Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ODYSSEY MARINE EXPLORATION INC | Financial_Report.xls |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - ODYSSEY MARINE EXPLORATION INC | d258164dex311.htm |

| EX-32.2 - SECTION 906 CFO CERTIFICATION - ODYSSEY MARINE EXPLORATION INC | d258164dex322.htm |

| EX-23.1 - CONSENT - ODYSSEY MARINE EXPLORATION INC | d258164dex231.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - ODYSSEY MARINE EXPLORATION INC | d258164dex312.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - ODYSSEY MARINE EXPLORATION INC | d258164dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-31895

ODYSSEY MARINE EXPLORATION, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 84-1018684 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

5215 W. Laurel Street, Tampa, Florida 33607

(Address of principal executive offices)

(813) 876-1776

(Registrant’s telephone number including area code)

Securities registered pursuant Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $.0001 par value | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ¨ No x

Indicate by mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the 69 million shares of voting stock held by non-affiliates of Odyssey Marine Exploration, Inc. as of June 30, 2011 was approximately $215 million. As of February 23, 2012, the Registrant had 73,144,592 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Form 10-K is incorporated by reference to the Company’s Definitive Proxy Statement for the Registrant’s Annual Meeting of the Shareholders to be held on June 18, 2012.

Table of Contents

| Page | ||||||

| PART I | ||||||

| Item 1. | 1 | |||||

| Item 1A. | 10 | |||||

| Item 1B. | 12 | |||||

| Item 2. | 12 | |||||

| Item 3. | 12 | |||||

| PART II | ||||||

| Item 5. | 13 | |||||

| Item 6. | 14 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | ||||

| Item 7A. | 25 | |||||

| Item 8. | 25 | |||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

25 | ||||

| Item 9A. | 25 | |||||

| Item 9B. | 26 | |||||

| PART III | ||||||

| Item 10. | 26 | |||||

| Item 11. | 26 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

26 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

26 | ||||

| Item 14. | 26 | |||||

| PART IV | ||||||

| Item 15. | 27 | |||||

| 63 | ||||||

| 64 | ||||||

Table of Contents

As used in this Annual Report on Form 10-K, “we,” “us,” “our company” and “Odyssey” mean Odyssey Marine Exploration, Inc. and our subsidiaries, unless the context indicates otherwise.

PART I

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934. The statements regarding Odyssey Marine Exploration, Inc. and its subsidiaries contained in this report that are not historical in nature, particularly those that utilize terminology such as “may,” “will,” “should,” “likely,” “expects,” “anticipates,” “estimates,” “believes,” “plans,” or comparable terminology, are forward-looking statements based on current expectations and assumptions, and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements.

Important factors known to us that could cause such material differences are identified in this report and in our “RISK FACTORS” in Item 1A. Accordingly, readers of this Annual Report on Form 10-K should consider these factors in evaluating, and are cautioned not to place undue reliance on, the forward-looking statements contained herein. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| ITEM 1. | BUSINESS |

Overview

Odyssey Marine Exploration, Inc. is a world leader in deep-ocean shipwreck and mineral exploration, with expertise in innovative search technology and archaeological recovery operations on deep-ocean shipwrecks throughout the world. In 2011, we discovered two long-lost British commercial shipwrecks whose combined cargo could total over 7 million ounces of silver. In addition, we began to leverage our core business expertise and technology for exploration services for use in deep-ocean mineral exploration and our expeditions in partnership with Neptune Minerals and Chatham Rock Phosphate have resulted in the discovery of significant potentially valuable ore bodies and resource analyses. We also completed our first ever fully underwritten stock offering that featured participation by several large and respected investment funds.

We employ state-of-the-art technology, including side-scan sonar, magnetometers, remotely operated vehicles (ROVs), and other advanced equipment that enables us to locate shipwrecks and natural resource sites at depths that were previously unreachable in an economically feasible manner. Odyssey continues to build on a foundation of shipwreck research, government relationship development and the pioneering of techniques in deep-ocean exploration. Although we utilize technologies that have been developed at great expense in other fields, primarily the military, oil and telecommunications industries, we use our deep-ocean experience to modify and customize these technologies to create proprietary applications specific to our exploration and recovery needs.

Our shipwreck projects go through several phases, beginning with research of historical records and academic materials to establish potential target sites for search operations. Sites that meet our criteria are selected for exploratory search which may last as long as several years. If and when a target site is identified, we undertake an archaeological pre-disturbance survey and finally excavation of the site. The excavation phase is followed by conservation, recording, documentation and commercial monetization under established Admiralty Law or contract with sovereign nation governments.

The Odyssey team shares the knowledge gained through our expeditions with the world. We share this information through a variety of media including television, the Internet, books, research papers, periodicals, educational programs and traveling exhibits. We maintain several Internet sites including www.shipwreck.net, www.odysseysvirtualmuseum.com and www.shipwreckstore.com. We also allow collectors to own a piece of history from a shipwreck’s cargo by offering select duplicate items, artifact replicas and collectibles that provide an opportunity for everyone interested in shipwrecks to participate in Odyssey’s fascinating discoveries at the level of their choice. Information that is included on or linked to our Internet sites is not considered part of this Annual Report.

Project and Research Criteria

The United Nations Educational Scientific and Cultural Organization, or UNESCO, has estimated that there are approximately 3,000,000 shipwrecks contained within the oceans of the world. Historical records suggest that many were lost with verifiable cargoes of intrinsically valuable material. Odyssey’s research department maintains data on thousands of shipwrecks and continuously develops new potential projects.

Project research may focus on a particular search area where historical documents suggest recorded and unrecorded high-value targets may rest due to the proximity of shipping routes frequented by vessels carrying rich cargoes.

1

Table of Contents

Each project that targets a specific shipwreck begins with the research necessary to evaluate the potential value, location and likelihood of finding the wreck. Research is also necessary to establish the historical significance of the sunken ship and helps define the context in which the ship sank – essential for preparing an archaeological project plan and the complex logistics that precede excavation of a site.

Our marine research department continuously conducts research in an attempt to identify shipwreck projects that meet the following criteria:

| • | Documented Cargo Value – The research must indicate that the shipwreck was likely carrying enough intrinsically valuable cargo to cover the high costs associated with deep-ocean exploration and advanced archaeological recovery. Commercially viable cargo typically includes gold, silver, jewels, or other high-value items. Odyssey sometimes engages in the preliminary exploration of a shipwreck for purely scientific purposes, even if the value of the wreck is largely cultural, historical or educational. |

| • | Documented Navigation Information – The research must provide sufficient navigational information documenting the sinking location (or a particular area with potential for producing high-value targets) in order to minimize the search area, as well as the cost and time involved, and to provide a reasonable expectation that the shipwreck can be found. |

| • | Path to Ownership – The research must resolve or reasonably predict prior to recovery any issues relating to ownership of the shipwreck and its cargo. Questions pertaining to potential claimants, the location of the wreck inside or outside territorial waters, and the nature of the ship’s commercial or military mission are some of the important considerations that need to be understood in advance. |

Search Operations

Shipwreck search operations are conducted from a research vessel fitted with survey equipment and often with a Remotely Operated Vehicle (ROV). Odyssey’s ships can conduct deep-sea search operations 24 hours a day, seven days a week and have been deployed throughout the world – in the English Channel, the Mediterranean Sea, and the Atlantic and Pacific Oceans. A search typically begins with a side-scan sonar survey of the target area, which is typically paired with a magnetometer survey and multi-beam bathymetric surveys in some cases. The most interesting anomalies on the ocean floor are then inspected visually with an ROV, which sends real-time video images to monitors on the survey vessel for observation by the scientific and technical teams. These images are also downloaded and saved for additional evaluation ashore. Sometimes, it is immediately obvious whether the inspected site is of interest or not – as in the case of geology, modern debris, or when coins or valuables are readily apparent on the site. In other instances, it may take additional research and return visits to a site to arrive at probable or positive identity and to determine the next step forward.

Archaeological Excavation and Recovery

Archaeological excavation and recovery operations combine ROVs with sophisticated positioning systems, cameras and specialized computer hardware and software to carefully record the location of artifacts in situ and to document the entire archaeological process as the artifacts are recovered from a shipwreck site. As they conduct robotic archaeological operations at sites hundreds and sometimes thousands of feet below the ocean surface, Odyssey’s ROV pilots are directed by marine archaeologists aboard the recovery vessel.

The Odyssey Explorer, a 251-foot Class II dynamically positioning (DP) ship, serves as Odyssey’s principal state-of-the-art deep-ocean archaeological platform for shipwreck exploration. She carries fuel and stores for missions of up to 60 days, accommodates 42 crew members, including technicians, scientists and archaeologists, and has extensive onboard storage space for workshops, an archaeology laboratory, multiple cranes and a large A-frame for exceptional handling capability. When working on a project, operations are generally conducted 24 hours a day, seven days a week.

The centerpiece of Odyssey’s advanced robotic archaeology system is the ROV, which serves as the archaeologist’s eyes and hands in the deep ocean. Odyssey owns two work-class ROVs, nicknamed ZEUS and ZEUS II. The 200HP and 400 HP vehicles, respectively, are each approximately the size of a small truck; they stand about 10 feet high and weigh 8 tons. Driven by eight powerful hydraulic thrusters, they are rated to operate up to depths of 2,500 meters (8,200 ft.). Both ROVs have been custom-designed for deep-ocean archaeological survey and recovery operations, including visual inspection, pre-disturbance photographic and video documentation, scientific excavation and artifact recovery.

Conservation and Documentation

Shipwreck finds represent a diversity of objects made up of a variety of organic and inorganic materials, including metals, ceramics, glass, leather and other materials that are of cultural, historical, archaeological or educational value. Artifacts recovered from the ocean are generally impregnated with corrosive salts that can be very damaging to the object. In particular, a saltwater environment accelerates the corrosion processes of many metal artifacts. The salts must be removed and artifacts treated in a timely and judicious manner or they will deteriorate and lose their value as diagnostic specimens, museum display objects, or valuable collector’s pieces. Therefore, the conservation process is essential to maintaining the integrity of the artifacts as important relics of the past, and for what they may contribute to the historical record and offer to the general public through exhibits, private collections and publications. Every item recovered from a shipwreck site must go through a conservation process, which in some cases may require weeks, months, or even years depending on the artifact’s material make-up, the salinity of the water from where it was recovered, and the length of time it remained in the saltwater environment.

2

Table of Contents

Sharing the Story

Odyssey is committed to sharing with the public the thrill and adventure of deep-ocean exploration as well as the historical and scientific knowledge and artifacts acquired from each shipwreck project. We provide an opportunity for collectors and anyone interested in shipwreck exploration to participate in Odyssey’s fascinating discoveries by owning select duplicate shipwreck artifacts, artifact replicas or collectibles. Odyssey also shares this information through a variety of media including television, the Internet, books, research papers, periodicals, educational programs and traveling exhibits. A few of these are described as follows:

| • | Exhibits – All of the culturally and archaeologically significant artifacts recovered from our shipwreck projects remain in Odyssey’s permanent collection and are available for public exhibits and further study by researchers and academia. Odyssey’s SHIPWRECK! Pirates & Treasure, an interactive multi-media exhibit, features over 500 artifacts recovered from our deep-ocean shipwreck expeditions. Visitors also are immersed in the technology and process Odyssey uses to find and recover shipwreck treasures. The exhibit recently opened in February 2012 at the Mid America Science Museum in Hot Springs, Arkansas and will run through August 2012. In 2010 the exhibit was featured at two locations (Charlotte, North Carolina and Baltimore, Maryland). In 2011 the exhibit was featured at three locations (Baltimore, Maryland; Sarasota, Florida and San Antonio, Texas). We have a smaller exhibit at the New Orleans Mint and have had small displays at the Baldwin County Historical Museum in Alabama and the Museum of the History of Science at Oxford, England. |

| • | Television Programming – Discovery Channel’s 12-epsiode series, “TREASURE QUEST” premiered worldwide in 2009 and is available for unlimited rebroadcasts at Discovery Channel’s discretion. “TREASURE QUEST” showcases the Odyssey team as we searched for and discovered shipwrecks with unique stories to tell. Emmy® Award-winning JWM Productions was granted exclusive access to film Odyssey’s 2008 “Atlas” search expedition to produce this exciting high-definition series. Episodes include forensic analysis with stunning computer graphics as well as experts in cutting-edge laboratories laboring to analyze and conserve fragile artifacts recovered from the watery depths. During each episode, viewers are treated to spectacular underwater HD video of shipwreck discoveries through the cameras of Odyssey’s ROVs. Odyssey’s discovery of HMS Victory was captured during filming for the series and was showcased in two one-hour long episodes. Odyssey’s “Black Swan” discovery was also showcased in an episode. The SS Republic project was featured in two National Geographic shows, a one-hour special for PBS, “Civil War Gold” and as an episode of National Geographic Ultimate Explorer. Odyssey is currently finalizing an agreement for at least three one-hour specials based on 2012 operations which will air internationally. |

| • | Books and Other Publications – Shipwreck expeditions and projects are chronicled in various publications including books, newspaper articles, magazine features, archaeological reports, scientific articles, and professional journals. Our goal is to document thoroughly our shipwreck discoveries, while informing, entertaining and educating the general public as well as making our results accessible to the archaeological community. Two books have been published about the SS Republic shipwreck: “Lost Gold of the Republic” and “Bottles From the Deep.” Odyssey also developed and supports a number of educational programs, including shipwreck exploration and marine archaeology curriculum developed as an educational tool for our traveling exhibit, SHIPWRECK! Pirates & Treasure. The curriculum has also been used successfully as stand-alone lessons in both public and private schools. A variety of reports and publications are now available to the public, including 22 “Odyssey Papers” that are available on our website. Ten of our archaeological papers have been published by Oxbow books in a hard-cover book titled “Oceans Odyssey,” and an additional twelve papers are included in “Oceans Odyssey 2,” which became available in the second quarter of 2011. |

Sales and Marketing

Select artifacts considered “trade goods” (coins, bullion and other mass-produced cargo) are made available for sale to collectors only after conservation, thorough documentation and study. The cultural collection of artifacts is kept in our permanent collection for exhibit and further study or made available to museums or other institutions. Replicas are created of some of the permanent collection’s significant artifacts and are made available for sale.

The recovery of coins and artifacts from the SS Republic required us to create a marketing plan specifically to sell these coins and artifacts. Initially, coins were sold to independent coin dealers who sold them through direct marketing and television outlets. The SS Republic silver coin program was re-developed in the first quarter of 2008 to take advantage of emerging research on the silver coins from the SS Republic. This included the release of the 1861-O silver half dollar issued by the State of Louisiana in between the time it seceded from the Union and when it joined the Confederate States of America. Additionally, Odyssey continued to expand distribution channels in 2008 with a broader base of coin and collectible marketers, including opening markets overseas. In 2009, 2010 and 2011 we sold through several independent dealers of which two represented 72%, 83% and 90%, respectively, of total artifact sales. Artifact sales including coins were predominantly U.S. domestic-based even though we have distributors throughout the world.

3

Table of Contents

The availability of raw materials is primarily dependent on the success of finding intrinsically valuable cargoes from shipwrecks. We recovered over 51,000 coins (approximately 4,000 $10 and $20 gold coins and 47,000 silver half dollars) and approximately 14,000 non-coin artifacts from the SS Republic. As of December 31, 2011, we have a remaining inventory of approximately 27,000 silver coins.

During 2011 and 2010, our primary source of revenue was from expedition charter services. In 2011, two customers, Neptune Minerals, Inc. and Robert Fraser Partners LLP accounted for 97% or our charter services revenue. In 2010, two customers, Robert Fraser Partners LLP and Dorado Ocean Resources, accounted for 82% of our charter services revenue.

Archaeology and Science

Many of the shipwrecks we intend to pursue may have important historical and cultural characteristics. All historically or archaeologically significant projects undertaken will be subjected to stringent archaeological standards, thus adding to the body of knowledge of the people, the history and culture of the vessel’s time. Adherence to these principles is a core value of the Company, and in addition to satisfying professional international standards, will enhance shareholder value by increasing the economic value of the artifacts and intellectual property rights of each project.

Operational Projects and Status

We have numerous shipwreck and other deep-ocean projects in various stages of development around the world. In order to protect the targets of our planned search or recovery operations, in some cases we will defer disclosing specific information relating to our projects until we have located a shipwreck or other potentially valuable resources of interest and determined a course of action to protect our property rights.

“Atlas” Search Project

Between 2005 and 2011, we searched more than 5,000 square nautical miles of seabed in the western English Channel and the Western Approaches to the Channel, recording approximately 300 shipwrecks. The shipwrecks discovered include site “35-F,” the Marquise de Tornay, and HMS Victory (1744) as well as other identified and unidentified shipwrecks. Additional high-value targets are believed to be within the “Atlas” search area. Operations in the “Atlas” search area during 2011 included additional search, inspection and verification work on several targets.

HMS Victory Project

In 2008, Odyssey discovered HMS Victory and is, under international law, salvor-in-possession of the wreck. After a period of joint consultation between the UK Ministry of Defense and the UK Department for Culture, Media and Sport, and a public consultation period, the title to the HMS Victory was transferred to the Maritime Heritage Foundation in January 2012. The Foundation is a charity established to locate shipwrecks, investigate, recover and preserve artifacts to the highest archaeological standards and to promote knowledge and understanding of Britain’s maritime heritage, has now assumed responsibility for the future management of the wreck site. The Foundation has contracted with Odyssey to provide a full range of archaeological services.

Pursuant to an agreement with the Foundation, Odyssey has produced an extensive project design for the archaeological excavation of the site, including a complete plan for recording, documentation, conservation, publication and public education. The agreement calls for Odyssey’s project costs to be reimbursed and for Odyssey to be paid a percentage of the recovered artifacts’ fair value. The preferred option is for Odyssey to be compensated in cash. However, if the Foundation determines, based on the principles adopted for their collection management and curation policy, that it is in its best interest to de-accession certain artifacts, the Foundation may choose to compensate Odyssey with artifacts in lieu of cash.

Odyssey will receive the equivalent of 80% of the fair value of artifacts that were primarily used in trade or commerce or were private property and bear no direct connection to the construction, navigation, defense or crew of the ship, such as coins or other similar cargo. Odyssey will receive the equivalent of 50% of the fair value of all other recovered objects typically associated with the construction, crewing and sailing of ships including, but not limited to, the ship’s hull, fittings, fasteners, construction elements, clothing, organic remains, foodstuffs, cooking utensils, pottery, weapons, ammunition, ground tackle and navigational equipment. For any private property including coins or other cargo administered through the Receiver of Wreck, the Foundation has agreed that Odyssey shall receive 80% of the value.

4

Table of Contents

A Private Curatorship Program will be established for artifacts from the site considered by the Foundation to be suitable for de-accession to prevent their irretrievable dispersal and to allow ongoing scientific study.

We have recently completed an extensive non-intrusive preliminary survey of the Victory site, using several new advanced technologies which have provided a detailed three dimensional inspection of both the surface and sub-sedimentary portions of the site. We now have a detailed map which shows a total of at least 75 bronze cannon on the site, as well as differentiated deposits of both ferrous and non-ferrous metals. This data will be used to guide the preliminary excavation of the site, once the Foundation approves the commencement of this excavation. The Foundation has approved the Project Design which was required prior to the start of excavation, and it has been submitted to the Advisory Group chaired by the UK MOD for the purpose of opining as to whether the Project Design is consistent with the archaeological principles of the Rules of the UNESCO Convention. We are confident that the Research Design is consistent with these Rules, as they were followed precisely to conform with the archaeological principles as delineated.

“Gairsoppa” Project

On January 25, 2010, Odyssey was awarded the exclusive salvage contract for the cargo of the SS Gairsoppa by the United Kingdom (UK) Government Department for Transport. The contract was awarded after a competitive bid process.

The SS Gairsoppa was a 412-foot steel-hulled British cargo ship that was torpedoed by a German U-boat in February 1941 while enlisted in the service of the United Kingdom (UK) Ministry of War Transport. Contemporary research and official documents indicate that the ship was carrying £600,000 (1941 value) or up to 7 million total ounces of silver, including over 3 million ounces of private silver bullion insured by the UK government. The British Ministry of War Transport paid a War Risk Insurance Claim for £325,514 (in 1941 value) for 2,817 bars of silver that was reported to be on board the Gairsoppa when she sank.

Under the recovery contract, Odyssey assumes the risk, expense, and responsibility for the search, cargo recovery, documentation, and marketing of the cargo. Any monetary proceeds from the salvage will first be applied to reimbursement of Odyssey’s recovery and processing expenses. Any remaining monetary proceeds will next be divided with Odyssey retaining 80% of the net salved value, and 20% retained by the UK. This project aligns with our preferred strategy to focus our search and recovery activities on partnership projects with governments when appropriate, so as to provide straightforward legal contractual arrangements prior to our recovery efforts.

In June 2011, we executed a charter agreement to utilize the Russian Research Vessel Yuzhmorgeologiya to conduct search operations for the SS Gairsoppa. Search operations began in July 2011. On September 26, 2011, we announced confirmation of the identity and location of the SS Gairsoppa approximately 300 miles southwest of Galway, Ireland in waters approximately 4700 meters deep. We subsequently began acquiring and assembling the vessel, equipment, tools and team for the salvage. We anticipate salvage recovery operations will begin in late May to mid-June 2012.

Odyssey is planning a reconnaissance trip to the SS Gairsoppa site in March using an advanced ROV system which features a second miniature ROV similar to the one used to inspect the interior spaces on the Titanic. This system is capable of entering tiny spaces and sending high resolution video back to the ship in real time. This expedition may last up to a month and is designed to plan the recovery operations, including determination of the possible location of the silver cargo.

“Mantola” Project

Odyssey was also awarded the exclusive salvage contract for the cargo of the SS Mantola by the United Kingdom (UK) Government Department for Transport. On October 10, 2011, we announced the discovery of the SS Mantola, which sank on February 9, 1917, after being torpedoed by German submarine U-81. Odyssey discovered the shipwreck approximately 2,500 meters beneath the surface of the northern Atlantic Ocean, approximately 100 miles from the SS Gairsoppa shipwreck.

In 1917, the British Ministry of War Transport paid a War Risk Insurance Claim for £110,000 (in 1917 value) for silver that was reported to be on board the Mantola when she sank. This sum would equate to more than 600,000 ounces of silver based on silver prices in 1917. In September 2011, the UK Government Department for Transport awarded Odyssey a salvage contract for the cargo of the SS Mantola. The terms and conditions are similar to the SS Gairsoppa salvage contract. Under the agreement, Odyssey will retain 80% of the net salved silver value recovered.

We are planning to conduct the recovery expedition in conjunction with the SS Gairsoppa recovery.

5

Table of Contents

Robert Fraser Projects

Odyssey executed agreements in 2010 with clients of Robert Fraser & Partners LLP (RFP) for three shipwreck search projects code named “Firebrand,” “Shantaram” and “Enigma II.” In 2011, we also executed three additional projects, two of which were shipwrecks projects which provided additional work on projects of interest, and the other was for mineral exploration in the South Pacific.

In April 2010, we entered into agreements to provide project research and shipwreck search and survey services for a project code-named “Firebrand” to clients of RFP. Work has been completed in this area and the subject shipwreck has not been located.

In June 2010, we entered into agreements to provide project research and shipwreck search and survey services for a project code-named “Shantaram” with clients of RFP. The survey of the “Shantaram” search block was completed, and targets of interest have been inspected with a remotely operated vehicle. In March 2011, we entered into another agreement with RFP to provide the research vessel, equipment, technical and archaeological crew to conduct additional work on this site. The contract provides for cash payments totaling approximately U.S. $2.0 million to Odyssey, plus additional payments based upon revenue derived from the project. After the repayment of all recovery costs, Odyssey will receive 75% of net revenue until an additional £5.9 million (approximately U.S. $9.6 million) has been received and then will receive a minimum of 50% of further net revenue in accordance with the search contracts. This work has been completed, and while targets of interest were identified, including a portion of a shipwreck that bears the characteristics of the target shipwreck, the cargo of the project shipwreck was not identified. After analysis of the final data from this work is completed, a plan will be made regarding additional work on the project.

In September 2010, we executed agreements to provide supplementary project research and shipwreck search and survey services for a project code-named “Enigma II” with clients of RFP. (Our initial project with RFP, which began in November 2009 code-named “Enigma”, was completed in March 2010. Eight target sites were identified, including two sites that had some of the characteristics of the “Enigma” shipwreck. However, our subsequent analysis indicated that the sites were not the “Enigma.”) As part of the agreements for the “Enigma II” project, Odyssey furnished research related to the anticipated location of the “Enigma II” and agreed to provide the research vessel, equipment and crew to search a specified area and inspect targets in that area. Survey operations were completed in 2010. In January 2011, we executed agreements to provide additional marine archaeological excavation and related services on the “Enigma II” project to certain client companies of RFP. The work will be conducted on the shipwreck site that Odyssey discovered and inspected in order to verify the contents of the target shipwreck. The contract provides for cash payments totaling approximately U.S. $2.3 million to Odyssey (of which $2 million was received in 2011), plus additional payments based upon revenue derived from the project. After the repayment of all recovery costs, Odyssey will receive at least 50% of net revenue until an additional £1.9 million (approximately U.S. $3.0 million) has been received and then will receive a minimum of 50% of further net revenue in accordance with the search contracts. Subject to the verification of the shipwreck’s identity, the condition of the cargo and confirmation of jurisdiction for administering legal rights and title to the shipwreck and its cargo, Odyssey expects to enter into additional agreements for the complete archaeological excavation of the site and for the conservation and documentation of any artifacts recovered. Work on this project is anticipated to be conducted in 2012.

In April 2011, we executed an agreement to provide marine services including mining exploration and drilling operations to client companies of RFP in a tenement area controlled by Dorado Ocean Resources (now Neptune Minerals, Inc.). The drilling will be conducted on a Seafloor Massive Sulfide (SMS) deposit that was surveyed by the Odyssey and Dorado teams during the first 100 days of exploration in Dorado’s South Pacific concession areas in 2010. The contract provides for preliminary cash payments totaling approximately U.S. $1.4 million to Odyssey plus additional payments based upon revenue derived from the project. After the repayment of mining costs, Odyssey will receive 50.2% of net revenue until an additional £3.7 million (approximately U.S. $5.9 million) has been received. Work on this project is anticipated to be conducted in 2012.

Subsea Mineral Mining Exploration Projects

In November 2009, Odyssey acquired a 25% interest in SMM Project LLC, a company funded by a group of investors to bring together the licenses and skills of world renowned deep-ocean geologist Dr. Timothy McConachy of Bluewater Metals, the offshore coring and mining expertise of Robert Goodden and Subsea Minerals.

SMM Project LLC purchased a majority interest in Bluewater Metals Pty Ltd, an Australian company with licenses for mineral exploration of approximately 150,000 square kilometers of ocean floor in territorial waters controlled by four different countries in the South Pacific. A new business entity, Dorado Ocean Resources Ltd (DOR), a limited liability company organized in Hong Kong, was formed to focus on the exploration and monetization of gold, silver, zinc and copper-rich Seafloor Massive Sulfide (SMS) deposits. In April 2010, DOR acquired SMM Project LLC and the remaining interest in Bluewater.

In March 2010, Odyssey entered into a long-term charter agreement for a vessel, the Dorado Discovery, a 311-foot DP2 vessel which we mobilized with advanced mining and exploration equipment. Utilizing the vessel, equipment and proprietary expertise, we began subsea mineral exploration in the South Pacific in August 2010 under charter in areas covered by exploration permits held by DOR.

6

Table of Contents

In April 2010, we purchased 1,200 shares of DOR for a purchase price of U.S. $2.0 million. Under the terms of the Share Subscription Agreement, Odyssey had the option to pay for this investment in cash or by providing marine services to DOR over a three-year period. Odyssey also exchanged its five membership units in SMM Project, LLC for 450 DOR shares bringing Odyssey’s total ownership in DOR to approximately 41%.

The Dorado Discovery continued charter work conducting geological exploration services to Neptune Minerals, Inc. (NMI) to explore NMI’s tenements in the waters surrounding New Zealand in the first quarter 2011. This 50-day charter concluded in May 2011. Odyssey received $3.0 million in cash plus additional equity in Neptune for this charter.

In June 2011, NMI completed a share exchange with the stockholders of DOR whereby each one outstanding share of DOR was exchanged for 1,000 shares of NMI Class B non-voting common stock. Prior to the share exchange, Odyssey was a stockholder of DOR, and Odyssey received 1.65 million shares of NMI Class B non-voting common stock pursuant to the share exchange. In connection with the share exchange, NMI executed an assignment and assumption agreement, whereby NMI assumed $8.2 million of the outstanding debt of DOR owed to Odyssey. In addition, Odyssey executed a debt conversion agreement with NMI, whereby Odyssey converted $2.5 million of the debt for 2.5 million shares of NMI Class B non-voting common stock.

The vessel Dorado Discovery completed charter work conducting geological exploration services to NMI to explore NMI’s South Pacific tenement areas. The 100-day charter concluded in October 2011. The charter was valued at $6.9 million representing both cash and additional equity in Neptune. This expedition documented several new discoveries of SMS deposits with assay results indicating substantial incidence of high grade gold, silver, zinc and copper ore.

Odyssey is currently in negotiations to add advanced drilling and coring capabilities to the Dorado Discovery which will significantly enhance the ship’s ability to delineate and assess the potential value of ocean ore bodies. The company is currently in negotiations for a 120-day charter for drilling and coring which is expected to begin during the second quarter of 2012.

At December 31, 2011, we owned 6,216,500 shares (approximately 31% of NMI). To-date Neptune has been successful in attracting the investment capital required to fund mineral exploration expeditions and to facilitate its path to commercially viable ore extraction. Neptune’s most recent capital raise was for $12 per share of Class B common stock.

During December 2011, we chartered the Dorado Discovery vessel to Chatham Rock Phosphate, Ltd. for $1.2 million in relation to deep-ocean surveying. The charter permits Chatham to pay for services in either cash or common shares of their company. At December 31, 2011, Chatham was planning on a financing to pay for the charter. We did not record the revenue from this charter because of their liquidity and capital positions at that time. If and when Chatham completes their financing and remits payment to us, we will then recognize this revenue since all revenue accounting criteria will be satisfied. If the customer remits shares, this would relate to approximately 7.2 million shares which equates to an approximate 13% ownership based on their December 31, 2011 capital structure. We were informed in March 2012 that the capital raise is expected to be completed shortly that will pay us $4 million for work performed and additional charter services. Odyssey is planning on completing an additional second phase charter for Chatham Rock Phosphate by early April, 2012 assuming the financing has been completed. The first charter consisted of geophysical, environmental and sampling operations.

Other Syndication Projects

In February 2011, Odyssey closed on a project syndication deal with Galt Resources LLC (Galt). Odyssey received $7.5 million in cash from Galt to fund working capital of ongoing exploratory search operations for target projects. Odyssey elected not to increase the funding to $10 million which was permitted in the agreement. In return Galt received the rights to future revenues of the project(s) Galt was required to select prior to December 31, 2011. If the project(s) selected by Galt is successful and artifacts are sold by Odyssey, Galt will recoup their investment plus three times the investment. These amounts will be only be paid out of proceeds of the project. Galt will receive 50% of the proceeds until this amount is recouped. In addition, Galt will share in the future net proceeds of the project at the rate of 1% for every million invested. In January 2012, Odyssey and Galt agreed to bifurcate Galt’s selection between two projects, the SS Gairsoppa and HMS Victory. Galt will receive 50% of Odyssey’s net proceeds, if any, on the SS Gairsoppa project until Galt receives two times its initial investment of $7,512,500. Galt will also receive 50% of Odyssey’s net proceeds, if any, on the HMS Victory project until Galt receives two times its initial investment and thereafter will receive 7.5125% of Odyssey’s net proceeds from the HMS Victory project.

7

Table of Contents

HMS Sussex Project

On September 27, 2002, we entered into an agreement with the Government of the United Kingdom of Great Britain and Northern Ireland, which we refer to as Her Majesty’s Government (HMG), which allows us to conduct an archaeologically sensitive exploration of the shipwreck believed to be HMS Sussex and to recover artifacts from the shipwreck site. The agreement provided for us to submit a Project Plan to HMG concerning the equipment, personnel and methodologies we intend to use in the exploration of the shipwreck, and the conservation and documentation of any artifacts and cargo that may be recovered. This Plan was submitted and approved. We began exploration of the site during December 2005.

As a sovereign warship, HMS Sussex remains the property of HMG which, to our knowledge, has not been contested by the Spanish government or other entities. As part of the partnering agreement signed between Odyssey and HMG in 2002, the following sharing arrangements have been agreed upon with respect to the aggregate amount of the appraised values and/or selling prices of the artifacts, net of agreed selling expenses:

| Range |

British Government |

Odyssey | ||||||

| $0 – $45 million |

20 | % | 80 | % | ||||

| $45 million to $500 million |

50 | % | 50 | % | ||||

| Above $500 million |

60 | % | 40 | % | ||||

Our agreement with HMG is for a period of 20 years, and can only be terminated if:

| • | the shipwreck is not HMS Sussex; |

| • | we are in serious breach of our obligations under our agreement with HMG. |

The project has been delayed due to interference in Odyssey’s operations off the coast of Gibraltar by the Spanish Autonomous Region of Andalucía and the “Black Swan” project. See “Black Swan” in the next section.

Admiralty Legal Proceedings

“Black Swan”

On September 21, 2011, a panel of the Eleventh Circuit Court of Appeals upheld the dismissal of the case by the United States Federal District Court for the Middle District of Florida finding no subject matter jurisdiction under the Foreign Sovereign Immunities Act. Without concluding that the coins and artifacts recovered were owned by the Kingdom of Spain, the Court upheld the order to transfer all property to Spain based upon a finding that it was once carried aboard the Nuestra Senora de Las Mercedes, a Spanish naval vessel. The appeal had been argued before a panel of three judges. Odyssey and other claimants including the country of Peru filed Petitions for Rehearing En Banc, requesting that the entire Court hear the case. Those Motions were denied.

In an order issued January 31, 2012, the Eleventh Circuit Court of Appeals denied the company’s motion for a stay of mandate, which would have delayed execution of the order for release of the property to Spain. Odyssey then filed an Emergency Motion for Stay with the U.S. Supreme Court to stay the release until the high Court could consider the Company’s Petition for Writ of Certiorari in the case. Justice Clarence Thomas denied our request to stay the mandate, and subsequently, the Eleventh Circuit issued a mandate to the district court. On February 17, 2012 the district court held a hearing and entered its order to Odyssey to provide an inventory of artifacts and to release to Spain the artifacts within its jurisdiction to Spain by February 24, 2012. Odyssey complied with the Court order and the coins were taken by Spain to a local U.S. Air Force base for transport to Spain on February 23, 2012. Odyssey filed its Petition to the U.S. Supreme Court on February 27, 2012.

All of Odyssey’s significant filings to-date, including those made at the district court level, can be viewed at http://www.shipwreck.net/blackswanlegal.php.

Unidentified Shipwreck (Bray Case)

On March 31, 2011, the Eleventh Circuit Court of Appeals reversed the dismissal of the case ruling that an alleged oral agreement for purchase of research materials was a maritime contract. Upon remand to the district court, Plaintiff Bray filed an Amended Complaint seeking to rescind the written and fully performed contract, and adding yet more terms allegedly agreed upon over ten years ago prior to the written contract. Odyssey filed a Motion to Dismiss the Amended Complaint. On February 3, 2012, the district court entered an Order to Show Cause requesting Bray to explain why with no case or controversy, the Motion to Dismiss should not be granted. Bray’s response was due on or before February 24, 2012, but Bray filed a request for an extension of time to file. We will continue to vigorously defend against what we consider to be a frivolous claim.

8

Table of Contents

Legal and Political Issues

Odyssey works with a number of leading international maritime lawyers and policy experts to constantly monitor international legal initiatives that might affect our projects. As a matter of policy, we begin with the assumption that some entity, whether a government, private concern or insurance company, may have some rights to shipwrecks that are slated for search and recovery operations. Based on this assumption, a rigorous legal analysis is undertaken in order to ascertain which entities might be able to create roadblocks to a successful project. In some cases, such as that of HMS Sussex, it was determined that the most prudent mechanism for moving forward was to negotiate a contract with the owner of the vessel in order to manage the litigation risk.

In other cases, such as the SS Republic project, we entered into an agreement whereby we purchased the insurance company’s interest in the shipwreck and cargo, opening the way for an immediate grant of title to Odyssey by the federal court that had jurisdiction.

To the extent that we engage in shipwreck search and recovery activities in the territorial, contiguous or exclusive economic zones of countries, Odyssey intends to comply with verifiable applicable regulations and treaties. Prior to beginning operations for any project, the legal and political aspects are carefully researched to ascertain what effect these issues may have on the potential success of the operation.

These factors are taken into account in determining whether to proceed with a project as planned. Other factors, such as the UNESCO Convention for the Protection of Underwater Cultural Heritage are also taken into consideration. New political initiatives such as this Convention could require compliance with additional cultural resource management guidelines and regulations. Some of these will require adherence to strict archaeological practices and we intend to follow reasonable guidelines in all projects to which they are applicable. Greg Stemm, Odyssey’s Chief Executive Officer and co-founder, was a member of the United States delegation that negotiated the UNESCO Convention, and as such provides us with a thorough understanding of the underlying principles and ramifications of the Convention, and advance notice of other cultural resource management issues that might affect our projects.

The UNESCO Convention is not expected to impact operations in international waters, and the United States, the United Kingdom and other major maritime governments have already stated explicitly that they do not intend to sign the Convention. Nevertheless, some countries in whose waters we may consider working may sign or have already signed the Convention. While the UNESCO Convention states that artifacts may not be sold, it also states that this prohibition may not prevent the provision of archaeological services, and we intend to provide such services in contracts with governments.

We believe there will be increased interest in the protection of underwater cultural heritage throughout the oceans of the world. We are uniquely qualified to provide governments and international agencies with resources to help manage these resources while providing the public with educational, scientific, historical and entertainment initiatives that originate from our shipwreck exploration activities.

Competition

There are a number of companies that publicly identify themselves as engaged in aspects of the shipwreck business, but they do not compete directly with us as an established deep-ocean archaeological shipwreck exploration company. These entities include, but are not limited to Blue Water Ventures, Mel Fisher’s Treasures, Deep Blue Marine, Marine Exploration, Inc., Oceanic Research and Recovery, Seafarer Exploration, Deep6 Ltd., Sub Sea Research and UnderSea Recovery Corporation. It is possible that one of these companies or some currently unknown group may locate and recover a shipwreck on our project roster; however, due to the breadth of our historical and archival research, the already completed sonar and deep-water ROV inspection efforts, and the number of shipwreck projects in various stages of development, we do not believe that competition from one or more of these entities, known or unknown, would materially affect our operating plan or alter our current business strategy.

Cost of Environmental Compliance

With the exception of vessel operations and conservation activities, our general business operations do not expose us to environmental risks or hazards. We carry insurance that provides a layer of protection in the event of an environmental exposure resulting from the operation of our vessels. The cost of such coverage is minimal on an annual basis. We believe the risk associated with our conservation activities is minimal.

Executive Officers of the Registrant

The names, ages and positions of all the executive officers of the Company as of March 1, 2012 are listed below.

9

Table of Contents

Gregory P. Stemm (age 54) has served as Chief Executive Officer since January 3, 2008 and prior to June 2010 was also Chairman of the Board. Mr. Stemm previously served as Vice President, Research and Operations and as a member of the Board of Directors since May 1994. He served as Co-Chairman of the Board since February 24, 2006 until his present appointment.

Mark D. Gordon (age 51) has served as President and Chief Operating Officer since October 2007 and was appointed to the Board of Directors in January 2008. Previously Mr. Gordon served as Executive Vice President of Sales and Business Development since January 2007 after joining Odyssey as Director of Business Development in June 2005. Prior to joining Odyssey, Mr. Gordon owned and managed four different ventures (1987-2003).

Michael J. Holmes (age 62) has served as Chief Financial Officer since May 2004. Mr. Holmes joined Odyssey as Controller in March 2004 and had previously served in a variety of financial management positions with Anheuser-Busch Companies, Inc. including Vice President Finance, Sea World Orlando (1998-2003).

David A. Morris (age 61) has served as Secretary since August 1997 and Treasurer from August 1997 until May 2010.

Jay A. Nudi (age 48) has served as Principal Accounting Officer since January 2006 and joined Odyssey as Controller in May 2005. Mr. Nudi assumed the additional responsibilities of Treasurer in May 2010. Prior to joining Odyssey, Mr. Nudi served as Controller for The Axis Group in Atlanta (2003-2004). Previously he served as a consultant to various companies on specific value added engagements.

Laura L. Barton (age 49) was appointed Vice President of Communications in November 2007. Ms. Barton previously served as Director of Corporate Communications and Marketing for Odyssey since July 2003. Ms. Barton was previously President of LLB Communications, a marketing and communications consulting company whose customers included a variety of television networks, stations and distributors and the Company (1994-2003).

Melinda J. MacConnel (age 47) was appointed Vice President 2008. She joined Odyssey in March 2006 as a Legal Consultant and became Odyssey’s General Counsel in January 2007. Prior to joining the Company, Ms. MacConnel practiced law as a Litigation Consultant, providing counsel to attorneys in all areas of law.

Employees

As of December 31, 2011, we had 42 full-time employees, most working from our corporate offices in Tampa, Florida. Additionally, we contract personnel who operate our two vessels and technicians who perform marine survey and recovery operations on our vessels and from time to time we hire subcontractors and consultants to perform specific services.

Internet Access

Odyssey’s Forms 10-K, 10-Q, 8-K and all amendments to those reports are available without charge through Odyssey’s web site on the Internet as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. They may be accessed as follows: www.shipwreck.net (SEC Filings Link).

You should carefully consider the following factors, in addition to the other information in this Annual Report on Form 10-K, in evaluating our company and our business. Our business, operations and financial condition are subject to various risks. The material risks are described below, and should be carefully considered in evaluating Odyssey or any investment decision relating to our securities. This section is intended only as a summary of the principal risks. If any of the following risks actually occur, our business, financial condition, or operating results could suffer. If this occurs, the trading price of our common stock could decline, and you could lose all or part of the money you paid to buy our common stock.

Our business involves a high degree of risk.

An investment in Odyssey is extremely speculative and of exceptionally high risk. Although we have access to a substantial amount of research and data which has been compiled regarding various shipwreck projects, the quality and reliability of such research and data is uncertain. Even if we are able to plan and obtain permits for our various projects, there is a possibility that the shipwrecks may have already been salvaged or may not be found, or may not have had anything valuable on board at the time of the sinking. Even if objects of value are located and recovered, there is the possibility that the excavation cost will exceed the value of the objects recovered or those others, including both private parties and governmental entities, will assert conflicting claims and challenge our rights to the recovered objects. Finally, even if we are successful in locating and retrieving objects from a shipwreck and establishing title to them, there are no assurances as to the value that such objects will bring at their sale, as the market for such objects is uncertain.

10

Table of Contents

The research and data we use may not be reliable.

The success of a shipwreck project is dependent to a substantial degree upon the research and data we have obtained. By its very nature, research and data regarding shipwrecks can be imprecise, incomplete and unreliable. It is often composed of or affected by numerous assumptions, rumors, legends, historical and scientific inaccuracies and misinterpretations which have become a part of such research and data over time.

Operations may be affected by natural hazards.

Underwater recovery operations are inherently difficult and dangerous and may be delayed or suspended by weather, sea conditions or other natural hazards. Further, such operations may be undertaken more safely during certain months of the year than others. We cannot guarantee that we, or the entities we are affiliated with, will be able to conduct search and recovery operations during favorable periods. In addition, even though sea conditions in a particular search location may be somewhat predictable, the possibility exists that unexpected conditions may occur that adversely affect our operations. It is also possible that natural hazards may prevent or significantly delay search and recovery operations.

We may be unable to establish our rights to any objects we recover.

Persons and entities other than Odyssey and entities we are affiliated with (both private and governmental) may claim title to the shipwrecks and/or valuable cargo that we may recover. Even if we are successful in locating and recovering shipwrecks and/or valuable cargo, we cannot assure we will be able to establish our right to property recovered if challenged by governmental entities, prior owners, or other attempted salvors claiming an interest therein. In such an event we could spend a great deal of time and money on a shipwreck project, and receive no salvage claim or revenue for our work.

The market for any objects we recover is uncertain.

Even if valuable items can be located and recovered in the future, it is difficult to predict the price that might be realized for such items. The value of recovered items will fluctuate with the precious metals market, which has been highly volatile in past years. In addition, the entrance on the market of a large supply of similar items from shipwrecks and/or valuable cargo located and recovered by others could depress the market.

We could experience delays in the disposition or sale of recovered objects.

The methods and channels that may be used in the disposition or sale of recovered items are uncertain at present and may include several alternatives. Ready access to buyers for any artifacts or other valuable items recovered cannot be guaranteed. Delays in the disposition of such items could adversely affect our cash flow.

Legal, political or civil issues could interfere with our recovery operations.

Legal, political or civil initiatives of countries and/or major maritime governments could restrict access to shipwrecks or interfere with our search and recovery operations.

Objects we recover could be stolen from us.

If we locate a shipwreck and assert a valid claim to items of value, there is a risk of theft of such items at sea by “pirates” or poachers before or after the recovery or while in transit to a safe destination as well as when stored in a secured location. Such thefts may not be adequately covered by insurance.

We may be unable to get permission to conduct salvage operations.

It is possible we will not be successful in obtaining title or permission to excavate certain wrecks. In addition, permits that are sought for the projects may never be issued, and if issued, may not be legal or honored by the entities that issued them.

Changes in our business strategy or restructuring of our businesses may increase our costs or otherwise affect the profitability of our businesses.

As changes in our business environment occur we may need to adjust our business strategies to meet these changes or we may otherwise find it necessary to restructure our operations or particular businesses or assets. When these changes or events occur, we may incur costs to change our business strategy and may need to write down the value of assets. In any of these events our costs may increase, and we may have significant charges associated with the write-down of assets.

We may be unsuccessful in raising the necessary capital to fund operations and capital expenditures.

Our ability to generate cash flow is dependent upon the success of our ability to recover and monetize high-value shipwrecks. However, we cannot guarantee that the sales of our products and other available cash sources will generate sufficient cash flow to meet our overall cash requirements. If cash flow is not sufficient to meet our business requirements, we will be required to raise additional capital through other financing activities. While we have been successful in raising the necessary funds in the past, there can be no assurance we can continue to do so in the future.

11

Table of Contents

We depend on key employees and face competition in hiring and retaining qualified employees.

Our employees are vital to our success, and our key management and other employees are difficult to replace. We currently do not have employment contracts with our key employees. We may not be able to retain highly qualified employees in the future which could adversely affect our business.

We may continue to experience significant losses from operations.

We have experienced a net loss in every fiscal year since our inception except for 2004. Our losses from operations were $16.2 million in 2011, $23.3 million in 2010 and $18.6 million in 2009. Even if we do generate operating income in one or more quarters in the future, subsequent developments in our industry, customer base, business or cost structure or an event such as significant litigation or a significant transaction may cause us to again experience operating losses. We may not become profitable for the long-term, or even for any quarter

Technological obsolescence of our marine assets or failure of critical equipment could put a strain on our capital requirements or operational capabilities.

We employ state-of-the-art technology including side-scan sonar, magnetometer, ROVs, and other advanced science and technology to locate and recover shipwrecks at depths previously unreachable in an economically feasible manner. Although we try to maintain redundancy on critical equipment and components, equipment failures may require us to delay or suspend operations. Also, while we endeavor to keep marine equipment in excellent working condition and current with all available upgrades, technological advances in new equipment may provide superior efficiencies than the capabilities of our existing equipment and this could require us to purchase new equipment which could require additional needs for capital.

We may not be able to contract with clients or customers for marine services or syndicated projects.

During 2011 and 2010 we recorded approximately $15 million and $21 million of revenue, respectively, by chartering vessels, equipment and crew and providing marine services to clients or customers. While the results of these syndicated projects were generally successful, the clients or customers may not be willing or financially able to continue with syndicated projects of this type in the future. Failure to secure such revenue producing contracts in the future would have a material impact on our revenue and operating cash flows.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We maintain our offices in Tampa, Florida where we purchased a 23,500 square-foot two story office building in 2004 to serve as our corporate and operations headquarters. In May 2008, we purchased a one story 8,100 square-foot commercial building in proximity to our corporate headquarters which is utilized by our conservation, research and archaeology departments. We believe these facilities are sufficient for our foreseeable needs.

See the information set forth under the heading “Admiralty Legal Proceedings” in Part I, Item 1 of this report for disclosure regarding certain admiralty legal proceedings in which Odyssey is involved. Such information is hereby incorporated by reference into this Part I, Item 3.

The Company is not currently a party to any material litigation other than the admiralty proceedings described in this Annual Report on Form 10-K. From time to time in the ordinary course of business, the Company may be subject to or may assert a variety of claims or lawsuits.

12

Table of Contents

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

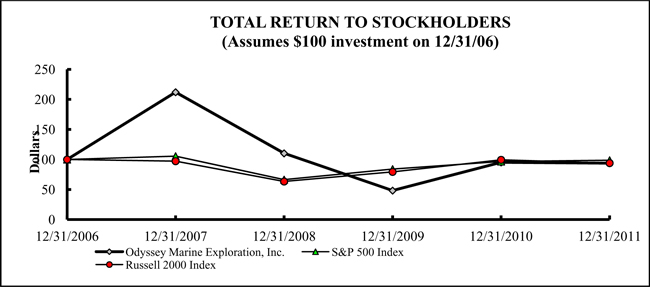

Performance Graph

This performance graph shall not be deemed “filed” with the SEC or subject to Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any of our filings under the Securities Act of 1933, as amended.

Assuming an investment of $100 on December 31, 2006, and reinvestment of all dividends, the graph below compares the cumulative total stockholder return on the Company’s Common Stock for the last five fiscal years with the cumulative return of the Standard & Poor’s 500 Market Index and the Russell 2000 Market Index.

COMPARISON OF FIVE-YEAR TOTAL RETURN AMONG ODYSSEY,

S&P 500 STOCK INDEX AND RUSSELL 2000 STOCK INDEX

| Total Return Analysis |

12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | ||||||||||||||||||

| Odyssey Marine Exploration, Inc. |

$ | 100.00 | $ | 211.99 | $ | 110.27 | $ | 48.29 | $ | 95.21 | $ | 93.84 | ||||||||||||

| S&P 500 Index |

$ | 100.00 | $ | 105.49 | $ | 66.46 | $ | 84.04 | $ | 96.70 | $ | 98.68 | ||||||||||||

| Russell 2000 Index |

$ | 100.00 | $ | 97.25 | $ | 63.41 | $ | 79.40 | $ | 99.49 | $ | 94.07 | ||||||||||||

Price Range of Common Stock

On November 19, 2003, our common stock was listed on the American Stock Exchange and was traded under the symbol OMR. On July 10, 2007, trading of our common stock moved from the American Stock Exchange to the NASDAQ Capital Market under the symbol OMEX. The following table sets forth the high and low sale prices for our common stock during each quarter presented.

| Price | ||||||||

| High | Low | |||||||

| Quarter Ended |

||||||||

| March 31, 2010 |

$ | 1.56 | $ | 1.27 | ||||

| June 30, 2010 |

$ | 1.50 | $ | 0.94 | ||||

| September 30, 2010 |

$ | 1.95 | $ | 0.97 | ||||

| December 31, 2010 |

$ | 2.90 | $ | 1.73 | ||||

| Quarter Ended |

||||||||

| March 31, 2011 |

$ | 3.78 | $ | 2.32 | ||||

| June 30, 2011 |

$ | 4.43 | $ | 2.86 | ||||

| September 30, 2011 |

$ | 3.56 | $ | 1.80 | ||||

| December 31, 2011 |

$ | 3.06 | $ | 2.11 | ||||

13

Table of Contents

Approximate Number of Holders of Common Stock

The approximate number of record holders of our common stock at February 14, 2012 was 244. This does not include shareholders that hold their stock in accounts in street name with broker/dealers which approximate more than 11,000 shareholders.

Dividends

Holders of our common stock are entitled to receive such dividends as may be declared by our Board of Directors. No dividends have been declared with respect to our common stock or preferred stock and none are anticipated in the foreseeable future. Holders of our Series G 8% Convertible Preferred Stock accumulate dividends as described in NOTE Q of the financial statements. These dividends are not payable until declared by the Board of Directors.

Unregistered Sales of Equity Securities

There were no unregistered sales of equity securities during the year ended December 31, 2011 that have not been reported in a Current Report on Form 8-K.

Issuer Purchases of Equity Securities

There were no repurchases of shares of the Company’s common stock during the quarter ended December 31, 2011.

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected financial data, which should be read in conjunction with the Company’s Consolidated Financial Statements and the related notes to those statements included in “Item 8. Financial Statements and Supplementary Data” and with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this Form 10-K. The selected financial data have been derived from the Company’s audited financial statements.

| Years Ended December 31, | ||||||||||||||||||||

| Dollars in thousands except per share amounts | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| Results of Operations |

||||||||||||||||||||

| Revenue |

$ | 15,727 | $ | 21,001 | $ | 4,347 | $ | 4,105 | $ | 6,147 | ||||||||||

| Net income (loss) |

(16,225 | ) | (23,343 | ) | (18,628 | ) | (24,841 | ) | (23,833 | ) | ||||||||||

| Earnings (loss) per share – basic |

(0.28 | ) | (0.36 | ) | (0.33 | ) | (0.50 | ) | (0.54 | ) | ||||||||||

| Earnings (loss) per share – diluted |

(0.28 | ) | (0.36 | ) | (0.33 | ) | (0.50 | ) | (0.54 | ) | ||||||||||

| Cash dividends per share |

— | — | — | — | — | |||||||||||||||

| Financial Position |

||||||||||||||||||||

| Assets |

$ | 23,414 | $ | 19,407 | $ | 20,256 | $ | 30,462 | $ | 38,558 | ||||||||||

| Long-term obligations |

5,690 | 2,776 | 2,950 | 3,123 | 2,601 | |||||||||||||||

| Shareholder’s equity (deficit) |

(9,775 | ) | (7,548 | ) | 7,562 | 18,125 | 30,199 | |||||||||||||

14

Table of Contents

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis is intended to provide a narrative of our financial results and an evaluation of our financial condition and results of operations. The discussion should be read in conjunction with our consolidated financial statements and notes thereto. A description of our business is discussed in Item 1 of this report which contains an overview of our business as well as the status of our ongoing project operations.

Results of Operations

The dollar values discussed in the following tables, except as otherwise indicated, are approximations to the nearest $100,000 and therefore do not necessarily sum in columns or rows. For more detail refer to the Financial Statements and Supplementary Data in Item 8. The tables identify years 2011, 2010 and 2009, all of which included a twelve-month period fiscal year that ended December 31.

2011 Compared to 2010

| 2011 vs. 2010 | ||||||||||||||||

| (Dollars in millions) | 2011 | 2010 | $ | % | ||||||||||||

| Artifact sales and other |

$ | .9 | $ | .4 | $ | .5 | 118 | % | ||||||||

| Exhibit |

.2 | .1 | .1 | 48 | ||||||||||||

| Expedition charter |

14.7 | 20.5 | (5.8 | ) | (28 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

$ | 15.7 | $ | 21.0 | $ | (5.3 | ) | (25 | )% | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of sales |

.4 | .2 | .2 | 117 | % | |||||||||||

| Operations and research |

21.3 | 19.6 | 1.7 | 8.8 | ||||||||||||

| Marketing, general and administrative |

9.4 | 9.2 | .2 | 3.0 | ||||||||||||

| Receivable reserves |

0 | 8.5 | (8.5 | ) | (100 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

$ | 31.1 | $ | 37.4 | $ | (6.3 | ) | (17 | )% | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income (expense) |

$ | (.9 | ) | $ | (6.9 | ) | $ | 6.1 | 88 | % | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

Revenue

Revenue is generated through the sale of coins, artifacts and merchandise, the lease of our themed attraction exhibit and expedition charters.

Expedition charter revenue was $14.7 million in 2011 versus $20.5 million in 2010. In 2011, $2.9 million related to syndicated projects with the clients of Robert Fraser Partners LLP (RFP) that included two separate projects (Firebrand and Shantaram). In 2010, $9.0 million related to our syndicated projects with clients of RFP that included four separate projects (Enigma I and II, Firebrand and Shantaram). In 2011, revenue included $11.3 million which represented two separate charters with Neptune Minerals Inc. (NMI) for deep ocean mineral mining exploration. In 2010, $7.9 million represented charter services sold to Dorado Ocean Resources for deep ocean mineral mining exploration. RFP and NMI represented 97% of our expedition charter revenue in 2011. Other projects for 2011 included $.5 million for other miscellaneous commercial charters. In 2010, other miscellaneous charters included the ET 409 aircraft recovery and photomosaic project ($2.9 million) and $.7 million from other charter services.

Artifact sales and other revenues primarily include coin sales, but also include other artifacts, merchandise, commissions, and other miscellaneous revenue. Artifact and other revenues for 2011 and 2010 were $.9 million and $.4 million, respectively. The increase of $.5 million in artifact sales and other in 2011 was primarily due to several factors including the addition of a major new distributor in the first quarter 2011 and new marketing programs leveraging the 150th Anniversary of the Civil War. Additionally, authorized distributors invested in promoting the SS Republic product as it continued to be a collectible in high demand. Our artifact and other and exhibit revenue for 2011 and 2010 was predominantly U.S. domestic-based.

Exhibit revenue was $.2 million and $.1 million in 2011 and 2010, respectively. Odyssey’s SHIPWRECK! Pirates & Treasure is an interactive multi-media exhibit and features over 500 artifacts recovered from our deep-ocean shipwreck expeditions. The increase of $.1 million in 2011 was because Odyssey’s exhibit, SHIPWRECK! Pirates & Treasure, was on tour for four months in 2010 versus ten months on three separate tours in 2011. The non-booked months in 2010 were related to downtime for planned exhibit refurbishment after runs at five venues and over 600,000 visitors. The exhibit opened at the Witte Museum in San Antonio, Texas in October 2011 and ran through January 2012. In 2010 the exhibit was featured at two locations (Charlotte, North Carolina and Baltimore, Maryland). In 2011 the exhibit was featured at three locations (Baltimore, Maryland; Sarasota, Florida and San Antonio, Texas). The exhibit opened in February 2012 at the Mid America Science Museum in Hot Springs, Arkansas and will run through August 2012.

15

Table of Contents

Cost and Expenses

Cost of sales consists of shipwreck recovery costs, grading, conservation, packaging, and shipping costs associated with artifact and merchandise sales. The primary cost component is from the sale of coins. Cost of sales for coins increased 117% for 2011 versus 2010 primarily because we sold approximately 950 more coins in 2011 than in 2010. Actual cost as a percentage of coin sales was 49% and 49% in 2011 and 2010, respectively. There is no cost of sales component associated with the themed attraction and expedition charter revenues.