Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Elevance Renewable Sciences, Inc. | d231495dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 9, 2012

No. 333-176933

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Elevance Renewable Sciences, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2860 | 26-1340859 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2501 Davey Road

Woodridge, Illinois 60517

(866) 625-7103

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

K’Lynne Johnson

Chief Executive Officer

Elevance Renewable Sciences, Inc.

2501 W. Davey Road

Woodridge, Illinois 60440

(866) 625-7103

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| R. Henry Kleeman Christopher P. Bennett Kirkland & Ellis LLP 300 North LaSalle Chicago, Illinois 60654 (312) 862-2000 |

Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer |

¨ |

Accelerated filer | ¨ | |||||

| Non-accelerated filer |

þ |

(Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(2)(3) | ||

| Common Stock, $0.0001 par value per share |

$100,000,000 | $11,610 | ||

|

| ||||

|

| ||||

| (1) | Includes the offering price of shares of common stock that may be sold if the over-allotment option granted by us to the underwriters is exercised. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (3) | Previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer and sale is not permitted.

PROSPECTUS (Subject to completion)

Issued March 9, 2012

Shares

COMMON STOCK

Elevance Renewable Sciences, Inc. is offering shares of its common stock. This is our initial public offering and no public market exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share.

We have applied for listing of our common stock on The NASDAQ Global Market under the symbol “ERSI.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 11.

PRICE $ A SHARE

| Price to |

Underwriting and |

Proceeds to Elevance, | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

We have granted the underwriters a 30-day option to purchase up to additional shares of common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2012.

| MORGAN STANLEY | J.P. MORGAN | JEFFERIES |

| PIPER JAFFRAY | RAYMOND JAMES |

, 2012

Table of Contents

We and the underwriters have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States. The information in this prospectus or a free writing prospectus is accurate as of the date of this prospectus or the applicable free writing prospectus, as the case may be, or as of the date or dates that are specified in those documents. Our business, financial condition, results of operations and prospects may have changed since those dates. We will update this prospectus as required by law.

Until , 2012 (25 days after the commencement of this offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

Table of Contents

This prospectus includes our trademarks and service marks such as “Elevance,” “Elevance Renewable Sciences” and “NatureWax” which are protected under applicable intellectual property laws and are the property of Elevance Renewable Sciences, Inc. or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read this summary together with the entire prospectus, including the more detailed information regarding our company, the common stock being sold in this offering and our consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus. You should carefully consider, among other things, our consolidated financial statements and the related notes thereto included elsewhere in this prospectus and the matters discussed in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus before deciding to invest in our common stock. Some of the statements in this summary constitute forward-looking statements, with respect to which you should review the section of this prospectus entitled “Forward-Looking Statements.” Except where the context otherwise requires or where otherwise indicated, the terms “ERS,” “we,” “us,” “our,” “our company” and “our business” refer to Elevance Renewable Sciences, Inc., together with its consolidated subsidiaries as a combined entity.

ELEVANCE RENEWABLE SCIENCES, INC.

Company Overview

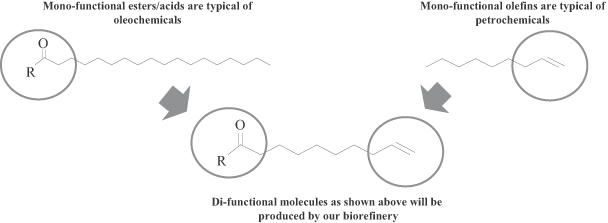

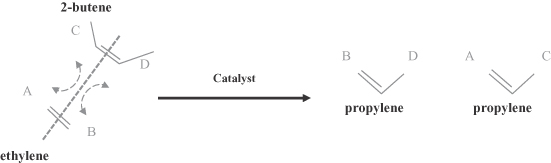

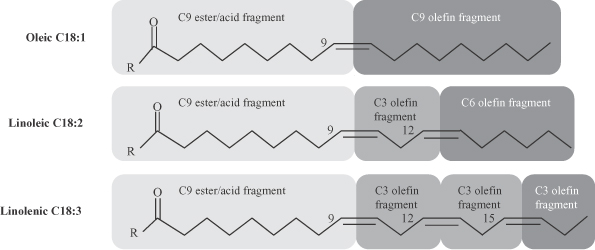

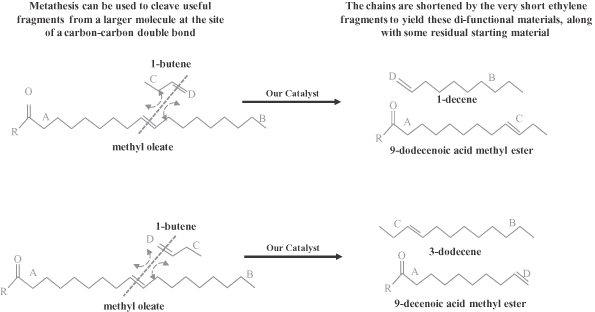

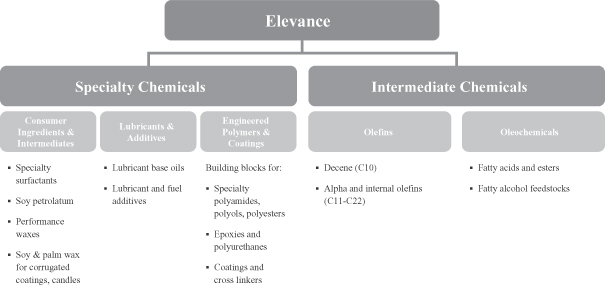

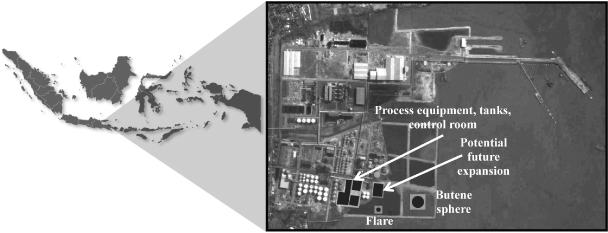

We produce high performance specialty chemicals and intermediate chemicals from renewable natural oils. The specialty chemicals that we currently produce and intend to produce address a potential market size that we estimate to be $176 billion. We produce these chemicals using our proprietary, low-cost, capital efficient production process, which utilizes Nobel Prize-winning innovations in metathesis catalysis. Our process uses a highly efficient and selective metathesis catalyst to break down the complex molecules found in natural oils and recombine the fragments to produce high value chemicals. We can produce these chemicals at lower cost and with lower capital investment than conventional processes positioning us to deliver attractive returns on capital. We are building what we believe will be the world’s largest integrated biorefinery in Gresik, Indonesia, as part of a 50/50 joint venture with Wilmar International Limited, the largest global processor and merchandiser of palm, palm kernel and coconut oils. We plan to begin commercial operations at this facility by the second quarter of 2012. We are also repurposing an existing facility in Natchez, Mississippi into an integrated biorefinery. We expect construction of our first two facilities to cost $215 to $535 per metric tonne ($0.10 to $0.25 per pound) of annual production capacity compared to $920 to $2,300 per metric tonne ($0.42 to $1.04 per pound) of annual production capacity for conventional facilities. We have established strategic partnerships with market leaders to accelerate the commercialization and rapid deployment of our technology.

Our specialty chemicals have unique and desirable functional attributes previously unavailable in the marketplace. We believe these products will be key performance ingredients and building blocks used in large end markets including detergents, lubricants, personal care products, coatings and plastics. Our intermediate chemicals, namely olefins and oleochemicals, can directly replace critical molecules in large, attractive markets. We expect that prevailing market dynamics, such as the desire for new and increasingly demanding performance characteristics, changing regulatory requirements and structural supply shortages will support rapid adoption of our specialty chemicals and market penetration of our intermediate chemicals. We are in discussions with existing partners and potential new customers for long-term purchasing or offtake agreements for the entirety of our projected 2013 production.

1

Table of Contents

Our Manufacturing Plan

We expect to have three world-scale facilities across three continents by the end of 2014, with combined annual production capacity of approximately one million metric tonnes (2.2 billion pounds). We have entered into the 50/50 joint venture (the “Wilmar JV”) with a subsidiary of Wilmar International Limited (“Wilmar”) to build an integrated biorefinery in Gresik, Indonesia (the “Indonesia facility”), our first world-scale biorefinery. The Indonesia facility, at a total construction cost of approximately $40 million, is fully funded and currently under construction. The Indonesia facility will have an annual production capacity of 185,000 metric tonnes (400 million pounds), with an option to expand the annual production capacity to 370,000 metric tonnes (810 million pounds). We plan to be operating a 280,000 metric tonne (610 million pound) biorefinery in Natchez, Mississippi (the “Mississippi facility”) in the second half of 2013 at a site we have acquired. By the end of 2014, we expect to be operating an additional world-scale facility in South America. We plan to rapidly deploy our technology using a combination of modular facility design and repurposing of or integration into existing industrial sites. All of our products are currently manufactured using tolling facilities, which are facilities owned and operated by third parties with whom we contract for such production. We have produced our chemicals at commercial scale through multiple production campaigns ranging in size from 23 metric tonnes (50,000 pounds) to 450 metric tonnes (one million pounds), including two production campaigns that utilized our proprietary biorefinery process, the first of which was completed in November 2010. Our use of tolling facilities has enabled us to validate the target cost of production for our biorefineries because these tolling facilities are similar in size and have similar process conditions as the commercial scale facilities we are designing and constructing. We plan to continue to use tolling facilities to a limited extent after we complete construction of our biorefineries.

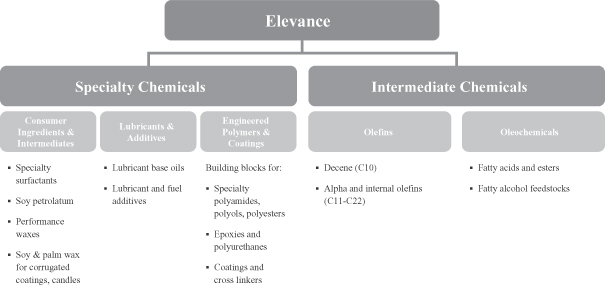

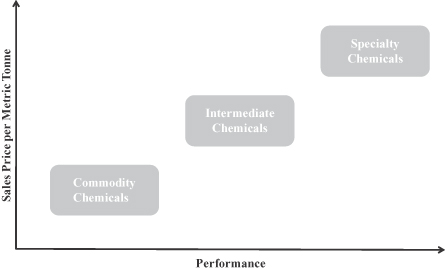

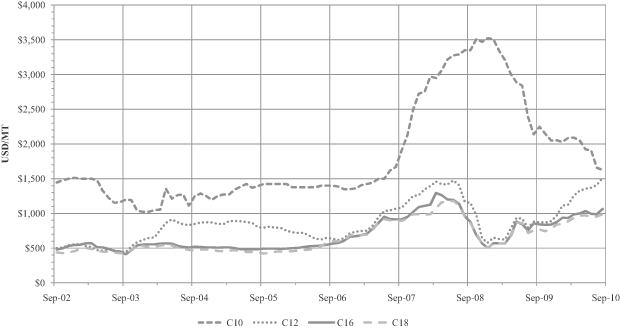

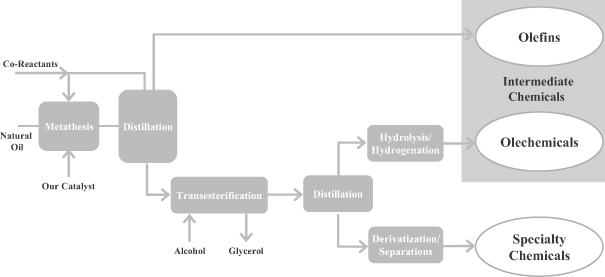

Our Product Portfolio

Our products will include both specialty chemicals and intermediate chemicals. Our novel di-functional specialty chemicals enable the development of products that are both innovative and high value. Our customers are encouraged by our ability to produce specialty chemicals that allow them to manufacture products with enhanced functional attributes that can be sold at competitive prices. Our intermediate chemicals, which include olefins and oleochemicals, will be direct replacements for both olefins and oleochemicals produced using conventional processes. The following chart sets forth our intended product portfolio.

2

Table of Contents

To date, our revenues have been primarily derived from product sales in the performance waxes and candles markets and in the personal care markets, which utilize our specialty chemicals. The sales into these markets constituted approximately 91% and 96% of our revenue in the nine months ended September 30, 2011 and 2010, respectively.

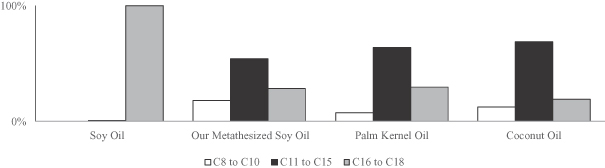

Our Feedstocks

Our primary feedstocks will include palm, soy and rapeseed oils, all of which we have used in our pilot plant to produce an array of specialty chemicals and intermediate chemicals. These natural oils are available in liquid form in industrial quantities from a variety of geographic regions. These characteristics allow for low-cost transportation and storage compared to other renewable feedstocks such as industrial sugars, biomass and waste. Our ability to adjust our inputs in real time allows us to take advantage of changes in feedstock prices and product demand. We have used multiple natural oils to produce our products to date. Palm oil was used in commercial-scale toll production runs mirroring our biorefinery process. Soy oil has been used in multiple toll production runs using our metathesis process to produce material for cosmetics, polymer modification and industrial applications. Canola and mustard oils have been used to produce products in our pilot plant. We have also tested other oils at lab scale including algae, camelina, pennycress, jatropha and waste oils.

Our Partnerships

Our collaborative business model is designed to accelerate the commercialization and rapid deployment of our technology. We have established strategic partnerships with market leaders in the specialty chemical and intermediate chemical value chains, including: Cargill, Incorporated, one of the world’s largest agribusinesses (“Cargill”); Clariant International AG, a leading global specialty chemicals company (“Clariant”); Dow Corning Corporation, a global leader in silicone-based technology and innovation (“Dow Corning”); Royal DSM N.V., a global science-based company (“DSM”); Stepan Company, a leading producer of surfactants (“Stepan”); and Wilmar. These partners provide us with sales and marketing expertise, established distribution channels, technical know-how, product and application development expertise and manufacturing infrastructure.

Our Industry

We develop applications that will go into several large segments of the specialty chemical industry. Our primary target markets in the specialty chemical industry include surfactants, lubricants and additives and polymers. In addition, our manufacturing platform will produce two key categories of intermediate chemicals: olefins and oleochemicals.

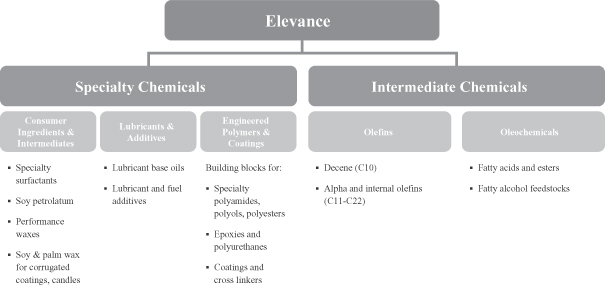

Specialty Chemicals

We believe the size of the global specialty chemical industry was approximately $706 billion in 2010. Specialty chemicals are sold based on the additional value their unique and tailored performance characteristics deliver versus intermediate chemicals or commodity chemicals, which must only meet general specifications. As a result, demand for specialty chemicals is generally driven by customer-specific requirements to enable product performance.

A number of key challenges currently impact the specialty chemical industry, including the following: (1) demand for improved performance characteristics driven by evolving consumer preferences or changing regulatory requirements; (2) limited availability of certain critical feedstocks and intermediate chemicals; (3) feedstock price levels and volatility; and (4) increasing demand for products made from non-toxic, environmentally friendly and renewable sources.

Intermediate Chemicals

As the building blocks for most of the finished products in the industry, intermediate chemicals have higher margins per unit than commodity chemical feedstocks. We estimate that the total size of the oleochemical market

3

Table of Contents

was $38 billion in 2010. We estimate that the total size of the intermediate olefin market was $7 billion in 2008. This intermediate olefin market, on which we focus our olefin production, consists of higher value olefins, specifically linear alpha olefins (“LAOs”) or linear internal olefins (“LIOs”) with ten or more carbon atoms (“intermediate olefins”).

A number of key challenges are affecting the market for intermediate chemicals, including the following: (1) increasing cost, volatility and scarcity of certain key feedstocks leading to uncertain profitability; (2) limited flexibility to produce higher value chemicals without also producing other lower value chemicals given that conventional processes produce a largely fixed product mix; (3) need for new regional supply to meet increasing emerging market demand; and (4) increasing demand for products made from renewable sources.

Our Solution

Our proprietary process technology and the catalyst that we exclusively license and source from Materia, Inc., a leading- edge catalyst technology company (“Materia”) enable us to produce both unique specialty chemicals with desirable functional attributes previously unavailable in the marketplace, as well as key intermediate chemicals that are in limited supply. For more information regarding our license with Materia, including a discussion of its duration, see “Business—Intellectual Property.”

We combine the performance attributes of both oleochemicals and olefins into di-functional specialty chemicals that we believe cannot be economically produced by either the oleochemical or olefin industry, providing our customers new solutions to address their performance challenges. We believe we will be able to produce these specialty chemicals economically through our biorefineries and to sell them at competitive prices. We expect our product characteristics to drive rapid adoption by customers looking for solutions to their product performance needs.

Our intermediate chemicals are produced from renewable feedstocks and are direct replacements for olefins and oleochemicals produced using conventional processes for which demand is growing and supply is constrained. Our ability to use a wide variety of natural oil feedstocks and to produce our intermediate chemicals in several regions can help our customers mitigate input cost volatility and reduce supply concerns.

Our Competitive Strengths

Our business model benefits from a number of competitive strengths, including the following:

| • | Proprietary technology. Our proprietary metathesis technology platform utilizes Nobel Prize-winning innovations in metathesis catalysis. Our platform enables us to produce high-value specialty chemicals and direct replacement intermediate chemicals that are cost-advantaged compared to those available from conventional production methods. |

| • | High performance products. Our specialty chemicals have unique and desirable functional attributes previously unavailable in the marketplace. We are currently commercializing products such as fuel additives and personal care products that have enhanced performance features. In addition, we have demonstrated our ability to secure a premium price for certain high performance specialty chemicals. |

| • | Low capital requirements. Our biorefinery design requires less capital per unit of production than conventional technologies because of the following characteristics: (1) fewer major process steps; (2) lower operating temperatures and pressures; (3) limited production of hazardous and toxic by-products; and (4) the ability to integrate our process into existing industrial sites. |

| • | Low operating costs. Conversion using our process achieves lower unit-level production costs than alternative routes to comparable products because of the following characteristics: (1) more direct process, resulting in fewer conversion steps; (2) highly efficient and selective catalyst; (3) feedstock flexibility; and (4) lower operating temperatures and pressures, resulting in greater energy efficiency. |

4

Table of Contents

| • | Established partnerships with industry leaders. We have developed strategic partnerships which provide us with sales and marketing expertise, established distribution channels, technical know-how, product and application development expertise and manufacturing infrastructure. |

| • | Feedstock flexibility. Our primary feedstocks will include palm, soy and rapeseed oils, all of which we have used in our pilot plant to produce an array of specialty chemicals and intermediate chemicals. Our ability to adjust our inputs in real time allows us to take advantage of changes in feedstock prices and product demand. |

| • | Large and well-established end markets. Our technology enables us to target a wide variety of end markets. We currently estimate our addressable specialty chemical markets represent $176 billion in annual commercial opportunity. |

| • | Rapid deployment of commercial production. We can rapidly deploy our technology because of: (1) our ability to repurpose or integrate into existing industrial sites; (2) our low capital requirement per unit of capacity; (3) existing and available large markets for our products; and (4) our relatively short engineering, procurement and construction cycle. |

Our Strategy

Our goal is to become the global market leader in the design and production of specialty chemicals. The key elements for accomplishing our goal are:

| • | Complete rapid deployment of multiple world-scale facilities. We expect to have three world-scale facilities across three continents by the end of 2014, with combined annual production capacity of approximately one million metric tonnes (2.2 billion pounds). |

| • | Develop new and existing market partnerships to accelerate growth and maximize profitability. To accelerate growth, we plan to continue cultivating strategic partnerships with industry leaders. These partners provide us with sales and marketing expertise, established distribution channels, technical know-how, product and application development expertise and manufacturing infrastructure. |

| • | Invest in research and development to enhance product performance characteristics. We intend to leverage our extensive intellectual property portfolio to target unique solutions for customers demanding higher performance chemicals than those offered today. We plan to continue to develop new specialty chemicals with increased functional attributes, such as highly concentrated detergents and lubricants that enable better fuel economy. |

| • | Leverage feedstock flexibility to maximize margins. We continuously monitor the costs of various feedstock alternatives to take advantage of their imperfect price correlations to each other and to our selling prices. |

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider these risks, including those highlighted in the section entitled “Risk Factors,” before investing in our common stock. Risks relating to our business include, among others, the following:

| • | we have a limited operating history and have incurred significant losses to date, anticipate continuing to incur losses for a period of time, and may never achieve or sustain profitability; |

| • | we may be unable to continue our business or may be prevented from operating our business as it is currently conducted if we are unsuccessful in defending against any claims by competitors or others that we or Materia are infringing upon their intellectual property rights; |

5

Table of Contents

| • | if either the Indonesia facility or the Mississippi facility is not completed in a timely manner for any reason, our ability to produce specialty chemicals and intermediate chemicals could be materially adversely affected; |

| • | we lack direct experience operating world-scale commercial biorefineries, and may encounter substantial difficulties operating such biorefineries or expanding our business; |

| • | we may be unable to produce specialty chemicals and intermediate chemicals that meet our customers’ needs or specifications; |

| • | our specialty chemicals may not be accepted by the market; and |

| • | we are dependent on our partners, and our failure to successfully manage these relationships could delay or prevent us from developing and commercializing many of our products and achieving or sustaining profitability. |

Corporate Information

We were incorporated in the State of Delaware on October 17, 2007, to pursue work started in 2004 in a collaboration between Cargill and Materia. Our corporate headquarters are located at 2501 Davey Road, Woodridge, Illinois 60517. Our telephone number is (866) 625-7103. Our website address is www.elevance.com. The information on our website is not deemed, and you should not consider such information, to be part of this prospectus.

6

Table of Contents

THE OFFERING

| Common stock offered |

shares. | |

| Common stock to be outstanding immediately after this offering |

shares. | |

| Option to purchase additional shares |

shares. | |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We expect to use substantially all of the net proceeds from this offering for general corporate purposes, including funding capital expenditures, research and development, working capital, product development and operating expenses. For additional information, see “Use of Proceeds.” | |

| Risk factors |

Investing in shares of our common stock involves a high degree of risk. For additional information, see “Risk Factors” beginning on page 10 of this prospectus for a discussion of factors you should carefully consider before investing in shares of our common stock. | |

| NASDAQ Global Market symbol |

“ERSI” | |

Unless otherwise indicated, all information in this prospectus relating to the number of shares of common stock to be outstanding immediately after this offering:

| • | gives effect to the -for- split of our common stock, which was effective , 2012 (the “ -for- stock split”); |

| • | gives effect to the issuance of shares of our common stock upon the automatic conversion of all of our outstanding shares of preferred stock upon consummation of this offering pursuant to the terms of our Fourth Amended and Restated Certificate of Incorporation (our “certificate of incorporation”); |

| • | gives effect to the issuance of shares of our common stock to holders of our outstanding preferred stock as a dividend payment pursuant to our certificate of incorporation; |

| • | gives effect to the issuance of shares of our common stock upon the conversion of each outstanding warrant to purchase shares of our preferred stock into a warrant to purchase shares of our common stock pursuant to the terms of such existing warrant and the exercise thereof (together with the three bullets above, the “IPO Share Adjustments”); |

| • | gives effect to the issuance of shares of our common stock in this offering; |

| • | excludes (1) 2,304,484 shares of common stock that will be issuable upon the exercise of outstanding stock options as of September 30, 2011 at a weighted average exercise price of $2.14 per share; and (2) an aggregate of shares of our common stock reserved for future grants under the 2012 |

7

Table of Contents

| Incentive Compensation Plan (the “2012 Plan”) that we intend to adopt in connection with this offering, which will amend and restate our 2007 Equity Incentive Plan (the “2007 Plan”); |

| • | assumes no exercise by the underwriters of their over-allotment option to purchase up to additional shares of our common stock from us; and |

| • | assumes the effectiveness of our Fifth Amended and Restated Certificate of Incorporation (the “amended and restated certificate of incorporation”) and amended and restated bylaws, which we will adopt in connection with the consummation of this offering. |

8

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following tables summarize our financial data as of the dates and for the periods indicated. We have derived the summary consolidated financial data for the fiscal years ended December 31, 2008, 2009 and 2010 from our audited consolidated financial statements for such fiscal years included elsewhere in this prospectus. We have derived the summary consolidated financial data as of September 30, 2011 and for the nine months ended September 30, 2010 and 2011 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The summary historical and consolidated data presented below should be read in conjunction with the sections entitled “Risk Factors,” “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto and other financial data included elsewhere in this prospectus. Our unaudited condensed consolidated financial statements have been prepared on the same basis as our audited combined financial statements, and in our opinion, include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of our financial position and results of operations for such periods. Operating results for the nine months ended September 30, 2010 and 2011 are not necessarily indicative of results for a full year or for any other period.

| Years Ended December 31, | For the Nine Months Ended September 30, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Product sales |

$ | 18,913 | $ | 12,186 | $ | 20,227 | $ | 13,303 | $ | 16,319 | ||||||||||

| Other revenue |

— | — | — | — | 903 | |||||||||||||||

| Grants |

— | — | 961 | 732 | 604 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

18,913 | 12,186 | 21,188 | 14,035 | 17,826 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Cost of product sales |

14,425 | 11,860 | 17,824 | 11,603 | 16,751 | |||||||||||||||

| Cost of other revenue |

— | — | — | — | 628 | |||||||||||||||

| Selling, general and administrative |

8,086 | 8,168 | 11,356 | 8,457 | 15,260 | |||||||||||||||

| Research and development |

5,539 | 7,760 | 8,896 | 6,728 | 6,383 | |||||||||||||||

| Intangible asset amortization |

1,506 | 1,506 | 1,506 | 1,129 | 1,129 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

29,556 | 29,294 | 39,582 | 27,917 | 40,151 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(10,643 | ) | (17,108 | ) | (18,394 | ) | (13,882 | ) | (22,325 | ) | ||||||||||

| Gain (loss) on change in fair value of warrants |

1,787 | 652 | (4,506 | ) | (3,172 | ) | (98,823 | ) | ||||||||||||

| Interest expense |

— | (437 | ) | (4,415 | ) | (3,289 | ) | — | ||||||||||||

| Other income, net |

636 | 56 | 14 | 4 | 21 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income taxes |

(8,220 | ) | (16,837 | ) | (27,301 | ) | (20,339 | ) | (121,127 | ) | ||||||||||

| Income taxes |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(8,220 | ) | (16,837 | ) | (27,301 | ) | (20,339 | ) | (121,127 | ) | ||||||||||

| Less net loss attributable to the noncontrolling interest |

— | — | 10 | 1 | 82 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to the company |

(8,220 | ) | (16,837 | ) | (27,291 | ) | (20,338 | ) | (121,045 | ) | ||||||||||

| Less accretion on Series A and B preferred stock and cumulative dividends on Series B, C and D preferred stock |

(6,689 | ) | (6,876 | ) | (6,349 | ) | (4,409 | ) | (10,731 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss available to our common shareholders |

$ | (14,909 | ) | $ | (23,713 | ) | $ | (33,640 | ) | $ | (24,747 | ) | $ | (131,776 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share attributable to our common shareholders, basic and diluted |

$ | (99.39 | ) | $ | (33.08 | ) | $ | (14.64 | ) | $ | (10.83 | ) | $ | (54.96 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share attributable to our common shareholders(1) |

||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (1) | Gives effect to the IPO Share Adjustments, but not this offering. |

9

Table of Contents

| As of September 30, 2011 | ||||||||

| Actual | Pro Forma(1) |

Pro

Forma As Adjusted(2) | ||||||

| (unaudited) | ||||||||

| (in thousands) | ||||||||

| Balance Sheet Data: |

||||||||

| Cash, cash equivalents and short-term investments |

$ | 90,402 | ||||||

| Working capital |

2,598 | |||||||

| Total assets |

146,197 | |||||||

| Total debt |

107 | |||||||

| Preferred stock |

215,335 | |||||||

| Total company shareholders’ deficit |

(200,483 | ) | ||||||

| (1) | Gives effect to the IPO Share Adjustments, but not this offering. |

| (2) | Gives effect to the IPO Share Adjustments and this offering. |

10

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flow and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

We have a limited operating history and have incurred significant losses to date, anticipate continuing to incur losses for a period of time, and may never achieve or sustain profitability.

We are an early stage company with a limited operating history and have incurred substantial net losses since our inception, including net losses attributable to our common stockholders of $14.9 million, $23.7 million and $33.6 million for the years ended December 31, 2008, 2009 and 2010, respectively. We expect these losses to continue for a period of time as we continue to invest in research and development, expand our manufacturing capacity and build out our product pipeline. As of September 30, 2011, we had an accumulated deficit of $200.5 million. For the foreseeable future, we expect to incur additional costs and expenses related to the continued development and expansion of our business, including: research and development; construction and operation of the Indonesia facility and the Mississippi facility; and management of operations as a public company. As a result, our annual operating losses will likely increase in 2011. Any assessments you make about our current business and predictions you make about our future success or viability may not be as accurate as they would be if we had a longer operating history.

We, along with our development and commercialization partners, will need to be successful developing additional products, producing them in commercial quantities cost effectively and marketing and selling them profitably. We and our partners will also need to obtain any necessary regulatory approvals. If we fail to become profitable, or if we are unable to fund our continuing losses, we may be unable to continue our business operations. There can be no assurance that we will ever achieve or sustain profitability.

We have generated limited revenues from the sale of our products and we face significant challenges to developing our business.

To date, we have had only modest sales of several products and have not commenced operations of our biorefineries. If we are not successful in constructing and operating our biorefineries or otherwise increasing our manufacturing capacity, developing products that meet our customers’ specifications and further advancing our existing commercial arrangements with strategic partners, we will be unable to generate meaningful revenues from our products. Consequently, we are subject to the substantial risk of failure facing businesses seeking to develop products based on a new technology. Certain factors that could, alone or in combination, prevent us from successfully commercializing our products include:

| • | our ability to defend against any claims by competitors or others that we or Materia are infringing upon their intellectual property rights; |

| • | the completion of construction, and successful operation of, the Indonesia facility and the Mississippi facility; |

| • | our ability to develop, commercialize and manufacture new specialty chemicals that meet customer needs and specifications on a cost-effective basis, in a timely manner and in significant volumes; |

| • | our ability to manage our growth; |

11

Table of Contents

| • | our ability to gain market acceptance of our specialty chemicals and to establish and maintain relationships with our customers; |

| • | our ability to reliably secure sufficient volumes of feedstock at commercially viable prices; |

| • | actions of direct or indirect competitors that may seek to enter (or preserve their position in) the markets in which we expect to compete or that may seek to impose or maintain barriers to one or more of those markets; |

| • | our ability to adequately protect our proprietary technologies, including our ability to enforce our intellectual property rights around the world; |

| • | our ability to maintain our exclusive license with Materia; |

| • | our dependence on our feedstock, manufacturing and commercialization partners; |

| • | our reliance on our toll manufacturers; |

| • | our ability to retain key personnel; |

| • | our ability to secure and maintain necessary regulatory approvals for the production, distribution and sale of our products and to comply with applicable laws and regulations; and |

| • | public concerns about the legal, environmental and social ramifications of the use of our feedstocks in light of concerns regarding the diversion of resources from food production and the deforestation of tropical rainforests. |

We may be unable to continue our business or may be prevented from operating our business as it is currently conducted if we are unsuccessful in defending against any claims by competitors or others that we or Materia are infringing upon their intellectual property rights.

The specialty chemical markets in which we operate are subject to litigation regarding patents and other intellectual property rights. In addition, many companies in intellectual property-dependent industries, including the chemical industry, have employed intellectual property litigation as a means to gain an advantage over their competitors. As a result, we may be required to defend against claims of intellectual property infringement that may be asserted by our competitors against us or Materia, from whom we license our proprietary catalyst. If the outcome of any such litigation is adverse to us or Materia, it may affect our ability to compete effectively or may prevent us from operating our business as it is currently conducted.

Our involvement in litigation, interferences, opposition proceedings or other intellectual property proceedings inside and outside of the United States could divert our management from focusing on business operations or cause us to spend significant amounts of money. Such involvement in litigation has no guarantee of success. Any current and potential intellectual property litigation also could force us to do one or more of the following:

| • | stop selling, incorporating, manufacturing or using our products that use the intellectual property that is the subject of such litigation, including our proprietary licensed catalyst; |

| • | obtain a license to sell or use the relevant intellectual property from any third party asserting its intellectual property rights (including Evonik Degussa GmbH (“Evonik Degussa”) (as discussed below in “—If Materia is unsuccessful in defending against a lawsuit filed by Evonik Degussa or if our related license expires prior to the resolution of such litigation in favor of Materia, we may experience a material adverse effect on our business, financial condition or results of operations.”), which license may not be available on commercially reasonable terms, or at all; |

| • | redesign those products or processes that use any allegedly infringing or misappropriated catalyst or technology, which may result in significant cost or delay to us, or which redesign could be technically infeasible; or |

12

Table of Contents

| • | pay damages, including the possibility of treble damages in a patent case, if a court finds us to have willfully infringed certain intellectual property rights. |

We are aware of a number of patents and patent applications relating to aspects of our technologies or those which we license from Materia filed by, and issued to, third parties, including, but not limited to Evonik Degussa. We cannot assure you that we or Materia will ultimately prevail if any third parties assert intellectual property claims against us or Materia, as applicable, or in the current patent infringement lawsuit recently filed by Evonik Degussa discussed above. If we or Materia do not prevail, such litigation could have a material adverse effect on our business, financial condition or results of operations.

If either the Indonesia facility or the Mississippi facility is not completed in a timely manner for any reason, our ability to produce specialty chemicals and intermediate chemicals could be materially adversely affected.

Our business plan contemplates bringing significant commercial capacity online over the next few years. We will need to complete construction of the Indonesia facility and the Mississippi facility, in a timely manner in order to commercialize our products in accordance with our business plans.

In June 2010, we entered into the Wilmar JV to construct a world-scale biorefinery. The Indonesia facility will be located within Wilmar’s new integrated manufacturing complex now under construction. Construction of the Indonesia facility commenced in November 2010. The Wilmar JV plans to complete construction of the Indonesia facility in the second quarter of 2012. Once construction is complete, we anticipate that the Indonesia facility will have an annual production capacity of 185,000 metric tonnes (400 million pounds), and the Wilmar JV will have the ability to expand annual production capacity to 370,000 metric tonnes (810 million pounds).

In June 2011, we acquired a former biodiesel facility, which we intend to repurpose into the Mississippi facility. We have commenced engineering design for the facility and are currently negotiating a related engineering, procurement and construction contract. We are also in discussions with petrochemical and agricultural processors to evaluate partnership and offtake opportunities for the Mississippi facility. Prior to the completion of construction, we will need to complete the design and related plans and secure the requisite permits, licenses and governmental approvals. We expect to begin commercial operations at the Mississippi facility in 2013, with annual production capacity of 280,000 metric tonnes (610 million pounds).

We may encounter significant delays, cost overruns, engineering problems, equipment supply constraints or other unexpected difficulties which could cause construction to cost more than we currently anticipate. These increased costs could require that we secure additional funding. Such funds may be unavailable when we need them or on terms that are acceptable to us. Furthermore, we may not be able to obtain the necessary regulatory approvals to complete construction of the biorefineries or operate either the Indonesia facility or the Mississippi facility in accordance with our business forecasts, including those approvals set forth below as further risks.

The Indonesia facility and the Mississippi facility may not perform as expected. For example, production rates may vary from our expectations. We may need to install additional equipment to achieve desired specifications, which could delay operations and increase costs. We may encounter these or other operational challenges and may be unable to devise workable and cost effective solutions, which could delay or prevent our ability to provide specialty chemicals or intermediate chemicals to our customers and could have a material adverse effect on our business, financial condition or results of operations.

We lack direct experience operating world-scale commercial biorefineries, and may encounter substantial difficulties operating such biorefineries or expanding our business.

We have never operated a world-scale commercial biorefinery. We have only completed two commercial-scale toll production runs of specialty chemicals and intermediate chemicals utilizing our proprietary biorefinery technology using palm oil. Our future success depends on our ability to produce commercial quantities of a broad

13

Table of Contents

range of our specialty chemicals and intermediate chemicals using a variety of natural oils with our proprietary biorefinery technology. While we have successfully completed demonstration size production runs using soy and other oils, we may not be able to successfully increase the scale of production to commercial quantities using these oils in a timely or economic manner or at all. Accordingly, we may encounter significant difficulties operating a world-scale biorefinery. Even after construction is completed at the Indonesia facility and the Mississippi facility, we will continue producing specialty chemicals and intermediate chemicals through toll manufacturing arrangements. We will need to successfully administer and manage this production while we complete construction of our other facilities and transition production to these new facilities. Additionally, the skills and knowledge gained in operating our pilot facility in Illinois and managing our toll manufacturers may prove insufficient for successful operation of a world-scale biorefinery and we may be required to expend significant time and money to enhance our capabilities in commercial biorefinery operation, which could have a material adverse effect on our business, financial condition or results of operations.

We may be unable to produce specialty chemicals and intermediate chemicals that meet our customers’ needs or specifications, which may have a material adverse effect on our business, financial condition or results of operations.

A key component of our business strategy is to develop and market our specialty chemicals. We may be unable to produce specialty chemicals that meet customers’ needs or specifications even if we produce specialty chemicals at our targeted rates. If we fail to meet specific product or volume specifications contained in a supply agreement, the customer may have the right to seek an alternate supply of chemicals or to terminate the agreement. A failure to successfully meet the specifications of our potential customers could decrease demand or otherwise significantly hinder market adoption of our products and may have a material adverse effect on our business, financial condition or results of operations.

Our intermediate chemicals may fail to meet established product or customer specifications. If one of our intermediate chemicals fails to meet established specifications, our customer may reject the product. We may need to reduce the price of the product in order to find a replacement buyer or to sell it on the spot market, or we may be unable to sell the product. Even if we were able to sell the rejected intermediate chemical for an identical price, our costs may increase if we are required to store the intermediate chemical longer or transport it farther than originally anticipated.

Our facilities and process may fail to produce specialty chemicals or intermediate chemicals at the volumes, rates and costs we expect.

The facilities we repurpose or construct for chemical production may fail to perform as expected. When we repurpose an existing biorefinery, the equipment and subsystems installed during the repurposing may never operate as planned. Our systems may prove incompatible with the original facility or require additional modification after installation. Similarly, a newly constructed facility may not operate as we expect it to operate. Our proprietary catalyst may perform less efficiently than it did at any of our toll manufacturers or at our pilot facility in Illinois. Contamination of biorefinery equipment may reduce the efficiency of the catalyst and may require us to replace the catalyst more often than expected. Likewise, if we were to experience routine feedstock contamination from contaminants such as peroxide and water, it could reduce the purity of the chemicals that we produce and require us to invest in more costly separation or transesterification processes or equipment. Unexpected problems may force us to cease or delay production and the time and costs involved with such delays may prove prohibitive to commercial operation. Any or all of these risks could prevent us from achieving the production necessary to achieve our target annualized production run rates. Failure to achieve these rates, or achieving them only after significant additional expenditures, may have a material adverse effect on our business, financial condition or results of operations.

14

Table of Contents

We have limited experience in structuring arrangements with customers for the purchase of our products and we may not be successful in this essential aspect of our business.

Because we currently only sell a limited number of products and have not yet completed development of many planned products, we have limited experience operating in many of our customers’ industries and interacting with the customers that we intend to target. Developing that expertise may take longer than we expect and may require that we expand and improve our sales and marketing infrastructure. These activities could delay our ability to capitalize on the opportunities that our technology and products present, and may prevent us from achieving commercialization of our specialty chemicals. The companies with which we expect to have customer arrangements are generally much larger than we are and have substantially longer operating histories and more experience in our target industries. As a result, we may not be effective in negotiating or managing the terms of our relationships with these companies, which may have a material adverse effect on our business, financial condition and results of operations.

Our specialty chemicals may not be accepted by the market.

Obtaining market acceptance in the chemical industry is complicated by the fact that many potential chemical industry customers have invested substantial amounts of time and money in developing established production channels. These potential customers generally have well-developed manufacturing processes and arrangements with suppliers of chemical components and may display substantial resistance to changing these processes. Preexisting contractual commitments, unwillingness to invest in new infrastructure, distrust of new production methods and long-standing relationships with current suppliers may all slow market acceptance of our products. To be successful, we must effectively demonstrate the commercial advantages of our specialty chemicals in lieu of other established chemicals. We must also demonstrate our ability to produce specialty chemicals reliably on a commercial scale and be able to sell them at a competitive price, or, we may experience a material adverse effect on our business, financial condition and results of operations.

We face substantial competition, which could adversely affect our performance and growth.

We face substantial competition in the specialty chemical and intermediate chemical markets. Our products will compete with traditional chemicals, petrochemicals and oleochemicals that serve our targeted markets, as well as products from emerging companies that have targeted the production of substitutes or replacements for existing products. The traditional chemical companies benefit from large, established production capabilities and business relationships. The incumbents’ greater resources and financial strength provide significant competitive advantages that we may not be able to overcome in a timely manner.

If any of our competitors succeed in producing competing specialty chemicals or intermediate chemicals more efficiently, in higher volumes or that offer performance superior to our chemicals, our financial performance may suffer. Furthermore, if our competitors have more success marketing their competing products or reach development or supply agreements with major customers or partners, our competitive position may also be harmed.

Our ability to compete successfully will depend on our ability to develop proprietary, high-performance products that reach the market in a timely manner and are priced competitively. Some of our competitors have substantially greater production, financial, research and development, personnel and marketing resources than we do. In addition, certain of our competitors may also benefit from local government subsidies and other incentives that are not available to us. As a result, our competitors may be able to develop competing or superior technologies and processes, and compete more aggressively and sustain that competition over a longer period of time than we could. Our technologies and products may be rendered obsolete or uneconomical by technological advances or entirely different approaches developed by one or more of our competitors. As more companies develop new intellectual property in our markets, we face the increased possibility of a competitor acquiring patent or other rights that may limit our ability to freely develop and sell our products. In order to secure

15

Table of Contents

purchase agreements from certain customers, we may be required to enter into exclusive supply contracts, which could limit our ability to further expand our sales to new customers. Potential customers may be locked into long-term, exclusive agreements with our competitors, which could inhibit our ability to compete for their business.

Our limited resources relative to many of our competitors may cause us to fail to anticipate or respond adequately to new developments and other competitive pressures. This failure could reduce our competitiveness and market share, adversely affect our results of operations and financial position and prevent us from obtaining or maintaining profitability.

Fluctuations in the availability or price of our feedstocks may affect our cost structure and cause delayed production, reduced output and reduced revenues if the cost or availability of feedstocks or other factors requires us to change feedstocks.

Our business is dependent on ready access to feedstocks, which are the largest component of our cost of product sales. We cannot be sure that our suppliers (including Cargill, the current supplier of the majority of our feedstocks) will be able to supply them in sufficient quantities or in a timely manner. A decrease in the availability of feedstocks or an increase in their price, which cannot be offset by an increase in our product selling prices, may have a material adverse effect on our financial condition and operating results. If locally produced feedstocks are unavailable, we may elect to use alternative feedstocks, which may be more expensive to acquire or deliver. General market conditions might also cause increases in feedstock prices, which could increase our production costs. At certain levels, feedstock prices may make our products uneconomical to use and produce, as we may be unable to pass all or any amount of feedstock cost increases on to our customers.

We also face risks related to unexpected reductions in feedstock prices. If feedstock prices fall, then the prices that we will be able to charge for our products may similarly fall. Additionally, we will likely have a supply of feedstock which we acquired prior to the reduction in feedstock prices (or products produced with more expensive feedstocks) for a period of time. Until such time as we have depleted our inventory of the more expensive feedstocks and products produced with such inventory, our margins may be reduced when compared to those we would have been able to secure had we used a less expensive feedstock in our production.

The price and availability of our feedstocks may be influenced by general economic, market and regulatory factors and may be cyclical or volatile. The supply of feedstocks may be interrupted by growing season disruptions, low crop yields, crop disease, droughts, floods, infestations, natural disasters, farming decisions or governmental policies and subsidies. In particular, weather conditions have historically caused volatility in certain portions of the agricultural industry by causing crop failures or reduced harvests. Excessive rainfall can adversely affect the supply of certain feedstocks. Crop disease and pestilence can adversely affect growth, potentially rendering unusable all or a substantial portion of affected harvests. We cannot predict the future availability of such feedstocks or whether any replacement or substitute feedstocks will be successfully developed at commercial scale. Our product mix differs from feedstock to feedstock, so prices of various feedstocks may prevent us from optimizing our product mix. Inability to obtain feedstocks at commercially viable prices could materially adversely affect our results of operations and financial position and prevent us from obtaining or maintaining profitability.

Our current business is dependent on the supply of the appropriate catalyst.

At present, the only catalyst that has been proven to be technically viable and cost effective is one that we obtain from Materia. We have a license for this particular catalyst and other technology from Materia that is important to our business. Materia may not comply with all of the terms of the license. We also have a catalyst supply agreement with Materia. Although we are allowed to produce or obtain catalyst from third parties in the event of a breach of the license agreement by Materia, we would need to find, retain and certify (in accordance with the terms of the license agreement) an alternative production source and may not be able to do so quickly, in a cost-effective manner or at all. Any dispute over this license agreement or this supply agreement could, even if

16

Table of Contents

successfully resolved, result in significant legal fees and other expenses, diversion of management time and efforts and disruption to our business created by any time between a breach of the license agreement by Materia and our being able to acquire acceptable catalyst from an alternative source. In addition, intellectual property suits against Materia, including the current suit filed by Evonik Degussa GmbH (“Evonik Degussa”), could disrupt our supply of catalyst from Materia if such suits are not favorably resolved. See “—If Materia is unsuccessful in defending against a lawsuit filed by Evonik Degussa or if our related license expires prior to the resolution of such litigation in favor of Materia, we may experience a material adverse effect on our business, financial condition or results of operations.” There may also be other technical or economic factors that could disrupt our supply of catalyst, which could have a material adverse effect on our business, financial condition and results of operations.

Materia’s catalyst uses ruthenium, which is only available in limited quantities. The limited availability of ruthenium can result in cost volatility.

Ruthenium can only be obtained from a limited number of producers in a limited number of geographic sites. If worldwide demand for ruthenium increases, it could take significant time for production of ruthenium to be increased to meet demand. If we are unable to improve the efficiency of our metathesis catalysis process, economically recycle our catalyst, develop alternatives to our ruthenium-based catalyst or if annual ruthenium production does not increase, we will require a material percentage of the annual supply of ruthenium in order to support our annual biorefinery production. As a result, we could experience shortages of or increases in the cost to obtain Materia’s catalyst, which could have a material adverse effect on our business, financial condition and results of operations.

Our ability to compete may be adversely affected if we do not obtain adequate intellectual property protection for our proprietary technologies or if we lose some of our intellectual property rights through costly litigation or administrative proceedings.

Our success will depend in part on our ability to obtain patents and maintain adequate protection of our intellectual property covering our technologies and products and potential products in the United States and other countries. We have adopted a strategy of seeking patent protection in the United States and in certain foreign countries with respect to certain of the technologies used in or relating to our products and processes. As such, as of September 30, 2011, we have exclusive license rights to Materia’s portfolio of 85 U.S. Patents, six published U.S. Patent Applications and 47 published Patent Cooperation Treaty (“PCT”) applications, together with the corresponding foreign patents and patent applications. The first of our licensed patents will expire as early as April 3, 2012. When and if issued, patents would expire at the end of their term and any patent would only provide us commercial advantage for a limited period of time, if at all. Our patent applications are directed to our enabling technologies and to our methods and products that support our business in the specialty chemical and intermediate chemical markets. We intend to continue to apply for patents relating to our technologies, methods and products as we deem appropriate.

A filed patent application does not guarantee a patent will be issued and a patent issuing does not guarantee it will never be invalidated, nor does it give us the right to practice the patented technology or commercialize the patented product. Third parties may have or obtain rights to “blocking patents” that could be used to prevent us from commercializing our products or practicing our technology. The scope and validity of patents and success in prosecuting patent applications involve complex legal and factual questions and, therefore, issuance, coverage and validity cannot be predicted with any certainty. Patents issuing from our filed applications may be challenged, invalidated or circumvented. Moreover, third parties could practice our inventions in secret and in territories in which we do not have patent protection. Such third parties may then try to sell or import products made using our inventions in and into the United States or other territories and we may be unable to prove that such products were made using our inventions. Additional uncertainty may result from the passage of patent reform legislation by the U.S. Congress and from legal precedent as handed down by the U.S. Court of Appeals for the Federal Circuit and the U.S. Supreme Court, as they determine legal issues concerning the scope, validity and construction of patent claims.

17

Table of Contents

Because patent applications in the United States and many foreign jurisdictions are typically not published until 18 months after filing, or in some cases not at all, and because publication of discoveries in the scientific literature often lags behind the actual discoveries, there is additional uncertainty as to the validity of any patents that may issue and the potential for blocking patents coming into force at some future date. Accordingly, our currently filed or future patent applications may not result in issued patents, or even if related patents are issued, we cannot predict the scope of the claims that may issue in our and other companies’ patents.

The degree of future protection for our proprietary rights is uncertain because: (1) we may not have been the first to make the inventions covered by each of our filed applications; (2) we may not have been the first to file patent applications for these inventions; (3) the proprietary technologies we develop may not be patentable; (4) any patents issued may not be broad enough in scope to provide commercial advantage and prevent circumvention; and (5) competitors and other parties may have or may obtain patent protection that will block our development and commercialization activities. These concerns apply equally to patents we have licensed, which may likewise be challenged, invalidated or circumvented, and the licensed technologies may be obstructed from commercialization by competitors’ “blocking patents.”

In addition, unauthorized parties may attempt to copy or otherwise obtain and use our products or technology. Monitoring unauthorized use of our intellectual property is difficult, particularly where, as in our situation, the end products reaching the market generally do not reveal the processes used in their manufacture, and particularly in certain foreign countries where the local laws may not protect our proprietary rights as fully as in the United States. As such, we cannot be certain that the steps we have taken in obtaining intellectual property and other proprietary rights will prevent unauthorized use of our technology. If competitors are able to use our technology without our authorization, our ability to compete effectively could be adversely affected. Moreover, competitors and other parties such as universities may independently develop and obtain patents for technologies that are similar to or superior to our technologies. If that happens, the potential competitive advantages provided by our intellectual property may be adversely affected. We may then need to license these competing technologies, and we may not be able to obtain licenses on reasonable terms, if at all, which could cause material harm to our business. Accordingly, litigation may be necessary for us to assert claims of infringement, enforce patents we own or license, protect trade secrets or determine the enforceability, scope, validity and infringement of the intellectual property rights of others.

Under the provisions of some of our research, joint development and commercial agreements, ownership of certain intellectual property developed thereunder may be owned jointly by us and our contractual counterparty, or may be owned entirely by our counterparty. In addition, we may be restricted from using such developed intellectual property in certain fields or market areas or may be required to pay royalties to use such developed intellectual property in certain circumstances, either during the term of the applicable agreement or upon certain events of default or termination scenarios. Such provisions may limit our ability to exploit such jointly developed intellectual property in certain fields (or to do so without paying a royalty) and our ability to work with other parties in certain fields and may lead to costly and time-consuming inventorship or ownership disputes.

If any other party has filed patent applications or obtained patents that claim inventions also claimed by us, we may have to participate in interference proceedings declared by the U.S. Patent and Trademark Office to determine priority of invention and, thus, the right to the patents for these inventions in the United States. Even if successful, an interference may result in loss of certain patent claims, significant legal fees and other expenses, diversion of management time and efforts and disruption in our business. Uncertainties resulting from initiation and continuation of any patent or related litigation could harm our ability to compete and may have a material adverse effect on our business, financial condition or results of operations.

If we infringe the intellectual property rights of third parties, we might be required to obtain a license, redesign or forgo one or more of our current or future processes or products, rebrand our current or future products or services, pay damages or defend against litigation.

Patents that impact our technology may exist or may issue in the future in the United States or other countries. Trademark rights may exist or may come into existence in the United States or other countries which

18

Table of Contents

impact the marks that we use with our products and services. If our products, methods, processes, packaging or marketing infringe or are at least asserted to infringe the patents or trademarks of other parties, we could incur substantial costs and we might have to:

| • | obtain licenses, which might not be available on commercially reasonable terms, if at all; |

| • | abandon an infringing mark, process or product; |

| • | redesign, reformulate or rebrand our products or processes to avoid infringement; |

| • | stop using the mark or the subject matter claimed in the patents held by others; |

| • | pay damages; or |

| • | defend litigation or administrative proceedings, which might be costly whether we win or lose, and which could result in a substantial diversion of our financial and management resources. |

Any of these events may have a material adverse effect on our business, financial condition and results of operations.

As is commonplace in both the specialty chemical and intermediate chemical industries, some of our directors, employees and consultants are or have been employed at, or associated with, companies and universities that compete with us or have or will develop similar technologies and related intellectual property. While employed at these companies, these employees, directors and consultants may have been exposed to or involved in research and technology similar to the areas of research and technology in which we are engaged. Though we have not received such a complaint, we may be subject to allegations that we or our directors, employees or consultants have inadvertently or otherwise used, misappropriated or disclosed alleged trade secrets or confidential or proprietary information of those companies. Litigation may be necessary to defend against such allegations, and the outcome of any such litigation would be uncertain and could have a material adverse effect on our business, financial condition or results of operations.

If Materia is unsuccessful in defending against a lawsuit filed by Evonik Degussa or if our related license expires prior to the resolution of such litigation in favor of Materia, we may experience a material adverse effect on our business, financial condition or results of operations.

Currently, Materia is defending against a lawsuit filed by Evonik Degussa in which Evonik Degussa has alleged that Materia has infringed its U.S. patents relating to specific types of catalysts for olefin metathesis chemical reactions. Previously, we were a co-defendant with Materia in such litigation, but were dismissed as a party in connection with entering into the Confidential Settlement Agreement with Mutual Release and Patent License with Evonik Degussa on June 23, 2010 (the “Degussa Settlement Agreement”). The license to certain of its U.S. patents, which Evonik Degussa granted to us pursuant to the Degussa Settlement Agreement, is scheduled to expire on December 31, 2012. We may elect to extend the license for an additional year to December 31, 2013 for $300,000. We currently have no right to extend the license granted to us by Evonik Degussa past December 31, 2013 and may be unsuccessful in any attempt to extend this license beyond December 31, 2013, which may have a material adverse effect on our business, financial condition or results of operations if we are unable to successfully develop and produce a suitable replacement catalyst for use in commercial production of our specialty chemicals and intermediate chemicals.

Under our license with Materia, we must make certain exclusivity payments each year to preserve our license thereunder and any failure to make such payments (or portion thereof) could cause us to lose our rights under the license which would have a material adverse effect on our business.

Under our license agreement with Materia, we must make an annual exclusivity payment of $250,000 to Materia during the first five years of the license agreement in order to maintain our exclusive license thereunder. If we fail to make any such payment in accordance with the terms of the license agreement, our exclusive license shall be converted into a non-exclusive license upon one month’s prior notice from Materia. Additionally,

19

Table of Contents