Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | d314027d8k.htm |

Section 2 – Exhibit 99.1

FIRST BUSINESS CEO PERORT Foutht Quarter 2011

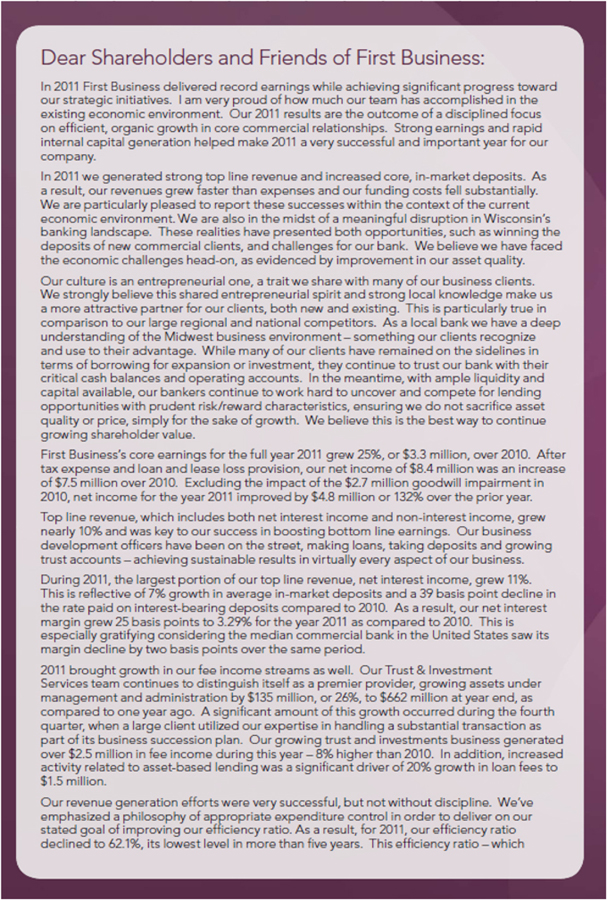

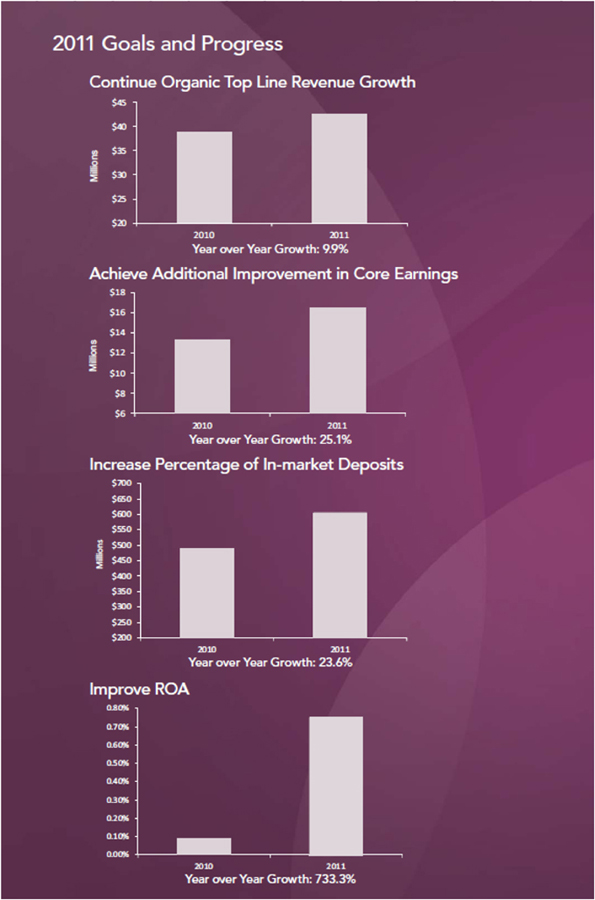

Dear Shareholders and Friends of First Business: ln2C’1 First Business delive’ed recopc earnings wnile achieving significant progress toward our strategic Initiatives. I am very proud of how much our team has accomplished In the existing economic environment Cur 201” results a re the outcome of a disciplined foe us on efficient, organic growth m core conrrne’cial relationships. Strong earnings and rapid internal capital generation helped make 2011 a ve^ysuccessfjl and Important year for our company. In 2G’1 we generated strong top line revenue and increased core, m-market deposits. As a result, our -evenjes grew faster than expenses and our funding costs fell substantially. We are pa’ticula’ly pleasec to report these sjccesses within the context of the current economic environment. We are also in the Tiidst of a meaningful disruption In Wisconsin’s banking landscape. Tnese realities nave presented both opportunities, such as winning the deposits of new commereia I clients, and chalIenges for our bank. We believe we have faced the economic challenges head-on, as evidences by improvement in our asset quality. Our culture is an entrepreneurial one, a traitwe share with many of our business clients. We strongly believe this snarec entrepreneurial spirit and strong local knowledge make us a more attractive partner for our clients, both new and existing. Tnis is particularly tnje in compa-lson to o jt large regional and national competitors. As a local bank we have a deep understanding of the Midwest business environment — somethlng our clients recognize and use to their advantage. While many of our clients have remained on the sidelines in ternrs of boTowlng for expansion o’investment, they continue to trust our bank with their critical cash balances anc ope’ating accounts. In the meantime, with anrpie liquidity and capital available, curbanke-i ccntinjetc wo- hard to jncover and ccmpetefor lending opportunities with prudent risk/reward characteristics, ensuring we do not sacrifice asset quality or p’ice, sinrply for the sake of growth. We believe this is the best way to continue growing snareholde-value. First Business’s core earnings for the full year 2011 grew 25%, or $3.3 million, over 2010. After tax expense and loan and lease loss provision, our net income of $3.4 million was an increase of $7.5 million over 2O10. Excluding the impact of the $2.7 million goodwill Impairment In 2010, net income for the year 2011 improved by $4.3 million or 132% over the prior year. Top line revenue, which Includes both net interest income and n on-interest Income, grew nearly 10% and was key to our success in boosting bottom line earnings. Our business development officers have been on the street, making loans, talcing deposits a^d growing trust accounts - achievlng sustai nable re suIts in virtually every aspect of our business. During2011,thelargest portion of our top Iine revenue net Interest income, grew 11%. This Is reflective of 7% growth In average in-market deposits and a 39 basis point decline in the rate paid on interest-bearing deposits com pa red to 2010. As a result, our net interest margin grew 25 basis points to 3.29% for the year2G11 as compared to 2010. This is especially gratifying considering the median coTirrercial bank in the United States saw Its margin decline by two basis points over the same period. 2011 brought growth in our fee income streaTis as well. Our Trust ft Investment Services team continues to distinguish itself as a p-emler p-cvide-, grcwing assets under manag emen t an d admini stration by $135 m i II ion, or 26%, to $662 m i I li on at year en d, as compared to one yea - ago. A significant a mount of this growth occurred during the fourth quarter, wnen a large client utilized our expertise in handling a substantial transaction as part of Its business s jccession plan. Our growing trust anc investments business generated over $2.5 million in fee Income during this year-8% higher than 2010. In addition, increased activity related to asset-based lending was a significant driver of 20% growth in loan fees to $1.5 million. Our reven je generation efforts were veny successful, but not without discipline. We’ve emphasized a philosophy of appropriate expenditure control in order to deliver on our statec goal of improving our efficiency ratio. As a result, for 201*, our efficiency ratio declined to i2.1%, its lowest level In more than five years. This efficiency ‘atio—wnlch

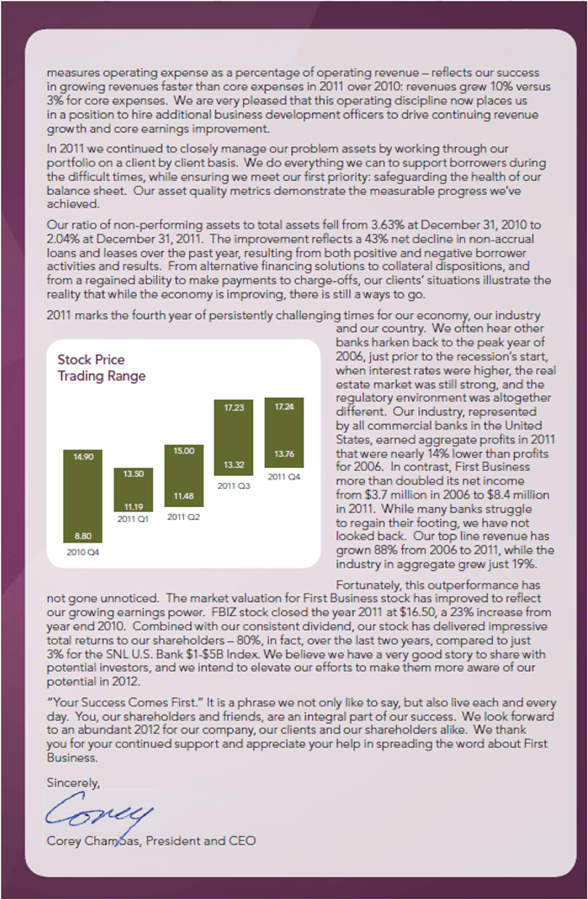

rrea^j’es operating expense a= a percentage of operating revenue-reflects our success in growing ‘eveHues faster than core expenses In 2011 over 2010: revenjes grew 10% versus 3% for core expen ses. We are very p lease d th at th is operating di sci p li n 9 now pi aces u s in a position to hire additional business development officers to drive continuing revenue g’cwth and tore earnings improvement. I n 2011 we continued to c losely m an ag e our pnob lem as sets by world ngthroughour portfolio on a client by client basis. We do everything we can to s jpport borrowers during the difficult times, while ensjring we meet ojr first priority: safeguarding the hearth of our ba la nee sh e et. Our asset quality metrics demonstrate the measurable progress we’ve achieved. Our ratio of non-performing assets to total assets fell from 3.63% at December 31, 2010 to 2.04% at December 31, 2011. The improvement reflects a 43% net decline m non-accrual loans and leases over the past year, resulting from both positive and negative bo’iower activities and results. From alternative financing solutions to collateral dispositions, and from a regained ability to make paynrents to charge-offs, our clients’ situatfons illustrate the reality tnatwhilethe economy is improving, there is still a ways to go. 2011 marks the fourth year of persistently challenging times for our econorry, our industry and our country. We often hear other banks ha ‘<en back to the peak year of Stock Price 2006, just prior to the recession’s start. Trad i ng Range wtien i”tere st rates we ^e h ig h e r, th e real estate market was still strong, and the regulatory environment was altogether different. Our industry, represented by all comrrercial banks in the United States, ea’nec aggregate profits in 2011 that were nearly 14% lower than profits for 2006. In contrast, First Business more than doubles its net income from $3.7 million in 2006 to $6.4 million in 2011. While many banks struggle to regain their footing, we have not looked back. Our top line revenue has grown 88% from 2006 to 2011, while the industry in aggregate grew just 19%. Fortunately, this outperformance has not gone unnoticed. The market valuation for First Business stock has improved to refect our growing earnings power. FBIZ stock closed the year 2011 at $16.50, a 23% increase from year end 2010. Combined with our consistent dividend, our stock has delivered impressive total returns to our shareholders-80%r in fact, over the last two years, corn-pared to just 3% for the SNLU.S. Bank$1-$5B Index. We believe we nave a very good story to share with potential investors, and we intend to elevate our efforts to make them more aware of our potential in 2012. Your Success Comes First.” It is a phrase we nol only like to say, but also live each and every day. You, our shareholders and friends, are an integral part of our success. We look forward to an abundant 2012 for our company, our clients and our shareholders a like. We thank you for your continued support and appreciate your help in spreading thewond about First Business. Since’elv. Corey ChanySas, President and CEO

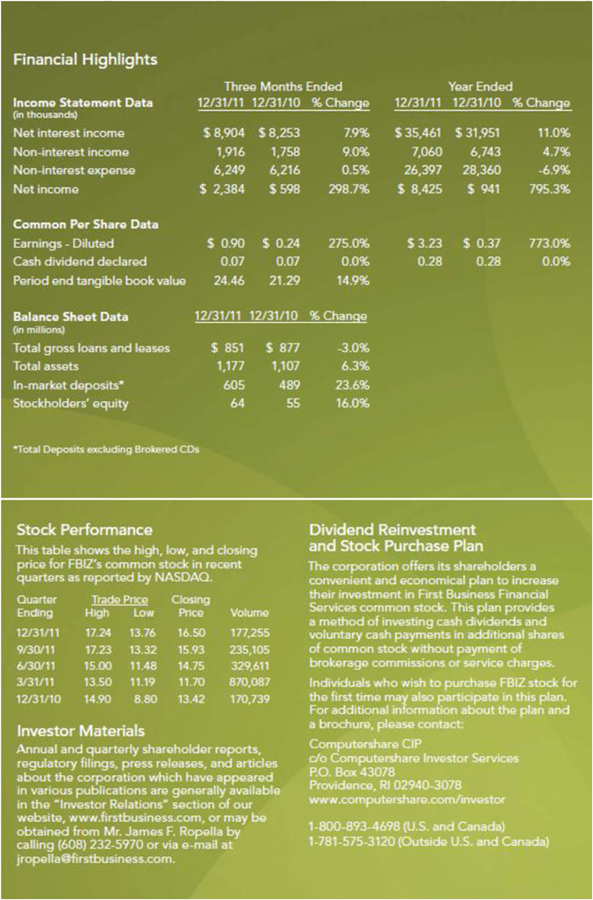

financial highilights Income Statement Data Three Months Ended 12/31/11 12/31/10 % Change Year Ended 12/31/11 12/31/10 % Change (in thousands) Net interest income $8.904 S 8,253 7.9% $ 35.461 $ 31.951 11.0% Non-interest income 1,916 1.758 9.0% 7.060 6.743 4.7% Non-interest expense 6,249 6.216 0.5% 26,397 28,360 -6.9% Net income $ 2,384 $598 298.7% $ 8.425 $ 941 795.3% Common Per Share Data Earnings - Diluted S 0.90 $ 0.24 275.0% $3.23 $ 0.37 773.0% Cash dividend declared 0.07 0.07 0.0% 0.28 0.28 0.0% Period end tangible book value 24.46 21.29 14.9% Balance Sheet Data 12/31/11 12/31/10 %Charwo (in millions) Total gross loans and leases $ 851 $ 877 -3.0% Total assets 1,177 1,107 6.3% In-market deposits* 605 489 23.6% Stockholders’ equity 64 55 16.0% 3^3 stock performance this table shows the high low, and closing price for fbiz’s common stock in recent quarters as reported by NASDAQ. Quarter Ending Trade Price High Low Closing Price Volume 12/31/11 17.24 13.76 16.50 177.255 9/30/11 17.23 13.32 15.93 235.105 6/30/11 15.00 11.48 14.75 329,611 3/31/11 13.50 11.19 11.70 870,087 12/31/10 14.90 8.80 13.42 170,739 Investor Materials annual and quarterly shareholders reports, regulatory fillings, press realase, and articles about the corporation which have appeared in the “Investor relations” section of our website, www.firstbusiness.com, or may be obtained form Mr. James F. Ropella by calling (608) 232-5970 or via e-mail at jropella@firstbusiness.com. dividend reinvestment and shock purchase plan the corporation offers its shareholders a convenient and economical plan to increase services common stock. this plan provices voluntary cash payments in additional shares of common stock with who wish to purchase fbiz stock for a brochure please contact computershare cip c/o computershare investor serves p.o. Box 43078 computershare. com/investor

2011 goals and progrees continue organic top line revenue growth Year over Year Growth: 9.9% Achieve additional Improvemtnt in Core earnings 2010 2011 Year over Year Growth: 25.1% Increase Percentage of In-market Deposits Year over Year Growth: 23.6% Improve ROA Year over Year Growth: 733.32%

Footprint * Full Service Banking Office ** Asset-Based Lending Business Development Office Timeline 1990, April – First Business Bank Madicon 1995, May – First Business Capital Corp. 1998, October – first Business Equipment Finance 2000, June – First Business Bank – Mulwaukee 2001, December – First Business Trust & Investments 2006, September — first Business Bank – Northeast