Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Nuverra Environmental Solutions, Inc. | d313266dex991.htm |

| EX-99.3 - PRESS RELEASE - Nuverra Environmental Solutions, Inc. | d313266dex993.htm |

| 8-K - FORM 8-K - Nuverra Environmental Solutions, Inc. | d313266d8k.htm |

Acquisition of Thermo Fluids Inc.

March 8, 2012

Exhibit 99.2 |

Cautionary Note Regarding Forward-Looking Statements

This document contains forward-looking statements as defined in the Private

Securities Litigation Reform Act of 1995, including statements regarding

expected cost synergies and other anticipated benefits of the proposed

acquisition of Thermo Fluids Inc. (“TFI”), the expected future

operating results of the combined company, the expected timing of completion of

the acquisition and the other expectations,

beliefs,

plans,

intentions

and

strategies

of

Heckmann

Corporation

(“Heckmann”

or

“HEK”).

Heckmann

Corporation

has

tried to

identify these statements by using words such as "expect,"

"anticipate," "believe," "could," "should," "estimate," "expect," "intend,"

"may,"

"plan,"

"predict,"

"project"

and

"will"

and

similar

terms

and

phrases,

but

such

words,

terms

and

phrases

are

not

the

exclusive

means of

identifying such statements. These forward-looking statements are made based

on management's expectations and beliefs concerning future

events

and

are

subject

to

uncertainties

and

factors

relating

to

operations

and

the

business

environment,

all

of

which

are

difficult

to

predict and many of which are beyond management's control. Actual results,

performance and achievements could differ materially from those expressed

in, or implied by, these forward-looking statements due to a variety of risks, uncertainties and other factors, including, but

not

limited

to,

the

following:

the

risk

that

the

proposed

business

combination

transaction

is

not

completed

on

a

timely

basis

or

at

all;

the

ability

to

integrate

Thermo

Fluids

into

the

business

of

Heckmann

Corporation

successfully

and

the

amount

of

time

and

expense

spent

and

incurred in connection with the integration; the risk that the economic benefits,

cost savings and other synergies that Heckmann Corporation

anticipates as a result of the transaction are not fully realized or take longer

to realize than expected; the risk that Heckmann Corporation or Thermo

Fluids may be unable to obtain antitrust or other regulatory clearance required for the transaction, or that required

antitrust

or

other

regulatory

clearance

may

delay

the

transaction

or

result

in

the

imposition

of

conditions

that

could

adversely

affect

the

operations

of

the

combined

company

or

cause

the

parties

to

abandon

the

transaction;

intense

competition;

the

loss,

or

renewal

on

less

favorable

terms,

of

management

contracts

and

leases;

and

changes

in

general

economic

and

business

conditions

or

demographic

trends.

For a detailed discussion of factors that could affect Heckmann Corporation's

future operating results, please see Heckmann Corporation's filings

with

the

United

States

Securities

and

Exchange

Commission

(the

"SEC"),

including

the

disclosures

under

“Risk

Factors”

in

those

filings.

Except

as

expressly

required

by

U.S.

federal

securities

laws,

Heckmann

Corporation

undertakes

no

obligation

to

update

or

revise any

forward-looking statements, whether as a result of new information, changed

circumstances, future events or for any other reason. 2

|

Acquisition of TFI Holdings, Inc. (“Seller”) by Heckmann

Corporation Transaction expected to close in early Q2 2012, subject to

customary legal and regulatory closing conditions

Transaction

Heckmann intends to enter into a new bank facility prior to the closing

and is considering a range of financing options

Focus will be on maintaining a conservative and flexible capital

structure which coupled with cash on hand provides the Company with

significant liquidity

Transaction Financing

Financially Attractive Acquisition that Diversifies HEK’s

Operations and Revenue Stream

Consideration

Total purchase consideration of $245 million

Includes $227.5 million of cash and $17.5 million in HEK shares,

issued to the Seller

Debt-free, cash-free transaction with normalized working capital

remaining in the business at close

3 |

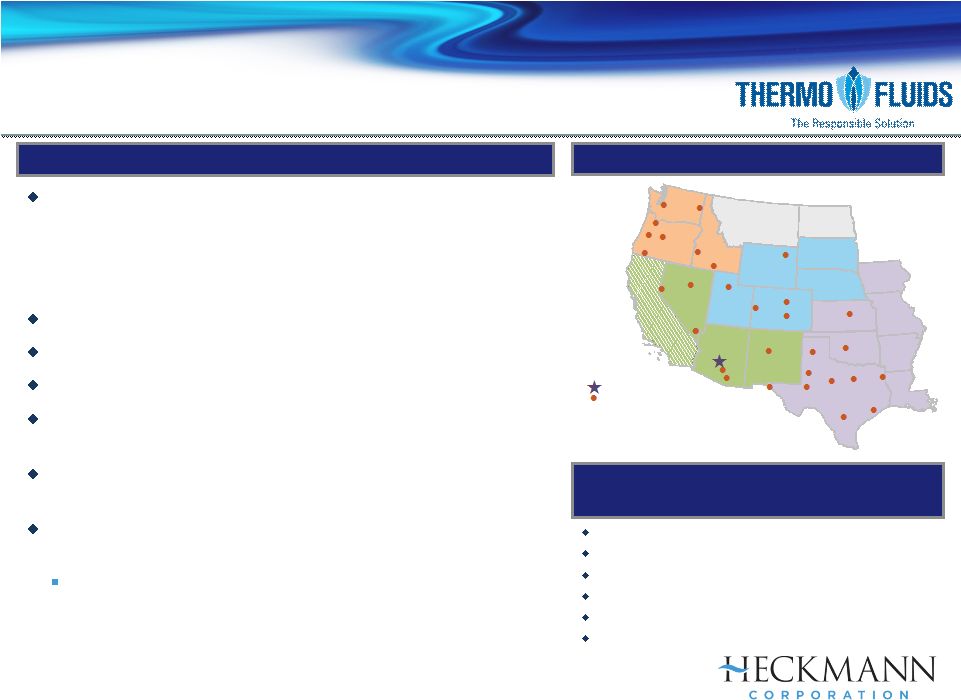

TFI has one of the largest environmental services networks

in the Western U.S. and engages in the collection and

reprocessing of used motor oil (“UMO”) into reprocessed

fuel oil (“RFO”) for sale into the asphalt, re-refining and

other industrial markets

More than 18 states served through 31 facilities

Large asset base of 290 trucks and more than 180 railcars

More than 250 employees

Estimated total market share of approximately 35% (in

markets served)

Limited geographic concentration with volume (both UMO

and RFO) and revenue well diversified across regions

Regionally-focused business model that drives operating

scale and route density

Cluster facilities in close proximity to UMO and RFO

customers

Overview

Market Presence

Facility Locations

Southwest Region

South Central Region

Mountain States Region

Northwest Region

Las Vegas, NV

Beowawe, NV

Odessa, TX

Abilene, TX

Dallas/ Ft. Worth, TX

Marshall, TX

Phoenix, AZ

Scottsdale, AZ

Albuquerque, NM

Amarillo, TX

Brownfield, TX

El Paso, TX

Colorado Springs, CO

Oklahoma City, OK

Houston, TX

Grand Junction, CO

Denver, CO

Salina, KS

Salt Lake City, UT

Twin Falls, ID

Boise, ID

Gillette, WY

Bend, OR

Spokane, WA

Reno, NV

Medford, OR

Eugene, OR

Seattle, WA

Portland, OR

San Antonio, TX

Tucson, AZ

Headquarters

Thermo Fluids Inc.

“One-Stop”

Shop of Environmental

Services

Used oil collection & recycling

Wastewater collection

Spent antifreeze collection & recycling

Used oil filter collection

Industrial waste management

Parts washer services

($ Millions)

4 |

Environmental Services

Oily wastewater collection &

recycling

Antifreeze collection &

remanufacturing

Used oil filter collection & recycling

Industrial waste management

Parts washer services

Broad Portfolio of Products & Services

UMO

RFO

Collects UMO from a diverse base of

customers

Regular on-time scheduled or on-

demand collection

Full-service waste stream

management solution

Value-added Green Shield

Partners™

program

TFI recycles UMO into RFO

Sold as a feedstock for re-refineries

Sold as an industrial fuel for:

Asphalt plants

Pulp and paper mills

Bunker market

Industrial users

Representative Customers

5 |

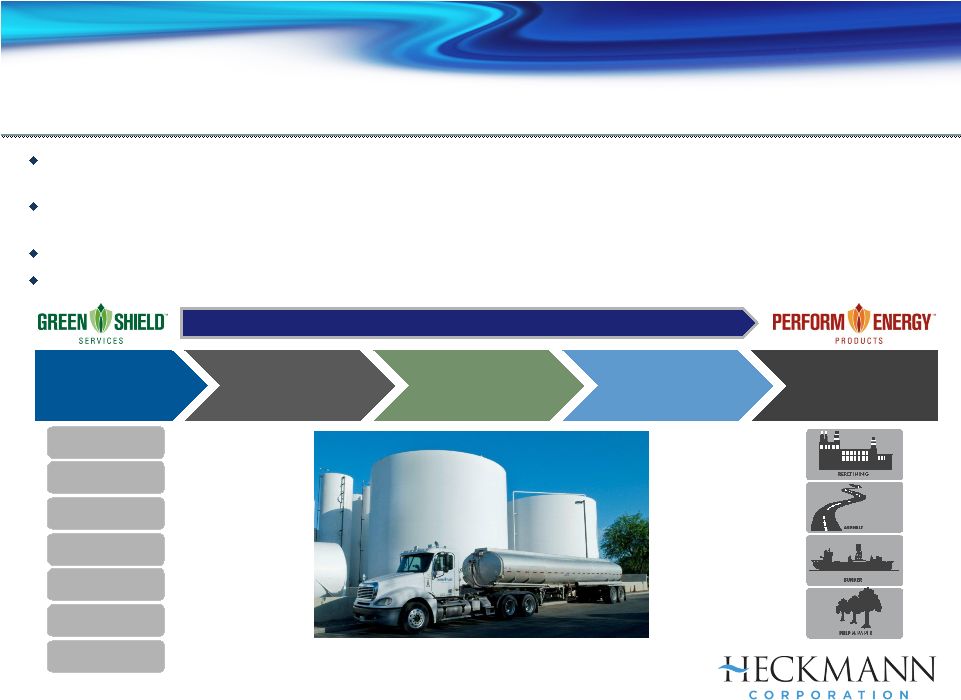

TFI has developed an efficient and low-cost process whereby UMO is converted

into RFO utilizing a proprietary filtration process to remove impurities

and produce a cleaner, more desirable RFO with superior energy output characteristics

RFO is sold to industrial customers for less than half the cost of diesel while

generating more than twice the energy and BTU output (on a per $

basis) RFO is also increasingly sold to re-refiners as a critical

feedstock for the production of base lubricants In 2011, TFI processed and

sold approximately 54 million gallons of RFO to over 250 individual

customers TFI Operations Overview

Collection of UMO

Analysis and

Filtration of

Used Oil

Separation of Oil

from

Undesirable

Fluids

Final Inspection

and Assurance

Testing

Transportation

and Delivery to

Customer

UMO to RFO Conversion Process

Quicklube

Car Dealerships

Automotive

Repair Shops

Manufacturing

Truck Fleets

Transportation

Used Oil Transport Truck and Treatment Facility

Energy

6 |

Compelling Strategic and Financial Rationale

Unique Scale and Range of Services

in Highly Fragmented Sectors

Senior Management with Extensive

Experience

Diversified Revenue Mix with High

Quality Customer Base

Leveraged to Increasingly Complex

Environmental Regulations

High Cash Flow Visibility Driving

Strong, Stable Margins

The TFI acquisition diversifies our operating platform, increases our leverage to

oil and capitalizes on our management team’s extensive experience with

an environmental services platform Enhances our position as the only

“one- stop”

shop for shale water solutions and

environmental services

Large, high quality asset base provides

superior service and is difficult to

replicate

Historically strong operating margins at

TFI with hedged business model and

contracts to drive stability

TFI’s management team has a combined

43 years of experience at Waste

Management running operations with

$4.2 billion in revenues

Leverages our management’s expertise,

having operated a similar business as

part of U.S. Filter

Ideally positioned as a large-scale, HSE—

driven water and environmental service

company providing leading edge

solutions

Diversifies revenue sources by service

offering, commodity exposure,

geographic footprint and customer base

Blue chip customer base, including Shell,

Chevron, ExxonMobil, Wal-Mart Stores,

Waste Management

7 |

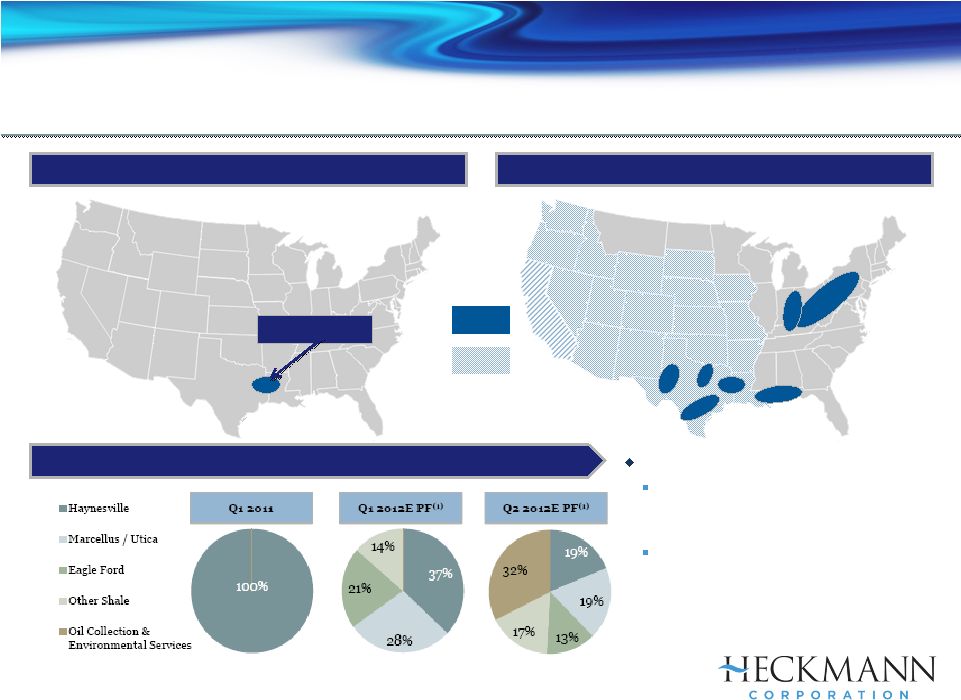

Synergistic Footprint Providing Operational and Revenue

Diversification

HEK a Year Ago

HEK Today

(1)

Haynesville

TFI

HEK

(1)

Pro forma for TFI acquisition, which is expected to close early Q2 2012.

Increasing Revenue Diversity

Targets for Q2 2012:

35% of revenues will be leveraged to

wet gas and oil (Eagle Ford, Utica,

Permian, Tuscaloosa and Eaglebine)

28% of HWR’s truck fleet will be in

the Haynesville, the majority of which

will be LNG-powered trucks with

their fuel/cost advantage, providing

us a hedge on natural gas prices

8 |

HEK’s management team consists of a veteran group of executives with

more than 170 years experience in the acquisition and

integration of companies in the water and environmental services

industries

The entire HEK team is comprised of former U.S. Filter executives

James Devlin and Greg Guard have a combined 43 years of experience at Waste

Management running operations with $4.2 billion in revenues, and the

entire management team will be staying on with the business Name

Richard J. Heckmann

Chairman & Chief Executive Officer

Charles R. Gordon

President & Chief Operating Officer

Damian C. Georgino

Executive Vice President, Corporate Development & Chief Legal

Officer

W. Christopher Chisholm

Executive Vice President & Chief Financial Officer

Brian R. Anderson

Executive Vice President, Finance

John T. Lucey

Executive Vice President, Business Development and Engineering

Senior Management with Extensive Experience

Name

James Devlin

Chief Executive Officer

Greg Guard

Chief Marketing Officer

Ted Sinclair

Chief Operating Officer

Roy Schumacher

VP of Market Development

Mark Kuleck

Chief Financial Officer

9 |