Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - YORK WATER CO | Financial_Report.xls |

| EX-23 - CONSENT OF PARENTEBEARD LLC - YORK WATER CO | exhibit23-123111.htm |

| EX-32.1 - YWC SECTION 906 CERTIFICATION OF CEO - YORK WATER CO | exhibit32_1-123111.htm |

| EX-31.2 - YWC CERTIFICATION OF CFO - YORK WATER CO | exhibit31_2-123111.htm |

| EX-31.1 - YWC CERTIFICATION OF CEO - YORK WATER CO | exhibit31_1-123111.htm |

| EX-32.2 - YWC SECTION 906 CERTIFICATION OF CFO - YORK WATER CO | exhibit32_2-123111.htm |

|

UNITED STATES

|

||||||

|

SECURITIES AND EXCHANGE COMMISSION

|

||||||

|

Washington, D.C. 20549

|

||||||

|

FORM 10-K

|

||||||

|

(Mark One)

|

||||||

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||||

|

For the fiscal year ended December 31, 2011

|

||||||

|

OR

|

||||||

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||||

|

For the transition period from __________to____________

|

||||||

|

Commission file number 001-34245

|

||||||

|

THE YORK WATER COMPANY

|

||||||

|

(Exact name of registrant as specified in its charter)

|

||||||

|

||||||

|

PENNSYLVANIA

|

23-1242500

|

|||||

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|||||

|

130 EAST MARKET STREET, YORK, PENNSYLVANIA

|

17401

|

|||||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||||

|

Registrant's telephone number, including area code (717) 845-3601

|

||||||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||||||

|

None

|

||||||

|

(Title of Each Class)

|

(Name of Each Exchange on Which Registered)

|

|||||

|

Securities registered pursuant to Section 12(g) of the Act:

|

||||||

|

COMMON STOCK, NO PAR VALUE

|

||||||

|

(Title of Class)

|

||||||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

||||||

|

¨ YES

|

ýNO

|

|||||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

||||||

|

¨ YES

|

ýNO

|

|||||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

||||||

|

ý YES

|

¨NO

|

|||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

||||||

|

ýYES

|

¨NO

|

|||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

|

||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

||||||

|

Large accelerated filer ¨

|

Accelerated filer ý

|

|||||

|

Non-accelerated filer ¨

|

Small Reporting Company ¨

|

|||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

||||||

|

¨ YES

|

ýNO

|

|||||

|

The aggregate market value of the Common Stock, no par value, held by nonaffiliates of the registrant on June 30, 2011 was $210,903,923.

|

||||||

|

As of March 12, 2012 there were 12,807,000 shares of Common Stock, no par value, outstanding.

|

||||||

|

DOCUMENTS INCORPORATED BY REFERENCE

|

||||||

|

Portions of the Proxy Statement for the Company's 2012 Annual Meeting of Shareholders are incorporated by reference into Part III.

|

||||||

Certain statements contained in this annual report and in documents incorporated by reference constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Words such as "may," "should," "believe," "anticipate," "estimate," "expect," "intend," "plan" and similar expressions are intended to identify forward-looking statements. These forward-looking statements include certain information relating to the Company’s business strategy; statements including, but not limited to:

|

|

·

|

statements regarding the amount and timing of rate increases and other regulatory matters including the recovery of costs recorded as regulatory assets;

|

|

|

·

|

expected profitability and results of operations;

|

|

|

·

|

statements as to trends;

|

|

|

·

|

goals, priorities and plans for, and cost of, growth and expansion;

|

|

|

·

|

strategic initiatives;

|

|

|

·

|

availability of water supply;

|

|

|

·

|

water usage by customers; and

|

|

|

·

|

ability to pay dividends on common stock and the rate of those dividends.

|

The forward-looking statements in this Annual Report reflect what the Company currently anticipates will happen. What actually happens could differ materially from what it currently anticipates will happen. The Company does not intend to make a public announcement when forward-looking statements in this Annual Report are no longer accurate, whether as a result of new information, what actually happens in the future or for any other reason. Important matters that may affect what will actually happen include, but are not limited to:

|

|

·

|

changes in weather, including drought conditions;

|

|

|

·

|

levels of rate relief granted;

|

|

|

·

|

the level of commercial and industrial business activity within the Company's service territory;

|

|

|

·

|

construction of new housing within the Company's service territory and increases in population;

|

|

|

·

|

changes in government policies or regulations;

|

|

|

·

|

the ability to obtain permits for expansion projects;

|

|

|

·

|

material changes in demand from customers, including the impact of conservation efforts which may impact the demand of customers for water;

|

|

|

·

|

changes in economic and business conditions, including interest rates, which are less favorable than expected;

|

|

|

·

|

changes in, or unanticipated, capital requirements;

|

|

|

·

|

changes in accounting pronouncements;

|

|

|

·

|

changes in the Company’s credit rating or the market price of its common stock;

|

|

|

·

|

the ability to obtain financing; and

|

|

|

·

|

other matters set forth in Item 1A, “Risk Factors,” of this Annual Report.

|

THE YORK WATER COMPANY

|

Business.

|

The York Water Company (the “Company”) is the oldest investor-owned water utility in the United States and is duly organized under the laws of the Commonwealth of Pennsylvania. The Company has operated continuously since 1816. The business of the Company is to impound, purify to meet or exceed safe drinking water standards and distribute water. The Company operates within its franchised territory, which covers 39 municipalities within York County, Pennsylvania and seven municipalities within Adams County, Pennsylvania. The Company is regulated by the Pennsylvania Public Utility Commission, or PPUC, in the areas of billing, payment procedures, dispute processing, terminations, service territory, debt and equity financing and rate setting. The Company must obtain PPUC approval before changing any practices associated with the aforementioned areas. Water service is supplied through the Company's own distribution system. The Company obtains its water supply from both the South Branch and East Branch of the Codorus Creek, which together have an average daily flow of 73.0 million gallons per day. This combined watershed area is approximately 117 square miles. The Company has two reservoirs, Lake Williams and Lake Redman, which together hold up to approximately 2.2 billion gallons of water. The Company has a 15-mile pipeline from the Susquehanna River to Lake Redman which provides access to an additional supply of 12.0 million gallons of untreated water per day. As of December 31, 2011, the Company's average daily availability was 35.0 million gallons, and daily consumption was approximately 18.5 million gallons. The Company's service territory had an estimated population of 187,000 as of December 31, 2011. Industry within the Company's service territory is diversified, manufacturing such items as fixtures and furniture, electrical machinery, food products, paper, ordnance units, textile products, air conditioning systems, laundry detergent, barbells and motorcycles.

The Company's business is somewhat dependent on weather conditions, particularly the amount of rainfall. Revenues are particularly vulnerable to weather conditions in the summer months. Prolonged periods of hot and dry weather generally cause increased water usage for watering lawns, washing cars, and keeping golf courses and sports fields irrigated. Conversely, prolonged periods of dry weather could lead to drought restrictions from governmental authorities. Despite the Company’s adequate water supply, customers may be required to cut back water usage under such drought restrictions which would negatively impact revenues. The Company has addressed some of this vulnerability by instituting minimum customer charges which are intended to cover fixed costs of operations under all likely weather conditions.

The Company’s business does not require large amounts of working capital and is not dependent on any single customer or a very few customers for a material portion of its business. Increases in revenues are generally dependent on the Company’s ability to obtain rate increases from the PPUC in a timely manner and in adequate amounts and to increase volumes of water sold through increased consumption and increases in the number of customers served. The Company continuously looks for acquisition and expansion opportunities both within and outside its current service territory. The Company also looks for additional opportunities to enter into bulk water contracts with municipalities and other entities to supply water.

In addition to its primary business of providing water, the Company has recently begun to provide sewer billing services for various municipalities. The level of activity has not reached that of a reportable segment.

Competition

As a regulated utility, the Company operates within an exclusive franchised territory that is substantially free from direct competition with other public utilities, municipalities and other entities. Although the Company has been granted an exclusive franchise for each of its existing community water systems, the ability of the Company to expand or acquire new service territories may be affected by currently unknown competitors obtaining franchises to surrounding water systems by application or acquisition. These competitors may include other investor-owned utilities, nearby municipally-owned utilities and sometimes from strategic or financial purchasers seeking to enter or expand in the water industry. The addition of new service territory and the acquisition of other utilities are generally subject to review and approval by the PPUC.

Water Quality and Environmental Regulations

Provision of water service is subject to regulation under the federal Safe Drinking Water Act, the Clean Water Act and related state laws, and under federal and state regulations issued under these laws. The federal Safe Drinking Water Act establishes criteria and procedures for the U.S. Environmental Protection Agency, or EPA, to develop national quality standards. Regulations issued under the Act, and its amendments, set standards on the amount of certain contaminants allowable in drinking water. Current requirements are not expected to have a material impact on the Company’s operations or financial condition as it already meets or exceeds standards.

The Clean Water Act regulates discharges from water treatment facilities into lakes, rivers, streams and groundwater. The Company complies with this Act by obtaining and maintaining all required permits and approvals for discharges from its water facilities and by satisfying all conditions and regulatory requirements associated with the permits.

Under the requirements of the Pennsylvania Safe Drinking Water Act, or SDWA, the Pennsylvania Department of Environmental Protection, or DEP, monitors the quality of the finished water supplied to customers. DEP requires the Company to submit weekly reports showing the results of daily bacteriological and other chemical and physical analyses. As part of this requirement, the Company conducts over 77,000 laboratory tests annually. Management believes that the Company complies with the standards established by the agency under the SDWA. DEP also assists the Company by preventing and eliminating pollution by regulating discharges into the Company’s watershed area.

DEP and the Susquehanna River Basin Commission, or SRBC, regulate the amount of water withdrawn from streams in the watershed to assure that sufficient quantities are available to meet the Company’s needs and the needs of other regulated users. Through its Division of Dam Safety, DEP regulates the operation and maintenance of the Company’s impounding dams. The Company routinely inspects its dams and prepares annual reports of their condition as required by DEP regulations. DEP reviews these reports and inspects the Company’s dams annually. DEP most recently inspected the Company’s dams in May 2011 and noted no significant violations.

Since 1980, DEP has required any new dam to have a spillway that is capable of passing the design flood without overtopping the dam. The design flood is either the Probable Maximum Flood, or PMF, or some fraction of it, depending on the size and location of the dam. PMF is very conservative and is calculated using the most severe combination of meteorological and hydrologic conditions reasonably possible in the watershed area of a dam.

The Company engaged a professional engineer to analyze the spillway capacities at the Lake Williams and Lake Redman dams and validate DEP’s recommended design flood for the dams. Management presented the results of the study to DEP in December 2004, and DEP then requested that the Company submit a proposed schedule for the actions to address the spillway capacities. Thereafter, the Company retained an engineering firm to prepare preliminary designs for increasing the spillway capacities to pass the PMF through armoring the dams with roller compacted concrete. Management met with DEP in September 2006 to review the preliminary design and discuss scheduling, permitting, and construction requirements. The Company is currently completing preliminary work on the dams as well as the final design and the permitting process. The Company expects to begin armoring one of the dams between 2014 and 2015. The second dam is expected to be armored in a year or two following the first dam armoring. The cost to armor each dam is expected to be approximately $6 million.

Capital expenditures and operating costs required as a result of water quality standards and environmental requirements have been traditionally recognized by state public utility commissions as appropriate for inclusion in establishing rates. The capital expenditures currently required as a result of water quality standards and environmental requirements have been budgeted in the Company’s capital program and represent less than 10% of its expected total capital expenditures over the next 5 years.

Growth

During the five year period ended December 31, 2011, the Company maintained growth in the number of customers and distribution facilities.

The following table sets forth certain of the Company’s summary statistical information.

|

(In thousands of dollars)

|

For the Years Ended December 31,

|

||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

|

|

Revenues

|

|||||

|

Residential

|

$25,693

|

$24,478

|

$23,299

|

$20,572

|

$19,722

|

|

Commercial and industrial

|

11,820

|

11,440

|

10,734

|

9,671

|

9,290

|

|

Other

|

3,116

|

3,087

|

3,010

|

2,595

|

2,421

|

|

Total

|

$40,629

|

$39,005

|

$37,043

|

$32,838

|

$31,433

|

|

Average daily consumption

|

|||||

|

(gallons per day)

|

18,465,000

|

18,875,000

|

18,233,000

|

18,298,000

|

19,058,000

|

|

Miles of mains

|

|||||

|

at year-end

|

929

|

925

|

922

|

884

|

845

|

|

Additional distribution mains

|

|||||

|

installed/acquired (ft.)

|

17,212

|

19,886

|

200,439

|

206,140

|

147,803

|

|

Number of customers

|

|||||

|

at year-end

|

62,738

|

62,505

|

62,186

|

61,527

|

58,890

|

|

Population served

|

|||||

|

at year-end

|

187,000

|

182,000

|

180,000

|

176,000

|

171,000

|

Executive Officers of the Registrant

The Company presently has 106 full time employees including the officers detailed below.

|

Name

|

Age

|

Positions and Offices Held

|

Officer Since

|

|

|

Jeffrey R. Hines, P.E.

|

50

|

President and Chief Executive Officer,

|

5/1/1995

|

|

|

The York Water Company, March 2008 to date

|

||||

|

Chief Operating Officer and Secretary,

|

||||

|

The York Water Company, January 2007 to March 2008

|

||||

|

Vice President-Engineering and Secretary,

|

||||

|

The York Water Company, May 1995 to January 2007

|

||||

|

Joseph T. Hand

|

49

|

Chief Operating Officer,

|

3/3/2008

|

|

|

The York Water Company, March 2008 to date

|

||||

|

Chief, Navigation Branch, Baltimore District,

|

||||

|

U.S. Army Corps of Engineers, September 2006

|

||||

|

to February 2008

|

||||

|

Kathleen M. Miller

|

49

|

Chief Financial Officer and Treasurer,

|

1/1/2003

|

|

|

The York Water Company, January 2003 to date

|

||||

|

Vernon L. Bracey

|

50

|

Vice President-Customer Service,

|

3/1/2003

|

|

|

The York Water Company, March 2003 to date

|

||||

|

Bruce C. McIntosh

|

59

|

Vice President-Human Resources, Secretary and Assistant Treasurer,

|

5/4/1998

|

|

|

The York Water Company, March 2008 to date

|

||||

|

Vice President-Human Resources and Assistant Treasurer,

|

||||

|

The York Water Company, January 2003 to February 2008

|

||||

|

Mark S. Snyder, P.E.

|

41

|

Vice President-Engineering,

|

5/1/2009

|

|

|

The York Water Company, May 2009 to date

|

||||

|

Engineering Manager,

|

||||

|

The York Water Company, December 2006 to May 2009

|

||||

|

John H. Strine

|

55

|

Vice President-Operations,

|

5/1/2009

|

|

|

The York Water Company, May 2009 to date

|

||||

|

Operations Manager,

|

||||

|

The York Water Company, February 2008 to May 2009

|

||||

|

Maintenance and Grounds Superintendent,

|

||||

|

The York Water Company, August 1991 to February 2008

|

||||

Available Information

The Company makes available free of charge, on or through its website (www.yorkwater.com), its annual report on Form 10-K, its quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC.

Shareholders may request, without charge, copies of the Company’s financial reports. Such requests, as well as other investor relations inquiries, should be addressed to:

|

Kathleen M. Miller

|

The York Water Company

|

(717) 845-3601

|

|

Chief Financial Officer

|

P. O. Box 15089

|

(800) 750-5561

|

|

York, PA 17405-7089

|

kathym@yorkwater.com

|

|

Risk Factors.

|

The rates we charge our customers are subject to regulation. If we are unable to obtain government approval of our requests for rate increases, or if approved rate increases are untimely or inadequate to cover our investments in utility plant and equipment and projected expenses, our results of operations may be adversely affected.

Our ability to maintain and meet our financial objectives is dependent upon the rates we charge our customers, which are subject to approval by the PPUC. We file rate increase requests with the PPUC, from time to time, to recover our investments in utility plant and equipment and projected expenses. Any rate increase or adjustment must first be justified through documented evidence and testimony. The PPUC determines whether the investments and expenses are recoverable, the length of time over which such costs are recoverable, or, because of changes in circumstances, whether a remaining balance of deferred investments and expenses is no longer recoverable in rates charged to customers. Once a rate increase application is filed with the PPUC, the ensuing administrative and hearing process may be lengthy and costly. The timing of our rate increase requests are therefore dependent upon the estimated cost of the administrative process in relation to the investments and expenses that we hope to recover through the rate increase.

We can provide no assurances that future requests will be approved by the PPUC; and, if approved, we cannot guarantee that these rate increases will be granted in a timely or sufficient manner to cover the investments and expenses for which we sought the rate increase. If we are unable to obtain PPUC approval of our requests for rate increases, or if approved rate increases are untimely or inadequate to cover our investments in utility plant and equipment and projected expenses, our results of operations may be adversely affected.

We are subject to federal, state and local regulation that may impose costly limitations and restrictions on the way we do business.

Various federal, state and local authorities regulate many aspects of our business. Among the most important of these regulations are those relating to the quality of water we supply our customers and water allocation rights. Government authorities continually review these regulations, particularly the drinking water quality regulations, and may propose new or more restrictive requirements in the future. We are required to perform water quality tests that are monitored by the PPUC, the EPA, and the DEP, for the detection of certain chemicals and compounds in our water. If new or more restrictive limitations on permissible levels of substances and contaminants in our water are imposed, we may not be able to adequately predict the costs necessary to meet regulatory standards. If we are unable to recover the cost of implementing new water treatment procedures in response to more restrictive water quality regulations through our rates that we charge our customers, or if we fail to comply with such regulations, it could have a material adverse effect on our financial condition and results of operations.

We are also subject to water allocation regulations that control the amount of water that we can draw from water sources. The SRBC and DEP regulate the amount of water withdrawn from streams in the watershed for water supply purposes to assure that sufficient quantities are available to meet our needs and the needs of other regulated users. In addition, government drought restrictions could cause the SRBC or DEP to temporarily reduce the amount of our allocations. If new or more restrictive water allocation regulations are implemented or our allocations are reduced due to weather conditions, it may have an adverse effect on our ability to supply the demands of our customers, and in turn, on our revenues and results of operations.

Our business is subject to seasonal fluctuations, which could affect demand for our water service and our revenues.

Demand for our water during the warmer months is generally greater than during cooler months due primarily to additional requirements for water in connection with cooling systems, swimming pools, irrigation systems and other outside water use. Throughout the year, and particularly during typically warmer months, demand will vary with temperature and rainfall levels. If temperatures during the typically warmer months are cooler than expected, or there is more rainfall than expected, the demand for our water may decrease and adversely affect our revenues.

Weather conditions and overuse may interfere with our sources of water, demand for water services, and our ability to supply water to our customers.

We depend on an adequate water supply to meet the present and future demands of our customers and to continue our expansion efforts. Unexpected conditions may interfere with our water supply sources. Drought and overuse may limit the availability of surface water. These factors might adversely affect our ability to supply water in sufficient quantities to our customers and our revenues and earnings may be adversely affected. Additionally, cool and wet weather, as well as drought restrictions and our customers’ conservation efforts, may reduce consumption demands, also adversely affecting our revenue and earnings. Furthermore, freezing weather may also contribute to water transmission interruptions caused by pipe and main breakage. If we experience an interruption in our water supply, it could have a material adverse effect on our financial condition and results of operations.

The current concentration of our business in central and southern Pennsylvania makes us susceptible to adverse developments in local economic and demographic conditions.

Our service territory presently includes 39 municipalities within York County, Pennsylvania and seven municipalities within Adams County, Pennsylvania. Our revenues and operating results are therefore subject to local economic and demographic conditions in the area. A change in any of these conditions could make it more costly or difficult for us to conduct our business. In addition, any such change would have a disproportionate effect on us, compared to water utility companies that do not have such a geographic concentration.

Contamination of our water supply may cause disruption in our services and adversely affect our revenues.

Our water supply is subject to contamination from the migration of naturally-occurring substances in groundwater and surface systems and pollution resulting from man-made sources. In the event that our water supply is contaminated, we may have to interrupt the use of that water supply until we are able to substitute the flow of water from an uncontaminated water source through our interconnected transmission and distribution facilities. In addition, we may incur significant costs in order to treat the contaminated source through expansion of our current treatment facilities or development of new treatment methods. Our inability to substitute water supply from an uncontaminated water source, or to adequately treat the contaminated water source in a cost-effective manner, may have an adverse effect on our revenues.

The necessity for increased security has and may continue to result in increased operating costs.

We have taken steps to increase security measures at our facilities and heighten employee awareness of threats to our water supply. We have also tightened our security measures regarding the delivery and handling of certain chemicals used in our business. We have and will continue to bear increased costs for security precautions to protect our facilities, operations and supplies. We are not aware of any specific threats to our facilities, operations or supplies. However, it is possible that we would not be in a position to control the outcome of such events should they occur.

The growing dependence on digital technology has increased the risks related to cybersecurity.

Computers and the Internet have led to increased company productivity and improved customer service. Unfortunately, progress in this area has brought with it cybersecurity risks. Recently, the frequency and severity of cyber attacks on companies has increased resulting in a disruption to business operations and the corruption or misappropriation of proprietary data. We have and will continue to bear increased costs for security precautions to protect our information technology. However, if such an attack was to occur and could not be prevented, customer information could be misappropriated, our networks may be down for an extended period of time disrupting our business, and it could require costly replacement of hardware and software.

We depend on the availability of capital for expansion, construction and maintenance.

Our ability to continue our expansion efforts and fund our construction and maintenance program depends on the availability of adequate capital. There is no guarantee that we will be able to obtain sufficient capital in the future or that the cost of capital will not be too high for future expansion and construction. In addition, approval from the PPUC must be obtained prior to our sale and issuance of securities. If we are unable to obtain approval from the PPUC on these matters, or to obtain approval in a timely manner, it may affect our ability to effect transactions that are beneficial to us or our shareholders. A single transaction may itself not be profitable but might still be necessary to continue providing service or to grow the business.

The failure to maintain our existing credit rating could affect our cost of funds and related liquidity.

Standard & Poor's Ratings Services rates our outstanding debt and has given a credit rating to us. Their evaluations are based on a number of factors, which include financial strength as well as transparency with rating agencies and timeliness of financial reporting. In light of the difficulties in the financial services industry and the difficult financial markets, there can be no assurance that we will be able to maintain our current strong credit rating. Failure to do so could adversely affect our cost of funds and related liquidity.

We may face competition from other water suppliers that may hinder our growth and reduce our profitability.

We face competition from other water suppliers for acquisitions, which may limit our growth opportunities. Furthermore, even after we have been the successful bidder in an acquisition, competing water suppliers may challenge our application for extending our franchise territory to cover the target company’s market. Finally, third parties either supplying water on a contract basis to municipalities or entering into agreements to operate municipal water systems might adversely affect our business by winning contracts that may be beneficial to us. If we are unable to compete successfully with other water suppliers for these acquisitions, franchise territories and contracts, it may impede our expansion goals and adversely affect our profitability.

An important element of our growth strategy is the acquisition of water systems. Any pending or future acquisitions we decide to undertake will involve risks.

The acquisition and integration of water systems is an important element in our growth strategy. This strategy depends on identifying suitable acquisition opportunities and reaching mutually agreeable terms with acquisition candidates. The negotiation of potential acquisitions as well as the integration of acquired businesses could require us to incur significant costs. Further, acquisitions may result in dilution for the owners of our common stock, our incurrence of debt and contingent liabilities and fluctuations in quarterly results. In addition, the businesses and other assets we acquire may not achieve the financial results that we expect, which could adversely affect our profitability.

We have restrictions on our dividends. There can also be no assurance that we will continue to pay dividends in the future or, if dividends are paid, that they will be in amounts similar to past dividends.

The terms of our debt instruments impose conditions on our ability to pay dividends. We have paid dividends on our common stock each year since our inception in 1816 and have increased the amount of dividends paid each year since 1997. Our earnings, financial condition, capital requirements, applicable regulations and other factors, including the timeliness and adequacy of rate increases, will determine both our ability to pay dividends on our common stock and the amount of those dividends. There can be no assurance that we will continue to pay dividends in the future or, if dividends are paid, that they will be in amounts similar to past dividends.

If we are unable to pay the principal and interest on our indebtedness as it comes due or we default under certain other provisions of our loan documents, our indebtedness could be accelerated and our results of operations and financial condition could be adversely affected.

Our ability to pay the principal and interest on our indebtedness as it comes due will depend upon our current and future performance. Our performance is affected by many factors, some of which are beyond our control. We believe that our cash generated from operations, and, if necessary, borrowings under our existing credit facilities will be sufficient to enable us to make our debt payments as they become due. If, however, we do not generate sufficient cash, we may be required to refinance our obligations or sell additional equity, which may be on terms that are not as favorable to us. No assurance can be given that any refinancing or sale of equity will be possible when needed or that we will be able to negotiate acceptable terms. In addition, our failure to comply with certain provisions contained in our trust indentures and loan agreements relating to our outstanding indebtedness could lead to a default under these documents, which could result in an acceleration of our indebtedness.

We depend significantly on the services of the members of our senior management team, and the departure of any of those persons could cause our operating results to suffer.

Our success depends significantly on the continued individual and collective contributions of our senior management team. If we lose the services of any member of our senior management or are unable to hire and retain experienced management personnel, our operating results could suffer.

There is a limited trading market for our common stock; you may not be able to resell your shares at or above the price you pay for them.

Although our common stock is listed for trading on the NASDAQ Global Select Market, the trading in our common stock has substantially less liquidity than many other companies quoted on the NASDAQ Global Select Market. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the market of willing buyers and sellers of our common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which we have no control. Because of the limited volume of trading in our common stock, a sale of a significant number of shares of our common stock in the open market could cause our stock price to decline.

The failure of, or the requirement to repair, upgrade or dismantle, either of our dams may adversely affect our financial condition and results of operations.

Our water system includes two impounding dams. While we maintain robust dam maintenance and inspection programs, a failure of the dams could result in injuries and damage to residential and/or commercial property downstream for which we may be responsible, in whole or in part. The failure of a dam could also adversely affect our ability to supply water in sufficient quantities to our customers and could adversely affect our financial condition and results of operations. We carry liability insurance on our dams, however, our limits may not be sufficient to cover all losses or liabilities incurred due to the failure of one of our dams. The estimated costs to maintain and upgrade our dams are included in our capital budget. Although such costs have previously been recoverable in rates, there is no guarantee that these costs will continue to be recoverable and in what magnitude they will be recoverable.

We are subject to market and interest rate risk on our $12,000,000 variable rate PEDFA Series A bond issue.

We are subject to interest rate risk in conjunction with our $12,000,000 variable interest rate debt issue. This exposure, however, has been hedged with an interest rate swap. This hedge will protect the Company from the risk of changes in the benchmark interest rates, but does not protect the Company’s exposure to the changes in the difference between its own variable funding rate and the benchmark rate. A breakdown of the historical relationships between the Company’s cost of funds and the benchmark rate underlying the interest rate swap could result in higher interest rates adversely affecting our financial results.

The holders of the $12,000,000 variable rate PEDFA Series A Bonds may tender their bonds at any time. When the bonds are tendered, they are subject to an annual remarketing agreement, pursuant to which a remarketing agent attempts to remarket the tendered bonds pursuant to the terms of the Indenture. In order to keep variable interest rates down and to enhance the marketability of the Series A Bonds, the Company entered into a Reimbursement, Credit and Security Agreement with PNC Bank, National Association (“the Bank”) dated as of May 1, 2008. This agreement provides for a three-year direct pay letter of credit issued by the Bank to the trustee for the Series A Bonds. The letter of credit expires May 6, 2013 and is reviewed annually for a possible one-year extension. The Bank is responsible for providing the trustee with funds for the timely payment of the principal and interest on the Series A Bonds and for the purchase price of the Series A Bonds that have been tendered or deemed tendered for purchase and have not been remarketed. If the Bank is unable to meet its obligations, the Company would be required to buy any bonds which had been tendered.

|

Unresolved Staff Comments.

|

None.

|

Properties.

|

Source of Supply

The Company owns two impounding dams located in York and Springfield Townships adjoining the Borough of Jacobus to the south. The lower dam, the Lake Williams Impounding Dam, creates a reservoir covering approximately 165 acres containing about 870 million gallons of water. The upper dam, the Lake Redman Impounding Dam, creates a reservoir covering approximately 290 acres containing about 1.3 billion gallons of water.

In addition to the two impounding dams, the Company owns a 15-mile pipeline from the Susquehanna River to Lake Redman that provides access to a supply of an additional 12.0 million gallons of water per day. As of December 31, 2011, the Company's present average daily availability was 35.0 million gallons, and daily consumption was approximately 18.5 million gallons.

Pumping Stations

The Company's main pumping station is located in Spring Garden Township on the south branch of the Codorus Creek about 1,500 feet upstream from its confluence with the west branch of the Codorus Creek and about four miles downstream from the Company's lower impounding dam. The pumping station presently houses pumping equipment consisting of three electrically driven centrifugal pumps and two diesel-engine driven centrifugal pumps with a combined pumping capacity of 68.0 million gallons per day. The pumping capacity is more than double peak requirements and is designed to provide an ample safety margin in the event of pump or power failure. A large diesel backup generator is installed to provide power to the pumps in the event of an emergency. The raw water is pumped approximately two miles to the filtration plant through pipes owned by the Company.

The Susquehanna River Pumping Station is located on the western shore of the Susquehanna River several miles south of Wrightsville, PA. The pumping station is equipped with three Floway Vertical Turbine pumps rated at 6 million gallons per day each. The pumping station pumps water from the Susquehanna River approximately 15 miles through a combination of 30” and 36” ductile iron main to the Company’s upper impounding dam, located at Lake Redman.

Water Treatment

The Company's filtration plant is located in Spring Garden Township about one-half mile south of the City of York. Water at this plant is filtered through twelve dual media filters having a stated capacity of 31.0 million gallons per day with a maximum supply of 42.0 million gallons per day for short periods if necessary. Based on an average daily consumption in 2011 of approximately 18.5 million gallons, the Company believes the pumping and filtering facilities are adequate to meet present and anticipated demands. In 2005, the Company performed a capacity study of the filtration plant, and in 2007, began upgrading the facility to increase capacity for future growth. The project is expected to continue over the next several years.

The Company’s sediment recycling facility is located at its Spring Garden Township location. This state of the art facility employs cutting edge technology to remove fine, suspended solids from untreated water. The Company estimates that through this energy efficient, environmentally friendly process, approximately 600 tons of sediment will be removed annually, thereby improving the quality of the Codorus Creek watershed.

Transmission and Distribution

The distribution system of the Company has approximately 929 miles of main water lines which range in diameter from 2 inches to 36 inches. The distribution system includes 28 booster stations and 30 standpipes and reservoirs capable of storing approximately 58.0 million gallons of potable water. All booster stations are equipped with at least two pumps for protection in case of mechanical failure. Following a deliberate study of customer demand and pumping capacity, the Company installed standby generators at all critical booster stations to provide emergency power in the event of an electric utility interruption.

Other Properties

The Company's distribution center and material and supplies warehouse are located at 1801 Mt. Rose Avenue, Springettsbury Township, and are composed of three one-story concrete block buildings aggregating 30,680 square feet.

The accounting and executive offices of the Company are located in one three-story and one two-story brick and masonry buildings, containing a total of approximately 21,861 square feet, at 124 and 130 East Market Street, York, Pennsylvania.

All of the Company's properties described above are held in fee by the Company. There are no material encumbrances on such properties.

In 1976, the Company entered into a Joint Use and Park Management Agreement with York County under which the Company licensed use of certain of its lands and waters for public park purposes for a period of 50 years. Under the agreement, York County has agreed not to erect a dam upstream on the East Branch of the Codorus Creek or otherwise obstruct the flow of the creek.

|

Legal Proceedings.

|

There are no material legal proceedings involving the Company.

|

Mine Safety Disclosures.

|

Not applicable.

|

Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

Market for Common Stock and Dividends

The common stock of The York Water Company is traded on the NASDAQ Global Select Market (Symbol “YORW”). Quarterly price ranges and cash dividends per share for the last two years follow:

|

2011

|

2010

|

|||||

|

High

|

Low

|

Dividend*

|

High

|

Low

|

Dividend*

|

|

|

1st Quarter

|

$17.51

|

$15.81

|

$0.1310

|

$15.00

|

$13.04

|

$0.1280

|

|

2nd Quarter

|

17.72

|

16.40

|

0.1310

|

15.60

|

12.83

|

0.1280

|

|

3rd Quarter

|

18.14

|

16.00

|

0.1310

|

16.40

|

13.42

|

0.1280

|

|

4th Quarter

|

18.00

|

15.86

|

0.1336

|

18.00

|

15.52

|

0.1310

|

*Cash dividends per share reflect dividends declared at each dividend date.

Prices listed in the above table are sales prices as listed on the NASDAQ Global Select Market. Shareholders of record (excluding individual participants in securities positions listings) as of December 31, 2011 numbered approximately 1,658.

Dividend Policy

Dividends on the Company's common stock are declared by the Board of Directors and are normally paid in January, April, July and October. Dividends are paid based on shares outstanding as of the stated record date, which is ordinarily the last day of the calendar month immediately preceding the dividend payment.

The dividend paid on the Company’s common stock on January 17, 2012 was the 564th consecutive dividend paid by the Company. The Company has paid consecutive dividends for its entire history, since 1816. The policy of the Company’s Board of Directors is currently to pay cash dividends on a quarterly basis. The dividend rate has been increased annually for fifteen consecutive years. The Company’s Board of Directors declared dividend number 565 in the amount of $0.1336 per share at its January 2012 meeting. The dividend is payable on April 16, 2012 to shareholders of record as of February 29, 2012. Future cash dividends will be dependent upon the Company’s earnings, financial condition, capital demands and other factors and will be determined by the Company’s Board of Directors. See Note 4 to the Company’s financial statements included herein for restrictions on dividend payments.

Purchases of Equity Securities by the Company

The Company did not repurchase any of its securities during the fourth quarter of 2011.

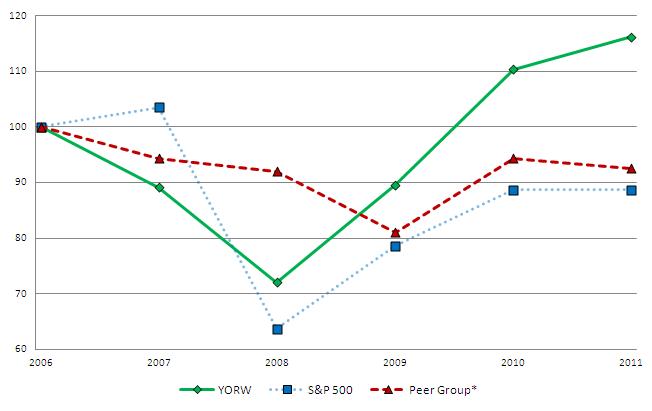

Performance Graph

The following line graph presents the annual and cumulative total shareholder return for The York Water Company Common Stock over a five-year period from 2006 through 2011, based on the market price of the Common Stock and assuming reinvestment of dividends, compared with the cumulative total shareholder return of companies in the S&P 500 Index and a peer group made up of publicly traded water utilities, also assuming reinvestment of dividends. The peer group companies include: American States, Aqua America, Artesian Resources, California Water Service, Connecticut Water Service, Middlesex Water, Pennichuck Corporation and San Jose Water.

The York Water Company: Price Performance

(2006 - 2011)

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

|

|

The York Water Company

|

100.00

|

89.16

|

72.08

|

89.63

|

110.40

|

116.22

|

|

S&P 500 Index

|

100.00

|

103.53

|

63.69

|

78.62

|

88.67

|

88.67

|

|

Peer Group*

|

100.00

|

94.37

|

92.07

|

81.05

|

94.40

|

92.53

|

*ARTNA, AWR, CTWS, CWT, MSEX, PNNW, SJW, WTR

Source: FactSet Research Systems Inc.

|

Selected Financial Data.

|

(All dollar amounts are stated in thousands of dollars.)

|

Summary of Operations

|

|||||

|

For the Year

|

2011

|

2010

|

2009

|

2008

|

2007

|

|

Water operating revenues

|

$40,629

|

$39,005

|

$37,043

|

$32,838

|

$31,433

|

|

Operating expenses

|

20,754

|

19,238

|

19,655

|

18,158

|

17,333

|

|

Operating income

|

19,875

|

19,767

|

17,388

|

14,680

|

14,100

|

|

Interest expense

|

5,155

|

4,795

|

4,780

|

4,112

|

3,916

|

|

Other income (expenses), net

|

(677)

|

(465)

|

(517)

|

(509)

|

(78)

|

|

Income before income taxes

|

14,043

|

14,507

|

12,091

|

10,059

|

10,106

|

|

Income taxes

|

4,959

|

5,578

|

4,579

|

3,628

|

3,692

|

|

Net income

|

$9,084

|

$8,929

|

$7,512

|

$6,431

|

$6,414

|

|

Per Share of Common Stock

|

|||||

|

Book value

|

$7.45

|

$7.19

|

$6.92

|

$6.14

|

$5.97

|

|

Basic earnings per share

|

0.71

|

0.71

|

0.64

|

0.57

|

0.57

|

|

Cash dividends declared per share

|

0.5266

|

0.5150

|

0.5060

|

0.4890

|

0.4750

|

|

Weighted average number of shares

|

|||||

|

outstanding during the year

|

12,734,420

|

12,626,660

|

11,695,155

|

11,298,215

|

11,225,822

|

|

Utility Plant

|

|||||

|

Original cost,

|

|||||

|

net of acquisition adjustments

|

$278,344

|

$269,856

|

$259,839

|

$245,249

|

$222,354

|

|

Construction expenditures

|

9,472

|

10,541

|

12,535

|

24,438

|

18,154

|

|

Other

|

|||||

|

Total assets

|

$274,219

|

$259,931

|

$248,837

|

$240,442

|

$210,969

|

|

Long-term debt

|

|||||

|

including current portion

|

85,017

|

85,173

|

77,568

|

86,353

|

70,505

|

For Management's Discussion and Analysis of Financial Condition and Results of Operations, please refer to Item 7 of this Annual Report.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

(All dollar amounts are stated in thousands of dollars.)

Overview

The York Water Company (the “Company”) is the oldest investor-owned water utility in the United States, operated continuously since 1816. The Company is a purely regulated water utility. Profitability is largely dependent on water revenues. Due to the size of the Company and the limited geographic diversity of its service territory, weather conditions, particularly rainfall, economic, and market conditions can have an adverse affect on revenues. 2011 was a challenging year in many respects. Market conditions and the economy in general are recovering very slowly from the recession. As a result, there was very little growth in the customer base and existing customers reduced their water usage. In 2011, total water usage per customer declined by 1.7% compared to 2010. Much of the reduction is attributed to record rainfall, particularly during the third quarter which is normally a high usage period. The Company recorded 22 more inches of rainfall in 2011 than in 2010. Conservation efforts account for a lesser portion of the decline in consumption.

Despite these challenges, the Company was able to increase revenues in 2011 compared to 2010 due to a timely rate filing which settled in November 2010. The Company also benefited from reduced income taxes in 2011 due to the deductibility of bonus depreciation for state tax purposes. The tax savings helped to offset unexpected increases in expenses for tank remediation and bad debts.

The Company’s business does not require large amounts of working capital and is not dependent on any single customer or a very few customers for a material portion of its business. In 2011, operating revenue was derived from the following sources and in the following percentages: residential, 63%; commercial and industrial, 29%; and other, 8% which is primarily from the provision for fire service. The customer mix helps to reduce volatility in consumption.

The Company seeks to grow revenues by increasing the volume of water sold through increased consumption and increases in the number of customers served, and the timely filing for rate increases. The Company continuously looks for acquisition and expansion opportunities both within and outside its current service territory as well as through contractual services and bulk water supply.

In 2011, the Company entered into agreements with several municipalities to provide sewer billing services. In addition, the Company signed an agreement to purchase the assets and operate its first wastewater collection and treatment system. The wastewater acquisition is subject to PPUC approval, but provides additional opportunities for the Company to expand its business. In 2012, the Company expects to pilot a service line protection program as well in order to further diversify the business.

Performance Measures

Company management uses financial measures including operating revenues, net income, earnings per share and return on equity to evaluate its financial performance. Additional statistical measures including number of customers, customer complaint rate, annual customer rates and the efficiency ratio are used to evaluate performance quality. These measures are calculated on a regular basis and compared with historical information, budget and the other publicly-traded water companies.

The Company’s 2011 performance was strong under the above measures. Increased rates from a rate filing and increases in the number of customers resulted in higher revenue. In addition, the Company incurred lower income taxes in 2011. The overall effect was an increase in net income in 2011 over 2010 of 1.7% and a return on year end common equity of 9.5% which was consistent with 2010.

The efficiency ratio, which is calculated as net income divided by revenues, is used by management to evaluate its ability to control expenses. Over the five previous years, the Company’s ratio averaged 20.9%. In 2011, the ratio was higher than the average at 22.4% due to the higher net income resulting from higher revenue and reduced income tax expense. Management is confident that its ratio will again exceed that of its peers. Management continues to look for ways to decrease expenses and increase efficiency as well as to file for rate increases promptly when needed.

Results of Operations

2011 Compared with 2010

Net income for 2011 was $9,084, an increase of $155, or 1.7%, from net income of $8,929 for 2010. The primary contributing factors to the increase in net income were higher water revenues and lower income taxes which were partially offset by higher interest on debt and increased operating expenses, primarily for depreciation, pension, distribution system maintenance and the provision for doubtful accounts.

Water operating revenues for the year increased $1,624, or 4.2%, from $39,005 for 2010 to $40,629 for 2011. The primary reason for the increase in revenues was a rate increase effective November 4, 2010. The 8.7% rate increase was partially offset by a lower volume of water sold. The total per capita volume of water sold in 2011 decreased compared to 2010 by approximately 1.7%. The decrease is mainly attributed to lower residential consumption due to record rainfall. Commercial and industrial consumption was also slightly lower than last year. The average number of customers served in 2011 increased as compared to 2010 by 203 customers, from 62,474 to 62,677 customers. The Company expects revenues for 2012 to remain consistent with 2011. A potential rate filing, other regulatory actions and weather patterns could impact results.

Operating expenses for the year increased $1,516, or 7.9%, from $19,238 for 2010 to $20,754 for 2011. The increase was primarily due to higher depreciation expense of approximately $313 due to increased plant investment, higher pension expense of approximately $313 due to increased contributions, higher distribution system maintenance expense of approximately $310 primarily due to a tank remediation project and a higher provision for doubtful accounts of approximately $258 due to additional inactive accounts. Also contributing to the increase were higher salary and wage expense of approximately $127 and other expenses aggregating approximately $195. Depreciation expenses are expected to continue to rise due to investment in utility plant, the provision for doubtful accounts is expected to decrease with the absence of the 2011 adjustment, pension expense is expected to remain consistent and other operating expenses are expected to increase at a moderate rate as costs to serve customers and to extend the distribution system continue to rise.

Interest on debt for 2011 increased $348, or 7.1%, from $4,906 for 2010 to $5,254 for 2011. The increase was primarily due to interest of $577 on the 5.00% Senior Notes, Series 2010A, issued in October of 2010. Offsetting the increase were lower interest payments of $149 on the Company’s lines of credit due to reduced borrowings, lower interest of $67 due to retirement of the 3.75% Industrial Development Authority Revenue Refunding Bonds, Series 1995, in June of 2010 and other lower interest expense of $13. During 2011, there were no borrowings under the lines of credit. The average interest rate on the lines of credit was 1.54% for 2010 on average debt outstanding of $7,191. Interest expense in 2012 is expected to remain consistent with 2011.

Allowance for funds used during construction decreased $12, from $111 for 2010 to $99 in 2011, due to a lower volume of eligible construction. Allowance for funds used during construction is expected to show a modest increase in 2012 based on a projected increase in the amount of construction expenditures.

Other income (expenses), net for 2011 reflects increased expenses of $212 as compared to 2010. The increase was primarily due to higher employee retirement expense of approximately $154 due to increased liabilities from a decline in the discount rate which was partially offset by life insurance proceeds. Also contributing to the increase were higher charitable contributions of approximately $25 and increased other expenses aggregating approximately $33. In 2012, other income (expenses) will be largely determined by the change in market returns and discount rates.

Income taxes for 2011 decreased $619, or 11.1%, compared to 2010. The Company’s effective tax rate was 35.3% for 2011 and 38.5% for 2010. The decrease in the effective tax rate was due to the deductibility of bonus depreciation for state purposes in 2011. The Company expects a lower effective tax rate to continue through 2012 if bonus depreciation remains deductible. A higher effective tax rate is likely if bonus depreciation returns to 2009 levels.

2010 Compared with 2009

Net income for 2010 was $8,929, an increase of $1,417, or 18.9%, from net income of $7,512 for 2009. The primary contributing factors to the increase in net income were higher water revenues and reduced expenses for salary and wages, distribution system maintenance and employee retirement. Higher capitalized overhead and lower interest expense added to the reduction in expenses which were partially offset by higher depreciation expense, a reduced allowance for funds used during construction, higher power costs and increased capital stock tax.

Water operating revenues for the year increased $1,962, or 5.3%, from $37,043 for 2009 to $39,005 for 2010. The primary reasons for the increase in revenues were an increased distribution system improvement charge (DSIC), a rate increase effective November 4, 2010 and growth in the customer base. The DSIC allows the Company to add a charge to customers’ bills for qualified replacement costs of certain infrastructure without submitting a rate filing. The average number of customers served in 2010 increased as compared to 2009 by 577 customers, from 61,897 to 62,474 customers. The total per capita volume of water sold in 2010 increased compared to 2009 by approximately 0.3%. Per capita consumption by industrial and commercial customers showed a modest increase over prior year and was partially offset by a slight decrease in use by residential customers.

Operating expenses for the year decreased $417, or 2.1%, from $19,655 for 2009 to $19,238 for 2010. The decrease was primarily due to lower salary and wage expense of approximately $177. This was mainly a result of the vacation accrual recorded in 2009 as discussed in Note 1 (Reclassifications) to the Company’s financial statements included herein. Lower distribution system maintenance expense of approximately $158, increased capitalized overhead of approximately $152, and reduced pension cost and other expenses aggregating approximately $275 added to the reduction of expenses. Higher depreciation expense due to increased plant investment, increased power costs and higher capital stock tax aggregating approximately $345 partially offset the decrease.

Interest on debt for 2010 decreased $84, or 1.7%, from $4,990 for 2009 to $4,906 for 2010. The primary reasons for the decrease were lower interest payments of $131 due to the retirement of the 3.60% Industrial Development Authority Revenue Refunding Bonds, Series 1994, in May of 2009 and the 3.75% Industrial Development Authority Revenue Refunding Bonds, Series 1995, in June of 2010, lower interest of $81 on the Company’s lines of credit due to reduced borrowings and lower interest of $47 on the $12,000 variable rate bonds due to reduced interest rates. The decrease in expense was partially offset by higher interest of $175 primarily for the newly issued 5.00% Senior Notes, Series 2010A, in October of 2010. The average interest rate on the lines of credit was 1.54% for 2010 compared to 1.41% for 2009. The average debt outstanding under the lines of credit was $7,191 for 2010 and $16,848 for 2009.

Allowance for funds used during construction decreased $99, from $210 for 2009 to $111 in 2010, due to a lower volume of eligible construction. Eligible 2009 construction expenditures included a main extension to West Manheim Township.

Other income (expenses), net for 2010 reflects decreased expenses of $52 as compared to 2009. The decrease was primarily due to lower employee retirement expense.

Income taxes for 2010 increased by $999, or 21.8%, compared to 2009, primarily due to an increase in taxable income. The Company’s effective tax rate was 38.5% in 2010 and 37.9% in 2009.

Rate Developments

See Note 7 to the Company’s financial statements included herein for a discussion of its rate developments.

Acquisitions

See Note 2 to the Company’s financial statements included herein for a discussion of its acquisitions.

On December 28, 2011, the Company agreed to purchase the assets of Asbury Pointe Wastewater Collection and Treatment System in York County, Pennsylvania. Closing of the acquisition is contingent upon receiving approval from all required regulatory authorities. Closing is expected in the second quarter of 2012 at which time the Company will add approximately 240 wastewater customers. This acquisition provides further diversification to the Company’s business by adding wastewater collection and treatment to its services.

On March 2, 2012, the Company signed an agreement to purchase the assets of Section A Water Corporation in Adams County, Pennsylvania, at a purchase price of $135. The Company will initially serve approximately 100 new customers by operating the current system as a satellite location. The acquisition is expected to close in the third quarter of 2012 following necessary approvals from regulatory authorities.

On March 7, 2012, the Company signed an agreement to purchase the water assets of York Starview, LP in York County, Pennsylvania, at a purchase price of $125. Because York Starview, LP is already in the Company’s service territory, fewer approvals will be needed. The Company expects to begin serving approximately 240 new customers through an interconnection with its current distribution system during the second quarter of 2012.

These acquisitions are expected to be immaterial to total company results. The Company is also pursuing other bulk water contracts and acquisitions in and around its service territory to help offset further declines in per capita water consumption.

Capital Expenditures

During 2011, the Company invested $9,472 in construction expenditures including routine items, upgrades to its water treatment facilities, reinforcing water mains, and various replacements of aging infrastructure. The Company replaced and relined over 41,000 feet of main in 2011. The Company was able to fund operating activities and construction expenditures using internally-generated funds, proceeds from its stock purchase plans (see Note 5 to the Company’s financial statements included herein), and customer advances.

The Company anticipates construction and acquisition expenditures for 2012 and 2013 of approximately $12,040 and $13,660, respectively. In addition to routine transmission and distribution projects, a portion of the anticipated 2012 and 2013 expenditures will be for additional main extensions, further upgrades to water treatment facilities, a new pumping station, improvements to the dams, an upgrade to the enterprise software system, and various replacements of aging infrastructure. The Company intends to use internally-generated funds for at least half of its anticipated 2012 and 2013 construction and fund the remainder through line of credit borrowings, proceeds from its stock purchase plans, potential debt and equity offerings, the DSIC and customer advances and contributions (see Note 1 to the Company’s financial statements included herein). Customer advances and contributions are expected to account for less than 5% of funding requirements in 2012 and 2013. The Company believes it will have adequate credit facilities and access to the capital markets, if necessary during 2012, to fund anticipated construction and acquisition expenditures.

Liquidity and Capital Resources

Cash

The Company manages its cash through a cash management account that is directly connected to a line of credit. Excess cash generated automatically pays down outstanding borrowings under the line of credit arrangement. If there are no outstanding borrowings, the cash is used as an earnings credit to reduce banking fees. Likewise, if additional funds are needed, besides what is generated internally, for payroll, to pay suppliers, or to pay debt service, funds are automatically borrowed under the line of credit. The cash balance of $4,006 at December 31, 2011 represents the balance of the proceeds of the October 2010 long-term debt issue plus the funds from operations generated internally in 2011 primarily due to lower cash required for income taxes due to bonus depreciation. The Company expects the cash balance to decline in 2012 based on currently allowable bonus depreciation. After the cash balance is fully utilized, the cash management facility is expected to provide the necessary liquidity and funding for the Company’s operations for the foreseeable future based on its past experience.

Accounts Receivable

Recently the Company has noticed a decline in the timeliness of payments by its customers and an increase in the number of inactive accounts with outstanding balances. The Company has increased its allowance for doubtful accounts in consideration of this trend. If this trend continues, the Company may incur additional expenses for uncollectible accounts and experience a reduction in its internally-generated funds. The Company made a one-time adjustment during the second quarter of 2011 to the allowance and corresponding provision for doubtful accounts for inactive accounts that were written off during the second half of 2011. The amount of the adjustment was not considered material to the financial statements. No further adjustments are expected in 2012.

Internally-generated Funds

The amount of internally-generated funds available for operations and construction depends on the Company’s ability to obtain timely and adequate rate relief, customers’ water usage, weather conditions, customer growth and controlled expenses. In 2011, the Company generated $17,474 internally as compared to $14,755 in 2010 and $15,801 in 2009. The reduction in income taxes paid increased cash flow from operating activities.

Credit Lines

Historically, the Company has borrowed $15,000 to $20,000 under its lines of credit before refinancing with long-term debt or equity capital. As of December 31, 2011, the Company maintained unsecured lines of credit aggregating $29,000 with three banks at interest rates ranging from LIBOR plus 1.20% to LIBOR plus 2.00%. The Company had no outstanding borrowings under any of its lines of credit as of December 31, 2011. The Company plans to renew a $5,000 line of credit that expires in June 2012 under similar terms and conditions.

The credit and liquidity crisis which began in 2008 has caused substantial volatility and uncertainty in the capital markets and in the banking industry resulting in increased borrowing costs and reduced credit availability. Since then, the Company has experienced more stability as the economy recovers from the recession. Actual interest rates remain low and two of the Company’s banks recently reduced the interest rate on its lines of credit. One of the lines of credit continues to carry a commitment fee, although it has been reduced. The Company has taken steps to manage the risk of reduced credit availability such as maintaining primarily committed lines of credit that cannot be called on demand and obtaining a 2-year revolving maturity. Despite the general improvements and actions taken, there is no guarantee that the Company will be able to obtain sufficient lines of credit with favorable terms in the future. In addition, if the Company is unable to refinance its line of credit borrowings with long-term debt or equity when necessary, it may have to eliminate or postpone capital expenditures. The Company was able to pay off its line of credit borrowings by issuing long-term debt in October 2010. Management believes the Company will have adequate capacity under its current lines of credit to meet financing needs throughout 2012.

Long-term Debt

The Company’s loan agreements contain various covenants and restrictions. Management believes it is currently in compliance with all of these restrictions. See Note 4 to the Company’s financial statements included herein for additional information regarding these restrictions.

The 6.00% Pennsylvania Economic Development Financing Authority Exempt Facilities Revenue Bonds, Series 2008B, contain special redemption provisions. Under these provisions, representatives of deceased beneficial owners of the bonds have the right to request redemption prior to the stated maturity of all or part of their interest in the bonds. In 2011, the Company retired $115 under these provisions. Currently, no additional bonds that met the special provisions have been tendered for redemption. The Company is not obligated to redeem any individual interest exceeding $25, or aggregate interest exceeding $300 in any annual period.

The Company’s debt (long-term debt plus current portion of long-term debt) as a percentage of the total capitalization, defined as total common stockholders’ equity plus long-term debt (including current portion of long-term debt), was 47.2% as of December 31, 2011, compared with 48.3% as of December 31, 2010. As debt load trends upward in the future, the Company will likely match increasing debt with increasing equity so that its debt to total capitalization ratio remains at nearly fifty percent. This capital structure has historically been acceptable to the PPUC in that prudent debt costs and a fair return have been granted by the PPUC in rate filings. See Note 4 to the Company’s financial statements included herein for the details of its long-term debt outstanding as of December 31, 2011.

The Company has an effective “shelf” Registration Statement on Form S-3 on file with the Securities and Exchange Commission (SEC), pursuant to which the Company may offer an aggregate remaining amount of up to $25,000 of its common stock or debt securities subject to market conditions at the time of any such offering. The Company is not currently planning to issue securities under the shelf Registration Statement in 2012.

Deferred Income Taxes and Uncertain Tax Positions

The Company has seen an increase in its deferred income tax liability amounts over the last several years. This is primarily a result of the accelerated and bonus depreciation deduction available for federal tax purposes which creates differences between book and tax depreciation expense. The Company expects this trend to continue as it makes significant investments in capital expenditures and as the tax code continues to extend bonus depreciation.

The Company has a substantial deferred income tax asset primarily due to the differences between the book and tax balances of the pension and deferred compensation plans from lower discount rates. The Company does not believe a valuation allowance is required due to the expected generation of future taxable income during the periods in which those temporary differences become deductible. The Company has determined there are no uncertain tax positions that require recognition as of December 31, 2011.

Common Stock