Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NBC ACQUISITION CORP | d312767d8k.htm |

| EX-99.1 - SECOND AMENDED JOINT PLAN OF REORGANIZATION OF NEBRASKA BOOK COMPANY, INC - NBC ACQUISITION CORP | d312767dex991.htm |

Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| ) | ||||

| In re: |

) | Chapter 11 | ||

| ) | ||||

| NEBRASKA BOOK COMPANY, INC., et al.,1 |

) | Case No. 11-12005 (PJW) | ||

| ) | ||||

| Debtors. |

) | Jointly Administered | ||

| ) |

DISCLOSURE STATEMENT RELATING TO

THE SECOND AMENDED JOINT PLAN OF REORGANIZATION

OF NEBRASKA BOOK COMPANY, INC., ET AL.,

PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE

| Marc Kieselstein, P.C. (admitted pro hac vice) |

Laura Davis Jones (DE Bar No. 2436) | |

| Chad J. Husnick (admitted pro hac vice) |

James E. O’Neill (DE Bar No. 4042) | |

| Daniel R. Hodgman (admitted pro hac vice) |

Peter J. Keane (DE Bar No. 5503) | |

| KIRKLAND & ELLIS LLP |

PACHULSKI STANG ZIEHL & JONES LLP | |

| 601 Lexington Avenue |

919 North Market Street, 17th Floor | |

| New York, New York 10022-4611 |

Wilmington, Delaware 19899-8705 | |

| Telephone: (212) 446-4800 |

Telephone: (302) 652-4100 | |

| Facsimile: (212) 446-4900 |

Facsimile: (302) 652-4400 | |

| Counsel to the Debtors and Debtors in Possession |

||

Attorneys for the Debtors

Dated: March 7, 2012

| 1 | The debtors in the Chapter 11 Case, along with the last four digits of each debtor’s federal tax identification number include: Nebraska Book Company, Inc. (9819); Campus Authentic LLC (9156); College Bookstores of America, Inc. (9518); NBC Acquisition Corp. (3347); NBC Holdings Corp. (7477); NBC Textbooks LLC (1425); Net Textstore LLC (6469); and Specialty Books, Inc. (4807). The location of the debtors’ service address is: 4700 South 19th Street, Lincoln, Nebraska 68512. |

TABLE OF CONTENTS

| I. Questions and Answers Regarding this Disclosure Statement and the Plan |

3 | |||

| II. The Debtors’ History and the Chapter 11 Cases |

8 | |||

| III. Events Leading to the Chapter 11 Cases |

13 | |||

| IV. Events Since Commencement of the Chapter 11 Cases |

15 | |||

| V. Treatment of Claims and Interests Under the Plan |

21 | |||

| VI. Management of the Company |

28 | |||

| VII. Composition of New Board of Directors |

28 | |||

| VIII. Capital Structure of the Reorganized Debtors upon Consummation |

29 | |||

| IX. Summary of Legal Proceedings |

30 | |||

| X. Valuation Analysis |

30 | |||

| XI. Liquidation Analysis |

37 | |||

| XII. Projected Financial Information |

44 | |||

| XIII. Risk Factors |

48 | |||

| XIV. Confirmation of the Plan |

56 | |||

| XV. Effect of Confirmation of the Plan |

60 | |||

| XVI. Important Securities Laws Disclosure |

64 | |||

| XVII. Nominee Voting Instructions |

65 | |||

| XVIII. Certain U.S. Federal Income Tax Consequences of the Plan |

67 | |||

| XIX. Recommendation of the Debtors |

75 | |||

i

EXHIBITS

EXHIBIT A Plan of Reorganization

EXHIBIT B Reorganized Debtors’ Financial Projections

ii

Important Information About this Disclosure Statement

This disclosure statement (this “Disclosure Statement”) provides information regarding the Second Amended Joint Plan of Reorganization of Nebraska Book Company, Inc., Et Al., Pursuant to Chapter 11 of the Bankruptcy Code (the “Plan”) that Nebraska Book Company, Inc. and the other debtors in the above-captioned chapter 11 cases (collectively, the “Debtors”) are seeking to have confirmed by the Bankruptcy Court. A copy of the Plan is attached as Exhibit A hereto. All capitalized terms used but not otherwise defined herein shall have the meaning ascribed to them in the Plan. The Debtors believe that the Plan is in the best interests of all Holders of Claims and Interests. The Debtors urge all Holders of a Claim or Interest entitled to vote on the Plan to vote in favor of the Plan.

Confirmation and Consummation of the Plan are subject to certain material conditions precedent described in Article IX of the Plan. There is no assurance that the Plan will be confirmed or, if confirmed, that such material conditions precedent will be satisfied or waived.

You are encouraged to read this Disclosure Statement in its entirety, including the Plan, and the Section herein entitled “Risk Factors” prior to submitting your ballot to vote to accept or reject the Plan.

The Bankruptcy Court’s approval of this Disclosure Statement does not constitute a guarantee of the accuracy or completeness of the information contained herein or an endorsement of the merits of the Plan by the Bankruptcy Court.

Summaries of the Plan and statements made in this Disclosure Statement in connection therewith are qualified in their entirety by reference to the Plan, the exhibits and schedules attached to the Plan, and the Plan Supplement. The statements contained in this Disclosure Statement are made only as of the date of this Disclosure Statement, and there is no assurance that the statements contained herein will be correct at any time after such date. Except as otherwise provided in the Plan or in accordance with applicable law, the Debtors are under no duty to update or supplement this Disclosure Statement.

The information contained in this Disclosure Statement is included for purposes of soliciting acceptances to the Plan and obtaining Confirmation and may not be relied upon for any other purpose. The Debtors believe that the summary of certain provisions of the Plan and certain other documents and financial information contained or referenced in this Disclosure Statement is fair and accurate. The summaries of the financial information and the documents attached to this Disclosure Statement, or otherwise incorporated herein by reference, are qualified in their entirety by reference to those documents. In the event of any inconsistency between this Disclosure Statement and the Plan, the relevant provision of the Plan, as it relates to such inconsistency, shall govern.

No representations concerning the Debtors or the value of the Debtors’ property has been authorized by the Debtors other than as set forth in this Disclosure Statement. Any information, representations, or inducements made to obtain acceptance of the Plan, which are other than or inconsistent with the information contained in this Disclosure Statement and in the Plan, should not be relied upon by any Holder of a Claim or Interest entitled to vote to accept or reject the Plan.

Neither the United States Securities and Exchange Commission (“SEC”) nor any similar federal, state, local, or foreign regulatory agency has approved or disapproved of the offered securities or the Plan or passed upon the accuracy or adequacy of the statements contained in this Disclosure Statement.

The Debtors have sought to ensure the accuracy of the financial information provided in this Disclosure Statement, but the financial information contained in, or incorporated by reference into, this Disclosure Statement has not been, and will not, be audited or reviewed by the Debtors’ independent auditors unless explicitly provided otherwise.

1

The shares of the common stock to be issued pursuant to the Plan (the “New Common Equity”) as described in this Disclosure Statement will be issued without registration under the Securities Act of 1933, as amended (the “Securities Act”), or similar federal, state, local, or foreign laws, in reliance on the exemptions from the registration requirements of those laws and the exemption set forth in section 1145 of the Bankruptcy Code and other applicable exemptions in foreign jurisdictions. Other shares of the New Common Equity may be issued pursuant to other applicable exemptions under the federal and foreign securities laws. To the extent exemptions from registration other than section 1145 apply, such securities may not be offered or sold except pursuant to a valid exemption or registration under the Securities Act or similar foreign laws.

The Debtors make statements in this Disclosure Statement that are considered forward-looking statements under the federal securities laws. The Debtors consider all statements regarding anticipated or future matters, including the following, to be forward-looking statements:

| • any future effects as a result of the pendency of the Chapter 11 Cases; |

• plans and objectives of management for future operations; | |

| • growth opportunities for existing service; |

• financing plans; | |

| • projected general market conditions; |

• business strategy; | |

| • disruption of operations; |

• potential asset sales; | |

| • projected cost reductions; |

• competitive position; and | |

| • contractual obligations;

• budgets; |

• the Debtors’ expected future financial position, liquidity, results of operations, profitability, and cash flows. | |

Statements concerning these and other matters are not guarantees of the Debtors’ future performance. Such statements represent the Debtors’ estimates and assumptions only as of the date such statements were made. There are risks, uncertainties, and other important factors that could cause the Debtors’ actual performance or achievements to be materially different from those they may project, and the Debtors undertake no obligation to update any such statement. These risks, uncertainties, and factors include:

| • lower prices for the Debtors’ goods or a decline in the Debtors’ market share due to competition or price pressure by customers; |

• continued decline in the general economic, business, and market conditions where the Debtors operate; | |

| • the Debtors’ ability to confirm and consummate the Plan; |

• the Debtors’ ability to reduce their overall financial leverage; | |

| • inability to have claims discharged or settled during the Chapter 11 Cases; |

• financial conditions of the Debtors’ customers; | |

2

| • changes in laws and regulations; |

• labor costs; | |

| • interest rate fluctuations; |

• adverse tax changes; | |

| • customer response to the Chapter 11 Cases; |

• commodity prices, including cost of producing textbooks and general merchandise; | |

| • limited access to capital resources; |

• seasonality; and | |

| • cost of raw materials; |

• the Debtors’ ability to implement cost reduction initiatives in a timely and effective manner. | |

I. Questions and Answers Regarding this Disclosure Statement and the Plan

Why are the Debtors sending me this Disclosure Statement?

The Debtors are seeking to obtain Bankruptcy Court approval of the Plan. Prior to soliciting acceptances of a proposed plan, section 1125 of the Bankruptcy Code requires a debtor to prepare a disclosure statement containing adequate information of a kind, and in sufficient detail, to enable a hypothetical reasonable investor to make an informed judgment regarding whether to accept or reject the Plan. This Disclosure Statement is being submitted in respect of the Plan in accordance with such requirements.

Am I entitled to vote to accept or reject the Plan? What will I receive from the Debtors if the Plan is consummated?

Your ability to vote and your distribution, if any, depend on what kind of Claim or Interest that you hold. In accordance with section 1123(a)(1) of the Bankruptcy Code, Administrative Claims and Priority Tax Claims have not been classified. Such Claims must be satisfied in full in Cash on the Effective Date or, in the case of Priority Tax Claims, within five years of the Petition Date in accordance with section 1129(a)(9)(C) of the Bankruptcy Code. Administrative Claims and Priority Tax Claims are not entitled to vote to accept or reject the Plan and are conclusively deemed to have accepted the Plan. The remainder of Claims and Interests are classified into the following Classes and their respective voting statuses and anticipated recoveries are as follows:

3

| Class |

Claims and Interests |

Status |

Anticipated |

Voting Rights | ||||

| Class 1 |

Senior Secured Notes Claims | Impaired | 100% | Entitled to Vote | ||||

| Class 2 |

Other Secured Claims | Unimpaired | 100% | Not Entitled to Vote (Deemed to Accept) | ||||

| Class 3 |

Other Priority Claims | Unimpaired | 100% | Not Entitled to Vote (Deemed to Accept) | ||||

| Class 4 |

8.625% Notes Claims | Impaired | 1.5% | Entitled to Vote | ||||

| Class 5 |

General Unsecured Claims | Impaired | 1.5% | Entitled to Vote | ||||

| Class 6 |

AcqCo Notes Claims | Impaired | 0% | Not Entitled to Vote (Deemed to Reject) | ||||

| Class 7 |

Intercompany Claims | Unimpaired | 100% | Not Entitled to Vote (Deemed to Accept) | ||||

| Class 8 |

Intercompany Interests | Unimpaired | 100% | Not Entitled to Vote (Deemed to Accept) | ||||

| Class 9 |

HoldCo Interests | Impaired | N/A | Not Entitled to Vote (Deemed to Reject) | ||||

| Class 10 |

Subordinated Securities Claims | Impaired | N/A | Not Entitled to Vote (Deemed to Reject) |

For more information about the treatment of Claims and Interests, see the Section herein entitled “Treatment of Claims and Interests Under the Plan.”

If the Plan provides that I get a distribution, when do I get it, and what do you mean when you refer to “Confirmation,” “Effective Date,” and “Consummation”?

Confirmation of the Plan refers to the Bankruptcy Court’s approval of the Plan. Confirmation of the Plan does not guarantee that you will receive the distribution indicated under the Plan. After Confirmation of the Plan, there are conditions (described in Article IX of the Plan) that need to be satisfied or waived so that the Plan can be consummated and become effective. References to the Effective Date mean the date that all conditions to the Plan have been satisfied or waived, at which point the Plan may be “consummated.” Distributions only will be made after Consummation of the Plan. See the Section herein entitled “Confirmation of the Plan,” for a discussion of the conditions to Confirmation.

How will the Reorganized Debtors fund distributions under the Plan?

The Reorganized Debtors will fund distributions under the Plan with cash on hand, including cash from operations, as well as proceeds from the New ABL Facility and the New Money First Lien Term Loan, and through issuance of New Common Equity, the New Take-Back Note, and the New Warrants.

How is the Plan going to be implemented?

The Restructuring Transactions will be effected in accordance with the Restructuring Transaction Memorandum, a copy of which will be filed as an exhibit to the Plan Supplement. Reorganized NBC will issue the New Common Equity and the New Take-Back Notes and enter into the New ABL Facility, the New Money First Lien Term Loan, and New Warrants on the Effective Date.

4

What are the contents of the solicitation packages to be sent to Holders of Claims and Interests who are eligible to vote to accept or reject the Plan?

Holders of Claims and Interests who are eligible to vote to accept or reject the Plan will receive appropriate solicitation materials including:

| • | the appropriate ballot (each, a “Ballot”), beneficial holder ballot (each, a “Beneficial Holder Ballot,”) or master ballot (each a “Master Ballot”) (where any broker, dealer, commercial bank, trust company, savings and loan financial institution, or other party (a “Nominee”) is entitled to cast a vote to accept or reject the Plan on behalf of an Entity holding the beneficial interest in such Claim, as applicable) and applicable voting instructions; |

| • | a pre-addressed, postage pre-paid return envelope; and |

| • | this Disclosure Statement with all exhibits, including the Plan. |

The notices sent to parties in interest will indicate that this Disclosure Statement, the Plan, and all of the exhibits thereto are (and, in the future, the Plan Supplement will be) available for viewing by any party by: (a) contacting the Nebraska Book Company, Inc. restructuring hotline at (888) 647-1738, or by writing to Nebraska Book Company, Inc. Balloting Processing Center c/o Kurtzman Carlson Consultants LLC, 2335 Alaska Ave., El Segundo, California 90245; or (b) downloading such documents (excluding the Ballots) from the Debtors’ restructuring website at http://www.kccllc.net/nbc or by visiting the Bankruptcy Court’s website at http://www.deb.uscourts.gov.

Will the Debtors file reports with the SEC?

The Debtors expect to continue filing reports under the Securities Exchange Act of 1934 (as amended) with the SEC after the filing of the Chapter 11 Cases and after the Effective Date.

What rights will the Debtors’ new stockholders have?

Each holder of New Common Equity issued under the Plan will be entitled to one vote per share of New Common Equity on all matters subject to a vote of holders of New Common Equity under applicable law and will be entitled to a pro rata share of any dividends that are declared by the New Board to the extent such dividends are permitted. The New Common Equity will be the sole class of voting stock of Reorganized NBC. The rights of new stockholders shall be consistent with those set forth in the Shareholders Agreement, the Registration Rights Agreement, and any terms set forth in the Plan Supplement related to the New Common Equity and the New Warrants, as applicable.

The holders of New Common Equity shall be parties to the Shareholders Agreement, which shall be in form and substance satisfactory to the Senior Secured Notes Steering Committee.

The holders of New Common Equity and the Debtors shall be parties to the Registration Rights Agreement, which shall be satisfactory in form and substance to the Senior Secured Notes Steering Committee, obligating the Reorganized Debtors to register for resale certain shares of the New Common Equity under the Securities Act in accordance with the terms set forth in such agreement.

How will the New Common Equity be distributed? Will holders be entitled to stock certificates?

The New Common Equity delivered to Holders of Claims and Interests is expected to be delivered to Depository Trust Company (“DTC”). DTC will then distribute the New Common Equity to accounts at DTC designated by Holders of Claims entitled to a distribution of New Common Equity under the Plan.

5

It is not expected that holders of New Common Equity will be entitled to stock certificates. DTC or its nominee will initially be considered the sole owner or holder of the New Common Equity issued. Holders of Claims that receive New Common Equity will be owners of beneficial interests in such New Common Equity and will not receive or be entitled to receive physical delivery of such securities.

What is the deadline to vote on the Plan?

The deadline to vote on the Plan is 4:00 p.m., prevailing Eastern Time, on May 21, 2012.

How do I vote to accept or reject the Plan?

The Debtors are distributing this Disclosure Statement, accompanied by a Ballot, Beneficial Holder Ballot, or Master Ballot, as applicable, to be used for voting to accept or reject the Plan, to the Holders of Claims and Interests entitled to vote to accept or reject the Plan (and Nominees, as applicable). If you are a Holder of Claims or Interests in Classes 1, 4, and 5, you may vote to accept or reject the Plan by completing the Ballot or Beneficial Holder Ballot and returning it in the envelopes provided.

The Debtors have engaged Kurtzman Carson Consultants LLC to serve as the Claims and Balloting Agent. The Claims and Balloting Agent is available to answer questions, provide additional copies of all materials, and oversee the voting process. In addition, the Claims and Balloting Agent will process and tabulate Ballots for each Class entitled to vote to accept or reject the Plan.

6

BALLOTS

Ballots and Master Ballots must be actually received by the Claims and Balloting Agent by the Voting Deadline, which is 4:00 p.m., prevailing Eastern Time, on May 21, 2012, at the following address:

For Senior Secured Notes Claims and 8.625% Notes Claims:

Nebraska Book Company, Inc.

Balloting Processing Center c/o

Kurtzman Carson Consultants LLC

599 Lexington Avenue, 39th Floor,

New York, New York 10022

For General Unsecured Claims:

Nebraska Book Company, Inc.

Balloting Processing Center

c/o Kurtzman Carson Consultants LLC,

2335 Alaska Ave

El Segundo, California 90245

If you received an envelope addressed to your Nominee, please allow enough time when you return your Ballot for your Nominee to cast your vote on a Master Ballot before the Voting Deadline.

If you have any questions on the procedure for voting on the Plan, please call the Nebraska Book Company restructuring hotline at:

(888) 647-1738

More detailed instructions regarding how to vote on the Plan are contained on the Ballots and Beneficial Holder Ballots distributed to Holders of Claims and Interests that are entitled to vote to accept or reject the Plan and the Master Ballots distributed to Nominees. For your vote to be counted, your Ballot or Beneficial Holder Ballot must be completed, signed, and received by the Voting Deadline; provided, however, that Ballots and Master Ballots received by the Claims and Balloting Agent after the Voting Deadline may be counted only in the sole and absolute discretion of the Debtors.

Any Ballot, Beneficial Holder Ballot, or Master Ballot that is properly executed by the Holder of a Claim or Interest or a Nominee, but which does not clearly indicate an acceptance or rejection of the Plan or which indicates both an acceptance and a rejection of the Plan, will not be counted.

Each Holder of a Claim or Interest entitled to vote to accept or reject the Plan may cast only one Ballot for each Claim or Interest held by such Holder. By signing and returning a Ballot, each Holder of a Claim or Interest in Classes 1, 4, and 5 will certify to the Bankruptcy Court and the Debtors that no other Ballots with respect to such Claim or Interest have been cast or, if any other Ballots have been cast with respect to such Claim or Interest, such earlier Ballots are superseded and revoked.

7

All Ballots are accompanied by return envelopes. It is important to follow the specific instructions provided on each Ballot. For information regarding voting by Nominees, see the Section herein entitled “Nominee Voting Instructions.”

When is the Confirmation Hearing expected to occur?

The Bankruptcy Court has scheduled the Confirmation Hearing for May 30, 2012 at 9:30 a.m., prevailing Eastern Time. The Confirmation Hearing may be adjourned from time to time without further notice except for an announcement of the adjourned date made at the Confirmation Hearing or by notice of any adjournment of the Confirmation Hearing filed by the Debtors and posted on their website at www.kccllc.net/nbc.

II. The Debtors’ History and the Chapter 11 Cases

| A. | Historical Overview. |

Nebraska Book Company, Inc. (“NBC”) was founded in 1915 with a single bookstore near the University of Nebraska campus. Following World War II, when the supply of new textbooks could not meet the demand created by returning soldiers attending college, NBC began buying books back from students at the end of the term and reselling them, thus becoming an integral part of the earliest years of the used textbook industry. In 1964, NBC became a national, rather than a regional, wholesaler of used textbooks by acquiring The College Book Company of California. During the 1970’s, NBC continued to focus on the wholesale business, throughout the 1980’s the Debtors expanded their efforts in the college bookstore market to primarily operate bookstores on or near larger campuses, typically where the institution-owned college bookstore was contract-managed by a competitor or where the Debtors did not have a significant wholesale presence. In the last several years, the Debtors revised their college bookstore strategy to expand their efforts in the contract-management of institutional bookstores. The Debtors continue to develop innovative strategies in order to remain at the forefront of the used textbook industry, including pioneering new technology-savvy retail software and entering the textbook rental market. Today, the Debtors service the college bookstore industry through its bookstore, textbook, and complementary services divisions, each as described more fully below.

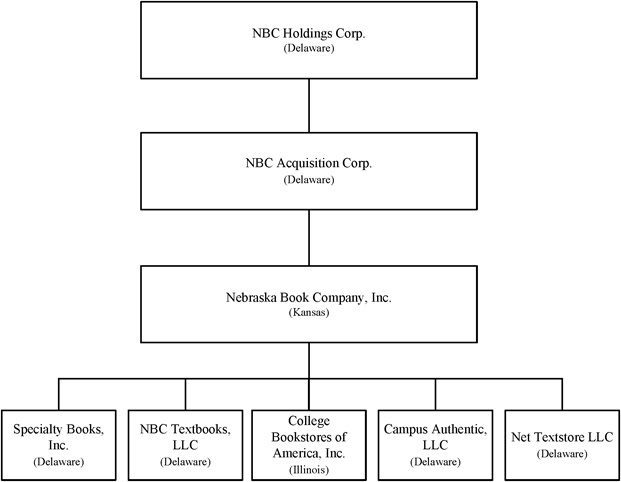

In an effort to remain a competitive player in the college services market, the Debtors include a diverse network of companies. Effective July 1, 2002, the Debtors’ distance learning division was separately incorporated under the laws of the State of Delaware as Specialty Books, Inc., a wholly-owned subsidiary of NBC (“Specialty Books”). On January 1, 2005, the textbook division was separately formed under the laws of the State of Delaware as NBC Textbooks LLC, a wholly-owned subsidiary of NBC (the “Textbook Division”). On May 1, 2006, NBC added another wholly-owned subsidiary through the acquisition of all of the outstanding stock of College Book Stores of America, Inc. (“CBA”), an entity separately formed under the laws of the State of Illinois. On April 24, 2007, NBC established Net Textstore LLC, a wholly-owned subsidiary separately formed under the laws of the State of Delaware. Finally, effective January 26, 2009, NBC established Campus Authentic LLC, a wholly-owned subsidiary separately incorporated under the laws of the State of Delaware.

On March 4, 2004, a group of jointly managed private equity funds, including Weston Presidio Capital III, L.P., Weston Presidio Capital IV, L.P., WPC Entrepreneur Fund, L.P., and WPC Entrepreneur Fund II, L.P. (collectively “Weston Presidio”) gained a controlling interest in NBC Acquisition Corp. (“AcqCo”) and NBC.

8

| B. | The Debtors’ Business Operations. |

The Debtors operate approximately 290 retail college bookstores and are one of the largest wholesale distributors of used college textbooks in North America, offering over 169,000 textbook titles and selling over 6.1 million books annually, primarily to bookstores serving campuses located in the United States. The Debtors’ principal executive offices are located in Lincoln, Nebraska. As of March 31, 2011, the Debtors employed approximately 1,100 full time employees, 700 part time employees, and 900 temporary workers. Since its founding in 1915, the Debtors have successfully adapted to the changing landscape of American colleges and universities, including the increase in student enrollment, and the advancement of technology and e-commerce.

Today, the Debtors serve the college bookstore industry through the operation of three main divisions, their campus and off-campus bookstore locations (the “Bookstore Division”), their wholesale textbooks business (the “Textbook Division”), and their distance education business and e-commerce software development (collectively, the “Complementary Services Division”). For the 12 months ended March 31, 2011, the Debtors generated approximately $598.4 million in total revenues.

The Bookstore Division. As of March 31, 2011, the Debtors operated approximately 290 college bookstores on or adjacent to college campuses throughout the United States. The Debtors’ bookstores include on-campus locations leased from the educational institution that they serve, as well as owned or leased off-campus bookstores. The Bookstore Division encompasses a number of operations, including: (1) selling and renting a wide variety of used and new textbooks; (2) selling assorted merchandise, including apparel, sundries, and gift items; (3) selling various technology items such as calculators and computers; and (4) selling general books. Over the past three fiscal years, bookstore revenues from activities other than used and new textbook sales and rentals have been between 16.6% and 19.1% of total revenues. The Debtors tailor each of their bookstores to fit the needs and lifestyles of each campus. While the individual managers have significant planning and managing responsibilities, the Debtors’ staff also includes specialists to assist bookstore managers in store planning, merchandise purchasing, media buying, inventory control, and layout. In addition to in-store sales, the Debtors sell textbooks and other merchandise via the internet through each store’s individual website as well as the Debtors’ consolidated website, known as Neebo.com, and numerous third-party websites such as Amazon.com and Half.com.

The Debtors have enhanced the Bookstore Division within the last year by implementing a new focus on textbook rentals. Several years ago, textbook rentals were uncommon, both online and in bookstores. However, the availability and popularity of textbook rentals has rapidly increased with online companies such as Chegg, Inc. and BookRenter.com leading that change. The college bookstore industry is quickly reacting to this new competition, and the Debtors have been testing various textbook rental models for the past two years. As a result of that testing, the Debtors implemented the “Rent Every Book” model in the vast majority of their stores January 2011. Given that the textbook rental model is in its nascent state, the Bookstore Division’s full potential utilizing that model remains to be seen. However, with the “Rent Every Book” model, the Debtors remain a competitive and innovative player in the college bookstore arena.

In addition, the Debtors introduced a new website. Prior to implementing their new website, Neebo.com, the Debtors maintained over 250 separate websites, each representing the inventory offered by the Debtors’ bookstore serving a college or university where the Debtors had a brick–and–mortar store. However, the websites were not connected to each other so a customer on one web site could not access the inventory of the other Debtor bookstore locations. The Debtors had significant viewership on the individual websites, but were unable to leverage that volume—Neebo.com will allow the Debtors to better capitalize on that traffic volume.

9

Through the “Rent Every Book” initiative and Neebo.com, the Debtors’ Bookstore Division continues to adapt to the increasingly competitive marketplace and changes in customer demands. The Bookstore Division produced approximately $468 million in total revenues over the 12 months ended March 31, 2011.

The Textbook Division. The Debtors also serve the college bookstore industry through their Textbook Division. The Textbook Division utilizes three avenues to effectively service the Debtors’ customers and to remain a pioneer of the college bookstore industry. First, the Debtors engage in the procurement and redistribution of used textbooks on college campuses primarily across the United States and through third-party websites. Second, the Textbook Division focuses on maintaining current catalogs of textbooks. The Debtors publish a buyer’s guide which lists approximately 51,000 textbooks according to author, title, and price. The guide is an important part of the Debtors’ inventory control and textbook procurement system. The Debtors maintain a staff dedicated to gathering information from all over the country to make the guide a comprehensive and up-to-date pricing and buying aid for college bookstores. Third, the Debtors maintain a database of approximately 169,000 titles to better serve their customers. For the 12 months ended March 31, 2011, the Textbook Division produced approximately $135 million in revenue.

The Complementary Services Division. The Debtors further expanded their services through their Complementary Services Division. Through Specialty Books the Debtors access the market for distance education products and services. As of June 2010, the Debtors provided students at approximately 30 colleges and private high schools with textbooks and materials for use in distance education and other education courses, and provided textbooks to nontraditional programs. In addition, the Debtors offer services and specialty course materials to the distance education marketplace. Over the past three fiscal years, Specialty Books external customer revenues comprised between 42.3% and 54.9% of total Complementary Services Division revenues. The Complementary Services Division generated approximately $35 million during the 12 months ended March 31, 2011.

The Complementary Services Division also provides the Debtors’ customers with access and services related to the Debtors’ “turnkey” bookstore management software (the “Turnkey Software”). The Turnkey Software incorporates point of sale, inventory control, and accounting modules that collectively generate revenue and assist the Debtors in gaining access to new sources of used textbooks. In total, including the Debtors’ own bookstores, almost 1,200 college bookstore locations use the Turnkey Software products. In addition, the Debtors have developed and deployed software for e-commerce capabilities. This software allows college bookstores to launch their own e-commerce sites and effectively compete against other online textbook and general merchandise sellers by offering textbooks and both traditional and non-traditional store merchandise online. As of July, 2011, there were approximately 660 stores, including the Debtors own stores, licensing the Debtors’ e-commerce technology through their e-commerce software CampusHub. Also, the Debtors offer digital delivery solutions which enable college bookstores to offer students the option of purchasing E-books via download. Through the Debtors’ continued software innovation and adaption, the Debtors are able to adjust to the rapidly changing college bookstore landscape.

The Debtors also remain competitive with online customers. The Debtors launched a web site for their retail division called Neebo.com in October, 2011. Prior to implementing Neebo.com, the Debtors maintained over 250 separate web sites, each representing a college or university where the Debtors had a brick–and–mortar store. The Debtors had significant viewership on the individual websites, but were unable to leverage that volume —Neebo.com allows the Debtors to use the volume of information, a significant competitive advantage. The Debtors now operate a site that drives traffic from the 250 separate sites to Neebo.com. Through this initiative, the Debtors continue to adapt to the increasingly competitive marketplace and changes in customer demands.

10

| C. | The Debtors’ Prepetition Organizational Structure. |

The following chart generally depicts the Debtors’ prepetition organizational structure:

| D. | The Debtors’ Prepetition Capital Structure. |

As of March 31, 2011, the Debtors reported approximately $508.3 million in total assets and approximately $547.7 million in total liabilities. As of the Petition Date, the Debtors have approximately $478.5 million in indebtedness and related obligations, consisting of (1) secured obligations of (a) $200 million plus accrued interest and fees under the Senior Secured Notes Indenture; and (b) $26.5 million outstanding under the ABL Facility, and (2) unsecured obligations of (a) approximately $175 million under the 8.625% Notes, and (b) approximately $77 million under the AcqCo Notes. These obligations are discussed in turn.

| (i) | Secured Indebtedness. |

| (a) | ABL Facility. |

NBC, as borrower, NBC Holdings Corp., AcqCo, and all NBC subsidiaries, as guarantors, JP Morgan Chase Bank, N.A., as administrative agent (the “ABL Agent”), and the lenders party thereto (the “ABL Lenders”) are parties to that certain amended and restated ABL Credit Agreement (as amended, the “ABL Facility”), dated as of March 22, 2010.

11

The ABL Facility provides the Debtors with an asset-based revolving credit facility with $75.0 million of maximum availability. Borrowings under the ABL Facility are subject to the Eurodollar interest rate (with a 1.5% floor) plus an applicable margin ranging from 4.25% to 4.75% or a base interest rate. In addition, the applicable margin increases 1.5% during the time periods from April 15 to June 29 and from December 1 to January 29 of each year. As of the Petition Date, approximately $26.3 million was outstanding under the ABL Facility (including $3.7 million in issued and undrawn letters of credit). The interest rate as of the Petition Date was 8.25%. Shortly after entry of that certain Final Order under 11 U.S.C. §§ 105, 361, 362, 363(c),364(c)(1), 364(c)(2), 364(c)(3), 364(d)(1), 364(e), and 507 and Bankruptcy Rules 2002, 2001, and 9014 (I) Authorizing the Debtors to Obtain Postpetition Financing, (II) Authorizing the Debtors to Use Cash Collateral and (III) Granting Adequate Protection to Prepetition Secured Lenders, dated July 21, 2011, [Docket No. 195] (the “Final DIP Order”), the Debtors used the proceeds of the DIP Facility to satisfy all obligations outstanding under the ABL Facility.

The ABL Facility was secured by a first priority interest in substantially all of the Debtors’ property and assets, in addition to a pledge of all capital stock held by the Debtors. The ABL Facility matured on the earlier of October 2, 2012, or 90 days prior to the earliest maturity of any current outstanding debt obligations. The Senior Secured Notes matured on December 1, 2011; as a result the ABL Facility matured 91 days prior, or on September 1, 2011.

| (b) | Senior Secured Notes. |

NBC, as borrower, and Wilmington Trust FSB, as trustee and collateral agent, are parties to that certain indenture (the “Senior Secured Notes Indenture”), dated as of October 2, 2009. The Debtors issued $200 million senior secured notes at a discount of $1.0 million with unamortized bond discount of $0.5 million (collectively, the “Senior Secured Notes” and the noteholders thereunder, the “Senior Secured Noteholders,” together with the ABL Lenders, the “Prepetition Secured Lenders”). The Senior Secured Notes are secured by a second priority interest in substantially all of the Debtors’ property and assets and a subordinated pledge of all capital stock held by the Debtors. The Senior Secured Notes require semi-annual interest payments at a fixed rate of 10% and mature on December 1, 2011. Each of NBC’s subsidiaries guarantees the Senior Secured Notes, pursuant to the Senior Secured Notes Indenture. As of the Petition Date, the outstanding principal balance of the Senior Secured Notes was $200 million.

| (c) | Intercreditor Agreement. |

The Debtors, the ABL Agent, and the Senior Secured Notes Trustee were parties to that certain intercreditor agreement (the “Intercreditor Agreement”), dated as of October 2, 2009. The Intercreditor Agreement assigned relative priorities to claims arising under the ABL Facility and the Senior Secured Notes Indenture. The Intercreditor Agreement provided that claims arising under the Senior Secured Notes Indenture were junior to claims arising under the ABL Facility. The Intercreditor Agreement also imposed certain limitations on: (a) the rights and remedies available to the Senior Secured Noteholders in an event of default under the Senior Secured Notes Indenture; (b) the Senior Secured Noteholders’ ability to challenge the validity or priority of liens arising under the ABL Facility; (c) the Senior Secured Noteholders’ ability to object to debtor-in-possession financing under section 363 or section 364 of the Bankruptcy Code provided or consented to by one or more of the ABL Lenders; and (d) the extent to which the Senior Secured Noteholders may be entitled to request adequate protection during a bankruptcy proceeding.

12

| (d) | Other Liens. |

In the ordinary course of business, the Debtors have incurred certain secured indebtedness, including mortgage liens, as permitted by their prepetition credit facilities (collectively, the “Permitted Encumbrances”). As described more fully below, the Permitted Encumbrances are not subject to the first priority priming liens granted pursuant to the Final DIP Order.

| (ii) | Unsecured Indebtedness. |

| (a) | 8.625% Notes. |

NBC, as borrower, and The Bank of New York Mellon Trust Company, N.A., as successor indenture trustee, are parties to that certain indenture (the “8.625% Indenture”), dated as of March 4, 2004. Pursuant to the 8.625% Indenture, NBC issued $175 million senior subordinated notes (collectively, the “8.625% Notes”). The 8.625% Notes require semi-annual interest payments at a fixed rate of 8.625% and mature on March 15, 2012. The 8.625% Notes are guaranteed by each of NBC’s subsidiaries, but are unsecured. As of the Petition Date, the outstanding principal balance of the 8.625% Notes was approximately $175 million.

| (b) | AcqCo Notes. |

AcqCo, as borrower, and U.S. Bank National Association, as successor trustee pursuant to Certification of Counsel Regarding Stipulation By and Among NBC Acquisition Corp., The Bank of New York Mellon Trust Co., N.A., and U.S. Bank National Association Authorizing the Substitution of Indenture Trustee [Docket No. 110], are parties to that certain indenture (the “AcqCo Notes Indenture”), dated as of March 4, 2004. AcqCo issued $77 million senior discount notes (collectively, the “AcqCo Notes”). The AcqCo Notes require semi-annual interest payments which began on September 13, 2008, at a fixed interest rate of 11% and mature on March 15, 2013. The AcqCo Notes are not guaranteed by NBC, any of its subsidiaries, or any other party and are unsecured. As of the Petition Date, the outstanding principal balance of the AcqCo Notes was approximately $77 million.

III. Events Leading to the Chapter 11 Cases

As discussed above, the Debtors have approximately $454.1 million of indebtedness and related obligations, consisting of their ABL Facility, Senior Secured Notes, 8.625% Notes, and AcqCo Notes. The changing industry dynamics placed significant strain on the Debtors’ ability to continue to grow EBITDA and fully refinance their debt and ultimately led to the Debtors’ filing of the Chapter 11 Cases. In addition a few events contributed to the Debtors’ filing of the Chapter 11 Cases, including: (A) the changing market, operational initiatives, and debt maturity; (B) the Debtors’ unsuccessful out-of-court restructuring efforts; and (C) the Debtors’ prepetition negotiations with its key stakeholders with respect to a prearranged chapter 11 plan of reorganization.

| A. | Changing Market, Operational Initiatives, and Debt Maturity. |

The Debtors filed the Chapter 11 Cases after the Debtors’ Bookstore Division suffered through several years of declining or stagnant levels of profitability, which in turn contributed to the Debtors inability to fully refinance certain funded debt as it was scheduled to mature in 2011 and early 2012. While the Debtors’ on-campus stores have maintained strong financial performance over the past several years, the Debtors’ off-campus stores have struggled over the same time period. This disparity is attributable, in large part, to advantages that the Debtors on-campus stores have when compared to the Debtors off-campus stores, including: better location, ties to the school’s financial aid system, and school

13

administration support. In addition, many of the Debtors’ on-campus store customers are typically “convenience” shoppers who value the ease of getting the right book at the right time with the least amount of time and effort expended on their part. In contrast, the Debtors’ off-campus stores typically appeal to more price-conscious students who are willing to put forth more time and effort in obtaining their classroom materials. These “value shoppers” are willing to go through the trouble of comparison shopping and searching for used books, the historic value proposition for the Debtors’ off-campus stores.

Given the difference between the Debtors’ on- and off-campus shoppers, the competitive environment for the Debtors’ off-campus stores has made it more difficult to maintain market share, which is reflected in the declining performance of the Debtors’ off-campus stores. The Debtors’ believe that the attrition of their off-campus stores’ performance is due to a combination of on-line textbook sales and rental programs and two on-campus rental programs, which have been successful in attracting “value shoppers,” the Debtors’ primary customers in the off-campus stores.

In response to this trend, the Debtors expended significant efforts to, among other things, improve the off-campus stores’ online capabilities to both sell and acquire textbooks, improving the look and feel of these off-campus stores, and aggressively manage labor and other controllable costs. Despite those improvements, the Debtors’ off-campus store performance continued to suffer. Specifically, the Debtors’ EBITDA for their off-campus stores peaked in 2008 at approximately $36 million, declined to approximately $31 million in 2009, and eventually fell to $19 million in the year ending March 31, 2011.

After further analyzing market trends, the Debtors’ determined that student demand for textbook rental had increased significantly, and implemented extensive rental programs at all their brick-and-mortar stores, especially the Debtors’ off-campus locations. The Debtors’ off-campus stores historically have had large numbers of used textbooks to price aggressively and make the value proposition once again attractive to the value shopper. As discussed above, the Debtors’ “Rent Every Book” model has shown significant promise and the Debtors were optimistic that their off-campus stores could rebound as a result. However, the Debtors’ require additional time to fully establish the rental model during several more “back to school” periods.

Unfortunately, the Debtors did not have sufficient time to fully implement the rental model without refinancing significant portions of their capital structure given (a) the imminent maturities of the ABL Facility in September 2011 and the Senior Secured Notes Indenture in December 2011, and (b) the change in credit terms from the new textbook publishers, who were expected to require shorter credit terms including up front payment for the large purchases that began in July and August 2011 due to the uncertainty surrounding the Debtors’ refinancing efforts and capital structure.

| B. | Prepetition Negotiations. |

In late 2010, the Debtors recognized that, given their seasonal spending to acquire books during July and August 2011 and the imminent maturity of approximately $478 million of debt shortly thereafter, they faced an impending liquidity crisis. In response, the Debtors proactively undertook extensive efforts to position themselves for ongoing success in the current industry environment and right-size their capital structure. Initially, the Debtors’ implemented a number of operational initiatives to improve earnings and their competitiveness, including cutting certain labor costs that ultimately will save the Debtors’ approximately $6 million over the next 12 months. In addition, the Debtors engaged a third-party operational consulting firm to analyze the Debtors’ business practices and help implement inventory optimization models. While these efforts will streamline the Debtors’ business operations, they cannot alone prevent a liquidity shortfall.

14

To address the Debtors’ imminent liquidity issue, the Debtors engaged an investment banker, Rothschild Inc. (“Rothschild”) and restructuring legal counsel, Kirkland & Ellis LLP (“Kirkland”) to potentially refinance certain of their debt obligations and, if necessary, engage creditors and other potential partners for a restructuring transaction. Beginning in January 2011, the Debtors and their advisors began an extensive review of strategic alternatives available in light of the Debtors’ current operating environment and leverage constraints. The Debtors focused their initial efforts on refinancing all of the 8.625% Notes debt obligations and seeking to extend the maturity of the AcqCo Notes. However, lender demand was insufficient to support a refinancing transaction.

Shortly after it became clear that an 8.625% refinancing transaction was not available, the Debtors and their advisors began discussing the preliminary terms of a potential balance sheet restructuring with their major stakeholders, including with certain holders of the 8.625% and AcqCo Notes and their respective advisors. Upon execution of customary confidentiality agreements, the Debtors provided parties with information regarding the Debtors’ operations, projections, and business plan to facilitate their ability to develop a potential restructuring plan or to otherwise constructively participate in the process.

| C. | The Debtors Negotiate a Prearranged Chapter 11 Plan. |

After good-faith, arm’s-length negotiations, the Debtors reached an agreement with Holders of an aggregate amount of over 95% of the 8.625% Notes and Holders of over 75% of the AcqCo Notes (such Holders, collectively, the “Plan Support Parties”) with respect to a consensual restructuring on the terms set forth in the Joint Plan of Reorganization of Nebraska Book Company Inc., et al., Pursuant to Chapter 11 of the Bankruptcy Code [Docket No. 134], filed on July 17, 2011, amended on August 22, 2011 [Docket No. 456] (as amended, the “First Amended Plan”), and formalized by the Restructuring and Support Agreement (the “RSA”), dated June 26, 2011.

The Debtors received an executed RSA from holders of (1) over 95% of the 8.625% Notes, and (2) more than 75% of the AcqCo Notes that contemplates a comprehensive reorganization through a pre-arranged plan of reorganization. In conjunction with the First Amended Plan, the Debtors obtained commitments for a $200 million debtor-in-possession financing, $75 million of which is a revolving loan and $125 million of which is a term loan. This financing, together with cash on hand, has enabled the Debtors to fund the administration of these cases and pay off the remaining indebtedness under the ABL Facility.

| D. | The Debtors Commence the Chapter 11 Cases. |

The Debtors filed the Chapter 11 Cases to effectuate the terms of the RSA and the First Amended Plan. Based on the RSA, the Debtors were prepared to seek confirmation of the First Amended Plan as soon as possible after the Petition Date. Indeed, because the First Amended Plan was based on a consensual deal with the Debtors’ key stakeholders and contemplated a significant de-leveraging of the Debtors’ balance sheets and a full recovery for Holders of Allowed General Unsecured Claims, confirmation of the First Amended Plan was expected to occur over a relatively short timeframe.

IV. Events Since Commencement of the Chapter 11 Cases.

| A. | The Debtors’ Initial Motions in the Chapter 11 Cases and Certain Related Relief. |

In order to minimize disruption to the Debtors’ operations and effectuate the terms of the Plan, the Debtors obtained certain relief, including the relief summarized below.

15

(i) Motion for Authority to Use DIP Financing.

The Debtors filed the Motion of the Debtors for Entry of Interim and Final Orders (A) Authorizing the Debtors to Obtain Postpetition Financing and Letters of Credit, (B) Authorizing the Debtors to Use Cash Collateral, (C) Granting Adequate Protection to Prepetition Secured Lenders and Approving the Adequate Protection Stipulation, and (D) Scheduling a Final Order [Docket No. 12] (the “DIP/ Cash Collateral Motion”) requesting (1) authority to obtain postpetition loans in a principal amount not to exceed $125 million on an interim basis, and $200 million on a final basis, consisting of a $75 million revolving loan and a $125 million term loan (collectively, the “DIP Facility”). In addition, the Debtors requested that the Bankruptcy Court grant adequate protection to certain prepetition secured lenders for priming of their existing liens on the prepetition collateral.

On June 28, 2011, the Bankruptcy Court entered the order (the “Interim DIP Order”) [Docket No. 56] authorizing the Debtors to obtain postpetition financing up to $125 million in term loans under the DIP Agreement on a superpriority, priming lien basis and use cash collateral pursuant to sections 363 and 364 of the Bankruptcy Code on an interim basis and approving an adequate protection package for certain of the Debtors’ prepetition secured lenders. The Interim DIP Order provides that the Debtors shall use the proceeds of the DIP Facility to pay interest, fees, and expenses in connection with the DIP Loans (as defined in the Interim DIP Order) and to repay not less than $26,300,000 in loans made and $3,733,597 in letters of credit issued and outstanding under the ABL Facility. Pursuant to the Interim DIP Order and the terms of a separate adequate protection stipulation with an ad hoc group of Holders of Senior Secured Notes, the Bankruptcy Court granted adequate protection to the Holders of Senior Secured Notes for the priming of their existing liens on the Prepetition Collateral (as defined in the Interim DIP Order). On July 21, 2011, the Bankruptcy Court entered the Final DIP Order [Docket No. 195] authorizing the Debtors to obtain $200 million in postpetition financing consisting of $125 million of term loans and $75 million of revolving loans and letters of credit. The Final DIP Order also authorizes the Debtors to use Cash Collateral (as defined in the Final DIP Order).

(ii) Motion to Pay Employee Wages and Associated Compensation.

The Debtors filed the Motion of the Debtors for Entry of An Order Authorizing the Payment of Prepetition (A) Wages, Salaries, and Other Compensation, (B) Reimbursable Employee Expenses, And (C) Employee Medical And Similar Benefits [Docket No. 10] (the “Wages Motion”). Among other things, the Debtors requested authority in the Wages Motion to implement a retention program for certain of the Debtors’ non-insider employees (the “Non-Insider Employee Retention Program”) to ensure the Debtors retain the services of their most critical non-insider employees (collectively, the “Critical Employees”). Pursuant to the Non-Insider Employee Retention Program, 50 Critical Employees are entitled to receive additional compensation in the aggregate amount up to $500,000. No individual Critical Employee will receive a payment totaling more than 15% of his or her base salary under the Non-Insider Employee Retention Program. On June 28, 2011, the Bankruptcy Court entered an interim order [Docket No. 50] authorizing the Debtors to honor their wage and benefit obligations (except the Non-Insider Employee Retention Program) in accordance with their stated policies and in the ordinary course of their businesses. On July 21, 2011, the Bankruptcy Court entered a final order [Docket No. 202] authorizing the Debtors to honor their wage and benefit obligations, including the Non-Insider Employee Retention Program.

16

(iii) Motion to Pay Taxes and Fees.

The Debtors filed a Motion of the Debtors for the Entry of An Order Authorizing The Debtors to Pay Certain Prepetition Taxes and Fees and Granting Related Relief [Docket No. 8]. On June 28, 2011, the Bankruptcy Court entered the order [Docket No. 55] authorizing, but not directing the Debtors, to pay certain taxes and fees that in the ordinary course of business accrued or arose before the Petition Date.

(iv) Motion to Prohibit Utilities from Terminating Service.

The Debtors filed a Motion of the Debtors for Entry of Interim and Final Orders Determining Adequate Assurance of Payment for Future Utility Services [Docket No. 5]. On June 28, 2011, the Bankruptcy Court entered an interim order [Docket No. 67] setting a final hearing to approve, among other things, the Debtors’ proposed adequate assurance of payment for future service to the utility providers and procedures governing any requests for additional or different adequate assurance, and prohibiting the utility providers from altering, refusing, or discontinuing utility services on account of any unpaid prepetition charges. On July 21, 2011, the Bankruptcy Court entered a final order (the “Final Utilities Order”) [Docket No. 194] authorizing the Debtors’ adequate assurance of payment for future service to utility providers and the procedures related thereto.

(v) Motion to Honor Customer Programs.

The Debtors filed a Motion of the Debtors for Entry of an Order Authorizing the Debtors to Maintain and Administer Customer Programs and Honor Prepetition Obligations Related Thereto (the “Customer Programs Motion”) [Docket No. 7]. On June 28, 2011, the Bankruptcy Court entered a final order [Docket No. 51] authorizing, but not directing, the Debtors to honor and continue certain prepetition customer programs in the ordinary course of business. On July 26, 2011, the Bankruptcy Court entered an amended final order (the “Amended Final Order”) [Docket No. 227] authorizing the Debtors to pay claims owed to Customers (as defined in the Amended Final Order) not to exceed $23.09 million, which included an additional $1.2 million on account of certain commissions not originally sought in the Customer Programs Motion.

(vi) Motion to Pay Shippers, Warehousemen, and Materialmen.

The Debtors filed a Motion of the Debtors for Entry of an Order (A) Authorizing the Debtors to Grant Administrative Expense Priority to All Undisputed Obligations for Goods Ordered Prepetition and Delivered Postpetition and Satisfy Such Obligations in the Ordinary Course of Business and (B) Authorizing, But Not Directing, the Debtors to Pay Prepetition Claims of Shippers, Warehousemen, and Materialmen [Docket No. 9]. On June 28, 2011, the Bankruptcy Court entered a final order [Docket No. 52] (i) granting administrative expense priority status in accordance with section 503(b) of the Bankruptcy Code to certain outstanding orders; and (ii) authorizing, but not directing, the Debtors to pay prepetition amounts owed to shippers, warehousemen, and materialmen.

(vii) Motion to Pay Critical Vendors.

The Debtors filed a Motion of the Debtors for Entry of Interim and Final Orders Authorizing Payment of (A) Prepetition Critical Vendors Claims and (B) Section 503(b)(9) Claims [Docket No. 6]. On June 28, 2011, the Bankruptcy Court entered an interim order [Docket No. 53] authorizing the Debtors to pay, in the ordinary course of business, prepetition claims held by (i) certain critical trade vendors that are essential to the Debtors ongoing business operations, and (ii) prepetition claims entitled to administrative priority under section 503(b)(9) of the Bankruptcy Code. On July 21, 2011, the Bankruptcy Court entered a final order (the “Critical Vendors Order”) [Docket No. 203] authorizing the Debtors to, among other things, pay (i) Section 503(b)(9) Claims (as defined in the Critical Vendors Order) not to exceed $7.44 million, (ii) Critical Vendor Claims (as defined in the Critical Vendors Order) not to exceed $13.35 million.

17

(viii) Motion to Execute and Implement the Plan Support Agreement.

On August 22, 2011, the Debtors filed a Motion For an Order Authorizing Execution and Implementation of Plan Support Agreement [Docket No. 462]. After extensive negotiations between the Debtors, the 8.625% Noteholders, the AcqCo Noteholders, and Weston Presidio, the parties reached an agreement memorialized in that certain plan support agreement dated August 22, 2011 (the “Plan Support Agreement”). In exchange for Weston Presidio’s support of the First Amended Plan, the Debtors have agreed to provide an enhanced package of New Warrants as more fully described in Art. IV.F.5.

(ix) Other Related Relief.

In addition, the Debtors filed motions seeking certain other relief, all of which were granted after a hearing in the Bankruptcy Court, including: (i) an order [Docket No. 40] directing the joint administration of the eight chapter 11 cases under a single docket, Case Number 11-12005 (PJW); and (ii) an order [Docket No. 44] authorizing the Debtors to continue to use their existing cash management system and maintain existing bank accounts and business forms.

| B. | The Debtors Chief Financial Officer. |

On August 31, 2011, Mr. Alan G. Siemek resigned from his position as the Debtors chief financial officer (“CFO”). Mr. Siemek continues to serve as the Vice President, a position he has held since 2001. The Debtors immediately began their search for a qualified replacement, with the help of a national executive search firm and actively considered several qualified candidates for the vacant CFO position. After extensive discussions and deliberation, the Debtors requested authority from the Bankruptcy Court to hire Ms. Alexi A. Wellman as their new CFO. On October 31, 2011, the Bankruptcy Court entered the Order Authorizing the Debtors to Enter into an Employment Agreement with the Permanent Chief Financial Officer to the Debtors [Docket No. 695]. On December 19, 2011, Ms. Wellman became the Debtors’ CFO.

| C. | The Debtors File the Original Plan and Disclosure Statement. |

The Debtors filed the disclosure statement related to the First Amended Plan on July 17, 2011 [Docket Nos. 135, 458] (as amended, the “First Amended Disclosure Statement”), less than one month after the Petition Date. The Bankruptcy Court held a hearing to approve the First Amended Disclosure Statement on August 22, 2011, and entered an order approving the First Amended Disclosure Statement on August 23, 2011 [Docket No. 472]. Subsequently, the Debtors, working with their notice, claims, and balloting agent, Kurtzman Carson Consultants, LLC began soliciting votes to accept or reject the First Amended Plan. The Debtors also negotiated a plan support agreement with their prepetition equity holders, which the Bankruptcy Court approved on September 7, 2011 [Docket No. 557].

The First Amended Plan was predicated on $250 million in exit financing (the “Exit Financing”). The Debtors and their advisors worked diligently to secure the necessary Exit Financing. Unfortunately, various macroeconomic indicators disrupted the capital markets and made the Exit Financing impossible to obtain, prohibiting the Debtors from confirming the First Amended Plan on the short timeframe originally contemplated. In addition, the Debtors Fall 2011 rush results fell short of expectations, further impending the Debtors efforts to obtain Exit Financing and requiring the Debtors to take more time to re-evaluate their business plan. As such, the Debtors adjourned the hearing on confirmation of the First Amended Plan multiple times, eventually delaying confirmation to March 22, 2012.

18

| D. | The Debtors Obtain an Extension of the Exclusivity Periods and the RSA Deadlines. |

To ensure that the Debtors would be the only party allowed by the Bankruptcy Court to file and solicit votes on any potential plan of reorganization, the Debtors requested an extension of the Debtors’ exclusive periods to file and solicit acceptances of a chapter 11 plan. On October 18, 2011, the Bankruptcy Court extended the Debtors’ exclusive filing period to January 23, 2012, and the exclusive solicitation period to March 23, 2012. On February 12, 2012, the Bankruptcy Court further extended the Debtors’ exclusive filing period to April 23, 2012, and the exclusive solicitation period to June 21, 2012 [Docket No. 938].

To facilitate continued plan negotiations with their key stakeholders, the Debtors also negotiated two separate amendments to the RSA, among the Debtors and the Plan Support Parties. The Debtors and the Plan Support Parties first negotiated an amendment to the RSA in early November 2011, extending, among other RSA milestones, the deadline for the Debtors to complete their restructuring from November 3, 2011, to December 23, 2011. The Debtors then negotiated an agreement in principle for a second amendment to the RSA to extend, among other RSA milestones, the December 23, 2011 deadline for the Debtors to complete their restructuring to March 30, 2012.

| E. | The Debtors Re-evaluate Their Business Plan and Rationalize Their Off-Campus Portfolio. |

In October and November 2011, the Debtors received and began analyzing the financial results from the Fall back-to-school rush period and the results from the consumer surveys they had conducted to detect the latest trends in textbook buyer behavior. On one hand, the results showed that on-campus store operations experienced only a minor decline year over year in EBITDA (from $13.6 million to $13.5 million) for the six-month period ending September 30, 2011. On the other hand, off-campus stores experienced an almost 35% decline year-over-year in EBITDA for the same six-month period (from $20.4 million to $13.4 million). As a result, the Debtors assessed their proposed post-chapter 11 capital structure and concluded that they needed to reevaluate their business plan to adapt to recent trends in the textbook industry, including the apparent decline in students’ usage of off-campus stores, and the evolving state of the capital markets.

The Debtors undertook a store-by-store analysis of their portfolio of approximately 290 store locations to determine the long-term profitability of their on- and off-campus stores. After careful examination and consultation with their advisors and various creditor constituencies, the Debtors decided to use the tools available in chapter 11 to close certain of their unprofitable off-campus stores. To that end, the Debtors received Court authority to: (a) reject seven of their off-campus store leases, which will result in approximately $1 million in savings for the Debtors; and (b) moved to assume approximately 90 of their off-campus store leases related to the Debtors’ most profitable store locations [Docket No. 870]. The Debtors obtained consensual extensions of the deadlines to assume or reject the underlying lease for 45 additional off-campus store locations. After analyzing these stores’ performances in the Spring rush period, contemporaneously herewith the Debtors have filed the Motion for Entry of an Order Authorizing the Debtors to Reject Certain Unexpired Leases and Ancillary Contracts Effective as of March 31, 2012, seeking Bankruptcy Court authority to reject 39 unexpired leases and 33 ancillary contracts in connection with the closure of 38 off-campus stores. The Debtors will continue to analyze the remaining off-campus store leases and make final decisions on whether to assume or reject these off-campus store leases.

| F. | The Debtors Amend the DIP Facility. |

Having completed their store-by-store analysis, the Debtors also finalized their revised business plan and updated their valuation and debt capacity analyses. In light of their revised projections, the Debtors anticipated being unable to comply with the minimum cumulative EBITDA requirements under

19

their existing DIP Facility for the months of November and December, 2011, as well as January through June, 2012. The Debtors, therefore, engaged their DIP lenders in a week of intense negotiations, and, on December 20, 2011, the Debtors reached an agreement with the requisite threshold of DIP lenders on the terms of modified financial covenants under the DIP Agreement. The Court entered an order approving the proposed DIP amendment on December 28, 2011 [Docket No. 827].

| G. | The Debtors Formulate an Amended Plan of Reorganization. |

The combination of the Debtors’ revised business plan and inability to obtain sufficient exit financing from uncertain capital markets caused the Debtors to consider amendments to the First Amended Plan. To keep their key stakeholders informed regarding the Debtors’ business and strategy for emerging from chapter 11, the Debtors organized an in-person meeting in early December 2011 with financial and legal advisors for (a) the Senior Secured Ad Hoc Group, (b) the Ad Hoc 8.625% Noteholders, (c) the JPMorgan Noteholders, and (d) the Committee. At this meeting, the parties discussed the Debtors’ Fall rush period financial results, the Debtors’ business plan, certain forward-looking financial projections, and preliminary revised views on valuation and debt capacity.

In early January 2012, the Debtors circulated a term sheet for an amended plan of reorganization to financial and legal advisors for the Senior Secured Ad Hoc Group, the Ad Hoc 8.625% Noteholders, the JPMorgan Noteholders, and the Committee. The term sheet proposed a structure similar to that of the Plan, under which value is distributed to the Debtors’ creditors in accordance with the absolute priority rule, while also permitting the Debtors to raise additional capital, through new debt or a rights offering, to satisfy obligations under the Senior Secured Notes.

After circulating the term sheet, the Debtors continued to communicate with the Senior Secured Ad Hoc Group, the Ad Hoc 8.625% Noteholders, and the JPMorgan Noteholders toward their goal of a fully consensual plan. On January 12, 2012, the Debtors met with certain members of the Senior Secured Ad Hoc Group, the Ad Hoc 8.625% Noteholders, and the JPMorgan Noteholders, as well as both groups’ financial and legal advisors, to discuss potential emergence strategies and provide additional public information regarding the Debtors’ business and financial performance. Thereafter, during the week of January 16, 2012, certain members of the Senior Secured Ad Hoc Group and the JPMorgan Noteholders signed confidentiality agreements with the Debtors, restricting their ability to trade the Debtors’ securities, and gained access to an online dataroom containing financial forecasts and other material non-public information that assisted in evaluating the Plan. In late January 2012, the Debtors also negotiated and executed confidentiality agreements with (a) certain of the 8.625% Noteholders and (b) certain of the AcqCo Noteholders.

Since executing these confidentiality agreements, the Debtors and the Senior Secured Ad Hoc Group have engaged in over a month of good faith negotiations for a revised plan of reorganization. As part of the negotiation process, the parties organized a face-to-face meeting on February 15, 2012, and negotiated six extensions to these confidentiality agreements to provide the Debtors and certain holders of the Senior Secured Notes (the “Consenting Noteholders”) with additional time to reach a mutually acceptable framework for an amended plan of reorganization.

On February 24, 2012, the Debtors and the Consenting Noteholders reached an agreement in principle on the terms of the Plan. The Plan provides, among other things, that 100% of the equity in the reorganized Debtors, subject to dilution from a Management Equity Incentive Plan, and $100 million of New Second Lien Take-Back Notes, will be distributed on a pro rata basis to existing holders of Senior Secured Notes. In addition, as part of the Plan, the Debtors will also receive $80 million in the form of a New Money First Lien Term Loan, fully backstopped (the “Backstop Commitment”) by and among the Debtors and a subset of the Consenting Noteholders (the “Backstop Participants”), including one of the largest Consenting Noteholders in dollar amount. As consideration for the Backstop Commitment, the Debtors will seek Bankruptcy Court authority to pay the Backstop Participants the following:

| • | a commitment fee of 1% per month on the total face value of the Backstop Commitment for each month that the Backstop Commitment is outstanding, until funding (the “Commitment Fee”); |

20

| • | a funding fee of 1% of the aggregate funded amount of the Backstop Commitment (the “Funding Fee”); and |

| • | the reasonable fees, costs, expenses, disbursements, and charges of the Backstop Participants, relating to the exploration and discussion of the Backstop Commitment and/or to the preparation and negotiation of this Backstop Commitment Agreement, the Term Sheet, and the proposed documentation and transactions contemplated thereby. |

The Debtors and the Consenting Noteholders also filed the Debtors’ Motion for an Order Authorizing Execution and Implementation of a Plan Support Agreement (the “PSA Motion”) seeking authority to execute the Plan Support Agreement on March 7, 2012. The Plan Support Agreement memorializes the Consenting Noteholders’ commitment to support the Plan and enabling the Debtors to move expeditiously towards confirmation and consummation of the Plan with the support of a key constituency. In addition, the Debtors are currently negotiating a backstop agreement by and among the Debtors and the Backstop Participants, which will memorialize the Backstop Participants’ commitment to fund the $80 million New Money First Lien Term Loan, an essential component of the Plan.

V. Treatment of Claims and Interests Under the Plan.

| A. | Substantive Consolidation. |

The Plan shall serve as a motion by the Debtors seeking entry of a Bankruptcy Court order substantively consolidating all of the Estates and its subsidiaries into a single consolidated Estate for all purposes associated with Confirmation and Consummation.

If substantive consolidation of all of the Estates is ordered, then on and after the Effective Date, all assets and liabilities of the Debtors shall be treated as though they were merged into the Estate of NBC for all purposes associated with Confirmation and Consummation, and all guarantees by any Debtor of the obligations of any other Debtor shall be eliminated so that any Claim and any guarantee thereof by any other Debtor, as well as any joint and several liability of any Debtor with respect to any other Debtor shall be treated as one collective obligation of the Debtors. Substantive consolidation shall not affect the legal and organizational structure of the Reorganized Debtors’ Entities or their separate corporate existences or any prepetition or postpetition guarantees, Liens, or security interests that are required to be maintained under the Bankruptcy Code, under the Plan, any contract, instrument, or other agreement or document pursuant to the Plan (including the New ABL Facility, New Money First Lien Term Loan, New Take-Back Notes, New Warrants, Registration Rights Agreement, or Shareholders Agreement, or the identity of the New Board and management), or, in connection with contracts or leases that were assumed or entered into during the Chapter 11 Cases. Furthermore, creditor recoveries will not be adversely affected by substantive consolidation of the Debtors’ estates. Any alleged defaults under any applicable agreement with the Debtors, the Reorganized Debtors, or their Affiliates arising from substantive consolidation under the Plan shall be deemed cured as of the Effective Date.

Notwithstanding the substantive consolidation provided for in the Plan, nothing shall affect the obligation of each and every Debtor to pay quarterly fees to the Office of the United States Trustee pursuant to 28 U.S.C. § 1930 until such time as a particular case is closed, dismissed, or converted.

21

| B. | Asserted and Scheduled Claims. |

Claims and Interests, except for Administrative Claims and Priority Tax Claims, are classified in the Classes set forth in Article III of the Plan. A Claim or Interest is classified in a particular Class only to the extent that the Claim or Interest qualifies within the description of that Class and is classified in other Classes to the extent that any portion of the Claim or Interest qualifies within the description of such other Classes. A Claim or Interest also is classified in a particular Class for the purpose of receiving distributions pursuant to the Plan only to the extent that such Claim is an Allowed Claim in that Class and has not been paid, released, or otherwise satisfied prior to the Effective Date.

Distributions under the Plan will be made only to Holders of Allowed Claims or Allowed Interests. As more fully described in Articles VI and VII of the Plan, Holders of Disputed Claims or Disputed Interests will receive no distributions unless and until their Claims or Interests become Allowed.

Pursuant to the terms of the Plan, except for Claims or Interests that are (1) expressly exempted from the discharge provisions of the Bankruptcy Code or (2) specifically identified as being reinstated, all Claims or Interests that arose prior to Confirmation will be discharged.

| C. | Administrative Claims. |

In accordance with section 1123(a)(1) of the Bankruptcy Code, Administrative Claims and Priority Tax Claims have not been classified and, thus, are excluded from the Classes of Claims and Interests set forth in Article II of the Plan.

Except as specified in Article II of the Plan, unless otherwise agreed to by the Holder of a General Administrative Claim and the Debtors or the Reorganized Debtors, as applicable, each Holder of an Allowed General Administrative Claim will receive, in full satisfaction of its General Administrative Claim, Cash equal to the amount of such Allowed General Administrative Claim either: (1) on the Effective Date; (2) if the General Administrative Claim is not Allowed as of the Effective Date, 30 days after the date on which an order allowing such General Administrative Claim becomes a Final Order, or as soon thereafter as reasonably practicable; or (3) if the Allowed General Administrative Claims are based on liabilities incurred by the Debtors in the ordinary course of their business during the Postpetition Period, pursuant to the terms and conditions of the particular transaction giving rise to such Allowed General Administrative Claims, without any further action by the Holders of such Allowed General Administrative Claims. All fees and disbursements payable under the Stipulation shall be paid in accordance with the terms thereof.

| D. | Professional Compensation. |

(i) Final Fee Applications.