Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TUCSON ELECTRIC POWER CO | d308625d8k.htm |

Exhibit 99.1

| Investor and Analyst Meetings March 6-8, 2012 |

| Contact Information & Safe Harbor Paul J. Bonavia, Chairman and CEO David G. Hutchens, President Kevin P. Larson, SVP and CFO Phil Dion, Vice President of Public Policy Investor Relations Contact Information Chris Norman, Manager Daniel Mark, Senior Analyst (520) 884.3649 (520) 884.3621 cnorman@uns.com dmark@uns.com Investor Information http://ir.uns.com Safe Harbor and Non-GAAP Measures This document contains forward-looking information that involves risks and uncertainties, that include, but are not limited to: state and federal regulatory and legislative decisions and actions; regional economic and market conditions which could affect customer growth and energy usage; weather variations affecting energy usage; the cost of debt and equity capital and access to capital markets; the performance of the stock market and changing interest rate environment, which affect the value of the company's pension and other postretirement benefit plan assets and the related contribution requirements and expense; unexpected increases in O&M expense; resolution of pending litigation matters; changes in accounting standards; changes in critical accounting estimates; the ongoing restructuring of the electric industry; changes to long-term contracts; the cost of fuel and power supplies; performance of TEP's generating plants; and other factors listed in UniSource Energy's Form 10-K and 10-Q filings with the Securities and Exchange Commission. The preceding factors may cause future results to differ materially from historical results or from outcomes currently expected by UniSource Energy. The Company's press releases and other communications may include certain non-Generally Accepted Accounting Principles (GAAP) financial measures. A "non-GAAP financial measure" is defined as a numerical measure of a company's financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in the Company's financial statements. Non-GAAP financial measures utilized by the Company include presentations of revenues, operating expenses, operating income and earnings (loss) per share. The Company uses these non-GAAP measures to evaluate the operations of the Company. Certain non-GAAP financial measures utilized by the Company exclude: the impact of non-recurring items; the effect of accounting changes or adjustments; expenses that are reimbursed by third parties; and other items. The Company's management believes that these non-GAAP financial measures provide useful information to investors by removing the effect of variances in GAAP reported results of operations that are not indicative of fundamental changes in the earnings or cash flow capacity of the Company's operations. Management also believes that the presentation of the non-GAAP financial measures is largely consistent with its past practice, as well as industry practice in general, and will enable investors and analysts to compare current non-GAAP measures with non-GAAP measures with respect to prior periods. 1 |

| Long-Term Value Proposition Fully Regulated Utility With Long-Term Growth Drivers Fully Regulated Utility With Long-Term Growth Drivers Fully Regulated Utility With Long-Term Growth Drivers 2 |

| (CHART) (CHART) Attractive dividend yield Payout target provides flexibility 13 consecutive years of dividend increases 2000 2012 *Yield and payout for regulated utilities from EEI Q4 2011 Financial Update Note: UNS payout ratio based on net income associated with mid-point of 2012 earnings guidance and indicated annual dividend of $1.72 (CHART) Generating Strong, Stable Cash Flow Attractive Dividend Yield and Opportunity for Growth (CHART) 3 Q1 2012 dividend raised to $0.43 per share. Represents a 2.4% increase from 2011. |

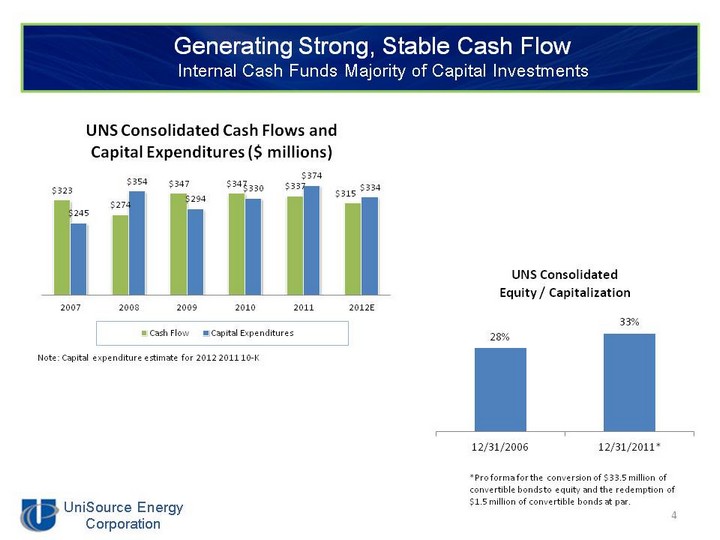

| Note: Capital expenditure estimate for 2012 2011 10-K Generating Strong, Stable Cash Flow Internal Cash Funds Majority of Capital Investments 4 (CHART) *Pro forma for the conversion of $33.5 million of convertible bonds to equity and the redemption of $1.5 million of convertible bonds at par. (CHART) |

| (CHART) (CHART) Note: Capital expenditure estimates for 2012-2016 are from the 2011 Form 10-K. Excludes optional purchase of leases assets in 2015. Investing in Our Utility Businesses Nearly $2 Billion of Utility Investments Through 2015 (CHART) 5 |

| Investing in Our Utility Businesses TEP Rate Base Growth of $400 - $500 Million TEP Rate Base Growth Generation and distribution investments from 2007-2011 Environmental upgrades Sundt Unit 4 Renewable energy investments $1.02B 6 $1.4B - $1.5B (CHART) |

| Strengthening Our Regulatory Foundation Constructive Outcomes and Progress in Recent Cases 7 |

| Positioning for TEP 2012 Rate Filing Building Blocks for 2013 Rate Increase Building Blocks for 2013 Rate Increase Building Blocks for 2013 Rate Increase July 2, 2012 anticipated filing date Parties to 2008 Settlement committed to use best efforts to implement new rates within 13 months of filing date 8 |

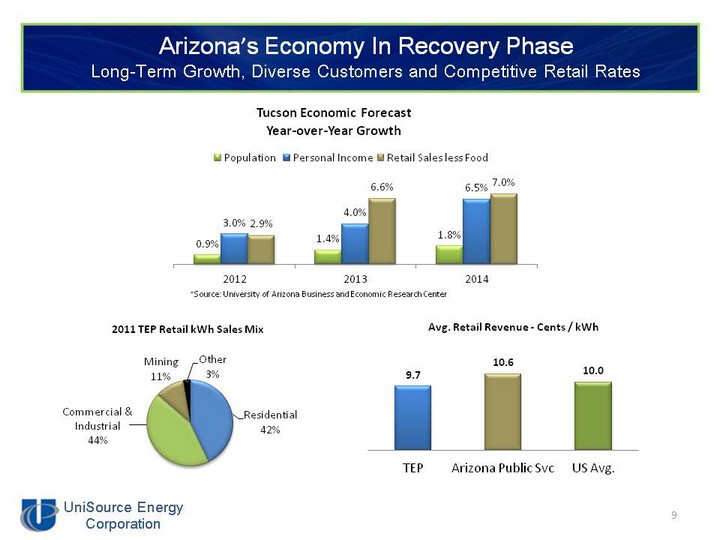

| Arizona's Economy In Recovery Phase Long-Term Growth, Diverse Customers and Competitive Retail Rates 9 (CHART) (CHART) *Source: University of Arizona Business and Economic Research Center |

| Financial Update and Outlook 10 |

| 2011 Highlights 2011 diluted EPS of $2.75 in middle of guidance range TEP financing reduced variable rate interest exposure Amended and extended credit agreements Transfer of BMGS to UNS Electric UNS Gas rate case Approval of TEP's renewable energy plan 11 * Base O&M and Retail Margin Revenues are non-GAAP measures. Please refer to the end of this presentation for a reconciliation of non-GAAP measures. (CHART) (CHART) |

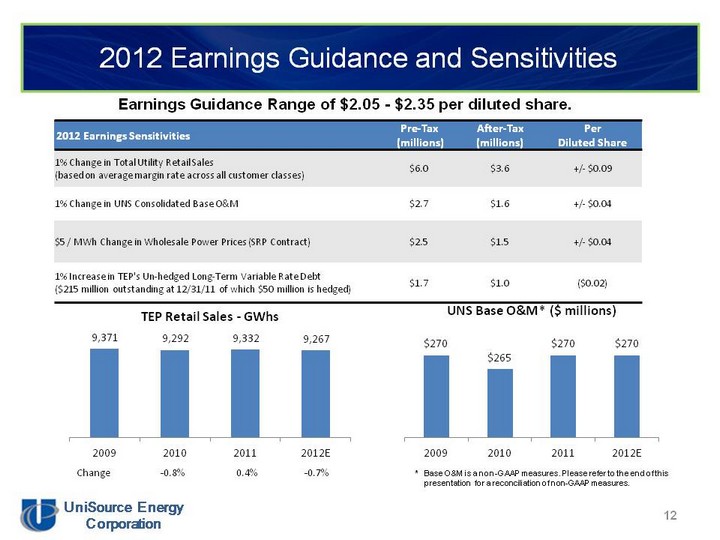

| 2012 Earnings Guidance and Sensitivities 12 * Base O&M is a non-GAAP measures. Please refer to the end of this presentation for a reconciliation of non-GAAP measures. presentation for a reconciliation of non-GAAP measures. presentation for a reconciliation of non-GAAP measures. (CHART) (CHART) Change -0.8% -0.7% 0.4% Earnings Guidance Range of $2.05 - $2.35 per diluted share. |

| 2012- 2014 Financial Outlook Continued O&M cost containment UNS Gas case decision expected in Q2 2012 TEP rate case filed in July 2012 with new rates effective 13 months from filing date 2014 first full year of new TEP rates UNS Convertible Bond redemptions Refinancing opportunities Potential increase in TEP's mining load Up to 100 MW in the next 3-5 years from expansion of existing mining operations and re- opening of dormant mines At full production, 100 MW from the proposed new Rosemont Copper mine 13 |

| TEP Long-Term Wholesale Sales Margin on long-term wholesale sales benefits shareholders Gross margin on total long-term wholesale sales was $13 million in 2011 Expect gross margin on 2012 long-term wholesale sales of $8 million Salt River Project (SRP) Contract modified in Dec. 2011 SRP required to take 500,000 MWh annually (on-peak) Priced at a discount to on-peak Palo Verde prices Contract expires May 2016 Navajo Tribal Utility Authority (NTUA) No demand charge; energy priced in mid - $50 per MWh range No minimum purchase requirement Contract modifications effective 2010 Energy charge for 50% of sales (June-Sept) based on Palo Verde Index (~30 GWhs) Contract expires December 2015 14 (CHART) (CHART) * L-T Wholesale Margin Revenue is a non-GAAP measures. Please refer to the end of this presentation for a reconciliation of non-GAAP measures. |

| Credit Ratings Sufficient lines of credit TEP - $200 million; UES - $100 million; UNS - $ 125 million; mature in Nov. 2016 Credit ratings Fitch placed TEP on positive outlook in October 2011 TEP Fitch Secured BBB Unsecured BBB- Issuer BB+ Outlook S&P BBB+ BBB- BB+ Stable Moody's Baa1 Baa3 Baa3 Stable Positive UniSource Energy Moody's Ba1 Stable Secured Credit Facility Outlook UNS Electric Moody's Baa3 Stable Sr. Unsecured Notes (guaranteed) Outlook UNS Gas Moody's Baa3 Stable Sr. Unsecured Notes (guaranteed) Outlook 15 |

| Long-Term Debt Summary Balances as of 12/31/11 Rates as of 2/21/12 Interest Curr. Balance Issue Maturity Current Facilities Debt Issue Rate (in millions) Date Date Call Price Security Financed TEP Unsec. Ind. Dev. Bonds (Tax-Exempt) 2009 Pima A 4.950% 80 Oct-09 Oct-20 N/C Unsecured San Juan PC 2010 Coconino A 0.23% 37 Dec-10 Oct-32 100% Navajo PC 2009 Coconino A 5.125% 15 Oct-09 Oct-32 N/C 10 Navajo PC 1998 Apache A 5.850% 84 Mar-98 Mar-28 100% SGS 1 PC 1998 Apache B 5.875% 100 Mar-98 Mar-33 100% SGS 2 PC 1998 Apache C 5.850% 16 Mar-98 Mar-26 100% Local T&D Subtotal $ 866 Var. Rate Bonds (Tax-Exempt) 1982 Pima A - Irvington 0.18% 39 Oct-82 Oct-22 100% Local T&D / Irvington 1982 Pima A 0.16% 40 Dec-82 Dec-22 100% Local T&D / 4 Corners PC 1983 Apache A 0.14% 100 Dec-83 Dec-18 100% SGS 2 Subtotal $ 215 TEP TOTAL $ 1,081 2008 Pima A 6.375% 91 Mar-08 Sep-29 N/C 5 Local T&D UES UNS Gas Unsecured Notes 5.390% 50 Aug-11 Aug-26 MW + 50 Unsecured General Purpose UNS Gas Unsecured Notes 6.230% 50 Aug-03 Aug-15 MW + 50 General Purpose UNS Electric Unsecured Notes 6.500% 50 Aug-08 Aug-15 MW + 50 General Purpose 2008 Pima B 5.750% 130 Jun-08 Sep-29 N/C 5 Local T&D UNS Electric Unsecured Notes 7.100% 50 Aug-08 Aug-23 MW + 50 General Purpose UES TOTAL $ 230 UniSource Stand-Alone Sr. Unsec. Convertible Notes (1) 4.500% 115 Mar-05 Mar-35 Par Unsecured General Purpose Revolving Credit Facility LIBOR + 1.75% 57 Nov-10 Nov-14 Par Unsecured General Purpose UNISOURCE STAND-ALONE TOTAL $ 172 UNISOURCE CONSOLIDATED TOTAL $1,483 2.220% Mortgage Bonds 2010 Pima A 5.250% $ 100 Oct-10 Oct-40 N/C 10 Local T&D UNS Electric Term-Loan 30 Aug-11 Aug-15 Par General Purpose 16 2011 Sr. Unsecured 5.150% $ 250 Nov11 Nov21 100% General Purpose (1) Pro-forma for redemption of $35 million of convertible notes in Jan 2012 |

| SUPPLEMENTAL INFORMATION 17 |

| Regulated Electric and Gas Utility Businesses Largest Subsidiary of UNS Approx. 80% of Revenues and Assets Vertically Integrated Electric Utility 404,000 Electric Customers Gas & Electric T&D Businesses 148,000 Gas Customers 91,000 Electric Customers NYSE: UNS 2011 Operating Revenues: $1.5B Market Cap: $1.4B 18 |

| Utility Service Areas Navajo Sundt Moenkopi Peacock Marketplace Kayenta Tucson Generating Station Coal Mine Interconnection With Other Utility Substation Solar Station TEP 404,000 customers UNS Gas 148,000 customers UNS Gas & Electric UNS Electric 91,000 customers High Voltage Transmission Lines San Juan Ship Rock Four Corners San Juan Mine Navajo McKinley McKinley Mine Coronado Springerville Luna Hidalgo Greenlee South Vail Valencia Nogales Davis Mead Black Mountain Kingman Kingman Black Mountain Griffith Griffith N. Havasu Lake Havasu City Parker Parker Saguaro West Wing Liberty Palo Verde Phoeni x Pinal West Cholla Flagstaff Lee Ranch Yavapai Prescott MEXICO NEVADA UTAH COLORADO CALIFORNIA NEW MEXICO Lake Havasu City Pinnacle Peak 19 Service Areas / Customers |

| TEP's Diverse Retail Customer Base TEP's Diverse Retail Customer Base TEP's Diverse Retail Customer Base University of Arizona Davis Monthan Air Force Base Freeport McMoRan Largest Retail Customers 20 (CHART) (CHART) Customer Sector Freeport McMoRan Copper Mining Asarco Copper Mining University of Arizona Education Fort Huachuca, US Army Intelligence Center Military Raytheon Defense IBM Technology Davis Monthan Air Force Base Military Arizona Portland Cement Construction Liquid Air Manufacturing |

| (CHART) TEP - Retail Customers TEP customer base continues to grow at a modest pace Long-term outlook positive with a customer growth rate of approx. 1% in 2013 Retail Customer Growth Possible addition of Rosemont Copper mine in 2014 with usage of ~ 100MW Support from local business organizations; opposition from local government and environmental groups Requires a U.S. Forest Service Record of Decision 21 |

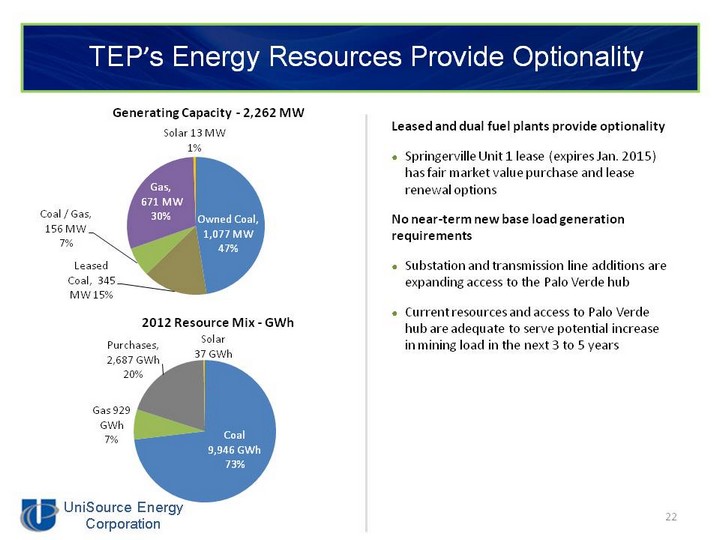

| TEP's Energy Resources Provide Optionality Leased and dual fuel plants provide optionality Springerville Unit 1 lease (expires Jan. 2015) has fair market value purchase and lease renewal options No near-term new base load generation requirements Substation and transmission line additions are expanding access to the Palo Verde hub Current resources and access to Palo Verde hub are adequate to serve potential increase in mining load in the next 3 to 5 years 22 (CHART) (CHART) |

| Springerville Leases Springerville Leases Note: If TEP exercises its purchase options, Tri-State (owner of Springerville 3) will have the option to purchase from TEP a 17% interest in the Coal Handling Facilities and 14% interest in the Common Facilities; SRP (owner of Springerville 4) will be obligated to purchase the same interests. 23 |

| Strong Coal Plant Operating Performance Average Equivalent Availability Factor Baghouse - Low NOx Existing Environmental Equipment Operator TEP's Share (MW) Coal Delivery In Service Dates TEP's Share (%) TEP 156 MW rail 1967 100% TEP 770 MW rail Unit 1 - 1985 Unit 2 - 1990 100% Arizona Public Service 110 MW mine mouth Unit 4 - 1969 Unit 5 - 1970 7% Salt River Project 168 MW mine mouth Unit 1 - 1974 Unit 2 - 1975 Unit 3 - 1976 7.5% Public Service of New Mexico 322 MW mine mouth Unit 1 - 1976 Unit 2 - 1973 50% Coal Supplier Contract Term Peabody 2020 BHP Billiton 2016 Peabody 2019 San Juan Coal 2017 Peabody 2012 Annual Expected Coal Usage 350 k tons 3.2 mil. tons 400k tons 500k tons 1.3 mil. tons Baghouse Scrubbers Low NOx Baghouse Scrubbers - Precipitators Scrubbers - Baghouse Scrubbers Low NOx Mercury removal Sundt Unit 4 coal/gas Navajo Units 1,2&3 coal Industry Avg. coal Four Corners Units 4&5 coal San Juan Units 1&2 coal Springerville Units 1&2 coal (CHART) 93% 87% 93.8% (CHART) 88.7% (CHART) 80.3% (CHART) 85.9% (CHART) 79.0% (CHART) 85.0% 07 08 09 10 11 24 07 08 09 10 11 07 08 09 10 11 07 08 09 10 11 07 08 09 10 11 |

| TEP Environmental Overview Coal Plant TEP's Anticipated Environmental Capital Costs for 2011 - 2018 Pending Regulations Upgrades Springerville Units 1 & 2 $5M MATs (2015) Mercury controls San Juan Units 1 & 2 $180M-$200M Regional Haze / BART (2016) SCR Navajo Units 1 - 3 $86M MATs (2015), Regional Haze / BART (2017) Mercury controls SCR, Baghouses Four Corners Units 4 & 5 $36M MATs (2015) Regional Haze / BART (2018) Mercury controls SCR 25 |

| TEP Generation Portfolio Fuel/ Plant Fuel/ Plant Unit No. Location Date In Service Operator TEP's Share % TEP Share Net Capacity MW Coal Coal Springerville Station 1 Springerville, AZ 1985 TEP 100 401 Springerville Station 2 Springerville, AZ 1990 TEP 100 403 San Juan Station 1 Farmington, NM 1976 PNM 50 170 San Juan Station 2 Farmington, NM 1973 PNM 50 170 Navajo Station 1 Page, AZ 1974 SRP 7.5 56 Navajo Station 2 Page, AZ 1975 SRP 7.5 56 Navajo Station 3 Page, AZ 1976 SRP 7.5 56 Four Corners Station 4 Farmington, NM 1969 APS 7 55 Four Corners Station 5 Farmington, NM 1970 APS 7 55 Gas Gas Luna Energy Facility 1 Deming, NM 2006 PNM 33.3 185 North Loop Tucson, AZ 2001 TEP 100 95 Gas/Oil Gas/Oil Sundt Station 1 Tucson, AZ 1958 TEP 100 81 Sundt Station 2 Tucson, AZ 1960 TEP 100 81 Sundt Station 3 Tucson, AZ 1962 TEP 100 104 Sundt ICTs Tucson, AZ 1972 TEP 100 50 DeMoss Petrie Tucson, AZ 1972 TEP 100 75 Coal/Gas Coal/Gas Sundt Station 4 Tucson, AZ 1967 TEP 100 156 Springerville Solar Station Springerville Solar Station Springerville, AZ 2002 TEP 100 6 Community Solar Projects Community Solar Projects Tucson, AZ 2010 TEP 100 7 Total 2,262 26 |

| Investments in Renewable Energy Arizona Renewable Energy Standard and Tariff 15% of all retail energy needs from renewable resources by 2025 Cost recovery, including ROI, through RES surcharge on owned resources 27 (CHART) |

| Resource/ Counterparty Resource/ Counterparty Technology Location Operator Completion Date Term (Years) Purchase Option Capacity MW Solar Solar Amonix Concentrating PV Tucson, AZ Amonix Mar 2011 20 On or after yr. 6 at FMV 2 Swan Solar Concentrating PV Tucson, AZ Amonix Oct 2012 20 12 NRG Solar Fixed PV Tucson, AZ NRG Solar Sept 2012 20 25 AstroSol Fixed PV Tucson, AZ Astronergy Jun 2012 20 5 Emcore Solar Concentrating PV Tucson, AZ Emcore Feb 2012 20 2 Solon SAT PV Kingman, AZ Solon Sept 2012 20 10 FRV Tucson Solar SAT PV Tucson, AZ Renewable Ventures July 2012 20 25 FSP Solar One SAT PV Tucson, AZ Foresight Solar Sept 2012 20 4 FSP Solar Two SAT PV Tucson, AZ Foresight Solar Dec 2012 20 12 Avalon Solar Fixed PV Marana, AZ Avalon Dec 2012 20 35 Wind Wind Western Wind Energy US Corp Wind Kingman, AZ Western Wind Sept 2011 20 None 11 Macho Springs Wind Deming, NM Element Power Sept 2011 20 None 50 Landfill Gas Landfill Gas Sexton Energy Landfill Gas Tucson, AZ Sexton Energy Dec 2013 15 None 2.2 Total 198.5 Fuel/ Plant Fuel/ Plant Technology Status Completion Date Net Capacity MW Solar Solar Springerville Solar Station Fixed PV Complete 2002 4.6 Springerville Solar Expansion Fixed PV Complete 2010 1.8 Univ. of Arizona Tech Park SAT PV Complete 2010 1.6 Univ. of Arizona Tech Park II Fixed PV Complete 2011 5 DM Air Corridor (pima County) Fixed PV Scheduled 2012 5 Total 18 TEP & UNSE Renewable Contracts and Projects PPAs Owned / In Development |

| UniSource Energy Services UNS Gas T&D retail gas business 148,000 retail customers 2011 retail sales - 114 million therms Rate Case Activity Base rate increase of $3.5 million effective April 2010 Pending rate case $2.7 million base rate increase Lost fixed cost recovery mechanism Decision expected in Q2 2012 UNS Electric Vertically integrated electric utility 91,000 retail customers 2011 retail sales - 1,853 GWh Rate Case Activity Base rate increase of $7.4 million effective October 2010 Black Mountain Generating Station transfer completed 7/1/11 Investments of $5 million annually in company-owned solar projects from 2012-2014 29 (CHART) (CHART) |

| Regulatory Overview 30 |

| Regulatory Oversight Arizona Corporation Commission Set retail energy rates Constitutionally created branch of Arizona government Five commissioners elected state-wide Limited to serve two consecutive four year terms Commissioner Term Expires Gary Pierce (R) (Chairman) Jan. 2015* Brenda Burns (R) Jan. 2015 Bob Stump (R) Jan. 2013 Sandra Kennedy (D) Jan. 2013 Paul Newman (D) Jan. 2013 * Unable to run for re-election - two term limit Federal Energy Regulatory Commission Transmission rates Long-term wholesale transactions 31 |

| Energy Efficiency Standards ACC Energy Efficiency Standards Designed to require TEP and other affected utilities to implement cost effective demand side management programs Electric EE Standards target total retail kWh savings in 2012 of 3.0% of 2011 sales Targeted kWh savings increase annually in subsequent years until they reach a cumulative annual reduction in retail kWh sales of 22% by 2020 ACC Decoupling Policy Adopted in December 2010 Designed to encourage energy conservation by restructuring utility rates to separate the recovery of fixed costs from the level of energy consumed Policy indicates that revenue per customer decoupling may be well suited for Arizona as it responds to customer growth Utilities can propose decoupling mechanism in next general rate case application TEP Energy Efficiency Proposal TEP proposal and Staff recommendation filed with ACC 32 |

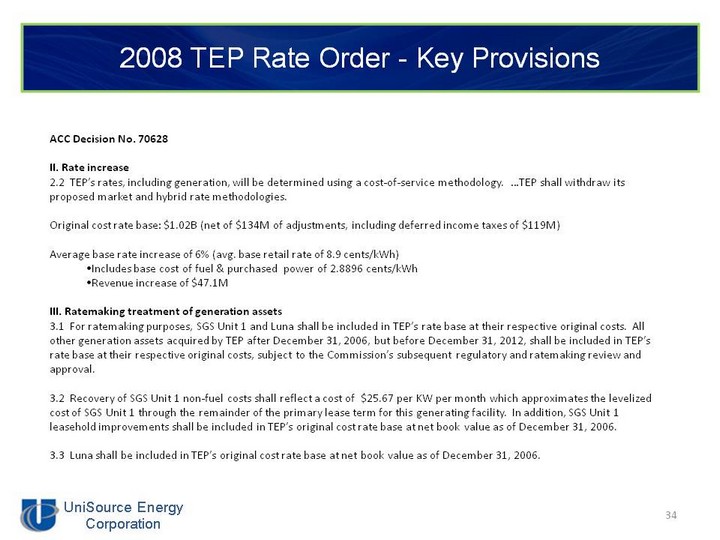

| 2008 TEP Rate Order Key Provisions Methodology Cost-of-service Test year 12/31/2006 Rate base $1.02 billion 2006 Retail Sales (GWh) 9,320 Allowed ROE 10.25% Capital Structure 42.5% equity / 57.5% debt (Actual capital structure was 40% equity, excluding capital leases, and 60% debt) Non-fuel base rate increase 6% (approx. $47 million). Effective Dec. 1, 2008. Purchased Power and Fuel Adjustment Clause (PPFAC) Effective Jan. 1, 2009 Forward looking Energy, capacity and transmission Springerville Unit 1 - 387 MW coal-fired plant leased by TEP. Lease expires Jan. 1, 2015. Non-fuel recovery of $25.67 per kW per month or approx. $117 million Approximates levelized cost through the remainder of the term of the lease Average base retail rate 8.9 cents / kWh (base non-fuel rate of 6.0 cents) Rate case moratorium Cannot file new case before 6/30/2012 with a test year no earlier than 12/31/11 33 |

| 2008 TEP Rate Order - Key Provisions ACC Decision No. 70628 II. Rate increase 2.2 TEP's rates, including generation, will be determined using a cost-of-service methodology. ...TEP shall withdraw its proposed market and hybrid rate methodologies. Original cost rate base: $1.02B (net of $134M of adjustments, including deferred income taxes of $119M) Average base rate increase of 6% (avg. base retail rate of 8.9 cents/kWh) Includes base cost of fuel & purchased power of 2.8896 cents/kWh Revenue increase of $47.1M III. Ratemaking treatment of generation assets 3.1 For ratemaking purposes, SGS Unit 1 and Luna shall be included in TEP's rate base at their respective original costs. All other generation assets acquired by TEP after December 31, 2006, but before December 31, 2012, shall be included in TEP's rate base at their respective original costs, subject to the Commission's subsequent regulatory and ratemaking review and approval. 3.2 Recovery of SGS Unit 1 non-fuel costs shall reflect a cost of $25.67 per KW per month which approximates the levelized cost of SGS Unit 1 through the remainder of the primary lease term for this generating facility. In addition, SGS Unit 1 leasehold improvements shall be included in TEP's original cost rate base at net book value as of December 31, 2006. 3.3 Luna shall be included in TEP's original cost rate base at net book value as of December 31, 2006. 34 |

| 2008 TEP Rate Order - Key Provisions X. Rate case moratorium 10.1 TEP's base rates shall remain frozen through December 31, 2012. 10.2 TEP shall not submit a rate application sooner than June 30, 2012. ...test year ending no earlier than December 31, 2011. 10.2 Signatories agree to use their best efforts to have post-moratorium rates in place no later than thirteen months after TEP's rate application is filed with the Commission. XI. Emergency Clause 11.1 ...TEP shall not be prevented from requesting a change to its base rates, or necessary changes to the PPFAC mechanism, the DSM or REST, that would take effect prior to January 1, 2013, in the event of conditions or circumstances that constitute an emergency. ...emergency is limited to an extraordinary event that is beyond TEP's control and that, in the Commission's judgment, requires rate relief in order to protect the public interest. This provision is not intended to preclude TEP from seeing rate relief pursuant to this paragraph in the event of the imposition of a federal carbon tax or related federal cap and trade system. 35 |

| Reconciliation of Non-GAAP Measures 36 |

| Reconciliation of Non-GAAP Measures Base O&M 37 Base O&M, a non-GAAP financial measure, should not be considered as an alternative to Other O&M, which is determined in accordance with GAAP. We believe Base O&M provides useful information to investors because it represents the fundamental level of operating and maintenance expense related to our core utility business. Base O&M excludes expenses that are directly offset by revenues collected from customers and other third parties. 2011 2010 2009 -Millions of Dollars- -Millions of Dollars- -Millions of Dollars- TEP Base O&M (non-GAAP) $ 237 $ 228 $ 231 UNS Gas Base O&M (non-GAAP) 24 25 25 UNS Electric Base O&M (non-GAAP) 20 21 21 Consolidating Adjustments and Other (11) (9) (7) UniSource Energy Base O&M (non-GAAP) 270 265 270 Reimbursed Expenses Related to Springerville Units 3 & 4 63 65 41 Expenses Related to Customer-Funded Renewable Energy and Demand Side Management Programs 46 40 23 Total UniSource Energy O&M (GAAP) $ 379 $ 370 $ 334 |

| Reconciliation of Non-GAAP Measures TEP Retail Margin Revenues 38 Retail Margin Revenues, a non-GAAP financial measure, should not be considered as an alternative to Net Electric Retail Sales, which is determined in accordance with GAAP. Retail Margin Revenues excludes: (i) revenues collected from retail customers that are directly offset by expenses recorded in other line items; and (ii) revenues collected from third parties that are unrelated to kWh sales to retail customers. We believe the change in Retail Margin Revenues between periods provides useful information to investors because it demonstrates the underlying revenue trend and performance of our core utility business. Retail Margin Revenues represents the portion of retail operating revenues available to cover the operating expenses of our core utility business. 2011 2010 2009 -Millions of Dollars- -Millions of Dollars- -Millions of Dollars- Retail Margin Revenues: Residential $ 252 $252 $ 254 Commercial 160 159 160 Industrial 95 97 100 Mining 32 31 30 Public Authorities 12 12 12 Total Retail Margin Revenues (Non-GAAP)** $ 551 $551 $ 556 PPFAC Revenues 307 279 287 RES and DSM Revenues 46 38 25 Total Retail Revenues (GAAP) $ 904 $868 $ 868 |

| Reconciliation of Non-GAAP Measures TEP Long-Term Wholesale Margin Revenues 39 Long-Term Wholesale Margin Revenues, a non-GAAP financial measure, should not be considered as an alternative to Electric Wholesale Sales, which is determined in accordance with GAAP. We believe the change in Long-Term Wholesale Margin Revenues between periods provides useful information to investors because it demonstrates the underlying profitability of TEP's long-term wholesale sales contracts. Long-Term Wholesale Margin Revenues represents the portion of long-term wholesale revenues available to cover the operating expenses of our core utility business. 2011 2010 2009 Long-Term Wholesale Revenues: -Millions of Dollars- -Millions of Dollars- -Millions of Dollars- Long-Term Wholesale Margin Revenues (Non-GAAP)* $ 13 $ 28 $ 25 Fuel and Purchased Power Expense Allocated to Long- Term Wholesale Revenues 28 28 23 Total Long-Term Wholesale Revenues $ 41 $ 56 $ 48 Transmission Revenues 16 21 19 Short-Term Wholesale Revenues 73 64 86 Electric Wholesale Sales (GAAP) $130 $141 $153 |