Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MUFG Americas Holdings Corp | d313935d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - MUFG Americas Holdings Corp | d313935dex21.htm |

| EX-99.2 - PRESS RELEASE - MUFG Americas Holdings Corp | d313935dex992.htm |

Acquisition of

Exhibit 99.1 |

Safe

Harbor Statement 2

This document includes forward-looking statements that involve risks and uncertainties.

Forward-looking statements can be identified by the fact that they do not relate strictly

to historical or current facts. Often, they include the words “believe,”

“continue,” “expect,” “target,” “anticipate,”

“intend,” “plan,” “estimate,” “potential,” “project,” or words of similar

meaning, or future or conditional verbs such as “will,” “would,”

“should,” “could,” or “may.” There are numerous risks and

uncertainties that could and will cause actual results to differ materially from those

discussed in UNBC’s forward-looking statements. Many of these factors are beyond

UNBC’s ability to control or predict and could have a material adverse effect on

UNBC’s financial condition, results of operations and/or prospects. Such risks and

uncertainties include, but are not limited to uncertainties as to the timing of completion of the

proposed acquisition, the possibility that various closing conditions (including regulatory

approval) for the proposed transaction may not be satisfied at all or in a timely manner or

waived, UNBC’s ability to retain key employees and other risks and uncertainties discussed

in UNBC’s public filings with the SEC. All forward-looking statements included in

this document are based on information available at the time of such document, and UNBC assumes

no obligation to update any forward-looking statement. |

Growing Our California Franchise

3

•

Acquiring the leading bank in attractive Santa Barbara market

•

Strengthens retail banking scale and distribution

•

Complementary service-oriented and relationship based model

–

Combines two community focused cultures

•

Significant revenue opportunities from expanded product offerings and

cross-sell in business

banking,

wealth

management

and

commercial

and

community

banking

•

Credit write-up and reversal of Deferred Tax Asset (DTA) valuation allowance

unlocks tangible book value

•

Leverages strong capital

•

Improves Union Bank funding mix by adding valuable, low-cost retail

deposits •

Significant operating synergies

–

Cost saves of approx. $80 million or approx. 40% of PCBC expenses

•

Exceeds internal financial hurdles

•

Balance sheet marked at time of recapitalization in August 2010

–

No credit write-down required

•

Strong pro forma capital position

•

Reviewed significant portion of loan files with Union Bank credit team

•

Recent track record of successful integrations

Strategic

Rationale

Financially

Attractive

Relatively

Low Risk |

Transaction Assumptions

4

Consideration

100% Cash

Purchase Price Per Share

$46.00

Aggregate Value

$1.5Bn

Anticipated Closing

Q4 2012

Approvals

Regulatory (Pacific Capital majority

shareholder consent already obtained)

Due Diligence

Complete

|

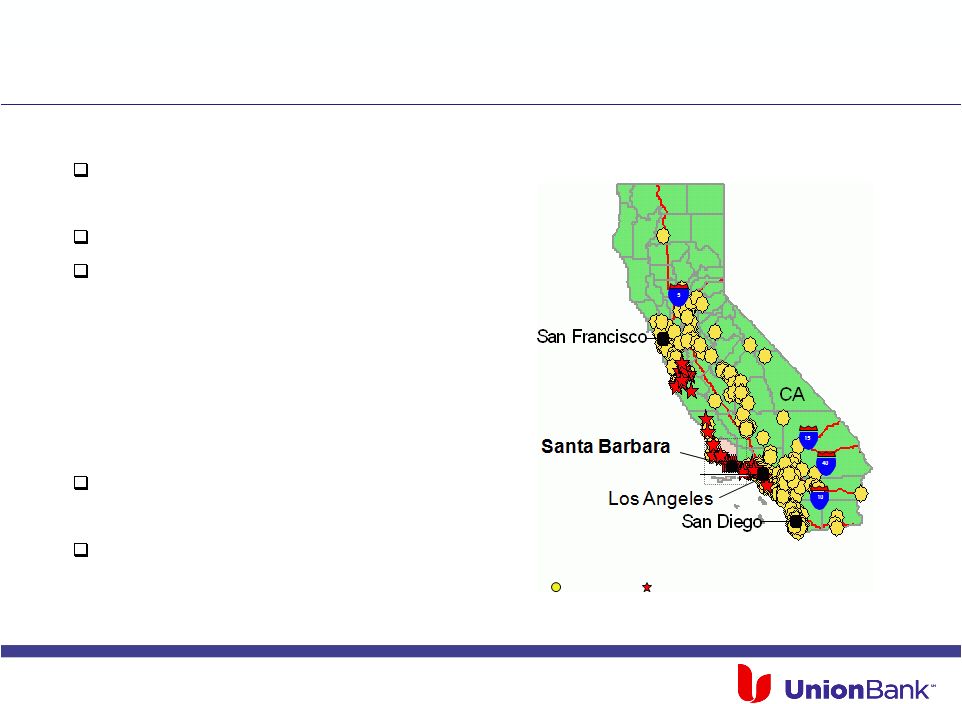

Building Branch Density in Attractive California Markets

5

Commenced operations in 1960

–

Headquartered in Santa Barbara, CA

$5.9Bn in assets; $4.6Bn in deposits

47 branches in Central Coast of California

–

Largest independent bank in Central Coast

–

#1 in Santa Barbara MSA

–

#4 in Oxnard-Thousand Oaks MSA

–

Median

household

income

of

$69K

(1)

for

Pacific

Capital

markets

compared

to

$54K

(1)

for entire U.S.

Recapitalization in August 2010

–

Ford Financial Fund L.P. owns 76%

Strong core deposit funding

–

Non-interest bearing deposits comprise

25.5% of total deposits

Overview of Pacific Capital

1. Source: SNL Financial. Weighted by total deposits in market

Union Bank

Pacific Capital Bancorp |

Leading

Presence in Santa Barbara, Strengthened Position in Adjacent Markets

6

Institution

Market Share

(%)

1

Bank of America

26.3

2

Wells Fargo

20.0

3

JP Morgan

7.5

–

Union Bank / Pacific Capital

6.7

4

Union Bank

6.2

5

Citigroup

5.3

18

Pacific Capital

0.5

California

Institution

Market Share

(%)

–

Union Bank / Pacific Capital

23.7

1

Pacific Capital

22.4

2

Wells Fargo

17.6

3

Bank of America

13.5

4

Rabobank Nederland

10.1

5

Montecito Bancorp

8.1

15

Union Bank

1.3

Institution

Market Share

(%)

1

Wells Fargo

26.2

2

Bank of America

21.6

3

JP Morgan

11.9

–

Union Bank / Pacific Capital

8.1

4

Pacific Capital

6.2

5

Citigroup

6.0

12

Union Bank

1.9

Santa Barbara MSA

Oxnard MSA (Ventura)

Institution

Market Share

(%)

1

Wells Fargo

29.2

2

Bank of America

17.4

3

Rabobank Nederland

14.3

4

JP Morgan

13.3

–

Union Bank / Pacific Capital

12.6

5

Pacific Capital

9.3

6

Union Bank

3.3

Salinas MSA (Carmel / Monterey)

(Median HH Income: $60,992)

(Median HH Income: $61,338)

(Median HH Income: $77,837)

(Median HH Income: $62,850) |

Pacific Capital: Significantly Strengthened Franchise

Improved Funding Base

Deposit Composition (%)

CDs

Money Market & Savings

Non-interest Bearing

Solid Credit Quality w/ Marked Balance Sheet

Nonperforming Assets (%)

Rebuilt Capital Position

Tier 1 Common Ratio (%)

Return to Profitability

Net Income ($MM)

7

(Pre-Ford Investment)

Cost of Deposits:

1.54%

1.06%

0.53%

(Pre-Ford Investment) |

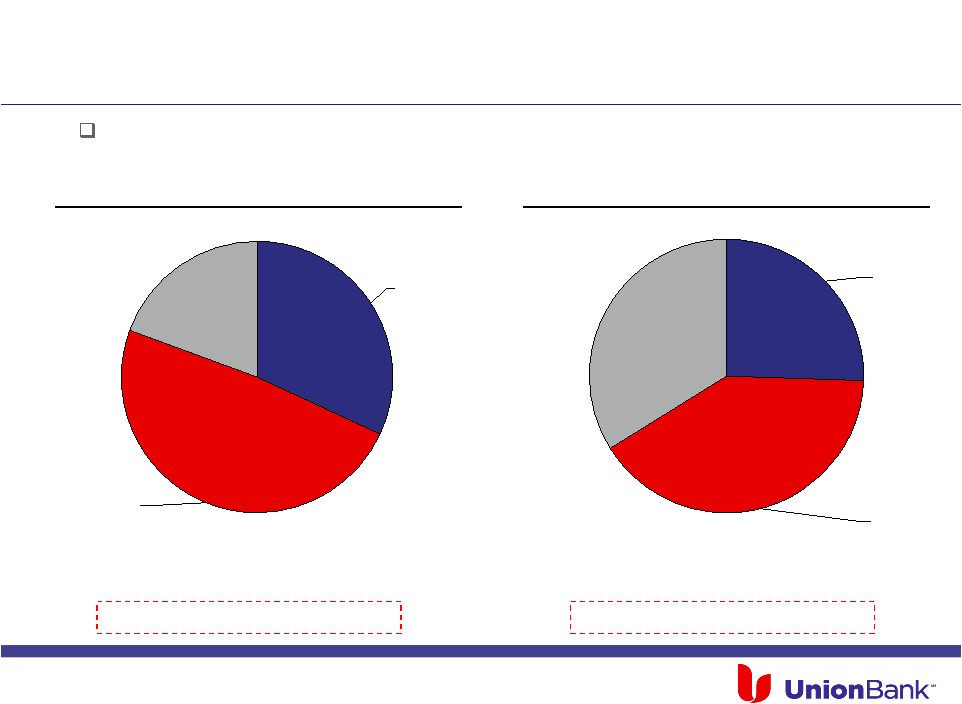

Combining Two Strong Core Deposit Bases

8

Money

Market

and

Savings

49%

CDs

19%

Non-

Interest

Bearing

32%

Union Bank

Money

Market

and

Savings

41%

CDs

34%

Non-

Interest

Bearing

25%

Pacific Capital

(1)

1. Includes interest-bearing transaction accounts

(1)

Pacific Capital’s cost of deposits is similar to Union Bank’s

12/31/2011 Total Deposits ($MM):

64,420

2011 Cost of Deposits:

0.36%

2011

Cost

of

Deposits

exl.

CDs:

0.14%

12/31/2011 Total Deposits ($MM):

4,617

2011 Cost of Deposits:

0.53%

2011 Cost of Deposits exl. CDs:

0.17% |

Significant Write-Ups to Tangible Book Value at Closing

9

Purchase Price

$1,517

Pacific Capital Shareholder Equity

762

Less: Goodwill and Intangibles

(89)

PCBC 12/31/2011 Tangible Book Value

$673

Adjustments

Reversal of DTA Valuation Allowance

248

Net Write-up of 2010 Credit Mark (After-Tax)

20

Total Adjustments

$268

Adjusted 12/31/2011 Tangible Book Value

$941

Price / Adjusted Tangible Book Value

1.6x

1.

Adjusted to reflect announced after-tax loan mark, net of reserves. Includes the

following transactions with deal values greater than $500MM: Prosperity /

American State, PNC / RBC Bank, Comerica / Sterling, Hancock / Whitney, BMO

Financial / M&I, and First Niagara / NewAlliance. 2.

As of 12/31/2011

3.

The net write-up of the 2010 credit mark is equal to the sum of the pre-tax

$27MM credit write-up ($17MM after-tax) as of 1/31/12 and the $5MM pre-tax

reserve balance ($3MM after-tax) as of 12/31/2011

Reversal of DTA valuation

allowance and recapturing a

portion of Ford Financial’s

original credit mark enhances

tangible book value

Price to adjusted tangible book

value of 1.6x compares

favorably with selected

comparable transactions

median of 2.1x

(1)

Acquiring strong core deposits

in attractive markets

(2)

(3) |

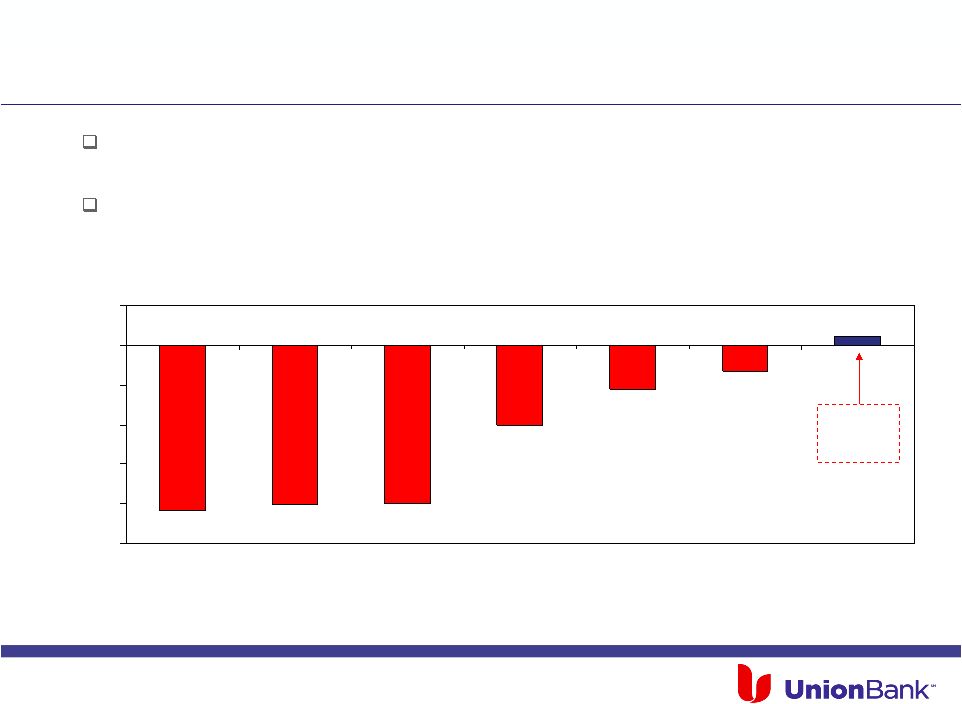

1. As of 1/31/2012

2. Transactions with deal values greater than $500MM since January 1, 2010

Pacific Capital’s Legacy Loan Portfolio Marked in 2010 Recapitalization

10

Credit mark of $440MM or 10.6% of principal balance results in a

pre-tax credit write-up of

$27MM, or ~0.7% of the current marked book value of the loan portfolio

(1)

Median credit mark for recent comparable transactions of 9.0%

Source: Investor Presentations

(15)

(12)

(9)

(6)

(3)

0

3

PNC / RBC Bank

BMO / M&I

Comerica /

Sterling

Hancock /

Whitney

First Niagara /

New Alliance

Prosperity /

American State

Union Bank /

Pacific Capital

(%)

Credit

Write-up

/

Write-down

for

Precedent

Transactions

(2)

Write-up

of Book

Value

(1) |

Comprehensive Credit and Operational Due Diligence Completed

11

Due diligence completed, including all major business and functional areas

Reviewed Ford’s original mark in context of today’s market conditions and

recent and projected performance of loan portfolio

–

Union Bank’s analysis resulted in a pre-tax $27MM write-up of the

loan portfolio balance

Extensive

review

of

loan

portfolios

including

internal

loan

file

reviews,

thorough analysis of data provided, and discussions with management

–

Overall credit analysis and individual credit files reviewed onsite by senior

Union Bank banking and credit professionals to assess risk profile and

credit mark

–

On-site team conducted extensive review of commercial portfolio (over 300

loan files representing $1.1Bn of customer balances) providing coverage

across all major asset types

–

Detailed analysis of consumer portfolios completed, including selected file

reviews

Systems integration expected to occur in 1Q 2013

–

Dedicated integration team with deep transaction experience

|

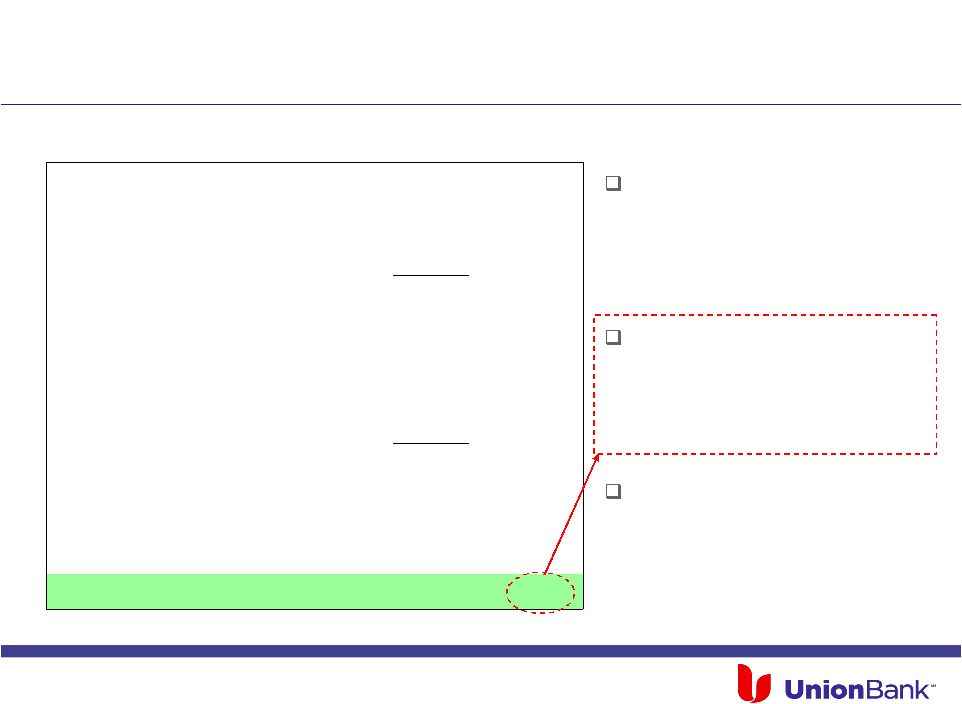

Continued Capital Strength and Flexibility

12

On a pro forma basis:

UNBC will continue to have the

highest Tier 1 Common ratio

among its peers

(1)

Estimated Pro forma 12/31/11 Tier

1 Common Ratio of ~12.4%

Quality of capital is very strong:

100% of Tier 1 consisting of

common equity

Capital strength provides flexibility

for further growth

Tier 1 Common Ratio at 12/31/11

Peer Median: 9.7%

(%)

(Pro Forma)

1.

Regional banks with assets > $50 billion |

Strategically Compelling, Financially Attractive Combination

13

Combination creates leading market opportunity for business banking,

wealth management and commercial and community banking in Central

Coast region

Complementary relationship and service oriented business model, and

commitment to community

Financially attractive transaction which exceeds internal financial hurdles

Relatively low risk, highly diligenced transaction

Strong capital and liquidity post-transaction to fund future growth

|