new technologies. BTU offers next generation thermal processing equipment to enable such new technologies. Annealing of additional and/or novel layers and plating are becoming important process steps. BTU has developed products for these applications, providing production scale equipment to several key solar companies and pilot units to others. We expect this to be an emerging business in the years to come, and we are well positioned to be a leader in this emerging area.

In thin film photovoltaics, BTU leverages its experience with large-scale, custom, in-line thermal processing systems. System designs are scalable and are sold for lab, pilot and production sized applications. These systems generally sell for in excess of $1 million, although the price can vary widely based on size and features.

Nuclear Fuels. We offer both walking beam and pusher systems for sintering nuclear fuel. These processes operate at temperatures in the range of 1750°C in a hydrogen reduction atmosphere. Our most important product for this market is our patented Walking Beam system designed for high volume manufacture of nuclear fuels. It uses a walking beam transport system to eliminate friction associated with the conveyance of heavy loads. Walking Beam systems are used to sinter gadolinium and uranium pellets used for nuclear fuel generation. These systems generally sell in the range of $2.4 million to $3.3 million.

Electronics Products

Printed Circuit Board Assembly. We currently sell thermal processing systems used in the solder reflow and curing stages of printed circuit board assembly. Our printed circuit board assembly products are used primarily in the advanced, high-density segments of the market that utilize surface mount technology.

Our PYRAMAX™ family of convection reflow systems is designed on a single platform to be rapidly configurable, which is intended to reduce the product build cycle and allow us to meet customer demands for shorter delivery lead times. We believe PYRAMAX™ products offer our customers reduced capital cost, lower nitrogen consumption and reduced scheduled maintenance cycles.

PYRAMAX™ systems provide increased process flexibility due to their ability to process printed circuit boards up to 24 inches wide. Rated up to 400°C, these products are designed to be capable of operating in air or nitrogen atmospheres and to have increased convection flow for greater performance and lead free processes. PYRAMAX™ utilizes impingement technology to transfer heat to the substrate. These systems are offered in 6, 8, 10 and 12-zone heated lengths and are capable of processing lead free solder. They generally range in price from $40,000 to $150,000.

The market need for lead free solder reflow presents a unique challenge by requiring a process temperature that is critically close to the destruct temperature of the components that are being attached. PYRAMAX™ system’s unique closed loop convection control is designed to provide a repeatable tight temperature window that is optimized for lead free solder reflow.

The solder reflow process requires the thermal processing system to manage flux residues eliminated during the processing of the printed circuit boards. PYRAMAX™ systems are equipped with a patented flux management system that is structured to isolate the flux outside the main process chamber, thereby helping to maintain the integrity of the atmosphere and facilitate easy disposal.

5

Table of Contents

Wafer Level and Die Level Semiconductor Packaging. We sell several systems for the thermal processes used in advanced semiconductor packaging.

Flip-chip reflow provides the physical and electronic bond of the semiconductor device to its package. The PYRAMAX™ families of convection reflow systems, utilizing our closed loop convection technology, rate at up to 400°C and operate in air or nitrogen atmospheres. These products utilize impingement technology to transfer heat to the substrate. Using thermal power arrays of five-kilowatt heaters, they can process substrates in dual lane, dual speed configurations, thereby enabling our customers to double production without increasing the machine’s footprint. These products are available in four models based on the heated lengths of thermal processing chambers. Heated length is based on the required production rate and loading requirements. The products generally range in price from $70,000 to $180,000.

Customers

Many of our principal customers are large-volume global manufacturers that use our products in multiple facilities worldwide. Of our top ten revenue generating customers in 2011, six were solar customers, and one customer accounted for $11.9 million or 15.6% of total net sales and another customer accounted for $7.9 million or 10.4% of total net sales.

Sales, Marketing and Support

We market and sell our products primarily through our direct sales force and independent sales representatives throughout the world. Our sales and marketing team is responsible for evaluating the marketplace, generating leads and creating sales programs and sales support materials, such as literature. Our on-site direct service organization and our independent sales representatives provide ongoing support to customers using our products. These services include implementing continuous improvement tools related both to the cost of our products and to their technical performance. As well as process support, our strong global support infrastructure allows us to market future sales within our current customer base and contributes to our competitive position. Our management and sales teams participate in periodic trade conventions, through which we market our products to potential customers.

Research, Development and Engineering

Our research, development and engineering efforts are directed toward enhancing existing products and developing our next generation of products. Research, development and engineering activities in 2011 were focused on the development of new products and improved furnace applications for thermal solutions for alternative energy application processes. The introduction of the TRITAN™ system, a new platform for solar cell metallization and improving the capability on our MERIDIAN™ In-Line Diffusion System were the primary focus for our silicon based solar cell product applications. Thin-film solar cell thermal equipment systems and process applications for various substrates are under on-going development to meet market needs.

In the electronics assembly markets, we continue to enhance our numerous PYRAMAX™ models including the capability for dual lane, dual speed to meet the expanding needs of our customers. These improved PYRAMAX™ offerings were developed jointly by BTU engineers in China and the U.S. In addition, our development team is involved in basic research on high temperature materials and different heating methods that can be used in different thermal process applications.

Close working relationships between our key customers and our product engineering teams enable us to incorporate our customers’ feedback and needs into our product development efforts. We have integrated our product design, manufacturing, engineering and after sales support documentation in support of the new product introduction process.

Our research, development and engineering costs for the years ended December 31, 2011, 2010 and 2009 can be found on our Consolidated Statements of Operations, contained herein.

6

Table of Contents

Manufacturing and Suppliers

Our principal manufacturing operations consist of final assembly, systems integration and testing at our facilities in North Billerica, Massachusetts and Shanghai, China. We outsource the manufacture of many of our subsystems to a number of key suppliers and maintain close relationships with them while also maintaining qualified alternative suppliers. In 2004, our manufacturing facility in Shanghai, China was established for our electronics assembly products and solar cell metallization products, as well as local sourcing of materials.

In the past few years, we have substantially improved our global supply chain and reduced our material costs. We have upgraded and reorganized our operations organization in the U.S. In addition, we have leveraged our presence in China to widen the supply base for our Shanghai manufactured electronics assembly and solar cell metallization products.

Continuous improvement in the supply chain is a key strategic imperative. We have established a global sourcing organization, based in China, to further develop high quality, cost effective suppliers throughout the world.

Our commitment to developing new products, a desire to increase collaboration between engineering teams located in the U.S. and China, and the need to protect our intellectual property led us to implement an enterprise data management system in our North Billerica and Shanghai design centers. In addition to the overall benefits of increased collaboration and information control, the system has significantly improved the productivity of China-based engineers, speeding migration of new products to manufacturing facilities in Shanghai.

We have outsourced the manufacture of most of our significant component systems, thereby reducing cycle time and increasing our inventory turnover. We seek to adhere closely to the principles of total quality management and have been ISO 9001 certified since 1998. In our North Billerica facility, we converted to ISO 9001:2008 in October 2009, and our Shanghai, China manufacturing operations has been ISO 9001:2008 certified since July 2009. Our customers, suppliers and employees are strongly encouraged to provide feedback and suggestions for improvements in products and services.

Intellectual Property

We seek to protect our intellectual property by filing patents on proprietary features of our advanced thermal processing systems and by challenging third parties that we believe infringe on our patents. We also protect our intellectual property rights, including our trademarks, trade secrets and copyrights with nondisclosure and confidentiality agreements with employees, consultants and key customers. As a global supplier of equipment, we recognize that the laws of certain foreign countries may not protect our intellectual property to the same extent as the laws of the U.S. Our current portfolio includes 66 issued patents, 4 trademarks that are registered or pending and 31 pending patent applications.

We license software programs from third party developers and incorporate them into our products. Generally, these agreements grant us non-exclusive licenses to use the software and terminate only upon a material breach by us. We believe that such licenses are generally available on commercial terms from a number of licensors.

Backlog

Backlog as of December 31, 2011, was $11.7 million, compared to $39.3 million as of December 31, 2010. As of December 31, 2011, we expected to ship our year-end backlog within 40 weeks. Most of our backlogs for solar applications are expected to be shipped in 8 – 20 weeks. Solder reflow systems are typically shipped within 3 to 8 weeks. The backlog of our custom systems is expected to be shipped within 12 to 40 weeks. We include in backlog only those orders for which the customer has issued a purchase order and for which we have a defined delivery schedule within 12 months. Due to possible changes in delivery schedules, lead time variations and order cancellations, our backlog at any particular date is not necessarily representative of sales for any subsequent period.

7

Table of Contents

Competition

Several companies compete with us in selling thermal processing systems. Although price is a factor in buying decisions, we believe that technological leadership, process capability, throughput, environmental safeguards, uptime, mean time-to-repair, cost of ownership and after-sale support have become increasingly important factors. We compete primarily on the basis of these criteria, rather than on the basis of price only.

Our systems for the alternative energy markets and other applications compete primarily against products offered by Despatch, AMTECH, Centrotherm, SierraTherm, Smit and Harper. Our principal competitors for printed circuit board assembly equipment and advanced semiconductor packaging vary by product application. Our principal competitors for solder reflow systems are Vitronics-Soltec, Heller, Furakawa, ERSA, and Rehm. Our principal competitors for advanced semiconductor packaging are Vitronics-Soltec and Heller. We also face competition from emerging low cost Asian manufacturers and other established European manufacturers.

Employees

As of December 31, 2011, we had 356 employees, of whom 82 are engaged in sales, marketing and service, 28 in research, development and engineering, 37 in finance and administration and 209 in operations. Of these 356 employees, 211 reside outside of the U.S. None of our employees are represented by a collective bargaining agreement, and we believe that we have satisfactory relations with our employees.

Environmental

One of our core values is protecting the environment in which we operate and the environment in which our equipment operates. Compliance with laws and regulations regarding the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had any material effects on our capital expenditures, earnings or competitive position. We do not anticipate any material capital expenditures for environmental control in our facilities in 2012.

As an equipment manufacturer, we generate and dispose of small quantities of solid waste that is considered hazardous under Environmental Protection Agency (“EPA”) regulations. Because we used a waste disposal firm that disposed the solid waste at a site that the EPA has designated as a Superfund site, we have been named by the EPA as one of the entities responsible for a portion of the expected clean-up costs. Based on our proportional responsibility, as negotiated with and agreed to by the EPA, our liability related to this matter is $225,140. This amount is included in Other Current Liabilities on the Consolidated Balance Sheet as of December 31, 2011 as it had not been paid as of that date.

Our Web Site

Our web site is www.btu.com . It provides information about us, and allows you to obtain, free of charge, a copy of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits, and any amendments to those reports filed or furnished with the Securities and Exchange Commission pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make these reports available through our web site as soon as reasonably practicable after our electronic filing of such materials with, or the furnishing of them to, the Securities and Exchange Commission. The information contained or incorporated on our web site is not a part of this Annual Report on Form 10-K.

| ITEM 1A. | RISK FACTORS |

Risks Relating to Our Business

Our industry has historically been cyclical and experienced periodic downturns.

Our business depends on capital spending by solar power, electronics, and semiconductor manufacturers, which in turn depends on current and anticipated market demand for solar panels, printed circuit boards,

8

Table of Contents

integrated circuits and the products that use them. We are currently experiencing a significant downturn in the solar industry. Capital equipment demand by the solar industry has been heavily impacted as a result of the worldwide over capacity of solar manufacturing driven by the following: meaningful reduction in governmental subsidies worldwide, and significant capacity additions in China and potential anti dumping legislation. Significant reductions in material and solar-cell costs are likely to have a positive impact in the medium and long term.

The electronics and semiconductor industries have historically been cyclical and have experienced periodic downturns that have had a material adverse effect on the demand for equipment that we manufacture and market.

We have made substantial investments in our organization to develop new products for the alternative energy market. Sales of our products to the alternative energy generation markets are subject to substantial risks.

Solar Energy. The solar energy sector is primarily dependent upon continuation of governmental subsidies, some of which have been scaled back, and the supply of materials that may be constrained. A further decline in these subsidies would reduce our ability to grow our business in this market segment. The solar energy sector also depends on the availability of raw materials such as silicon. The solar industry is currently facing overcapacity in its production capacity. This overcapacity has a meaningful negative impact on demand for capital equipment supplied to this industry.

Nuclear Energy. The market for nuclear fuel pellets used in power generation is dependent upon further growth in nuclear power production. Consequently, without growth in the production of nuclear power, our opportunities to grow in this area will be limited. In addition, we may need export licenses to supply this type of equipment to certain countries. Failure to maintain such licenses or obtain new required licenses may impact our ability to expand our revenue from this market.

If we are unable to increase sales and reduce costs, our profitability may be affected negatively.

We had an operating loss of $1.6 million in 2011 compared to operating income of $4.1 million in 2010. We attribute a large portion of the decrease in operating income in 2011 to decreases in sales and lower gross profits caused primarily by the under-absorption of costs in our facilities and an increase in our inventory obsolescence reserve due to slow demand for solar equipment. We may not experience the projected growth in our alternative energy business in 2012, which will negatively impact our profitability.

Our future success will depend on our ability to effectively develop and market our products against those of our competitors.

The industry in which we do business is highly competitive. Some of our competitors have substantially greater financial, engineering, manufacturing and customer support capabilities and offer more extensive product offerings. If customers prefer products offered by our competitors, we will have difficulty maintaining or increasing our revenue. Our systems for the alternative energy markets and other applications compete primarily against products offered by Centrotherm, Amtech, Factory 48, Despatch, SierraTherm, Smit and Harper. Our principal competitors for solder reflow systems are Vitronics-Soltec, Heller, Furakawa, ERSA, and Rehm. Our principal competitors for advanced semiconductor packaging are Vitronics-Soltec and Heller. We expect our competitors to continue to improve the design and performance of their current products and to introduce new products with improved performance capabilities. Our failure to introduce new products in a timely manner, or the introduction by our competitors of products with perceived or actual advantages, could result in reduced sales of, or lower margins on, our products. In future years, we expect to face increased competition based on price, particularly from companies in Asia. If we are unable to reduce the costs of our products or introduce new lower cost products, we may lose sales to these competitors.

9

Table of Contents

Sales made by our international operations are subject to the economic, political, legal and business environments of the countries in which we do business, and our failure to operate successfully or adapt to changes in these environments could cause our international sales and operations to be limited or disrupted.

Our international sales accounted for 82.7% of our consolidated revenue for 2011. We expect to continue to generate a significant percentage of our revenue outside the United States for the foreseeable future. In addition, we have direct investments in a number of subsidiaries outside of the U.S., primarily in Asia and Europe. Our international operations could be limited or disrupted, and the value of our direct investments may be diminished, by any of the following:

| • | fluctuations in currency exchange rates; |

| • | the imposition of governmental controls; |

| • | import and export license requirements; |

| • | political instability; |

| • | difficulties enforcing contractual and intellectual property rights; |

| • | terrorist activities and armed conflict; |

| • | restrictions on direct investments by foreign entities and trade restrictions; |

| • | changes in tax laws and tariffs; |

| • | costs and difficulties in staffing and managing international operations; and |

| • | longer customer payment cycles. |

Additionally, we are subject to the Foreign Corrupt Practices Act, which may place us at a competitive disadvantage to foreign companies that are not subject to similar regulations.

We conduct only a small portion of our sales in currencies other than the U.S. dollar. We recognize foreign currency gains or losses arising from our operations in the period in which we incur those gains or losses. As a result, currency fluctuations among the U.S. dollar and the other currencies in which we do business have caused foreign currency transaction gains and losses in the past and will likely do so in the future. Because of the number of currencies involved, the variability of currency exposures and the potential volatility of currency exchange rates, we may suffer foreign currency transaction losses in the future due to the effect of exchange rate fluctuations.

Over the past few years, a majority of our revenue has been generated from sales in the Asia Pacific region. Our operations are particularly vulnerable to instability in this region and competition from organizations based in this region.

During 2011, 69.7% of our revenue was generated from sales in the Asia Pacific region. Political or economic instability in any of the major Asia Pacific economies may adversely impact the demand for capital equipment, including equipment of the type we manufacture and market. In addition, we face competition from a number of suppliers based in the Asia Pacific region that have certain advantages over U.S. suppliers, including us. These advantages include, among other things, lower operating and regulatory costs, proximity to customers, favorable tariffs and affiliation with significantly larger organizations. In addition, changes in the amount or price of electronics or solar cells produced in the Asia Pacific region could negatively impact spending by our customers.

If we fail to maintain positive relationships with key personnel, we may be unable to successfully grow our business.

Our future operating results depend substantially upon the continued service of our key personnel, who are not bound by employment agreements. Our future operating results also depend in significant part upon our

10

Table of Contents

ability to attract and retain qualified management, manufacturing, technical, engineering, marketing, sales and support personnel. Competition for qualified personnel, particularly those with technical skills, is intense, and we may fail to attract and retain qualified personnel. Our business, financial condition and results of operations could be materially adversely affected by the loss of any of our key employees, by the failure of any key employee to perform in his or her current position, or by our inability to attract and retain skilled employees.

The income tax rate on our consolidated income before taxes is subject to variables beyond our control.

Our net income and cash flow can be adversely affected by innumerable conditions affecting income taxes which are outside of our control. To name but a few of the potential uncontrollable circumstances that could affect the consolidated tax rate:

| • | We sell and operate globally, with manufacturing in both the United States and China. Disagreements could occur on the jurisdiction of income and taxation among different country governmental tax authorities. Potential areas of disputes could include transfer pricing values, inter-company cross charges and inter-company balances. |

| • | We are subject to a China withholding tax on certain non-tangible charges made under our transfer pricing agreements. The interpretation of what charges are subject to the tax and when the liability for the tax occurs has varied and could change in the future. |

| • | In the United States, new tax disclosure regulations, unfavorable interpretations and unforeseen enforcements by the government tax authorities of various provisions of the federal and state tax codes, could have an unfavorable impact on the amount and timing of our tax provision and cash flow. |

Failure of critical suppliers to deliver sufficient quantities of parts in a timely and cost-effective manner would adversely impact our operations.

Although we use numerous vendors to supply components for the manufacture of our products, not all are qualified suppliers for all of our parts. Some key parts may only be available from a single supplier. Accordingly, we may experience problems in obtaining adequate and reliable quantities of various components. In addition, suppliers may cease manufacturing certain components that are difficult to replace without significant reengineering of our products. Our results of operations will be materially adversely impacted if we are unable to obtain adequate supplies of components in a timely and cost effective manner.

The occurrence of natural disasters in the Asia Pacific region may adversely impact our operations and sales.

We have an expanding engineering and manufacturing facility in China, and the majority of our sales are made to destinations in the Asia Pacific region. This region is known for being vulnerable to natural disasters and other risks, such as earthquakes and floods, which at times have disrupted the local economies. A significant earthquake or other crisis could materially affect our operating results. We are not insured for most losses and business interruptions of this kind, and we do not have redundant, multiple site capacity in the event of a natural disaster. In the event of such a disaster, our business would suffer.

Provisions in our organizational documents could prevent or frustrate attempts by stockholders to replace our current management and could make acquisitions more difficult.

Our certificate of incorporation and by-laws contain provisions that could make it more difficult for a third party to acquire us without the consent of our board of directors. Our certificate of incorporation provides that our stockholders may not take action by written consent. This provision may have the effect of preventing or hindering attempts by our stockholders to replace our current management. Furthermore, Delaware law prohibits a corporation from engaging in a business combination with any holder of 15% or more of its capital stock until the holder has held the stock for three years unless, among other possibilities, the corporation’s board of directors approves the transaction. Our board of directors may use this provision to prevent changes in our management. Also, our board of directors may adopt additional anti-takeover measures in the future.

11

Table of Contents

Our officers and directors may be able to block proposals for a change in control.

Paul J. van der Wansem, our chairman and chief executive officer, beneficially owns approximately 19.7% of our outstanding common stock as of December 31, 2011. Due to this concentration of ownership, Mr. van der Wansem may be able to prevail on all matters requiring a stockholder vote, including:

| • | the election of directors; |

| • | the amendment of our organizational documents; or |

| • | the approval of a merger, sale of assets, or other major corporate transaction. |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. PROPERTIES |

Facilities

We maintain our headquarters in North Billerica, Massachusetts, where we own a 150,000 square foot facility. We also operate an approximately 45,000 square foot leased manufacturing, engineering, sales and service facility in Shanghai, China.

In England, we lease a facility for our European and Near East sales and service operations. In the Asia Pacific region, we lease sales and service offices in Singapore and Malaysia.

| ITEM 3. | LEGAL PROCEEDINGS |

On October 25, 2011, one of the Company’s overseas customers filed an appeal with the Grenoble Court of Appeals, Grenoble, France, seeking to overturn a decision of the lower court denying its request to nominate a surveyor to examine allegations that furnaces it had purchased from the Company in 2006 had not functioned properly. The Company is preparing a response to deny this customer’s allegations and is vigorously contesting this matter. On July 6, 2011, in a separate proceeding involving this customer, the Company filed a request for arbitration with the International Court of Arbitration of the International Chamber of Commerce in Paris, France asking the arbitrators to certify that the customer is barred from receiving any remedy. In addition the Company has filed claims for reimbursements of work performed, as well as reimbursements of legal costs related to the arbitration proceedings. The customer has filed a counterclaim for damages. Each party has nominated an arbitrator and these two arbitrators have selected a neutral arbitrator who will act as the chairman of the tribunal. The Company strongly believes that the equipment the customer purchased met all applicable specifications, that there is no basis for a valid warranty claim and that the risk that a loss has occurred with respect to this matter is not probable. An estimate or a range of any possible loss cannot be made at this juncture due to the early stage of the proceedings. However, litigation is inherently uncertain and an adverse result in this matter could have a material adverse effect on the Company’s results of operations and financial condition.

| ITEM 4. | MINE SAFETY DISCLOSURE |

Not applicable.

12

Table of Contents

| ITEM 4A. | EXECUTIVE OFFICERS OF THE REGISTRANT |

The following table lists our executive officers and their ages. Following the table is a description of the business experience of each of our executive officers

| Name |

Age | Position | ||||

| Paul J. van der Wansem |

72 | Chairman and Chief Executive Officer (principal executive officer) | ||||

| Peter J. Tallian |

53 | Chief Financial Officer and Principal Accounting Officer (principal financial and accounting officer) | ||||

| James M. Griffin |

54 | Vice President Sales and Service, and Corporate Officer | ||||

| John J. McCaffrey, Jr. |

60 | Vice President Operations and Engineering, and Corporate Officer | ||||

| Jan-Paul van Maaren Ph.D. |

50 | Vice President Marketing and Corporate Officer | ||||

Paul J. van der Wansem, the Chairman of our board of directors since 1979, returned as our Chief Executive Officer in October 2004 after a two-year hiatus. He previously served as our Chief Executive Officer from 1979 to July of 2002. From December 1977 to 1981, he served as Vice President of Holec, N.V., a Dutch electronics company, and from 1978 through 1981 he was President of Holec (USA), Inc. From 1973 to 1977, Mr. van der Wansem worked as a Management Consultant for the Boston Consulting Group, Inc., and from 1970 through 1973, Mr. van der Wansem worked as an Adjunct Director of First National City Bank in Amsterdam and New York. Mr. van der Wansem received an undergraduate degree in automotive engineering from Bromsgrove College, England, and holds an M.B.A. from IMD, Switzerland.

Peter J. Tallian joined BTU as our Chief Financial Officer in April 2009. He previously served as Chief Financial Officer of Distributed Energy Systems Corporation and Chief Accounting Officer of Northern Power Systems, Inc., companies that serve the alternative energy market. Prior to that, Mr. Tallian served as Senior Vice President, Chief Financial Officer and Treasurer at Transwitch Corporation, a leading provider of semiconductor solutions to the communications industry. He also served as Executive Vice President and Chief Financial Officer of Metavante Corporation. Mr. Tallian began his career in finance with a number of strategic roles at IBM. Mr. Tallian holds a bachelor’s degree in economics from the Wharton School of the University of Pennsylvania and an M.B.A. from the University of Chicago.

James M. Griffin has been our Vice President Sales and Service since April 2005. Previously, Mr. Griffin was our Vice President Sales-Americas, and has held a number of positions within our sales organization. He has been with us for 24 years. Mr. Griffin attended Worcester Polytechnic Institute in the mechanical engineering program.

John J. McCaffrey, Jr . joined BTU in early 2008 as Vice President Operations and Engineering. After graduating from the U.S. Naval Academy and serving as a nuclear engineer officer, he held a variety of positions at Polaroid. Mr. McCaffrey joined Evergreen Solar as a startup in 1999, where he designed, built, and operated their U.S. pilot and initial manufacturing facilities, achieving required margin and revenue targets. He next worked with Q Cells to design the initial 30 megawatt EverQ factory in Germany. He then moved to Daystar Technologies, a CIGS thin film solar company, setting up their pilot line for foil, and led the initial design for their 25 megawatt glass manufacturing facility in California. Mr. McCaffrey was also responsible for product development at both companies.

13

Table of Contents

Jan-Paul van Maaren joined BTU in May of 2009 as Vice President Marketing, responsible for all of our strategic marketing and marketing communications activities with a focus on solar markets. Prior to joining BTU, Mr. van Maaren served as Vice President of Corporate Marketing at MKS Instruments, a global supplier of semiconductor and solar manufacturing equipment. Previously, he was Vice President and General Manager at GretagMacbeth, a manufacturer of optical instruments and software for color measurement and control. From 1997 to 2005, Mr. van Maaren held various positions at Eaton/Axcelis Technologies, including Vice President and General Manager of the cleaning and curing systems division. Mr. van Maaren holds a master’s degree with a concentration in marketing from the Wharton School of Business at the University of Pennsylvania and a doctorate in physics from the University of Utrecht in the Netherlands.

14

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Price Range of Common Stock

Our common stock is quoted on the NASDAQ Global Market under the symbol “BTUI.” The following table sets forth, for the periods indicated, the high and low sale prices per share of our common stock as reported on the NASDAQ Global Market.

| High | Low | |||||||

| Year Ended December 31, 2010 |

||||||||

| First Quarter |

6.80 | 4.43 | ||||||

| Second Quarter |

6.27 | 4.95 | ||||||

| Third Quarter |

7.69 | 4.94 | ||||||

| Fourth Quarter |

9.20 | 6.57 | ||||||

| Year Ended December 31, 2011 |

||||||||

| First Quarter |

13.41 | 8.97 | ||||||

| Second Quarter |

12.45 | 6.70 | ||||||

| Third Quarter |

7.76 | 3.95 | ||||||

| Fourth Quarter |

4.71 | 2.43 | ||||||

As of February 10, 2012, we had 408 record holders of our common stock.

Dividend Policy

Our policy is to retain earnings to provide funds for the operation and expansion of our business. We have not paid cash dividends on our common stock and do not anticipate that we will do so in the foreseeable future. The payment of dividends in the future will depend on our growth, profitability, financial condition and other factors that our board of directors may deem relevant.

15

Table of Contents

Equity Compensation Plan Information

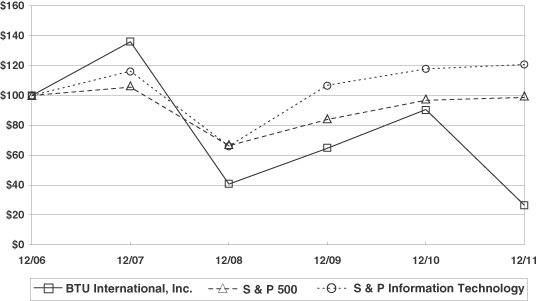

The following graph compares the cumulative 5-year total return provided shareholders on BTU International, Inc.’s common stock relative to the cumulative total returns of the S&P 500 index and the S&P Information Technology index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on 12/31/2006 and its relative performance is tracked through 12/31/2011.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among BTU International, Inc., the S&P 500 Index,

and the S&P Information Technology Index

| * | $100 invested on 12/31/06 in stock or index, including reinvestment of dividends. |

Fiscal year ending December 31.

Copyright© 2012 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected consolidated statement of operations data for each of the years ended December 31, 2009, December 31, 2010 and December 31, 2011 and the selected consolidated balance sheet data as of December 31, 2010 and December 31, 2011 have been derived from our consolidated financial statements audited by independent registered public accountants, which are included elsewhere in this Form 10-K. The selected consolidated statement of operations data for the years ended December 31, 2007 and December 31, 2008 and the selected consolidated balance sheet data as of December 31, 2007, December 31, 2008 and December 31, 2009 have been derived from audited financial statements not included in this Form 10-K. This data should be read together with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this Form 10-K.

16

Table of Contents

| Years Ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Consolidated Statement of Operations Data: | (In thousands, except per share data) | |||||||||||||||||||

| Net sales |

$ | 76,128 | $ | 81,607 | $ | 45,086 | $ | 72,266 | $ | 63,723 | ||||||||||

| Cost of goods sold |

47,542 | 47,851 | 32,706 | 41,542 | 36,337 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

28,586 | 33,756 | 12,380 | 30,724 | 27,386 | |||||||||||||||

| Selling, general and administrative |

22,721 | 23,063 | 18,957 | 23,168 | 19,009 | |||||||||||||||

| Research, development and engineering |

7,056 | 6,575 | 6,882 | 7,273 | 5,658 | |||||||||||||||

| Restructuring |

401 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

(1,592 | ) | 4,118 | (13,459 | ) | 283 | 2,719 | |||||||||||||

| Interest income |

77 | 81 | 236 | 354 | 909 | |||||||||||||||

| Interest expense |

(481 | ) | (601 | ) | (673 | ) | (697 | ) | (602 | ) | ||||||||||

| Foreign exchange gain (loss) |

(139 | ) | (33 | ) | (278 | ) | 40 | (478 | ) | |||||||||||

| Other income (loss), net |

365 | (6 | ) | 44 | 1 | 106 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before provision for income taxes |

(1,770 | ) | 3,559 | (14,130 | ) | (19 | ) | 2,654 | ||||||||||||

| Provision for income taxes |

952 | 1,378 | 435 | 1,077 | 706 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (2,722 | ) | $ | 2,181 | $ | (14,565 | ) | $ | (1,096 | ) | $ | 1,948 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) per share: |

||||||||||||||||||||

| Basic |

$ | (0.29 | ) | $ | 0.24 | $ | (1.58 | ) | $ | (0.12 | ) | $ | 0.21 | |||||||

| Diluted |

$ | (0.29 | ) | $ | 0.23 | $ | (1.58 | ) | $ | (0.12 | ) | $ | 0.20 | |||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

9,434 | 9,277 | 9,222 | 9,375 | 9,297 | |||||||||||||||

| Diluted |

9,434 | 9,428 | 9,222 | 9,375 | 9,544 | |||||||||||||||

| December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Consolidated Balance Sheet Data: | (In thousands) | |||||||||||||||||||

| Cash and cash equivalents |

$ | 18,948 | $ | 22,753 | $ | 25,397 | $ | 27,464 | $ | 25,065 | ||||||||||

| Working capital |

41,634 | 41,537 | 37,132 | 50,120 | 50,565 | |||||||||||||||

| Total assets |

56,718 | 67,645 | 58,794 | 71,315 | 69,512 | |||||||||||||||

| Total liabilities |

17,266 | 27,805 | 23,101 | 21,735 | 20,577 | |||||||||||||||

| Stockholders’ equity |

39,452 | 39,840 | 35,693 | 49,580 | 48,935 | |||||||||||||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward Looking Statements

This Annual Report on Form 10-K contains expressed or implied forward-looking statements. The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “may,” “intends,” “believes,” “estimate,” “project” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are neither promises nor guarantees but rather are subject to risks and uncertainties described in this report, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements are made pursuant to the “safe harbor” provisions established by the federal securities laws, and are based on the assumptions and expectations of our management at the time such statements are made. Important factors that could cause actual results to differ include, but are not limited to, the condition of the world economy, the timely availability and acceptance of new products in the electronics, semiconductor and alternative energy generation industries, manufacturing problems with our foreign operations in China, the impact of competitive products and pricing, particularly from companies in Asia, and other risks detailed above under “Risk Factors.” Actual results

17

Table of Contents

may vary materially. Unless otherwise required by law, we disclaim any obligation to revise or update this information in order to reflect future events or developments, whether or not anticipated. Accordingly, you should not place undue reliance on any forward-looking statements, which speak only as of the date made.

Overview

BTU International, Inc. (“BTU”), founded in 1950 and headquartered in North Billerica, Massachusetts, is a market-leading, global supplier of advanced thermal processing equipment to the alternative energy and electronics manufacturing markets. BTU equipment is used in the production of solar cells and nuclear fuel, as well as in printed circuit board assembly and semiconductor packaging.

Our customers require high throughput, high yield and highly reliable thermal processing systems with tightly controlled temperature and atmospheric parameters. In the solar market, BTU offers processing equipment for both silicon and thin film photovoltaics. Also in alternative energy, our customers use our thermal systems for the processing of nuclear fuel. Our convection solder reflow systems are used to attach electronic components to the printed circuit boards, primarily in the advanced, high-density, surface mount segments of this market. In the semiconductor market, we participate in both wafer level and die level packaging, where our thermal processing systems are used to connect and seal integrated circuits into a package.

In 2004, we began manufacturing and material sourcing operations in leased facilities in Shanghai, China. In addition, we expanded our product development capability to China, creating a global engineering team. This team has developed and commercially introduced our latest PYRAMAX ™ and TRITAN ™ products and continues to collaborate with our U.S. headquarters on additional product initiatives.

Critical Accounting Policies and Significant Estimates

The following is a discussion of those accounting policies that we deem to be “critical”—that is, they are important to the portrayal of our financial condition and results of operations, and they reflect management’s reliance on estimates regarding matters that are inherently uncertain.

Revenue Recognition. We recognize revenue in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 605, “Revenue Recognition” (“ASC 605”). Under these guidelines, we recognize revenue when persuasive evidence of an arrangement exists, delivery has occurred or services rendered, the price is fixed or determinable and payment is reasonably assured. Under these requirements, we recognize revenue upon acceptance when the terms of sale include customer acceptance provisions and compliance with those customer acceptance provisions has not been previously demonstrated. Furthermore, we recognize revenue upon completion of installation for products that require installation for which the installation is essential to functionality or is not inconsequential or perfunctory. Revenue for products sold where installation is not essential to functionality and is deemed inconsequential or perfunctory are recognized upon shipment with estimated installation and warranty costs accrued.

Applying the requirements of ASC 605 to future sales arrangements used in our equipment sales may result in the deferral of the revenue for some equipment sales. Products shipped to customers that do not meet the threshold requirements for revenue recognition as outlined above remain in our inventory on the Consolidated Balance Sheet until revenue is recognized. Any cash collected from customers for products for which revenue has been deferred is recorded as Deferred Revenue on the Consolidated Balance Sheet.

We also have certain sales transactions for products which are not completed within the normal operating cycle of the business. It is our policy to account for these transactions using the percentage of completion method for revenue recognition purposes when all of the following criteria exist: (1) we received the purchase order or entered into a legally binding contract, (2) the customer is credit worthy and collection is probable or customer prepayments are required at product completion milestones or specific dates, (3) the sales value of the product to

18

Table of Contents

be delivered is significant in amount when compared to our other products, and (4) the costs can be reasonably estimated, there is no major technological uncertainty and the total engineering, material procurement, product assembly and test cycle time extend over a period of six months or longer.

Under the percentage of completion method, revenue and gross margins to date are recognized based upon the ratio of costs incurred to date compared to the latest estimate of total costs to complete the product as a percentage of the total contract revenue for the product. Revisions in costs and gross margin percentage estimates are reflected in the period in which the facts causing the revision become known. Provisions for total estimated losses on uncompleted contracts, if any, are made in the period in which such losses are determined.

Inventory Valuation. Our inventories consist of material, labor and manufacturing overhead costs. We determine the cost of inventory based on standard cost and then adjust inventories to actual cost at reasonable intervals to reflect current conditions to approximate the first-in, first-out method. We regularly review the quantity of inventories on hand and compare these quantities to the expected usage of each applicable product or product line. Our inventories are adjusted in value to the lower of costs and/or net realizable value. Since the value of our inventories depends in part on our estimates of each product’s net realizable value, adjustments may be needed to reflect changes in valuation. Any adjustments we are required to make to lower the value of the inventories are recorded as a charge to cost of sales.

Stock-Based Compensation. Effective January 1, 2006, we adopted the provisions of FASB ASC Topic 718, “Compensation—Stock Compensation” (“ASC 718”). Under ASC 718, we are required to record compensation cost for all share-based payments granted after the date of adoption based on the grant date fair value, estimated in accordance with the provisions of ASC 718, and for the unvested portion of all share-based payments previously granted that remained outstanding at the date of adoption based on the grant date fair value, estimated in accordance with the original provisions of SFAS No. 123, “Accounting for Stock-Based Compensation”. We expense share-based compensation under the straight-line method.

The choice of a valuation technique, and the approach utilized to develop the underlying assumptions for that technique, involve significant judgments. These judgments reflect management’s assessment of the most accurate method of valuing the stock options we issue based on our historical experience, knowledge of current conditions and beliefs of what could occur in the future given available information. Our judgments could change over time as additional information becomes available to us, or the facts underlying our assumptions change over time, and any change in our judgments could have a material effect on our financial statements. We believe that our estimates incorporate all relevant information and represent a reasonable approximation in light of the difficulties involved in valuing non-traded stock options.

Accounting for Income Taxes. We determine our annual income tax provision in each of the jurisdictions in which we operate. This involves determining our current and deferred income tax expense as well as accounting for differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. The future tax consequences attributable to these differences result in deferred tax assets and liabilities, which are included in our Consolidated Balance Sheets. We assess the recoverability of the deferred tax assets by considering whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. To the extent we believe that recovery does not meet this “more likely than not” standard as required in FASB ASC Topic 740, “Income Taxes” (“ASC 740”), we must establish a valuation allowance.

Management’s judgments and estimates are required in determining our income tax provision, deferred tax assets and liabilities and any valuation allowance recorded against deferred tax assets. We have established a valuation allowance attributable to substantially all U.S. federal and state as well as United Kingdom deferred tax assets as of December 31, 2011 since they do not meet the “more likely than not” threshold of realization based on our ability to generate sufficient taxable income in the carryback and carryforward periods based on the criteria set forth in ASC 740. We review the recoverability of deferred tax assets during each reporting period by

19

Table of Contents

reviewing estimates of future taxable income, future reversals of existing taxable temporary differences, and tax planning strategies that would, if necessary, be implemented to realize the benefit of deferred tax assets before expiration.

We assess tax positions taken on tax returns, including recognition of potential interest and penalties, in accordance with the recognition thresholds and measurement attributes outlined in ASC 740. Interest and penalties recognized, if any, would be classified as a component of income tax expense. An uncertain tax position represents our expected treatment of a tax position taken in a filed tax return, or planned to be taken in a future tax return, that has not been reflected in measuring income tax expense for financial reporting purposes. The Company believes that we have appropriate support for the income tax positions taken and to be taken on our tax returns and that our accruals for tax liabilities are adequate for all open years based on an assessment of many factors, including past experience and interpretations of tax law applied to the facts of each matter.

We have benefited from a partial “tax holiday” in our Shanghai manufacturing subsidiary. The Chinese government tax authorities passed legislation that imposes an equalization of income tax rates for both domestic and foreign companies at a rate of 25%. This new law became effective on January 1, 2008 and is being phased in by gradually increasing our tax rate until it reaches 25% in the first quarter of 2012. The new law supersedes and overrides our tax holiday agreements. The applicability of this new uniform income tax rate law will continue to have an adverse effect on our net income and cash flow.

For the year ended December 31, 2011, there were no material changes to the total amount of unrecognized tax benefits. We do not expect any significant increases or decreases for uncertain tax positions during the next 12 months.

The Company’s major tax jurisdictions include the United States and China. We are no longer subject to U.S. state or local and non-U.S. income tax examinations by tax authorities in our major jurisdictions for years before 2007, except to the extent of net operating loss and tax credit carryforwards from those years.

RESULTS OF OPERATIONS

The following table sets forth the percentage of net sales of certain items in our Consolidated Statements of Operations for the periods indicated.

| Years Ended December 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Net sales |

100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of goods sold |

62.5 | % | 58.6 | % | 72.5 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

37.5 | % | 41.4 | % | 27.5 | % | ||||||

| Operating expenses: |

||||||||||||

| Selling, general and administrative |

29.8 | % | 28.3 | % | 42.0 | % | ||||||

| Research, development and engineering |

9.3 | % | 8.1 | % | 15.3 | % | ||||||

| Restructuring |

0.5 | % | 0.0 | % | 0.0 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Operating income (loss) |

(2.1 | )% | 5.0 | % | (29.9 | )% | ||||||

| Interest income |

0.1 | % | 0.1 | % | 0.5 | % | ||||||

| Interest expense |

(0.6 | )% | (0.7 | )% | (1.5 | )% | ||||||

| Foreign exchange loss |

(0.2 | )% | (0.0 | )% | (0.6 | )% | ||||||

| Other income (loss), net |

0.5 | % | (0.0 | )% | 0.1 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before provision for income taxes |

(2.3 | )% | 4.4 | % | (31.3 | )% | ||||||

| Provision for income taxes |

1.3 | % | 1.7 | % | 1.0 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

(3.6 | )% | 2.7 | % | (32.3 | )% | ||||||

|

|

|

|

|

|

|

|||||||

20

Table of Contents

YEAR ENDED DECEMBER 31, 2011 AS COMPARED TO YEAR ENDED DECEMBER 31, 2010

| Years Ended December 31, | Percent change |

|||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||

| ( $ in thousands) | ||||||||||||||||||||

| % of net sales |

% of net sales |

|||||||||||||||||||

| Net sales |

$ | 76,128 | 100.0 | % | $ | 81,607 | 100.0 | % | (6.7 | )% | ||||||||||

| Cost of goods sold |

47,542 | 62.5 | % | 47,851 | 58.6 | % | (0.6 | )% | ||||||||||||

|

|

|

|

|