Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - First California Financial Group, Inc. | fcal-8k_021312.htm |

Investor Presentation February 2012

This presentation contains certain forward - looking information about First California Financial Group, Inc. (“First California” or “FCAL” that is intended to be covered by the safe harbor for "forward - looking statements" provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward - looking statements. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the cont rol of First California. First California cautions that a number of important factors could cause actual results to differ materiall y f rom those expressed in, or implied or projected by, such forward - looking statements. Risks and uncertainties include, but are not limited to, revenues are lower than expected, credit quality deterioration which could cause an increase in the provision for credit losses, First California’s ability to complete future acquisitions, successfully integrate such acquired entities, or ach ieve expected beneficial synergies and/or operating efficiencies within expected time - frames or at all, changes in consumer spending, borrowing and savings habits, technological changes, the cost of additional capital is more than expected, a change in the in ter est rate environment reduces interest margins, asset/liability repricing risks and liquidity risks, general economic conditions, particularly those affecting real estate values, either nationally or in the market areas in which First California does or a nti cipates doing business are less favorable than expected, a slowdown in construction activity, recent volatility in the credit or equi ty markets and its effect on the general economy, legislative or regulatory requirements or changes adversely affecting First California’s business, the effects of and changes in monetary and fiscal policies and laws including the interest rate policies of the Board of Governors of the Federal Reserve , demand for the products or services of First California as well as their ability to attract and retain qualified people, competition with other banks and financial institutions, the costs and effects of legal, accounting and regulatory developments, the inability to obtain regulatory approvals for acquisitions on the terms expected o r on the anticipated schedule , First California’s level of small business lending, and other factors. If any of these risks or uncertainties materialize or if any of the assumptions underlying such forward - looking statements prove to be incorrect, First California's results could differ materially from those expressed in, or implied or projected by, such forward - looking statement s. First California assumes no obligation to update such forward - looking statements. For a more complete discussion of risks and uncertainties, investors and security holders are urged to read the section titled "Risk Factors" in First California's Annua l R eport on Form 10 - K, Quarterly Reports on Form 10 - Q and any other reports filed by it with the Securities and Exchange Commission ("SEC"). 2 Safe Harbor

First California Snapshot ▪ NASDAQ: FCAL ▪ Total assets of $1.8 billion ▪ Legacy First California Bank 32 years old ▪ 19 offices in 7 counties 3 ▪ FCAL created in 2007 as a result of merger of equals between FCB Bancorp and National Mercantile Bancorp ▪ Current management in place since 1999

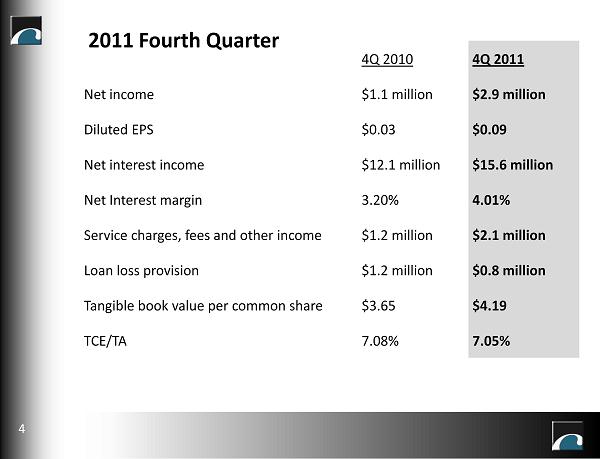

4Q 2010 4Q 2011 Net income $1.1 million $2.9 million Diluted EPS $0.03 $0.09 Net interest income $12.1 million $15.6 million Net Interest margin 3.20% 4.01% Service charges, fees and other income $1.2 million $2.1 million Loan loss provision $1.2 million $0.8 million Tangible book value per common share $3.65 $4.19 TCE/TA 7.08% 7.05% 2011 Fourth Quarter 4

2010 2011 Net income $1.4 million $23.4 million Diluted EPS $0.01 $0.71 Net interest income $44.7million $59.5 million Net Interest margin 3.46% 3.92% Service charges, fees and other income $4.5 million $7.6 million Loan loss provision $8.3 million $5.3 million Tangible book value per common share $3.65 $4.19 TCE/TA 7.08% 7.05% Full Year Results 5

▪ Proactively and diligently addressed asset quality • Only three non - covered nonaccrual loans greater than $1 million • Non - performing assets continue to decrease ▪ Strengthened market presence with skilled banking teams ▪ Re - entry into SBA lending ▪ Largest loan pipeline at end of quarter since beginning of recession 6 Strong Quarter … On Solid Footing

Asset Quality - Non - Covered Loans 4.54% 4.42% 4.04% 3.65% 3.58% $18.2 $22.0 $17.8 $15.9 $13.9 $44.3 $42.0 $38.0 $34.3 $34.2 $0 $10 $20 $30 $40 $50 $60 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Non - performing Loans Non - performing Assets 7 NPAs as % of Loans & OREO ($Millions) NPAs as % of total Assets = 1.86%

$5 $47 $34 $25 $19 $6 $58 $39 $37 $34 $0 $10 $20 $30 $40 $50 $60 $70 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Covered Non - performing Loans Covered Non - performing Assets Asset Quality - Covered Loans ($Millions) 8

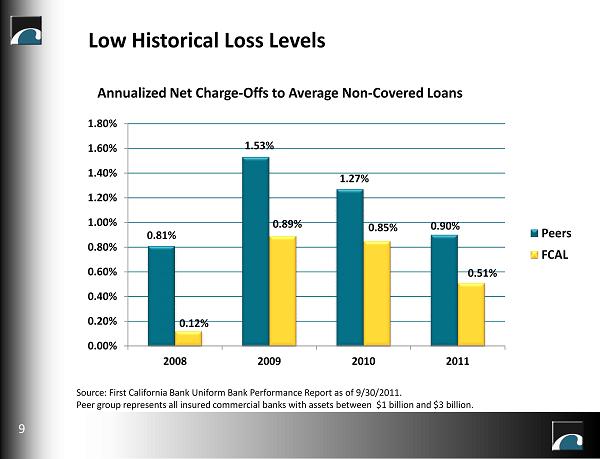

Low Historical Loss Levels Annualized Net Charge - Offs to Average Non - Covered Loans 0.81% 1.53% 1.27% 0.90% 0.12% 0.89% 0.85% 0.51% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2008 2009 2010 2011 Peers FCAL 9 Source: First California Bank Uniform Bank Performance Report as of 9/30/2011. Peer group represents all insured commercial banks with assets between $1 billion and $3 billion.

Construction and Land Commercial Mortgage Multi - Family C&I Owner - Occupied Investor Portfolio Size $35.1 million $124.6 million $268.8 million $187.3 million $180.4 million % of Non - Covered Portfolio 2.7% 13.3% 28.7% 20.0% 19.3% Weighted Avg LTV 69.9% 58.6% 60.3% Weighted Avg DSCR 1.70 1.44 Average Balance/ Commitment $1,958,000 $1,061,000 $1,223,000 $219,000 0 nonaccrual loans > $1.0 million 0 nonaccrual loan > $1.0 million 0 nonaccrual loans > $1.0 million 3 nonaccrual loans > $1.0 million Non - Covered Loan Portfolio Characteristics 10

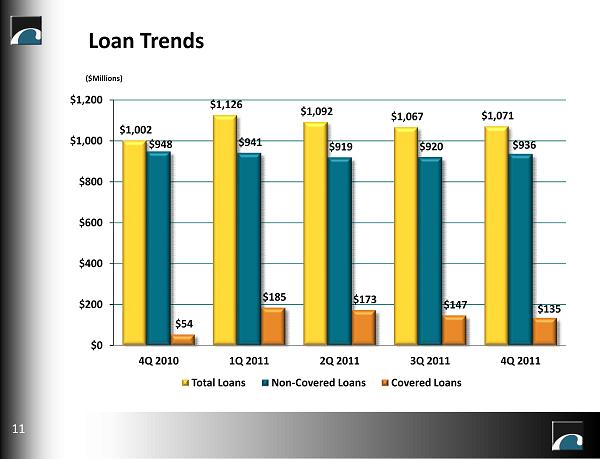

Loan Trends ($Millions) $1,002 $1,126 $1,092 $1,067 $1,071 $948 $941 $919 $920 $936 $54 $185 $173 $147 $135 $0 $200 $400 $600 $800 $1,000 $1,200 4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011 Total Loans Non - Covered Loans Covered Loans 11

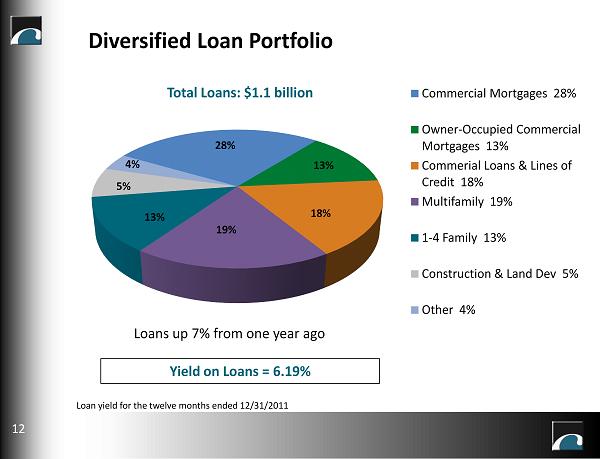

Diversified Loan Portfolio 13% 28% 13% 5% 19% 4% Commercial Mortgages 28% Owner - Occupied Commercial Mortgages 13% Commerial Loans & Lines of Credit 18% Multifamily 19% 1 - 4 Family 13% Construction & Land Dev 5% Other 4% Loans up 7% from one year ago Yield on Loans = 6.19% Total Loans: $1.1 b illion 12 18% Loan yield for the twelve months ended 12/31/2011

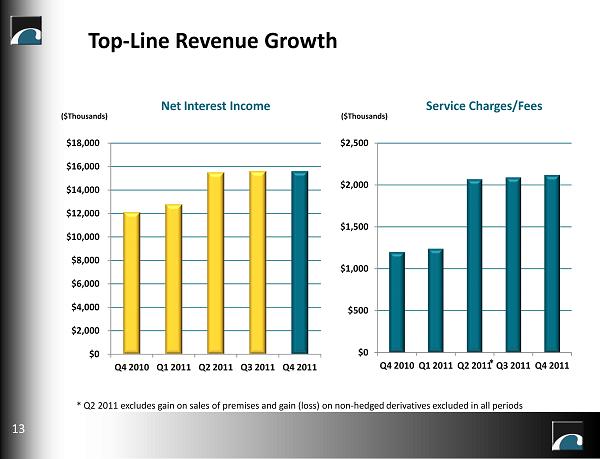

Top - Line Revenue Growth $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 $0 $500 $1,000 $1,500 $2,000 $2,500 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Net Interest Income Service Charges/Fees ($Thousands) ($Thousands) 13 * * Q2 2011 excludes gain on sales of premises and gain (loss) on non - hedged derivatives excluded in all periods

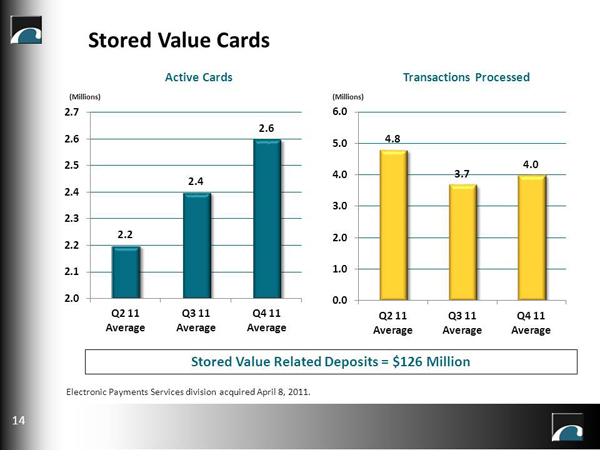

Electronic Payments Services division acquired April 8, 2011. Stored Value Cards 14 (Millions) (Millions) 2.2 2.4 2.6 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 Q2 11 Average Q3 11 Average Q4 11 Average 4.8 3.7 4.0 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Q2 11 Average Q3 11 Average Q4 11 Average Active Cards Transactions Processed Stored V alue R elated D eposits = $126 Million

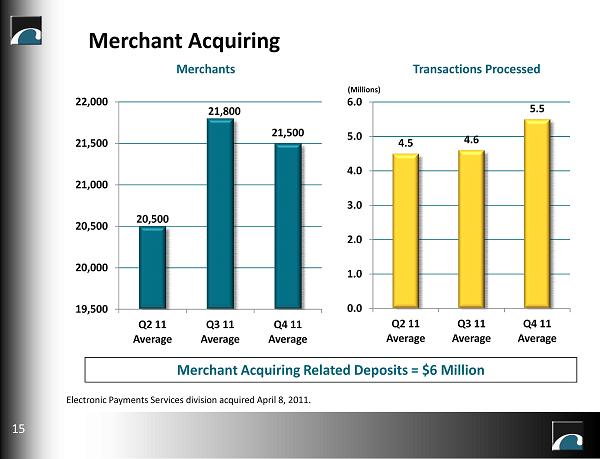

Merchant Acquiring 20,500 21,800 21,500 19,500 20,000 20,500 21,000 21,500 22,000 Q2 11 Average Q3 11 Average Q4 11 Average 4.5 4.6 5.5 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Q2 11 Average Q3 11 Average Q4 11 Average (Millions) 15 Merchants Transactions Processed Merchant A cquiring R elated Deposits = $6 Million Electronic Payments Services division acquired April 8, 2011.

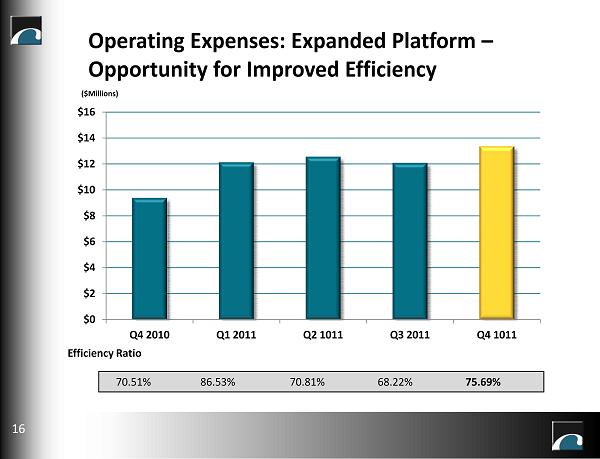

$0 $2 $4 $6 $8 $10 $12 $14 $16 Q4 2010 Q1 2011 Q2 1011 Q3 2011 Q4 1011 Operating Expenses: Expanded Platform – Opportunity for Improved Efficiency 70.51% 86.53% 70.81% 68.22% 75.69% ($Millions) Efficiency Ratio 16

▪ Employee headcount increased from 248 to 304 at year end due to • Acquisition of EPS division • Acquisition of San Luis Trust Bank from FDIC • Successful recruitment of 3 lending teams • Increase in special assets personnel due to covered loans from 2 FDIC assisted transactions ▪ Non recurring legal expenses totaling $1.9 million ▪ Non recurring expenses associated with a branding initiative of $0.2 million Items Impacting 2011 non - interest expense/efficiency 17

How to get there? ▪ Workforce reduction ▪ Reduction of legal expenses ▪ EPS revenues expected to more than double compared to 2011 actuals without adding significant expenses ▪ Increased revenues expected from growing earning asset base and introduction of SBA gains 4Q 2012 Target Efficiency Ratio of Low 60’s 18

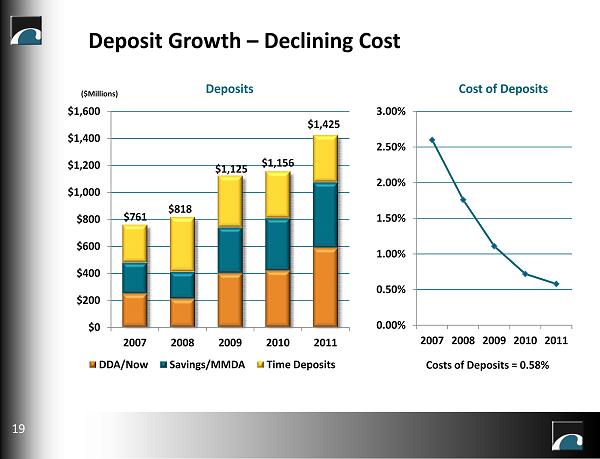

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2007 2008 2009 2010 2011 DDA/Now Savings/MMDA Time Deposits 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2007 2008 2009 2010 2011 $761 $818 $1,125 $1,156 $1,425 ($Millions) Deposit Growth – Declining Cost Costs of Deposits = 0.58% Deposits Cost of Deposits 19

$300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 12/31/10 3/31/11 6/30/11 9/30/11 12/31/11 Core Maturity Deposits Core Nonmaturity Deposits Strong Core Deposit Base (1 ) ($Millions) 77% 72% 79% 81% 81% Core Deposits to Total Deposits 20 (1 ) CD’s < $100K

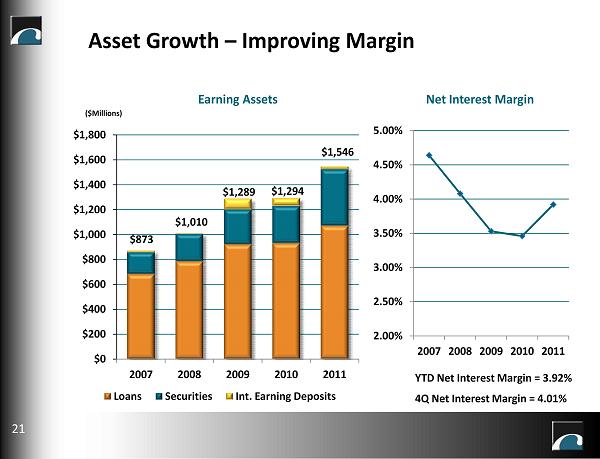

Asset Growth – Improving Margin Earning Assets Net Interest Margin ($Millions) $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2007 2008 2009 2010 2011 Loans Securities Int. Earning Deposits $1,546 $1,294 $1,289 $1,010 $873 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2007 2008 2009 2010 2011 YTD Net Interest Margin = 3.92% 21 4Q Net Interest Margin = 4.01%

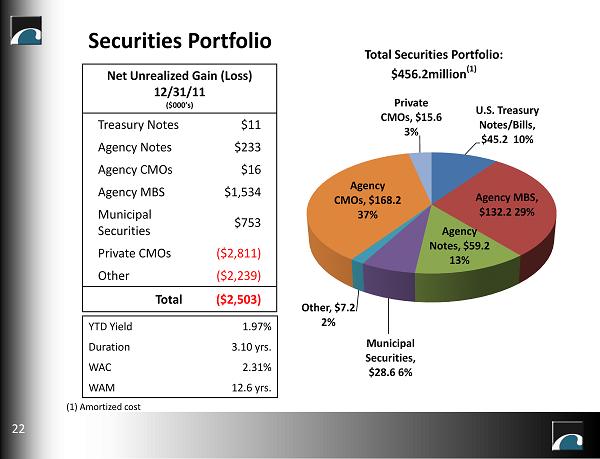

N et U nrealized G ain ( L oss) 12/31/11 ($000’s) Treasury Notes $11 Agency Notes $233 Agency CMOs $16 Agency MBS $1,534 Municipal Securities $753 Private CMOs ($2,811) Other ($2,239) Total ($2,503) Securities Portfolio Total Securities Portfolio: $456.2 million (1) 22 YTD Yield 1.97% Duration 3.10 yrs. WAC 2.31% WAM 12.6 yrs. (1 ) Amortized cost U.S. Treasury Notes/Bills, $45.2 10% Agency MBS, $ 132.2 29 % Agency Notes, $59.2 13% Municipal Securities, $ 28.6 6 % Other, $7.2 2% Agency CMOs, $ 168.2 37 % Private CMOs, $15.6 3 %

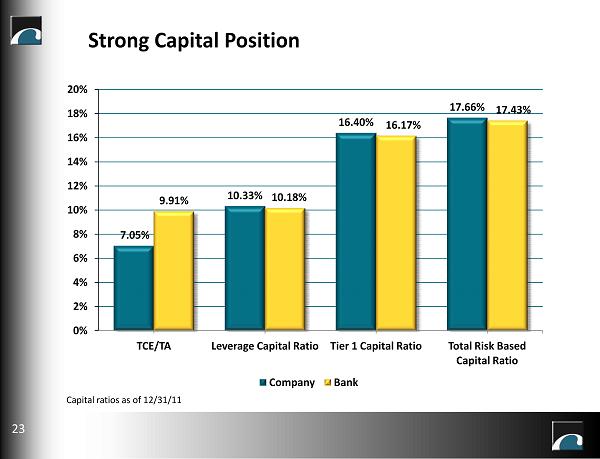

7.05% 10.33% 16.40% 17.66% 9.91% 10.18% 16.17% 17.43% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% TCE/TA Leverage Capital Ratio Tier 1 Capital Ratio Total Risk Based Capital Ratio Company Bank Strong Capital Position Capital ratios as of 12/31/11 23

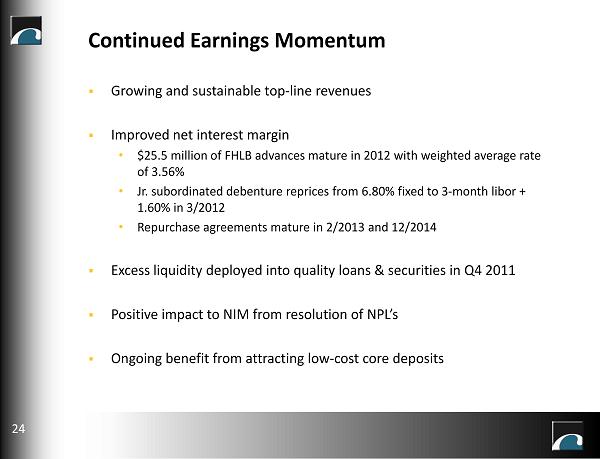

▪ Growing and sustainable top - line revenues ▪ Improved net interest margin • $25.5 million of FHLB advances mature in 2012 with weighted average rate of 3.56% • Jr. subordinated debenture reprices from 6.80% fixed to 3 - month libor + 1.60% in 3/2012 • Repurchase agreements mature in 2/2013 and 12/2014 ▪ Excess liquidity deployed into quality loans & securities in Q4 2011 ▪ Positive impact to NIM from resolution of NPL’s ▪ Ongoing benefit from attracting low - cost core deposits Continued Earnings Momentum 24

▪ Significant market opportunities for institution of our size • Many smaller institutions looking for strategic partner • Infrastructure in place for further efficiencies and economies of scale ▪ EPS division brings significant new revenue stream • Adds new products and services – prepaid debit cards and merchant card acquiring • Adds low - cost core deposits ▪ Two new lending teams ▪ New SBA department ▪ Demonstrated capability in: • FDIC - assisted transactions • Whole bank acquisitions • De novo branches and business lines Foundation for Our Future 25

▪ Strong deposit base in attractive markets ▪ Talented bankers and expanded operating platform in place to increase and diversify revenues, improve profitability and efficiency ▪ Healthy balance sheet ▪ Superior credit quality ▪ Resources to capitalize on market opportunities ▪ Experienced acquirer, FDIC - assisted or otherwise ▪ Continuity of leadership Why First California 26