Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - BALLANTYNE STRONG, INC. | Financial_Report.xls |

| EX-23 - EX-23 - BALLANTYNE STRONG, INC. | a2207794zex-23.htm |

| EX-24 - EX-24 - BALLANTYNE STRONG, INC. | a2207794zex-24.htm |

| EX-32.1 - EX-32.1 - BALLANTYNE STRONG, INC. | a2207794zex-32_1.htm |

| EX-32.2 - EX-32.2 - BALLANTYNE STRONG, INC. | a2207794zex-32_2.htm |

| EX-31.2 - EX-31.2 - BALLANTYNE STRONG, INC. | a2207794zex-31_2.htm |

| EX-31.1 - EX-31.1 - BALLANTYNE STRONG, INC. | a2207794zex-31_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File No. 1-13906 |

||

Ballantyne Strong, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

47-0587703 (I.R.S. Employer Identification No.) |

|

4350 McKinley Street, Omaha, Nebraska (Address of principal executive offices) |

68112 (Zip Code) |

Registrant's telephone number, including area code: (402) 453-4444

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |

|---|---|---|

| Common Stock, $0.01 par value | NYSE Amex |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports filed pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No ý

The aggregate market value of the Company's voting common stock held by non-affiliates, based upon the closing price of the stock on the NYSE AMEX on June 30, 2011 was $66,261,708. The Company does not have any non-voting common equity. As of March 5, 2012, 14,286,508 shares of common stock of Ballantyne Strong, Inc., were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company's Proxy Statement for its Annual Meeting of Stockholders to be held on May 2, 2012 are incorporated by reference in Part III, Items 10, 11, 12, 13 and 14.

This Annual Report on Form 10-K contains not only historical information, but also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements that are not historical are forward-looking and reflect expectations for future Company performance. In addition, forward-looking statements may be made in press releases, orally, at conferences, on the Company's worldwide web site, or otherwise, by or on behalf of the Company. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve a number of risks and uncertainties, including but not limited to those discussed in the "Risk Factors" section contained in Item 1A. Given the risks and uncertainties, readers should not place undue reliance on any forward-looking statements and should recognize that the statements are predictions of future results which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described herein, as well as others not now anticipated. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in the forward-looking statements. Except as required by law, the Company assumes no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements.

(a) General Description of Business

General

We are a Delaware corporation and maintain our corporate offices in Omaha, Nebraska. We were founded in 1932 and went public in 1995. Our shares are traded on the NYSE Amex under the symbol BTN. We primarily operate within two business segments, theatre and lighting. Approximately 98%, 97% and 96% of our sales were from theatre products for the years ended 2011, 2010 and 2009, respectively.

During the fourth quarter of 2011 the Board of Directors and management approved a corporate-wide strategic initiative to refocus our worldwide digital equipment distribution business, services platform and cinema screen business. The strategic initiative consists of selling our Omaha, NE-based manufacturing facility and equipment and relocating the corporate headquarters to a new, smaller location in Omaha, which will also house our Network Operations Center ("NOC"). It was determined the best course of action for long-term success and future growth opportunities is a focus on our equipment distribution, cinema service and screen businesses while exiting the analog projector manufacturing business. The strategic initiative is expected to be completed by the end of 2012.

We are a distributor, integrator and service provider to the theatre exhibition industry on a worldwide basis. Through our Strong® trademark, we can fully outfit and automate a theatre projection booth for movie projection. We have sales and service offices in Hong Kong, Beijing, and certain other locations in China. We manufacture cinema screens in Joliette, Canada through our Strong/MDI Screens Systems, Inc. subsidiary. We have a centralized NOC to monitor and track a full range of digital equipment for all makes of digital projection and audio systems, flat panels and the associated network systems. We also have an extended network of service technicians located throughout the country to install and service film, digital and other cinema and non-cinema products.

1

We also design, develop, manufacture and distribute lighting systems to the worldwide entertainment lighting industry through our lighting segment.

(b) Operating Segments

We conduct our operations through two primary business segments: Theatre and Lighting. The presentation of segment information reflects the manner in which management assesses performance.

Theatre: This segment consists primarily of the assembly, distribution, installation and service of film and digital projection equipment and accessories for the movie exhibition industry.

Lighting: This segment consists of the design, assembly and distribution of lighting systems to the worldwide entertainment lighting industry.

Refer to the Business Segment Information set forth in Note 19 of our consolidated financial statements for further information concerning the amounts of revenues, profits and total assets attributable to each segment for the last three fiscal years.

(c) Narrative Description of Business

The following information describes the principal products produced, services rendered, principal markets for, and methods of distribution of each business segment of our Company.

Theatre Segment

Overview

The theatre exhibition industry is in the midst of a significant transformation from film to digital equipment. Theatre exhibition companies are retrofitting their existing complexes by removing the film projectors and replacing them with digital equipment providing opportunities for our Company to deliver digital products and services as this conversion continues.

Products

Digital Equipment—Through distribution agreements with NEC and BARCO, we distribute DLP Cinema projectors. All of the projectors use the DLP cinema technology from Texas Instruments.

NEC offers DLP Cinema projectors ranging from their NC1200C projector for screens up to 46 feet wide to the NC3240S which is a 31,000 lumen 4K projector designed for screens up to 105 feet wide.

BARCO offers DLP Cinema projectors ranging from their DP2K-12C projector for screens up to 39 feet to the DP4K-32B cinema projector which is an ultra-bright enhanced 4K cinema projector for screens up to 105 feet.

Through a formal distribution agreement with GDC Technology (USA), LLC, we distribute GDC's line of digital cinema servers in North and South America. However, we distribute their servers in certain other areas of the world under less formal arrangements. In addition, we distribute servers for other server manufacturers including those manufactured by Doremi. Digital servers and the related integrated media block are used by our customers for the storage and delivery of digital content.

We also distribute certain accessories which coupled with the cinema projector, server and integrated media block can fully outfit and automate a projection booth. The significant accessories include, but are not limited to: 1) library management systems; 2) automation products; 3) pedestals; 4) 3D accessories; 5) lenses; and 6) lamps.

2

Motion Picture Projection Analog Equipment—We will continue to support our customers who operate film equipment through sales of replacement parts, lenses, lamps and certain other accessories.

Cinema Screens—We manufacture multiple standard and large format 2D and 3D screens for cinema and special venue applications through our manufacturing facility in Canada. In most instances, a screen can be used interchangeably with either a digital or film projector. There are certain digital 3D applications, such as the technology by RealD, that require special "silver" screens that we manufacture and were specially designed for digital or 35mm projection. We manufacture screens for the IMAX Corporation that are primarily used in large-format applications.

Xenon Lamps—We distribute xenon lamps for resale to the theatre (both digital and film) and lighting industries through a distributorship agreement with Phillips. We also distribute other brands of xenon lamps as requested by our customers from time to time.

Lenses—We distribute digital projection lenses throughout the world.

Service & Maintenance—Our service subsidiary, Strong Technical Services, Inc. is a leading supplier of digital installations and after-sale maintenance services. Our technicians are certified to install and service all digital, film and audio equipment, and related peripherals including the equipment of our competitors. We also offer service contracts to the theatre industry whereby for an agreed upon fee, a series of maintenance or repair services will be performed. In addition, we offer cabling, wiring, digital menu boards, and digital signage installation and maintenance services.

Network Operations Center ("NOC")—Our NOC operates 24/7/365 utilizing Level I and Level II engineers to monitor our customers' equipment across secure virtual private network ("VPN") links. High priority notifications automatically generate trouble tickets with the appropriate escalation procedures. Normal incident tracking procedures ensure the timely resolution of trouble tickets. When one of our NOC personnel observes an issue, the customer is proactively notified to explain the issue and begin the resolution process. Many issues are addressed by our NOC engineering team without having to dispatch a technician to the customer's location. By utilizing NOC personnel to solve customer issues whenever possible, we eliminate travel time and expenses normally incurred by sending a technician on site for repairs. Nearly any issue that doesn't involve parts replacements or physical contact with the hardware can be handled remotely using the available remote assistance technologies.

Markets

We market and sell our products to end users and through certain domestic and international dealers to theatre exhibitors. During the past few years we have increasingly sold directly to the end-users thereby bypassing this distribution network. We believe this trend will continue in the future and has changed how we market our products to the industry due in large part to the shift to digital cinema. Sales and marketing professionals principally develop business by maintaining regular personal customer contact including conducting site visits, while customer service and technical support functions are dispatched when needed. In addition, we market our products in trade publications such as Film Journal and Box Office and by participating in annual industry trade shows such as CinemaCon, ShowEast, CineAsia in Asia and Cinema Expo in Europe, among others. Our sales and marketing professionals have extensive experience with the Company's product lines and have long-term relationships with many current and potential customers.

Our non-exclusive distribution agreements with NEC and BARCO allow us to market digital projectors in North and South America, including the Caribbean. In addition, we have distribution rights in China, Hong Kong and certain other areas of Asia for the NEC product lines. We do not have any territorial restrictions for any of our other products and services.

3

Competition

Digital Equipment—The markets for our products in the theatre segment are highly competitive. The primary competitive factors are price, customer support, product quality and features and customer support. Competition in the digital cinema equipment market includes one other licensed OEM of the Texas Instruments' DLP cinema technology besides our partners NEC and BARCO; Christie Digital Systems. We also compete with SONY, which uses its own 4K digital cinema technology. Certain of our competitors for digital equipment have significantly greater resources than Ballantyne.

Screens—While there are numerous screen manufacturing companies in the world, the primary competitor in the worldwide cinema screen market is Harkness Screens. Competitive factors include product quality, availability and price.

Service & NOC—The competition in the cinema service industry for installation and after—sale maintenance services is primarily driven by the two largest cinema service companies including Christie Digital Cinema and ourselves. There are several other smaller scale providers in the market. We compete with Christie Digital Systems, NEC, BARCO and SONY and other providers for NOC services. Certain of these competitors have significantly greater resources than Ballantyne.

Our business strategy is to expand our service business into channels outside the cinema industry. As we get further into this strategy, we expect to encounter other forms of competition. The primary competitive factors in the cinema service market are responsiveness, customer service and price.

Strategy

We have a corporate-wide strategic initiative to refocus our worldwide digital equipment distribution business, services platform and cinema screen manufacturing business and to stop manufacturing certain analog and lighting equipment. The strategic initiative consists of selling our Omaha, NE-based facility and manufacturing equipment and relocating our corporate headquarters to a new, smaller location in Omaha, which will also house our NOC. The strategic initiative is expected to be completed by the end of 2012. The following is a discussion of certain of these strategies.

Expand Product Sales Opportunities. We currently are a party to various distribution agreements with NEC, BARCO and other manufacturing companies to distribute and integrate their products. The strategy to expand our sales opportunities combines the following key elements:

- •

- Increase market share in the digital cinema marketplace by leveraging our industry knowledge and relationships;

- •

- Obtain additional territories to distribute product under our distribution agreements with NEC and BARCO;

- •

- Continue to develop new screen coating formulations to enhance screen performance and expand our screen product offerings;

- •

- Expand our screen business internationally;

- •

- Expand our lighting segment by aggressively marketing existing product lines, adding complementary products and developing

new LED solutions;

- •

- Identify and pursue acquisition targets that will complement our existing product offerings.

Expand Service and Network Operations Center. Capitalizing on our growth, capabilities and strategic partnerships, we have expanded our core service offerings to include cabling, wiring, digital menu boards, and digital signage. As a result, we believe we are in a position to increase this business in the coming years. We feel that we will be able to work with industry leaders and are currently working on major contracts to expand our service opportunities. It is also our belief that with our

4

capabilities in the field and corporate offices, we will expand our reach into the technology field of many organizations beyond the cinema world.

Our business strategy associated with the NOC is to leverage our technical capabilities while meeting industry demands for remote digital systems monitoring. We are anticipating growth in NOC revenues from monitoring digital cinema equipment, back room operations, and from industries outside cinema.

We will also pursue acquisition targets that will complement our service organization and leverage our NOC and skilled technician organization.

Lighting Segment

Overview

Under the trademark Strong®, we are a supplier of long-range followspots and other entertainment and architectural lighting products which are used for both permanent and touring applications.

Products

Followspots—We have been a developer, manufacturer and distributor of long-range followspots since 1950. Our followspots are primarily marketed under the Strong® trademark and recognized trademarked models such as Super Trouper® and Gladiator®. Our long-range followspots are high-intensity general use illumination products designed for both permanent installations, such as indoor arenas, theatres, auditoriums, theme parks, amphitheaters, stadiums, and touring applications. Our followspot line consists of six basic models ranging in output from 850 watts to 4,500 watts. Lower wattage models, have a range of 20 to 110 feet, are compact, portable and appropriate for small venues and truss mounting. The 4,500-watt model, which has a range of 300 to 600 feet, is a high-intensity xenon light followspot appropriate for large theatres, arenas and stadiums. Most of our followspots employ a variable focal length lens system which increases the intensity of the light beam as it is narrowed from flood to spot.

In response to a segment of the marketplace demanding less expensive, smaller and more user-friendly products, we have introduced certain new followspots over the last few years. We now distribute an Italian manufactured followspot line called Canto. The Canto product line consists of seven basic models ranging in output from 250 watts to 2,000 watts. During 2010, we signed an agreement to be the exclusive distributor of the DTS line of lighting products in the United States. DTS is an Italian manufacturer that supplies us with a wide-range of entertainment and architectural lighting products. We also introduced two new lines of LED lighting fixtures during 2010. The first product line is marketed under the trademark name Solutions™. The line primarily is made up of two 650 watt fixtures. One, the Solutions 650, is a white LED fixture and the second, the 650C, is a color mixing RGB fixture. These lights are designed to fill a demand for efficient long-throw LED-based lighting solutions for the entertainment and architectural lighting marketplaces. The second new product line is marketed under the trademark name Neeva™. Neeva is a unique product that fulfills the promise of a highly controllable LED light source that is positioned at a modest cost. In 2011 we added two new models to the Neeva line and plan to add two additional models in 2012 taking advantage of the growing interest in LED lighting products.

Markets

We sell our lighting products through a combination of a small direct sales force, dealer network and commissioned sales representatives to arenas, stadiums, theme parks, theatres, auditoriums and equipment rental companies. Our followspot products are marketed using the Strong® trademark and are used in over 100 major arenas throughout the world.

5

Strategy

Our goal is to increase revenues from existing product lines by increasing market share and by increased emphasis on expanding our product offerings by developing new products and new distribution agreements. Our main focus is in the emerging LED market.

Competition

The markets for our lighting products are also highly competitive. We compete in the lighting industry primarily on the basis of quality, price, branding and product line variety. Many of our competitors have significantly greater resources than Ballantyne.

Subsidiaries

We have four wholly-owned operational subsidiaries: Strong Technical Services, Inc., Strong/MDI Screen Systems, Inc., Strong Westrex, Inc. and Strong Westrex (Beijing) Trading Inc.

- •

- Strong Technical Services, Inc. was formed in 2006 to service the film and digital marketplace.

- •

- Strong/MDI Screen Systems, Inc. manufactures cinema screens and related accessories.

- •

- Strong Westrex, Inc. is the holding company for our sales and service office in Hong Kong.

- •

- Strong Westrex (Beijing) Trading Inc. a/k/a American West Beijing Trading Company, Ltd. is located in Beijing, China and is our sales and service business for China.

Backlog

At December 31, 2011 and 2010, we had backlogs of $37.6 million and $24.0 million, respectively. Our backlog fluctuates from period to period and can be subject to cancellation. The dollar amount of our order backlog is therefore not considered by management to be a leading indicator of our expected sales in any particular fiscal period.

Manufacturing

We manufacture cinema screens through our screen subsidiary in Joliette, Canada. These manufacturing operations consist of a 75,000 square-foot facility for the manufacture of cinema screen systems. These facilities include expanded PVC welding operations with programmable automations, as well as two 90-foot high screen coating towers with state of the art precision coating application software and painting systems. This world class ISO certified operation has the capability of manufacturing multiple standard screens simultaneously to large format 2D and 3D screens for cinema and special venue applications.

During the fourth quarter of 2011, we made a decision to exit the analog equipment manufacturing business and sell our Omaha-NE-based analog projector facility and manufacturing equipment. We will also continue to perform assembly work for certain of our products at either the current or new facility.

Quality Control

We believe that our quality control procedures and the quality standards for the products we manufacture, distribute or service have contributed significantly to our reputation for high performance and reliability. The inspection of incoming materials and components as well as the testing of all of our products during various stages of the sales and service cycle are key elements of this program.

6

Patents and Trademarks

We own or otherwise have rights to various trademarks and trade names used in conjunction with the sale of our products. We currently own one patent. We believe our success will not be dependent upon patent or trademark protection, but rather upon our scientific and engineering capabilities and research and production techniques. We consider the following trademarks to be of value to our business: Strong®, Strong Digital Systems®, Radiance®, Sky-Tracker®, Super Trouper®, Gladiator®, Solutions™, and Neeva™.

Employees

We employed 236 persons on a full-time basis at December 31, 2011. Of these employees, 87 were considered manufacturing, 5 were executive, 72 were service related and 72 were considered sales and administrative. We are not a party to any collective bargaining agreement. During January 2012, we announced a strategic initiative which would reduce our workforce due a determination that the best course of action for long-term success and future growth opportunities was a focus on our equipment distribution, cinema service and screen businesses while exiting the analog projector manufacturing business.

Environmental Matters

We are subject to various federal, state and local laws and regulations pertaining to environmental protection and the discharge of material into the environment. During 2001, we were informed by a neighboring company of likely contaminated soil on certain parcels of land adjacent to Ballantyne's main manufacturing facility in Omaha, Nebraska. The Environmental Protection Agency ("EPA") and the Nebraska Department of Health and Human Services subsequently determined that certain parcels of Ballantyne property had various levels of contaminated soil relating to a former pesticide company which previously owned the property and that burned down in the 1960's. During October 2004, Ballantyne agreed to enter into an Administrative Order on Consent ("AOC") to resolve the matter. The AOC holds Ballantyne and two other parties jointly and severally responsible for the cleanup. In this regard, the three parties have also entered into a Site Allocation Agreement by which they will divide past, current and future costs of the EPA, the costs of remediation and cost of long term maintenance. In connection with the AOC, we have paid our share of the costs. At December 31, 2011, we have provided for management's estimate of any future payments relating to this matter which are not material to the consolidated financial statements.

Executive Officers of the Company

Gary Cavey, age 62, has been our President, CEO and a member of the Board of Directors since November 2010. Mr. Cavey succeeded John Wilmers, who is retired.

Christopher Stark, age 51, assumed the responsibilities of VP-Operations in May of 2007 and is currently Senior Vice President and Chief Operating Officer.

Ray F. Boegner, age 62, has been Senior Vice President since 1997. Mr. Boegner joined us in 1985 and has acted in various sales roles for our Company.

Mary A. Carstens, age 55, assumed the role of CFO in July of 2011. Ms. Carstens previously worked for Belden, Inc. (NYSE:BDC), a global manufacturer of cable and networking products as CFO and VP of Belden's Asia Pacific Division.

Kevin S. Herrmann, age 46, is currently a Vice President as well as our Corporate Secretary and Treasurer. Mr. Herrmann previously held the title of CFO in addition to the Corporate Secretary and Treasurer titles. Mr. Herrmann joined us in 1997 as Corporate Controller.

7

Information available on Ballantyne Website

We make available free of charge on our website (www.strong-world.com) through a link to the Securities and Exchange Commission ("SEC") website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended, as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC. However, information posted on our website is not part of the Form 10-K. The Board of Directors has adopted the following governance documents which are also posted on our website:

- •

- Code of Ethics

- •

- Corporate Governance Principles, including procedures for bringing concerns or complaints to the attention of the Board,

any Committee or any individual Director.

- •

- Audit Committee Charter

- •

- Nominating and Corporate Governance Committee Charter

- •

- Compensation Committee Charter

These corporate governance documents are also available in print to any stockholder upon request by writing to:

| Corporate Secretary Ballantyne Strong, Inc. 4350 McKinley Street Omaha, NE 68112 |

Financial Information About Geographic Areas

The information called for by this item is included in Note 19 of our consolidated financial statements in this report.

You should carefully consider the following risk factors and other information contained in this Annual Report on Form 10-K before investing in shares of our common stock. Investing in our common stock involves a high degree of risk. If any of the following risk factors actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our common stock could decline and you may lose part or all of your investment. We undertake no obligation to revise or update any forward-looking statements contained herein to reflect subsequent events or circumstances or the occurrence of unanticipated events. Also refer to the note regarding Forward-Looking Statements in Item 7 of Part II of this Form 10-K.

Our future operating revenues could be impacted by lower demand for our digital products and installation services.

The theatre exhibition industry is currently in the midst of a significant transformation from film to digital equipment. Theatre exhibition companies are retrofitting their existing complexes by removing the film equipment and replacing it with digital equipment. While we expect the conversion to digital cinema to continue for a period of time, there is no assurance that once the first conversion cycle is over, there will be additional replacements of existing digital systems. If we are unable to expand our revenues streams with other products and services, our future growth would be significantly curtailed.

8

In addition, growth in the number of new movie screens may be adversely affected by the economy or other factors such as the global credit situation as the industry is very capital intensive. A lack of movie screen growth would lead to less demand for our products and would have a material adverse effect on our business, financial condition and results of operations.

Our financial results depend largely on the health of the theatre exhibition industry.

In 2011, approximately 98% of our revenues resulted from sales to the theatre exhibition industry. The current transformation from analog to digital requires significant investment and there can be no assurance that our customers will be able to obtain a sufficient amount of this capital to continue the transformation. Without access to this capital, our theatre customers would be unable to purchase our products which would have a material adverse effect on our business, financial condition and results of operations. In addition, while the health of the theatre exhibition industry has improved significantly over the past few years, there are still risks in the industry which result in continued exposure to Ballantyne.

Interruptions of, or higher prices of components from our suppliers may affect our results of operations and financial performance.

Our revenues are substantially dependent on the distribution of products supplied by various key suppliers. We believe we have good supplier relationships and that we are generally able to obtain adequate pricing and other terms from our suppliers. However, if we fail to maintain satisfactory relationships with them or if our suppliers experience significant financial problems, we could experience difficulty in obtaining needed goods and services. Some suppliers could also decide to reduce inventories or raise prices to increase cash flow. The loss of any one or more of our suppliers could have an adverse effect on our business unless alternative manufacturing arrangements are secured.

If the current digital technology changes to a format not supported by the DLP cinema technology from Texas Instruments, we could lose our ability to participate fully in the digital cinema market place.

We cannot provide assurance that there will be a continued demand for the DLP-based digital cinema products we distribute. There can be no assurance that other technologies developed, or being developed, by competing companies will not gain traction in the exhibition industry which could affect our ability to fully participate in the digital cinema market place. If we were forced to participate in digital cinema in ways other than being a distributor and service provider, we may have to leverage the Company. There is no assurance that we would be able to access sufficient capital.

Growth through acquisition is a part of our business plan and we may not be able to successfully identify, finance or integrate acquisitions.

Our strategy is to pursue acquisitions that would fit in our business plans. We expect to make acquisitions in the future. However, we cannot assure that we will be able to locate appropriate acquisition candidates, that any identified candidates will be acquired or that acquired operations will be effectively integrated or prove profitable.

The markets for our products are highly competitive.

The domestic and international markets for our product lines are highly competitive, evolving and subject to rapid technological and other changes. We expect the intensity of competition in each of these areas to increase in the future. Certain of the competitors for our digital equipment have significantly greater resources than we do. In addition, many of our competitors are manufacturing their own digital equipment, whereas, we employ a distribution business model through our distribution

9

agreements with NEC, BARCO and certain other suppliers. As a result, we may suffer from pricing pressures that could adversely affect our ability to generate revenues. If we lose market share due to these issues, we may be unable to lower our cost structure quickly enough to offset the lost revenue. If we are unable to compete successfully, our business and results of operations will be seriously harmed.

Our business is subject to the economic and political risks of selling products in foreign countries.

Sales outside the United States (mainly theatre sales) continue to be significant, accounting for approximately 22% of consolidated sales in fiscal 2011, which include $26.0 million of sales in China. This compared to 44% in 2010 and $34.9 million of sales in China. We are seeking to expand our share of foreign sales, which we expect will continue to account for a significant portion of our revenues. Foreign sales are subject to political and economic risks, including political instability, currency controls, fluctuating exchange rates with respect to sales not denominated in U.S. dollars, changes in import/export regulations, tariffs and freight rates. A significant amount of our foreign sales are denominated in foreign currencies and amounted to $33.8 million in 2011. To the extent that orders are denominated in foreign currencies, our reported sales and earnings are more subject to foreign exchange fluctuations. In addition, there can be no assurance that our remaining international customers will continue to accept orders denominated in U.S. dollars. For those sales which are denominated in U.S. dollars, a weakening in the value of foreign currencies relative to the U.S. dollar could have a material adverse impact on us by increasing the effective price of our products in international markets. Certain areas of the world are also more cost conscious than the U.S. market and there are instances where our products are priced higher than local manufacturers. We are also exposed to foreign currency fluctuations between the Canadian and U.S. dollar due to our screen manufacturing facility in Canada where a majority of their sales are denominated in the U.S. dollar while their expenses are denominated in Canadian currency. We cannot assure that these factors will not adversely affect our foreign activities in the future.

The risk of non-compliance with U.S. and foreign laws and regulations applicable to our international operations could have a significant impact on our results of operations, financial condition or strategic objectives.

Our global operations subject us to regulation by U.S. federal and state laws and multiple foreign laws, regulations and policies, which could result in conflicting legal requirements. These laws and regulations are complex, change frequently, have tended to become more stringent over time and increase our cost of doing business. These laws and regulations include import and export control, environmental, health and safety regulations, data privacy requirements, international labor laws and work councils and anti-corruption and bribery laws such as the U.S. Foreign Corrupt Practices Act, the U.N. Convention Against Bribery and local laws prohibiting corrupt payments to government officials. We are subject to the risk that we, our employees, our affiliated entities, contractors, agents or their respective officers, directors, employees and agents may take action determined to be in violation of any of these laws, particularly as we expand our operations through organic growth and acquisitions. An actual or alleged violation could result in substantial fines, sanctions, civil or criminal penalties, and debarment from government contracts, curtailment of operations in certain jurisdictions, competitive or reputational harm, litigation or regulatory action and other consequences that might adversely affect our results of operations, financial condition or strategic objectives.

Current negative economic conditions could adversely affect our results.

The current issues in the global credit markets and weak worldwide economies may continue to negatively impact the theatre and lighting markets we serve. This environment could serve to reduce demand for our products and adversely affect our operating results. These economic conditions may

10

also impact the financial condition of one or more of our key suppliers, including NEC and BARCO, which could affect our ability to secure product to meet our customers' demand.

We are substantially dependent upon significant customers who could cease purchasing our products at any time.

Our top ten customers accounted for approximately 53% of our 2011 consolidated net revenues and were from the theatre segment. Trade accounts receivable from these customers represented approximately 48% of net consolidated receivables at December 31, 2011. Sales to CDF2 Holdings, LLC represented approximately 19% of total sales. Additionally, receivables from CDF2 Holdings, LLC. and NEC Financial Services, LLC represented approximately 12% and 15% of net consolidated receivables at December 31, 2011, respectively. While the Company believes its relationships with such customers are stable, most arrangements are made by purchase order and are terminable at will by either party. A significant decrease or interruption in business from the Company's significant customers could have a material adverse effect on the Company's business, financial condition and results of operations. The Company could also be adversely affected by such factors as changes in foreign currency rates and weak economic and political conditions in each of the countries in which the Company sells its products.

Security and privacy breaches could harm our business if we are affected by a cyber-attack.

A cyber-attack that bypasses our information technology (IT) security systems causing an IT security breach, may lead to a material disruption of our IT business systems and/or the loss of business information resulting in adverse business impact. The risks may include such items as:

- •

- Future results could be adversely affected due to the theft, destruction, loss, misappropriation or release of

confidential data or intellectual property

- •

- Operational or business delays resulting from the disruption of IT systems and subsequent clean-up and

mitigation activities

- •

- Negative publicity resulting in reputation or brand damage with our customers, partners or industry peers.

The Company has recorded deferred tax assets that are subject to annual valuation testing.

At December 31, 2011, we have recorded net deferred tax assets of $3.2 million. In assessing the ability to realize the deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. If it would be determined that some or all of these assets would not be realized, valuation reserves would be required which would have a material adverse affect on our results of operations.

If we fail to retain key members of management, our business may be materially harmed.

Our success depends, in substantial part, on the efforts and abilities of our current management team. Many of these individuals have acquired specialized knowledge and skills with respect to Ballantyne and its operations. If certain of these individuals were to leave unexpectedly, we could face difficulty in hiring qualified successors and could experience a loss in productivity while any successor obtains the necessary training and experience.

Our stock price is vulnerable to significant fluctuations.

The trading price of our common stock has been highly volatile in the past and could be subject to significant fluctuations in response to variations in quarterly operating results, general conditions in the industries in which we operate and other factors. In addition, the stock market is subject to price and

11

volume fluctuations affecting the market price for the stock of many companies generally, which fluctuations often are unrelated to operating performance.

Our 44.4% ownership in our joint venture with RealD is subject to credit and concentration risk.

Digital Link II, LLC, ("Digital Link II") was formed between Ballantyne and RealD for the purposes of commercializing certain 3D technology and to fund the deployment of digital projection systems to third party exhibitors. As of December 31, 2011, Digital Link II has deployed approximately $3.7 million of such projection equipment, net of accumulated depreciation of $1.2 million. Such equipment is subject to system use agreements with certain exhibitors whereby the exhibitors must purchase the equipment upon the occurrence of certain triggering events. However, if any of these exhibitors would file for bankruptcy protection or be unable to fulfill their commitments in other ways, Digital Link II would be forced to remove the equipment and attempt to resell such equipment. While Digital Link II has received certain down payments against this equipment, it is unclear at this time what the financial impact would be to the joint venture.

Item 1B. Unresolved Staff Comments

None.

Our headquarters, main manufacturing facility and NOC are located at 4350 McKinley Street, Omaha, Nebraska, where we own a building consisting of approximately 166,000 square feet on approximately 12.0 acres. The premises are used for offices, the manufacture, assembly and distribution of certain products, and operating the NOC. As discussed in other parts of this document, we plan to sell this facility in 2012 and relocate to a smaller location. In addition, our subsidiaries owned or leased the following facilities as of December 31, 2011.

- •

- Our Strong/MDI Screen Systems, Inc. subsidiary owns a 75,000 square-foot manufacturing plant in

Joliette, Canada. The facilities are used for offices, manufacturing, assembly and distribution of the cinema screens. We believe this facility is well maintained and adequate for future needs.

- •

- Our Strong Westrex (Beijing) Trading Inc. subsidiary leases office and warehouse space in Beijing and certain other

cities in China. The leases expire between May and December 2012.

- •

- We also lease office and warehouse space in Hong Kong. The leases expire between November 2012 and November 2014.

- •

- Strong Technical Services, Inc. leases a small administrative office on a month-by-month basis in Fall River, Massachusetts.

We do not anticipate any difficulty in retaining occupancy of any leased facilities, either by renewing leases prior to expiration or replacing them with equivalent leased facilities.

In the ordinary course of our business operations, we are involved, from time to time, in certain legal disputes. No such disputes, individually or in the aggregate, are expected to have a material effect on our business or financial condition.

Item 4. Mine Safety Disclosures

Not applicable.

12

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed and traded on the NYSE Amex under the symbol "BTN". The following table sets forth the high and low per share sale price for the common stock as reported by the NYSE Amex.

| |

|

High | Low | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2011 | First Quarter | $ | 8.01 | $ | 6.18 | ||||

| Second Quarter | 7.28 | 4.69 | |||||||

| Third Quarter | 4.77 | 3.08 | |||||||

| Fourth Quarter | 4.23 | 2.76 | |||||||

2010 |

First Quarter |

$ |

5.89 |

$ |

3.10 |

||||

| Second Quarter | 9.00 | 5.45 | |||||||

| Third Quarter | 9.66 | 6.91 | |||||||

| Fourth Quarter | 9.74 | 6.48 | |||||||

2009 |

First Quarter |

$ |

2.42 |

$ |

0.88 |

||||

| Second Quarter | 3.27 | 1.80 | |||||||

| Third Quarter | 3.88 | 2.02 | |||||||

| Fourth Quarter | 3.98 | 3.08 | |||||||

According to the records of our transfer agent, we had 161 stockholders of record of our common stock on March 5, 2012. Because brokers and other institutions hold many of our shares on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders. The last reported per share sale price for the common stock on March 5, 2012 was $5.03. We had 14,286,508 shares of common stock outstanding on March 5, 2012.

On December 22, 2011, we announced that our Board of Directors adopted a stock repurchase program authorizing the repurchase of up to $8 million of our outstanding Common Stock pursuant to a plan adopted under Rule 10b5-1 of the Securities Exchange Act of 1934 (as amended). No repurchases were made during the fourth quarter of 2011, as reflected in the following table:

ISSUER REPURCHASES OF EQUITY SECURITIES(1)

| |

(a) |

(b) |

(c) |

(d) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Period

|

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs ($ in thousands) |

|||||||||

December 22 - December 31, 2011 |

— | $ | 0.00 | — | $ | 8,000 | |||||||

- (1)

- Information for Stock Repurchase Program announced December 22, 2011, in maximum amount of $8 million.

Dividend Policy

We intend to retain our earnings to assist in financing our business and do not anticipate paying cash dividends on our common stock in the foreseeable future. The declaration and payment of dividends by the Company are also subject to the discretion of the Board. Any determination by the

13

Board as to the payment of dividends in the future will depend upon, among other things, business conditions, our financial condition and capital requirements, as well as any other factors deemed relevant by the Board. We have not paid cash dividends since we went public in 1995.

Equity Compensation Plan Information

The following table sets forth information regarding our Stock Option, Restricted Stock and Stock Purchase Plan Agreements as of December 31, 2011.

Plan Category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights(2) |

Weighted average exercise price of outstanding options, warrants and rights(2) |

Number of securities remaining available for future issuance under equity compensation plans excluding securities reflected in column (a) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(a) |

(b) |

(c) |

|||||||

Equity compensation plans approved by security holders |

— | — | 914,773 | (1) | ||||||

Equity compensation plans not approved by security holders |

— | — | — | |||||||

Total |

— | — | 914,773 | (1) | ||||||

- (1)

- Includes

68,177 securities for the 2005 Stock Purchase Plan, 246,596 securities for our employee and director Restricted Stock Plans and 600,000 securities

for our 2010 Long-Term Incentive Plan.

- (2)

- Amounts exclude 52,200 options to purchase our Common Stock granted to the current CEO and CFO outside of the Company's existing stock compensation plans pursuant to applicable regulations allowing for such grants.

14

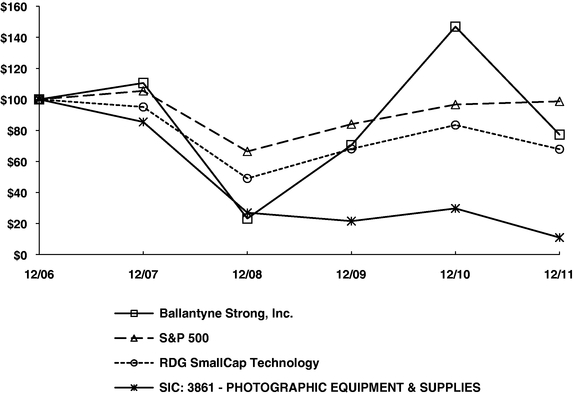

The following graph compares Ballantyne Strong's cumulative total stockholder return over the last five fiscal years with the Standard and Poor's 500 Index® ("S&P 500"), the Research Data Group, Inc. ("RDG") SmallCap Technology Index and a peer group consisting of the following issuers: AFP Imaging Corp. American Tonerserve Corp., Avid Technology, Inc., Chyron Corp., Eastman Kodak Company, Ikonics Corp., MDI, Inc., Swordfish Financial, Inc. and X-Rite, Inc. The Company has in good faith selected these peer issuers on the basis of their sharing the same SIC code (3861, Photographic Equipment & Supplies). The peer group total return was calculated using a weighted average market value. The graph assumes $100 was invested on December 31, 2006, and assumes reinvestment of all dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Ballantyne Strong, Inc., the S&P 500 Index, the RDG SmallCap Technology Index,

and SIC: 3861—PHOTOGRAPHIC EQUIPMENT &

SUPPLIES

- *

- $100 invested on 12/31/06 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

Copyright© 2012 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

| |

12/06 | 12/07 | 12/08 | 12/09 | 12/10 | 12/11 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Ballantyne Strong, Inc. |

100.00 | 110.59 | 23.25 | 70.51 | 146.88 | 77.32 | |||||||||||||

S&P 500 |

100.00 | 105.49 | 66.46 | 84.05 | 96.71 | 98.75 | |||||||||||||

RDG SmallCap Technology |

100.00 | 95.13 | 49.08 | 68.13 | 83.49 | 67.91 | |||||||||||||

SIC: 3861—PHOTOGRAPHIC EQUIPMENT & SUPPLIES |

100.00 | 85.46 | 26.99 | 21.57 | 29.75 | 10.97 | |||||||||||||

15

Item 6. Selected Financial Data(1)

| |

Years Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||

| |

$ in thousands |

|||||||||||||||

Statement of operations data |

||||||||||||||||

Net revenue |

$ | 184,433 | $ | 136,335 | $ | 72,146 | $ | 54,815 | $ | 51,486 | ||||||

Gross profit |

$ | 30,213 | $ | 24,739 | $ | 14,732 | $ | 8,794 | $ | 9,456 | ||||||

Net earnings (loss) |

$ | 10,347 | $ | 8,434 | $ | 2,071 | $ | (3,034 | ) | $ | 228 | |||||

Net earnings (loss) per share |

||||||||||||||||

Basic |

$ | 0.72 | $ | 0.60 | $ | 0.15 | $ | (0.22 | ) | $ | 0.02 | |||||

Diluted |

$ | 0.71 | $ | 0.59 | $ | 0.15 | $ | (0.22 | ) | $ | 0.02 | |||||

Balance sheet data |

||||||||||||||||

Working capital |

$ | 50,504 | $ | 40,400 | $ | 35,805 | $ | 21,810 | $ | 32,390 | ||||||

Total assets |

$ | 113,456 | $ | 92,031 | $ | 60,210 | $ | 51,113 | $ | 54,140 | ||||||

Total debt |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||

Stockholders' equity |

$ | 63,223 | $ | 52,376 | $ | 42,518 | $ | 38,835 | $ | 43,042 | ||||||

- (1)

- All amounts in thousands (000's) except per share data

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere in this report. Management's discussion and analysis contains not only historical information, but also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements that are not historical are forward- looking and reflect expectations for future Company performance. For these statements, the Company claims the protection of the safe harbor for forward- looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve a number of risks and uncertainties, including but not limited to those discussed in the "Risk Factors" section contained in Item 1A. Given the risks and uncertainties, readers should not place undue reliance on any forward-looking statement and should recognize that the statements are predictions of future results which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described herein, as well as others not now anticipated. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Except as required by law, the Company assumes no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements.

Overview

We are a distributor and service provider for the theatre exhibition industry on a worldwide basis. We also design, assemble, develop, manufacture and distribute lighting systems to the worldwide entertainment lighting industry through our Strong Entertainment lighting segment.

We have two primary reportable core operating segments: theatre and lighting. Approximately 98% of fiscal year 2011 sales were from theatre products and approximately 2% were lighting products. Additional information related to our reporting segments can be found in the notes to the consolidated financial statements.

16

Results of Operations:

The following table sets forth, for the periods indicated, the percentage of net revenues represented by certain items reflected in our consolidated statements of operations.

| |

Years Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||

Net revenue |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

Cost of revenues |

83.6 | 81.9 | 79.6 | 84.0 | 81.6 | |||||||||||

Gross profit |

16.4 | 18.1 | 20.4 | 16.0 | 18.4 | |||||||||||

Selling and administrative expenses(1)(2) |

7.5 | 9.5 | 15.3 | 19.7 | 18.1 | |||||||||||

Income (loss) from operations |

8.2 | 8.8 | 5.1 | (7.4 | ) | (0.8 | ) | |||||||||

Net earnings (loss) |

5.6 | 6.2 | 2.9 | (5.5 | ) | 0.4 | ||||||||||

- (1)

- Amounts

exclude goodwill impairment charges of $2.3 and $0.6 million for the years ended December 31, 2008 and 2007, respectively.

- (2)

- Amounts for the year ended December 31, 2011 exclude severance charges of $1.3 million.

Corporate-wide restructuring

In the fourth quarter of 2011, the Board of Directors and management of the Company approved a corporate-wide strategic initiative to refocus our worldwide digital equipment distribution business, services platform and cinema screen manufacturing business. The strategic initiative consists of selling our Omaha, NE-based analog projector facility and manufacturing equipment and relocating our corporate headquarters to a new, smaller location in Omaha, which will also house our Network Operations Center. It was determined that the best course of action for long-term success and future growth opportunities is a focus on our equipment distribution, cinema service and screen businesses while exiting the analog projector manufacturing business. The strategic initiative is expected to be completed by the end of 2012. In connection with the strategic initiative, we recorded a pre-tax severance charge of approximately $1.0 million in the fourth quarter pertaining to ongoing termination benefits, all of which will result in future cash expenditures in 2012.

2011 Compared to 2010

Revenues

Net revenues during the twelve months ended December 31, 2011 rose 35.3% to $184.4 million from $136.3 million in 2010.

| |

2011 | 2010 | |||||

|---|---|---|---|---|---|---|---|

| |

$ in thousands |

||||||

Theatre |

|||||||

Products |

$ | 167,017 | $ | 125,044 | |||

Services |

14,157 | 7,882 | |||||

Total theatre revenues |

181,174 | 132,926 | |||||

Lighting |

3,259 | 3,409 | |||||

Total net revenues |

$ | 184,433 | $ | 136,335 | |||

17

Theatre Segment

Sales of theatre products and services increased 36.3% to $181.2 million in 2011 from $132.9 million in 2010.

Digital Product Sales

Sales of digital products rose 59.5% to $138.8 million from $87.0 million a year-ago due to the following:

- •

- A significant sale of digital equipment to a theatre customer which represented approximately 26% of digital product

revenues during 2011.

- •

- A general increase in sales volume in the U.S as theatre exhibition companies continued to convert their theatre complexes

to digital-based projection equipment.

- •

- Sales of lamps rose to $15.3 million from $5.8 million in 2010 while sales of servers rose to $14.3 million from $7.4 million a year-ago.

We also continued to integrate projection equipment in our Omaha plant for a large exhibition customer. Revenues generated from the accessories we sell with the integration services increased to $8.6 million in 2011 from $5.0 million in 2010. We do expect this integration business to substantially decline after fiscal 2012 due to the exhibition customer's digital conversion being substantially completed.

Screen Product Sales

Revenues from the sale of screens decreased 7.9% to $17.4 million in 2011 compared to $18.9 million a year-ago primarily due to lower demand for digital 3D screens. Sales were at record levels in 2010 as exhibition companies pushed to capture the relative new 3D movie Box Office during the 2010 period. We sell screens for both digital cinema and film applications. In some instances, a screen can be used interchangeably with either a digital projector or a film projector. However, there are certain digital 3D applications such as the technology by RealD that require special "silver" screens that we manufacture.

Film Product Sales

The transition to digital cinema has impacted sales of film equipment, accessories and replacement parts and these products are expected to further decline in future periods. As expected, sales declined year-over-year as follows:

- •

- Sales of projection equipment declined to $5.7 million from $10.9 million.

- •

- Replacement part sales declined to $3.6 million from $4.7 million.

- •

- Sales of lamps declined to $1.5 million from $3.4 million.

Service Revenues

Service revenues increased 79.7% to $14.2 million from $7.9 million in 2010 resulting from increased demand for installation, maintenance and other services pertaining to the digital conversion. Digital service revenues rose to $13.1 million from $5.6 million in 2010 as the rollout is creating opportunities for our service group to sell a range of services including, but not limited to, installations, after-sale maintenance, repairs, cabling, wiring and NOC services.

The industry transition to digital is affecting revenues from servicing film equipment which declined to $1.1 million from $2.3 million in 2010.

18

Lighting Segment

Sales of lighting products declined slightly to $3.2 million from $3.4 million during 2010 due to lower demand for follow spotlights. Lighting products have been impacted by the effects of economic conditions as a significant portion of the business is dependent on the construction or improvements of stadiums and auditoriums around the world.

Foreign Revenues

Foreign revenues (primarily from the theatre segment) fell to $41.1 million from $60.1 million in 2010 resulting in large part to sales volume in Mainland China decreasing to $26.0 million from $34.9 million in 2010. The results out of China reflect increased competition and the shifting of scheduled installations due to changing theatre construction timelines. However, we believe there are future growth opportunities in China going forward and we continue to allocate resources to add sales and service offices throughout the Mainland. We also experienced lower sales volume in South America, Canada, Mexico and Europe. The results were primarily due to the timing of the digital cinema rollout in these countries coupled with lower sales of film equipment. Export sales are sensitive to worldwide economic and political conditions that can lead to volatility. Certain areas of the world are more cost conscious than the U.S. market and there are instances where our products are priced higher than local manufacturers making it more difficult to generate sufficient profit to justify selling into these regions. Additionally, foreign exchange rates and excise taxes sometimes make it difficult to market our products overseas at reasonable selling prices.

Gross Profit

Consolidated gross profit increased 22.1% to $30.2 million from $24.7 million in 2010 but as a percent of total revenue decreased to 16.4% from 18.1% in 2010. Gross profit in the theatre segment increased to $29.2 million from $23.8 million in 2010 but as a percentage of theatre sales decreased to 16.1% from 17.9% a year-ago. The higher gross profit was due to the increase in sales volume while the decline in gross margin is reflective of:

- •

- Higher sales of digital products which carry substantially higher revenue price points but lower gross margins than our

other products and services.

- •

- Lower screen revenues which carry higher manufacturing margins.

- •

- Lower revenues from film replacement parts which historically carry strong margins.

The gross profit in the lighting segment amounted to $1.0 million or a gross margin of 30.9% compared to $0.9 million or a gross margin of 27.4% during 2010. The results primarily reflect a favorable product mix during 2011.

Selling Expenses

Selling expenses increased 3.0% to $3.9 million from $3.8 million in 2010 but as a percent of total revenue declined to 2.1% from 2.8% a year-ago. The results principally reflect additional personnel and their associated costs to expand our domestic sales and service marketing efforts and to expand our sales offices in Mainland China.

Administrative Expenses

Administrative expenses rose 22.5% to $11.1 million in 2011 from $9.1 million in 2010 but as a percent of total revenue decreased to 6.0% from 6.7% in 2010. The increase in expenses was due to severance charges of $1.3 million during the year coupled with additional personnel and related costs necessary to manage the significant growth in revenue experienced during the year. Approximately

19

$1.0 million of the severance charges occurred in the fourth quarter and were a result of a strategic initiative to refocus certain key areas of our Company as discussed throughout this document.

Segment Operating Income

We generated operating income in the theatre segment of $22.8 million in 2011 compared to $17.8 million in 2010. The results reflect an increase in business where product revenues rose 33.6%. We also generated significantly higher operating profit from our service business which increased to $2.4 million from $0.6 million a year ago on a revenue increase of 79.6%.

Operating income from the lighting segment rose to $0.2 million from less than $0.1 million in 2010 due to a favorable product mix.

Other Financial Items

Our results for 2011 reflect a loss of $0.2 million pertaining to our 44.4% share of equity in the loss from Digital Link II, LLC compared to income of $0.6 million in 2010. The change from 2010 reflect less sales of equipment by the LLC to customers for projectors previously held in the LLC compared to 2010. The loss in the current year primarily is a result of depreciation expense.

Other income amounted to $0.1 million in 2011 compared to expense of $0.2 million in 2010. The results primarily reflect the impact of foreign exchange gains and losses due primarily to the U.S. dollar fluctuating against the Canadian dollar from year-to-year.

We recorded income tax expense of approximately $4.7 million in 2011 compared to $4.0 million in 2010. The effective tax rate (calculated as a ratio of income tax expense to pretax earnings, inclusive of equity method investment income (losses)) was approximately 31.3% for 2011 and 31.9% in 2010. The effective tax rate differs from the statutory rates primarily as a result of differing foreign and U.S. tax rates applied to respective pre-tax earnings by tax jurisdiction. In addition, our effective rate was lower than the prior year period in part due to estimates for certain Canadian tax credits.

For the reasons outlined herein, we generated net earnings of approximately $10.4 million and basic and diluted earnings per share of $0.72 and $0.71 in 2011, respectively compared to $8.4 million and basic and diluted earnings per share of $0.60 and $0.59 in 2010, respectively.

2010 Compared to 2009

Revenues

Net revenues during the twelve months ended December 31, 2010 rose to $136.3 million from $72.1 million in 2009.

| |

2010 | 2009 | |||||

|---|---|---|---|---|---|---|---|

| |

$ in thousands |

||||||

Theatre |

|||||||

Products |

$ | 125,044 | $ | 65,186 | |||

Services |

7,882 | 3,811 | |||||

Total theatre revenues |

132,926 | 68,997 | |||||

Lighting |

3,409 | 3,122 | |||||

Other |

— | 27 | |||||

Total net revenues |

$ | 136,335 | $ | 72,146 | |||

20

Theatre Segment

Sales of theatre products and services increased to $132.9 million in 2010 from $69.0 million in 2009.

Digital Product Sales

Sales of digital products rose to $87.0 million in 2010 from $27.9 million in 2009 as the industry change from analog to digital projection increased during 2010, primarily in the U.S. and China. The growth in business in the U.S. was primarily driven by customers taking advantage of the opportunities that digital technology offers such as the ability to show 3D movies among other items. The growth in China resulted not only from converting analog equipment to digital but also due to the construction of new theatre complexes in China. The majority of the increase in digital sales resulted from sales of digital projectors and certain accessories; however, sales of digital lamps also rose from $3.0 million in 2009 to $5.8 million in 2010 while sales of digital servers rose to $7.4 million from $1.2 million in 2009. We also began to integrate projection equipment in our Omaha plant where we consolidate and test digital equipment. Revenues generated from the product sold as part of this business was $5.0 million during 2010.

Film Product Sales

The transition to digital cinema has negatively impacted sales of film equipment, accessories and replacement parts. The following is a summary of the year-over-year results:

- •

- Sales of projection equipment declined to $10.9 million in 2010 from 12.0 million in 2009.

- •

- Replacement part sales declined to $4.7 in 2010 million from $6.8 million in 2009.

- •

- Sales of lamps declined to $3.4 million in 2010 from $6.0 million in 2009.

Screen Product Sales

Revenues from the sale of screens rose to $18.9 million in 2010 compared to $12.2 million in 2009 due to the substantial demand for digital 3D screens as theatres expanded the number of screens that can project 3D images. Sales were at record levels for this product line during 2010 due to the higher demand for special "silver" screens needed for certain digital 3D applications. This demand is the result of both our customers wanting to show more movies in digital 3D coupled with more 3D movies being available from the Hollywood studios. In addition, sales of large format screens to IMAX were also higher in 2010 than 2009.

Service Revenues

Service revenues increased to $7.9 million during 2010 from $3.8 million in 2009. Revenues generated from servicing film equipment were $2.3 million during 2010 compared to $2.6 million during 2009 while revenues generated from servicing digital equipment increased to $5.6 million in 2010 compared to $1.2 million in 2009. The results reflect increased demand for installation and maintenance services pertaining to the conversion from analog to digital projectors by our customers primarily in the U.S. As discussed in relation to digital product sales, we recognized service revenues of $0.3 million associated with the integration of digital projection equipment in the Omaha plant during 2010.

Lighting Segment

Sales of lighting products rose to $3.4 million during 2010 from $3.1 million in 2009. Sales of follow spotlights rose to $2.0 million from $1.8 million in 2009. Sale of skytrackers rose to $0.2 million

21

from $0.1 million in 2009, while replacement part sales rose from $0.6 million in 2009 to $0.7 million in 2010. Sales of all other lighting products, including but not limited to xenon lamps, britelights and LED products amounted to $0.5 million in 2010 compared to $0.7 million in 2009.

Foreign Revenues

Sales outside the United States increased to $60.1 million in 2010 from $33.2 million in 2009 resulting primarily from increased demand in China and South America where sales increased by $23.4 million and $5.6 million, respectively. The increased demand in China resulted from theatres chains retrofitting their current operations with digital equipment as well as the growth of new theatre complexes. Sales in South America were driven primarily by existing theatre complexes retrofitting their equipment to digital in order to take advantage of the 3D technology. These sales were partially offset by a decrease in sales in Mexico of $2.6 million year over year. Sales in all other regions including Canada, Europe, Asia (excluding China) and all other regions were relatively flat year over year all together driving a net increase of $0.5 million in sales. Export sales are sensitive to worldwide economic and political conditions that can lead to volatility. Certain areas of the world are more cost conscious than the U.S. market and there are instances where our products are priced higher than local manufacturers making it more difficult to generate sufficient profit to justify selling into these regions. Additionally, foreign exchange rates and excise taxes sometimes make it difficult to market our products overseas at reasonable selling prices.

Gross Profit

Consolidated gross profit increased 67.9% to $24.7 million in 2010 from $14.7 million in 2009 but as a percent of total revenue decreased to 18.1% in 2010 from 20.4% in 2009. Gross profit in the theatre segment increased to $23.8 million in 2010 from $13.8 million in 2009 but as a percentage of theatre sales decreased to 17.9% in 2010 from 20.0% in 2009. The decrease in gross margin resulted from increased sales of digital projection equipment which carry lower margins but substantially higher revenue price points than our other products. The lower digital projection margins were offset to a degree by improved margins from our screen and service business due primarily to the increased volume of sales from these businesses due the conversion to digital cinema.

The gross profit in the lighting segment amounted to $0.9 million or 27.4% of lighting revenues in 2010 compared to $0.9 million or 28.5% of lighting revenues in 2009. The results reflect relatively flat sales year over year.

Selling Expenses

Selling expenses increased 31.2% to $3.8 million in 2010 from $2.9 million in 2009 but as a percent of total revenue declined to 2.8% in 2010 from 4.0% in 2009. The results reflect an increase in personnel and associated costs coupled with increases in commission expenses due to the increase in product and services demand.

Administrative Expenses

Administrative costs rose to $9.1 million in 2010 from $8.1 million in 2009 but as a percent of total revenue decreased to 6.7% in 2010 from 11.3% in 2009. The increase in expenses is primarily due to the growth in personnel and related costs necessary to manage the significant growth in revenue experienced during the year.

22

Other Financial Items

Our results for 2010 reflect a gain of $0.6 million pertaining to our 44.4% share of equity in the income from Digital Link II, LLC. This gain compares to the loss of $0.9 million in 2009 and was due to the sale of equipment by the LLC to customers for projectors previously held in the LLC.

Other expense amounted to $0.2 million in 2010 compared to $0.1 million in 2009. The results primarily reflect the impact of transaction losses arising from foreign exchange fluctuations during the year due to the U.S. dollar weakening against the Canadian dollar.

We recorded income tax expense of approximately $4.0 million in 2010 compared to $0.7 million in 2009. The effective tax rate (calculated as a ratio of income tax expense to pretax earnings, inclusive of equity method investment earnings (losses)) was approximately 31.9% in 2010 and 24.7% in 2009. The effective tax rate change from year to year results primarily from differing foreign and U.S. tax rates applied to respective pre-tax earnings amounts by tax jurisdiction.

For the reasons outlined herein, we generated net earnings of approximately $8.4 million and basic and diluted earnings per share of $0.60 and $0.59 in 2010, respectively, compared to net earnings of $2.1 million and basic and diluted earnings per share of $0.15 in 2009.

Liquidity and Capital Resources

During the past several years, we have met our working capital and capital resource needs from either our operating or investing cash flows or a combination of both. We ended fiscal year 2011 with total cash and cash equivalents of $39.9 million compared to $22.3 million at December 31, 2010.

We are a party to a $20 million Revolving Credit Agreement and Note (collectively, the "Credit Agreement") with Wells Fargo Bank, N.A. ("Wells Fargo"). We may request an increase in the Credit Agreement of up to an additional $5 million; however, any advances on the additional $5 million are subject to approval of Wells Fargo. The borrowings from the Credit Agreement are to be used for working capital purposes and for other general corporate purposes. Our accounts receivable, general intangibles and inventory secure the Credit Agreement. We plan to renew the credit facility prior to its expiration.