Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHART INDUSTRIES INC | d312086d8k.htm |

Exhibit 99.1

INVESTOR

PRESENTATION

MARCH 2012 |

| Disclosure

Forward-Looking

Statements:

This

presentation

includes

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation Reform Act of 1995. The use of words such as “may”,

“might”, “should”, “will”, “expect”, “plan”, “anticipate”, “believe”,

“estimate”,

“project”,

“forecast”,

“outlook”,

“intend”,

“future”,

“potential”

or

“continue”,

and

other

similar

expressions

are

intended

to

identify

forward-looking

statements.

All

of

these

forward-looking

statements

are

based

on

estimates

and

assumptions

by

our

management

as

of

the

date

of

this

presentation

that,

although

we

believe

to

be

reasonable,

are

inherently

uncertain.

Forward-looking

statements involve risks and uncertainties that could cause the Company’s

actual results or circumstances to differ materially from those expressed or

implied by forward-looking statements. These risks and uncertainties include, among others, the following: the

cyclicality of the markets that the Company serves; a delay, significant reduction

in or loss of purchases by large customers; fluctuations in energy prices;

changes in government energy policy or failure of expected changes in policy to materialize; the potential

for

negative

developments

in

the

natural

gas

industry

related

to

hydraulic

fracturing;

competition;

economic

downturns

and deteriorating

financial conditions; our ability to manage our fixed-price contract exposure;

our reliance on key suppliers and potential supplier failures or defects;

the modification or cancellation of orders in our backlog; the Company’s ability to successfully manage its costs and growth,

including its ability to successfully manage operational expansions and the

challenges associated with efforts to acquire and integrate new product

lines or businesses; changes in government healthcare regulations and reimbursement policies; general economic,

political, business and market risks associated with the Company’s global

operations and transactions; fluctuations in

foreign

currency

exchange

and

interest

rates;

the

financial

distress

of

third

parties;

the

loss

of

key

employees

and

deterioration

of

employee

or

labor

relations;

the

pricing

and

availability

of

raw

materials;

the

regulation

of

our

products

by

the

U.S.

Food

&

Drug

Administration and other governmental authorities; potential future impairment of

the Company’s significant goodwill and other intangibles; the cost of

compliance with environmental, health and safety laws; additional liabilities related to taxes; the impact of

severe weather; litigation and disputes involving the Company, including product

liability, contract, warranty, employment and environmental claims;

technological security threats; risks associated with our indebtedness, leverage, debt service and liquidity; and

volatility and fluctuations in the price of the Company’s stock. For a

discussion of these and additional risks that could cause actual

results

to

differ

from

those

described

in

the

forward-looking

statements,

see

disclosure

under

Item

1A.

“Risk

Factors”

in

the

Company’s

most recent Annual Report on Form 10-K and other recent filings with the

Securities and Exchange Commission, which should be reviewed

carefully. Please consider the Company’s forward-looking statements in light of these risks. Any forward-looking statement

speaks only as of its date. We undertake no obligation to publicly update or revise

any forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by law. 1 |

GTLS: GAS TO LIQUID

SYSTEMS Technology leader that provides high-end equipment to the energy industry, which is

the largest end-user of Chart’s products

One

of

the

leading

suppliers

in

all

primary

markets

served

Global

footprint

for

our operations on four continents with approximately 3,800 employees

Worldwide earnings with approximately 60% of sales derived from outside the U.S.

Company Overview

Chart Industries is a leading provider of highly engineered cryogenic equipment

for the hydrocarbon, industrial gas, and biomedical markets

Asia

19%

U.S.

42%

Americas

(Non-US)

9%

RoW

6%

Europe

24%

2011 Sales by Segment

Energy

49%

BioMedical

25%

General

Industrial

26%

2011 Sales by Region

2011 Sales by End-User

Energy &

Chemicals

26%

Distribution

& Storage

49%

BioMedical

25%

2 |

GTLS: GAS TO LIQUID

SYSTEMS Energy

&

Chemicals

(E&C)

Segment

Overview

Production

Brazed Aluminium

Heat Exchangers

44%

Cold Boxes and

LNG VIP

23%

2011 Sales by Product / Region

Highlights

Technology

leader

–

providing

heat

exchangers

and

cold

boxes critical to LNG, Olefin petrochemicals, natural gas

processing and industrial gas markets

–

Separation,

liquefaction

and

purification

of

hydrocarbon

and

industrial gases

Market

leader

–

leading

industry

positions

worldwide

Manufacturing

leader

–

one

of

three

global

suppliers

of

mission-critical LNG and LNG liquefaction equipment

Selected Products

Americas

(Non-US)

11%

Middle East &

RoW

18%

Asia

23%

U.S.

47%

Europe

1%

3

Air Cooled Heat

Exchangers

33%

Cold

Box

Heat

Exchanger |

GTLS: GAS TO LIQUID

SYSTEMS Distribution & Storage (D&S) Segment Overview

2011 Sales by Product / Region

Highlights

Balanced

customer

base

–

46%

of

segment

sales

derived

from products used in energy applications

Strategic

footprint

–

manufacturing

located

near

growing

end

markets and lower-cost countries

–

Positioned to capitalize on strong expected growth in Asia and

North America

–

Continued investment in key global manufacturing facilities

Bulk

MicroBulk

Distribution

Storage

Selected Products

Satellite

LNG

Storage

Bulk Storage

Systems

36%

Packaged Gas

Systems

28%

VIP, Systems

and Components

9%

Parts, Repair and On-

Site Service

9%

Beverage Liquid

CO

2

Systems

6%

LNG Terminals

and Vehicle Fuel

Systems 12%

Americas

(Non-US)

10%

RoW

3%

Asia

21%

U.S.

42%

Europe

24%

4 |

GTLS: GAS TO LIQUID

SYSTEMS BioMedical Segment Overview

2011 Sales by Product / Region

Highlights

Strong

growth

–

increase

in

oxygen

respiratory

therapy

and

biomedical research, led by international markets, expected

Robust end markets include:

–

Home healthcare and nursing homes

–

Hospitals and long-term care

–

Biomedical and pharmaceutical research

–

Animal breeding

End-Use Consumption

Liquid Oxygen

(LOX) Therapy

Systems

52%

Biological

Storage

Systems

30%

Selected Products

Americas

(Non-US)

5%

U.S.

38%

Europe

46%

Asia

10%

RoW

1%

5

Non-LOX

Respiratory

Therapy Systems

18%

Portable

Oxygen

Stainless

Steel

Freezer

Lab

Storage |

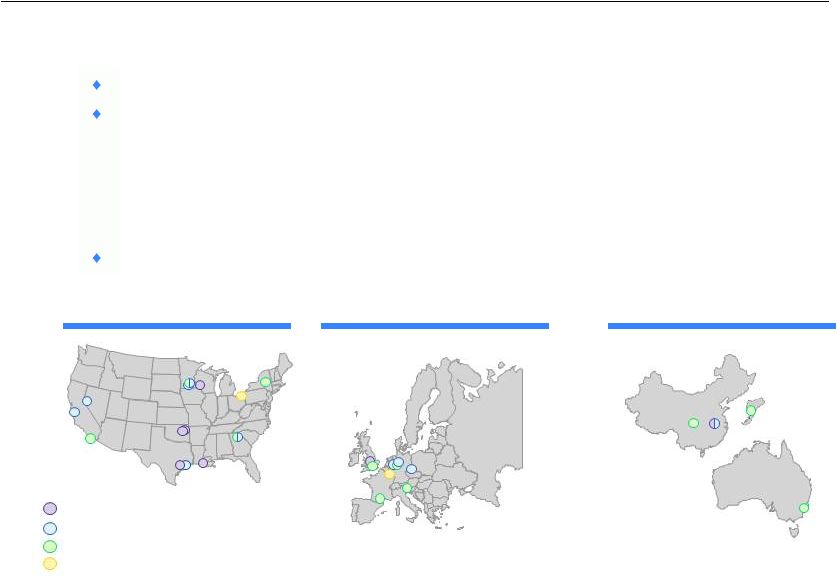

GTLS: GAS TO LIQUID

SYSTEMS Global Manufacturing and Distribution Platform

Operating

leverage

provides

the

flexibility

to

expand

and

reduce

capacity

as

needed

Major manufacturing locations include:

China,

Changzhou (D&S and E&C) and Chengdu (BioMedical)

Czech

Republic,

Decin

(D&S)

Georgia,

Canton and Minnesota,

New Prague (D&S and BioMedical) Wisconsin, La

Crosse,

Louisiana,

New

Iberia

and

Oklahoma,

Tulsa

(E&C)

Expansion of facilities in China, Louisiana and Minnesota are currently in process

Manufacturing facilities are strategically located in lower-cost countries

and near centers of demand

Corporate

Energy & Chemicals

Distribution & Storage

BioMedical

Asia-Pacific

North America

6

Europe |

GTLS: GAS TO LIQUID

SYSTEMS BioMedical

•Aging demographics

•

Product expansion

•

Increasing biological

research

Growth Opportunities

7

D&S

•Global LNG opportunity

•

Strong relationships with

Industrial Gas customers

•

Demand for Industrial Gas

projected to increase 8%

per year

E&C

•Global base load LNG

projects

•

Growth in natural gas

processing

•

Emerging market

opportunities |

GTLS: GAS TO LIQUID

SYSTEMS Natural

gas

expansion

–

Natural

gas

demand

is

expected

to

continue

to

grow

at

a

pace

faster

than

coal

and oil, and will be heavily weighted towards emerging economies, which is expected to drive demand

for Chart’s products

LNG

growth

leader

–

The

natural

gas

industry

is

expected

to

invest

approximately

$720

billion

in

LNG

facilities from 2009 to 2035, with LNG reaching 25% of world demand in 2035 (Source:

International Energy Agency –

World Energy Outlook 2011, Golden Age of Gas Scenario)

Natural Gas Expected To Grow Globally

8

Source: ExxonMobil

–

The

Outlook for Energy, A View to 2040 |

GTLS: GAS TO LIQUID

SYSTEMS Increasing

natural

gas

penetration

as

a

viable

energy

source

and

transportation

fuel

due

to

its

high

energy density, lower costs, cleaner emissions profile, and plentiful supply due to improved drilling

technologies (e.g. shale gas). U.S. trucking is converting a portion of its fleets to natural

gas. Recent announcements in domestic LNG infrastructure by major natural gas producers and

equipment providers, as well as recent order intake have validated expectations

China’s

twelfth

5-year

plan

(2011

-

2015)

mandates

an

increase

in

gas

use

as

a

percentage

of

energy

consumption from less than 4% to over 8%

Dramatic increase in imported LNG in China is in process and is expected to continue, with

significant investment in infrastructure, including LNG transportation and storage equipment

Lack

of

pipeline

infrastructure

in

China

requires

“virtual

pipeline”

with

LNG

Chart provides a broad offering of products and solutions for the full LNG value chain: LNG

liquefiers, transportation

equipment,

terminal

storage

equipment

and

vehicle

tanks

for

both

on-road

and

off-road

heavy duty vehicles and marine applications

LNG Value Chain Opportunities

9 |

GTLS: GAS TO LIQUID

SYSTEMS Strong Track Record of Successful Execution

Last Growth

Cycle CAGR

(2004-2008)

Sales 25%

Oper. Inc. 38%

¹Included in 2005 are non-recurring costs of $26.5 million for the

acquisition of Chart Industries by First Reserve

During last growth cycle Company leveraged its flexible

manufacturing platform resulting in operating income

growth that outpaced sales

Flexible cost structure and good execution allowed for

aggressive response to economic downturn resulting in

higher operating income level than last cycle low point

10

Similar or higher growth, leveraged by

acquisitions, expected to occur again during the

current growth cycle

The return of large contract orders and the

improvement in base order levels have

confirmed the recovery in the growth cycle

1

0

50

100

150

200

250

300

350

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Large Contract Orders

Base Orders

0

20

40

60

80

100

120

140

160

0

100

200

300

400

500

600

700

800

900

2004

2005

2006

2007

2008

2009

2010

2011

Sales

Operating Income |

GTLS: GAS TO LIQUID

SYSTEMS Historical Orders and Year-end Backlog

11

Year-end Backlog ($MM)

Annual Orders ($MM) |

GTLS: GAS TO LIQUID

SYSTEMS Outlook for 2012

12

Based

on

a

substantial

order

backlog,

solid

financial

resources,

and

an

attractive

portfolio of product solutions, we expect another solid year in 2012.

We believe energy investments, especially in natural gas applications, are at

an early-stage of a multi-year growth cycle.

We

anticipate

continued

growth

in

demand

for

our

products

and

we

have

stepped up our investment in capacity to capture and execute on these

opportunities.

Order

strength

in

first

quarter

2012

continues

at

an

exceptional

rate

for LNG

opportunities. Between E&C and D&S, we have booked over $190 million in

new LNG orders during January and February 2012.

Sales for 2012 are expected to be in a range of $950 million to $1 billion.

Including continuing costs related to the ramp-up of the Company’s

infrastructure,

diluted

earnings

per

share

are

expected

to

be

in

a

range

of

$2.60 to $2.90 per share, based on approximately 31 million shares

outstanding. |

Summary of Investment

Highlights 13

Chart continues to represent a unique investment opportunity to capitalize on global

energy demand, growth in natural gas use, and biomedical opportunities

Exploit LNG and NG growth

Opportunities with global

infrastructure build-out

New product development and

innovation

Expanded new business and

inorganic pipeline

Strong

organic

earnings

should

provide substantial free cash flow

and liquidity

Permit

continued

accretive

organic

and inorganic growth

Attractive industry with long-term

customer relationships

Solid platform with worldwide

presence and leading industry

positions in all segments

7 yr. $250 million convertible notes

-

2% cash interest cost

Actively considering financing

opportunities with a view toward

cost efficiency and financial

flexibility

Strong Balance Sheet

Positioned for Significant Growth

Flexible / Low Cost Capital Structure

Very Stable Business Model |