Attached files

| file | filename |

|---|---|

| 8-K - CENTRAL VALLEY COMMUNITY BANCORP | cvcy8-k3x06x12soppresentat.htm |

Central Valley Community Bancorp Strong. Solid. Unchanging Values. www.cvcb.com Daniel J. Doyle President & CEO David A. Kinross Senior Vice President, CFO 7100 N. Financial Drive, Suite 101 Fresno, CA 93720 559-298-1775

Forward Looking Statement Forward-looking Statements -- Certain matters discussed constitute forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained herein that are not historical facts, such as statements regarding the Company's current business strategy and the Company's plans for future development and operations, are based upon current expectations. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates, a decline in economic conditions at the international, national or local level on the Company's results of operations, the Company's ability to continue its internal growth at historical rates, the Company's ability to maintain its net interest margin, and the quality of the Company's earning assets; (3) changes in the regulatory environment; (4) fluctuations in the real estate market; (5) changes in business conditions and inflation; (6) changes in securities markets; and (7) the other risks set forth in the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2010. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company.

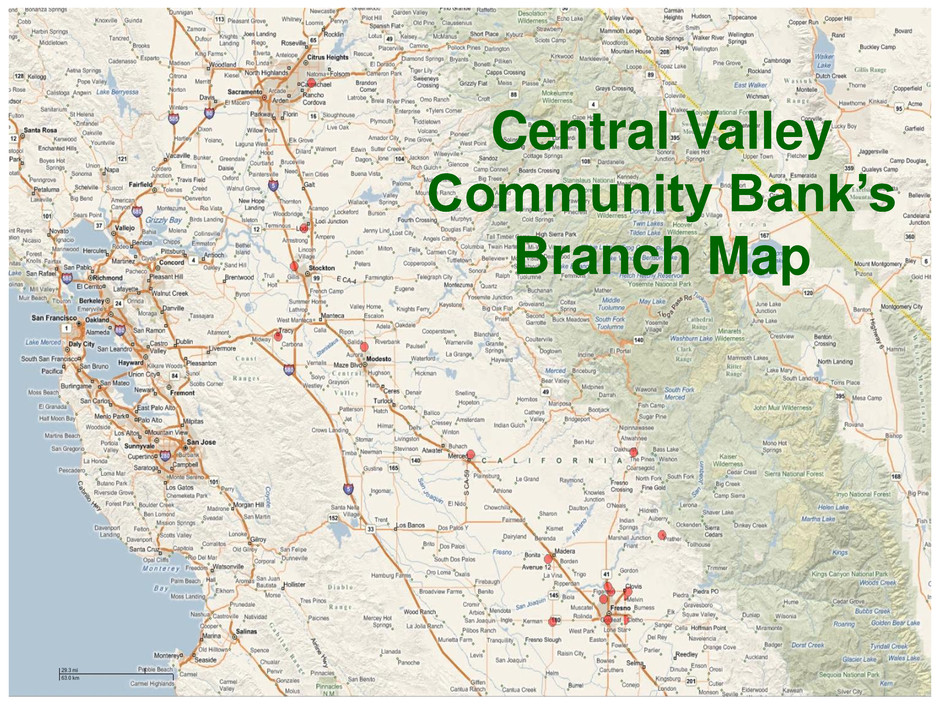

Corporate Overview • Established in 1979 / Holding Company Formed in 2000 • 16 Full-Service Branches plus Service/Support Center: – Fresno, Madera, Stanislaus, Merced, San Joaquin & Sacramento Counties • Primary Focus: Small & Medium sized business, professionals & agriculture • Banking Departments: – Commercial Banking Center, Agribusiness, SBA & Real Estate Divisions, Cash Management, Private Banking • Investment Centers of America Affiliation • Central Valley Community Insurance Services, LLC

Central Valley Community Bank’s Branch Map

2011 Financial Highlights • Market Share: – Fresno County: 4.29% – Madera County: 7.27% – Merced County: 0.79% – San Joaquin County: 1.63% – Sacramento County: 0.05% – Stanislaus County: 0.50%

Net Income (In Thousands)

Average Total Deposits (In Thousands)

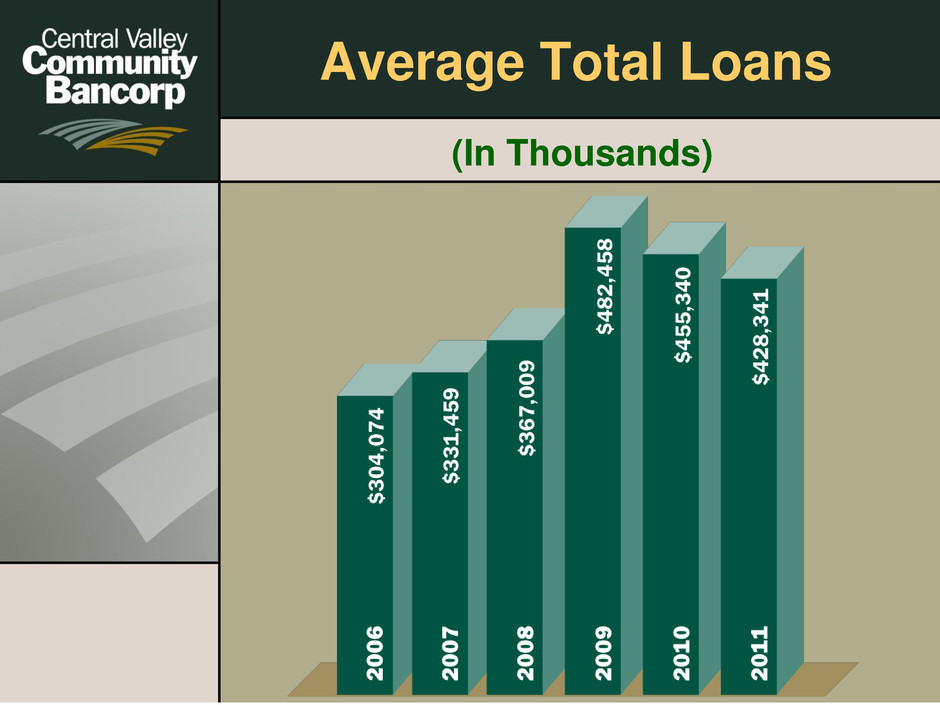

Average Total Loans (In Thousands)

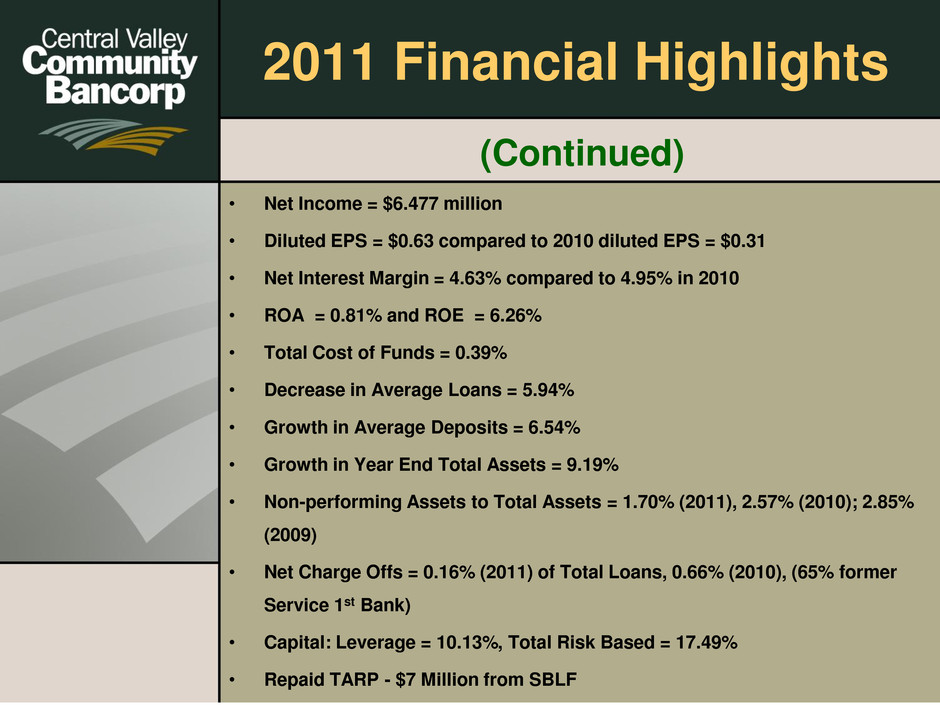

2011 Financial Highlights • Net Income = $6.477 million • Diluted EPS = $0.63 compared to 2010 diluted EPS = $0.31 • Net Interest Margin = 4.63% compared to 4.95% in 2010 • ROA = 0.81% and ROE = 6.26% • Total Cost of Funds = 0.39% • Decrease in Average Loans = 5.94% • Growth in Average Deposits = 6.54% • Growth in Year End Total Assets = 9.19% • Non-performing Assets to Total Assets = 1.70% (2011), 2.57% (2010); 2.85% (2009) • Net Charge Offs = 0.16% (2011) of Total Loans, 0.66% (2010), (65% former Service 1st Bank) • Capital: Leverage = 10.13%, Total Risk Based = 17.49% • Repaid TARP - $7 Million from SBLF (Continued)

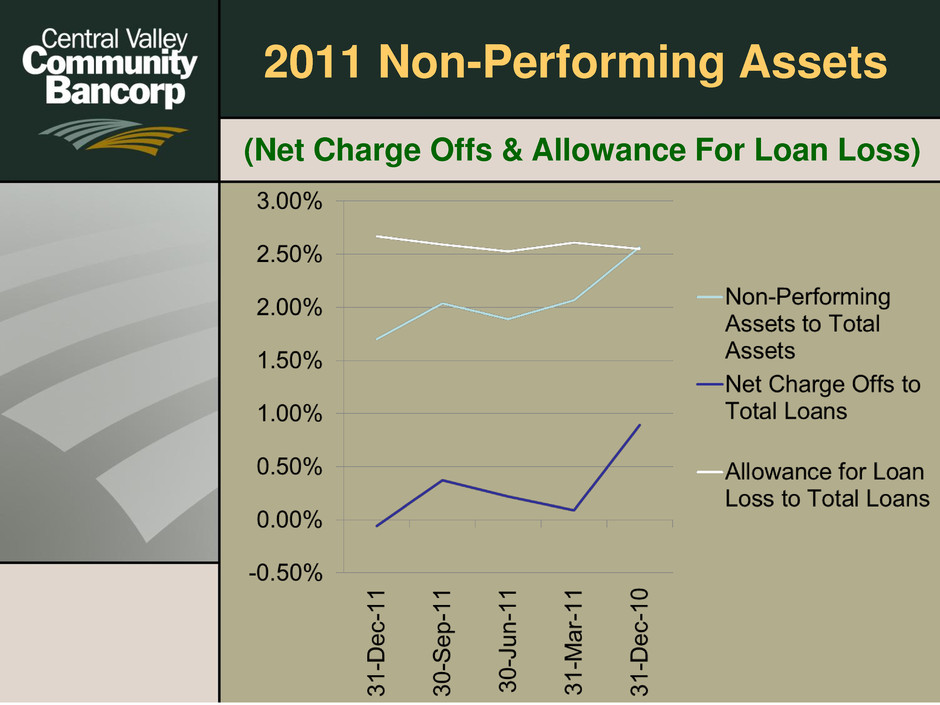

2011 Non-Performing Assets (Net Charge Offs & Allowance For Loan Loss)

Loan Portfolio at December 31, 2011 Gross Loans = $427,395,000

Deposit Mix At December 31, 2011 Total Deposits: $712,986,000

Industry Sectors & Factors • Strength: – Agriculture – Food Processing – Transportation, Distribution – Healthcare – Population Growth – Exports – Less Expensive Land & Real Estate Costs – Seismic “Free” • Weakness: – Construction – Government – Manufacturing – Water – Education

Housing Starts (% of change)