Attached files

| file | filename |

|---|---|

| EX-21 - LIST OF SUBSIDIARIES - AMERICAN VANGUARD CORP | d275133dex21.htm |

| EX-23 - CONSENT OF BDO USA, LLP - AMERICAN VANGUARD CORP | d275133dex23.htm |

| EXCEL - IDEA: XBRL DOCUMENT - AMERICAN VANGUARD CORP | Financial_Report.xls |

| EX-32.1 - SECTION 906 OF CEO & CFO - AMERICAN VANGUARD CORP | d275133dex321.htm |

| EX-31.2 - SECTION 302 OF CFO - AMERICAN VANGUARD CORP | d275133dex312.htm |

| EX-31.1 - SECTION 302 OF CEO - AMERICAN VANGUARD CORP | d275133dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Year Ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Transition Period From To

Commission file number 001-13795

AMERICAN VANGUARD CORPORATION

| Delaware | 95-2588080 | |

| (State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 4695 MacArthur Court, Newport Beach, California | 92660 | |

| (Address of principal executive offices) | (Zip Code) | |

(949) 260-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, $.10 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock of the registrant held by non-affiliates is $293.0 million. This figure is estimated as of June 30, 2011 at which date the closing price of the registrant’s Common Stock on the New York Stock Exchange was $12.97 per share. For purposes of this calculation, shares owned by executive officers, directors, and 5% stockholders known to the registrant have been deemed to be owned by affiliates. The number of shares of $.10 par value Common Stock outstanding as of June 30, 2011, was 27,566,878. The number of shares of $.10 par value Common Stock outstanding as of February 20, 2012 was 27,614,623.

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

December 31, 2011

i

Table of Contents

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

PART I

Unless otherwise indicated or in the context otherwise requires, the terms “Company,” “we,” “us,” and “our” refer to American Vanguard Corporation and its consolidated subsidiaries.

Forward-looking statements in this report, including without limitation, statements relating to the Company’s plans, strategies, objectives, expectations, intentions, and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties. (Refer to PART II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, Risk Factors, of this Annual Report.)

| ITEM 1 | BUSINESS |

American Vanguard Corporation (“AVD”) was incorporated under the laws of the State of Delaware in January 1969 and operates as a holding company. Unless the context otherwise requires, references to the “Company”, or the “Registrant” in this Annual Report refer to AVD and its consolidated subsidiaries. The Company conducts its business through its subsidiaries, AMVAC Chemical Corporation (“AMVAC”), GemChem, Inc. (“GemChem”), 2110 Davie Corporation (“DAVIE”), Quimica Amvac de Mexico S.A. de C.V. (“AMVAC M”), AMVAC de Costa Rica Sociedad Anonima (“AMVAC CR”), AMVAC Switzerland GmbH (“AMVAC S”), AMVAC do Brasil Representácoes Ltda (“AMVAC B”), AMVAC Chemical UK Ltd. (“AMVAC UK”) and Environmental Mediation, Inc (“EMI”).

Based on similar economic and operational characteristics, the Company’s business is aggregated into one reportable segment. Refer to Part I, Item 7 for selective enterprise information.

AMVAC

AMVAC is a California corporation that traces its history from 1945. AMVAC is a specialty chemical manufacturer that develops and markets products for agricultural and commercial uses. It manufactures and formulates chemicals for crops, human and animal health protection. These chemicals, which include insecticides, fungicides, herbicides, molluscicides, growth regulators, and soil fumigants, are marketed in liquid, powder, and granular forms. Years ago AMVAC considered itself a distributor-formulator, but now AMVAC primarily manufactures, distributes, and formulates its own proprietary products or custom manufactures or formulates for others. AMVAC has historically expanded its business through both the acquisition of established chemistries (which it has revived in the marketplace) and the development and commercialization of new compounds through licensing arrangements. Below is a description of the Company’s acquisition/licensing activity over the past five years.

On October 7, 2011—AMVAC completed the acquisition of the international rights to the cotton defoliant product tribufos (sold under the trade name Def ®) from Bayer CropScience AG (“BCS AG”). The acquired assets include registrations and data rights, rights relating to manufacturing and formulation know-how, inventories, and the trademark Def. Def complements AMVAC’s existing cotton defoliant product Folex®, which it has marketed since 2002. This acquisition also compliments the U.S. rights to Def that the Company purchased from BCS AG in July 2010 (see below). Both Folex and Def are fast and effective cotton defoliants that facilitate the removal of leaves surrounding the cotton boll and in combination with other products function as a harvest aid.

On December 20, 2010—AMVAC completed the acquisition of a global product line relating to the active ingredient tebupirimfos from BCS AG. The acquired assets include registrations and data rights, rights relating to manufacturing and formulation know-how, inventories, and the trademarks Aztec®, Azteca® and Capinda®. When combined in a mixture with another active ingredient Cyfluthrin, the resulting dual active ingredient product is a leading insecticide that is registered in the United States as Aztec and Mexico as Azteca, where it is used to combat such soil borne insects as rootworm, cutworm, wireworm, seed corn maggots/beetles and white grub in a variety of corn crops. Additionally, it is registered in South Korea (and sold under the trade name Capinda) for use primarily in vegetable crops such as Chinese cabbage and ginseng.

On December 7, 2010—AMVAC completed the acquisition of a global insecticide product line relating to the active ingredient ethoprophos (sold under the trade name Mocap®) from BCS AG. The acquired assets include registrations and data rights, rights relating to manufacturing and formulation know-how, inventories, the Ultima® packaging system and the trademarks Mocap and Ultima. Mocap is a leading soil insecticide that is registered in 50 countries where it is used to combat nematode species in wide range of crops.

1

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

On December 7, 2010—AMVAC completed the acquisition of a global (except for Europe and Argentina) insecticide product line relating to the active ingredient fenamiphos (sold under the trade name Nemacur®) from BCS AG. The acquired assets include registrations and data rights, rights relating to manufacturing and formulation know-how, inventories and the trademark Nemacur. Nemacur is a leading soil insecticide that is registered in 30 countries for use primarily as a nematicide with additional efficacy against above ground sucking insects.

On October 14, 2010—AMVAC and Kanesho Soil Treatment completed agreements with Certis-USA regarding the crop protection product Basamid® (dazomet) under which AMVAC will become the exclusive distributor and registration holder for this granular soil fumigant in the United States. Certis-USA, will continue to market Basamid into non-food crop applications under a distribution agreement with Amvac. Basamid complements the strong market position of AMVAC’s Vapam® & K-Pam® soil fumigant brands. The Company will be developing the use of Basamid for high-valued crop segments such as strawberries, tomatoes, lettuce & spinach and will be responsible for the re-registration of dazomet in the United States.

On July 21, 2010—AMVAC completed the acquisition of the U.S. cotton defoliant product tribufos (sold under the trade name Def®) from BCS AG. The acquired assets include registrations and data rights, rights relating to manufacturing and formulation know-how, inventories, and the trademark Def. Def complements AMVAC’s existing cotton defoliant product Folex®, which it has marketed since 2002. Both are fast and effective cotton defoliants that facilitate the removal of leaves surrounding the cotton boll and in combination with other products function as a harvest aid.

On May 16, 2008, AMVAC completed the acquisition of the phorate (sold by the Company under the Trade name Thimet) insecticide product line from Aceto Agricultural Chemicals Corporation (“Aceto AG”). Thimet is used on agricultural crops, mainly potatoes, corn, cotton, rice, sugarcane and peanuts, to protect against chewing and piercing-sucking insects. Purchased assets included registrations, data, know-how and certain inventories. The acquisition was made in connection with the settlement of litigation between AMVAC and Aceto AG.

On March 7, 2008, AMVAC acquired from Bayer Cropscience LP (“BCS LP”) certain assets at BCS LP’s facility located in Marsing, ID, (the “Marsing Facility”). The Marsing Facility consists of approximately 17 acres of improved real property, 15 of which are now owned by AMVAC and two of which are leased by AMVAC from the City of Marsing for a term of 25 years. The acquired assets, primarily include real property, buildings and manufacturing equipment. In connection with the acquisition, AMVAC and BCS LP agreed to enter into a master processor agreement under which AMVAC is providing certain tolling services to BCS LP for a period of four years.

On January 16, 2008, AMVAC, acquired from Valent U.S.A. Corporation the Orthene® insecticide product line. Orthene is used on agricultural crops, including beans, brussels sprouts, cauliflower, celery, cotton, cranberries, head lettuce, mint and ornamental and forests. AMVAC purchased the proprietary formulation information, registration rights, marketing materials, certain intellectual property rights and existing inventories of the agricultural and professional product lines.

Seasonality

The agricultural chemical industry in general is cyclical in nature. The demand for AMVAC’s products tends to be seasonal. Seasonal usage, however, does not necessarily follow calendar dates, but more closely follows varying growing seasonal patterns, weather conditions and weather related pressure from pests, and customer marketing programs and requirements.

Backlog

AMVAC does not believe that backlog is a significant factor in its business. AMVAC primarily sells its products on the basis of purchase orders, although it has entered into requirements contracts with certain customers.

Customers

Tenkoz; Crop Production Services, Inc (formerly United Agri Products, Western Farm Services and Crop Production Services); and Winfield accounted for 26%, 18%, and 11%, respectively of the Company’s sales in 2011; 23%, 19% and 11% in 2010; and 21%, 20%, and 9% in 2009.

2

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Competition

AMVAC faces competition from many domestic and foreign manufacturers in its marketplaces. Competition in AMVAC’s marketplace is based primarily on quality, efficacy, price, safety and ease of application. Many of our competitors are larger and have substantially greater financial and technical resources than AMVAC. AMVAC’s ability to compete depends on its ability to develop additional applications for its current products and expand its product lines and customer base. AMVAC competes principally on the basis of the quality and efficacy of its products, its price and the technical service and support given to its customers.

Generally, the treatment against pests of any kind is broad in scope, there being more than one way or one product for treatment, eradication, or suppression. In most cases, AMVAC has attempted to position itself in smaller niche markets which are no longer addressed by larger companies.

Intellectual Property

AMVAC’s proprietary product formulations are protected, to the extent possible, as trade secrets and, to a lesser extent, by patents. Further, AMVAC’s trademarks bring value to its products in both domestic and foreign markets. Although AMVAC considers that, in the aggregate, its trademarks, licenses, and patents constitute a valuable asset, it does not regard its business as being materially dependent upon any single trademark, license, or patent.

EPA Registrations

AMVAC’s products also receive protection afforded by the effect of the Federal Insecticide, Fungicide and Rodenticide Act (“FIFRA”) legislation. The legislation makes it unlawful to sell any pesticide in the United States unless such pesticide has first been registered by the United States Environmental Protection Agency (“USEPA”) as well as under similar state laws. Substantially all of AMVAC’s products are subject to USEPA registration and re-registration requirements and are conditionally registered in accordance with FIFRA. This registration by USEPA is based, among other things, on data demonstrating that the product will not cause unreasonable adverse effects on human health or the environment when it is used according to approved label directions. All states where any of AMVAC’s products are used require a registration by that specific state before it can be marketed or used in that state. State registrations are renewed annually, as appropriate. The USEPA and state agencies have required, and may require in the future, that certain scientific data requirements be performed on registered products sold by AMVAC. AMVAC, on its own behalf and in joint efforts with other registrants, has furnished, and is currently furnishing, certain required data relative to specific products.

Under FIFRA, the federal government requires registrants to submit a wide range of scientific data to support U.S. registrations. This requirement results in operating expenses in such areas as testing and the production of new products. AMVAC expensed $6,555, $5,876, and $4,876 during 2011, 2010 and 2009 respectively, related to gathering this information. See also PART II, Item 7 of this Annual Report on form 10-K for discussions pertaining to research and development expenses.

Raw Materials

AMVAC utilizes numerous companies as well as internal sources to supply the various raw materials and components used in manufacturing its products. Many of these materials are readily available from domestic sources. In those instances where there is a single source of supply or where the source is not domestic, AMVAC seeks to secure its supply by either long-term (multi-year) arrangements or purchasing on long lead times from its suppliers. AMVAC believes that it is considered to be a valued customer to such sole-source suppliers.

Environmental

During 2011, AMVAC continued activities to address environmental issues associated with its facility (the “Facility”) in Commerce, CA. An outline of the history of those activities follows.

In 1995, the California Department of Toxic Substances Control (“DTSC”) conducted a Resource Conservation and Recovery Act (“RCRA”) Facility Assessment (“RFA”) of those facilities having hazardous waste storage permits. During that same year, ten underground storage tanks located at the Facility were closed. In March 1997, the RFA culminated in DTSC accepting the Facility into its Expedited Remedial Action Program. Under this program, the Facility was required to prepare and implement an environmental investigation plan. Depending on the findings of the investigation, the Facility might also be required to develop and implement remedial measures to address any historical environmental impairment.

3

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

This activity then took two paths: the RCRA permit closure and the larger site characterization. With respect to the permit closure, in 1998, AMVAC began the formal process to close its hazardous waste permit at the Facility (which had allowed AMVAC to store hazardous waste longer than 90 days) as required by federal regulations. Formal regulatory closure actions began in 2005 and were completed in 2008, as evidenced by DTSC’s October 1, 2008 acknowledgement of AMVAC’s Closure Certification Report.

With respect to the site characterization, soil and groundwater characterization activities began in December 2002 in accordance with the Site Investigation Plan that was approved by the DTSC. Additional activities were conducted from 2003 to 2011 with oversight provided by the DTSC. Additional analysis of groundwater and soil are being conducted in response to federally-mandated initiatives of similarly affected sites. Area-wide groundwater studies of perchlorate (typically associated with rocket fuel, explosives and fertilizer) require the Facility and neighboring sites to monitor existing wells for perchlorate in groundwater. Risk Assessment activities have commenced and are likely to conclude over the next year under the oversight of the DTSC, after which further investigation may be required, and the company will prepare and submit a remedial action plan. Until the remedial action plan has been submitted and comments are received from DTSC, it is uncertain whether the cost associated with further investigation and potential remediation activities will have a material impact on the Company’s financial statements. Thus, the Company is unable to determine whether remediation is reasonably probable, nor can the cost of remediation be reasonably estimated (the scope can vary depending upon the risk assessment and many other factors). Accordingly, the Company has not set up a loss contingency with respect thereto.

AMVAC is subject to numerous federal and state laws and governmental regulations concerning environmental matters and employee health and safety at the Commerce, CA; Marsing, ID; Hannibal, MO and Axis, AL facilities. AMVAC continually adapts its manufacturing process to the environmental control standards of the various regulatory agencies. The USEPA and other federal and state agencies have the authority to promulgate regulations that could have an impact on AMVAC’s operations.

AMVAC expends substantial funds to minimize the discharge of materials in the environment and to comply with the governmental regulations relating to protection of the environment. Wherever feasible, AMVAC recovers raw materials and increases product yield in order to partially offset increasing pollution abatement costs.

The Company is committed to a long-term environmental protection program that reduces emissions of hazardous materials into the environment, as well as to the remediation of identified existing environmental concerns. As part of its continuing environmental program, the Company has been able to comply with such proceedings and orders without any materially adverse effect on its business.

Employees

As of December 31, 2011, the Company employed approximately 390 employees. AMVAC, on an ongoing basis, due to the seasonality of its business, uses temporary contract personnel to perform certain duties primarily related to packaging of its products. None of the Company’s employees are subject to a collective bargaining agreement. The Company believes it maintains positive relations with its employees.

4

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Domestic operations

AMVAC is a California corporation incorporated in 1971. It is the Company’s main operating subsidiary. It owns and/or operates the Company’s domestic manufacturing facilities and is also the parent company for all its foreign corporations. AMVAC manufactures, formulates, packages and sells our products predominantly in the USA and, in 2011, in 41 other countries. AMVAC is a wholly owned subsidiary of AVD.

GemChem is a California corporation incorporated in 1991 and purchased by the Company in 1994. GemChem is a national chemical distributor. GemChem, in addition to purchasing key raw materials for the Company, also sells into the pharmaceutical, cosmetic and nutritional markets. Prior to the acquisition, GemChem acted in the capacity as the domestic sales force for the Company (from September 1991). GemChem is a wholly owned subsidiary of AVD.

DAVIE currently owns real estate for corporate use only. See also PART I, Item 2 of this Annual Report. DAVIE is a wholly owned subsidiary of AVD.

EMI is an environmental consulting firm. EMI is a wholly owned subsidiary of AVD.

Export Operations

The Company opened an office in 2008 in Costa Rica to conduct business in the country. The office is operated by AMVAC CR and markets chemical products for agricultural and commercial uses.

The Company opened an office in Basel, Switzerland in 2006. The office is operated by AMVAC S. The Company formed the new subsidiary to expand its resources dedicated to non-U.S. business development opportunities.

The Company also formed a Brazilian entity in 2006 operating as AMVAC B. It functions primarily to maintain the company’s registrations in that country.

The Company opened an office in 1998 in Mexico to conduct business primarily in Mexico. The office is operated by AMVAC M and markets chemical products for agricultural and commercial uses.

The Company opened an office in 1994 in the United Kingdom. The office is operated by AMVAC UK and manages product registrations for AMVAC’s product lines throughout Europe.

The Company classifies as export sales all products bearing foreign labeling shipped to a foreign destination.

| 2011 | 2010 | 2009 | ||||||||||

| Export Sales |

$ | 63,454 | $ | 39,049 | $ | 37,964 | ||||||

| Percentage of Net Sales |

20.8 | % | 17.2 | % | 18.4 | % | ||||||

5

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Risk Management

The Company continually evaluates insurance levels for product liability, property damage and other potential areas of risk. Management believes its facilities and equipment are adequately insured against loss from usual business risks. The Company has purchased claims made products liability insurance. In addition, the Company regularly monitors matters, whether insurable or not, that could pose material risk to its operations. The Company’s Board of Directors has formally assumed responsibility for risk oversight; in 2010, the Board formed a Risk Committee, which, at present, consists of five members of the Board of Directors. The committee meets regularly with senior management to evaluate the company’s risk profile, to identify mitigation measures and to ensure that the company is prudently managing these risks. In the spirit of helping the Risk Committee oversee risk management, senior management has appointed a risk manager and a team of executives to serve as a management risk committee; this group performs analysis with the benefit of operational knowledge. Over the course of 2011, the company continued to implement an enterprise risk management program, which extends to all areas of potential risk and is intended to serve as a permanent feature in the company’s operation.

Available Information

The Company makes available free of charge (through its website, www.american-vanguard.com), its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (“SEC”). Such reports are also available free of charge on the SEC website, www.sec.gov. Also available free of charge on the Company’s website are the Company’s Audit Committee, Compensation Committee, Finance Committee and Nominating and Corporate Governance Committee Charters, the Company’s Corporate Governance Guidelines, the Company’s Code of Conduct and Ethics, the Company’s Employee Complaint Procedures for Accounting and Auditing Matters and our policy on Stockholder Nomination and Communication. The Company’s Internet website and the information contained therein or incorporated therein are not intended to be incorporated into this Annual Report on Form 10-K.

6

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| ITEM 1A. | RISK FACTORS |

The regulatory climate has grown increasingly challenging to the Company’s interests both domestically and internationally.

Under the current U.S. Administration, various agencies within the Federal government have begun to exercise increased scrutiny in permitting continued uses (or the expansion of such uses) of older chemistries, including many of the Company’s products and, in some cases, have initiated or entertained challenges to these uses. At the regulatory level, the principles of sound science to which the Company has always subscribed have been adulterated, in some cases, by political considerations. The challenge of the regulatory climate is even more pronounced in certain other geographical regions, most especially the European Union and Brazil, where the Company faces resistance toward the continued use of certain of its products. There is no guarantee that this climate will change in the near term. Nor is there any guarantee that the Company will be able to maintain or expand the uses of many of its products in the face of these regulatory challenges.

The Company is dependent upon certain sole source suppliers for certain of its active ingredients.

In conjunction with the purchase and/or licensing of various product lines (including Folex, Mocap, Nemacur, Impact and Force), the Company has been required by seller/licensor to enter into multi-year supply arrangements under which such counterparties are the sole source of either active ingredients or formulated end-use product. In some cases, the manufacturer has been unable to deliver the volume of product necessary to meet the Company’s demand. Further, certain manufacturers have expressed a desire to discontinue production of such goods earlier than anticipated. In one case, the manufacturer has entered the market as a competitor. There is no guarantee that these sole source manufacturers will be willing or able to supply these products to the Company reliably, continuously and at the levels anticipated by the Company or required by the market. In addition, while the Company is making efforts to transfer production of certain of these products to its own facilities, there is no guarantee that these initiatives will be successful or that they will be completed in a timely fashion so as to permit the Company to meet market demand in the short to mid-term. If these sources prove to be unreliable and the Company is not able to supplant or otherwise second source these manufacturers, it is possible that the Company will not realize its projected sales, which, in turn, could adversely affect the Company’s profitability.

The Company may be subject to environmental liabilities.

While the Company expends substantial funds to minimize the discharge of materials into the environment and to comply with governmental regulations relating to protection of the environment and its workforce, federal and state authorities may nevertheless seek fines and penalties for violation of the various laws and governmental regulations. Further, these various governmental agencies could, among other things, impose liability on the Company for cleaning up the damage resulting from release of pesticides and other agents into the environment. In addition, while the Company continually adapts its manufacturing process to the environmental control standards of regulatory authorities, it cannot completely eliminate the risk of accidental contamination or injury from hazardous or regulated materials. In the event of such contamination or injury, the Company may be held liable for significant damages or fines. In the event that such damages or fines are assessed, it could have a material adverse effect on the Company’s financial and operating results.

Use of the Company’s products is subject to continuing challenges from activist groups.

Use of agrochemical products, including the Company’s products is regularly challenged by activist groups in many jurisdictions under a multitude of federal and state statutes, including FIFRA, the Food Quality Protection Act, Endangered Species Act, and the Clean Water Act, to name a few. These challenges typically take the form of lawsuits or administrative proceedings against the USEPA and/or other federal or state agencies, the filing of amicus briefs in pending actions, the introduction of legislation that is inimical to the Company’s interests, and/or adverse comments made in response to public comment invited by USEPA in the course of registration, re-registration or label expansion. It is possible that one or more of these challenges could succeed, resulting in a material adverse effect upon one or more of our products.

The Company’s business may be adversely affected by cyclical and seasonal effects.

Demand for the Company’s products tends to be seasonal. Seasonal usage follows varying agricultural seasonal patterns, weather conditions and weather related pressure from pests, and customer marketing programs and requirements. Weather patterns can have an impact on the Company’s operations. The end user of its products may, because of weather patterns, delay or intermittently disrupt field work during the planting season, which may result in a reduction of the use of some products and therefore may reduce our revenues and profitability. There can be no assurance that the Company will adequately address any adverse seasonal effects.

7

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

The Company faces competition in certain markets from manufacturers of genetically modified seeds.

The Company faces competition from larger chemical companies that market genetically modified (“GMO”) seeds in certain of the crop protection sectors in which the Company competes, particularly that of corn. Many growers that have chosen to use GMO seeds have reduced their use of pesticides sold by the Company. Further, the federally mandated “refuge acre” requirement for corn (which, in the name of preventing pest resistance, required growers using GMO seeds to set aside a percentage of their planting acres for non-GMO seed), has been sharply reduced. There is no guarantee that the Company will maintain its market share or pricing levels in sectors that are subject to competition from GMO seed marketers or that federal mandates to set aside acreage for non-GMO seed will continue.

The Company faces competition from generic competitors that source product from countries having lower cost structures.

The Company continues to face competition from competitors that enter the market through making offers to pay data compensation and subsequently sourcing material from countries having low cost structures (typically India and China). These competitors typically operate at thinner gross margins and, with low costs of goods, drive pricing and profitability of subject product lines downward. Further, such competitors typically spend little on product stewardship and employ few personnel within the United States. In effect, they tend to commoditize all products which they distribute; that is, they operate by offering the lowest price goods. There is no guarantee that the Company will maintain market share over generic competitors or that such competitors will not offer generic versions of the Company’s products in the future.

The Company’s key customers typically carry competing product lines and may be influenced by the Company’s larger competitors.

A significant portion of the Company’s products are sold to national distributors who also carry product lines of competitors that are much larger than the Company. Typically, revenues from the sales of these competing product lines and related program incentives constitute a greater part of our distributors’ income than do revenues from sales and program incentives arising from the Company’s product lines. Further, these distributors are often under pressure to market competing product lines in favor of the Company’s. In light of these facts, there is no assurance that such customers will market or continue to market our products aggressively or successfully or that the Company will be able to influence such customers to purchase our products in favor of those of our competitors.

To the extent that capacity utilization is not fully realized at its manufacturing facilities, the Company may experience lower profitability.

The Company has pursued a business strategy of acquiring manufacturing facilities at a steep discount to their replacement value. These acquisitions have enabled the Company to be more independent of overseas manufacturers than some of our competitors. While the Company endeavors continuously to maximize utilization of these several facilities, our success in these endeavors is dependent upon many factors beyond our control, including fluctuating market conditions, product life cycles, weather conditions, availability of raw materials and regulatory constraints, among other things. There can be no assurance that the Company will be able to maximize its utilization of capacity at its manufacturing facilities. To the extent that the Company experiences excess manufacturing capacity, it may experience lower profitability.

Reduced availability and higher prices of raw materials may reduce the Company’s profitability and could threaten the viability of some of its products.

In the recent past, there has been a material reduction in the number of suppliers of certain important raw materials used by the Company in many of its products. Certain of these raw materials are available solely from sources overseas or from single sources domestically. In the recent past, the price of these raw materials has fluctuated sharply. There can be no assurance that the Company will be able to source some or all of these materials indefinitely or that it will be able to do so at a level of cost that will enable it to maintain its profit margin on its products.

8

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Foreign currency and interest rate risk and the use of derivative instruments and hedging activities.

The Company engages in global business transactions. Where possible, the Company does business in its functional currency. However, there are certain situations in which the Company is unable to transact in its functional currency and engages in agreements that require settlement in a different currency. The Company may enter into derivative instruments to manage foreign currency risk of these agreements. That is to say, establish a forward exchange rate at the point of placing a purchase order and thereby insure the Company against movement in exchange rate. In addition, the Company may use interest rate derivates to manage interest rate expense generated by variable rate debt. The Company has in place one fixed interest rate swap with the objective of reducing the Company’s exposure to movements in the LIBOR rate over time. This is required as a condition of the Company’s Senior Credit Facilities agreement.

Dependence on the Company’s banking relationship.

The Company’s main bank is Bank of the West, a wholly-owned subsidiary of the French bank, BNP Paribas. Bank of the West has been the Company’s primary bank for more than 30 years. Bank of the West is the syndication manager for the Company’s loans and acts as the counterparty on the Company’s derivative transactions. The Company reviews the creditworthiness of its banks on a quarterly basis via credit agencies and also has face-to-face meetings with senior management of the banks. Management believes that the Company has an excellent working relationship with Bank of the West and the other financial institutions in the Company’s lender group. In light of the uncertainties in global financial markets, there is no guarantee, however, that the Company’s lenders will be either willing or able to continue lending to the Company at such rates and in such amounts as may be necessary to meet the Company’s working capital needs.

The distribution and sale of the Company’s products are subject to prior governmental approvals and thereafter ongoing governmental regulation.

The Company’s products are subject to laws administered by federal, state and foreign governments, including regulations requiring registration, approval and labeling of its products. The labeling requirements restrict the use of and type of application for our products. More stringent restrictions could make our products less available, which would adversely affect our revenues and profitability. Substantially all of the Company’s products are subject to the USEPA registration and re-registration requirements, and are conditionally registered in accordance with FIFRA. Such registration requirements are based, among other things, on data demonstrating that the product will not cause unreasonable adverse effects on human health or the environment when used according to approved label directions. All states where any of the Company’s products are used also require registration before they can be marketed or used in that state. Governmental regulatory authorities have required, and may require in the future, that certain scientific data requirements be performed on the Company’s products. The Company, on its behalf and also in joint efforts with other registrants, have and are currently furnishing certain required data relative to its products. There can be no assurance, however, that the USEPA will not request certain tests or studies be repeated or that more stringent legislation or requirements will not be imposed in the future. The Company can provide no assurance that any testing approvals or registrations will be granted on a timely basis, if at all, or that its resources will be adequate to meet the costs of regulatory compliance.

The manufacturing of the Company’s products is subject to governmental regulations.

The Company currently owns and operates three manufacturing facilities—in Los Angeles, California; Axis, Alabama; and Marsing, Idaho—and owns and has manufacturing services provided in a fourth facility in Hannibal, Missouri (the “Facilities”). The Facilities operate under the terms and conditions imposed by required licenses and permits by state and local authorities. The manufacturing of key ingredients for certain of the Company’s products occurs at the Facilities. An inability to renew or maintain a license or permit or a significant increase in the fees for such licenses or permits could impede the Company’s access to key ingredients and increase the cost of production, which, in turn, would materially and adversely affect the Company’s ability to provide its products in a timely and affordable manner.

The Company is dependent on a limited number of customers, which makes us vulnerable to the continued relationship with and financial health of those customers.

In 2011, three customers accounted for 55% of the Company’s sales. The Company’s future prospects will depend on the continued business of such customers and on our continued status as a qualified supplier to such customers. The Company cannot guarantee that our current significant customers will continue to buy products from us at current levels. The loss of a key customer could have a material adverse effect on the Company.

9

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2 | PROPERTIES |

The Company’s corporate headquarters are located in Newport Beach, California. This facility is leased. See PART IV, Item 15 of this report for further information.

AMVAC owns in fee the Facility constituting approximately 152,000 square feet of improved land in Commerce, California (“Commerce”) on which its West Coast manufacturing and some of its warehouse facilities and offices are located.

DAVIE owns in fee approximately 72,000 square feet of warehouse, office and laboratory space on approximately 118,000 square feet of land in Commerce, California, which is leased to AMVAC.

In 2001, AMVAC completed the acquisition of a manufacturing facility from E.I. DuPont de Nemours and Company (“DuPont”). The facility is one of three such units located on DuPont’s 510 acre complex in Axis, Alabama. The acquisition consisted of a long-term ground lease of 25 acres and the purchase of all improvements thereon. The facility is a multi-purpose plant designed primarily to manufacture pyrethroids and organophosphates.

On December 28, 2007, AMVAC, pursuant to the provisions of the definitive Sale and Purchase Agreement (the “Agreement”) dated as of November 27, 2006 between AMVAC and Badische Anilin-und Soda-Fabrik (“BASF”), through which AMVAC purchased the global Counter product line from BASF. AMVAC purchased certain manufacturing assets relating to the production of Counter and Thimet and located at BASF’s multi-plant facility situated in Hannibal, Missouri (the “Hannibal Site”). Subject to the terms and conditions of the Agreement, AMVAC purchased certain buildings, manufacturing equipment, office equipment, fixtures, supplies, records, raw materials, intermediates and packaging constituting the “T/C Unit” of the Hannibal Site. The parties entered into a ground lease and a manufacturing and shared services agreement, under which BASF continues to supply various shared services to AMVAC from the Hannibal Site.

On March 7, 2008, AMVAC acquired from BCS LP a facility (the “Marsing Facility”) located in Marsing, ID, which consists of approximately 17 acres of improved real property, 15 of which are owned by AMVAC and two of which AMVAC leases from the City of Marsing for a term of 25 years. The Marsing Facility is engaged in the blending of liquid and powder raw materials and the packaging of finished liquid products in the agricultural chemical field. With this acquisition, AMVAC acquired the ability to formulate flowable materials. In connection with the acquisition, AMVAC and BCS LP agreed to enter into a master processor agreement under which AMVAC provides certain tolling services to BCS LP on an ongoing basis through 2012.

The production areas of AMVAC’s facilities are designed to run on a continuous 24 hour per day basis. AMVAC regularly adds chemical processing equipment to enhance its production capabilities. AMVAC believes its facilities are in good operating condition and are suitable and adequate for current needs, can be modified to accommodate future needs, have flexibility to change products, and can produce at greater rates as required. Facilities and equipment are insured against losses from fire as well as other usual business risks. The Company knows of no material defects in title to, or encumbrances on, any of its properties except that substantially all of the Company’s assets are pledged as collateral under the Company’s loan agreements with its primary lender group. For further information, refer to note 2 of the Notes to the Consolidated Financial Statements in PART IV, Item 15 of this Annual Report.

AMVAC owns approximately 42 acres of unimproved land in Texas for possible future expansion.

GemChem’s, AMVAC UK’s, AMVAC M’s, AMVAC CR’s and AMVAC S’s facilities consist of administration and sales offices which are leased.

10

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| ITEM 3 | LEGAL PROCEEDINGS |

A. PCNB Matters

In August 2010, the USEPA issued a Stop Sale, Use and Removal Order (“SSURO”) relating to the Company’s USEPA-registered pentachloronitrobenzene (“PCNB”) product line. The Company sells PCNB primarily for use on turf with the bulk of sales occurring in September and October. In issuing the SSURO, the USEPA alleged that the Company’s product did not comply with the confidential statement of formula (“CSF”) due to the presence of trace impurities that are not listed on the CSF. The SSURO was issued by the agency without either i) a specific finding of risk, ii) providing the Company an opportunity to present a technical case regarding the basis for USEPA’s SSURO, or iii) any forewarning that USEPA planned to issue a SSURO. Despite its efforts, the Company was unable to obtain informal resolution of the matter with the agency and, in an effort to protect its business, filed an action against USEPA with the United States District Court for the District of Columbia in late August 2010 in which it sought emergency and permanent injunctive relief. Over the course of several months, the Company worked with USEPA’s technical team to address purported deficiencies in the CSF. Then, on August 17, 2011, the Chief Justice of that court granted the Company’s motion for summary judgment and vacated the SSURO on the ground that the signatory of the SSURO lacked the requisite authority to sign the order. Following the court’s action, the Company continued working with USEPA both to revise the CSF and to consolidate product labels. On November 23, 2011, the USEPA approved registrations for the PCNB product line for all major commercial uses (including golf course, turf, certain potato uses, cotton, ornamental bulb and cole crops). Following issuance of the registrations, the Company sold a limited amount of PCNB into the turf market at the tail end of the season. The Company remains in discussion with the agency on expanding the label to include certain minor uses and as to the proper labeling and disposition of some existing stocks. Given USEPA’s issuance of the registrations, the Company cannot conclude that a loss is probable or reasonably estimable and has not set up a loss contingency.

On or about April 6, 2010, the Pest Management Regulatory Agency (“PMRA”) notified the Company of its intention to cancel the Canadian registration for PCNB in that country, citing as a reason the Company’s failure to provide certain manufacturing data to the agency in a timely fashion. The Company subsequently provided the agency with the required data, and PMRA extended its notice to permit continued registration through at least the end of the calendar year. Notwithstanding the Company’s objections, PMRA permitted certain registrations of PCNB to be cancelled as of December 31, 2010. The Company intends to seek a new registration for this product line in Canada; this process could take in excess of one year to complete. With respect to inventory in the Canadian channel, the Company will seek to have the goods returned and then to resell them. The value of these goods has been recorded at the appropriate net realizable value.

B. DBCP Cases

Over the course of the past 30 years, AMVAC and/or the Company have been named or otherwise implicated in a number of lawsuits concerning injuries allegedly arising from either contamination of water supplies or personal exposure to 1,2-dibromo-3-chloropropane (“DBCP”). DBCP was manufactured by several chemical companies, including Dow Chemical Company, Shell Oil Company and AMVAC and was approved by the USEPA to control nematodes. DBCP was also applied on banana farms in Latin America. The USEPA suspended registrations of DBCP in October 1979, except for use on pineapples in Hawaii. The USEPA suspension was partially based on 1977 studies by other manufacturers that indicated a link between male sterility and exposure to DBCP among their factory production workers producing the product.

At present, there are approximately 100 lawsuits, foreign and domestic, filed by former banana workers in which AMVAC has been named as a party. Fifteen of these suits have been filed in the United States (with prayers for unspecified damages) and the remainder have been filed in Nicaragua. Three of these domestic suits were brought by citizens of Nicaragua while the other domestic suits have been brought by citizens of other countries. These claims are all in various stages and allege injury from exposure to DBCP, including claims for sterility. Only two of the suits (Suazo and Castillo, indicated below) filed in Nicaragua have been served on AMVAC. It should be noted that Nicaraguan plaintiffs had not been able to obtain domestic enforcement of decisions rendered by Nicaraguan courts. The Eleventh Circuit recently upheld a U.S. District Court’s refusal to enforce a $97,000 Nicaraguan judgment rendered against certain US-based DBCP defendants finding, among other things, lack of international due process.

Over the course of 2009, two actions that had been filed in the Los Angeles County Superior Court (named Mejia and Rivera) involving claims for personal injury to Nicaraguan banana plantation workers allegely arising from exposure to DBCP, were dismissed with prejudice by the court on its own motion with a finding of “fraud on the court” and “blatant extortion of the defendants.” We believe that the court’s findings in these cases has diminished the viability of the pending Nicaraguan cases generally. Further, we

11

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

believe that Mejia and Rivera have had an effect upon other cases involving exposure to foreign residents, most notably the several cases alleging injury to 668 residents of the Ivory Coast (banana and pineapple plantation workers) which were dismissed in 2009 by the Los Angeles Superior Court without prejudice, as plaintiffs’ counsel withdrew from the case and no one came forward to prosecute the action.

As described more fully below, of the cases that were still pending domestically in 2011, in Hawaii, Patrickson, et. al. v. Dole Food Co., et. al was dismissed and is on appeal, while Adams involves claims that pre-dated AMVAC’s sales into the relevant market; and the state cases in Louisiana continue to lie dormant. However, during 2011, following the dismissal of various cases in 2009, there was a resurgence of activity by plaintiffs in i) state court in California, where approximately 2,444 plaintiffs from the Philippines filed an action (Macasa); ii) in federal district court in Louisiana, where an action has been filed by the Hendler law firm on behalf of 259 workers from Ecuador, Panama and Costa Rica (Aguilar), and iii) in state court in Delaware, where an individual from Costa Rica has brought an action (Blanco). In all of the newly-filed matters, some or all of the plaintiffs face challenges from applicable statutes of limitations; many of them were parties to prior lawsuits.

California Matter

On August 8, 2011, an action encaptioned Macasa v. The Dole Food Company, Inc. et al., was filed with the Superior Court for the State of California for the County of Los Angeles (No. BC 467134) on behalf of 2,444 individual plaintiffs from the Philippines against several defendants, including, among others, The Dole Food Company, Del Monte Foods, Inc., Shell Chemical Company, the Dow Chemical Company and AMVAC. Plaintiffs, all of whom worked on banana plantations in the Philippines, have alleged physical injury (namely, sterility) arising from alleged exposure to DBCP for an indeterminate period of time commencing in the 1970’s. It has been reported that approximately three quarters of the claimants were members of a banana workers’ association that was a party to an action that had been brought in the Philippines in about 1998 and that other plaintiffs were members as of 2008. Defendants contend these plaintiffs’ claims are barred by the statute of limitations. AMVAC answered the complaint on October 3, 2011. On February 9, 2012, plaintiffs filed a first amended complaint increasing the number of claimants to 2,939 and stating, among other things, that plaintiffs had alleged identical claims against defendants in 1998. At this very early stage of the case, no discovery has taken place, it is unknown how many of the plaintiffs may have been exposed to AMVAC’s product, what injuries may have been sustained and whether any statutes of limitations may bar recovery. The initial case management conference with the court took place on February 1, 2012 and an early step in the case is to determine the statute of limitations issue. AMVAC intends to defend this matter vigorously. At this early stage of the case, the Company does not believe that a loss is either probable or reasonably estimable and has not set up a loss contingency for this matter.

Delaware Matter

On or about July 21, 2011, an action encaptioned Blanco v. AMVAC Chemical Corporation et al was filed with the Superior Court of the State of Delaware in and for New Castle County (No. N11C-07-149 JOH) on behalf of an individual plaintiff residing in Costa Rica against several defendants, including, among others, AMVAC, The Dow Chemical Company, Occidental Chemical Corporation, and Dole Food Company. In the action, plaintiff claims personal injury (sterility) arising from the alleged exposure to DBCP between 1979 and 1980 while working as a contract laborer in a banana plantation in Costa Rica. Defendant Dow has filed a motion to dismiss the action as being barred under the applicable statute of limitations, as this same plaintiff filed the same action in 1995. Plaintiff contends that the statute of limitations was tolled by a prior motion for class certification, which was denied. AMVAC also contends that the plaintiff could not have been exposed to any AMVAC supplied DBCP in Costa Rica. The motion to dismiss, which has been joined by all defendants, is presently scheduled for a hearing on March 9, 2012. AMVAC intends to defend the matter vigorously. The Company does not believe that a loss is either probable or reasonably estimable and has not set up a loss contingency for the matter.

Hawaiian Matters

Patrickson, et. al. v. Dole Food Co., et. al

In October 1997, AMVAC was served with a Complaint(s) in which it was named as a defendant, filed in the Circuit Court, First Circuit, State of Hawaii and in the Circuit Court of the Second Circuit, State of Hawaii (two identical suits) entitled Patrickson, et. al. v. Dole Food Co., et. al (“Patrickson Case”) alleging damages sustained from injuries caused by plaintiffs’ exposure to DBCP while applying the product in their native countries. Other named defendants include: Dole Food Co., Shell Oil Company, and Dow

12

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Chemical Company. The ten named plaintiffs are variously citizens of four countries—Guatemala, Costa Rica, Panama, and Ecuador. Punitive damages are sought against each defendant. The plaintiffs were banana workers and allege that they were exposed to DBCP in applying the product in their native countries. The case was also filed as a class action on behalf of other workers so exposed in these four countries. The plaintiffs allege sterility and other injuries.

After several years of law and motion activity, Dow filed a motion for summary adjudication as to the remaining plaintiffs based on the statute of limitations, as they had filed suit in Florida in 1995. All defendants joined in this motion. The court granted this motion on June 9, 2009. Plaintiffs’ counsel unsuccessfully argued that their claims were tolled by prior class action cases. On November 30, 2009, the court denied a motion for reconsideration. Judgment in favor of the defendants was entered on July 28, 2010. On August 24, 2010, the plaintiffs filed a notice of appeal, which is presently pending. In March 2011, Dow filed a brief in opposition to the appeal, arguing that plaintiffs are barred from this action by the applicable statute of limitations. The Company does not believe that a loss is either probable or reasonably estimable and, accordingly, has not set up a loss contingency for this matter.

Adams v. Dole Food Co. et al

On approximately November 23, 2007, AMVAC was served with a suit filed by two former Hawaiian pineapple workers and their spouses, alleging testicular cancer due to DBCP exposure: Adams v. Dole Food Co. et al in the First Circuit for the State of Hawaii. The complaint was filed on June 29, 2007 and names Dole Food Co, Standard Fruit and Steamship Company, Dole Fresh Food, Pineapple Growers Association, AMVAC, Shell Oil Co., Dow Chemical Co. and Occidental Corporation. Plaintiff Mark Adams alleges he was exposed to DBCP in 1974 and 1975 while working on Dole’s plantation on Oahu. Plaintiff Nelson Ng alleges he was exposed between 1971 and 1973 while working in Lanai City, Lanai. AMVAC answered the complaint on or about December 14, 2007. While little discovery has taken place, AMVAC denies that any of its product could have been used at the times and locations alleged by these plaintiffs. Dole Food Co. was dismissed on the basis of the exclusive remedy of worker’s compensation benefits as it was the employer of plaintiffs. However, plaintiffs have been granted relief to seek an interim appeal as to the dismissal of Dole, which appeal is pending. A stay has been placed on discovery other than to obtain written records. The Company does not believe that a loss is either probable or reasonably estimable and has not set up a loss contingency for this matter.

Louisiana Matters (Federal)

On June 1, 2011, seven separate actions were filed by the Hendler law firm in the United States District Court for the Eastern District of Louisiana on behalf of 259 individual plaintiffs (banana plantation workers from Ecuador, Panama and Costa Rica) against Dole Food Company, the Dow Chemical Company, Shell Oil Company, and AMVAC Chemical Corporation (to name a few) which, for purposes of convenience here, are encaptioned Aguilar et al., v. Dole Food Company, Inc., et al (U.S.D.C., E.D. of Louisiana No. CV-01305-CJB-SS). These matters allege personal injury (including sterility, cancer, skin disorders and other conditions) arising from alleged exposure to DBCP within the time period from 1960 through 1985 or later. A number of the plaintiffs appear to have been drawn from earlier DBCP litigation matters filed by the Hendler law firm, including, for example, the Mendez case that was dismissed from state court in Hawaii (see the Company’s Form 10-Q for the period ended March 31, 2011). It is unknown how many of the plaintiffs have been exposed to AMVAC’s product, what are the actual injuries if any and whether and what statutes of limitation may apply. AMVAC intends to defend these matters vigorously. With respect to these matters, the Company does not believe that a loss is either probable or reasonably estimable and has not set up a loss contingency for these matters.

Louisiana Matters (State)

In November 1999, AMVAC was served with three complaints filed in the 29th Judicial District Court for the Parish of St. Charles, State of Louisiana; we have reported on these matters under the name of the lead case, Eduardo Soriano, et al. v. AMVAC, et al. These matters allege personal injuries to about 314 persons (167 from Ecuador, 102 from Costa Rica, and 45 from Guatemala) from alleged exposure to DBCP. With the United States Supreme Court holding there was no federal court jurisdiction in the Patrickson case, the federal court judge remanded the cases to Louisiana state court in June 2003. In state court, the three cases were assigned to two different judges. On November 17, 2006, the state court separated the cases handled by attorney Scott Hendler from the cases being pursued only against the growers handled by different counsel. Subsequently, the cases against the growers were settled and all those actions were dismissed. The cases handled by Mr. Hendler were supposed to be placed in a new action, which was not done. After a hearing on January 29, 2008, the court ruled on February 8, 2008 that these plaintiffs could still proceed in the existing cases rather than in a new pleading. In mid-June 2011, some 12 years after filing the actions, plaintiffs have propounded written discovery

13

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

against defendants. No other discovery has been made; hence, it is unknown how many (if any) of the plaintiffs have been exposed to AMVAC’s product, what are the actual injuries if any and whether and what statutes of limitation may apply. AMVAC intends to defend these matters vigorously. With respect to these matters, the Company does not believe that a loss is either probable or reasonably estimable and has not set up a loss contingency for this matter.

Nicaraguan Matters

In May 2005, two suits filed in Nicaragua in 2004 were received that name AMVAC, The Dow Chemical Company, Dole Food Co., Dole Fresh Fruit, and Standard Fruit Company. The two suits for personal injuries for sterility and reduced sperm counts have been filed on behalf of a total of 15 banana workers: Flavio Apolinar Castillo et al. v. AMVAC Chemical Corporation et al., No. 535/04 and Luis Cristobal Martinez Suazo et al. v. AMVAC Chemical Corporation et al., No. 679/04. In December 2005, AMVAC received six additional, similar, lawsuits filed on behalf of a total of 30 plaintiffs. On January 25, 2006, AMVAC was served with the Suazo and Castillo suits, and in March 2006, counsel in Nicaragua filed objections to jurisdiction over AMVAC in these two cases. The court finally ruled on all the defendants’ objections on March 20, 2007, by denying each objection to jurisdiction; this ruling has been appealed.

A review of court filings in Chinandega, Nicaragua, by local counsel has found 85 suits filed pursuant to Public Law 364 that name AMVAC and include approximately 3,592 plaintiffs. However, only two cases, Castillo and Suazo, have been served on AMVAC. All but one of the suits in Nicaragua have been filed pursuant to Special Law 364, an October 2000 Nicaraguan statute that contains substantive and procedural provisions that Nicaragua’s Attorney General previously expressed as unconstitutional. Each of the Nicaraguan plaintiffs’ claims $1,000 in compensatory damages and $5,000 in punitive damages. In all of these cases, AMVAC is a joint defendant with Dow Chemical and Dole Food Company, Inc.

AMVAC contends that the Nicaragua courts do not have jurisdiction over it and that Public Law 364 violates international due process of law. AMVAC intends to contest personal jurisdiction and demand under Law 364 that the claims be litigated in the United States. Thus far, it appears that the Nicaraguan courts have denied all requests of other defendants under Law 364 that allow the defendants the option of consenting to jurisdiction in the United States. It is not presently known as to how many of these plaintiffs actually claim exposure to DBCP at the time AMVAC’s product was allegedly used nor is there any verification of the claimed injuries. Based on the precedent of the earlier suits in Nicaragua, it would appear likely that the Nicaragua courts will, over the defendants’ objections, enter multi-million dollar judgments for the plaintiffs and against all defendants in these cases.

However, to date, plaintiffs have not had success in enforcing Nicaraguan judgments against domestic companies before U.S. courts. One such judgment (not including the Company) was entered in August 2005 for $97,000 for 150 plaintiffs against Dole Food and other entities. It has also been reported that on December 1, 2006, the Nicaraguan court rendered a judgment for $802,000 against Dow Chemical Company, Shell Occidental, and Standard Fruit Company for some 1,200 plaintiffs. An enforcement action (entitled Osorio) against Dole and Dow for the $97,000 judgment was filed in the U.S. District Court in Miami, Florida. In this enforcement action, on October 20, 2009, the federal court issued a lengthy decision refusing to enforce the judgment on the grounds that Law 364 violated due process of law and that the Nicaraguan courts were not impartial tribunals. The plaintiffs filed a notice of appeal to the Eleventh Circuit Court of Appeal on March 10, 2010. On March 25, 2011, the United States Court of Appeals for the 11th Circuit upheld the lower court’s decision to refuse to enforce the Nicaraguan judgment under the Florida Recognition Act, finding, among other things, the fact that judgment had been rendered under a system (in Nicaragua) that does not provide procedures compatible with the requirements of due process of law and was contrary to public policy. The 11th Circuit Court did not address whether the Nicaraguan courts “do not provide impartial tribunals” as the district court had found.

C. Other Matters

Brazilian Citation. On or about October 5, 2009, IBAMA (the Brazilian equivalent of the USEPA) served AMVAC B with a Notice of Violation alleging that two lots of Granutox 150 (formulated product having phorate as the active ingredient) stored at BASF S.A. (AMVAC’s exclusive distributor in Brazil) and FMC Quimica do Brasil Ltda. (which formulates end-use product in that country) were not in compliance with the end-use registration on file with IBAMA. Specifically, IBAMA alleged that the color of the lots (gray) was inconsistent with the description in IBAMA’s files (pink). IBAMA also indicated an intention to assess a fine of approximately $200 against AMVAC B. The Company has challenged the citation, among other reasons, on the ground that the change in color has to do with the removal of a coloring component and that such removal poses no environmental or toxicity risk. In

14

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

March 2011, IBAMA denied AMVAC B’s first appeal. The Company believes, however, that the agency is statutorily prevented from levying a fine of this magnitude for an infraction of this nature. Thus, the Company has filed another appeal on these grounds and expects to hear a response within six months. At this stage, the Company believes that a loss of between $150 and $200 is probable and has set up a loss contingency in the amount of $150.

Philip Adame v. State of California et al. On or about November 8, 2011, plaintiffs (approximately 130 residents living proximally to a 17 acre parcel in Santa Clara County, California, that had been operated by the University of California from 1921 to 2003 as a fungicide and herbicide testing facility known as the Bay Area Research Extension Center (“BAREC”)) designated AMVAC and 11 other companies as defendants in an Amendment to Second Amended Complaint (entitled Philip Adame v. State of California, Superior Court of California, County of Santa Clara, Case No. 1-08-CV-106710) in which plaintiffs allege property damage and physical injuries arising from the operation of BAREC. The Second Amended Complaint in this matter had been filed in October 2008 and had included defendants The Regents of the University of California and Velsicol Chemical Corporation, both of whom have since been dismissed from the action with prejudice following settlement with plaintiffs. At this stage, AMVAC has not been served with any pleadings. However, those defendants who have been served with the Second Amended Complaint have filed both a motion to quash and a motion to dismiss on the ground that plaintiffs failed to serve any of the newly named defendants with the pleading in which they were designated as defendants and, at any rate, failed to designate any of them as defendants within three years of the filing of the Complaint. AMVAC believes that the case has no merit and, if served, will defend the matter vigorously. At this stage, the Company does not believe that a loss is either probable or reasonably estimable and has not set up a loss contingency for this matter.

| ITEM 4 | MINE SAFETY DISCLOSURE |

Not Applicable

15

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Effective March 6, 2006, the Company listed its $0.10 par value common stock (“Common Stock”) on the New York Stock Exchange under the ticker symbol AVD. From January 1998 through March 6, 2006, the Common Stock was listed on the American Stock Exchange under the ticker symbol AVD. The Company’s Common Stock traded on The NASDAQ Stock Market under the symbol AMGD from March 1987 through January 1998.

The following table sets forth the range of high and low sales prices as reported for the Company’s Common Stock for the calendar quarters indicated (as adjusted for stock splits and stock dividends).

| High | Low | |||||||

| Calendar 2011 |

||||||||

| First Quarter |

$ | 9.66 | $ | 7.63 | ||||

| Second Quarter |

14.25 | 8.31 | ||||||

| Third Quarter |

14.77 | 9.63 | ||||||

| Fourth Quarter |

14.36 | 10.70 | ||||||

| Calendar 2010 |

||||||||

| First Quarter |

$ | 8.71 | $ | 6.28 | ||||

| Second Quarter |

9.65 | 7.37 | ||||||

| Third Quarter |

9.60 | 5.93 | ||||||

| Fourth Quarter |

9.17 | 6.18 | ||||||

As of February 20, 2012, the number of stockholders of the Company’s Common Stock was approximately 3,650, which includes beneficial owners with shares held in brokerage accounts under street name and nominees.

On September 8, 2011, the Company announced that the Board of Directors declared a cash dividend of $0.05 per share. The dividend was distributed on October 14, 2011, to shareholders of record at the close of business on September 29, 2011.

On March 10, 2011, the Board of Directors declared a cash dividend of $0.03 per share. The dividend was distributed on April 15, 2011 to stockholders of record at the close of business on April 1, 2011.

On September 14, 2010, the Board of Directors declared a cash dividend of $0.02 per share. The dividend was distributed on October 14, 2010 to stockholders of record at the close of business on September 24, 2010.

On March 4, 2010, the Board of Directors declared a cash dividend of $0.01 per share. The dividend was distributed on April 16, 2010 to stockholders of record at the close of business on April 2, 2010.

On September 14, 2009, the Board of Directors declared a cash dividend of $0.01 per share. The dividend was distributed on October 7, 2009 to stockholders of record at the close of business on September 25, 2009.

On March 6, 2009, the Board of Directors declared a cash dividend of $0.05 per share. The dividend was distributed on April 15, 2009 to stockholders of record at the close of business on March 31, 2009.

The Company has issued a cash dividend in each of the last fifteen years dating back to 1996.

16

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

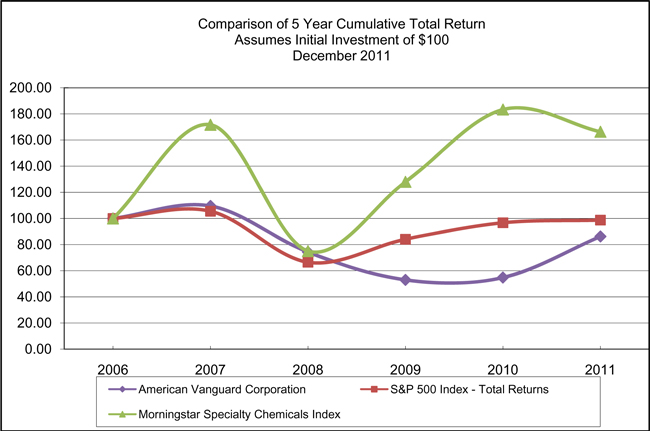

Stock Performance Graph

The following graph presents a comparison of the cumulative, five-year total return for the Company, the S&P 500 Stock Index, and a peer group (Chemical—Specialty Industry). The graph assumes that the beginning values of the investments in the Company, the S&P 500 Stock Index, and the peer group of companies each was $100. All calculations assume reinvestment of dividends. Returns over the indicated period should not be considered indicative of future returns.

17

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| ITEM 6 | SELECTED FINANCIAL DATA |

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Net sales |

$ | 304,429 | $ | 226,859 | $ | 205,801 | $ | 236,465 | $ | 212,479 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

$ | 123,068 | $ | 86,321 | $ | 56,898 | $ | 100,058 | $ | 91,547 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

$ | 39,226 | $ | 19,191 | $ | (6,329 | ) | $ | 36,144 | $ | 36,013 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income tax (benefit) expense |

$ | 35,223 | $ | 16,174 | $ | (9,538 | ) | $ | 32,173 | $ | 30,526 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 22,068 | $ | 10,984 | $ | (5,789 | ) | $ | 20,019 | $ | 18,728 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (loss) per common share(1) |

$ | 0.80 | $ | 0.40 | $ | (0.21 | ) | $ | 0.75 | $ | 0.71 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (loss) per common share—assuming dilution(1) |

$ | 0.79 | $ | 0.40 | $ | (0.21 | ) | $ | 0.73 | $ | 0.68 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 339,141 | $ | 280,179 | $ | 255,268 | $ | 286,937 | $ | 248,581 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Working capital |

$ | 99,440 | $ | 69,046 | $ | 68,797 | $ | 96,357 | $ | 75,144 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Long-term debt less current portion |

$ | 51,917 | $ | 53,710 | $ | 45,432 | $ | 75,748 | $ | 56,155 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Stockholders’ equity |

$ | 187,072 | $ | 166,437 | $ | 153,087 | $ | 155,943 | $ | 139,739 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding—basic(1) |

27,559 | 27,385 | 27,120 | 26,638 | 26,307 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding—assuming dilution(1) |

27,875 | 27,652 | 27,120 | 27,469 | 27,436 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends per share of common stock(1) |

$ | 0.080 | $ | 0.030 | $ | 0.060 | $ | 0.080 | $ | 0.070 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||